Why The Price Of Oil Must Rise – Arthur Berman (podcast)

(PeakProsperity.com) Geologist Art Berman explains why today’s low oil prices are not here to stay, something investors and consumers alike should be very aware of.

(PeakProsperity.com) Geologist Art Berman explains why today’s low oil prices are not here to stay, something investors and consumers alike should be very aware of.

(UPI) Tensions between Iran and Saudi Arabia pale in comparison to market fundamentals, leaving crude oil prices less exposed to crises in the Middle East, analysis from Wood Mackenzie finds.

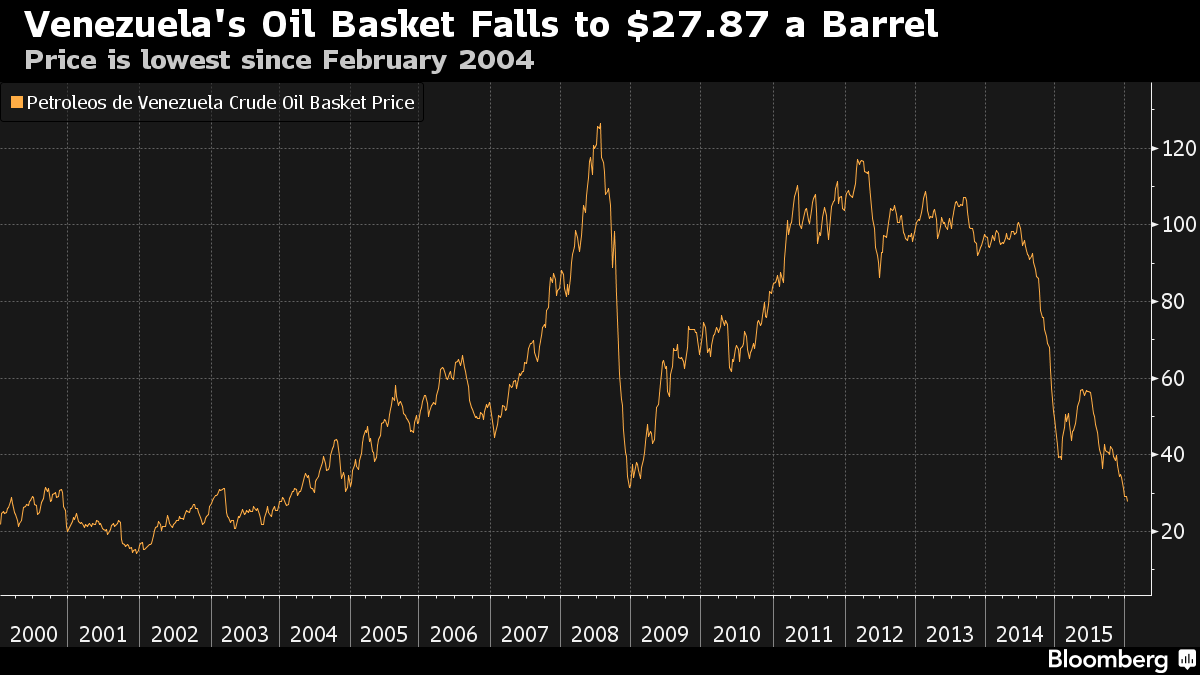

(Wall Street Journal) Oil prices have slumped to 12-year lows , shocking even the most bearish forecasters. But back in February 2004, the last time the U.S. benchmark settled below $33.50 a barrel, oil at these prices was considered pricey.

(Bloomberg) When looking for the prime culprit behind widespread weakness in commodity prices, fingers often point squarely at China.

(Reuters) The global oil glut will swell until late 2017, the U.S. government forecast on Tuesday in an outlook that offered little hope of near-term relief for energy producers reeling from the collapse of crude prices to 12-year lows around $30 a barrel.

