Editors: Tom Whipple, Steve Andrews

Quote of the Week

“There’s a war over talent globally. The renewable sector, given the massive amount of growth that is expected, doesn’t have enough people.”

Miguel Stilwell, CEO Portuguese clean-energy firm EDP Renovaveis SA.

The company is a top-tier installer of green power and plans to hire 1,300

employees over the next two years.

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Crude posted its third straight weekly rise on improving demand, with the International Energy Agency warning the market will need extra supply next year. New York futures rose 1.9% last week, extending their rally to the highest settlement since October 2018. The IEA said that OPEC and its allies would need to lift output to keep the market adequately supplied, though the agency predicted demand wouldn’t reach pre-virus levels until late 2022. Meanwhile, road traffic in the US and much of Europe is essentially back to levels seen before the pandemic.

Goldman Sachs has reiterated its forecast that Brent crude will hit $80/barrel this summer as demand quickly recovers. “Rising vaccination rates are leading to higher mobility in the US and Europe, with global demand estimated up 1.5 million b/d in the last month to 96.5 million.” Goldman first said it expected Brent to hit $80 this year in March, expecting this to happen by 2021’s third quarter. Then, in April, the bank noted, “The magnitude of the coming change in the volume of demand — a change which supply cannot match — must not be understated.”

Traders have alighted on what some believe to be a one-way bet on oil prices going to $100 a barrel. Oil prices haven’t topped that milestone since 2014 when a gusher of US shale oil depressed energy markets.

Global oil demand is set to rebound and remain robust for some time, BP’s chief executive Bernard Looney told Bloomberg News, reiterating views expressed by most forecasters and analysts. “There is a lot of evidence that suggests that demand will be strong, and the shale seems to be remaining disciplined. I think that the situation we’re in at the moment could last like this for a while.” Looney’s assessment of the oil market is similar to the views recently expressed by investment banks such as Goldman Sachs and Barclays and OPEC, and the International Energy Agency (IEA).

Construction of the controversial Keystone XL pipeline was officially terminated on Wednesday, handing a significant victory to environmentalists that fought the project for more than a decade. The decision by TC Energy and the government of Alberta to pull the plug on the $8 billion pipeline had been widely expected after President Biden scrapped the permit to build its US leg in one of his first acts as president.

In Canada, where politicians had lobbied to keep the project alive, Biden’s decision was greeted with dismay. This was especially true in Alberta, where the province had taken a $1.1 billion stake in the project and lent TC Energy another $4-7 billion for construction. Some 150km of the pipeline had already been installed in the Canadian province. Production from Canada’s ultra-heavy oil deposits is more carbon-intensive than most other forms of crude. This made the Keystone XL a target for environmentalists, who argued that new pipeline projects encourage continued fossil fuel production when the world needs to slash its emissions.

International Energy Agency: Oil demand is expected to exceed pre-coronavirus levels by the end of 2022, the IEA said on Friday. Consumption declined by a record 8.6 million b/d last year as coronavirus raged around the world. It is expected to rebound by 4-5 million b/d this year as vaccines are rolled out, and countries open up again. In 2022, the IEA expects a further 3.1 million b/d increase, to average 99.5 million b/d with a boost at the end of the year that will surpass the level of demand before the coronavirus crisis took hold.

Slow vaccine distribution, the agency says, could “jeopardize” any rebound. The aviation sector will be slowest to recover as governments keep certain travel restrictions until the pandemic is brought firmly under control. Gasoline demand could take longer to recover as work-from-home practices continue, and electric vehicles’ rising adoption offsets increased mobility.

China’s energy experts expressed concerns over the IEA’s net-zero emissions pathway, citing the lack of a differentiated approach between developed and developing countries and unrealistic milestones to phase out fossil fuels. They said the IEA’s ambitious milestones were arduous given China’s continued energy demand growth, coal-dominant electricity system, and yet-to-be-reinforced market mechanisms for electricity and carbon pricing; thus they suggested a more localized approach. “Countries are at different stages of development; they have different energy resources and different population sizes. China is the largest energy producer and energy consumer, but its per capita energy consumption is still small,” Xie Qiuye, Dean of China’s Electric Power Planning and Engineering Institute,

OPEC: Crude oil production from OPEC and its allies jumped 430,000 b/d in May, the latest S&P Global Platts survey found. The increase was led by Saudi Arabia, which accounted for about 84% of the total monthly rise. The OPEC+ alliance, which held almost 7 million b/d of production offline in April to speed the market’s rebalancing, began significantly relaxing its output quotas last month to anticipate rising summer oil demand and a healthier global economy. OPEC’s 13 members pumped 25.71 million b/d in May, its highest since April 2020.

OPEC is sticking to its prediction of strong world oil demand recovery in 2021 led by the US and China. This prediction comes despite uncertainties stemming from the pandemic, pointing to a need for more oil from the producer group. In a monthly report on Thursday, OPEC said demand would rise by 6.6% or 5.95 million b/d this year.

