Editors: Tom Whipple, Steve Andrews

Quote of the Week

[defaulting on cost of abandoned oil and gas wells in US] “Colorado oil and gas companies can post a bond of $60,000 to cover up to 100 wells, or $100,000 to cover any total of wells over 100. It isn’t hard to understand the massive underfunding of cleanup responsibilities when the cost to bond for over 100 wells is less than the known cost to cap and abandon one well.”

Justin Mikulka,DeSmog blog

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices finished lower last week in anticipation of a surge in Libya’s crude supply and concerns about rising coronavirus cases in the US and Europe. Crude prices sank after Libya’s National Oil Corp said it lifted force majeure on exports from key ports and output would reach 1 million b/d in four weeks. In New York, futures settled at $39.85 a barrel, and Brent crude settled at $41.77. For the week, US crude futures lost 2.5 percent, and Brent dropped 2.7 percent.

US gasoline demand is weakening, prompting refineries to cut crude processing — a sign that resurging coronavirus cases are slowing the need for fuel. According to last week’s petroleum inventory report from the EIA, gasoline stocks in the US increased by 1.9 million barrels for the week to October 16th. Gasoline production averaged 8.9 million b/d, compared with 9.2 million b/d a week earlier. The gasoline supply in the US has now declined to 9 percent below the previous five-year average, compared to 4 percent below the five-year average at the beginning of October.

A Rystad Energy analysis of oil production costs concludes that the average break-even price has dropped to around $50 per barrel, down around 10 percent over the last two years and 35 percent since 2014. This means that oil is much cheaper to produce now compared to six years ago. with the cost savings winner being new offshore deepwater projects.

“The implication of falling break-even prices is that the upstream industry, over the last two years, has become more competitive than ever and can supply more oil at a lower price. However, the average break-even prices for most of the sources remain higher than the current oil price. This is a clear indication that for investments to rebound, oil prices must recover from their current values,” says Espen Erlingsen, Head of Upstream Research at Rystad Energy.

In 2014, Rystad Energy estimated the average break-even price for tight oil to be $82 per barrel and the potential supply in 2025 at 12 million b/d. Since then, the break-even price has come down, and Rystad reports the potential supply has increased for tight oil. In 2018, Rystad estimated an average break-even price of $47 per barrel and a potential supply of 22 million b/d. Rystad now estimates that tight oil can potentially supply around 18 million b/d of liquids in 2025—a hard-to-believe number. This drop in potential is due to the sharp reduction in tight oil output during the first half of this year.

Natural Gas: The Henry Hub 2021 forward curve is trading at its highest in more than four years as supply-demand fundamentals in the US natural gas market continue to tighten. On October 22nd, the curve settled at an average of $3.09 per million BTUs. The 2021 gas market’s bullish outlook comes as many traders continue to anticipate US production headwinds, as production remains sharply below its pre-pandemic highs. In October, production has averaged just 86.7 billion cf/d – off nearly 9 percent from its November 2019 record-high average at 95 billion cf/d.

This year, commodity-market volatility prompted many producers to cut drilling budgets and rig counts and even curtail production temporarily. While some producers are bringing rigs back in the Permian and other select basins, the recent uptick in activity doesn’t appear likely to restore output quickly to its previous growth. On October 21st, the weekly US rig count was estimated at 347, up from a 15-year low at 279 in July. Earlier this year, the rig count had totaled over 840. For the upcoming heating season, Platts Analytics forecasts US production to see minimal growth, rising to about 87.5 billion cf/d from November to March – more than 6 billion cf/d below its winter 2019-20 level.

One of France’s biggest energy companies delayed a decision on a $7 billion deal to import liquefied natural gas from the US after pressure from the government in Paris to seek cleaner supplies of the fuel. Engie SA said it had postponed work on a contract to take LNG from NextDecade Corp.’s operation, which is fed by shale gas fields using the controversial fracking technology.

OPEC: As OPEC+ mulls over whether to ease their collective production cut at the end of the year, a very interested Trump administration is watching closely. The OPEC+ pact, agreed upon in April during the worst of the pandemic market meltdown, saw the 23-country alliance rein in nearly 10 percent of global crude supply and was critical in clawing back US oil prices from negative territory to about $40/b now.

But the original reductions, already decreased in August from 9.7 million b/d to 7.8 million b/d, are scheduled to roll back further to 5.8 million b/d starting in January. The second wave of coronavirus infections weighing on the oil market’s outlook, the additional barrels from the quota easing, along with a ramp-up in output from Libya, threaten to undo the price recovery and re-hit already impaired producers around the world.

Many OPEC+ ministers appear open to keeping the current cuts in place, though no final decision has been made, and not all members are convinced that the January increase in production should be rescinded. The alliance will meet Nov. 30th -Dec. 1st to make its decision.

