Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Canada has set ambitious targets for slashing emissions to fight climate change but faces a stiff challenge: not only is its economy dependent on oil production, but the Canadian oil industry’s carbon emissions are among the world’s highest for every barrel of oil it pumps. In the long term, Canada needs to cut its dependence on the energy sector that accounts for 10% of its economy, as the world works on a transition and being less reliant on fossil fuels.”

BOE Report; June 22, 2021

“There is not a dial on the wall where we can dial ‘low carbon.’ To decarbonize significantly takes capital—massive quantities of capital over many years.”

Alex Pourbaix, CEO Cenovus Energy (Canada’s 3rd largest oil producer)

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices posted their fifth straight weekly gain, the longest winning streak since December, as demand recovers and supplies continue to tighten in the US and China. Futures in New York rose 3.4% last week to the highest level since October 2018. Demand continues to rebound while the market expects output will only get a modest increase from the OPEC+ alliance, which meets this week to discuss supply policy.

US crude inventories fell by 7.6 million barrels in the week to June 18th to 459.1 million barrels, their lowest since March 2020. The draw was nearly double analysts’ expectations. Crude oil inventories in America’s largest storage hub could fall to historically low levels by the end of September as the demand rebound continues to outpace production. US refining capacity last year fell 4.5% to 18.13 million b/d from a record 18.98 million a year earlier. It was the first annual decline since 2018.

The chief executive officers of Royal Dutch Shell and TotalEnergies joined major commodity traders and banks in predicting that oil could go as high as $100 a barrel. However, they also said volatile markets could drive prices back down again. Low investment is “going to exacerbate supply and demand tightness as the economies pick back up again, and then in time we’ll see supply pick up and rebalance,” Exxon Mobil CEO Darren Woods said at the Qatar Economic Forum Tuesday.

OPEC: Oil inventories are falling, and market forecasters warn of a supply crunch this summer if OPEC and its allies do not agree to pump more crude imminently. OPEC+ ministers may oblige when they meet this week to discuss production quotas for August and possibly beyond. But how much crude to produce and for how long are the key questions. Many analysts expect a tempered short-term rise of perhaps 500,000 b/d to 700,000 b/d. Members will be keen to capture some of the rising oil demand without pushing prices down, while they also await the outcome of the stalled US-Iran nuclear deal negotiations.

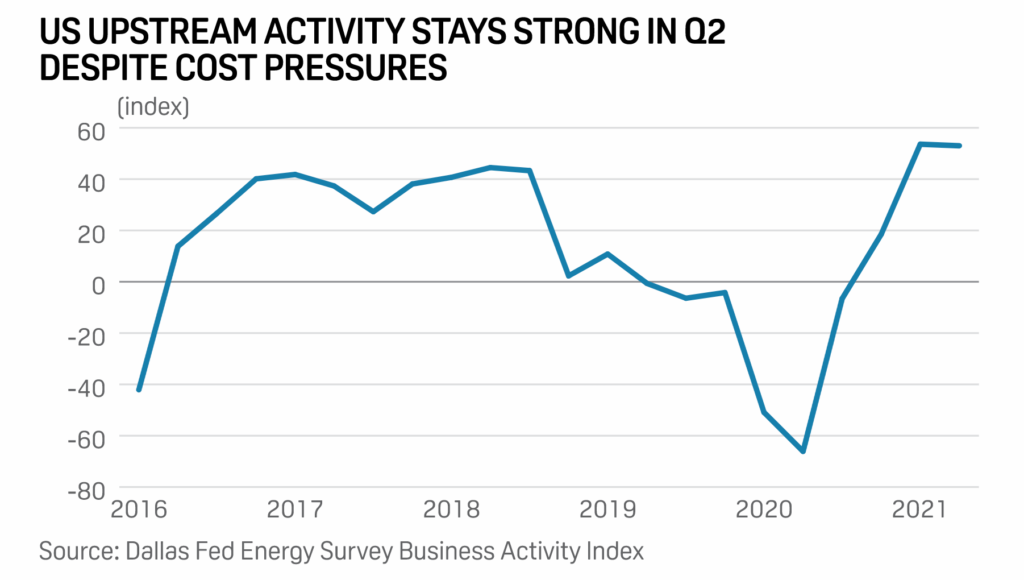

Shale Oil: Activity in the US oil and gas sector continued growing strongly in the second quarter, with higher capital spending and significant cost pressures, according to the Dallas Fed survey of 152 energy companies released June 23rd. The oil production index jumped 18.7 points to 35 points for Q2, its second-highest reading since the survey started in 2016. The natural gas production index rose 19 points to 35. Executives expect the WTI crude oil prices to be $70/b at year’s end and the Henry Hub natural gas price at $3.10/MMBtu

With oil trading above $70 per barrel while investment activity remains low, the world’s publicly traded exploration and production companies are set to generate record-breaking free cash flows (FCF) in 2021, Rystad Energy reports. Their combined FCF is expected to surge to $348 billion this year, with the previous high being $311 billion back in 2008. In addition, Rystad Energy estimates that total gross revenue for all public upstream companies is expected to increase by almost $500 billion in 2021, or 55% compared to last year. At the same time, the investment level of these companies is only expected to grow by around 2% in 2021, resulting in significantly higher profits.

