Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The company [NuScale Power] expected to be the first in the United States to operate a small nuclear reactor is facing setbacks that have caused supporters to question whether the novel technology will ever realize its potential as a tool to combat climate change.”

Josh Siegel, Energy and Environment reporter, Washington Examiner

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices rose for a fourth week in a row as the US Gulf Coast refineries began restarting, though gains were capped as investors shifted their focus from hurricane Laura toward the slowing rebound in consumption. While Laura was one of the most powerful hurricanes ever to hit Louisiana, facilities in southeast Texas avoided the worst of the storm, allowing infrastructure there to start the recovery process immediately.

New York oil futures jumped 1.7 percent to a five-month high on Tuesday as more than 84 percent of oil output from the Gulf of Mexico was shut down, and almost 3 million b/d of refining capacity along the Gulf Coast was closed. WTI closed at $42.97 on Friday for a 1.5 percent weekly gain, and London’s Brent closed Friday at $45.05 up 1.6 percent for the week. Oil prices have been in a narrow range around $40 a barrel since late May.

Natural Gas: Hotter weather has helped lift natural gas prices by nearly 75 percent since late June when they hit their lowest level since 1995. On the back of a scorching June and July, and the ongoing heatwave in August, natural gas has experienced a jump from higher air conditioning use. Prices ended on Friday at a nine-month high of $2.579 per MMBtu.

US energy companies are boosting their LNG production and export capacity despite a drop in exports over the past few months. According to the EIA, US LNG export capacity was three times that of the actual exports last month. Since February, LNG exports have fallen sharply from a record-high of 8 billion cubic per day to just 3.1 bcf.

Cheniere Energy, the biggest US LNG exporter, said earlier this month that it planned to complete the sixth liquefaction train at the Sabine Pass terminal in 2022 rather than 2023. Kinder Morgan is putting the finishing touches to the ninth train at its 10-train Elba Island facility. Pembina is fighting legal challenges in the path of its Jordan Cove LNG project, the first LNG export facility on the West Coast. All this comes despite dozens of canceled cargos and an uncertain outlook for gas demand.

“LNG prices are now far too low for US exporters to make any profit, prompting many to simply shut off,” finance analyst Clark Williams-Derry from the Institute for Energy Economics and Financial Analysis said recently. “It is not so much that the coronavirus crisis is going to last for a long time, it is more than the ‘new normal,’ post-COVID may be one in which the US LNG export dream seems out of reach,” he added.

Shale Oil: A Rystad Energy analysis shows that with WTI climbing past $40 a barrel, most exploration and production firms (E&Ps) have been able to keep their heads above water. However, unless prices strengthen further, about 150 more E&Ps will need to seek Chapter 11 protection during the next two years. According to Haynes & Boone, 32 E&Ps have already filed for Chapter 11 this year, with a cumulative debt of about $40 billion. In the oilfield services sector, 25 companies have filed for Chapter 11. If WTI remains at $40, Rystad Energy estimates 29 more E&P Chapter 11 filings this year, adding another $26 billion of debt at risk.

If WTI continues to hover around $40 over the next two years, we can expect another 68 Chapter 11 filings from E&Ps in 2021, and 57 more in 2022, adding $58 billion and $44 billion of more debt at risk. That would bring the total amount of E&P debt at risk from now until the end of 2022 to $128 billion.

This year, Norway’s Equinor will not drill any more shale wells in the US as it adjusts to a lower-for-longer oil price environment, a spokesperson for the firm said. The company stopped drilling during March in the Bakken and the Marcellus shale plays where it has acreage as it slashed billions in spending in response to the oil price collapse. Now, Equinor will also be cutting jobs in the shale fields, although it has yet to specify how many. “The action that we are taking now is to ensure that our business is profitable in a lower price scenario.”

Prognosis: Oil prices have failed to break out of their narrow trading ranges over the past few weeks despite a flurry of positive news including declining inventories and reports that OPEC+ producers are mostly sticking to their pledged cuts. After a brief, half-hearted rally, oil prices have dropped back to an average trading range in the low-$40s after the Labor Department reported that US weekly jobless claims totaled 1.106 million. This comes just a week after the tally dipped below the 1M mark for the first time since March, thus raising serious doubts about the economic recovery’s sustainability.

Given the uncertainties for the pandemic, climate change, the renewables boom, and oil’s supply glut, a sharp increase in oil prices soon seems problematic.

According to IHS Markit’s latest forecast, post-covid-19 global oil demand growth—on which the future of the oil industry hinges—is expected to taper off. This report joins the growing chorus of pessimistic forecasts looking at the future of global oil demand growth, which has been pushed down due to the lockdowns and much less travel.

