Editors: Tom Whipple, Steve Andrews

Quote of the Week

“While Norway is leading the way in green energy at the national level, many are criticizing its high level of oil exports, which are anything but carbon friendly. As country leaders talk of a ‘green transition’, it has not been overlooked that Norway still relies heavily on its oil and gas revenues even if looking to make the switch to renewables at home. Norway’s ambitious carbon-cutting targets do not consider the emissions from the oil and gas that it sells to other countries, meaning it could still achieve net-zero without curbing its fossil fuel production.”

Felicity Bradstock, Oilprice.com

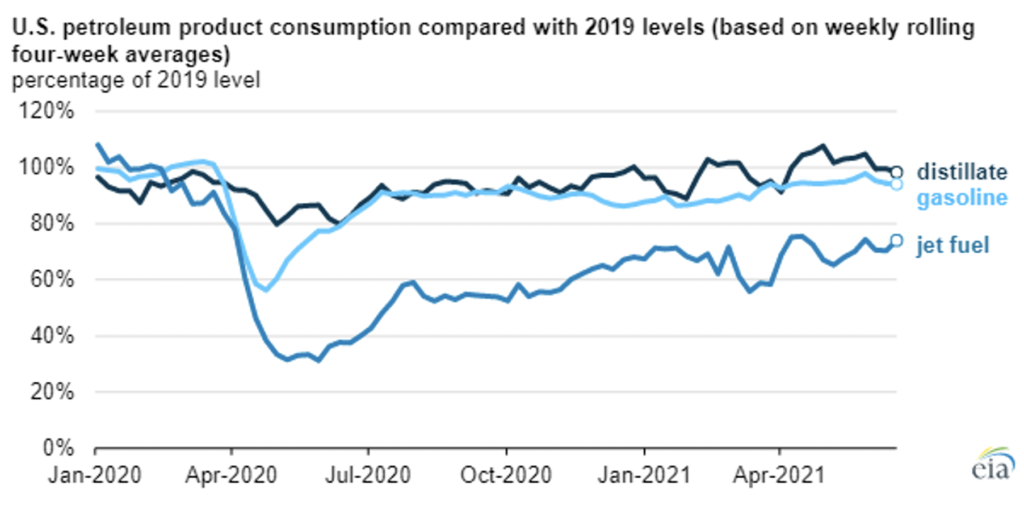

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Futures posted their sixth straight weekly gain, the longest winning streak since December, as the standoff between OPEC+ ministers over output dragged on. New York prices rose 1.7% last week, closing at $75.16, with London closing at $76.17. Most members of the OPEC alliance backed a proposal to increase supply and extend the deal into later next year, but the United Arab Emirates remains opposed.

The US oil futures curve is pointing to a tightness the market hasn’t seen in years, sparking concerns of the potential for sharp inventory drawdowns. The three nearest time spreads on the West Texas Intermediate futures curve hit $1 a barrel or more on Thursday. That’s an indicator that the market is growing increasingly worried about supply tightness, particularly at the key storage hub of Cushing, Oklahoma.

Crude oil prices jumped higher after the EIA reported an inventory decline of 6.7 million barrels for the week to June 25th. This follows a draw of 7.6 million barrels for the previous week. US crude exports over the four weeks ended on June 25th rose to a more than one-year-high; the four-week moving average for exports rose 292,000 b/d on the week to 3.546 million b/d.

The US Department of Energy will conduct a broad review of the Strategic Petroleum Reserve by the end of September, the first in five years, to assess its size and responsiveness to current energy markets. Since the SPR was created four decades ago, its structure generally has not changed, even as demands for crude oil and petroleum products have changed significantly.

The gradual decline of North Sea output has compelled pricing agencies to include newer grades into the Brent basket to ensure the traded benchmark’s liquidity. The recent maintenance on the Forties pipeline system, with the UK grade being the largest stream within the Brent price-setting barrel pool, has rekindled speculation that pricing transparency requires substantial volumes, which can only come about by physically extending the basket. Norway’s Johan Sverdrup is believed to be the prime candidate to be added to that basket.

International Energy Agency: Hydropower capacity is vital for faster integration of wind and solar power. Still, its growth is set to slow by 23% this decade without a comprehensive policy and investment push, the IEA said. “Hydropower is the forgotten giant of clean electricity, and it needs to be put squarely back on the energy and climate agenda if countries are serious about meeting their net-zero goals,” said IEA Executive Director Fatih Birol. In addition to producing massive quantities of low-carbon electricity, many hydropower plants can ramp generation up and down very rapidly, allowing for the integration of more intermittent wind and solar power output.