New Mexico has become the first major oil-producing state to see its production rate rebound to pre-pandemic levels, but the situation remains volatile. In March, oil and gas production in New Mexico hit a record high of 36 million barrels of oil and 188 trillion cu ft of natural gas. In further good news for the industry, a consulting company said President Biden’s moratorium on new oil and gas leases on federal lands would not hurt New Mexico’s oil and gas production as most of the federal lands previously open to leasing are already leased out.

OPEC sources told Reuters at meetings of the cartel’s economic and technical think-tank that the group has solid reasons to believe that its control over the global oil supply for the first time in nearly a decade will not be ruined by a surge in US production. This is due to ongoing restraint in drilling for shale oil. Last week, OPEC+ was told by major international forecasters—including the EIA, the IEA, Wood Mackenzie, IHS, Argus Media, Energy Intelligence, and Energy Aspects—that US crude oil production would grow by just 200,000 b/d this year.

Coal: Tight natural gas supplies and a rebound in electricity consumption have combined to push thermal coal prices to the highest in a decade. Insufficient rainfall in China has contributed to the trend. The price of export coal from Newscastle, Australia—most of which goes to Asia—has gained 56 percent over the last year. Supplies have been crimped by a closed mine in Colombia, flooding Indonesia and Australia, and distorted trade flows caused by a Chinese ban on Australian coal.

European prices have also risen, adding 64 percent since the start of the year. Coal supply is experiencing a growing tightness because of low investment in new production, partially due to a drive towards lower use of the dirtiest fossil fuel and a boost in renewable electricity generation capacity. However, the latest price trends suggest that this capacity still falls short of meeting the demand for electricity in most key markets.

The rally is a reminder that efforts to wean power systems off coal, to limit planet-warming emissions, are in their early stages and may prove halting while the fuel competes with other energy sources. The world’s appetite for coal peaked in 2014 and is unlikely to return to pre-coronavirus levels, the IEA forecasts. But analysts say spurts of demand, coupled with a shortage of investment in new supplies, will lead to periods of higher prices.

Natural Gas: The Henry Hub prompt-month gas futures contract surged to a 30-month high on June 25th as concerns over US supply tightness continue to build. The increase was fueled by a series of weak storage injections, stronger-than-anticipated summer power burn, and persistently high export demand. On June 25th, the July contract traded up to $3.508 before settling modestly lower in morning trading. The July-October 2021 contracts averaged $3.506/MMBtu, and the November 2020-April 2022, averaged $3.486/MMBtu.

Despite a jump in the cost of US exports of liquefied natural gas to the biggest import market, Asia, American LNG shipments abroad have soared to record highs and are likely to reach new all-time highs later this year. According to estimates from independent energy research firm Rystad Energy, the short-run marginal cost of US LNG exports to the Asian market has risen to about $5.60 per million British thermal units as of June 2021. That cost is a massive 65-percent higher than in the middle of last year, when LNG demand was depressed with the pandemic, and is 30 percent higher than the 2020 average of $4.30 per MMBtu.

According to executives and analysts, Russia has exacerbated a shortage of European natural gas supplies that has driven prices to a 13-year high by quietly limiting sales to customers. Pipeline exports of natural gas from Russia’s state-backed monopoly Gazprom to continental Europe have dropped roughly one-fifth in 2021 on pre-pandemic levels despite a sharp rebound in demand and low stockpiles of the vital fuel. The imbalance has helped send prices in Europe to the highest levels since 2008, increasing energy costs for homes and businesses.

Energy industry executives and analysts say that while Gazprom was meeting its long-term contractual obligations, its reluctance to boost supplies to Europe through more immediate measures such as spot market sales was putting pressure on the market. “Gazprom is just trying to maximize its profits at a time when spot prices are high, gas storage is empty, and LNG demand in Asia is strong,” said one executive at a German energy company. “They’re just opportunistic.” Gazprom said in a statement that it “supplies gas precisely in line with consumers’ requests.”

Electricity: The Electric Reliability Council of Texas (ERCOT) has met record peak demand so far in June despite tight grid conditions last week. Yet analysts and residents question whether the power grid reliability will stay the same during the hotter heat waves in August, after the disastrous events during the Texas Freeze in February. Last week, peak demand in Texas broke the June record, with demand up to 69,957 MW. Since February, the state passed some reforms to address the problems. However, ERCOT still relies on lopsided incentives, triggered only during a crisis, to get generators to produce more electricity.

Californians’ electricity prices are spiking, but so is the danger of blackouts—both planned and unplanned. Exceptional drought forecasts for this summer prompted PG&E to warn earlier this month that it might need to implement more rolling blackouts. Then, last week, the California Independent System Operator issued a so-called flex alert, which effectively means it asked people to use less electricity between 5 pm and 10 pm because of heightened energy consumption during that time of day.

