Editors: Tom Whipple, Steve Andrews

Quote of the Week

“By any measure, the amount of private money currently allocated in the US to plug and reclaim oil and gas wells is a small fraction of the real costs. That means oil and gas wells — and the US had 1 million active wells and even more abandoned — will either be left to fail and potentially contaminate the surrounding water, air, and soil, or the public will have to pick up the tab. This represents just one of the many ways the public subsidizes the oil and gas industry.”

Justin Mikulka, DeSmog blog site

Graphic of the Week

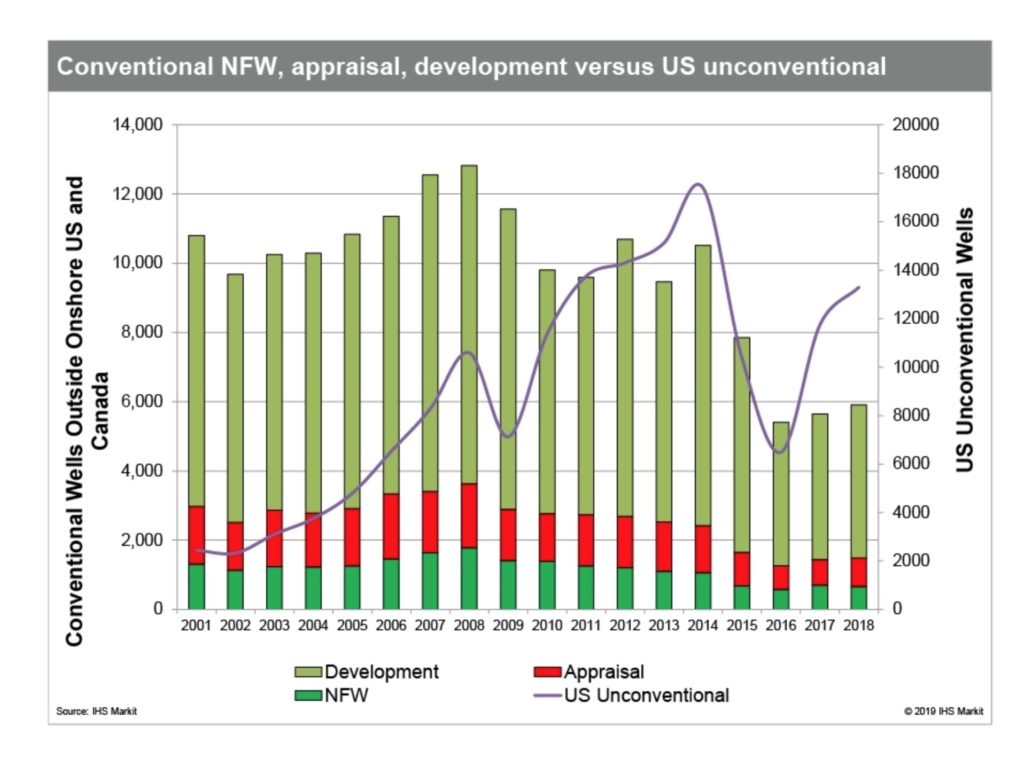

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Prices were up about $2 last week on an unexpected drawdown in US crude stocks and rumors that OPEC+ is considering another production cut. Forecasters see a supply glut continuing in 2020 due to slowing economies and growth in US shale oil production. Beyond that, prices could increase considerably as supply growth slows to a trickle. Goldman Sachs says that slowing US shale production growth combined with a shortage of investment in long-term projects will lead to a new boom. Goldman lowered its forecast for US oil production growth to 0.7 million b/d in 2020, down sharply from its 1 million b/d forecast previously. Goldman attributed the downward revision not just to a slowdown in drilling, but also to “updated longer-term decline rates to be consistent with play-to-date results” –a complicated way of saying shale wells are not performing as well as previously anticipated. Reuters says OPEC+ may announce larger cuts in response to weak demand at its December meeting. A cut is not certain, however, as Moscow and Riyadh want to see 100 percent compliance with the existing production cuts before cutting more. Iraq and Nigeria, for instance, have produced more than their quotas. Moreover, Russia poured cold water on the idea last week, with its energy minister saying that nobody from OPEC+ had proposed production cuts. There are some reasons, however, why OPEC+ might implement deeper cuts. Seasonal demand is lower in the winter, so larger cuts would be in keeping with seasonal swings. The news from the shale oil industry continues to be gloomy. Financing is running dry for large portions of the US shale oil industry, forcing drillers into bankruptcy and threatening the industry’s growth. The financial reckoning has been a long time coming. In the aftermath of the 2014-15 oil price crash, US oil and gas producers managed to raise $56.6 billion from equity and debt capital markets in 2016. This year they have raised just $19.4 billion, even though US oil production has grown by more than a third in the past three years. The first- and third-largest oilfield service companies in the world saw their earnings hit in the third quarter due to the slowdown in US shale drilling. Schlumberger took a $12.7 billion impairment charge related to its North American business, a rather dramatic write-down. That led to an $11.4 billion loss for the quarter, the largest in the company’s history. Halliburton also