The OPEC+ member countries are on the brink of a financial crisis if the IMF’s latest assessments are accurate. The IMF presents a very bleak outlook for an economic recovery in the Middle East and Central Asia, predicting a 4.1 percent contraction for the region. This bearish outlook’s main driving factor is the IMF’s forecast that oil prices will remain in the $40 to $50 range in 2021.

Shale Oil: Fracking has emerged as a hot button issue of the 2020 election. President Trump is claiming his political rival will cripple the economy in politically important states such as Pennsylvania and Texas by putting an end to fracking despite Biden’s assertions to the contrary. There’s a good reason it’s getting so much attention: hydraulic fracturing is used for roughly 95 percent of new US wells, according to government data.

While Biden has called for prohibiting new oil and gas projects on federal land, the candidate has made it clear he does not support a widespread ban on fracking. Even if Biden wanted to, he couldn’t unilaterally ban fracking on private lands. Under a 2005 law, the Environmental Protection Agency has almost no regulatory power over fracking. Changing that reality would require an act of Congress.

The issue is more complicated, however. It is becoming apparent that the profitable “sweet spots” in the older shale oil basins have already been drilled. The only place in the US where undrilled and potentially profitable shale land is still available is in the New Mexico portion of the Permian Basin — and much of this is federal property. Drillers in the Permian are already rushing to get drilling permits in New Mexico in case a Biden administration should be in charge of federal drilling permits next year.

The associated debt from North American oil and gas bankruptcies in 2020 has already reached an all-time high. Rystad Energy concluded this in a statement, adding that this associated debt is set to grow even further this year, “as the wave of Chapter 11 filings continues.” Rystad Energy says the combined count of Chapter 11 filings from exploration and production firms and oilfield service companies this year in North America has so far reached 84, which is lower than the historical high of 142 in 2016. However, the company added that the associated debt these companies are carrying is “much higher,” at $89 billion so far, which is believed to be $19 billion more than in 2016.

With oil prices around $40 a barrel, Rystad Energy projects that more bankruptcies will follow this year and push the cumulative associated debt to over $100 billion. In terms of the absolute number of Chapter 11 cases, though, it is unlikely that we will ever see a repeat of the number of bankruptcies in 2016.

ConocoPhillips agreed to buy Concho Resources for about $9.7 billion in stock, the largest shale industry deal since the collapse in energy demand earlier this year. The pandemic-induced price crash and lackluster global economic recovery have accelerated the push for consolidation across the shale patch, which is under severe financial strain after years of debt-fueled growth. Conoco and Concho in combination will be one of the dominant operators in the Permian Basin of West Texas and New Mexico, rivaling Occidental and Chevron.

Prognosis: President Trump has had an extraordinary impact on the global oil market. From crippling the oil exports of Iran and Venezuela to taking credit for brokering the biggest-ever voluntary production cuts, Trump’s fingerprints are all over. Things will carry on pretty much as they are if Trump retains his place in the White House. There are no new energy initiatives on his campaign website, and the achievements listed on his energy and climate page consist mostly of reversing his predecessor’s actions.

If Joe Biden wins, government policies will change for domestic energy companies. The Democratic candidate’s climate plan includes the following:

- Requiring aggressive methane pollution limits for new and existing oil and gas operations

- Permanently protecting the Arctic National Wildlife Refuge and other areas

- Banning new oil and gas permitting on public lands and waters

- Modifying royalties to account for climate costs

A lot of what happens in the next four years depends on who controls the Congress. If the Democrats should have control of the Senate, House and the White House, then there is likely to be a flurry of legislation and policies that will send US energy policy off in new directions.

2. Geopolitical instability

Iran: The Trump administration plans to issue new pre-election sanctions against Iran to fortify its pressure campaign against any future effort to unwind it by a Biden administration. Trump administration officials fear Biden’s plan to reengage with Iran could upend the diplomatic leverage they believe is critical to strong-arm Tehran into signing a new nuclear and security deal. The administration has levied sanctions under counterterrorism authorization and plans to impose more. Analysts say counterterrorism sanctions are potentially tricky to undo.

Iranian tankers are hiding in Iraqi waters to do their ship-to-ship transfers of crude oil to avoid US sanctions. The Iraqi port of Al Faw is one regularly used for Iranian tankers to offload the crude to other vessels where it is mixed with oil from other sources. Ship-to-ship transfers, not just off the Iraqi coast but elsewhere too, have become Iran’s favorite method of getting its crude oil to foreign buyers amid the sanctions. Tehran is still exporting over 800,000 b/d.

Following the end of the 13-year UN embargo on Iran buying or selling weapons last week, the military component of the 25-year deal between China and Iran was revealed. Included in the agreement may be North Korean weaponry and technology in exchange for oil. This could include Hwasong-12 mobile ballistic missiles, with a range of 4,500 kilometers, and rocket engines suitable for intercontinental ballistic missiles (ICBMs) or satellite launch vehicles.

Tehran has decided to use local firms to develop a large offshore natural gas field discovered by an Indian company and set to be developed by a group of Indian firms. Iran and India have been negotiating the terms of the field’s development since 2008, when the field was discovered. Three years ago, the Indian consortium led by ONGC Videsh offered Iran $11 billion in investments into the field on the condition that Iran guaranteed an 18 percent return.

