Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The Governor has long-held concerns about fracking and its impacts on Californians and our environment and knows that ultimately California and our global partners will need to transition away from oil and gas extraction.”

Governor Gavin Newsom’s chief of staff Ann O’Leary, after the Governor, fired the state’s lead oil regulator upon learning that fracking permits had doubled this year over last.

Graphic of the Week

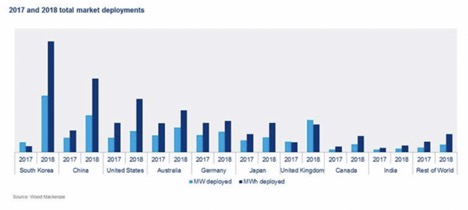

Battery storage deployment during the last two years:

| Contents 1. Oil and the Global Economy 2. The Middle East & North Africa 3. China 4. Russia 5. The Briefs 1. Oil and the Global Economy After six days of steady price drops that took prices down about $5 a barrel, oil rebounded about 1 percent on Friday. The rebound came on news that Iran had seized a British registered tanker while sailing in Omani waters through the Straits of Hormuz. Oil closed out the week at $55.63 in New York and $62.47 in London. So far, there is no indication that Britain is planning a military response to the seizure of the ship which is owned by a Swedish firm. The escalation of the Straits standoff adds another dimension to the oil price story. For now, there seem to be three major factors at work that will determine the immediate future of oil prices. Any interruption in tanker traffic through the Straits of Hormoz would obviously send oil prices higher – perhaps even to unprecedented levels if the outage is widespread and prolonged. There are few good alternatives to shipping oil, and in 2018, its daily oil flow averaged 21 million b/d, or the equivalent of about 21 percent of global petroleum liquids consumption. The Saudis and the UAE have pipelines which bypass the Straits, but their capacity is only about 6 million b/d. Marine insurance rates on ships passing through the Straits are reported to be up nearly 10-fold. The next major factor that will determine oil prices is slowing demand and a glut in the global crude markets. The IEA is reducing its 2019 oil demand growth forecast to 1.1 million b/d from 1.2 million due to a slowing global economy and the US-China trade dispute. With the growth of China’s economy recently registering a 27-year low, settlement of the disagreement may be the only hope for increasing demand. Finally, we have the growth rate of the US shale oil industry, which has been lagging this year. A few months back we were looking a 1 million b/d + annual increase in production. It is too early to say that the US shale oil production is going into decline. However, it is clear that estimates of rapid growth continuing for decades were too optimistic and could well pause soon. The factors that are leading to a decline in shale oil production will not always obtain. Fighting in the Middle East could well drive oil prices so high that production may become profitable again. Overproduction gluts are always cleared, and business activity always rebounds. US shale oil production declined in 2016-2017 but rebounded to new highs. The OPEC Production Cut: The cartel is currently restricting production for at least a year to keep oil prices from tumbling in an oversupplied market showing signs of faltering demand growth. However, the national oil companies (NOCs) of the cartel’s most significant producers are thinking long term and want a share of the profitable oil trading business. The state-held oil firms of OPEC’s largest producers—Saudi Arabia, Iraq, and the United Arab Emirates —plan to significantly boost their respective oil trading businesses in search of additional income from the enormous commercial and marketable oil resources they own. The NOCs are already competing with the largest independent oil traders such as Vitol, Trafigura, Glencore, Mercuria, and Gunvor; however, the NOCs have one massive advantage over independent oil traders, and that is the fact that NOCs own their oil. The Abu Dhabi National Oil Company (ADNOC), which pumps most of the crude oil from the UAE, plans to launch its own oil benchmark for the region, possibly as soon as November. The new benchmark would be part of a more extensive plan to overhaul its oil trading division and gain more pricing influence for its oil sales. Earlier this year, ADNOC signed strategic partnership agreements with Italy’s Eni and Austria’s OMV, under which the European oil majors bought minority stakes in ADNOC Refining, and the three companies agreed to create a trading joint venture. US Shale Oil Production: The rapid growth that doubled crude output from the Permian Basin in three years is waning. Oil flows from the formation are set to increase by less than 1% in August from July, data from the Energy Information Administration show. So far this year, the monthly rate has only exceeded 2% once, compared with six times in 2018. Producers are dialing back growth plans due to a myriad of problems, including pipeline jams, slower flows from wells drilled too close together, and higher costs for acreage. The dilemmas are killing returns and keeping investors at bay. Permian explorers such as Parsley Energy Inc. are cutting their 2019 growth rates by as much as 40 percentage points below last year’s. The number of rigs in the basin has dropped 10% from a peak in November to 437 last week, the fewest since March 2018, according to data from Baker Hughes. S&P Global Ratings say the number of financially distressed oil and gas companies is increasing as investors lose interest, access to more credit is throttled, and companies struggle to live within cash flows. Consolidation through mergers that lower costs may not prove to be a solution as oil and gas prices stay low, the credit rating agency said. Bankruptcy may be the only option, even for companies that declared bankruptcy during the 2015-2017 oil price trough. The July issue of the EIA’s Drilling Productivity Report attempts to forecast how much each shale oil basin will change its production in the month ahead. This month the Administration says that US shale oil production will increase by 49,000 b/d from the six largest shale oil basins. For August 2018, the increase was estimated to be 143,000 b/d. These days the estimates are frequently optimistic and are revised downwards when actual production numbers become available six weeks later. If US shale oil production goes into decline in the next few years, either due to geological conditions or unprofitability, there will be a major change in the nature of the oil business. For now, the major forecasters, including the IEA, are saying it won’t and that there will be plenty of oil into the 2030s or 40s. |

