Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Even as American fossil fuel producers proudly declared the country to be energy independent once more in recent years, the energy sector has stripped redundancy out of its systems, at the risk of leaving customers in the lurch when things go wrong. Some companies have declined to take the precautions needed to survive the unexpected, whether it’s bad weather or a cyberattack.”

Will Englund, The Washington Post

“The two aging, 4.5-mile sections of underwater pipeline are a ticking time bomb. I’m taking every action I can to shut them down, to protect two Great Lakes and the jobs that depend on them.”

Gretchen Whitmer, governor of Michigan

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices have been stuck in a range lately, with optimism around global inventories rebalancing being offset by constant reminders that parts of the world remain far from a full recovery from the pandemic. The International Energy Agency said last week that the global glut that built up last year has cleared. However, the agency also lowered its demand estimates due to the virus’ resurgence in India.

Futures in New York surged the most in a month on Friday as prices garnered support from a recovery in equities and a softer dollar. West Texas Intermediate climbed back above $65 a barrel, eking out a third straight weekly gain as a weakening dollar boosted appeal for commodities priced in the currency. Concerns persist over the spread of Covid-19 in Asia and that has tempered further gains.

Progress on reopening economies in countries including the US supports expectations for heavy summer travel, bolstering the market’s underlying structure from recent weakness. The price of Brent’s nearest contract against the next month strengthened to $67.72 on Friday to its widest in over a week.

The US reduced its forecast for oil output through 2022 as drillers across the prolific shale patch pledge austerity over the allure of increasing prices. Oil explorers throughout the country will produce 20,000 barrels a day less than previous forecasts for this year, at 11.02 million barrels. Supply next year is set to reach 11.84 million barrels day, down from the prior estimate of nearly 11.9 million, the Energy Information Administration said in a report Tuesday. This marks the second straight downward revision for 2021 and 2022 forecasts. The agency’s reduced predictions come even as US crude futures prices have risen more than 30% this year. The EIA raised its price projections for West Texas Intermediate oil next year by 25 cents a barrel.

Under the current OPEC+ production scenario, supplies won’t rise fast enough to keep pace with the expected demand recovery. As vaccination rates rise and mobility restrictions ease, global oil demand is set to soar from 93.1 mb/d in 1Q21 to 99.6 mb/d by year-end. Weaker-than-expected 1Q21 oil use in the US and Europe, plus a reduced outlook for India due to the recent surge in Covid-19, led to downward revisions for 2021 demand growth to 5.4 mb/d. However, the forecast for the second half of the year is essentially unchanged on the assumption that the situation in India and elsewhere improves.

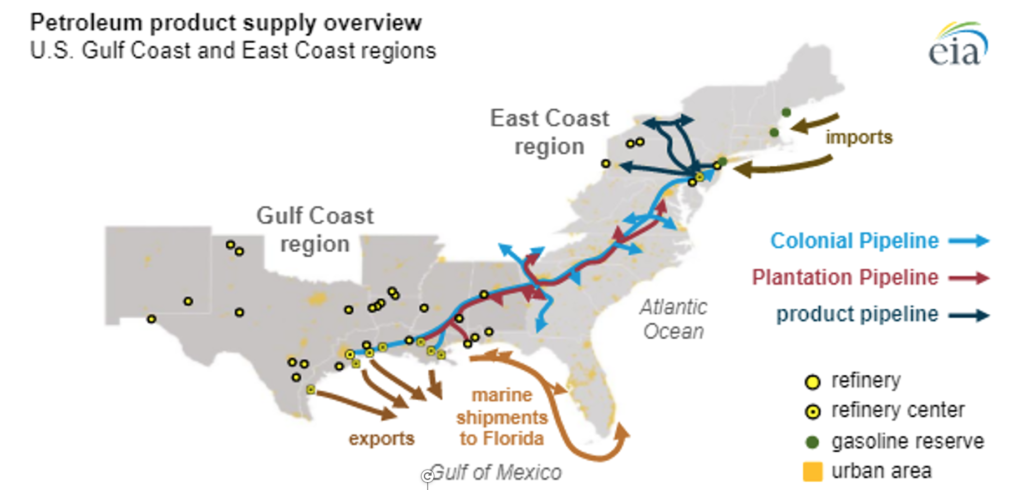

Colonial Pipeline Outage: Widespread gasoline shortages along the US East Coast began to ease on Sunday as the operator of the nation’s most significant fuel pipeline said it was back to delivering “millions of gallons per hour” following last week’s cyberattack. Ships and trucks were deployed to fill up storage tanks after the six-day Colonial Pipeline shutdown. The most disruptive cyberattack on record triggered widespread panic buying that left filling stations across the US Southeast dry. On Saturday evening, about 75% of gas stations in Washington DC were still without fuel, an improvement from Friday’s figure of 88%. Shortages also eased in North Carolina and Virginia but were about the same in Georgia. US gasoline demand dropped 12.6% from the previous week, probably due to an easing of “crazed” panic buying just after the pipeline shut.

On Monday, the ransomware group operator said that its goal was to make money and not sow mayhem, a statement that experts saw as a sign the cybercriminals’ scheme had gone farther than they had intended. The FBI accused the group that calls itself DarkSide of a digital extortion attempt that prompted Colonial Pipeline to shut down its network. Colonial Pipeline paid nearly $5 million to Eastern European hackers on Friday, contradicting reports earlier this week that the company had no intention of paying an extortion fee. The company paid the hefty ransom in difficult-to-trace cryptocurrency within hours after the attack, underscoring the immense pressure to get gasoline flowing.

