Editors: Tom Whipple, Steve Andrews

Editor’s Note: The Peak Oil Review will not be published on 18 November as I will be in the hospital for a medical procedure. – T.W.

Quote of the Week

“… [shale oil] Operators were able to outperform the price collapse in 2015-2016 because they were able to vastly outspend cash flow thanks to accommodative debt and equity markets, while at the same time achieving huge leaps in well productivity and capital efficiency. This time around, capital markets are skeptical and wary, and the scope for further productivity gains is limited.”

Raoul LeBlanc, IHS Markit’s vice president for North American unconventionals

“Palm oil represents a difficult dilemma: How does the West address negative social or environmental implications from the development of an industry that is helping to lift rural people out of poverty?… Rather than attempting to address the issue through Western boycotts, the global community—from Western policymakers to international organizations like Rainforest Action Network— would be better served by putting pressure on the governments of Malaysia and Indonesia to sustainably produce palm oil while protecting rainforests.”

Robert Rapier, energy industry analyst, and commentator

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production US futures fluctuated between $56 and $57.50 last week as stockpiles rose, the rig count dropped, and hopes for a breakthrough in the US-China trade negotiations kept coming and going. Brent rose above $63 a barrel on Thursday after China hinted at progress towards a trade deal with the United States. The 16-month trade war between the world’s two biggest economies has slowed economic growth around the globe and prompted analysts to lower forecasts for oil demand, raising concerns that a supply glut could develop in 2020. Saudi Arabia has bounced back from the mid-September attack on its oil facilities, with its crude output in October recovering to pre-attack volumes, according to the latest S&P Global Platts survey of OPEC production. The kingdom pumped 9.80 million b/d in October, leading OPEC’s total production back to 29.71 million b/d, a 1.26 million b/d rebound from its lowest level since the depths of the global financial crisis in 2009. With production now stabilized, OPEC has to focus on its next meeting, December 5-6 in Vienna, when the cartel and its allies, including Russia, will debate the future of their collective output cuts, which expire in March. Whispers of potentially deeper cuts have been dispelled in recent days by OPEC officials. Marine fuel sulfur regulations that go into effect January 1 and an easing of trade tensions between the US and China could be bullish catalysts. US crude oil stockpiles rose by 7.9 million barrels the week before last as refineries cut output, and exports dropped. Meanwhile, US energy firms last week reduced the number of oil rigs operating for a third week in a row. Drillers cut seven rigs in the week to November 8, bringing the total down to 684, the lowest since April 2017. Several stories discussing the possibility that the US shale oil boom could be coming to an end appeared last week. IHS Markit predicts that growth in US oil production is heading for a “major slowdown,” falling from 440,000 b/d in 2020 to “essentially flattening out” the following year. The 440,000 b/d in annual growth projected for 2020 itself represents a dramatic reduction from last year’s figure. “Going from nearly 2 million b/d annual growth in 2018, an all-time global record, to essentially no growth by 2021 makes it pretty clear that this is a new era of moderation for shale producers,” according to Raoul LeBlanc, IHS Markit’s vice president for North America. “This is a dramatic shift after several years, where annual growth of more than 1 million barrels per day was the norm.” Given the financial trends and assuming a West Texas Intermediate crude oil price averaging around $50 per barrel in 2020 and 2021, IHS Markit foresees significant effects on operations. The firm noted that it expects a nearly $20 billion drop in onshore drilling and completions spending over three years. IHS Markit contends the industry can still grow rapidly, given the right conditions. The report finds that a $65 per barrel oil price would support strong volume growth and give shareholders meaningful returns. It also concludes an oil price in the mid-$50s represents the “crucial tipping point for this new shale era,” explaining the range maintains viability – sustaining some production growth and delivering returns to shareholders. IHS Market’s appraisal of the prospects for shale oil was seconded by two shale oil pioneers who believe the days of relentless production growth from US unconventional oil fields are ending. The CEO of Pioneer Natural Resources, Scott Sheffield, said that the Permian basin is “going to slow down significantly over the next several years.” He noted on the company’s latest earnings call that the company is also acting with more restraint because of pressure from shareholders not to pursue unprofitable growth. But there are also operational problems that have become impossible to ignore for the industry. He listed several factors that explain the Permian slowdown: “the strained balance sheets lots of the companies have, the parent-child relationships that companies are having, people drilling a lot of Tier 2 acreage,” Sheffield said. “So, I’m probably getting much more optimistic about 2021 to 2025 now regarding oil price.” In other words, US shale is slamming on the brakes, which may yet engineer a rebound in global oil prices. Mark Pappa, CEO of Centennial Resource Development (and former CEO of EOG Resources), was also downbeat on growth prospects. “At a September investor conference, I predicted that 2020 total US year-over-year oil growth would be 700,000 b/d, which at that time was considerably below consensus,” said Pappa. “Given additional data, I now think that 2020 year-over-year oil growth will be roughly 400,000 barrels per day, which is below the current consensus.” He noted that US oil production has been mostly flat for 9 out of the last ten months, and “it’s likely to decline over the next six months.” An analysis by SRSrocco concludes there is trouble brewing for ExxonMobil’s shale oil operations. Exxon added a record number of wells in the Permian during the first three quarters of 2019, only to see the company’s shale oil production plateau. |

