Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Global carbon dioxide emissions from fuels burned for power, transportation, industry, and building-related applications probably peaked in 2019. The peak in energy-sector emissions BNEF identified would have sounded ridiculous in 2010 and seemed exceedingly unlikely even in 2015. In 2020, it’s not the future; it’s the immediate past.”

BloombergNEF publication “New Energy Outlook”

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil posted its largest monthly drop since March as renewed lockdown measures to contain the coronavirus threatened to upend a shaky demand recovery. Futures fell 1.1 percent in New York on Friday to end the week below $36 a barrel, taking their cue from a broader market selloff and the worst week for US stocks since March. Simultaneously, the US posted a record surge in daily coronavirus infections, while new restrictions in Europe could drive the region toward another recession.

Oil futures settled near five-month lows Oct 30th as rising COVID-19 cases continued to weigh on demand outlooks. New York settled at $35.79, and London was down to $37.46. Front-month WTI last settled lower on Jun 1st, while Brent futures were the weakest since May 29th. The slide comes as Europe’s three largest economies, the UK, Germany, and France, prepare to enter partial one-month lockdowns to halt a growing second wave of the pandemic. European energy demand was already trending lower ahead of the lockdowns.

Two-thirds of the US Gulf of Mexico’s crude oil production was shut on Oct 28th ahead of Hurricane Zeta. About 35 percent of the Gulf’s platforms and rigs, or 231 facilities, were evacuated. Zeta was the 27th named storm of the year, tying the 2005 record with more than a month remaining in the hurricane season. New Orleans-area refineries are returning after Hurricane Zeta knocked out power in much of southeastern Louisiana. An estimated 1.23 million b/d of crude production and 1,090 million cf/d of natural gas production remained offline on Oct 30th.

The monthly Reuters poll of 41 analysts forecasts that oil prices will continue to trade in a narrow range for the rest of the year, and the average Brent price next year will not exceed $50 a barrel. In another sign that the second coronavirus wave is hitting fuel demand, oil trading firms are looking for supertankers to use as floating storage for diesel. Analysts are expecting lower than usual diesel demand from the industrial, heating, and transport sector in the coming months.

Natural Gas: Cooler late-autumn weather and rising gas demand are lifting Henry Hub gas to annual highs. However, prices in Appalachia continue to lag as the region becomes increasingly disconnected from Gulf Coast markets. On Oct 26th, Henry Hub cash surged to a 19-month high at $3.08 per million Btu, propelled by a jump in residential-commercial heating and more modest gains in industrial and LNG feedgas demand. As winter-like temperatures in the Midwest and the Rockies pushed benchmark gas prices higher, Appalachia’s cash markets also climbed but remained at a significant discount to the Gulf Coast.

Appalachian Basin gas production edged up to its highest on record last week, dampening recent cash and forward-market bullishness over the promise of colder weather. US natural gas storage volumes expanded well below market expectations last week. Simultaneously, a net withdrawal is anticipated for the week in progress, kicking off the heating season two weeks earlier than last year.

OPEC: While the oil market speculates on whether OPEC+ will ease its production cuts in January, rumors emerged on Thursday that the three biggest OPEC producers outside of Saudi Arabia may not be on board with extending the current cuts into next year. Iraq, the United Arab Emirates (UAE), and Kuwait are not particularly inclined to support a rollover of the reductions of 7.7 million b/d because such cuts are too deep for their economies and budgets to sustain.

Sources in OPEC told Reuters that the two leaders of the OPEC+ pact, Saudi Arabia and Russia, would be inclined to favor rolling over the cuts of 7.7 million b/d in 2021 instead of easing them by 2 million b/d. Given that Libya is on track to add a million b/d to the world markets within the next few weeks, a 2 million b/d increase from current OPEC+ production can only hurt prices. The CEO of Aramco Trading told Gulf Intelligence last week that OPEC and its Russia-led partners will consider “many demand issues” before tapering their cuts. Iraqi Oil Minister Ismaael said on Friday that Baghdad would support any unanimous decision that the OPEC+ group makes regarding the alliance’s future oil production policy. He also denied a Reuters report that said Iraq wants to seek an exemption from OPEC+ output cuts in 2021.

Given that oil demand is dropping in the US and Europe, and China has bought all the low-price oil it can store, the prospects that OPEC plus will extend the current cut of 7.7 million b/d are looking better all the time.

