Editors: Tom Whipple, Steve Andrews

Quote of the Week

“If climate change causes more volatile frequent and extreme weather events, you’re going to have a scenario where these large providers of financial products — mortgages, home insurance, pensions — cannot shift risk away from their portfolios. It’s abundantly clear that climate change poses a financial risk to the stability of the financial system.”

-Rostin Benham, commissioner at the Commodities Futures Trading Commission (6/13)

Graphic of the Week

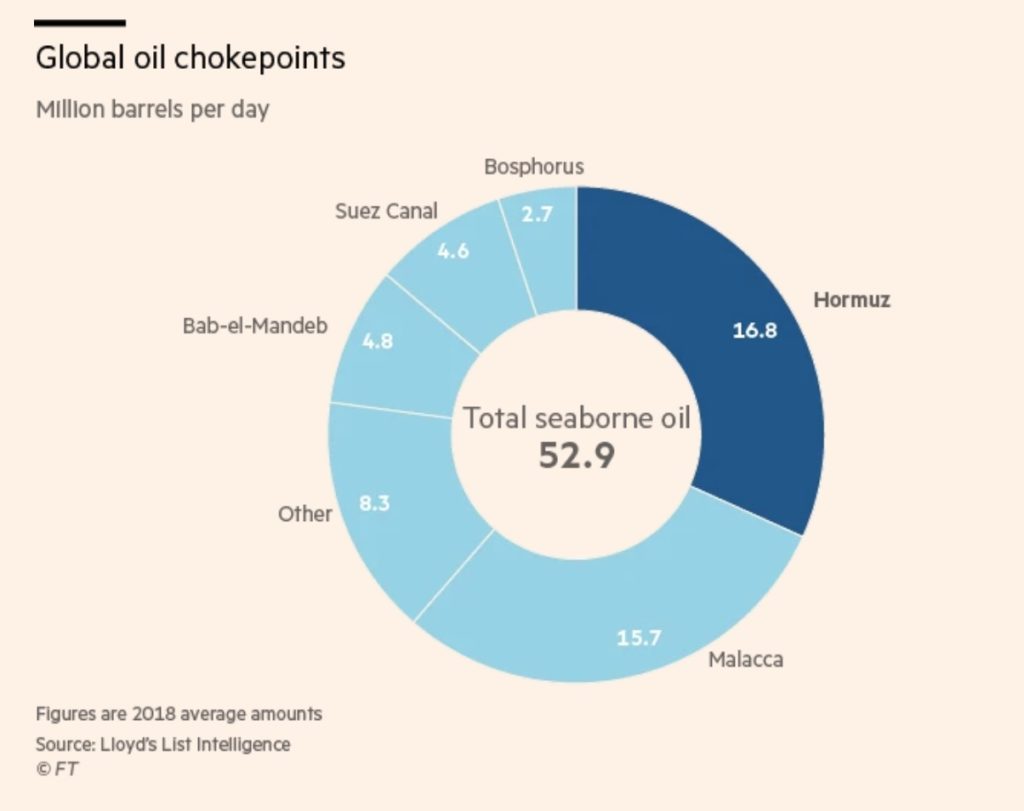

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. Nigeria 6. Venezuela 7. The Briefs 1. Oil and the Global Economy Brent futures dropped steadily for the first three days last week, falling to a low below $60 on Wednesday before the attack on two oil tankers just south of the Straits of Hormuz. Prices then rebounded to close the week at $62.01. New York futures performed similarly, closing out the week at $52.51. Many observers commented on the relatively mild market reaction to the tanker attacks. Considering that a third of the world’s seaborne exports (some 18 million b/d) pass through the straits, many expected to see prices move much higher. The US and the Saudis already are saying that Iran was responsible for the attacks, while Tehran denies any involvement. Concerns are rising as to where the US vs. Iran confrontation is going. Both sides say they do not want to start a war. However, the possibility of miscalculation is growing every day. If Iran was behind the attacks that only inflicted damage on six oil tankers in the Gulf of Oman, they were designed to send a message in a way that would not provoke immediate retaliation. Both sides are playing a perilous game. Tanker owners and insurance companies are already worried about their valuable ships and cargoes that move 18 million b/d of crude and oil products through the straits. The loss, even a temporary one, of these barrels would have the most severe consequences for the global economy and likely move oil prices to unprecedented levels. Last week, the IEA cut its estimate for the increase in global oil demand this year from 1.3 million to 1.2 million b/d but believes it will increase to 1.4 million b/d in 2020. June was the second straight month that the Agency has lowered its forecast based on deteriorating economic prospects in many countries. The rebound next year is based on the success of economic stimulus packages and interest rate cuts that governments are expected to launch later this year. The IEA’s downgrading of the prospects for growth this year was the third significant oil market report last week to take a more bearish stance on oil demand, coming after the EIA released downbeat demand numbers last Tuesday and the OPEC said about the same thing on Thursday. The OPEC+ Production Cut: The cartel lowered its oil production down to 29.87 million b/d in May according to the latest edition of OPEC’s Monthly Oil Market Report. Iran’s May oil production fell to 2.370 million barrels per day, a decrease of 227,000 barrels per day from April. Nigeria and Saudi Arabia produced less oil in May, with Nigeria’s production falling to 1.73 million b/d —a decrease of 92,000. Saudi Arabia’s oil production fell to 9.69 million b/d, a decline of 76,000. OPEC also cut its forecast for growth in global oil demand due to trade disputes and pointed to the risk of a further reduction. This assessment comes as part of building a case for continuing the production caps. The dispute over OPEC’s meeting date continues with only two weeks left until the production cuts expire at the end of June. Initially scheduled for June 25-26, OPEC’s