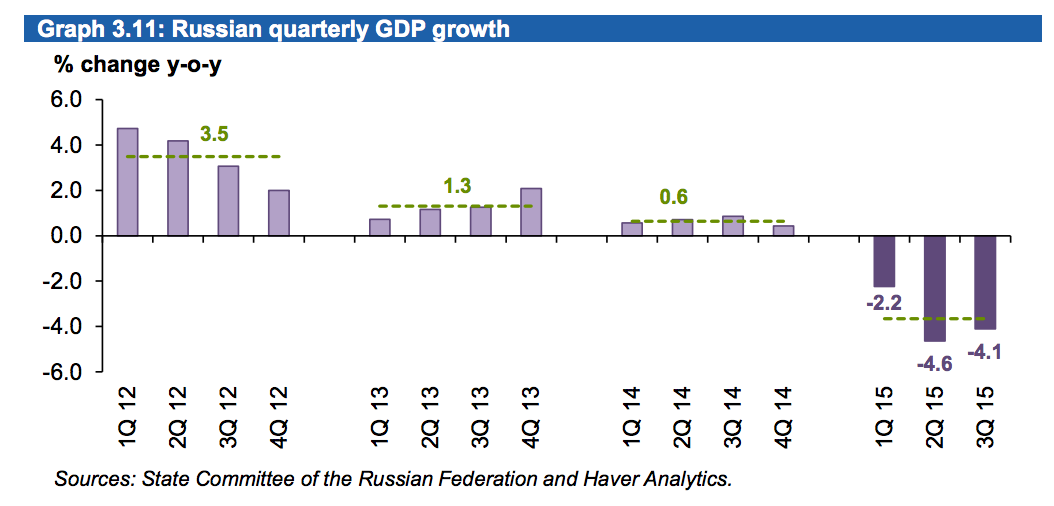

(The National Interest) In the middle of 2014, oil traded for more than $100 a barrel . Today, it is below $35. Traditionally, there would be numerous positives from low oil prices, but many of these have yet to materialize or may no longer be relevant at all.

(CNBC) Saudi Arabia’s planned cuts in spending and energy subsidies signal that the world’s largest crude exporter is bracing for a prolonged period of low oil prices.

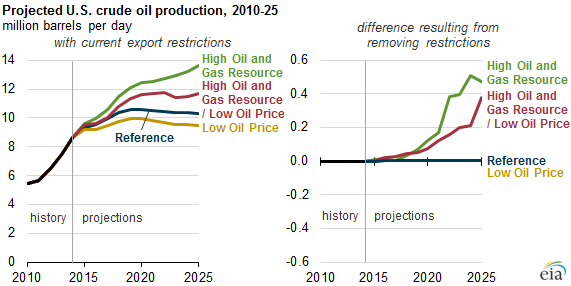

(Forbes) Congress ended the U.S. crude oil export ban last week. There is apparently no longer a strategic reason to conserve oil because shale production has made American great again. At least, that’s narrative that reality-averse politicians and their bases prefer.

(Business Insider) A year ago, Saudi Oil Minister Ali Naimi made it plain that he didn’t care what happened to Russia if oil-producing countries failed to cooperate with Saudi-dominated OPEC on keeping prices high by restricting production.

(Seeking Alpha) I follow the JODI World Oil Database primarily because it is now four months ahead of the EIA international database. I make some adjustments however. I use the OPEC MOMR “secondary sources” for all OPEC data, where JODI also uses the MOMR but uses their “direct communication” data instead.

(Forbes) I have seen the handwriting on the wall for the coal industry for more than a decade. Not only is coal the most carbon-intensive of the fossil fuels, it is also the fuel that has the greatest number of potential replacements. Renewables may ultimately scale to displace a substantial fraction of our coal consumption, but it’s natural gas and nuclear power that spell the beginning of coal’s demise.

(Washington Post) There is no reprieve, of late, for the oil market. And U.S. consumers have been reaping the benefits.

