Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Today we write to request your support and leadership in urgently addressing one of the most important and overlooked drivers of climate change: ending the flow of private finance from Wall Street to the industries driving climate change around the world — fossil fuels and forest-risk commodities.”

Letter from 145 environmental organizations to John Kerry, special climate envoy for the Biden administration

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: West Texas Intermediate and Brent crude futures posted solid increases on Thursday after OPEC+ decided to increase production slowly. WTI for May delivery gained $2.29 to $61.45 per barrel. June Brent futures closed at $64.86/barrel, up $2.12. Oil futures received a boost from the OPEC+ group of significant producers’ decision to increase output from May to July.

US crude inventories edged lower in the week ended March 26th as refinery demand tested one-year highs, US EIA data showed March 31st. Total commercial oil stocks fell 880,000 barrels to 501.84 million, leaving storage levels around 5.4% above the five-year average. Total net refinery inputs climbed 3.8% to 14.94 million b/d, the highest since the week ended March 20th, 2020. Refinery utilization reached 83.9% of total capacity, up 2.3% from the week prior and exceeding levels before mid-February’s deep freeze.

OPEC: After months of preaching caution and saying the time was not right to raise oil production, OPEC and its partners abruptly agreed on April 1st to add more than 2 million b/d into the market in July. The move is a bet that the OPEC+ alliance can gradually reclaim some of its lost market share, even as the global economy faces an uneven recovery from the pandemic. The increases will be phased-in and the alliance reserves the right to U-turn if market conditions deteriorate, Saudi energy minister Prince Abdulaziz bin Salman said. OPEC+ ministers are planning to meet again on April 28th to review their decision.

Consumer countries are also watching the actions of OPEC+, with those wary about producers keeping too tight a hold on output that will only propel a surge in prices. Jennifer Granholm, US energy secretary, added another layer of uncertainty into the group’s decision-making. She called Prince Abdulaziz on Wednesday and emphasized the importance of “affordable” energy.

Producers will collectively increase output by 350,000 b/d in May, another 350,000 b/d in June, and around 441,000 b/d for July, one OPEC delegate said. Some analysts had expected countries to hold fire on additional increases.

OPEC’s crude production rose last month as rebounding supplies from Iran and Libya complicated the group’s efforts to keep global markets in balance. According to a Bloomberg survey, the cartel boosted output by 300,000 b/d to an average of 25.33 million b/d in March. Iran and Libya accounted for most of the increase.

Iran and Libya have so far been exempted from the alliance’s agreement to reduce supplies because of disruptions they’ve suffered, but the two have recently managed to stage a recovery. According to the survey, Tehran ramped up production by 140,000 b/d to 2.32 million, the highest since May 2019.

Iranian shipments to China have surged so substantially that vessels bearing Iranian crude are clogging Chinese ports. The country’s exports surpassed 1 million b/d this month, said Sara Vakhshouri, SVB Energy International president. Libya boosted output by 100,000 b/d to 1.25 million as a continued cease-fire in internal conflict allows it to expand exports.

OPEC’s secretariat had previously forecast demand growth of 5.9 million b/d in its latest oil market report on March 11th. However, an advisory committee has determined that the projection was overly optimistic.

Abu Dhabi allowed trading of a futures contract linked to its flagship-grade of crude for the first time last week in a debut that could test OPEC’s grip on oil prices.

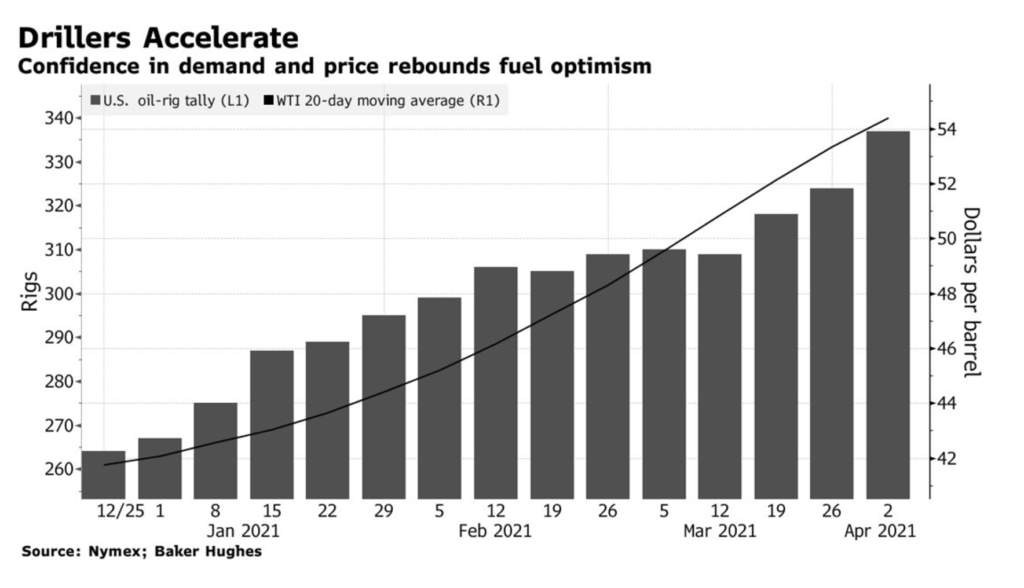

Shale Oil: Drilling expanded in the US at its fastest pace since the start of the pandemic amid rising prices and an increasingly optimistic demand outlook. According to Baker Hughes, the total number of rigs drilling for oil across the country rose by 13 last week to 337, the largest jump since January 2020. Explorers are gaining confidence this year’s 25% run-up in prices is here to stay after the US benchmark crude, West Texas Intermediate, averaged more than $60 a barrel in March — the first calendar month above that threshold since May 2019.

