Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Declining well productivity in some [tight oil/shale] plays, despite the application of better technology, is a prelude to what will eventually happen in all plays: production will fall as costs rise. Assuming shale production can grow forever based on ever-improving technology is a mistake—geology will ultimately dictate the costs and quantity of resources that can be recovered.”

David Hughes, earth scientist, energy researcher and author of How Long Will the Shale Revolution Last?

Graphic of the Week

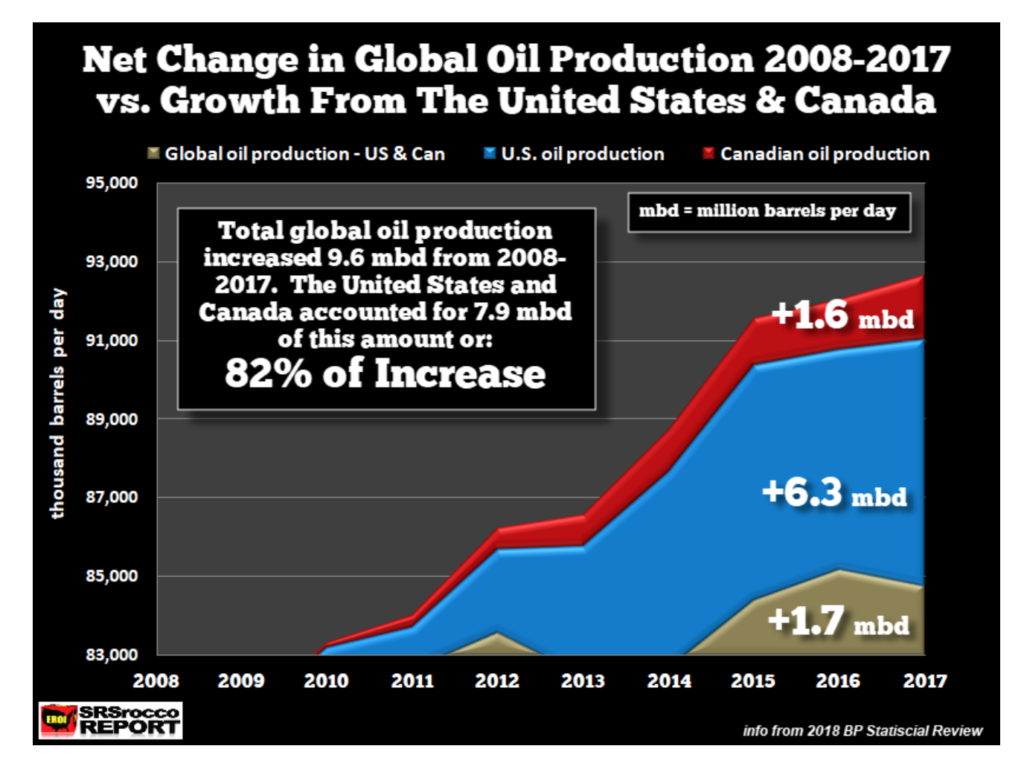

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. Nigeria 6. Venezuela 7. The Briefs 1. Oil and the Global Economy Uncertainty was the watchword of the week as oil traders juggled the faltering US/China trade deal, increasing tensions in the Middle East, and falling US crude stocks. Oil futures gyrated in a narrow range closing at $70.62 in London and $61.68 in New York with a small weekly loss. The EIA reported a 4-million-barrel drop in US crude inventories the week before last, and there remains a question as to how fast US oil production is increasing. Brent crude futures have opened up a steep backwardation, evidence that the physical market for crude is tightening. Given that Iranian exports are plunging, Russia’s are temporarily lower due to contaminated oil, and the future of Libyan and Venezuelan oil exports is cloudy, higher oil prices would seem to be coming. Some financial institutions are bullish for oil. The other side of the story is that the US and China now consume nearly a third of global oil production. A lasting trade dispute between the two would undoubtedly have implications for global oil demand. For now, the financial markets are not overly concerned about the course of the trade dispute but given that Washington is now preparing to impose tariffs on another $325 billion of Chinese imports, a lot could happen in the next few weeks. Last week a story posted by SRSrocco reminds us that of the 9.6 million b/d of global oil production growth between 2008 and 2017, the United States supplied two-thirds or 6.3 million b/d of the total.BP will be providing data for through 2018 when their 2019 Statistical Review is published on June 11th. |

Most observers, including the EIA, say the most likely source of any substantial increase in global oil production during the coming decade will most likely be from the Permian Basin. It would seem that the future of global economic growth, which has been requiring an additional 1.5 million b/d of new oil annually, has most of its eggs in a single basket called the Permian Basin. Given the political instability in several of the world’s major oil exporters it seems likely that the net amount of oil coming from outside of North America will not grow much if at all in the decade ahead. With the uncertainties, it is too early to make a call as to when global oil production will peak, but the possibility should be kept in mind.

