Quote of the Week

“…The US is deluding itself when it comes to energy abundance (generally) and oil (specifically). Yet that’s not what we hear from the cheerleaders in the industry or in our media. From them, we hear a silver-tongued narrative of coming riches — a narrative that contains some truth, some myth, and a lot of fantasy. It’s those last two parts — the myths and fantasies — that are going to seriously hurt many investors, as well cause a lot of extremely poor policy and investment decisions.”

Chris Martenson, commentator at www.peakprosperity.com, former investments manager

Graphic of the Week

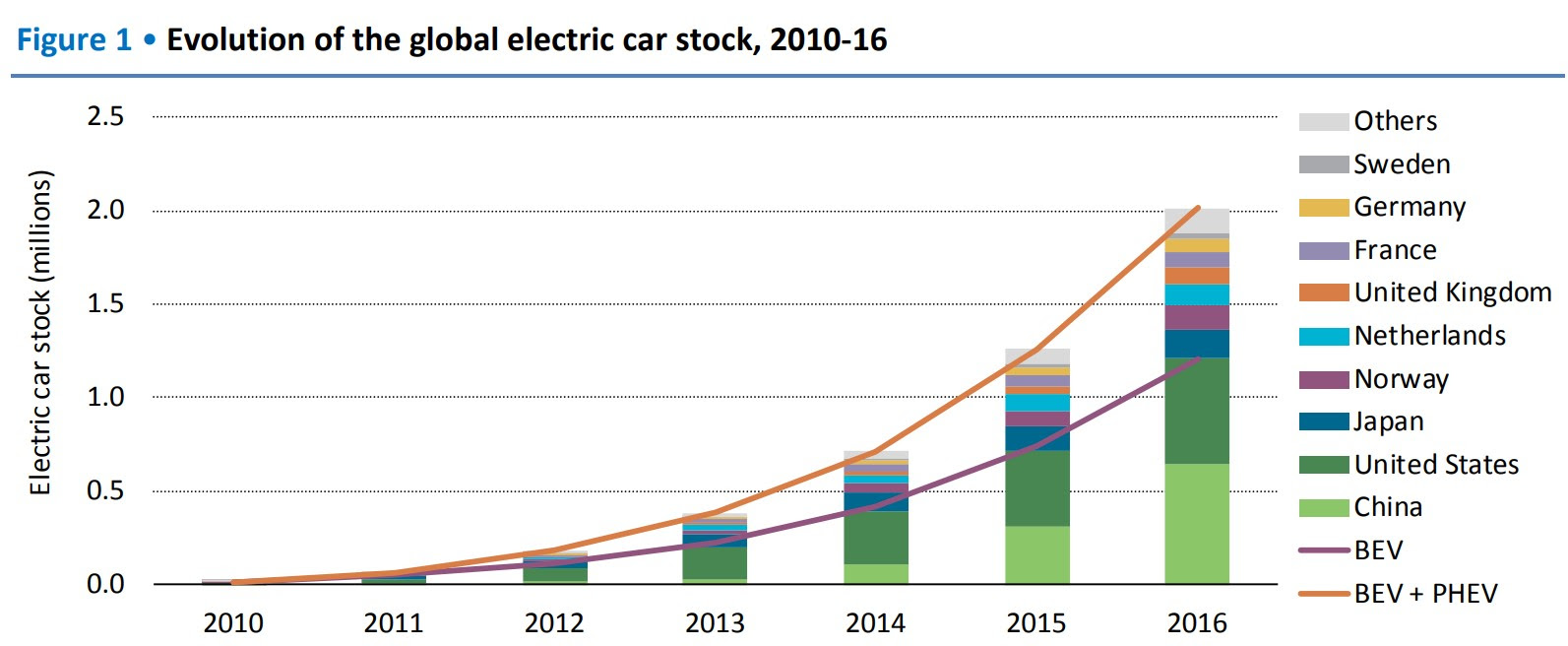

EV forecast: There will be more than a billion electric vehicles on the road by 2050, according to Morgan Stanley. (9/7)

Contents

1. Oil and the Global Economy

2. The Middle East & North Africa

3. China

4. Russia

5. Nigeria

6. Venezuela

7. The Briefs

1. Oil and the Global Economy

Oil prices rose some $3 a barrel for the first three days last week and then collapsed on Thursday and Friday as Beijing announced its plans to reduce the capacity of its small “teapot” refineries, and Hurricane Irma closed in on Florida reducing demand for oil products in the state. Recovery from the Texas hurricane, Harvey, continues with 8 of 20 refineries that were closed by the hurricane now back to normal operations. The ports of Corpus Christi and Houston are returning to normal, and several other refineries report they will be back in operation in the next week or two. Gasoline prices in the US are starting to retreat from storm-induced spikes as refineries and pipelines return to normal. The unusually large crude and product reserves in stockpiles have helped cushion price increases.

