Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The energy transition has accelerated during COVID-19, and the combination of changing consumer habits and a heightened sense of urgency around climate change will result in greater political commitment and financial backing for decarbonization of the industry.” Thus, the world’s demand for oil will peak by 2036.

Sandeep Sayal, a vice president at IHS Markit

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices rose for the fifth straight week with the global energy crunch set to boost demand for crude as stockpiles decline from the US to China. Futures in New York gained 2.8% last week. The global benchmark Brent settled at the highest in nearly three years for the second day in a row on Friday. Global onshore crude supplies sank by almost 21 million barrels last week, led by China, while US inventories are near a three-year low.

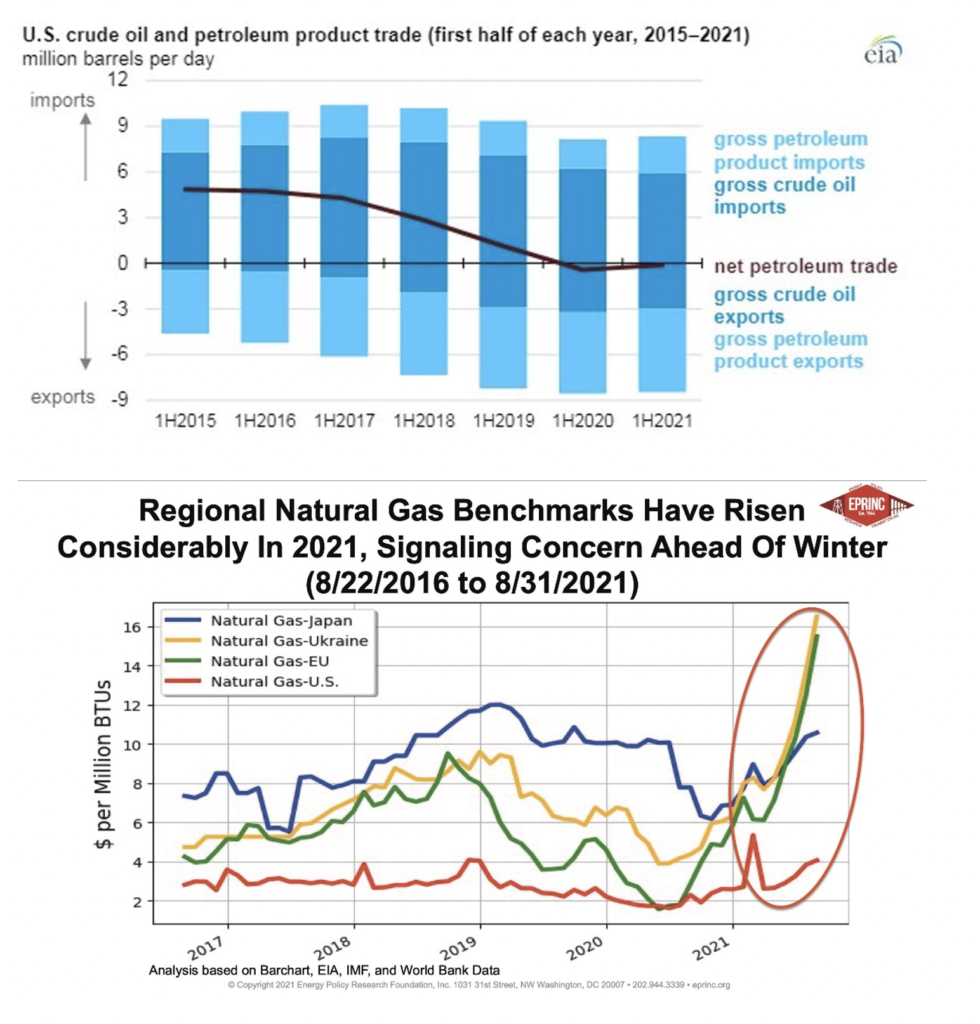

For the first time on record, the value of US energy exports exceeded the value of imports based on 2020 data. There was an energy trade surplus of $27 billion last year, as coal, electricity, natural gas, and petroleum exports surpassed that of the value of the imports. For the first six months of this year, the trade value of energy was a surplus of $9 billion, even as non-energy goods exports experienced a record $938-billion deficit. The bulk of the US energy trade is petroleum, but in 2020 the trade value of petroleum exports vs. imports was a deficit. The surplus comes from natural gas which is a growing percentage of the total, accounting for 5% of energy import value in 2020 and 22% of energy export value – for a surplus of $26 billion. Natural gas exports continue to grow this year with increased pipeline gas to Mexico and increased LNG exports.

Royal Dutch Shell, the largest US Gulf of Mexico oil producer, said damage to offshore transfer facilities from Hurricane Ida would cut production until early next year. Shell was the hardest-hit producer from Ida, which tore through the US Gulf of Mexico last month and removed 27 million barrels from the market. The ongoing disruptions have hampered export activity and raised crude prices worldwide, as Asian buyers searched for substitutes for the popular Gulf Mars grade.

Rising US oil consumption and the loss of Gulf of Mexico production this year have led to crude oil inventories at Cushing, Oklahoma, dropping by as much as 42% so far. In the week ending Sept. 10th, crude oil stocks at Cushing were at 32.9 million barrels. Inventories are now 26% lower than usual, based on the previous five-year (2016–2020) average for that time of year. Storage withdrawals from Cushing are consistent with withdrawals from inventories elsewhere in the world, generally indicating that consumption exceeds production.

