Editors: Tom Whipple, Steve Andrews

Quote of the Week

“This quarter’s [bad] results reflected a macro environment of slowing production growth rate in North America land as operators maintained capital discipline, reducing drilling and frac activity.”

Olivier Le Peuch, CEO of largest oil services company Schlumberger

Graphic of the Week

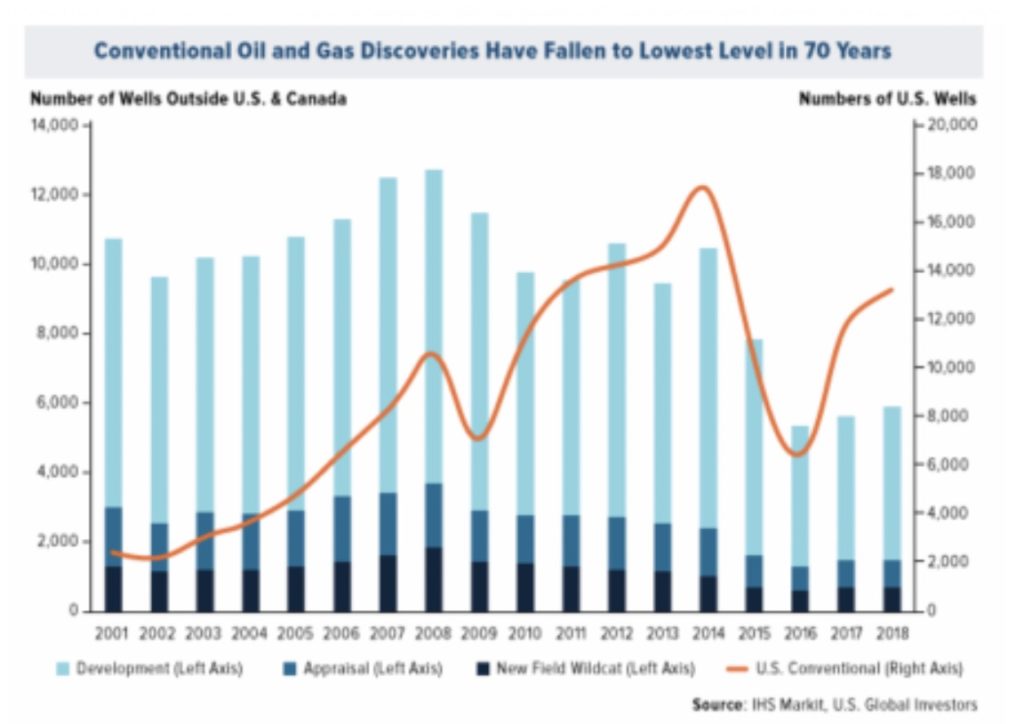

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil prices slipped last week with Brent down 1.8 percent to close at $59.42. WTI closed $53.82, down 1.7 percent. Concerns increased about China’s economy, which slowed to 6 percent year-over-year growth in the third quarter, the slowest growth in 27-1/2 years. Many outside observers of China’s economy have noted for years that GDP numbers are likely inflated due to the nature of China’s economic reporting systems. Crude inventories continue to grow with US crude inventories up by 9.3 million barrels in last week’s stockpiles report. A combination of a trade war and slowing economies are keeping a lid on oil prices despite the geopolitical news from the Middle East, which could eventually lead to lower oil production. Commerzbank pointed out several factors that have failed to move the needle on oil prices. The “robust Chinese crude oil imports reported for September are being ignored by the market, as is the military escalation brought about by Turkey’s invasion of the Kurdish areas of northern Syria,” the investment bank said. US oil production continues to slow. Amid low oil prices skeptical investors are becoming increasingly worried that the shale oil industry will never produce profits. The total number of active oil and gas rigs in the US is now 851, down 216 from the count of 1,067 a year ago. The EIA’s monthly Drilling Productivity Report forecasts that shale oil production will only increase by 58,000 b/d between October and November. For the same period in 2018, the administration estimates an increase of 98,000 b/d. The gap between production from “legacy” wells that have been in production for more than a month, and production from wells that came into production in the current month continues to narrow. When the two lines cross, US shale oil production will start to decline. The EIA says that Permian regional production averaged 3.3 million b/d in 2018 and is expected to average 3.9 million b/d in 2019. Permian may reach 5.4 million b/d by 2023, according to oil industry consultants IHS Markit but this forecast seems optimistic. Sweet spots are becoming less productive, and only Exxon and Chevron have the in-house capital to continue drilling at the pace necessary to offset the increasing depletion from existing wells. |

2. Geopolitical instability

Northern Syria is still in chaos with scattered firing continuing as thousands of Kurds evacuate before the “ceasefire” ends on Tuesday. Everybody involved in the incursion is putting out press releases accusing whoever they don’t like of ceasefire violations. If the fighting continues, it is difficult to see how the Turks can allow Kurdish oil exports through Turkey to continue. In the longer run, Ankara’s incursion is likely to lead to instability that will continue for years.