President Biden said the US government has a “strong reason” to believe the hackers behind cyber-attacks are based in Russia. “We do not believe the Russian government was involved in this attack, but that is where it came from,” the US president said in a speech on Thursday. “We have been in direct communication with Moscow about the imperative for responsible countries to take decisive action against these ransomware networks.” Late in the week there were unconfirmed reports that the “DarkSide” hacker group was closed down and that they had lost access to the $5 million they were paid by Colonial Pipeline.

OPEC: A resurgent Iran pumped its largest volume of crude in almost two years in April, while an increasingly compliance-challenged Russia also boosted its output yet again, bringing total production by OPEC and its allies to a three-month high, according S&P Global Platts. OPEC produced 25.28 million b/d, up 80,000 b/d from March; Russia and eight other non-OPEC partners in the group’s supply accord added 13.21 million b/d, an increase of 130,000 b/d. The rising output is a preview of the wave of OPEC+ crude set to hit the market over the next few months. In anticipation of rising global oil demand, the alliance plans to roll back its quotas by 350,000 b/d in May, another 350,000 b/d in June, and 441,000 b/d in July, for a total of 1.14 million b/d.

According to the bloc’s latest oil forecast, the February deep freeze in Texas gave OPEC a bit more room to expand its market share in 2021. OPEC’s analysts kept their global oil demand outlook for the year unchanged but downgraded their projection of non-OPEC liquids supply by 230,000 b/d due to the vast US well shut-ins during the winter ice storm. As a result, the call on OPEC crude — the volume needed from the organization to balance global demand and supply — will rise to 27.65 million b/d in 2021, it said in its closely watched monthly oil market report.

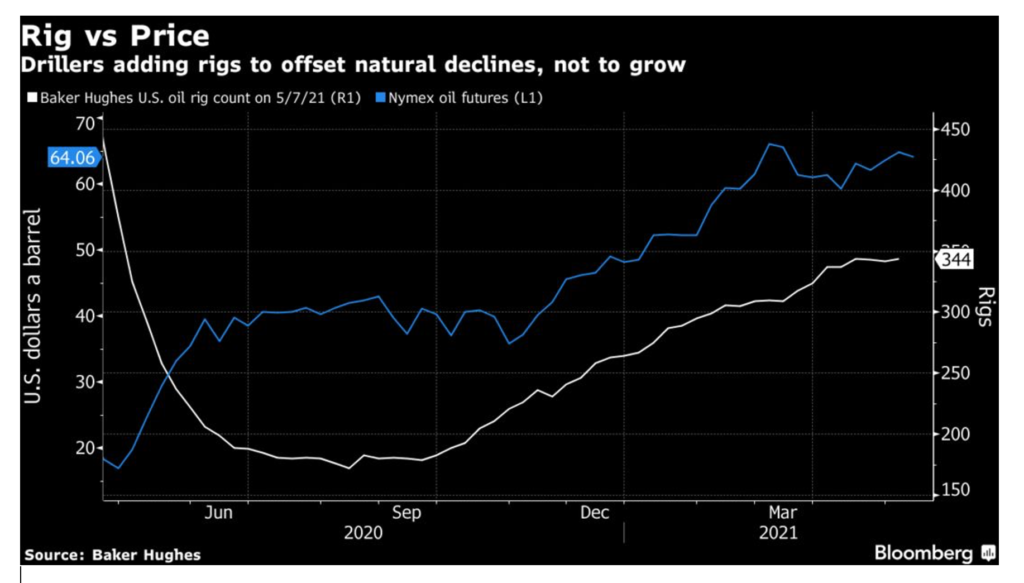

Shale Oil: The US rig count keeps on increasing, but analysts say the pace of the increase is only sufficient to maintain, rather than increase, the current level of production.

Natural Gas: The winter storms in February triggered the largest monthly drop in US natural gas production on record, primarily due to freeze-offs in Texas, the EIA said last week. Output across the US, especially in Texas, was disrupted, while natural gas consumption in the residential sector hit a record high, EIA data showed. US natural gas production in February 2021—measured by gross withdrawals—averaged 104.8 billion cubic feet per day. This was 8.1 Bcf/d, or a 7% decline, compared to January, and was the largest monthly decline on record. In Texas, natural gas production dropped by a record 15%, or by 4.3 Bcf/d, to 21.5 Bcf/d. The decline in Texas production accounted for most of the overall slump in American gas output.

Liquefied natural gas was a big thing a couple of years ago in the US. With so much cheap gas coming out of the ground thanks to hydraulic fracturing, the country had enough natural gas for its domestic needs plus some for gas-thirsty neighbors and far-off buyers such as China and South Korea. LNG was one of the weapons of US energy dominance during the Trump administration, and indeed, Washington did what it could to motivate more export capacity. Planned LNG terminals dotted the Gulf Coast and moved fast to final investment decisions not infrequently with Chinese purchase commitments. And then the trade war happened. Before the industry got back on its feet, the pandemic struck, and all bets were off.

Global forecasts for liquefied natural gas are bright; however, they are not necessarily as promising for those US LNG projects that have yet to start getting built, for which their developers need billions. These billions typically come from long-term commitments from large buyers. The problem is that US LNG projects are not the only ones being planned for the next few years. The Wall Street Journal recently wrote in an article that the number of US LNG suppliers to overseas clients might be about to shrink in the next few years, with only the most significant players such as Cheniere Energy surviving and thriving.