2. The Middle East & North Africa

Iran: The standoff within the Gulf took a turn for the worse last Friday when Iranian special forces rappelled from a helicopter onto a Swedish-owned, but UK-registered tanker transiting Omani waters in the Strait of Hurmuz and forced it to sail to an Iranian port. The move was in retaliation for Britain’s seizure of an Iranian tanker trying slip crude into Syria but was in Gibraltar’s territorial waters at the time it was seized. The EU sanctions on Syria ban any foreign shipments of oil to Damascus.

Before the recent seizure, British Foreign Secretary Hunt offered to return the detained Iranian tanker provided that Iran guaranteed its oil wouldn’t go to Syria. Gibraltar on Saturday freed the four Indian seamen who crewed Iran’s ship. Hunt said last week that he spoke with Iranian Foreign Minister Zarif on “finding a resolution to the current situation and avoiding further escalation.”

The UK has warned Iran that it risks taking a “dangerous path” after the Islamic republic seized the British-flagged tanker and said Britain’s response would be “considered and robust”. Jeremy Hunt, the UK’s foreign minister, made it clear that the UK was seeking to solve the crisis through diplomacy. “We are not looking at military options, we are looking at a diplomatic way to resolve the situation, but we are very clear that it must be resolved,” Hunt told Sky News after meetings of the government’s top crisis management body Cobra on Friday.

Facing vigorously enforced US sanctions directed principally at oil, Iran is focusing on the less targeted strategic areas in its hydrocarbons business, notably continuing to develop its gas sector and building out its petrochemicals and related capacity. One such area is the generation of sufficient gasoline at least to meet its own needs, as its reliance on other countries during the previous sanctions’ era was seen as a national humiliation. Despite the worsening sanctions environment, Iran is now not only self-sufficient for gasoline but is rolling out plans to allow it to export the product.

The increased use of drones by Iran and its allies for surveillance and attacks across the Middle East is raising alarms in Washington. The US believes that Iran-linked militia in Iraq has recently increased their surveillance of American troops and bases in the country by using off-the-shelf, commercially available drones, US officials say. The disclosure comes at a time of heightened tensions with Iran and underscores the many ways in which Tehran and the forces it backs are increasingly relying on unmanned aerial vehicles in places like Yemen, Syria, the Strait of Hormuz and Iraq. Beyond surveillance, Iranian drones can drop munitions and even carry out a “kamikaze flight.”

