Editors: Tom Whipple, Steve Andrews

Quote of the Week

No matter how you slice it, the U.S. will need to dedicate more land to producing power in an emissions-free future.”

Dave Merrill, Bloomberg Green

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices rose last month with much positive economic data and signs of a fuel consumption revival in key economies offsetting a worsening coronavirus crisis elsewhere. Futures in New York rose last week, extending their monthly gain to 7.5%. The near-certain likelihood of higher fuel consumption in the US, China, and the UK has brightened the overall demand outlook, even as a resurgent pandemic in India, Brazil, and Japan cloud those prospects. OPEC and its allies see world consumption rebounding by 6 million b/d this year, while Goldman Sachs says demand could post a record jump as vaccination rates increase.

Despite high vaccination rates in many parts of the world, people appear to be still wary of public transit, opting for personal vehicles. Called “the great car comeback” by Bloomberg, the trend is visible in locations as diverse as Tel Aviv, Moscow, and Bucharest. Car sales in Europe soared by 63 percent last month to 1.39 million, which was high not just compared to the previous year when sales of everything but handwash and toilet paper were subdued.

However, India’s worsening COVID outbreak could disturb the nearly balanced global oil market, which will show a surplus of as much as 1.4 million b/d next month amid a sizeable loss of demand from the world’s third-largest oil importer. India has seen fuel demand decline in recent weeks as record-high new coronavirus infections prompt lockdowns and curfews in many states in the country of 1.3 billion. India’s combined demand for diesel and gasoline is set to drop by as much as 20% in April compared to March.

Big oil companies returned to profitability during the first quarter as they recovered from the unprecedented destruction of oil-and-gas demand wrought by the coronavirus pandemic. Exxon Mobil reported $2.7 billion in net income Friday, its first quarterly profit since the pandemic erupted last spring, while Chevron reported $1.4 billion in first-quarter profit. The largest European oil companies–BP, Shell, and Total–all reported profits earlier in the week after enduring huge losses last year.

OPEC: The cartel and allies probably raised their total oil production in April, driven by another supply increase from Iran, one of the three OPEC members exempted from the OPEC+ production cuts, according to the monthly Reuters survey. Iran raised its oil production by as much as 200,000 b/d in April vs. March to reach an output of 2.5 million b/d. According to the survey of OPEC sources, refiners, and tanker-tracking data, Iran’s supply increase was the largest among all OPEC members. As a result of Iran’s higher output, the total production of all 13 members of OPEC rose by 100,000 b/d month over month to 25.17 million in April.

OPEC+ members have the cartel’s permission to ease their production cuts after the ministers’ April 27th meeting endorsed previously agreed plans to boost crude oil output from May. The alliance, which intends to pump some 2 million b/d more crude oil by July, mainly from Saudi Arabia, is betting that improvements in the global economy will outweigh the surge of coronavirus cases. For now, rosier demand forecasts and robust vaccination programs in the US, UK, and other countries are enough to give OPEC+ members confidence that a production increase will not tank prices.

Shale Oil: Drilling and completion activity continued its robust recovery trajectory during the first quarter of 2021. Higher rig and frac crew counts led to higher US production, according to S&P Global Platts. In general, completions outpaced drilling, which led to higher utilization of the US DUC (drilled but uncompleted) inventory. However, the number of young DUCs has started to rebuild with additional rig activity in the most profitable US oil and gas shale plays. A young DUC is a well that has been drilled within the last 90 days and is waiting on a frac crew to finish the well.

The Texas Oil and Gas Association (TXOGA) reported last week that the state’s upstream sector added 4,300 jobs in March. In addition to representing the third straight month of an upstream employment uptick in the state, the latest figure marks the largest single month-over-month gain since the summer of 2011. Since bottoming out in September 2020 amid the pandemic, Texas’ upstream sector has added 12,000 jobs, TXOGA noted.

America’s shale producers will keep output in check even as global crude oil prices near $70 a barrel, Ovintiv Chief Executive Officer Doug Suttles said in an interview with Bloomberg Television. Explorers are focused on low growth, strong operating performance, and returning cash to shareholders, Suttles said. Ovintiv is prioritizing paying down debt and maintaining its dividend, he said. Private operators’ ability to weigh on oil prices by ramping up production is limited after recent tie-ups with publicly traded companies. While closely held producers have more influence on the natural gas market, “it’s a little bit of a concern, not a big one,” he said.

According to US government data, the Arctic blast that swept through the US South in February caused a much bigger loss in oil supply than previously estimated, with output falling to a three-year low. Drillers cut oil production by almost 1.2 million b/d, the biggest decline since May and far more than the 800,000 b/d officials had estimated in early April.

Commodity trading major Vitol is negotiating a deal to acquire the oil wells of Hunt Oil in the Permian Basin. According to Bloomberg, which cited unnamed sources, this would be the most significant foray of an independent oil trader into the upstream. Last year, the Swiss-based commodity trader set up Vencer Energy in Texas to buy oil and gas production assets in the US.

Revenues disbursed to states from federal oil and gas leasing are not expected to decline significantly in the near term due to the Biden administration’s pause and review of the program. Nada Culver, deputy director of policy and programs for the US Bureau of Land Management, told a Senate committee that no timeline had been set for completing the review, which froze new oil and gas leasing. At the same time, officials will study the program’s benefits to taxpayers and environmental impacts. The pause, which is opposed by oil-producing states, is widely seen as a first step to delivering on US President Biden’s campaign promise to end new oil and gas drilling on federal land and waters to fight climate change. Around a quarter of the nation’s oil and gas comes from wells drilled on federal lands.