Electricity: Texas lawmakers advanced eight bills related to the mid-February storm that shut off power for about 4 million customers, with two sent to Gov. Greg Abbot to sign. But none of the eight bills addressed key concerns around weatherizing power infrastructure. One of the bills approved for the governor’s signature, House Bill 16, bans wholesale indexed electricity to residential consumers, which became a big issue when customers of the Griddy retail electricity provider passed on the $9,000/MWh wholesale cost of electricity to customers. ERCOT barred Griddy from the Texas market in late February. The other bill pending the governor’s signature is House Bill 2586, which would require an independent audit of ERCOT to be posted publicly.

The Texas Legislature also approved House Bill 17, which would prohibit a local government from banning an energy service based on the resource type. This bill would, for example, keep local governments from banning the installation of natural gas distribution lines in a new residential neighborhood. House Bill 3648, which requires the designation of certain gas facilities as critical infrastructure during an energy emergency, is pending in the Senate.

Prognosis: The year 2020 was a watershed moment for the fossil fuel sector. Faced with a global pandemic, severe demand shocks, and a shift towards renewable energy, experts warned that nearly $900 billion worth of reserves–or about one-third of the value of big oil and gas companies–were at risk of becoming worthless. Even Big Oil mostly appeared resigned to its fate, with Royal Dutch Shell’s CEO Ben van Beurden declaring that we had already hit peak oil demand. At the same time, BP noted that “concerns about carbon emissions and climate change mean that it is increasingly unlikely that the world’s reserves of oil will ever be exhausted.” BP went on to announce one of the most significant asset write-downs of any oil major after slashing up to $17.5 billion off the value of its assets and conceded that it “expects the pandemic to hasten the shift away from fossil fuels.”

The fossil fuel sector is enjoying a rare blowout season. The majority of companies in the energy sector beat Wall Street earnings estimates, while more than 80% have surpassed revenue expectations. With impressive bottom-line growth, many top energy names returned more capital to shareholders in the form of share buybacks and dividends. Companies usually repurchase shares when they believe they are undervalued, a big positive for oil and gas bulls.

US Secretary of Energy Jennifer Granholm recently told a prominent political news website that oil companies risk a fate like Kodak’s if they fail to diversity to “clean energy solutions.” Once a leader in the production of cameras and films, Eastman Kodak was slow to embrace the growing popularity of digital cameras – and its competitive dominance evaporated as a result. Moreover, Granholm warned energy players that the depth of their diversification efforts – or lack thereof — would become evident over time.

2. Geopolitical instability

(These are the situations that are reducing the world’s energy supplies or have the potential to do so.)

Israel-Palestine: Violence between Israelis and Palestinians expanded in new directions last week, with deadly clashes convulsing the occupied West Bank and anti-Israeli protests erupting along Israel’s borders with two Arab neighbors. The widening sense of mayhem in Israel and the Palestinian territories came as Israeli airstrikes brought mass evacuations and funerals to Gaza. Hamas rockets showered down on Israeli towns. Hamas and Israeli officials signaled they were open to discussing a cease-fire amid global calls for peace and frantic diplomacy aimed at heading off a further fracturing in one of the Middle East’s most intractable struggles.

However, the violence has increased with incredible velocity compared with previous Israeli-Palestinian conflicts. It is finding new footholds and threatening Israeli society in ways not seen before. By Friday evening, Israel faced furious demonstrations in at least 60 places across the West Bank and new protests across the borders with Jordan and Lebanon, all atop the vigilante violence between Arabs and Jews within Israel and the continuing battle with Gaza militants.

Chevron has complied with Israel’s energy ministry instructions to shut down operations at the Tamar natural gas field offshore Israel. Chevron has interests in another gas field offshore Israel, the Leviathan gas field, the most significant energy project in Israel ever. Currently, the Leviathan gas field continues production, and Chevron is “working with customers and the relevant regulatory bodies to ensure that natural gas supplies continue.” A fire broke out on the Trans-Israel pipeline in Ashkelon, Israel, after a rocket from Gaza hit a crude oil storage tank on May 11th. The 600,000 b/d oil pipeline connects the Red Sea port city of Eilat in southern Israel to the Mediterranean port city of Ashkelon.

Iran: The US could announce a deal with Iran as early as the end of May, leading to the lifting of oil and energy sanctions. Analysts predict a return to pre-pandemic oil production levels for Iran, around 3.9 million b/d, by 2022, assuming that the US eases the sanctions that have been suffocating Iran’s economy. Production levels in March stood at about 2.3 million b/d, the highest level since May 2019, an increase that highlights how Iran’s oil exports have already been recovering despite US sanctions.

Tehran hopes to persuade its regional rival Saudi Arabia to help to sell Iranian crude oil on international markets in exchange for limiting attacks from the Houthi rebels in Yemen on Saudi oil infrastructure. Middle East Eye reported the Iranian initiative on Wednesday, quoting Iraqi officials with knowledge of recent secretive Iranian-Saudi talks in Baghdad.

Candidates began signing up on Tuesday for Iran’s June 18th presidential polls, with the clerical establishment hoping for a high turnout in a vote seen as a referendum on the leaders’ handling of the Islamic Republic’s political and economic crises. Turnout may be hit by rising discontent over steep rises in consumer prices and high unemployment as US sanctions have crippled the economy. Registration for the election will last five days, after which entrants will be screened for their political and Islamic qualifications by a hardline vetting body, the Guardian Council, which has in the past disqualified many moderate candidates.

Iran’s hardline former president Mahmoud Ahmadinejad on Wednesday registered to run again. Vilified in the West for his questioning of the Holocaust, Ahmadinejad had to step down in 2013 because of term limit rules, when incumbent President Hassan Rouhani who negotiated Iran’s 2015 nuclear deal with world powers, won in a landslide.