saw its earnings hit by the slowdown in shale drilling and the oilfield services giant shifted its focus to international markets as the signs of a shale rebound do not appear to be imminent. The US oil and gas rig count fell sharply last week with a drop of 25 rigs. This marks nine decreases out of the previous ten weeks. The total number of active oil rigs in the United States decreased by 17, according to the report, reaching 696. That marks the first time since April 2017 that the oil rig count has fallen below 700. In a recent report, IHS Markit concludes that the trend toward unconventional projects has caused the number of conventional discoveries to plunge to a 70-year low. |

Although unconventional projects give oil and gas firms more flexibility in responding to market changes, the wide disparity in depletion rates between unconventional and conventional wells could become particularly evident in years to come, given the shortfall in conventional reserves additions.

US shale production growth is slowing down, and America’s shale output will likely peak in the next few years, Russia’s Energy Minister Alexander Novak said on Tuesday. “We see that there is slowing activity in US shale, although that production continues to grow, growth is weaker than in previous years,” Novak told reporters in Sochi. The number of drilling rigs in the United States dropped by 160 in a year, Novak noted.

2. Geopolitical instability

Chaos increased across the Middle East last week as Turkish and Russian forces moved to secure their new Kurd-free security zone; protests against the government resumed in Iraq; and nationwide protests that have going on for nearly two weeks in Lebanon. With the US, Russia, the Assad government, Kurds, ISIS, and Syrian rebel groups all trying to control some portion of what was once Kurdish territory, chaos is bound to result from years of confrontation.

There are not many working oil wells left in Syria even though the US just sent tanks into Syria to keep ISIS from taking control of any working oil wells from the Kurds. Before Syria’s 2011 revolution and the ensuing civil war, the country had a lucrative oil industry, pumping about 400,000 barrels a day. The war devastated Syria’s economy, cutting production by as much as 90% and forcing the Assad regime to rely heavily on imports of oil from Iran.

The situation in Syria is too volatile to predict what might happen there. A lot of ominous threats are being made by the various parties involved, including one from the Turks to dump 3.6 million Syrian refugees into the EU unless it starts paying more for their upkeep.

The demonstrations in Iraq resumed last week. Hundreds of Iraqi protesters remained in Baghdad’s central Tahrir Square on Sunday, defying a bloody crackdown that killed scores over the weekend. At least 67 Iraqis were killed, and hundreds wounded on Friday and Saturday, as demonstrators clashed with security forces and militia groups in a second wave of protests against Prime Minister Adel Abdul Mahdi’s government this month, bringing the total death toll in October to 224.