Global oil demand is currently sitting at 89 percent of pre-pandemic levels, IHS Markit said. It is expected to rise a bit and level off at between 92 percent and 95 percent of the demand pre-pandemic. Therefore, oil demand growth will plateau through Q1 2021 as fewer people are commuting to work, and as air travel slumps considerably amid remaining travel restrictions and people’s fear of air travel which forces many people together in confined spaces. So far in 2020, global jet fuel demand and gasoline have rebounded from April lows, but global jet fuel demand is still off 50 percent year to date. US gasoline demand is down by a lesser amount, but still significant, at around 20 percent.

2. Geopolitical instability

Iran: One of the critical priorities for Tehran – along with completing all of the phases on its supergiant South Pars natural gas field and expanding its value-added petrochemicals sector – is to increase crude oil production and exports from its West Karoun cluster of giant oil fields. These fields contain at least 67 billion barrels of oil and dramatically increase Iran’s crude oil revenues. With China remaining a willing buyer for all oil that Iran can sell it, Tehran last week announced a swathe of initiatives aimed at completing the production-transportation-export chain for West Karoun oil.

Official data shows that China imported 120,000 b/d of oil from Iran in July. Beijing resumed reporting crude imports from Iran after reporting no such imports for June. According to Chinese customs data, imports of Iranian oil averaged 77,000 b/d between January and July this year, roughly 90% less than the figures China had reported before the US re-imposed sanctions on Iran’s oil industry and exports. In reality, however, various reports, media investigations, and tanker-tracking firms suggest that China is receiving much more oil from Iran than the official figures report.

The Caribbean island state of St. Kitts & Nevis has stripped four oil tankers of its flag after an investigation found that as many as 15 tankers under various flags had manipulated their trackers to skirt the US sanctions on Iran’s oil exports.

Iran held talks with the International Atomic Energy Agency head and will fulfill its commitments under the 2015 nuclear deal but will not accept any additional restrictions beyond those already in place. Iran’s nuclear agency said the fire last month at the Natanz uranium enrichment site was sabotage but has not said who it believes was behind the fire. Some Iranian officials have said the fire might have been the result of cyber sabotage. There were several fires and explosions at power facilities and other sites in the weeks surrounding the incident.

Years of recession, high inflation, and unemployment have all contributed to declining fertility rates. Iranian health authorities warned last month that the population growth rate had dipped below 1 percent for the first time. According to Iranian data, the fertility rate in Iran is 1.7 children per woman, below the 2.1 births per woman needed to ensure the population remains stable. For the Middle East and North Africa as a whole, it was 2.8 births per woman in 2018.

Iraq: The Trump administration urged Iraq to proceed with a project to connect its power grid with Saudi Arabia and other Gulf states that would reduce Baghdad’s longstanding dependency on Iranian energy. The grid-connection was the subject of consultations in recent months and was discussed during Iraqi Prime Minister Mustafa al-Kadhimi’s recent visit to Washington. The countries involved are moving toward making deals which would mark a significant rapprochement between Iraq and former Arab adversaries who clashed in the 1991 Persian Gulf War. Iraqi Finance Minister Ali Allawi said Friday the project was “on the verge of being defined and that Iraq’s electrical grid would probably be tied up to Saudi Arabia and Kuwait.

Iraq is hoping to reach an oil production capacity of 7 million b/d, compared with 5 million b/d currently, to stop flaring gas, and to stop importing fuel from Iran by 2025. OPEC’s second-largest oil producer is also increasing its oil export capacity to 6 million b/d from the current level of around 3.8 million b/d. The country has implemented nearly 80 percent of the projects to reduce gas flaring and imports from Tehran.

Libya: Last week, Libyan strongman General Haftar rejected the ceasefire announced by the UN-backed government of Libya and the east-based rival administration. Haftar dismissed the proposal for truce as a “marketing stunt”. If the ceasefire deal fails, renewed fighting between the factions could push back the reopening of Libya’s oil terminals and resumption of oil exports, which have been closed since January.

Venezuela: Venezuela is struggling with resuming production at its few operating refineries. PDVSA, the state oil firm, has resumed gasoline production at the Cardon refinery by processing naphtha and raising its octane levels. The reformer unit at Cardon—a refinery with a capacity of 310,000 b/d—currently produces around 25,000 b/d of gasoline from naphtha.

President Maduro thanked Iran for helping his country overcome US sanctions on its oil industry. He also floated the idea of purchasing missiles from Tehran. Maduro said he was weighing the purchase of these missiles days after Colombian President Ivan Duque accused him of doing so. “It’s not a bad idea,” Maduro said he’s since asked Defense Minister Padrino to look into “every possibility” of acquiring short-, medium- and long-range missiles from the Islamic Republic. “Venezuela is not prohibited from acquiring weapons,” Maduro said. “If Iran can sell us a bullet or a missile, and we can buy it, we will.”