Siemens Smart Infrastructure said most electricity distribution system operators are not ready to accommodate the increase in demand that will come with the energy transition. Surveying distribution system operators around the globe or looking at studies and market research shows around 90% of them are not ready for the increased demand that rising electrification will bring. This is because the grids were not technologically prepared and lacked flexibility, security, and maturity.

Prognosis: Underinvestment and a focus on the energy transition will create a global oil supply shortage in two to four years, according to three-quarters of US oil and natural gas executives surveyed by the Federal Reserve Bank of Dallas. One upstream executive said policies focused on limiting oil and gas growth, restrained capital budgets in favor of free-cash-flow generation, and continued consolidation could lead to an undersupply vs. growing demand. “OPEC is back in the driver’s seat,” the executive said. “If they can balance market share with high prices, they’ll take it.”

Another respondent said only one of 400 institutional investors their company has worked with is currently willing to give new capital to the oil and gas sector. And the same is true for public companies and international exploration, the executive said. “This underinvestment coupled with steep shale declines will cause prices to rocket in the next two to three years,” the respondent said. “I don’t think anyone is prepared for it, but US producers cannot increase capital expenditures: the OPEC+ sword of Damocles still threatens another oil price collapse the instant that large publics announce capital expenditure increases.”

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: The hardline victory in Iran’s presidential election tilted the domestic balance of power towards the country’s anti-Western clergy and away from officials chosen by the popular vote. Judiciary chief Ebrahim Raisi, a protege of Supreme Leader Ayatollah Ali Khamenei and a trusted ally of the security establishment, was elected Iran’s next president. He takes office in August. While his win presages no change in Iran’s push to revive a 2015 nuclear deal and break free of sanctions, it points to Raisi as s a potential successor to Khamenei. It also brings all state arms under the control of hardliners suspicious of the West, officials and analysts say.

Raisi said last Monday that he opposes talks on limiting Tehran’s ballistic missile program and its support for regional proxy forces. Raisi also said he is unwilling to meet President Biden, even as the two sides work to revive a 2015 nuclear deal between Iran and world powers.

Human rights groups have linked Raisi to numerous episodes of repression over decades and said he played a central role in the mass killings of dissidents in the late 1980s. Raisi had “been a member of the ‘death commission’ which forcibly disappeared and extrajudicially executed in secret thousands of political dissidents in Evin and Gohardasht prisons near Tehran in 1988,” Amnesty International said in a statement Saturday, calling for Raisi to be investigated under international law.

American authorities took down a range of Iran’s state-linked news websites under unclear circumstances, a move that appeared to be a far-reaching crackdown on Iranian media amid heightened tensions between the two countries. The US seized roughly three dozen websites, most of which are linked to Iranian disinformation efforts, said a US official.

Iran has started pumping oil at a giant new reservoir in their offshore sector of the Persian Gulf. The Iranian Offshore Oil Company announced it had achieved first oil from the Asmari reservoir of Abuzar oilfield, located Southwest of Kharg Island.

Not only does Iran possess the world’s 2nd largest natural gas reserves and 4th largest oil reserves, but its renewables potential is also substantial. As Iran faces an electricity shortage of epic proportions, the government is tapping into its solar and wind potential instead of fossil fuels or nuclear energy. Although there is significant potential, most initiatives have yet to materialize. Iran’s renewables capacity is about 13.92 GW. This is mostly hydropower from the country’s extended network of dams in the mountainous and rainy north. However, climate change and an extended period of drought have reduced the flow of water into rivers, which has reduced the country’s power production capacity by 50 percent

Iraq: The news that BP is working on a plan to spin off its operations in Iraq’s supergiant Rumaila oil field into a standalone company had a familiar ring. It was reminiscent of the withdrawal of Shell, from Iraq’s supergiant Majnoon oil field in 2017 and its withdrawal from Iraq’s supergiant West Qurna 1 oil field in 2018. Each of these announcements also bore a strong similarity to ExxonMobil’s withdrawal from Iraq’s crucial Common Seawater Supply Project some time ago and its recent report that it too wants to get out of West Qurna 1.

The reason why so many Western IOCs are exiting Iraq is the endemic corruption that permeates any sector of Iraq in which there is money to be found. Transparency International (TI), in various of its ‘Corruption Perceptions Index’ publications, normally features Iraq in the worst 10 out of 180 countries for its scale and scope of corruption. “Massive embezzlement, procurement scams, money laundering, oil smuggling and widespread bureaucratic bribery that have led the country to the bottom of international corruption rankings, fueled political violence and hampered effective state-building and service delivery,” TI states.

Corruption, though, is not the only reason for the mass exodus of Western IOCs from Iraq. The other major factor is China and its partner, Russia, in Middle East affairs. The two countries already effectively control almost everything worth having in Iraq’s oil and gas sector and are working on gaining power over everything that remains. These most recently included granting the $121 million engineering contract to upgrade the facilities, used to extract gas during crude oil production, to the China Petroleum Engineering & Construction Corp.