semi-annual gathering in Vienna could be moved to the week after, to accommodate a request by Russia, which has cited a potential conflict with the G20 summit on June 28-29. Saudi Energy Minister Khalid al-Falih said on Sunday that OPEC would probably meet in the first week in July in Vienna. Moscow still is not ready to commit to further production cuts with the oil market facing many uncertainties. According to the Saudis’ oil minister “almost every member of the 24-country coalition is on board with a rollover of the agreement, except for Russia, which is vacillating over how much production it is willing to cut. Russia’s oil minister affirmed this position by saying “lots depends on the market situation in the second half” such as sanctions and trade disputes. US Shale Oil Production: The EIA lowered its forecast for the increase in US oil production this year to 1.36 million b/d, down by 140,000 b/d from the previous forecast. In 2020, US crude production is expected to rise 94,000 bpd, 1,000 b/d more than previously forecast. If production meets these forecasts, the US would be producing 13.5 million b/d by the end of 2020. Production gains in 2019 and 2020 will be driven by shale oil output, with growth in the offshore Gulf of Mexico expected to be 190,000 b/d in 2019 and 130,000 b/d in 2020. US crude stockpiles rose unexpectedly by 2.2 million barrels in the week to June 7, despite the highest refining rates in six months and lower imports and production, the EIA reported last week. At 485.5 million barrels, commercial stocks are at their highest since July 2017 and about 8 percent above the five-year average for this time of year. Lower oil prices will hurt shale drillers at a time when their finances are already looking shaky. WTI is in the low-$50s per barrel, which means that the average shale driller is likely burning through cash. In the first quarter, most US E&Ps were cash flow negative, at a time when WTI averaged $54 per barrel. The rig count continues to fall. In recent years, the SCOOP (South Central Oklahoma Oil Province) and the STACK (Sooner Trend, Anadarko, Canadian and Kingfisher) basins drew producers and private equity firms to invest billions of dollars on what many considered the next Permian basin. However, the region’s geology proved worse than first thought, undercutting results and making it a higher-cost area for producers. Alta Mesa Resources managed to turn a $3.8 billion investment in the oilfield into a valuation just under $30 million in just two years and says it may not be able to pay creditors. Geology has stymied hopes for a “Permian Jr” in the SCOOP/STACK. Exploration wells suggest a uniform geology that produced high levels of oil, but drillers encountered more complexity underground, and production weighted toward gas – at a time of a global glut and stubbornly low prices for that commodity. Perhaps more than any other US shale basin, the SCOOP/STACK has suffered from a condition known as the “parent/child” well problem, where secondary wells produce less oil than the original. Rising shale oil production in the US that drove gas flaring up 48 percent in 2018 also pushed up the global total by 3 percent to 145 billion cubic meters according to the World Bank’s Global Gas Flaring Reduction partnership. The agency cited satellite imagery that showed the most gas flaring was in the Bakken, the Permian, and the Eagle Ford shale basins. Oil production, the World Bank said, increased by as much as 40 percent in the Permian, 29 percent in the Bakken, and 15 percent in the Eagle Ford. The good news, however, was that the intensity of gas flaring was low, at 0.3 cubic meters of gas per barrel of oil. |

