Editors: Tom Whipple, Steve Andrews

Quote of the Week

“But as soon as [oil] prices rise above certain levels, with investors still chasing yield at every twist and turn, the flood of new money will wash over the sector again, with investors having already forgotten by then that shale oil and gas was where money went to die every time. And this new money will cause a new surge in production, which will collapse prices once again. It’s a cycle that the shale industry has a hard time getting out of, under the current loosey-goosey monetary conditions.”

Wolf Ricter, Wolfstreet.com

Graphic of the Week

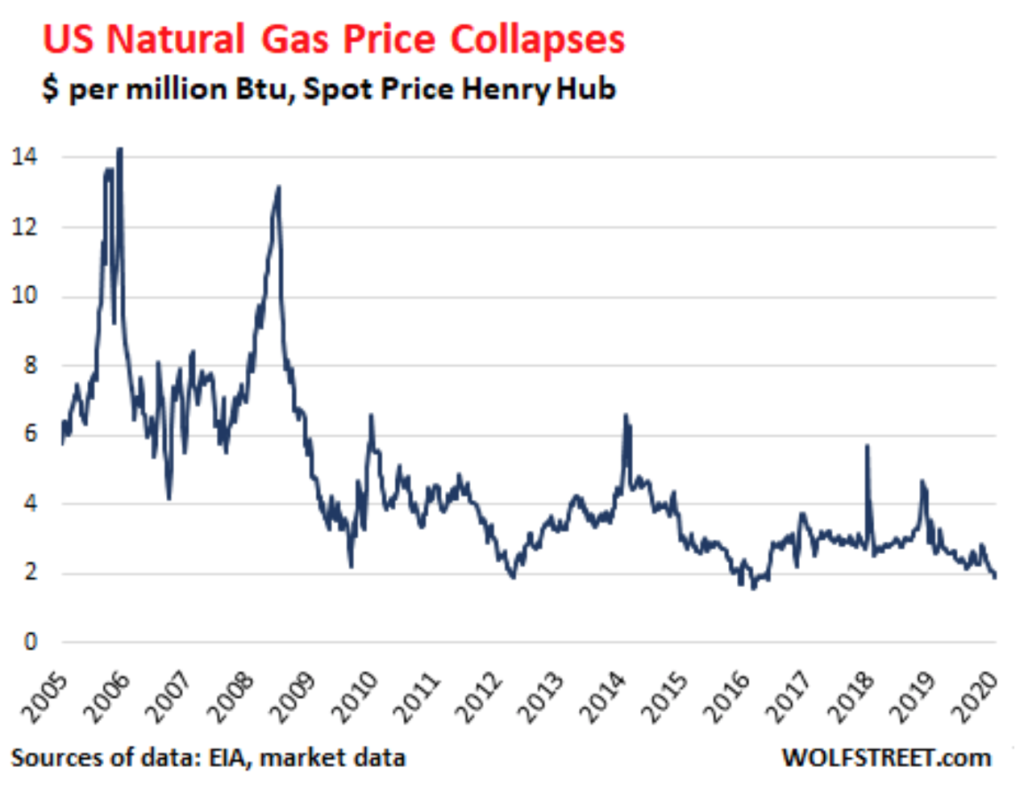

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Brent crude closed at $60.56 on Friday, its biggest weekly decline in more than a year as concerns that the coronavirus will spread farther in China, curbing oil demand. The disease spread rapidly over the weekend, with more than 2,800 people infected across the world and 81 in China killed by the disease. West Texas futures fell from $59 a barrel on Monday to close Friday at $54.20. The Saudi energy minister hinted at further OPEC+ production cuts to head off another market meltdown. The EIA’s latest Drilling Productivity Report estimates oil production growth of just 22,000 b/d in February, a much slower pace than usual in recent years. Global supply outages such as the 1 million b/d event in Libya are no longer affecting commodity prices. Concerns about demand growth in China and India have gained the upper hand. Before the coronavirus, China’s oil consumption was expected to grow by only 440,000 b/d this year, slower than the 615,000 b/d last year. India has undershot demand forecasts in the previous few years. New Delhi’s oil demand grew by 155,000 b/d in 2019 and is expected to grow by only 170,000 this year, a trivial growth for a country of over 1.2 billion people. Oil prices have already given back much of December’s gains, following rising global supplies and easing tensions in the Middle East. This price drop is a warning to investors who expected higher oil prices this year to provide a lifeline to embattled US oil and gas companies, where defaults have been on the rise. Prices for West Texas Intermediate crude, the US benchmark, briefly settled at a seven-month high on Jan. 6th at $63.27 a barrel, following the US killing of General Soleimani. WTI prices are now nearly $10 a barrel lower. The price of natural gas fell below $2 per million BTUs last week to its lowest level in nearly four years, closing on Friday at $1.89. The gas market is suffering from oversupply, as the shale industry has drilled the market into another bust. But production continues to climb, and with a mild start to the winter prices have fallen off a cliff for this time of year. Part of the problem is the ongoing production increases in the Permian with total disregard for any price signals. Permian drillers are after the oil, leading to continued output increases of associated gas, despite prices often traded at or even below zero. Liquefied natural gas is a critical outlet for the US’s surfeit of cheap natural gas, and the country is on track to pull ahead of Australia and become the world’s biggest exporter by 2024. Gas deliveries to US liquefaction facilities topped 9 billion cf/d for the first time over the holiday weekend. They hit a new record Tuesday as exporters seemed unfazed by weak prices in Asia. This boom is leading companies ranging from Royal Dutch Shell and Total to utilities and smaller independent groups racing into the LNG export business. Still, planned capacity exceeds what is likely to be needed. The consultancy McKinsey predicts that only one in 10 proposed export terminals will ever be built. In an interesting twist, Australia’s federal government may seek a national gas “reservation policy” that could have ramifications for the country’s LNG exports at a time when it just became the largest LNG exporter. The minister for resources and northern Australia said Friday, “We can’t repeat the mistakes of the past in just letting our gas be shipped overseas with no thought to our domestic requirements.” The devastating climate change-induced fires are forcing Australia to consider whether to keep on digging up, burning, and exporting so much coal. The global oil and gas industry is facing the “twin threats” of the loss of profitability and the loss of social acceptability as the