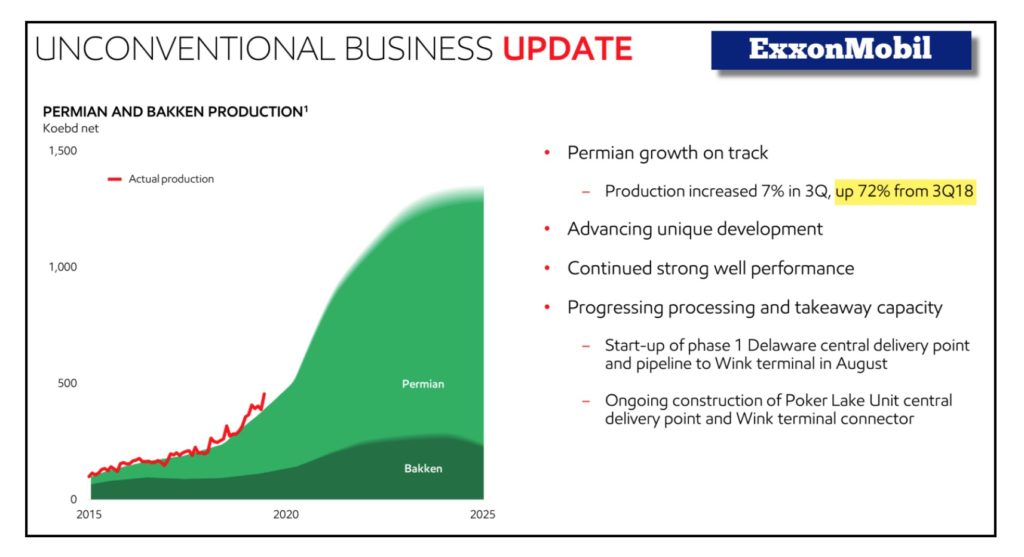

The chart above is stated in Koebd, or 1,000 barrels of oil equivalent per day. Exxon’s Permian production shown in that chart includes natural gas. While Exxon’s Permian production continues to increase in 2019, the majority of the gain is from natural gas.

