Editors: Tom Whipple, Steve Andrews

Quote of the Week

“With the petroleum age clearly past its peak, investors are looking for companies that can treat them well on the long, slow ride down. “

Jinjoo Lee, The Wall Street Journal

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

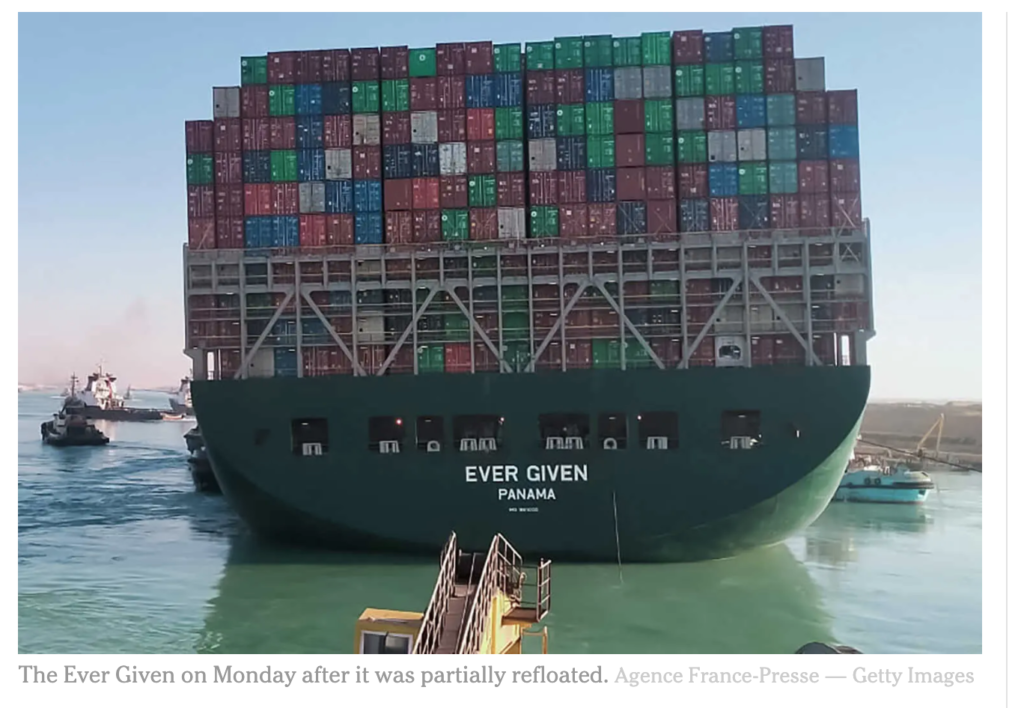

Oil: Prices were volatile last week as the grounding of the “Ever Given” container ship in the Suez Canal set off a chain of events that wreaked havoc on global trade. On Tuesday last week, Brent crude’s price plunged to $60.86 per barrel from $69.63 per barrel on March 11th. The price had rebounded to nearly $64 per barrel by Wednesday. The dramatic price fluctuations are attributable to various events, including US oil inventory figures, another round of lockdowns in the EU, AstraZeneca vaccine safety and efficacy concerns, and the vessel stuck in the Suez Canal. On Friday, the markets closed essentially unchanged for the week at $60.97 in New York and $64.57 in London. Prices are up roughly 25% this year, and there’s confidence in the longer-term outlook as vaccination rates climb, and OPEC+ keeps supply in check.

Engineers on Monday “partially refloated” the container ship that continues to block traffic through the Suez Canal, authorities said, without providing further details about when the vessel would be set free. Satellite photography shows that the ship’s bulbous bow, once lodged deep in the canal’s eastern bank, had been partly wrested from the shore — although it remained stuck at the canal’s edge. The ship’s stern had swung around and was now in the middle of the waterway.

However, the canal remains blocked by the cargo vessel for a sixth consecutive day, with more than 320 ships — including crude, product and chemical tankers, dry bulk carriers and container vessels — waiting to transit the canal from both sides as of March 28th. There are at least 28 crude tankers estimated to be carrying around 26 million barrels and 24 product and chemical tankers holding around 1 million mt waiting to navigate through the canal

US crude inventory builds extended in the week ended March 19th, as refinery runs continued to see lingering effects from the mid-February polar vortex. Commercial oil stocks climbed 1.91 million barrels the week before last to 502.71 million, leaving supplies 6.4% above the five-year average for this time of year. The build was concentrated on the US Gulf Coast, which saw inventories rise 5.39 m/b to 293.57 million. Stocks at the NYMEX delivery point of Cushing, Oklahoma, saw a 1.94-m/b draw, the largest one-week slide since mid-February.

The board of directors of the American Petroleum Institute, one of Washington’s most influential trade associations, on Thursday approved a “climate action framework,” a wide-sweeping plan to lower the emissions blamed for global warming. The API now backs increasing government and industry collaboration, seeking to preserve a role for oil companies to solve a problem it says requires “continuous innovation.” Skeptics say the API is supporting a carbon tax, which they do not expect will ever be enacted, only to garner credit among environmentalists.

