Editors: Tom Whipple, Steve Andrews

Quote of the Week

“…if [Canadian Prime Minister Justin] Trudeau was serious about the phase-out of the oil sands, he would need to come up with an alternative source for the 11 percent of GDP that the energy industry contributes currently.”

Irina Slav, Oilprice.com

“…the Warren-Sanders, ban-all-fracking-right-now” position would “absolutely devastate communities throughout the Rust Belt” and pit environmentalists against workers at a time when Democrats need both. “If a candidate comes into this state and tries to sell that policy, they’re going to have a hard time winning.”

Bill Peduto, Mayor of Pittsburg (PA)

Graphic of the Week

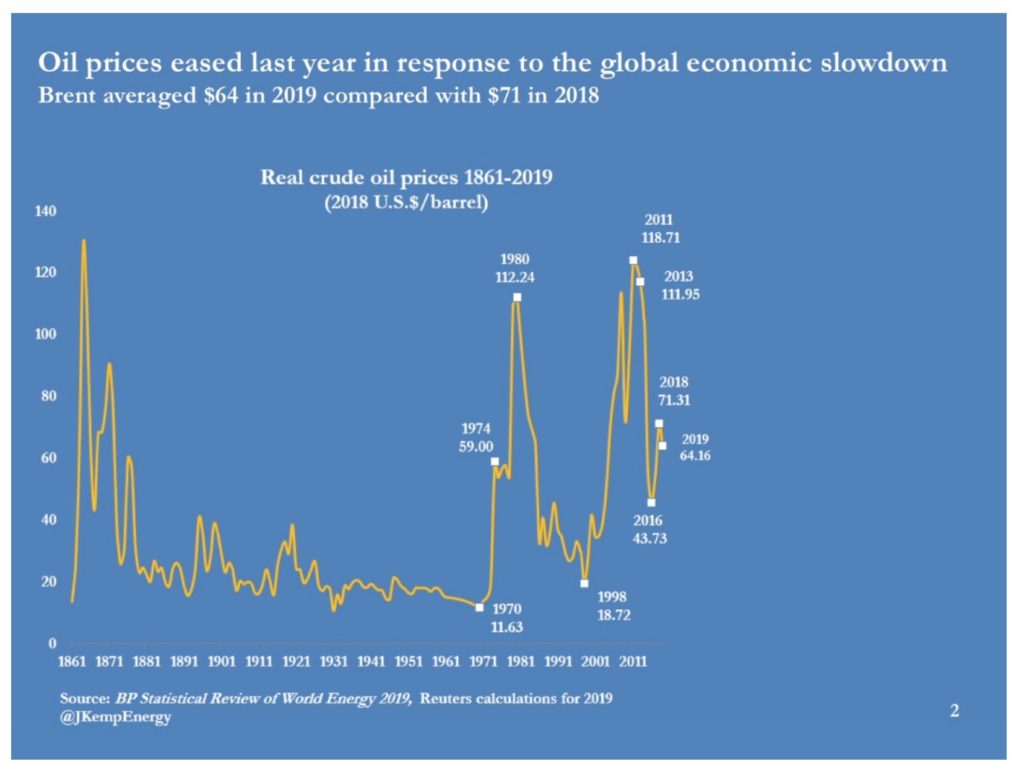

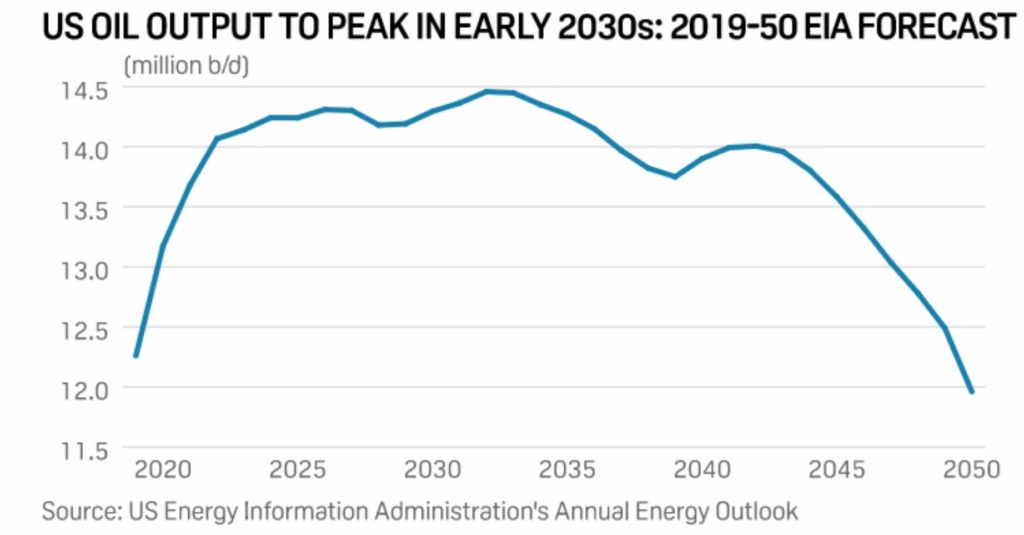

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil prices fell for the fourth straight week on mounting worries about economic damage from the coronavirus that has spread from China to around 20 countries. Futures closed the month down about $10 a barrel since the beginning of the year, seeing the biggest January loss since 1991. New York futures settled at $51.56 and London at $56.62. The rapid price decline is causing much consternation with OPEC+ as some commentators are talking about $40 oil if the virus situation gets much worse. Global oil prices rallied at the end of last year due to announcements of cuts in production, followed by a boost in early January due to tensions in the Middle East. But Brent crude is now down almost 17 percent from its early January peak, while US natural gas prices are also under pressure due to a mild winter. That is prompting a lot of investors to consider more in-depth, longer-term challenges for producers and refiners. Some analysts warn that too many companies in the oil and gas sector have unsustainable balance sheets, weighed down by too much debt. The coronavirus-triggered fall in crude oil prices over the last few weeks has shaken some OPEC countries, including Saudi Arabia, to the realization that waiting until March 5-6, as scheduled, to potentially announce deeper production cuts may be too late. OPEC’s core Middle East members typically announce how they have allocated their crude exports to customers between the 10th and 15th of each month. March loading programs and allocations have already been set, so any OPEC+ decision would affect April shipments at the earliest. Holding the meeting on its scheduled date of March 5-6 would push any changes to the May loading program. Beyond the physical market practicalities, the politics of agreeing on deeper cuts could be complicated. OPEC and its ten allies are one month into their latest production accord, which commits them to a 1.7 million b/d cut through the end of March. The deal, signed at a highly fractious meeting in December 2019, saw Angola walk out of the talks at one point, and Iraq and Russia play hardball in negotiating their new quotas. “Saudi Arabia, as expected, is leading by example, but should other producers fail to pull their weight or offer further adjustments, does the kingdom act unilaterally if the coronavirus impact escalates and spirals from here on out?” said an analyst with Medley Global Advisors. Even with Libya’s oil production plummeting by nearly 1 million b/d due to a port blockade, oil prices have seen downward pressure over the past week as fears of oil demand destruction currently outweigh supply outages. Last week’s EIA inventory report was