Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Europe’s top energy companies are cutting back their oil and gas portfolios to keep only the assets most likely to be profitable and redeploy capital for a transition to clean energy as uncertainty mounts over future demand for fossil fuel.”

Ron Bousso, Stephen Jewkes and Dmitry Zhdannikov; Reuters

“With over 100 billion barrels of oil still in our ground, most [African] economies are still heavily dependent on oil revenue. Is Africa ready to forgo the production of those 100 billion barrels and classify them as wasted assets?”

Dr. Omar Ibrahim, Secretary-General, African Petroleum Producers’ Organization

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Futures rose towards $72 a barrel on Friday, trading close to a two-year high as OPEC+ supply discipline and recovering demand countered concerns about the pace of the COVID-19 vaccination rollout around the globe. Brent crude settled at $71.89 a barrel after touching $72.17, its highest since May 2019. The session high for West Texas Intermediate was $69.76, its highest since October 2018. OPEC and allies said they would stick to agreed supply restraints. US crude oil inventory declines extended in the week ended May 28th amid rising refinery demand and lower production.

Total commercial crude oil inventories were down 5.08 million barrels to 479.27 million barrels in the week to May 28th, pushing them to the lowest since the week ended February 19th and nearly 3% behind the five-year average. The draw was concentrated on the US Gulf Coast, which saw a 5.64-million-barrel decline in inventories to 264.81 million barrels.

“After much dilly-dallying, Brent appears to have found a new home above $70,” said Stephen Brennock of oil broker PVM. “Summer and the reopening of the global economy is bullish for oil demand in the second half of the year.”

OPEC: The cartel and allied producing countries have confirmed plans to restore 2.1 million barrels per day of crude production, balancing fears that continuing COVID-19 outbreaks in some countries will sap demand against the rising need for energy in recovering economies. Saudi Energy Minister Prince bin Salman said recent market developments proved that the decision to increase production gradually, initially made in April and reconfirmed Tuesday, was “the right decision.” He said that there were still “clouds on the horizon” regarding the recovery and demand for energy. The cartel decided to stay the course set at earlier meetings to raise production by 2.1 million barrels per day from May to July. The group planned to add back 350,000 b/d in June and 440,000 b/d in July.

The Joint Technical Committee of the OPEC+ group maintained its outlook for global oil demand growth at around 6 million b/d this year, two OPEC+ sources told Reuters. The committee meets ahead of the monthly ministerial meetings of the OPEC+ alliance. It takes stock of the market developments, inventories, and compliance rates and, when asked, gives recommendations for policy actions to the meetings of the ministers. OPEC itself said in its Monthly Oil Market Report in May that it was optimistic that accelerating vaccination programs and rising fuel demand would raise global oil demand by 5.95 million b/d this year despite the COVID crisis in India.

Shale Oil: After last year saw some huge deals in the US shale industry, with ConocoPhillips merging with Concho Resources and Chevron buying Devon Energy, among others, it looks like this year will see a continuation of the M&A trend. Indeed, it is likely that consolidation is the only way forward for the industry. “It’s a better way to ride through the cycles in our business,” said the chief executive of Cimarex following the announcement of its all-stock merger with Cabot Oil & Gas Corp earlier this month.

Small US oilfield service companies sold equipment and shut their doors as business activity shrank last year, and contract prices have remained below profitable levels despite oil-price gains. The companies that provide equipment and services to the shale oil industry were among the hardest hit after the coronavirus pandemic sent oil prices reeling to record lows. The departures of loss-making businesses have raised the hopes of larger firms that industry margins will rise.