Optimism has also been buoyed by expectations that global crude supplies won’t grow fast enough to satisfy demand as Covid-19 vaccinations proliferate and more economies reopen. Despite the recent jump, the oil rig count stands at about half of what it was when the pandemic started. Even the agreement by OPEC+ producers won’t head off that tightening of supplies, according to Jeff Currie, Goldman Sachs Group Inc.’s head of commodities research.

Exxon Mobil and Chevron have scaled back activity dramatically in the Permian Basin, where just a year ago, the two companies were dominating in the high-desert oil field. The cautious approach of the two largest US oil companies is a significant reason domestic oil production has been slow to rebound. Shale oil production now is about 11 million b/d, down sharply from the record of nearly 13 million hit in late 2019. Exxon and Chevron’s share of drilling activity in the Permian Basin oil field in Texas and New Mexico dropped to less than 5% last month.

Pioneer Natural Resources has closed a deal to acquire energy independent DoublePoint Energy for $6.4 billion. This is the second significant acquisition for Pioneer, which late last year bought Parsley Energy for nearly $8 billion. “DoublePoint has amassed an impressive, high-quality footprint in the Midland Basin, comprised of tier-one acreage adjacent to Pioneer’s leading position,” said Pioneer CEO Scott Sheffield.

Natural Gas: US storage fields posted the first net injection of the year in the week ended March 27th–one week earlier than usual. The Henry Hub summer and winter gas prices slipped slightly to $2.70/MMBtu and $2.90/MMBtu, respectively. The forecast increase in storage would be a dramatic change relative to last year and the five-year average, which saw inventories decrease by 20 and 24 Bcf, respectively.

Texas moved to stop the city of Austin and others from imposing a California-style ban on natural gas in new homes and buildings. This action is the latest salvo in the gas industry’s bid to protect itself from local climate regulations. The move comes after Austin weighed a proposal to phase out fossil fuel use as part of the city’s climate plan. More than 40 cities in California, including San Francisco, have passed measures designed to end gas connections into homes amid concerns over the fuel’s contribution to global warming.

Since the fall of 2020, the US has significantly boosted its liquefied natural gas exports to the top LNG-importing region, Asia, to the point of setting record highs in recent weeks. The US now is competing with Qatar for supplying LNG’s largest buyers. Below-normal winter temperatures in north Asia—the home of the world’s top three LNG importers Japan, China, and South Korea—led to high gas demand in recent months. Simultaneously, the recovery of industrial activities from the pandemic also helped to push up demand.

Soaring American LNG exports could become a powerful tool of the Biden Administration. The exports would help other countries reduce their carbon footprint from more emission-intensive fossil fuels such as coal. However, the Biden Administration doesn’t yet have a precise position on natural gas, especially regarding the domestic energy mix in light of the ambitious climate goal to have 100% clean electricity by 2035. US Secretary of Energy Granholm said last week, “We need to get to 100% clean electricity by 2035,” acknowledging this is an ambitious goal.

Harsh weather across Europe has emptied the continent’s gas storage, and now exporters from around the world are preparing to respond to the rising demand. Bloomberg reports that Europe’s natural gas inventories are about 25 billion cubic meters below the levels from this time last year. Luckily, there is a lot of supply around. From Qatar and Russia to Australia and the US, LNG producers are preparing to increase Europe-bound shipments. And Gazprom is preparing to finish the Nord Stream 2 pipeline despite objections from Washington.

Russia is likely to remain the dominant gas supplier to Europe to 2040, according to S&P Global Platts Analytics. Russia’s market share in Europe is expected to remain above 30%, rising close to 40% by 2040, as domestic European gas production and supplies from Norway dwindle. The share of global LNG supplies in Europe’s energy mix is expected to increase to 2040 to offset the decline in local output; still, global supplies lag Russian deliveries throughout the forecast.

Prognosis: Despite recent signs of weakening oil demand as Europe grapples with a new wave of COVID cases, the crude oil futures market structure still points to demand beginning to outpace supply in the second half of 2021, analysts told Reuters. In some circles, the question is increasingly whether the many victims of the COVID-19 virus may include multinational oil and gas companies. Indeed, the 2020 reductions in travel and work hit energy companies hard. At the same time, a growing awareness of the potential devastation from climate change – fires in California, freak storms in Texas – has focused attention on the importance of reducing reliance on fossil fuels.

Both have meant a sour 2020 bottom line for Big Oil. ExxonMobil, once one of the largest companies in the world, reported a staggering loss of $22 billion in 2020. BP, Shell, and Chevron were not far behind, with $20 billion, $22 billion, and $5 billion in losses to show for the year. These returns, combined with a growing US acknowledgment of climate change and the need to address it, have led some energy pundits to question Big Oil’s future.

“The world’s largest oil companies are emerging diminished and humbled by the pandemic-fueled oil bust,” wrote Paul Takahashi in an article for the Houston Chronicle. “They face an uncertain future, under pressure from governments looking to curb greenhouse gases, investors seeking better returns, and others simultaneously wanting both.”

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: After weeks of failed starts and back-channel exchanges, Iran and the US will begin exchanging ideas about how to restore the 2015 nuclear deal. Initially there will be no direct talks between the two countries, officials in Europe and the US said on Friday. Restoring the nuclear agreement would be a significant step, nearly three years after President Trump scrapped it, and perhaps begin a thaw in the frozen hostility between the two countries. On Saturday, Tehran announced that it rejects any “step-by-step” easing of the restrictions until the US lifts all sanctions on its country.