Turkey-Aegean: The European Union on Friday urged Turkey to halt its “illegal” prospecting activities in the eastern Mediterranean and ordered EU officials to speed up work aimed at blacklisting Turkish officials linked to the energy exploration. Turkish and Greek armed forces have been conducting war games in the area. EU foreign policy chief Joseph Borrell said the sanctions — including asset freezes and a travel ban — could be extended, with Turkish vessels being deprived access to European ports, supplies, and equipment.

The Turkish vessel Oruc Reis has been carrying out seismic research escorted by Turkish warships. Greece, which says the ship is operating over the Greek portion of the continental shelf, sent warships to shadow the Turkish flotilla. Turkey disputes Greece’s claims, insisting that small Greek islands near the Turkish coast should not be considered when delineating maritime boundaries.

President Erdogan said last week that Turkey would make no concessions in the eastern Mediterranean. France announced that it was joining naval exercises alongside Greece, Cyprus, Italy, and Greece in the east Mediterranean amid the increasing tensions. Erdogan warned that Turkey would do “whatever is politically, economically and militarily necessary” to protect its rights.

3. Climate change

China has seen faster temperature increases and sea level rises than the global average over the past few decades and experienced more frequent extreme weather events. From 1951 to 2019, China’s temperature rose an average of 0.24 degrees Celsius every ten years, according to the Blue Book on Climate Change published this week by Beijing’s National Climate Center. The average sea-level rise near China’s coastal regions was 3.4 millimeters per year from 1980 to 2019, faster than the global average of 3.2 millimeters per year from 1993 to 2019. Last year, the level rose 24 millimeters from the previous year and was 72 millimeters higher than the country’s average from 1993 to 2011.

Last year, several significant glaciers and frozen areas in China melted at a faster pace, according to the report. Urumqi Glacier No.1 in northwest China, one of the glaciers most closely watched for the impact of climate change, melted in 2019 at the fastest pace since the 1960s, when data was first available.

The European Union is likely to propose the most ambitious acceleration of its emissions target as it ramps up efforts to slow pollution through its Green Deal. The EU Commission probably will seek to accelerate pollution cuts to 55 percent compared with 1990 levels by the end of the next decade. The current target, approved in 2014, is to lower pollution by 40 percent. The new 2030 target will be added as an amendment to an already proposed law to make the 2050 goal of climate-neutrality binding. To enter into force, it will need approval by the European Parliament and national governments. The plan is likely to fan tensions among the bloc’s member states given the differences in energy sources, wealth, and industrial strength.

