Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“At the end of the day, to have an orderly transition, oil and gas are part of the solution, not the problem. Our carbon footprint is 10% less now than 10 years ago. The real takeaway is that the energy transition will take a long time, cost a lot of money, and need technologies that don’t exist. We need climate literacy, energy literacy and economic literacy.”

John Hess, CEO Hess Corp.

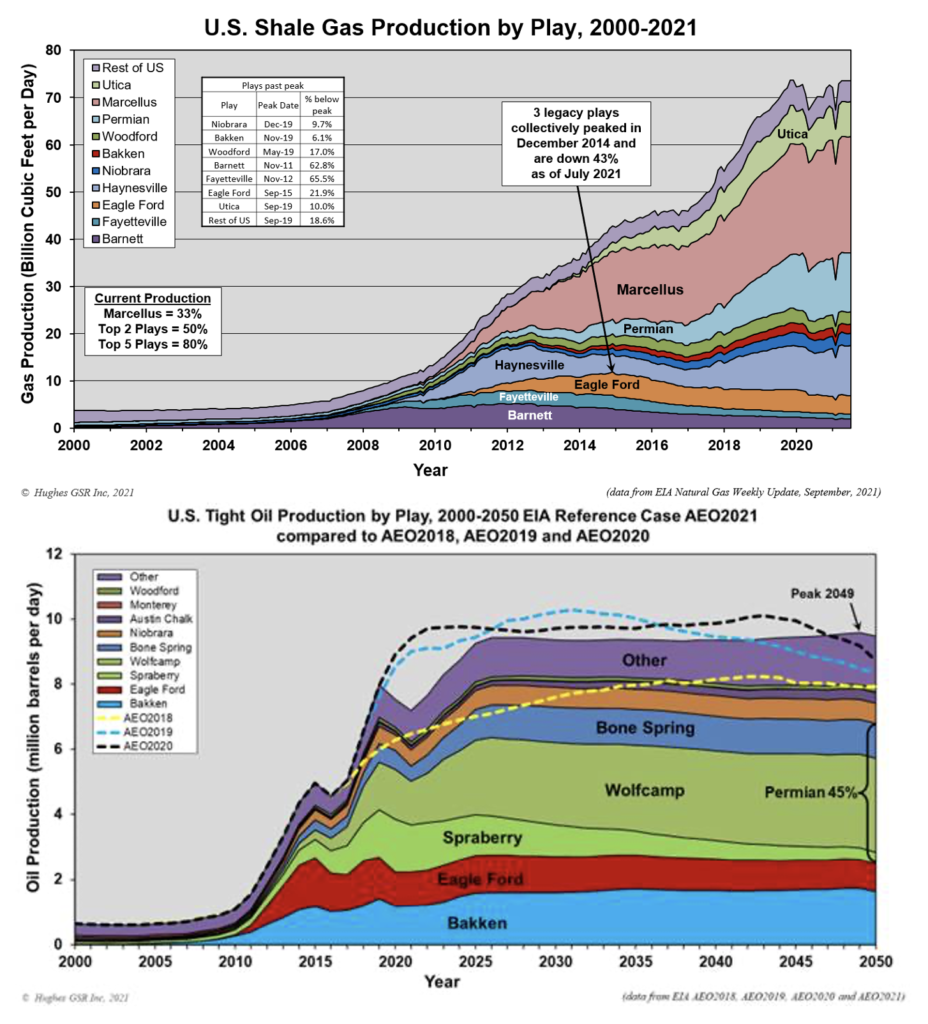

“The EIA’s 2021 reference case play-level oil production forecasts through 2050 are found to be highly to extremely optimistic for the most part and therefore are unlikely to be realized. In most plays, meeting EIA forecasts through 2050 would require the recovery of all proven reserves and a high proportion of the EIA’s estimates of unproven resources. In most plays the EIA forecasts exit 2050 at high production levels—often significantly higher than current production rates —implying that vast additional resources would remain after 2050.

“In reality, the high productivity “sweet spots” within plays are being drilled off first, and declining new well productivity in several plays shows that sweet spots are becoming saturated with wells. As drilling moves into lower productivity areas higher drilling rates will be required to maintain play production or even to stem production declines.”

David Hughes, retired geologist, from the recent report “Shale Oil Reality Check: 2021”

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

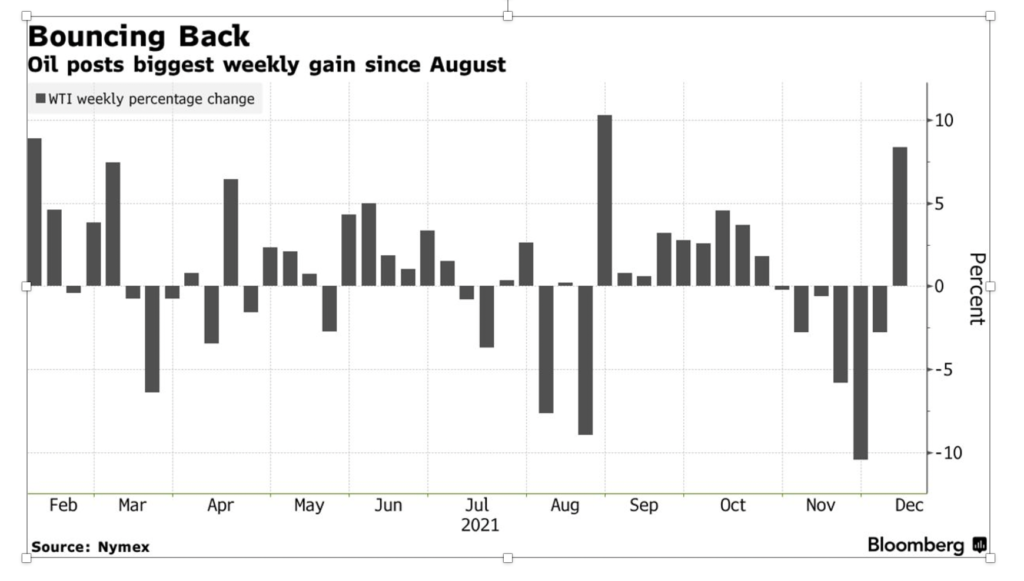

Oil: Futures saw their biggest weekly gain in more than three months as the worst fears over the new virus strain have receded. Brent and WTI posted gains of about 8% this week, their first weekly gain in seven, even after a brief bout of profit-taking. Brent futures settled at $75.15 a barrel, after falling 1.9% on Thursday. WTI rose 73 cents, to $71.67 after sliding 2% in a volatile session the previous day.