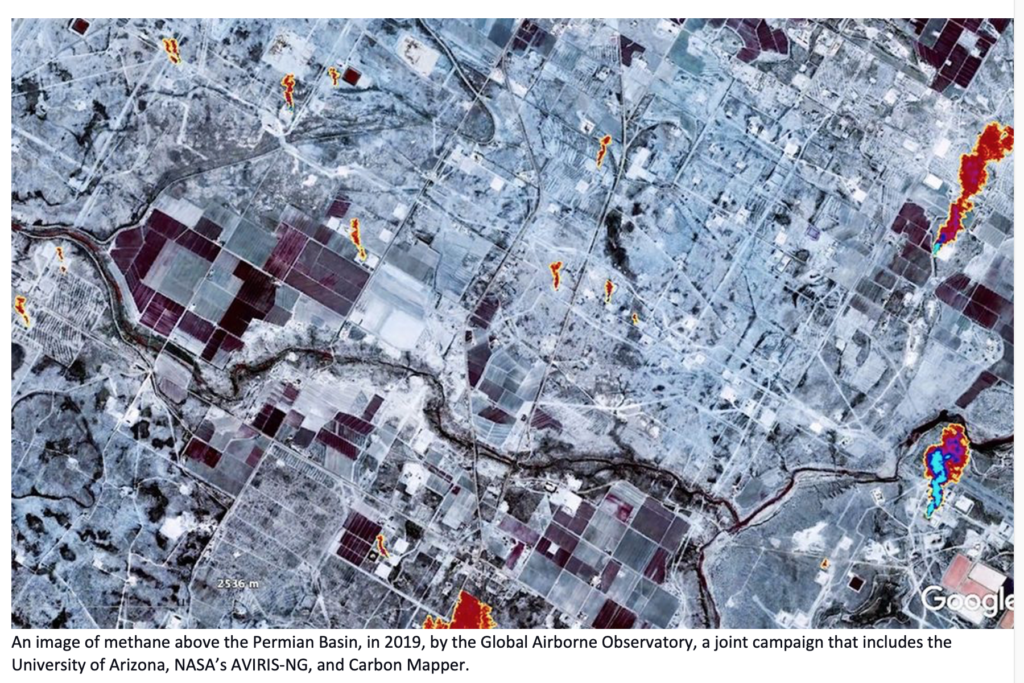

The Permian Basin has expanded its production more quickly than any other oil and gas region in recent years, reaching 38% of US oil and 17% of gas production in 2020. With this increase in production, greenhouse gas emissions have increased substantially, although just how much has until recently been impossible to say. Between September and November 2019, a team of scientists from the NASA Jet Propulsion Laboratory, the University of Arizona, and Arizona State University flew multiple times over the 21,000 square miles of the Permian Basin with airplanes bearing sensors that allowed them to pinpoint “super-emitters” of methane.

About 29% of the total lost gas quantified in flyovers between September and November 2019 came from “routinely persistent” sources, indicating that these leaks could be largely eliminated with repairs and diligent monitoring. The releases represented just 11% of emissions sites from a total of 1,100 unique sources studied.

While carbon dioxide is a more significant driver of global warming and lasts longer in the atmosphere, methane—the main component of natural gas—traps more than 80 times as much heat over 20 years. Halting methane emissions from the oil and gas industry has jumped to the top of climate to-do lists in part because policy analysts have identified it as one of the cheapest and easiest ways to hold down global temperatures.

International Energy Agency: Oil demand is recovering faster than previously expected. Unless OPEC+ puts additional barrels on the market on top of the plans to restore 2 million b/d by July, oil prices will be heading higher as the gap will widen, the EIA’s Executive Director, Fatih Birol, told Bloomberg. According to Birol, global oil demand could return to the pre-crisis levels of 2019 as soon as in a year. This most recent oil demand proclamation is in stark contrast to its forecast three months ago. The IEA said in its annual Oil 2021 report, with projections through 2026, that global oil demand would take until 2023 to return to the pre-pandemic levels of 100 million b/d. Back then, the Paris-based agency warned that COVID-19 would change parts of consumer behavior forever, with global gasoline demand likely past its peak already.

Energy investment is on track to recover by nearly 10% in 2021 as the world emerges from the COVID-19 pandemic, the IEA said last week. However, spending will fall far short of meeting urgent climate goals. More than $1.9 trillion in investment is projected to shift toward electricity, with more than $820 billion earmarked for power – the sixth year in a row renewables will outstrip investment in traditional oil and gas. “The rebound in energy investment is a welcome sign, and I’m encouraged to see more of it flowing towards renewables,” Fatih Birol said in an introduction to the annual World Energy Investment report.

Natural Gas: US natural gas storage fields injected just above the five-year average for the week ended May 28th. However, below-normal builds are expected in the weeks ahead as gas-fired power generation accelerates and LNG exports outpace June expectations. Storage volumes now stand at 386 billion cf, or 41%, less than the year-ago level of 2.699 trillion cf, and 61 billion cf, or 2.6%, less than the five-year average of 2.374 Tcf.

Living for seven years with sanctions that target its oil and gas projects, Russia has grown accustomed to living under pressure. The sanctions have made it much more difficult to lend money, more challenging to secure viable partnerships and access state-of-the-art technologies. Going beyond the day-to-day challenges, there is one thing missing from Russia’s portfolio – a breakthrough within its import substitution drive.