OPEC: The cartel and its allies disagreed on raising oil production on Friday as talks hit a deadlock for a second day. The UAE remained opposed to a deal that does not address concerns over its output target. As oil prices traded close to the highest level in three years, around $76 a barrel, the White House flagged the impact of the ongoing rally on US motorists as the global economy rebounds from the initial hit from the pandemic. The group said it would reconvene by videoconference on Monday.

Saudi Arabia and Russia had proposed increasing production cautiously by 400,000 barrels each month between August and December, which other countries have broadly supported. They also sought to extend a supply deal among OPEC+ producers beyond next April into the latter half of 2022.

According to a survey, the 13-member organization raised its production to 26.47 million b/d last month, up by 855,000 b/d compared to May. Saudi Arabia, OPEC’s top producer, accounted for more than half of June’s production increase as it hiked its output by 490,000 b/d to 8.95 million.

Shale Oil: The US shale industry is holding back on significant production investments despite bumper profits and surging crude prices, as executives seek to avoid being punished again for responding with rapid investment. Although US crude prices have doubled in the past 12 months, the number of operating oil rigs remains well below recent years. As a result, US oil production languishes almost 15% beneath last year’s record high near 13 million b/d. Industry observers and insiders had expected a rapid recovery from the US shale industry. Now tepid spending and sluggish oilfield activity could leave supplies short as demand recovers. “We are underinvesting as an industry around the globe,” said Rick Muncrief, chief executive of Devon Energy, one of the largest US shale producers.

Devon has pledged to hold production flat this year and cap any growth in 2022 at just 5 percent — less than half the annual pace across the shale patch in the three years of bumper output increases before the pandemic. After years of outspending, Devon is among the shale groups that have pledged to use windfalls from higher prices to strengthen their balance sheets and return capital to investors through dividends or share buybacks.

Large oil companies are unloading properties from Texas to California, with some using the market rally as a chance to rake in cash for future investment in the transition to cleaner energy. Other sellers are taking the chance to profit when just a few months ago significant properties were being sold at a loss.

Banks have started to cut their exposure to US shale, seeing more than 100 producers and oilfield services firms go bust last year and feeling the environmental, social, and governance pressure to reduce credit to fossil fuels. While traditional lenders are cutting their losses and de-risking energy loan portfolios, alternative capital providers are stepping up to scoop up US energy debt at a discount.

Hydraulic fracturing, the technology that made the US the world’s top oil and gas producer, has earned a bad rap. Much of that ill reputation relates to increased seismic activity in shale oil and gas regions. Research cited by the US Geological Survey showed a few years ago that it’s not fracking itself that is the problem. Instead, the problem is the disposal of wastewater, and it is not going away. Earlier this month, Rystad Energy warned in a report that the number of seismic events in critical oil-producing regions has been on the rise.

Natural Gas: Markets around the globe are rallying as the world’s importers have come to a stark realization: there isn’t enough supply to go around. A long, frigid winter drained gas stockpiles from Louisiana to Germany, and utilities struggled to build them back up. But unforeseen supply disruptions and a rebounding global economy are making it impossible to keep up. That’s setting up a desperate scenario as hot summer temperatures approach, and it’s bound to get even worse when demand peaks this winter.

Tight US supply-demand fundamentals led to the highest prices since December 2018. Last week, the expiring July contract gained 13 cents, hitting a 30-month high at $3.63 per million BTUs. Further out along the curve, the monthly gas contracts gained about 11 to 12 cents up to an average of $3.65 per million. Over the past week, Henry Hub futures and forwards prices have gained about 40 to 45 cents as temperatures across much of the continental US pushed into the 80s F., with even 100s appearing in some locations.

Asian spot liquefied natural gas prices spiked to a new eight-year seasonal high last week, as demand remained robust globally for power generation needs during the Northern Hemisphere’s summer. As a result, the average LNG price for August delivery into Northeast Asia was estimated at $14 per metric million British thermal units, up $1.50 from the previous week.

The Panama Canal Authority says high arrivals of LNG ships is taking place during the early part of July following a surge in transits during the final week of June. From June 25-29, 11 LNG vessels arrived with reservations and three without.

On Tuesday, the US Supreme Court removed a hurdle to the construction of a natural gas pipeline through Pennsylvania and New Jersey, ruling the pipeline developer could invoke the power of the federal government to take state property needed for the project. The court’s 5-4 opinion handed a significant victory to the natural-gas industry by rejecting New Jersey’s challenge to the actions of the PennEast Pipeline Co., a joint venture of several energy companies that aims to build a 116-mile interstate pipeline.

The Environmental Protection Agency estimates that the number of abandoned oil and natural gas wells, many of which are leaking methane, exceeds 3 million. A non-profit, the “Well Done Foundation,” is tackling global warming one well at a time by plugging orphaned wells and trapping the methane underground. The effort started in Montana in 2019 but will expand to other states before the fall.