The EIA reported that crude stocks fell by a less than expected 240,000 barrels in the week ended Dec. 3rd. Domestic oil production was higher, rising to 11.7 million b/d, the most since May of last year. Refinery activity picked up to 89.9% of capacity boosting stocks of oil products. U.S. gasoline stocks rose by 3.9 million barrels in the week, compared with expectations for a 1.8-million-barrel rise. Distillate stockpiles, which include diesel and heating oil, rose by 2.7 million barrels, versus expectations for a 1.6 million-barrel rise. “These are decent product builds across the board which far outweighs the small decline in crude stocks,” said an energy market analyst at CHS Hedging. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 2.4 million barrels.

Americans are feeling some relief as the impact of a recent drop in oil prices trickles down to gasoline stations. According to AAA data, the average retail price has dropped more than 2% nationwide since touching a 7-year-high a month ago and now goes for $3.34 a gallon. Gasoline could slip below $3.30, said the head of petroleum analysis at GasBuddy. Despite the recent price pullback, data shows little sign of a significant hit to oil consumption thus far.

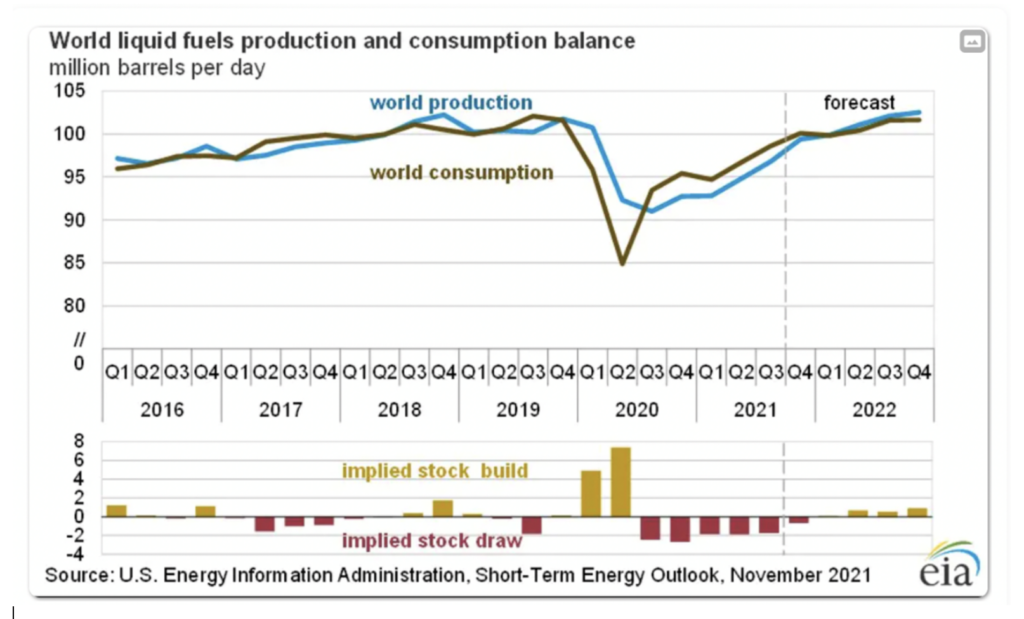

The US Energy Information Administration’s December Short-Term Energy Outlook remains subject to heightened levels of uncertainty related to the ongoing recovery from the COVID-19 pandemic. Notably, the emergence of the Omicron variant raises uncertainty about the level of energy consumption throughout the world compared with last month’s forecast. Brent crude oil spot prices averaged $81 in November, a $3 decrease from October 2021 but a $38 increase from November 2020. Crude oil prices have risen over the past year due to steady draws on global oil inventories, which averaged 1.4 million b/d during the first three quarters of 2021.

The Riyadh-based International Energy Forum has called on companies to raise oil and natural gas investment to $523 billion a year by the end of this decade to prevent a surge in energy prices and economic unrest. The think tank’s comments echo Saudi Aramco, whose chief executive officer on Monday said there could be “chaos” unless governments stopped discouraging investment in fossil fuels. The IEF said spending on oil and gas projects slumped 30% to $309 billion in 2020 and had only recovered slightly this year. It needs to reach $4.7 trillion over this decade as a whole to meet demand.

According to a person familiar with the administration’s thinking, the Biden administration is not considering reinstating a ban on US oil exports as a tool to control gasoline prices. The gamble taken by OPEC and its allies, under pressure from top oil consumers and the U.S. to raise oil output in January despite forecasts of oversupply, appears to be paying off as prices stabilize.

World Petroleum Congress: The Conference started with chief executives from Exxon Mobil, Saudi Aramco, and Halliburton promoting the need to deliver oil and gas even as the world transitions to cleaner fuels. Speakers at the conference offered their dire counterpoint to last month’s COP26 climate change conference. At COP26, environmentalists warned of a climate catastrophe; however, oil and gas executives forecast uncertain energy security and supply without their products. The thrust of the conference was that there would be the need for more oil for decades to come; there is not enough investment taking place; and if the world transitions to renewable energy too fast, there will be much higher prices and social chaos.

The top energy executives urged a more cautious energy policy transition away from oil and gas. Still, a US Energy Department official said the industry has a moral obligation to address climate change and the economic opportunity it represents. For recent fuel shortages and price volatility, executives from Saudi Aramco, Exxon Mobil, and Chevron blamed demand for renewables and the lack of investment in fossil fuels. Moreover, oil and gas investment declined in 2020 and 2021 because of the pandemic, a “recipe for more volatility,” according to Joseph McMonigle, the International Energy Forum secretary-general. “Capex cuts by international oil companies and national oil companies in 2020 was about 35%,” he said. “We’re now showing another 23% reduction in CAPEX levels” from pre-pandemic levels this year.

Halliburton, the biggest provider of fracking, warned that the world is headed into a period of scarcity for oil after seven years of underinvestment following crude’s plummet from $100 a barrel in 2014. “For the first time in a long time, we’ll see a buyer looking for a barrel of oil as opposed to a barrel of oil looking for a buyer,” noted CEO Jeff Miller. Miller said that Halliburton crude explorers outside the US and Canada cut spending by roughly half compared with historical norms. Oil patch contractors have also been squeezed this year by rising costs, while producers have sought to return profits to investors rather than boost spending.

A day after Halliburton warned of an imminent oil shortage, oilfield rival Baker Hughes offered a sunnier outlook. “We don’t see a shortage at the moment,” Lorenzo Simonelli, CEO at the world’s No. 2 oilfield contractor, said in an interview. “We’ll see how the demand continues to improve, but I do see countries such as Saudi Arabia and also UAE having the ability to increase their production.” As a result, Baker Hughes is gearing up for a 20% increase in North American oilfield activity in 2022 and a rise of at least 15% elsewhere, he said.