According to a senior executive at the world’s biggest independent oil trader, Vitol Group, the cartel appears in control of crude prices as US production is lagging pre-pandemic levels. The decline in US drilling and output leaves little competition to efforts by the producers’ group to manage markets.

Shale Oil: ExxonMobil’s oil wells in part of the Permian shale field generated fewer barrels per well as it ramped up overall spending and production, according to a new report that looks at data from 2018-2019. A $6.6 billion acquisition in 2017 of New Mexico acreage doubled Exxon holdings in the basin. The Permian’s New Mexico portion is among Exxon’s priorities to boost shale output to 700,000 b/d by 2025. Exxon’s average liquids output over a well’s first 12 months fell to 521 b/d in 2019 in its Delaware basin holdings in New Mexico, down from an average of 635 b/d in 2018, according to IHS Markit data compiled by the Institute for Energy Economics and Financial Analysis.

A oil price recovery to more than two-year highs offers a long-awaited opening to companies and private equity firms to shed unloved assets in the US oil patch. Sales of land parcels worth $6.9 billion have been announced in the first five months of 2021, almost eclipsing the $7 billion recorded in all of 2020. Occidental Petroleum said it would sell some of its Texas Permian acreages to an affiliate of private equity-backed Colgate Energy Partners for $508 million.

The number of earthquakes rattling the US shale patch is growing exponentially as producers pump massive amounts of dirty water from their oil and gas wells back underground. Tremors registering at least a 2.0 on the Richter scale quadrupled from 2017 levels to a record 938 last year and are on pace to top that this year, according to a Rystad Energy analysis of data in Oklahoma, Texas, Louisiana, and New Mexico. Though earthquakes have long been linked to activity related to shale production, the report provides more evidence of the connection in the US Southwest, where oil drilling has intensified in the past decade.

Natural Gas: The EIA raised by 1.63 billion cf/d to 99.76 billion its natural gas marketed production estimate for the US in the third quarter of 2021. In its June Short-Term Energy Outlook, EIA also raised its 2021 production forecast by 1.43 billion cf/d to 99.29 billion.

US exports of liquefied natural gas are set to surge this year from the already record levels in 2020 as demand in Asia and Europe is high. All-time high LNG exports are set to keep the US benchmark, the Henry Hub spot price, averaging above $3 per million British thermal units this year. This would be more than $1 per million above last year’s average price of just $2.03.

New wind capacity and higher gas prices appear to be slashing Midwest power burn, with Illinois showing the most significant drop in deliveries to power plants this year versus last. On a per-degree basis, Midwest power burn is down year over year so far this summer. The accelerating transition toward a low-carbon future promises a slow decline for gas-fired power generation in the years ahead as wind and solar continue to gain traction, propelled by low costs and mounting policy pressure for adoption.

In 2020, natural gas accounted for a record 38% of total power generation in the US. By the early 2030s, its market share is now forecast to fall below 30%. Over the same decade-long period, total generation from wind and solar is expected to climb from just 11% in 2020 to more than 30% by 2030, according to recent S&P Global Platts analysis. As the energy transition unfolds in the 2030s and beyond, the trajectory of individual gas-fired power plants will vary widely depending upon their location and the prevailing market and policy environment.

Electricity: Extreme heat is expected to blanket the western US this week, causing power prices to soar. High temperatures will reach the low 90s F in Los Angeles on Monday-Wednesday, which is about 20 degrees higher than the city’s average high for June. Last summer an August heatwave forced California utilities to impose rotating blackouts that left over 400,000 homes and businesses without power for up to 2-1/2 hours when energy supplies ran short.

Abnormally warm early-summer weather and falling wind generation have lifted US gas-fired power burn to seasonal highs this month but rising gas prices threaten to put a damper on the rally. On June 9th, total demand from generators topped 39.6 billion cf/d, marking a record high for demand in any late-spring period before the June 20th official start to summer. This month’s record came as population-weighted temperatures along the Eastern seaboard, the Southeast, and Texas topped 80 degrees F, spurring a wave of electric cooling.

There are malign cyber actors capable of shutting down parts of the US power grid, US Secretary of Energy Granholm said. “Even as we speak, there are thousands of attacks on all aspects of the energy sector and the private sector generally,” she added. When asked if American adversaries have the capability now of shutting down the US power grid, Secretary Granholm said: “Yes, they do.”

Prognosis: Standard Chartered’s latest oil market report looks at when global oil demand will peak. The report noted that it expects the month-on-month momentum of global demand to reach a peak in June and July. Standard Chartered is forecasting that global demand will increase from 94.97 million b/d in May to 97.22 million in June and 99.03 million barrels in July. After July, the company sees the pace of increase moderating, with 100 million b/d forecasted for December and 101 million b/d forecasted for July 2022. “We expect two-thirds of the increase in oil demand from May 2021 to July 2022 to occur this month and next month alone.”