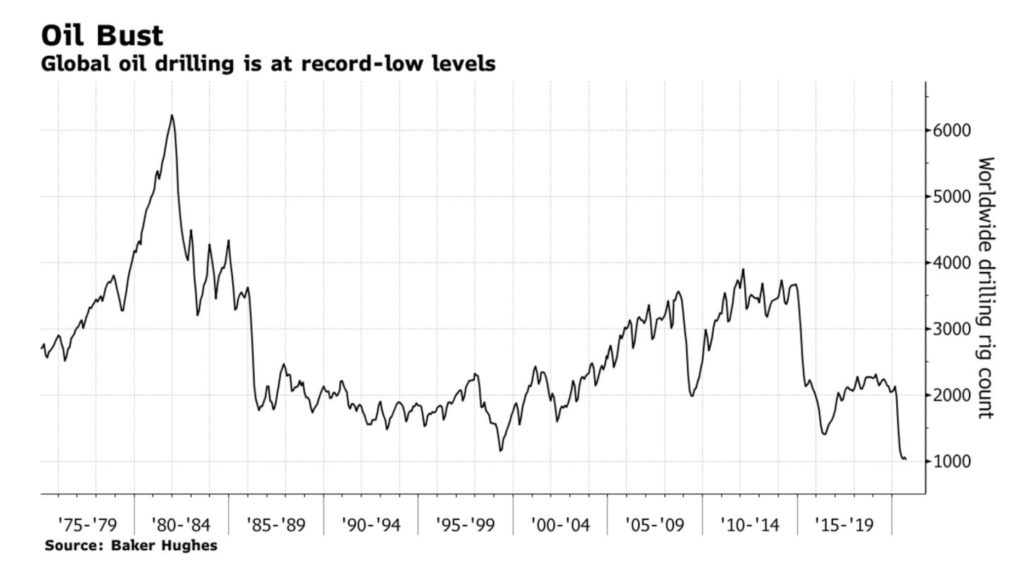

Shale Oil: According to the IEA, the pandemic’s impact on investments in the oil industry will continue to be felt for years to come. The agency noted a 45-percent cut in investments by US shale oil companies this year, combined with a 50-percent jump in financing costs. The number of active drilling rigs in the US have been rising a bit in the last two weeks, but the total is still down some 550 rigs year-over-year. It takes about six weeks or more from the decision to activate a rig until it shows up in the count.

The White House is trying to draft an executive order that will show how much President Trump supports fracking. If an order is issued, it would be unlikely to have any short-term impact on an energy industry struggling with an oil glut tied to the coronavirus. The exercise’s purpose is to draw a political contrast between President Trump and his opponent in Tuesday’s election.

Devon Energy will soon have enough shale drilling permits on federal lands to cover its oil and gas production plans in the Permian Basin through 2024. This will protect the company’s output from potential US fossil fuel policy changes if Biden is elected.

Chesapeake Energy and Franklin Resources need to defend their debt restructuring plan from attacks by unsecured creditors who claim the proposal is built on a fraudulent scheme. A committee of unsecured creditors said in court papers that the two firms concocted a “liability management scheme” that shifted value to Franklin and other senior lenders at the expense of unsecured noteholders. The plan “infected” Chesapeake’s capital structure with $1.5 billion in debt from a unit that should have been responsible for paying the liability on its own.

Prognosis: According to S&P Global Platts, the shift from fossil fuels to renewables is in full swing, and it will carry on in the coming years regardless of who sits in the Oval Office. That’s in large part due to renewable energy sources such as solar and wind becoming very cost-competitive with traditional fuels, while more novel fuels such as hydrogen are also becoming less expensive and gaining traction. Over the past decade alone, solar generation costs have fallen nearly 90 percent and wind by almost 70 percent thanks to major technology advances. Renewables have also been proving to be remarkably resilient, being the only energy sector that has continued to grow despite the global pandemic.

Market analyst Wood Mackenzie published a report on the future of clean energy and electric vehicles following the November 3rd election. President Trump promises to maintain the status quo, somehow favoring oil, gas, and coal and rejecting the idea of cutting greenhouse gas emissions. On the other hand, Biden promises to launch a “clean energy revolution” whose goal is to reach net-zero emissions by 2050.

According to Wood Mac’s vice chair for the Americas, Biden’s proposal would entail one of the most radical infrastructure overhauls in US history, particularly the plan for creating a carbon-free electricity system by 2035. “The plan creates enormous opportunities: it could mean a seven-fold expansion of US onshore wind and utility-scale solar generation capacity, coupled with steep growth in offshore wind and battery.”

US Energy Secretary Brouillette said he’s not sure US oil production will rebound to 13 million b/d quickly. The reason, according to Brouillette, is that consumer demand just isn’t sufficient to push demand for crude oil. As a result, US production might hover around 11 million b/d next year.

ExxonMobil warned on Friday that it could write down North American natural gas assets with a carrying value of up to $30 billion as it reported its third consecutive loss this year. Exxon is currently re-assessing its portfolio to decide which assets with the highest potential to create value should be developed. Unlike other major oil corporations, Exxon hasn’t yet adjusted the value of its holdings during the pandemic.

2. Geopolitical instability

(These are the situations that are reducing the world’s energy supplies or have the potential to cause serious reductions.)

Iran: President Rouhani announced new 10-day coronavirus restrictions that will take effect on Wednesday in 25 of Iran’s 31 provinces. Weddings, wakes, and conferences will be banned in Tehran until further notice as the Middle East’s hardest-hit nation battles a third wave of the pandemic. Police will make unannounced visits to high-risk businesses, and those that violate health protocols will be shut down. The deputy health minister said the new restrictions would include the closure of institutions such as schools, universities, libraries, and mosques.