2. The Middle East & North Africa

Iran: The situation changed radically last week when the US accused Tehran of being responsible for the attacks on two oil tankers in the Gulf of Oman. The details of the attacks are not clear, and Iran has denied responsibility; however, in the past, they have threatened many times that they would close off the Straits of Hormuz. From Tehran’s point of view, the problem is to send a message to Washington that it should back off from efforts to take down Iran’s economy without precipitating a total war which would not be good for either side. So far six tankers have been damaged in the vicinity of the Hormuz Straits. This confrontation still has a long way to play out, and there is considerable danger that the 18 million b/d of crude that pass through the straits could be constrained or stopped completely. Concerns are growing that Washington is contemplating some sort of action against Iran; in which case, we could see hostilities by miscalculation.

After the US ended all sanction waivers for Iranian oil customers on May 2nd, Iran’s crude oil exports dropped significantly in May 2019 compared to April and plunged by more than 2 million b/d from their 2.5-million-b/d peak in April 2018, just before the US withdrew from the Iran nuclear deal and moved to re-impose sanctions on Iran’s oil industry. According to industry sources and tanker-tracking data, Iran’s oil exports in May fell to 400,000 b/d, which is less than half of Iranian oil exports in April. Oil income is an essential part of Iran’s state revenues, and the plunging crude exports are crippling the economy.

As Tehran’s economic situation becomes direr, the government is thrashing around for options. For a while, most believed China would ignore the US sanctions and keep Iran afloat, but during May Chinese refiners drastically reduced Iranian imports in May after the US waivers expired on May 2nd. With the US-China trade war still going on, it seems that Beijing does not want to risk more problems and is replacing its Iranian imports with oil from other sources.

Iran has been trying to increase exports of petrochemicals and tap new markets to compensate for sliding oil sales. Tehran has been selling increased volumes of petrochemical products at below market rates in countries including Brazil, China, and India, but now risks losing that market as Washington extends the sanctions to cover more products.

Last week Iran’s Foreign Minister Zarif said: “we will find ways for the welfare and comfort of our nation in these hard conditions, including revising the budget and financial policies to make them oil-free.” “They have opened an economic war on our nation, and we are also facing the Americans’ propaganda and attempts to spread hatred.”

Iraq: Despite an OPEC quota, oil output is rising. Iraq increased crude production in May by about 234,000 b/d, reversing a months-long trend of cuts to meet OPEC ceilings. The federal government and the autonomous Kurdistan Regional Government together produced about 4.85 million b/d in May, up 5 percent from April’s production of 4.62 million b/d, according to an analysis based on data gathered from the country’s producing fields.

IHS Markit says that Iraq shipped an average 1.04 million b/d of crude to India over the first five months of the year and another 870,000 b/d to China—the two biggest buyers of Iranian oil that were left hanging after the sanction waivers expired. Europe was also a large buyer of Iraqi crude, taking in an average 615,000 b/d between January and May this year.

The United States, however, reduced its intake of Iraqi oil significantly: the latest data from the Energy Information Administration said that the US imported an average 275,000 b/d of Iraqi crude in March, down from 422,000 b/d in February and 429,000 b/d in January. The average for January to May, according to IHS Markit, stood at 209,000 b/d.

Washington is allowing Iraq to import Iranian gas for its power grid for another three months by extending a waiver to sanctions – but insists that Baghdad seek alternative sources.

