Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Our window of opportunity is closing. If we fail to improve our response now, based on science, I fear the pandemic will get worse and be prolonged…. Without better planning, 2020 could be the darkest winter in modern history.”

Dr. Richard Bright, to a congressional committee

“…even at $25 to $30 per barrel – a once unthinkably low price – crude oil might be getting overvalued. The IEA sees a market steadily on the mend, but that’s only true if the pandemic is on its way to some sort of resolution, which, of course, it isn’t.”

Nick Cunningham, Oilprice.com

“In the past, we have always dealt with either a demand-side [food] crisis, or a supply-side crisis. But this is both—a supply and a demand crisis at the same time, and at a global level. This makes it unprecedented and uncharted.”

Arif Husain, chief economist at the UN’s World Food Program

Graphics of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil prices continued to rise last week despite the uncertainty surrounding COVID-19. New York futures closed at $29.43 and Brent at $32.50. As US storage capacity is limited, it is questionable whether cash oil prices are as high as speculators have driven futures. US crude stocks decreased slightly the week before, raising the question of whether there is enough demand to consume new production. Washington now is allowing producers to put crude that they can’t sell to refineries or put into commercial storage to be pumped temporarily into the Strategic Petroleum Reserve.

By the end of this week, much of the US will no longer be under mandatory lockdowns. It seems the new standard for imposing the harsh social restrictions that appeared to have worked in other countries is whether hospitals are swamped with new cases. Otherwise, it will be up to individuals and their employers to determine what precautions against contracting the coronavirus should be taken. Numerous polls say that the bulk of Americans are so concerned about the virus that they will take precautions to the extent possible.

The numbers regarding supply and demand are all over the board. Two months ago, we were seeing the drop in demand estimates ranging from 10 to 40 million b/d from the pre-virus 100 million b/d. In the last few weeks, we have seen most of China, Europe, and the US lower restrictions on energy-consuming activities. While fewer restrictions will increase the demand for gasoline in those regions, there will still be large segments of the global economy that will not see much of an increase in oil demand.

While China, the US, and Europe are the largest consumers of oil, much of the world, especially in Africa, Latin America, South Asia, and the Middle East, is only beginning to deal with COVID-19 by imposing lockdowns. These countries have only limited medical facilities and are almost sure to suffer many fatalities before the pandemic is over. Air travel, which is down 90 percent and container shipping down by some 25 percent, is unlikely to rebound anytime soon.

Consumers released from mandatory lockdowns are likely to return to work, if it is still available, and purchase essentials such as food and medicine. However, many are unlikely to risk contracting the coronavirus on non-essential activities such as entertainment, recreation, and non-essential shopping. The former high level of demand for petroleum liquids, mostly trucks and personal travel, which supports these activities, is unlikely to return soon. It is likely to be several months before we have a good picture of whether the demand for energy will stabilize or increase.

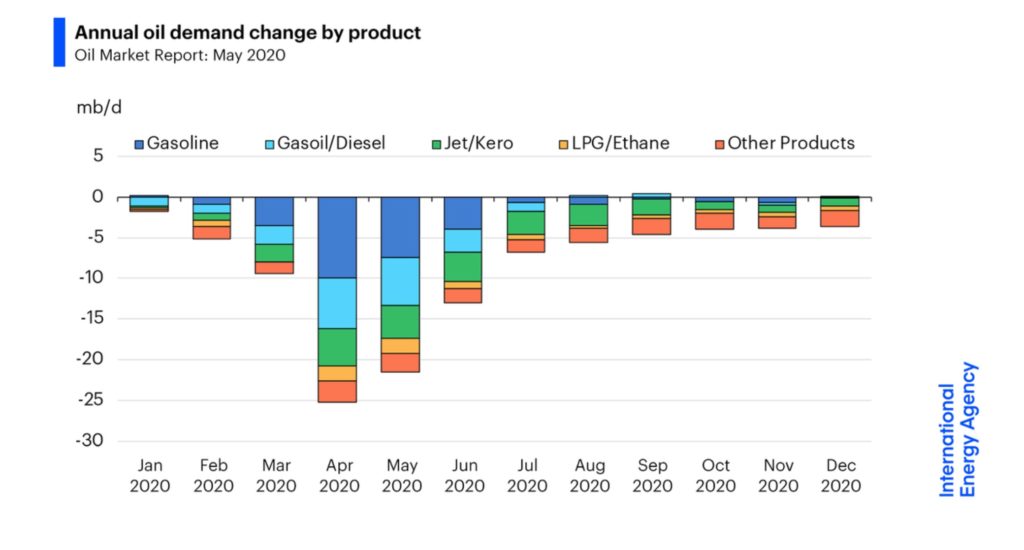

The IEA said in its latest Oil Market Report that global oil demand hit its nadir in April down by 25.2 million b/d and will still be down by 21.5 million b/d in May. The IEA revised up its global oil demand figure for 2020, projecting a decline of 8.6 million b/d for the year, which is slightly better than the drop of 9.3 million b/d that the agency saw last month. Still, that is the largest decline of demand in the history of the oil market. However, the agency is somewhat optimistic in saying that in the second half of the year, gasoline demand will “return to normal.” But that assumes “no continued impact from confinement measures,” a rather significant caveat. “Our global 2020 forecast assumes the virus is largely under control at the global level and that containment measures do not return on a significant scale,” the report said.