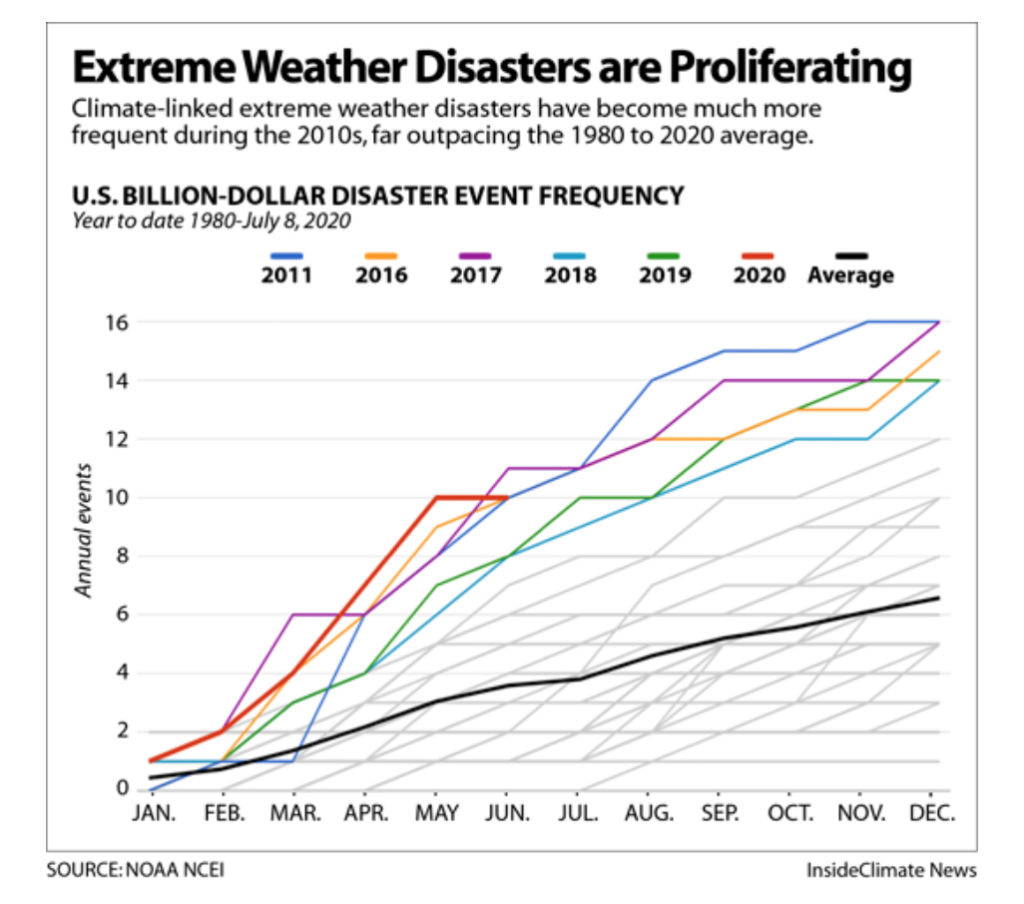

In California and Colorado, the wildfires that exploded over the past few weeks show clear global warming influences, climate scientists say. They may also be the latest examples of climate-driven wildfires worldwide burning not only much hotter and faster, but also exploding into landscapes and seasons in which they were previously rare. According to a new analysis commissioned by the Environmental Defense Fund, the cost of this year’s fires can’t even be guessed. The report details how the financial impacts of fires, tropical storms, floods, droughts, and crop freezes have quadrupled since 1980.

In the last 40 years, 663 disasters linked to climate change in the United States killed 14,223 people. The total cost: an estimated $1.77 trillion. Economic losses in Europe resulting from climate-linked extreme weather from 1980 to 2017 were lower, totaling $537 billion. The difference was the cost of tropical storms, which don’t affect Europe but accounted for nearly half of the US’s total. The $1.77 trillion total cost in the United States included $954.4 billion from 45 tropical storms and hurricanes, by far the costliest extreme weather category. Next came $268.4 billion in costs from 125 hail, wind, ice storms, and blizzards, followed by $252.7 billion from drought, $150.4 billion from flooding, and $85.4 billion from wildfires.

Using tax dollars to move whole communities out of flood zones, an idea long dismissed as radical, is swiftly becoming policy, marking a new and more disruptive impact of climate change. Last week’s one-two punch of Hurricane Laura and Tropical Storm Marco may be extraordinary. Still, the storms are just two of nine to strike Texas and Louisiana since 2017 alone, helping to drive a significant change in how the nation handles floods.

This month, the Federal Emergency Management Agency detailed a new program, costing an initial $500 million, with billions more to come, designed to pay for large-scale relocation nationwide. The Department of Housing and Urban Development has started a similar $16 billion program. That followed a decision by the Army Corps of Engineers to start telling local officials that they must agree to force people out of their homes or forfeit federal money for flood-protection projects. New Jersey has bought and torn down some 700 flood-prone homes around the state and made offers on hundreds more. On the other side of the country, California has told local governments to begin planning to relocate homes away from the coast.

4. The global economy and the coronavirus

United States: US consumers boosted their spending in July, but more slowly than in prior months as new coronavirus infections rose and the expiration of enhanced unemployment checks loomed. “Spending numbers have come back more than the economy as a whole, with the help of a lot of fiscal support,” said Jim O’Sullivan, an economist at TD Securities. “The question from now on is as fiscal support wanes, to what extent will it weaken.”

The surge in unemployment in March and April was supposed to be temporary. Nearly half a year later, many of the jobs that were stuck in purgatory are being lost permanently. About 33 percent of the employees put on furlough in March were laid off for good by July. Only 37 percent have been called back to their previous employer. According to the Labor Department, there were 3.7 million US unemployed who had permanently lost their previous job as of July.

A new wave of layoffs is washing over the US as big companies reassess staffing plans and settle in for an extended period of uncertainty. MGM Resorts International and Stanley Black & Decker told some employees furloughed at the coronavirus pandemic outset that they wouldn’t be put back on the payroll. United is preparing for its biggest pilot furloughs ever after announcing the need to cut 2,850 pilot jobs this year, or about 21 percent of the total. American Airlines said it would cut more than 40,000 jobs, including 19,000 through furloughs and layoffs.

The outlook reflects an acceptance by corporate executives that they will have to contend with the pandemic and its economic fallout for a more extended period than they had hoped. The US economy shrank at an alarming annual rate of 31.7 percent during the April-June quarter. It was the sharpest quarterly drop on record. One of the most successful elements of the government’s response to the coronavirus — protecting people on the margins from falling into poverty — is faltering as the safety net shrinks and federal benefits expire. Now, data show that those protections are eroding as federal inaction deprives Americans of additional financial support.

The Dow Jones Industrial Average’s removal of Exxon Mobil is the latest sign of America’s energy sector’s waning influence. When trading begins this week, the blue-chip benchmark will include only one energy stock, Chevron, representing just 2.1 percent of the price-weighted index.

China: Senior US and Chinese officials said they were committed to carrying out the phase-one trade deal after the two sides discussed the pact. The videoconference brought together US Trade Representative Robert Lighthizer, Treasury Secretary Steven Mnuchin, and Chinese Vice Premier Liu He for a formal review of the trade deal signed in January. A statement published by China’s official Xinhua News Agency said the two sides had “a constructive dialogue on strengthening bilateral coordination of macroeconomic policies and implementing the phase-one trade agreement.”