Saudi Arabia: Saudi Arabia’s proved oil reserves are 11 percent higher than previously announced and are now close to 300 billion barrels. This increase comes after the Saudis provided new details on the make-up of their oil and gas reserves. The Saudi’s have 297.7 billion barrels of proved crude and natural gas liquids at the end of 2018, with reserves climbing by 1.7 billion barrels during the year before, BP said in its latest annual Statistical Review. However, the new Saudi reserve figures are some 30 billion barrels higher because Saudi Aramco began classifying its natural gas liquids as crude oil.

Saudi Aramco will hold its very first earnings call in August revealing to the world its H1 2019 results, according to Arabian Business. Aramco first shed some light on a few of its financial figures that were long shrouded in secrecy. In January Aramco shared its independent audit results of reserves and a few months later revealed its 2018 profit. Much of this transparency is due to the need to disclose more information before its stock can be listed publicly. However, the project to list 5 percent of the company on a stock exchange remains on hold.

Aramco has offered to buy a stake in Russia’s liquefied natural gas project Arctic LNG 2 and hopes that project operator Novatek will accept the offer. Asked about recent reports that Aramco has backed out of a deal for the Russian LNG project, Saudi Oil Minister al-Falih told TASS: “No, no, this is not true. Aramco extended the offer, and we hope that offer will be accepted by Novatek.”

Riyadh joined Washington in blaming its rival Iran for the recent attacks on oil tankers along the critical shipping route in the Gulf. Saudi Crown Prince Mohammed bin Salman says his country “won’t hesitate” to tackle any threats, as tensions continue to rise in the region. “We do not want a war… but we won’t hesitate to deal with any threat to our people, our sovereignty, our territorial integrity and our vital interests,” Prince bin Salman told the pan-Arab daily newspaper Asharq al-Awsat.

Libya: Libya’s National Oil Corporation said on Thursday that it is concerned about an increased military presence inside one of the country’s vital oil terminals, Ras Lanuf, warning that the presence of soldiers in the terminal puts critical oil infrastructure at risk. The warning is the latest sign that the ongoing fighting among forces loyal to the Tripoli-based UN-recognized government and a self-styled army of a military commander from the east could spill over to Libya’s oil infrastructure, potentially leading to a supply outage. Libya currently produces just over 1 million b/d.

3. China

President Trump said last Monday he was ready to impose another round of punitive tariffs on Chinese imports if he does not reach a trade deal with China’s president at a Group of 20 summit later this month. After two days of trade talks last month in Washington ended in a stalemate, Trump has repeatedly said he expected to meet Chinese President Xi Jinping at the June 28-29 summit in Osaka, Japan. The next day China said it would respond firmly if the US insists on escalating trade tensions.

Consumer items, largely spared in existing tariffs on Chinese imports, would face 25 percent levies under the Trump administration’s plan targeting $300 billion of Chinese goods that haven’t yet been taxed. This week, the Office of the US Trade Representative is due to open seven days of hearings on the new tariffs to solicit public comment, ending June 25. That is to be followed by one week for submission of written comments, after which President Trump could direct the office to impose the new tariffs.

The US started the tariff battle with China in 2018, seeking sweeping structural changes in Beijing’s policies. Tensions rose sharply in May after the Trump administration accused China of reneging on promises to make fundamental economic changes during months of trade talks. China’s commerce ministry said on Thursday Beijing will not yield to any “maximum pressure” from Washington, and any attempt by the US to force China into accepting a trade deal will fail. Both leaders are set to attend the G-20 summit at the end of June.

Financial advisor Kudlow said last week that “President Trump has indicated his strong desire for a meeting, but the meeting is not yet arranged.” “He’s also indicated that if the meeting doesn’t come to pass, there may be consequences.”

China’s crude oil imports dropped 11 percent to 9.47 million b/d in May from a monthly record in April. Chinese refiners drastically reduced Iranian oil imports after the end of the US waivers, and some state refineries were offline for planned maintenance. In April, just before the waivers ended, Chinas stocked up on Iranian crude, importing about 800,000 b/d —the highest amount that Iran’s top oil customer had purchased since August of 2018.