“It is on the supply side where market forces have demonstrated their power and shown that the pain of lower prices affects all producers,” the IEA said in its report. “We see massive cuts in output from countries outside the OPEC+ agreement and faster than expected.” The agency said non-OPEC countries could lose 4 million b/d by June, “with perhaps more to come.” And because the OPEC+ deal went into effect in May, total global supply could decline by 12 million b/d in May compared to April.

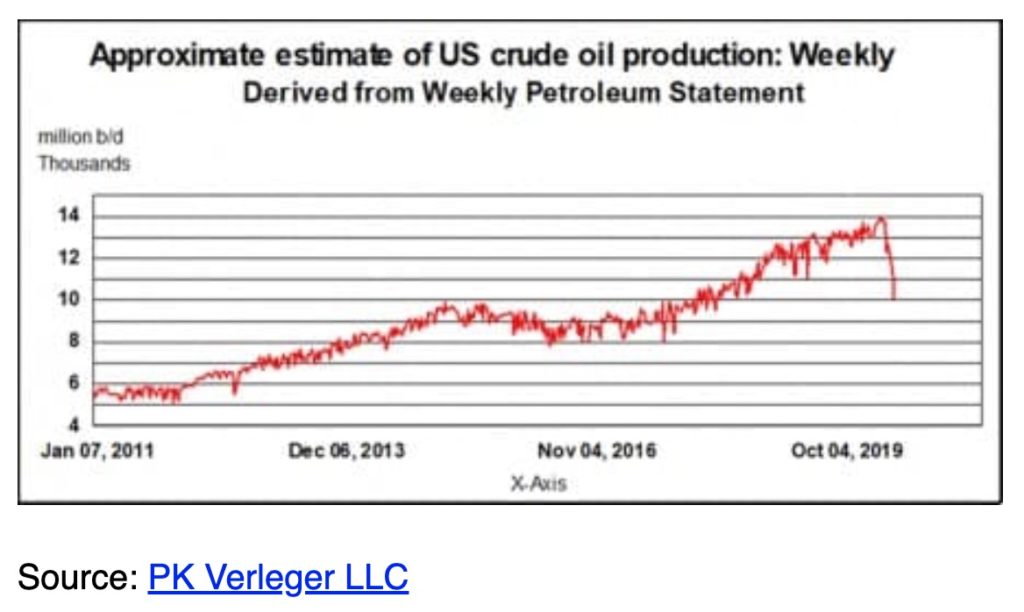

US oil production continues to decline as drillers shut-in wells and cut back spending. New data from Rystad Energy predicts US oil production declines of roughly 2 million b/d by the end of June. “Actual production cuts are probably larger and occur not only as a result of shut-ins but also due to a natural decline from existing wells when new wells and drilling decline,” Rystad said in a statement.

Energy expert Philip Verleger, in an article for Energy Intelligence, reports that the magnitude of output declines is much larger. His latest research shows that production as of May 10th is down by almost 4 million b/d from its peak.

The sharp decline in rigs, drilling, and completion activity means that the steep decline rates endemic to shale drilling will overwhelm what little new production comes online. Standard Chartered said that if the activity were to remain stuck at current levels, US production in the five main shale basins would fall by 2.89 million b/d by the end of 2020. Those declines would come on top of the output that has only been shut in temporarily. Standard Chartered envisions a “squashed-W pattern” for supply, in which temporarily idled production comes back online in a few months, but more structural declines continue after that.

The EIA, characteristically, is much more optimistic about the state of US supply. The agency said on Tuesday that it only sees a 0.5 million b/d decline in oil production this year, compared to 2019. Notably, Secretary of Energy Dan Brouillette says production will increase in the third and fourth quarters as the economy roars back. Others aren’t so sunny. A report from Wood Mackenzie released on Wednesday says that oil demand will take years to recover. The Secretary of Energy may predict “greatness” ahead, but others see a long, protracted economic recovery.

2. Geopolitical instability

Iraq: The new prime minister has appointed finance minister Ali Allawi as acting oil minister after parliament postponed a vote on the oil ministry post. Allawi, who had served in previous governments following the US invasion in 2003, was appointed finance minister last week as parliament granted its vote of confidence to Prime Minister Mustafa al-Kadhimi, most of his cabinet and his government program. Allawi, a former professor at Oxford University, was appointed by the Interim Iraq Governing Council in 2003 as both minister of trade and minister of defense and remained in his post until 2004. He later served as minister of finance in the Iraqi transitional government from 2005 to 2006.