The prospect of summer drivers crowding US highways is powering steep gains in the price of gasoline, a sign of economic recovery and a boon for the pandemic-ravaged energy industry. According to the AAA, lifted by oil’s rally and growing consumer demand, gasoline prices at pumps in the US hit an average of $2.88 a gallon over the past week. That is up about one-third over this time last year.

After last year’s lowest spending on new oil field developments in 30 years, the offshore oil and gas sector is set to significantly increase capital expenditures in 2021 to around $44 billion, compared to just $12.3 billion worth of engineering, procurement, and construction contracts awarded in 2020. In 2019, before the pandemic hit oil demand and prices, the contracts in the offshore oil and gas industry were around $40 billion.

OPEC+: The cartel will likely decide to keep oil production essentially steady for another month. Saudi Arabia and the UAE have spoken in favor of the need to tread lightly regarding how much oil is put into the market. According to the Asia head of VITOL, the world’s largest independent oil trader, the OPEC+ alliance is set to push global oil inventories back to 2019 levels later this year, with demand recovering in China. Demand is still about 5-6 million b/d below 2019 levels.

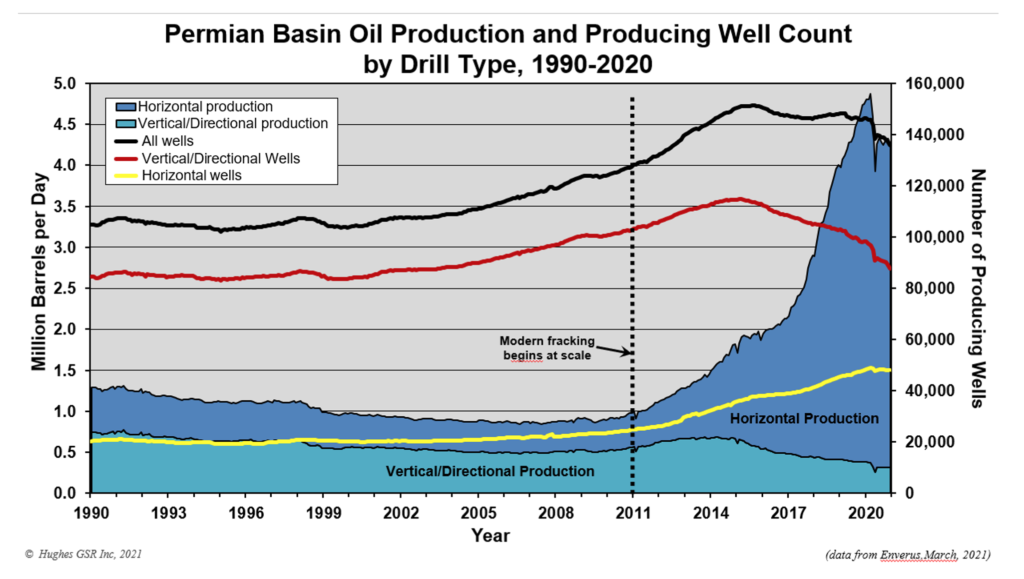

Shale Oil: US oil drillers are once again in growth mode, according to the first-quarter energy survey by the Dallas Federal Reserve. As oil prices rebound, activity in the oil patch is expanding strongly. From a reading of just 18.5 for the fourth quarter of 2020, the survey’s business activity index soared as high as 53.6 over the first quarter of this year. The data supports evidence from other agencies. The number of active drilling rigs is steadily rising and so is production. According to the latest weekly report by the EIA, oil production last week averaged 11 million b/d. That’s still 2 million b/d below the average for this time last year, but above the average for a week earlier.

A backlog of pre-drilled shale oil wells is rapidly shrinking as oil prices rise, signaling that producers are ready to put drilling crews back to work. Drilled but uncompleted wells, known as DUCs, are expected to fall to less than 5,000 by the final three months of this year, dropping about 2,000 wells compared to the second quarter of 2020. After history’s worst crash last year, shale explorers cut back on drilling and focused on completing existing wells, cutting into the so-called fracklog. But now that oil prices have climbed more than 60% in the past five months, the shale patch can afford to bring drilling crews back. Though most explorers expect production to be flat this year, output is poised to climb next year as rigs rise.

It hasn’t been this cheap for shale oil drillers to raise money on the high-yield bond market since oil was at $100 a barrel back in 2014. They’re jumping on the opportunity to refinance debt at lower rates. According to Bloomberg Intelligence, drillers have already sold $11 billion in new junk-rated energy debt through the first ten weeks of the year, and this quarter is shaping up to be the busiest in at least half a decade. After the pandemic brought shale’s debt-fueled boom to an abrupt halt last year, many explorers got shut out from capital markets and went bankrupt. Since then, drillers have largely refrained from embarking on another growth spurt and have pledged to focus instead on balancing their books.

Despite the optimism, Noble Corp.’s acquisition of Pacific Drilling, announced last week in a merger of drillers, points to the troubled state of the oilfield service sector, even with more activity expected this year. Drillers and suppliers of oilfield support services and equipment have struggled as oil prices have waxed and waned in recent years and face headwinds even now despite prices recovering above $60 a barrel after a tumultuous 2020.