Natural Gas: Production in the US is set to grow to a new record in 2022, at 93.3 billion cubic feet per day, and will continue to rise further, exceeding 100 Bcf/d in 2024, a Rystad Energy analysis shows. As a result, the performance of the country’s key gas basins is going to attract increased interest from investors and markets, with CO2 emissions intensity, capital efficiency, and potential bottlenecks drawing scrutiny. The country’s output reached a record in 2019, at 92.1 Bcfd, but production declined subsequently to 90.8 Bcfd in 2020 due to the pandemic.

Appalachian producers expect more robust year-over-year returns in 2021 based on a sizable percentage of hedged volumes, higher prices, increased export and LNG demand, and the completion of an expansion project in the fourth quarter. Several interlocking factors look to produce more substantial US natural gas prices in 2021.

Last week saw some much-needed good news for natural gas. The EU signaled that it would include natural gas in its energy plans for the future, emissions and all. The EU might also oblige gas suppliers to minimize these as much as is possible. In the early days of the rush to cut emissions, natural gas was hailed as what many called a bridge fuel, the bridge being between fossil fuels and renewable energy. Then, as the rush accelerated, the bridge-fuel status of natural gas began to be questioned increasingly loudly. Many of the proponents of a net-zero energy world became more radical with the help of statistics that showed US emissions did not decline with the replacement of coal power plants with gas-fired plants.

Asia’s LNG demand has been dampened by the worsening pandemic in India, spot cargoes already impacted, and the declaration of emergency in Japan, where imports are already hovering near year-ago levels. The adverse impact of India and Japan on the LNG market will be offset by more robust growth in other regions like China. However, downside risks have increased, especially with the deteriorating situation in India.

Electricity: The White House hopes to capitalize on growing support from US utilities, unions, and green groups for a national clean energy mandate by backing efforts to require the US grid to get 80% of its power from emissions-free sources by 2030, according to a senior administration official. A 2030 target would be a milestone on the way to achieving President Biden’s ambition of net-zero carbon emissions in the grid by 2035. It could also potentially be passed without Republican support through budget reconciliation.

“There are things President Biden has proposed in the infrastructure bill that just are plain common-sense infrastructure projects that will have an impact on our emissions,” John Kerry, US special presidential envoy for the climate. “For instance, if you build out a smarter energy grid where you can send power produced in one part of the country to another … that can help reduce costs.

Last week, the US Energy Department said it is offering up to $8.35 billion in loans for companies to upgrade the power grid. The department is making financing available for projects that improve resilience and expand transmission capacity, “so we can reliably move clean energy from places where it’s produced to places where it’s needed most,” Energy Secretary Jennifer Granholm said.

US electricity consumption is recovering from the lows seen during the pandemic’s peak last year. Still, a full recovery to 2019 levels will only be seen next year, according to Lynn Good, president and chief executive officer of Duke Energy. For the whole year of 2020, the decline in electricity load was about 3 percent, although, at the start of the pandemic, it was 10-15 percent at industrial customers, she added.

Two months on from the winter freeze that paralyzed Texas and sent electricity and gas prices soaring, another big winner has emerged. BP said last week its gas trading unit had an “exceptional” first quarter, helping to drive profit well above pre-pandemic levels. While executives didn’t spell it out, all signs point to significant gains from the frigid weather in Texas. “It was a very exceptional quarter in gas trading, “We were well-positioned for colder-than-normal weather in the US,” as well as in Asia. The London-based oil major doesn’t disclose trading results, but its quarterly earnings suggest the gas and power unit “easily topped $1 billion.” Although not mentioned by name, the positioning around the February storm in Texas — Storm Uri — has been the biggest driver of these gains.

BP wants to be your power supplier, too. The oil and natural gas giant is seeking permission to become a retail electricity provider to homes and businesses initially in Illinois, Ohio, Texas, California, and Pennsylvania.

Texas moved to ban retail electricity providers from offering the kinds of plans that led to astronomical power bills for customers during February’s energy crisis. Legislation passed by the state Senate Thursday and sent to the desk of Governor Greg Abbott for signature prohibits companies from tying electricity rates to the state’s volatile wholesale power market. Prices in that market soared to $9,000 a megawatt-hr for several days during the February deep freeze.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Indirect negotiations between the US and Iran are in “an unclear place,” US National Security Adviser Jake Sullivan said on Friday. Sullivan’s comments followed the start this week of a third round of the talks in Vienna in which representatives of Britain, China, France, Germany, Russia, and the EU shuttle between the US and Iranian delegations. “I’m not going to characterize the substance of the negotiations at this point because they are in … an unclear place,” Sullivan told a webinar. “We’ve seen the willingness of all sides, including the Iranians, to talk seriously about sanctions relief restrictions and a pathway back into the agreement.”

Iranian President Hassan Rouhani recently said the talks in Vienna had progressed by around 60%-70%. A breakthrough in negotiations could see the lifting of US sanctions on Tehran’s energy sector, adding more oil to a market whose recovery has been carefully managed by OPEC and its allies. According to S&P Global Platts, positive steps on nuclear talks last week point to an accelerated timeline for sanctions relief. France’s Total said it is too early to consider returning to Iran even as negotiations for the US to return to nuclear deal start to make some progress.