Baghdad has been conducting negotiations with the international oil companies that are producing domestic oil on postponing payments to them and cutting costs as the government grapples with the crude price crash. Iraq is committed to the OPEC+ oil production cuts agreement, the acting oil minister said Thursday. A Reuters report on Wednesday, citing unnamed Iraqi officials, said the country was cutting its oil output by around 700,000 b/d after failing to persuade global oil companies operating its giant fields to agree to deeper reductions.

The Islamic State capitalized on deteriorating US-Iraqi relations as the pandemic further distracted the unfinished fight against it. Last year, Iraqi F-16 fighter jets would swoop across the vast deserts of Anbar province twice a week, surveilling militants from the Islamic State group. The pilots were “watching for leaks” across the Syrian border. Now Iraq’s F-16 program “is almost gone,” the official said in interviews this month outlining the state of the high-profile fighter jet program. Three senior Western security officials familiar with the program confirmed that the program’s operational effectiveness is diminished.

The Kurdistan semi-autonomous region of Iraq is ready to hand over to the federal government 250,000 b/d of oil production and its revenues. At the end of 2019, Kurdistan and Baghdad agreed that KRG would transfer oil revenues and 250,000 b/d to the federal government. Kurdistan failed to send oil or cash to the capital due to falling oil prices and the impact of the coronavirus. After weeks of negotiations, the spokesman for Kurdistan’s Regional Government said, “Within the framework of the agreement, we are willing to deliver 250,000 b/d to the federal government and are committed to transferring the revenues generated from oil sales to the Iraqi state treasury.”

Iran: The government is quarantining part of the oil-rich southwest of the country for the next week, with all main routes into the area closed, the semi-official Tasnim news agency reported. All banks, offices, and businesses in Abadan county, which is home to the Middle East’s oldest oil refinery and the traditional heart of Iran’s energy industry, will be shut, Tasnim said, citing the public affairs office of the county governor.

Tehran reported an increase in the daily number of new Covid-19 cases earlier last week. The growth came a month after officials decided to loosen some restrictions on businesses and public activity. The Islamic Republic has so far reported more than 107,000 cases and some 6,640 deaths, according to the latest official figures. The Health Ministry stopped giving provincial breakdowns more than a month ago to prevent people from traveling into areas where the virus is less prevalent.

The militant rhetoric emanating from Tehran has been much subdued in recent weeks as the government deals with the US embargo, low oil prices, and coronavirus; the latter has likely hit Iran harder than any other state in the Middle East.

Libya: A withering bombardment shook Tripoli last week as the eastern-based forces of Khalifa Haftar fought overnight for new territory in the southern suburbs after losing ground recently around the city. Tripoli residents described the bombardment as the worst so far after weeks of fighting as the GNA attempts to end Haftar’s campaign to seize the capital and push his forces out of artillery range.

Haftar’s Libyan National Army (LNA) has been trying to capture Tripoli for 13 months. Turkish military aid this year for the internationally recognized Government of National Accord (GNA) has helped it regain some ground. The LNA, backed by the United Arab Emirates, Egypt, and Russia, announced a new air campaign last week, but most bombardment since then has been through artillery. Last month the pro-GNA forces recaptured a string of towns in the northwest from the LNA, re-establishing their control between Tripoli and the Tunisian border.

Turkey’s intervention in the Libyan conflict six months ago has altered the course of the war, boosting the prospects and military strength of the United Nations-backed GNA in the capital. However, Turkey’s deployment of troops, mercenaries, and sophisticated equipment to help its Libyan allies have failed to lift Haftar’s siege of Tripoli while emboldening his allies and pushing him to resort to more devastating air power.

Venezuela: Russia’s Rosneft confirmed on Friday that it had discontinued all operations in Venezuela, including joint ventures, trading, and oilfield services, as the firm looks to avoid further US sanctions for doing business with Venezuela. Rosneft announced the sale of its Venezuelan assets to a company 100-percent owned by the Russian government.

3. Climate change

Climate scientists have warned for years that a combination of heat and humidity will make currently inhabited parts of the planet uninhabitable for months at a time. A study in the journal Science Advances last week entitled “The emergence of heat and humidity too severe for human tolerance” found the Persian Gulf, along with parts of Pakistan, is already susceptible to intolerable temperature excursions.

The researchers found that conditions briefly crossed into the danger zone, a combined heat and humidity, or “wet-bulb temperature,” of 35°C, on 14 occasions, according to 40 years of hourly data. Readings of 33°C have come 80 times, and 31°C have occurred about 1,000 times, reaching beyond the Middle East and southern Asia. Dozens of extreme events have occurred along the US Gulf Coast, including New Orleans and Biloxi, Mississippi.

When heat and humidity produce a wet-bulb temperature of 35°C, the body passes a “survivability threshold,” said Radley Horton, an associate research professor at Columbia University’s Earth Institute and a co-author of the study. The 35oC threshold is theoretically the point when humidity and heat prevent skin from cooling off by sweating, causing the body to overheat, with potentially fatal results.