Coal: The US Supreme Court decided that it won’t allow Wyoming and Montana to sue Washington state for denying a pivotal permit to build a coal export dock that would have sent coal to Asia. The two major coal mining states have sought to boost exports to prop up an industry in decline for a decade. The Washington State Department of Ecology in 2017 denied a permit for the export dock, saying the facility on the Columbia River would cause “irreparable and unavoidable” environmental harm.

Electricity: A clean electricity standard, or CES, and tax credits for renewable energy are “bottom lines” needed in a second infrastructure package that could be passed this year. President Biden has sought to reassure environmental and progressive groups that he will include key climate policy measures in a second infrastructure package that could be passed on a party-line vote through budget reconciliation. The first package, a bipartisan bill in the works between Biden and lawmakers, does not include a CES. This standard would reduce emissions by adopting renewables like wind and solar, nuclear energy, or finding ways to sequester greenhouse gas emissions from fossil-fuel plants.

Prognosis: The oil market will end 2021 in a deficit of 5 million b/d as demand grows by another 2.2 million b/d in the second half of the year, Goldman Sachs analysts say. This means that OPEC+ needs to bring more supply online to help narrow this deficit because other suppliers would find it more challenging to step in and boost production. “While a large new infection wave could slow the market rebalancing, we expect OPEC+ to remain tactical in its output hikes with downside risks to global supply elsewhere pointing to a more robust outlook for crude and the upstream sector than petroleum products and the downstream sector.”

The spotlight on the insurance industry’s support of fossil fuel projects is proving so searing that the names of some of those involved have been scrubbed from the record. For example, Canada’s Trans Mountain, the operator of a pipeline that takes crude from Alberta’s oil sands to the west coast of British Columbia, made a request of the country’s energy regulator in February. It wished to redact the names of the pipeline’s insurers in its public filings, now and in the future, to shield them against a barrage of publicity from climate campaigners targeting the energy-intensive tar sands industry.

The regulator granted the request two months later, despite protestations from groups including the indigenous Tsleil-Waututh Nation. Like the controversial Carmichael coal mine in Australia, the pipeline extension has become a critical battleground for campaigners seeking to stop the financing and underwriting of the most polluting industries.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Tehran has been restricting UN nuclear inspectors’ access to its main uranium enrichment plant at Natanz, citing security concerns after what it says was an attack on the site by Israel in April. The standoff, which one official said has been going on for weeks, is in the course of being resolved, diplomats said. Still, it has also raised tensions with the West, just as indirect talks between Iran and the United States on reviving the Iran nuclear deal have adjourned without a date set for their resumption.

A key oilfield near a US military base in Syria’s Deir Ezzor region came under rocket attack on Monday, hours after the US military said it had carried out airstrikes against Iran-backed militia storage facilities in Iraq and Syria. It wasn’t immediately clear if US military personnel were near the oilfield when it was attacked.

Oil and petrochemical workers from 60 companies across eight Iranian provinces are now on strike demanding higher wages and better contractual conditions. Iran International reported that the strikes have been intensifying since last week. The London-based Iran news outlet explained that the strikes follow a change in the way people are rehired in the country’s oil industry. Retiring full-time workers are being replaced with employees hired on a temporary contract basis. After 20 years of this practice, there are more than 150,000 temporary workers in the Iranian oil industry who are denied the benefits that full-time, long-term contract workers enjoy.

Iraq: Oil prices have been steadily increasing since the beginning of the year, as the government promises higher export levels. Crude was going for $65.842 a barrel in May, up 23.5% from January. Iraq is expecting $80 a barrel, although no timeframe has been given for this confident prediction. Iraq’s oil exports have been doing well in 2021, as the third-largest oil exporter to China, after Saudi Arabia and Russia, and the top supplier to India. Iraq has been setting its sights on China and India, as oil demand from the two Asian giants looks set to grow well into the next decade.

Iran has drastically cut gas and electricity exports to Iraq, contributing to severe power shortages across the country that prompted the resignation of Iraqi Electricity Minister Hantoush. The gas supply has been reduced to a fraction of contracted volumes, and electricity exports have stopped. The reason was not immediately apparent, but Baghdad owes Tehran billions of dollars for gas and power sales that it has been unable to pay because of US sanctions on money transfers to Iran.

Just when it looked like Iraq was becoming a regional leader, it decided to halt a $2 billion pre-paid oil supply deal with China’s state-owned Zhenhua Oil despite its aims to strengthen ties with China. Instead, Iraq agreed to end an agreement with Zhenhua and sell its crude supply to other customers as oil prices continue to rise. The Chinese company agreed to a deal earlier this year that would have seen 4 billion b/d of oil supplied each month.