The unrest has broken nearly two years of relative stability in Iraq, which from 2003 to 2017 endured a foreign occupation, civil war, and an Islamic State insurgency. It poses the biggest challenge to Abdul Mahdi since he took office just a year ago. Despite promising reforms and ordering a broad cabinet reshuffle, he has so far struggled to address the protesters’ discontent. Political alliances backing his fragile coalition government are beginning to fracture, making his continued leadership increasingly precarious.

The protesters’ anger has been directed increasingly at political parties with ties to Iran and their militias. The militias are now part of the Iraqi security forces, but their origins, and sometimes their training, involve Iran. The offices of some of those political parties and militias were vandalized or burned in the Shiite-dominated south of Iraq, prompting the government on Saturday to impose tough new restrictions on movements there. Protesters are demanding more jobs, better public services, and an end to corruption.

In Tahrir Square, many protesters described the security forces firing at them as Iranian or from the Iranian political parties. “Iran Get Out, Get Out,” demonstrators chanted. Protesters set fire to offices belonging to a Shi’ite political party and a Shi’ite militia group in Iraq’s southern Muthanna province on Friday, police sources said. The offices of the Hikma movement and Asaib Ahl al-Haq were set ablaze by protesters in central Samawa city.

So far, the demonstrations do not seem to have much impact on Iraq’s oil exports. However, the evolving situations in Iraq, Syria, and a revived ISIS caliphate could change that.

Lebanon has been swept with protests against a political class accused of corruption, mismanagement of state finances, and pushing the country toward an economic collapse unseen since the 1975-90 civil war. Banks, schools, and many businesses have shut their doors. The protests have continued to grip Lebanon despite the government announcing an emergency reform package this week that failed to defuse anger. It has also yet to reassure foreign donors to unlock the billions in badly needed aid they have pledged.

Protesters trickled back on to the streets across Lebanon on Saturday, despite army efforts to unblock roads, with no end in sight to a crisis that has crippled the country for ten days. A military statement said army and security commanders met to plan ways to re-open main arteries to get traffic flowing again while “safeguarding the safety of protesters.” People have closed routes with barriers and sit-ins as part of a wave of unprecedented protests demanding the government resign.

Lebanon has one of the world’s highest levels of government debt as a share of economic output. The size and geographic reach of the protests have been extraordinary in a country where political movements have long been divided along sectarian lines and struggled to draw nationwide appeal.

3. Climate change

Climate change is reshaping the evolution and intensity of El Niño events in a way that favors the occurrence of more “super” El Niños. According to a new study, there has been a westward shift by up to thousands of miles in where in the Pacific Ocean El Niño is originating. The new study, published in the journal Proceedings of the National Academy of Sciences, uses statistical methods as well as eight different computer models to uncover previously unseen trends in El Niño occurrences to date. The study finds the key may lie in the increasingly mild ocean waters of the western tropical Pacific Ocean — an area known as the West Pacific Warm Pool. The westward move is significant since it means El Niño is now forming and peaking in a region of the Pacific Ocean that is naturally warmer. This shift can increase the chances of a moderate to strong event.

All 11 El Niños that have taken place since 1978 formed in the Central or Western Pacific Ocean, according to the study, including three super El Niños that helped push global temperatures to record levels and wreaked havoc with weather patterns worldwide. Super El Niños, like the ones that occurred in 1982, 1998, and 2015-2016, can vault global temperatures to new heights, killing coral reefs worldwide and flooding parts of Africa and Asia while starving other parts of the globe of moisture. In short, they can lead to lasting extreme weather events affecting hundreds of millions and costing hundreds of billions of dollars in damage.

One difference between the western Pacific El Niños and eastern Pacific events is that the western-based events can begin to affect global weather patterns during the summer in the Northern Hemisphere, rather than reserving the most significant impacts for the winter months. These earlier events can lead to long-lasting drought and heatwaves in the Western US, for example.