The OPEC Production Cut: After four months of decline, OPEC’s collective crude oil production in April held relatively steady from March, rising 30,000 b/d to 30.26 million. Iran’s sanctions-induced slump and Angola’s drop were offset by an increase in Nigeria and Iraqi production and higher production in Libya and Venezuela. Saudi Arabia held its April output at 9.82 million b/d, the lowest in over four years and well below its quota under an OPEC+ agreement. Iran produced 2.57 million b/d in April, a 120,000 b/d drop from March, and the lowest since December 1988, as buyers slowed their orders in anticipation of Washington’s elimination of sanctions waivers.

Saudi Arabia is to host a meeting of the nine-country OPEC+ market monitoring committee on May 19th. The next full OPEC meeting will take place on June 25th with Russia and the nine other non-OPEC accord members joining the talks on June 26th. The decision on the production cuts will come from an agreement between Riyadh and Moscow with the others falling in line. In recent weeks Russia seems to be favoring the elimination of the cuts at the end of June while the Saudis say they want to see what happens in the next six weeks. There are many situations affecting oil prices at the minute including the US/China trade war, the crises in Libya and Venezuela, the efficacy of the US sanctions on Iran, and even the rate at which US shale oil is produced. How these factors affect prices between now and the end of June is likely to be an essential part of the Saudis’ position at the June meeting.

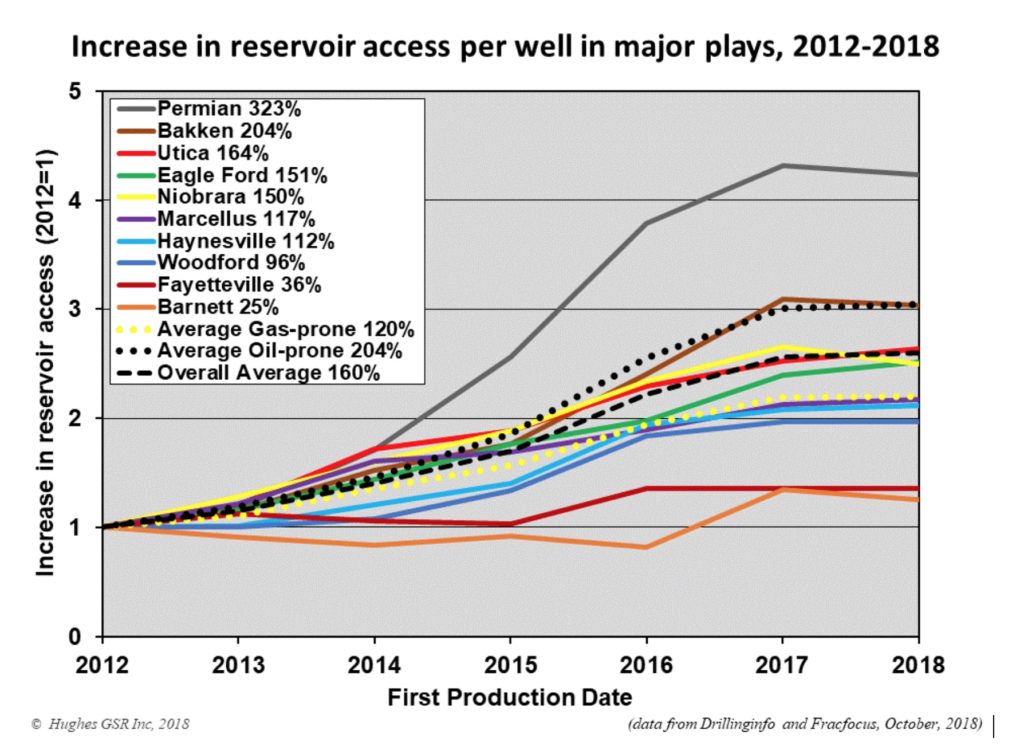

US Shale Oil Production: Last week the Post Carbon Institute released a new study titled, How Long Will the Shale Revolution Last? written by David Hughes. The study examines what has happened in the US shale oil and gas industries since new drilling techniques were introduced in the wake of the oil price collapse five years ago. These techniques include drilling multiple wells from the same pad, drilling longer horizontal laterals, using more water and sand to frack wells, and spacing wells closer together to ensure that as much oil as possible is extracted. The industry touts these techniques as the path to profitability for shale oil drillers and the way the industry can overcome the rapid rate at which production from shale oil wells declines.