Developing and commissioning its liquefaction technology might have been just that, a clear statement that Russian companies can overcome their technological arrears in a sector they had previously put on the back burner. Yet, that is what we see right now. The “Arctic Cascade” project is destined to become the jewel in the crown of Yamal LNG. The first patented Russian technology to liquefy natural gas, Arctic Cascade seems poised to decrease liquefaction costs.

Electricity: The first technical conference on climate change sponsored by the Federal Energy Regulatory Commission called for greater integration of climate projections, resource adequacy, and grid planning. Today’s approaches will not suffice in meeting future electricity needs brought on by extreme weather and the changing climate, the power sector experts said. They advocated for a greater emphasis on climate vulnerability. “Climate change presents a fundamentally different problem than electric utilities and others in the industry have had to deal with in the past,” Romany Webb, a senior fellow at Columbia University’s Sabin Center for Climate Change Law, said during the technical conference.

Texas legislators hashed out their differences in proposed legislation to address the failures at power plants and gas infrastructure and prevent another deadly power crisis like the disaster in February, which left over 11 million without electricity for days. The Texas House and Senate passed new legislation, Senate Bill 3, and sent it to Gov. Greg Abbott one day before the 87th Texas Legislature expired. In the version passed by the House and sent to the Senate, the state would require power plants to weatherize to be prepared for extreme weather events such as the Texas Freeze in February. Some gas infrastructure related to feeding gas to gas-fired power plants—considered critical — will also be required to weatherize to avoid a repeat disaster.

Prognosis: Get ready for $5 per gallon gasoline – especially if you live in California. At least, that was the contention of a new WSJ op-ed that claims higher taxes and environmental regulations are both driving up gas prices. Author Allysia Finley notes that the average cost at the pump in California is now $4.18 a gallon, pointing out that in 2017, Democrats in the state’s legislature raised a tax on each gallon by 20.8 cents over three years.

California drivers are now paying an astonishing average of 63 cents a gallon in state and local taxes, compared to an average of 36.8 cents elsewhere in the country. The reasoning for the price hike was to repair the state’s infrastructure, but instead, the proceeds have been “directed toward projects aimed at reducing greenhouse gas emissions, such as bike lanes and mass transit,” the op-ed notes. The California Air Resources Board is also responsible for imposing a tax through its cap-and-trade program, which has added about 14 cents per gallon to the state’s average gas price.

“This time is different” may be the most dangerous words in business: billions of dollars have been lost betting that history won’t repeat itself. And yet now, in the oil world, it looks like this time really will be different. For the first time in decades, oil companies aren’t rushing to increase production to chase rising oil prices as Brent crude approaches $70. Even in the Permian, the prolific shale basin at the center of the US energy boom, drillers resist their traditional boom-and-bust cycle of spending. The oil industry is on the ropes, constrained by Wall Street investors demanding that companies spend less on drilling and instead return more money to shareholders and climate change activists pushing against fossil fuels.

The recent dramatic events in the industry only add to what is emerging as an opportunity for the producers of OPEC+, giving the coalition led by Saudi Arabia and Russia more room for maneuver to bring back their production. “We see a shift from stigmatization toward the criminalization of investing in higher oil production,” said Bob McNally, president of consultant Rapidan Energy Group and a former White House official.

Beyond 2021, oil output is likely to rise in a handful of nations, including the US, Brazil, Canada, and new oil-producer Guyana. But production will decline elsewhere, from the UK to Colombia, Malaysia, and Argentina. As non-OPEC+ production increases less than global oil demand, the cartel will control the market, executives and traders said. It’s a significant break with the past when oil companies responded to higher prices by rushing to reinvest, boosting non-OPEC output, and leaving the ministers led by Saudi Arabia’s Abdulaziz bin Salman with a much more difficult balancing act.

2. Geopolitical instability

(These are the situations that are reducing the world’s energy supplies or have the potential to do so.)

Iran: The US State Department signaled on June 3rd that indirect talks with Iran on rejoining the 2015 nuclear deal and removing US energy sanctions could stretch on for weeks. The Biden administration had been attempting to strike a framework deal with Iran before the country’s June 18th presidential election, which hardliners are expected to win. US Spokesperson Ned Price noted, “We’ve always said this will be a set of negotiations that spans multiple rounds. We expect there will be a sixth, and I think there’s just about every expectation there will be subsequent rounds beyond that.”