Libya: UN-sponsored talks aimed at paving the way for elections in late December failed to find common ground. However, Raisedon Zenenga, assistant secretary-general and mission coordinator of the UN Support Mission in Libya, called on participants to pursue the effort, describing the talks as “heated debate” marked by walk-out threats. “The people of Libya will certainly feel let down as they still aspire to the opportunity to exercise their democratic rights in presidential and parliamentary elections on December 24th,” Zenenga told the closing session.

Venezuela: Oil traders discharged record imports of Venezuelan crude in China masked as Malaysian bitumen blends ahead of a June 12th tax that raised import costs by at least 40% for several fuel types. The tax coincided with the restart of a crude upgrade and an oil-blending plant that processed extra-heavy crude from the Orinoco Belt for export. The upgrader is operated by the Petrocedeno joint venture between PDVSA, TotalEnergies and Equinor. The Petrosinovensa blending plant belongs to PDVSA and China National Petroleum Corp.

PDVSA will use 17 drill rigs, contracted at $1.5 million each, to raise production to an average of 1 million b/d in 2021. Although Orinoco Belt production is key to reaching the nation’s goal in the second half of the year, Venezuela’s state-owned PDVSA will restart the drilling of oil wells while intensifying work to open 3,700 shuttered wells.

The central bank is planning to slash six zeroes from the bolivar as early as August after previous attempts to issue larger-denomination bills failed to resolve problems created by endemic inflation. As a result, one dollar would be worth 3.2 bolivars instead of 3,219,000 at present. Venezuela last carried out a “redenomination” of the bolivar in 2018 and in March began printing one million bolivar notes, the largest in the country’s history. But that bill is now worth just $0.32 and isn’t enough to buy a cup of coffee.

3. Climate change

It was the most extreme heatwave on record in the Pacific Northwest. As officials count the heat-related deaths over the following weeks, it will almost certainly turn out to be one of the deadliest. Unfortunately, the East Coast was not spared either. Newark recorded its hottest ever June day with a high of 103 degrees Fahrenheit, and in New York, thousands of homes were without power. As climate change drives up global temperatures, deaths linked to extreme heat are increasing, with some scientists projecting that by 2100, the number of heat deaths will match those from all infectious diseases.

Life-threatening extreme heat linked with global warming has broiled parts of every continent over the last few decades, killing at least 166,000 people from 1998 to 2017. A recent study found that, since the 1950s, periods of extreme heat have become more frequent, longer lasting, and hotter, matching, and even exceeding, climate projections made 20 years ago

The European Council set into legislation the objective of a climate-neutral EU by 2050. This follows a political agreement reached with the European Parliament on April 21st. In addition to the goal of climate neutrality and an aspirational goal for the Union to eliminate harmful emissions after 2050, the European climate law sets a binding Union climate target of a reduction of net greenhouse gas emissions by at least 55% by 2030 compared to 1990. Furthermore, to ensure that sufficient efforts to reduce and prevent emissions are deployed until 2030, the climate law introduces a limit of 225 million tons of CO2 equivalent to achieve that target.

The UK is bringing forward its target to end coal use in electricity generation by one year to October 2024 as part of its aim to lead the world in tackling climate change, the government said on Wednesday. “Today we’re sending a clear signal around the world that the UK is leading the way in consigning coal power to the history books and that we’re serious about decarbonizing our power system so we can meet our ambitious, world-leading climate targets.”

4. The global economy and the coronavirus

The fast spread of the coronavirus’ Delta variant in much of the world is thwarting plans in many countries to lift lockdowns and reopen economies. Moreover, the variant’s spread has heightened a likely feature of an extended global pandemic: the contrast between poorer unvaccinated countries where hospitalizations and death rates are surging and highly vaccinated populations.

United States: Employers added 850,000 jobs in June—the biggest gain in 10 months—and workers’ wages rose briskly, both signs of robust demand for workers. The unemployment rate, derived from a separate household survey, rose to 5.9% last month from 5.8% in May.

The infrastructure bill, a central plank of the Biden plan, faces a complex path to passage in the narrowly divided Congress. In the Senate, Democrats hope to pass the bipartisan bill by drawing enough Republican votes to reach the 60-vote threshold required for most legislation to advance. They also hope to pass the broader bill, which expands childcare, Medicare, affordable housing, and other programs, under a unique process tied to the budget, known as reconciliation, that requires only a simple majority.

An effort to push the most sweeping changes to the global tax system in a century gained significant momentum on Thursday when 130 nations agreed to a blueprint in which multinational corporations would pay a fair share of tax wherever they operate.

