Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The developed economies have a responsibility to fund the just transition to a low carbon economy and climate resilient society.”

Albi Modise, spokesman for South Africa’s environment department

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Brent futures dipped on Friday but held above $75 a barrel, remaining on track for weekly gains of more than 3% thanks to the slow recovery in output after two hurricanes in the Gulf of Mexico. Brent crude futures fell 27 cents, or 0.36%, to $75.40 a barrel. West Texas Intermediate (WTI) crude futures closed at $72.22 after settling unchanged in the previous session. Hurricane Ida is now officially the most devastating hurricane ever in terms of oil production disruption, and experts expect the outages to last throughout September.

After 95% of US Gulf oil and gas production was shut in near the end of August as Ida made a Louisiana landfall, 422,078 b/d of crude, or 23.2%, remained offline Sept. 17th, according to the US Bureau of Safety and Environmental Enforcement. The return of natural gas supplies continued to lag a bit more than oil. BSEE said that an estimated 765.5 million cf/d, or 34.4% of natural gas production, was still shut in. Hurricane Ida has led to oil supply losses of 30 million barrels so far, driving the first decline in global oil supply in five months and pushing global inventories sharply down, the IEA said on Tuesday.

The EIA reported on Wednesday a 6.4-million-barrel draw in crude oil inventories and for the week to Sept. 10th, the EIA reported another draw in gasoline inventories, at 1.9 million. In addition, middle distillate inventories shed 1.7 million barrels in the week, compared with a draw of 3.1 million barrels for the previous week. US stockpiles of the so-called big 4—crude oil, gasoline, distillate, and jet fuel—are below 2018 levels now, according to data compiled by HFI Research. Low stocks of crude and fuels are a key reason why gasoline prices are not falling after a busy driving season ended.

US oil demand continues its upward trajectory—reaching a record high last week–while product inventories have fallen to the lowest levels in three years. If the demand trend holds, analysts say oil prices have room to rise even more in the rest of the year. The world is facing high energy prices for the foreseeable future as oil and natural gas producers resist the urge to drill again, according to Chevron Corp.’s top executive. “There are things that are interfering with market signals right now that we haven’t seen before. Eventually, things work out, but eventually can be a long time.”

International Energy Agency: After three consecutive months of declines due to the Delta variant, global oil demand is set to rebound with a 1.6-million-b/d jump in October and continue rising through the end of the year, the IEA said on Tuesday. In its closely watched Oil Market Report, the agency slightly revised down its full-year 2021 demand growth projection but noted that pent-up demand and vaccine programs are expected to give rise to “a robust rebound” in global oil demand from the fourth quarter of this year. As a result, the IEA now sees oil demand growing worldwide by 5.2 million b/d in 2021, down by 110,000 b/d compared to last month’s assessment.

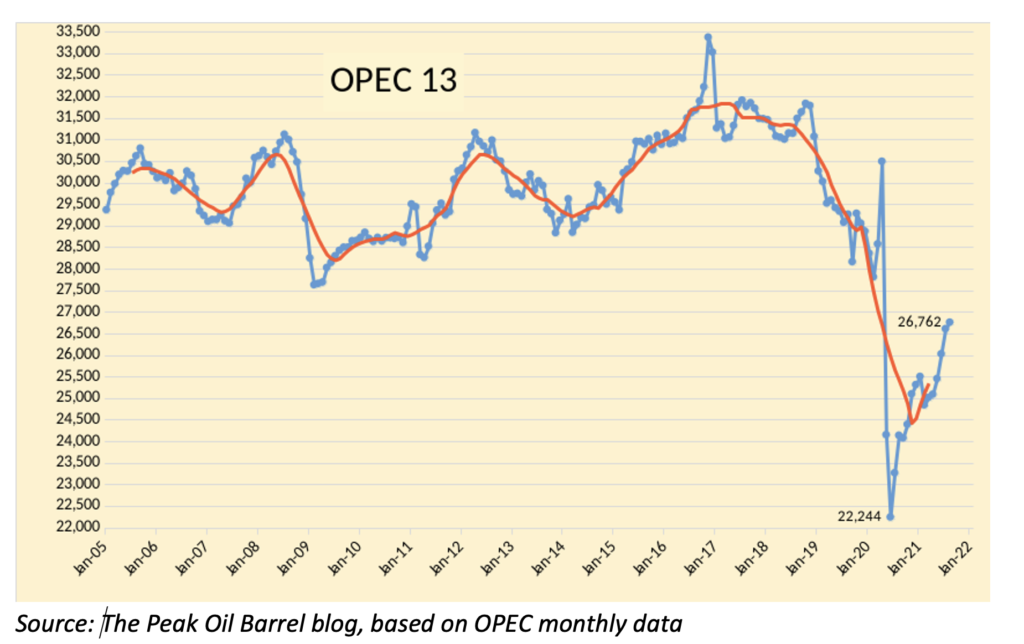

OPEC: The cartel saw its crude oil production rise by 150,000 b/d in August, data from secondary sources in the cartel’s monthly report showed. However, even at higher quotas, the OPEC members’ share of the OPEC+ pact pumped less than estimated by tanker tracking surveys and less than the OPEC overall quota in the agreement. As a result, total crude oil production from all 13 OPEC members averaged 26.76 million b/d in August. The increase, however, was lower than estimated in the monthly Reuters survey, which had pegged the rise at 210,000 b/d to average 26.93 million b/d.