Estimates of Ida’s damage have continued to climb as insurers disclose their costs. In one of the newest revisions, Risk Management Solutions, a major catastrophe-risk modeling firm, last week estimated Ida’s US insured losses at between $31 billion and $44 billion since its Aug. 29th landing in Louisiana. As a result, Ida would nudge ahead of 1992’s Hurricane Andrew at the low end of RMS’s range, the current sixth-place costliest storm with $29.7 billion in insured losses in 2020 dollars.

New IMF research estimates annual global fossil fuel subsidies at about $6 trillion, with about 70% from “under-charging” for the environmental costs associated with the fuels. The IMF previously had estimated such costs at about $5.2 trillion in 2017. “The good news is that global carbon emissions would fall by one-third — in line with keeping global warming to 1.5 degrees Celsius — if fossil fuel prices increase to reflect fully environmental and supply costs by 2025.”

OPEC: The cartel+ lifted its production in August, but underinvestment and maintenance work has hampered the group’s ability to raise production—and supply could be insufficient to meet the world’s growing oil demand, Reuters suggested on Tuesday. Global oil demand has recently risen to near-record levels as global activity picks up steam despite the pandemic. In response, OPEC+ agreed to increase oil production starting in August by another 400,000 b/d each month. But not all producers have responded to the call for more barrels. For example, Angola, Nigeria, and Kazakhstan have been unable to lift their oil production to meet the call for more oil.

Shale Oil: US oil production is set to pick up steam again — this time led by little-known privately-owned companies impervious to the demands of the stock market.

Forecasters project that the nation’s crude oil output will increase by about 800,000 barrels a day throughout 2022, accelerating sharply from this year and making the US the fastest-growing supplier outside the OPEC+ cartel.

These privately held producers, often smaller companies, will account for more than half of total US output growth next year compared with about 20% in a typical year, said Raoul LeBlanc, an analyst at IHS Markit. The expected output gains come as US oil prices hover at about $70 a barrel, making most shale wells profitable to drill. But many of the largest producers have promised their shareholders they will cap spending on growth after racking up huge losses during a decade-long drilling binge.

Private companies, by contrast, have led the rise in the number of rigs drilling for oil and gas in the US this year, which has more than doubled from this time last year. “The privates are not on board with this whole capital discipline thing. So, for them, this is their window,” LeBlanc said. “They’re thinking, ‘here’s my chance, and I’m going to take advantage of it’ because they see it as maybe their last, best chance.”

Prolific production from shale oilfields enabled the US to eclipse Saudi Arabia and Russia as the world’s largest oil producer. Still, the onset of the coronavirus pandemic hollowed out oil demand and crushed prices, forcing American producers to throttle back output from a peak of about 13 million b/d in late 2019 to approximately 11.1 million by the end of 2020.

The US Energy Information Administration now expects domestic crude oil production to begin to tick higher this autumn after Hurricane Ida disrupted offshore supplies, eventually reaching about 12.2 million b/d by the end of 2022. As a result, spending on drilling and bringing new wells into production in shale patches onshore will rise from about $65 billion in 2021 to more than $80 billion next year as activity picks up, LeBlanc said.

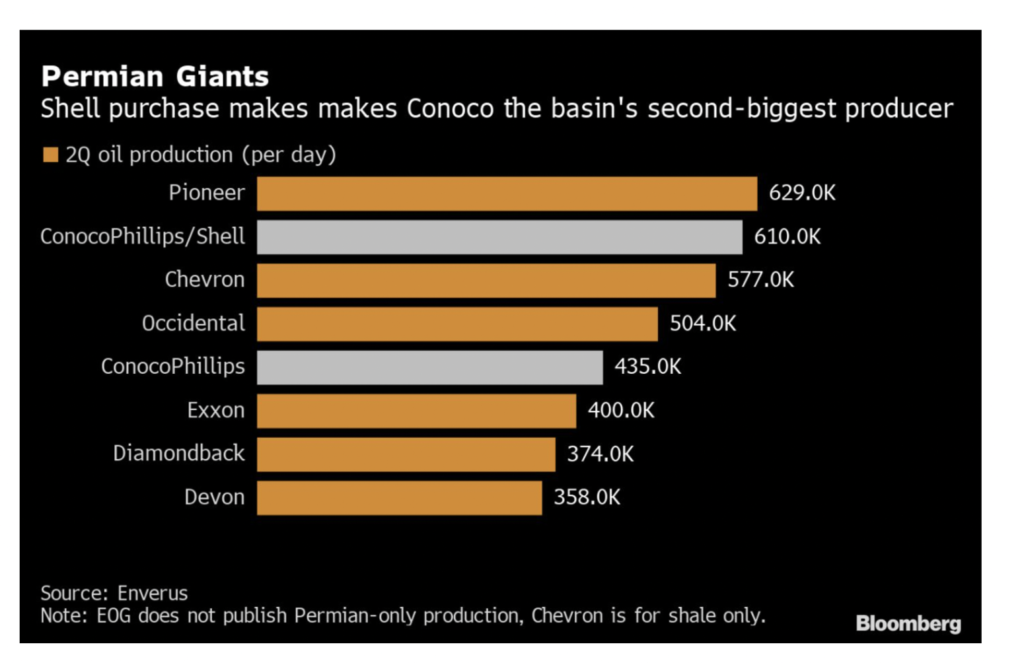

Royal Dutch Shell said last Monday it would sell its Permian Basin assets to ConocoPhillips for $9.5 billion in cash, an exit from the largest US oilfield for the energy major. ConocoPhillips’ purchase is the second sizable acquisition in a year in the Permian Basin, as American and European producers diverge on whether to focus on hydrocarbons going forward. Like all the world’s largest oil companies, Shell is under pressure from investors to reduce fossil-fuel investments to help reduce global carbon emissions and fight climate change. Europeans such as Shell and BP have set targets to slowly move away from crude production while investing in non-fossil energy sources.