not supportive, reporting a 3.5 million build during the seven days to January 4th. According to oil market analysts, until the impact of the Wuhan virus on the Chinese economy and oil demand becomes clearer, market participants will continue to be spooked by the specter of waning oil demand during the season when demand is weakest. The Phase One trade deal between the US and China may end up being exports on paper only—at least as far as energy is concerned. Analysts concur that the Chinese promise to buy an additional $52.4 billion worth of US energy products in 2020 and 2021 on top of the 2017 levels is most likely unachievable, even if China intends to fulfill all its pledges in the deal. With the coronavirus epidemic leaving a large share of Chinese industry, retail, and non-essential transportation shut down for an indefinite period, demand for oil in China and even around the world is bound to slow significantly. The US shale oil boom will not burn out but will spend the next 20 years fading away, the US Energy Information Administration said Wednesday in its latest Annual Energy Outlook. Annual US crude oil output is expected to climb to 14 million b/d by 2022, an increase of nearly 7.6 million b/d in a decade. But domestic production will then level off, increasing by less than 400,000 b/d over the next decade as operators move to less productive plays and well productivity declines, according to the report. US oil output will begin a slow decline in the mid-2030s, falling another 500,000 b/d over the next decade and declining below 12 million b/d by 2050, EIA said. |

In its reference case, EIA forecasts production in the Lower 48 to account for 70 percent of cumulative domestic output, peaking at 13.84 million b/d in 2032, accounting for 96 percent of total US output that year. Oil production in Alaska will climb from 480,000 b/d in 2019 to a peak of 910,000 b/d in 2041, due mainly to the development of fields in the National Petroleum Reserve in Alaska before 2030.

The agency said it remains unclear, however, if prices will make exploration and development of ANWR fields economical. The EIA said the US Gulf of Mexico production would reach a record 2.4 million b/d in 2026, due to deepwater discoveries of oil and natural gas resources. “Many of these discoveries occurred during exploration that took place before 2015 when oil prices were higher than $100 per barrel, and they are being developed as oil prices rise,” the EIA said. “Offshore production increases through 2035 before generally declining through 2050 as a result of new discoveries only partially offsetting declines in legacy fields.”

This assessment of US oil production during the next 30 years sounds rather optimistic, given that the oil industry, mainly shale oil, is pulling back sharply due to the lack of profitability and environmental pressures.

2. Geopolitical instability

Libya’s oil production fell to less than 300,000 b/d last week, from over 1 million b/d, following a blockade of its main oil export terminals, which in turn prompted the shutdown of several large fields. Tribal groups affiliated with General Haftar’s Libyan National Army, itself affiliated with the eastern government in Libya, occupied the terminals three weeks ago and then seized several fields in Libya’s main oil-producing region. The Libyan National Oil Corporation declared force majeure on oil exports and warned that the blockade could cost the country $55 million daily.