To decrease the oil used for power generation, Iraq has signed an agreement with Masdar, the renewable energy arm of Abu Dhabi’s sovereign wealth fund, to develop at least 2 GW of solar projects in the country. Iraqi officials said the agreement would help further the country’s goal of generating 20-25% of its energy from renewables, equivalent to 10-12 GW, by 2030. The projects will be in central and southern Iraq, which suffer from acute electricity shortages.

Venezuela: Caracas is investing in crude oil production recovery and aims to more than double its current output by the end of the year, to 1.5 million b/d, Oil Minister El Aissami told Bloomberg in a recent interview. “Without any financing, with our own money, we’ve been able to invest enough to stop the slide and start a gradual recovery,” El Aissami said. According to the minister, crude oil production in Venezuela now exceeds 700,000 b/d, up from less than 400,000 bpd in the summer of last year when output plunged in the wake of the pandemic and the crash in oil prices.

3. Climate change

As temperatures approached 115 degrees Fahrenheit in the Pacific Northwest this past weekend, a second regime of heat scorched Europe amid a record-breaking heatwave. Monthly records have already fallen as highs climb to 100 degrees in some areas, with temperatures in the Arctic Circle spiking close to 90. Moscow and St. Petersburg soared to their highest June temperature on record last Wednesday, reaching the mid-90s, while Estonia and Belarus established new all-time highs for the month last week.

Highs some 20 degrees or more above average currently wrap across central and Eastern Europe, with the most extraordinary anomalies centered on Scandinavia and parts of western Russia. The second lobe of intense heat is parked over eastern Russia along the shores of the East Siberian Sea. Exceptional heat waves, which are becoming disproportionately more significant and frequent due to human-induced climate change, are the leading cause of weather-related fatalities in most of Europe and Asia.

According to new research, the US Southwest, already the US’s driest region, has become even drier since the mid-20th century, particularly on the hottest days. Humidity has declined in summers over the past seven decades, and the declines have accelerated since 2000, a period of persistent drought in the region.

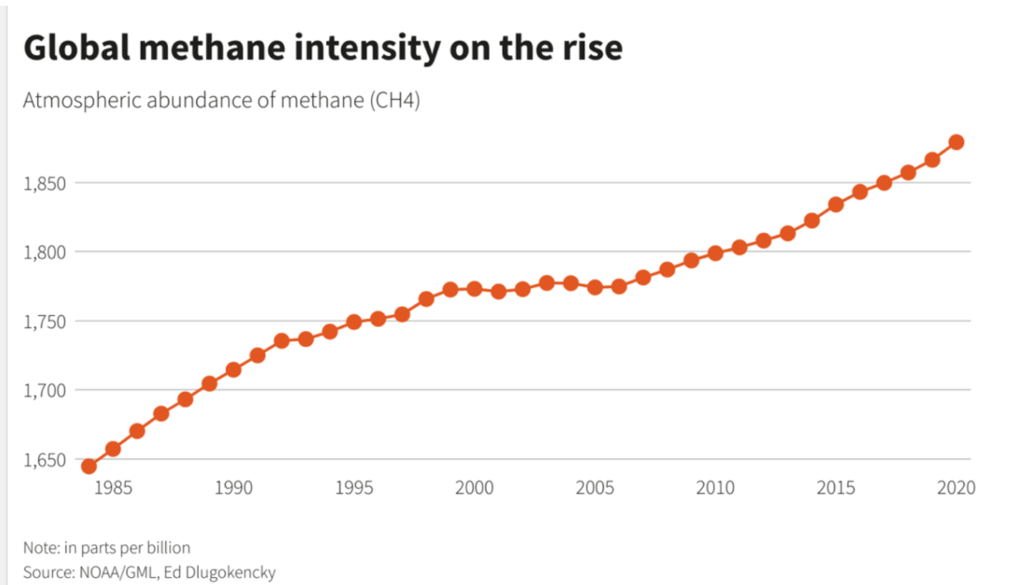

According to video footage, methane is spewing out of natural gas infrastructure across the European Union because of leaks and venting. Using an infrared camera, the non-profit Clean Air Task Force (CATF) found methane seeping into the atmosphere at 123 oil and gas sites in Austria, Czech Republic, Germany, Hungary, Italy, Poland, and Romania.

| Currently, the EU does not regulate methane emissions in the energy sector, meaning companies running the sites surveyed by CATF are not breaking laws because of leaks or venting. While some member states require firms to report some emissions, there is no overarching framework forcing them to monitor more minor leaks or fix them. That’s set to change. The EU is proposing laws this year that will force oil and gas companies to monitor and report methane emissions and improve the detection and repair of leaks. A small but growing number of Republicans say the GOP needs a coherent climate strategy and formed a “Conservative Climate Caucus” on Capitol Hill. When Representative John Curtis quietly approached fellow Republicans to invite them to discuss climate change at a clandestine meeting in his home state of Utah, he hoped a half dozen members might attend. Soon the guest list blew past expectations as lawmakers heard about the gathering and asked to be included. Under President Trump, even uttering the phrase “climate change” was verboten for many Republicans. Many in the Republican Party are coming to terms with what polls have been saying for years: independents, suburban voters, and especially young Republicans are worried about climate change and want the government to act. On Capitol Hill, Kevin McCarthy, the House Republican leader, plans to start a Republican task force on climate change, his staff confirmed. |

| Mountain regions are melting so fast that the changes can be seen from space, with the shrinkage now measured in years rather than decades. Just over 4% of the ice volume in these two regions disappeared between 2011 and 2019, according to the first study to monitor large-scale changes in glacier thickness, mass, and sea-level contribution. |

4. The global economy and the coronavirus

The super-contagious Delta variant of the coronavirus is now responsible for about one in every five Covid-19 cases in the US, and its prevalence has doubled in the last two weeks, health officials said. First identified in India, Delta is one of several “variants of concern,” as designated by the Centers for Disease Control and Prevention and the World Health Organization. It has spread rapidly through India and Britain.