As was the case with Hurricane Harvey, the full impact of Irma on Florida will not be known until the hurricane has passed by the state. Some are predicting that economic activity in the states impacted by the giant storm could be curtailed for many weeks or even months as reconstruction takes place. Irma is also delaying and disrupting crude shipments across the Caribbean in and out of the US.

As seems normal these days, predictions as to where oil prices are going in the next year are mixed. Some see a tighter oil market in 2018 while others see prices remaining in the vicinity of $50 a barrel for the immediate future. There are so many variables that could have a significant impact on oil prices in play at the minute, a clear look ahead is becoming difficult. New factors such as increasing tensions in Korea and the possibility of military hostilities had some warning of a major oil price spike and others feeling that hostilities could curb demand.

At the minute, we have concerns that the US shale oil industry may be reaching peak production due to production costs continuing to be below selling prices. The outlook for major oil consumers such as the US and China is not that good as the US has to pay for the costs of two major hurricanes and China borrowing continues at an unsustainable level. Venezuela moves closer to total collapse with each passing week. Increasing temperatures in the Middle East are forcing some exporting countries to consume a greater portion of their oil production domestically. Most major oil exporters are outspending their revenues. In short, much is in flux these days.

The OPEC Production Cut: The cartel exported 25.19 million b/d of crude last month, the lowest since April. At least one observer, Kpler, a firm of tanker trackers, says that the Reuters export estimate is too low and the August number was closer to 25.9 million b/d. The eight-month average for 2017 was 25.05 million b/d which was above the corresponding period in 2016 before the production caps begun. The 370,000 b/d decline in OPEC exports was due to geopolitical troubles in Nigeria, Libya, and Venezuela rather than any conscious effort to lower exports.

With seven months left in the current production cut agreement, it does not appear that the production cut is going too well. Hence efforts to extend the cut further into 2018. OPEC has invited Libya and Nigeria to a meeting on Sept. 22nd to discuss the outlook for their production. Together, the two countries have increased their production between 700,000 to 900,000 b/d in the past year. This, coupled with a revival of US shale oil production, has largely offset the cuts made by Middle Eastern producers.

Declines in US crude stocks are no longer as meaningful as they were last year and the US is now exporting large amounts of its shale oil production and the Saudis are making a deliberate effort to reduce exports to the US. Moreover, before the recent hurricanes, the US was refining and exporting well above normal quantities of oil products to Latin America and other countries. There is no reason to believe that these exports will not resume after the US recovers from the hurricanes.

Moscow said last week that it is willing to consider an extension of the production cuts if the glut persists, but that it is still too early to make a decision.

US Shale Oil Production: For many years now a small number of observers mostly from outside of the financial and oil industries have said that the US shale oil boom that raised US oil production by about 6 million barrels per day is unsustainable. Despite the hype about “efficiencies”, most shale oil producers are still losing money on every barrel of oil that is sold. The losses are being made up by issuing equity to fund drilling costs and outright loans from banks. In the last four years, a weighted average of 33 shale oil E&P companies has been losing some $15 to $20 billion each year.

Losses were taking place even when shale oil was selling for above $100 a barrel. North Dakota reports that last month its shale oil production was selling for $38 a barrel as compared to the all-time high of $136 back in 2008. This likely is the reason why production in the Bakken seems to be peaking at around 1 million b/d.

Depletion rates of shale oil wells are so high that most are only producing on the order of 15 percent of their original production after three years. Production from legacy wells in the major basins is already declining by over 400,000 b/d each month. To maintain production at current levels, the industry must open 400,000 b/d of new production each month just to stay even. As long as Wall Street is willing to keep pumping some $15 to $20 billion into the oil industry each year, then production will continue or even grow. If outside money stops flowing into the shale oil industry, then drastic declines in US shale oil production necessarily would take place very quickly.