The Trump administration rolled out another round of sanctions and other punitive actions against Iran. Washington is blacklisting Iranian and Chinese energy companies and announcing forfeiture actions against two Iranian missiles shipments recently seized by the US Navy. The move is part of a strategy intended to lock in as much diplomatic leverage from its four-year pressure campaign as possible in what could be the last days of the administration. All of the US actions involved measures previously announced. The Treasury and State Department sanctions against 11 companies and five individuals involved allegations they were helping Iran trade its petroleum products, a key source of funding for the regime.

Four Iranian gasoline cargoes, bound for Venezuela but seized by the US earlier this year, have been sold in a forfeiture auction for more than $40 million. The money will go into a fund for US victims of state-sponsored terrorism.

Iran’s oil minister said that his industry will not yield to pressure from the US and that the sanctions against him and his colleagues “are a passive reaction to Washington’s failure to cut Tehran’s oil exports to zero.” “The era of unilateralism is over in the world. Iran’s oil industry will not be hamstrung.”

Iraq: The Kurdistan Region Government in Iraq declared a halt to all oil exports on Friday after experiencing an attack on the Turkish side of the pipeline to the port of Ceyhan in Turkey. The Kurdistan Workers’ Party (PKK) is suspected of the attack.

If confirmed as an act of PKK sabotage, the incident would represent a significant new threat to the KRG’s oil exports of 450,000 b/d, which depends on Ceyhan’s pipeline to sell almost all of its production. While pipeline operations have occasionally been interrupted due to damage and theft in recent years, the PKK has not used deliberate pipeline attacks as a pressure tactic since 2015.

Libya: Libya’s oil production is rising rapidly toward 1 million b/d, as a truce in the nation’s civil war allows the state energy firm to ramp up operations at previously idled fields and ports. Daily crude output already has reached 800,000 b/d and the country is targeting 1.3 million by the beginning of 2021. The OPEC member was pumping less than 100,000 barrels a day in early September. The quick revival of its production — following an almost total shutdown in January as fighting in the war intensified — has taken oil traders by surprise. That has weighed on crude prices just as a resurgence of coronavirus cases hammers global demand for energy. Benchmark Brent crude fell 10 percent last week to $37.46 a barrel, its lowest level since May.

The Atlantic Basin could see increased competition among the region’s sweet crude producers as 1 million + b/d of Libyan crude returns to the oil market. Industry sources said the resumption of Libyan exports is already weighing on other sweet grades from the US, Algeria, Azerbaijan, Nigeria, and Kazakhstan. More and more sweet crudes will be pushed east, as oil demand in Europe is likely to slow down amid the second wave of coronavirus infections.

Some are skeptical that the Libyan cease-fire agreement will hold. The UN-brokered deal has been hailed by the Joint Military Commission members and the Tripoli-based government as a significant step forward. At the same time, General Haftar, the Libyan National Army leader in the eastern part of the country, has been quiet on the deal. His backers, mainly Russia, the UAE, and Egypt, have been generally supportive of the agreement but have warned that there is still more to be done.

Nagorno-Karabakh: The US brokered cease-fire between Armenia and Azerbaijan barely lasted an hour. Now the conflict continues. Civilian casualties are mounting, with both sides accusing the other of bringing in foreign fighters and indiscriminately targeting urban areas with missile and artillery fire. Last week, Azerbaijani authorities said at least 21 civilians were killed and dozens more injured after rockets fired by Armenian forces, using a Russian-made missile system, hit a town some 20 miles away from the conflict’s front lines. Amnesty International later confirmed that those rockets contained cluster munitions designed to inflict indiscriminate damage and are banned under international convention.

At the conflict’s heart is Soviet mapmaking in the 1920s when Joseph Stalin left a large group of Catholic Armenians inside a region of Muslin Azerbaijanis. Soviet police and the Red Army kept the situation under control until the Soviet Union collapsed. Then, in the early 1990s the region was bitterly fought over, displacing nearly a million Azerbaijanis before Moscow negotiated a truce.

For now, Azerbaijan appears to be winning the current war. Its superior military, purchased with Baku’s oil wealth, has taken control of districts abutting Nagorno-Karabakh that had been in Armenian hands. Azerbaijani forces also are threatening to close the land bridge from Nagorno-Karabakh to Armenia. The Turks’ involvement on the side of Azerbaijan and the Russian military base in Armenia makes the situation dangerous. There is also the threat of closing the pipelines that brings oil and gas from Baku to the West.

Venezuela: An explosion hit a distillation unit at the 645,000 b/d Amuay refinery last Tuesday. The incident came while workers at the plant, which had not operated for weeks, were attempting to restart some of its production. President Maduro called the incident a terrorist attack; however, starting up an oil refinery is a complicated procedure, so there is a possibility the explosion was accidental.

Concerns are rising that Venezuela’s oil reserves totaling several hundred billion barrels could become a stranded asset. The push to combat climate change, reduce emissions and cut particulate pollution has sparked a world push to reduce the sulfur content of fuels significantly. This situation has hurt demand for oil from countries producing heavier sour crude, like Canada, Colombia, Ecuador, Saudi Arabia, and Venezuela. Massive injections of capital, technology, and skilled labor would be required to resurrect the country’s oil industry. It would likely take over a decade for the oil industry to rebuild to resemble its pre-catastrophe level.