The complex diplomatic choreography now under discussion — in which American sanctions would be lifted as Iran cuts back on its production of nuclear fuel and allows international inspectors full access to its facilities — could happen before the Iranian presidential election in June. But even an agreement in principle before the election, if approved by Iran’s supreme leader, Ayatollah Ali Khamenei, could lock in the new Iranian government, American and European officials say.

China and Iran signed a deal to chart the course of their economic, political, and trade relations over the next 25 years. China plans to invest in Iran and buy oil from the Islamic Republic, further straining ties with the US already frayed by China’s imports of covertly shipped Iranian crude. Beijing’s alliance with Tehran is a challenge to US President Biden’s administration as it sets about trying to rally allies against China, which Secretary of State Antony Blinken has said is the world’s “greatest geopolitical test.”

Iran’s only operational nuclear power plant risks shutdown as US sanctions prevent the Islamic Republic from transferring money internationally to buy equipment. Due to the US sanctions on banking transfers involving Iranian entities, the Islamic Republic is struggling to keep up with the nuclear reactor’s operational and maintenance costs, and with paying the Russian contractors, an Iranian official was quoted as saying.

Iraq: The parliament passed a 2021 budget Wednesday that preserves a recent currency devaluation, projects a record-setting deficit, and outlines a vague but hopeful compromise for oil and revenue cooperation between Baghdad and Erbil. The budget anticipates $55.98 billion in federal oil revenues this year, based on a projection that the government will sell an average of 3.25 million b/d of oil at $45 per barrel — including 250,000 b/d from Kurdistan.

Iraq’s nationwide oil exports held steady in March, averaging 3.367 million b/d, while revenues surged due to higher crude prices. To fully fund that spending with oil sales, given the budget’s projected export levels, oil prices would need to stay well above $60 per barrel for the year.

The country’s oil ministry announced Iraq and France’s Total agreed to develop four associated gas and solar power projects jointly so that Iraq can reduce dependence on Iranian energy imports for power generation. The most critical task is constructing complexes and units to treat associated gas, which will be in two phases with a capacity of 600 million cf. The other projects are a solar energy plant with a capacity of 1,000 MW for the Ministry of Electricity, a seawater project, and the Ratawi field’s development to increase natural gas output.

Libya: The National Oil Company may be able to maintain its current level of oil production of around 1.2 million b/d until the end of the year as the oil sector is finally receiving enough funding for field maintenance and development, Libya’s new oil minister told Bloomberg. The new cabinet is the first unity government of the war-torn country since 2014 and could pave the way to more stability in oil production. The government has now approved a budget of $1.6 billion to the National Oil Corporation, the largest recipient of Libya’s development budget.

Venezuela: Caracas likely will face a severe shortage of diesel in the next few months forcing the Biden administration to ease sanctions by again allowing crude-for-diesel swaps as a means of humanitarian aid. The Biden administration is figuring how to seek concessions from Maduro while likely knowing that ongoing US demands for regime change are unrealistic, analysts said.

Venezuela could pay with oil for COVID-19 vaccines. “Venezuela has the oil vessels and has the customers who will buy our oil,” Maduro said during a television address on Sunday. “We are ready and prepared for oil for vaccines, but we will not beg anyone,” Maduro added.

The Venezuelan government has long tolerated armed groups trafficking drugs and contraband near its border with Colombia. A new campaign by the Venezuelan military near the border is sparking a surge of refugees, with thousands defying the spiking pandemic to pack into makeshift shelters and tent settlements in Colombia. Concern is also rising about mounting tensions between the left-wing Venezuelan and right-wing Colombian governments, which blame each other for the uptick in violence in Venezuela’s western Apure state.

Mozambique: The country’s leadership was dazzled by natural gas and believed Mozambique would be like Abu Dhabi, Qatar, or Kuwait. Gas would make the elite fabulously wealthy and also trickle down to ordinary people. But in the northern province of Cabo Delgado where the gas is found, they did not, and an insurgency began in 2017 – over growing poverty and inequality, as well as political and economic exclusion.

Three multinational giants control the gas – ENI the far offshore section, ExxonMobil the middle section, and Total (France, taking over from Anadarko) the area closest to the coast. ENI was first to start, with a small floating gas liquefication platform ordered in 2017 but not yet in operation. Total began work on the part of its gas production and liquefaction plant last year. Abundant natural gas supplies around the world have already combined with the insurgency problem to cut back development. ExxonMobil has made clear it is unlikely to go ahead; ENI has said nothing about anything more than the initial floating platform.

Insurgents affiliated with the Islamic state reached Total’s under-construction LNG liquefication plant on New Year’s Eve, and Total pulled out its staff. The company said it would not employ a private army for protection. Insurgents now have occupied Palma, killing contract staff working on the project and driving thousands from town. Total says work is now suspended and will only resume when the government really can provide security. This is unlikely to happen soon and LNG from Mozambique will not be coming to market anytime soon.

Yemen: The world waits to see what Saudi Arabia will do next as the Houthis continue to apply pressure. Houthis recently claimed to have launched drone attacks on Riyadh, though there has been no confirmation of this. The Saudi-proposed ceasefire is coming from Washington, and the crown prince could use a ceasefire as a means of partly repairing his global reputation. The Saudis appear motivated to pursue a ceasefire in a war that was supposed to last six weeks and is now in its sixth year, with Riyadh having failed to achieve any of its objectives.