Saudi Crown Prince bin Salman said he wants to resolve its differences with Iran, a marked shift in tone in the wake of the election of President Biden. In an interview on Saudi television, Prince Mohammed said that Riyadh did not want “the situation with Iran to be difficult.” He wanted to build a “good and positive relationship” with the Islamic republic. “We are working now with our partners in the region and the world to find solutions for these problems,” he said. “At the end of the day, Iran is a neighboring country. All we ask for is to have a good and distinguished relationship with Iran.”

Saudi and Iranian intelligence officials held secret talks last month in Baghdad to repair relations between the regional powerhouses. The rivals severed diplomatic ties five years ago. Prince Mohammed has regularly railed against Iran, accusing the republic of stoking conflict in the Middle East and seeking to destabilize Saudi Arabia. In 2018, he likened Iran’s supreme leader, Ayatollah Ali Khamenei, to Adolf Hitler. At the time, he was a staunch backer of former President Trump’s decision to unilaterally withdraw the US from the nuclear deal Iran signed with world powers and impose crippling sanctions on the Islamic republic.

Iraq: Nationwide oil production averaged about 4.04 million b/d in March, a drop of 100,000 b/d from February. According to an Iraq Oil Report analysis based on data collected independently from each field, the decrease came entirely from fields controlled by the federal government, which produced 3.57 million b/d in March. Output was steady at fields controlled by the semi-autonomous Kurdistan Regional Government, which averaged 471,000 b/d.

Libya: After falling below 1 million b/d last week, Libya’s oil production could be set for recovery as the National Oil Corporation said on Monday that it had lifted a force majeure on oil terminal loadings. Libya’s oil production target of 1.5 million b/d by the end of 2021 depends on parliament approving the national budget quickly, Oil Minister Mohamed Oun said.

Venezuela: Six Houston-based Citgo Petroleum Corp employees were released from prison and placed in house arrest in Caracas. Known as the Citgo Six, the men —five of whom are naturalized US citizens and one a US resident— were sentenced to lengthy prison terms in November on corruption charges. US officials tracking their case have suspected that Venezuelan President Maduro might use the affair to appeal to the Biden administration as his country slips into deeper economic turmoil, exacerbated by the Covid-19 pandemic.

The government is crafting an emergency plan to guarantee diesel supply to farmers but with reduced price subsidies. Oil minister Tareck El Aissami and agriculture minister Wilmar Castro have been tasked with ensuring up to 30,000 b/d of low-sulfur diesel to farmers and livestock producers within two months.

Venezuela’s attorney general said that ten officials from state-owned oil company PDVSA were arrested for allegedly diverting and selling some 800,000 gallons of fuel illicitly, as long lines continue at gas stations throughout the country.

Venezuelan Defense Minister Vladimir Padrino said eight soldiers were killed in combat amid continuing clashes between the armed forces and armed groups along the Colombian border.

Yemen: The Iran-aligned Houthi movement launched a drone attack on a military base in the southern Saudi city of Khamis Mushait. There was no immediate confirmation from Saudi Arabia, which has lead a military coalition battling the Houthis for more than six years.

3. Climate change

According to a new UN report, deep cuts in methane emissions, including from the fossil fuel industry, are urgently needed to slow the rate of global warming. Methane has a much higher heat-trapping potential than carbon dioxide. It also breaks down in the atmosphere much more quickly than CO2, meaning cutting methane emissions can have a climate impact sooner. “Urgent steps must be taken to reduce methane emissions this decade,” according to the Global Methane Assessment published by the United Nations Environment Program.

The Senate voted to restore an Obama-era regulation that imposed limits on methane leaks from oil and gas operations. The move marks both the first major congressional rebuke of former President Trump’s environmental policies and a step forward for the Biden administration’s ambitious climate agenda. The vote is also the first time Democrats have used the 1996 Congressional Review Act to reverse a federal regulation. The measure cleared the divided Senate by a 52 to 42 vote. It is expected to pass the House quickly and would then head to President Biden’s desk.

Scientists have identified a massive 5.5-billion-ton gap between greenhouse gas emissions acknowledged each year by the world’s nations and the emissions calculated by independent models. This discrepancy threatens to complicate the already difficult task of resetting the world’s climate trajectory. The reasons for the gap — which is roughly as large as annual emissions from the US— are highly technical. But the most significant discrepancy involves countries claiming substantial reductions to their annual emissions due to forests sucking carbon dioxide out of the air. This includes carbon that humans have unleashed by burning fossil fuels, meaning that large-emitting countries that happen to have extensive forests are arguably getting an offset for their pollution.

The US Environmental Protection Agency took the first steps in dismantling the Trump administration’s rollback of fuel economy standards for cars and light trucks, including announcing it will uphold states’ rights to set tougher-than-federal rules. The proposal ends a battle over California’s waiver to impose stricter limits, which 14 other states follow. The Trump administration’s fuel economy targets for model years 2022-2025 would have increased US oil demand by an estimated 500,000 b/d.

The world’s glaciers are shrinking faster than before, with densely populated parts of Asia at risk of flood and water shortages if the trend continues. A new study by ETH Zurich and University of Toulouse researchers found the world’s ice fields lost 298 gigatons of ice per year from 2015 to 2019, a 30% increase in the rate of retreat compared with the previous five years. Glaciers in Alaska, the Alps, and Iceland are among those disappearing at the fastest pace. “The situation in the Himalayas is particularly worrying,” said one of the study’s authors, adding that swathes of India and Bangladesh could face water stress during dry periods when significant rivers like the Ganges and Indus are mainly fed by glacial runoff.