So far, Ankara’s invasion of northern Syria and the pullout of US troops from the area have had little impact on oil prices. Russia’s Rosneft has temporarily suspended work at one block in Iraq’s semi-autonomous region of Kurdistan due to security concerns because of the blocks’ proximity to the Syrian border. In the chaotic aftermath of the US military’s withdrawal from northern Syria, Iraqi leaders are bracing for an influx of refugees and are scrambling to prevent a resurgence of ISIS. “There is a security plan, which the Defense Ministry is implementing jointly with other service ministries, to prepare for any emergency, such as waves of displacement,” said a senior officer. “As for the IS militants who might sneak in with other families and civilians, we have full information and databases.”

Iran-backed militias deployed snipers on Baghdad rooftops this month during Iraq’s deadliest anti-government protests in years, Iraqi security officials told Reuters. The deployment of militia fighters underscores the chaotic nature of Iraqi politics amid mass protests that led to more than 100 deaths and 6,000 injuries during the week starting Oct. 1st. Such militias have become a fixture in Iraq with Iran’s rising influence. They sometimes operate in conjunction with Iraqi security forces, but they retain their own command structures. The Iraqi security sources say the leaders of Iran-aligned militias decided on their own to help put down the mass protests against the government of Iraqi Prime Minister Adel Mahdi.

The United States is considering extending Chevron Corp’s waiver to operate in Venezuela with more limitations by granting the company a 90-day sanctions reprieve. The company’s future in Venezuela now depends on President Trump, who must decide by Oct. 25 whether to renew a waiver allowing Chevron to keep operating in Venezuela despite U.S. sanctions. Some analysts believe that Venezuela’s oil output, already at a historically low 600,000 b/d, could plunge below 300,000 b/d if the waiver is allowed to expire. In Venezuela. drinking water is an increasingly risky gamble. Venezuela’s current rate of infant mortality from diarrhea is six times higher than 15 years ago, according to the World Health Organization.

3. Climate change

The 2019 Arctic sea ice minimum extent was probably reached on Sept. 18 and was the second-lowest coverage on record. There is no El Niño forming in the tropical Pacific Ocean this year to add extra heat to the oceans and atmosphere, but the relentlessly accumulating greenhouse gases in the atmosphere have helped to push 2019 toward record warmth anyway. Through September, which the National Oceanic and Atmospheric Administration reports was the hottest such month on record globally, the year ranks as the second warmest since records began in the late 19th century. The odds slightly favor that 2019 will end up being the second-warmest year, coming in behind 2016.

Japan, a nation grimly accustomed to natural disasters, has invested many billions of dollars in a world-class infrastructure meant to soften the effects of unprecedented storms. But with the flooding in areas across central and northern Japan in recent days, the country has been forced to examine more deeply the assumptions that undergird its flood control system. That is raising a difficult question, for Japan and the world. After a devastating typhoon killed more than 1,200 people in the late 1950s, Japan embarked on a series of public works projects aimed at taming its many rivers. Levees and dams sprang up on nearly every river, and civil engineers lined long stretches of riverbeds in concrete. While the projects have saved countless lives, they are insufficient to meet the challenge of increasingly extreme weather patterns,

The massive investment in infrastructure has not come without a cost. The spending has helped send Japan’s national debt to record highs. The country has approved many projects that turned out to be minimally effective or, at worst, damaging to the environment.

When leaders from Exxon Mobil and BP gathered last month with other fossil-fuel executives to declare they were serious about climate change, they cited progress in curbing flaring — the intentional burning of natural gas — as companies drill faster than pipelines can move the gas away. But in recent years, some of these same companies have significantly increased their flaring, as well as the venting of natural gas and other potent greenhouse gases directly into the atmosphere, according to data from the three largest shale-oil fields in the US.