Iran’s oil minister said the country should try to increase its crude production rapidly as world powers enter the final stages of negotiations to revive the 2015 nuclear accord with the Islamic Republic. “The next Iranian government should make it a top priority to raise oil production to 6.5 million barrels a day,” Oil Minister Bijan Zanganeh told reporters. Iran’s daily production is only around 2.5 million barrels, and it hasn’t reached levels of 6 million since the 1970s. If the nuclear deal is revived, the US would probably ease sanctions on Tehran’s oil, banking and shipping sectors.

In Tehran, an oil refinery caught fire just hours after the Islamic Republic’s largest warship caught fire and sank in the Gulf of Oman under mysterious circumstances. Operations are expected to resume on June 3rd at the Tehran refinery, according to Oil Minister Bijan Zanganeh.

Iran’s nuclear fuel production plunged in recent weeks, the UN’s atomic agency reported last week, following the sabotage of its main nuclear facility in April that Tehran has blamed on Israel. The drop in production, detailed in the International Atomic Energy Agency’s confidential report circulated Monday, gives the first substantive insight into the impact of the incident, which took out the power supply at Natanz and destroyed potentially hundreds of centrifuges, the machines that enrich uranium.

Iran has started sending crude oil via the Goreh-Jask pipeline that passes by the Strait of Hormuz and ends at the port city of Jask in the Gulf of Oman, from where the oil can be loaded on tankers for export.

Iraq: Oil exports in May averaged 3.33 million b/d, according to Oil Ministry and industry data — a slight decline from April for both the federal government and Kurdistan Regional Government’s oil sectors. The average price for Iraqi oil increased by nearly $3 per barrel, giving the federal government $5.9 billion in oil revenue last month, up from $5.5 billion in April and the highest monthly total since $6.1 billion in January 2020.

The oil ministry should conduct an “appropriate” study of the government’s contracts with foreign oil companies according to a Cabinet decision. Some members of parliament and other politicians often express concern about specific agreements signed with oil majors, which they believe carry unfair financial terms. This debate has gone on for years.

Since the fall of Saddam Hussein in 2003, Iraq has played the central powers in the Middle East off against each other – the US axis focused on Saudi Arabia (and Israel) on one side, and the Sino-Russia axis focused on Iran on the other. Overall, these efforts have been broadly successful, allowing Iraq to gain hundreds of billions of dollars from the US while also playing a crucial part in extending Iran’s power across the region and beyond. With the onset of the US’s new strategy to tie in Arab states through a series of ‘relationship normalization’ deals with Israel, the difficulties for Iraq in maintaining this difficult balancing act have increased markedly.

Libya: During May, revenues from sales of crude oil, gas, condensates, and petrochemical by-products came in at $1.3 billion. In March, Libya had generated as much as $2.05 billion in revenues, and for April, Libya’s crude oil sales dropped sharply to $1.24 billion. Crude oil production in April was lower than the average oil output in March because of a force majeure on one of its export terminals.

Venezuela: The Biden administration has given Chevron and four other US oil service companies until Dec 1st to wind down operations in Venezuela. The action by the Treasury Department extends a previous six-month waiver that was set to expire on Jun 3rd. It allows Chevron, Halliburton, Schlumberger, Baker Hughes, and Weatherford International to continue limited work with Venezuela’s state PDVSA outside of US sanctions. It is the latest in a string of extensions since a waiver was initially issued under the Trump administration in January 2019.

As the Venezuelan state disintegrates under the weight of President Maduro’s corrupt leadership and American sanctions, his government is losing control of segments of the country, even within his stronghold: the capital, Caracas.

Nowhere is Maduro’s weakening grip on territory more evident than in Cota 905, a shantytown that clings to a steep mountainside. In the maze of shacks that make up Cota 905 and the adjoining communities of El Cementerio and La Vega, home to about 300,000 people, the capital’s largest gang has moved into the power vacuum left by an unraveling nation. The territory the gang controls is off-limits to law enforcement. And, a local police commander said, with access to grenade launchers, drones, and high-speed motorbikes, the gangsters are better armed and better paid than most of Venezuela’s security forces.

3. Climate change

Almost three-fourths of the western US is gripped by drought so severe that it’s off the charts of anything recorded in the 20-year history of the US Drought Monitor. Mountains across the West have seen little precipitation, robbing reservoirs of dearly needed snowmelt and rain, said Brad Rippey, a meteorologist and Drought Monitor author. The arid conditions mean the wildfire threat is high, and farmers are struggling to irrigate crops.