When ExxonMobil decided to get out of a giant oil field in Iraq, the Iraqi government took on the unusual role of salesman. Iraqi officials pitched West Qurna-1 to likely buyers from among Exxon’s supermajor peers, including arch-rival Chevron. There weren’t any takers. That left Iraq with narrowed options: sell to one of China’s state-backed oil majors or buy back Exxon’s stake itself. The sale process remains unresolved, but either outcome would stand as a powerful indicator of what’s become of the global oil market. With supermajors from the US and Europe in retreat worldwide, national oil champions are set to fill the void.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: US, Iranian, European, and Chinese negotiators are preparing to start the sixth round of talks to restore the 2015 nuclear deal with Iran. According to people involved in the negotiations, discussions in Vienna were expected to start up again over the weekend. The US Treasury Department repealed sanctions on former senior National Iranian Oil officials and several companies involved in shipping and trading petrochemical products. The administration described the moves as routine administrative actions, saying the officials were removed from US blacklists because they no longer held positions in the sanctioned entities.

But officials familiar with talks underway in Vienna on the future of the 2015 multilateral Iran nuclear agreement said the Biden administration has been looking at how it could inject momentum into the negotiations. “These actions demonstrate our commitment to lifting sanctions in the event of a change in status or behavior by sanctioned persons,” Secretary of State Antony Blinken said in a statement accompanying the notice of the action.

Platts Analytics sees US sanctions relief by September, with Iran’s oil output expected to return to capacity next year. Analysts expect the Biden administration to take several weeks or months to remove them after the two countries agree to rejoin the 2015 nuclear deal.

In the latest attempt to block a new nuclear deal, US Republican senators proposed a bill to require that President Biden submits to Congress any renewed agreement with Tehran as a treaty. Analysts do not expect the Republican proposal to get enough votes for passage. Still, they said it shows the rhetorical opposition the Biden administration faces domestically if the US and Iran both agree to return to the 2015 Joint Comprehensive Plan of Action.

Iran plans to swiftly restore its crude oil production to pre-sanctions levels of nearly 3.4 million b/d, a senior Iranian industry official said. According to OPEC’s secondary sources in its latest monthly report, Iran’s crude oil production averaged 2.393 million b/d in April.

Iraq: For more than two months, the topic of selling ExxonMobil’s share in the Technical Service Contract for the West Qurna 1 oilfield has been under discussion. Referring to this as a “share sale” is incorrect since, when translated, the word mentioned in Article 28, “assignment,” means “transfer of ownership” or “forfeiture or giving up of ownership.”

Given the US’s scaling-down of its on-the-ground operations in the Middle East over the past five years, China and Russia have been busy occupying the spaces left by the US. Just a few days ago, Washington appeared finally to have caught up to what has been going on. Deputy Assistant Secretary of Defense, Dana Stroul, said: “It’s… clear that certain countries and partners would want to hedge and test what more they might be able to get from the United States by testing the waters of deeper cooperation with the Chinese or the Russians, particularly in the security and military space.”

According to industry officials, production resumed at the Qayarah heavy oil field in Ninewa province after a 14-month shut-in due to protests at export terminals, OPEC-plus output restrictions, and disputes over crude transport. According to the industry officials, production at Qayarah, which Angolan state oil company Sonangol operates, restarted at 10,000 b/d, with the crude being trucked to Kirkuk. This is far below the field’s 30,000-plus b/d capacity.

BP is planning to spin off its operations in Iraq into a standalone company as the oil major looks to shift focus to low carbon investments. The new company would hold BP’s interest in Iraq’s giant Rumaila oil field and be jointly owned by China National Petroleum Corp, one of BP’s partners at the site. The new entity will hold its own debt, separate from BP, and pay dividends.

Libya: Production recovery is slowing as the country’s aging oil infrastructure comes under pressure, with more falls likely in coming days due to a series of pipeline leaks. The national oil company’s CEO, speaking at the Libya Investment Conference, said the country’s crude output had fallen by 50,000 b/d in recent days due to issues at the Sharara, the largest oil field, along with pipeline leaks which were affecting operations at the Waha oil fields.

3. Climate change

The Northern Hemisphere awakens every June to another rite of spring—a new peak level for global atmospheric carbon dioxide. This year, that number is 419 CO₂ molecules for every million molecules of air, a.k.a. parts per million. Based on geological evidence collected over 60 years, scientists have been tracking atmospheric CO₂, this year’s peak appears to be the highest in 4.5 million years. This continued accumulation of greenhouse gas is driving dangerous global heating around the world. In 1958, when modern measurements began, atmospheric CO₂ was at 316 ppm. Three centuries ago, before the industrial age, geological records show that number was 280 ppm. In other words, by burning fossil fuels in generators and cars, humanity has increased concentrations of the most important greenhouse gas by 50%.

Temperatures in the Middle East topped 125 degrees F. after a run of record-breaking heat. Several countries tied or challenged national records amid the blistering heatwave, which has brought a string of temperatures about 15 degrees above normal to the already baked region. Five countries joined the 50-degree Celsius club, which equates to 122 degrees Fahrenheit. Humidity and heat extremes are on the verge of exceeding the limits of human survivability.

Last year, Saudi Arabia burned 25% more oil for electricity production than usual. The Kingdom also said that it might need to add 1 million b/d to its domestic consumption for electricity generation purposes. If this happens again this year, it could push oil prices higher.