China is set to buy a record amount of American soybeans this year as lower prices help Beijing boost purchases pledged under the phase-one trade deal. The total buy from the US will probably reach about 40 million tons in 2020. That would be around 25 percent more than in 2017, the baseline year for the trade deal, and roughly 10 percent more than the record set in 2016.

China’s July crude imports from the US surged 524.4 percent from June to a fresh high of 867,000 b/d, propelling America to become China’s fifth-largest supplier last month. The US’ crude oil imports to China were last highest in January 2018 when inflows hit 474,000 b/d. The flow then slowed and dried up for a few months amid the China-US trade tensions. In the second half of 2020, China is expected to receive about 80 million barrels over July-December based at the current buying pace, as Beijing steps up efforts to comply with the Phase 1 trade deal.

However, China will likely pull back on spot purchases of liquefied natural gas before the peak demand season as a flurry of earlier bargain buying nearly maxed out storage space. Seaborne and pipeline deliveries deferred during the worst of the Covid-19 pandemic are expected to arrive, further weakening China’s need for supplies from the open market.

European Union: Coronavirus cases are surging again in Europe after months of relative calm, but the second wave looks different from the first: Fewer people are dying. The newest and mostly younger victims of the pandemic need less medical treatment. Unlike the initial days of the epidemic in the spring, which overwhelmed hospitals, the recent European resurgence has not forced as many people into medical wards.

Leaders are eager to avoid reimposing drastic controls on freedom of movement because they want to allow economies to recover from the deepest recession since World War II. And with almost every European country planning a return to in-person schooling, many starting next week, public health officials are holding their breaths for the impact.

India: The increase in coronavirus cases is unlikely to ebb anytime soon, experts say, as the outbreak spreads to new parts of the country and political leaders continue to reopen the economy. This week, India recorded the highest one-day jump in new cases — more than 77,000 — anywhere in the world since the pandemic began. A biostatistician at the University of Michigan who developed a model to predict India’s outbreak said the country would shortly overtake Brazil, putting it second to the US in total cases.

The virus has now spread throughout the world’s second-most-populous country, reaching even isolated indigenous tribes in far-flung Indian territory. The pandemic has also crippled economic activity — experts believe the economy contracted by 20 percent in the three months to June — with only anemic signs of recovery.

Government officials regularly highlight India’s comparatively low rate of deaths as a percentage of cases to indicate their efforts are working. India has a predominantly youthful population, something that experts say may be helping to hold down deaths. Some also speculate the disease may be less severe here for as-yet unproven reasons, although concerns remain that many fatalities are missing from the official count.

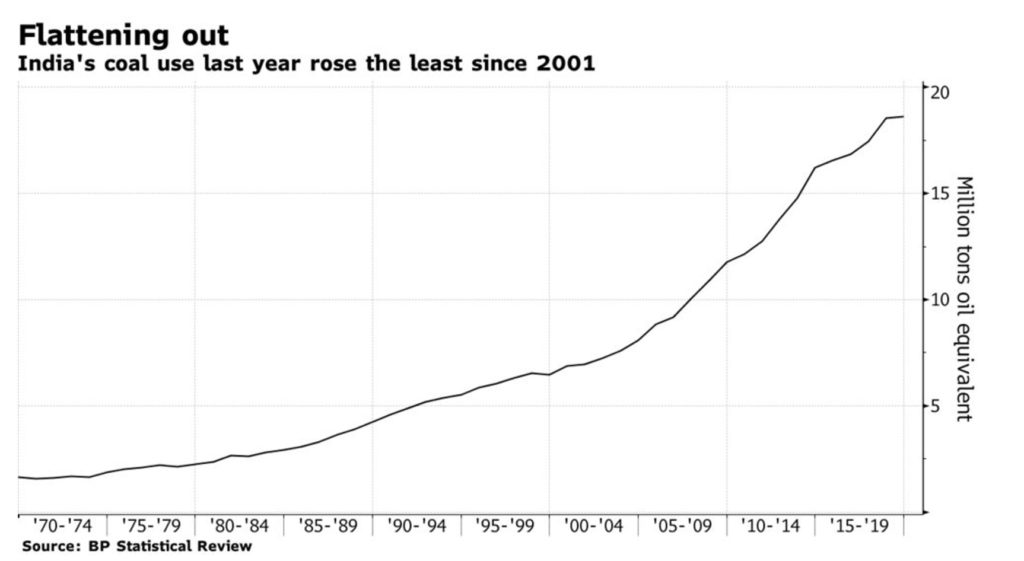

India must stop building coal infrastructure and focus on renewable power generation to aid the global fight against climate change and lift its citizens out of poverty, United Nations Secretary-General Antonio Guterres said. After China, the biggest coal consumer, the nation must invest in a “clean, green transition” as it recovers from the Covid-19 pandemic, Guterres said at an event organized by New Delhi-based environment advocacy group TERI. He said it must also end fossil-fuel subsidies, which are about seven times as high as those for clean energy.