climate crisis continues to worsen. The industry is not adequately responding to either of those threats, according to a new report from the International Energy Agency. “Oil and gas companies have been proficient at delivering the fuels that form the bedrock of today’s energy system; the question that they now face is whether they can help deliver climate solutions,” the IEA said. The discovery of new oil fields has moved into trickier geological territory — mostly offshore. Oil and gas companies discovered 12.2 billion new barrels of oil and oil equivalent last year, according to Rystad Energy—a figure that represents a four-year high. It should be noted, however, that this figure contains a significant portion of natural gas while the world is consuming some 36 billion barrels of oil each year. The discoveries, despite a banner year, still replaced much less than a third of annual global requirements. US shale oil fracking has already peaked and is in a period of sustained contraction, according to two major providers of services to the industry. That view from Halliburton and Schlumberger signals an eventual deceleration in US oil production, which is currently at record highs. Slower output growth would have global ramifications, given that additional American barrels are forecast to account for most of the increase in worldwide supply this year. Halliburton Chief Executive Officer Jeff Miller said Tuesday that customer spending in North America would keep falling this year. That echoes Schlumberger, which said Friday it’s continuing to shrink its business in the region to match lower demand. For years the largest oil and gas companies have lived beyond their means and paid more money to investors than they can reasonably afford, according to a new report. The study from the Institute for Energy Economics and Financial Analysis found that the five largest Big Oil majors — Exxon Mobil, Chevron, Royal Dutch Shell, BP, and Total — spent $536 billion on shareholder dividends and stock buybacks since 2010 while bringing in just $329 billion in free cash flow. |

2. Geopolitical instability

Iran said last Monday it would quit the global nuclear Non-Proliferation Treaty (NPT) if European countries refer the country to the UN Security Council. The threat includes the 2015 deal Iran signed with world powers that offered it access to global trade in return for accepting curbs to its nuclear program. The fate of the 2015 pact has been in doubt since President Trump pulled the United States out of it and reimposed sanctions. Iran has responded by scaling back its nuclear commitments, although it says it wants the pact to survive. Britain, France, and Germany declared Iran in violation of the 2015 agreement two weeks ago.

There is more to the decision by the UK, France, and Germany to trigger the dispute resolution mechanism in the 2015 nuclear deal with Iran than meets the eye. Those countries – three out of the total six states that formed the P5+1 group that signed the agreement – are responding to pressure from the US either to force Iran back to the negotiating table or to increase its economic pain exponentially. According to a senior Iranian official, “this time around, the US is looking for Iran to make the decision: either go back to the pro-West moderate policies of President Hassan Rouhani and all will be good, or allow the Islamic Revolutionary Guards Corps to tighten its grip on the country and suffer further economic hardships.”

The United States on Thursday said it blacklisted companies based in Hong Kong, Shanghai, and Dubai for helping Iran’s state-owned National Iranian Oil Company (NIOC) export millions of dollars of goods in violation of US sanctions. However, the new US sanctions are unlikely to impact China’s status as the top importer of Iranian crude, with more than 200,000 b/d of illicit flows.

Following a new wave of cold weather blanketing Iran in recent weeks, natural gas consumption by Iranian households has hit record highs. The increased use is ringing warning bells about possible problems with fuel supply to the country’s power plants and other industries which mainly consume natural gas. The amount of daily gas consumption by the domestic sector is reaching the total amount of the gas supplied by the oil ministry, and they believe that people will have to cut their use of both gas and electricity to get past the current tight supply situation.