BP, among other major energy companies and institutions, including the IEA, believes oil demand will plateau by around 2030 and start to decline after that point. This indicates a limited window for Venezuela to profit from the vast wealth held by its oil reserves.

3. Climate change

Regardless of the outcome of the presidential election, the US will officially be out of the 2015 Paris climate agreement on Nov. 4th. Climate experts say that if the US doesn’t slash emissions, there’s little hope of meeting the Paris target of averting catastrophic global warming. However, the US could rejoin the global climate pact, and Democratic presidential candidate Joe Biden has said he would do that early in his presidency.

The issue of whether the world is transitioning to non-polluting sources of energy fast enough to forestall an apocalypse is still open. In recent months the leaders of several leading carbon emitters, including the EU, China, Japan, South Korea, have announced plans to move towards zero emissions. Even the US may join if there is a new administration after this week’s election. The downside of these pledges is that they will not be fulfilled until 2030, 2040, or 2050. In the meantime, the emissions will continue to grow.

We have heard similar pledges during the string of UN-sponsored climate summits that have been going on for thirty years. During these decades, emissions have continued to grow, except during the recent pandemic, which forced many people to stay at home and not emit so much carbon. Air travel fell by over 60 percent.

There are several reasons why so little progress has been made on an existential challenge, such as climate change. First, the effects of higher temperatures are not yet harmful enough to convince enough people that the use of fossil fuels will have to slow — no matter what the cost. Recent years have seen a steady increase in storms, floods, droughts, fires, etc. Nearly every part of the world is being affected.

Then we have a significant difference in national emissions and, even more controversial, per capita emissions. The arguments over who should cut how much have dominated international meetings with the wealthy and large emitters plus the poor and large emitters trying to work things out with the numerous small emitters who can’t afford to do much about the problem.

Then we have the problem of maintaining economic growth and upgrading living standards, which is the underlying goal of nearly every country in the world. Much of the world’s financial wealth today is supported by heavy consumption of fossil fuels, so most governments are not ready to pay the perceived price of switching to new sources of energy. The Europeans have already recognized that climate change costs will far outweigh the temporary cost and disruptions of replacing fossil fuels. Others will follow as climate change costs, such as abandoning seacoast cities or failing agriculture, are not acceptable.

According to BloombergNEF’s annual New Energy Outlook, some $11 trillion will be spent on new Green energy investment in the coming decades as the cost of renewables plummets and more of the world’s energy comes from electricity. Despite the massive sum, BNEF said the pace of building out new renewables would need to increase further to limit global warming to less than 2 degrees Celsius by the end of the century. The projected increases in renewable energy and battery technology — wind and solar will grow to 56 percent of global electricity in 2050 — cause emissions to peak in 2027 and then fall 0.7 percent annually until 2050.

4. The global economy and the coronavirus

United States: A record surge of coronavirus cases in the US is pushing hospitals to the brink of capacity and killing up to 1,000 people a day. The country recorded its nine millionth case on Friday with almost 229,000 official deaths. Since March, the “above normal” deaths are now about 300,000, which is a more realistic number for the toll taken by the virus.

The economy is weakening and facing renewed threats. Hiring has sagged. Government stimulus has run out. Even last quarter’s economic rebound will leave the economy far below its level before the pandemic. Stocks dropped last week, capping their biggest weekly rout since March after earnings from the largest tech companies disappointed investors concerned that a slowing economy will dampen profit.

Surging deliveries to the US, due to several previous months of limited shipping, are fueling record high freight costs and logjams at seaports. Still, transportation executives say the rally will lose steam with the second wave of coronavirus. Container shipping companies, which move goods for customers, including Amazon and Walmart, were badly hurt earlier this year when worldwide trade halted. The container companies now question whether the US import boom can be sustained.

Nationwide, state budget shortfalls from 2020 through 2022 could amount to about $434 billion. This estimate assumes no additional fiscal stimulus from Washington, further coronavirus-fueled restrictions on business and travel, and extra costs for Medicaid amid high unemployment. That’s greater than the 2019 K-12 education budget for every state combined, or more than twice the amount spent that year on state roads and other transportation infrastructure.

State workers are being laid off and are taking pay cuts, and the retirement benefits for police, firefighters, teachers, and other government workers are under more pressure. Even after rainy day funds are used, Moody’s projects 46 states coming up short, with Nevada, Louisiana, and Florida having the most significant gaps as a percentage of their 2019 budgets.

China: Manufacturing activity expanded in October for the eighth straight month, though at a slightly slower rate than in September. The economy grew 4.9 percent in the three months ending Sept. 30th, the second consecutive quarter of growth after a 6.8 percent contraction from January to March.

China will promote “technological self-reliance” under the latest five-year plan but will open further to trade. The emphasis on technology reflects concern over the welfare of producers of processor chips and other technology when US export curbs have reduced access to this technology.

China accelerated purchases of US farm products last month. Overall, it remains far behind on a commitment to buy some $140 billion in specific US agricultural, energy, and manufactured goods this year under a trade accord signed in January. As of Sept. 30th, China had purchased $58.8 billion in goods covered by the agreement, according to calculations based on Commerce Department figures released last week. Purchases should have reached $108 billion by that time to be on track toward the full-year target.