The Shenghong Group started to build a 320,000 b/d crude distillation unit (CDU) in Jiangsu province on June 1. When completed, this would be the largest CDU in China. The refinery is scheduled to come online in 2021 and will produce a total of about 5.90 million mt of gasoline and diesel per year when it runs at full capacity. The opening of this refinery will intensify competition in China’s domestic fuel market, which is already oversupplied.

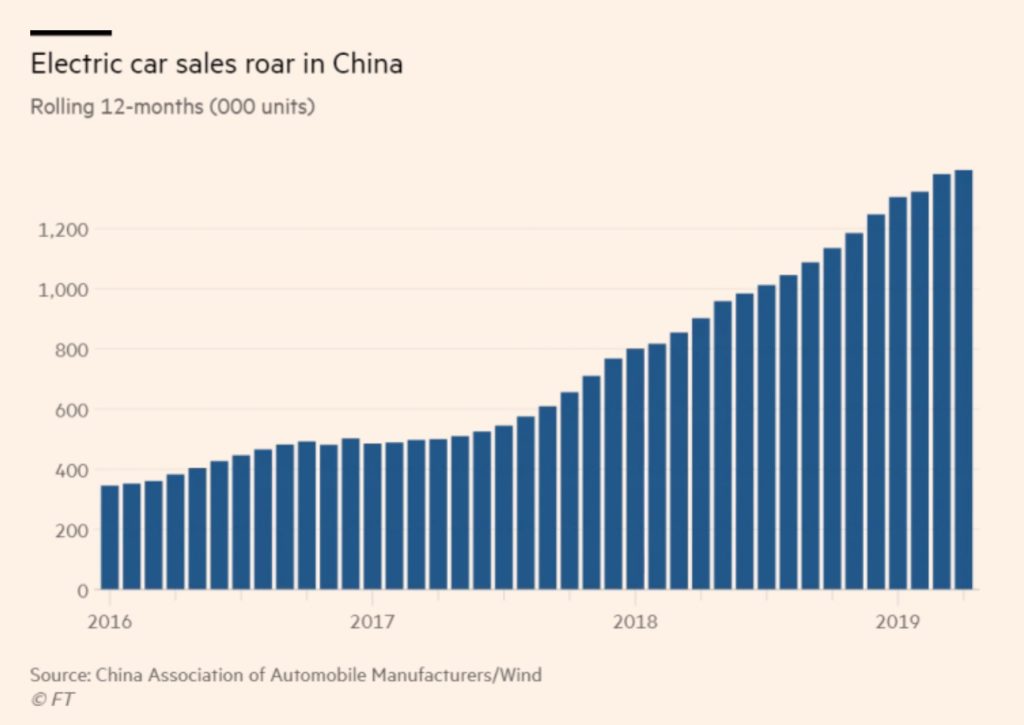

China’s electric vehicle sales have grown tenfold since 2014, and last year it became the first country to see new energy vehicle sales surpass 1 million, about three-quarters of which were pure EVs and the rest hybrids. That growth has been dependent on subsidies averaging at $10,100 per vehicle, allowing companies to lower prices. This month, subsidies will be cut to about $3,600 for most vehicles. The reduction in the subsidy will force companies to raise prices, wiping away one of the key reasons for their sales at a stroke, or accept lower margins on businesses that are already lossmaking. The cut is expected to reduce the year-on-year growth of EV sales to about 20 percent in the second half of 2019 compared with 60 percent in April, as consumers rushed to beat the end of subsidies.

4. Russia

Moscow remains uncertain as to whether to join OPEC in extending the production freeze until the end of the year. Statements by senior officials are ambivalent as to the pros and cons of the extension. One day the officials are talking about oil prices falling to $30 a barrel because too much oil is being produced, and next they are worried about sanctions and other outages resulting in shortages.

5. Nigeria

Nigeria saw production fall significantly during May, mainly due to a fire at its Trans Forcados crude pipeline that forced shut down and force majeure on the key export grade, Bonny Light. The shutdown was a blow to the Forcados exports of roughly 240,000 b/d. Shell manages the crude export terminal, while Heritage Energy operates the pipeline. According to S&P Global Platts survey, Nigeria’s production dropped to 1.86 million b/d last month against 1.95 million recorded in April.