Emerging and developing economies are set to account for the bulk of greenhouse gas emissions growth in the coming decades unless much more decisive action is taken to transform their energy systems, the IEA said recently. Emissions from emerging and developing economies (EMDEs) are projected to grow by five gigatons over the next two decades. In contrast, emissions are projected to fall by 2 gigatons in advanced economies and to plateau in China, the IEA said in a report, Financing Clean Energy Transitions in EMDEs. “By the end of the 2020s, annual capital spending on clean energy in these economies needs to expand by more than seven times, to above $1 trillion.”

Lake Mead, the largest reservoir in the US, has dipped to its lowest ever level as an extreme drought continues in the region. The surface elevation of Lake Mead has sunk about 140ft since 2000. The reservoir is a significant water supply source for more than 20 million people. Among them are residents of such big cities as Los Angeles and Las Vegas.

4. The global economy and the coronavirus

More people have died from Covid-19 this year than in all of 2020, highlighting how the global pandemic is far from over even as vaccines beat back the virus in wealthy nations. It took less than six months for the globe to record more than 1.88 million Covid-19 deaths this year, according to a Wall Street Journal analysis of data collected by Johns Hopkins University. These numbers underscore how unevenly the pandemic spread around the globe, often hitting poorer nations later, before they had access to the vaccines that have benefited Europe and the US.

The global chip shortage is disrupting the car industry and threatening the supply of consumer technology products. That shortage will last for at least another year, one of the world’s largest electronics contract manufacturers has warned. The forecast from Flex, the world’s third-biggest such manufacturer, is one of the gloomiest yet for a crisis that is forcing car and consumer electronics groups to re-examine their global supply chains. A rapid rebound in vehicle sales combined with a lockdown-driven boom in games consoles, laptops, and televisions has left the world’s chipmakers overwhelmed by the sharp increase in demand.

United States: The nation is averaging fewer than 1 million shots per day, a decline of more than two-thirds from the peak of 3.4 million in April, even though all adults and children over age 12 are now eligible. Small armies of health workers and volunteers often outnumber the people showing up to get shots at clinics around the country.

US lockdowns have lifted, and shopping is back. Retail sales are expected to jump between 10.5% and 13.5% to more than $4.44 trillion this year compared with last. That is nearly double the forecast in February when the forecast was for 6.5% to 8.2% growth in US retail spending.

The number of Americans applying for unemployment benefits fell for the sixth straight week as the US economy, held back for months by the coronavirus pandemic, reopened rapidly. Jobless claims fell by 9,000 to 385,000 compared to the prior week, the Labor Department reported Thursday. The number of people signing up for benefits exceeded 900,000 in early January and has fallen fairly steadily ever since. Before the pandemic brought economic activity to a near-standstill in March 2020, weekly applications regularly came in below 220,000.

Consumer prices rose during May at the fastest annual rate since 2008, a more significant jump than economists had expected and one that is sure to keep inflation at the center of political and economic debate in Washington. Prices are rising for a range of goods and services, from airfares to used cars, resulting from data quirks, supply bottlenecks, and strong consumer demand. Government officials and many economists say much of the jump will fade with time.

European Union: The news media call it “Freedom Day,” the fast-approaching moment when England’s remaining coronavirus restrictions are scheduled to be cast-off on June 21st. But a recent spike in cases of the highly transmissible corona virus variant called Delta has prompted such alarm among health professionals that the country now seems destined to wait a little longer for its liberty. For Prime Minister Johnson, the question is not so much whether to postpone “Freedom Day,” but to what degree. Four weeks seems to be the maximum under consideration, with some advocating going ahead with a limited version of the whole opening and others favoring a two-week delay.

Germany’s economy is poised for a strong upswing in the second half of this year, with activity likely to reach pre-crisis levels as soon as this summer, the Bundesbank said. The central bank’s updated projections, which are published twice a year, are more optimistic than in December. They see Europe’s largest economy expanding 3.7% this year and 5.2% in 2022.

China: Top economic planners have put the brakes on attempts by environmental officials to reduce carbon emissions as growth takes priority over meeting climate targets for now. Officials at China’s principal economic planning agency, the National Development and Reform Commission, have gained the upper hand in negotiations over drafting a detailed road map to fulfill pledges to achieve a peak in carbon dioxide emission before 2030.

The environmental ministry has risen in prominence over the past decade and appeared to be newly empowered to exert more influence in recent months. However, the new developments show the economic agency, which sets China’s energy and emissions targets, still has more significant clout.

For the second time in six months, Chinese provinces are rationing electricity as the nation’s grids struggle to manage a surge in demand. This time, it’s partly because residents use their air conditioners to keep cool during a hot summer. Cities in Guangdong, a manufacturing hub in the south that’s home to 130 million people, have been limiting power use by factories since mid-May. Some plants have been forced to shut for several days a week.

China’s imports grew at their fastest pace in 10 years in May, fueled by surging demand for raw materials, although export growth slowed more than expected amid disruptions caused by COVID-19 cases at the country’s major southern ports. While a speedy recovery in developed markets has bolstered demand for Chinese products, a global semiconductor shortage, higher raw material and freight costs, logistics bottlenecks, and a strengthening yuan have dimmed the outlook for the world’s largest exporting nation.