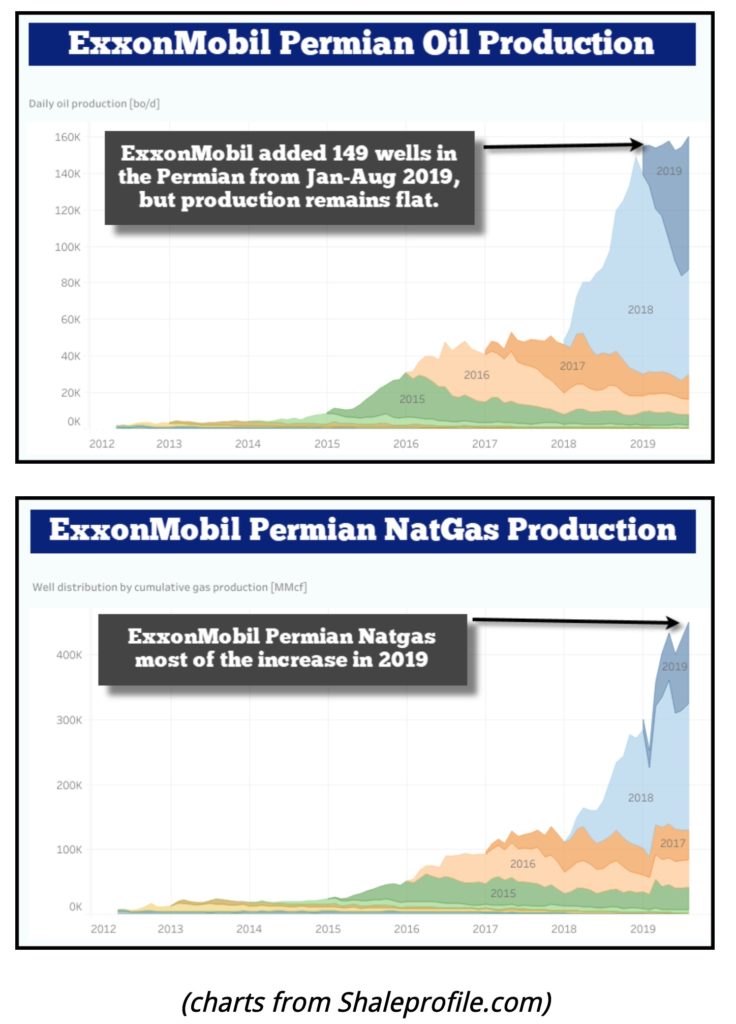

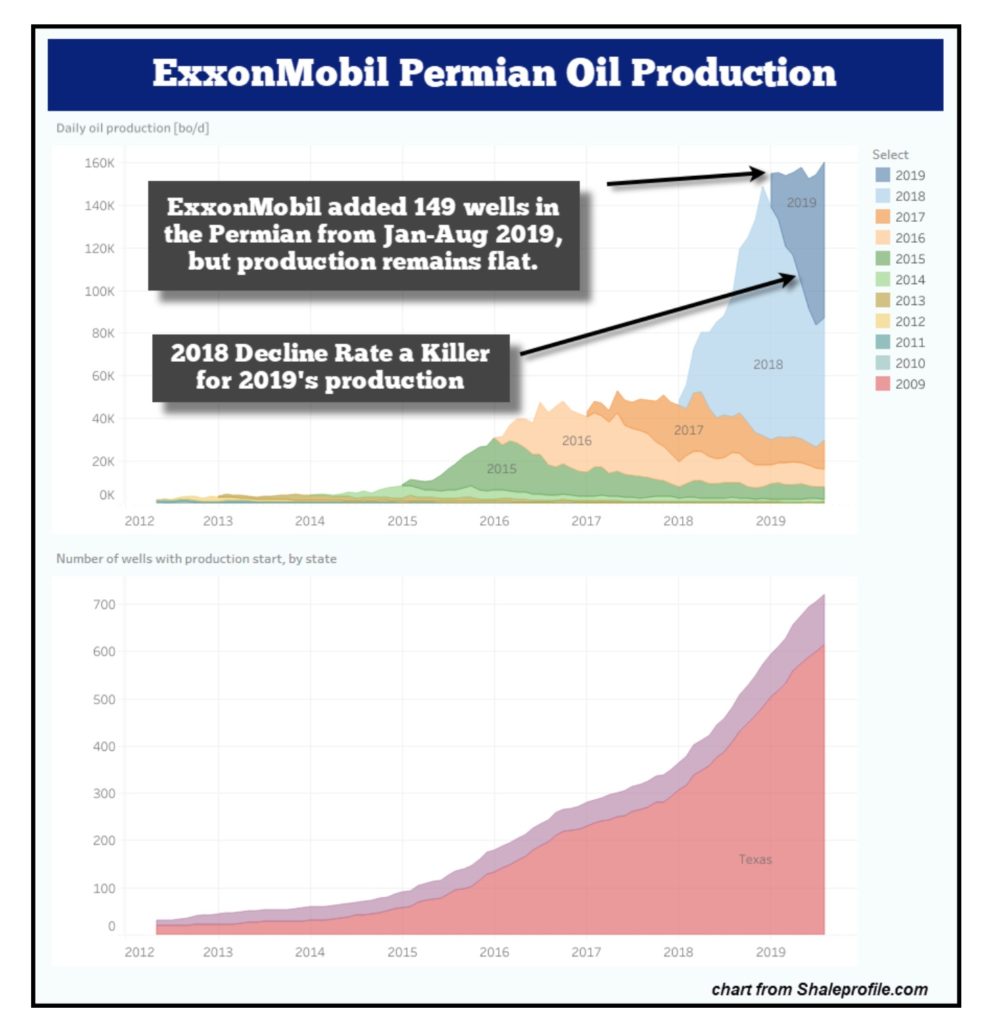

According to Shaleprofile.com, Exxon’s Permian oil production rose slightly since January, but natural gas was the clear source of that increase. ExxonMobil added 133 wells from Jan-Aug 2018 to increase overall Permian oil production by 84 percent. However, when ExxonMobil added 149 wells from Jan-Aug 2019, oil production only increased by 3 percent during the same period. The reason for the plateauing of Exxon’s Permian shale oil production has to do with the massive decline rate taking place in its 2018 production.

Exxon’s Permian 2018 oil production is displayed in the light blue color. At peak production in December 2018, Exxon’s Permian oil production reached 148,734 b/d and then declined 41 percent to 87,154 b/d by August 2019. So ExxonMobil had to make up that 61,580 b/d decline with its new wells added in 2019. You will notice the 2018 decline rate is much more severe than the 2017 (orange color) decline rate. This is the big problem facing ExxonMobil and other oil companies trying to outrun the industry’s annual decline rate.

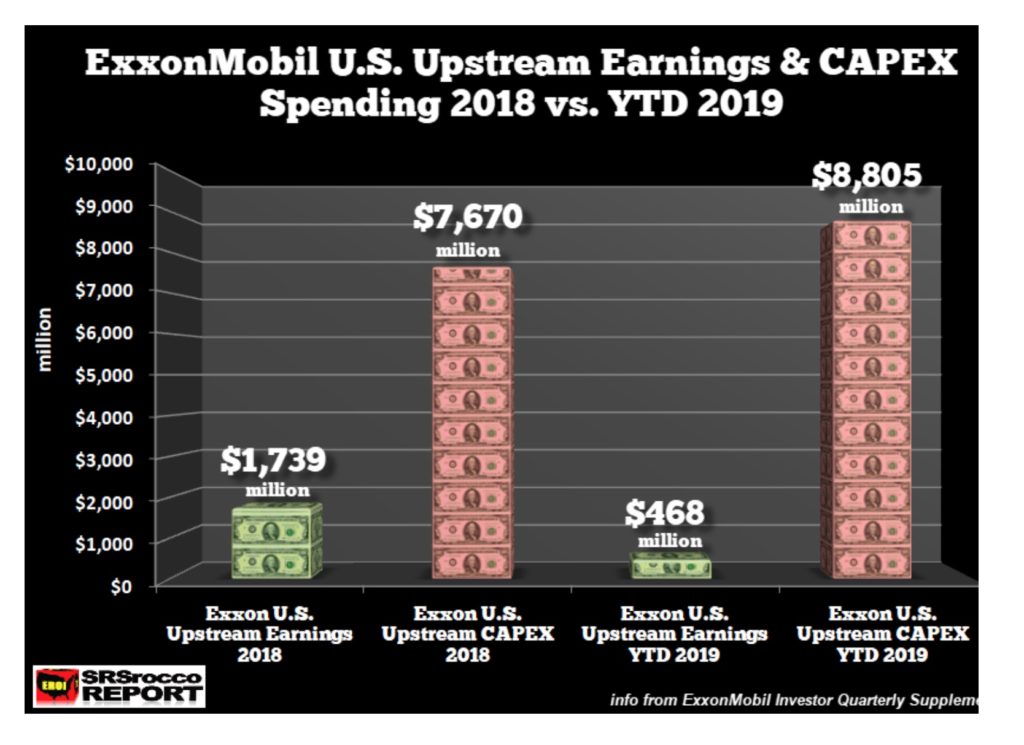

ExxonMobil spent $3 billion on its US upstream (oil & gas wells) CAPEX to make $37 million in earnings. Now, compare that to the $2.8 billion of CAPEX spent on the company’s International Upstream sector to receive $2.1 billion in profits. Of the total $2.17 billion of ExxonMobil’s Q3 Upstream Earnings, the U.S. sector accounted for 1.7 percent of the amount. Here is a chart comparing ExxonMobil’s 2018 U.S. Upstream Earnings and CAPEX versus YTD 2019.

Last year, ExxonMobil invested $7.67 billion of CAPEX on its US Upstream sector while earning $1.7 billion. In the first three quarters of 2019, ExxonMobil spent $8.8 billion in CAPEX to earn $468 million. In recent years there have been scattered reports that the Permian Basin was producing more natural gas along with its oil than had been expected. This SRSrocco report is one of the first to dig into the details of the problem.

The massive wave of investment that went into offshore oil projects earlier this decade may produce a lot of oil, but profits might not materialize. Earlier this decade, between 2010 and 2014, oil prices were above $100 per barrel. That led to a massive wave of spending on costly, often high-risk oil projects, many of which were offshore in deepwater or ultra-deepwater. The projects may have made sense when oil was above $100 per barrel, although even then, there were serious questions. A wave of unprofitable oil Is about to hit the market.