Iraq is the second-largest oil producer and exporter in OPEC. It has been hit by a series of economic protests that started last year and are not showing any signs of ending any time soon as disgruntled citizens demand better public services, economic reforms, and protest against widespread government corruption.

Iraqi security forces fired teargas and live bullets in renewed clashes with protesters in Baghdad and other cities on Sunday, following a push to clear a sit-in camp in the heart of the capital. At least 14 protesters were injured in clashes in the capital, security and medical sources said. At the same time, unrest in the southern city of Nassiriya left at least 17 protesters wounded, four of them by live bullets.

The authorities’ latest attempt to push back protesters and restore order came hours after populist cleric Moqtada al-Sadr, who has millions of supporters in Baghdad and the south, said on Saturday he would end his involvement in anti-government unrest. Al-Sadr said his move was a result of what he called the antagonistic behavior of some of the protesters toward his followers. His withdrawal of support, and the resulting departure of many of his followers from the demonstrations, deprived the protests of a critical base of participants, leaving those remaining more vulnerable to a government crackdown.

Iraq set a record for nationwide annual oil production in 2019, averaging 4.77 million b/d, according to an Iraq Oil Report analysis based on data gathered from each of the country’s producing fields. Although the Iraqi Oil Ministry brought significant new production capacity online in 2019, there was no actual output growth at fields managed by the federal government rather than foreign oil companies, as it sought to comply with an OPEC quota agreement. Federal production averaged 4.28 million b/d in both 2018 and 2019.

BP has withdrawn from the Kirkuk oilfield in northern Iraq after its field study contract expired, and no deal was signed for a potential expansion. This was likely because of discouraging study results. BP’s presence in Iraq began in Kirkuk in the 1920s when the company now known as BP helped Iraq to locate, produce, and export oil from Baba Gurgur, which was the largest oil field in the world at the time. BP provided technical assistance to the Iraqi state-held North Oil Company to help it with the redevelopment of the Kirkuk field, which is estimated to have some 9 billion barrels of recoverable oil remaining.

Iraq may have severe problems in securing its energy needs if the US doesn’t extend a waiver for an Iraqi bank to process payments for Iraq’s imports of electricity and natural gas from Iran. Major Iraqi power plants are dependent on Iranian natural gas supply, and Iraq imports electricity from Iran, as Baghdad’s power generation is not enough to ensure domestic supply.

Escalating protests in Iraq have led to a halt in production at the Al Ahdab oil field, which pumps some 70,000 bpd. Another field is at risk of shutting down as well. Al Ahdab is operated by China’s CNPC, but it has been blockaded by security guards who are protesting against the absence of permanent employment contracts. The other field at risk of closure, Badra, produces about 50,000 b/d. Russia’s Gazprom Neft is the operator of that field.

Baghdad’s ambition to dramatically increase its oil production is now at a crucial point. Until recently, Iraq was rolling along breaking its previous and current OPEC+ production quota in producing oil in the 4.5-4.7 million b/d range as and when it could. Its oil production targets of 6.2 million bpd by the end of 2020 and 9 million b/d by the end of 2023 looked relatively realistic in size, albeit with some slippage on timing, provided that planned infrastructure and field development projects continued to make progress.

The recent events before and after the US execution of Iran’s Major General Soleimani—including the siege of the US embassy in Baghdad and the attack on the US Ain al-Assad military base in Iraq—raise questions as the whether these goals can be reached as the turmoil increases.

In Libya, Mustafa Sanalla, chairman of the National Oil Corporation, said the country’s output had already plummeted from some 1.3 million b/d to just 400,000 b/d since the strongman, Gen Khalifa Haftar, started the blockade on Friday. Production is now expected to fall to as little as 72,000 b/d within days, or at most weeks, Haftar told the Financial Times.

Shutting off Libya’s oil was always General Haftar’s trump card to play when the time was right. That time is now, with 800,000 b/d in exports officially off the market and the country’s entire 1.3 million b/d in production set to be shuttered during the next few weeks. The Government of National Accord (GNA) will be starved to the tune of $77 million a day.

Haftar was not assured of winning a ground-based military battle against the GNA and its band of militias in Tripoli, now with Turkish troops (and Syrian mercenary) support. Haftar can cripple Tripoli with superior airpower, thanks to his external alliances. Still, on the ground, it would be a fierce battle to gain full control of the capital – which is where all the oil revenues are.

In the latest move to back Venezuelan opposition leader Juan Guaido, the Trump administration on Tuesday sanctioned aircraft used to support President Maduro’s government. The US Department of Treasury identified 15 aircraft operated by Venezuela’s state-owned oil company, Petroleos de Venezuela SA, or PDVSA, that transport senior members of the Maduro regime.

Venezuelan President Maduro cast himself as the wily survivor of a dramatic, year-long struggle by the opposition at home and its allies in Washington to unseat him. Last week, in an exclusive, extensive interview with The Washington Post Maduro said it’s now time for direct negotiations with the US to end the political stalemate that has crippled this nation of some 30 million.