Shale Oil: US shale oil producer Pioneer Natural Resources has put its assets in the Delaware basin of Texas on the block, aiming to secure more than $2 billion for the properties, two sources familiar with the matter told Reuters. A strong rebound in crude oil prices following last year’s pandemic-led crash has sparked a wave of shale consolidation and opened a window for producers to offload unwanted properties. In addition, Pioneer wants to streamline its business and reduce debt after two significant acquisitions this year. In March, it sold an oilfield services business for an undisclosed amount. However, there is no guarantee Pioneer will end up striking a deal.

It would have been unthinkable a few months ago: ramping up production was the last thing US shale drillers would do amid a hesitant price recovery and heavy uncertainty around demand recovery. In these few months, however, a lot has changed. Now, US shale drillers may be ready to get back to increased drilling.

Inventories are down considerably, thanks to recovering demand. But they are also down due to the recent shut-ins of offshore production thanks to Hurricane Ida. On top of that, the shale industry’s inventory of drilled but uncompleted wells (DUCs) is also down considerably. All this suggests that we could see a more sizeable increase in the US rig count as shale producers seek to avert a decline in production.

Natural Gas: Prices worldwide are surging amid a perfect storm of tight regional gas markets and soaring power prices in Europe. The natural gas rally isn’t over yet—and it has further room to hit fresh record highs, especially if the coming winter turns out to be colder than typical in the northern hemisphere. Analysts say that weather will be the most critical factor for natural gas prices and markets in the next few months. Natural gas prices have surged, prompting worries about winter shortages and forecasts for the most expensive fuel since frackers flooded the market more than a decade ago.

US natural-gas futures ended Friday at $5.105 per million British thermal units. They were about half that six months ago and have leaped 17% this month. It is supposed to be the offseason for demand, and prices haven’t climbed so high since blizzards froze the Northeast in early 2014. However, analysts say that it might not have to get that cold this winter for prices to reach heights unknown during the shale era, which transformed the US from a gas importer to a supplier to the world. Rock-bottom gas prices have been a reliable feature of the US economy since the financial crisis. Then, gas crashed and never recovered, thanks to the abundance extracted with horizontal drilling and hydraulic fracturing.

The EIA on Thursday will give a new estimate of the volume of natural gas in storage, which it last estimated to be 16.5% less than a year ago. Now is the time of year when drillers fill storage tanks and caverns to get through winter when demand is greatest, and households are most exposed to higher prices in their heating bills. Crude prices haven’t warranted much new oil drilling, which has cut down on the amount of gas produced as a byproduct. The Appalachian firms that swing the market have given priority to profits over production growth and held back. As a result, the number of rigs drilling for gas has been basically flat since spring despite much higher prices. According to Baker Hughes, when prices rose above $5 in 2014, there were more than three times as many rigs drilling gas wells as the 100 operating now.

The UK government is scrambling to respond to a surge in natural gas prices that has forced the closure of fertilizer plants, driven up consumer energy costs, and now threatens the supply of products from meat to steel. In addition, soaring natural gas prices have stoked a surge in electricity costs, sending several smaller energy suppliers to the wall. “We could easily end up with less than ten suppliers by the time we come through winter,” said Ellen Fraser of Baringa, a London-based consultancy.

The gas price surge has already hit heavy industry, with the Energy Intensive Users Group calling on Friday for “immediate steps in the face of unprecedented recent increases in energy prices to maintain the international competitiveness of a key economic sector.”

Natural gas production is set for a significant increase over the next year thanks to the current imbalance between demand and supply, which has pushed prices to record highs, Reuters’ John Kemp reports, citing energy traders. Meanwhile, the gas supply for this winter season will be tight. Kemp also noted that as a result and in anticipation of next year’s supply recovery, Henry Hub futures have swung into backwardation, with contracts for delivery in January 2023 round $1.15 per million Btu lower than contracts for delivery next January.

An ongoing force majeure on El Paso Natural Gas is limiting westbound flows from the Permian Basin. The weeks-long pipeline maintenance keeps pressure on West Texas production and poses a risk to spot and forward gas prices in the US Southwest. On Aug. 15th, El Paso declared a force majeure on its Line 2000 near Coolidge, Arizona, after a segment of the pipeline suffered a failure. As El Paso works to repair the line, capacity through the Cimarron compressor station has been reduced to zero, down from its fully operational 567 million cf/d.