In 2017 Tehran signed an initial agreement for Farzad-B with Russia’s Gazprom. The news, announced by Oil Minister Bijan Zanganeh, came on the back of earlier remarks that Russian energy companies may take the place of Indian sector players in Iran’s oil and gas fields. However, after three more years of stalled development talks, complicated by the US sanctions, it now looks like Iran has decided to replace the Indian consortium with domestic companies.

Iraq: The Oil Ministry has ordered more than 250,000 b/d in production hikes this month, according to officials at eight fields that have received instructions to raise output. The new increases reverse a recent set of cuts that brought Iraq’s September production down by 200,000 b/d to its lowest monthly average in five years, as the ministry sought to compensate for previously exceeding its OPEC quota.

The semi-autonomous Kurdistan region has agreed to reduce its crude oil production as part of the ongoing OPEC+ agreement. The regional government’s statement came after Iraq’s Oil Minister Jabbar said earlier last week that “the Kurdistan Region has not contributed to OPEC+ cuts.” The Kurds replied that it would trim its output in line with OPEC+ cuts provided the federal government pays the dues to Erbil.

Iraq expects global oil demand to grow at 3 percent a year in 2023 and does not plan to cancel projects due to the current slowdown. OPEC has forecast a “catching up” by the sectors most affected by COVID-19 lockdown restrictions to help a rebound in oil demand back to previous volumes by about 2022. However, other organizations, most notably BP, have more bearish views for an oil demand recovery.

Libya: The warring factions signed an agreement on a permanent ceasefire after five days of talks. The National Oil Company says Libya’s crude oil production could accelerate beyond 700,000 b/d by the end of the year.

The deal between military leaders from Libya’s Tripoli government, and those from opposition forces led by General Haftar, was brokered by the UN. AFP quotes the UN’s envoy as saying the ceasefire will allow displaced people and refugees inside and outside the country to return to their homes. Explaining the terms of the deal, she said all parties agreed that “all military units and armed groups on the front lines shall return to their camps.” This will be “accompanied by the departure of all mercenaries and foreign fighters from all Libyan territory, land, air, and sea within a maximum period of three months from today.”

On-and-off blockades have plagued Libya’s oil industry as rival factions have been fighting for control over areas in Libya and its oil terminals and ports since the toppling of Muammar Gaddafi in 2011. The most recent blockade in Libya, between January and the middle of September, has cost Libya almost US$10 billion. Over the past few years they have cost the country a total of US$130 billion in lost revenues, Finance Minister Faraj Boumtari told Al-Jazeera on Thursday.

Venezuela: Crude inventories have surged 84 percent over the last three weeks as the threat of US sanctions wards away buyers of the nation’s most important commodity. The increase raises the risk that state-run PDVSA will have to start shutting in production again. The port of Jose, the main gateway of the country’s oil exports, has been empty for a week as importers of Venezuelan crude, including India’s Reliance Industries, Spain’s Repsol, and Italy’s Eni, skipped oil purchases this month. Last month the three companies took a combined 9.7 million barrels, accounting for more than half of September’s exports.

The government is approaching some of the nation’s creditors in a bid to lay the groundwork for a debt deal should sanctions ease after next month’s US election. The new discussions reflect an attempt to avoid lawsuits from creditors demanding to be reimbursed for missed payments, coupled with the hope that a potential Joe Biden administration would reassess the US sanctions. A debt restructuring isn’t practical so long as some of the nation’s top creditors — based in the US — are left out of the talks due to sanctions.

The floating storage and offloading vessel Nabarima is in danger of sinking off the Venezuelan coast with more than 1 million barrels of crude. PDVSA does not have the equipment necessary to perform a complicated operation to transfer the cargo to another ship. The Venezuelan ship, whose cargo of Corocoro and Pedernales crudes has not found a market, has been anchored in northeastern Venezuela waters since January 2019. PDVSA has not been able to maintain the vessel properly.

Nigeria: Nationwide protests continued last week. Nigeria’s chief of police has ordered all police resources’ immediate mobilization to combat days of street violence and looting. The protests, which began on Oct 5th, spread to half of the country’s 36 states after a violent crackdown by security forces sparked international condemnation.

President Buhari dissolved the SARS police unit – accused of harassment, extortion, torture, and extra-judicial killings – but the protests continued, demanding broader reforms in how Nigeria is governed. They escalated after unarmed protesters were shot in the nation’s biggest city, Lagos, on Tuesday.

In recent days, Lagos has seen widespread looting of shops, malls, and warehouses, with the businesses of prominent politicians targeted. Many buildings have been torched, and prisons attacked. Elsewhere on Saturday, there were reports of hundreds of people looting government warehouses in Bukuru.