Venezuela’s government is promising to replenish the oil supply to its close political ally Cuba as part of a broad push to relaunch its PetroCaribe regional oil supply initiative. Senior Venezuelan and Cuban government officials met in Caracas yesterday to discuss ways to neutralize escalating US sanctions on the two countries.

3. Climate change

The annual meeting of the World Economic Forum in Davos showed climate change has become a top issue for many businesses and governments, but also demonstrated a yawning gap between how they view the scale of the challenge and what can be achieved without significant new policies. It was an event at which the issue appeared to shift from a fashionable talking point to a matter that is beginning to have real-world consequences for many banks and businesses.

Having previously played down the need for the reform that scientists had urged, finance leaders and company chiefs conspicuously rallied around a consensus that accelerating global temperatures pose a significant risk to society — and business. Missing, though, was a clear answer to the question of what exactly they would do about it and how quickly.

Many companies said they would aim to lower their emissions of planet-warming gases to net-zero by 2050 or earlier. A coalition of major financial institutions, representing $4.3 trillion in assets, said it would take steps to minimize carbon-heavy investments in its portfolios and lobbied other investors to join it. A group of 140 of the world’s largest companies pledged to develop a core set of standard metrics to track environmental and social responsibility. Companies and government leaders, including President Trump, who has rolled back dozens of environmental and climate policies, said they would aim to plant one trillion new trees around the world.

A report issued last week by an umbrella organization for the world’s central banks warned that central bankers lack tools to deal with what it says could be one of the most significant economic dislocations of all time. The book-length report, published by the Bank for International Settlements in Basel, Switzerland, signals what could be the overriding theme for central banks in the decade to come.

“Climate change poses unprecedented challenges to human societies, and our community of central banks and supervisors cannot consider itself immune to the risks ahead of us,” François Villeroy de Galhau, governor of the Banque de France, said in the report. Central banks spent much of the last ten years hauling their economies out of a deep financial crisis that began in 2008. They may well spend the next decade coping with the disruptive effects of climate change and technology, the report said.

Economists across the political spectrum overwhelmingly say the best way to tackle climate change is to enact a carbon tax or a “cap-and-trade” system in which there’s a limit on carbon emissions; companies that exceed their limit must purchase credits. But at the World Economic Forum, the idea is still a somewhat dicey subject, at least among chief executives and government leaders from certain parts of the world. “Few chief executives are brave enough to say they are against a carbon tax publicly.”

“If you want to put a tax on people, go ahead and put a carbon tax. That is a tax on hard-working people,” US Treasury Secretary Steven Mnuchin said on a panel Friday. He argued that a tax was unnecessary because technology would almost certainly bring down clean-energy costs. However, there are signs US President Trump is starting to engage more seriously on climate change and listening to the concerns of corporations, the European Commission’s vice-president and head of its ‘Green Deal’ said on Thursday.

In the real climate debate, no one denies the relationship between human emissions of greenhouse gases and a warming climate. That debate is for political rallies. Instead, the disagreement comes down to different views of climate risk in the face of multiple, cascading uncertainties. On one side of the debate are optimists, who believe that, with improving technology and greater affluence, our societies will prove quite adaptable to a changing climate. On the other side are pessimists, who are more concerned about the risks associated with rapid, large-scale, and poorly understood transformations of the climate system.

But most pessimists do not believe that runaway climate change or a hothouse earth are plausible scenarios, or that human extinction is imminent. And most optimists recognize a need for policies to address climate change, even if they don’t support the radical measures that young climate activist Greta Thunberg and others have demanded.

Frans Timmermans, who is driving the Commission’s work on a multi-year, trillion-euro plan to make the European Union’s 27 member states carbon-neutral by 2050, said the science could not be ignored, even by the US president. “We’ve seen over the last couple of years that radical climate-change deniers have changed their position because the facts are so overwhelming. It’s an untenable position.”

Australia’s fire-stricken state of Queensland saw heavy rainfalls on Sunday, dampening some of the fires that have razed 1.2 million acres of land since September, but the wet weather caused significant flooding. Some areas received a quarter of the annual average rainfall, with the state’s Bureau of Meteorology saying coastal areas experienced up to 6.3 inches of rain in the 24 hours on Sunday. “More rain expected over the coming days,” the bureau said Sunday.

4. The global economy and trade wars

President Xi Jinping said China was facing a “grave situation” as the death toll from the coronavirus outbreak jumped to 81 on Sunday. The epidemic has forced the extension of the traditional celebration of the Lunar New Year when some 420 million people normally travel. More than 2,000 people have been infected worldwide, most of them in China. The virus has also been detected in Thailand, Vietnam, Singapore, Japan, South Korea, Taiwan, Nepal, Canada, the US, and Europe. The airport at the center of the epidemic, Wuhan, had direct flights to 15 foreign cities which is why the disease is showing up so rapidly across the world; those flights have since been stopped. The cases in the US came directly from Wuhan.