(OurFiniteWorld.com) This past week, I gave a presentation to a group interested in a particular type of renewable energy–solar energy that is deployed in space, so it would provide electricity 24 hours per day. Their question was: how low does the production cost of electricity really need to be?

(Motley Fool) The U.S. Energy Information Administration routinely puts out a Short-Term Energy Outlook, and one component of that outlook is an oil price forecast. Last year at about this time, its STEO forecast that crude would average around $77.75 per barrel in 2015.

(Fortune) The oil industry is going through its third crash in prices since the formation of the OPEC cartel. Many are wondering when the market will recover and what oil prices will be when it finally does.

(CNBC) Energy stocks have been summarily punished over the past year and a half. And it hasn’t been a minor selloff. Now that the Federal Reserve has begun the tightening process, it will likely further cloud the outlook for the sector.

(CNN) Oil plummeted below $30 a barrel on Tuesday for the first time since December 2003. The latest wave of selling leaves crude oil down 19% this year alone. It represents an incredible 72% plunge from crude oil’s June 2014 peak of almost $108.

“The fundamental situation for oil markets is much worse than previously thought,” Barclays commodities analysts wrote in a client note.

(The Economist) For decades, the word “market” has been a misnomer for global trade in oil. Not only has the business been manipulated by an international cartel, OPEC, with varying degrees of success. Since 1975 America has also distorted it by banning the export of almost all crude oil.

(The Globe and Mail) The U.S. Congress voted on Friday to repeal the 40-year-old ban on exporting U.S. crude oil in an energy policy shift sought by Republicans as part of a bipartisan deal that also provided unprecedented tax incentives for wind and solar power.

(Wall Street Journal) For struggling U.S. oil producers, Congress’ plan to lift the ban on most crude-oil exports is too little, too late.

(FuelFix.com) Houston — Since Congress and the President agreed last week to lift the ban on oil exports the government’s energy forecasting arm decided on Monday to highlight a recent analysis it did on the topic.

Q: “Can you imagine selling shares in Saudi Aramco?

A: “This is something that is being reviewed, and we believe a decision will be made over the next few months. Personally, I’m enthusiastic about this step. I believe it is in the interest of the Saudi market, and it is in the interest of Aramco, and it is for the interest of more transparency, and to counter corruption, if any, that may be circling around Aramco.”

Interview with Saudi Arabia’s deputy crown prince Muhammad bin Salman in The Economist

Oil prices plunged again last week from a high above $38 a barrel on Monday to a new low of $32.10, touched by NY futures on Thursday. For the week New York futures were down $3.88 or 10.5 percent to close at $33.16. London’s Brent was down 10 percent for the week closing at $33.55, the lowest closing since June of 2004. The usual factors of too much oil and too little demand as the US and Chinese economies continue to weaken were behind the move. A number of the factors that usually move oil markets are beginning to change. For example, another large drop of 20 units in the US rig count failed to drive the market higher for more than a few minutes as traders have come to recognize that changes in the rig count do not translate into short-term supply changes. Likewise the increase in enmity between Iran and the Saudis is having very little impact on prices as the markets believe the harsh rhetoric is unlikely to lead to hostilities – at least in the short term. Even a US jobs report which showed the creation of 292,000 new jobs, 39 percent more than expected, did little to move prices higher. Usually traders see more people working as a sign that there will soon be more demand for gasoline, but not this time. Fundamentals are ruling the markets.

(Bloomberg) Venezuela’s new economy minister , who has argued that inflation doesn’t exist “in real life,” said policies to be announced on Jan. 12 would seek to avoid sacrifices by ordinary people as the price the South American country receives for oil exports plunges to a 12-year low.

(artberman.com) Daniel Yergin and other experts say that U.S. tight oil is the swing oil producer of the world.

They are wrong. It is preposterous to say that the world’s largest oil importer is also its swing producer.

There are two types of oil producers in the world: those who have the will and the means to affect market prices, and those who react to them. In other words, the swing producer and everyone else.