After oil majors promised to impose tighter regulations on gas flaring, following widespread criticism over the levels of gas being released, they are putting their money where their mouths are and taking action. In recent years, natural gas flaring has been increasing, with an estimated 150 billion cubic meters flared worldwide in 2019. Around 75% of the world’s associated gas is now being used on-site or re-injected into the well while 25% of that gas is wasted.

Natural gas drillers’ earnings would take a hit from a potential US crackdown on methane leaks, but the magnitude of the impact depends on how emissions are measured. Lawmakers have proposed adding a $1,680-per-ton fee on methane to the budget bill making its way through Congress. If the levies are based on figures reported by the companies themselves, the hit to gas producers will be less than 1% of 2023 earnings, Citigroup said. But if the gauge is based on the much higher emissions detected by satellite from shale basins, the financial impact could jump to 8.5% of earnings.

Natural Gas: Prices have soared by around 280% in Europe this year and by more than 100% in the US, pushing up winter fuel bills and exacerbating a near-term spike in inflation. Low storage inventories, high demand for gas in Asia, less Russian and liquefied natural gas supply to Europe than usual, high carbon prices, and outages have led to the spike.

As the cat-and-mouse game continues over Russian gas to Europe, Gazprom has refused to allow more gas into Europe via Ukraine for October, sending prices soaring another 10% last week. Russia’s move to keep flows to Europe at a minimum means the continent cannot store up ahead of the winter months. According to Bloomberg, European gas storage is only at 72% capacity. According to Reuters, Gazprom has only booked approximately one-third of the Yamal-Europe pipeline’s gas transit capacity that it was offered for October. Moreover, Gazprom has not attempted to book extra transit capacity via Ukraine.

The International Energy Agency has called on Russia to send more gas to Europe to help alleviate the energy crisis, becoming the first significant international body to address claims by traders and foreign officials that Moscow has restricted supplies. The Paris-based group said that while Russia was fulfilling long-term contracts with European customers, it supplied less gas to Europe than before the coronavirus pandemic. “The IEA believes that Russia could do more to increase gas availability to Europe and ensure storage is filled to adequate levels in preparation for the coming winter heating season.”

Some European members of parliament have called for an investigation into Gazprom. In addition, foreign officials and traders have questioned why the company has limited sales in the spot market to Europe, which has fueled a surge in prices, rising household bills, and threatening industries across the continent.

The company also has unsettled energy traders by keeping the underground storage facilities it controls in Europe stocked at low levels compared with previous years. Last week, Gazprom’s chief executive Alexei Miller said the company was meeting its supply obligations and was ready to increase production if needed. But he warned prices could rise further in the winter because of shortages in underground facilities.

On Friday, a manufacturers trade group urged the Department of Energy to order US liquefied natural gas producers to reduce exports, warning of price increases and supply shortages this winter. The call for US natural gas has more than doubled prices, with exports up 41% from a year ago. US gas was trading around $5.22 per million British thermal units on Friday, up from $2.54 per million in January.

“We urge you to take immediate action under the Natural Gas Act to prevent a supply crisis and price spikes for consumers this winter by requiring LNG exporters to reduce export rates … to allow US inventories to reach the five-year average storage levels,” the Industrial Energy Consumers of America wrote in a letter to Energy Secretary Granholm. The group also asked DOE to review “existing, pending, and prefiling permits and approvals” in export facilities to determine whether the permits are in the public interest.

Coal: European coal prices have hit a 13-year high as coal supply to Europe remains constrained and utilities fire up more coal power plants amid surging natural gas prices. The price of coal for delivery next year to the Amsterdam-Rotterdam-Antwerp hub has risen to $137 per metric ton. The prices are at their highest since 2008 as more coal is added to Europe’s electricity output these days amid record-high gas prices and as supply and stockpiles are scrambling to meet demand. “Stock levels across Europe are low, and as on the gas market, coal supply from Russia has fallen lately,” trading group Energi Danmark says.

More than three-quarters of the world’s proposed coal power projects have been canceled since the Paris Agreement was adopted in late 2015, according to a new report by the climate think tank E3G. Globally, the scuttled plants would have created about 1,175 gigawatts of electricity-generating capacity, which is comparable to “adding a second China,” the report states. In addition, the analysis notes that 44 countries have committed to stop initiating new coal projects, signaling a substantial shift toward more sustainable energy sources, as the economics of coal become increasingly uncompetitive with renewable energy.

A bipartisan infrastructure package to be considered by the US House of Representatives later this month would fund $11.3 billion to remediate coal mines abandoned before 1977. It’s essentially a taxpayer subsidy of a polluting industry, yet it has plenty of support on both sides of the political aisle.

The world’s biggest coal exporters, Australia and Indonesia, face an accelerated decline in global demand for their coal shipments after China said it would stop building coal-fired power plants overseas.

Prognosis: Brent could reach $90 per barrel if the weather in the northern hemisphere turns out to be colder than usual this winter, Goldman Sachs’ Jeff Currie said on Wednesday. This is $10 per barrel more than Goldman’s current forecast. The call for higher oil prices would come on top of the already too-high natural gas prices, which have sunk some natural gas power providers in Europe. The natural gas situation in Europe will have a spillover effect on the oil market, with natural gas in short supply and crude oil one of the only viable alternatives as wind and solar power prove insufficient at this time. On Tuesday, commodity trader Vitol said that weather was the key to stopping the panic in the market—with warmer winter weather the only hope for falling prices.