China’s health minister said the incubation period for the coronavirus could range from one to 14 days, and that the virus is infectious during incubation, which was not the case with Severe Acute Respiratory Syndrome (SARS) crisis in 2002. The long symptomless incubation period makes it very difficult to detect and quarantine travelers already infected

President Xi Jinping established a new, high-level party committee to take control of the Chinese government’s response to the new virus. Beijing halted overseas departures of Chinese tour groups yesterday. The authorities, meanwhile, sent hundreds of doctors and troops to the epicenter of the crisis, setting plans to build a second special-purpose clinic and repurposing 24 existing hospitals as specialized wards in a bid to contain the epidemic.

Wuhan City banned non-essential vehicles from its downtown starting Sunday, further paralyzing a city of 11 million that has been on virtual lockdown since Thursday. Nearly all flights were canceled, and checkpoints are blocking the main roads leading out of town. Authorities have imposed transport restrictions on almost all of Hubei province, which has a population of 59 million.

China’s quarantine is almost certainly the largest in modern public-health history. It is troubling experts who said such drastic restrictions rarely work and often backfire — cordoning off a region like China’s Hubei province pens the sick together with the uninfected. It increases the burden on authorities, who must ensure the flow of food, water, and other supplies to the quarantined area. It is nearly impossible to enforce.

The coronavirus is similar to the SARS epidemic, which engulfed China in 2002-2003. Worldwide, some 8.000 people contracted SARS, and the virus had a fatality rate of 9.6 percent. Some 250 Canadians and 27 Americans were affected. While it is too early to predict the economic effects of the epidemic, in retrospect, China did not take much of a financial hit from SARS. There seem to be more precautions this time, with Beijing closing the Shanghai Disneyland and part of the Great Wall and suspending public transportation in 10 cities to contain the virus.

Chinese jet fuel demand growth may slow to 3 percent from 7-8 percent average due to the epidemic. Hong Kong’s jet fuel imports fell 37 percent on-year at the height of the SARS epidemic 18 years ago. China’s oil product consumption growth will likely receive a setback in the first quarter as a dampened Lunar New Year festive period reduces fuel demand.

After months of negotiations, the US and China have finally signed a phase-one trade agreement which would see China purchase billions of dollars’ worth of oil, coal, and LNG from the US, to the tune of $52 billion—a scenario that, if fulfilled, would change the course of the world’s energy landscape forever. For some analysts, as spectacular as this may sound to fossil fuel bulls, at best it’s unrealistic. The agreement, which analysts prefer to call a ‘trade truce’ because it does not address any of the major underlying issues that started the trade war in the first place, is a step toward resolving differences that have eaten into US energy-product exports to China.

Before China’s epidemic, the IMF trimmed its global economic growth forecast for 2020 from 3.4 percent in October to 3.3 percent and reduced the outlook for next year from 3.6 percent to 3.4 percent. These figures are only a little better than the 2.9 percent achieved in 2019, the worst year for the global economy since the financial crisis more than a decade ago. The IMF also praised the speedy actions of central banks to loosen monetary policy, saying global growth would have been 0.5 percentage points lower had the Federal Reserve and the European Central Bank not cut interest rates in the second half of last year.

Credit applications by eurozone companies unexpectedly declined last quarter for the first time in six years, despite a further reduction in the European Central Bank’s primary interest rate. The eurozone has been struggling with sluggish growth for two years as a global trade war and a slowdown in China hurt its exports, offsetting stronger domestic demand in some countries. This is now starting to show in companies’ decisions to cut down on investment and credit – a trend that banks now expect to continue.

President Trump on Wednesday threatened to impose high tariffs on cars imported from the European Union if the bloc doesn’t agree to a trade deal. Trump has previously made threats to place duties on European automobile imports, with the intent of receiving better terms in the U.S.-Europe trade relationship. France’s finance minister quickly shot back. “If we were to be hit by American tariffs, we would have no choice but to retaliate,” he told The Wall Street Journal. The minister said the EU had already shown itself prepared to retaliate when the US imposed tariffs on European steel. “A trade war between the US and Europe would be a full political and economic failure,” he said. In many ways, Europe is less vulnerable to US levies than China. The US exports three times more to the EU than it does to China, giving Europe plenty of targets for retaliation.

The shipping industry must spend at least $1 trillion on new fuel technology if it is to meet UN emissions targets by 2050. According to a new study by experts from the Energy Transitions Commission, the minimum average that would need to be spent every year from 2030 is $50 billion. Global shipping is responsible for about 2.2 percent of the world’s carbon dioxide emissions. The International Maritime Organization has set itself the target of reducing emissions by 50 percent by 2050. If the sector were to fully decarbonize by 2050, an additional $400bn of investment would be needed over the 20 years.