Many poorer countries receiving Covid-19 vaccines through a global sharing scheme do not have enough doses to continue programs, the World Health Organization said. WHO senior adviser Dr. Bruce Aylward said the Covax program had delivered 90 million doses to 131 countries. But he said this was nowhere near enough to protect populations from a virus still spreading worldwide. The shortages come as some nations in Africa see the third wave of infections.

United States: An Associated Press analysis of government data shows that nearly all COVID-19 deaths in the US now are of people who weren’t vaccinated, a staggering demonstration of how effective the shots have been. The highly transmissible Delta variant of the Covid-19 virus is spreading rapidly in the US; it could become the dominant strain in the next two to three weeks.

A deal reached Thursday between President Biden and a bipartisan group of senators for $579 billion in new spending to repair the nation’s roads, rails, and bridges will do relatively little to fight climate change, an issue that the president has called an “existential threat.” The deal provides funding for public transit, passenger and freight rail, electric buses, and charging stations for electric vehicles, all designed to reduce pollution from passenger vehicles and trucks. And it includes $47 billion to help communities become more resilient to disasters and severe weather. Selling crude oil from the US Strategic Petroleum Reserve would be one funding source for the $579 billion.

Within hours of the bipartisan agreement being announced on Thursday, Republicans expressed frustration that Biden explicitly connected its signing and a trillion-dollar social spending package that Democrats will try to push through Congress without relying on Republican support. However, Biden on Saturday withdrew his threat to veto a $1.2 trillion bipartisan infrastructure bill unless a separate Democratic spending plan also passes Congress, saying that was never his intent.

Europe: The Delta coronavirus variant that swept the UK has become dominant in Portugal and appeared in clusters across Germany, France, and Spain, prompting European health officials to warn further action is needed to slow its spread.

Consumers in the eurozone are flocking back to bars and restaurants, booking holidays, and traveling to work again, according to unofficial data that suggest pre-pandemic patterns of economic activity are re-emerging. According to high-frequency data, the use of public transport and journeys to workplaces has hit their highest levels since early last year in many countries.

From abattoirs to restaurant kitchens, the UK food sector faces a massive challenge this summer: there just aren’t enough workers. The food industry, already facing labor shortages because of Brexit and the pandemic, is now being stretched to capacity as the country reopens.

China: The latest obstacle hitting global shipping is likely to jolt trade flows for several more weeks and could delay shipments heading into the year-end holiday shopping season. Shipping executives say around 50 container ships remain backed up around the Yantian port in Southern China. Some 350,000 loaded containers are stacked up on docks as the primary gateway for China goods heading to Western nations struggles to recover from a Covid-19 outbreak that disrupted operations there.

The Biden administration said it banned US imports of a key solar panel material from the Chinese-based Hoshine Silicon Industry. Still, it stopped short of imposing a ban on all imports of silica from Xinjiang and said the action would not harm US clean energy goals. The Commerce Department separately added five Chinese entities to the US economic blacklist over forced labor allegations in Xinjiang — including Hoshine.

China National Petroleum Corporation made an oil and gas discovery with reserves estimated at 900 million tons. The discovery was made after six years of exploration work in the Tarim Basin in the Xinjiang Uygur Autonomous Region, northwestern China. The formation’s geology is challenging, the report said, requiring ultra-deep drilling at a record 8,470 meters. This is the largest discovery of oil exploration in the Tarim Basin in a decade.

The first deepwater gas field entirely operated by a Chinese company, Lingshui 17-2, started production, the country’s national offshore producer CNOOC said. In the South China Sea, the gas project is expected to reach peak production of 328 million cubic feet of natural gas and 6,751 barrels of condensate per day in 2022, with a 10-year stable production period.

The lack of available storage in China limited the importing of light cycle oil in May and June, ahead of implementing a new consumption tax on June 12th. The inflow in May dropped 23.5% to 1.59 million tons from the record high 2.08 million in April. Light cycle oil is essentially a blending material to produce gasoil.

China National Petroleum Corp expects China to cut its coal use to 44% of energy consumption by 2030 and 8% by 2060 as the country aims to use more natural gas to achieve its climate change goals. China is expected to increase the use of natural gas in its primary energy mix to 12% in 2030 from 8.7% in 2020.