Fossil fuels are here to stay because they help ensure a country’s energy security. This is the message Baker Hughes CEO Lorenzo Simonelli had for those watching the surge of gas prices in Europe. “We think there are three hard truths,” Simonelli told CNBC in an interview. “Firstly, we’ve got to work together, accelerate the move towards decarbonization and eliminating emissions. Secondly, hydrocarbons are here to stay, and natural gas is a key element. And thirdly, we’ve got to do it together, collaborate, and adopt the new available technologies.”

Another view, however, is that the oil industry is in a terminal decline, hedge fund manager James Jampel told Bloomberg last week, noting that this year’s rise in oil stocks has been “the biggest dead-cat bounce in history.” Jampel, who manages the HITE Carbon Offset hedge fund that aims to profit from decarbonization by “shorting decarbonization losers,” is highly bearish on oil, despite the 33% rise of the S&P’s energy index this year. The oil industry will be the loser of the energy transition, says Jampel. “Industries where volume is declining, where demand is declining, have a lot of trouble making money,” Jampel told Bloomberg in an interview published on Friday.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Iranian Foreign Minister Abdollahian said on Saturday that when his government says it will return soon to talks on resuming compliance with the 2015 nuclear deal, it means when Tehran has completed its review of the nuclear file. It remains unclear if and when the talks in Vienna will restart or who might represent Iran’s new government. In the interim, Iran has continued to expand the quantity and quality of its uranium enrichment, leading some experts to conclude it is now even closer to possessing enough fissile material to build a bomb. At the same time, Iran has repeatedly sparred with the International Atomic Energy Agency over monitoring its nuclear activities initially agreed in the 2015 deal.

A vaccination center, a hospital, a pharmacy, and finally a morgue. The first public visits by Iran’s new hardline president Ebrahim Raisi have made clear his top priority — accelerating imports of Covid-19 vaccines into a country hard hit by the pandemic. Since the 60-year-old cleric was inaugurated last month, replacing centrist President Hassan Rouhani, there has been a considerable rise in imports of vaccines. A regime that in January this year banned western vaccine now welcomes it, and Raisi has led the push.

Iranian oil minister Javad Owji has appointed a special energy envoy to help bolster Tehran’s ties with Iraq. Owji, in a ministerial decree, appointed Abbas Beheshti to follow up on the settlement of gas export dues and identify other common interests that include oil and oil product trading and private sector investments in the two countries’ oil industries.

Iran is drafting plans to attract as much as $145 billion in domestic and foreign investments in its oil industry over the next eight years. Iran is also working to boost cooperation with Chinese companies, the minister added. Earlier this month, Owji met with a top official from the China National Petroleum Corporation in Tehran to discuss cooperation and expansion of bilateral relations.

Iraq: Insurgents from the Islamic State militant group are evolving their tactics and launching increasingly bold attacks as they continue to exploit chronic security gaps in northern Iraq’s disputed territories. In the most recent incident, two people were killed and four wounded after militants disguised as Kurdish security forces set up a fake checkpoint in Garmian.

Iraq’s state-owned South Gas Co. and Baker Hughes plan to develop a 200 million cf/d gas recovery project as part of plans to end associated gas flaring and reduce Iranian energy imports. The project, which will process associated gas from Nasiriyah and al-Gharraf fields in the southern province of Dhi Qar, was supposed to start at the end of 2018 but has faced delays.

Libya: The long-serving head of Libya’s state-run oil company will remain in his post, Prime Minister Abdul Hamid Dbeibah said in a decree, looking to end a feud between two key oil officials. Dbeibah’s decree effectively nullifies an earlier decision by the oil minister, who sought to suspend the National Oil Corp.’s chairman, Mustafa Sanalla.

Libya’s state-run oil firm has opened an office in London to boost the OPEC nation’s production capacity. Murzuq Oil Services Ltd. will act as the overseas arm of Libya’s National Oil Corp. and a hub for UK engineering, procurement, and construction contractors.

Venezuela: International companies are starting to give up on Venezuela, which has the world’s largest proven oil reserves standing at 304 billion barrels, as US sanctions and the country’s political state present too much risk to ongoing investment. This summer, both TotalEnergies, and Equinor divested their interests in Venezuelan state-owned Petrocedeno, leaving PDVSA with all the equity, in a move that suggests they are giving up on their stake in the Latin American oil giant after decades of investment.

The United States is giving $247 million in humanitarian aid and $89 million in economic and development assistance to Venezuelans, State Department spokesman Ned Price said on Wednesday.

3. Climate change

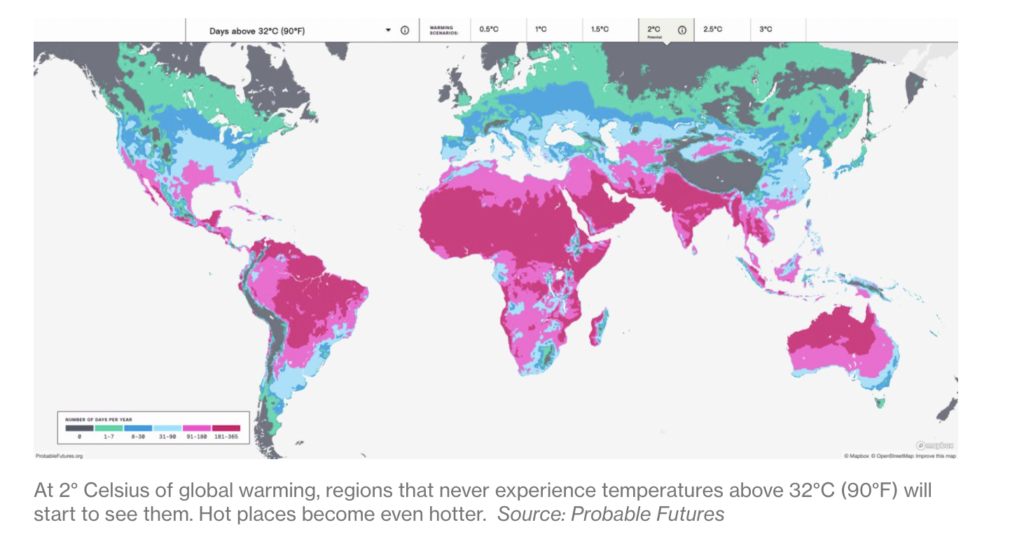

The Probable Futures’ Initiative hopes its interactive maps showing how fast the Earth could heat will lead citizens and countries to ask questions about how climate change is transforming their world.

