Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Africa is the final frontier for oil discoveries because it’s so vastly under-explored and we could even be looking at the last major onshore oil discovery on Earth…. [In Namibia’s Kavango Basin] I’ve been conservative with the numbers, and even so, if the potential pans out in full, they are pretty comparable to the Permian Wolfcamp and the Eagle Ford in Texas.”

Daniel Jarvie, geochemist and wildcat explorer

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: New York futures settled near two-month lows after gains in the dollar reduced the appeal of commodities priced in US currency and concerns about over-supply mount. Prices were pressured by extended declines in the US equities market and by a report showing US job growth slowed further in August as financial assistance from the government ran out. October futures settled $1.60 lower at $39.77 on Friday, while London’s Brent was down $1.41 to settle at $42.66.

A swift recovery in fuel consumption by US drivers is petering out. After gasoline demand surged from mid-April to late June, consumption has stayed relatively flat in the past two months and remains well below its pre-pandemic levels. Combined with other data showing that improvements in consumer spending and hiring are cooling, the slower increase in fuel demand illustrates that the next economic recovery phase could be more difficult. The stalled demand rebound helps keep US crude-oil prices stuck around $40 per barrel, even with OPEC and companies from Exxon to Chevron curbing supply.

Gulf of Mexico oil and gas operators continue to restore oil and natural gas output, albeit slowly, from platforms temporarily taken offline before Hurricane Laura. As of Friday, 300,000 b/d of oil production, or 16.3 percent of the region’s total, was still shut in from the storm.

Natural Gas: The recovery in industrial gas demand is stumbling in Hurricane Laura’s wake amid a recent slowdown in operations at refineries and chemicals facilities across the Gulf Coast. US industrial gas demand is averaging 20.4 Bcf/d, down 270 million cf/d, or about 1.3 percent, compared with the August average. In the Southeast alone, where the contraction has been heavily concentrated, industrial demand this month is down 255 million cf/d, or almost 9 percent, compared with its prior-month average.

An early summer rebound in Permian Basin gas production stalled out in recent weeks as drilling, well completions, and rig counts across West Texas hit multiyear lows. In August, Permian gas production averaged 11.3 billion cf/d – down about 250 million compared with the prior month. In July, output hit summer highs at over 12.2 billion cf/d as many previously curtailed wells were brought back online.

Investors managing more than $2 trillion are calling on Texas regulators to ban the routine burning of natural gas from shale fields, arguing that the energy industry hasn’t moved quickly enough to curb the controversial practice. According to a letter to the Texas Railroad Commission, AllianceBernstein, the California State Teachers’ Retirement System, and Legal & General Investment Management said they support eliminating gas flaring by 2025. The three investors have been vocal on environmental issues before, but it’s the first time large institutional investors have taken such a public stance to the Texas regulator.

Prognosis: The US presidential election in November presents a stark contrast for the next four years of US oil policy that could shape supply/demand dynamics domestically and abroad. There could be significant implications for shale, sanctions, trade, and OPEC relations. The most significant domestic impact might come from a promise by Joe Biden to stop issuing drilling permits for federal lands and waters. According to S&P Global Platts Analytics, this action would shrink US oil production by up to 2 million b/d by 2025, primarily from New Mexico’s Delaware Basin and the Gulf of Mexico.

The top risks to the international oil market depend on a possible new administration’s approach to Iran and Venezuela, which have seen their oil exports fall by a combined 3 million b/d due to President Trump’s enforcement of sanctions against both OPEC producers. Other potential oil impacts run the gamut of environmental, foreign relations, and trade policies. Still, the market will ultimately dictate how the White House’s actions influence oil supply, demand, and prices.

While some US oil executives have warned of bleak times for the industry if Biden wins, Platts Analytics does not expect anti-fossil fuel measures to top the new administration’s early agenda. “I don’t believe for a moment that his first year will be marked by him taking on the oil and gas sector at a time when they’re all struggling,” said Chris Midgley, Platts global head of analytics. “That would be suicide. He needs to make sure he’s sustaining the momentum of the economy.”

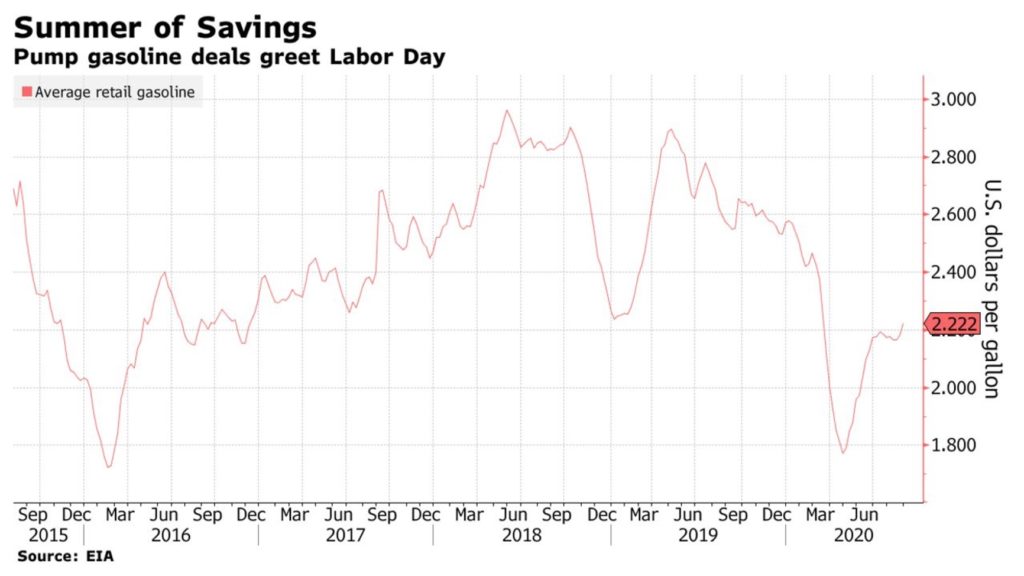

US drivers saw cheap gasoline over the Labor Day Weekend, spelling hard times ahead for oil. Gasoline prices on average this year are $2.22 per gallon, the lowest for this time of year since 2004, according to the US EIA. For the owner of a Ford F-150 with a 26-gallon tank, filling up is almost $10 cheaper than last year.