Nigeria’s four refineries operated at just 5.55 percent of their combined nameplate capacity of 445,000 b/d, according to the latest data released by Nigerian National Petroleum Corporation. Despite this dismal performance, throughput was the highest operating level the four refineries have reached in the last six months. The government keeps announcing programs to overhaul the refineries, but nothing seems to happen. The two refineries, located in Port Harcourt, have not operated beyond a quarter of their nameplate capacity for many years, mainly due to sabotage attacks on pipelines carrying crude to the plants as well as technical problems brought on by many years of neglect.

The major International Oil Companies, which have been operating in Nigeria, seem to be tiring of the constant hassle of trying to produce oil onshore in the country and are slowly selling out. Last week Shell called on all stakeholders to help curb the incessant vandalism of pipelines. According to Shell, 90 percent of pipeline leaks are attributable to illegal activities, noting that sabotage spill rate has risen steeply and crude oil theft from Shell’s pipeline network averaged 11,000 b/d in 2018.

6. Venezuela

Yet again, the Trump administration is talking about secondary sanctions against Caracas, although most analysts say they will do no good as Venezuela is already dependent on China and Russia which pay no attention to US sanctions.

The US has blocked imports of Venezuelan crude and condensate into the US, prohibited US dollar transactions with PDVSA, and threatened sanctions on virtually all diluent trade with the company. But the US has yet to impose secondary sanctions on Venezuelan oil flows, similar to those fully re-imposed on Iranian crude last month, subjecting essentially all petroleum trade with a targeted country to US sanctions.

India has agreed to stop exporting gasoline to Venezuela and has reduced its Venezuelan crude imports in response to pressure from the US, but Russia, Venezuela’s most significant remaining crude and refined product trading partner, probably will not halt purchases even if secondary sanctions are imposed, especially since the US is sanctioning Russia itself.

7. The Briefs (date of the article in the Peak Oil News is in parentheses)

In the UK, three Greenpeace activists stopped a BP exploration rig that was supposed to leave this weekend from Scotland to an offshore oil field. (6/11)

Germany and Russian gas: President Trump continued his relentless offense against Russian gas in Europe this week by threatening to slap sanctions on Germany for its equally relentless support of the Nord Stream 2 pipeline project that will increase the flow of Russian gas into Europe. Threats of sanctions have come from Washington earlier as well, targeting European companies involved in the Nord Stream 2 project, including supermajor Shell, Austria’s OMV, and German Wintershall and Uniper, along with French Engie. (6/14)

In Kazakhstan, the Kashagan oil field hit a record-high oil production of 400,000 b/d on Tuesday, a few weeks after returning from planned maintenance. Kashagan, which began production in 2016, has reserves of 13 billion barrels of crude and in-place resources of as much as 38 billion barrels. (6/13)

Caspian swindle? When representatives of the five Caspian littoral states meet on the 11th and 12th of August, Iran intends to seek some redress from Russia on Moscow’s maneuvering last August. The Islamic Republic believes that it was robbed of its historical rights in the Caspian, conned out of a US$50 billion per year income, and left without Russia’s support against the re-imposition of US sanctions. (6/14)

Indonesia on Thursday began testing biodiesel with a bio-content of 30% in cars, its energy ministry said, as the Southeast Asian nation pushes to boost local markets for its vast palm oil crop. The world’s top palm oil exporter aims to make it mandatory for all biodiesel to have a 30% bio-content, known as B30, from next year, up from 20% now. (6/13)

In Sierra Leone’s capital Freetown, fuel scarcity has hit since Sunday, causing long queues at gas stations and hampering the movement of vehicles and goods across the country. (6/13)

In Argentina, Exxon plans to drill 90 wells and produce 55,000 barrels of oil equivalent from an oil and gas block in the Vaca Muerta shale play. Exxon said this production rate would be achieved in five years. A further production expansion would be in order, to bring the total production from the block to 75,000 barrels of oil equivalent daily. Vaca Muerta holds reserves estimated at 22.8 billion barrels of oil equivalent. Argentina wants production to hit 1 million b/d by 2023—a tall order given the state of the region’s oil infrastructure today, the lack of frack sand near the play, and regulatory barriers. (6/13)