The previous week’s news was nothing short of astonishing. A court in the Netherlands issued a landmark ruling against Royal Dutch Shell — an oil company already pledging to cut its carbon emissions to net-zero by 2050 — ordering it to act faster. At Chevron’s shareholder meeting, investors voted to demand that the company reduce its contribution to climate change. The demand was short on specifics, but investors made it clear that it was not enough to use renewable energy to power oil and gas operations: Real action on climate change means selling less oil.

In Royal Dutch Shell’s case, The Hague District Court declared that the company had contributed substantially to climate change and that its plan to address greenhouse emissions is insufficiently ambitious. Under the court’s order, Shell must ditch its strategy to cut its carbon intensity, which would not necessarily reduce the amount of emissions it releases into the atmosphere, and devise a way to nearly halve the emissions for which it is responsible by 2030. The decision could signal follow-on rulings against other big polluters subject to European courts.

A much more significant shareholder revolt took place at ExxonMobil. Activist investors took on the giant and won, delivering a stinging rebuke to the company’s management. The hedge fund Engine No. 1 placed three new directors on the board of what was once the world’s most influential oil company.

The tiny activist fund that recently won three seats on Exxon’s board sets its sights on a new challenge — the $6.3 trillion ETF industry. Engine No. 1 is now planning to launch its first exchange-traded fund. According to a regulatory filing, the “Transform 500” ETF’s goal is to encourage changes at the companies it holds through proxy voting.

Climate activists who scored big against Western majors the week before last had some unlikely cheerleaders in the oil capitals of Saudi Arabia, Abu Dhabi, and Russia. Defeats in the courtroom and boardroom mean Royal Dutch Shell, ExxonMobil, and Chevron are all under pressure to cut carbon emissions faster. That’s good news for the likes of Saudi Arabia’s national oil company Saudi Aramco, Abu Dhabi National Oil Company, and Russia’s Gazprom and Rosneft. It means more business for them and the Saudi-led OPEC.

Small, privately held drilling companies are becoming the country’s biggest emitters of greenhouse gases, often by buying up the industry’s high-polluting assets. According to a new analysis of the latest emissions data disclosed to the Environmental Protection Agency, five of the industry’s top ten emitters of methane are little-known oil and gas producers, some backed by obscure investment firms, whose environmental footprints are wildly large relative to their production. In some cases, the companies are buying up high-polluting assets directly from the largest oil and gas corporations, like ConocoPhillips and BP; in other cases, private equity firms acquire risky oil and gas properties, develop them, and sell them quickly for maximum profits.

4. The global economy and the coronavirus

The US, European Union, Canada, and other developed countries have signed deals to get hundreds of millions of doses of Covid-19 vaccines and boosters over the next two years, reducing a divide between rich and developing countries. About 6 billion doses have been purchased by more than two dozen rich nations and the European Union. By comparison, the rest of the world has combined to buy only some 3 billion doses.

A strengthening world recovery from the Covid-19 pandemic risks leaving many regions behind, fueling inequalities across and within borders. The OECD revised its 2021 global growth forecast to 5.8% from 5.6%; it warned that living standards for some people won’t return to pre-crisis levels for an extended period.

Global food prices have surged by the biggest margin in a decade, as one closely watched index jumped 40% in May, heightening fears that the inflation initially stoked by pandemic disruption was accelerating. The year-on-year rise in the UN Food and Agriculture Organization’s monthly index was the largest jump since 2011, as commodity prices surged.

United States: The US economic recovery is unlike any in recent history, powered by consumers with trillions in extra savings, businesses eager to hire, and enormous policy support. Businesses and workers are poised to emerge from the downturn with far less permanent damage than occurred after recent recessions, particularly the 2007-09 downturn. Payrolls increased by 559,000 last month after a revised 278,000 gain in April, according to a Labor Department report Friday.

Intel Corp’s CEO said it could take several years for a global shortage of semiconductors to be resolved, a problem that has shuttered some auto production lines and is also being felt in other areas, including consumer electronics.

European Union: Germany is considering lifting 2030 targets for solar and onshore wind by 50 GW and 24 GW, respectively, according to a leaked document. The “climate action plan 2022” draft sets Germany’s target for solar at 150 GW and onshore wind at 95 GW. The paper said the measures starting 2022 were needed to deliver on a new 2030 climate law draft.

The European Commission and Bill Gates joined forces in an initiative to mobilize as much as $1 billion investment in clean technologies such as green hydrogen and sustainable fuels. The Commission and Breakthrough Energy Catalyst, a program founded by Gates, want to muster the funding in 2022-2026 to build large-scale, commercial-demonstration projects that will deliver significant reductions in carbon dioxide. The partners will also invest in direct air emissions capture and long-duration energy storage.