“Fluctuations” at Iran’s Natanz plant pushed the purity to which it enriched uranium to 63%, higher than the announced 60%.

Iraq: Across Baghdad and southern Iraq, a rising tide of attacks on activists and journalists is alarming what remains of a protest movement that has demanded the ouster of Iraq’s US-molded political system. Mass street demonstrations were crushed last year with deadly force, often by paramilitary groups that the protesters have denounced. Now, as some activists prepare to run in elections, prominent figures in the protest movement are being picked off while they walk the streets or drive home at the end of the day. The assassinations, officials and human rights monitors say, underscore the reach of Iraq’s militia network.

Baghdad declared its willingness to invest $15 billion into new gas-focused projects that could reduce its reliance on gas imports. The Iraqis have committed to an ambitious timeline of reaching self-sufficiency by 2024-2025, with several large-scale projects being developed simultaneously. The announced gas-boosting drive will encompass Total spearheading the revived $7 billion Common Seawater Supply Project.

Sinopec is developing the 4.5 trillion Cf Mansuriya gas field and another, yet unnamed, investor is taking up the 5.6 trillion cf Akkas gas field. Baghdad has also announced that it intends to revisit a long-forgotten pipeline project.

Libya: The National Oil Company produced 1.168 million b/d of crude in April, according to OPEC’s latest monthly report. April crude production slid by 115,000 b/d compared to March. Production fell as a funding dispute between state oil companies and the central government caused several fields to be shut in. As a result, the National Oil Corporation declared force majeure on crude exports out of the 250,000 b/d Marsa el-Hariga terminal for almost a week. But the budget strife was resolved by the end of April, paving the way for production to rebound. Yet observers expect output to remain volatile amid political and security instability.

The Biden administration has named a new envoy for Libya ahead of the country’s planned elections later this year. Richard Norland, who currently serves as US ambassador to Libya, will take on the additional role as special envoy. Since 2019, Norland has served as head of the US mission to Libya, based in neighboring Tunisia for security reasons.

The appointment signals an intensification of US attempts, up to now unsuccessful, to persuade Turkey, Russia, the United Arab Emirates and other powers to end their roles in turning Libya into a proxy conflict. Tens of thousands of foreign fighters are deployed in Libya to support the two rival factions, one based in the capital Tripoli and the other in the country’s east. Outside nations have also provided advanced weaponry, including fighter jets, drones, and air defense systems.

Venezuela: Amid a humanitarian crisis of epic proportions, it would take $58 billion to return its oil industry to its former glory and 1998 production levels, according to a PDVSA study. The February 2021 document titled Investment Opportunities and authored by PDVSA’s planning and engineering division revealed its need for cash from the Venezuelan government and foreign partners to restore its energy infrastructure. Venezuela’s production has sunk from more than 3 million barrels per day pre-Hugo Chavez to just over half a million barrels today.

PDVSA engineering wanted to use foreign investors as the vehicle to improve the oil giant’s oil production. In this theoretical-at-best scenario, PDVSA contractors would 100% finance oilfield operations. As compensation, these not-so-risk-averse contractors would receive part of the free cash flow. But foreign oil companies have been down this road before, and many were burned.

3. Climate change

For years, President Trump and his deputies played down the impact of greenhouse gas emissions from burning fossil fuels and delayed the release of an Environmental Protection Agency report detailing climate-related damage. But last week, the EPA released a detailed and disturbing account of the startling changes that Earth’s warming had on parts of the Un during Trump’s presidency.

The destruction of year-round permafrost in Alaska, loss of winter ice on the Great Lakes, and spikes in summer heatwaves in US cities signal that climate change is intensifying, the EPA reported. The Biden administration gave the agency’s imprimatur to a growing body of evidence that climate effects are happening faster and becoming more extreme than when EPA last published its “Climate Indicators” report in 2016.