After an exhaustive examination of the major US shale oil and gas basins’ production through late 2018, Hughes concludes that indeed the longer laterals allow newly drilled wells, fracked with more water and sand, to reach 2.6 times more oil-bearing rock from a given well than from earlier wells. Drilling ten wells from the same pad has resulted in substantial cost savings and the need for fewer drilling rigs. Technological improvements, however, “don’t change the fundamental characteristics of shale production, they only speed up the boom-to-bust life cycle,” Hughes said.

In 2018, the industry spent $70 billion on drilling 9,975 oil and gas wells, according to Hughes. “Of the $54 billion spent on tight oil plays in 2018, 70 percent offset field declines and 30 percent increased production.” This ratio likely will continue to get worse as production increases and larger declines from existing wells need to be offset by new drilling.

As a shale basin matures, the profitable sweet spots become fewer and operational problems begin to increase. “Declining well productivity in some plays, despite the application of better technology, is a prelude to what will eventually happen in all plays: production will fall as costs rise,” Hughes said. “Assuming shale production can grow forever based on ever-improving technology is a mistake—geology will ultimately dictate the costs and quantity of the oil and gas that can be recovered.”

The Post Carbon report estimates that the industry’s premier play, the Permian Basin, currently requires 2,121 new wells each year just to keep production flat, and in 2018 the industry drilled 4,133 wells there, leading to a big jump in the basin’s output. With heavy drilling, the Permian could continue to see production growth in the next few years, but merely increasing the water and fracking sand “have reached their limits” as a technique. “Declining well productivity as sweet-spots are exhausted will require higher drilling rates and expenditures in the future to maintain growth and offset field decline,” Hughes warned.

Despite the pessimism in some quarters such as portrayed in the Post Carbon report, Rystad Energy, an industry consulting firm, said on Thursday that North America’s tight oil had reduced costs so much over the past four-five years that it is now a competitive source of crude even when oil prices are not very high. Rystad estimates in its latest cost-of-supply update that the average breakeven price for tight oil is now $46 a barrel, just four dollars above the average $42 per barrel breakeven oil price for the giant onshore fields in Saudi Arabia and other Middle Eastern countries.

Companies involved in the shale oil boom continue to fall by the wayside. Last week we heard that Product & Logistics Services, a subsidiary of Schlumberger, is ceasing operations at its facility in the Permian Basin, resulting in layoffs of 124 employees. Oilfield services provider Weatherford International, burdened by a heavy debt load and years of losses, said it would file for Chapter 11 bankruptcy protection. Triangle Petroleum, which has interests in North Dakota’s energy and commercial real-estate markets, filed for bankruptcy on Wednesday with a reorganization plan under which bondholder J.P. Morgan Securities will get all of the equity.

Some are convinced that the shale oil boom still has many years to go. Occidental Petroleum and Anadarko signed a merger agreement last week. Vicki Hollub, Occidental’s chief executive, said: “This transaction further establishes Occidental as a premier operator in prolific global oil and gas regions with the ability to deliver production growth of 5% through investment in projects with industry-leading returns.” The deal will expand Occidental’s position as the largest oil producer in the Permian after it incorporates Anadarko’s acreage, which includes some 600,000 acres in the Delaware oil field part of the Permian Basin.

Chevron had offered to pay $33 billion for Anadarko and assume $15 billion in debt, with 75 percent of the price to be paid in stock and the rest in cash. Occidental, however, which had tried to acquire Anadarko before, outbid Chevron with a $38 billion offer and a higher percent of the total to be paid in cash. The deal raises the issue as to whether Occidental can succeed where smaller firms have been unable to turn a profit.

2. The Middle East & North Africa

Iran: As the sanctions tighten on Tehran’s economy, the government is turning to the few tools they have left to fight the sanctions. Threats to attack US forces in the region the week before last resulted in the dispatch of a US carrier task force to the Gulf and a force of heavy bombers to the area. Iran’s Revolutionary Guards said on Friday Tehran would not negotiate with the US, and a senior cleric warned that a US Navy fleet could be “destroyed with one missile.” In response, the US warned shipping to watch out for possible attacks on oil tankers in the straits.

Of more concern was Tehran’s warning that it was renouncing parts of the nuclear agreement, which could lead to more trouble if they go back to working on weapons. Iran is also making an effort to sell more oil in the “grey market” which would avoid the sanctions. Washington added new sanctions on Iran’s metals exports and vows to keep squeezing Tehran until it “fundamentally alters” its policies.