Crude throughputs at China’s refineries continued to fall in October, with both state-owned oil companies and independent refineries cutting run rates amid weakening refining margins. Combined run rates at the four state-owned oil companies — Sinopec, PetroChina, CNOOC, and Sinochem — averaged 78.9 percent in October, down from 81.5 percent in September.

Several recent policy changes have strengthened expectations for an increase in natural gas consumption. PetroChina, China’s largest natural gas supplier, has predicted that demand will double over the next 15 years to 620 billion cm despite the pandemic and the rising importance of renewables. China’s announcement that it will become carbon neutral by 2060 would suggest less, not more, fossil fuel consumption. However, several natural gas characteristics make it indispensable in a future where renewables dominate, with the Chinese people becoming increasingly vocal in their demand for cleaner air in the cities polluted by the burning of coal for heat and light. Natural gas is the quickest and surest way to solve this problem.

European Union: The continent is again at the pandemic’s epicenter, with more and faster-rising deaths than the US. The resurgence is leading some governments to reimpose lockdowns they had hoped to avoid. The surge in infections is stretching hospitals’ capacity in the worst-hit cities in the UK, France, Belgium, Italy, and elsewhere. Around 1,370 Covid-19 patients are dying in the European Union and the UK every day compared to some 1,000 in the US.

A coronavirus variant that originated from Spanish farm workers has spread rapidly through much of Europe since the summer and now accounts for most new Covid-19 cases in several countries. Because each variant of the virus has its own genetic signature, it can be traced back to the place it originated. Tracking of infections suggests that people returning from a holiday in Spain played a crucial role in transmitting the virus across Europe.

The risk of another severe economic downturn in Europe is rising as new lockdowns take effect in countries like Germany, France, Belgium and the UK where the authorities are desperate to prevent a surge in infections from overwhelming hospitals. Governments in the EU are straining to find ways to support furloughed and unemployed workers and keep restaurants and other businesses from going bankrupt.

Economic mobility indicators often used as a proxy for energy demand have fallen in Europe’s largest economies to more than two-month lows. Based on activity at workplaces, retail and recreational sites, and transport hubs, mobility indexes in Germany, the UK, France, Italy, and Spain were 23.6 percent below pre-crisis levels in the week to Oct. 25th. This is marginally lower than the previous week and the lowest regional average since Aug. 21st.

European driving activity fell for the third week running in the week ended Oct. 25th as growing measures by regional governments to contain a spike in coronavirus infections continue to curb activity. Average weekly road congestion in Europe’s top five capital cities fell to 19 percent below a year earlier. Road congestion levels fell in London, Berlin, Paris, and Rome but rose in Madrid, where a 15-day emergency lockdown expired on Oct. 23rd.

Russia: During the spring, the pandemic struck Moscow particularly hard while mostly sparing provincial locations. But now infections are rising in several of Russia’s far-flung regions. Hospitals and morgues are being overwhelmed. In his long tenure, President Putin has centralized political power. But during the pandemic, he has delegated to regional authorities’ decisions on locking down businesses, shutting schools and taking other public health precautions.

The stated purpose was to allow local officials to tailor their responses to local circumstances, though political analysts noted that it allowed Putin to deflect blame for the unpopular shutdowns, or bad outcomes. Either way, the result has become a patchwork of rules throughout the country that are often poorly observed.

Russia has reported 1,624,648 cases, the fourth-highest number in the world, after the US, India, and Brazil. Over the past week, 16,546 people have been infected daily which is a fraction of the new infections in the US. Russia approved a vaccine for the coronavirus in August, before completing clinical trials, but it has not been administered widely. In Moscow, the health authorities said Friday that about 2,500 people in the city had received the vaccine under emergency-use approval.

Russia’s reported mortality rate of 19 per 100,000 people is lower than that of most West European countries and the United States. One explanation is that testing in Russia turns up many mild or asymptomatic cases which are not included in the official count. There have also been indications that mortality has been seriously underreported. Anecdotal stories saying that hospital beds are full continue to filter out of provincial cities. The government has stopped the regular reporting of death statistics to Moscow.

Moscow’s crude oil exports dropped by 7.9 percent year over year in the period January to August. For most of this period, Russia was part of the OPEC+ agreement to curtail supply to the market, except in March and early April. In those months Russia and Saudi Arabia disagreed on managing oil supply. The current production cuts began in May 2020 and are much deeper than in the previous deal. Russia’s crude oil exports also dropped in terms of value due to the slump in oil prices. Between January and August, the value of Russian crude oil exports plunged by 38.9 percent compared to the same period last year. The combination of the pandemic, western sanctions, low oil prices, and the OPEC+ cuts suggests that the economic situation in Russia is a lot worse than they let on.

President Putin approved the strategy for developing Russia’s Arctic zone last week. Russia continues to see the Arctic as a key development priority, despite growing concerns over the impact of climate change on the region. The strategy acknowledged that temperatures in the area are warming 2-2.5 times faster than the global average. It says that this reality poses both opportunities and risks for the economy and environment. The opportunities include further developing hydrocarbons reserves in Russia’s Arctic offshore zone, which contains over 85.1 trillion cubic meters of natural gas and 17.3 billion mt of crude and condensate.