Exxon’s venting and flaring have surged since 2017 to record highs, both in absolute terms and as a proportion of gas produced, the numbers show. Exxon flared or vented 70 percent more gas in 2018 than it did the previous year, according to the data, bringing an end to several years of improvements. Companies often treat natural gas as a byproduct when drilling for oil, which is far more lucrative.

Northern Californians can expect widespread power cuts aimed at preventing wildfires for a decade while Pacific Gas & Electric upgrades wires systems, cut back trees, and takes other safety measures. Bill Johnson, who became CEO of bankrupt PG&E Corp earlier this year, told an emergency meeting with the California Public Utilities Commission that the day when preemptive power outages would no longer be necessary is still years away.

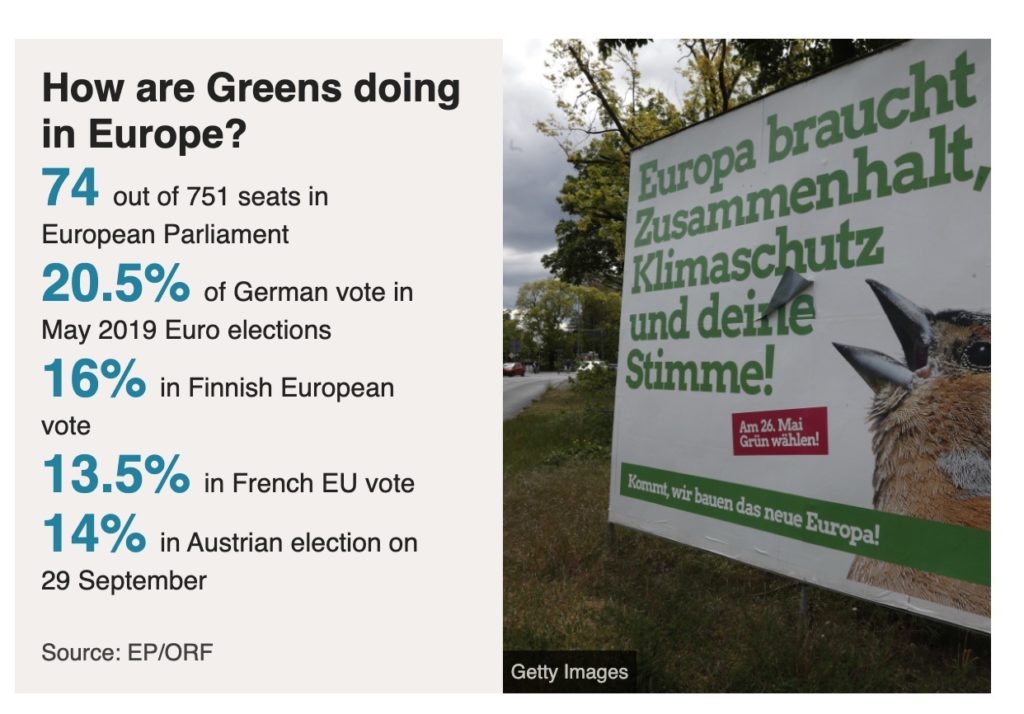

Climate change has risen to the top of Switzerland’s political agenda and observers are eyeing a possible “green tsunami” in the 20 October elections. For decades Switzerland has been dominated by four main parties; the Swiss People’s Party, the Social Democrats, the Radical Party, and the Christian Democrats. But as the glaciers melt, the president of the Green party’s youth wing sees an opportunity. “This is our year,” says Maja Haus. “There is a climate crisis, and for the Green party, this is a huge chance because we have the answers to this problem: 2019 will be the climate elections.

Italian authorities have closed roads and evacuated mountain huts after experts warned that part of a glacier on Mont Blanc could collapse. About 250,000 cubic meters of ice is in danger of breaking away from the Planpincieux glacier on the Grandes Jorasses peak, officials said. On Tuesday, Courmayeur Mayor Miserocchi signed an order closing roads in the Val Ferret on the Italian side of Mont Blanc, after experts warned that a section of the glacier was sliding at speeds of 50-60cm (16-23in) per day.

The Russian government has abandoned key provisions of a new “climate change” legislation package after the country’s leading businesses mounted a significant protest. The abandoned legislation included quotas on carbon emissions at Russia’s largest companies, along with a national carbon trading system and strict penalties for the country’s worst polluters. All that remains of the proposals are a plan to measure and collect emissions data as part of a so-called ‘green audit’ lasting five years.