Ford Motor said several of its North American factories would be shut for a few weeks in July and August due to a global shortage of semiconductors. The supply crunch would cost it $2.5 billion this year and halve vehicle production in the second quarter, the Dearborn, Michigan-based company had said in April.

The European Union: The number of new coronavirus cases increased across Europe for the first time in 10 weeks, ending a stretch that had raised hopes the pandemic would recede as vaccinations were on the rise. A European Union COVID-19 travel certificate launched last week may help some make trips, but arrivals to tourist hotspots from Portugal to Croatia are set to remain well down from normal levels.

China: Expansion in China’s factory sector slowed in June, as export demand weakened while supply bottlenecks held back production. China’s services sector, a persistent laggard in the country’s post-pandemic rebound, softened as recent coronavirus outbreaks again hindered consumer spending. The hints of weakness on both fronts come as economists lowered expectations for China’s growth. Morgan Stanley and Barclays, among others, have downgraded their forecasts for China’s full-year gross domestic product to below 9%, citing the impact of higher raw material prices on production and weaker-than-expected consumption.

Chinese oil companies are likely to slash their July gasoline, gasoil, and jet fuel exports to a six-year low of 1.15 million tons amid tight export quota availability and better domestic margins. Moreover, outflows from China are likely to stay at low levels in the rest of the year, contrasting to a monthly average of 4.31 million tons in the first five months.

According to a new report by an independent think tank, most new coal-power plants being planned will struggle to make back their upfront costs, including all of those under construction in China. It is calculated that 92% of facilities proposed or under construction globally would cost more to build than the future cash flow they would generate. China leads the field with plans to add 187GW of coal-power capacity to the existing supply of more than 1,000GW. India follows with 60GW in the pipeline, compared to the current capacity of 248GW. Indonesia, Vietnam, and Japan make up the remainder of the five Asian countries responsible for 80% of the world’s planned new coal plants. Together they are set to build more than 620 new units with a capacity of more than 300GW.

Russia: The government has introduced harsh new restrictions, including regional lockdowns and compulsory vaccinations, in a belated response to a third coronavirus wave sweeping the country. President Putin backed away from his claims about Russia’s “victory” over the pandemic and admitted that the situation had “taken a turn for the worse” last week as coronavirus cases rocketed.

Despite the vaccine being free and open to all since December, only 16.7 million of Russia’s 145 million population, or about 13 percent, have had two shots in a country where mistrust of the state and its medical system is high. So, Moscow is requiring most people aged 18 to 60 to be vaccinated and forcing anyone who wants to visit a restaurant starting next week to show a QR code proving they have been vaccinated, been sick with Covid-19 in the past six months or had a negative test result in the past three days.

According to analysts, Russia will keep pace with any easing of OPEC+ production cuts in both the short and medium-term. As the cartel discusses whether to boost output further in August, there has been renewed speculation about whether record production cuts could permanently damage Russian oilfields. While some old and inefficient wells have been shut for good in the past year, the country has largely preserved its pre-pandemic capacity, according to a Bloomberg survey. Russia could boost output by about 700,000 b/d from current levels within six to 12 months. That could return the country to just under the post-Soviet annual production record of 11.25 million b/d reached in 2019.

Saudi Arabia: The government plans to start a second national airline to turn the oil-rich kingdom into a transport hub and help diversify its economy. The strategy includes increasing air connectivity to 250 destinations and doubling air cargo capacity to 4.5 million tons. It will go along with plans to develop ports, rail, and road networks, increasing the transport sector’s contribution to the country’s gross domestic product to 10% from 6% by 2030. In addition, Saudi Arabia is considering building a new airport in its capital Riyadh to serve as a base for a new airline, which would serve tourists and business travelers. The existing flag carrier, now called “Saudia,” would focus on religious tourism from its base in Jeddah.

India: Fuel demand, hit by a deadly second wave of coronavirus, will recover to pre-pandemic levels by the end of this year, Oil Minister Pradhan said. In May, local fuel consumption- a proxy for oil demand – slumped to its lowest since last August as lockdowns and restrictions in several states stalled mobility and muted economic activity. However, Indian fuel demand showed signs of a resurgence this month due to the lifting of lockdowns by states and a gradual pick-up in economic momentum, Pradhan said at an energy summit. India imports 80%+ of its oil needs.

Africa: The variant-driven coronavirus outbreak that public health officials across Africa had warned about for months is underway — and it’s happening without the urgently needed ramping up of the continent’s access to vaccines. The variant is driving a sharp increase in infections across each of Africa’s central regions, with only a trickle of vaccination donations coming in from wealthy countries.