A resumption in fighting in Libya last week is threatening to unravel efforts to end the crisis less than two weeks after foreign backers of the two main warring factions agreed to support a cease-fire there. Forces loyal to Haftar shelled the Libyan capital’s only functioning airport last week as they once again attempted to take control of Tripoli from the UN-backed government. Haftar’s forces also battled pro-government fighters near the port city of Misrata. On Thursday, pro-government forces said they shot down a Russian surveillance drone over Tripoli.

The Libyan conflict is increasingly a battleground for foreign powers with competing agendas. The UAE and Egypt support Haftar as a part of what they see as a regionwide battle against Islamist groups. Russia is also backing Haftar, as it moves to expand its influence in the region. Turkey, a regional rival to the three countries, recently dispatched troops to support the Tripoli-based government of Prime Minister Fayez al-Sarraj.

In Iraq, anti-government protesters have been quick to dismiss President Salih’s appointment of Mohammed Tawfiq Allawi as prime minister-designate, as rallies took place in Baghdad and cities in the country’s southern provinces. The president’s move to end more than two months of political deadlock came after he issued an ultimatum to Iraq’s fractious parliament, warning that if they did not appoint a new prime minister by Saturday, he would do so himself. Salih’s announcement was not welcomed by the protesters who have camped out for months calling for an overhaul of Iraq’s political system, with hundreds in the capital’s Tahrir Square chanting “Mohammed Allawi, rejected!”.

Iraqi government security forces attempted to oust protesters from public squares in Baghdad and Basra. In Baghdad, security forces moved on two of the smaller protest sites and approached the central one, Tahrir Square, before falling back. As they withdrew, security forces fired tear gas and bullets, wounding at least four. The government’s move to clear protesters came after the prominent Shiite cleric, Moqtada al-Sadr, announced that he was withdrawing support for the demonstrators and would no longer intervene on their behalf.

A rocket attack on the US Embassy in Baghdad wounded one last week amid calls for an end to America’s military presence. Late-night rocket attacks on Baghdad’s Green Zone have become commonplace as the Trump administration increases financial and political pressure on Iran, which backs several militias in Iraq.

Nearly two years after awarding six development and exploration deals to foreign oil companies, Iraq’s Cabinet authorized the Oil Ministry to sign all six contracts. The projects are slated to provide significant new natural gas production for Iraq, potentially reducing its reliance on Iranian gas, and likely giving a boost to Iraqi and American advocates for renewing a waiver related to Iranian sanctions that expire Feb. 13. Due to the US sanctions, Tehran is unable to use or transfer $5 billion in revenues it has received from Iraq for supplying natural gas and electricity to Baghdad.

Iran’s Deputy Atomic Energy Organization Director Ali Zarean made a provocative announcement last week by saying the Islamic Republic has now passed the low uranium enrichment thresholds. “At the moment the authorities make the decision, the Atomic Energy Organization, as the executor, will be able to enrich uranium at any percentage.” Early last month Iran’s leaders declared they consider the program under “no limitations” following the Soleimani assassination. The announcement also comes two weeks after European signatories to the 2015 nuclear deal – Germany, France, and Britain – said they are moving to trigger the JCPOA’s dispute resolution mechanism formally declaring Tehran is in breach. This move could bring UN sanctions on Tehran.

Following the new wave of cold weather blanketing Iran in recent weeks, natural gas consumption by the Iranian households has hit record highs. The cold weather raises the possibility of problems with the fuel supply to the country’s power plants and industries. Considering remarks made by senior officials with energy and oil ministries, the amount of daily gas consumption by the domestic sector is touching the total amount of gas supplied by the oil ministry.

3. Climate change

Predicting the impact of global temperature rise in the next 80 years is a challenging exercise. Some people now are claiming that that the “worst-case” increase of a 5 degree C scenario temperature increase is likely too high. These researchers seem to believe that the Paris Treaty agreements will be at least partially fulfilled and that fossil fuel extraction is already dropping. While this may be true in Europe, the ongoing greenhouse gas production in Asia is enough to offset declines elsewhere. Some of the optimists’ projections, such as a decline in petroleum and probably natural gas production in the next 80 years, seem likely. However, so is the possibility that the world’s large reserves of coal will be exploited even faster.

Thawing permafrost in the Arctic is a significant uncertainty when it comes to the future of climate change. As the Arctic warms, permafrost can release unknown, but probably large, quantities of potent methane into the atmosphere. Some scientists worry that that thawing permafrost, and other similar natural feedbacks, will accelerate global warming until it is too hot to burn fossil fuels. Even then, methane from permafrost could continue belching until it is all gone. It is far too early to say that global warming will stabilize at a level bearable to mankind.

Scientists in Antarctica have recorded, for the first time, unusually warm water beneath a glacier the size of Florida that is already melting and contributing to the rise in sea levels. Researchers drilling through the Thwaites Glacier recorded water temperatures at the base of the ice of more than 2 degrees C. above the normal freezing point. It is unclear how fast the glacier is deteriorating; however, studies have forecast its total collapse in a century and also in just a few decades. The presence of warm water in the grounding line may support estimates at the faster end of the range.