Traditionally, families hitting the road for the three-day weekend provide a capping finale to summer-driven fuel demand. This year, though, the customary drop off in consumption is especially fraught for an industry that missed out on the season’s typical profits. Continuing orders to stay-at-home in some of the nation’s largest school districts threaten to further delay any meaningful recovery.

2. Geopolitical instability

Iran: The official death toll from the coronavirus rose by 118 to 22,044, a health ministry spokeswoman told state TV on Friday, with the total number of identified cases rising to 382,772. The spokesman said 2,026 new cases were identified in the last 24 hours. Iranian authorities said schools would be open on Saturday under strict health protocols allowing them to operate safely. Last week, the government allowed thousands of its Shia faithful to gather for one of the Islamic sect’s most important religious holidays, the latest attempt on the part of Iran’s leaders to preserve a sense of normalcy even as the country grapples with high infection rates from coronavirus.

Iran was the first country in the Middle East to be struck by the virus. After reporting the first case of Covid-19 in the holy city of Qom in February, Iranian authorities identified religious sites and ceremonies as hot spots for the virus. They closed mosques, shrines, and Friday prayers, despite anger from conservative clerics opposed to interference in religious practices. After a lockdown slowed the virus’ spread, the government in April began reopening the economy, triggering rising infection rates. Iran, for months, has logged around 2,000 new cases daily.

President Rouhani bemoaned Iran’s friends for not standing up to the US and breaking crippling sanctions during the coronavirus pandemic. He also said that if the US had a “bit of humanity or brain,” it would have lifted sanctions on Iran for the health crisis’s duration.

Reaching natural gas production of one billion cubic meters per day has been one of Iran’s three top hydrocarbons resource goals since Tehran began to seriously develop the supergiant South Pars natural gas field in 1990. Over the past week or so, the government has announced several initiatives to increase gas output from South Pars to significantly surpass that bcm/d figure as quickly as possible. With an estimated 14.2 trillion cubic meters of gas reserves in place plus 18 billion barrels of gas condensate, South Pars already accounts for around 40 percent of Iran’s total estimated 33.8 tcm of gas reserves and about 60 percent of its gas production.

Washington announced new sanctions on 11 entities based in Iran, the UAE, and China for continuing to facilitate sales of Iranian petrochemical and oil products. The move is the latest in the Trump administration’s efforts to clamp down on flows of oil and petrochemical products from Iran to China.

According to the International Atomic Energy Agency, Iran’s enriched uranium stockpile had reached 2,105kg (4,640lb), more than ten times the amount of enriched uranium permitted under the international agreement. The announcement comes after Iran gave IAEA inspectors access to one of two suspected former nuclear sites. Tehran insists its nuclear program is exclusively for peaceful purposes.

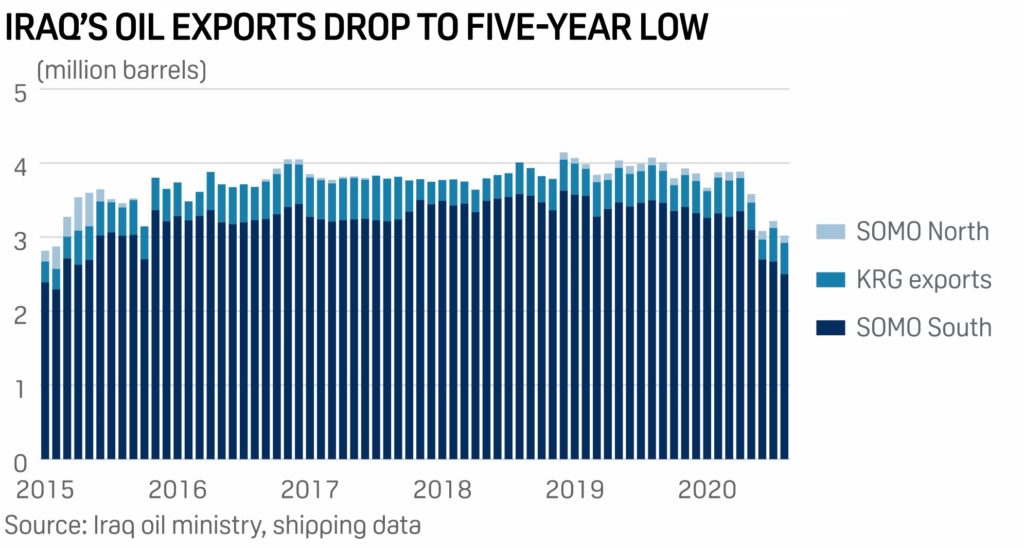

Iraq: Oil exports, excluding those from the semi-autonomous Kurdish region, fell 6 percent in August from July, signaling better compliance with its OPEC+ quota. Exports were 2.597 million b/d in August from 2.763 million b/d in July, the oil ministry said. Exports were only 2 percent lower in July than in May.

The government said it might seek a two-month extension to implement the extra production cuts it’s carrying as part of the OPEC+ deal, suggesting that Baghdad wouldn’t be able to reduce its output as quickly as it promised. The country pumped above its OPEC+ output quota earlier this year, and as a result, it’s now making deeper cuts to compensate. Initially, Baghdad promised to resolve the matter in August and September, but now it’s signaling it may need a bit longer. Iraq relies almost entirely on oil revenues for its government income.