Indian refiners have stopped buying crude oil from Chinese sellers. The move comes from new legislation that aims to restrict imports from China after bilateral relations deteriorated following a border clash that involved fatalities on the Indian side. Earlier this month, Indian refiners stopped chartering Chinese-owned or China-flagged tankers for oil and fuels. Vessels owned or registered by China were prohibited from taking part in tenders for oil tankers that import crude oil into India or export refined petroleum products out of India.

5. Renewables and new technologies

Announcements of plans and projects for hydrogen-based energy appear with ever grander scale and ambition in Europe and Asia. The US is making modest progress and laying the basis for what could soon emerge as a national strategy for hydrogen energy.

The US Department of Energy’s H2@Scale program, a ‘multi-year initiative to fully realize hydrogen’s benefits across the economy,’ is a four-year-old effort that is beginning to show results. During the past year, DOE has channeled more than $100 million in grants to some 50 projects to further the H2@Scale initiative.

Six of these projects are for research and development on fuel cell technology and the manufacturing of heavy-duty fuel cell trucks. There is support for R & D on electrolyzer manufacturing as well as corporate and academic research on high-strength carbon fiber for hydrogen storage tanks. There are two projects to spur demonstrations of large-scale hydrogen utilization at ports and data centers plus theoretical research on the application of hydrogen to produce ‘green steel.’ One project is devoted to a training program for a future hydrogen and fuel cell workforce.

Dozens of scientific projects have tried for decades to make commercial nuclear fusion a reality. None have succeeded. However, in 2021, an ambitious European-funded project in the UK will switch on for the first time in 23 years, and it could be a vital step on the road to fusion. In many ways, this project is a miniature model of the massive ITER tokamak project in France. “Inside a reactor shaped like a giant doughnut, scientists from the Joint European Torus (or JET) project will smash hydrogen atoms together at high speed, releasing a huge amount of energy and heat in the form of plasma. Temperatures will reach a level ten times hotter than the Sun as the plasma swirls around,” the article details. ITER, Wired writes, is relying on the smaller-scale experiments currently underway at JET to fast-track nuclear fusion for commercialization by “[cutting] down the amount of time required to take fusion power out of the lab and into our homes.”

New England for Offshore Wind is a regional coalition that supports offshore power development, which is set to launch later this month. The group will argue that offshore wind is necessary to address growing energy demands, as more fossil-fueled power plants go offline in the coming years.

The federal Bureau of Ocean Energy Management is currently weighing concerns from commercial fishers, environmentalists, coastal communities, and other stakeholders before deciding where leases on the Outer Continental Shelf in the Gulf of Maine might be allocated and where they wouldn’t be allowed. The first offshore wind farm is still six to 10 years from operation.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