Natural Gas: Domestic gas production surged to a nearly 12-month high last week as rising optimism in the US oil and gas industry continues to fuel an expansion in drilling activity and upstream investment. Amid a surprisingly strong recovery from last month’s historic freeze-off, output surpassed 93 billion cf/d, setting a recent high. The sustained rebound in production can be attributed mainly to recent growth in the Haynesville shale, along with smaller gains from the Permian, the Bakken, and the SCOOP/STACK. In all four basins, many operators have significantly expanded their drilling this quarter.

There is a mismatch between the amount of available financing and the number of quality liquefaction projects, making it difficult to add new supplies to a tight global market. Newly sanctioned export projects have been absent in 2020 and so far in 2021, especially in North America, responsible for most new LNG supply over the last five years. This is a worrisome sign that could lead to more price volatility in the future, officials said.

While burning gas emits less greenhouse gas than coal does, environmental gains are lost if there is a leakage of methane, the main component of natural gas. Methane is massively more potent than carbon dioxide in contributing to climate change and has become a target of environmentalists. Falling prices for wind and solar power, coupled with government and businesses’ new green goals, are accelerating a shift to cleaner energy and leaving natural gas—long seen by energy companies as a bridge between coal and renewables—in the lurch. The gas industry is also under growing scrutiny for its methane leaks, leading some potential customers to skip gas and move ahead to lower-carbon alternatives.

That is a risk for Shell and rivals such as Exxon Mobil and Total, which also invested in gas. Given that gas projects typically cost billions of dollars upfront and take decades to recoup the investment, Shell last month halved its outlook for global gas demand growth to 1% a year and said demand for the fuel could peak as soon as the 2030s. “If you look at the global gas industry, its role in the energy transition and the world energy mix decades from now is up for grabs,” Maarten Wetselaar, who heads Shell’s gas business, said last month. He noted that more action to reduce methane leakage was needed.

As Texas was crippled last month by frigid temperatures, drilling companies in the state’s largest oil field were forced to burn off an extraordinary amount of natural gas that could have powered tens of thousands of homes for at least a year. According to satellite analysis, the need to flare an estimated 1.6 billion cubic feet of gas in a single day — a fivefold increase from rates seen before the crisis — came as the state’s power plants went offline. Pipelines froze, so the wells simply had no place to send the natural gas still streaming out of the ground.

Democrats on Capitol Hill are aiming to swiftly reinstate Obama-era rules designed to rein in the emission of methane. Senate Majority Leader Schumer announced Thursday he is backing an effort to restore Environmental Protection Agency requirements meant to fix leaks of the potent greenhouse gas from new wells, pipelines, and other equipment watered down by the Trump administration, with a floor vote planned for April. Congressional Democrats want to take advantage of the Congressional Review Act, which allows Congress to overturn what it sees as objectionable rules completed in the waning days of the outgoing administration without having to go through a cumbersome rulemaking process.

New Mexico regulators finalized rules to nearly eliminate routine natural gas flaring, making it the second state in the US to ban the practice.

Prognosis: The IEA suggests in Oil 2021, its latest medium-term outlook, that there may be no return to normal for the world oil market in the post-Covid era. This judgment has brought a sharp retort from the industry, hoping to continue with business as usual for decades. The Agency says global oil demand is, admittedly, rebounding after an unprecedented collapse in 2020. But rapid changes in behavior caused by the pandemic, as well as accelerated commitments by governments towards decarbonizing their economies “have caused a dramatic downward shift in expectations for oil demand over the next six years” while possibly pushing forward the timeline for peak oil demand.

This, in turn, is forcing “hard decisions” on oil-producing countries and companies, which do not want to be left with stranded oil resources but also do not want to invest in new production capacity that may increase life-of-asset risk. The IEA warns the latter concern is leading to a lack of investment that could cause yet another supply crunch further along the line.

Industry apologists respond that the IEA’s mandate of “energy security” has induced a bias towards over-warning about possible troubles ahead, such as global warming concerns reducing the demand for fossil fuels. The industry naturally foresees no change in the ever-increasing demand for fossil fuels which has been going on for decades. They cite recent projections by the IEA itself, which show higher demand in the immediate future.

After a challenging 2020, the oil and gas demand recovery – supported by vaccination efforts and OPEC+ supply cuts – is proving good for drilling activity. Rystad Energy expects around 54,000 wells to be drilled worldwide in 2021, a 12% increase from 2020 levels. In 2022 drilling is set to increase even more, by another 19% year-on-year to about 64,500 wells, though activity will still fall short of the 73,000 wells drilled in 2019. Onshore drilling activity is expected to increase by 12% from the 46,000 wells drilled in 2020 to about 51,700 wells in 2021 and climb by another 19% in 2022 to reach around 61,700 wells. Despite the increased activity, it still looks like drilling needs some more time to recover to pre-pandemic levels, as the onshore well count was nearly 71,000 in 2019.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Supreme Leader Ayatollah Ali Khamenei said last week that Tehran does not trust US promises on lifting sanctions and will only return to its commitments under a 2015 nuclear deal once Washington entirely removes sanctions. The US and the other Western powers that signed on to the 2015 deal still appear to be at odds with Tehran over which side should return to the accord first.