Cubans are experiencing chronic food shortages after imports of fuel from Venezuela dried up, leading to rationing being widely imposed. Havana has attributed the lack of food to problems with overseas providers, many of whom are trying to cope with US sanctions. (6/13)

Mexico’s oil regulator plans to announce the cancellation of auctions scheduled for October to pick joint venture partners for state-run energy company Pemex in seven onshore areas, two sources close to the decision told Reuters on Thursday. The auctions have already been postponed twice since last year. (6/14)

Rystad high on US oil: In its latest annual report of world recoverable oil resources, Rystad Energy finds that the US currently holds 293 billion barrels of recoverable oil resources. This is 20 billion barrels more than Saudi Arabia and almost 100 billion barrels more than Russia. Rystad Energy’s estimate of US recoverable oil is also five times more than officially reported proven reserves as published in the BP Statistical Review of World Energy 2019. Tight oil plays in the Permian Basin in Texas and New Mexico now hold 100 billion barrels of recoverable oil resources, according to Rystad. (6/14)

Record production increases: US natural gas and crude oil production increased last year at the fastest pace ever for a single country. US oil output jumped 2.2 million barrels a day while natural gas output soared 86 billion cubic meters in 2018—both one-year records during the world’s petroleum era. (6/12)

The US oil rig count fell by 1 to 788 while the gas rig count dropped by 5 to 181, according to GE’s Baker Hughes. (6/15)

Exxon Mobil Corp. and Saudi Basic Industries Corp. (SABIC) will proceed with construction of a 1.8-million-metric-ton ethane steam cracker complex — “The world’s largest” according to Exxon Mobil—near Corpus Christi, Texas, that will create more than 6,600 jobs, ExxonMobil reported Thursday. (6/14)

Prices for jet fuel for later this year and into 2020 are expected to rise due to new marine fuel regulations – as the need for lower-sulfur fuels in ships cuts into the available supply for similar distillates like diesel or jet fuel. However, the global abundance of light crude could help offset that. Light crudes produce a byproduct known as naphtha, normally used to make plastics, but refiners can shift their processes to use it for jet fuel production instead. (6/11)

Biofuels come up short: Since its introduction more than a decade ago, the Renewable Fuel Standard hasn’t cut gasoline prices outside the Midwest and has even led to a slight rise in pump prices in states far from ethanol production, while the standard has had a limited effect, if any, on greenhouse gas emissions. These are the key findings of a new report from the US Government Accountability Office prepared at the request of Oklahoma Republican Senator James Lankford. (6/10)

The main US refining industry association said on Monday it sued to block the Trump administration’s effort to expand sales of higher ethanol blends of gasoline, arguing the move exceeded the administration’s authority. The legal challenge from the American Fuel and Petrochemical Manufacturers association escalated a battle between the oil and corn industries over the nation’s biofuel policy, which requires refiners to blend biofuels like corn-based ethanol into their gasoline, often at great expense. (6/11)

EVs could slow: A potential shortage of minerals needed to produce the billions of batteries required to power electric vehicles risks slowing down the transition from internal combustion engines to cleaner forms of transport, according to a team of UK-based scientists. (6/13)

Chinese EV start-ups face a struggle to survive in the face of intensifying competition and subsidy cuts. Although analysts are reluctant to name companies that could disappear, the two dozen Chinese EV start-ups such as Nio and Xpeng, which have raised more than $10 billion in recent years, are expected to be cut down to a handful. (6/13)

Nuclear headed for sunset: Recently, the International Energy Agency (IEA) warned that neglect of the world’s nuclear electric generating plants would lead to a precipitous decline in climate-friendly nuclear energy production around the world. The agency, a consortium of 30 countries which monitors energy developments worldwide, said 25 percent of nuclear capacity could be lost by 2025 and two-thirds by 2040. The cause is clear. Little new capacity is being built and much of the current fleet of reactors is nearing the end of its lifespan. (6/10)