4. The global economy and trade wars

The International Monetary Fund slashed its global growth forecast once again, predicting economic growth will fall to its weakest rate since the financial crisis a decade ago. The IMF said that the world economy is in a “synchronized slowdown,” and will only expand by 3 percent this year. Last year, the IMF forecasted a 3.9 percent growth for 2019. “Growth continues to be weakened by rising trade barriers and increasing geopolitical tensions,” the Fund said in a statement. The ongoing U.S.-China trade war looms large in the analysis. “We estimate that the US-China trade tensions will cumulatively reduce the level of global GDP by 0.8 percent by 2020.” The world is also facing structural issues, such as low productivity growth and aging demographics.

The U.S.-China trade war is highly unpredictable and could deteriorate again, while the Brexit mess could yet blow up and derail the European economy. For the four largest economies – the US, China, the Eurozone, and Japan – the IMF sees no improvement in their growth prospects over the next five years. This helps explain the pessimism dominating the oil market right now, which is overshadowing the fundamentals.

Even as the IEA downgraded its 2019 oil demand estimate two weeks ago to an increase of just 1 million b/d – the weakest growth rate in years – it may still be overestimating demand. “The lack of any significant downgrade to the IEA forecasts is doubly surprising given the downward revisions in the latest OECD Interim Economic Outlook, which is embedded in the IEA demand model.”

The severe strain that US sanctions have placed on Iran was spelled out in the IMF report when it forecast that Tehran’s economy would contract by 9.5 percent this year, although the government of Hassan Rouhani insists that the worst is over. The IMF said that Iran had seen “a dramatic worsening of macroeconomic conditions” in the past two years and had experienced “severe distress.” “This is a rare episode of low economic growth in Iran’s contemporary history,” said one Iranian economist. “We didn’t have this in much of the war with Iraq in the 1980s.”

US retail sales fell for the first time in seven months in September, suggesting that manufacturing-led weakness could be spreading to the broader economy. The report from the Commerce Department last week came on the heels of data showing moderation in job growth and services sector activity in September. Signs of cracks in the economy’s main pillar of support, ahead of the holiday season, could further stoke financial market fears of a sharper slowdown in economic growth.

The economy is being hampered by a 15-month trade war between the United States and China, which has soured business sentiment, leading to a decline in capital expenditure and a recession in manufacturing. “This report solidifies concerns of the consumer’s inability to perpetually support the economy alone,” said Lindsey Piegza, chief economist at Stifel in Chicago. “With business investment declining and manufacturing activity deteriorating, many investors brushed off fears of a slowdown because the consumer was still spending.”

5. Renewables and new technologies

Public opposition has forced the Norwegian government to scrap plans for large-scale onshore wind power development. According to a statement from the Norwegian Water Resources and Energy Directorate, the plan received 5,000 responses from the public, and most of these “were from private individuals who do not want wind power in their municipality.” The plan that sparked these responses envisaged the designation of 13 areas on which wind farms were to be built. Now, the plan will be canceled, and the government will instead focus on tightening the licensing regime for new wind projects, environmental assessment rules, and rules regarding construction deadlines.

Norway currently has a wind power capacity of 1.7 GW with another 1.8 GW under construction amid falling costs that have spurred a major investment wave in the sector.

Researchers at Zhengzhou University, Tsinghua University, and Stanford University have developed a solid-electrolyte-based liquid Li-S and Li-Se battery system with the potential to deliver energy densities exceeding 500 Wh kg -1 and 1,000 Wh L -1. The current state-of-the-art lithium-ion batteries have an energy density of less than 300 Wh kg-1 and 750 Wh L-1.

The UK has just ended its first quarter ever in which electricity generation from renewables outpaced fossil fuel-fired power generation—a landmark achievement for the country that started the Industrial Revolution with coal. In the UK, as much as 40 percent of electricity generation in Q3 came from renewables—including wind, biomass, and solar—while fossil fuels accounted for 39 percent of generation. Most of the remaining energy came from nuclear power, which generated 19 percent of the UK’s electricity in that quarter.