5. Renewables and new technologies

The Hydrogen Council has published a new report, Path to Hydrogen Competitiveness: A Cost Perspective, demonstrating that the cost of hydrogen solutions could fall sooner than previously expected. As the scale-up of production, distribution, and equipment manufacturing continues, the cost of hydrogen is projected to decrease by up to 50 percent by 2030 for a wide range of applications, making hydrogen financially competitive with other low-carbon alternatives.

IBM lifted the veil last week on a new battery for EVs, consumer devices, and electric grid storage that it says could be built from minerals and compounds found in seawater. The battery is also touted as being non-flammable and able to recharge to 80 percent of its capacity in five minutes. The battery’s specs are, says Donald Sadoway, MIT professor of materials chemistry, “staggering, yet lacking any substantive data on the device, he has “no basis with which to be able to confirm or deny” the company’s claims.

Performance boosts that IBM touts in its announcement include the battery’s reported improvement in cost, charging time, power/energy density, and energy efficiency. Sadoway says he thinks the fact that IBM’s blog specifically calls out the battery’s non-reliance on either nickel or cobalt may indicate it’s still lithium-based.

OXIS Energy has successfully tested its Lithium-sulfur battery cell prototypes at 471Wh/kg and is confident of achieving 500Wh/kg in the next 12 months. The company is consistently shipping cells at 400Wh/kg to its clients in Europe, the US, and Japan. OXIS is collaborating with European chemical partners to develop an advanced lithium metal protection mechanism to ensure a significant improvement in the Lithium-Sulfur life cycle.

Brilliant Light Power announced last week that it produced steam for five hours from its SunCell® energy production device, which is based on converting hydrogen to another form in which the orbit of the electron’s orbit around the proton is lowered. For the past two years, Brilliant Light has had trouble turning the immense heat developed in the SunCell® into useful steam. Many tests have resulted in the test device melting down before heat can be moved away to external systems.

In the latest test, water jets maintained a stable external cell temperature while avoiding localized hot spot formation on the walls by using a tungsten liner. Brilliant Light says that the SunCell® engineering issues are largely solved.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

At the World Economic Forum in Davos, where climate change and the urgency to act has taken center stage this year, the top executives of oil companies Chevron, BP, Shell, Total, and Saudi Aramco, among others, met to discuss whether the industry should start accounting for and drafting emission reduction targets. These changes would be not only for their respective oil production but also for emissions ‘at the pump’ or the emissions from the fuels they sell. (1/23)

Turkey called on Sunday for the European Union to end what it said was the bloc’s prejudice against Turkish Cypriots, defending its launch of a fresh round of hydrocarbons drilling off the Mediterranean island. Turkey began drilling for oil and gas near Cyprus last year despite warnings from the EU, stoking tensions with neighboring members Greece and Cyprus. (1/20)

Jordan shuns Israeli natural gas: The parliament of Jordan has voted to approve a draft law that would ban natural gas imports from Israel. According to local media reports, the parliament voted to ban the imports amid concern that Jordan would become too dependent on gas from its neighbor and civilian protests against buying gas from a country considered by some as an enemy state despite a 1994 peace treaty. (1/21)

China National Petroleum Corporation has found crude oil and natural gas in the deepest well drilled in Asia’s onshore, striking hydrocarbons in a pre-salt layer for the first time in China. The discovery was made in the Tarim oilfield in China’s northwestern region of Xinjiang in a well deep 8,882 meters (29,140 feet), which was first drilled in July last year. (1/21)

Somalia has invited Turkey to carry out offshore oil exploration works in the territorial waters of the African country, Turkish President Recep Tayyip Erdogan said on Monday, as reported by broadcaster NTV. Turkey has an offer from Somalia which states that Ankara can conduct oil exploration the way it has agreed to do with Libya in the eastern Mediterranean. (1/21)

The Nigerian National Petroleum Corporation has revealed that the nation’s pipeline infrastructure has suffered 45,347 pipeline breaks in the last 18 years. Many have been the result of vandalism, with much-resulting theft of oil. (1/21)

Guyana, the world’s newest oil frontier, officially shipped its very first batch of crude oil on Monday. A million barrels of Liza sweet crude oil is currently on a Suezmax tanker headed for the US. The Liza field is co-owned by Hess Corp, China’s CNOOC, and operator ExxonMobil; the later has 15 oil finds offshore Guyana. The project has uncovered more than 6 billion barrels of recoverable oil and gas. (1/21)

Brazil produced more than 1 billion barrels last year, the first time it has breached the 1-billion-barrel mark, according to the country’s oil regulator, ANP. The daily average stood at 3.106 million b/d, up 7.78 percent in 2018. More than half of the total oil production Brazil recorded in 2019 came from the prolific pre-salt zone off its coast. The strong output result came on the back of the ongoing ramp-up of production at eight new floating production, storage, and offloading facilities. (1/24)