The Gulf of California, the Gulf of Mexico, the shores of the Red Sea, and India’s Southern coast will also suffer from dangerous wet-bulb events decades ahead of previous projections, the researchers found. The survivability threshold is a general designation. Life-threatening conditions have already come at lower extreme humid-heat levels. Recent mass-casualty events have occurred with wet-bulb temperatures of about 28°C, including the 2003 European heatwave, which killed more than 70,000 people, and the 2010 Russian heatwave and fires that killed more than 50,000.

Extreme heat and humidity are threatening millions of lives and economies in places where it could become fatal to work outdoors. Parts of Australia, India, Bangladesh, the Persian Gulf, China, Mexico, and the United States have experienced hundreds of previously rare incidents of extreme heat and humidity since 1979, said the study in the journal Science Advances. These conditions have lasted only one to two hours, but climate change is likely to prolong them to about six hours at a time by 2060 and expand the affected areas.

An indicator of China’s coal demand surged almost a third above levels last year as hotter-than-usual weather and factories rushing to make up for lost orders boosted power demand, spurring a rebound in prices. Coal use by coastal power plants at five major utilities rose for an eighth day to 577,100 tons, more than 30 percent higher than the same period last year and the most since Jan. 12.

There are now four major oil companies pledging to cut emissions to “net-zero,” after Total followed Repsol, BP, and Shell in laying out its plans. And yet, each one of them defines that vital goal differently. The variations might seem small and technical, but they matter. Oil companies sell fossil fuels that create billions of metric tons of carbon emissions each year. How each company counts and categorizes those greenhouse gases will have a direct impact on the emissions trajectory the world follows in the decades to come.

4. The global economy

The future of our energy industries and, indeed, the global economy is becoming more deeply involved with the course of the coronavirus pandemic. With billions of people under some form of restriction, either mandated or voluntary, the demand for energy fell precipitously as did the prices for fossil fuels. Where this is all going is currently unclear with optimists hoping the situation will shortly return to normalcy and others warning that the nature of the energy business will change forever. In the meantime, keeping a close eye on the course of the virus and the state of the world’s major economies is likely to give more insight than watching the usual “fundamentals” of the energy market.

Global: The UN forecasted last week that the pandemic would shrink the world economy by 3.2 percent this year, the sharpest contraction since the Great Depression in the 1930s. The organization’s mid-year report said the impact of the coronavirus crisis is expected to slash global economic output by nearly $8.5 trillion over the next two years, wiping out almost all gains of the last four years. Before COVID-19 became a pandemic, the UN had forecast a modest acceleration in the growth of 2.5 percent in 2020. But UN chief economist Elliott Harris told a news conference that the global economic outlook “had changed drastically” since then, with the pandemic’s official death toll above 320,000 and climbing. “With the large-scale restrictions of economic activities and heightened uncertainties, the global economy has come to a virtual standstill in the second quarter of 2020,” he said.

World trade is set to slump at a rate not seen since the financial crisis in 2009, with estimates becoming increasingly gloomy over the past weeks, the United Nations Conference on Trade and Development (UNCTAD) said on Wednesday. Merchandise trade is seen down 3.0 percent in the first quarter from the final three months of 2019 and by a further 26.9 percent so far during the second quarter. “There were falls of a similar magnitude in 2009 during the global financial crisis. At that time, global trade rebounded quickly, in line with global economic recovery,” said UNCTAD’s chief of statistics Steve MacFeely. “At this moment, the shape of the recovery is still not clear, and it will depend on how fast the economies return to positive growth.”

Last week, new coronavirus clusters surfaced around the world as nations struggle to balance reopening economies and to prevent a second wave of infections. A top global health official warned Wednesday that COVID-19 could be around for a long time. The pandemic consequences may prove more devastating than the disease itself for the world’s poorest countries as the global economy goes into recession, people lose jobs by the hundreds of millions, and the risk of hunger grows, UN officials and aid experts fear.

For now, at least, COVID-19 seems to be primarily a disease of the rich, developed world, with 74 percent of the 4.4 million cases reported worldwide occurring in North America and Europe, along with an overwhelming 85 percent of the deaths. However, it is in developing countries, where the vast majority of the world’s population lives, that the most damaging long-term repercussions could be felt. Most underdeveloped countries have little or no ability and as a result are reporting very low numbers of deaths from the disease.

International agencies have released figures in recent weeks highlighting the risk that poverty and hunger could kill even more people worldwide than the 40 million victims researchers project would die from the virus if sufficient control measures are not taken. Some 1.6 billion of the world’s 2 billion informal workers, or nearly half the global workforce, have already lost their jobs, according to the International Labor Organization. They include gig workers in Western economies, but the vast majority are in developing countries, where most employment is informal, and families live hand-to-mouth, relying on a daily wage if they are to eat at the end of the day.

One of the more interesting troubles to emerge from the pandemic is the future of air travel which is now down by roughly 90 percent of its pre-virus volume. Until a vaccine is found or herd immunity develops so that COVID-19 is no longer a factor, measures to protect passengers from each other are projected to increase the cost of air travel so high that there will be only limited demand.