Iraq: Oil production jumped by over 100,000 b/d in February, pushing the country further from OPEC expectations, although rising oil prices helped deflect potential scrutiny from fellow exporters. Nationwide output averaged 4.15 million b/d, up from 4.03 million in January, according to an analysis based on data collected from each producing field in both federal Iraq and the Kurdistan region.

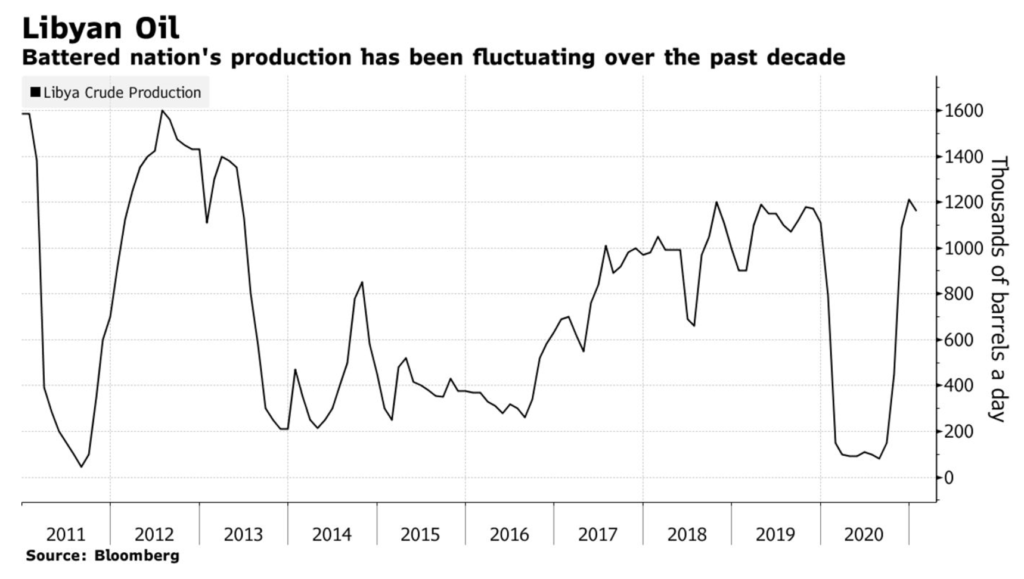

Libya: The oil industry’s rehabilitation is one of the new budget’s main pillars. According to the draft, the spending plan estimates annual oil revenues at $19.7 billion, accounting for 80% of the total. That’s based on exports of 1.1 million b/d at $60 a barrel, around the same as today’s prices. Oil revenues withheld by the National Oil Company last year amid a conflict with the central bank are estimated at $3.9 billion and are part of the 2021 budget, which is yet to be approved by parliament.

The oil company insisted last year that it would keep the revenues until the bank spelled out how it spent the funds and until a comprehensive political settlement could be reached. Last week, the NOC said it’s considering unfreezing the funds, potentially ending a significant point of contention that had complicated Libya’s recovery from the civil war.

Venezuela: Representatives of foreign oil companies have been visiting Caracas recently to discuss a possible return to Venezuela’s oil industry after Nicolas Maduro began promising earlier this year that he would end the monopoly of PDVSA. The state oil company already has overseas partners, but foreign investments in Venezuela’s oil industry are capped at 49 percent of any given project to protect the sector’s state control. Now, with the industry—and Venezuela’s whole economy—in tatters, this may have to change. Venezuela’s crude oil and refined product exports plummeted in 2020 to their lowest level in 77 years.

Venezuelan farmers have asked the government to allow them to import diesel themselves to alleviate shortages that are hindering food production and distribution. Diesel has become scarce due to meager output at the PDVSA refineries. Venezuela’s hydrocarbons law reserves the right to international trade in crude and refined products only to the state and state-owned companies. But groups representing ranchers and milk producers said they were seeking temporary authorization to import diesel due to the current crisis.

The operator of an oil terminal run by PDVSA has declared bankruptcy, blaming it on US sanctions. The operator of the terminal on the Caribbean island of Bonaire filed for bankruptcy earlier this month, saying it could not keep paying its debts because US sanctions had cut off its access to “international trade” and to cash in bank accounts.

Saudi Arabia-Yemen: The Saudis unveiled a proposal for a cease-fire aimed at disentangling itself from Yemen’s civil war, as rebel forces press an offensive and the Biden administration seeks to extricate the US from the six-year-old conflict. The proposal announced last week includes a nationwide cease-fire, reopening of both the airport in the capital Sanaa and the country’s largest port at Hodeidah and the start of political consultations under UN supervision. Earlier proposals like this have failed to resolve the conflict between the Saudi-backed forces and the Houthi rebels.

The Houthis, who have aligned with Saudi archenemy Iran, dismissed the proposal as containing nothing new. “Any positions or initiatives that don’t recognize that Yemen has been subjected to hostility and blockade for six years, and don’t separate the humanitarian aspect from any political or military bargain or lift the blockade are nothing new or serious,” said the group.

The Saudi-led coalition said on Thursday it had intercepted and destroyed several explosive-laden drones aimed at Saudi Arabia. The coalition said the Houthis attempted to target universities in Najran and Jazan, Saudi cities near the Yemeni border. The coalition said it had destroyed the one targeting Najran and six other explosive-laden drones fired by the Houthis aimed at the kingdom.