2. Geopolitical instability

Fresh clashes between Iraqi security forces and anti-government protesters broke out in Baghdad on Friday, killing one person, despite a call for calm by the country’s top Shi’ite cleric. More than 280 people have died, according to police and medics, since the protests over a lack of jobs and services began in Baghdad on Oct. 1 and quickly spread to southern provinces. The demonstrators, mostly unemployed youths, demand an overhaul of the political system and a corrupt ruling class that has dominated state institutions since the U.S.-led overthrow of Saddam Hussein in 2003.

Grand Ayatollah Ali al-Sistani, who only speaks on politics in times of crisis and wields enormous influence over public opinion in Shi’ite-majority Iraq, held security forces accountable for any violent escalation and urged the government to respond as quickly as possible to demonstrators’ demands. “The biggest responsibility is on the security forces,” a representative of Sistani said in a sermon after Friday prayers in the holy city of Karbala. “They must avoid using excessive force with peaceful protesters.” Protesters, some of whom view Sistani as part of the political and religious system they say is the cause of many Iraqis’ misery, took little solace from the cleric’s words.

Operations resumed at a port and an oil refinery in southern Iraq on Thursday after protesters left both areas. Anti-government demonstrators had blocked roads at Umm Qasr commodities port, halting operations for more than a week. On Wednesday, they stopped fuel tankers entering or leaving the Nassiriya oil refinery, causing shortages in the south. The blocking of Umm Qasr, which receives imports of grain, vegetable oils, and sugar shipments that feed a country largely dependent on imported food, has cost the country more than $6 billion, the government said on Wednesday.

Iraq’s nationwide oil sales dropped by more than 3 percent from September, averaging 3.85 million b/d in October. While loadings by the Kurdistan Regional Government via the Turkish port of Ceyhan slightly increased, those exports were more than offset by a decline in federal exports from southern Iraqi ports. Bagdad’s massive protest movement is having its first direct effects on the country’s oil output, as production is now curtailed at the Qayarah field. The field’s 30,000 b/d have been shut in for several days because road blockades in Basra are preventing tanker trucks from bringing crude to the Khor al-Zubair port.

Iran will start injecting uranium gas into centrifuges at its underground Fordow enrichment facility, a highly symbolic breach that will complicate European efforts to salvage Tehran’s nuclear deal. Under the 2015 agreement, Iran agreed to turn Fordow into a “nuclear, physics and technology center” where 1,044 centrifuges are used for purposes other than enrichment. Tehran has gradually scaled back its commitments to the deal after the US reneged on the agreement. The other signatories opposed the US president’s action and remain committed to the agreement. France, Germany, and the UK have been working for months on measures to help counter the sanctions, but the scale of the punitive measures has meant the so-called E3 has struggled to keep finance and trade channels open.

A senior Iranian official said Tehran’s decision to increase its nuclear activity for the fourth time this year should act as a “wake-up call” for European signatories of Tehran’s 2015 atomic accord to resolve the deepening crisis. He added that Iran would continue to increase its nuclear activity every two months unless it received the economic benefits it was promised when it signed the nuclear deal with the US, France, Germany, the UK, China, and Russia.

The medics at the Aziziya field hospital south of Tripoli are seeing something new: narrow holes in a head or a torso left by bullets that kill instantly and never exit the body. The lack of an exit wound is a signature of the ammunition used by Russian mercenaries elsewhere. The snipers are among about 200 Russian fighters who have arrived in Libya in the last six weeks, part of a broad campaign by the Kremlin to reassert its influence across the Middle East and Africa. These Russian mercenaries are fighting alongside renegade Libyan commander Khalifa Haftar as he seeks to oust the country’s United Nations-backed government, according to Libyan military commanders and other Western officials.

The US military near the oil fields in northern Syria has every right to defend against other forces if the oil is threatened, according to a Pentagon spokesman. Proceeds from the oil fields under US control will go to the Kurdish allies Syrian Democratic Forces (SDF). On Wednesday, a senior State Department official said: “Our local SDF allies are reliant upon the oil fields. We also have had – ever since we went in there the mission of denying the oil revenues to Daesh, because this was a major source of Daesh money.”

3. Climate change

A top Federal Reserve policymaker on Friday signaled that the US central bank might join its international peers in incorporating climate change risk into its assessments of financial stability and may even take it into account when setting monetary policy. The remarks, from Fed Governor Lael Brainard at the opening of the Fed’s first-ever conference on climate change and economics, mark a shift for the Fed, which lags other major central banks in making climate change an explicit part of its financial stability remit.

“Congress has assigned the Federal Reserve specific responsibilities in monetary policy, financial stability, financial regulation and supervision, community and consumer affairs, and payments,” Brainard said. “The Fed will need to look at how to keep banks and the financial system resilient amid risks from extreme weather, higher temperatures, rising sea levels and other effects of the accumulation of greenhouse gases in the atmosphere.”