For some time now, it has been clear that the effects of climate change are appearing faster than scientists anticipated. Now it turns out that there is another form of underestimation as bad or worse than the scientific one: the underestimating by economists of the costs. This failure by economists means that world leaders understand neither the magnitude of the risks to lives and livelihoods nor the urgency of action. How and why this has occurred is explained in a recent report by scientists and economists at the London School of Economics and Political Science, the Potsdam Institute for Climate Impact Research and the Earth Institute at Columbia University.

One reason is apparent: Since climate scientists have been underestimating the rate of climate change and the severity of its effects, then economists will necessarily underestimate their costs. A set of assumptions and practices in economics has led economists both to underestimate the economic impact of many climate risks and to miss some of them entirely. That is a problem because, as the report notes, these “missing risks” could have “drastic and potentially catastrophic impacts on citizens, communities and companies.”

4. The global economy and trade wars

The collateral damage of the United States’ trade wars is being felt from the fjords of Iceland to the auto factories of Japan. Central bank governors and finance ministers traded grim tales of suffering economies at the International Monetary Fund and World Bank fall meetings in Washington last week. As the IMF’s gathering of 189 member-nations drew to a close, the unintended negative impacts of the trade wars were becoming evident, IMF Managing Director Kristalina Georgieva said. “Everybody loses.”

The United States, the world’s largest importer, started a bitter tariff war with China, the world’s largest exporter, 15 months ago. President Trump is also renegotiating and sometimes upending, trade relationships with many of Washington’s top trading partners. The fallout will slow global growth in 2019 to 3.0%, the slowest pace in a decade, the IMF estimated this week. This pain is not being shared equally. The US remains the least exposed of the world’s 20 largest economies to a decline in exports, in part because of its massive domestic consumer spending base.

The damage is being particularly felt in European countries which “rely on exports and are open to trade,” the European Union’s Economic and Financial Affairs Commissioner Pierre Moscovici said.

More than 40 percent of Germany’s GDP was derived from exports in 2018, the most of any major global economy. Uncertainty in the business community is widespread, German Finance Minister Olaf Scholz told reporters.

On Friday, Japan’s Cabinet Office, which helps coordinate government policy, downgraded its assessment of factory output in October. The softness in production was mostly due to car exports to the United States turning weaker, after growing steadily until the spring, a government official said at a briefing. “The pick-up in global growth is being delayed,” Bank of Japan Governor Haruhiko Kuroda said. “Japan’s economy is seeing exports weaken significantly. and that’s affecting factory output.”

The United States hasn’t been immune from the impact of the trade wars. American farmers have been particularly hurt by Chinese tariffs on US agricultural products, prompting the Trump administration to give billions in aid to the farm belt.

US companies are preparing for tensions with China to extend far beyond the status of the continuing trade discussions, an executive for the U.S.-China Business Council said Monday. “When we talk to companies, there’s a realization that no matter what happens with this trade deal, we’re going down a trajectory of a much more confrontational relationship with China that’s very unlikely to shift in the opposite direction in the future”. Businesses are making arrangements to diversify their supply-chain investments away from the China market and enacting other structural changes.

China has set its sights high – very high – in terms of economic development, aiming to become the leading superpower worldwide by 2049, the 100th anniversary of the People’s Republic of China. China is already the second-largest economy in the world and growing all the time. But for China, this comes with challenges. “China faces a protracted and increasingly difficult struggle to secure energy and water supplies to feed its appetite for rapid growth. From having to sustain a population over four times that of America’s 330 million, China is already at a severe disadvantage against the US for the title of preeminent superpower.

It has only a portion of the US’s oil, gas, and water resources, and that gap in self-sufficiency is likely to widen further. In June the IEA reported that the country’s natural gas consumption is projected to grow at nearly double the rate of Beijing’s previous projections. While China is doing its best to boost its energy production, it may be too little too late. The country’s demand for fuel is insatiable and simply cannot be met without the massive imports that China has already become entirely dependent on and will continue to rely on as the economy grows.