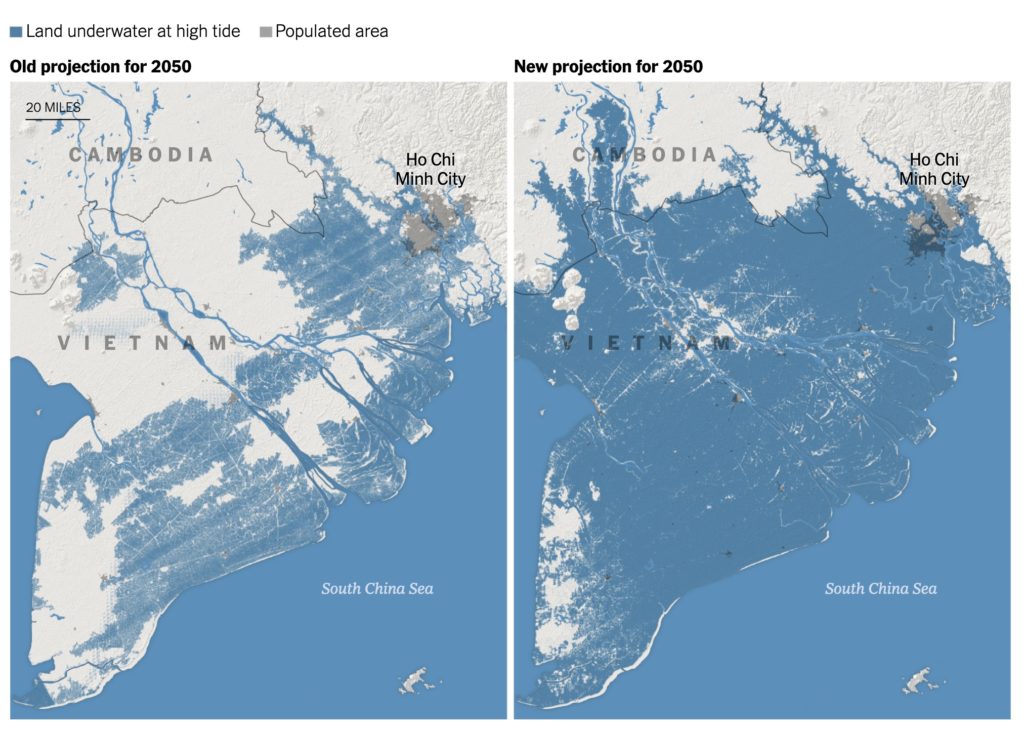

The authors of a new paper developed a more accurate way of calculating land’s elevation above sea level by using satellite readings and found that the previous estimates of much of the world’s shoreline were far too optimistic. The latest research shows that some 150 million people are now living on land that will be below the high-tide line by midcentury.

Reporters across the southeastern US are publishing coordinated stories on the progress and problems their communities face from climate change. The journalists found communities struggling with funding or a lack of political will, and an urgent need for breakthroughs to meet global warming. In the conservative South, few politicians are ready to say publicly that dealing with climate change already needs more money.

At the fall meeting of the Southern States Energy Board, an organization of Southern governors and lawmakers, the COO of Louisville Gas and Electric said his company was planning for different carbon reduction options, “free of commitments.” The executive also expressed a commonly held sentiment. “We want to continue to provide energy to our customers at a reasonable, low cost,” he said. “If that means coal, it means coal. If that means some other resource, it means some other resource.”

For many years, as the danger of human-caused climate change grew ever clearer, TV meteorologists avoided discussing the topic on air for fear of driving away advertisers. Today, many weathercasters bring up climate change regularly. By embracing science and presenting it in a simple, locally relevant manner, TV meteorologists have managed to become some of the most effective and trustworthy climate change educators in the country.

Now some meteorologists are taking the conversation a step further and talking not just about the science of climate change, but how we can solve it. At the 100th annual meeting of the American Meteorological Society in Boston earlier this month, a panel of broadcast meteorologists, climate communicators, and policy experts discussed how solutions to the climate crisis could be woven into TV weather reporting.

The reputation of natural gas as a clean fuel has been repeatedly undermined by unfavorable emissions data. But now, several new studies suggest that the problem could be worse than we imagined. A report from the University of Texas recently warned that the expansion of oil, gas, and petrochemical infrastructure along the Gulf Coast could add half a billion tons of greenhouse gas emissions to America’s total every year by 2030. This number is equivalent to 8 percent of the country’s current total in emissions and would come from new refineries, petrochemical plants, and, perhaps, a little unexpectedly for the layperson, liquefied natural gas plants.

Australian authorities warned on Friday of severe fire danger in densely populated areas this weekend, declaring a state of emergency in Canberra. By Sunday, however, fire fighters had succeeded in keeping the flames away from the capital.