“Anyone who cares about this pandemic in the true sense should be frustrated,” John Nkengasong, head of the Africa Centers for Disease Control and Prevention, said in an interview. “As of one week ago, we had vaccinated 1.1 percent of the population of Africa. If you square that with Africa’s population of 1.2 billion, you see we still have a very long way to go to get to 60 percent if vaccines continue this way.”

5. Renewables and new technologies

Announcements of sizeable new electrolyzer projects and the formation of consortia to build them appear in the news almost daily. The growing number of projects would indicate that capacity to produce green hydrogen will increase sharply in the next few years. Indeed, according to a recent report of the International Renewable Energy Agency (IRENA), entitled ‘Green Hydrogen Supply, A Guide to Policy Making,’ electrolyzer manufacturing capacity worldwide is expected to rise to 3.1GW per year by the end of 2021.

Energy professionals say a lack of infrastructure investment, along with cost, is the main barrier to expanding the hydrogen economy. Therefore, repurposing existing infrastructure would be essential to developing a large-scale low-carbon and renewable hydrogen economy.

Norway’s Equinor and US Steel will examine the potential for developing clean hydrogen production in Ohio, Pennsylvania, and West Virginia, the two companies announced last week. The companies have signed a memorandum of understanding to assess the technological and commercial possibilities for hydrogen and carbon capture and storage and looking at potential customers and suppliers. Hydrogen, long used as rocket fuel and in oil refining and to produce ammonia, is an opportunity for the oil and gas sector to reduce greenhouse gas emissions.

At least two dozen US energy firms, including Dominion Energy and Sempra Energy, have started producing hydrogen or testing its viability in natural gas pipes to take advantage of existing infrastructure. Utilities can potentially benefit if they find that clean-burning hydrogen can be successfully transported in existing gas pipes and used in power plants.

Nabors Industries reported last week that it is investing a total of $21 million in a pair of geothermal technology companies. In one instance, the drilling contractor will invest $10 million in Sage Geosystems, which is developing geothermal technologies integrating surface (plant) and subsurface (well) components to improve heat harvesting efficiency at a lower capital cost.

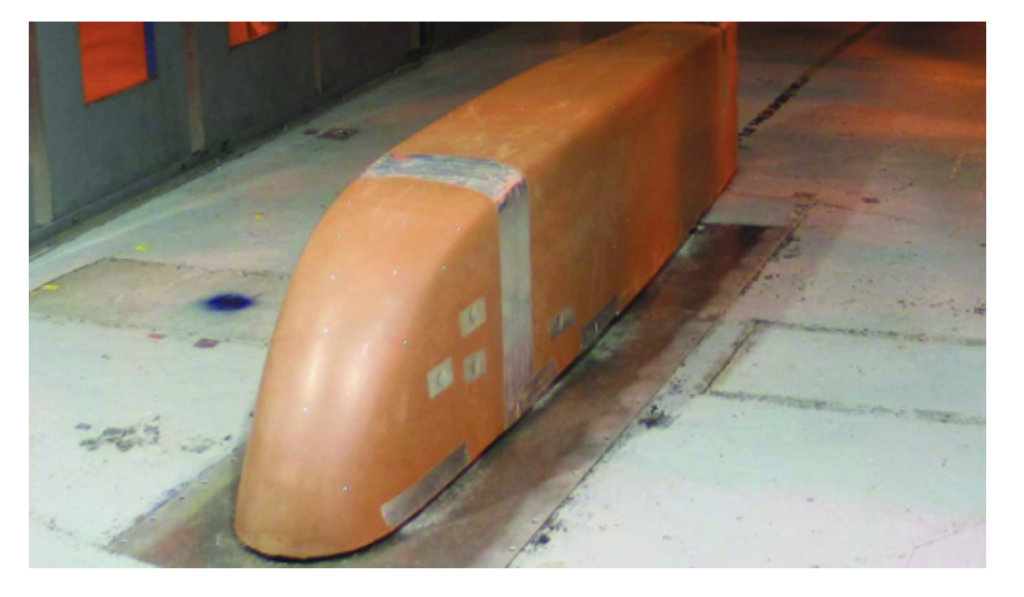

Using wind tunnel measurements and computational fluid dynamics simulations, Lawrence Livermore National Laboratory engineers have demonstrated that aerodynamically integrated vehicle shapes decrease body-axis drag in a crosswind. This creates considerable negative front pressures that effectively “pull” the vehicle forward against the wind, much like a sailboat. One of the primary sources of inefficiency contributing to the low fuel economy (about six mpg) of heavy vehicles is their relatively large body-axis drag.