Blazes in the Mediterranean basin, North America and Siberia resulted in the highest carbon emissions from wildfires ever recorded during summer in the Northern Hemisphere. According to a report by Europe’s Earth observation agency Copernicus, the fires released a record 1.3 billion metric tons of carbon dioxide into the atmosphere in July and 1.4 billion tons in August. Just under a third of the emissions came from blazes in Russia.

The World Health Organization (WHO) issued its first update on air quality guidelines in 15 years, lowering the recommended emissions limits, including those linked to the burning of fossil fuels. The WHO’s new guidelines recommend air quality levels for six different pollutants, where evidence has advanced the most on health effects from exposure. When action is taken on the so-called classical pollutants—particulate matter (PM), ozone (O), nitrogen dioxide (NO2), sulfur dioxide (SO2), and carbon monoxide (CO), it also has an impact on other damaging pollutants, the organization said. “Disparities in air pollution exposure are increasing worldwide, particularly as low- and middle-income countries are experiencing growing levels of air pollution because of large-scale urbanization and economic development.

The United States and the European Union are calling on the world to join a global initiative to significantly reduce methane emissions as major economies proceed with plans to tackle the worst effects of climate change. At a recent summit, the United States, the EU, and several other countries, including OPEC’s number two, Iraq, indicated supporting the so-called Global Methane Pledge. The initiative, expected to be launched at the UN Climate Change Conference (COP 26) in November in Glasgow, calls for countries to join it in committing to a collective goal to cut global methane emissions by at least 30% from 2020 levels by 2030.

The Biden administration will finalize its first new climate rule Thursday, slashing the use of greenhouse gases warming the planet at a rate hundreds to thousands of times higher than carbon dioxide. The EPA regulation, which establishes a program to cut the use and production of chemicals known as hydrofluorocarbons in the United States by 85% over the next 15 years, implements a law passed by Congress last year.

President Biden’s pledge to double the money the US will spend helping poorer nations fight climate change is drawing a mixed response from environmentalists. But the real test is whether he can win over Congress and spur other countries to step up their climate ambitions.

4. The global economy and the coronavirus

The US and European economies slowed in September as supply-chain bottlenecks and worries over the Delta variant weighed on businesses. Manufacturing and services businesses in the US and Eurozone reported slower growth in activity this month, although the pullback was more pronounced in Europe.

United States: COVID-19 has killed about as many Americans as the 1918-19 Spanish flu pandemic did — approximately 675,000. The US population a century ago was just one-third of what it is today, meaning the flu cut a much bigger, more lethal swath through the country one hundred years ago before there was a vaccine.

Before the pandemic, it was unusual for more than one container ship to wait for a berth. Now, big vessels are continuing to join the bottleneck because shipping lines and their cargo customers have few options for resetting countless supply chains moving goods into the US constructed over decades around the critical San Pedro Bay gateway. Although some ships have headed to other import gateways, and a handful of shippers have chartered smaller vessels to move goods through other ports, the diversion is minor compared with the hundreds of thousands of containers idled in the waters off Southern California.

Europe: Price spikes have started to hit industrial activities, threatening the post-COVID recovery in European economies with a triple whammy of reduced consumer purchasing power, lower industrial production, and higher operating costs. From chemicals and mining to the food sector, giant European firms say sky-high gas and electricity prices are hitting their profit margins and forcing some of them to curtail operations. Some factories have shut down because of record natural gas prices. More idling of industrial activity across Europe is likely in the coming weeks. Meanwhile, the record European natural gas prices are sending Asian spot prices of liquefied natural gas to record levels for this time of the year.

Surging energy costs force European governments to discuss billions of euros in aid for households and stricken suppliers as concern mounts over a looming winter energy crisis. EU energy ministers met last week to discuss national responses to a surge in wholesale gas prices. They are concerned that they will jeopardize Europe’s post-pandemic economic recovery and undermine Brussels’ plans for ambitious but costly green reforms. Norway and Russia are big winners from Europe’s gas price rally as they benefit from volatility after the European Union forced their gas producers years ago to shift away from steady, long-term contracts.

Efforts to green up energy have contributed to the impending shortage. Europe has been phasing out coal power plants, and the price of permits to emit carbon in the UK and EU has rocketed this year, making it painfully expensive to keep on burning coal. That makes gas, while still a fossil fuel, an essential alternative. The impact on companies, from food processors to fertilizer manufacturers, has been severe. To prevent households and businesses from having to turn off the lights or shiver through the winter, governments also are stepping in with billions of euros in support.

German business confidence fell to a five-month low in September amid a “bottleneck recession” for industry just before voters redraw the political makeup of Europe’s biggest economy in the era after Chancellor Angela Merkel. An index measuring expectations for the next six months fell, as did one assessing current conditions. The outcome hints at the challenges facing German businesses even after a growth upswing over the summer months, as stubborn shortages of parts and raw materials bedevil the sizable manufacturing sector while persistent coronavirus infections carry the threat of further disruption.