Iraq: Exports from Iraq’s southern ports reached 3.42 million by the middle of July, two oil officials told Reuters last week. These exports fell to 3.39 million b/d in June from 3.441 million b/d in the previous month. Officials said repairs on a section of a marine pipeline in the Gulf which transports crude oil to the Basra ports slowed shipments for three days in mid-June. Iraq has been under pressure both to lower and to raise production. OPEC members have insisted that all countries should comply with their quotas, while the US has been lobbying for higher output.

Baghdad wants to increase its oil production to 6.2 million b/d by end-2020 and 9 million bpd by end-2023, up from the current 4.6 million b/d and on a par with Saudi Arabia’s output. Government officials have made it clear to foreign and domestic oil field developers alike that increases must be made, or contracts will be reviewed. Three key fields are currently in the spotlight – Rumaila, West Qurna 1, and Gharraf – with more to follow shortly.

Infrastructure constraints, however, may continue to thwart the realization of these ambitions on schedule. Rumaila produced 1.467 million b/d last year, its highest annual rate of production for 30 years. This figure is above the 1.173 million b/d initial target output figure agreed with BP in the original 2008 contract but still well below the plateau target at that time of 2.850 million b/d. The re-negotiated objective for Rumaila is 2.1 million b/d.

An American consortium led by Honeywell is poised to win a major gas deal in Iraq, bolstered by US government lobbying for projects that would reduce Iraqi dependence on Iranian energy. Honeywell, which is partnering with the US firm Bechtel, signed a memorandum of understanding in Baghdad last week to build the Ratawi gas hub.

Libya: Oil revenues dropped in the first half of 2019, according to its central bank. In the first six months of the year, the revenues were down 11.2 percent from the same period in 2018, falling to $10.2 billion in H1. Like most OPEC members, oil is the backbone of the Libyan economy, representing 92.8% of its total income.

Despite the sagging revenue, oil production in the first two quarters of 2019 was higher than in 2018, according to OPEC secondary sources found in its Monthly Oil Market Report. However, oil prices were less favorable at the beginning of 2019 than they were at the beginning of 2018, with the OPEC basket price the first week of January in 2019 running about $10 under the level it was trading at that same time during the year prior.

3. China

China’s growth fell to its slowest pace in nearly three decades, officials announced last week, as a resurgence of trade tensions with the United States and lingering financial problems take an increasing toll on one of the world’s most important economic engines. Officials said the economy grew 6.2 percent between April and June compared with a year earlier. While such economic growth would be the envy of most of the world’s countries, it represented the slowest pace in Chinese economic growth since the beginning of modern quarterly record-keeping in 1992. Numerous outside analysts have noted that official statistics probably paint too flattering a picture of the Chinese economy. Per-capita income may be a quarter lower than reported, based on a study of nighttime light co-authored by Yingyao Hu of Johns Hopkins University. Alternative data such as tax collections suggest growth was 1.8 points lower than reported from 2010 to 2016, Chang-Tai Hsieh of the University of Chicago and three co-authors conclude.

China rebuffed a suggestion from President Trump that Beijing needs a trade deal with the United States because its economy is slowing, saying this was “totally misleading” and that both countries wanted an agreement. Trump, in a Monday tweet, seized on slowing economic growth in China as evidence that US tariffs were having “a major effect” and warned that Washington could pile on more pressure.

Trump warned that the US-China trade war could ratchet up further if the United States wants. In a cabinet meeting last Tuesday, Trump said, “we have a long way to go as far as tariffs, where China is concerned if we want.” “We have another $325 billion that we can put a tariff on if we want,” he continued. In the meeting, the president confirmed that the US is currently talking to China about a deal but added that he wished China “didn’t break the deal that we had.”

Chinese crude oil throughput hit a new record in June as two new large refineries started up, driving processing rates higher, according to official data from China. Last month, Chinese refineries increased crude throughput by 7.7 percent year on year, to around 13.07 million b/d. Throughput, however, is not expected to break the new record from June at least in the next few months, as there would be extended shutdowns amid high diesel and gasoline inventories and weak domestic fuel demand.