Cabinet and Oil Ministry legal teams have proposed amendments to the 2018 law to reconstitute the Iraqi National Oil Company. Efforts to re-create the company have been stalled since January 2019, when the Federal Supreme Court struck down so many fundamental provisions of the law that it could not be implemented. The Cabinet is now seeking to address the Supreme Court’s concerns, though it has not decided on a final set of amendments to send to Parliament for ratification.

Iraq has managed to overcome the worst of the 2020 oil market slump in its upstream sector. It demonstrated it could work its Kurdish exports and has more or less reined in its OPEC+ non-compliance problem, to avoid the ire of other crude exporters. Iraqi authorities have started to chart a pathway to dealing with its refinery problems. Iraq’s only fully functional refinery is located in Shuaiba near the Basra hub of crude production, where a 210,000 b/d refinery is serving the product needs of the south.

Libya: Less than three months after pro-government forces pushed General Haftar’s forces away from of the Libyan capital, infighting within the government now threatens to unravel and again plunge the country into chaos. Powerful militias in the capital are exerting their influence, sensing an opportunity to grab power and wealth. Pro-government forces and political figures are turning on one another in an effort to gain supremacy in western Libya, according to analysts.

As temperatures in Tripoli reach 104 Fahrenheit, endless power failures leave residents struggling to stay cool without air-conditioners and fans. Poor maintenance, a shortage of fuel at generating plants, and a blockade stopping oil exports have stretched the power grid to breaking point.

The latest phase in the country’s civil war brought more blackouts. Haftar and his forces advanced on Tripoli in April 2019, determined to unseat the United Nations-backed government based there. Although he withdrew in June after failing to capture the western city, the fighting damaged transmission lines and control stations. Looters stripped high-voltage cables from power poles during Haftar’s siege. Power output nationwide has declined for five years and now meets only about 60 percent of peak summer demand.

Libya’s largest oilfield, Sharara, is stopping all operations, and the operator is evacuating the workers as a foreign employee tested positive for the coronavirus after coming into contact with the Petroleum Facilities Guard. Sharara has not produced oil since January, when forces affiliated with General Haftar occupied Libya’s oil export terminals and oilfields. Early in June, the Libyan National Oil Company (NOC) resumed production at the 300,000-bpd Sharara oilfield after negotiating the opening of an oilfield valve. Just a day later, however, Sharara shuttered again after an armed force had told the workers in the field to stop working. Sharara now has stopped all operations, including fuel supplies to the Obari power plant according to the NOC.

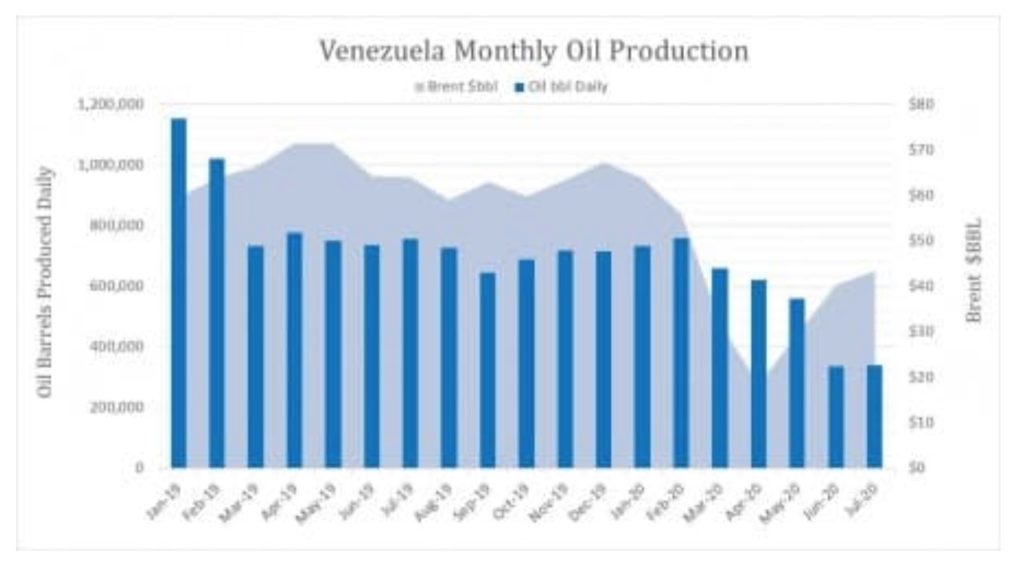

Venezuela: By July 2020, Venezuela only produced a daily average of 339,000 barrels of crude compared to 755,000 a year earlier and almost a seventh of a decade earlier.