OPEC: The cartel and its allies boosted crude oil production by 500,000 b/d in November, with 80% of the increase attributed to five members – Saudi Arabia, Russia, Iraq, Kazakhstan, and Nigeria — according to the latest S&P Global Platts survey. OPEC’s 13 countries pumped 27.85 million b/d, up 300,000 b/d from October, while Russia and eight other partners produced 13.86 million b/d, up 200,000 b/d, the survey found. The collective OPEC+ output of 41.71 million b/d was the group’s highest in 19 months, but still 4.15 million b/d below what it pumped in April 2020, when Saudi Arabia and Russia launched an oil price war.

Shale Oil: “Shale Reality Check 2021” by The Post Carbon Institute’s David Hughes seriously undermines the long-term forecasts made by the US Energy Information Administration for US oil and natural gas from shale deposits. Of the 13 significant plays he evaluated, Hughes rates the EIA’s production forecast for five as “moderately optimistic,” five as “highly optimistic,” and three as “extremely optimistic.” Saturation of sweet spots in crucial shale plays may lead to an irreversible production decline.

The EIA’s forecasts count on shale oil for 69% of all US oil production from 2020 to 2050 and 77% of all US natural gas production in the same period. And it matters to the world because between 2008 and 2018, growth in US oil production accounted for 73% of the entire increase in global supplies.

In 2013 Hughes released a damning and prescient analysis on the Monterey Shale, an underground formation in California that the EIA was touting as containing 15.4 billion barrels of recoverable oil. Hughes wrote that the EIA’s estimate was likely to be “highly overstated.” The following year the EIA stunned the industry, investors, and California officials with a 96% reduction in estimated tight oil resources for the Monterey shale basin—a virtual wipeout. Before the downgrade, Monterey comprised 60% of all US tight oil resources.

The massive oil price correction in November 2021, which turned out to be the worst month for crude since March 2020, came just as US oil producers drafted their capital budget plans for 2022. The plunge in prices, which sent WTI Crude from over $80 in early November to $67 in early December, was not so devastating as it would have been two years ago when producers were drilling at a record pace and were investing most of their cash flows into new wells. The current price slump is not spooking US oil producers. They are keeping disciplined spending plans and are expected to raise budgets cautiously for next year as each new COVID variant could throw the market into panic-selling—as Omicron did two weeks ago.

Natural Gas: The Biden administration signaled it was prepared to block the startup of the Nord Stream 2 gas pipeline and impose new and harsh economic sanctions that could target the energy sector in the event of a Russian attack on the Ukraine. The Russia-led Nord Stream 2 gas pipeline cannot start sending natural gas to Europe until it is certified by German authorities, which have suspended the certification process.

Warm weather pushed US natural gas futures down 11.5% on Monday to $3.657 per million BTUs. That is down more than 40% from October’s peak, erasing a run-up that stoked fears of exorbitant heating bills. However, by Friday’s close, natural gas futures were back up to $3.93.

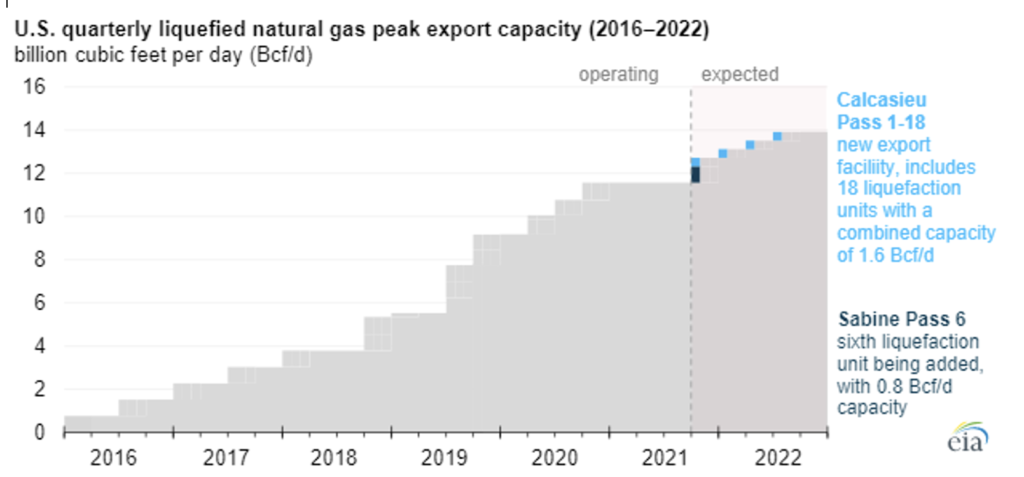

US LNG feed gas surged during the week of Nov. 30th -Dec. 7th as a sixth train at Cheniere Energy’s Sabine Pass terminal began production, and Venture Global LNG’s Calcasieu Pass conducted commissioning activities ahead of starting. In addition, strong fundamentals in end-user markets helped exports, with US Gulf Coast cargo values fluctuating at high levels during the week. The S&P Global Platts says the Gulf Coast Marker was at $28.40 per million BTUs on Dec. 7th.

The US will have the world’s largest LNG export capacity next year, exceeding the capacity of the top LNG exporters Australia and Qatar. Thanks to a growing number of US LNG export projects coming into service, US nominal capacity will increase by the end of 2022 to 11.4 billion cubic feet per day and peak capacity to 13.9 billion.

Environmentalists have stepped up opposition to US LNG export facilities by backing restrictive legislation in the US House of Representatives barring the Federal Energy Regulatory Commission from approving new LNG terminals. It would also prohibit hydraulic fracturing, ban crude oil and natural gas exports, and block new GHG emissions from all new power plants.

US oil and gas producers Diamondback Energy and ConocoPhillips said the Permian Basin would face natural gas pipeline constraints in coming years as production grows. While other US oil basins are seeing a production plateau, the Permian Basin in west Texas and New Mexico is anticipated to continue to grow because of its low output cost. At the same time, operators there are under pressure to reduce the flaring of excess natural gas.

Biofuels: The US EPA has proposed reducing the amount of biofuels that oil refiners are mandated to add to petroleum fuels to provide some breathing space to the refining industry amid demand damage and high prices. While it may seem that the move favors the oil industry, the industry is not happy with it, Reuters has reported, adding that the biofuels industry is also unhappy, although for more obvious reasons.

US refiners will need to provide ever-higher volumes of renewable fuels or pay for more significant amounts of renewable fuel credits to meet the proposed fuel blending standards. Under the Renewable Fuel Standard (RFS), the total volume of renewable blend stocks added to fuels in 2022 would set a new record at 20.77 billion gallons. However, the EPA is proposing a small “supplemental obligation” of 250 million gallons be added to that total. The supplement responds to a 2017 decision by a US Court of Appeals that narrowed the criteria for calculating “inadequate domestic supply” when the EPA issues waivers.