China continued to import crude oil from the US, Iran. and Venezuela in September, but Asia’s biggest energy consumer kept shipments from the three producers minimal due to the tariff and sanctions barriers blocking easier access to those supplies, latest data from the General Administration of Customs showed last week.

US and Chinese officials are “close to finalizing” some parts of a trade agreement after high-level telephone discussions last week. The US Trade Representative’s office provided no details on the areas of progress. Washington and Beijing are working to agree on the text for a “Phase 1” trade agreement announced by US President Donald Trump on Oct. 11. Trump has said he hopes to sign the deal with China’s President Xi Jinping next month at a summit in Chile. Outside observers continue to note that the “Phase 1” agreement only contains minor issues that were agreed to months ago.

5. Renewables and new technologies

Renewable energy capacity is set to grow by 50 percent by 2024, according to a new report from the IEA. In 2019, renewable energy is set to grow by 12 percent, the fastest rate in four years, as solar and wind power are quickly becoming cheaper than coal in most of the world.

A decade ago, onshore wind led the way initially, aided by lower costs. But the cost of solar has plunged in recent years, and more policy support has helped it continue to gain ground. The IEA estimates that costs for solar PV will decline by another 15 to 25 percent for both utility-scale solar and distributed projects over the next few years. “Recent competitive auction results indicate that the levelized cost of generation for utility-scale solar PV plants will become comparable with or lower than that of new fossil fuel plants sooner than expected in a growing number of countries,” the agency said.

However, the IEA also says that offshore wind power can meet all of the world’s electricity demand and is set to be a “game-changer” for energy systems. The landmark EIA report is the first time that the agency has conducted such an in depth examination of offshore wind.

The agency is known for its conservative reputation, repeatedly over-predicting oil demand and under-predicting the pace of growth for renewable energy. Notably, even the IEA says that solar and wind outcompete fossil fuels on price alone. A September report from the Rocky Mountain Institute finds that renewable energy already beats out new natural gas-fired power plants on costs. But by the mid-2030s, it will be cheaper to build new solar and wind than it will be to run existing gas plants, let alone build new ones.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Saudi Arabia, the world’s top oil exporter, is issuing $2.5 billion worth of Islamic bonds, or Sukuk, on Tuesday, returning to the bond market to take advantage of the low borrowing costs in hopes of replenishing its government coffers as persistently low oil prices depress revenues. (10/23)

Iraq has throttled back its crude production since setting an all-time record in August, averaging 4.85 million b/d in September. The month-on-month reduction of about 120,000 b/d comes after their Oil Minister promised OPEC members that Iraq would move back toward compliance with a quota designed to buoy global crude prices. (10/24)

India, one of the drivers of oil demand growth in Asia and the world, has just seen its oil imports drop to three-year lows, and fuel processing rates plunge to a 15-year low, as slowing economic growth is taking its toll on demand. (10/26)

In China, state-owned Sinopec expects natural gas demand to increase by 82 percent to 510 Bcm in 2030, from 280 Bcm in 2018, driven by continued industrial upgrading and urbanization. Gas demand growth will come mainly from city gas, industrial usage, and gas-powered utilities. Demand is expected to exceed 300 Bcm in 2019, up by almost 10% year on year. (10/24)

China’s refining overcapacity is increasingly exported. Traders expect China’s growing product exports to underpin gasoline and gasoil trade flows in Asia, much like the emergence of refining hubs in Singapore and India did in the past. China’s current crude distillation unit capacity has equaled that of the US, the world’s largest, at 18.2 million b/d. (10/24)

In Nigeria, Russia is looking to strengthen ties with Africa’s largest oil producer with a focus on reforming that nation’s downstream and gas sector, the Russian energy ministry said late Wednesday. (10/25)