On Friday, the Houthi group said it had launched attacks against several Saudi Aramco facilities and military sites in the kingdom. A Houthi military spokesman said on Twitter that the group had targeted King Abdelaziz military base in Dammam, military sites in Najran and Asir, and Aramco facilities in Ras al-Tanura, Rabigh, Yanbu, and Jizan. A Saudi Aramco petroleum product distribution terminal in Jazan, near the border with Yemen, was hit by a projectile on March 25th, causing a fire in a storage tank, the Saudi energy ministry said.

3. Climate change

According to nine member states, the European Union must set a date to phase out the sale of new gasoline and diesel cars so that the region meets its aim of becoming climate neutral. Tackling pollution from transport, which accounts for a quarter of EU greenhouse gas emissions, is one of the biggest challenges for the 27-nation bloc in its sweeping environmental commitment. Europe must give a clear signal to manufacturers, fleet owners, and consumers to accelerate the shift to electric vehicles, according to a document sent to EU climate and transport chiefs. “If you take into account the lifetime of cars, you just need to stop adding new fossil fuel cars around 2030 if you want to be carbon neutral in 2050.”

The legislative package, known as ‘Fit for 55’, will include revised regulation on CO2 standards for cars and vans, which the countries said should be “significantly strengthened.” According to the group, the measure should also include the phase-out provisions for fossil-fuel vehicles, which also includes Austria, Belgium, Greece, Ireland, Lithuania, Luxembourg, and Malta.

NATO Secretary-General Jens Stoltenberg wants to make global warming a significant focus of the military alliance’s strategy and planning, pushing environmental issues to the center as a security threat. The new push at NATO, which was approved Tuesday by alliance foreign ministers at a gathering in Brussels, signals a significant shift for the organization, which has traditionally guarded against threats from Russia and other political actors around the world. “Climate change is a crisis multiplier,” Stoltenberg said in an interview. “Climate change will lead to more extreme weather, to droughts, and to flooding, force people to move, to more fierce competition about scarce resources, water, land.”

Much of the US West is facing the driest spring in seven years, setting up a climate disaster that could strangle agriculture, fuel deadly wildfires and even hurt power production. Across 11 western states, drought has captured about 75% of the land and covers more than 44% of the contiguous US, the US Drought Monitor said. While drought isn’t new to the West, global warming exacerbates the problem — shrinking snowpack in the Rocky Mountains and extending the fire season on the West Coast.

That means ranching and farming may become costlier and less sustainable, with some operations forced to move to wetter regions. Western cities will face tighter water-use restrictions, rekindling political battles over increasingly scarce resources. And the threat of catastrophic fires will increase, with big areas of West Texas, Arizona, New Mexico, and Oklahoma at risk. It could be fierce in California, set to endure another potentially hellish year of blazes that force evacuations, destroy homes and end lives.

4. The global economy and the coronavirus

Covid-19 spread rapidly in many countries last week. The situation is particularly dangerous in Europe, India, and Brazil. In the US and UK, where vaccinations are increasing rapidly, and in China which relies on rapid, tight shutdowns, the situation is relatively stable although parts of the US are seeing increasing infections.

US: Covid-19 vaccine manufacturers are ramping up production, churning out far more doses a week than earlier in the year. Mass vaccination campaigns are accelerating in the US after a slow start. Pfizer, its partner BioNTech, and Moderna Inc. have raised output by gaining experience, scaling up production lines, and taking other steps like making certain raw materials on their own. The US government will distribute 11 million doses of Johnson & Johnson’s Covid-19 vaccine this week in its continued effort to get 200 million shots in people’s arms in the first 100 days of President Biden’s term.

The number of people seeking unemployment benefits fell sharply last week to 684,000, the fewest since the pandemic erupted a year ago and a sign that the economy is improving. Administration officials are crafting a plan for a multipart infrastructure and economic package that could cost as much as $3 trillion. The first proposal would center on roads, bridges, and infrastructure projects.

European Union: Governments say that their hospitals are at risk of being overwhelmed by Covid-19 as leaders struggle to get a grip on the pandemic after a week of ill-conceived lockdown measures and recriminations over the EU’s slow vaccine rollout. Germany’s third wave of the coronavirus could be the worst so far, and 100,000 new daily infections are not out of the question, the head of the Robert Koch Institute for infectious diseases said on Friday. The number of new confirmed infections in Germany has jumped in recent weeks, driven by a more transmissible variant known as B117, and moves to ease some lockdown measures.

French authorities placed three more regions under lockdown as the country tries to stop the spread of a growing outbreak. Intensive care units in France treated more than 4,700 people with Covid-19, the highest number so far this year and close to the peak of the second wave in November. France on Friday reported nearly 42,000 people tested positive for the virus, with a further 897 deaths. Some 7.2m people have now received their first vaccination.