Demand for lithium will be booming over the next few years, and the US wants to increase its share in the global market. San Diego-based company EnergySource is taking on this challenge by bringing a new lithium extraction technique to market that can reduce lithium costs for US battery makers when compared to imports. This supply is nested beneath geothermal power plants that have been operating next to one of the world’s geothermal hot spots — the Salton Sea in the California desert, where the plants have been operating since the 1980s.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Shipping rates bonanza: Oil tankers that had been scheduled to install emissions-cutting equipment ahead of stricter pollution standards starting in 2020 have deferred their visits to the dry docks to capitalize on an unexpected surge in freight rates. US sanctions on subsidiaries of vast Chinese shipping fleet Cosco in September sparked a surge in global oil shipping rates as traders scrambled to find non-blacklisted vessels to get their oil to market. The rates for chartering a supertanker from the US Gulf Coast to Singapore hit record highs of more than $17 million and a record $22 million to China earlier this week. By comparison, prior to the sanctions, shipping crude from the US Gulf to China cost around $6 million-$8 million. (10/18)

Refiners take hit: The US sanctions on Chinese tanker firms and the increased tensions in Middle Eastern waters have spoiled what many refiners had anticipated could be a bumper Q4 quarter just ahead of the new rules on cleaner shipping fuel taking effect in January 2020. The cost of chartering supertankers to carry crude oil from the Middle East to Asia has soared and made oil procurement costs so high to the point of eroding refining profits for refiners. (10/16)

Russia’s oil production inched down to 11.23 million b/d in the first half of October, yet Moscow is still several thousand barrels above its quota under the OPEC+ production cut deal. Russia is taking the lion’s share of the non-OPEC cuts under the agreement, vowing to reduce production by 230,000 b/d from a very high level of 11.421 million b/d it pumped in October last year. (10/17)

Saudi Aramco has delayed the planned launch of its initial public offering (IPO), as the giant oil company wants to update investors with its latest earnings before proceeding. After a Sept. 14 attack on its Abqaiq and Khurais plants knocked out half the crude output of the world’s top exporter, Aramco wants to reassure investors by presenting results covering the period. (10/18)

China imported 10.08 million b/d of crude oil last month, up 11 percent on the year. At the same time, oil product exports surged. Chinese refiners are already producing more fuels than the domestic market needs and the resulting surge in exports is depressing refiners’ margins both at home and in neighboring countries. (10/15)

South Korea’s crude oil imports from the US in September more than doubled from a year earlier, while intakes of Saudi crude dropped 17.6% year on year due to the September 14 attacks on Saudi’s major oil facilities. (10/16)

The Nigerian National Petroleum Corporation (NNPC) has said that the rate at which pipelines of major oil companies are sabotaged in Nigeria has continued to increase, stating that it rose by 115 percent in July 2019. In a statement issued by the NNPC, they explained that a record number of 228 points were broken on the country’s pipelines in the month under review. (10/16)

The Venezuelan government is readying to hand over control over state oil company PDVSA to Russia’s Rosneft, a local newspaper has reported. Russian TASS reports, quoting El Nacional, that the radical move is being discussed as a way of erasing Caracas’ debt to Moscow. The debt is sizeable: at the end of June this year, money owed to Rosneft alone stood at $1.1 billion. Since 2006, Russian loans to Venezuela have reached more than $17 billion in total. (10/19)

Venezuela will not hand over control of its cash-strapped state oil firm PDVSA to Russian oil giant Rosneft, a close aide to Nicolas Maduro told Russian news agency RIA Novosti, dismissing such reports as false. (10/19)

Venezuela’s opposition is getting ready to file within days a lawsuit in the United States seeking to prevent bondholders of Venezuelan state oil firm PDVSA from going after shares in its US subsidiary Citgo over an expected PDVSA bond default this month. (10/17)

In Venezuela, Chevron is pushing back against the Trump administration’s plans to let the company’s Venezuela sanctions waiver expire, arguing such a move could ultimately drive oil production up, bolstering both the Maduro regime and Russia’s standing in the global market. Some analysts believe that Venezuela’s oil output, already at a historically low 600,000 b/d, could plunge below 300,000 b/d, if the waiver is allowed to expire, making this option an attractive one to Trump administration officials eager to ratchet up pressure on the Maduro regime. (10/18)

The US State Department has granted another Iran sanctions waiver to Iraq, further extending a grace period for vital energy imports. (10/16)

The US oil rig count increased by one, the smallest possible uptick following two consecutive months of declines, according to Baker Hughes Co. Meanwhile, the gas rig count dropped by six. The total number of active rigs in the US is now 851, down 216 from the count of 1,067 a year ago. (10/19)

Oil exports from Corpus Christi, TX, reached a record high of 1.626mn b/d in the week ending September 27, buoyed by increased flows into the port from new pipelines coming online. The high exports from Corpus Christi partially drained crude inventories that grew 2.7 million barrels between mid-August and late September, following the start-up of Plains All American’s 585,000 b/d pipeline and EPIC’S 400,000 b/d pipeline. (10/16)