The Nord Stream-2 saga continues. Although Gazprom received Denmark’s agreement on Oct. 1st to lay pipe on the Danish continental shelf, the project is still where it was a year ago. The ambiguous prospects for Nord Stream 2 have forced Gazprom to be cautious. As of end-October 2020, Gazprom has still not started pipelaying works on Nord Stream 2, despite having all required permits.

5. Renewables and new technologies

Wind and solar power have become even cheaper compared to fossil fuels in the past year, making them an attractive way to stimulate economies recovering from the Covid-19 pandemic, according to annual analysis by Lazard Ltd. Without subsidies, the cost of energy from onshore wind has fallen to as low as $26 a megawatt-hour while utility-scale solar is as cheap as $29. That undercuts even the most efficient type of new gas-fired turbines.

Lazard also looked at using hydrogen as a fuel to decarbonize the natural gas system and store excess electricity generated by wind or solar. Blue hydrogen, which is produced from gas, sequesters the carbon and eliminates 90 percent of the CO2 that normally would come from burning the fuel. Green hydrogen, that uses wind and solar electricity to get hydrogen from water, is carbon free. Using existing or upgraded gas pipelines and underground storage space for hydrogen could help slash costs.

Corporate America is aggressively pushing to lower its carbon footprint–and hydrogen has emerged as one way for clean energy to make a massive comeback. Shares in the hydrogen sector have been climbing lately.

Green or non-polluting hydrogen is produced by breaking down ultra-pure water in an electrolyzer. Observers are starting to note that purifying water, which currently is best done by distillation, could add significant cost to the production of green hydrogen. Using clean water and transporting as much as 18 tons of it for every ton of hydrogen produced may turn out to be a factor limiting the growth of the green hydrogen industry.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Offshore Norway, oil and gas operators are expected to drill around 30 exploration wells this year—just half the number of exploration wells from last year and the lowest number in nearly a decade and a half. Earlier this year, the crash in oil prices and oil demand led to operators significantly cutting their budgets, including for exploration. (10/28)

Norway’s giant Johan Sverdrup oilfield in the North Sea is expected to increase its oil production this quarter after the Norwegian government raised the Q4 production permits for Western Europe’s biggest producing field. Officials claim the field can produce 470,000 boe per day. (10/31)

Spain’s Repsol SA has invested more in recent months in developing renewable power projects than searching for oil and gas, offering the latest example of how Europe’s energy giants are accelerating their shift away from fossil fuels. (10/31)

South Africa strike: Total and its partners have made a “significant” gas condensate discovery near the Brulpadda find off South Africa’s Western Cape, raising the prospects of a new gas push in the country’s coal-dominated energy sector. (10/28)

Guyana’s gusher: Estimated resources at the ExxonMobil-led offshore Stabroek block in Guyana have been raised to roughly 9 billion boe, up from more than 8 billion earlier this year, thanks to recent discoveries at the prolific South American asset. The Stabroek partners, including China’s CNOOC, now see the potential of up to 10 floating production, storage, and offloading facilities to develop the block’s discovered recoverable resources. (10/29)

Colombia: After a positive start to 2020, there is little evidence of a sustained recovery for the Andean country’s economically crucial oil industry. Significantly weaker oil prices, the COVID-19 pandemic, and a deteriorating internal security environment weigh on Colombia’s oil industry. During the second quarter, the economy shrank 16 percent while unemployment hit 17%. (10/28)

Mexico is sitting on top of the sixth biggest collective shale reserve in the entire world. Yet for now, challenges of infrastructure, investment, and regulation are leaving Mexico’s potentially massive shale deposits mostly untapped. The market is dead right now. Fracking isn’t going forward. (10/30)

Canada’s zombie wells: Alberta, the heart of Canadian hydrocarbon extraction, has set a goal of a 45 percent drop in the industry’s methane footprint from active infrastructure by 2025. But the inactive wells — the ones no longer producing oil or natural gas but many still lingering in suspension like zombies — may be as significant a threat to the planet. There are now 97,920 wells licensed as temporarily suspended, compared to the province’s 160,000 active wells. The inactive wells are unlikely to be switched on ever again but have not yet been decommissioned. No one knows how many are leaking methane and other pollutants. (10/31)

According to Baker Hughes, the US oil rig count rose by 10 to 221 while the gas rig count slipped by 1 to 72. The offshore rig count stands at 13, down from 22 rigs in 2019. Canada’s rig count stands at 86, with 40 for oil and 46 for gas. (10/31 and others)

In Alaska, the Bureau of Land Management approved a ConocoPhillips-led oil exploration project, which could yield some 160,000 barrels of crude daily when it becomes operational, the BLM said. (10/29)