4. The global economy and trade wars

The number of deaths from the coronavirus epidemic in China rose to over 360, as of yesterday, as the US and other nations announced new border curbs on foreigners who have been in China. Reported infections in China jumped to 17,205 as of today. The central province of Hubei, the center of the epidemic, is under a virtual quarantine, with roads sealed off and public transport shut down. Elsewhere in China, authorities have placed restrictions on travel and business activity in a bid to contain the spread of the virus. Bloomberg estimates that at least two-thirds of China’s economy would stay shut this week after the end of the New Year’s holiday.

Epidemiologists calculate that there are far more cases in China than have been offically diagnosed, and by this week, there may be more than 200,000 cases. Computer models suggest that, as with flu, Ebola, and SARS, travel restrictions may have little impact. One appraisal of the situation is that if the number of new cases slows by the middle of February, it is a good sign that the epidemic is coming under control. However, if the new cases continue to balloon, it may be many months and massive economic and human losses before the situation stabilizes.

The World Health Organization said on Thursday it was declaring the China coronavirus outbreak a global emergency, as cases spread to 18 countries. Efforts to combat the virus increased many-fold last week as China has left many factories closed after the holiday and severely restricted travel across the country. Nearly all foreign airlines have canceled or severely reduced flights to China, and some governments are making efforts to repatriate their citizens from the region around the Wuhan epicenter.

The rapidly spreading virus is emerging as a potentially significant new risk to the global economy. China is offering force majeure certificates to companies, unable to fulfill its international contractual obligations due to the coronavirus outbreak. The newswires are filled with stories about the impact of a partial shutdown is having on the Chinese economy. Travel and tourism have come to a halt. Coal production and oil imports are slowing, as is the demand for LNG.

Outside of China, the virus is already impacting many industries. Many firms, some with large factories and business interests in China, have banned their employees from traveling there. Perhaps the most significant threat, however, is the virus’s impact on supply chains. The world’s biggest tech companies are facing disruptions from prolonged factory closures and labor shortages, as the deadly coronavirus outbreak threatens the nation’s vast manufacturing network. Electronics, telecom, and semiconductor companies all rely on factories in China, honed to efficiency by years of servicing Western tech giants. Wuhan, the epicenter of the outbreak that is under lockdown by Chinese authorities, is home to numerous high-tech component suppliers and is a crucial transportation hub.

The US economy expanded last year at its slowest annual pace since a manufacturing slowdown in 2016, as consumer spending showed signs of decreasing. Gross domestic product rose at a 2.1 percent annualized rate in the final three months of 2019, according to the first estimate from the US commerce department, released last week. For the full year, the economy expanded 2.3 percent, which is down from 2.9 percent in 2018, and well shy of the Trump administration’s goal of 3 percent annual growth.

On the optimistic side, the US economy will grow at a “solid” rate of 2.2 percent this year, the non-partisan Congressional Budget Office forecast on Tuesday, but with federal budget deficits hitting $1.015 trillion. In its updated budget and economic outlook spanning the next decade, CBO said that consumer spending, spurred by rising wages and household wealth, will remain strong. But federal deficits will average $1.3 trillion per year during the next decade.

The French economy unexpectedly contracted in the final quarter of last year as manufacturing output slumped in the face of strikes over unpopular pension reform, data showed on Friday.

German business morale deteriorated unexpectedly in January as the outlook for services darkened, suggesting that Europe’s largest economy got off to a slow start in 2020 after narrowly avoiding a recession last year. The Ifo Institute said its business climate index fell to 95.9 from 96.3 in December.

India is grappling with its worst economic slowdown in a decade, with falling employment, consumption, and investment ratcheting up pressure on the government to revive growth. New Delhi estimates that economic growth this year, which ends on March 31, will slip to 5 percent, the weakest pace since the global financial crisis of 2008-09. Last week the government announced a $49 billion-dollar package of farm and infrastructure support in its 2020/21 budget.

5. Renewables and new technologies

Rolls-Royce plans to install by 2029 mini nuclear reactors in the UK that would be built in factories and delivered in modules, according to the company’s chief technology. “The trick is to have prefabricated parts where we use advanced digital welding methods and robotic assembly, and then parts are shipped to the site and bolted together.” Historically, nuclear energy has had little-to-no standardization, and building a new nuclear energy plant, therefore, was time-consuming and costly. Small-scale reactors can be easily standardized and built offsite, making them much cheaper, more efficient, and easily scalable. However, the problem of storing nuclear waste remains unresolved.

In November, researchers will attempt to create a ball of plasma hotter than the sun inside a doughnut-shaped machine in southeast England. It will be the first attempt at nuclear fusion in the UK since 1997. The test will attempt to fuse two forms of hydrogen at the Joint European facility in Culham, Oxfordshire.

A growing number of US utilities plan to add energy storage to their facilities during this decade, as declining renewable energy costs and investor and public pressure to curb emissions are forcing a shift to renewables. A growing number of those utilities are combining battery energy storage with their new solar and wind facilities.