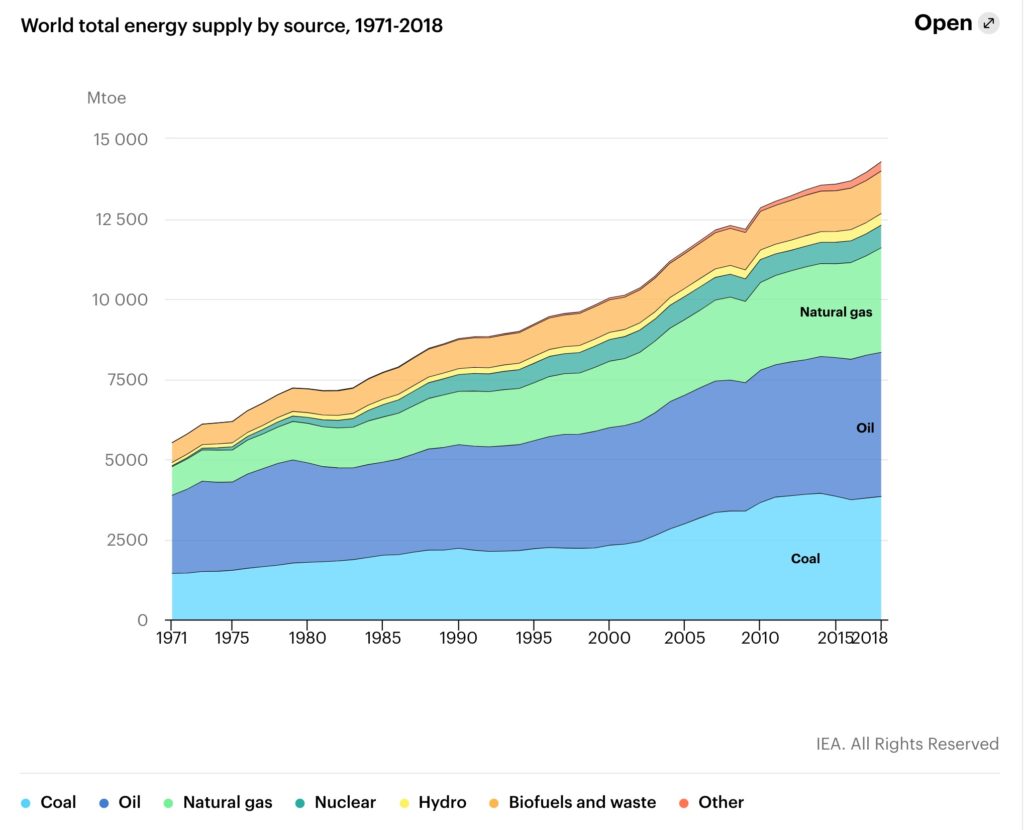

Shifting shares of fossil fuels [see Graphic of the Week]: Coal’s percentage of total energy supply increased between 1973 and 2018, while the share of oil shrunk as the share of energy supply from China surged at the expense of supply in developed economies, the IEA said in its new report Key World Energy Statistics 2020. In 1973, when the total global energy supply was just over half the current supply, coal held a share of 24.5 percent of global energy supply, while oil accounted for the largest percentage at 46.2 percent. In 2018, coal’s share increased to 26.9 percent, while oil’s share of global energy supply dropped to 31.6 percent. The share of natural gas rose from 16 percent in 1973 to 22.8 percent in 2018. (8/28)

Orders for new ships plunged to a 20-year low due to a potent combination of uncertainty over environmental regulations, the economic fallout from the coronavirus pandemic, and a lack of financing. (8/27)

In Syria, ISIS is believed to have been behind a significant attack on energy infrastructure last week that caused a nationwide blackout following an explosion at the Arab Gas Pipeline. (8/29)

Asian plastics: As the age of hydrocarbon enters its final era, the action increasingly moves to Asia, and plastics take center stage. With demand for transport fuels set to tail off in the years ahead, a new breed of processing plants sprouts up across the region. These integrated refineries convert oil into petrochemicals, the building blocks for everything from food packaging to car interiors, and produce fewer fuels like gasoline. (8/27)

Africa is the next great oil frontier, where small-cap companies are staking large-cap claims of the kind that generously reward investors with a bigger risk appetite. This could be the final, underexplored frontier for oil; is there anywhere else to go? (8/25)

In South Sudan’s oil patch, China is losing influence. The newly independent country has said it will allow CNPC’s contract to operate several oilfields to expire. At that point, the state-run Nile Petroleum company will take over operations to keep more revenues. The transition won’t occur until 2027. (8/29)

Mozambique could potentially become a chief LNG supplier to China. However, for this to become a reality, President Nyusi will need to guarantee security to all the companies investing in a region where Islamic State-linked insurgents have lately intensified attacks against security forces and civilians. The government will be charged with the task of not only halting the attacks but also addressing the critical drivers of the insurgency, including unemployment, poverty, and a general lack of economic opportunities. (8/25)

In Mozambique, France’s Total has signed a pact with the government to bolster security for a $20-billion liquefied natural gas (LNG) development the energy group leads in the African country, which has seen renewed militant attacks in recent weeks. Total’s $20 billion Mozambique LNG Project is on track to deliver LNG in 2024. (8/25)

The US oil rig count declined by three to 180 while the gas rig count increased by three to 72, Baker-Hughes reported. The US offshore rig count this past week was 13, down by 50 percent from last year (8/29)

New Jersey’s gasoline tax will rise 22 percent, to 50.7 cents per gallon, to maintain a revenue stream for road and rail projects amid a massive drop in fuel consumption. Diesel will go up 19 percent to 57.7 cents. 8/29)

The so-called “natural gas power burn”—the natural gas consumed by power plants—hit a daily record of 47.2 billion cubic feet (Bcf) on July 27th this year. Before that date, the previous daily record for natural gas power burn in the US was set on August 6th, 2019, when power plants consumed 45.4 Bcf. This year, natural gas power burn exceeded 45.4 Bcf per day on seven days in July 2020 and August. EIA attributed the records to the heatwave, lower gas prices than the summer of 2019, and growing natural gas-fired capacity across the country. (8/27)

US coal-fired power generation totaled 65.5 TWh in June, up 40.8 percent from May, EIA data showed. It was the highest level of coal-fired generation since December 2019, and it produced 18.6 percent of total US power generation in July, the highest level since January. Year on year, generation declined 16.7 percent. (8/26)

Coal slide continues: Illinois Basin second-quarter deliveries to coal-fired power plants are down 36 percent from the year-ago quarter, EIA data showed August 27th. (8/29) According to EIA estimates, in the US a total of 103 coal-fired power plants have been converted to natural gas or replaced by wild gas-fired plants since 2011. (8/28)