Poland’s prime minister said his country’s hospitals were caring for more Covid-19 patients than at any time in the pandemic and were “a step” away from being unable to treat new patients. Hungary’s hospitals are under “extraordinary” pressure from rising coronavirus infections, its surgeon general said as the third wave of a pandemic hit Central Europe. Like much of the region, Hungary managed to curb infections during the pandemic’s initial phase in March-April last year with fast and strict lockdown measures. However, a new wave of infections that has swept through the region in 2021 has seen Hungary this week overtake the Czech Republic as the country with the world’s highest daily Covid-19 deaths per capita.

Economists are cutting growth forecasts for the eurozone economy as a third wave of infections and vaccination delays spur tighter restrictions in many countries. The reintroduction of lockdown measures across the continent is fueling concerns that the region could suffer another disappointing summer tourism season if vaccinations do not speed up enough to allow travel restrictions to be eased. The French government is close to finalizing a recapitalization plan for Air France. The multi-billion-euro package could be announced in the coming days following final approval from Brussels.

China: The US, EU, UK, and Canada have imposed sanctions on China over its treatment of Uyghur Muslims in a coordinated move that sparked immediate retaliation from Beijing. Travel bans and asset freezes have now been imposed on four officials and a security organization over persecution and mass internments of Uyghurs in the Xinjiang region. China on Saturday imposed sanctions against two American religious rights officials and one Canadian lawmaker in response to sanctions imposed by the US and Canada over Xinjiang.

The EU was the first western power to announce the sanctions. It was hit with immediate retaliation from China’s foreign ministry, which imposed travel bans on 10 EU individuals and four entities. However, the US and China are tiptoeing toward cooperation on climate change despite recent and testy high-level talks. The two governments’ chief climate envoys are scheduled to come together for formal discussions.

In a significant boost for renewable energy, the People’s Bank of China announced that it will increase financial support for wind and solar power development to meet carbon emissions targets. New financing measures will include preferential subsidies for promising wind and solar companies, increased credit and loan support, and arrangements for loan extensions.

Observers say Beijing is set to dominate refined oil exports in the Asia-Pacific region. China has rapidly increased its refinery capacity and Australia is set to close two of its last four refineries. Chinese exports of refined oil products to Australia rose to nearly 300,000 tons last year. China’s crude throughput has started to fall in March, with refinery maintenance beginning in late February and likely to continue over April-June. A combined capacity of 36 million tons per year of refining capacity at five state-owned refineries has been offline, including four from Sinopec and one from CNOOC.

Russia: Fuel oil exports fell 2.9% year on year to 2.72 million tons in February, according to data released March 22 by the statistical arm of the Russian Energy Ministry. The exports were down 6.4% from January shipments of 2.9 million tons. Export flows were down slightly in February due to higher domestic demand which a cold spell boosted. Russia uses fuel oil as a reserve fuel for power generation during the heating season. Buying by utilities has remained strong despite surging domestic prices, which were tracking the strengthening exports.

Russia’s government approved the country’s long-term development program for liquefied natural gas, expecting production capacity to rise threefold from current levels to 140 million tons per year by 2035. Russia is also targeting increased LNG exports, assuming sustained growth in LNG demand. Global LNG demand is set to nearly double from 360 million tons last year to 700 million tons by 2040, thanks to continued solid demand from Asia and a rise in gas use for powering hard-to-electrify sectors.

The controversial Nord Stream 2 natural gas pipeline project will be completed this year, the chairman of the board of Russia’s Gazprom said on Friday. Around 90-92% of the work required for the project has already been done. The project, which has divided Europe and drawn opposition and criticism from the US, has to complete pipe-laying work in Danish territorial waters.

While the pipeline is owned by Gazprom and co-financed by five European companies (France’s Engie, Austria’s OMV, the Dutch-British Shell, and the German Uniper and Wintershall), its political ownership resides in Berlin. Most other European governments oppose it; some German policymakers devoutly wish it would go away. Yet German Chancellor Angela Merkel’s government had been counting on being able to persuade Washington to accept a pragmatic solution for a construction project that is nearly complete. However, the Biden team is itself in a double bind. It wants to stand up to Russia but improve US-German relations, which had fallen to a nadir in the Trump era. A bipartisan group in Congress has been clamoring for more companies to be put on the sanctions list.

Saudi Arabia: Aramco is conducting engineering analysis to expand its maximum sustained crude oil production capacity to 13 million b/d, but the work could be pushed forward if market conditions require extra Saudi supplies. “The capacity expansion will come in increments…We can accelerate if the market calls for it, but the work at the moment is at the detailed engineering phase.”

Last year, Saudi Aramco sent shockwaves through the natural gas markets after it announced it was kicking off the biggest shale gas development outside of the US. The company said it plans to spend $110 billion over the next couple of years to develop the Jafurah gas field, which is estimated to hold 200 trillion cubic feet of gas. The state-owned company hopes to start natural gas production from Jafurah in 2024 and reach 2.2 billion cf/d of gas by 2036 with an associated 425 million cubic feet per day of ethane. Aramco has now announced that instead of chilling that gas and exporting it as LNG, it will use it to make much cleaner fuel, blue hydrogen. During the company’s earnings call on Monday, Saudi Aramco’s CEO told investors that the company had abandoned plans to develop its LNG in favor of hydrogen.