The Greens in the European Parliament warned that some member states’ recovery plans may lead to so-called greenwashing and could fail to meet the region’s climate-related spending goals. The political group called on the European Commission to reject national measures that are not in line with standards set for a climate-friendly recovery. While some national plans appear to meet climate-related spending targets on paper, “a closer look reveals that billions of euros are subject to mis-tagging and rule-bending.”

China: Factory activity slipped in May, but consumer spending held up. The result was broadly in line with the 51.1 median forecast expected by economists polled by The Wall Street Journal and marked the 15th straight month that the gauge came in above the 50 mark that separates expansion from contraction. Total new orders retreated to the lowest level in a year as fewer bookings from overseas markets pushed new export orders into contraction territory.

China’s runaway economic recovery has been so successful that it has caused power shortages across dozens of its manufacturing and industrial hubs in the country’s south. Factories across cities such as Guangzhou, Foshan, and Dongguan, known for producing global consumer and high-tech products, have been ordered to use less power and even close between one to three days a week to mitigate the shortfall. China’s state planner warned provincial and regional governments against missing their energy consumption, and efficiency targets for 2021 after two-thirds of them fell short of at least some of their goals in the first quarter.

Electric vehicle makers and suppliers rallied on Tuesday after a string of positive news for the industry, with Chinese companies clocking in the most significant gains. This year, electric-car makers have had a hard time holding on to the intense market enthusiasm of 2020 amid an increasing threat of competition from legacy automakers, the global semiconductor shortage, and a rising reluctance among investors for holding onto riskier assets.

China’s independent refineries are struggling to secure adequate feedstock for the coming months due to tight regional supplies and high prices, market and industry sources told S&P Global Platts. Beijing introduced a consumption tax on imported cargoes of blended heavy crudes, at the same rate as fuel oil from June 12th, leading to independent refineries imported crude feedstock to be restricted mainly by their crude import quota.

China is likely to cap its key oil product exports — gasoline, gasoil, and jet fuel — in 2021 by slashing quota allocation to meet the carbon emission peak target. Several Beijing-based sources with knowledge of the matter said on June 1. “Exporting these cargoes of oil products to overseas almost [equates] to exporting carbon to other countries, which goes against the global goal of making carbon peak earlier,” one of the sources said. “We never believed China wanted to become increasingly short on crude just to export more products, in part as it raises pollution and increases carbon intensity,” said Grace Lee, senior analyst with S&P Global Platts Analytics. As a result, the government planned to cut the annual export quota for the products significantly from 2020.

Russia: President Putin’s government is spending more than $10 billion on railroad upgrades that will help boost exports of coal. Authorities will use prisoners to help speed the work, reviving a reviled Soviet-era tradition. The project to modernize and expand railroads that run to Russia’s Far Eastern ports is part of a broader push to make the nation among the last standing in fossil fuel exports as other countries switch to greener alternatives. The government is betting that coal consumption will continue to rise in big Asian markets like China.

President Putin said on Friday that Russia’s Nord Stream 2 gas pipeline is ready to start pumping gas to Germany, and the final stretch will be completed. Successive US administrations have imposed sanctions to block the project that will ship gas directly from Russia to Germany, bypassing Western ally Ukraine. Russia’s Gazprom has pressed ahead with building the pipeline after US sanctions left it without a Western pipe-laying company in late 2019. Still, the administration of President Biden last month waived some sanctions. “I think it should be completed especially given that the new US administration speaks of its intention to build up good relations with its key partners in Europe,” Putin told a forum in St Petersburg.

Saudi Arabia: Oil giant Aramco plans to raise around $5 billion in a new bond sale as early as this month, as it looks to fund its massive annual dividend of $75 billion. Saudi Aramco has already lined up more than a dozen banks to manage the bond sale. The debt sale could be both US-denominated and denominated in the local currency or Islamic bonds issue. “I think it was expected. They need the cash to pay the dividends that have been promised. They’ve done it in the past too,” a debt banker told Reuters.

India: The Indian capital, which just weeks ago suffered a devastating wave of the coronavirus, with tens of thousands of new infections daily and funeral pyres that burned day and night, is taking its first steps back toward normalcy. Last week, officials reopened manufacturing and construction activity, allowing workers in those industries to return to their jobs after six weeks of staying at home to avoid infection. The move came after a sharp drop in new infections, at least by the official numbers, and as hospital wards emptied and the strain on medicine and supplies has eased. Life on the streets of Delhi is not expected to return to normal immediately. Schools and most businesses are still closed. The Delhi Metro system, which reopened after last year’s nationwide lockdown, has suspended service again.