Electricity: President Biden issued an executive order directing all federal agencies to transition to a Zero-Emission Fleet. Under the order, each agency needs to achieve 100% zero-emission vehicle acquisitions by 2035, including 100% zero-emission light-duty vehicle acquisitions by 2027. In addition, each agency with a fleet of at least 20 vehicles is to develop and annually update a zero-emission fleet strategy that includes optimizing fleet size and composition, deploying zero-emission vehicle refueling infrastructure, and maximizing acquisition and deployment of zero-emission light, medium, and heavy-duty vehicles. Other provisions of the order include 100% carbon pollution-free electricity on a net annual basis by 2030.

Prognosis: The EIA lowered its Brent spot average price forecasts for 2021 and 2022 and now sees Brent spot prices averaging $70.60 per barrel in 2021 and $70.05 per barrel in 2022. In November, its previous estimate saw Brent spot prices averaging $71.59 per barrel in 2021 and $71.91 per barrel in 2022.

JP Morgan said in its Outlook 2022, titled ‘Preparing for a vibrant cycle,’ that things are looking up for the global economy next year and consumption will remain strong for years to come. The bank highlights inflation, the Chinese economy, and the transition from a pandemic to an endemic disease as the three economic factors to watch moving forward. This prediction for a vibrant economy supports the banks earlier claim that oil prices could hit $125 per barrel next year.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Ukraine: President Biden warned President Putin that an invasion of Ukraine would result in heavy economic penalties for him and lead NATO to reposition its troops in Europe. These measures he said would go well beyond the West’s response to Russia’s annexation of Crimea seven years ago. Mr. Biden also said an invasion could end Russia’s hopes of completing the Nord Stream II gas pipeline to Europe, which would be a significant new source of energy revenue.

It is too early to tell whether the much-anticipated conversation, whose details were hard to elicit as both the White House and the Kremlin put their spin on it, will alleviate the immediate crisis. Nevertheless, Biden has made a significant diplomatic concession to Moscow by signaling he wants to convene meetings between NATO allies and Russia to discuss Putin’s grievances with the transatlantic security pact. Speaking on Wednesday, a day after he held a bilateral call with Russia’s leader, the US president said he hoped to announce high-level talks “to discuss the future of Russia’s concerns relative to NATO writ large.”

The talks would explore “whether or not we can work out any accommodation related to bringing down the temperature along the eastern front,” Biden added. The US president said he hoped the participants would include Washington and Moscow and “at least four of our major NATO allies,” although he declined to name the specific countries. Moscow wants NATO to commit to halting any eastward expansion and to refrain from deploying troops and equipment that could be used to attack Russia from neighboring countries.

Though Putin has periodically demanded similar talks for more than a decade, Moscow’s “red lines” have come to the fore in the last month, after the US warned allies Russia was massing up to 175,000 troops at its borders in preparation for a possible invasion of Ukraine early next year.

Belarus: The Belarusian oil company, Belorusneft, has canceled its 2022 exports to Germany via the Druzhba pipeline following new EU sanctions on the company. On Dec. 2nd, the EU imposed sanctions on several Belarusian individuals and entities, including Belorusneft. The new sanctions aim to increase the pressure on President Lukashenko, accused by Western governments of rigging his election, ordering a massive crackdown on the opposition, and pushing Middle Eastern migrants towards the border with Poland. Lukashenko denies the allegations.

Belorusneft exports most of its relatively modest oil production to Germany, regularly using Russia’s Druzhba pipeline. According to the quarterly schedule, Belarus was to supply about 450,000 tons of oil to Germany in October-December.

Iran: Talks on reviving the 2015 Iran nuclear deal resumed on Thursday with the US and Israel ramping up the rhetorical pressure on Tehran about the possible economic or military consequences if diplomacy fails. Iran’s top negotiator said Tehran was sticking to the stance it laid out last week when the talks broke off with European and US officials accusing Iran of making new demands and of reneging on compromises worked out earlier this year. World powers will assess this week whether Iran is serious in nuclear negotiations.

With talks on restoring the 2015 nuclear deal at risk of collapse, the Biden administration faces the prospect of relying on two of its biggest international rivals, Russia and China, to end the nuclear standoff with Iran. Even as US tensions mount with Russia over Ukraine and China over Taiwan and other issues, Western officials acknowledge that the fastest route to increasing economic and political pressure on Tehran’s new hardline government runs through Moscow and especially Beijing.

China helped Iran stabilize its economy after the US reimposed sanctions in 2018, pushing it into a severe slump. China has imported up to 700,000 barrels of Iranian oil a day in recent months, according to energy analysis firm Vortexa. China has also used networks designed by Iran to skirt sanctions to carry out other trade, from automotive parts to railway construction.

While Israel had applauded President Donald Trump’s withdrawal from the accord in 2018, several former officials have concluded that his “maximum pressure” policy built primarily on sanctions has failed to prevent Iran from dangerously advancing its nuclear program.

Long-running differences over dealing with Iran’s nuclear program have erupted into new tensions between the Biden administration and Israel. The strains were evident all week, as the Biden administration sought to bring the alliance with Israel into a united front about dealing with Iran over the next year. To close the gap, American officials let out word this week that two months ago, President Biden asked his national security adviser, Jake Sullivan, to review the Pentagon’s revised plan to take military action if the diplomatic effort collapsed.

Iraq: Crude oil production, including flows from the Kurdistan region, rose to an 18-month high of 4.2 million b/d in November, the State Oil Marketing Organization said. The figure increased 138,000 b/d from October and was slightly above its agreed OPEC+ quota for November of 4.19 million b/d. Federal exports jumped to 3.27 million b/d in November from 3.11 million b/d in October, while Kurdistan Regional Government flows were unchanged on the month at 408,000 b/d. Domestic use, including crude burn and refinery runs, averaged 518,000 b/d, a fall of 5,000 b/d from October.

Iraq is looking to neighboring countries to fill an electricity shortage and diversify its sources of supply as Iranian exports of gas and electricity have diminished. Baghdad is discussing potential electricity interconnections with Saudi Arabia, Turkey, Jordan, and Kuwait. But failure to agree on the price that Iraq would pay for the imported power has hindered progress after long-running negotiations.

Yemen: The Iran-aligned Houthi movement in Yemen said that it attacked oil infrastructure and military compounds in Saudi Arabia with drones and ballistic missiles. Saudi Aramco’s oil facilities in Jeddah were targeted in the attack. “In response to the crimes of the US-Saudi, the Armed Forces carried out a qualitative military operation targeting several enemy military targets in Riyadh, Jeddah, Taif, Jizan, Najran, and Asir,” the Houthi Armed Forces spokesman said. Apart from Aramco sites, the Houthis also claimed to have targeted the Saudi Defense Ministry in Riyadh, the King Khalid airport, and other military targets with drones and missiles.

Venezuela: Sanctions by the Obama and Trump Administrations have failed to have a material impact on Venezuela’s regime, resulting in Russia, China, and Iran expanding their influence in the country. While US policymakers continue to believe that harsh sanctions will bring the Maduro government to its knees and trigger regime change, there are increasing signs that they are failing and have strengthened his position.