In general, the tougher US sanctions seem to be cutting Tehran’s exports for now. Some are saying that they could be down to circa 500,000 b/d this month. China and India both bought large quantities of oil in April before the waivers expired. The Saudis are offering to increase oil shipments to India by 200,000 b/d. China’s Sinopec and CNPC seem to be foregoing Iranian imports during May while waiting to see what happens in US/China relations. Beijing imported 475,000 b/d of Iranian crude during the 1st quarter. Sinopec, which buys the majority of China’s Iranian oil imports, does not wish to breach a long-term supply contract with Iran but has opted to suspend booking new cargoes for now. The loss of the Chinese and Indian markets alone will be a significant blow to Iran’s economy.

Iraq: Baghdad is about to sign a long-term deal with Exxon and PetroChina. The 30-year contract will involve investments of $53 billion. The agreement will include the further development of two oil fields in southern Iraq—Nahr Bin Umar and Artawi—and the construction of water injection system to force more oil to the surface for the southern oil fields. The combined production of Nahr Bin Umar and Artawi oil fields could reach half a million barrels of oil daily, from 125,000 b/d today.

Another part of the deal is the production and processing of up to 100 million cu ft of natural gas. Iraq is a minor producer of natural gas and imports what it needs from neighbor Iran. Baghdad wants to increase oil production from its current level to approximately 8.5 million b/d in 2025 after infrastructure has been upgraded. The expansion would include 6.5 million b/d from southern oilfields, and another 1 million bpd from Kirkuk after a new pipeline to Turkey’s Ceyhan port on the Mediterranean has been constructed.

Saudi Arabia: Riyadh is expected to keep its crude exports below 7 million b/d in June, maintaining output under its production OPEC+ quota. The Saudis are reluctant to boost oil supply too quickly and risk a price crash and a build-up in inventories, despite pressure from Washington to reduce oil prices. A government spokesman said, “moderate requests have been received from customers for June shipments, which will all be met.” These are from countries which previously had waivers from US sanctions that were recently discontinued by the US. Aramco has offered to boost shipments to India by 200,000 b/d which would make up for almost half of India’s oil imports from Iran.

Even as oil production reached a record 11.1 million b/d in November 2018, Aramco was increasing investment to ensure there is spare capacity to meet a global supply shock. According to Energy Minister Khalid Al Falih, the country will invest $20 billion to increase its capacity by another 1 million b/d.

Saudi Aramco is considering investing in the Marcellus shale gas assets of Norway’s Equinor in what would be the first-ever venture into the natural gas business outside the Kingdom. Aramco is mulling over investing in Equinor’s Marcellus position either via a joint venture or by acquiring a stake in the operations. The Saudis may also team up with other oil firms to get US shale gas acreage. Equinor has gas and oil assets in the Marcellus, in the Eagle Ford, and the Bakken shales.

Libya: There has been little news on General Haftar’s offensive to take Tripoli in the past week, suggesting that the situation has stalemated. Last week Haftar urged the troops trying to take Tripoli to battle harder and teach their enemies a lesson during the Muslim holy month of Ramadan. His comments came just hours after the UN called for a week-long humanitarian truce following a month of fighting for the capital that has displaced 50,000 people. The markets are starting to notice that a million b/d of oil production is at stake if the fighting continues indefinitely.

Mustafa Sanalla, chairman of Libya’s internationally recognized National Oil Corporation (NOC), held meetings with US companies last week to discuss $60 billion worth of procurement contracts necessary to more than double Libyan oil production by 2023. While Libya’s long-term plans are to double its oil production, its immediate output may be threatened as the security situation has materially worsened. Sanalla said on Wednesday that “the Tripoli assault and ongoing hostilities are a direct threat to Libyan oil sector development and procurement.”

3. China

Trade talks between China and the United States ended on Friday without a deal as President Trump raised tariffs on $200 billion worth of Chinese imports and signaled that he was prepared for a prolonged fight. The world’s two largest economies seem to be back into a trade war that one week ago was widely believed to be ending. Mr. Trump and his advisers were surprised by what they deem as China’s attempt to renege on parts of an emerging deal. The president is now moving ahead with plans to impose 25 percent tariffs on all remaining Chinese imports. Those new tariffs could go into effect in a matter of weeks. China has reiterated its intention to respond to the US tariff, but the lack of details about Beijing’s next moves have left market participants hanging. Some observers already are talking about a trade war which could damage the global economy and lead to lower demand for oil.