Brazil will discuss potential cooperation with OPEC on the sidelines of a Group of 20 events scheduled to be held in Saudi Arabia later this year, the country’s Mines and Energy Ministry said. (1/25)

The US oil rig count increased by three to 676 while the gas rig count decreased by five to 115, according to Baker Hughes data. (1/25)

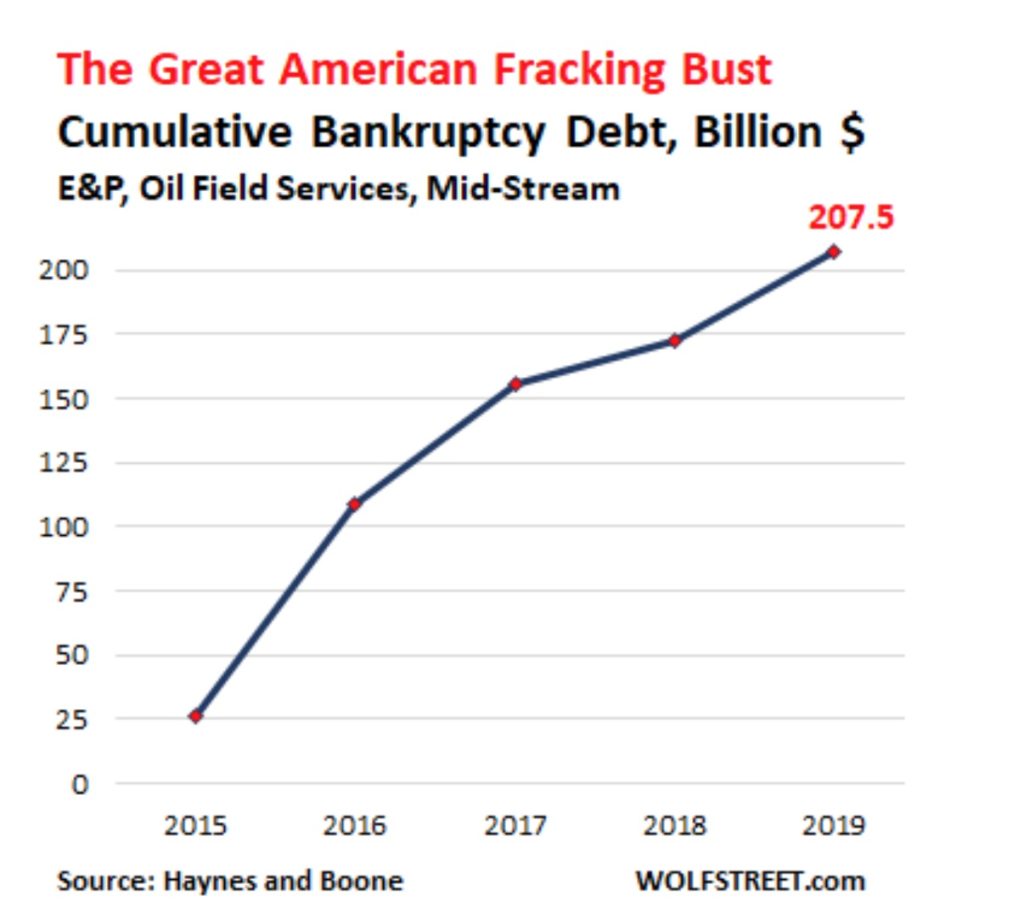

O&G bankruptcies update: Following the sharp re-drop in oil and natural gas prices in late 2018, bankruptcy filings in the US by already weakened exploration and production companies, oilfield services companies, and “midstream” companies…jumped by 51% in 2019, to 65 filings, according to data compiled by law firm Haynes and Boone. This brought the total of the Great American Shale Oil & Gas Bust since 2015 in these three sectors to 402 bankruptcy filings. (1/25)

Prices headed down: US West Texas Intermediate and international-benchmark Brent crude oil futures are in a position to finish the week sharply lower as well as natural gas futures, which pierced the psychological $2.00 level earlier in the week, seemingly on its way to the multi-year low of $1.60. The catalyst behind the selling pressure is the concern that a virus in China may spread, hurting travel and fuel demand. This news is overshadowing OPEC and its allies’ cuts in supply and an unexpected drop in US weekly inventories. (1/25)

Refinery capacity: In 1982, there were over 250 operating crude oil refineries in the US; that number declined to 132 by 2019, according to data from the US Department of Energy. Meanwhile, the total distillation capacity of all refineries combined increased from a low of 14.4 million barrels per calendar day in 1985 to a high of 18.7 in 2019. Thus, the average distillation capacity per refinery increased by 123% from 1982 to 2019. (1/21)

Keystone approval: The US Interior Department on Wednesday authorized the Keystone XL pipeline to be built across 44 miles of federal lands in Montana. Still, court challenges remain before the long-delayed oil sands pipeline can be built. The 1,200-mile pipeline, intended to move crude from western Canada to the US Gulf Coast, was proposed more than ten years ago. (1/23)