4. The global economy and the coronavirus

United States: The spring wave of coronavirus infections that began in March is subsiding in most of the country, with 42 states and DC reporting lower caseloads for the past two weeks. Hospitals in hard-hit Michigan and other Upper Midwest states flooded with patients in mid-April are discharging more than they’re admitting. The daily average of new infections nationwide has dropped to the lowest level since mid-October, and many cities are rapidly reopening after 14 months of restrictions.

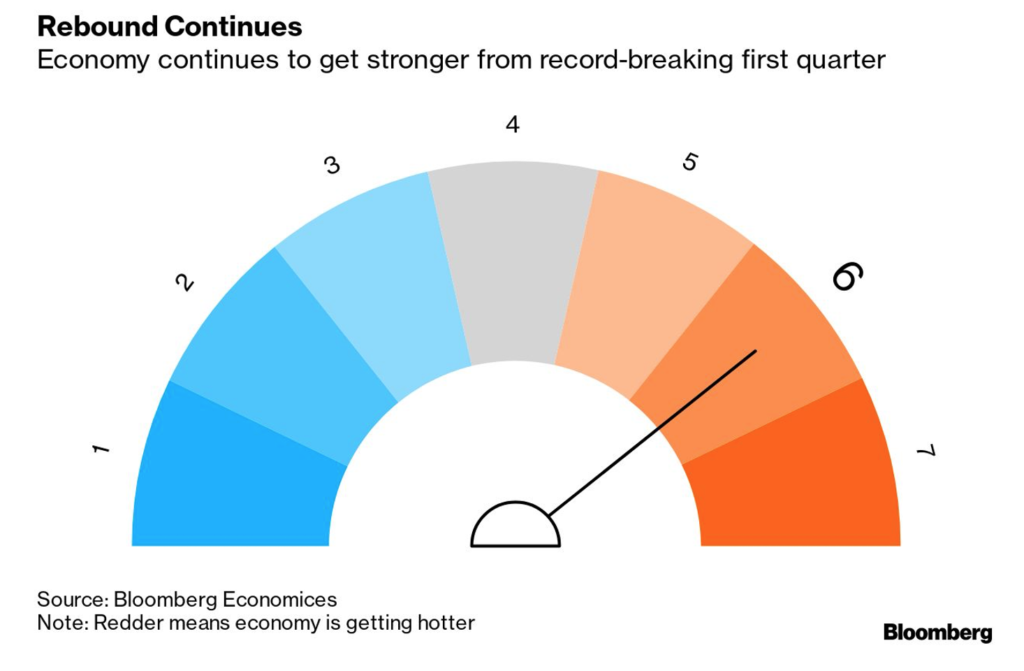

US economic growth accelerated in the first quarter as a rush of consumer spending helped bring total output near its pre-pandemic level. Gross domestic product expanded at a 6.4% annualized rate following a softer 4.3% pace in the fourth quarter. Personal consumption, the biggest part of the economy, surged an annualized 10.7%, the second-fastest since the 1960s.

US consumer confidence jumped to a 14-month high in April as increased vaccinations and additional fiscal stimulus allowed more services businesses to reopen, boosting demand and hiring by companies. Growth this year is expected to be the best in nearly four decades.

European Union: France reported a rise in patients with COVID-19 in intensive care units. The country entered into its third national lockdown at the end of March after suffering a spike in COVID deaths and case numbers during that month. Germany’s coronavirus infection rate rose last week despite tougher restrictions, and Finance Minister Olaf Scholz said he did not expect moves to ease curbs before the end of May.

The euro-area economy slid into a double-dip recession at the start of the year as strict coronavirus lockdowns across the region kept many businesses shuttered and consumers wary of spending. Reports from some of its most significant members show how far behind the EU is in recovering from the pandemic amid a slow vaccine rollout. Output in the euro area was down 0.6% in the first quarter and declined at nearly three times that pace in Germany. The EU’s joint recovery fund should ultimately boost the upturn, but it won’t kick in until at least summer. The European Commission must approve national spending blueprints, and member states still need to ratify the mechanism to raise $969 billion of debt to finance the plans.

Germany’s economy shrank 1.7% in the first three months of this year due to lockdown measures to contain rising coronavirus infections. The decline in Europe’s largest economy, a reversal from the growth of 0.5% in the previous quarter, came as figures showed that Spain’s gross domestic product shrank 0.5% due to declines in household consumption and manufacturing. At the same time, Italy’s output fell 0.4 percent, dragged down by lower services sector activity. French GDP outshone expectations by growing 0.4% in the first quarter, lifted by higher construction activity and a mild rebound in household consumption.

American tourists who have been fully vaccinated against Covid-19 might be able to visit the EU this summer. The fast pace of vaccination in the US and talks between authorities there and the EU over making vaccine certificates acceptable as proof of immunity for visitors might lead to a switch in policy that could see trans-Atlantic leisure travel restored.

European Union leaders and their British counterparts expressed hope that the final ratification of the post-Brexit trade deal will open a new, optimistic era of cooperation. After European lawmakers ratified the agreement, ensuring that trade continues without tariffs and quotas, UK Prime minister Boris Johnson said the vote marked the “final step in a long journey, providing stability to our new relationship with the EU”.

China: The economy continued to boom in April from the record growth in the first quarter, with strong exports and rising business confidence supporting the recovery. That’s the outlook, tracked by Bloomberg, of an aggregate index combining eight early indicators which remained unchanged from March in solid expansionary territory. Some of the strength this month may be exaggerated by the comparison with April 2020, when the country was still struggling to recover and reopen after a lockdown to contain the world’s first coronavirus cases.