China’s crude oil imports in April hit a record high of 10.68 million b/d, up from 9.3 million b/d in March. The record import represented a 14.9 percent month-on-month jump, and a 10.8 percent from April 2018. The previous record high was 10.48 million b/d in November 2018 when the country’s crude imports were above 10 million b/d for four months until March, when the volume fell to 9.3 million b/d. Crude oil imports in April surged despite refinery maintenance outages and tepid domestic fuel demand, as state-run refiners built up stocks of Iranian oil anticipating a sanctions clampdown.

4. Russia

Moscow halted oil flows through the Druzhba pipeline to Eastern Europe and Germany in late April because of contaminated crude, contributing to a rise in global oil prices and leaving refiners in Europe scrambling to find supplies. All of the importing nations stopped taking Russian oil via the pipeline on April 25-26. At least 40 million barrels were contaminated by organic chloride, a chemical compound used to boost oil extraction by cleaning wells and accelerating the flow of crude. Transneft said the contamination happened in the Volga region of Samara and blamed unidentified “fraudsters.”

With an important export route shut, Transneft asked oil producers to reduce supplies to the system by over 1 million b/d between May 3-6. It was not clear if limits have been extended beyond May 6, but sources said it was likely because Druzhba was not yet in operation on Friday. At least ten crude tankers with 1 million tons of oil, worth more than $500 million, are marooned across Europe and still looking for buyers because they contain tainted oil. In a search for alternative export routes, Rosneft will load an extra crude oil cargo from the Pacific

port of Kozmino on May 30-31 in addition to the initial loading plan. Russian oil quality from the Baltic port of Ust-Luga was improving on Thursday but was still not good enough for refiners in Europe, with required standards expected to be reached by May 11.

The president of Belarus Alexander Lukashenko said the cost of damages to pipelines and refineries from the contaminated oil would be hundreds of millions of dollars. Belarus expects compensation from Russia.

5. Nigeria

The Nembe Creek Trunk Line, one of the two critical pipelines of Nigeria’s Bonny Light crude grade capable of transporting 150,000 bpd to the export terminal was shut down last week after leaks were detected. Pipeline Leaks in the Niger Delta are often caused by oil theft. Shell and Total have declared force majeure on Bonny Light exports. Nigeria produced 1.95 million b/d during April. Nigeria’s output remains below the 2019 budget benchmark of 2.3 million at $60 per barrel.

The Movement for the Survival of the Ogoni People (MOSOP) said it had uncovered plans by the Nigerian government to commence oil drilling in Ogoniland and that it would resist such attempts. The organization said oil drilling operations, with military cover, are to begin in the coming months, and that the security agencies have been asked to tackle voices of dissent in the Ogoni community.

Nigeria’s deepwater operations have generated over $180 billion following a capital investment of more than $65 billion made by the oil and gas industry. Out of the 15 Floating Production Storage and Offloading (FPSO) units in Nigeria, seven are located in deep water. Nigeria ranks only behind Angola within the African deepwater operations in terms of FPSO deployment.

The Nigerian government has accused former President Goodluck Jonathan and his then oil minister of accepting bribes and breaking the country’s laws to broker a $1.3 billion oil deal eight years ago according to a London court filing shows. Corruption in Nigeria has been commonplace for decades and is one of the reasons there has been little progress in increasing Nigeria’s oil production.

6. Venezuela

The failure of the uprising against the Maduro government two weeks ago has left the opposition movement demoralized, even if it remains intact. Last week the government arrested Edgar Zambrano, the opposition-run National Assembly’s vice president after ten lawmakers were stripped of their congressional immunity by the puppet supreme court. The court alleged that they were part of the attempted uprising, and accused them of “treason, conspiracy, instigation of an insurrection, and civil rebellion.” This action caused several other opposition leaders to take sanctuary in foreign embassies. Maduro’s government has so far avoided arresting Guaido, which would likely provoke an international backlash.

There was little news on the oil situation last week with production believed to be somewhere around 600,000-800,000 b/d. There have been no significant power outages reported in the previous week, and 2-3 of the four upgraders which are run with foreign help are operating.

The collapse of the country’s economy and health system has caused a resurgence of malaria, which is creeping across the borders into Colombia and Brazil. The World Health Organization says that between 2010 and 2017 Venezuela witnessed a nine-fold increase in the number of confirmed cases of malaria, climbing to 412,000. That was the fastest rate of growth for malaria found anywhere in the world.

The US sanctions are not particularly popular in Venezuela as they have only made the economic situation worse. In recent days the US has backed away from a previous tactic of threatening military intervention. Administration officials continue to echo Trump’s claim that “all options are on the table,” however; there appears to be little appetite in Washington for use of force, and neighboring countries have come out firmly against foreign military intervention.