Citizens of Mumbai now pay twice as much for gasoline as a citizen of New York City, Bloomberg reported, with prices at the pump up 11% since the start of the year in India’s most populous city. However, the price rise has to do with a series of increases in the sales tax, which, Bloomberg says, the government applied in an attempt to prop up public finances. Since 2013, the sales tax on gasoline and diesel has risen almost six times and currently makes up about 60 percent of the end-price of the fuels.

Oil demand in India has been clouding the outlook of global crude consumption since a devastating second COVID wave resurged in the world’s third-largest oil importer three months ago. India’s uneven—and now stalled—recovery has been the key source of concern about global oil demand recovery in recent months, primarily because of the unknowns about when localized lockdowns would end.

As severe and deadly as the second coronavirus wave in India is, it hasn’t hit the economy and fuel demand as much as the onset of the pandemic hurt the country in April 2020. This year, the central government refrained from imposing a nationwide lockdown, fearing an economic collapse during regional elections.

5. Renewables and new technologies

Chinese media have reported that researchers working on a nuclear fusion project have succeeded in holding plasma of 120 million degrees Celsius for close to two minutes. The fusion project succeeded in maintaining plasma at 160 million degrees Celsius for 20 seconds. The next step would be to keep these temperatures for as long as a week, according to a physics professor at the Southern University of Science and Technology. China’s nuclear fusion reactor first made headlines in 2019 when Beijing said it would soon begin operations.

A Dominion Energy ship being built to install offshore wind farms will be the first to comply with a US domestic transport mandate. The power company expects the vessel to play a vital role in the nation’s clean-energy plans. The ship is scheduled to be sea-ready by late 2023 and will adhere to the Jones Act, a century-old law that goods transported between US ports be carried on domestically built and crewed ships. Ørsted and Eversource will charter the $500 million vessel to build two offshore wind farms that will power nearly a million homes in Rhode Island, Connecticut, and New York.

SK Corp has made an investment in Monolith, a US company that has developed a plasma-based process to produce “cyan” hydrogen—between green (via electrolysis using renewable energy) and blue (conversion of methane accompanied by CO2 capture and storage). Monolith’s cyan hydrogen is produced by injecting natural gas containing methane (CH4) as the main component into a high-temperature reactor and decomposing it into hydrogen (H2) and solid carbon. The carbon is processed into carbon black, the main component of tires, and sold. Because carbon dioxide is not generated during the production process, it is classified as clean energy.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