General Motors will invest $2.2 billion at its Detroit-Hamtramck assembly plant to produce a variety of all-electric trucks and SUVs. GM’s first electric truck will be a pickup with production scheduled to begin in late 2021. The truck’s debut will be followed soon after by the Cruise Origin, a shared, electric, self-driving vehicle unveiled by Cruise in San Francisco last week.

According to a report from the Rocky Mountain Institute, replacing the fossil fuels used in industrial processes with hydrogen will be essential to achieve net-zero emissions by 2050. “The industrial processes used in the production of things like steel, cement, glass, and chemicals all require high-temperature heat. For these hard-to-abate sectors, there is essentially no way to reach net-zero emissions at the scale required without using hydrogen.” Replacing natural gas with hydrogen in industrial processes could open up a $1 trillion market.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

The world’s largest oil companies invested billions of dollars in boosting crude production, and their success has turned around and bit them — and their shareholders. Oil majors Exxon Mobil, Chevron, and Royal Dutch Shell all reported earnings on Thursday and Friday that showed critical units significantly underperformed, particularly refining and chemicals. Investor discontent with weak returns, previously concentrated on smaller shale companies or oil services firms, has worked its way up to the majors. In the last six months, the broad S&P 500 is up 10.4 percent, while Chevron shares have lost 8 percent, Shell is down 10 percent, and Exxon has lost 12 percent. (2/1)

Global traffic congestion has increased globally during the last decade, and the 239 cities (57 percent) TomTom included in the new Traffic Index report had increased congestion levels between 2018 and 2019, with only 63 cities showing measurable decreases. This global increase in congestion, despite being an indicator of a strong economy, is understood to cost economies billions. (1/30)

According to BP’s CEO Bob Dudley, there will be a reduction in the use of oil over time; it will be displaced by natural gas or other things to generate power. He believes that the oil price of $100 per barrel is unlikely within the context of rising US production output. (1/28)

Russian pipeline liability: Russian oil pipeline operator and owner, Transneft, which supplies Urals crude to European customers via the Druzhba pipeline, faces compensation claims of up to US$1 billion for the contaminated oil it sent to Europe last year. (1/31)

Russia has said it will complete construction of the controversial Nord Stream 2 gas pipeline under the Baltic Sea without the help of foreign companies, marking a victory for the US, which imposed sanctions in an attempt to halt the project. The Nord Stream 2 project is already 94 percent complete. (1/29)

Russia’s first Billion cm of Russian natural gas has now flowed through the 31.5 Bcm/year capacity TurkStream pipeline from Russia to Turkey, Russian gas giant Gazprom said Monday. Gas started flowing January 1. (1/28)

In Egypt, ExxonMobil has signed two oil and gas exploration deals in the Eastern Mediterranean. The two exploration deals call for a total investment of at least $332 million. At the end of 2019, ExxonMobil said that it had acquired more than 1.7 million acres offshore Egypt, adding upstream interests to its downstream business in the country. (1/29)

In Mozambique, Exxon and Total have asked the government to send more troops to guard their operations in the far north after a surge of attacks by Islamist militants. Mozambique’s northern province is home to one of the world’s most significant gas finds in the past decade, and both oil majors are working on massive LNG projects that could transform the economy. The area is also the center of an Islamist insurgency that has killed hundreds since 2017. (2/1)

Guyana’s offshore: ExxonMobil raised the amount of its estimated recoverable reserves in Guyana Monday by more than 30 percent to more than 8 billion boe, up from 6 billion barrels last July, even excluding the just-announced latest discovery. Urau-1 is the 16th discovery at the offshore deepwater Stabroek block for the ExxonMobil-led consortium that includes Hess and China’s CNOOC. Analysts see another 25 prospects worth drilling. Four drillships continue to explore and appraise new resources and develop the projects. (1/28)

Brazil has decided to stay out of OPEC for the time being as it seeks to expand its oil production, according to energy minister Bento Albuquerque. “The idea is just to increase our production and to participate more in the international oil and gas market…We don’t want restrictions; we want to increase our production.” (1/28)

In Argentina, Equinor, Shell, and Total vowed to press on with projects in Vaca Muerta, even as policy uncertainty and price controls make it harder to plan investment in Argentina’s biggest shale play, raising concerns of a slowdown in oil and natural gas production growth. (1/28)

In Venezuela, PDVSA has shut down its last two operating refineries, closing its Amuay and Cardon facilities at the Paraguana Refining Center, the largest refining complex in the country. Due to multiple failures and a lack of crude to process, the 645,000 b/d Amuay refinery was completely shut down Monday. One operator said it might only be a few days before Amuay restarts, but the Cardon refinery may be offline for several weeks due to distiller repairs. (1/28)

In Cuba, the latest US sanctions reversed the progress made by the Obama administration, and the brunt of their force is being felt by the very people the measures claim to support. In Havana, Cuba, the effects of sanctions imposed by the Trump administration have seeped their way into daily life: the long lines of cars outside gas stations, the dwindling stock on store shelves, the increasingly frequent power outages. (2/1)