Observers are starting to note that there is a growing divergence between the EIA’s weekly estimate of US oil production which is mostly informed guesses and the monthly figures which are not released until several weeks after the month is over. In May, the EIA weekly publications had the US producing 9.34 million b/d. When the more accurate monthly numbers came out the country was only producing 9.16 million b/d. For June, the weekly numbers had production at 9.31 million, but the monthly analysis came out 220,000 b/d lower at 9.09 million. There seems to be a reason for those skeptical of EIA’s weekly production estimates.

The EIA sees US oil production surging from 9.3 million b/d in 2017 to 9.9 million next year. Given the interruptions caused by Hurricane Harvey, it seems unlikely that US production will be approaching 10 million b/d anytime soon. If the size of the shale industry’s losses ever sinks into Wall Street, US oil production could be declining rather rapidly. Prices, of course, would be much higher, making OPEC and the other major exporters very happy, but also putting a crimp in economic growth and cutting demand.

2. The Middle East & North Africa

Iraq: Oil exports by the federal government were slightly lower in August (3.23 million b/d vs. 3.21 in August), but revenues were up due to higher oil prices. The issue is complicated by the oil being exported through Turkey by the semi-independent Kurdish province, where the volume of exports is in dispute. Norway’s DNO is teaming up with Exxon and a Turkish company in Ninawa province, controlled by the Kurds. DNO will assume operatorship of the license with a 40 percent interest, acquiring one-half of ExxonMobil’s position. Exxon retains a 40 percent interest, the Turkish Energy Company its 20 percent interest and the Kurdistan Regional Government the rest.

The biggest challenge facing Iraq since the US invasion may be the upcoming referendum on independence that is scheduled for September 25th. The referendum is expected to pass easily and could be followed by a declaration of independence. Should this happen, the political landscape of the region could change radically. Baghdad is not completely opposed to its province of Kurdistan seceding but draws the line at the Kurds annexing the region around Kirkuk and its oil riches which they seized during the ISIS uprising.

Most states in the region are opposed to an independent Kurdistan. The Turks fear that it will increase the problems with their large Kurdish population who would want to join the new state. Iran and Syria face the same problem. Tehran has already indicated that it will help its fellow Shiites in Baghdad maintain control of the Kirkuk area. A declaration of independence by Erbil could lead to decades of turmoil involving numerous regional and world powers.

Saudi Arabia: Riyadh says it will cut crude oil allocations by 350,000 b/d in October which is in line with its commitment to cut 486,000 b/d under the production freeze agreement. Initial indications show that exports to the United States in October will be lower than 600,000 b/d. The Saudis have been slashing shipments to the US in an attempt to drain the US crude inventory. The US inventory is reported weekly which gives it much more prominence in the eyes of oil traders.

When the Saudis disclose the balance sheet of their flagship oil company, Aramco, to investors next year, it must either show record profits which would attract outside investors, or be faced with admitting that the company is not worth $2 trillion as the government has been claiming. Based on Aramco’s “official” oil reserves of 261 billion barrels and the current price of oil assets which is $7 to $8 per barrel Aramco believes the company is worth close to the $2 trillion. To justify such a valuation, however, Aramco has to report earnings on the order of $130 billion before interest, taxes, depreciation, and amortization. By comparison, Apple, the current most valuable firm in the world is worth around $830 million on gross earnings of $82 billion. Many observers believe that the Saudi claim of $2 trillion is an exaggeration given the current outlook for the global oil market and dubious claims as to how much oil is left in its fields.

Libya: The country’s largest oil field again is operational following a two-week shutdown. In late August, the assaults by the armed group Reyayna Patrol Brigade had forced some of the pipelines connected to the Sharara field to be shut down. Libyan output fell from 990,000 b/d in July to 830,000 b/d in August due to the pipeline closures. This development, which if recent history is any guide, may not last long, but puts the country back to producing close to a million b/d which is not helping the OPEC production cut.

3. China

The conglomerate CEFC China Energy will buy a 14 percent stake in Russia’s Rosneft for $9.1 billion from a consortium of Glencore and the Qatar Investment Authority, thereby strengthening the energy partnership between Moscow and Beijing. The deal comes as the US imposes a new round of economic sanctions on Russia, making it difficult for Western firms such as Glencore to increase ties with state-owned firms such as Rosneft.

Independent refineries holding crude import quotas in China’s Shandong province are planning to consolidate into a single corporate entity to strengthen their competitive edge. The Shandong Economic and Information Technology Committee said it had approved the setting up of Shandong Refining Energy Group Corp., a proposal which was brought up by the Shandong Oil Refining Association, an independent organization.