7. The Briefs (date of the article in the Peak Oil News is in parentheses)

Commodity trading shifting? The next couple of months could see a reshuffle of global commodity trade and financial markets as a structured Arab strategy is kicking in. International media has slowly started to report on the ongoing new ventures of oil and gas giants, such as Aramco and ADNOC, with international trading houses and IOCs making a move to capture a larger part of the global commodity market. The current assessments still tend to look at the attempts by Aramco, ADNOC, QP, and Sonatrach, as mere minor disturbance and not a cause to worry. But change seems afoot. (5/6)

The lingering oversupply of oil tankers in the VLCC market has left shipowners weighing options to either idle, reduce sailing speed extensively or take on only short voyages as freight returns are seen below operating costs. The earnings accrued for a modern VLCC have slumped to around $7,000/day on the Persian Gulf to North Asia routes, which hardly covers the daily running cost of the vessel, according to market participants. (5/10)

The European Union has promised to double its intake of US liquefied natural gas over the next five years with the yearly total reaching the equivalent of 8 billion cubic meters in 2023, double the current annual rate of imports. The news is good for both sides. For US LNG producers, a growing export market is always good news. For the European Union, this pledge to buy more US LNG will defuse a tariff bomb that President Trump threatened to blow up last year: he said he would slap import tariffs on German cars if the EU did not play nice. (5/7)

In Argentina, YPF, the largest oil and natural gas producer, is focusing on shale oil for production growth as a glut slows natural gas output. The shift is aimed at reversing an expected up to 3 percent decline of overall output this year. The company has shifted its focus to accelerating shale oil developments in Vaca Muerta, the country’s largest shale play. (5/11)

The Panama Canal Authority announced a new maximum draft restriction of 43 feet, or 13.11 meters, the sixth since January, in the Gatun Lakes, which will come into effect May 28. The current maximum draft is set at 44 feet, or 13.41 meters, which came into effect April 30 and was announced April 1. The continued tightening of draft restrictions in the Gatun Lakes is a response to drought conditions leading to lower lake levels. (5/7)

Mexico’s government is notching some successes in its battle against the country’s fuel thieves, dealing a blow to organized crime and restoring lost revenues to financially troubled state-run oil company Petróleos Mexicanos. During the first three weeks in April, fuel theft fell to just 4,000 barrels a day, compared with an average of 56,000 barrels a day in 2018. (5/7)

Mexico’s President Andrés Manuel López Obrador said state oil company Petróleos Mexicanos would build an oil refinery after bids by private companies came in above his government’s $8 billion budget. The refinery, to be built in the southern state of Tabasco with the capacity to process more than 300,000 barrels of crude oil a day, is one of Mr. López Obrador’s signature projects and part of his plans to raise Pemex’s production of fuels and reduce Mexico’s reliance on imports. (5/10)

The US oil rig count declined by two to 805, well below the 844 one year ago, GE’s Baker Hughes said Friday. The gas rig count held steady at 183, putting the combined rig count last week at 988; that’s down 57 rigs year-over-year. Year-to-date, the total number of oil and gas rigs active in the United States has averaged 1,031. (5/11)

Bankruptcy: Oilfield services provider Weatherford International Plc, burdened by a heavy debt load and years of losses, said it would file for Chapter 11 bankruptcy protection. The company, which at its peak was valued at more than $50 billion, never recovered from the 2014 oil price collapse. (5/11)

BP in GOM: BP, the biggest oil producer in the US Gulf of Mexico, has just announced that it is expanding the development at one of its fields, unlocking additional production from its offshore US platforms, while the American supermajors look to significantly boost their output from the hottest shale play, the Permian. Nearly a decade after the 2010 Deepwater Horizon disaster, BP bets big on the Gulf of Mexico to grow its global production of ‘high-margin oil.’ (5/8)

US refiners had a plan for 2020: use their complex operations to maximize profits by making products that would comply with new international laws capping sulfur content in shipping fuels. But after a series of unexpected market moves, heavy, sour crude oil processed by US refiners had become more expensive, eating up hoped-for profit windfalls before they even materialized, forcing refiners to rethink plans to invest more in heavy crude processing units. (5/10)

Dismantling an offshore oil and gas platform in the Gulf of Mexico is becoming even more challenging as the complexity of decommissioning and abandonment (D&A) projects intensifies. Assets located in deeper water depths are increasingly reaching the end-of-life stage, translating into D&A projects that are much more challenging to complete. Some key facts going forward: global D&A spending should reach $13 billion per year by 2040; from 2021 to 2040, there will be an estimated 2,000 offshore D&A projects; in just the GOM, decommissioning liabilities amount to roughly $40 billion. (5/8)