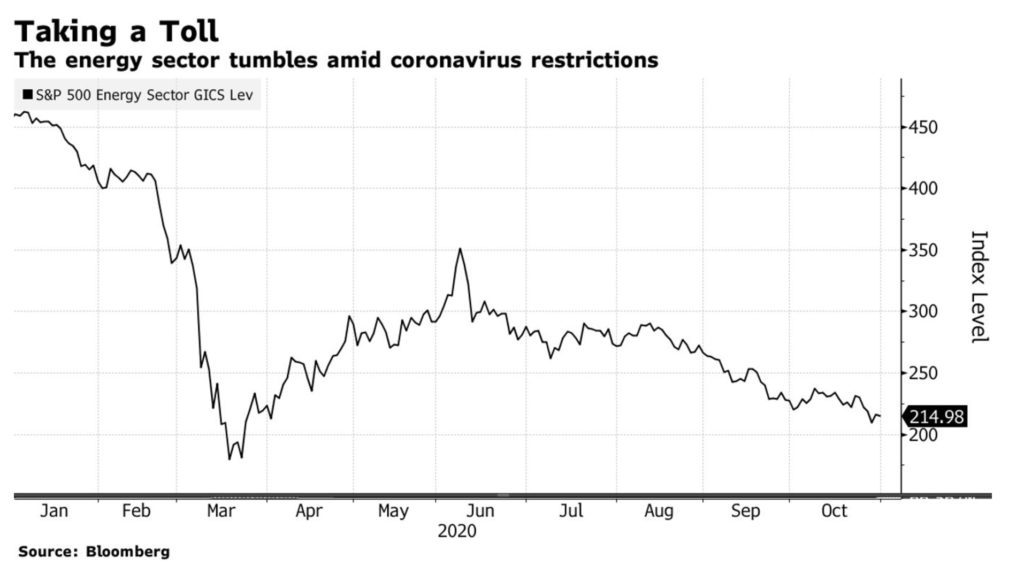

US energy stocks cratered: Energy stocks are suffering through their worst retreat in almost a century. In the biggest drop of any sector going back to 1928, energy stocks have lost 60 percent more value than the S&P 500 Index has. (10/31)

Big oil dividends: ExxonMobil is keeping its quarterly fourth-quarter dividend flat at $0.87 per share – the first time in 38 years the company has failed to increase the dividend that it has been paying for more than 100 years. Exxon and Chevron hadn’t touched shareholder payouts, unlike their European rivals Shell, Equinor, BP, and Eni, which slashed dividends earlier this year amid massive losses in Q1 and Q2. (10/30)

Exxon’s job cuts: The company will slash its global workforce by 14,000 (or 15%) by the end of 2022, an unprecedented culling by North America’s biggest oil explorer as it struggles to preserve dividends. The cuts will include 1,900 US jobs, mostly in Houston, as well as layoffs previously announced in Europe and Australia and reductions in the number of contractors. (10/30)

Job Big Oil cuts: Exxon’s rivals are also cutting thousands of jobs in response to the pandemic-induced demand slump. BP plans to slash 10,000 jobs, Royal Dutch Shell will cut as many as 9,000, and Chevron has announced around 6,000 reductions. (10/30)

Refinery shutdown: PBF Energy’s Paulsboro refinery in New Jersey has become the latest oil processing facility to fall victim to a Covid-driven collapse in fuel demand, announcing plans to idle operations for the foreseeable future. The company plans to lay off 250 employees at the 160,000-b’d plant and halt fuel production due to low demand. (10/29)

The US vehicle market showed ongoing signs of recovery in October, with sales continuing to follow positive trends over the six months since April’s historic lows, industry analysts said Oct. 28. Cox Automotive said new vehicle sales in the US are forecast to rise to 1.36 million units in October, up 1.7 percent year on year, and 1.9 percent month on month. (10/29)

Sails back on cargo vessels: Cargill and BAR Technologies have embarked on a strategic project with naval architect Deltamarin to bring cutting edge wind propulsion technology to commercial shipping. The project will see BAR Technology’s WindWings—large, solid wing sails that measure up to 45 meters in height—fitted to the deck of bulk cargo ships to harness the power of the wind and reduce CO 2 emissions by as much as 30%. The number of wing sails can be tailored to the vessel’s size and the route it will take. (10/29)

Some US electric grid operators, such as the Electric Reliability Council of Texas Inc., have pursued the notion that if they build transmission, generators will come. But in the budding US offshore wind industry, the opposite is now confirmed: States accept proposals from developers that bundle generation and transmission together, creating a patchwork of proposals to deliver wind-generated power from offshore to a limited number of onshore interconnections. (10/28)

US nukes waning: The US has long been the world’s single-biggest generator of nuclear power, accounting for a third of global atomic energy production. That status will likely soon be stripped away as the US has seen one nuclear plant after another shutter after struggling and failing to stay in the black while other nations have expanded their nuclear programs. China, in particular, has invested huge sums into building up its nuclear program and is on track to overtake France and then the US to become the world’s #1 nuclear power producer. (10/26)

US nuke boost: The winds of change could soon be blowing for US nuclear. Last month the nuclear sector got a small but certainly not insignificant state-sponsored lifeline when the Department of Energy announced that “it would be awarding more than $65m in nuclear energy research, crosscutting technology development, facility access, and infrastructure awards.” (10/26)