In Libya, the unstable security situation and the continued bickering between rival governments have kept international oil companies from resuming exploration activities in the civil war-torn North African oil producer. The latest sign that the deteriorating situation is dampening the investment climate in the oil and gas sector comes from two oil majors, BP and Eni, which have shelved plans to install rigs and start exploration in Libya. (10/25)

Venezuela and Chevron: The US government has given Chevron and four oil service providers permission to keep working in Venezuela for another three months, extending their exemption from oil sanctions that have hit the rest of the industry in the South American country to a full year. When Washington imposed an embargo on Venezuelan oil in January, it gave US companies operating there a six-month exemption. It extended that waiver for three months in July and has now done the same again. (10/22)

Venezuelan standoff: The US Treasury is blocking for 90 days creditors from seizing shares in Venezuela’s US subsidiary Citgo, temporarily shielding the prized Venezuelan asset in a win for Venezuela’s opposition and its leader Juan Guaidó. Venezuela’s state oil firm PDVSA must make a payment of US$913 million on a 2020 bond on Monday, October 28. Still, the bond is widely expected to go into default because the Venezuelan oil firm doesn’t have the money to make the payment. PDVSA, however, has used shares in its most prized foreign asset, Citgo, as collateral for the bond. The bonds are backed by 50.1 percent in the U.S.-based refiner, so should the bond default, bondholders may rush to claim shares of Citgo. (10/26)

Ecuador has restarted crude oil exports after massive protests caused the country’s oil industry to more or less grind to a halt. The protests were ignited by a set of austerity measures the Ecuadorean government wanted to implement as part of efforts to reduce its fiscal deficit. They were a condition for the Andean country to get a $2.4-billion loan from the International Monetary Fund. However, the measures included the removal of fuel subsidies that led to a 120-percent spike in prices at the pump. This sparked the anger of indigenous groups and farmers who led the protests that began on October 3. (10/22)

The US oil rig count declined by 17 last week to 696 while the gas rig count dropped by 4 to 133, according to Baker Hughes. The total rig count now stands at 830, or down 238 from this time last year. Oil rigs have seen a loss of 179 rigs year on year, with gas rigs down 60 since this time last year. (10/26)

Growing US crude oil production and exports have resulted in America selling oil to more destinations around the world (31) than the number of countries from which it imports crude oil (27), the Energy Information Administration said on Tuesday. A decade ago, the United States was importing crude oil from as many as 37 foreign sources per month, and its exports were restricted almost exclusively to Canada. After the lifting of those restrictions at the end of 2015, US crude oil exports have been on the rise and reaching more destinations. (10/23)

$18 billion missteps: The US has forfeited some $18 billion tied to oil and gas production in the Gulf of Mexico since 2000 because of a decades-old law that gave energy companies a break on paying royalties when drilling in deep waters, federal investigators concluded Thursday. The foregone revenue will keep climbing, as energy companies continue to harvest oil and gas royalty-free from dozens of affected tracts in the Gulf, long after lawmakers realized sloppy legislative writing prevented the government from making the price breaks temporary. (10/25)

Abandoned well costs: Increasingly, US shale firms appear unable to pay back investors for the money borrowed to fuel the last decade of the fracking boom. In a similar vein, those companies also seem poised to stiff the public on cleanup costs for abandoned oil and gas wells once the producers have moved on. (10/24)

Coal’s water usage: There is a massive new benefit to ditching coal plants: Doing so will free up billions of gallons of water. If all coal-fired power plants in the US were converted to natural gas, the annual water savings could reach 12,250 billion gallons or 2.6 times as much as the entire US industrial water use. Arguably, ditching coal could make up for all the water that fracking is sucking down in the shale patch, so it could take the pressure off that controversial method of extracting oil. (10/24)

EV subsidy proposal: Senator Chuck Schumer, the top Senate Democrat, late on Thursday proposed a $454 billion plan over 10 years to help shift the US away from gasoline-powered vehicles by offering cash vouchers to help Americans buy cleaner vehicles. Schumer said his plan, which would provide rebates of $3,000 or more to individual buyers, would help transition 25 percent of the US fleet, or 63 million vehicles, away from traditional internal combustion engine vehicles within 10 years. The plan would be key to reducing the impact of climate change, Schumer said, noting that the transportation sector accounts for nearly one-third of US carbon output. (10/25)