The US Fish and Wildlife Service announced last week a proposal to change the status of the American burying beetle from “endangered” to merely “threatened,” which would make it easier for oil and gas producers who must work around the insect when drilling and laying pipeline. (5/7)

Offshore locked out: Ninety-four percent of the U.S.’ offshore resources are not available for investment. That’s what Eric Oswald, vice president for the Americas at ExxonMobil, revealed during a presentation at the Offshore Technology Conference in Houston, Texas, on Wednesday. (5/9)

New environmental regulations in Colorado have chilled investment in the state’s oil and gas fields as companies grapple with how local officials will respond to a law giving them more power to restrict energy production. Colorado now ranks fifth among US states in oil production at about 500,000 barrels per day (bpd), up from just 90,000 barrels in 2010. That boom, however, has come just as state politics has shifted to the left with an influx of urbanites who tend to oppose fossil-fuel development. The Colorado law is one sign of pushback to the oil boom in the United States. (5/10)

In Colorado, as the state starts to turn Senate Bill 181 — the new law giving greater power to local governments over oil and gas drilling projects — into flesh following the end of the legislative session, communities are re-establishing moratoriums. (5/10)

US coal production in 2019 will total 699.8 million tons, the US EIA forecast Tuesday. US coal production in 2019 would still be down 7.2% from last year’s output, according to the May STEO. The EIA projected production of 638.1 million tons in 2020. Based on the current forecasts, 2020 output would drop 8.8% from this year’s production. (5/8)

End- game for coal: New York environmental regulators adopted rules to reduce carbon dioxide emissions from power plants that will force generators to stop burning coal in the state by the end of 2020. New York Governor Andrew Cuomo, who has been highly critical of US President Donald Trump’s support for the coal industry, said in a statement on Thursday that state’s new carbon reduction rules would deliver on his 2016 pledge to go coal-free by 2020. (5/11)

TMI’s final shutdown: US energy company Exelon Corp said Wednesday it would shut the last reactor at the Three Mile Island power plant, site of the worst nuclear accident in US history, on Sept. 30 due to legislative inaction on a nuclear subsidy bill in Pennsylvania. Exelon said it had to decide by June 1 to purchase fuel for the plant for its next operating cycle. (5/9)

New renewables on a plateau: Renewable energy deployment stalled out last year, raising alarm bells about the pace of the clean energy transition. In 2018, the total deployment of renewable energy stood at about 180 gigawatts (GW), which was the same as the previous year. It was the first time since 2001 that capacity failed to increase year-on-year, according to the International Energy Agency (IEA). (5/8)

World’s largest solar: Egypt expects the 1.6-gigawatt solar park it is building in the south of the country to be operating at full capacity in 2019. The $2 billion project, set to be the world’s largest solar installation, has been partly funded by the World Bank, which invested $653 million through the International Finance Corporation. Some parts of the park are already operating on a small scale, while other areas are still undergoing testing. Egypt aims to meet 20 percent of its energy needs from renewable sources by 2022 and up to 40 percent by 2035. Renewable energy currently covers only about 3 percent of the country’s needs. (5/6)

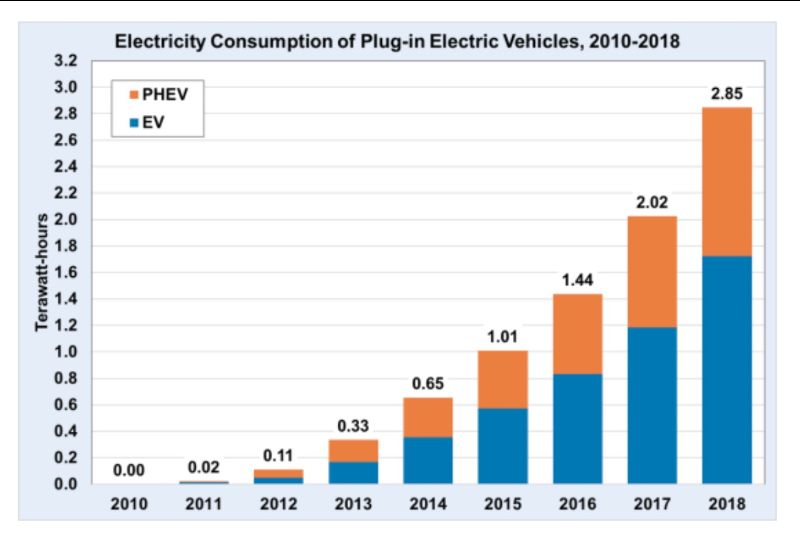

Elec vehicle usage: The amount of electricity consumed by plug-in electric vehicles (PEV) in the United States has nearly doubled in the last two years—from 1.44 terawatt-hours in 2016 to 2.85 terawatt-hours in 2018, according to the US Department of Energy. (5/7)