United Kingdom: There is “no question of the lights going out” this winter because of considerable rises in gas prices, the UK business secretary, Kwasi Kwarteng, said. He does “not expect supply emergencies.” Consumers should not panic-buy products as Britain is not heading back into a 1970s-style “winter of discontent,” a junior minister said on Thursday. After gas prices triggered a carbon dioxide shortage, Britain was forced to extend emergency state support to avert a shortage of poultry and meat.

Green Energy and Avro, small and medium-sized energy retailers, respectively, declared bankruptcy last week, leaving 1.5 million households scrambling for a new provider. More UK energy suppliers are set to go bust as soaring gas prices are putting an unprecedented cost burden on smaller electricity and gas providers, the head of the UK’s energy regulator said on Wednesday.

Tesco, Britain’s biggest supermarket group, told government officials last week the shortage of truck drivers would lead to panic-buying in the run-up to Christmas if action were not taken. As a result, supermarket shelves of carbonated drinks and water were left empty in some places, and turkey producers have warned that families could be left without their traditional turkey. In addition, BP has canceled deliveries to some gas stations as it does not have enough tanker drivers.

Britain is expected to announce plans to issue temporary visas to foreign truck drivers to alleviate an acute labor shortage that has led to fuel rationing at some filling stations and warnings from retailers of significant disruption.

China: As the world’s second-largest economy has surged back to life in the wake of the pandemic, energy demand has skyrocketed, leading to soaring fuel prices and unprecedented government decisions to keep the lights on in the immediate term. All of this occurs as the Chinese economy enters a slowdown and inflation rates are on the rise. “Inflation is soaring, and the country’s producer price index hit a 13-year high last month, driven by rising commodity prices,” CNN Business reported. “The government has warned that high costs for raw materials such as energy and petrochemical products will exacerbate growth and employment challenges facing manufacturers — especially small and medium-sized businesses.”

In China, power rationing and forced cuts to factory production are widening amid electricity supply issues and a push to enforce environmental regulations. The curbs have expanded to more than ten provinces, including economic powerhouses Jiangsu, Zhejiang, and Guangdong, the 21st Century Business Herald reported Friday. Last month, the country’s top economic planner flagged nine provinces for increasing intensity over the first half of the year amid a strong economic rebound from the pandemic. Meanwhile, record-high coal prices make it unprofitable for many power plants to operate, creating supply gaps in some provinces.

In preparation for the Winter Olympics, China has been shoring up gas supply for the coming 2021-2022 winter-spring heating season to prevent a supply shortage like the one it experienced in the previous winter. This includes stepping up pipeline natural gas imports, boosting domestic gas production levels, asking its top national oil and gas companies to step up procurement.

An industry association said that major Chinese coal producers are trying to resolve supply shortages and curb price rises as the country’s winter consumption peak approaches. However, with coal demand set to surge as temperatures drop, China’s state planning body said on Tuesday that it would send investigators to the regions to ensure that supply and price stabilization measures were implemented.

President Xi Jinping said Beijing would stop building coal-fired power plants abroad, in a public commitment to redirect the country’s huge engineering industry away from adding to a huge source of global pollution. However, Beijing has faced pressure from the US, the European Union, and environmental groups to stop financing and building coal-fired power plants in many developing countries, even as it said it would cut greenhouse emissions at home.

“We need to accelerate a transition to a green and low-carbon economy,” Mr. Xi said in a taped speech for the United Nations General Assembly. “We will make every effort to meet these goals. China will step up support for other developing countries in developing green and low-carbon energy and will not build new coal-fired power projects abroad.” Coal is still central to China’s energy mix, and it is the world’s biggest producer and consumer of the resource.

In his UN address, Mr. Xi reiterated his commitments that China will cap its carbon emissions before 2030 and achieve carbon neutrality before 2060. “This requires tremendous hard work,” he said. Though China has continued to commission coal plants at home faster than any nation, Mr. Xi told a conference convened by President Biden in April that China would begin cutting its coal consumption after 2026.

According to officials familiar with the discussions, Chinese authorities are asking local governments to prepare for the potential collapse of China’s Evergrande Group, signaling a reluctance to bail out the debt-saddled property developer while bracing for any economic and social fallout from the company’s bankruptcy. The officials characterized the actions being ordered as “getting ready for the possible storm.”

They say that local-level government agencies and state-owned enterprises have been instructed to step in to handle the aftermath only at the last minute should Evergrande fail to manage its affairs in an orderly fashion. In addition, they said that local governments had been tasked with preventing unrest and mitigating the ripple effect on home buyers and the broader economy, for example, by limiting job losses—scenarios that have grown in likelihood as Evergrande’s situation has worsened.

Russia: The government reported a record 828 Covid-19 deaths in the latest day, as officials warned of a new pandemic wave. The actual number of deaths linked to the coronavirus is likely much higher, as the initial reports by the government’s Covid-19 task force are generally revised upward. Last week, Moscow’s Deputy Mayor Anastasia Rakova said that the capital was reopening coronavirus hospital wards as cases spiked.

Moscow sees raising its oil production to an average of 11.24 million b/d in 2022, which would be an 8% increase from 2021 as OPEC+ eases the production cuts. The forecast production figure was included in a draft budget estimating how much revenue Russia could gain from oil and gas between 2022 and 2024. The 11.24 million b/d estimate is close to the 11.25 million b/d post-Soviet record Russia pumped back in 2019. However, the expected output includes both crude oil and condensate and does not discriminate between them. Moreover, Russia’s condensate production—estimated at around 800,000-900,000 b/d—is not part of the OPEC+ production cuts, so it’s not easy to assess how much crude oil Russia is pumping.