According to Alexey Miller, chairman of Russia’s Gazprom, China’s energy market has the most dynamic growth in the world. “Every year, it simply stuns us with the growth of China’s consumption, and 2021 is no exception.” Miller added that in the first half of this year, China’s natural gas consumption increased by more than 15% – and imports increased by more than 23%. “This means that by the end of 2021, the forecast estimates of consumption in China will amount to 360 billion cubic meters, and the volume of imports will be 160 million cubic meters.” Miller sees China’s natural gas imports climbing to 300 billion cubic meters per year by 2035.

Miller also claims that Russia’s natural gas reserves will last for more than a century: “Gazprom’s gas reserves are the largest in the world. And we won’t have any problems with our reserves for the next 100 years.” Moreover, some of the gas fields that Gazprom is developing in the Yamal region can produce gas until 2132, Miller noted.

Electricity: Several European power firms have been shut out of bumper revenues from record-high gas and electricity prices. Their sales are primarily locked in at lower prices and face extra pressure from governments acting to protect consumers. Power generators say government intervention could prevent longer-term investment needed to drive the bloc’s energy transition plans. At the same time, smaller retail suppliers without the capital to hedge could go bust – limiting choice for consumers. Benchmark European gas prices have soared some 250% this year due to several factors such as low stock levels, high demand in Asia, and infrastructure outages, taking power prices to record highs across Britain and Europe.

Prognosis: World oil demand will rise back above 100 million b/d, a level last reached in 2019, as soon as the second quarter of next year, according to major forecasters, challenging views that the pandemic may curb oil use for longer or for good. The IEA, OPEC, and the EIA all updated their world oil demand and supply estimates in monthly reports in the past week. “Economies are reopening and recovering further from the pandemic,” said Carsten Fritsch, an analyst at Commerzbank. “A peak in demand and it starting to decline is still some years off.” Before the pandemic, the rise of electric cars and a shift to renewable energy prompted downward revisions in long-term oil demand forecasts.

Global crude inventories that ballooned during the pandemic have shrunk to the lowest level in 20 months as an economic rebound in China and the US drive a robust recovery in fuel demand. About 2.97 billion barrels of crude oil were stored onshore globally as of Sept. 5th, the least since January 2020 before Covid-19 eviscerated demand. In addition, US stockpiles are at a two-year low. Those in China are the smallest since September 2020, while inventories at the African hub of Saldanha Bay are at the lowest since April last year.

Oil prices could climb above $100 if winter temperatures in the northern hemisphere turn out to be below seasonal norms, Bank of America Global Research said in a recent note. The bank said in June that expectations of a strong demand recovery that outpaces supply in the coming months could lead to oil prices briefly hitting $100 per barrel in 2022. “We believe that the robust global oil demand recovery will outpace supply growth over the next 18 months, further draining inventories and setting the stage for higher oil prices.”

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Tehran reached an agreement with the UN atomic agency that will grant international inspectors access to some of the country’s nuclear-related sites, a step likely to avert a crisis in the negotiations on restoring the 2015 nuclear deal. The agreement comes after International Atomic Energy Agency Director-General Rafael Grossi made a last-minute trip to Tehran this weekend to persuade Iran to step up its cooperation with the agency ahead of a meeting of the IAEA’s top member states starting Monday.

The US, France, Britain, and Germany discussed a formal censure motion against Iran if no agreement was reached, a step that Iran’s new President Ebrahim Raisi had said could scuttle the resumption of nuclear talks. The atomic negotiations started in April but were interrupted after Mr. Raisi was elected in June. The new government has refused so far to fix a date for resuming talks. However, in a joint statement issued following talks between Mr. Grossi and the head of Iran’s atomic energy agency, Iran agreed to allow the agency access to a range of nuclear sites to reset equipment installed by the agency to monitor Iran’s activities.

Iranian fuel and petrochemical exports have boomed in recent years despite stringent US sanctions, leaving Iran well placed to expand sales swiftly in Asia and Europe if Washington lifts its curbs. When the US imposed sanctions on Iran’s oil and gas industry in 2018 to choke off Tehran’s primary source of revenue, the steps crippled crude exports but not sales of fuel and petrochemicals.

Iraq: Over the past few years, Norway’s DNO has faced uncertainty around when it would be able to drill more wells to offset the natural decline of existing production at Tawke. One of the most prolific fields in Kurdistan, this field is now down by more than two-thirds from its peak production reached in 2015. Now, even without new drilling, the reservoir pressure is getting a much-needed boost. A new plant at DNO’s nearby Peshkabir field is processing 30 million cubic feet per day of associated gas produced along with crude oil and pumping it through a high-pressure pipeline for injection into Tawke’s reservoir. It’s a success story that underscores the potential commercial benefits of capturing rather than burning associated gas.

Last week Iraq’s Finance Minister Ali Allawi called for oil producers to move into renewable energy. This call is contradictory, with Iraq still funding new oil projects. However, looking at the overall regional picture, this claim is less surprising. The Gulf is facing the stark possibility of an ‘end to oil,’ forcing them to reassess the very basis of their economies. As a result, the first shoots of a Middle Eastern green energy arms race are sprouting, with Iraq’s declaration emblematic of this development.