In May, China’s exports grew 27.9% from a year earlier, slower than 32.3% growth reported in April and missing analysts’ forecast of 32.1%. “Exports surprised a bit on the downside, maybe due to the COVID cases in Guangdong province which slowed down the turnover in Shenzhen and Guangzhou ports,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management.

China will soon overtake Japan as the world’s largest importer of liquefied natural gas, ICIS Edge said this week. The forecast is based on China’s rapid economic recovery, its efforts to reduce pollution, and the cold start to the year. China is already catching up with Japan regarding LNG imports. Japan imported 76.32 million tons of LNG between June 2020 and May this year. China’s imports hit 76.27 million tons during the same period. These import figures compare with demand forecasts of 75.2 million tons for Japan from ICIS and a whopping 81.2 million tons for China. Because of its growing appetite for LNG, which substitutes for much more polluting coal to generate electricity, China will lead global capacity expansion in regasification facilities.

The price of goods leaving China’s factories has risen at its fastest pace since the financial crisis, piling pressure on policymakers as they grapple with the effects of a global commodity price rally. China’s producer price index added 9% in May. The National Bureau of Statistics data showed its most significant year-on-year increase since September 2008 and higher than economists’ forecasts.

The index has been rising sharply in recent months — gaining 6.8 percent in April — driven by an international rally in commodities markets as well as a low base effect after being in negative territory for most of last year. While consumer price increases remain common in China, the country’s soaring producer prices are set to increase costs for businesses and exporters at a time of mounting concerns over higher inflation in the US and around the world.

Chinese authorities have ordered a unit of state-run PetroChina to stop trading crude oil import quotas with local refineries as part of a crackdown on excessive fuel production, a move that could cut the country’s crude imports by 3%. China’s crude imports slumped 14.6% on the year to a five-month low of 9.69 million b/d in May amid destocking activities, shown by preliminary data released June 7th by the General Administration of Customs or GAC.

Russia: Moscow has nearly finished laying pipes for the Nord Stream 2 first line and is set to finish the second one within two months. Less than 100 kilometers (62 miles) are left to complete the project. Once Nord Stream 2 is finished, it will double the existing route’s annual volume to 110 billion cubic meters and increase European energy dependency on Russia.

On Friday, Gazprom started to fill the two pipelines with natural gas. This will take several months. Nord Stream 2, which runs on the bed of the Baltic Sea from Russia to Germany, bypassing Ukraine, has faced criticism from the US regarding increased dependency on Russia.

The head of Ukraine’s state-owned oil and gas company was in Washington last week to deliver a message to US lawmakers that allowing the completion of the Nord Stream 2 pipeline would be a victory for Russian President Putin and a blow to American credibility in Eastern Europe.

Saudi Arabia: Aramco raised $6 billion last week via its first Islamic bond denominated in US dollars, orders for which exceeded $60 billion, according to a document from one of the bank’s arrangers of the deal. The Saudi oil giant is looking to raise funding to meet its massive $75 billion annual dividend and reduce its debt load that had swelled after acquiring local chemicals giant Sabic and the collapse in oil prices last year. In the issue of the Islamic bond, the so-called Sukuk, Moody assigned a provisional A1 rating on Aramco’s new Sukuk program with a ‘negative’ outlook in line with the negative outlook on existing ratings of Saudi Aramco.

Saudi Aramco is proceeding with engineering evaluations and assessing its options for implementing the government’s directive to increase its maximum sustained capacity to produce oil. During the grandstanding between Saudi Arabia and Russia that culminated in the collapse of the OPEC+ production cut negotiations in March 2020, the Saudi Ministry of Energy said it would increase its maximum sustained capacity to 13 million b/d. The target does not include output from the shared Neutral Zone.

India: Two months ago, the Lok Nayak Jai Prakash Narayan Hospital in India’s capital was a battlefield. Every one of its 1,500 beds for coronavirus patients was full. It came perilously close to running out of oxygen not once but three times. Now, the hospital has space for every patient who needs a bed, and there is oxygen to spare. Many public health experts fear a resurgence of the coronavirus if nothing is done. Key to the scramble is a renewed vaccination push and efforts to boost India’s medical infrastructure to stockpile supplies, such as oxygen cylinders, and augment care networks from city slums to far-flung villages.

One Indian state has raised its COVID-19 death toll sharply higher after discovering thousands of unreported cases, lending weight to the suspicion that India’s overall death tally is significantly more than the official figure. Indian hospitals ran out of beds and life-saving oxygen during a devastating second wave of coronavirus in April and May. People died in parking lots outside hospitals and at their homes. Many of those deaths were not recorded in COVID-19 tallies, doctors and health experts say.

5. Renewables and new technologies

Four months after the failure of the Texas electric grid sparked a backlash against clean power, investors and developers have decided just what the state needs: more renewable energy. Much more. According to the American Clean Power Association, projects totaling 15 gigawatts — equal to the total electrical capacity of Finland in 2019 — are under construction or in advanced development, more than double three years ago.