Nord Stream 2, the controversial pipeline, may yet flop, according to the co-leader of the European Greens, Reinhard Butikofer. In an interview, the co-chair of the Green Party in the European Parliament said there are still obstacles that Nord Stream 2 needs to clear before it is put into operation. Even after it clears them, the European Commission could still stop the project and turn it into an “investment ruin.” Nord Stream 2 is set to expand the capacity of an existing pipeline under the Baltic Sea to Germany twofold, to 110 billion cubic meters annually. In addition, it has exacerbated bilateral problems between Russia and the EU because its route bypasses Ukraine, which relies on Russian gas transit fees for much of its budget revenues. The UK does not support Russia’s Nord Stream 2 gas pipeline project to Germany. UK Secretary of State for Business, Energy, and Industrial Strategy Kwasi Kwarteng told a parliamentary committee that it does not need its long-term storage facility.

India: India reported 29,616 new COVID-19 cases for the last 24 hours. According to the health ministry, the nationwide tally of infections has reached 33.62 million since the start of the pandemic. The country reported 290 deaths overnight, taking the overall total to 446,658 fatalities.

Indian refiners are gearing up to alter their crude oil import mix in favor of lighter grades that yield more gasoline to meet a surge in demand for the motor fuel in Asia’s third-largest economy. Refiners in the world’s No. 3 oil importer and consumer will increase imports of gasoline-yielding crudes from the U.S. and West Africa while cutting heavier sour grades from the Middle East that yield more middle distillates like diesel and kerosene, they said. The move dovetails with an earlier push to reduce India’s reliance on the Middle East crudes to enhance energy security.

5. Renewables and new technologies

BMW and Audi are developing hydrogen fuel-cell passenger vehicle prototypes alongside their fleets of battery cars as part of preparations to abandon fossil fuels. However, they are hedging their bets, calculating that a change in political winds could shift the balance towards hydrogen in an industry shaped by early-mover Tesla’s decision to take the battery-powered road to clean cars. Germany is already betting billions on hydrogen fuel in sectors like steel and chemicals to meet climate targets.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Peak demand in 2036: IHS Markit, of which Pulitzer Prize-winning oil historian Daniel Yergin is vice chairman, released a report Monday predicting that demand for refined petroleum products like gasoline and diesel would peak in 2036. (9/20)

Offloading O&G for RE hits profits: BP is still losing money from its renewable energy ventures while selling stakes in oil and gas developments to help fund them. The supermajor’s current pace of moving into clean energy could be too fast and leave it with lower profits from oil until the renewable business starts generating profits, Reuters’ Ron Bousso notes in a unique report. (9/21)

Arctic O&G investing: Oil and gas companies are set to ramp up production in the Arctic by 20% in the next five years. The main Arctic expansionists – Gazprom, Total, and ConocoPhillips – are backed by hundreds of billions of pounds from dozens of City banks and investors, despite many holding commitments to restrict fossil financing in the region. A report details £230 billion of loans and underwriting from commercial banks to Arctic oil and gas expansionists between 2016 and 2020. JPMorgan Chase was the biggest investor, followed by Barclays, Citigroup, and BNP Paribas. (9/24)

Lebanon has rejected Israeli gas exploration in a disputed area in the Levant Basin. Israel has already signed a contract for exploration with Halliburton. This isn’t an end to negotiations over the disputed area. Rather, Lebanon objects to the fact that while UN-sponsored talks are ongoing, Israel has jumped the gun by signing a contract with Halliburton. (9/24)

Kuwait’s plan to invest at least US$6.1 billion in exploration over the next five years to increase production to a minimum of 4 million barrels per day by 2040 – up from the 2020 average of 2.43 million mb/d – look highly optimistic. This is even without factoring in the other adverse effects of its inescapable but toxic relationship with Saudi Arabia. (9/21)

A UAE contractor has begun operations at its 600,000 cubic meters second phase storage facility at the Port of Fujairah. In so doing, the UAE and US hope to counter the threat that Iran will disrupt crude supplies through the Strait of Hormuz chokepoint – through which around 30% of the world’s oil transits – while being able to freely export its oil supplies from the recently completed Jask hub. (9/22)

Lebanon’s critical fuel shortages show no signs of ending despite the arrival of Iranian oil smuggled into the country through neighboring Syria. The rampant power outages have hit even Lebanon’s parliament. Monday’s session to discuss the new government’s policies was delayed by an hour because of a power cut. (9/21)

In Yemen, military forces of the Iran-aligned Houthi movement are advancing amid heavy fighting in the regions of Yemen that hold its oil and gas fields and assets. (9/24)

Tanzania’s and Uganda’s private sector partners have agreed on four issues that need addressing if local businesses in the two countries are to benefit from the $3.5 billion East African Crude Oil Pipeline from Hoima in Uganda to the port city of Tanga. (9/24)

For the first time since 2020, Nigeria’s rig count, which had declined to five rigs, grew to 11 in August, signaling readiness by the Nigerian National Petroleum Corporation and its partners to pump more oil. (9/21)

Nigeria’s President Muhammadu Buhari has ordered that incorporating the state oil firm as a private company should begin immediately. This is in line with the recent oil reform bill, which he signed into law mandating the incorporation of the Nigerian National Petroleum Company Limited within six months. (9/20)

In Canada, Syncrude Canada Ltd., a light crude producer majority-owned by Suncor Energy Inc., cut September supplies due to a mechanical disruption at its oil sands site. Syncrude’s upgrader, which turns mined bitumen from the oil sands of northern Alberta into light synthetic crude, produced about 275,000 barrels a day between January and May. (9/24)