United States: Bad news came steadily last week. Industrial production in April was down 11.2 percent. Three million more unemployment claims brought the total over the previous two months to 36 million. The oil and gas industry in the US could end up shedding 100,000 jobs. Goldman Sachs revised their forecast upwards now saying that the US unemployment rate soon will top out at 25 percent

Federal Reserve Chairman Powell, in a review of where the US economy stands as much of it reopens, said the country could face an “extended period” of weak growth and stagnant incomes. The economic paralysis caused by the coronavirus led in April to the steepest month-to-month fall in US consumer prices since the 2008 financial crisis. A 0.8 percent drop was driven by the plunge in gasoline prices. Excluding the usually volatile categories of food and energy, so-called core prices declined 0.4%, the government said in its monthly report on consumer inflation. That was the sharpest such drop on records dating to 1957.

The Federal Reserve issued a warning Friday that stock and other asset prices could suffer significant declines should the coronavirus pandemic deepen, with the commercial real estate market being among the hardest-hit industries. The Fed’s report highlighted the central bank’s race to intervene in markets and temporarily dial back regulations on financial firms in response to the COVID-19 crisis.

The next few weeks should give us a better feel as to the results of opening much of the US economy along with modified social distancing. Most epidemic experts are warning that there is a good chance the rates of COVID-19 infections will increase across the country. At the same time, nationwide polling shows that a majority of Americans would rather stay at home. A week or two should show whether many restaurants, stores, and entertainment facilities can remain economically viable under the new rules. Regions where hospitals are flooded with new coronavirus cases are likely to reimpose restrictions.

According to the American Petroleum Institute, the oil and gas industry in the United States supports as many as 10.3 million jobs and generates close to 8 percent of US GDP. This is a portion sizeable enough to suggest that the shutdowns in the oil industry are already harming the national economy.

China: Factory output rose for the first time this year as Beijing’s economy slowly emerges from its coronavirus lockdown, although consumption remained depressed amid ongoing job losses. Industrial production climbed 3.9 percent in April from a year earlier. However, factory-gate prices are falling by the steepest amount in four years, as manufacturers struggle with deflationary pressures from the pandemic, which has crimped demand at home and abroad.

The producer-price index dropped by 3.1 percent from a year earlier in April, compared with a 1.5 percent fall in March, the National Bureau of Statistics reported on Tuesday. Prices for crude oil and other commodities collapsed, contributing to the decline in wholesale prices. “There will be no V-shaped rebound in economic activity,” said Liu Xuezhi, an analyst at Bank of Communications, following the data release. “The recovery from COVID-19 will be slow.”

China’s central bank said last week it would step up counter-cyclical adjustments to support the economy and make monetary policy more flexible to fend off financial risks. China’s long-term stable economic trend remains unchanged, despite the coronavirus outbreak, the central bank said. “But at present, challenges faced by China’s economic development are unprecedented; we must fully consider difficulties, risks, and uncertainties,” it said.

Decoupling between the US and Chinese economies grew in the first quarter of this year, as the economic impact of the coronavirus pandemic exacerbated what some analysts are calling a “cold war” chill in ties between the two countries. The value of newly announced Chinese direct investment projects in the US fell to just $200 million in the first quarter of this year, down from an average of $2 billion per quarter in 2019, according to a report by the National Committee on United States-China Relations. The fall comes after Chinese direct investment in the US dropped to the lowest level since 2009 last year – down from $2.7 billion a quarter in 2018 and $8 billion a quarter in the boom years of 2016 and 2017 – amid souring bilateral ties.

President Trump suggested on Thursday that the US could “cut off the whole relationship” with China, claiming that doing so would save the US $500 billion. The US and many other nations have become increasingly critical of China amid the ongoing novel coronavirus pandemic. China has been accused of covering up the extent of the outbreak and failing to be transparent about the seriousness of the virus. Beijing has attempted to dismiss these criticisms and claimed that the Trump administration is trying to deflect criticism of its response to the crisis. Entwining such claims with restrictions on investing in Chinese equities is causing January’s “phase one” trade deal with Beijing to unravel.

Chinese authorities reported last week on what could be the beginning of a new wave of coronavirus cases in northeast China, with one city in Jilin province being reclassified as high-risk, the top of a three-tier zoning system. Jilin officials raised the risk level of the town of Shulan to high from medium, having hoisted it to medium from low just the day before. Shulan has increased virus-control measures, including a lockdown of residential compounds, a ban on non-essential transportation, and school closures, the Jilin government said. The new cases pushed the overall number of new confirmed cases in mainland China on May 9th to 14, according to the National Health – a remarkably low figure for a county the size of China.

Europe: European Union officials are seeking to finalize a plan for taking public stakes in key European companies to shield them from the economic fallout of the pandemic. The EU is looking to take decisive action to support corporations after plans to help struggling southern states became mired in dispute. Some politicians are questioning the future of the European Union. After weeks of negotiations, France called for “an equity fund, either to recapitalize or to acquire shares in strategic companies that need capital, especially for those operating in European strategic value chains,” according to a proposal submitted to the EU commission.