Raising oil taxes in Alaska: Whether or not the oil and gas tax structure needs to be changed in Alaska is the talk of the town of Juneau once again. According to Anchorage Democratic Senator Bill Wielechowski, the people of Alaska are not receiving the amount of profit from the oil industry that they should. A new bill by Wielechowski also makes provisions for additional taxes on major oil fields, as well as reducing allowable deductions, and doing away with the customary per-barrel credit. (1/22)

Coal’s financial fade: In a finance world increasingly committing to investing with environmental, social, and governance factors as a priority, the coal sector is finding it difficult to find its place. Over the past several years, the industry has seen banks and insurers increasingly pledge to abandon the business to appease environmental concerns, particularly around climate change. There are 116 globally significant banks and insurers with coal divestment, exclusion, or restriction policies in place. The divestment movement is accelerating and marked a significant milestone this month when BlackRock, the world’s largest asset manager, announced a coal exclusion policy impacting about $500 million of its assets under management. (1/25)

Nuclear: For all its virtues, nuclear energy has its fair share of drawbacks. It does not emit greenhouse gases. It does produce nuclear waste that remains radioactive for up to millions of years, and we still don’t know what to do with it other than hold onto it in ever-growing storage spaces. (1/20

Storing nuclear waste is an expensive proposition. With no place of its own to keep the waste, the US government now says it expects to pay $35.5 billion to private companies as more and more nuclear plants shut down, unable to compete with cheaper natural gas and renewable energy sources. Storing spent fuel at an operating plant with staff and technology on hand can cost $300,000 a year. The price for a closed facility: more than $8 million, according to the Nuclear Energy Institute. (1/23)

Chinese EV wave? China’s ambitions to have new energy vehicle sales account for a quarter of car sales in 2025 means that the Chinese authorities want the EV industry in the country to flourish. Western analysts warn that a Chinese EV oversupply could lead to cut-price exports of China’s electric cars, potentially distorting and pressuring the auto industries in other countries, and possibly setting the stage for the next U.S.-China trade war front—electric vehicles. (1/20)

Cutting shipping emissions: A new study prepared for the Global Maritime Forum for the Getting to Zero Coalition estimates that the cumulative investment needed between 2030 and 2050 to halve shipping’s CO 2 emissions amounts to approximately $1-1.4 trillion—an average of $50 billion to $70 billion annually for 20 years. The report authors note that these figures should be viewed in the context of annual global investments in energy, which in 2018 alone amounted to US$1.85 trillion. The global shipping fleet accounts for ~2.2% of CO 2 emissions. (1/22)

Bad faith on emissions? The manufacturing of HCFC-22, a refrigerant used in air conditioners, releases a greenhouse gas byproduct. Reducing this gas would be one of the least expensive methods to address climate change. Atmospheric concentrations of a greenhouse gas nearly 13,000 times more potent than carbon dioxide rose faster than ever before over three years starting in 2015, a new study has found. The findings suggest that China and India may not be living up to recent pledges to reduce emissions of the pollutant dramatically. (1/23)

Climate mitigation $$: The Trump administration is about to distribute billions of dollars to coastal states, mainly in the South, to help steel them against natural disasters worsened by climate change. But states that qualify must first explain why they need the money. (1/21)

The symbolic Doomsday Clock, which indicates how close our planet is to complete annihilation, is now only 100 seconds away from midnight. The Bulletin of the Atomic Scientists said on Thursday that the change was made due to nuclear proliferation, failure to tackle climate change, and “cyber-based disinformation.” The clock now stands at its closest to doomsday since it began ticking 1947. Time is now kept in seconds rather than minutes because “the moment demands attention.” (1/25)

Water rules rollback: The US EPA released new federal clean-water regulations Thursday that are less restrictive than those adopted under the Obama administration, eliminating many seasonal streams, small waterways, and wetlands from federal oversight. The new rules will exclude most roadside and farm ditches, groundwater, farm, and stock watering ponds and water bodies that form only when it rains. (1/24)

Sewage rules rollback: The US EPA has made it easier for cities to keep dumping raw sewage into rivers by letting them delay or otherwise change federally imposed fixes to their sewer systems. The actions are the latest example of the Trump administration’s efforts to roll back nearly 95 environmental rules that it has said are too costly for industry or taxpayers. (1/25)

Locusts hammer Africa: The UN has called for international help to fight huge swarms of desert locusts sweeping through east Africa. A spokesman for the UN’s Food and Agricultural Organization (FAO), called for aid to “avert any threats to food security, livelihoods, malnutrition.” Ethiopia, Kenya, and Somalia are all struggling with “unprecedented” and “devastating” swarms of the food-devouring insects, the FAO has said. In just one day, a swarm of locusts the size of Paris could eat the same amount of food as half the population of France. (1/24)