Although the clashes have yet to disrupt oil production, Nigerian oil officials said if the government did not move faster to ease the rising tensions, they could escalate in the restive Niger Delta region. “To us in the industry, it is a matter of time before oil operations are disrupted if the situation remains unchecked and allowed to escalate,” an oil official said. Nigeria’s oil production plummeted to a 30-year low of around 1.4 million b/d in mid-2016 due to devastating militant attacks on Niger Delta’s oil installations. It has since rebounded to circa 2 million b/d.

Nagorno-Karabakh: Armenia and Azerbaijan announced last Tuesday their foreign ministers would meet US Secretary of State Pompeo in Washington on Friday to end the fighting, which has killed hundreds of people since Sept 27th. Russia has sponsored mediation efforts, but two ceasefires brokered by Moscow this month have not stopped the fighting. The two ex-Soviet republics said there was intense fighting in and around Nagorno-Karabakh last week, with the enclave reporting 43 more of its defense personnel had been killed.

The violence has raised fears that regional powers Turkey and Russia could be sucked into a wider conflict, plus heightened concern about the security of pipelines in Azerbaijan that carry natural gas and oil to world markets.

3. Climate change

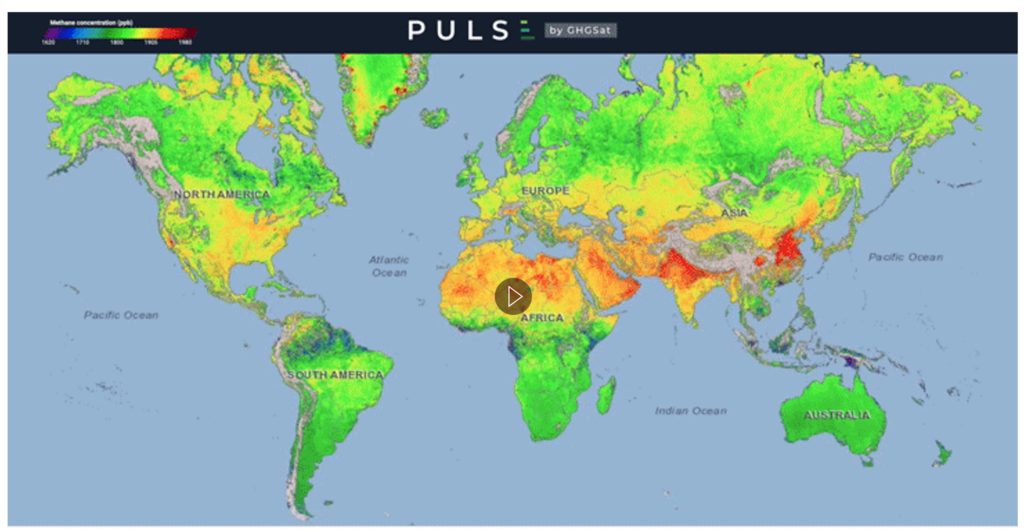

A recent report by data analytics company Kayrros revealed that global methane emissions grew by as much as 32 percent over the first eight months of 2020 compared with the same period a year ago. These emissions resulted from an increase in methane leaks, whose source is almost invariably the oil and gas extraction and transportation industry.

Many companies in Europe and the US are taking methane emissions seriously, setting themselves methane leak monitoring targets, and working to reduce these leaks. However, one significant factor in controlling methane leaks is that these pledges are only made for projects where they are operators. Many other projects are called non-operated assets—or joint ventures—where large oil and gas companies with ambitious emission targets don’t have the final say.

For an average of 40 percent of an oil major’s projects, another company is deciding on emission reduction. The decision-makers are often national oil companies (NOCs) that answer governments which may have little interest in limiting methane emission. According to the Kayrros report, methane emissions are exceptionally high in Russia, Algeria, and Turkmenistan, where national oil companies are the leading operators. NOCs operate nearly 51 percent of global gas and are the stewards of approximately 60 percent of the world’s gas reserves.

Global methane concentrations from June through October.

The map identifies the concentration of methane across the troposphere, where naturally occurring emissions such as from wetlands mingle with those caused by human activity. Mountains can be seen trapping methane, such as in Southern California near the Sierra Nevada range or South Asia below the Himalayas. Methane is more than 80 times more potent than carbon dioxide, although its greenhouse impact fades much faster.

GHGSat claims its satellite offers the highest-resolution methane data publicly available. In the next year, GHGSat plans to release additional data that will quantify emissions. That will make it clear how much methane is released by drilling in the Permian Basin every week.

Satellite data will ultimately transform the way nations are held accountable for voluntary commitments under the Paris Agreement. “Very soon nobody is going to be able to hide from methane leakage,” former BP CEO Bob Dudley predicted in 2018.

According to Zhao Yingmin, Vice Minister of Ecology and Environment, efforts to reduce air pollution levels across China over the last five years have fallen short of expectations. China is the world’s biggest emitter of carbon dioxide and at the same time it is also the biggest investor in renewable energy projects. The country’s emissions are still on the rise, and they will only peak in 2030, under current decarbonization plans. Europe has asked China to try and accelerate the decarbonization push, moving peak emissions to 2025.