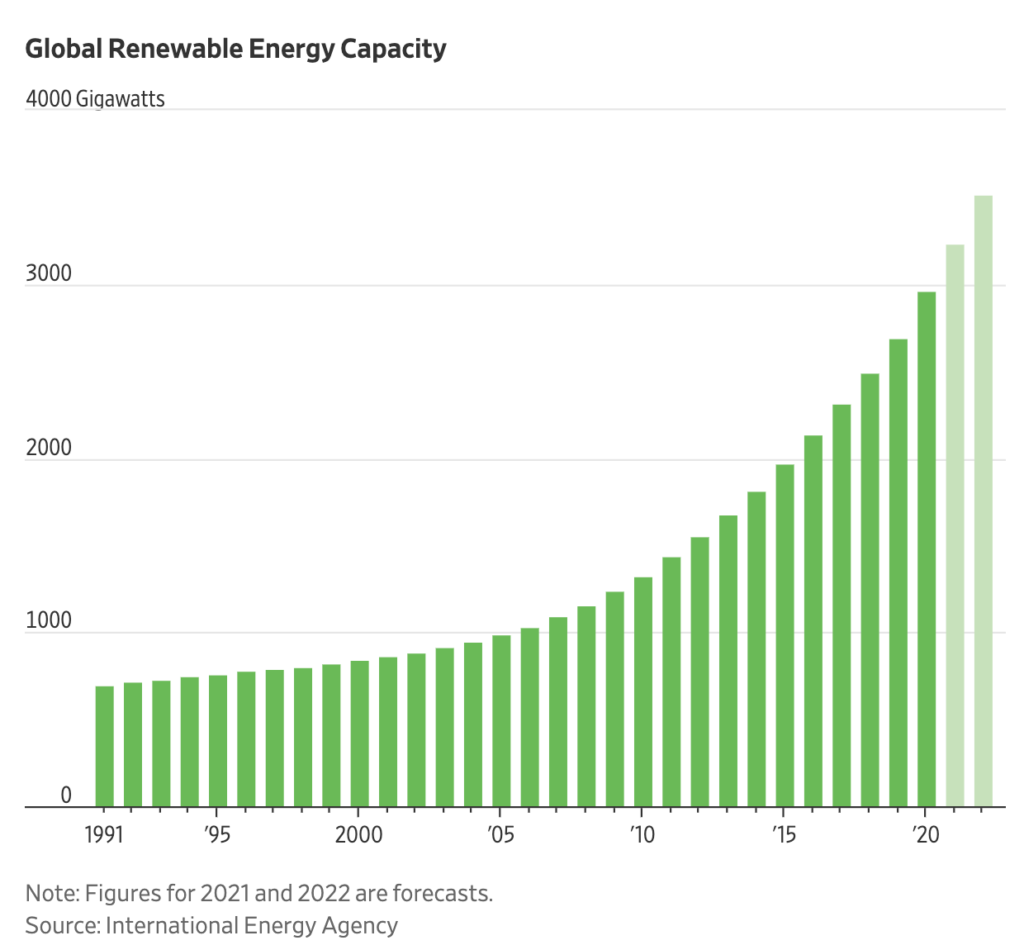

In Europe, according to a leaked draft of an official document, the European Commission intends to ask the Member States to make an additional effort to increase their share of renewable energy in the power mix. Brussels wants to upgrade its current 32% renewable energy target for 2030 to at least 38%, the document says. By the same deadline, the Commission aims to have 55% less greenhouse gas emissions than 1990 levels and a 32.5% improvement in energy efficiency.

German industry will need to swiftly implement a “massive” reduction in greenhouse-gas emissions to conform with targets in the ruling coalition’s new climate protection law. According to a draft, the industry will need to cut annual CO2 emissions to 118 million tons by 2030, from 186 million tons last year, as Germany seeks to achieve carbon neutrality by 2045. The energy sector’s target is even more ambitious, requiring it to slash emissions to 108 million tons from 280 million tons.

Chancellor Angela Merkel’s government recently pledged to eliminate greenhouse gas emissions by 2045, five years earlier than its previous goal and the shortest timeline among major economies. Her cabinet is due to sign off on the law on Wednesday before it goes to parliament for approval.

Renewable power capacity grew at its fastest pace this century in 2020, the IEA said last week, raising its growth forecast for wind and solar power for this year and next. According to the agency, renewables were the only energy source for which demand increased last year, with Covid-19 lockdowns hitting consumption of all other fuels as government restrictions shut factories, grounded planes, and kept people at home.

4. The global economy and the coronavirus

The ongoing second wave of the deadly coronavirus pandemic in India is expected to snowball into a major disruptor for the shipping and logistics industry. Several ports globally are shunning ships that have called at any location along the South Asian coastline.

United States: On Sunday, the Washington Post editorialized, “it was joyful to hear the Centers for Disease Control and Prevention announce on Thursday that fully vaccinated people do not have to wear masks, either inside or outside. It feels like an inflection point. Despite clouds over the horizon, this is a moment for the United States to savor.” For now, at least, the covid-19 epidemic is ebbing.

Retail sales in the US were flat in April after soaring in March when many Americans received $1,400 stimulus checks that boosted spending. “The April retail sales tip the odds toward slower sales in the coming months,” said analysts at Contingent Macro Advisors. Friday’s report comes amid other signs the economy is improving as vaccinations accelerate, and business restrictions are relaxed.

Employers posted a record number of available jobs in March, starkly illustrating the desperation of businesses trying to find new workers as the country emerges from the pandemic and the economy expands. Yet total job gains increased only modestly, according to a Labor Department report issued Tuesday. Americans accustomed to years of low inflation are beginning to pay sharply higher prices for goods and services as the economy strains to rev back up and the pandemic wanes. Price tags on consumer goods from processed meat to dishwashing products have risen by double-digit percentages from a year ago. Many building materials have doubled in price over the last six months.

European Union: The number of daily new COVID-19 infections in France fell to the lowest figure since the start of the year, while the tally of patients in intensive care for the disease was down for seven consecutive days. France exited its third lockdown a week ago and hopes to gradually unwind all its significant restrictive measures by the end of next month.

The EU economy is set to bounce back strongly this year after the coronavirus recession. Member states are forecast to have recouped the ground lost by the end of next year. In its latest forecast Wednesday, the EU’s executive commission significantly upgraded its predictions for economic growth. It said that growth in the 27-nation bloc is predicted to expand by 4.2% this year, a significant uptick from a February prediction of 3.7%.

China: The population hit 1.41 billion in 2020, eking out a slight rise from the previous year. The new count underlines how the world’s most populous nation is going to have to face its demographic challenges sooner than expected. The number—up from the 1.40 billion official data showed for 2019—indicated that China’s population has only gone up by 72 million since the last census in 2010.

Last year, there were 12 million births, an 18% drop from the 14.65 million the year before. This trend is likely to increase pressure on Beijing to ease remaining birth restrictions—the fourth straight year of declining births after a rise in 2016, the first year after China ended the three-decade-old one-child policy. The data showed a sharp rise in the percentage of Chinese aged 60 and above, to 18.7% of the population from 13.3% in 2010.