The German economy shrank 2.2 percent in the first quarter, the most in more than a decade, offering a new flavor of the damage from the coronavirus. Less than two weeks of official lockdown caused slumps in consumer spending and capital investment. Government spending and construction provided some stabilization.

A 3.8 percent slump in the euro-area economy led to a decline in employment, the first since 2013.

Coronavirus infections are rising in Germany again, just days after the country eased its lockdown restrictions. The reproduction rate – the estimated number of people a confirmed patient infects – is now above 1. This means the number of infections is currently rising in the country. The report came as thousands of Germans gathered, calling for a total end to the lockdown. Chancellor Angela Merkel announced a broad relaxation of federal restrictions on Wednesday after talks with the leaders of Germany’s 16 states. All shops are allowed to reopen, and pupils will gradually return to class.

Russia: Moscow has confirmed 272,000 cases of coronavirus – the second-highest toll in the world after the US. Last week, the country was reporting some new 10,000 infections a day. Among the infected is President Putin’s spokesman Dmitry Peskov. He is the latest high-profile official to test positive after Prime Minister Mishustin caught the illness. The news came the day after President Putin eased the country’s lockdown. Factory and construction workers returned to work last Tuesday, though Putin gave regions freedom to set restrictions depending on local circumstances. Despite the number of confirmed cases, Russia’s official death toll is only 2,537 as compared with 89,000 in the US.

Russia’s national death toll from coronavirus could be 70 percent higher than the official data show. The Financial Times’ analysis of all-cause mortality data in Moscow and St Petersburg found 2,073 more deaths in April than the historical average of the previous five years.

Russia has made it illegal to publish or discuss “fake news” about the pandemic in the country. This decision, critics say, is being used to muzzle independent media reports that contradict the government’s official statements. President Vladimir Putin has repeatedly told citizens that the pandemic is “under control.”

Mikhail Mishustin was appointed prime minister in January to spearhead a push for stimulus spending to help President Putin remain in power. Four months later, coronavirus has meant there is no longer money to spend, and Mishustin is in the state hospital recovering from COVID-19. A collapse in oil prices means that the $165 billion national reserve fund previously earmarked for Putin’s stimulus program is being rapidly used up to plug the resulting hole in the budget. Government officials expect the economy to contract by 6 percent this year and the budget to swing to a deficit of 4 percent of GDP, and unemployment to double.

During Putin’s office time, he has been more interested in ‘Making Russia Great Again,” through foreign ventures and a more robust military establishment, while letting others run Russia’s frail economy. At the virus’s present rate of growth in Russia, these policies may be challenging to continue.

Saudi Arabia: The government announced a surprise move to slash oil output to the lowest in 18 years. It is trying to spur the recovery from an energy crisis that has devastated the kingdom’s finances. Oil output will be cut by another 1 million b/d on top of what is already agreed with OPEC allies. Oil futures rose, and Kuwait and the United Arab Emirates followed up with extra cuts of their own.

This move marks the latest step in Saudi Arabia’s retreat from the price war it started in March when it moved to flood the market with cheap crude after talks with OPEC+ allies broke down. Saudi Aramco said its first-quarter profit fell sharply, and it would cut spending this year, underscoring the twin impact of an oil-price rout and the coronavirus pandemic on the kingdom’s worsening finances.

Since Ibn Saud first consolidated his Arabian conquests into the Kingdom of Saudi Arabia in 1932, has the ruling Saud dynasty faced such an existential threat to its continued rule over the country? Saudi Arabia announced late Tuesday that the whole country would go into 24-hour lockdown for the five-day holiday marking the end of Ramadan’s holy month in 10 days. The move rolls back the easing of restrictions that were allowed during the fasting time of Ramadan that started more than two weeks earlier. The same period has also seen a dramatic increase in new infections in Saudi Arabia as well as the rest of the Persian Gulf region.

For the five-day Eid al-Fitr holiday, traditionally a time of feasting and visiting family, Saudi citizens and residents will be confined to their homes. The holy city of Mecca, which was an early center of the outbreak, has remained in lockdown throughout this period. Since Ramadan began and authorities eased restrictions, however, there has been a steady increase in new infections, which now stand at about 55,000. Many foreign workers, which are the backbone of the Saudi’s economy, are leaving of the country if they can find transportation. India is sending ships to the country to help evacuate its citizens.

Kuwait on Sunday instituted a full curfew with just two hours allowed for shopping and exercise. Kuwait is reporting around 1,000 new cases a day for a total of more than 15,000. In the nearby United Arab Emirates, new cases have also increased to nearly 800 a day, for a total of 24,000 cases, but authorities have continued easing restrictions.

5. Renewables and new technologies

Wind and solar don’t stand much of a chance if there isn’t a way to store energy when the wind doesn’t blow and the sun doesn’t shine. As a result, some of China’s biggest state-owned companies are pouring in billions of dollars to build massive projects that will combine renewables with energy storage. The idea with these hybrid projects is that they will allow a more continuous supply of clean power, which will better enable China to reduce its reliance on coal, a significant source of smog and climate-warming greenhouse gases.