A constellation of 5,400 offshore wind turbines meets a growing portion of Europe’s energy needs. The US has only seven. With more than 90,000 miles of coastline, the country has plenty of places to plunk down turbines. But legal, environmental, and economic obstacles and even vanity have stood in the way. President Biden wants to catch up fast — in fact, his targets for reducing greenhouse gas emissions depend on that happening.

Yet problems abound, including a shortage of boats big enough to haul the massive equipment to sea, fishermen worried about their livelihoods, and wealthy people who fear that the turbines will mar the pristine views from their waterfront mansions. Even a century-old, politically fraught federal law, known as the Jones Act, blocks wind farm developers from using American ports to load foreign construction vessels.

For years, Danish Oil and Natural Gas Co. did what many other big oil companies do: pumped hydrocarbons out of the North Sea. Today, it’s the world’s largest offshore wind energy developer and exceeds the market value of oil giants Occidental Petroleum and Italy’s Eni.

A big reason for Ørsted’s success is that it doubled down on a single industry—offshore wind—where it already had a first-mover advantage. BP and Royal Dutch Shell, two big oil companies with the most significant ambitions for going green, are instead investing in a wide array of low-carbon pursuits, from solar and wind to carbon capture. They dabbled with those technologies for years but never pursued with the focus Ørsted applied to offshore wind. Ørsted said last week it planned to invest $57 billion by 2027 in wind energy.

The Department of Energy set a goal to lower the cost of hydrogen made with clean power, such as renewables and nuclear energy, by 80% to $1 per kilogram in a decade. “Clean hydrogen is a game-changer,” US Energy Secretary Granholm said in a statement. “It will help decarbonize high-polluting heavy-duty and industrial sectors while delivering good-paying clean energy jobs and realizing a net-zero economy by 2050.” It was the first of a series of DOE initiatives to accelerate and innovate clean energy called Energy Earthshots intended to help the economy.

A new study by Delta-EE, a specialist new energy research & consulting company, has found that the total announced project capacity of the growing European hydrogen electrolyzer market would take the green hydrogen sector to 2.7 GW by 2025. This increase would be a nearly 50-fold increase in capacity built during the last ten years. However, time is running out to establish the many projects on the 100s of MW scale required to achieve an EU target of 6 GW by 2024.

Most geothermal power plants are located where the subterranean Earth is hotter, much closer to the surface, such as areas with hot springs, geysers, or volcanic activity. Iceland, for example, gets 66% of its energy from geothermal sources. Having easy access to hot water and steam right under the Earth’s surface makes geothermal energy much more economically feasible and logistically practical.

However, some forward-thinking companies have devised closed-loop geothermal systems that drill into the ground, allowing the Earth’s naturally emanating warmth to heat a liquid. The created vapor would produce rotational energy and then allow that vaporized substance to condensate and turn back into liquid. The thing is, that liquid is not water but natural gas such as butane or pentane; each have a much, lower boiling point than water, meaning that less heat is needed, and wells don’t have to be dug as far under the ground.

For now, these technologies are prohibitively expensive. But if they become cheaper and more scalable, these natural-gas-based geothermal methods could have potentially enormous benefits for the global energy landscape and the climate. Geothermal energy holds a certain allure for countries that are rich in capital but short on space. Closed-loop geothermal plants take up considerably less surface area than other renewable energy sources such as wind and solar farms. This means that we could be seeing the spread of gas-based geothermal energy in countries such as Germany, the Netherlands, or Japan.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Germany said Ukraine should remain a transit country for Russian gas, the Frankfurter Allgemeine newspaper reported, after President Vladimir Putin said it would depend on the former Soviet republic showing “goodwill” towards Moscow. (6/7)

Turkey’s upstream operator TPAO will continue with plans to drill in both the Black Sea and the Mediterranean, Turkish energy minister Fatih Donmez said June 7, following a major upgrade in its Black Sea gas reserves announced last week. (6/9)

In Israel, the Minister of Environmental Protection Gila Gamliel is looking to have the recent oil pipeline deal between Israel and the United Arab Emirates scrapped because of security and environmental concerns. (6/10)

Nigeria’s National Petroleum Corporation (NNPC) yesterday sounded the alarm over the continuous rise in the smuggling of petroleum products, despite the establishment of the ‘Operation White’ initiative by the federal government to check smuggling. An official said the smuggling of petroleum products had become a national challenge that must be addressed urgently to stem the huge loss to the nation. (9/12)

Nigeria’s national oil company predicted that oil prices could climb as high as $200/barrel as banks and major International Oil Companies withdraw from funding critical projects in the industry, leading to supply shortage and a huge upsurge in the commodity’s price. (6/11)

Offshore Guyana, ExxonMobil said June 9 it made a successful crude oil discovery at its Longtail-3 well for its 20th total find from the Stabroek Block since 2015. ExxonMobil, along with its partners Hess Corp. and CNOOC, increasingly have turned to the offshore waters of the small South American nation for future crude oil development for years to come. (6/10)

In Canada, the biggest oil sands producers announced on Wednesday a net-zero collaboration initiative to achieve net-zero emissions from oil sands operations by 2050 to help Canada to meet its net-zero aspirations. The Oil Sands Pathways to Net Zero initiative includes companies that operate some 90 percent of Canada’s oil sands production. (6/10)

Pipeline process: An under-the-radar hearing on the way shippers will contract volumes on Canada’s key crude oil export pipeline began last month in what could turn out to be the most important battle for control of Canadian oil resources. The more than a month-long hearing at the Canada Energy Regulator (CER)—planned to end on June 25—is expected to end up with the regulator determining how Canadian oil firms and US refiners will pay to ship crude on Enbridge’s Mainline system over the next decade.