3. Climate change

The first greenhouse gas actions under the Biden administration are likely to be curbs on the climate “super-pollutant” methane, as both Congressional Democrats and the White House readied moves they can take even without help from Republicans. Senate Majority Leader Schumer pledged to bring a resolution to the floor in April that would reverse one of the Trump administration’s final climate policy rollbacks, lifting requirements for oil and gas companies to monitor and fix methane leaks from wells and other infrastructure.

The $2 trillion infrastructure plan that President Biden unveiled last week is aimed at tackling climate change in part by spending up to $174 billion to encourage Americans to switch to cars and trucks that run on electricity. Despite rapid growth in recent years, electric vehicles remain a niche product, making up just 2 percent of the new car market and 1 percent of all cars, sport-utility vehicles, vans, and pickup trucks on the road. They have been slow to take off primarily because they can cost up to $10,000 more than similar conventional cars and trucks.

President Biden aims to lower electric vehicles’ costs by offering tax credits, rebates, and other incentives. He also hopes to build half a million chargers by 2030 so people will feel confident that they won’t be stranded. He is offering help to automakers to make electric vehicles and batteries in the US.

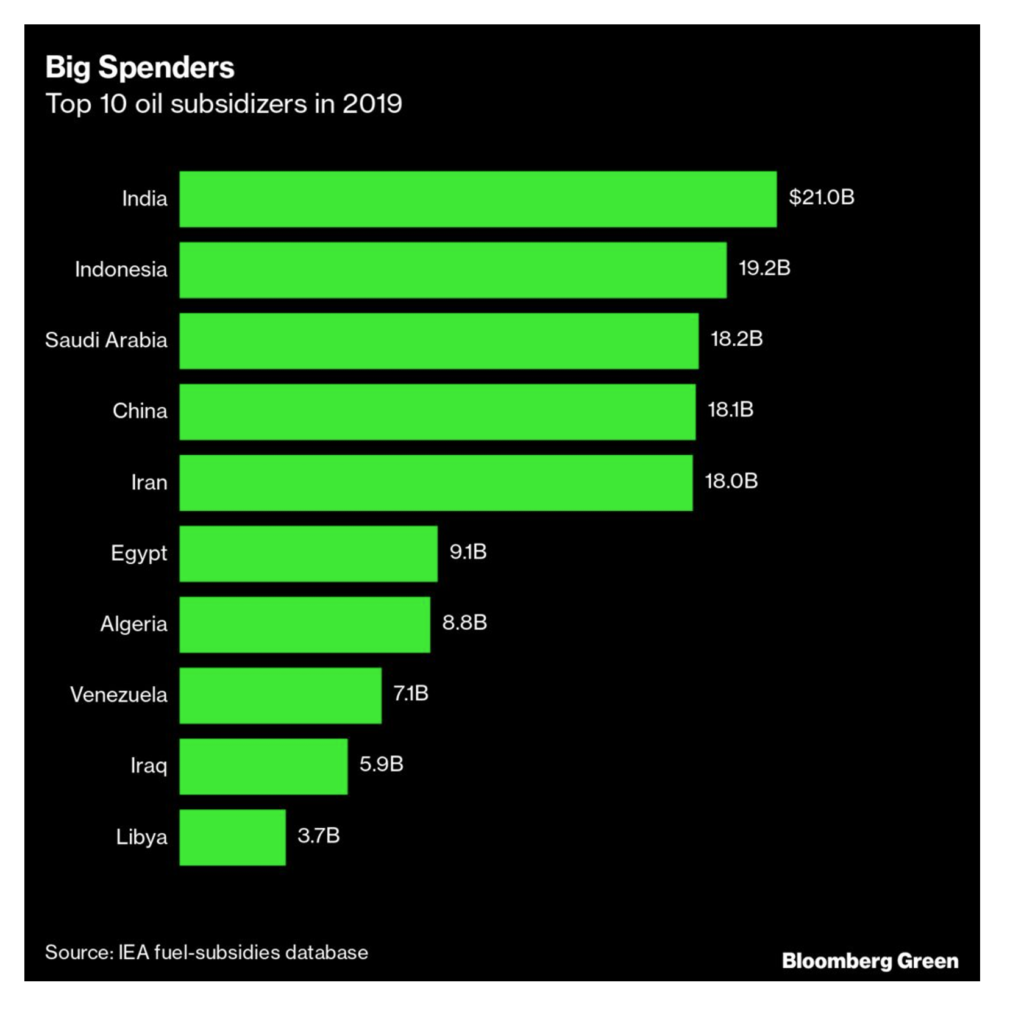

Around the world, countries spend a staggering $300 billion a year to keep a lid on fossil-fuel prices, stave off civil unrest, and prop up their economies. This year’s 20% rally in oil prices only kept those subsidies flowing. While world leaders from the US to Europe to China vow to slash emissions in their bid to combat climate change, some emerging markets are deepening their dependence on dirty energy and delaying the transition to clean energy.

Los Angeles has been collecting data on its carbon pollution footprint for over a decade as part of its efforts to fight climate change. In 2017, the city reported reduced greenhouse gas emissions by 40% from 2008 levels through various changes such as improving electricity usage in traffic lights, energy efficiency gains in buildings, and airport design modifications. It turns out that the city’s emissions measurements were off, though – by more than 50%.