Beijing hopes US companies will press their government to cancel additional tariffs on China, cease “decoupling” and supply suspension, and stop suppressing Chinese companies, a vice minister of foreign affairs commented during a meeting with officials from major US companies last week.

China has bet on developing its shale gas resources to boost its natural gas supply as demand surges. Despite recent shale production increases, China still has several significant challenges to overcome if it is to replicate the American shale boom. China is estimated to have many shale gas resources, even higher than those in the US; however, Beijing has struggled to develop those resources. The challenges arise because some of the most prolific basins are twice as deep underground as the shale gas resources in the US shale gas plays. Challenging geology leads to higher well drilling and completion costs, lower margins for exploration and production companies, and, at times, mixed results in gas flows.

China is set to cap coal consumption in 2021 by reducing it to less than 56% of its total energy mix while planning to boost domestic oil and gas output.

Over the past few decades, China has been all over Africa, building railroads, airports, bridges, and power dams. Trade between China and Africa has surged dramatically from $1 billion in 1980 to $128 billion in 2016, while cumulative loans to African governments have hit $143 billion, with half of them given over the last four years alone, making it Africa’s largest bilateral creditor.

Russia: The official coronavirus task force reported a modest 9,270 new COVID-19 cases on Saturday, including 3,208 in Moscow, taking the official national tally since the pandemic began to 4,814,558. However, according to Reuters calculations based on data from the state statistics agency, Rosstat, Russia recorded more than 400,000 excess deaths from last April to March 2021 during the pandemic.

Excess death figures, some epidemiologists say, are the best way to measure the actual toll from COVID-19. Excess deaths are typically defined as the difference between the observed numbers of deaths in specific periods and expected numbers of deaths in the same periods. Rosstat, the statistics agency, said Russia recorded around 250,000 deaths related to COVID-19 from last April to March of this year.

The European Parliament said in a resolution that the EU should follow Britain’s example and impose new anti-corruption sanctions on Russians suspected of fraud and graft, thus reflecting hardening attitudes to Moscow. Non-EU member Britain imposed sanctions on Monday on 14 Russians under a new law giving the British government the power to penalize those it says are credibly involved in the most severe corruption abroad. If EU governments follow through on the resolution, such measures could freeze the EU assets of Russians and other non-EU nationals and bar them from visiting the 27-nation bloc, as Britain has done for its banks and territory.

Putin’s multi-year push to reduce Russia’s exposure to the dollar hit a significant milestone as the share of exports sold in the US currency fell below 50% for the first time. According to the central bank, most of the slump in dollar use came from Russia’s trade with China, more than three-quarters of which is now conducted in euros.

A second Russian vessel has now begun laying the almost complete Nord Stream 2 gas pipeline in Danish waters, which is likely to accelerate the final work on the Russia-Germany link.

Saudi Arabia: Chinese investors, including the sovereign wealth fund China Investment Corporation and Chinese national oil companies, are looking to buy a stake in Saudi Aramco. Crown Prince bin Salman announced on Tuesday that Saudi Arabia was looking to sell 1% of Saudi Aramco to “one of the leading energy companies in the world.” The 1% stake sale could generate as much as $19 billion for the oil-dependent economy as the country tries to diversify.

Aramco is considering selling a stake in its vast natural gas pipeline network to help free up cash and draw more international investors to Saudi Arabia. Any deal could raise billions of dollars for Aramco depending on how a transaction is structured. The discussions are happening barely two weeks after the company announced that a consortium led by Washington-based EIG Global Energy Partners would invest $12 billion in its oil pipelines

Saudi Arabia could save $200 billion over the next 10 years by switching from crude oil to natural gas and renewables for electricity production. “Instead of buying fuel from the international markets at $60 and then selling it at $6 to Saudi utilities or using some of our quotas in OPEC to sell at $6, we’re going to displace at least 1 million b/d of oil equivalent in the next ten years and replace it with gas and renewables.”

India: The Covid-19 outbreak that has overwhelmed hospitals in New Delhi and Mumbai is spreading to states across India, as the world’s fastest-growing Covid-19 surge shows no signs of slowing. The second wave of COVID-19 topped 400,000 new daily cases for the first time on Saturday, as the country opened up its massive vaccination drive to all adults, although several states warned of acute shortages.

According to federal health ministry data, deaths from COVID-19 jumped by 3,523, taking the total toll in India to 211,853. The world’s biggest producer of COVID-19 vaccines has a limited number of shots available, worsening a surge in infections that has overwhelmed hospitals and morgues. Some epidemiologists are saying that the official government statistics are likely to be anywhere from two to five times lower than the actual toll.

As a second wave of the pandemic rages in India, the world is coming to the rescue. Oxygen generators from Saudi Arabia and the United Arab Emirates. Raw material for coronavirus vaccines from the US. Millions in cash from companies led by Indian American businessmen. But it is unlikely to plug enough holes in India’s sinking health care system to stop the deadly crisis that is well underway. The health emergency has global implications for new infections worldwide, as well as for countries relying on India for the AstraZeneca vaccine.

The US Chamber of Commerce warned that the Indian economy – the world’s sixth largest – could falter, with the spike in coronavirus cases creating a drag for the global economy. The risk of spillover effects is high given that many US companies employ millions of Indian workers to run their back-office operations.