China’s demographic situation has in a short time moved to the forefront of Beijing’s economic concerns. The trend of fewer young people to replace a growing number of retirees has been clear for years but dealing with it has essentially been kicked down the road as leaders focused on mounting debt, a trade war with the US, and reining in a once freewheeling private sector. Now, Beijing can no longer ignore the demographic shadow over long-term growth. Pension shortfalls in the country’s northeastern Rust Belt have forced the central government to ask state-owned enterprises and wealthier and younger provinces in the south to help out with the pension pool.

Chinese authorities are looking to ease the domestic fuel glut and reduce pollution by heavily taxing the imports of several kinds of blending fuels that refiners use to produce lower-quality fuels. On Jun. 12th, China will impose a consumption tax on imported light cycle oil (LCO), mixed aromatics, and diluted bitumen. The government seeks to close a tax loophole that refiners have used to import cheap blending fuels for making gasoline and other fuels.

Russia: President Putin has trumpeted Russia’s COVID-19 vaccine, Sputnik V, worldwide and said in March that Russia had signed export agreements to produce 700 million doses of the vaccine. But Russia had made just 33 million doses of the vaccine as of May 12th and exported fewer than 15 million, according to a Reuters tally that counted each vaccine as consisting of two doses. Russia’s output is much lower than the hundreds of millions being made each month by Pfizer and AstraZeneca.

The problems are a warning to foreign partners – including in India – that are planning to mass-produce the vaccine and those countries relying on Moscow to supply their inoculation programs. With the US and European countries focused on vaccinating domestic populations, Russia has stepped in the breach, offering shots to more than 50 countries, from Latin America to Asia. But delays in getting shots to those countries give China and the US time to fill the gap.

Russia’s oil reserves will last until 2080 at the current annual production pace, Resources Minister Kozlov told an interviewer last week. The minister said Russia also has natural gas reserves for another 103 years of annual production at current output levels. Russia’s actual oil and gas reserves could even rise if it steps up exploration in hard-to-drill areas, the minister added, noting that Russia needs to develop exploration, including in hard-to-reach areas. Last month, Evgeny Kiselev, the head of the Russian Federal Agency for Mineral Resources, told state outlet Rossiyskaya Gazeta that Russia has 58 years’ worth of oil reserves, including nine years to profitably pump those reserves at current levels with current technology. [Note: oil and gas resources have never been produced at an even level until they run out overnight; depletion makes such claims not useful.]

In the same way that the US’s global hydrocarbons power has been turbo-boosted by the rise of its shale energy industry, Russia has seen its oil and gas power extended by the sustained development of Arctic oil and gas reserves. Russia’s Arctic sector comprises over 35,700 billion cubic meters of natural gas and over 2,300 million metric tons of oil and condensate. According to President Putin, the next 10-15 years will witness a dramatic expansion in the extraction of these Arctic resources.

Around 100 km of the Nord Stream 2 gas pipeline from Russia to Germany remain to be laid, Russia’s ambassador to Germany, Sergei Nechayev, said in an interview with German media. Two pipelayers are now operational in waters off Denmark. Nechayev also said he was hopeful the pipeline would be completed before the upcoming German election on Sept. 26th. “The weather is now a key factor in completing the pipeline,” Nechayev said.

India: The tally of coronavirus infections climbed past 24 million on Friday amid reports that the highly transmissible variant first detected in India has spread across the globe. The Indian B.1.617 variant has been found in eight nations in the Americas, including Canada and the United States, said Jairo Mendez, an infectious diseases expert with the World Health Organization. “These variants have a greater transmission capacity, but so far, we have not found any collateral consequences,” Mendez said. “The only worry is that they spread faster.”

The desperation that engulfed New Delhi, India’s capital, over the past few weeks is now spreading across the entire country, hitting states and rural areas with many fewer resources. Dozens of bodies washed up on the banks of the Ganges last week, most likely the remains of people who perished from Covid-19.

India’s deadly COVID-19 outbreak and widening localized lockdowns have soured the country’s economic growth outlook, stifled its natural gas demand, and resulted in more LNG carriers being diverted elsewhere by gas companies. On May 8th, the southern Indian state of Tamil Nadu — one of the country’s most industrialized and among its largest by GDP — imposed a two-week lockdown amid growing infections, joining several other states that have taken similar measures.

The head of the central Indian health agency responding to the coronavirus said districts reporting many infections should remain locked down for another six to eight weeks to control the spread of the rampaging disease. Dr. Balram Bhargava, head of the Indian Council of Medical Research, said that lockdown restrictions should remain in all districts where the infection rate is above 10% of those tested. Currently, three-fourths of India’s 718 districts have a test-positivity rate above 10%, including major cities like New Delhi, Mumbai, and the tech hub of Bengaluru. Bhargava’s comments are the first time a senior government official has outlined how long lockdowns should remain in place.

In India, gasoline and diesel prices hit a new record-high on Wednesday, adding another concern for the oil market about demand in the world’s third-largest oil importer. The high fuel prices—too high for many households—also threaten to lead to further declines in India’s transportation fuel consumption. The cost of diesel, the most used fuel in India, jumped on Wednesday, and so did the price of gasoline, for the seventh increase in prices so far in May and the third day of price hikes last week alone.

Africa: At the small hospital where Dr. Oumaima Djarma works in Chad’s capital, there are no debates over which coronavirus vaccine is the best. There are simply no vaccines at all, not even for doctors and nurses like her, who care for COVID-19 patients. “I find it unfair and unjust, and it is something that saddens me,” the 33-year-old infectious diseases doctor says. “I don’t even have that choice. The first vaccine that comes along that has authorization, I will take it.”