Thanks to demand from the start-up of the two large refineries, Chinese crude oil imports in June also increased, by 1.7 percent from May, and by 15.2 percent from June last year. China’s crude oil imports in June averaged 9.63 million b/d, up from the average of 9.47 million bpd in imports in May, and a 15.2-percent increase from 8.36 million b/d in June last year.

To meet the growing demand for electricity, China’s biggest power generator, China Energy Group, is planning to build 11 gigawatts (GW) of new coal power during this and next year, according to a senior official with the firm on Thursday. More than 6 GW of new ultra-low emission coal-fired capacity will be added this year while another 5 GW is planned for 2020, the head of the state-run firm’s coal-fired power department, told Reuters. “China still has quite a big demand for electricity. The government now supports regions with poor wind and solar resources to use coal-fired power … it’s a more practical measure, as gas is still too expensive,” said Xiao. China Energy, which operated coal-fired plants with a total capacity of 175 GW, is planning to gradually replace small, polluting coal-fired power units with efficient ones.

As could be expected, China’s greenhouse gas emissions jumped by 53.5 percent in the decade between 2005 and 2014, according to Chinese government figures.

4. Russia

A small oil transport firm accused of pumping toxic chemicals into Russia’s crude pipeline network received daily documents from state pipeline monopoly, Transneft, giving its oil deliveries a clean bill of health. The documents seen by Reuters certified the oil deliveries from March 30 to April 19, the period when the worst contamination of Russian oil in decades was taking place

Russian prosecutors have detained two executives with the small oil transport firm, which is called Nefteperevalka. At an April 30 meeting with Putin, Transneft boss Tokarev said the contamination was the fault of an unnamed local oil company that supplied poor-quality oil as part of a criminal scheme. The firm to blame for the contamination “takes care of the quality of this oil, the certification of that quality, and then transmitting it into the trunk pipeline network,” Tokarev was quoted as telling Putin in a transcript released by the Kremlin.

The alarm was first raised about the contamination on April 19 after the tainted oil reached Russia’s western neighbor Belarus. The oil would have taken around eight days to travel the roughly 1,000 km from the Samara region, based on the average speed at which oil flows through the pipeline. Although the fighting over who pays for the debacle continues, the final bill could easily run into the hundreds of millions or even billions of dollars.

Gazprom’s natural gas exports outside the former Soviet Union declined by 5.6 percent to 102.8 billion cubic meters between Jan. 1 and July 15 compared to a year earlier. Gazprom’s natural gas output over the same period rose by 2.3 percent to 276.3 billion cm from a year earlier, the company said.

5. The Briefs (date of the article in the Peak Oil News is in parentheses)

Oil majors are investing in various alternative energy solutions in response to increased investor pressure to start thinking about reducing emissions instead of just growing profits. Some supermajors are investing in EV charging networks, others in research and development of advanced lower-emissions technologies, and a few others are looking into hydrogen and its various possible uses as a clean fuel–not only for cars but also for heavy industries and home heating. (7/17)

The world’s oil tankers risk losing almost a third of their value should a shift away from fossil fuels gain momentum in the coming decades, a new report has warned. The $160bn tanker market is “most exposed” to a low carbon energy system given that it is dependent on fossil fuels with few alternative cargos available. (7/17)

Compliance with the International Maritime Organization’s global sulfur limit for marine fuels will likely settle around 90% or 95% in the initial years after 2020, well above some industry estimates that pointed to compliance of 70%-80% a year ago, a bunker industry veteran and senior partner at 2020 Marine Energy, Adrian Tolson, said at an industry event Monday. (7/17)

The United Arab Emirates’ state-run ADNOC, long seen as one of the most conservative oil firms in the Middle East, plans an overhaul for its trading operations as it seeks to emulate the success of rival oil majors and bolster its regional influence. The company has splurged on hiring former employees of private-sector peers and wants to launch a regional oil benchmark, possibly this year, similar to international markers Brent and WTI, four sources familiar with the plans said. (7/17)