A Bloomberg analysis of political donations shows that the biggest US companies—even those with ambitious green agendas—are throwing their support behind lawmakers who routinely stall climate legislation. The political contributions by businesses in the S&P 100 and the US-based members of the Climate Action 100 represent the world’s largest corporate contributors to climate change.

For every dollar these corporations gave to one of the most climate-friendly Congress members during this election cycle, they gave $1.84—nearly twice as much—to an ardent obstructionist of proactive climate policy. This pattern of giving more to candidates who do less for the climate comes as polls show voters are more concerned about climate change than ever before, and it stands in contrast to the bold claims many of these companies make about themselves and their products.

4. The global economy and the coronavirus

United States: The number of people hospitalized with the coronavirus in the US rose 40 percent in the past month. The 85,000 new cases reported on Friday surpassed the record of 76,000 set in July. Since the start of October, the rise in cases has been steady with no plateau in sight. Some 41,000 people are now hospitalized across the country, including many in the Midwest and the Mountain states. While the nation has seen more people hospitalized at earlier points in the pandemic, patients are now spread out much more broadly, raising concern for critically ill patients in rural areas with limited medical resources.

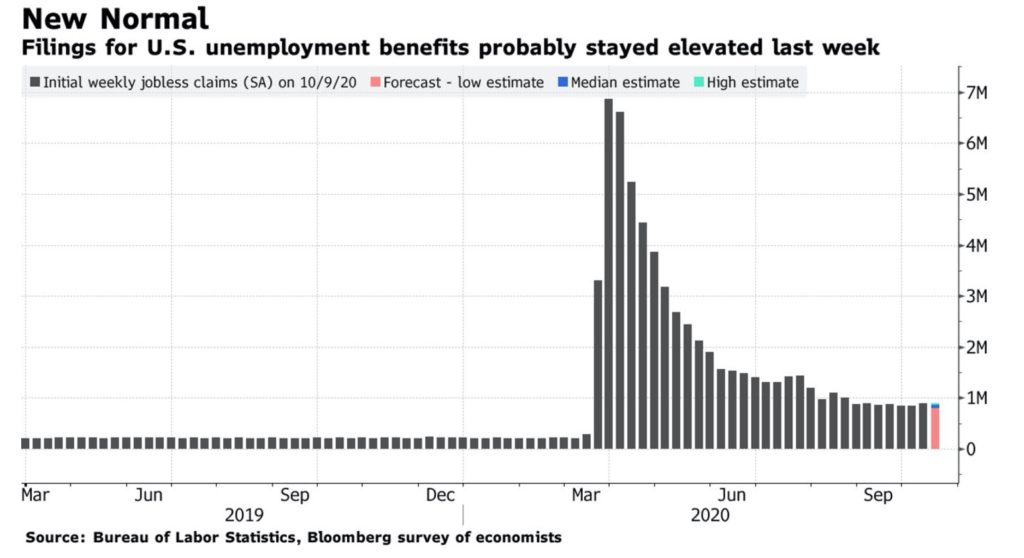

The number of laid-off Americans seeking unemployment benefits fell last week to 787,000, a sign that job losses may have eased slightly but are still running at historically high levels. With the need for more shutdowns growing, the unemployment numbers are likely to continue to grow.

China: Recovery from the coronavirus pandemic continued in the third quarter and showed signs of broadening in September as consumer spending accelerated. Gross domestic product expanded 4.9 percent in the third quarter with both retail sales and industrial production gaining momentum in September. The numbers show China’s early and aggressive containment of the coronavirus has set the economy up for a faster rebound than any of its peers.

While industrial sectors are still leading the recovery, consumers have finally started to catch up. Retail sales growth accelerated to 3.3 percent in. An unexpected surge in vehicle sales helped, but even excluding that, retail sales were up 2.4 percent from a year ago.

China’s top policy makers meet this week to discuss the country’s future economic blueprint, offering clues on how the leadership plans to pivot the economy to be more self-sufficient. The four-day meeting of the Communist Party’s Central Committee will take place behind closed doors from Monday in Beijing and will focus on China’s 14th five-year plan that runs from 2021 through 2025. The plan won’t be made public before being formally approved by China’s legislature in March. However, some of the details may emerge via state media once the plenum ends. The central issue will be how China can draw on domestic sources to sustain its growth.

Beijing will continue to have a significant impact on the oil market in the coming months, as most of the rest of the world continues to battle a second wave of coronavirus. China is likely importing now the last of the cheap crude its refiners snapped up in the spring when it took advantage of the lowest crude oil prices in nearly two decades. With the last of the delayed cargoes likely to discharge and clear customs in October, the market now looks with apprehension at signs about China’s oil-importing policies for the rest of the year.