Canadian Prime Minister Justin Trudeau is losing support for a plan to expand the Trans Mountain oil pipeline, raising the stakes for his government as the project navigates continued legal challenges. About 37 percent of Canadians oppose the government-owned plan, up from 31 percent in June. Backing for the pipeline is at 55 percent, down from 58 percent. (1/29)

In Canada, another billion-dollar energy project is polarizing the nation once again, but this time, it’s got nothing to do with pipelines or even LNG terminals. It’s the Frontier oil sands mine that the federal government of Justin Trudeau must approve or reject by the end of next month. According to most observers, this decision will seal the fate of Canadian oil sands forever. Many see the approval or rejection of the Frontier mine project as crucial in indicating, once and for all, what is more important for the Liberal government, environmental protection, or the development of Canada’s mineral resources. (1/30)

The US oil rig count decreased by 1 to 675, down by 172 rigs year-over-year, according to Baker Hughes. The gas rig count fell by 3 to 112, down from 198 active rigs year-over-year. (2/1)

Alaskan LNG: despite a world awash in liquefied natural gas, Alaska is still working on its $40 billion-plus Alaska LNG project, which, if built, could deliver 20 million mt/year of LNG to world markets. State officials involved in the project, however, say they are under no illusions about current LNG markets. Their goal is to get the project ready when it comes to licensing and permits and to get an updated cost estimate, so it is ready to go if markets turn around. (1/28)

Exxon’s oil-equivalent production in Q4 2019 was flat on Q4 2018, at 4 million barrels per day. Still, the company noted the ramp-up of development in the Permian shale play, where production rose by 54 percent from the fourth quarter of last year. (2/1)

Shell’s upstream oil production increased by 6 percent on the year to 1.77 million b/d in the fourth quarter of 2019, even as profits plummeted on the back of low commodity prices and financial impairments. Shell’s oil output was boosted by new developments ramping up in Brazil, the US Permian Basin, and the US Gulf of Mexico. However, a 9 percent reduction in its upstream gas output resulted in the flat overall production of 2.81 million b/d of oil equivalent. But Shell’s earnings of $2.9 billion were down by half from a year earlier; the company’s financial squeeze may slow the pace of share buybacks and force more asset sales. (1/31)

Chesapeake Energy is a company in dire straits. The Oklahoma-based exploration company ushered in America’s shale natural gas revolution a decade and a half ago; now, the odds are that it might not even survive the era of cheap gas it helped create. For years, Chesapeake borrowed heavily to finance an aggressive expansion of its shale projects. But lately, the company has been running on fumes, teetering on the brink of bankruptcy under a mountain of debt that it’s unable to repay thanks to energy prices remaining stubbornly low. (1/28)

PA gasoline tax? Pennsylvania state senators on Wednesday raised concerns that a possible multistate initiative to reduce emissions of climate-warming gases from cars and trucks will drive up fuel prices in the commonwealth. At a joint hearing of the Senate’s environment and transportation committees, Wolf administration officials said they do not support raising the gas tax in Pennsylvania, and they will not decide whether to sign on to the developing climate pact until the program’s design is complete. (1/31)

Fracking ban? In Pennsylvania, Democratic leaders agree on one thing: a pledge to ban all hydraulic fracturing, better known as fracking, could jeopardize any presidential candidate’s chances of winning this most critical of battleground states — and thus the presidency itself. So, as Senators Bernie Sanders and Elizabeth Warren woo young environmental voters with a national fracking ban, these two Democrats are uneasy. (1/28)

The natural gas emissions trap: Although natural gas produces about half the carbon dioxide emissions when burned than coal does, studies show methane leaks and flaring throughout the supply chain release far more greenhouse gas emissions than official data suggests. (1/31)