In Canada, Enbridge Inc.’s rationing of its heavy oil pipelines plummeted in October ahead of the imminent start-up of its newest export conduit to the US, which will expand its export capacity from 390,000 barrels/day to 600,000 b/day. (9/22)

Prime Minister Justin Trudeau’s narrow election victory last week reinforced Canada’s commitment to reach net-zero greenhouse gas emissions by 2050. Still, workers in the country’s sizable fossil fuel sector said they also expect him to keep his promises to retrain them for jobs in a clean-energy economy. (9/23)

The US oil rig count rose by 10 to 421 while the gas rig count fell by 1 to 100, according to Baker Hughes Inc. Canada’s overall rig count increased by 8. Active oil and gas rigs in Canada are now at 162, up 91 on the year. (9/25)

Exxon Mobil, Chevron, and ConocoPhillips are among companies failing to report all their tax payments despite being members of the Extractive Industries Transparency Initiative, the global anti-corruption body said Wednesday. The EITI revealed that a third of its members failed to uphold its tax transparency expectation in June. (9/23)

O&G >> water: The eventual demise of the oil and gas industry will leave a vast array of idle refineries, tank farms, and abandoned offshore drilling platforms (there are about 1,900 operating in the Gulf of Mexico alone). A considerable part of this vast system, the continent-spanning distribution system, holds immense promise for our warming and water-starved future, especially for drought-stricken states in the West. (9/21)

Biofuels’ loss? The administration of US President Joe Biden is considering significant cuts to the nation’s biofuel blending requirements, a move triggered by a broad decline in gasoline demand during the coronavirus pandemic. If adopted, the proposal would win the oil industry, which argues biofuel blending is costly. The cuts would anger ethanol producers. (9/23)

SAF: Royal Dutch Shell announced its ambition to produce around 2 million tonnes of sustainable aviation fuel (SAF) a year by 2025. It also aims to have at least 10% of its global aviation fuel sales as SAF by 2030. Currently, sustainable aviation fuel accounts for less than 0.1% of the world’s aviation fuel use. (9/21)

EVs impacting tax revenues: Governments around the world have long encouraged motorists to buy electric cars. Now they are starting to grapple with a consequence of the green drive: dwindling income from fuel taxes. More than two-thirds of new vehicles sold this year have been battery or plug-in electric cars in Norway, compared to just 4.6% of all cars sold globally last year. (9/24)

EV truck: Ford looks to be “full speed ahead” with plans for its electric F-150 Lightning, despite GM being in EV hell with its recall of roughly 150,000 Chevy Bolts. Ford said on Thursday that it had reached 150,000 reservations for the forthcoming electric pickup. As a result, the company has ramped up hiring and increasing capacity as it starts building prototypes. (9/21)

EV heavy trucks: A new total cost of ownership (TCO) study from the National Renewable Energy Laboratory finds that battery-electric and fuel-cell electric commercial trucks could be economically competitive with conventional diesel trucks by 2025 in some operating scenarios. (9/23)

Vitol & BYD = EV team: The world’s largest independent oil-trading house, Vitol Group, has formed a $250-million partnership with Chinese electric vehicle maker BYD to provide EV fleet mobility services in select markets worldwide. Vitol and BYD plan to offer municipal, corporate, and other customers a comprehensive solution including electric vehicles, charging infrastructure, and depot design. (9/23)

E-choppers: Bristow Group Inc., one of the biggest aircraft companies that ferry oil workers to offshore platforms, is considering purchasing as many as 50 electric-powered helicopters. The Houston-based chopper company has already pre-ordered 25 of the new 4-passenger, zero-carbon operating emission aircraft and has the option to buy 25 more from Vertical Aerospace Group Ltd. (9/22)

EV air mobility: Airbus announced plans for a new CityAirbus as the emerging Urban Air Mobility market grows. The fully electric vehicle is equipped with fixed wings, a V-shaped tail, and eight electrically powered propellers as part of its distributed propulsion system. It is designed to carry up to four passengers in a zero-emissions flight in multiple applications. (9/22)

FCEV vs. EV: The race is on car manufacturers to bring out their range on electric vehicles (EV). But what if the new kid on the block ends up taking over? Honda, Hyundai, and Toyota are among the significant firms now testing out hydrogen fuel cell electric vehicles (FCEVs) in their production lines to see which proves the most successful. (9/24)

Hydro-Québec has won a multibillion-dollar contract to deliver power into the heart of New York City, in a deal that helps cement the provincially owned corporation as a critical supplier of clean electricity in North America. (9/22)

Solar takes a $$ hit: An unexpected surge in demand for silicon, mainly from the solar energy industries in China, Europe, and the United States, has led to large deficits and fueled a price rally that shows no signs of abating. Silicon prices have climbed to around $4,000 a ton in all three locations, the highest on record, from levels below $2,000 a ton one year ago. (9/22)

Brazilian solar: The Brazilian subsidiary of Royal Dutch Shell will invest 3 billion reais ($565 million) in renewable energy in the country through 2025. Most of the CAPEX is related to solar energy projects. (9/22)

Quantifying heat impacts: The Biden administration is opening an effort across federal agencies to address the health impacts from heat, including the first-ever labor standard aimed at protecting workers from extreme heat, as part of a growing recognition of the dangers posed by warming temperatures caused by climate change. (9/21)

Flood insurance to cost more: Starting Oct. 1, communities in Florida and elsewhere around the country will see substantial federal flood insurance subsidies begin to disappear in a nationwide experiment in trying to adapt to climate change: Forcing Americans to pay something closer to the actual cost of their flood risk, which is rising as the planet warms. For example, Jennifer Zales, a real estate agent in Tampa, pays $480 a year for flood insurance. Under the new system, her rates will eventually reach $7,147, according to her insurance agent. (9/24)