Project Reconciliation, a Canadian indigenous group seeking a stake in the Trans Mountain oil pipeline, is now aiming for a path to full ownership. “We are hopeful that we can get our position across,” Robert Morin, the group’s new chairman, said in a phone interview. The group has said it has funding lined up for the purchase, without revealing any lender. (6/10)

The US oil rig count rose by 6 last week to 365 while the number of gas rigs decreased by 1 to 96, Baker Hughes reported on Friday. The total number of active oil and gas drilling rigs in the US is now 182 more than this time last year. (8/12)

Environmental protesters clashed with police on Monday after occupying a pump station as they rallied against Enbridge Inc’s Line 3 pipeline in Minnesota, while Enbridge said it had evacuated 44 workers from its site. Line 3, which entered service in 1968, ships crude from the Canadian province of Alberta to US Midwest refiners and carries less oil than it was designed for due to age and corrosion. (6/8)

Exxon Mobil Corp plans to invest $240 million to expand the crude slate and improve pollution control at its 502,500 barrel-per-day refinery in Baton Rouge, Louisiana. (6/10)

The recent overhaul of Exxon Mobil Corp’s board of directors could shift billions of dollars in spending and strategy over several years, but any changes likely will take time. A quarter of directors last month lost their seats to outsiders, and the March appointment of activist Jeff Ubben puts a third of the 12-member board in new and more cost-conscious hands. (6/10)

Biofuels: President Joe Biden’s administration, under pressure from labor unions and US senators including from his home state of Delaware, is considering ways to provide relief to US oil refiners from biofuel blending mandates. The issue pits two of the administration’s important political constituencies against each other: blue-collar refinery workers and farmers who depend on biofuel mandates to prop up a massive market for corn. (6/13)

The Biden administration is set to toss out President Donald Trump’s efforts to scale back the number of streams, marshes and other wetlands that fall under federal protection, kicking off a legal and regulatory scuffle over the fate of wetlands and waterways around the country. (6/10)

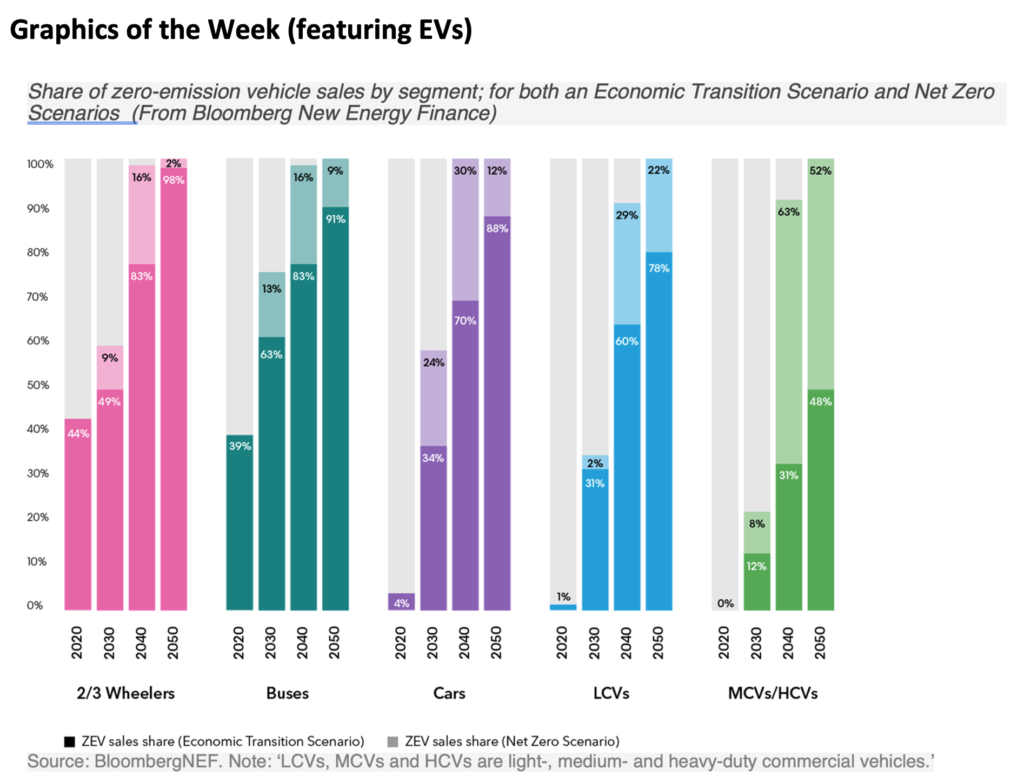

EV sales are set to rise faster than ever, but governments aiming for net-zero carbon emissions by 2050 must do more to spur their adoption, according to BloombergNEF’s latest annual Electric Vehicle Outlook. (6/11)