While wealthier nations have stockpiled vaccines for their citizens, many poorer countries are still scrambling to secure doses. A few, like Chad, have yet to receive any. The World Health Organization says nearly a dozen countries — many of them in Africa — are still waiting to get vaccines. Those last in line on the continent with Chad are Burkina Faso, Burundi, Eritrea, and Tanzania.

5. Renewables and new technologies

Last fall, European plane maker Airbus unveiled three hydrogen-powered aircraft concepts for 2035. More recently, UK startup ZeroAvia got backing from British Airways as part of a $24 million funding round. Likewise, Universal Hydrogen, led by former Airbus executive Paul Eremenko, has just raised $21 million from heavyweights such as the venture-capital subsidiaries of JetBlue and Toyota. The aviation industry has set itself a target of halving emissions by 2050, roughly in line with the 2016 Paris Agreement to limit climate change.

Hydrogen packs an impressive 140 MJ/Kg of energy and is a relatively mature technology. Fuel cells, which Universal Hydrogen and ZeroAvia use to convert light and regional aircraft, cost $40 per kilowatt, 68% less than in 2006, Bernstein Research estimates. That is expensive for a car but not a plane.

German steel companies Thyssenkrupp Steel and HKM and the Port of Rotterdam will jointly investigate setting up international supply chains for hydrogen in their transformation paths towards climate-neutral steel making. Thyssenkrupp Steel and HKM will require large and increasing quantities of hydrogen to produce steel without coal. Together, the partners will explore hydrogen import opportunities via Rotterdam as well as a possible pipeline corridor between Rotterdam and Thyssenkrupp Steel’s and HKM’s steel sites in Duisburg.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Chernobyl activity: Sensors have detected increased levels of neutrons in an inaccessible chamber at the Chernobyl site, signaling that nuclear fission reactions are taking place in the entombed reactor hall. The signs that fission reactions occur come 35 years, nearly to the date, when Ukraine’s Chernobyl nuclear power plant exploded on April 26, 1986.

Qatar is in discussions with Chinese state energy giants to potentially make them equity partners in the world’s largest liquefied natural gas (LNG) project. (5/13)

Nigeria’s oil production has fallen by 30% in the last four years to 1.423 million barrels per day, mb/d in 2020. Reasons cited for the decline include pipeline vandalism, oil theft in the Niger Delta, and a cutback to achieve stability in the global market by OPEC. (5/12)

In Guyana, ExxonMobil has revised upward its 2025 crude oil production on the back of its fourth deepwater project there. Under new estimates, Exxon expects to produce 800,000 bpd by 2025. Guyana projects output at 1 million bpd by 2027. (5/13)

Guyana-India deal: India needs new sources of supply, whilst the Guyanese government needs a reliable and long-term partner for its equity, having so far failed to find a marketer for its crude. India has reached out to Guyana. (5/13)

A Mexican court has issued an injunction against new legislation that sought to change the competition rules on the country’s fuel market. The legislation passed by the lower chamber of parliament last month involves changes to an energy law that gives the government power to restrict private oil companies’ activity in oil and fuel imports. (5/12)

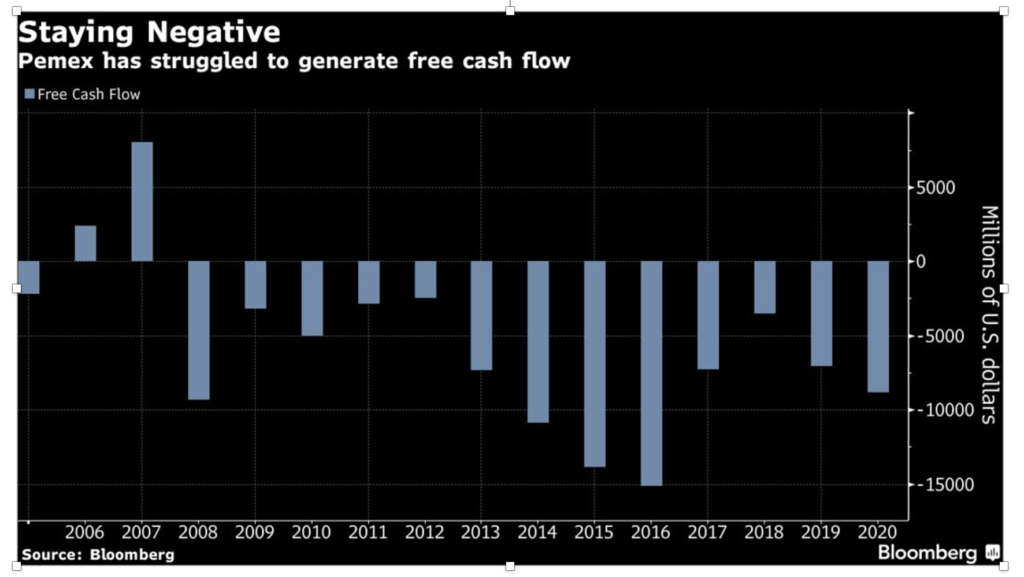

In Mexico, Pemex is racking up millions of dollars in late payments to oil companies as it struggles to generate cash amid skyrocketing debt and weaker crude sales. (5/11)

Pipeline bruhaha: In a legal filing, Ottawa said the shutting down of the Line 5 pipeline would harm relations between Canada and the United States, hurt jobs and gasoline prices, and violate a treaty from 1977. (5/13)

Canada’s Enbridge, despite Michigan’s deadline to shut down Line 5, continues to operate the oil pipeline through the Great Lakes, reiterating that it is up to the US federal government to say if the pipeline should continue operations. Michigan’s notice required Enbridge to cease operations of the pipelines in the Straits of Mackinac by May 12, 2021. (5/13)

Michigan Gov. Gretchen Whitmer threatened Tuesday to go after Enbridge’s profits from a Great Lakes oil pipeline if the company defies her order to shut it down. (5/12)

The US oil rig count increased by eight this week to 352, while the number of gas rigs decreased by 3 to 100, according to the weekly Baker Hughes report.