Battery recycling: Volkswagen plans to build one million electric vehicles a year by 2025; given this target, handling battery recycling in its own plants is a priority for cost and environmental reasons. In the long term, Volkswagen wants to recycle about 97% of all raw materials in end-of-life EV battery packs. Today, the level is roughly 53%. (5/11)

ExxonMobil is promising up to $100 million over the next ten years to US government laboratories to research technologies that could cut greenhouse gas emissions, as it seeks to show that it is responding to the threat of climate change. The largest listed US oil group will be giving the money to the National Renewable Energy Laboratory and National Energy Technology Laboratory to work on technologies including advanced biofuels and ways to capture and store carbon emissions. (5/9)

Losers in the carbon battle: In an opinion piece in the journal Nature, a team from the US and Europe suggests that the transition to a low-carbon world will create new rivalries, winners and losers, and that it is, therefore, necessary to put geopolitics at the heart of debates about the energy transition. So far, the policy focus has been on empowering the early winners of an unfolding renewable-energy race. It now needs to switch to the potential conflicts resulting from falling fossil-fuel demand, and the related economic and security risks, because abating carbon will create losers. (5/6)

Air pollution backfire? The processes that create ozone pollution in the summer can also trigger the formation of wintertime air pollution, according to a new study from researchers at the University of Colorado Boulder and NOAA, in partnership with the University of Utah. The team’s unexpected finding, published in the journal Geophysical Research Letters, suggests that in the US West and elsewhere, certain efforts to reduce harmful wintertime air pollution could backfire. (5/11)

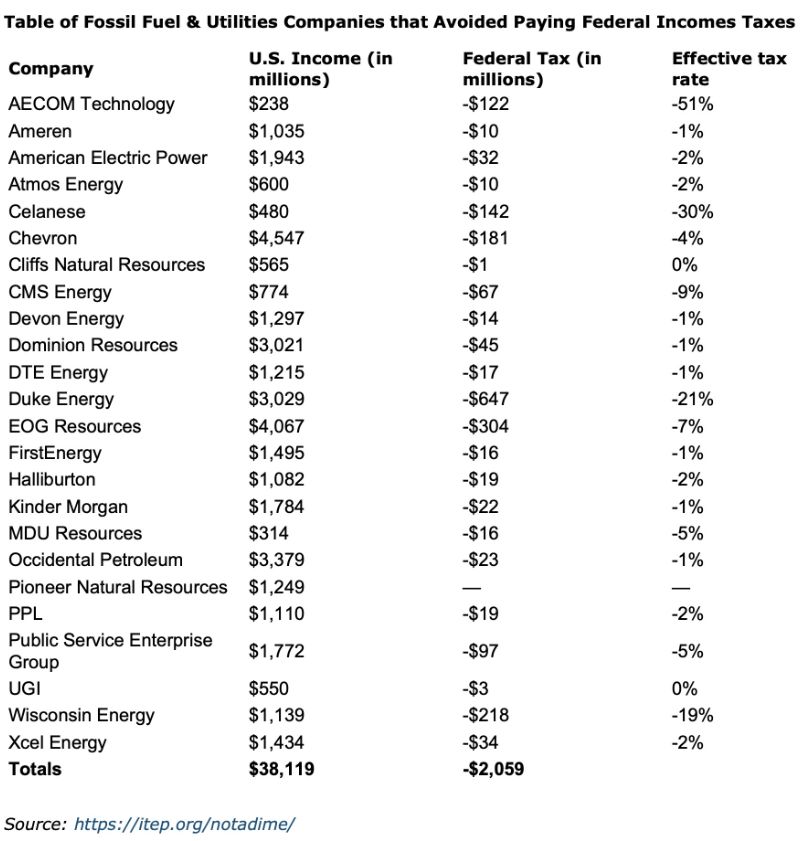

O&G escaping taxes: A recent report by the Institute on Tax and Economic Policy finds that 60 profitable companies that are on the Fortune 500 list paid no federal income taxes in 2018. All told, the 60 companies on the list did not merely avoid paying $16.4 billion in federal income taxes – they actually received a net tax rebate of $4.3 billion. A whopping 40 percent – 24 of the 60 companies – are tied to the oil, gas, and utility industries.