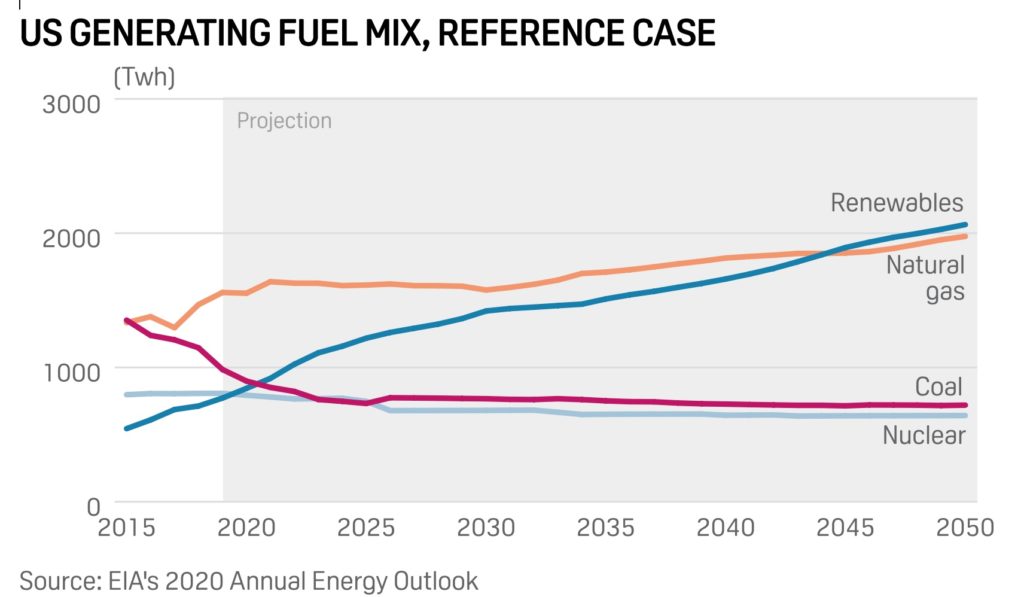

Coal down 21 percent y-o-y: US coal-fired power generation totaled 75.6 TWh in November, down 18.7 percent on-year but up 13.1 percent from October, EIA data showed Monday. It was the first month-on-month increase since July. From the five-year average of about 95.5 TWh produced in November, generation was at a 20.8 percent deficit this year, the lowest shortfall in nine months. Out of total power generation, coal took a 23.9 percent share. (1/28)

US coal-fired generation continued to decline in January as natural gas pricing dropped, and the weather remained mild. (2/1)

Jousting with coal: A proposed law in Indiana would make it harder for utilities to close coal plants, the latest effort by coal-heavy states to beat back the market forces making coal-fired power more expensive than wind, solar and natural gas. (1/30)

In Germany, Uniper will decommission hard coal plants at Scholven, Wilhemshaven, and Buer by end-2022, and at Staudinger and Heyden by end-2025 at the latest, the German company said, for a total of 2,922 MW shut down. (1/30)

German onshore wind additions amounted to 1,078 MW last year, their lowest level since 2000, German wind association BWE said Tuesday. Taking into account the 155 MW of repowered projects and 97 MW of retirements, net additions of 981 MW brought total installed capacity to 53.912 GW by end-2019. (1/29)

Wind power growth: The US is likely to build 15.2 GW of wind generation in 2020, a Wood Mackenzie consultant maintains, led by growth in the Midwest, West, and Texas, which industry observers said Friday would likely result in lower prices in heavy wind areas but increased price volatility. The federal $23/MWh production tax credit is a significant factor in 2020’s boom in construction. According to a May US EIA report, US wind project developers who want to receive the full 2016 value of the PTC must begin operations by the end of 2020. (2/1)

Renewable energy is projected to crowd out coal-fired and nuclear generation and even overtake natural gas as the dominant fuel for power generation by 2045, under the main reference case considered by the Energy Information Administration in its 2020 Annual Energy Outlook released Wednesday. (1/30)

Fukushima update: About a decade ago, a powerful earthquake triggered a 15-meter tsunami that disabled the power supply and cooling of three reactors at the Fukushima Daiichi nuclear power plant. The accident led to nuclear cores of three reactors to meltdown, causing widespread radiation release, along with the evacuation of thousands of people within a 30-kilometer radius. Plant operator Tokyo Electric Power Company Holdings Inc. released a statement last week detailing how it would take 44 years to decommission Fukushima No. 2 nuclear plant. (1/27)

General Motors unveiled plans to spend $2.2 billion to produce autonomous and electric vehicles at its Detroit Hamtramck plant, recently on the brink of closing down entirely. The announcement came just a week after GM’s Cruise subsidiary unveiled Origin, its first self-driving car without a steering wheel or pedals. GM plans to release 20 electric vehicles by 2023, the first of which will be an electric truck slated to go into production in 2021. (1/30)

EV boon: Widespread adoption of plug-in electric vehicles (PEVs) in California could confer significant economic benefits by both 2030 and 2050, resulting in increases to Gross State Product (GSP), employment, real household incomes, and state revenue, according to a new report commissioned by the think tank Next 10. (1/29)

E-plane development: Wright Electric announced the start of its electric propulsion development program for its flagship 186-seat electric aircraft, named Wright 1. To achieve the commercial flight capability of the Wright 1, Wright is engineering electrical systems at the megawatt scale by building a 1.5 MW electric motor and inverter at 3 kilovolts. Wright intends to conduct ground tests of its engine in 2021 and flight tests in 2023. The company expects entry into service of its flagship Wright 1 in 2030. (1/31)

When Rolls Royce in December unveiled its new electric plane, it said it would be the fastest electric aircraft, capable of achieving a top speed of 300 mph. It also said the plane would be able to fly from London to Paris on a single charge. They claim the battery pack of ACCEL is the most energy-dense pack and lightest ever made for a plane. (1/31)

The UK oil and gas industry can play a vital role in the hydrogen and Carbon Capture, Usage and Storage sectors are given its expertise in producing and transporting hydrocarbons, an official from industry association Oil & Gas UK said Wednesday. (1/30)

LNG = no climate benefits: The results of a new analysis by the International Council on Clean Transportation (ICCT) show that, when combined with a trend toward higher methane leakage and combustion slip, there is no climate benefit from using liquefied natural gas (LNG) as a marine fuel—regardless of the engine technology. (1/29)