India’s Covid-19 crisis sent the demand for transport fuels to the lowest in several months, highlighting the risks for energy consumption amid an uneven global recovery from the pandemic. April sales of gasoline fell to 2.14 million tons, the lowest since August, according to preliminary data from officials with direct knowledge of the matter.

India’s city gas demand is expected to drop by around 25% to 30% in the coming months as the pandemic spreads across large cities and states that are the primary consumers of natural gas. Weaker demand has already impacted gas procurement as spot LNG imports have been curtailed since the start of April. LNG carriers headed to Indian ports have been diverted to other markets, and many LNG vessels are waiting longer than usual to discharge their cargoes.

Latin America: Last week the continent accounted for 35% of all coronavirus deaths in the world, despite having just 8 percent of the global population, according to data compiled by The New York Times. Latin America was already one of the world’s hardest-hit regions in 2020, with bodies sometimes abandoned on sidewalks and new burial grounds cut into the forest. Yet even after a year of incalculable loss, it is still one of the most troubling global hot spots, with a recent surge in many countries that is even more deadly than before.

The crisis stems in part from predictable forces — limited vaccine supplies and slow rollouts, weak health systems, and fragile economies that make stay-at-home orders challenging to impose or maintain. But the region has another complex challenge, health officials say: living side-by-side with Brazil, a country of more than 200 million whose president has consistently dismissed the threat of the virus and denounced measures to control it, helping fuel a dangerous variant that is now stalking the continent.

A study suggests that as many as one-third of Mexicans may have been exposed to the coronavirus by the end of last year. Coronavirus antibodies were found in 33.5% of samples from blood banks and medical laboratory tests in Mexico unrelated to COVID-19. The Mexican Social Security Institute says the nationwide average may have risen as much as ten percentage points following a steep rise in cases in January.

Pfizer Inc’s shipment of vaccine to Mexico this week includes doses made in its US plant, the first of what are expected to be ongoing exports of its shots from the US. The vaccine shipment, produced at Pfizer’s Michigan plant, marks the first time the drug maker has delivered abroad from US facilities after a Trump-era restriction on vaccine exports expired at the end of March.

5. Renewables and new technologies

The offshore wind industry’s global installed capacity is set to exceed 250 gigawatts by 2030, driven by a surge in coming projects, according to a new Rystad Energy report. The combined capital and operational expenditure for the decade is set to add up to an eye-popping $810 billion, signaling an increasing shift of investments from oil and gas to renewable energy technologies. The cumulative installed capacity of global offshore wind projects climbed to 33 GW in 2020 – a significant achievement for an industry that has nearly tripled its size since 2016. We expect the world’s installed capacity to hit an estimated 109 GW by 2025 and rise further to 251 GW by 2030, growing by 22% a year on average.

Siemens Gamesa Renewable Energy sees enormous potential for offshore wind in the Baltic Sea as the world’s largest producer of turbines at sea looks to take advantage of a jump in global demand. The company estimates the capacity potential of the Baltic Sea at several dozen gigawatts by 2040. With the most ambitious targets in the Baltics, coal-reliant Poland plans to install as much as 11 gigawatts by then amid rising pressure to cut carbon emissions.

New solar projects over 200 megawatts have surged recently. The mega-sized projects represent a new class of renewable power capacity that’s finally approaching the scale of coal-, oil-, and natural gas-fired plants. Large-scale solar projects are getting more common every year. In 2019, developers set a record by commissioning at least 35 projects of at least 200 megawatts worldwide, up about 17% from the year prior. With approximately 3,000 solar panels needed for each megawatt of capacity, a 200-megawatt project would be at least as big as 550 American football fields.

The increasing size of solar farms comes as costs fall. At the same time, there’s a growing group of buyers in the market for renewable assets, particularly pension funds and other institutional investors keen to match their long-dated liabilities with the consistent returns of solar farms.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

EU refinery shrinkage: The pandemic has shortened Europe’s energy transition. By the time Europe recovers from the COVID-triggered slump, its fuel demand will have already dropped to the point where some downstream assets—refineries—are no longer needed. (4/27)

BP resumes share buybacks this quarter after more than tripling its first-quarter earnings from a year ago on the back of rising oil prices and strong gas marketing and trading performance. (4/29)