China’s coal-fired power generation increased last year as growing electricity demand outpaced the installations of new clean power capacity, making China the only G-20 country with rising coal generation. While wind and solar power generation led to a record fall of coal-fired generation in all other G-20 countries due to the pandemic, China’s coal power generation went up by 1.7 percent in 2020. Globally, coal generation saw its biggest fall on record last year, leaving China with an increasing share of global coal-fired electricity generation—up from 44% back in 2015 to 53% in 2020.

4. The global economy and the coronavirus

Factories worldwide are struggling to keep up with soaring demand for all types of goods as the global economic recovery from the pandemic accelerates. According to the Institute for Supply Management, US factory production and product sales soared in March. In the EU factory activity grew at the fastest pace since 2000. The resurgent global economy will likely drive world trade higher this year, despite a series of acute disruptions to strained supply chains.

US: New cases of COVID-19 rose 9% to more than 431,000 the week before last, the first time since January that patients have increased for two weeks in a row. Thirty-three out of 50 states reported more new infections in the week ended March 28th than the previous seven days. Federal health officials gave the green light Friday for fully vaccinated people to resume travel as an estimated 100 million Americans have had at least one dose of coronavirus vaccine, and evidence mounts of the shots’ effectiveness.

A measure of US manufacturing activity soared to its highest level in more than 37 years in March, driven by solid growth in new orders, the most unmistakable sign yet that a much-anticipated economic boom was underway. Texas manufacturing activity in March reached the highest level in the 17-year history of the Federal Reserve Bank of Dallas’ monthly survey. US employers added the most jobs in seven months with improvement across most industries as more vaccinations and fewer business restrictions supercharged the labor market recovery.

President Biden’s $2.3 trillion infrastructure plan faces a battle on Capitol Hill. Republicans criticized the proposed corporate tax increases as a nonstarter. Some Democrats began to jockey for their demands. Biden’s plan would provide $621 billion for surface transportation, $400 billion for long-term care for elderly and disabled people under Medicaid, and $300 billion for domestic manufacturing, along with hundreds of billions of dollars for other efforts. It also includes a series of tax increases on companies, including raising the corporate tax rate to 28% from 21%, which the White House said would cover spending over 15 years.

European Union: Much of Europe is suffering a third wave of coronavirus infections. With a slow vaccine rollout in the region, governments have re-imposed strict controls on citizens, likely hampering overall economies and hitting the bloc’s dominant services industry hard.

Despite the new outbreaks, Eurozone monthly factory activity grew faster in the nearly 24-year history of a leading business survey last month. Still, supply chain disruptions and renewed lockdowns in the region may rein in economic activity soon. French President Emmanuel Macron announced a nationwide four-week lockdown, closing schools and businesses, in the latest sign that Europe is yet again losing control of the pandemic. In Germany, Europe’s largest economy, activity grew at the fastest pace on record. In France, the bloc’s second-biggest economy, it hit levels not seen since the internet boom at the turn of the century.

China: US Secretary of State Blinken said he sees “increasingly adversarial” aspects to the US’ relationship with China. The US condemned China’s sanctions against two US religious rights officials and a Canadian lawmaker in a dispute over Beijing’s treatment of Uighur Muslims and other minorities. “China appears to be moving from a period of being content with the status quo over Taiwan to a period in which they are more impatient. They seem to be prepared to test the limits and flirt with the idea of unification,” a senior US official told the Financial Times. The official said the Biden administration had concluded there was a threat to Taiwan after assessing Chinese behavior during the past two months.

According to US Trade Representative Katherine Tai, the US isn’t ready to lift tariffs on Chinese imports soon but might be open to trade negotiations with Beijing. Ms. Tai said she recognized that the tariffs could exact a toll on US businesses and consumers, though proponents have said they also help shield companies from subsidized foreign competition.

China’s ambitious plan to vaccinate 40% of its population by the end of June could pave the way for lifting the economy’s growth rate to 9.3% this year. Business confidence and consumer spending will improve should China achieve its targeted rate, which Oxford Economics estimates will require inoculating 10 million people a day — twice the current pace. If Beijing can maintain the targeted rate in the quarter through September, it could translate into some form of herd immunity, with 60% to 70% of the population vaccinated.

China’s rebalancing of its economy from investment-led growth to consumption is likely to slow in the coming five years as the population ages and the workforce shrinks. Consumption’s share of the GDP is expected to rise at a slower pace than in previous years, said Xu Hongcai, deputy director of the China Association of Policy Science’s economic policy committee.

China’s build-up of oil refining capacity is threatening the viability of other Asian refiners as the country is about to become the world’s largest refiner this year amid still depressed demand for fuels. Bloomberg reports that the country’s refining capacity has increased threefold over the last 20 years and is on track to exceed the US’s refining capacity this year as more new refineries come online.

China had 1.4 million b/d in new refining capacity under construction as of November last year. This amount will add to the more than 1 million b/d in new capability that has already been added since 2019. Despite worries that this capacity will end up unused, especially with oil demand likely to stop growing, China recently gave the go-ahead to another refining project.

Russia: Moscow has lauded the arrival of its homegrown vaccine, Sputnik V, in Latin America and Africa, and even in some countries in Europe, calling it a solution to worldwide shortages. It has been less vocal about one country that is also importing the vaccine: Russia. The Russian government has contracted out Sputnik V’s manufacture to a South Korean company that has already sent the vaccine to Russia and plans to do the same with India. The imports could help Russia overcome a dismally slow vaccination rollout at home.