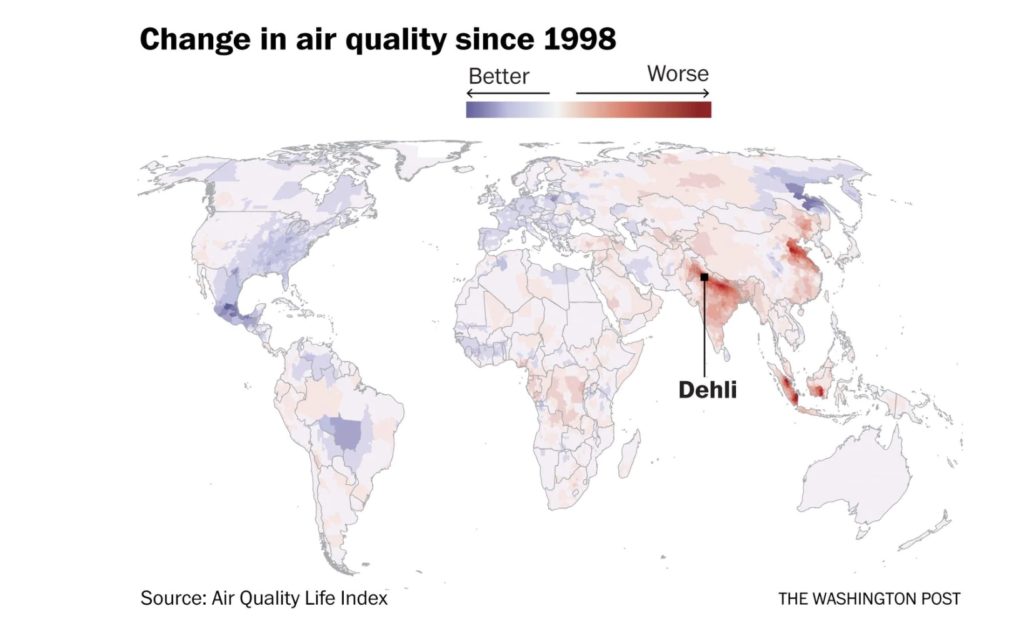

Delhi has been smothered in a dense blanket of smoke and haze for weeks. Farmers in the capitol’s three neighboring states have been given the bulk of the blame for the disastrous air pollution. Despite a ban by the country’s Supreme Court, many farmers continue setting their crop stubble on fire to prepare the land for the new crop. The court warned that the “time has come to punish government officers.”

Government representatives say they lack the resources and funds to monitor hundreds of thousands of farmers living in their districts. CBS News met several farmers in Haryana state who said there was a simple answer to why, even after an official ban, they continue to set their crop residue on fire: It’s what they can afford to do. “You just need a one-rupee matchbox to set the field on fire but 3,000 rupees (about $43) per acre of land to plow the stubble into the soil and prepare the land for the next crop.” So, they torch it, as they always have.

Russia has abandoned its plan to reduce emissions, under pressure from businesses that face steep fines if they don’t comply with the new rules. Moscow’s Economy Ministry said, “After consultations with the government, it was decided to abandon the specific regulatory requirements. The government will have the right to decide after Jan. 1, 2024, what measures to introduce if Russia is forecast to miss its emissions targets.” Moscow signed the Paris Agreement on mitigating the effects of climate change in September. At the time, Russia’s climate envoy told media that “When it comes to further actions, we will have to do a lot of work within the state. We will need to adopt a primary law on regulating greenhouse gas emissions.

The situation in California was better last week. The lull was mainly due to the end of the peak season for Diablo winds in Northern California that blow every October. In the south, last week also brought a break from strong winds, but they could return and continue into December or even January. Meteorologists now expect a higher-than-normal chance for big fires next month, with a late start to the rainy season looking increasingly likely.

Frustrated with wildfires and intentional blackouts caused by Pacific Gas & Electric, more than two dozen California mayors and county leaders are calling for a customer-owned power company to replace the giant utility. PG&E, which filed for bankruptcy protection in January after accumulating an estimated $30 billion in liabilities from wildfires caused by its equipment, is widely expected to emerge with a different structure. Any bankruptcy plan requiring a rate increase is subject to approval by the utility commission.

Last week, President Trump announced that his administration would begin the process of officially withdrawing from the Paris Agreement on climate change. The president’s announcement was met with condemnation by world leaders, environmental activists, business owners, as well as his political rivals—who railed against the prospect of having the world’s largest economy abandon its commitment to tackling the climate crisis.

The administration replied to the charges by having the Assistant Secretary for Fossil Energy at the DOE say that the US can tackle threats to the climate through technological advances and that fossil fuels will remain a priority for the US government and business. Officially, Trump cannot exit the agreement until the day after the November 2020 elections, and so the outcome of the race will determine whether or not the US would withdraw.

No major oil company has aligned its operations with the goals set out in the Paris Climate Agreement. The oil industry is moving ahead with oil and gas projects that completely defy climate targets, which means that they are taking on severe financial risk. “Companies who continue to sanction higher-cost projects which do not fit with a lower demand scenario risk destroying significant shareholder value through the creation of stranded assets,” Carbon Tracker warned.