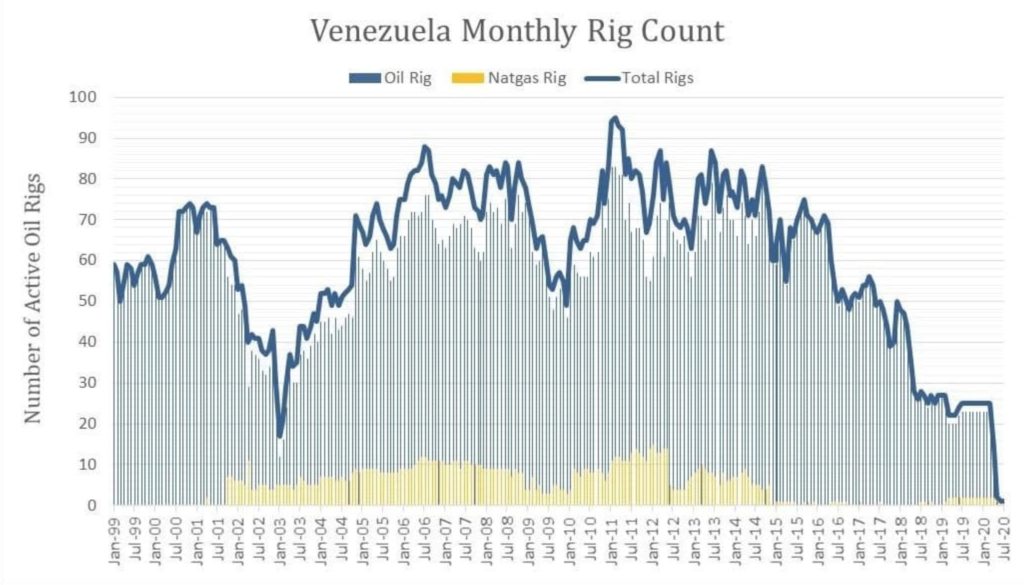

The outlook remains poor, particularly if the domestic rig count is used as a proxy measure of oil industry activity. At the end of July 2020, according to Baker Hughes, there were no active oil rigs in Venezuela and only one operational natural gas rig. That is compared to a total of 25 operational rigs for the same period a year ago and 70 rigs a decade earlier.

There are still rigs operating which are not captured by Baker Hughes because their count excludes cable tool rigs or very small truck mounted rigs . For this reason, national oil company PDVSA regularly contests the accuracy of the Baker Hughes data and will keep pumping crude, although likely at miniscule levels. Analysts predict Venezuela’s oil production could fall to zero sometime in 2021.

Industry consultancy IHS Markit estimates that Venezuela is pumping around 100,000 to 200,000 b/d and that production will keep falling. Weaker oil prices, economic breakdown and US sanctions could very well see the unthinkable occur, the fall of a major global oil producer and founding OPEC member. While an oil production recovery is possible, it is someway off because of the immense capital, skilled labor and infrastructure required. The Wall Street Journal says Venezuela’s oil industry is simply “fading away.”

Turkey-Greece

Turkey said on Tuesday that it was open to dialogue with Greece to end the dispute over the oil and gas resources in the eastern Mediterranean and the right to explore them, as long as Greece is open to talking as well. Tensions between Greece and Turkey flared up again in recent weeks after Turkey resumed drilling and exploration for oil and gas in the eastern Mediterranean in waters that Greece and Cyprus consider part of their territorial waters.

3. Climate change

European Union governments are considering a plan to set an intermediate emissions-cut goal for 2040 to keep the bloc on track for climate neutrality. Diplomats from the EU’s 27 nations are set to discuss a draft law next week that would make binding the region’s objective to become the world’s first climate-neutral continent by 2050. Germany, as the current holder of the bloc’s rotating presidency, proposed the landmark regulation be amended to include a more detailed trajectory.

For the first time, solar and wind made up most of the world’s new power generation — marking a seismic shift in how nations get their electricity. Solar additions last year totaled 119 gigawatts, representing 45 percent of all new capacity, according to a report by BloombergNEF. Together, solar and wind accounted for more than two-thirds of the additions. That’s up from less than a quarter in 2010.

During the mid-August heatwave that saw temperatures reach as high as 110 degrees in parts of California, the grid buckled under the strain of high demand and limited supply — forcing grid operators to initiate rolling blackouts that affected millions. In that case, natural gas and wind resources unexpectedly tripped offline, and electricity imports dried up, leaving operators with few options but to order cuts.

Excessive heat was again forecast to blanket the state through the Labor Day weekend, with temperatures forecast to reach 107 degrees Fahrenheit in Los Angeles. In response, California’s grid operator ordered transmission line operators and power plants to postpone any work that would take their assets offline on Saturday and Sunday, to ensure adequate power supplies during the weekend.

4. The global economy and the coronavirus

The coronavirus pandemic has brought hard times for many farmers and has imperiled food security for many millions in the cities and the countryside. UN experts held an online conference last week to brainstorm ways to alleviate hunger and prevent the problems from worsening in the Asia-Pacific region. The UN’s Food and Agriculture Organization forecasts that the number of undernourished people will increase by up to 132 million this year while the number of acutely malnourished children will rise by 6.7 million worldwide due to the pandemic.

The last time cruise ships were idled for any significant period was in the wake of the September 11th terrorist attacks. But executives say the coronavirus crisis, which has left ships moored off coastlines from the US to Indonesia, is far more life threatening for the industry. With Covid-19 resurgent in Europe, pockets of cases erupting in Asia, and the US still struggling to control the pandemic, the challenge of dealing with vessels risks becoming even more urgent as the financial burden on companies grows.

Royal Caribbean, the world’s second-biggest cruise line, has so far announced the scrapping of three of its vessels. Companies are being forced to accept “quite a low price” from scrappers because “it’s a buyer’s’ market” and taking apart such complicated vessels is “a cumbersome operation.”

United States: The number of Americans filing new claims for unemployment benefits fell below 1 million last week for the second time since the pandemic started, but that does not signal a strong recovery in the labor market. The drop in initial claims to a five-month low reported by the Labor Department primarily reflected a change in the methodology used to address seasonal fluctuations. The data signal progress as the labor market continues to improve, though at a more moderate pace since the initial bounce back in hiring, with payrolls remaining about 11.5 million below the pre-pandemic level.

The federal budget deficit is projected to hit a $3.3 trillion record as huge government expenditures to fight the coronavirus and prop up the economy have added more than $2 trillion in expenditures. US government debt will exceed the economy’s size in the government’s 2021 fiscal year, a milestone not hit since World War II. The US trade deficit surged in July to $63.6 billion, the highest level in 12 years, as imports jumped by a record amount.