Saudi Arabia: The value of the country’s oil exports in April climbed 109% to $13.79 billion from a year earlier, while non-oil exports rose by 46.3%. Oil exports made up 72.5% of total exports, up from 64.8% in April 2020 and 70% in March. Saudi Arabia suffered last year as the COVID-19 pandemic hit energy demand and its state coffers. China remained Saudi Arabia’s leading trading partner in April, with Saudi exports rising to $3.4 billion from $1.8 billion a year earlier. Saudi imports from China rose to $2.4 billion from $2.1 billion.

Aramco secured a one-year extension to a $10 billion loan it raised last year, negotiating improved terms in the process. The company has borrowed tens of billions of dollars in the past few years to keep up with Saudi Arabia’s financing needs in an era of lower oil prices. There is also a public sale of a minority stake in the company and the recent leasing of some of its pipeline assets for $12.4 billion.

For decades, the actual size of Saudi Arabia’s crude oil reserves and production potential have been a subject of much debate and confusion, not helped by the obfuscation from the Saudis over precisely what those numbers are. Saudi Arabia’s only source of real power in the world begins and ends with its oil reserves and production, so the higher these numbers, the more the power.

The official oil reserves have been a highly questionable since 1990 when the Kingdom suddenly increased the official number from 170 billion barrels to 257 billion barrels, despite no new oil discoveries or improvements in recovery rates being made. Shortly after that, Saudi Arabia increased its official crude oil reserves numbers again, to 266.4 billion barrels, a level that persisted until a slight increase in 2017, to 268.5 billion barrels.

From 1973 to last month, Saudi Arabia pumped an average of 8.1 million b/d, totaling about 142 billion barrels. Using the original number of crude oil reserves would have meant that Saudi Arabia’s reserves could be well below 100 billion barrels.

Saudi Arabia has announced several upstream projects scheduled to come online around the middle of the decade. Still, these are required mainly to offset the natural declines at existing fields. If the Kingdom is serious about wanting to raise production capacity, then this will require significant additional capital investments over several years.

India: Business conglomerate Reliance Industries, which owns some oil industry and telecoms and more, plans to invest more than $10 billion in three years in a new business unit that will build solar modules, battery storage, electrolyzers, and fuel cell factories. Reliance Industries owns the biggest refinery in India and the biggest refining hub in the world, Jamnagar. Reliance will now create a renewables division as part of a drive to be part of India-made energy transition solutions.

The share of Middle Eastern crude in India’s oil imports fell to a 25-month low in May as refiners tapped alternatives in response to the government’s call to diversify supplies. In March, India, the world’s third-biggest oil importer, directed refiners to diversify crude sources after OPEC and its allies ignored New Delhi’s call to ease supply curbs.

5. Renewables and new technologies

In Sweden, a partnership of a steel company, a mining company, and an electricity producer announced that it had succeeded in producing a form of iron using a nearly emissions-free process. The companies have been working for five years on a joint venture called HYBRIT to use renewable energy to produce hydrogen and then using the hydrogen, along with iron ore pellets, to make “sponge iron,” which can be used to make steel. Now, the companies report that they are the first to have used this process to produce sponge iron on a pilot scale, which is a step up from laboratory scale and a sign of progress toward doing it on a commercial scale

The technological breakthrough within the HYBRIT initiative cuts about 90% of the emissions in connection with steel production and is a decisive step on the road to fossil-free steel. The pilot plant has a direct reduction shaft, where the reduction occurs, and several electrolyzers for hydrogen production using fossil-free electricity.

Direct reduction means that iron ore, which mainly consists of different iron oxides, is reduced to a porous, solid product of pure metallic iron—sponge iron—at temperatures below the melting point of the iron. The reduction involves removing the oxygen from the iron ore, which is a prerequisite for steel production. This is done using carbon or coke in a traditional process, while in the HYBRIT process, the reduction is made using fossil-free hydrogen.

The move toward a cleaner method for making steel is significant because that heavy industry is one of the most challenging parts of the global economy to get to net-zero emissions. This contrasts with the electricity and transportation sectors, where there is a pretty good idea of how to cut emissions, even if that path is a difficult one.

The most prominent developer of offshore wind farms in the world, Denmark-based Ørsted, is concerned that the race of the biggest oil companies to enter offshore wind could lead to spikes in seabed acreage prices. Major international oil firms, including Europe’s biggest Shell, BP, Equinor, and TotalEnergies, have accelerated investments and development of offshore wind in Europe and the US as they plan to boost their renewable energy portfolios net-zero emissions commitments. Norway’s Equinor says it is “determined to be a global offshore wind energy major.”