| RE investment to trump O&G: Upstream oil and gas investment is expected to rise by about 10% in 2021 as companies recover from the financial shock of COVID-19, but spending will remain well below pre-crisis levels and is being outpaced by surging investment in renewable power, according to the IEA. (6/3) Corporate O&G tug of war: The world’s biggest asset manager and top BP investor BlackRock said it had backed a shareholder resolution calling for faster climate action, which the energy company’s board opposed. (5/31) The Polish government is analyzing Denmark’s decision to withdraw the environmental permit for the Danish section of the 10 Bcm/year Baltic Pipe project. The pipeline will allow Poland to directly import Norwegian gas and end its decades-long dependence on Russian imports. (6/4) Japan, the world’s fifth-largest crude importer, and second-largest LNG importer, provides only 7-8% of its energy from domestic resources. Against this background, Japan has started to make its first steps towards an all-encompassing renewables policy. Wind energy has so far been underrepresented in Japan’s energy matrix; however, a slew of recent developments could portend a solid future for wind farms along the Japanese coast. (6/3) In Australia, electric car giant Tesla said it expects to buy soon more than $1 billion a year of the nation’s lithium, nickel, and other critical minerals for its batteries and engines. (6/3) Some of Africa’s 15 oil-producing nations yesterday opposed what they described as the global conspiracy to shut down the economies of the continent’s resource-dependent countries. They urged members to take urgent action against the threat to their combined 100 billion barrels of oil reserves. They called for massive investment in R&D to prepare against the impending storm occasioned by the gradual withdrawal of external funding for fossil fuels and the plan by Europe and America to stop the production of machinery used in the oil and gas industry. (6/4) In Algeria, BP and Eni are in talks over their oil and gas assets in that nation. The two groups increase efforts to refocus their businesses to tackle falling margins, rising debt, and climate pressures. (6/1) Nigeria’s crude oil export revenues slumped by as much as 98 percent from March to April this year because of movements in the price of gasoline. (6/2) Exxon is leaving a deepwater prospect in Ghana after seismic work failed to produce good enough results. The work Exxon had performed consisted of processing some 2,200 square kilometers of seismic data. What it did not involve was drilling any exploration wells. (6/2) Brazil’s worst water crisis in almost a century is turning Latin America’s biggest economy into a hot spot for liquefied natural gas. As hydropower output declines, South America’s most populous nation is turning to the super-chilled fuel to keep lights on for its 212 million people. (6/4) Brazil thinks it can do it all as it refuses to curb fossil fuel production despite IEA warnings while still expecting to meet environmental goals. Meanwhile, Equinor, ExxonMobil, and Petrogas Brasil agreed on the $8 billion phase one development of Brazil’s Bacalhau oil field. (6/3) Ecuador’s state-owned Petroecuador has declared force majeure at Campo Eden Yuturi, a highly strategic field located in Block 12 in eastern Orellana province, saying blockades by an indigenous community have negatively impacted operations safety of workers. Last September, the area was producing 30,000 b/d and has been paralyzed since May 10; another 60,000 b/d are at risk. (6/5) The US oil rig count stayed the same last week at 359 while the gas rig count decreased by 1 to 97, Baker Hughes reported on Friday. Drillers have added 105 so far this year, with the count 172 more year over year. Yet recently, drillers have displayed some level of trepidation in roaring back. (6/5) ANWR drilling nixed: The Biden administration on Tuesday suspended oil leases in the Arctic National Wildlife Refuge in Alaska, blocking plans for the first-ever drilling program in the pristine 19-million-acre wilderness. (6/2) Fossil fuel tax breaks nixed: President Joe Biden’s budget proposal released Friday has targeted specific tax provisions that benefit the fossil fuel industry and aims to eliminate measures that will generate $35 billion over a decade. (6/3) States rights? Officials from California, New York, and other states urged the Environmental Protection Agency on Wednesday to allow California to set its own automobile tailpipe pollution standards, which would reverse a Trump administration policy and could help usher in stricter emissions standards for new passenger vehicles nationwide. (6/3) Lawmakers in more than a dozen red states around the nation are attempting to push through laws that would pull funding from state-run and large financial institutions that take steps to decarbonize their investment portfolios. (6/2) Seaborne coal prices have been bullish over the past year, mainly rising from pandemic lows last spring as global energy demand resumes and economies strengthen. (5/31) Billionaire Bill Gates’ advanced nuclear reactor company TerraPower LLC and PacifiCorp have selected Wyoming to launch the first Natrium reactor project on the site of a retiring coal plant, the state’s governor said on Wednesday. Small, advanced reactors, which run on different fuels than traditional reactors, are regarded by some as a critical carbon-free technology that can supplement intermittent power sources like wind and solar as states strive to cut emissions that cause climate change. Nuclear power experts have warned that advanced reactors could have higher risks than conventional ones. (6/3) UK nuke push: The United Kingdom will start to create a regulatory framework for supporting research and development of nuclear fusion technology to enable the delivery of clean and safe energy, the government said on Tuesday. (6/2) BP’s solar push: BP revealed that it had reached an agreement to purchase nine gigawatts (GW) of solar development projects in the US from 7X Energy. BP noted that the acquisition represents a significant step towards its target of growing its net developed renewable generating capacity to 20GW by 2025 and its aim to increase this to 50GW by 2030. (6/2) Danish renewables company Ørsted, the most prominent developer of offshore wind farms in the world, plans to invest the equivalent of over US$57 billion by 2027 as part of a new strategy to become a global green energy major. Ørsted, which currently has 12 gigawatts (GW) of installed renewable capacity worldwide, plans to increase that capacity to 50 GW by 2030. (6/3) Long before the era of fossil fuels, humans may have triggered a massive but mysterious “carbon bomb” lurking beneath the Earth’s surface. If the new scientific study is correct, it would mean that we have been neglecting a significant human contribution to global warming — one whose legacy continues. The researchers suggest that beginning well before the industrial era, the mass conversion of carbon-rich peatlands for agriculture could have added over 250 billion tons of carbon dioxide to the atmosphere. Peatlands are a particular type of wetland, one in which dead plant matter does not fully decay due to the damp conditions, and thus accumulates. In its normal state, peat slowly pulls carbon out of the atmosphere — unless you disturb it. (6/5) |