Libya: The National Oil Corp (NOC) said that a blockade of the Es Sider and Ras Lanuf oil terminals has ended and that export operations had returned to normal. Protesters at those two ports and another, Hariga, had been blocking exports since last week and demanding jobs for local people. NOC said on Wednesday that operations had also resumed at Hariga. A company statement said that NOC’s chairman, Mustafa Sanalla, held talks with local elders who had helped end the protests. Security issues in Libya, where a fragile peace process has installed a unity government, have repeatedly threatened to undermine oil output that has topped 1.3 million b/d this year.

The National Oil Corporation has revealed that the chairman of its board of directors recently held a meeting with the general manager of Schlumberger Libya. The NOC noted that the meeting was devoted to discussing several “common topics.” The most important of these was said to be the possibility of repaying debts owed by NOC. In the meeting, Sanalla explained that NOC had received a promise from the Prime Minister to liquidate the allocated budgets. According to NOC, once these are received, the debts will be paid immediately.

Venezuela: The nation’s heavy oil reserves will be left stranded as international players divest their interests. That’s what GlobalData said in a statement that highlighted that TotalEnergies and Equinor had recently transferred their respective interests in Petrocedeno to the state-owned PDVSA oil company. This means that due to high risks and the unstable, deteriorating economy in the country, international players no longer see an upside in Venezuelan projects. Furthermore, GlobalData noted that with fewer investments supplied from the private sector, Venezuela would not sustain its oil and gas industry for long, as its cash resources are “minimal.”

3. Climate change

According to a far-reaching survey published by the Pew Research Center, nearly three-quarters of residents of countries in some of the world’s most advanced economies worry that climate change will one day create suffering in their own lives. Based on responses from a representative sample of nearly 20,000 people in 17 countries spanning North America, Europe, and Asia, the findings underscore growing concerns about global warming — and how even wealthy nations can no longer avoid the worsening consequences.

Developed countries made almost no progress toward their goal of providing $100 billion a year to help developing countries tackle climate change, figures from the OECD showed on Friday. The data threaten to undermine UN climate talks that start in Glasgow, Scotland, in just weeks. Developing nations say the funding — which has never hit its annual target — is vital for them to pledge deeper emissions cuts to help achieve the Paris Agreement’s goal of limiting global warming to 1.5 degrees Celsius. “There is no excuse: delivering on the $100 billion goal is a matter of trust,” Alok Sharma, COP26 president, said in response to the figures.

Climate change could push more than 200 million people to leave their homes in the next three decades unless urgent action is taken to reduce global emissions and bridge the development gap, a World Bank report has found. The second part of the Groundswell report examined how the impacts of slow-onset climate change such as water scarcity, decreasing crop productivity, and rising sea levels could lead to millions of what it describes as “climate migrants” by 2050. Under the most pessimistic scenario, with a high level of emissions and unequal development, the report forecasts up to 216 million people moving within their own countries across the six regions analyzed.

The heavy rains that fell across western and southern Germany in July were both devastating and historic. Up to eight inches of rain fell in less than 24 hours, flooding communities and causing more than 200 fatalities. As global temperatures rise, researchers have been investigating how a warmer climate will affect flooding patterns. Although precipitation events have undoubtedly increased in frequency and intensity, researchers have been unable to discern how flooding will change — until now. New research shows the occurrence and intensity of extreme flood events will increase, but more minor and more moderate floods will probably decline.

According to a report from London’s Chatham House, technology to feed the world will struggle to keep pace with the world’s growing population as climate change sends temperatures soaring and droughts intensify. As a result, yields of staple crops could decline by almost a third by 2050 unless emissions are drastically reduced in the next decade, while farmers will need to grow nearly 50% more food to meet global demand, the think tank said. The Chatham House report was drawn up for heads of state before next month’s pivotal United Nations COP26 climate summit in Glasgow.

The head of the United Nations is calling for “immediate, rapid and large-scale” cuts in greenhouse gas emissions to curb global warming. Antonio Guterres warned governments ahead of next week’s annual UN General Assembly that climate change is proceeding faster than predicted, and fossil fuel emissions have already bounced back from a pandemic dip.

Investors managing more than $10 trillion published an ambitious blueprint for energy companies seeking to tackle climate change, including sharp cuts to greenhouse gas emissions and oil and gas production winding down. The unprecedented initiative – dubbed the Net Zero Standard for Oil and Gas – details ten required standards to help money managers compare companies’ strategies and understand whether they are aligned with UN efforts to reduce global carbon emissions.

The US and the EU have agreed to a plan to cut methane emissions by about a third by the end of the decade as part of a diplomatic push to get other nations to stop emitting the potent planet-warming gas. The US is now asking other countries to join the “global methane pledge” — an expected topic of discussion during a virtual meeting of the Major Economies Forum on Energy and Climate that President Joe Biden is convening. The conference is timed to help build momentum before a United Nations-sponsored climate summit in Glasgow from Oct. 31st to Nov. 12th. Biden plans to unveil the methane pledge at the climate summit.