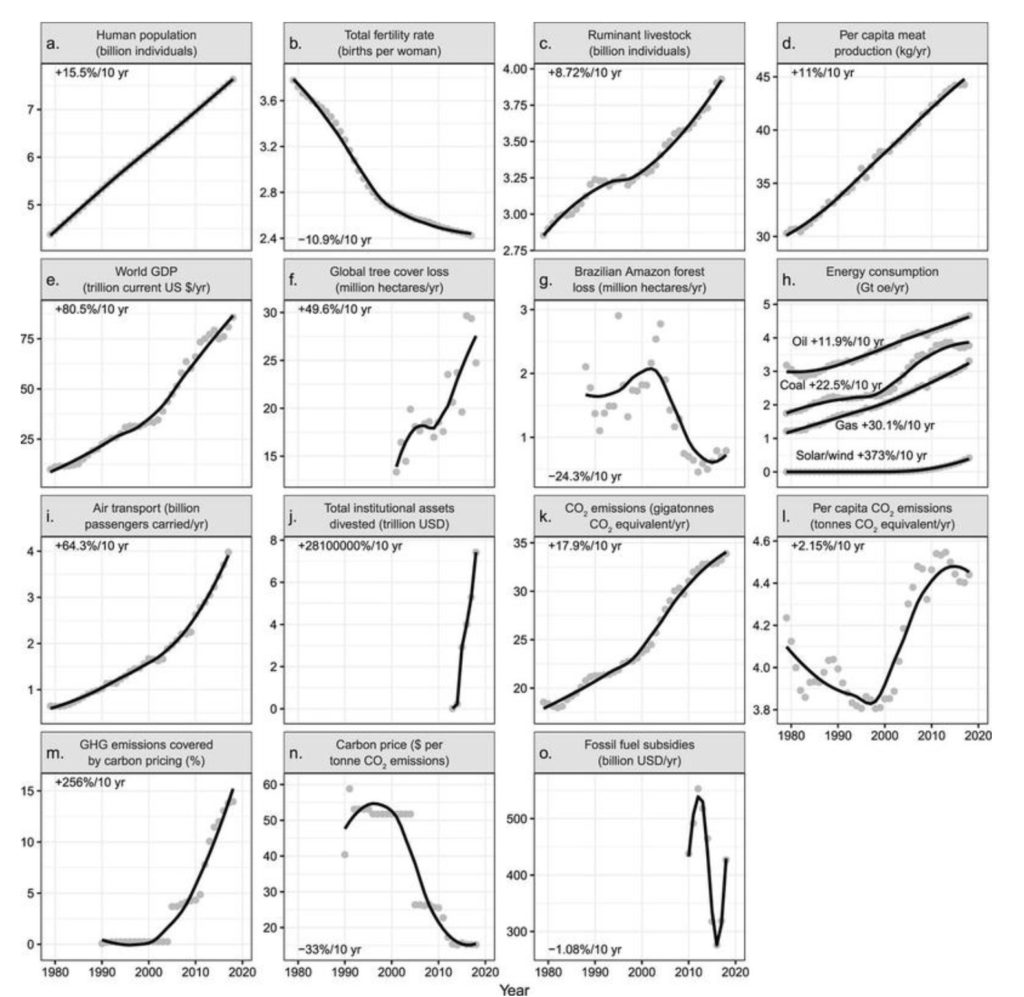

More than 11,000 scientists from 153 nations endorsed a newly published statement on climate change — and it’s exceptionally gloomy. “The climate crisis has arrived and is accelerating faster than most scientists expected,” the authors wrote. “It is more severe than anticipated, threatening natural ecosystems and the fate of humanity.” The statement, published on Tuesday in the journal BioScience, includes decades’ worth of hard data and scientific analysis on climate trends to support the authors’ claims.

The scientists make specific calls for policymakers to quickly implement systemic change to energy, food, and economic policies. But they go one step further, into the politically fraught territory of population control. It “must be stabilized—and, ideally, gradually reduced—within a framework that ensures social integrity.“ This statement brought about provocative headlines about the world needing to lose 4 billion inhabitants to stabilize the climate situation.

4. The global economy and trade wars

Last week’s developments were dominated by the state of the China-US trade negotiations. Markets soared on Thursday after the Chinese Commerce Ministry said the US and China had agreed to roll back tariffs as part of the accord. But Reuters reported later on Thursday the idea of tariff rollbacks at this time was meeting with stiff opposition within the Trump administration. Those divisions were on display Friday, when Trump told reporters at the White House that he had not agreed to reduce tariffs already put in place. Analysts point out that if substantial reductions in tariffs come in Phase one, the US would lose much of its leverage in further negotiations over more critical issues.

The 16-month trade war has slowed economic growth around the world and prompted analysts to lower forecasts for oil demand, raising concerns that a supply glut could develop in 2020. “Even if a partial US-China agreement is reached, the impetus for demand will not be enough to avoid an oversupply next year, meaning that OPEC will still need to make bigger production cuts,” Commerzbank said in a note. A deal between the Organization of the Petroleum Exporting Countries and allies, such as Russia, will limit supplies until March next year. The producers meet on Dec. 5-6 in Vienna to review that policy.

President Trump scrapped the Trans-Pacific Partnership, a proposed trade bloc that would have put the United States at the center of a trade zone that represented about a third of the global economy. Now, 2½ years later, China is putting itself at the center of an alternative trade zone that represents about a third of the worldwide economy. Last week, Asia-Pacific leaders descended on Bangkok for the Association of Southeast Asian Nations, or ASEAN, summit. The talks have centered on hammering out the Regional Comprehensive Economic Partnership (RCEP), which was intended to create a new trade bloc representing up to half the planet’s population and more than $3 out of every $10 in the global economy. India got cold feet and backed out of the deal, but the RCEP is still on track to be signed next year. A third-string American delegation to the summit was seen as an indication that the United States considers the ASEAN summit as a third-tier priority. It was an insult in a region where “saving face” matters as much culturally as politically.

As the global economy faces its sharpest slowdown since the financial crisis, one industry is both culprit and victim. The motor industry affects the health of the global economy far more than its share of total output would suggest. Last year the sector shrank for the first time since the global crisis of 2008-09. The IMF believes this fall in production accounted for more than a quarter of the slowdown in the global economy between 2017 and 2018. The sector may also be responsible for up to a third of the slowdown in global trade growth between 2017 and 2018, the fund said last month, after factoring in the spillover effects on trade in car parts and other intermediate goods.

5. Renewables and new technologies

Every week there are announcements from a variety of universities, national laboratories, and companies, large and small, trumpeting a new development that will make lithium-ion batteries better than ever before. Most of these are still at the lab bench stage of development, however, and it will be years before any real breakthrough reaches the market.

Last week, several stories appeared about energy technologies that are outside the box. A couple of these such as nuclear fusion – both hot and cold – have been around for decades, and a couple of others seem to be new, but years away from coming into everyday use, if ever.

The prospects for developing nuclear fusion as a possible source of energy have significantly improved, say “experts.” The UK government has recently announced an investment of £200 million to deliver electricity from a fusion reactor by 2040. Private companies and governments have told the BBC they aim to have demonstration models working within five years. But many serious hurdles remain. With the price of wind and solar continuing to drop, existing renewables might offer a more economical and timely method of tackling climate change and generating energy than an unproven technology like fusion. Even if the technology can be made to work, the costs of producing power in fusion reactors are likely to play a critical role in determining its commercial viability.