United Airlines announced that it is preparing to furlough 16,370 workers when federal aid expires on Oct. 1st though one union said many more people would be without pay. United’s cuts include 6,920 flight attendants, but the association representing them said 14,000 would not have a paycheck in October unless Congress acts to extend $25 billion in aid.

US manufacturing activity increased more than expected in August. Still, employment at factories continued to lag amid safety restrictions intended to slow the virus’s spread. An upbeat report from the Institute for Supply Management (ISM) strengthened expectations for a sharp rebound in economic activity this quarter. However, the outlook is uncertain as money from the government dries up.

China:

China’s manufacturing activity held steady in August as domestic demand helped offset weaker orders from export markets struggling with the pandemic. The monthly purchasing managers’ index released by the Chinese statistics agency and an industry group declined to 51 from July’s 51.1 on a 100-point scale on which numbers above 50 indicate activity increasing.

China’s record imports of crude are poised to end as state-issued allowances for imports dwindle, potentially taking the wind out of the uneven recovery across global oil markets. Crude and bitumen blend imports in August for China’s independent refineries fell 9.9 percent to 4.22 million b/d from a record high in July. The downtrend is expected to continue with much less crude imported in September and October than in May and June.

The worsening conflict between China and the US has damaged bilateral trade. However, a complete decoupling between the two largest global economies would be even more damaging to China’s long-term growth prospects. The country’s potential growth rate could fall to about 3.5 percent in 2030 if it decouples from the US. That’s down from the current forecast of 4.5 percent, which assumes relations remain broadly unchanged.

Such a decoupling — defined as ending the flow of trade and technology that boosts growth potential — would have a much larger impact on China than on the US as China gains more from cross-border exchanges of ideas and innovations. The US potential growth rate would be 1.4 percent in 2030 instead of the current forecast of 1.6 percent, the research estimates.

China already looks to be preparing for less connection with the global economy. President Xi Jinping’s new strategy positions the domestic economy as the main driver of growth, seeking to insulate the nation from a slowing global economy and rising hostility. China would face even more disastrous consequences if the US can coordinate its key allies, such as Japan, South Korea, Germany, and France, to decouple. In that case, China’s growth potential could fall to 1.6 percent in 2030, and it would be more challenging for Beijing to offset with countervailing policies.

European Union: European governments approved the most ambitious climate change plan to date, agreeing to pour more than $572 billion into everything from electric cars to renewable energy and agriculture. At a five-day summit in Brussels, heads of government reached a deal on an unprecedented economic rescue plan and seven-year budget for the region worth $2 trillion. Almost a third of that is earmarked for climate action, offering the bloc’s 27 nations a chance to develop clean energy resources, stimulate the market for emissions-free cars, invest in nascent technologies, and promote energy efficiency.

The plan is part of Europe’s bid to become the world’s first climate-neutral continent by 2050, putting it ahead of other major emitters such as the US, China, and India in the global fight against temperature rise. The proportion of the European package earmarked for climate projects illustrates that contrast dramatically. Only $54 billion of the trillions of dollars of recovery funds pledged globally will be channeled into green policies. In comparison, $697 billion has been allocated for carbon-intensive sectors such as air travel and fossil fuel extraction.

The Euro area’s recovery ran out of steam midway through the third quarter, with gauges of activity pointing to Italy and Spain’s contractions. According to an IHS Markit report, while manufacturing output rose markedly in August, the more extensive services sector saw only marginal growth. Orders increased at a slower pace, job cuts continued, and confidence about the outlook eased.

German unemployment eased for a second month as the economy slowly recovered from the pandemic. A drop of 9,000 in August left the total number of jobless people at 2.92 million. At the same time, millions of workers remain furloughed, with around 37 percent of companies still making use of government wage subsidies.

Facing resurgent virus infections, France’s government unveiled details on Thursday of a $118 billion recovery plan aimed at creating jobs and saving struggling businesses. The program hopes to create 160,000 jobs next year and restore France’s economic growth levels of 2019 by 2022 — the year of France’s next presidential elections. France reported more than 7,000 virus cases Thursday, the highest daily rate in Europe, and well above the several hundred cases a day in May and June when France was emerging from strict lockdown.

The European Central Bank’s emergency stimulus program is endangering the region’s climate-change objectives by “feeding a natural gas frenzy,” according to environmental campaigners. The central bank is buying bonds from fossil-fuel project developers, the Paris-based Reclaim Finance said in a statement. On Friday, Bank of France Governor Francois Villeroy de Galhau called on the ECB to incorporate climate change into its economic models within five years.

Producing hydrogen from renewable power could drive up its price over the coming decades as the gas becomes the low-carbon fuel of choice for the European Union. As the EU moves to aggressively cut carbon emissions across all sectors to hit climate neutrality by 2050, green hydrogen is seen as key to achieving that goal.

According to an Aurora Energy Research analysis, if the bloc shuns the use of hydrogen made from fossil fuels entirely, then using the green version of the gas across all sectors will become more costly as demand grows over the coming decades. A fundamental debate is whether to use hydrogen from renewable electricity, known as green hydrogen, or a version known as blue hydrogen that’s made from natural gas with a process that captures and stores CO2 emissions.

Russia: The European Union will likely impose new sanctions on Moscow over the poisoning of Russian opposition leader Alexei Navalny. German Chancellor Angela Merkel said the Kremlin critic, who is in intensive care in a Berlin hospital, was poisoned with a Soviet-style Novichok nerve agent in an attempt to murder him.

Merkel is facing intense pressure to scrap the Nord Stream 2 gas pipeline project to punish Moscow. German MPs from across the political spectrum are demanding Berlin drop its support for the scheme, one of Russian President Vladimir Putin’s pet projects. Politicians from both the opposition and chancellor Merkel’s party, the CDU/CSU, insist that the pipeline project has no future following Navalny’s attack. “The only language that Putin understands is the language of natural gas,” said Norbert Rottgen, chairman of the Bundestag’s influential foreign affairs committee.