4. The global economy and the coronavirus

Whether for bread, rice, or tortillas, governments worldwide know that rising food costs can come with a political price. The dilemma is whether they can do enough to prevent having to pay it. Data from the UN Food and Agriculture Organization show that global food prices were up 33% in August from a year earlier, with vegetable oil, grains, and meat on the rise. And it’s not likely to get better as extreme weather, soaring freight and fertilizer costs, shipping bottlenecks, and labor shortages compound the problem. Dwindling foreign currency reserves are also hampering the ability of some nations to import food.

The global shipping industry is getting its biggest payday since 2008 as the combination of booming demand for goods and a global supply chain that’s collapsing under the weight of Covid-19 drives freight prices ever higher. Whether its giant container ships stacked high with 40-foot steel boxes, bulk carriers whose cavernous holds house thousands of tons of coal, or specialized vessels designed to pack in cars and trucks, earnings are soaring for ships of almost every type. With the merchant fleet hauling about 80% of world trade, the surge reaches every corner of the economy.

United States: COVID-19 deaths and cases in the US have climbed back to levels not seen since last winter, erasing months of progress and potentially bolstering President Biden’s argument for his sweeping new vaccination requirements. The cases — driven by the delta variant combined with resistance among some Americans to get the vaccine — are concentrated mainly in the South. While one-time hot spots like Florida and Louisiana are improving, infection rates are soaring in Kentucky, Georgia, and Tennessee.

The US economy is proving resilient in the face of the Delta variant. Americans briskly increased spending at retailers last month while employers have primarily resisted the urge to lay off workers. Both are signs of strong demand in the economy. However, the failure by the US to bring Covid-19 under control is scrambling business expectations of a rapid economic revival, forcing companies to reset plans and revise forecasts as they also grapple with a new federal vaccine mandate. According to an Economic Innovation Group study, revenues have fallen at a quarter of US small businesses in each of the past three weeks while just 8 percent saw revenue growth. A growing minority now expects a full economic recovery to take more than six months.

The queue of container ships waiting to berth at the Los Angeles/Long Beach port complex grew to a record 60 vessels as the ports remain inundated with import volumes during the peak shipping season. The vessel queue has swelled well beyond the 40 ships from the last import surge in February as the August-November peak season for restocking ahead of year-end holidays got underway.

The European Union: Natural gas and energy prices in Europe have been continuing their record-breaking run. Europe’s energy crunch has forced a major fertilizer maker to shut down two UK plants, the first sign that a record rally in gas and power prices threatens to slow the region’s economic recovery. The move comes as Europe faces an extreme squeeze for energy supplies, with gas and power prices breaking records day after day. European gas prices have more than tripled this year, while power costs almost doubled. In addition, the continent is running out of time to refill storage facilities before the start of the winter as flows from top suppliers Russia and Norway remain limited. There’s also a fight for shipments of liquefied natural gas, with Asia buying up cargoes to meet its demand.

Europe’s top chemicals firm BASF SE said it has been unable to avoid the impact of record-breaking electricity prices despite producing 80% of its power. Aurubis AG, the continent’s biggest copper producer, said energy costs have already dragged down profits and will continue to weigh on margins for the rest of the year. The fallout from Europe’s energy crisis sent fresh shockwaves through the UK food sector after online grocer Ocado Group stopped supplying frozen products to customers. The meat industry warned that businesses could “grind to a halt” within two weeks.

The latest shock to the industry comes from a sudden shortage of carbon dioxide used to stun pigs and chickens for slaughter, as well as in packaging to extend shelf life and the ‘dry ice’ that keeps freezer items frozen during delivery. As a result, Britain’s food industry called on the government to subsidize carbon dioxide. The shortage of CO2, which is also used to put the fizz into beer, cider, and soft drinks, comes at a terrible time for the food industry, which is already facing an acute shortage of truck drivers and the impact of Brexit and COVID-19.

Italy will introduce short-term measures to offset the expected rise in retail power prices and is working on a longer-term reform of power bills, according to energy transition minister Roberto Cingolani. The Italian government also approved some of the strictest anti-COVID measures globally, making it obligatory for all workers to show proof of vaccination, a negative test, or recent recovery from infection. The new rules will come into force on Oct. 15th.

China: The economic slowdown worsened in August as coronavirus outbreaks exposed the lingering weakness in consumer spending and cast more significant doubts over the country’s growth prospects. Retail sales rose just 2.5 percent in August year-on-year, far below economists’ forecasts of a 7 percent rise and the slowest increase in 12 months. Industrial production, which was one of the main engines behind China’s world-beating recovery in 2020, also missed targets to add 5.3 percent. The figures add to mounting concerns over a loss of momentum across China’s economy. The recent flooding, regulatory interventions, new coronavirus infections, and a property slowdown are driving down growth expectations.