Stranded EVs? California might be blazing a trail with getting a large number of electric vehicles on the road, but the only trail California is currently blazing is the wildfire/PG&E fiasco that could once again plunge millions of Californians into the dark in the next wave of blackouts, expected today, the likes of which could sour investor confidence in purchasing a vehicle that relies on sketchy power sources. (10/24)

An electric SUV:Ford Motor Company will reveal on November 18 an all-electric SUV inspired by its iconic Mustang as legacy carmakers try to grab shares of the growing electric vehicle market. Ford released the first design sketch of the all-electric SUV on Thursday and said that the global reveal will be live streamed from Los Angeles on November 18. The new vehicle, which Ford described as “game-changing”, has a targeted driving range of up to 600 kilometers, or more than 370 miles. (10/26)

Tesla has begun selling Model 3 cars made in China, complete with its Autopilot system. The price tag for the vehicle will be a little over $50,300. This makes the China-made Model 3 the cheapest Tesla car on sale in China after the company discontinued online sales of a cheaper version that did not have the Autopilot. At the presentation of its third-quarter financial results, Tesla said its gigafactory in China had started operations ahead of schedule and was already making whole cars. (10/26)

Ballooning deficit: The US government’s budget deficit ballooned to nearly $1 trillion in 2019, the Treasury Department announced Friday, as the United States’ fiscal imbalance widened for a fourth consecutive year despite a sustained run of economic growth. The deficit grew $205 billion, or 26 percent, in the past year. The country’s worsening fiscal picture runs in sharp contrast to President Trump’s campaign promise to eliminate the federal debt within eight years. (10/26)

Builders’ backdoor deal: A secret agreement has allowed the nation’s homebuilders to make it much easier to block changes to building codes that would require new houses to better address climate change, according to documents reviewed by The New York Times. The written arrangement, in place for years and not previously disclosed, guarantees industry representatives four of the 11 voting seats on two powerful committees that approve building codes that are widely adopted nationwide. (10/26)

Swiss voters have shifted the country’s political direction decisively leftward in elections that delivered a triumph for two environmentally focused parties and reversed decades of gains for the country’s hard right. The green bloc will hold at least 44 of 246 seats, making it the second-largest in the parliament. (10/23)

A hole in the ozone layer located near the Earth’s South Pole is the smallest it has been since first being discovered in the 1980s, NASA said. While the depletion of the ozone has decreased over the years, the hole’s smaller size this year is related to abnormal weather and wind patterns. (10/24)

An extremely unusual “medicane” is set to lash parts of Egypt and Israel, bringing the potential for tropical-storm-force winds, heavy rainfall and perhaps even coastal flooding in spots. The hybrid low-pressure system, evocative of tropical cyclones yet bearing some mid-latitude characteristics, is “incredibly rare” that far east in the Mediterranean. (10/26)

Nuclear fusion researchers have always faced criticism due to the unfulfilled promise of a nuclear fusion reactor. However, in recent years, the fusion community has seen a few positive results. The ITER fusion reactor, which is near completion at Cadarache, France will finally turn on in 2025 following years of delays and cost hikes, though an actual power plant is unlikely to be built before 2040 at the earliest. With the fusion reactor race gaining momentum, the UK Government has announced £220m for the design of the Spherical Tokamak for Energy Production (STEP) fusion power station. The spherical tokamak design, pioneered by the UK and the US, would allow for much more compact and cheaper power plants. However, more research is required to be performed on the upgraded Mega Amp Spherical Tokamak in the UK and the National Spherical Torus Experiment in the US. The fusion power plant is expected to be completed by 2024. (10/26)