Russia increased its oil production in March amid a more generous OPEC+ quota, even as rising coronavirus cases threaten oil demand in the short term. According to the Energy Ministry, the nation pumped 10.249 million b/d of crude and condensate last month. If March’s condensate output was in line with February’s, then the crude-only daily production would be around 9.41 million b/d, some 165,000 barrels above its OPEC+ quota.

Gazprom has dominated the country’s gas sector for decades. Other companies, such as Rosneft, have tried convincing the Kremlin to provide a level playing field for marketing gas. Especially, Gazprom’s control of the gas infrastructure and monopoly concerning exports through pipelines has maintained the giant’s domestic position. Novatek’s success in developing the massive Yamal LNG project has created much-needed diversification for the Russian energy industry. Although Moscow has made it clear that it intends to become a top producer of LNG, the reality is that many consumers are looking for ways to curb emissions. Novatek, Russia’s LNG pioneer, is now also the first to change course and adjust to the market demands.

The second part of the EUGAL gas pipeline in Germany — designed to be the onshore extension of the unfinished Nord Stream 2 line — was on schedule to become operational on April 1st.

Saudi Arabia: Crown Prince Mohammed bin Salman laid out a $7.2 trillion (27 trillion riyal) domestic spending and investment plan that relies heavily on commitments from the kingdom’s private sector to bolster growth over the next ten years.

Aramco could pay less than the originally planned $73.5 billion to its Saudi state shareholder to prioritize investments, Crown Prince Mohammed said last week. The announcement took observers by surprise, although it came on the heels of another one that said Aramco and SABIC would lead a $1.3-trillion, five-year investment push aimed at boosting Saudi Arabia’s private sector. Aramco could maintain its payouts to all its shareholders and meet its obligations under the investment prioritization plan, chief executive Amin Nasser said. The dividends payable to private shareholders, around $1.5 billion, will not be touched according to the Crown Prince.

Egypt: The last 61 ships, out of 422 ships that were queuing when the Ever Given was stranded, passed through the canal by Saturday, ending the backlog. The Suez Canal’s immediate crisis may have ended, but the battle over damages from its most extended closure in almost half a century is just beginning. The long-term cost of the canal’s closure will likely be small, given that global merchandise trade amounts to $18 trillion a year

With cargoes delayed for weeks, the blockage could unleash a flood of claims by everyone affected, from the shipping lines to manufacturers and oil producers. “The legal issues are enormous,” said Alexis Cahalan, a partner at Norton White in Sydney specializing in transport law.

India: The chief minister of the western Indian state of Maharashtra has warned a total lockdown could be imposed unless Covid-19 cases begin to fall. Maharashtra recorded at least 47,828 cases on Friday. The same day, India reported 81,466 new patients and 469 deaths – the highest daily spike since December.

India’s consumption, demand, and business activity looked steady in February. However, chances of a strong recovery appear doubtful after a sharp surge in virus cases and the increasing risk of renewed lockdowns.

Despite growing international pressure, India is unlikely to commit to carbon neutrality by 2050, government officials told Reuters. Expecting strong energy demand growth in the coming decades, India is unwilling to bind itself to a hard deadline for reaching net-zero emissions as it fears it may have to compromise economic growth and consumption, Reuters’ sources said.

US climate envoy John Kerry will hold talks with Indian leaders during an Asian tour starting on Thursday to narrow differences on goals to slow global warming. Prime Minister Narendra Modi’s government faces calls from the US and Britain to commit India, the world’s third-biggest carbon emitter, to a net-zero emissions target by 2050. Note that India has per capita emissions are way lower than that of the US, European countries, and even China.

Brazil: More than a year into the pandemic, Brazil’s deaths are at their peak, and highly contagious variants of the coronavirus are sweeping the nation, enabled by political dysfunction, widespread complacency, and conspiracy theories. The country, whose leader has played down the threat of the virus, is now reporting more new cases and deaths per day than any other country in the world.

The virus has killed more than 300,000 people in Brazil, a spread aided by a highly contagious variant, political in infighting, and distrust of science. “We have never seen a failure of the health system of this magnitude,” said Ana de Lemos, the executive director of Doctors Without Borders in Brazil. “And we don’t see the light at the end of the tunnel.”

The heads of Brazil’s army, navy, and air force resigned Tuesday, rocking a right-wing government that is already facing public fury over President Jair Bolsonaro’s inability to contain the virus.

5. Renewables and new technologies

The Biden administration unveiled a goal to expand the nation’s offshore wind energy industry in the coming decade by opening new areas to development, accelerating permits, and boosting public financing for projects. Fighting climate change is a program that Republicans argue could bring economic ruin, but which Democrats say can create jobs while protecting the environment. The blueprint for offshore wind power generation comes after the administration suspended new oil and gas leasing auctions on federal lands and waters. This suspension is widely seen as a first step to fulfilling the president’s campaign promise of a permanent ban on new federal drilling to counter global warming. The US, with just two small offshore wind facilities, has lagged European nations in developing this renewable energy technology.