We have not heard much about “cold fusion” in the last 30 years. At the time of its rediscovery in 1989, the heat-producing phenomenon proved to be so difficult to reproduce that most experimenters soon gave up and concluded that low-temperature fusion was not real. A handful of experimenters have kept on developing the science, and at least one says he has a heat-producing device ready for the market.

Defense contractor Lockheed-Martin has been working on a “compact fusion reactor” program since 2014. Lockheed certainly has the resources to undertake such a project. Still, it is not clear whether they are developing a technology that can work at room temperatures or is working on a smaller device that can generate and contain the 50 million of degrees necessary for energy-producing reactions such as take place in thermonuclear weapons.

Lockheed hopes to commence work on the next iteration, the T5, before the end of the current year. The company will then build three more reactors culminating in T8, which it hopes will demonstrate stable fusion and full confinement.

A team from the Chalmers University of Technology in Sweden has been working on developing a “molecular solar thermal system” since 2013. The general concept is to design a molecule made of carbon, hydrogen, and nitrogen—which can capture solar energy and store it for as long as necessary until a catalyst causes a chemical reaction that results in the release of the energy in the form of heat.

While not the same as existing batteries that store electricity, heat storage could cut the electricity consumption of a household and, consequently, its carbon footprint. To attract investors, the team is coating a whole building on the campus of Chalmers University to showcase the potential of the technology.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

At the global scale, energy efficiency has tremendous potential to boost economic growth and avoid greenhouse gas emissions. Still, the global rate of progress has slowed each of the last three years, according to a new report by the IEA. Global primary energy demand rose by 2.3 percent in 2018, driven in large part by the People’s Republic of China, India, and the US, which were responsible for 70 percent of demand growth. In the US, primary demand increased for the first time since 2014. (11/4)

Tanker regs are looming: The upcoming IMO 2020 sulfur emission regulation is prompting both owners and charterers to negotiate and incorporate new clauses in their charter party agreements, or CPAs, to factor in the performance of scrubbers and use of compliant bunkers. At the same time, owners and charterers, who have non-scrubber ships on long-term charters, are exhausting their supply of high sulfur fuels by taking longer voyages. (11/9)

OPEC projected some 7.95 million b/d of new crude distillation capacity to come online in the next five years, more than 70 percent of it in Asia and the Middle East. Therefore, OPEC said in its World Oil Outlook that it expects 2.1 million b/d of refining capacity to be shuttered through 2025 due to overcapacity, and another 5 million b/d of further closures will be needed by 2040. (11/5)

Norway’s energy giant Equinor has made one of this year’s most significant discoveries in the North Sea estimated to contain up to 100 million barrels of oil equivalent in the most mature area of the basin. Equinor expects to tie back the discovery to existing infrastructure in this mature area. (11/8)

Israeli gas exports by pipeline to Egypt are on course to begin by the end of 2019 after a 39 percent stake in the idled EMG pipeline was transferred at the weekend to a new owner, paving the way for supplies to begin. (11/5)

Kuwait, OPEC’s fourth-largest producer currently, may revise down its long-term oil capacity production targets due to concerns that environmental risks will limit oil demand growth, in what would be a first acknowledgment from an OPEC member that climate change could stifle oil demand. (11/6)

Abu Dhabi’s Supreme Petroleum Council (SPC) upgraded on Monday the hydrocarbon reserves of the United Arab Emirates (UAE), saying that the country has added 7 billion barrels of oil, moving up to sixth from seventh place in reserves globally, the Abu Dhabi National Oil Company (ADNOC) said. (11/5)

Saudi Arabia is hitting up its wealthy citizens to buy stock in the Saudi Aramco IPO. The wealthy Olayan family is considering an investment in the realm of hundreds of millions of dollars worth of shares in Aramco. Even smaller investors are expected to invest, also if it means borrowing from banks on the cheap to do so—and rumor has it that the banks are willing to do just that. (11/8)

In China, refinery start-ups and stabilizing refining margins drove crude oil imports to a record high in October. The world’s top oil importer increased its crude intake in October by 11.5 percent compared to the same month last year, to an average of 10.72 million barrels per day (bpd), (11/9)

Somalia is preparing for the launch of its first-ever crude oil licensing round, with details about it to be announced in December. The results from seismic research conducted on the 15 blocks up for licensing was promising, suggesting they could hold as much as 30 billion barrels of crude. (11/7)

Senegal, a West African country that has seen several significant oil and gas discoveries in recent years, is launching a new licensing round to award three offshore blocks as it expects its first already sanctioned oil and gas projects to come online by the middle of the next decade. (11/6)

Nigeria’s Dangote refinery — set to be Africa’s biggest at 650,000 b/d plant — was expected to be ready to process crude by early 2021, officials said Monday. The plant, being built by Nigerian conglomerate Dangote Group and which will use Nigerian crude, was previously set to come on stream in 2020. (11/5)

In Venezuela, the glut of oil inventory that the nation has been nearly choking on in recent months appears to be finally draining as the crisis-stricken country managed to send off 800,000 b/d of oil for the second month in a row. But its list of oil buyers has shrunk to about a handful of loyal takers—China, Russia, and Cuba—who are unwilling to kowtow to US pressure in the form of sanctions. (11/5)

Venezuela’s state-held oil firm PDVSA has cut its outstanding debt to the largest Russian oil producer to below US$1 billion. Rosneft is one of the few companies still dealing with Venezuela. In its Q3 results presentation published today, Rosneft said that PDVSA’s debt as of September 30, 2019, had dropped to US$800 million, down from US$1.1 billion as at the end of the second quarter this year. (11/7)

Brazil’s attempt at its most prominent oil auction ever has ended in a near-total flop as oil majors steered clear of the pricey oil areas up for grabs. Brazil was hoping to rake in more than $25 billion from the auction to offset a portion of its budget deficit and change its nationalistic oil industry ways by offering foreign players a seat at the table. Another $25 billion was set to go to Petrobras in exchange for work Petrobras had already done in exploring the areas up for grabs. But Petrobras and a consortium that involved Petrobras were the only winning bidders. (11/7)