China is pushing ahead with plans to make hydrogen a key component in its energy mix as it looks to shed its dependence on fossil fuel imports as well as clean up its skies. The country is focusing on the adoption of hydrogen fuel cell vehicles in a small number of pilot cities. Analysts say Beijing needs to urgently push cost-effective technologies to effectively produce hydrogen from coal, which is available in plenty in the country. In Korea, a research group at Kobe University’s Molecular Photo Science Research Center has developed a strategy that increases the amount of hydrogen produced from sunlight and water using hematite photocatalysts. The group was able to raise the conversion rate to 42 percent of its theoretical limit by synthesizing small nanoparticle subunits in the hematite.

While wind and solar are already cost-competitive with fossil-fuel-generated power, a means of storing and transporting this energy at a large scale is a roadblock to investment and deployment. However, ammonia produced from renewables can be a viable liquid fuel replacement for many current day uses of fossil fuels, including as a shipping bunker fuel, as a diesel substitute in transportation, as a replacement fuel in power turbines, and even as potential jet fuel. The global transport of ammonia by pipeline and bulk carrier is already a well-developed technology.

Researchers at Monash University in Australia are proposing a roadmap to renewable ammonia being produced in the future at a scale that is significant in terms of global fossil fuel use.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Belarus will receive an 80,000-ton shipment of oil from the US in June. Tensions between Belarus and Russia have been heightened in recent months by stalled negotiations over the deeper integration of their economies. Belarusian President Lukashenko accused the Kremlin of using oil supplies as leverage for an eventual merger of the two countries. Belarus had long relied on discounted oil from Russia, but most shipments stopped in January after a disagreement over prices. (5/16)

A Russian pipelaying vessel expected to complete the controversial Nord Stream 2 gas pipeline from Russia to Germany is now outside the German port of Mukran where the Nord Stream 2 pipe is stored. The vessel has been widely billed as a replacement for the Allseas ships that laid most of the 55 Bcm/year line before US sanctions in December last year forced the Swiss company to halt work. (4/12)

Syrian squeeze: For nine years, Syrian President Bashar al-Assad has waged a brutal civil war against his enemies and allowed his friends to profit from it. Now, he’s squeezing those same allies to solidify power and ensure the economy stays afloat as the costs of rebuilding from the conflict pile up. Mr. Assad has been targeting more than a dozen pro-regime money men, in a shakedown that has touched industries from real estate to telecommunications and energy and imparted the message that he alone dictates Syria’s future. (5/15)

South China Sea dispute: In the middle of April, tensions flared up again in the disputed South China Sea after Chinese research and survey vessel Haiyang Dizhi 8 started tagging an exploration ship, West Capella, which Malaysia’s state oil firm Petronas had hired for exploration in the area. The long-running dispute in the South China Sea involves territorial claims by China, Vietnam, the Philippines, Taiwan, Brunei, and Malaysia. China has territorial claims to about 90 percent of the South China Sea, which has put it at odds with its neighbors. (5/16)

Somalia is preparing for a bid round covering seven blocks in its offshore with the official opening due on August 4. The closing date is March 12, 2021. The offering is taking place in challenging global circumstances. The round is Somalia’s first-ever license round. Mogadishu sees revenues from the hydrocarbon sector as a catalyst for the economy to become dynamic and self-sustaining. (5/14)

The US drilling rig count dropped by 35 last week, hitting 339—the lowest level since Baker Hughes started to keep track in 1940. Oil rigs were down by 34 to 258—a 544 -year-over-year rig decline. Gas rigs were down by 1 to 79, down from 185 last year. (5/16)

Corpus Cristi: Crude oil shipments from the United States’ top oil-exporting hub have plunged 35 percent since the first quarter with more declines expected this summer as the impacts of the coronavirus pandemic continue to ripple throughout the industry. (5/16)

Shale front quiet: Heading into the first-quarter earnings season, analysts were clear. They wanted no surprises from pure-play shale gas drillers — no new spending, no new debt, no mergers, and acquisitions — just cash discipline, despite the temptation of commodity prices set to rise near the end of the year. The analysts mostly got what they wanted. (5/14)

Exxon’s climate clash: Shareholder activists prodding Exxon Mobil Corp on climate-change proposals are backing calls for an independent board chairman as the oil company significantly steps up efforts to keep climate proposals off its ballot. Exxon’s broad rejection of climate proposals, challenging sponsors and rebuffing ballot measures as either micromanaging or unneeded, has accelerated under Chairman/CEO Darren Woods. (5/14)

Fossil fuel dustup: A group of nearly 40 Republican lawmakers on Friday urged the Trump administration to take actions against financial institutions that have shied away from financing specific fossil fuel projects. (4/12)

Missouri wind: Ameren Energy told analysts Tuesday during an earnings call that it is “transitioning to a cleaner generation profile” and has agreements in place to add 700 MW of wind generation. At the same time, it brings coal-fired generation down to 8 percent of its rate base by 2024. The state of Missouri has a total of 959 MW of wind generation currently installed. (4/13)