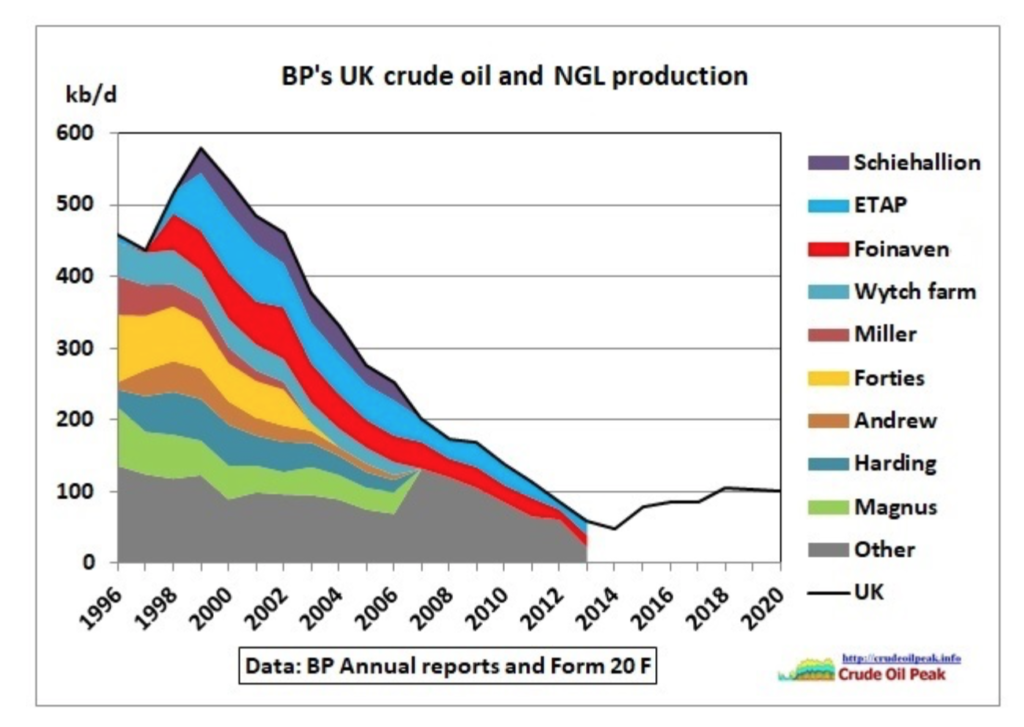

BP, on April 27th, forecast a further drop in its upstream production this year due to the impact of asset sales on its portfolio, as it reported a 14% year-on-year fall in upstream oil and gas output for the first quarter. (4/27)

Pakistan’s refining capacity is expected to rise sharply in coming years, paving the way for the nation to sharply reduce its dependence on imports for gasoline and other oil products. (4/27)

China is poised to report its first population decline in five decades following a once-in-a-decade census. A population drop will pressure Beijing to roll out measures to encourage couples to have more children and avert an irreversible decline. (4/28)

In Mozambique, France’s Total has declared force majeure on its LNG project and removed all staff from the site on the Afungi Peninsula. (4/26)

In Uganda, the Petroleum Authority will launch in December the first key tenders for the long-awaited oil resources development project in the East African country, which cleared a major hurdle earlier this month after France’s Total signed agreements to develop the project. (4/29)

Nigeria’s parliament called on the presidency, armed forces, and police to address the country’s mounting security crisis on Tuesday, with the lower house urging President Muhammadu Buhari to declare a state of emergency. The resolutions come as a wave of violence and lawlessness sweeps across Africa’s largest economy. (4/28)

Nigeria’s state-owned energy company assured it would continue to meet its financial obligations to the government despite indicating the cost of gasoline subsidies may make it impossible to contribute to the national purse next month. President Muhammadu Buhari has delayed a plan to phase out the expensive subsidies due to fears that any price increase will cause social unrest. (5/1)

Nigerian oil spills: Shell Petroleum Development Company of Nigeria Limited reported that a total of 4,309 barrels of crude was spilled into the Niger Delta environment from its operations in the second half of the year 2020. The report says the spills comprise 102.7 barrels through operational failure and 4,199 barrels through sabotage. (4/30)

Offshore Guyana, ExxonMobil, and its partner Hess announced a new oil discovery in the Stabroek Block that would add to the already announced 9 billion oil-equivalent barrels in more than a dozen discoveries in the block. (4/28)

Suriname, which shares the basin estimated to hold up to 32.6 billion barrels of oil resources, desperately seeks to replicate Guyana’s success after the COVID-19 pandemic hit its economy and government finances particularly hard. (4/27)

Latin American oil theft: Washington’s focus on disrupting narco-trafficking in Latin America, through a combination of coca crop eradication, enforcement, and seizures, is placing pressure on criminal organizations to find other sources of income. One illicit activity, which has exploded in popularity in Latin America since the start of the COVID-19 pandemic is the theft of crude oil and derivative products such as gasoline. (4/29)

In Mexico, crude oil projects involving private companies could bring an additional 704,000 bpd to total national oil production by 2030. This year, the output from projects involving private companies is seen at 264,000 bpd. (4/30)

Gas imports by Mexico from the US hit record levels just shy of 7 Bcf/d. The record-setting volumes were accompanied by population-weighted temperatures in the upper 70s Fahrenheit, about 5 degrees above average, and by a spike in electric cooling demand. (4/27)

In the Canadian oil sands, thousands of roughnecks have descended upon barracks in work camps. They have turned the area, which accounts for more than half of America’s oil imports, into a hot spot for a resurgence of the pandemic. It’s the latest blow to the oil-rich province of Alberta that in the past years has struggled with two crude-market crashes, rising unemployment, plus devastating wildfires and floods. (4/29)

Canada has repeatedly been raising with top US officials the issue with Enbridge’s Line 5, which Michigan wants shut down, and considers intervening in the legal dispute between the pipeline operator and the US state. (4/27)

The US oil rig count last week dropped by 1 to 342 while the gas rig count inched up by 2 to 96, Baker Hughes reported. The total of 440 is now 32 more than this time last year. (5/1)

Imports: The OPEC+ production cuts, lower overall oil demand, and declining demand for foreign-sourced lighter crudes resulted in 2020 in the lowest annual American crude oil imports from OPEC in data going back to 1973, the EIA reported. (4/30)

ExxonMobil faces an “existential business risk” by pinning its future on fossil fuels as governments move to slash emissions, an activist hedge fund will tell investors in the final push to overhaul the oil major’s board. (4/27)

The polar blast in Texas earlier this year revealed a dirty secret in the most prolific US oil field: Two under-the-radar natural gas plants that are a constant source of pollution. The Wildcat and Sand Hills plants, both run by Houston-based Targa Resources Corp., accounted for almost 20% of the state’s total pollution during the freeze and nearly four times the amount emitted by the country’s biggest refinery. That two mid-sized processing plants can become super emitters underscores how the vast US gas network is only as strong as its weakest link. (4/30)