A public-private partnership between Los Alamos National Laboratory and Oberon Fuels secured funding from the US Department of Energy to scale up steam reforming technology to produce renewable hydrogen (rH2) from renewable dimethyl ether (rDME)—a novel pathway for reducing the carbon content of the hydrogen supply. DME is a hydrogen-rich molecule produced from waste and renewable resources using Oberon’s modular production technology. Because DME handles like propane/liquefied petroleum gas, it requires minimal modifications to the existing global LPG distribution network and leverages the expertise of its current workforce.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

The United Arab Emirates, one of OPEC’s largest producers, is considering the potential adoption of a net-zero by 2050 goal. Suppose the Gulf oil producer joins major industrialized nations in the net-zero emissions commitments. In that case, it will become the first significant petrostate to balance primary emission-reduction goals with its essential oil and gas industry. (6/25)

Africa’s richest person, Aliko Dangote, said he plans to diversify his group’s investments in Cameroon, starting with energy. The Nigerian billionaire also announced his company would double cement production in Cameroon. (6/24)

In Nigeria’s oil-producing Delta region, a militant group has threatened to resume attacks amid rising insecurity and disagreements over the share of oil wealth communities should get. The group called the Niger Delta Avengers roughly halved Nigeria’s oil production in 2016, including an attack on an underwater pipeline that took it out for more than a year. It has since made a variety of threats but has not staged any attacks since 2017. (6/26)

Guyana: The deeply impoverished former English colony has become one of the world’s hottest offshore drilling locations. Global energy supermajors have made a slew of significant oil discoveries in Guyana’s and neighboring Suriname’s offshore waters. Exxon’s impressive oil discovery run in offshore Guyana sees it operating in the region with a healthy drilling success rate of around 80%. The low breakeven costs enhance working in offshore Guyana—typically $25 – $35/barrel. The International Monetary Fund announced that Guyana’s economy expanded by an incredible 43% during 2020, despite the pandemic. (6/23)

Canada’s oil sands production has come roaring back, and according to IHS Markit, the output is returning to pre-pandemic levels after a tough year that involved not only the Covid-19 pandemic but also a significant pipeline defeat in the Keystone XL cancellation. (6/24)

The Canadian oil patch exemplifies the most vexing problem of the energy transition. Long term, Canada needs to cut its dependence on the energy sector that accounts for 10% of its economy as the world moves away from planet-warming fossil fuels. Short term, Canada needs to clean up extracting oil to comply with national emissions targets. (6/22)

The US oil and gas rig count held steady last week at 470, according to Baker Hughes Inc. Oil rigs fell one to 372 last week, while gas rigs rose one to 98. That put the total rig count up 205 rigs, or 77%, over this time last year. It remained up 93% since falling to a record low of 244 in August 2020, according to data going back to 1940. The total count gained 13 rigs for the month, putting it up for the 11th month in a row for the first time since July 2017. However, it was the smallest monthly increase since September 2020. (6/26)

Pipeline update: US operators have completed, started building, or announced a total of 19 petroleum liquids pipeline projects so far this year. Of the 19 petroleum liquids pipelines, 12 are crude oil projects, six are hydrocarbon gas liquids projects, and one is for carrying petroleum products. Ten out of the 19 projects are new pipelines, seven projects are expansions or extensions of existing systems, and two projects are conversions of the commodity carried on the pipeline. Last year, the US saw a total of 24 petroleum liquids pipeline projects completed. (6/25)

Leasing update: US Interior Secretary Deb Haaland on Wednesday told a congressional hearing that there is no plan to ban new oil and gas drilling on federal land permanently. Her agency will soon release a report that will assess the future of the national oil and gas leasing program. (6/24)

Methane legislation retightens: Congress has moved to restore environmental regulations to limit the number of methane leaks from US oil and gas production facilities, reversing a Trump-era rollback for the greenhouse gas. (6/26)

An essential oil refinery for US East Coast consumers is halting operations after escalating environmental scrutiny made it impossible for backers to obtain desperately needed financing. The owners of the Limetree Bay refinery in the US Virgin Islands announced plans Monday to shut the 200,000-barrel-a-day facility and dismiss more than 250 workers just weeks after a federal crackdown over a series of pollution incidents. (6/23)

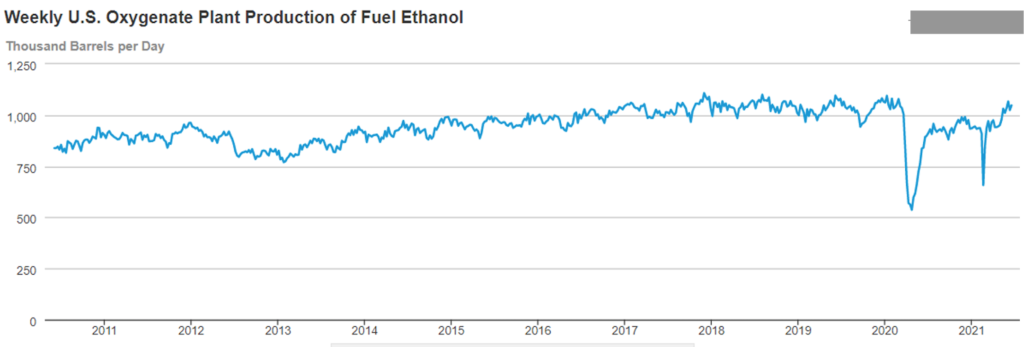

Biofuel’s slowdown? The United States and Brazil, the world’s top two ethanol producers, are expected to hold down production in the coming months because of the surging cost of corn and sugar. Tight corn and sugar supplies are passing through to ethanol costs, making producers reluctant to raise production and boosting gasoline prices as well. The United States and Brazil are the linchpins of worldwide ethanol supply, accounting for 75% of global ethanol exports last year. (6/22)