President Maduro plans to replace Oil Minister Tareck El Aissami – a critical ruling party official who also serves Venezuela’s OPEC representative and board member of the state oil company. In recent weeks, El Aissami’s health has deteriorated which could render him unable to fulfill his ministerial duties at least temporarily.

Roger Carstens, the US government’s top hostage negotiator, went to Caracas last week in an ongoing effort to secure the release of the men the Biden administration believes are being held as bargaining chips. It was the first known face-to-face outreach by a top US official since the Trump administration shuttered the American Embassy in Caracas in March 2019.

3. Climate change

Reliable, readily available data is of critical importance to governments working on setting policy and monitoring compliance with international climate pacts. It is also valuable to local authorities trying to help their communities adapt to unusual weather patterns or rising seas. “Now we can truly do climate studies because we have observations to precisely say how weather trends have changed and are changing,” says Suresh Vannan, who manages the NASA’s physical oceanography archive center. “When you are trying to develop long-term environmental records, including climate records, consistent measurement is incredibly valuable,” says Kevin Murphy, who, as NASA’s chief science data officer, oversees an archive of Earth observation data used by 3.9 million people last year. “It’s irreplaceable data.”

Energy efficiency and reducing emissions from buildings may be the cheapest way to lower carbon footprints and help reach climate goals. Still, the current pace of investments in energy efficiency is insufficient for a net-zero pathway. Now investors in energy efficiency, including companies and funds, are pushing for government policies targeting more efficient energy use, as they see a lack of action would be a missed opportunity to boost energy efficiency,

The La Niña phenomenon has developed for the second consecutive year, with the weather pattern expected to intensify rainfall and droughts around the world. The counterpart to the better known El Niño phenomenon, La Niña involves the large-scale cooling of the Pacific Ocean’s surface, which drives changes in wind and rainfall with consequences across the globe. In the past week, both the World Meteorological Organization and Australia’s Bureau of Meteorology have confirmed the back-to-back years of La Niña conditions, with scientific models indicating it will last into early 2022.

The WMO said the 2021-2022 La Niña would probably be “weak to moderate” and “slightly weaker” than the previous year. Yet, it would still be likely to affect agriculture and water supply, as it would cause extraordinary rain in some areas and less in others. Typical impacts of La Niña have included arid conditions in parts of the US and South America, and abnormal amounts of rain and more cyclones than usual in Australia, which has experienced the wettest November in 121 years of records for its most populated state.

This fall, warm and dry conditions have led to significant snowfall deficits across the western United States. November was warmer than average, and precipitation was below average everywhere except Washington state, which had a string of storms that caused significant flooding. As a result, the National Weather Service reported high elevation snowfall was lagging by 10 to 20 inches last month. This snowfall in the west is critical for filling the region’s most significant natural “reservoir” — mountain snowpack.

4. The global economy and coronavirus

BioNTech and Pfizer said a three-shot course of their COVID-19 vaccine was able to neutralize the new Omicron variant in a laboratory test, an early signal that booster shots could be crucial to protect against infection from the newly identified variant. The German and US companies said two doses of their vaccine resulted in significantly lower neutralizing antibodies but could still be protective against severe disease.

United States: The number of Americans fully vaccinated against COVID-19 reached 200 million last week amid a dispiriting holiday-season spike in cases and hospitalizations that has hit even New England, one of the most highly inoculated corners of the country. New cases in the US climbed from an average of nearly 95,000 a day on Nov. 22nd to almost 119,000 a day last week, and hospitalizations are up 25% from a month ago. As a result, New York will require all private-sector workers in the city to be vaccinated against Covid-19, in what would be the strictest vaccine mandate to be imposed anywhere in the US.

In recent weeks, demand for coronavirus vaccines has spiked in the US as more Americans are eligible for booster shots, and concerns grow over the omicron variant. Health-care providers administered 2.18 million doses of coronavirus vaccines on Thursday. According to the latest CDC report, the average number of daily administered vaccine doses reported to the agency was 22% higher than the previous week.

In November, US inflation reached a nearly four-decade high as solid consumer demand collided with pandemic-related supply constraints. The consumer-price index—which measures what consumers pay for goods and services—rose 6.8% in November from the same month a year ago. That would mark the fastest pace since 1982 and the sixth straight month in which inflation topped 5%.

Applications for US state unemployment benefits declined last week to the lowest level since 1969, illustrating difficulties adjusting the raw data for seasonal effects. Initial unemployment claims totaled 184,000 in the week ended Dec. 4th, down 43,000 from the prior period. The drop pushes the level of applications below the plunge two weeks earlier in what many economists attributed to difficulties adjusting for seasonal swings around the holidays. On an unadjusted basis, initial claims climbed by about 64,000.

Europe: Prime Minister Boris Johnson announced significant new restrictions to curb the fast-spreading Omicron variant, reversing course on a long-held policy. Johnson’s decision to adopt a contingency plan he had long resisted — even in the face of Britain’s already high daily rate of infections — underscored the threat posed by the new variant. But the timing raised questions about whether Mr. Johnson was motivated more by public health or politics.

The UK’s economy grew less than forecast in October as shortages of materials hit manufacturing and construction. A further loss of momentum now seems inevitable, with consumers facing new restrictions to contain the new strain of Covid-19. As a result, the gross domestic product grew 0.1%, compared with 0.6% in September.

The incoming German government wants to make COVID-19 vaccinations mandatory from Mar. 16th for people working in hospitals, nursing homes, and other medical practices. Germany has been reticent about making vaccines compulsory for fear of exacerbating a medical and nursing home staff shortage. Still, support has grown for the idea as the country has faced surging infections in a fourth wave of the pandemic. Police fired teargas and used water cannons last week to disperse protesters pelting officers with cobblestones and fireworks as a demonstration in Brussels over government-imposed COVID-19 restrictions turned violent.

According to European auto suppliers, half a million jobs would be at risk under EU plans to ban combustion-engine cars by 2035. More than two-thirds of those 501,000 roles would disappear in the five years before the date of the ban. But the survey also found that 226,000 new jobs would be created in the manufacturing of electric parts, reducing the net number of job losses to approximately 275,000 over the next couple of decades.

China: Chinese health officials say Beijing’s unwavering zero-Covid policy has proven to be a “magic bullet,” preventing at least 200 million infections and 3 million deaths. Western hubris, they argue, has led to negligence and now the potentially destabilizing Omicron outbreak. “Western countries are likely to be gripped by Omicron if the variant proves highly infectious, with their unscientific easing of epidemic control measures and overconfidence in vaccines,” reported the Global Times, a state news service.