Consumer activity, which has lagged the country’s broader recovery throughout the pandemic as households remained cautious, was hit hard by the disruption. Retail sales of catering and restaurants dropped 4%-5%, the first contraction since November 2020, HSBC analysts noted.

China is staring down another winter of power shortages that threaten to upend its economic recovery as a global energy supply crunch sends the price of fuels skyrocketing. The economy is at risk of not having enough coal and natural gas — used to heat households and power factories — despite efforts over the past year to stockpile fuel as rivals in North Asia and Europe compete for a finite supply. An energy deficit and sky-high prices could wreak havoc on Chinese industries, exacerbating faltering economic growth after stringent virus controls cut consumer spending and travel. Moreover, in a worst-case scenario, households may be unable to stay warm during bouts of frigid weather.

China’s crude oil throughput continued to fall in August, with daily runs hitting the lowest since May 2020. In addition, a resurgence in coronavirus cases and a drastic cut in fuel export quotas hurt production at refineries. As a result, processing volumes in August were 13.74 million b/d, down 2.2% from a year earlier. That was also less than the 13.91 million b/d in July, which was a 14-month low. Nevertheless, total throughput during the first eight months of 2021 reached 470.8 million tons, up 7.4% from a year earlier, mainly reflecting the economy’s recovery from the initial impact of the COVID-19 pandemic.

The state planning agency said in new policy guidelines that China will toughen punishments for regions that fail to meet targets aimed at controlling energy use. China has been cracking down on high-energy consuming projects after 20 of its 30 provinces and regions could not meet energy consumption targets in the first half of the year. The National Development and Reform Commission (NDRC) said it would hold local officials accountable for limiting absolute energy use and meeting targets to cut energy intensity – or the amount of energy used per unit of GDP.

China’s oil consumption is likely to peak around 2026 at about 16 million b/d and that of natural gas by around 2040, according to a top executive of Sinopec Corp. Sinopec’s forecast echoes a prediction by consultancy Rystad Energy that cited rapid adoption of electric vehicles would be the leading cause for global oil demand to peak over the next five years. Eventually, the oil will shift to become raw material for chemicals rather than fuel, Ma Yongsheng, Sinopec’s acting chairman, told a seminar. As a result, the top Asian oil refiner will “forcefully promote” green growth of its refining and petrochemical business.

Russia: The price of Russia’s flagship Urals grade slumped this week as Russian supply and exports are set to grow, and Iraq cuts its crude price for Europe. On Tuesday, the Urals grade from the Baltic Sea was offered at a discount of $2.35 per barrel to Dated Brent. While the discount to Brent is typical for the Urals grade, this week’s discount is much deeper than the $1.05 a barrel discount at which the Russian flagship crude was offered two weeks ago. One of the critical reasons for weaker prices of Urals, according to Bloomberg, is the expectation of rising supply out of Russia, which is pumping more oil under its higher OPEC+ quota and which is preparing to export more barrels next month.

The sooner Nord Stream 2 is commissioned and launched, the better chance the Russia-led gas pipeline to Germany will have to balance surging gas prices in Europe, a Kremlin spokesman said last week. Europe’s current natural gas demand is enormous, and if the winter is colder than usual, even more gas will be needed, the spokesman added. Last Friday, Gazprom said it had completed the construction of the Nord Stream 2 pipeline. However, gas flows on the controversial pipeline cannot begin until Germany grants an operating license to the project. Not surprisingly, Moscow says that Europe could be forced to burn more coal this winter if natural gas stockpiles are not adequately replenished with Russian natural gas.

A senior US envoy said that he had delivered reassurances to Ukraine and Poland on mitigating any threat posed by Russia’s Nord Stream 2 gas pipeline but that the project was now a “reality.” Amos Hochstein, the State Department’s senior adviser for energy security, told Reuters there was “breathing room” until 2024 to ensure Ukraine kept its status as a gas transit country but urged Kyiv to move towards alternative energy sources.

Senior Senate Republicans on Monday threatened to indefinitely hold up the nominations of five top Treasury Department officials if the Biden administration doesn’t blacklist the firm managing Russia’s Nord Stream 2 pipeline project. The Biden administration has implemented sanctions against several firms that have supported the project but not against Nord Stream 2 AG, saying that it would irritate relations with critical ally Germany and do little to stop the project, given that it was near completion.

Saudi Arabia: The Kingdom’s oil exports rose to above 6 million b/d in July, to the highest volume in six months, as the OPEC+ alliance continued to ease their supply cuts. The world’s largest oil exporter saw its crude exports hit 6.327 million b/d in July, up by around 360,000 from June, data from the Joint Organizations Data Initiative showed. The July crude export levels were the highest since January when the Kingdom’s exports averaged 6.582 million b/d.