China is expected to continue buying grains at a faster-than-expected pace in the coming months as the country looks to meet its internal demand and ensure stable domestic reserves. The increasing reliance on imports come in the midst of growing concerns around shortage of supply, rising domestic prices and fear of pandemic-induced logistical challenges, analysts said.

European Union: Governments across the continent are warning of an alarming rise in the number of coronavirus infections. A second wave, which threatens to overwhelm hospitals, will sharply increase the death toll in the weeks ahead. Europe faces a lengthy battle against the coronavirus at least until mid-2021. Anxious governments are introducing ever more restrictions to curb the disease.

Europe’s daily infections have more than doubled during the last 10 days, reaching a total of 7.8 million cases and about 247,000 deaths, as a second wave has crushed economic revival hopes. France passed 1 million cases on Friday with a new record daily total of more than 42,000. The resurgence of the coronavirus has dragged France’s economy back into a slump, cutting short the recovery from the lockdown recession. IHS Markit’s monthly survey of business activity dropped more than economists forecast in October, falling to a five-month low of 47.3 from 48.5.

Britain’s economic recovery has lost momentum this month as a resurgence of the coronavirus pandemic hit businesses in the hospitality and transport sectors, a survey showed on Friday. An early “flash” reading of the IHS Markit UK Composite Purchasing Managers’ Index, a gauge of private sector growth, fell to a four-month low of 52.9 in October from 56.5 in September.

With or without a deal, Britain will leave the EU’s customs union and single market for goods and services and will no longer have unfettered access to its biggest trading partner.

The two sides are hoping to agree on a free trade deal with no tariffs and no quotas. Even if that happens, the British government says businesses must prepare for new paperwork such as customs declarations, and “short-term disruption” to cross-Channel trade. It is building vast parking lots and customs clearance depots near ports and says a “reasonable worst-case scenario” could see backlogs of 7,000 trucks waiting to enter the EU.

A no-deal exit would be far more disruptive, bringing the instant imposition of tariffs on many goods at levels set by the World Trade Organization — including a 10% tax on cars and more than 30% on dairy products. Whole sectors of the British economy could be ruined, prices would rise and there could be temporary shortages of some goods.

Russia: The outbreak in Russia this month is breaking the records set in the spring, when a lockdown to slow the spread of the virus was put in place. However, the authorities in Russia are resisting shutting down businesses again. Some regions have closed nightclubs or limited the hours of bars and restaurants, but few measures have been implemented in Moscow, which is once again the epicenter of the surge. On Friday, Russian authorities reported over 15,000 new infections, the highest daily spike so far in the pandemic. Moscow — with less than 10 percent of the population — accounts for up to 30 percent of new infections each day. The health minister says 90 percent of hospital beds for coronavirus patients have been filled. Three times this week, Russia’s daily death toll exceeded the spring record of 232.

Even these soaring virus tolls are likely undercounts; experts have cautioned that official figures around the world understate the true toll, but critics have taken particular issue with Russia’s death tolls, alleging authorities might be playing down the scale of the outbreak. The spring lockdown hurt the country’s already weakened economy and compounded Russians’ frustration with plummeting incomes and worsening living conditions, driving Putin’s approval rating to a historic low of 59% in April, according to the Levada Center, Russia’s top independent pollster.

The US is broadening the sanctions against service providers and those funding vessels involved in the construction of Nord Stream 2 in a fresh attempt to prevent the Russia-led gas pipeline project from being completed. The sanctions are a follow-up to US sanctions on the Nord Stream 2 project from December 2019, which resulted in Western vessel and technology providers pulling out of the project. Now the US is sanctioning companies “providing services or facilities for upgrades or installation of equipment for those vessels, or funding for upgrades or installation of equipment for those vessels,” according to the latest guidance.

Middle East: The coronavirus pandemic has pushed nearly all Mideast nations into the throes of an economic recession this year, yet some rebound is expected as all but Lebanon and Oman are anticipated to see some level of economic growth next year according to the IMF. Well before the coronavirus, several Mideast countries were struggling with issues ranging from lower oil prices and sluggish economic growth to corruption and high unemployment.

Due to underreporting, Mideast nations have tallied fewer cases and deaths from the coronavirus than countries in Europe and the US; however, the region still faces challenges in containing the disease. “Risks of a worse-than-projected scenario loom large, particularly given recent surges in COVID-19 infections in many countries around the world that have reopened,” the IMF warned.

Iran, for example, recorded its highest daily official death tolls from the virus last week. Its economy shrank by 6.5 percent last year and is projected to contract by another 5 percent this year. The IMF, however, expects Iran’s economy to rebound with 3.2 percent growth next year, based in part on the government’s future capacity to manage the virus, which thus far it has struggled to do.

Saudi Aramco and Saudi Basic Industries Corporation have decided to reevaluate their crude-oil-to-chemicals project in Yanbu on the kingdom’s west coast as they slash spending due to low prices. The $20 billion project may be downsized to use Aramco’s existing facilities in the port city, instead of building a new plant, the statement posted by SABIC said.