Biofuel’s bailout? Billions of dollars in federal investments and tax credits to boost demand for US biofuels will be part of two bills that Democratic lawmakers will introduce to Congress. Congress members from rural states will introduce bills in coming weeks seeking federal funds to add more high-biofuel blend pumps at retail stations and tax credits for automakers that put more “flex-fuel” vehicles on the road. (6/22)

Activist investor Engine No.1 will soon launch its first exchange-traded fund (ETF) as it extends its efforts to improve the environmental and social impacts of large US corporations beyond supermajor ExxonMobil. (6/23)

Chevron doesn’t plan to reduce its oil and gas business to invest in solar or wind power. Shareholders have ramped up pressure on the world’s largest public companies—including Chevron—to start preparing their business for profits in the energy transition. To date, Chevron has rebuffed such efforts, including a recent 61% shareholder vote to reduce emissions. (6/25)

Exxon Mobil Corp. is preparing to reduce headcount at its US offices by between 5% and 10% annually for the next three to five years by using its performance-evaluation system to check out low performers. The cuts will target the lowest-rated employees relative to peers, and for that reason, will not be characterized as layoffs. (6/22)

Blocking EV taxis in NYC: The New York City Taxi and Limousine Commission, which regulates the for-hire vehicles, voted on Tuesday to stop issuing new for-hire licenses for electric vehicles (EVs), essentially blocking the efforts of EV transit startup Revel to deploy 50 Teslas unless it buys 50 gasoline vehicles first and swaps their licenses for EVs. (6/24)

EV charging in NYC: New York City will install its first curbside electric-vehicle charging stations this year, part of an effort to address the shortage of charging options in the city. The Department of Transportation said that by October, it would install 100 charging ports for public use. Another 20 ports will serve the city’s fleet of electric vehicles. (6/24)

USPS’s EV next steps: Oshkosh Defense has selected Spartanburg, South Carolina, to be the home of its efforts to build the Next Generation Delivery Vehicle (NGDV) for the US Postal Service. (6/23)

In China, Tesla Inc. plans to recall more than 285,000 electric vehicles sold in the country to address risks associated with its autopilot feature after an investigation conducted by its market regulator. The problem: the vehicles’ autopilot systems are too easily activated during a drive and could potentially lead to car crashes. (6/26)

The California Public Utilities Commission ordered on Thursday utilities to procure 11.5 gigawatts from zero-emission electricity sources. It described “a historic decision” aimed at ensuring reliability and the state’s clean energy goals. The commission ordered utilities to procure new electricity sources, which would come online between 2023 and 2026. (6/25)

US coal production through the first 24 weeks this year was approximately 279 million short tons, up 8.9% compared with the year-ago period. It is annualized to be 581 million tons for the year, up 8.7% from the previous year. (6/25)

Amazon.com signed deals to buy power from 14 wind and solar farms across North America and Europe, bolstering its position as the world’s largest corporate buyer of renewable electricity. The latest push is part of the company’s plan to use renewable sources for its power needs by 2025. (6/24)

South Korea’s state-run nuclear energy research institute and the country’s major shipbuilder have agreed to join forces to develop a marine molten salt reactor to develop small modular reactors to help achieve carbon neutrality in shipping and power generation (via floating power plant design). (6/23)

Closing a UK nuke: Preparations for the “defueling” of the Dungeness B nuclear power plant in Kent started with “immediate effect” on June 7 when its majority owner, French state-controlled utility EDF, announced it would close the plant seven years early. It had not been operational since September 2018 as engineers tried to fix problems, including corrosion and cracks in its pipework. The 1.1GW plant is the first of seven built in the UK between the mid-1960s and late-1980s using advanced gas-cooled reactor (AGR) technology to come out of service. It will kickstart a decommissioning process spanning generations, which skeptics argue strikes at the heart of why no new nuclear plants should be built. (6/25)

Germany has an opportunity to phase out coal power plants almost a decade ahead of schedule — but it will require a fleet of natural gas plants to do it, a new study by Wartsila Oyj shows. According to the Finnish company, adding as much as 12 gigawatts of gas-fired, combined heat and power plants to a mix of renewable energy sources would help the country replace existing coal facilities by 2030. (6/23)

Japan on Monday pledged to offer $10 billion financial aid for decarbonization projects in Asia, such as renewable energy, energy-saving, and conversion to gas-fired power generation from coal-fired power to help with an energy transition. (6/22)

Japan Airlines has conducted the first flight with a mixture of two different types of SAF (Sustainable Aviation Fuel) produced domestically in Japan. As a first step forward to the commercialization of domestically produced SAF around 2030, SAF made at the demonstration plants has passed the quality inspection and became available for use in actual flights. (6/22)

The Australian government has rejected an application to build the world’s most significant renewable hydrogen and ammonia plant, the 26 GW Asian Renewable Energy Hub in Western Australia. (6/22)