Fukushima water release: Greenpeace claims that the 1.23 million metric tons of water stored at the Fukushima plant — the scene of the 2011 nuclear disaster — contains “dangerous” levels of the radioactive isotope carbon-14 and other “hazardous” radionuclides, which it says will have “serious long-term consequences for communities and the environment” if the water is released into the Pacific Ocean. (10/26)

Vestas Wind Systems, the world’s biggest wind turbine manufacturer, will buy out its offshore joint venture partner in an all-share deal that looks to take advantage of an expanding industry at the heart of the energy transition. The 709 million-euro ($830 million) deal for Mitsubishi Heavy Industries Ltd.’s 50 percent share in the partnership will integrate the offshore business into Vestas’s much bigger onshore wind operation. (10/30)

Tesla’s EV boom: At a time when oil prices remain stuck in limbo, Tesla Inc. has continued to defy bearish expectations that low oil prices would put a damper on its core business of selling electric vehicles. For the fourth consecutive quarter, the EV maker posted yet another blowout that beat top-and bottom-line expectations. (10/30)

Euro Teslas soon: European reservation holders of Tesla’s Model Y could begin to receive their vehicles manufactured at Tesla’s Gigafactory in Berlin earlier than expected—during the first half of 2021 instead of after mid-year. (10/30)

First EV tour boats: Earlier this month, the Maid of the Mist tour boats line launched two electric catamaran tour boats on the Niagara Gorge routes to the base of the falls, the first of their kind in North America. The lithium-ion battery banks are powered by Niagara’s hydropower, making them zero emissions. (10/30).

India’s EVs: Just last week, India’s Department of Heavy Industries released an expression of interest (EoI) invitation to the private sector “to set up electric vehicle charging stations on major existing and upcoming expressways and highways running across the length and breadth of the country.” This is part of the country’s plan to establish an EV charging network at an unprecedented scale of one station every 25 kilometers (approximately 15.5 miles). (10/26)

EU charging points lagging: EV sales in the EU increased by 110 percent over the past three years. During the same period, however, the number of charging points grew by just 58 percent (to less than 200,000)—demonstrating that investment in infrastructure is not keeping pace with increased sales of electric vehicles. (10/30)

China—EV dominance? The world’s largest automotive market, China, is looking to become a dominant player in the rising global electric vehicle market. Chinese EV manufacturers are expected to expand overseas, while Beijing already controls a large part of the worldwide EV supply chain, beginning with critical minerals processing. The US has started to realize that China could dominate the future of transportation—electric transportation—if it does not counter the current Chinese influence over critical parts of the EV supply chain. (10/27)

German H2 train refueling: Representatives from the State of Hesse, RMV (Rhein-Main-Verkehrsverbund), Alstom, and Infraserv broke ground for a hydrogen filling station on the site of the Höchst industrial park in Frankfurt that will supply a fleet of 27 passenger fuel cell trains—currently, the world’s largest such. Alstom is supplying the iLint hydrogen trains for the Taunusbahn, Infraserv Höchst will operate the future hydrogen filling station, and the State of Hesse and RMV are setting the course for the future and financing them. (10/28)

H2 car companies: Automakers have spent decades developing hydrogen fuel cells as a green alternative for cars with little to show for it. Now, they are shifting their attention to the trucking industry. Car companies say fuel cell technology has particular advantages for commercial trucks that travel long distances and need to refuel quickly. They are trying to satisfy the growing interest in alternative-fuel big rigs. (10/27)

Global carbon dioxide emissions from fuels burned for power, transportation, industry, and building-related applications probably peaked in 2019. Power sector emissions—the largest single component of fuel combustion emissions today—probably peaked in 2018. Emissions from coal-fired power, still the single largest global power generation, peaked in 2018. Power emissions from natural gas probably peaked in 2019. So states Bloomberg’s New Energy Outlook. (NEO)

Carbon neutral LNG? Seeking to blunt concerns about the damage natural gas does to the environment, some of the world’s largest LNG shippers, including Shell and Total, are selling “carbon-neutral” cargoes that include a form of payback for pollution. The offsets pay for renewables, forests, or other measures that allow buyers to show they’re working to lower their output of climate-damaging greenhouse gases. (10/27)

The airline industry is gearing up for a challenging fourth quarter in 2020 as fresh outbreaks of coronavirus continue to crop up, and restrictions remain in place on cross-border travel, the International Air Transport Association said. Now IATA expects 2020 traffic to be 66 percent less than 2019’s level and December 2020 traffic to be 68 percent down year on year. (10/28)

The global travel and tourism industry is on course to lose 174 million jobs this year if current restrictions to curb the spread of the coronavirus remain in place. While alarming, the World Travel & Tourism Council’s projection was lower than previously expected, mainly because of a strong recovery in domestic travel in China and rebounds in other countries. (10/31)

PM 2.5 pollution was significantly associated with an increased risk of hospital admissions for several neurological disorders, including Parkinson’s, Alzheimer’s, and other dementias, in a long-term study of more than 63 million older US adults, led by researchers at Harvard, Emory University and Columbia University. This is the first nationwide analysis of the link between fine particulate (PM 2.5) pollution and neurodegenerative diseases in the US. (10/27)