EV world: The vehicle world hit a milestone in 2017, when consumers bought more than 85 million autos. But in 2018 sales volume declined, and again in 2019, then plummeted in 2020 due to Covid-19. Meanwhile, sales of electric vehicles rose, and rose again, making EVs the auto industry’s only growth market—and meaning that we almost certainly hit peak internal combustion engine car sales four years ago. Last year, EVs were roughly 4% of total passenger car sales, 1% of commercial vehicles, 44% of two- and three-wheeler sales, and 39% of bus sales. BloombergNEF sees mostly electric vehicle sales by the 2030s. (6/11)

General Motors said it can support greenhouse gas emissions limits that other car manufacturers negotiated with California — if they are achieved mostly by promoting sales of fully electric vehicles. It is a new stance for GM, which had supported the Trump administration’s efforts to end California’s ability to set its own limits. (6/10)

EV angle: The US must work with allies to secure the minerals needed for electric vehicle batteries and process them domestically in light of environmental and other competing interests, the White House said on Tuesday. (6/9)

New analysis from the California Energy Commission (CEC) shows the state will need nearly 1.2 million public and shared chargers by 2030 to meet the fueling demands of the 7.5 million passenger plug-in electric vehicles (EVs) anticipated to be on California roads. (6/10)

Apple is in early stage talks with China’s CATL and BYD about the supply of batteries for its planned electric vehicle. The discussions are subject to change, and it is not clear if agreements with either CATL or BYD will be reached. (6/8)

E-air taxis: American Airlines is the latest carrier to join the flying taxi trend as airlines, aerospace manufacturers and tech companies vie to get the new aircraft in the air. The airline plans to invest $25 million in Vertical Aerospace, a U.K.-based electric aircraft startup. (6/11)

E-plane: Vertical Aerospace, developer of the electric VA-X4 aircraft, has in hand $4 billion of pre-orders from American Airlines, Virgin Atlantic and Avolon for up to 1,000 aircraft in total. The VA-X4 is a piloted, electric Vertical Take Off and Landing (eVTOL) vehicle. The VA-X4 will be capable of traveling a more than 200 mph, with a range of more than 100 miles and capacity for 4 passengers and the pilot. The aircraft takes off vertically enabling it to operate in and out of cities and other confined locations. But temper your enthusiasm: Vertical will not conduct the first test flight of its VA-X4 aircraft until later this year (6/12)

UK EV: Ricardo will support a project led by Coventry City Council, working alongside electricity distribution network operator WPD, to investigate the implementation of dynamic wireless power transfer (WPT) solutions for electric vehicles in Coventry, UK. (6/8)

Coal use up: The US EIA forecast coal production of about 600 million tons in 2021, up 11.3% from the estimated 2020 output of 539 million. (6/10)

GOM wind? The Biden administration on Tuesday said it will explore the potential of offshore wind energy development in the Gulf of Mexico, part of its goal to supercharge growth in clean energy over the next decade. (6/9)

Serious cyber: Energy Secretary Jennifer Granholm on Sunday called for more public-private cooperation on cyber defenses and said US adversaries already are capable of using cyber intrusions to shut down the US power grid. (6/7)

Korean nuke: Samsung Heavy Industries (SHI) is making a full-scale effort to develop offshore nuclear power plant technology using a molten salt reactor. SHI plans to pioneer the MSR-based floating nuclear power plant and nuclear-powered ship market as part of strengthening its capacity for future new business expansion. (6/10)

Chinese H2: China’s state-controlled energy giant Sinopec aims to set up plants that can make 500,000 tons of hydrogen a year from renewable energy sources by 2025. The company currently has annual hydrogen production capacity of 3.84 million tons, with about half coming as a by-product from its refineries and a third made from coal. (6/9)

The Biden administration asked a federal judge to throw out a lawsuit by more than a dozen Republican-led states seeking to block the US government from strengthening the way it calculates the cost of greenhouse gas emissions. (6/9)

Green energy worker shortage: Clean energy giants are finding a shortage of workers with the skills needed to support their ambitious growth plans. The renewables jobs market is heating up and candidates with the right abilities are becoming harder to find. (6/8)

Lithium angle: Researchers at King Abdullah University of Science and Technology developed what they believe is an economically viable system to extract high-purity lithium from seawater. Previous efforts to tease lithium from the mixture the metal makes together with sodium, magnesium and potassium in seawater yielded very little. Although the liquid contains 5,000 times more lithium than what can be found on land, it is present at extremely low concentrations of about 0.2 parts per million (ppm); the new lithium-enriching process leads to a solution with 9000 ppm, plus commercial-scale hydrogen as an off-gas. (6/7)