State media crowing, however, belies uncertainty in the minds of many in China over the efficacy and durability of immunity of the country’s locally produced vaccines as Beijing rolls out booster shots and vaccinations for children as young as three. Doubts over the vaccine matters for the world’s most populous country, where 2.5 billion doses have been administered to 1.4 billion people. In addition, hundreds of millions of people outside of China have received vaccines made by Sinovac and Sinopharm — both of which use an inactivated vaccine rather than the genetic code used by mRNA vaccines such as BioNTech/Pfizer and Moderna.

A professor of epidemiology at the University of Hong Kong said there was “still a lot more uncertainty about the effectiveness of inactivated vaccines compared to some of the other vaccines being widely used.” For example, China’s recent Delta outbreak — which spread to more than half the country’s provinces — indicated that the effectiveness of the Chinese-made vaccines “against infection and transmission couldn’t be that high.” But the outbreak also suggested “vaccine effectiveness against severe Covid-19 appears to be high because the recent outbreaks have included very few severe cases.”

China has imposed a 14-day lockdown at Zhenhai, one of the six districts in Ningbo, amid an increase in coronavirus infections. This action prompted port disruptions and worsening supply chain blockages, market sources said. However, the reemergence of COVID-19 in Ningbo, which houses Sinopec’s flagship 540,000 b/d Zhenhai refinery, will have little effect on the country’s crude throughput in December because of rigorous efforts to contain infections, analysts said.

The Communist Party has long maintained tight control over information, and the effort has intensified under leader Xi Jinping. The country has become increasingly opaque over the past year, even as its presence on the world stage grows. A new data-security law has made it harder for foreign companies and investors to get information, including supplies and financial statements. Several providers of ship locations in Chinese waters stopped sharing information outside the country, making it hard to understand port activity there. Chinese authorities have restricted information on coal use, purged documents related to political dissent cases from an official judicial database, and shut down academic exchanges with other countries.

“China has always been a big black box,” said Stephen Nagy, a politics and international studies professor at the International Christian University in Tokyo. The diminishing access to information is making it even harder for foreigners to understand what’s happening in the country, he said, “and that black box becomes even blacker.”

A former Chinese finance minister criticized the country’s statistics for not correctly reporting negative economic changes. This was a rare harsh public statement from a senior figure highlighting long-standing concerns about the accuracy and reliability of national data. Last week, a meeting of top leaders said China’s growth next year would be weighed down by a “triple” whammy of contracting demand, a supply shock, and weakening expectations. However, none of those are visible in the statistical indicators, which have all been “very good,” Lou Jiwei, a former minister of finance, said Saturday. “There are insufficient figures reflecting negative changes” in the economy, Lou said, adding the one-sided data make it harder to assess the government’s current judgment on the “triple forces” overshadowing the economy.

The People’s Bank of China has never been politically independent like a Western central bank, but it has nonetheless enjoyed a special status in the nation’s economic hierarchy. Now, President Xi Jinping’s shake-up of China’s financial sector is stripping that away.

Earlier this week, pressured by senior leaders worried about plunging economic growth, the Central Bank said it would ease banks’ reserve requirements, effectively making more cash available for bank lending. The move went against policy signals it had sent weeks earlier and came as the central bank and other financial institutions came under scrutiny by Beijing, part of Xi’s effort to curb capitalist forces in the economy.

Fitch Ratings said China Evergrande Group and a second prominent property developer, Kaisa Group Holdings, had defaulted after missing US dollar bond payments. Kaisa, which in 2015 became one of the first Chinese developers to default abroad, has defaulted again after not repaying a $400 million bond that came due last week. In addition, Evergrande missed a final bond-interest payment deadline, something Fitch also said amounted to a default. Failures to repay investors are piling up in China’s property sector, as real-estate companies buckle under the strain of falling home sales, government curbs on borrowing, and a bond-market selloff that has all but shut the market for new deals.

In November, China’s crude imports rebounded 14.3% to 10.21 million b/d from the 39-month low in October as refineries had to increase buying to meet throughput demand. The inflow was 8.94 million b/d in October. State-owned refineries lifted their throughput in November to respond to Beijing’s call to raise oil product supplies. Independent refineries gained the final batch of crude import quotas, which allowed them to bring in more barrels.

China’s soybean demand in the marketing year 2021-22 (October-September) is expected to remain robust as the domestic production forecast was lowered, the monthly China Agriculture Supply and Demand Estimates report showed. Estimates for record soybean imports and cuts in domestic production in China are likely to support global prices. The world’s largest soybeans purchaser is expected to import a record 102 million mt of beans in 2021-22, unchanged from the previous month’s estimates and up 2.2% year on year. However, the domestic projection for 2021-22 soybean output has been cut from 18.65 million tons in November estimates to 16.40 million tons, compared with 19.60 million last year.

Russia: The coronavirus can’t be ignored, jailed, exiled, or co-opted — nor can it be locked down without significant economic cost. That puts President Putin in a bind. The pandemic, perhaps his hardiest foe to date, has starkly revealed the limits of his power. The past several weeks have been harrowing. Daily infections in the country have hovered around 35,000 — while the official figures, undercounted by 50 % or more, record over a thousand deaths each day. (And that’s before the Omicron variant, newly found in Russia, circulates widely.) The misery is primarily due to the low vaccination rate in the country: After a nearly yearlong campaign, only 41% of the country’s people are fully vaccinated.

The Kremlin has itself to blame. A successful vaccine rollout should have been possible given Russia’s intellectual, administrative, and technological capacities. Instead, the authorities fatally eroded the public’s trust with conflicting messaging — oscillating between triumphalism and scaremongering — and haphazardly applied containment measures. The result is a mistrustful, skeptical public — the latest poll from the Levada Center, an independent polling company, puts vaccine hesitancy at 36% — and a growing anti-vaccine movement headed by previously regime-friendly figures is stirring up trouble. Unfortunately, it’s not clear that Mr. Putin, usually adept at quashing sentiments not to his liking, can do much about it.

Bad weather at Russia’s Black Sea port of Novorossiysk is delaying loadings and creating traffic congestion on the straits of the Black Sea leading to the Mediterranean. Early winter storms have delayed loadings at the Novorossiysk and Yuzhnaya Ozereyevka terminals and disrupted the schedules of crude deliveries of the Urals and CPC Blend grades in November and December. According to traders with knowledge of the Novorossiysk port operations, around 300,000 tons of Russian crude grades Urals and Siberian Light have been delayed from the loading schedule.

The pace of Russia’s wheat exports remains slow for the marketing year 2021-22 (July-June) due to increases in export tariffs on food grains. As a result, the country’s wheat exports were down 18% year on year at 18.8 million mt over July 1st-Dec. 2nd. Russia is the world’s largest wheat exporter. Turkey remained the largest buyer of Russian wheat during the year, buying 3.9 million tons as of Nov. 25th, followed by Egypt at 2.8 million tons.