The Islamic State has called on its members to target Saudi Arabia’s oil infrastructure to punish the kingdom for warming up to Israel. “Targets are plenty…Start by hitting and destroying oil pipelines, factories, and facilities which are the source (of income) of the tyrant government,” a spokesman for the terrorist group said in a recorded message.

5. Renewables and new technologies

In May, the National Renewable Energy Laboratory announced a public-private consortium to foster the development of low-cost perovskite solar cells. Perovskites are a family of crystals that share characteristics that make them potential building blocks for solar cells. Perovskite thin-film PV panels can absorb light from a wider variety of wavelengths, producing more electricity from the same solar intensity.

The consortium recently announced encouraging advancements in perovskite technology that could boost perovskite solar cells’ efficiency from their current ceiling of ~25 percent. The Oak Ridge National Laboratory has made a breakthrough in the development of perovskite solar. According to the laboratory’s announcement, “When sunlight strikes a solar cell, photons create charge carriers–electrons and holes–in an absorber material. Hot-carrier solar cells quickly convert the charge carriers’ energy to electricity before it is lost as waste heat. Preventing heat loss is a grand challenge for these solar cells, which have the potential to be twice as efficient as conventional solar cells. The conversion efficiency of conventional perovskite solar cells has improved from 3 percent in 2009 to more than 25 percent in 2020. A well-designed hot-carrier device could achieve a theoretical conversion efficiency approaching 66 percent”.

A group of researchers from the UK, China, and Saudi Arabia has developed a new technology that converts plastic waste into hydrogen and carbon nanotubes by pulverizing it using microwaves with iron oxide and aluminum oxide serving as catalysts. The inventors concede that they have no idea whether their technology can work on an industrial scale. However, in the laboratory, the conversion process takes just 30-90 seconds and resulted in a 97 percent recovery rate of the hydrogen generated. The carbon nanotubes are of good enough quality to be used for other applications. The researchers note that microwaves are already used successfully in large-scale applications, meaning there’s a good chance their technology can be scaled, too.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Nord Stream 2 pushback: The US State Department on Oct. 20 widened the scope of sanctions against the Nord Stream 2 natural gas pipeline and warned companies involved in the final installation that they face sanctions if they do not wind down activities within 30 days. (10/21)

France’s government has asked local power group Engie to delay the signing of a 20-year deal worth $7 billion to buy liquefied natural gas from a planned export project in Texas due to concerns over gas production emissions. France is concerned that the shale gas producers in Texas emit too much methane and flare too much gas when the European Union and its major economies, including France, are looking to develop and import clean energy. (10/24)

Turkey has added a further 85 Bcm to the reserves’ size at its giant Black Sea Sakarya gas field, bringing the total to 405 Bcm. The Sakarya discovery was already a significant boost for Turkey before the upgrade because, to date, it has only had minimal gas production of its own and is dependent on imports, which last year totaled 45 Bcm. (10/19)

Israel and the United Arab Emirates signed this week a preliminary agreement under which crude oil from OPEC’s third-largest producer could be shipped to European markets via an oil pipeline in Israel connecting the Red Sea with the Mediterranean. The agreement comes after the two nations announced in August that they would normalize ties. (10/22)

Residents on the Yemeni island of Socotra have reportedly resorted to logging due to a shortage of domestic gas, heightening fears of its impact on the island’s unique biodiversity. Logging brings the threat of desertification, soil erosion, and the destruction of biodiversity in the Socotra Archipelago. (10/19)

Offshore Brazil, thanks to increased production at the prolific pre-salt offshore basin, Petrobras expects its oil and gas production this year to exceed earlier guidance. Petrobras sees its average production for 2020, reaching 2.84 million b/d equivalent, of which 2.28 million b/d is in oil. (10/22)

Suriname is where the next significant petroleum discovery could occur. ExxonMobil’s raft of discoveries in offshore Guyana, including the latest Redtail-1 find, its 18th offshore discovery in the impoverished former British colony, underscores the considerable potential held by the Guyana-Suriname Basin. (10/21)

Alberta’s two-year experiment with OPEC-style crude production curbs is coming to an end after a Covid-driven collapse in demand led the Canadian province’s battered oil-sands industry to idle more output than required. A production cap of 3.81 million barrels a day will no longer be in effect in December. Experts don’t expect production in Western Canada to be above pipeline capacity before the middle of 2021 at the earliest, and storage levels are expected to remain low. (10/24)

Most of Western Canada’s oil production has been restored. About 700,000 barrels of oil production per day have been brought back online after being forced to cut nearly 1 million barrels per day back in May. The total curtailments as of October now stand at 270,000 bpd. Last year, Western Canada produced an average of 4.4 million barrels per day. (10/22)

Canada’s oil sands’ benchmark price is expected to strengthen next year amid lower Mexican heavy crude oil supplies to the US. According to BMO Capital Markets, the discount of WCS to WTI could narrow to between US$5 and US$7 because of expected significant cuts of Mexican heavy crude flows to the US. (10/23)