Chevron-Ecuador saga continues: Steven Donziger once stood to gain hundreds of millions of dollars for winning a $9.5 billion environmental contamination verdict against Chevron Corp. in Ecuador. Now that judgment has been discredited, Mr. Donziger has lost his New York law license, and he is on trial for criminal charges that he disregarded a judge’s orders. (5/11)

Federal drilling leasing pause: Louisiana Governor John Bel Edwards (Democrat) has urged the federal government to resume oil and gas leases within months. He stated that a longer pause in offshore leasing would devastate the Gulf Coast state’s economy. (5/15)

“Oil on my windshield:” The EPA employee who had been deployed to the US Virgin Islands to investigate an accident-plagued refinery emailed colleagues to give them the news: “there is oil on my windshield.” On Friday, the Biden administration shut the plant down, citing an “imminent” threat to people’s health after several recent accidents contaminated St. Croix’s drinking water and left hundreds of people sick. (5/15)

Imperfect hedges: Many large airlines are now pulling back from oil hedging after suffering massive losses due to low oil prices last year. Indeed, some of the world’s biggest airlines are ditching or shrinking their mammoth fuel-hedging programs after losing billions of dollars in the derivatives during the pandemic. No less than 40 airlines went under in 2020 due to Covid-19., the highest number in history during such a short period. (5/13)

US highways will be far busier over the Memorial Day holiday weekend than last year, but traffic still won’t reach pre-pandemic levels. AAA officials say travel will increase because more Americans have been vaccinated against COVID-19, and consumer confidence is growing. (5/12)

Trucker pinch: Higher fuel prices and fuel shortages, even temporary ones, make it a lot harder for truckers to deliver goods. And as consumer spending heats up, the economy needs more truck drivers, not fewer, especially to help alleviate the current gasoline shortages. (5/15)

The North American Electric Reliability Corp warned that energy shortfalls were possible this summer in California, Texas, New England, and the central US based on above-normal temperature forecasts for much of the region. (5/15)

Giant offshore wind: The Biden administration is set to approve plans for the first major offshore wind farm in federal waters. The Interior Department authorization will pave the way for constructing the 800-megawatt Vineyard Wind LLC project near the coast of Massachusetts and puts it on a path to begin supplying power to East Coast homes late next year. (5/11)

USPS EVs: House lawmakers advanced language authorizing $8 billion for the U.S. Postal Service to buy more electric vehicles as the agency modernizes its aging fleet. The contract calls for 50,000 to 165,000 cars over ten years. (5/14)

In just one year, the world’s largest lithium producers turned from cautiously optimistic about prices and very careful about expansion projects to decisively bullish on near, medium, and long-term demand for the critical battery metal. Lithium has seen prices rising since automakers started pledging all-EV lineups and exponential growth in their electric car offerings. (5/14)

In China, US electric car maker Tesla has halted plans to buy land to expand its Shanghai plant and make it a global export hub due to uncertainty created by U.S.-China tensions. With 25% tariffs on imported Chinese electric vehicles imposed on top of existing levies under former President Donald Trump still in place, Tesla now intends to limit the proportion of China output in its global production. (5/11)

Chinese EVs: Electric and hybrids now account for about one-fifth of new car sales on average in the six biggest Chinese cities, according to data from the China Passenger Car Association. In some hubs, like Shanghai, that figure is even higher–around 31%. (5/11)

Green hydrogen company Everfuel is planning a 300-MW electrolyzer project adjacent to the Fredericia refinery in Denmark to supply renewable hydrogen to the plant and local zero-emission transport by 2025. (5/12)

Sail-boosted ship transport: The first installation of Norsepower’s innovative Rotor Sails on a bulk ore carrier demonstrates the adaptability of the technology to reduce fuel consumption, fuel costs and reduce emissions across various vessel types. (5/14)

Egypt on Tuesday announced plans to widen and deepen the southern part of the Suez Canal, where a hulking vessel ran aground and closed off the crucial waterway in March. (5/12)

Thru-vehicle bans: Paris Mayor Anne Hidalgo set a new benchmark in her ongoing campaign to reduce car use across the French capital: a prohibition on most vehicle traffic crossing the city center in 2022. The plan would stop through traffic from a large zone covering Paris’ core to cut pollution and noise and free up more space for trees, cycle lanes, and pedestrian areas. (5/14)

City investments vs. climate: Only 17% of cities implement actions across the four areas which the non-profit group CDP says have the highest impact on slashing emissions—building, transport, electricity grids, and waste management. (5/12)

Water crisis: In what shapes up to be the worst water crisis in generations, the US Bureau of Reclamation said it would not release water this season into the central canal that feeds the bulk of the massive Klamath Reclamation Project, marking a first for the 114-year-old irrigation system. (5/15)

Russia’s vaccine issue: Russian authorities have been having so many problems producing second doses of their Sputnik V coronavirus vaccine that Russia probably will not supply enough to people who already got the first dose, Mexican officials said Monday. Sputnik is unusual among coronavirus vaccines in that the two doses are different and not interchangeable. (5/12)