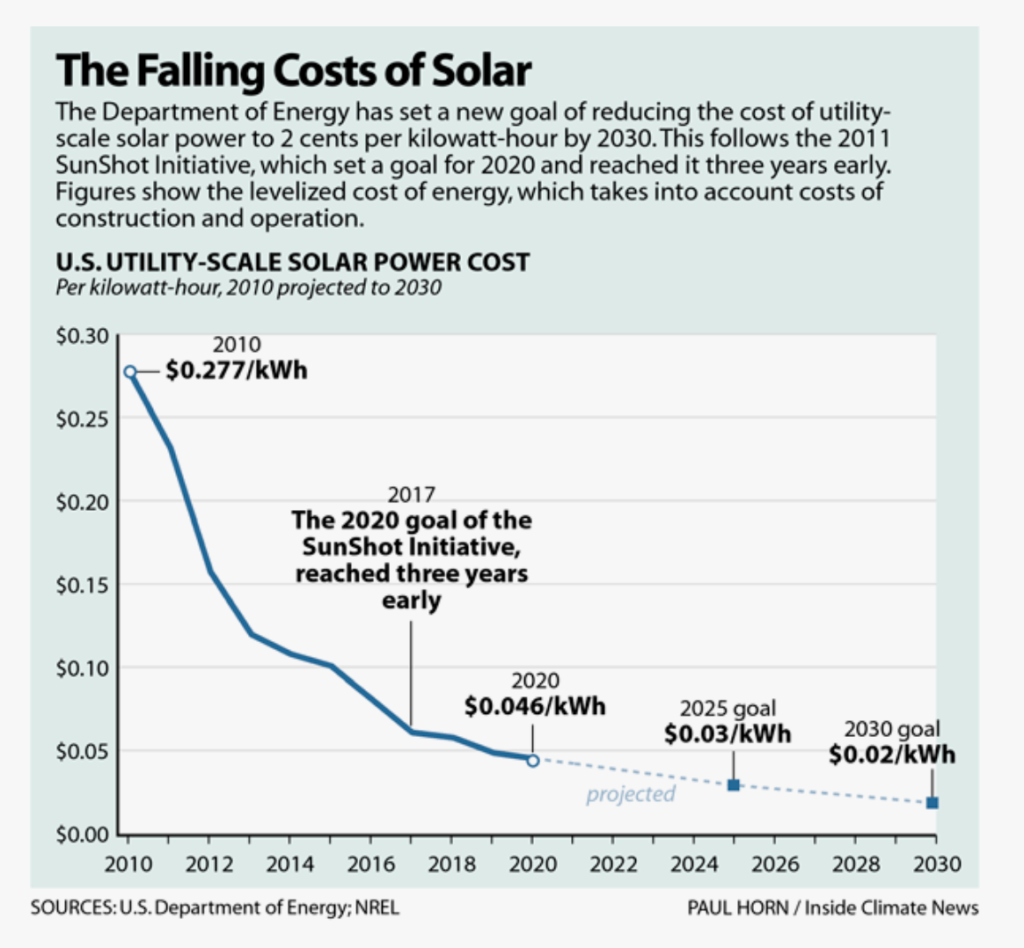

The plummeting price of electricity from solar panels is one of the driving forces aiding the transition to clean energy. Government policies and scientific innovation worldwide have helped reduce the average cost of utility-scale solar power by more than 80 percent since 2010, making it the least expensive power source in many, if not most, places. Now the Department of Energy has set a target of reducing the cost by more than half again by 2030, to an unsubsidized average of 2 cents per kilowatt-hour. That cost, which considers the price of construction and operation, would have seemed like a fantasy not long ago.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

World food/fuel price backfire: vegetable oil prices have risen to near-record highs since President Biden made clear that a substantial increase in biofuels’ production will be an essential part of his energy transition plan. This, they noted, pushed the UN food index to the highest in seven years; food is becoming more expensive for more impoverished people in developing economies. (3/29)

Oil industry robotics: In a report that looked into the adoption of robotics across the petroleum industry, Rystad Energy found that existing solutions could replace hundreds of thousands of oil and gas jobs globally and reduce drilling labor costs by several billion dollars by 2030 if there is an industry push for such a transition. (3/30)

For Russia, the Ever Given’s misadventures in the Suez Canal provide a rare chance to pitch what it’s framing as a golden marketing opportunity: shipping via the Northern Sea Route rather than the crowded Suez Canal. But given the need for ice breakers, it could be a hard sell. (4/1)

Asia-Pacific airlines carried only 1.2 million international passengers in February, just 6.3% of the 18.3 million recorded in the same month a year earlier. (3/30)

In Indonesia, firefighters are working to put out a massive fire that broke out Monday night out at one of the country’s largest oil refineries. (3/29)

Egypt said it might seek around $1 billion in compensation after the container vessel blocked the Suez Canal for almost a week and roiled shipping markets. The figure is a rough estimate of losses linked to transit fees, damage to the waterway during the dredging and salvage efforts, and equipment and labor costs. (4/2)

In Colombia, a dearth of significant conventional oil discoveries since the late 1990s means it must find alternate means of boosting crude oil and natural gas reserves if its hydrocarbon-dependent economy grows. Roughly a decade ago, hydraulic fracturing was identified as a means to mount a recovery. (3/30)

Canada’s biggest oil sands producers are generating billions more in free cash flow thanks to a faster-than-expected pandemic rebound. The sharp recovery has thrust companies deep into a debate on returns versus cleaner fuels that will determine their business makeup for decades. (4/2)

The US oil rig count increased by 13 this week to 337, and the number of gas rigs fell by 1 to 91, Baker Hughes reported Friday. (4/2)

In Alaska, Australian independent 88 Energy has made an apparent oil discovery with its Merlin-1 exploration well in the southeast National Petroleum Reserve-Alaska. An independent geologist said the find could be significant; it could show that an oil-bearing regional geologic formation, where discoveries have previously been made, is larger than expected. (4/1)

Halliburton Co. reported that it had given a large operator real-time automated control of fracture placement while pumping on a multi-well pad in the Permian Basin. The deployment used the “SmartFleet” intelligent fracturing system to drive fracture performance in real-time to optimize cost and performance continually. (4/1)