China’s new energy (electric) vehicle industry has seen rapid growth in the past few years. Production and sales of electric vehicles have surpassed 1 million units so far, with an annual growth rate of over 200 percent. With more than 50 percent of the world’s electric vehicle production, sales, and ownership in 2016, China is now a global leader. Domestic battery makers, motor producers, and other enterprises in the supply chain have become internationally significant suppliers, with more than 70 percent of the global shipments of batteries coming from China. Public charging facilities within China have surpassed 180,000, with their coverage increasing in residential areas, along highways, and in other public space.

4. Russia

President Putin said the dispute with ExxonMobil over the Sakhalin-1 oil and gas project has been resolved. Exxon has been in talks with Gazprom for years over gas sales from Sakhalin-1. Exxon also lodged a claim with a court of arbitration in Stockholm in 2015 seeking the return of $637 million which it said it had overpaid in taxes.

Despite sanctions from the US and the EU, and Europe’s determination to reduce its reliance on Russian gas, Moscow has been setting all-time highs in its exports to Europe in the past eight months. Gazprom has been setting all-time summer season export records, with current gas flows around 580-590 million cubic meters per day. Gazprom also announced it signed preliminary agreements for small- and mid-sized liquefied natural gas projects in the Japanese market. Economies in the Asia-Pacific region are expanding faster than developed nations and are importing more oil and gas.

As Russian reserves of conventional oil start to dwindle, the question arises as to whether Moscow will be able to exploit its reserves of shale oil as the US has done. Some 20 percent of Russian oil reserves are believed to belong to the “tight” oil category. Most of these reserves are located in current oil producing regions that already have a well-developed infrastructure to produce and transport tight oil.

So far there has been little movement in Russia to exploit shale oil deposits. Without the fracking techniques developed in the US, the yield from tight oil deposits is uneconomical. In comparison with traditional sources of oil, tight oils are much more expensive to produce and so far, there have been few incentives to begin production.

Initial efforts to produce tight oils could cost on the order of $80 to $90 a barrel which is well above the going price of oil these days. US and EU sanctions have prevented Russian oil companies from seeking technical assistance abroad, and so far, Moscow has done little to promote tight oil development while it pushes for increased Arctic oil production. This may be changing. The Ministry of Natural Resources is proposing changes to the existing legislation so that there would be no taxes on new technologies for producing oil.

5. Nigeria

The government’s plans to increase crude oil production will receive a boost, as the multi-billion dollar Egina Floating Production Storage and Offloading vessel, currently being constructed in South Korea, is scheduled to add 200,000 b/d to Nigeria’s output by the fourth quarter of 2018. Total said the completion of the vessel is on schedule and within budget. as Samsung Heavy Industries completes its construction. The government is insisting that the Egina FPSO must be fitted out in Nigeria. Samsung appears to have gone out of its way to integrate as much Nigerian content into the new vessel as possible.

6. Venezuela

The government has invited international bondholders to negotiations over its foreign debt as the government in Caracas seeks to mitigate the impact of US sanctions and survive a deepening economic crisis. President Maduro told the government-controlled constituent assembly on Thursday that almost three-quarters of the bondholders were from the US and Canada. Russia, the major lender to the South American country, confirmed that it had been asked to help with a restructuring. Moscow has extended state loans as well as financial assistance from Rosneft, the government controlled oil producer, to Venezuela’s state-owned PDVSA.

7. The Briefs(date of article in Peak Oil News is in parentheses)

Norway’s DNV GL, providing risk management advice, said in an energy transition outlook that global demand for energy, in general, would level off by 2030 and then move lower as efficiency improves. For oil, demand peaks in 2022 because of the rise in the use of electric vehicles, though energy trends might not be enough to stave off the impacts of climate change. (9/6)

Norway’s Statoil said the last of the 67 turbines at the Dudgeon wind farm off the British coast are in place. By next month, the facility could provide service for 410,000 average British homes at peak capacity. (9/8)

The North Sea has long been a costly place to produce oil. And as the aging oilfields in the North Sea suffer from declining output – a decline underway since the late 1990s – investing in a high-cost basin for the oil majors has slipped down on the priority list, especially when shale has emerged as an alternative in an uncertain market. (9/8)

The Scottish government has pledged to phase out new petrol and diesel cars and vans across Scotland by 2032, eight years ahead of the UK Government target. Nicola Sturgeon outlined plans to “massively expand” charging points and set up pilot projects to encourage uptake of electric vehicles. (9/8)