A nuclear energy venture founded by Bill Gates said Thursday it hopes to build small advanced atomic power stations that can store electricity to supplement grids increasingly supplied by intermittent sources like solar and wind power. The effort is part of the billionaire philanthropist’s push to help fight climate change. It is targeted at assisting utilities to slash their emissions of planet-warming gases without undermining grid reliability. (8/28)

French nuclear operator EDF extended a low river level warning on the Rhone River in southern France through the coming weekend as output across the reactor fleet fell below 30 GW overnight. Production restrictions were likely to affect one 1.3 GW reactor at the Saint Alban nuclear plant on August 29th and August 30th due to low flow forecasts on the Rhone river. (8/26)

Benchmark UK offshore wind load factors are seen rising to 57 percent in 2030 and 63 percent in 2040 by the Department of Business, Energy, and Industrial Strategy. The UK has a target of 40 GW of offshore wind capacity by 2030, which, using BEIS’s current assumed offshore load factor of 47.3%, would generate 166 TWh/year. (8/26)

India will propose a World Solar Bank at the World Solar Technology Summit organized in September. The likely capital size of the World Solar Bank would be US $10 billion. ISA officials said the country that would request to host the bank’s headquarters would have to contribute 30 percent of the proposed capital. (8/28)

India’s battery hope: A team of researchers in India has introduced an eco-friendly and energy-efficient battery that is being touted as “the future” of batteries — not only for the automobile world but for drones and other tech gadgets, too. Researchers claim the new batteries are three times more energy-efficient and cost-effective than currently used Li-S batteries. (8/29)

Germany’s battery hope: Researchers at Germany’s Karlsruhe Institute of Technology have developed an environmentally friendly process to extract lithium from the salty thermal water reservoirs located in the Upper Rhine Trench. The German scientists want to recover the white metal using minimally invasive techniques. The mechanism they have come up with consists of filtering out lithium ions from the thermal water and then further concentrating them until lithium can be precipitated as a salt. (8/25)

Elon Musk hinted on Monday that Tesla might be able to mass-produce EV batteries with 50 percent more energy density within three to four years. Although Musk’s track record for bold statements has been suspect, the market is all abuzz. The battery, Musk suggests, might be used to power an electric airplane. (8/27)

CA’s battery boost: the world’s most powerful lithium-ion battery (250 MW) was unveiled outside San Diego, showcasing a technology that could cut the risk of blackouts and aid the state’s climate goals. LS Power’s Gateway battery has far more wattage than the Tesla built Hornsdale Power Reserve (100 MW) in Australia, the previous record holder. Yet Gateway will soon be surpassed by even bigger projects in California. Batteries could help the state reach zero-carbon energy targets that were called into question over the past two weeks as furious demand for air-conditioning forced grid managers to make brief power cuts. (8/26)

E-ships: Making large ships electric faces the same problem as the main challenge for electric cars: range. The solution to the challenge has been relatively simple: bigger batteries. According to a recent report by market research firm IDTechEx, electric ships feature the biggest batteries out there. They are only going to get bigger because range remains a top priority. Japan’s e5 project should be completed in early 2022 and, according to IDTechEx, will have a battery of 4,000 kWh and a range of 80 miles. (8/28)

Hydrogen in WA: The Douglas County Public Utility District, in East Wenatchee, Washington, is purchasing a 5-MW Proton Exchange Membrane electrolyzer built by Cummins that it hopes to have operational by late fall or early next year. The electrolyzer will produce hydrogen using excess hydropower. (8/29)

Hydrogen in Denmark: Siemens Gamesa Renewable Energy plans to start a pilot project in Denmark to test how one of its 3-megawatt wind machines could power production of hydrogen fuel seen as key to reducing carbon emissions from transportation and heavy industries. The test project will include a 3-megawatt wind turbine that will power a small 400-kilowatt electrolyzer, a machine that separates the hydrogen atoms in water from oxygen atoms. (8/29)

Hydrogen planes? Paul Eremenko, a 41-old former chief technology officer for Airbus SE and United Technologies Corp., thinks he has a solution—hydrogen-powered airplanes—to concerns about the aviation industry’s immense carbon emissions. (Air travel accounts for roughly 2.5 percent of global greenhouse gas emissions.) He well understands, of course, that his idea conjures up visions of the flaming Hindenburg airship. (8/27)

Climate divestment: Storebrand Asset Management, a unit of Storebrand ASA with around $91 billion under management, said Monday it sold off more than $47 million in 21 companies and excluded another six from future investments. Storebrand’s decision comes as more investors in Europe and abroad have called for polluting companies to align their lobbying and businesses with the Paris Agreement on climate change, with some threatening to divest. Under its new policy, Storebrand said it would no longer invest in companies that earn more than 5 percent of revenue from coal or oil sands or that lobby against the Paris Agreement, among other criteria. (8/25)