Saudi Arabia: Aramco cut pricing for oil to be sold during October, a sign the world’s biggest exporter sees fuel demand wavering amid more coronavirus flare-ups around the globe.

The company also announced the discovery of two oil and gas fields in the northern parts of Saudi Arabia. Gas has started flowing from the Hadabat Al-Hajara field near the Iraqi border at an average daily rate of 16 million standard cubic feet and 1,944 barrels of condensates. The nearby Abraq at-Tulul field has started producing 3,000 b/d of crude, 49 barrels of condensates, and 1.1 million cubic feet of gas.

Aramco said it would drill more wells to evaluate how much energy the fields hold. The crude finds pale compared to the state firm’s existing production of around 8.5 million barrels a day. However, the gas discoveries could help meet Saudi Arabia’s gas targets and supply the west coast, which currently lacks a gas grid.

Saudi Arabia’s net foreign assets rose slightly during July even as crude prices lingering below $50 a barrel kept the financial reserves under pressure. The stockpile grew by $429 million, a rise of around 0.1 percent. Reserves in June had fallen to the lowest level since 2010.

In recent months Saudi Arabia has lost market share in China to the US. In recent months, China has imported record volumes of crude oil, taking advantage of the lowest crude prices in two decades in April to stock up on dirt-cheap oil. In their bargain-hunting, Chinese state oil giants and independent refiners alike snapped up cheap US cargoes in April, which were loaded in May, started to arrive in China in June, and set records in July. At the same time, Chinese oil imports from Saudi Arabia – after hitting all-time highs in May and June thanks to the bargain prices the Saudis offered during the brief price war for market share in March and April–slipped during July.

India: The world’s third-most infected nation now has over 4 million cases of the coronavirus and is likely to become the second most infected this week as it surpasses Brazil. The US is still ahead with 6.2 million cases, but there is considerable doubt about the reliability of the Indian case and death counts. The government collates the number of deaths from positive cases but not from suspected infections. The figure of 69,000 deaths in India is roughly the same as Mexico at 66,000. But infections in Mexico are only at 623,000, compared to India’s 3.5 million.

India’s economy contracted by an annualized 23.9 percent in the quarter ending during June when Prime Minister Modi imposed a draconian coronavirus lockdown. While lockdown hit the economy, it failed to stop the pathogen’s spread among India’s 1.4 billion. The country is detecting more new coronavirus cases than any other – with about 80,000 new infections confirmed every day. The gross domestic product contraction was far deeper than most analysts’ forecasts. It highlighted the severity of India’s initial strategy to contain the Covid-19 pandemic, which involved forcing businesses to shut down overnight and led to an estimated 140 million job losses.

The Indian government’s fiscal response to the crisis was also criticized as failing to hand out enough money to those whose incomes collapsed because of the government restrictions. “This confirms what we have been saying for a long time – India’s lockdown was the harshest and inflicted a huge economic cost,” says Priyanka Kishore, head of India and South East Asia Economics at Oxford Economics. “This GDP data confirms the extent of the cost.”

5. Renewables and new technologies

Last week, a new study published by Nature Communications focused on the potential negative impact of green energy expansion on biodiversity. It included an in-depth look at how the proliferation of mining operations for metals and minerals used in green energy technology will cause loss of habitat for many species.

The study was based on 40 critical materials essential to renewable energy production, which ran the gamut from bulk metals like iron and aluminum to more rare and costly materials like cobalt and lithium to rare earth elements like scandium. Researchers found that between currently operating sites and planned ones, mining influences nearly 20 million square miles of the Earth’s land surface. Eighty-two percent of those mining areas target materials that are used in renewable energy production.

Steel is arguably the most critical resource when it comes to constructing infrastructure. However, steel production is a highly energy-intensive process, and the vast majority of the required energy comes from fossil fuels. Globally, steel is responsible for 7 to 9 percent of all direct emissions from fossil fuels. Most of those emissions come from the burning of coal, which makes up 89 percent of the energy input for blast furnaces and energy constitutes between 20 and 40 percent of the cost of steel production, so the reality for most large producers is that ‘green steel’ is not affordable.

At current electricity prices, “green steel” melted using “green hydrogen” from electricity is thought to be 20-30 percent more expensive than when processed with coal. Efforts are underway, mostly in Europe, to bring down the cost of green hydrogen.

Hybrit, a new joint Swedish venture run by steelmaker SSAB, iron ore producer LKAB, and energy supplier Vattenfall, aims to remove fossil fuels from steelmaking by replacing coal with hydrogen. The project is now starting test operations for the production of fossil-free sponge iron. Product launch in a “big, commercial-scale” is planned for the first quarter of 2026 and will target “the automotive industry and others,” Lindqvist said in an interview.

US utilities are increasingly exploring the use of green hydrogen from wind and solar energy to reduce emissions from power plants and pipelines. The early investments by companies, including NextEra Energy and Dominion Energy, are expected to help commercialize a costly technology that has been slow to develop despite its ability to provide a steady carbon-free power source. Utilities and policymakers are beginning to view the technology as necessary to support ambitious renewable-energy goals.

The Los Angeles Department of Water and Power, the nation’s largest municipal utility, is spearheading a $1.9 billion effort to convert a coal-fired power plant in Utah to run on natural gas and hydrogen produced with excess wind and solar power. The plant, which serves numerous small utilities and electric cooperatives, has long been one of Southern California’s most significant power sources.

The government of Canada and the government of Alberta are each drafting hydrogen strategies to reduce emissions, which, in the case of Alberta, would allow it to cut the carbon intensity of oil sands production and expand it without breaching current caps on provincial emissions. Alberta, the oil-producing province, is preparing a hydrogen strategy to use the so-called blue hydrogen to extract heavy oil at the tar sands.