In Brazil, this year’s final oil auction in Brazil ended in a flop on Thursday, with Big Oil staying away from bidding and only one of five blocks awarded, suggesting that the large upfront payments and complex royalty schemes have kept the world’s largest oil companies from participating. (11/8)

In Argentina, oil and natural gas production in Neuquen, a leading source of the hydrocarbons, surged year on year in September. Total oil production in the province rose 25 percent on the year to 154,915 b/d in September. Vaca Muerta is helping to pull the country out of a nearly two-decade decline in oil production, which peaked at roughly 900,000 b/d in 2001 (BP data) and bottomed out at 479,000 b/d in 2017, according to Argentinian Energy Secretariat data. The country produced a total of 517,041 b/d in September, up 3.7 percent year on year. (11/5)

Argentina extended the deadline for bidding for an $800 million project to build a pipeline for moving natural gas out of Vaca Muerta, a key for increasing output and exports from the country’s biggest shale play. The deadline has been extended to March 31, 2020, from November 4—the second delay in the project since it was announced earlier this year. The two-stage plan calls for investing $2 billion to build a 1,000-km line for transporting gas from Vaca Muerta, in the southwestern Neuquen Basin, to near Buenos Aires. (11/7)

The US oil rig count declined by seven this week while the number of gas rigs remained flat, according to Baker Hughes Company data. This marks the nation’s fourth consecutive week for rig declines and brings the total number of active rigs to 817, down by 264 from the 1,081 count one year ago. (11/9)

Petroleum balance: For the first time since 1978, the US recorded a surplus in the petroleum trade, at $252 million in September, government data showed on Tuesday. The value of petroleum exports stood at $14.966 billion, while imports were at $14.714 billion. Both exports and imports in petroleum products in September were lower than in August, which also contributed to the first surplus in the oil trade in 41 years. (11/6)

Tanker rates: Fewer new vessels are hitting the water in the coming months, and more tankers are making longer journeys to load up cargoes in the US as buyers and sellers restructure energy supply chains. That adds up to tight shipping capacity on the horizon and higher prices in most forecasts. (11/5)

In Alaska, the US Bureau of Land Management will hold its annual lease sale in the National Petroleum Reserve-Alaska on December 11, the agency announced Tuesday. Three hundred and fifty tracts covering 3.98 million acres will be offered for competitive bid. The federal sale will occur two days after Alaska offers unleased state land east of the NPR-A in the central North Slope as well as state submerged lands in the Alaskan Beaufort Sea. (11/6)

Refinery risk: How did a piece of piping installed when Richard Nixon was US president go without once being checked before leading to a fire that devastated the East Coast’s largest and oldest oil refinery? That’s a question safety experts and activists are putting to regulators after the devastating fire at the Philadelphia Energy Solutions (PES) refinery in June, worried more disasters are waiting to happen in an industry reliant on old equipment. (11/6)

In Germany, coal produced 50 percent less energy than renewables during the first three quarters of 2019. Coal generated 125 billion kWh, down from the 171.1 billion kWh produced during the same period last year. Solar, wind, and other renewable sources, on the other hand, generated around 183 billion kWh of electricity between Q1 and Q3, 2019, which covered 42.9 percent of gross electricity consumption in the country and represented a 5 percent increase over the same period last year. (11/5)

Polish utility Polenergia is launching the construction of the 38 MW Szymankowo wind farm, the first sizeable renewable energy project in Poland that will not require state subsidies nor a long-term power purchasing agreement. (11/7)

Biofuels pushback: France’s constitutional court upheld the law cutting palm oil from the country’s list of approved biofuels and eliminating associated tax exemptions. The court rejected an appeal by French energy company Total, which had invested 300 million euros in converting a crude oil refinery into a biofuel plant that would use palm oil feedstock. In some locations, increased oil palm cultivation has resulted in severe environmental damage as rainforest has been cleared—often through widespread burning— to make room for new palm oil plantations. This severe deforestation has undermined biofuels’ sustainability credentials, as these tropical forests are vital absorbers of carbon dioxide. (11/7)

China may cut, yet again, subsidies for customers buying electric vehicles (EVs), in what could be another heavy blow to electric car sales in the world’s biggest EV market, which has already seen lower registrations due to previous subsidy cuts. (11/9)

EU’s EV pothole: Inconsistent requirements for charging stations across Europe are keeping the infrastructure for electric cars from growing as fast as it could, the CEO of ChargePoint, one of the world’s largest charging network operators, said on Tuesday. (11/7)

VW has started production of lithium-ion battery systems at a factory in Braunschweig, Germany, set to produce 500,000 units per year, the automaker said Friday. VW began to the production of its first electric-only model ID.3 on Monday, targeting 100,000 units in 2020, and rising to 330,000 by 2022. (11/9)

Deadly vehicle debt: Consumers, salespeople, and lenders are treating cars a lot like houses during the last financial crisis by piling on debt to such a degree that it often exceeds the car’s value. This phenomenon—referred to as negative equity or being underwater—can leave car owners trapped. Some 33 percent of people who traded in cars to buy new ones in the first nine months of 2019 had negative equity, compared with 28 percent five years ago and 19 percent a decade ago. Those borrowers owed about $5,000 on average after they traded in their cars, before taking on new loans. Five years ago, the average was about $4,000. (11/9)

Pig tariff tribulations: China is scouring the world for meat to replace the millions of pigs killed by African swine fever, boosting prices, business and profits for European and South American meatpackers—but not those in the tariff-bound US—as it re-shapes global markets for pork, beef, and chicken. 11/8)

New energy secretary: President Donald Trump has formally nominated Dan Brouillette to serve as the next Secretary of Energy. Brouillette, who is the current Deputy Secretary of Energy, would replace sitting Secretary Rick Perry if confirmed by the US Senate. (11/8)