Drilling access: The federal program that grants companies the right to drill for oil and gas on federal land is “fundamentally broken” and will be reviewed, according to Interior Secretary Deb Haaland. One of the primary flaws of the program, according to Haaland, is that those federal lands belong to more than just the oil and gas industry—they belong to everyone. (4/3)

US gasoline prices, before this week’s slight decline, had increased for 17 consecutive weeks—the longest streak of rising national average gasoline prices since 1994, according to EIA’s surveys. (3/31)

“Ad Agencies Step Away from Oil and Gas In An Echo of Cigarette Exodus,” a New York Times headline proclaimed last week. Already, there is a groundswell of activism from organizations such as Greenpeace USA trying to rally the advertising industry around the climate-conscious cause of boycotting Big Oil’s increasingly frequent “greenwashing” ad campaigns. (3/31)

Industry’s EV push: Automakers and parts suppliers are prepared to spend $250 billion on boosting the use of electric vehicles in the US and called on the Biden administration to urge Congress to extend tax credits to buyers. The funding is intended to spur the adoption of alternative-fuel cars like plug-in hybrid vehicles, battery-powered EVs, and fuel-cell EVs. (3/31)

New EV player: Chinese smartphone maker Xiaomi will set up an electric vehicle unit with an investment of $10 billion over 10 years, joining a competitive electric car market at home. (4/1)

CA’s E-push: California lawmakers introduced legislation to phase out the sale of new gas-powered small off-road engines (SORE), primarily used in lawn and garden equipment, including leaf blowers, lawnmowers, and other outdoor power equipment. AB 1346 would require new SORE sales to be zero-emission by 2024 or whenever the California Air Resources Board determines is feasible. (3/30)

The Texas Senate passed a sweeping bill to overhaul the state’s electricity market following last month’s historic blackouts by forcing power plants to winterize and barring the type of business model used by Griddy Energy. The measure would require the owners of all power generators, transmission lines, natural gas facilities, and pipelines to protect their facilities against extreme weather or face a penalty of up to $1 million a day. (4/1)

Coal’s slow downfall is gaining momentum across the US as clean energy becomes cheaper and wins widespread support. Still, lawmakers in mining states from Wyoming to West Virginia are determined to fight back with a series of roadblocks to President Biden’s plan to cut greenhouse-gas emissions. (3/30)

CCS: Two bipartisan bills introduced in the US Senate aim to support carbon capture and storage technologies as part of a drive to reduce emissions. (3/30)

The world’s wind energy industry could be on track to install nearly one terawatt of new capacity between 2021 and 2030, driven by surging installations in China, Europe, and the US, energy consultancy Wood Mackenzie said in the latest research. (3/31)

Korean wind: Offshore south-western South Korea, a $42.8 billion wind farm, to be built over the next decade, is expected to generate up to 8.2 gigawatts of power, one of a catalog of grand projects the government wants to roll out with private sector backing to meet its ambition of becoming carbon neutral by 2050. President Moon Jae-in’s Democratic Party has brought a new urgency to the transition, with a proposal to get more than 20% of its energy from renewables by 2030. (4/1)

CA’s battery boom: AES Corp. commissioned a 100-megawatt battery installation in Long Beach (CA) using Fluence batteries. California’s plan for avoiding a repeat of last year’s blackouts hinges on batteries. Giant versions of the same technology that powers smartphones and cars are being plugged into the state’s electrical grid at breakneck speed. California is set to add more battery capacity this year than all of China. (4/3)

Rolls-Royce has started building the world’s largest aero-engine, UltraFan. The engine is the basis for a potential new family of UltraFan engines able to power both narrow and widebody aircraft and deliver a 25% fuel efficiency improvement. (3/31)

Fuel cell for aircraft: Cranfield Aerospace Solutions —the UK firm leading the Project Fresson consortium—will exploit recent advances in hydrogen fuel cell technology to develop a commercially viable, retrofit powertrain solution for the nine-passenger Britten-Norman Islander aircraft. (3/31)

Emissions of methane, which can have up to 80 times the warming effect of carbon dioxide, plunged last year as a deep industry downturn halted most new drilling across the US. The drop mirrored a pandemic-driven downturn in carbon emissions as economies worldwide locked down and travel halted. But an oil price rally in recent months has spurred a pick-up in drilling, pushing emissions quickly back to pre-pandemic levels. (3/31)

Fighting climate consequences: There is a growing consensus among experts that not every vulnerable community in the US can be protected in the long run. Some areas — particularly coastal zones and inland along rivers— can’t successfully be defended no matter how much money the government might be willing to throw into fortifications, drainage upgrades, or other improvements. (4/1)

Destruction of the world’s forests increased last year even as pandemic shutdowns curbed economic growth, adding more pressure on nations and businesses trying to cut carbon emissions. Tree loss in the most critical tropical areas increased 12% in 2020 from the prior year. (3/31)

Temperatures in much of Europe are running 20 degrees or more above average as an early-season heat dome, a robust high-pressure system several miles up in the atmosphere that traps heat below, remains parked over the area. Monthly records have fallen in at least three countries as the region gets a taste of what could be another anomalously hot summer (4/2).

Fire danger: It might be only April, but summer weather is already baking the desert Southwest and bringing triple-digit heat. Phoenix could hit 100 degrees this weekend as a record-breaking air mass brings dangerous heat and fire weather concerns to the region. (4/3)