Exports to double? The US could see its crude oil exports nearly double by 2022, according to energy research firm Rystad Energy. Rystad forecasts that US crude exports could increase from current levels of 2.9 million b/d to nearly six million b/d by 2022. This is based off the nation’s expected production increase of 1.2 million b/d year-over-year in 2020 and domestic refineries at capacity to absorb shale growth. (10/16)

In the US, soaring oil-tanker costs are drying up activity in the export market as sellers are slow to lower offers and buyers are skittish, according to market participants. Hardly any deals have been booked over the past few days, compared to six or seven seen in a typical day. (10/17)

US working natural gas volumes in underground storage added 104 Bcf last week, flipping the deficit to the five-year average to a surplus for the first time in more than two years. Storage inventories increased to 3.519 Tcf for the week ended October 11, the US Energy Information Administration reported Thursday morning. (10/19)

Bad quarter: The world’s largest oilfield services provider, Schlumberger, reported on Friday a net loss of US$11.38 billion for the third quarter, compared to a $644-million profit for Q3 2018, after a hefty pretax charge of $12.7 billion weighed on the most recently reported results. (10/19)

Really bad quarter: Wall Street guessed that write-downs from Schlumberger Ltd. were coming, but some analysts were taken aback by the sheer size of the $12.7 billion in pretax charges reported by the oil services company on Friday. The write-downs led the company to post its largest net quarterly loss in at least a decade. (10/19)

Bio fuelers angry: A brief peace between the Trump administration and US grain farmers was at risk after his environmental agency published the details of a biofuels policy they had broadly praised 11 days before. In early October, the administration said it would compensate for any corn ethanol sales lost to the exemptions, winning cheers from the farm and ethanol lobbies. On Tuesday, the applause turned to dismay after the EPA released more precise information in a 20-page notice. The Iowa Corn Growers Association said it was “outraged”. The proposal “falls short of delivering on President Trump’s pledge”, said Geoff Cooper, president of the Renewable Fuels Association. About 40 percent of the US corn crop is processed into fuel ethanol. (10/16)

Power down: Pacific Gas & Electric, California’s largest utility, shut down power in stages last week to nearly 1 million customers in a ring around the Bay Area, from wine country to near the Oregon border, and as far east as several Sierra Nevada counties. It was the largest planned power outage of its kind in state history. It will not be the last. The utility says the outage might have prevented wildfires in several northern counties — and the company showed photos of downed power lines as evidence. (10/15)

Mini-EV: Toyota Motor will display its new, production-ready Ultra-compact BEV (battery electric vehicle) at a special exhibition of the 2019 Tokyo Motor Show ahead of the vehicle’s planned commercial launch in Japan in 2020. The ultra-compact, two-seater BEV is specifically designed to meet the daily mobility needs of customers who make regular, short-distance trips such as the elderly, newly licensed drivers, or business people visiting local customers. It can be driven a range of approximately 100 km on a single charge, reach a maximum speed of 60 km/h, and features an extremely short turning radius. (10/17)

Dirty Euro air: The European Environment Agency’s (EEA’s) “Air quality in Europe — 2019 report” shows that almost all Europeans living in cities are still exposed to air pollution levels that exceed the health-based air quality guidelines set by the World Health Organization (WHO). The new EEA analysis is based on the latest official air quality data from more than 4,000 monitoring stations across Europe in 2017. (10/18)

Climate protests: British police have ordered a halt to Extinction Rebellion protests in London after a week of civil disobedience by climate change activists who have targeted government building and major financial institutions. Police said 1,445 people had been arrested in the protests so far. Extinction Rebellion uses civil disobedience to highlight the risks posed by climate change and the accelerating loss of plant and animal species. (10/15)

Air-conditioning Qatar’s outdoors? It was 116 degrees Fahrenheit (46.7 degrees Celsius) in the shade outside the new Al Janoub soccer stadium, and the air felt to air-conditioning expert Saud Ghani as if God had pointed “a giant hairdryer” at Qatar. Yet inside the open-air stadium– one of eight stadiums that the tiny but fabulously rich Qatar must get in shape for the 2022 World Cup–a cool breeze was blowing. Beneath each of the 40,000 seats, small grates adorned with Arabic-style patterns were pushing out cool air at ankle level. (10/18)