France plans to pass legislation by the end of 2017 to phase out all oil and gas exploration and production on its mainland and overseas territories by 2040, becoming the first country to do so, according to a draft bill presented on Wednesday. President Emmanuel Macron wants to make France carbon neutral by 2050 and plans to curb greenhouse gas emissions by leaving fossil fuels. (9/7)

In Azerbaijan, BP’s stake in that nation’s oilfields is expected to shrink under a new production-sharing agreement with state energy company SOCAR. Azerbaijan plans to sign a new contract with BP next week on the development of the giant Azeri-Chirag-Guneshli oilfields that will run until 2050. The fields are the largest oilfields in the Azerbaijan sector of the Caspian basin. (9/9)

India’s second largest state has appealed to the country’s top court to quash a Goldman Sachs-backed solar project, highlighting the challenges faced by solar companies looking to expand in Asia’s third largest economy. (9/9)

In Argentina, indigenous Mapuche communities demanding cash payments and blocking oil wells in the Vaca Muerta area are threatening the long-delayed development of the world’s second-largest shale fields, oil companies say. Since the beginning of the year, the Mapuche have cut off access to 14 wells in the Loma de la Lata field, one of only two shale fields currently producing in the Belgium-sized Vaca Muerta area. (9/9)

In Brazil, the scope of the scandal called locally “Lava Jato” (Car Wash) is truly impressive. It may encompass two former presidents, the sitting president, the heads of both houses of Congress, ninety lawmakers and one-third of President Temer’s cabinet. President Temer is desperately trying to stabilize the wobbly Brazilian economy and get the government’s finances in order. One key measure: privatize a vast swath of the Brazilian economy now held by the government, selling off the mint, the state bank’s lottery unit, the federal savings and, most significantly to us, the government’s interest in the country’s largest electric utility, Electrobras. (9/4)

Colonial Pipeline, the biggest US pipeline system, said on Friday it expects the full restart of its crucial supply point at Port Arthur, Texas by the end of the month after Hurricane Harvey dumped heavy rains and caused flooding. In the meantime, Colonial is considering allowing shipments of fuel through the Port Arthur pumping facility at a reduced rate, starting September 15th. (9/9)

In Mexico, President Enrique Pena Nieto said on Friday operations at the Salina Cruz refinery on Mexico’s southern coast were temporarily suspended as a precautionary measure following a major earthquake nearby. (9/8)

In Mexico, Dutch supermajor Shell said it has opened its first retail gasoline service station in one of the largest gasoline markets in the world. The company said it’s the first part of a 10-year, $1 billion investment in the Mexican energy sector, provided market conditions continue to improve at their current rates. (9/7)

Hurricane Irma has shut down oil terminals across the northern Caribbean, worsening a fuel supply crunch in Latin American countries that have struggled to meet demand since Hurricane Harvey disrupted shipments from the US Gulf Coast last month. (9/7)

Canada’s oil-producing regions saw the highest increase in insolvencies over the 12 months to June 2017, according to the latest report by the federal government. (9/5)

TransCanada Corp will suspend the application for its Energy East pipeline for 30 days and may abandon the project, the company said on Thursday, weeks after Canada’s National Energy Board regulator announced a tougher review process. (9/8)

The US oil rig count declined by three last week to 756, the third decline in four weeks. Analysts at Simmons & Co forecast the total oil and gas rig count would rise to an average of 863 in 2017, 932 in 2018 and 1,078 in 2019. Most wells produce both oil and gas. That compares with 855 so far in 2017, 509 in 2016 and 978 in 2015. (9/9)

The Trump administration is waiving Jones Act requirements until September 15 to address a potential fuel shortage in Florida caused by the approaching Hurricane Irma and lingering Gulf Coast pipeline and refinery disruptions following Hurricane Harvey. The waiver covers seven states and Puerto Rico, and lasts for seven days, but may be extended. The Jones Act requires vessels transporting goods between US ports to be US-flagged, US-built, and majority US-owned. (9/9)

In Houston, ConocoPhillips is still shut out of its global headquarters nearly two weeks after Tropical Storm Harvey slammed into the city, so CEO Ryan Lance and thousands of employees are running the world’s largest independent oil and natural gas producer remotely. Lance, whose own Houston home was flooded by Harvey, has 2,800 employees in the region working at home or at smaller offices in Dallas or Bartlesville, Oklahoma, overseeing natural gas trading along with operations in the Texas Eagle Ford shale region and the Gulf of Mexico. Many moved out of Harvey’s path before the storm. (9/8)