Super solar: The Department of the Interior approved this week the biggest solar project in the US ever—an estimated $1-billion solar plus battery storage project in Nevada. Australia’s Quinbrook Infrastructure Partners and California-based Arevia Power now have the green light to build and operate the Gemini Solar Project some 30 miles northeast of Las Vegas in Clark County, Nevada. The project will consist of a 690-MW photovoltaic solar electric generating facility plus a battery storage facility. (4/13)

Tesla is set to launch a million-mile battery as soon as this year or early in 2021 for its Model 3 in China, as part of a broader plan to introduce longer-lasting, low-cost batteries that would bring electric vehicle prices to parity with conventional gas-powered cars. Last year, a team from the Dalhousie University in Halifax, Canada, who research for Tesla, said they had tested lithium-ion battery cell chemistry expected to be able to power electric vehicles for more than 1 million miles. The cells should last at least two decades in grid energy storage. (5/15)

EV wireless charging: For all their hype and techno-wizardry, EVs still bow down to their gas-powered cousins when it comes to driving range, not to mention that they take much longer to refuel. But what if you could not only charge your EV wirelessly but also be able to do it on the fly? Stanford University researchers have unveiled a wireless charging technology that employs magnetism to charge EVs, drones, and robots during operation seamlessly. (5/16)

Euro car market: In the first quarter of 2020, the electrically chargeable vehicle segment in Europe significantly increased its market share, rising to 6.8 percent (from 2.5 percent in Q1 2019) against the backdrop of the overall decline in passenger car registrations due to the COVID-19 outbreak. By contrast, demand for diesel and gasoline vehicles tumbled dramatically, although gasoline-powered cars still account for more than half of the EU market. (4/13)

United Airlines has told staff that it only has work for about 3,000 of its approximately 25,000 flight attendants in June and warned of job losses if demand does not recover by the time government payroll aid expires in the fall. United is paying flight attendants until September 30, thanks mainly to $5 billion the airline is receiving from government payroll aid under the CARES Act, which prohibits any job or pay cuts for employees before October. (5/16)

Boeing’s bearish news: Boeing CEO Dave Calhoun said in an NBC interview on Tuesday that a US airline bankruptcy is likely in 2020. It is a curious comment coming from an executive whose company sells to airlines, but COVID-19 has hit the industry particularly hard. Many airlines have gone bankrupt in the past, and demand for air travel continued to grow year by year. COVID-19, of course, is unprecedented, cratering demand for air travel like no other event in history. Air travel in the US is down more than 90 percent year over year. (4/13)

COVID-19 hammering Mumbai: The coronavirus problem that India had feared is becoming a reality in Mumbai. It is India’s most densely populated city, a scraggly peninsula framed by the Arabian Sea and other waterways, a metropolis of towering apartment blocks and endless slums, a city of oversize dreams, and desperate poverty, all sandwiched together. As the coronavirus gnaws its way across India, Mumbai has suffered the worst. This city of 20 million is now responsible for 20 percent of India’s coronavirus infections and nearly 25 percent of the deaths. (5/15)

Quandary in India: As India eases one of the world’s tightest coronavirus lockdowns, millions of migrant workers are struggling with a question. Stay put in cities or go back home? Self-employed people are allowed to resume work, and some factories and neighborhood shops have started to reopen, though at partial capacity. (4/12)

Borders still closed: The US government largely shut down international travel to the US in March with a series of rapid-fire moves. Restarting it will likely be a longer, more piecemeal process that could be complicated by rising tensions with China. Even as President Trump pushes US states to reopen their economies, US borders remain shut to travelers from China and Europe. (5/15)

Shipping down: Maersk, which moves 17 percent of all containers worldwide, posted better-than-expected first-quarter earnings on Wednesday as cost cuts, lower fuel outlays, and higher freight rates helped offset the demand slump. With the US and European countries stepping carefully toward reopening their economies, Maersk’s CEO expects no meaningful recovery until the end of the year, adding that container volumes are expected to fall 20 percent to 25 percent in the second quarter from a year ago. (5/14)

Growing food crisis: The coronavirus pandemic hit the world at a time of plentiful harvests and ample food reserves. Yet a cascade of protectionist restrictions, transport disruptions, and processing breakdowns has dislocated the global food supply and put the planet’s most vulnerable regions in particular peril. “You can have a food crisis with lots of food. That’s the situation we’re in,” said Abdolreza Abbassian, a senior economist at the UN’s Food and Agriculture Organization, or FAO. (5/14)

Water crises were ranked above both infectious diseases and food crises in the World Economic Forum’s latest Global Risks Report. This year, the world is likely to see all three. Inequality in water access worldwide will shape the course of the pandemic. In the immediate term, clean water must reach as many people as possible to take the necessary precautions needed to reduce the risk of infection from the coronavirus. (5/14)

Urban growth exploding: An international team of researchers has used satellite images to map urban growth between 1985 and 2015. In a paper in Nature Sustainability, they report that the global urban extent has expanded by 9,687 square km per year—a rate four times greater than a previous estimate, suggesting an unprecedented rate of global urbanization. (4/11)