Solid-state battery cells are seen as a potential game-changer for electric vehicles as they offer high performance and safety at a low cost. Low flammability, higher electrochemical stability, higher potential cathodes, and higher energy density than conventional lithium-ion are crucial features in new-generation electric vehicle batteries. Numerous labs worldwide are working on solid-state batteries for vehicles, but none have announced breakthroughs.

QuantumScape, a 10-year old battery company backed by Volkswagen and Bill Gates, is looking to go public through a $3.3 billion reverse-merger with SPAC Kensington Capital Corp. The San-Jose California based battery company is looking to become an industry-wide supplier of electric vehicle batteries. It has recently partnered with Volkswagen to produce solid-state battery cells.

Thermal Energy Partners, a developer of geothermal energy projects, and Schlumberger New Energy, a new Schlumberger business, agreed to create GeoFrame Energy, a geothermal project development company. GeoFrame Energy will leverage its partners’ expertise to develop efficient and profitable geothermal power generation projects worldwide, providing reliable, renewable energy with both baseload and load-following capabilities.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Mini-LNG plants: According to the World Bank, energy companies around the world flared 250 billion cubic meters of natural gas last year. That is the highest gas flaring rate since 2009, representing billions in lost profits from wasted gas. But there may be a creative solution to this problem: turn the gas into LNG and sell it abroad. (9/2)

Betting on plastics: Oil companies are risking some $400 billion in stranded assets, focusing on petrochemical production growth that relies on a substantial increase in plastics demand. Carbon Tracker says in a new report that the oil industry is pinning its hopes on strong plastics demand growth that will not materialize. Big Oil companies are banking on demand for plastics replacing much of the demand for oil from the transport sector as EVs displace internal combustion engines. (9/5)

Big oil shrinking: A dozen years ago, ExxonMobil was the bluest of blue-chip companies. Raking in record-breaking profit, it spent every quarter of 2008 as the world’s most valuable publicly-traded company. Not anymore. Today’s oil giant’s market value is a third of what it was in 2008 when it was worth over $500 billion. The Dow Jones industrial average removed ExxonMobil, the longest-serving component of the US stock indicator. This is just the latest sign of the decline of oil as a significant driver of the US and global economies. (9/5)

In London, BP plans to sell its headquarters as it cuts jobs and adopts flexible working, The Times reported on Sunday. The oil major, which employs 6,500 office staff in the UK, plans to rent back the building on St. James’s Square from the new owner for as long as two years before leaving for good. (8/31)

Japan’s crude oil imports tumbled to their lowest level during July in more than five decades, a stern reminder to major oil producers that Asia’s third-biggest petroleum consumer may struggle to register any meaningful oil demand recovery during the pandemic. (8/31)

South Korea is on track to restart operations at eight nuclear power plants that were shut for maintenance and start a newly built plant over the next two months to dampen demand for gas-fired power generation and put pressure on LNG imports. (9/2)

Tanker fire off Sri Lanka: The New Diamond — a 20-year old VLCC — was carrying around 260,000 mt of Kuwaiti crude from Mina al Ahmadi to Paradip when it caught fire in the engine room Sept. 2, close to 38 nautical miles off Sri Lanka’s coast. There has been no spillage from the cargo or the bunker tanks so far. Eight ships and tugs are trying to salvage the cargo and prevent an oil spill. (9/4)

Africa is the final frontier for oil and gas. Namibia is likely the onshore undiscovered sweet spot. According to well-known geochemist and wildcat explorer Daniel Jarvie, the small, independent explorer, Reconnaissance Energy Africa, is going after the Kavango Basin source rocks. (9/2)

Venezuela is finding it difficult to secure a vessel to empty an oil tanker at risk of sinking off its coast because of US sanctions. The sanctions are scaring off foreign tankers from potentially taking the 1.1 million barrels of crude out of the Venezuela-flagged Nabarima floating storage unit. (9/4)

In Mexico, there will be no new exploration and production contracts on the table for private or foreign companies under a government plan set to be made public soon. (9/5)

In Alberta, Exxon Mobil Corp.’s Imperial Oil shut down its oil-sands mine after a spill from a pipeline that supplies diluent to the operation, adding to Canada’s woes in its beleaguered energy industry. (9/3)

The US oil rig count rose by 1 to 181 while the natural gas rig count held steady, according to Baker Hughes Inc.

(9/5)

MPG standards save: In one of the first comprehensive assessments of the fuel economy standards in the United States, researchers from Princeton University and the University of Tennessee found that, over their 40-year history, the measures helped reduce reliance on foreign oil producers, cut greenhouse gas emissions, and saved consumers money. (9/5)

Exxon Mobil Corp is assessing possible worldwide job cuts after announcing a voluntary lay-off program in Australia. Exxon is the latest oil major to embark on axing jobs spurred by a historic collapse in fuel demand because of the coronavirus pandemic. The company has slashed capital spending this year by 30%. (9/2)

Speedy enviro reviews: The Trump administration is seeking to fast track environmental reviews of dozens of significant energy and infrastructure projects during the COVID-19 pandemic, including oil and gas drilling, hazardous fuel pipelines, wind farms, and highway projects in multiple states, according to documents provided to The Associated Press. (9/3)

Northern Appalachian coal deliveries to US power plants fell 31 percent during the second quarter from the first quarter, and 49 percent from coal delivered a year earlier, according to the US EIA. (9/1)