According to Baker Hughes’s weekly tally, the US oil rig count rose by 6 to 211 last week. The total number of active oil and gas rigs increased for the week by 5, with oil rigs rising by six and gas rigs falling by 1. (20/24)

Exxon is close to completing a workforce assessment for the United States and Canada, after which it will announce the number of people it needs to lay off in response to the crisis caused by the pandemic. (10/23)

TX oil jobs: a new study finds ongoing operations and construction in Texas’ pipeline industry provided nearly $49 billion in economic impact last year. They provided the state with more than $48.6 billion in economic impact and supported more than 238,000 jobs last year. (10/22)

Well cleanup obligations: Amid a record wave of bankruptcies, the US oil and gas industry is on the verge of defaulting on billions of dollars in environmental cleanup obligations. Even the industry’s largest companies appear to have few plans to properly clean up and plug oil and gas wells after the wells stop producing — despite being legally required to do so. The results may be publicly funded cleanups of the millions of oil and gas wells that these companies have left behind. (10/23)

Permitting process eased: The US EPA on Oct. 22 released a final rule that allows industrial facilities, such as power plants and refineries, to make upgrades in some instances without obtaining major construction permits that often require pollution controls. (10/24)

Land set-asides: One of the most significant parts of Democratic nominee Joe Biden’s green platform — and one that’s gotten little attention so far — is his commitment to protect nearly a third of the nation’s land and water by 2030—or the “30-by-30” commitment. Restricting human intrusion into nature is necessary, conservation proponents say, not only to curtail climate change but also to stave off the loss of even more plants and animals. (10/23)

Renewable energy consumption in the US continued to rise for the fourth year in a row in 2019, accounting for 11 percent of total US energy consumption. Of that total, wind energy and wood and waste energy each account for 24 percent of all renewable energy used in America. (10/20)

Geothermal energy has garnered a lot less attention than the more conventional forms of renewable energy generation, but this is slowly changing as parts of the world increasingly focus on replacing fossil fuels with cleaner alternatives. For example, Alberta will be promoting the development of geothermal energy as a means of diversifying its heavily oil-dependent economy. The oil and gas drilling industry has developed ways to deal with high levels of heat, thus making the most of geothermal resources unique. (10/23)

Polish nuke: The US and Poland closed a nuclear power deal potentially worth $18 billion as the Central European country seeks to reduce its reliance on coal and Russian natural gas. While the agreement is not yet final, there is a pretty good chance that Warsaw will pick the US over its main competitors, namely China and Russia. (10/21)

Fukushima release: Japan will release a million tons of water used in the Fukushima nuclear power plant into the sea. The reports add that the water will be diluted to reduce its radioactivity levels. Even so, environmental groups and fishing industry organizations are against releasing the liquid into the sea, despite assurances from scientists that the risk of contamination is low. (10/20)

Japan will promote the use of offshore wind generation and battery storage in its new effort to become carbon neutral by 2050, according to a government official, indicating how the nation might change its policies to meet the ambitious goal. This marks a move away from Japan’s relatively heavy reliance on coal-fired generation. (10/22)

The UK is at greater risk of electricity blackouts than indicated in National Grid’s Winter Outlook. The system operator’s Oct. 15 outlook acknowledged that generation margins were lower this year than last but that they remained well above loss-of-load risk targets set by the government. (10/23)

Iceland H2: Iceland’s largest electricity generator and Rotterdam port have agreed to study the best way to ship zero-carbon hydrogen produced from hydropower to feed Europe’s growing demand. (10/24)

Aussie H2: In Australia, the Asian Renewable Energy Hub, which would use electricity from wind and solar plants stretched across thousands of miles to produce hydrogen and ammonia, hopes to be soon awarded significant project status by the government. That would allow it to fast-track through approvals processes toward its first exports target by 2028 and bolster the nation’s ambitions to become a world-leading exporter of zero-emissions fuel. (10/21)

Shift on emissions: ConocoPhillips breaks with its US oil peers by aiming to eliminate carbon emissions from its operations and power providers by the middle of the century. Taking a page from the book of European rivals already pledged to go net-zero, Conoco outlined plans to reduce its so-called scope 1 and 2 emissions by as much as 45 percent by 2030. The goal is to wind that down to nothing by 2045 to 2055. (10/20)

Derecho’s cost: No single thunderstorm event in modern times — not even a tornado — has wrought as much economic devastation ($7.5 billion and counting) as the derecho that slammed the nation’s Corn Belt on Aug. 10. The storm complex, blamed for four deaths, hit Cedar Rapids, Iowa, particularly hard, cutting power to almost the entire city of 133,000 people and damaging most of its businesses and homes. (10/19)

India is reopening its borders to international visitors to revive economic growth even as the South Asian nation battles the world’s second-worst coronavirus outbreak. Prime Minister Narendra Modi uses a dip in new Covid-19 infections to pry open the economy from a strict lockdown, welcoming foreigners on business trips, but not tourists. (10/22)