India: Doctors have detected a new “double mutant variant” of the coronavirus, adding to concern as the government struggles with the highest single-day tally of new infections and deaths this year. Genome sequencing and analysis of samples from Maharashtra state found mutations in the virus that do not match previously cataloged “variants of concern.” Maharashtra imposed night curfews on Sunday to tackle a surge in coronavirus cases, with the financial capital Mumbai reporting its highest single-day jump since last March.

India’s COVID-19 caseload has risen to 11.69 million amid a second surge of infections, leading many states to ask the government to replenish vaccine stocks so they can cover more people faster. India has reported the third-highest total of coronavirus cases after the US and Brazil. As one of the world’s biggest vaccine producers, India has imposed a de facto ban on vaccine exports. It seeks to prioritize local vaccinations amid an accelerating second wave of coronavirus infections. The Serum Institute of India, the largest manufacturer of vaccines globally and the biggest supplier to the international Covax program, has been told to halt exports and that the measures could last as long as two to three months.

Top Indian officials are discussing whether to reach net-zero greenhouse gas emissions by 2050, yet little analytical work has been done on just what the country will have to do to meet that target. In February, the International Energy Agency found it’s possible for India to zero out its emissions by the mid-2060s. The conclusion was based on the IEA’s Sustainable Development Scenario, which sees the entire planet reaching net zero by 2070.

5. Renewables and new technologies

Renewable energy projects are expected to see a record investment at $243 billion this year, further closing the gap with expenditure on oil and gas projects, where Capex is expected flat at around $311 billion. Rystad Energy said in a recent analysis that spending on renewable projects in 2021 is set to rise from last year’s estimated expenditure of $224 billion.

Capex on renewable energy projects globally is now estimated at just 22% below the spending on upstream oil and gas projects. This year’s spending on renewables will go primarily to onshore wind, which will see Capex rising to $100 billion from $94 billion last year, and solar PV, where spending will grow to $96 billion from $88 billion in 2020. Offshore wind is also set for a rise in Capex, expected at $46 billion in 2021 from $43 billion last year.

Researchers from the Chalmers University of Technology have produced a structural battery that performs better than all previous versions. A structural battery is one that is integrated into the case or body of whatever needs electrical power. In the case of a vehicle, the body could be made from material that is also a battery as well as being part of the vehicles structure. If this technology comes into production, it will revolutionize battery powered devices or vehicles as they will no longer need separate batteries and be much lighter.

The Chalmers battery contains carbon fiber that serves simultaneously as an electrode, conductor, and load-bearing material. The structural battery uses carbon fiber as a negative electrode and a lithium iron phosphate-coated aluminum foil as the positive electrode.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

The biggest oil companies in the world, including Saudi Aramco, Russia’s top oil producers, and the top oilfield services providers, saw their combined revenues fall by 35.4% to $1.3 trillion in 2020 from US$2.02 trillion in 2019. Shell’s revenues dropped the most—by 48%—while BP, Aramco, and Exxon all saw their respective revenues fall by more than 30%. (3/27)

BP has dropped its oil and natural gas reserves replacement ratio as one of its key performance metrics, it said March 22, underscoring its ambitious plans to become an integrated energy player by targeting renewable and low-carbon energy investments. (3/23)

The UK government has approved new licenses for drilling more wells in the North Sea, saying their aim is compatible with the transition away from fossil fuels. The deal strives to safeguard better the British economy as well as oil industry jobs. (3/26)

Nord Stream 2 alert: The US secretary of state issued a terse statement on Nord Stream 2, a pipeline intended to bring Russian natural gas via the Baltic Sea to Germany, circumventing the critical transit route through Ukraine and Poland. Blinken called it “a Russian geopolitical project intended to divide Europe and weaken European energy security.” He warned that “any entity involved . . . risks US sanctions and should immediately abandon work on the pipeline.” (3/24)

Mercedes-Benz has started producing high-performance batteries for its all-electric luxury EQS ahead of the sedan’s world premiere on April 15, 2021. The EQS marks the start of a new generation of high-performance electric vehicles and will offer a range of more than 700 km (435 miles), using a high-efficiency powertrain and advances in battery energy density. (3/24)

Russia’s share of American oil exports hit a record-high 7 percent despite the US and Russia’s energy standoff. The US imported more oil and refined products from Russian than from Saudi Arabia. (3/25)

South Korea remains the weakest performer within OECD in terms of renewables’ penetration into the national energy matrix. Merely 5% of its electricity generation boils down to green energy. South Korea’s reliance on coal usage is likely to remain strong for years in the near term. (3/23)

China succeeded in overtaking the USA as the world’s biggest oil refiner in 2020, in large part due to decreased demand from the pandemic. China currently has at least four significant new refineries under construction, most of which are expected to produce plastic feedstocks, such as ethylene and propylene. (3/26)

Floods in eastern Australia, affecting the states of New South Wales and Queensland, have impacted operations at coal mines in the region, stalled railway transportation, affected port schedules, and disrupted supply chains in general, mainly for thermal coal exports. (3/23)

In northern Mozambique, Jihadi rebels started fighting to capture Palma just hours after Total, the France-based oil and gas company, announced that it would resume its liquified natural gas project, just a few kilometers outside the town. Mozambique’s defense and security forces are working to re-establish security. (3/26)