More methane leaks: A landfill in Bangladesh leaks enormous quantities of the potent greenhouse gas methane into the atmosphere, according to the emissions-tracking company GHGSat Inc. The company estimated the emissions rate at about 4,000 kilograms an hour, the planet-warming equivalent of running 190,000 traditional cars. Methane is about 84 times more potent than carbon dioxide in the first two decades in the atmosphere. (4/26)

Methane: The Appalachian Basin spanning Alabama to Maine spewed more methane last year than the oil- and gas-heavy Permian Basin of Texas and New Mexico — making the region the biggest emitter of the greenhouse gas in the nation. Satellites recorded 2.4 million tons of methane emissions in the Appalachian basin in 2020, compared with 2 million tons in the Permian. Nearly 42% of the Appalachian pollution came from coal mines. (4/26)

A group representing auto suppliers will tell US lawmakers it opposes setting a firm date to end the sale of new gasoline-powered passenger cars and expects those vehicles to be sold for at least another 20 years. (4/28)

CCS: ExxonMobil and Chevron confirmed their commitments to building large-scale projects to address climate change on April 30th, beginning with a focus on carbon capture. (5/1)

Oilfield services firm Schlumberger on Monday named new executives to energy transition units, a move that signals its growing commitment to lower carbon businesses. (4/28)

Greener gasoline: Odessa Development and Nacero Inc have announced plans to build a $7 billion lower-carbon gasoline manufacturing facility in Penwell, Texas. The gas will have half the lifecycle carbon footprint of traditional gasoline. The gasoline will be made from natural gas, captured bio-methane, and mitigated flare gas. (4/27)

Gasoline prices: Although California is alone among the 50 states in reaching the $4 mark, the rise may bode ill for the rest of the nation. Demand is already at the highest since pandemic lockdowns began kicking in early last year. As more cities and states relax virus restrictions, the economic activity underpinning energy demand is expected to blossom. (4/29)

The US Supreme Court is hearing oral argument on Tuesday in a case that has pitted the oil industry and the corn lobby for years—whether refiners can obtain exemptions from blending ethanol in gasoline and diesel under the Renewable Fuel Standard. (4/28)

US power generation from coal totaled a six-month high of 87.85 TWh in February, up 7.4% from January and 56.6% higher than the year-ago month, the EIA said. (4/28)

President Biden’s green energy plan will require a tremendous amount of land. Wind farms, solar installations, and other forms of clean power take up far more space on a per-watt basis than their fossil-fuel-burning brethren. Expanding wind and solar by 10% annually until 2030 would require a chunk of land equal to South Dakota. By 2050, when Biden wants the entire economy to be carbon-free, the US will need up to four additional South Dakotas to develop enough clean power to run all the electric vehicles, factories, and more. (4/30)

Building power plants in the middle of the sea was never going to be easy. The world’s largest developer of offshore wind farms, Orsted A/S, has found that some of its cables connecting to wind farms have been damaged by scraping against rocks on the seabed and will need to spend as much as 3 billion Danish kroner ($489 million) to fix them. (4/30)

Geothermal: Petrolern LLC, an Atlanta-based service and technology firm specializing in subsurface engineering and downhole tools, is looking to repurpose some orphaned oil and gas wells to produce geothermal energy. (4/26)

Ford Motor Co. posted a surprising $3.26 billion first-quarter net profit but then said a worsening global computer chip shortage could cut its production in half this quarter. (4/29)

Ford, saying that it wants to control the key technology for electric vehicles, plans to open a battery development center near Detroit by the end of next year. The company said the 200,000-square-foot facility would have the equipment to design, test, and even do small-scale manufacturing of battery cells and packs. (4/28)

Honda last week announced key targets for sales of electrified vehicles in North America, with a plan to make battery-electric and fuel cell electric vehicles (BEVs and FCEVs) to represent 100% of its vehicle sales by 2040, progressing from sales of 40% by 2030 and 80% by 2035. (4/27)

EV chicken-and-egg problem: President Joe Biden’s plan to wean US drivers off fossil fuels requires massive investment in public charging stations to power the electric-car revolution. So far, none of the companies that deploy the equipment have figured out how to profit. The dilemma boils down to demand. (5/1)

EV charging dilemma: The primary difference between charging up an EV versus filling up a regular car is that the former can often be done at home or the workplace; these account for the vast majority of connectors and likely will continue to do so. But they charge slowly; fine if you’re sleeping or working in the meantime but not if you’re on the go. This also doesn’t work so well if you live in an apartment without a garage. So to speed EV adoption, you need public chargers, especially high-power ones delivering a full charge in 30 minutes or less. (5/1)

Big oil to sell electrons? Public fast-charging is most akin to the existing gas-station business, and some oil majors are active already. BP, for example, has about 10,000 chargers installed and aims for 70,000 by the end of the decade. This represents a significant investment, as fast chargers cost upward of $50,000 apiece and can also require helping local grid upgrades. (5/1)

Energy from volcanoes? Scientists have found that volcanoes deep in the ocean discharge so much energy potential when they erupt that they could theoretically power the whole of the United States. (4/26)

China said the International Atomic Energy Agency had confirmed it would invite Chinese experts to join the working group carrying out work on Japan’s plan for disposal of contaminated water from the Fukushima nuclear plant. (4/26)