Coal closures hurting Trump? President Donald Trump spent more than $1 billion in taxpayer funds, rolled back environmental rules, and tried to stop power plant closings to fulfill a vow he made to West Virginia coal miners in the 2016 campaign. But nothing he’s done is rescuing the coal industry. Since Trump’s inauguration, US coal production—after a slight uptick in 2017—is expected to be down 31 percent this year from 2016 levels. By some estimates, more than five dozen coal-burning power plants have closed. The grim outlook for coal could take a political toll on Trump, whose 2016 victory was propelled by carrying West Virginia and Pennsylvania’s mining strongholds. (9/3)

Illinois nuke dustup: Illinois is up against what one observer calls a “nuclear hostage crisis”: The energy company Exelon says it will close two struggling nuclear power plants unless the state provides subsidies. If this sounds familiar, it’s because something very similar happened in Illinois about five years ago, leading to a 2016 state law that subsidized two other Exelon nuclear plants in the state—a law now tainted by a still-unfolding bribery scandal. (9/4)

Politics and nukes: The world’s largest nuclear power market is ready to gain more government backing for the energy — no matter who wins in November. The newly-released Democratic party platform says it favors a “technology-neutral” approach that includes all zero-carbon technologies, including hydroelectric power, geothermal, existing and advanced nuclear, and carbon capture and storage. (9/2)

Downsizing nukes: Only two reactors are being built in the US, in Georgia, and they are years behind schedule and weighed down by cost overruns and political opposition. But now there’s a race to take nuclear power in a radically different direction. Companies worldwide are developing a new generation of reactors, with some designs that will be more than 90 percent smaller than the hulking facilities that have dominated the industry for decades. One model can even fit into a single-family house. Advocates say small modular reactors, or SMRs as they’re generally called, can be built at factories, delivered by truck or train, and then assembled on-site, saving time and money. Utilities can install just one or bundle several together. NuScale is working on a 60-megawatt reactor design, enough to power 48,000 US homes, and its design just won approval from the Nuclear Regulatory Commission this month. The cylindrical power generator would be about 65 feet tall and 9 feet in diameter. (9/1)

EU ECV sales: In the second quarter of 2020, the market share of electrically-chargeable vehicles (including plug-in hybrids) increased to 7.2 percent of total EU car sales, compared to a 2.4 percent share during the same period last year. Some of that fractional increase is due to the loss of overall vehicles due to the pandemic. (9/4)

Tesla plans to sell additional common stock worth up to US$5 billion and has hired Wall Street’s biggest banks as sales agents, the EV maker said on Tuesday, days after its five-for-one stock split took effect. (9/2)

Chinese e-buses in CA: A California-wide purchasing contract would also allow US transit agencies to leverage California’s purchase power to buy US-built zero-emission BYD battery-electric motor coaches, made by union employees in Lancaster, California. (9/3)

EV calcs: According to a new study from the Eindhoven University of Technology, lifetime carbon emissions of electric cars are much lower than previously suggested. Der Spiegel first reported that the study also aims at previous studies claiming electric vehicles have higher overall emissions than internal-combustion vehicles. (9/4)

Car demand rebounding? The chief executive of Rolls-Royce said demand for his company’s luxury cars is rebounding, helped by sales in Asia, and he is optimistic about the outlook for next year after the coronavirus pandemic hit consumer confidence and closed dealerships. (9/2)

LA’s transit authority, with ridership hovering around 50 percent of pre-pandemic days, is considering a radical change: eliminating bus and rail fares. A new internal task force will study options for a fare-free system, calling the step a “moral obligation” to meet riders’ needs during the pandemic. (9/5)

Anti-solar panels??

While solar panels only work during the day, a new kind of panel could well solve that problem. This new tech is called the anti-solar panel. These panels capture heat that the earth radiates into the atmosphere at night as it cools off and radiates it out in turn. This radiated heat is then used to produce electricity with a thermoelectric generator. Stanford University researchers claim their product produces up to 50 watts per square meter. If the idea advances, it could add to renewable energy: anti-solar panels could be installed at industrial sites and run on the waste heat from industrial processes, producing clean energy and contributing to the much-hyped carbon neutrality of industrial activity. Or they can simply be installed on a rooftop, like regular solar panels, but capable of generating electricity 24/7. (9/4)

Renewable natural gas: Biodigesters use specialized bacteria to convert organic material—for example, cow poop—into biogas, a versatile fuel. Once it’s purified, this biomethane, also known as renewable natural gas (RNG), is chemically identical to the main ingredient in the fossil-based natural gas that comes out of your stove or heats your water. Agricultural waste is the single most significant contributor to the country’s total methane emissions from human activity. Some serious players, such as Virginia-based utility giant Dominion Energy, are interested. (9/1)

In Chile, renewables now make up 44 percent of the mix in a nation no longer dependent on imported energy. Chile is now hoping to add green hydrogen, a clean alternative to fossil fuels that – unlike solar and wind power – can be used at any time of day or night and in any weather conditions. Green hydrogen is made using electricity from renewable energy to electrolyze water, separating the hydrogen and oxygen atoms. McKinsey calculates that global investment in green hydrogen – the electrolyzers and the renewable power plants – should reach roughly $500 bn by 2030. (9/1)

Greener ships: A Japanese consortium led by NYK Line launched a pilot project Sept. 1 to demonstrate a high-powered fuel cell vessel’s operation by 2024 in order to commercialize such ships by the 2030s as part of global efforts to reduce greenhouse gas emissions in the shipping sector. (9/1)

H2 plans to boom: The EU has a highly ambitious plan to install 40 gigawatts of electrolyzers within its borders and support the development of another 40 gigawatts of green hydrogen in nearby countries by 2030 to export to the EU. That is a good 320x the current global installed capacity of 250 MW. But Australia is single-handedly developing a monster 15,000-megawatt project that will generate hydrogen for export, potentially making the world’s driest continent the ‘Saudi Arabia of renewables.’ (8/31)