India’s government doesn’t plan to completely ban diesel and gasoline vehicles because continuously rising fuel demand has to be met by a combination of fossil fuels, biofuels, and electric vehicles, Indian Oil Minister Dharmendra Pradhan said on Tuesday. India plans to significantly boost the use of electric vehicles in the coming years. (7/17)

China’s LNG push: Thanks to its massive coal-to-natural gas switch, China became the world’s second-biggest LNG importer in 2017, surpassing South Korea and second only to Japan. Demand for natural gas in China will continue to grow in the coming years. According to the IEA, China is set to surpass Japan as well, with Beijing’s imports expected to surge to more than 100 bcm in 2024. (7/17)

In China, a massive explosion has been reported at the Yima gas plant in Henan province, damaging buildings in a 3-kilometer radius. As of Sunday, Chinese news outlets report 15 dead and 15 seriously injured.

Argentina’s surging shale oil production is feeding more supplies to the country’s refineries, helping to increase run rates, the Neuquen government said Wednesday. Refineries operated at an average of 78.3% of capacity in May, the highest rate in seven months, the state statistics agency Indec reported Monday. The increase is a direct result of the takeoff of Vaca Muerta, a giant shale play. Vaca Muerta is leading a recovery in the country’s oil production, which rose 4.2% to 505,651 b/d in May from 485,165 b/d a year earlier. (7/17)

In Brazil, two Iran-flagged vessels have been sitting idle in ports for weeks because they need fuel to return to Iran, but Brazil’s Petrobras refuses to sell them fuel because of the U.S. sanctions on Iran that could also affect the Brazilian state energy firm listed in New York. The ships carried urea (for fertilizer) to Brazil and planned to return carrying corn. (7/20)

In Delta, British Columbia, the recently expanded Tilbury LNG terminal has won its first export contract. FortisBC stated that it will produce LNG for Top Speed Energy Corp. to export to China under a two-year term supply agreement. Under the agreement, 53,000 tons of LNG a year – approximately 60 standard-sized ISO shipping containers per week – will be shipped from Tilbury to China by the summer of 2021. (7/17)

In Kitimat, BC, Chevron Corp. is seeking approval to modify its plans for a liquefied natural gas export facility on to an all-electric design that it says will result in the lowest greenhouse gas emissions per ton of LNG of any large project in the world. Chevron and its partner Woodside Petroleum Ltd. earlier this year had announced they’d applied to expand the capacity of their LNG project on Canada’s Pacific coast by as much as 80% to 18 million metric tons a year. That triggered a new federal screening of the project. (7/16)

The U.S. oil rig count declined by five to 779, according to GE’s Baker Hughes. That’s down 79 rigs, over 9%, from last year at this time. (7/20)

Huge GOM lease sale: The U.S. Secretary of the Interior David Bernhardt and Bureau of Ocean Energy Management (BOEM) announced Thursday that BOEM proposes to offer 77.8 million acres for a region-wide lease sale. The sale is scheduled for August 21, 2019 and would include all available unleased areas in federal waters of the Gulf of Mexico. (7/20)

The Philadelphia Energy Solutions refinery in Pennsylvania, the oldest and largest one (335,000 b/day) on the U.S. East Coast, is expected to shut its remaining units on Monday as the plant uses up the last of its crude supplies. (7/17)

“Homeless crude”: A June 21 fire and explosion set to permanently close the biggest oil refinery on the U.S. East Coast has shaken markets as far away as the North Sea and West Africa, leaving millions of barrels of unsold oil in need of a new home. The Philadelphia Energy Solutions (PES) refinery was a consistent buyer of light sweet crude oil, and the backlog of cargoes bound for PES are either in limbo or in the process of being diverted to neighboring refineries and abroad. Prices for physical crude oil are being squeezed, with as many as 20 million barrels bound for PES in the process of being rerouted. (7/20)