Saudi Arabia: The first significant contracts for Saudi Arabia’s Jafurah field – supposedly the biggest shale gas field outside the US – were awarded two weeks ago. The Kingdom aims to become the third-largest natural gas producer globally by 2030, to the point where it could even become a net exporter of gas. This, in turn – if true – would allow Saudi to achieve its supposed aim of producing half of its electricity from gas and half from renewable energy sources in pursuit of its 2060 net-zero greenhouse gas emissions target.

However, Saudi Arabia’s statements on its oil sector in the past have been highly exaggerated. Consequently, its comments about its gas and net-zero projects should also be regarded with skepticism. Moreover, based on independent industry estimates on changing Saudi demographics and power demand patterns, the Kingdom will probably need gas production of around 23-25 billion cf/d within the next 15 years just to cover its power and industrial demand. In sum, even if the quality of the Jafurah find is unparalleled in the history of gas finds, the Saudis would still be in a deficit in their power generation sector if there was a straight switch from crude oil burning to gas-only burning.

India: Deaths, melting tarmac, and power outages are the consequences of summer heatwaves that have become more intense across India, routinely pushing temperatures above 104o F. Even in neighbor Pakistan’s city of Jacobabad, the temperature earlier this year reached the level at which the human body cannot cool itself. As temperatures soar, so does the demand for ways to stay cool. According to the IEA, India is expected to account for a third of all sales of air conditioners over the coming decades.

Ensuring access to cooling for the more than 1 billion people exposed to South Asia’s extreme heat is vital for health, economic, and social development. But more electricity-guzzling and greenhouse-gas emitting air conditioners risk accelerating global warming. That is why authorities and researchers are urgently working with companies and consumers to ensure India’s demand for cooling is met with the most energy-efficient methods. These can range from choosing refrigerant gases less harmful to the environment to making cleaner technologies more affordable.

There are no nationwide numbers on food insecurity in India, but recent studies point to an alarming problem. In October’s 2021 Global Hunger Index, India ranked 101st of the 116 countries surveyed, falling seven spots from the previous year. In a separate 2020 survey by Azim Premji University in Bangalore, 90% of respondents reported reduced food intake due to the lockdown. Some 20% of respondents continued to battle the problem even six months later.

5. Renewables and new technologies

Sinopec, China’s second-largest oil and gas company, set up a new subsidiary specializing in the hydrogen fuel business. Sinopec Xiong’an New Energy Co. has a registered capital of 100 million yuan. The new entity will engage primarily in building hydrogen infrastructure, managing hydrogen refueling stations, and storage and pipeline transportation of the low-carbon fuel. Sinopec has pledged to spend $4.6 billion on hydrogen energy by 2025. It pivots to producing natural gas and hydrogen as part of becoming a carbon-neutral energy provider by 2050.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

On Thursday, Royal Dutch Shell pulled its support for the Cambo oil development amid a broader public debate about the future of fossil fuels development in the North Sea. That threw the future of the $2.51 billion project into disarray. (12/6)

Royal Dutch Shell shareholders overwhelmingly (99.8%) voted to approve a plan to end its dual share structure and move its headquarters to London from The Hague. (12/11)

British Airways and Phillips 66 have entered into a multi-year supply agreement for sustainable aviation fuel produced at the Phillips 66 Humber Refinery, making the airline the first in the world to use SAF produced in the UK. SAF can reduce lifecycle carbon emissions by over 80% compared to the traditional jet fuel it replaces. (12/6)

Sweden has started up a backup oil-fired power plant to help with a looming electricity shortage in neighboring Poland, Swedish transmission system operator Svenska Kraftnaet said last week. (12/6)

In Nigeria, a well operated by Aiteo Co. that had been spilling oil into the Santa Barbara River for about a month was finally capped after the US’s Boot and Coots well fire extinguishing firm was called in. (12/9)

In Latin America, the recent rise in oil prices and the pressing need to rescue economies have incentivized several countries to develop their fossil fuels rather than focus on the world’s looming energy transition. An abrupt devaluation of oil and gas assets could lead to a significant socio-economic shock in several countries. (12/7)

In Guyana, Exxon Mobil Corp outlined a significant new investment amid government calls for delivering economic benefits to residents from deepwater oil and gas discoveries, helping turn the South American nation into an oil powerhouse. An onshore supply base will expand jobs and boost local fabrication for future projects starting with its fourth production unit. It will bring total investment in Guyana to $30 billion. (12/11)

Canadian oil production is rising again. Efforts are ongoing to invest more in emissions reduction, carbon capture, and more to make the industry better mesh with the ongoing energy transition and undo the longstanding reputation of the dirty oil sands. (12/8)

Western Canada’s Trans Mountain crude oil and products pipeline restarted Dec. 5 after a three-week shutdown from record rainfall that triggered severe flooding and landslides in British Columbia, resulting in the most extended closure in the 330,000 b/d pipeline’s nearly 70-year history. (12/6)

The US oil rig count rose by 4 to 471 while the gas rig count grew by 3 to 105, according to the latest data from Baker Hughes Co. Total rigs are up by 238 years over year. (12/11)

In the deepwater US Gulf of Mexico, Shell has made a material discovery at the Blacktip North prospect. The Blacktip North well encountered approximately 300 feet net oil pay at multiple levels. (12/10)

The Biden administration has approved more oil and gas drilling permits on public lands per month than the Trump administration did during the first three years of Donald Trump’s presidency, according to a report by Public Citizen. It shows that President Biden has been slow to reverse Trump’s fossil-fuel-friendly plan, despite his campaign promise to push for “no more drilling on federal lands” because of climate change. (12/7)

SPR sales: The US DOE said it would sell 18 million barrels of crude oil from its strategic petroleum reserve on Dec. 17 as part of a previous plan to reduce gasoline prices. (12/11)

BP’s 60,000-ton Argos platform, which started construction in March 2018 in South Korea, has arrived at its final location. The floating production unit, built for the $9 billion Mad Dog 2 project in the deepwater Gulf of Mexico, left South Korea for Texas in February 2021. (12/10)

California is by far the most ambitious US state regarding things like emission standards, EV sales, and renewable energy. It is also importing more oil from the Amazon rainforest than any country in the world. (12/7)

Methane leaks: Oil producers in the Permian Basin must do more to disclose and stop the leak of methane, a powerful greenhouse gas, a House committee wrote in a letter to 10 major oil companies. Rep. Eddie Bernice Johnson said she was concerned that leak detection and repair programs at the companies weren’t sufficient and demanded the companies disclose more information about their leaks and how they found them. (12/6)

The Biden administration has ordered US government agencies to immediately stop financing carbon-intensive fossil fuel projects overseas and prioritize international collaborations to deploy clean energy technology, according to US diplomatic cables. (12/11)