The new proposed shape, which looks like a bullet train design, would produce body-axis drag values significantly less than those of modern heavy vehicles. Although the reductions in drag come from additional frontal streamlining, manufacturers also would have to pay particular attention to the entire shape.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

A.P. Moller-Maersk — the largest shipping company in the world — has signed an agreement with South Korea’s Hyundai Mipo Dockyards to build a feeder vessel capable of sailing either on methanol or very low sulfur fuel oil. The project is part of the company’s plans to operate the world’s first carbon-neutral vessel by 2023. (7/1)

Rolls-Royce said it would partner with oil company Shell to develop sustainable aviation fuel in line with both their plans for net-zero emissions by 2050. The pair signed a memorandum of understanding on Wednesday. (7/1)

Shell’s H2: Royal Dutch Shell on Friday launched Europe’s most giant hydrogen electrolysis plant at the Wesseling site of its Rhein land refinery after two years of construction, as it expands further into alternative energies. The Refhyne plant, with a 10-megawatt capacity, will produce green fuels as part of a European Union-funded consortium that is already setting its sights on a 100 MW facility at the site near Cologne. (7/3)

Norway’s dubious path: Despite announcements last year that it is striving for net-zero carbon emissions by 2050, Norway has now said it will go full steam ahead in its oil ventures over the coming decades. While neighboring Denmark plans to end all North Sea operations by 2050, Norway, Western Europe’s largest oil producer, offers exploration and production contracts to several companies. (7/2)

Moscow’s EV bus push: Moscow is halting the purchase of diesel buses for its passenger transport fleet. Starting this year, the city will not buy diesel buses, except for transportation in a particular mode. Otherwise, they will buy only electric buses. (7/2)

Australia’s oil industry lobby group slammed as “extreme” the amount–A$0.48 per barrel—which the government has proposed as a levy on all of the country’s offshore oil producers to cover the cost of decommissioning an offshore field. (6/29)

Offshore Western Australia Chevron and its partners in the Gorgon LNG project have agreed to go ahead with a $4 billion project to improve gas recovery from offshore wells and keep the substantial liquefied natural gas plant filled for 40 years. The Jansz-Io Compression project, which will help gas recovery at the Gorgon LNG project as the Jansz-Io field ages, is expected to take five years to complete. (7/2)

Nigeria’s Petroleum Industry Bill has been two decades in the making to overhaul the way Nigeria will share its oil resources with international oil companies and attract new investment in oil and gas. But community leaders in oil-rich regions want changes to the bill’s latest version, asking for a larger share of revenues for the community. (6/30)

In Nigeria, the Managing Director of the National Petroleum Corporation yesterday explained why the national oil company was purchasing a stake in the Dangote oil refinery, saying it was for the country’s energy and fiscal security. (6/30)

The Niger Delta Avengers — a group of rebels responsible for the bulk of the attacks on Nigeria’s oil infrastructure — have vowed to commence bombing oil installations across the Niger Delta to protest the government’s neglect of the region. (6/28)

Angola owes foreign oil field operators some $1 billion. This level of debt had forced the country to put up stakes for sale in several offshore oil and gas blocks. (7/2)

Uganda’s first crude project: Lake Albert, Uganda’s first hydrocarbon project ever, will produce some 230kbpd once it reaches peak production. While Western economies are arguing whether oil companies should cease all future exploration activity along with the IEA’s Net-Zero by 2050 scenario, East Africa is shaping up to become one of the hottest exploration frontiers worldwide. (6/30)

In Namibia, Reconnaissance Energy Africa announced encouraging results in the first section of its second well in the Kavango Basin. (6/28)

In Brazil, there were fears earlier this year that the virus’s rapid spread would derail Brazil’s offshore oil boom, particularly with a surge in cases among energy sector workers. While production dropped in March, by May it was in a strong recovery. (6/29)

The Panama Canal faces a creeping threat from climate change, including droughts so intense that ships sometimes reduce their cargo not to run aground and giant storms that almost overwhelm its dams and locks. Unlike Suez, a flat seawater canal where the water depth is defined by the tide, the Panama Canal is a much more complex infrastructure that relies on freshwater and uses a system of locks as aquatic elevators, lifting ships almost 90 feet above sea level onto a navigable waterway, and then lowering them down at the other end. (6/29)

In the shadow of Canada’s mega oil sands projects, smaller, technologically outdated facilities produce up to three times more emissions per barrel than the already high sector average but rising oil prices have given them a new lease of life. With oil prices near 2-1/2-year highs and dim prospects for building new projects in a world heading toward net-zero emissions, operators aim to pump as much as they can from existing facilities – including from the most carbon-intense sites. Producers are cashing in as they seek to repair their balance sheets from the damage inflicted by the coronavirus. (6/29)

The Government of Canada is setting a mandatory target for all new light-duty cars and passenger trucks sales to be zero-emission by 2035, accelerating Canada’s previous goal of 100% sales by 2040. The Government of Canada will pursue a combination of investments and regulations to help Canadians and industry transition to achieve the new goal. (7/1)