Aramco may soon open a massive upstream asset to foreign investment. It would be a rare move for the country, which operates all oil and gas upstream assets in the Kingdom under a multi-decade concession agreement. Saudi Aramco is now looking to monetize its support on the one hand and raise money for the enormous capital investments needed to develop new assets on the other hand. Opening asset developments is one of the ways to raise money, considering that the oil sales Aramco is bringing in for the Kingdom are still being used to reduce the government deficit that had shot up with the oil price crash last year. Aramco’s capital budget is not unlimited either, since the oil giant pays $75 billion in annual dividends to shareholders, mainly the government.

Southeast Asia: The recent surge in Covid-19 cases has throttled ports and locked down plantations and processors, sparking extended disruptions of raw materials such as palm oil, coffee, and tin. In Malaysia, the world’s second-largest producer of palm oil, restrictions have prevented migrant laborers from traveling to plantations, raising prices of the ubiquitous edible oil used to make candy bars, shampoo, and biofuel.

5. Renewables and new technologies

A Rystad Energy analysis reveals that to meet the 1.5°C 2050 scenario under the Paris Agreement, global solar capacity must quadruple to 1,200-1,400 GW by 2035 to handle the number of new installations needed. This will be a challenging task, however, as manufacturers now see their utilization plummet due to rising costs and Covid-19 – a turn of events that could discourage the investments needed to expand capacity further. The aggregated utilization rate for solar modules (the difference between manufacturing capacity and shipments) was 84% in 2018 and has been decreasing since, to 71% in 2019 and to 58% in 2020, when logistics efficiency and transportation were hampered by the pandemic. The spread of Covid-19 has created a major economic disruption in the market and is expected to continue to impact utilization rates for most of 2021.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

The number of sweltering days every year when the temperature reaches 50C (122 deg F) has doubled since the 1980s, a global BBC analysis has found. They also now happen in more areas of the world than before, presenting unprecedented challenges to human health and how we live. (9/14)

In the UK, a large fire at a critical electricity converter station has shut down a significant cable that brings power from France, worsening Britain’s energy crunch. The outage couldn’t come at a worse time with supplies already short and prices at record highs. (9/15)

In the Netherlands, Royal Dutch Shell will build an 820,000-tons-a-year biofuels facility at the Shell Energy and Chemicals Park Rotterdam, formerly known as the Pernis refinery. Once built, the facility will be among the largest in Europe to produce sustainable aviation fuel (SAF) and renewable diesel made from waste. Shell expects the Rotterdam biofuels facility to start production in 2024. (9/18)

The Dutch government will not consider any change to its policy on gas output from the giant Groningen field despite record-high prices in the Netherlands and across Europe. Due to earthquake risks, Groningen is slated to be effectively closed in mid-2022, with only a few parts of the field to be kept open to provide some additional supply in the event of an emergency, such as a frigid winter. (9/16)

In Nigeria, a Bloomberg report indicated that the nation’s lenders likely do not have enough dollars to fund clients seeking to acquire the oil assets put on sale by Royal Dutch Shell for an estimated $2.3 billion. (9/17)

The Nigerian pipelines operated by the Nigerian Pipelines and Storage Company experienced 451 breaks and 11 fire incidents last year, data from the national oil company has revealed. (9/15)

Argentina’s government has unveiled a bill to promote investment in oil and gas in the country with the goal of boosting hydrocarbon production from its key shale play and export potential surplus. Argentina is betting big on increasing oil and gas production at its most significant shale play, Vaca Muerta, in the Neuquen province. (9/17)

The US oil rig count increased by 10 to 411 while the gas count slipped by 1 to 101, according to Baker Hughes. The total rig count is now 512, up 257 from last year, but lagging the 790 active rigs in March 2020. (9/18)

Propane prices have risen almost 60% so far this year in Mont Belvieu, Texas, the leading US trading hub, amid strong overseas demand and tighter production. A rally in natural gas adds momentum since about 80% of America’s propane is a byproduct of gas processing. (9/16)

TX flaring pushback: Getting a permit to burn excess natural gas at Texas oil wells is getting a little bit harder. Texas Railroad Commissioners limited an oil driller to flaring gas for just one year instead of the two years it sought at a meeting Tuesday. This marks a shift in thinking at the agency, which has been widely criticized for rubber stamping thousands of flaring permits without requiring oil companies to develop a plan to curb the practice. (9/15)

LA is shutting down oil: In a unanimous vote, Los Angeles County backed a ban on oil and gas drilling, which means some 1,600 active and inactive wells would be shut down. A timeline for the shutdown has yet to be determined. (9/17)

Sustainable jet fuel: As early as 2030, thanks to a new commitment, the US will aim to produce three billion gallons of sustainable fuel — about 10% of current jet fuel use — from waste plants and other organic matter, reducing aviation’s emissions of planet-warming gases by 20% and creating jobs. The airline industry has set sustainable fuel targets before, pledging to cut 10% of the jet fuel it uses with sustainable fuels by 2017. That year has come and gone, and sustainable fuels are still stuck at far less than 1% of supply. But there’s a twist: Depending on the type of alternative fuel, using billions of gallons of it could hurt, not help, the climate. (9/14)