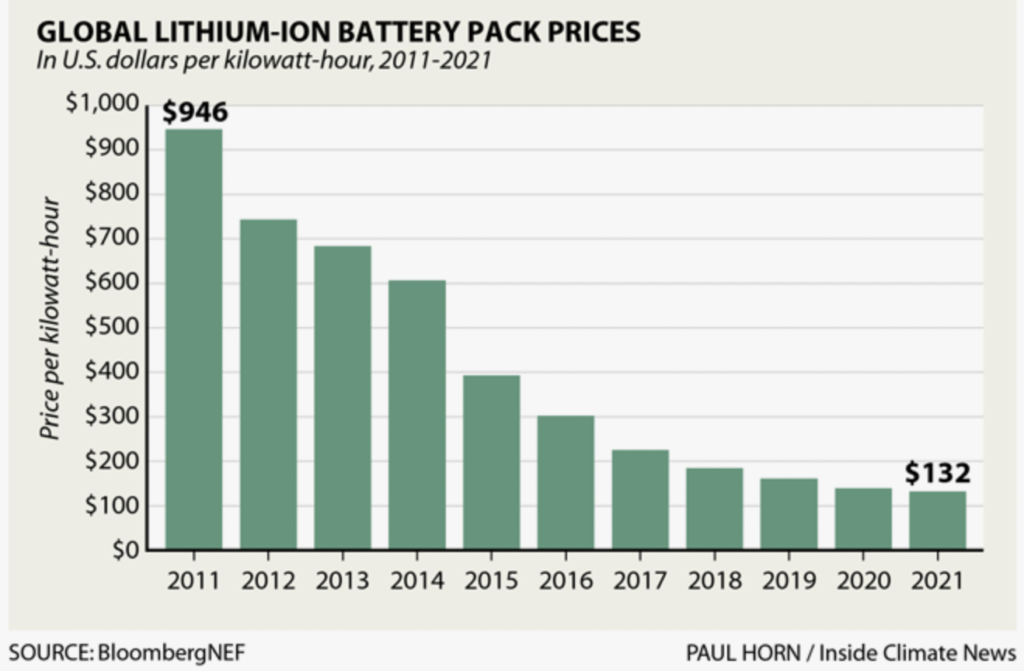

The price of the batteries that power electric vehicles have fallen by about 90% since 2010, a continuing trend that will soon make EVs less expensive than gasoline vehicles. (12/10)

EV growth: Last quarter, EVs were 10.8% of worldwide sales, a considerable increase in little more than four years since passing 1% in 2017. Those sales are not evenly distributed, however. Europe leads on a percentage basis, with 17.4% of new cars sold with a plug; Asia is second and close to the global average at 12%; the Americas are a distant third, at less than 4%. (12/10)

EV growth forecast: Credit Suisse said it now expects electrics to account for 24% of new-vehicle sales globally by 2025, up from a previous forecast of 17%. (12/11)

GM EV step: General Motors plans to invest more than $3 billion to make electric vehicles in Michigan, a potential win for the car maker’s home state after recent commitments of auto projects to Southern states. (12/11)

BP’s EV step: BP took its first significant step into electrification in the US by acquiring AMPLY Power, an electric vehicle (EV) charging and energy management provider for fleets that operate trucks, transit, school buses, vans, and light-duty vehicles. (12/8)

Battery winner: Toyota has selected Greensboro-Randolph as the location for their new $1.29-billion automotive battery manufacturing plant, to be named Toyota Battery Manufacturing, North Carolina (TBMNC). When it comes online in 2025, TBMNC will have four production lines, each capable of delivering enough lithium-ion batteries for 200,000 vehicles. (12/7)

In China, “new energy vehicle” sales (aka EVs) accounted for 17.8% of China’s total vehicle sales in November and has accounted for 10% of the market share for seven consecutive months. China’s NEV output surged 128% on the year, to 457,000 units in November. (12/11)

CA squeezing out gas: The California Air Resources Board approved a measure that will require most newly manufactured small off-road engines, such as those found in leaf blowers, lawnmowers, and other equipment, to be zero-emission starting in 2024. (12/11)

World’s worst traffic: As global traffic starts to recover from pandemic lockdowns earlier this year, London has emerged as the most congested city in the world. According to transportation analytics firm, Inrix, the city has the worst traffic levels among 1,000 across 50 countries. Paris, Brussels, Moscow, and New York are next. (12/8)

US coal stockpiles fell in September 2021 to the lowest level of total monthly coal stocks at the electric power sector since 2001, said the EIA. High natural gas prices have been driving increased use of coal for power generation at utilities in recent months, while the supply response has been muted due to closures of coal mines in recent years. (12/8)

Australia’s accelerating energy transition will see half of all homes installed with rooftop solar in the early 2030s, helping spur a faster exit from coal-fired power generation, according to the country’s primary electricity market operator. (12/10)

Urea shortages, prices: Prices for urea, an essential type of fertilizer, are soaring to levels not seen in over a decade. High prices are tied to the rising source materials: natural gas and coal. The shortages are linked to many factors, including restrictions on exports by China and Russia—two of the largest producers—to ensure supplies for their farmers. (12/7)

Virginia’s Republican Gov.-elect Glenn Youngkin announced Wednesday that he would use his executive powers to withdraw the commonwealth from a multistate carbon cap-and-trade program he said has overburdened ratepayers and businesses. Environmental attorneys and other advocates quickly shot back that Virginia’s participation, approved through legislation last year, could not be undone by the governor alone. (12/9)

Generational shift: A growing number of young people are zeroing-in on climate-related work, looking for green jobs, and turning away from mere money-making as companies fight for highly skilled talent. They’re leaving companies that fail to meet those standards and becoming more demanding toward those who profess to meet them. (12/10)

Russia’s nuclear-powered icebreakers have successfully escorted over a dozen ships stuck on the Northern Sea Route, state operating company Atomflot said Dec. 7, with the country considering restricting activities of foreign vessels along the route. (12/9)

China’s H2: PetroChina’s Huabei Petrochemical in North China shipped its first hydrogen cargo to the state-owned company’s refilling outlets in Beijing, signaling the oil giant’s intentions to boost its hydrogen fuel supply capability as it looks to transition to clean energy alternatives. (12/8)

State-owned Korea Gas Corp., one of the world’s biggest LNG buyers, plans to build three hydrogen production plants in South Korea to achieve a goal of hydrogen production of 1.04 million mt/year by 2030. (12/7)

Water supply woes: In Marin County, a $2 million house with an ocean view doesn’t necessarily come with a reliable water supply. To increase supply during the severe drought, the county is considering buying water from agricultural areas and piping it across San Francisco Bay. (12/6)

Dairy farmers in California, the nation’s top milk producer, face pressure from rising costs, increasingly complex environmental regulations, and a quest for water—challenges all magnified by a historic drought. For some, the challenges are existential. Dairy is the top farm industry by revenue in California, the nation’s biggest agricultural state. (12/6)