Nigeria adopted a new flexible exchange-rate policy for official transactions that effectively marks the naira’s third devaluation in a year. A weaker naira will boost Africa’s biggest crude producer’s revenue from oil, converted at the fixed official rate. (3/23)

Offshore Guyana and Suriname, the latest drilling news does not bode well for the underway oil boom. Tullow Oil, Total, and Apache all experienced non-commercial or unfeasible results from drilling. These latest events come on the back of a slew of recent poor drilling results in the Guyana-Suriname Basin. (3/25)

Mexico’s Pemex is considering letting US-based Talos Energy lead the development of the Zama oil field. Talos Energy discovered the large Zama oil deposit in 2015. At an estimated 670 million recoverable oil barrels, the discovery was the largest oil find in Mexico by a private company in decades. (3/24)

Mexican President Andrés Manuel López Obrador uses the Texas Freeze to cut the country’s dependence on US gas imports and garner support for rolling back the energy sector’s reforms that his predecessor passed. Mexico’s dependence on US natural gas imports became painfully evident last month when natural gas exports from the US to Mexico plummeted amid the Arctic cold spell. (3/27)

The US oil rig count increased by six this week to 324, and the number of gas rigs stayed the same at 92, Baker Hughes reported. (3/27)

Methane emissions from the Permian Basin are now back at pre-pandemic levels as drilling ramps up, reported the Environmental Defense Fund. Methane is about 80 times more potent than carbon dioxide over its first two decades in the atmosphere, and President Joe Biden has made eliminating emissions of the gas a priority. (3/25)

Solar push: The Biden administration on Thursday set a goal to cut the cost of solar energy by 60% over the next decade as part of an ambitious plan to decarbonize the US’ power sector by 2035. The US Dept. of Energy said the goal accelerates its previous utility-scale solar cost target by five years. For the US power grid to run entirely on clean energy within 15 years, solar energy will need to be installed as much as five times faster than it is today. (3/26)

The number of US air travelers exceeded 1.5 million on Sunday, for the first time since the middle of March 2020, in a good sign for oil demand as US citizens start to travel more, including by plane. (3/24)

Airlines and other tourism-related businesses are pushing the White House to draw up a plan in the next five weeks to boost international travel and eliminate restrictions imposed early in the pandemic. (3/23)

The UK government is planning to boost tax revenues from long-haul flights due to the country’s commitment to achieving net-zero greenhouse gas emissions by 2050. (3/24)

California’s two Democratic senators are urging the Biden Administration to follow California’s lead and set a date for phasing out new sales of gasoline and diesel-powered cars. (3/24)

The US Securities and Exchange Commission has directed two of America’s biggest oil companies to hold shareholder votes on far-reaching new emissions targets, as the regulator adopts a stricter approach to climate under the Biden administration. (3/22)

Big oil talks climate: Just two or three years ago, the biggest US oil corporations were not mentioning climate change or environmentally responsible investment at conference calls or results releases. However, the global push for cleaner energy solutions and investors pushing for sustainability has forced most US oil firms to talk about ways to reduce emissions, invest in new low-carbon technologies, and even align with the Paris Agreement goals. (3/24)

Climate costs: US coal, natural gas, and motor fuel producers get implicit benefits worth $62 billion a year by not paying for the damage their products do to the climate and human health, according to a study published in the Proceedings of the National Academy of Science. The overall health, environmental, and transportation costs to society are about $568 billion. (3/24)

Titled “Banking on Climate Chaos,” a new report by a group of environmentalist organizations says that the world’s 60 biggest banks have invested $3.8 trillion in fossil fuels in the five years since the Paris Agreement, wreaking “climate chaos” on the planet. (3/25)

India and H2: India’s steel mills, the second-largest producers globally, expect hydrogen-based production to be vital to cut pollution as the nation comes under pressure to zero out greenhouse gas emissions. (3/24)

Brazilian H2: EPC firm Black & Veatch will undertake feasibility studies central to developing the world’s largest green hydrogen plant. The highly ambitious new-build electrolysis facility will be powered entirely by renewable energy, initially 3.4 gigawatts of solar and onshore wind. (3/22)

A trade bottleneck born of the Covid-19 outbreak has US businesses anxiously awaiting goods from Asia — while off the coast of California, dozens of container ships sit anchored, unable to unload their cargo. The pandemic had wreaked havoc with the supply chain since early 2020 when it forced the closure of factories throughout China. The seeds of the current problems were sown last March when Americans stayed home and dramatically changed their buying habits — instead of clothes, they bought electronics, fitness equipment, and home improvement products. (3/22)

General Motors Co extended production cuts at their North America vehicle assembly plants on Wednesday due to a worldwide semiconductor chip shortage that has impacted the auto sector. GM forecasts that the chip shortage will shave $2 billion off 2021 profits. (3/25)

Plastics! First, it was a demand slump across pretty much every manufacturing industry because of the pandemic. A surge in demand for electronics caused a shortage of microchips, which hit the automotive industry particularly hard. Now, the Texas Freeze has caused a global shortage of plastics. (3/22)

Some 49 African banks in 14 countries are exposed to environmental risks that may threaten their credit quality and profitability as climate change makes shocks more frequent and severe, according to Moody’s Investors Service. (3/23)