A plan to push utilities to use more clean energy could eliminate coal from the US power grid by the end of the decade, according to a trade group that represents coal miners. For the coal industry, the carrot-and-stick approach is a serious threat, according to America’s Power. (9/14)

South African coal: Four of the world’s wealthiest nations—the US, UK, France, and Germany—will send a delegation to South Africa as soon as next week to seek a deal to begin closing the country’s coal-fired plants, according to people familiar with the matter. (9/16)

Coal shutout: FirstRand Ltd., Africa’s biggest bank by market value, is ending its funding of new coal-fired power stations immediately and will halt the financing of new projects to mine the fuel over the next five years. (9/16)

The Zimbabwe Electricity Transmission and Distribution Co. said Sunday it had begun daily 12-hour power cuts due to limited generation at its thermal plant and repairs at the Kariba Hydro Power Station dam. (9/13)

Vineyard Wind, which is on track to be the first central US offshore wind farm, closed on a $2.3 billion loan and will begin construction in Massachusetts as soon as this week. (9/16)

The British government announced on Monday the biggest auction round of its renewable energy scheme, hoping to build up enough extra offshore wind capacity to power about 8 million homes. (9/13)

The UK’s wind-power drive has dramatically cut carbon emissions, but it’s also created a vulnerability that’s been brutally exposed. Over the past two weeks, calm weather has cut output from the country’s 11,000 turbines, which account for more than 20% of electricity generation. Coupled with a Europe-wide gas shortage, the crunch has forced some companies to halt operations, which could hold back the economy if they become more widespread. (9/18)

New solar power capacity additions in the US are on track to book a record year despite supply chain disruptions that have seen price spikes that have effectively put an end to the cheap solar narrative. In the second quarter alone, new solar installations rose 45% on the year at a total 5.7 GW of installed capacity in residential and utility-scale facilities, energy consultancy Wood Mackenzie said in a joint report with the Solar Energy Industries Association. But this record has been marred by rising prices across the industry. (9/17)

Hurting UP’s rails? The financial impact of wildfires and heavy rains on the Union Pacific railway so far this year could top $100m, as intensifying effects of climate change brought cascading disruptions to the company’s 32,000-mile network. (9/17)

Emissions mismatch: Almost every government in the world isn’t doing enough to cut greenhouse gas emissions, making it likely that global temperatures will rise beyond the tipping point of 1.5 degrees Celsius in coming years. A new report by Climate Action Tracker said Wednesday. Global emissions must be halved by 2030 to keep that target in sight, but governments are nowhere near that reduction. (9/15)

EV buses: London Mayor Sadiq Khan brought forward by three years a pledge to electrify the city’s bus fleet, accelerating the UK capital’s push toward vehicles without tailpipe emissions. According to a statement by the mayor’s office, the city’s bus fleet will be zero-emission by 2034 instead of 2037. By the end of next year, 10% of London’s bus network will operate without emitting greenhouse gases. (9/18)

Emissions misdirections? US Democratic lawmakers on Thursday asked the chiefs of four major fossil fuel companies and two lobbying groups to testify next month on whether the industry led an effort to mislead the public and prevent action to fight climate change. (9/17)

FF funding: Several progressive House Democrats introduced this week a bill seeking to mandate the Fed to ban banks from funding all fossil fuel projects after 2030 and require the systemically important large banks to align emissions financing with US obligations under the Paris Climate Agreement. (9/18) [Editor’s note: how much gasoline and diesel will be necessary within 8+ years?]

Chevron Corp on Tuesday pledged to triple to $10 billion in its investments to reduce its carbon emissions footprint through 2028 while saying it was not yet ready to commit to a 2050 net-zero emissions target. Half of its spending will go to curb emissions from fossil fuel projects. A total of $3 billion will be applied for carbon capture and offsets, $2 billion for greenhouse gas reductions, $3 billion for renewable fuels, and $2 billion for hydrogen energy. (9/15)

CCS: Chevron New Energies division and a subsidiary of Enterprise Products Partners announced a framework to study and evaluate opportunities for carbon dioxide capture, utilization, and storage (CCUS) from their respective business operations in the US Midcontinent and Gulf Coast. (9/16)

More CCS: An ambitious project to capture millions of tons of carbon emissions along the US Gulf Coast in Texas garnered the support of some of the world’s biggest refiners and chemical manufacturers. Dow Inc., Chevron Corp., Phillips 66, and Calpine Corp. were among 11 companies who agreed to “begin discussing plans” on a project first floated by Exxon Mobil Corp. earlier this year. The proposed hub could store 50 million tons of carbon dioxide a year by 2030 and double that amount by 2040. (9/18) [Editors’ note: talk is cheap, while CCS is very expensive and hasn’t been particularly successful to date.]

Testing AV delivery: Walmart is working with Ford Motor Co. and Argo AI to start testing an autonomous vehicle delivery service in three US cities. The big-box retailer’s consumers continue to favor deliveries within the same or next day. (9/16)