The US oil rig count grew by 4 to 376 while the gas rig count inched up by 1 to 99, according to Baker Hughes’s weekly report. The total rig count of 475 represents an increase of 212 rigs this year and is 205 more than last year. (7/3)

Shell sells CA asset: Royal Dutch Shell plans to leave Aera, its California-based oil and gas-producing joint venture with Exxon Mobil Corp. Aera produces about 125,000 barrels of oil and 32 million cubic feet of natural gas each day, accounting for about 25% of the state’s oil and gas production. (7/1)

In Texas, Sempra’s efforts to finalize a long-term deal with Saudi Aramco to support the proposed Port Arthur LNG export terminal in Texas have fallen through. (6/30)

United Airlines announced Tuesday that it ordered 270 single-aisle planes from Boeing and Airbus, the biggest aircraft purchase in United’s history and the largest in the United States in a decade. The deal will drive an expansion of United’s fleet, in both the number and the size of its planes. (6/29)

Teaming up: The US Administration supports a city in Maine that has prohibited storage and handling of crude oil that would be shipped via a pipeline from Canada in a court brief that environmentalists hope would be similar to how the federal government could react to the Enbridge-Michigan saga. (7/1)

Biofuel’s waivers: US lawmakers introduced a bill on Friday to limit exemptions offered to refiners on blending biofuels after sources said the Environmental Protection Agency chief voiced disapproval about a Supreme Court ruling upholding broad use of the waiver program. (7/3)

Biofuels E-15: A US appeals court July 2nd vacated the Environmental Protection Agency’s approval of year-round E15 fuel sales, rejecting the regulatory process it took to fulfill former President Donald Trump’s October 2018 promise to farm-state senators to blend more ethanol into the nation’s gasoline supply. (7/3)

New Hudson tunnel? Transportation Secretary Pete Buttigieg got a close-up look at the crumbling state of New York City’s most critical rail link on Monday and vowed that the Biden administration was committed to getting a new train tunnel built under the Hudson River. The project cost is estimated at $11.6 billion. (6/29)

The US Supreme Court decided Monday that it won’t allow Wyoming and Montana to sue Washington state for denying a pivotal permit to build a coal export dock that would have sent coal to Asia. The two major coal mining states have sought to boost exports to prop up an industry in decline for a decade as US utilities switch to gas-fired power and renewable energy. (6/30)

Offshore US wind: The US must speed up project permits to meet the Biden administration’s 2030 target for offshore wind power, primary developer Orsted said on Thursday. The administration of President Joe Biden has set a goal to install 30 gigawatts of offshore wind power capacity in US waters by 2030 – nearly the amount that already exists in Europe’s two-decade-old industry. Yet, it can take as much as ten years to plan and build new projects. (7/2)

South Korea’s big wind: With a climate and topography ill-suited for large-scale wind power generation on the land, the country looks out to sea for its clean energy ambitions. Presently South Korea produces electricity from 20 wind turbines in the Southwest Sea. Soon the area is going to be turned into the world’s largest offshore wind farm. (7/1)

Germany has gathered support from four European Union countries around its opposition to classifying nuclear energy as “green” and sustainable for investment purposes. Spain, Austria, Denmark, and Luxembourg joined Germany in saying investors concerned about nuclear waste storage could lose confidence in financial products labeled green if they included nuclear energy without their knowledge. (7/3)

Zimbabwe faced prolonged power outages after a surge in electricity imports from neighboring South Africa overloaded its network and caused generating plants to fail. The surge caused a nationwide blackout early Monday. (6/29)

Brazil’s worst water crisis in nearly a century is fueling inflation that’s reverberating through the economy, posing an additional challenge for the central bank and President Jair Bolsonaro’s re-election bid. Electricity bills will increase as much as 15% next month as dangerously low water levels in hydroelectric reservoirs force the government to turn to more expensive power plants fueled by natural gas, diesel, or coal. Food prices are also going up as farmers lose part of their crops to the drought. (6/28)

Vaccination certs: The European Union started rolling out a first-of-a-kind digital health certificate that permits people who have been vaccinated to travel freely within the bloc without the need to quarantine or test negative for Covid-19 upon arrival at their destination. (7/2)

Kim Jong Un said North Korea’s Covid-19 situation has become grave and admonished senior officials for lapses in the fight against the disease. Mr. Kim, speaking at a Politburo meeting, didn’t specify what had gone wrong. (6/30)

Plastics: Covid-19 led to a sharp rise in the production of single-use plastics, a significant proportion of which end up in the world’s oceans. With the pandemic gradually being brought under control, emerging markets are now stepping up efforts to tackle marine pollution. (6/30)