US oil refinery utilization rates slumped 16.9 percentage points to 79.7 percent last week, the lowest rate since 2010, according to data released by the US EIA. US Gulf Coast utilization rates dropped to 63.4 percent, the lowest rates since the EIA began collecting the data in 2010. US refinery crude runs fell 3.3 million barrels per day to 14.5 million b/d in the week to Sept. 1. (9/4)

Ethylene is arguably the most important petrochemical on the planet — and much of it comes from the hurricane-stricken Gulf Coast. Ethylene is used to make cars, milk jugs, paint, and mattresses. More than half of US ethylene production has been knocked out by Harvey. (9/4)

Oil and petrochemical plants along the US Gulf Coast intend to go ahead with plans for near record spending on expansions next year, despite Hurricane Harvey driving up labor costs and slowing work. Harvey largely spared oil and petrochemical plants along the US Gulf Coast from significant damage. Refiners and recovery projects will compete for the same labor, driving up costs or causing labor shortages. Industrial investment in the Gulf Coast is expected to hit $51.9 billion next year, near the 2015 peak, requiring an army of pipefitters, ironworkers and other craftsmen. (9/8)

Cheniere Energy was preparing Wednesday to ship its first LNG export cargo from its Sabine Pass terminal in Louisiana since Harvey came ashore along the Gulf Coast as a powerful hurricane almost two weeks ago. (8/7)

The Bill Barrett Corp., which has a core focus in US shale oil basins, said production for the year could be higher than expected because of Colorado’s success. Bill Barrett said it was updating its guidance on 2017 production figures following positive results from a nine-well drilling program in Colorado. (9/7)

CCS: In Texas, a startup named Net Power is preparing for the first tests of its gas-fired, 50MW power plant that runs on natural gas and captures all the carbon dioxide the generation cycle produces to use it in that very cycle. Net Power basically replaces the water that ordinary natural gas plants use to heat up to steam and power the turbines with carbon dioxide. (9/4)

TX wind + storage: Two wind farms in Texas will become the second- and third-largest facilities with extra storage capacity installed so far, a German power company said. German energy company E.ON said it started construction on a 20-megawatt storage facility to service its Inadale and Pyron wind facilities in the west of Texas. (9/7)

Georgia Power and its partners requested permission from the Georgia Public Service Commission to finish Reactors 3 and 4 at Vogtle, which would be the first new nuclear reactors to come on line in the US in more than 30 years. They may need government help to complete the job. Georgia Power said its capital cost to complete would be an additional $4.5 billion. Total costs for the project would approach $30 billion. (9/4)

EV forecast: There will be more than a billion electric vehicles on the road by 2050, according to Morgan Stanley. The investment bank says that despite hiccups for many EV models to date, Tesla’s success thus far “shows that the consumer preference for internal combustion engines can be swayed.” Morgan Stanley analysts go on to add: “technology and usability are improving, and charging times are falling. There will come an inflection point where range and usability combine with the right price.” India is aiming to have almost all vehicles sold to be powered by electricity after 2030. (9/7)

The electric car race: big-name car makers are vying to win it—literally. This July, all of Germany’s motor-sport icons— Audi, Mercedes-Benz, Porsche, and BMW —said they would soon join Formula E, the electric-car equivalent of Formula One. The announcements come as the global auto industry is accelerating its shift toward electric cars, illustrated by Volvo’s recent decision to abandon conventional engines and go completely electric by 2019. Many see Formula E as a proving ground for vanguard electric vehicle technology. (9/9)

Tesla + Vestas: Electric car builder Tesla and wind turbine manufacturer Vestas have combined forces to create an energy storage system based on wind power. (9/6)

Hydrogen storage: Hydrogen has drawn backing from big energy companies from Royal Dutch Shell Plc to Uniper SE in addition to carmakers BMW AG and Audi AG. They’re supporting research into how the element can be used to store energy for weeks or even months beyond what lithium-ion batteries can manage. While industry’s investment in hydrogen is small at just $2.5 billion over the last decade, hydrogen can be kept indefinitely in tanks. (9/6)

Auto Zone: Harvey appears to be the most destructive event for cars in the nation’s history, based on early estimates, with floodwaters destroying hundreds of thousands of vehicles. (9/4)