LNG growth: The U.S. will surpass current market leaders Australia and Qatar to become the world’s biggest liquefied natural gas (LNG) exporter in 2024, a high-ranking official at the International Energy Agency (IEA) said on Tuesday. The U.S. exports of LNG are expected to exceed 100 billion cubic meters (bcm) in 2024. (7/17)

Permian Basin gas prices averaged their highest since mid-March during the past week propelled by rising summer demand in local and regional markets. Over the past seven days, cash prices at Waha have averaged 97 cents/MMBtu, up from negative territory during the first week of July. On Friday, prices were down nearly 40 cents from the prior-day settlement, trading around 37 cents/MMBtu. (7/20)

EV school buses: The California Energy Commission approved nearly $70 million in funding to replace more than 200 old diesel school buses with all-electric buses that will reduce school children’s exposure to harmful emissions and help the state reach its climate and air quality goals. (7/16)

RE nosedive: A marked decline in spending on renewable energy projects during the first half of the year has suggested that wind and solar have yet to become fully competitive with fossil fuel power generation despite the wealth of reports saying they already are cheaper in some parts of the world. Bloomberg NEF reports that spending on renewable projects between January and June totaled US$117.6 billion, which was 14 percent less than a year earlier and the lowest amount for a comparable period since 2013. (7/17)

China’s battery boom: China is set to become the single biggest energy storage market in the Asia Pacific region by 2024, according to consultancy group Wood Mackenzie. The company’s July 9th report states in no uncertain terms that the country is poised to take over the energy storage market, as its “cumulative energy storage capacity is projected to skyrocket from 489 megawatts (MW) or 843 megawatt-hours (MWh) in 2017 to 12.5 gigawatts (GW) or 32.1GWh in 2024. (7/15)

In Germany, power production from North Sea wind farms from January to June totaled 9.51 terawatt hours (TWh), 16% more than in the same 2018 period. Offshore wind from North Sea turbines had retained a 15% share of Germany’s total wind power production of nearly 64 TWh in the last six months. (7/15)

In India, nearly 75 percent of power is still generated from coal. While coal-fired power generation is still growing, ambitious clean energy policies and falling solar costs could soon stop this trend. Since demand for energy in India is set to double over next decade caused by the rapid growth of its economy and population, its complete rejection of coal dependence in the near future seems far too big of a challenge. (7/17)

America’s biggest solar power developers are stockpiling panels to lock in a 30% federal tax credit set to start phasing out next year, a strategy that could backfire if projects do not materialize or panel prices slide substantially. Duke Energy, 8minute Solar Energy and Shell-backed Silicon Ranch are among those working to claim the full subsidy, which is available to firms that either start construction or spend 5% of a project’s capital cost by the end of 2019. (7/20)

French extreme weather: France’s restrictions on crop irrigation are staggered by region, ranging from a one-day ban each week to a total prohibition of water usage in agriculture. France’s dryness stems in part from an abnormally hot summer in Europe, part of a broader trend of rising global temperatures. Temperatures spiked to never-before-seen levels across the south of France earlier this summer, exceeding 114 degrees Fahrenheit in late June. In Paris, there has been no precipitation since June 21. (7/17)

US CO2 down? The decrease in coal-derived energy in favor of natural gas-derived energy has the EIA forecasting that the CO2 emissions in the U.S. will fall in 2019, according to a new report. In the year prior, energy-related CO2 emissions in the United States had increased by 2.7%. (7/16)

In California, fracking for oil and gas is about to get a lot more difficult. Last week, California Governor Gavin Newsom sacked the state’s top oil regulator after the Desert Sun reported that fracking permits in California doubled in the first six months of this year without the Governor’s knowledge. (7/16)

African corruption: The bulk of an estimated $90 billion that left Africa annually through illicit financial flow to overseas might have come from Nigeria. The Chairman of the Independent Corrupt Practices and Other Related Offences Commission made the disclosure on Thursday at the 2019 Africa Union Anti-Corruption Day in Lagos. (7/15)