Coal pollution fraud? Three US senators on Monday urged the Internal Revenue Service to crack down on a $1 billion-a-year subsidy for burning chemically treated refined coal after a new study showed some power plants using the fuel produced surging amounts of mercury and smog instead of cutting pollution. (6/11)

UK coal shuttering: UK energy provider SSE said on Thursday that it is proposing to close its last coal-fired power plant in the country by March 2020, amid a national and international drive for lower-carbon sources of electricity generation. (6/14)

Coal offload: Norway’s $1 trillion sovereign wealth fund may have to sell its $1 billion stake in commodities giant Glencore, among other companies that derive more than 30 percent of their revenue from coal, to meet proposed tighter ethical investing rules. Under a plan expected to be adopted by Norway’s parliament on Wednesday, the world’s largest fund would no longer invest in companies that mine more than 20 million tons of coal annually or generate more than 10 gigawatts of power with coal. (6/12)

US wind farm projectdevelopers continue to announce new wind power capacity in an industry that grew eight percent last year and contributes more than US$1 billion in state and local taxes every year. US wind power construction and development jumped to a record level in the first quarter of 2019, increasing by 6,146 megawatts (MW)—more than the capacity of all operational wind farms in California. But the trade war with China and tariffs on Chinese imports threaten to slow down the US wind industry growth. (6/13)

Solar nirvana? Theoretically, the Sahara Desert has huge potential to be the world’s biggest renewable energy source. But in practice, there are technological, regulatory, environmental, and political hurdles to turning the Sahara into one giant solar park. Sand from wind storms could coat panels and/or mirrors, reducing output; PV panels are less efficient when hot; political stability in the region is an issue; and more. (6/12)

Position on climate shifting: A small but growing number of Republican lawmakers are urging action on climate change, driven by shifting sentiment among GOP voters and the effects of global warming, from stronger hurricanes to more-destructive wildfires. The group backs policies rooted in what they consider GOP principles, favoring market-based solutions. (6/13)

Fossil fuel companies are already grappling with the risks posed by climate change, from the physical threats of extreme weather to the challenge of switching to cleaner energy. Now they have a new item rising up their list of worries: liability lawsuits. Over the past two years, a growing number of legal cases in the US – brought by cities, counties, and the State of Rhode Island – are seeking damages from energy companies for a litany of climate-related problems. (6/11)

BP on climate: The world is moving further away from a sustainable path as carbon emissions increased last year at the fastest pace since 2011 due to unusually hot and cold spells in many parts of the world that drove a rise in energy use. This was one of the key messages in the 2019 BP Statistical Review of World Energy just released. BP has estimated that a large part of the surprisingly high growth in energy demand last year was due to weather-related effects, with an unusually large number of hot and cold days across major demand centers, especially in the U.S., China, and Russia. (6/13)

Climate push: A top US financial regulator is worried that climate change could threaten global financial markets. Rostin Behnam, a commissioner at the Commodity Futures Trading Commission (CFTC), said that the financial system was at risk from the growing frequency and severity of storms. (6/13)

Hard climate push: In the UK, greenhouse gas emissions will be cut to almost zero by 2050, under the terms of a new government plan to tackle climate change. Prime Minister Theresa May said reducing pollution would also benefit public health and cut NHS costs. Britain is the first major nation to propose this target – and it has been widely praised by green groups. But some say the phase-out is too late to protect the climate, and others fear that the task is impossible. (6/12)

Arctic warming: In recent days, observations have revealed a record-challenging melt event over the Greenland ice sheet, while the extent of ice over the Arctic Ocean has never been this low in mid-June during the age of weather satellites. Greenland saw temperatures soar up to 40 degrees above normal Wednesday. (6/15)

India’s killer climate: One of India’s longest and most intense heat waves in decades, with temperatures reaching 123 degrees, has claimed at least 36 lives since it began in May, and the government has warned that the suffering might continue as the arrival of monsoon rains has been delayed. India’s heat waves have grown particularly intense in the past decade, as climate change has intensified around the world, killing thousands of people and affecting an increasing number of states. (6/14)