Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“The United States cannot achieve its targeted reduction in methane emissions under the Global Methane Pledge without a swift and large-scale decline in oil and gas sector methane leaks.”

Rep. Eddie Bernice Johnson, chair of House Committee on Science, Space, and Technology

“If we were to say…that we close down [oil] production from the Norwegian shelf, I believe that would put a stop to an industrial transition that is needed to succeed in the momentum towards net zero. . . So, we are about to develop and transit, not close down.”

Norwegian Prime Minister Jonas Gahr Støre

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Crude prices ended little changed on Friday after erasing earlier gains on growing worries that rising coronavirus cases and a new variant could reduce global oil demand. Earlier in the day, oil prices climbed more than $2 a barrel after OPEC+ said it could review its policy to hike output if a rising number of pandemic lockdowns chokes off demand. Brent futures settled at $69.88 a barrel, while West Texas Intermediate ended at $66.26. Both benchmarks declined for a sixth week in a row for the first time since November 2018.

US crude stocks fell while gasoline and distillate inventories rose as demand weakened in the most recent week, the EIA said on Wednesday. Oil and fuel inventories have generally declined as demand has ramped up with the US economy booming. However, last week’s report reversed that trend, if only temporarily, and added to some of the bearish sentiment that has brought oil prices down in recent days.

Crude inventories fell by 910,000 barrels in the week to November 26th to 433 million barrels. Both gasoline and distillate stocks rose much more than expected. Gasoline stocks rose by 4 million barrels and are about 5% below the 5-year range for this time of year. Distillate stockpiles, including diesel and heating oil, rose by 2.2 million barrels, still 9% below the 5-year average for this time of year. Propane-propylene inventories decreased by 1.0 million barrels and are about 14% below the 5-year average for this time of year.

The Biden administration could adjust the timing of its planned release of strategic crude oil stockpiles if global energy prices drop substantially, US Deputy Energy Secretary Turk said on Wednesday. Turk added that other consumer nations that had agreed to release strategic reserves in concert with the U.S. to tame prices could also adjust their timing if needed.

According to Goldman Sachs, the plunge in oil prices in recent days was excessive, and traders “far overshot” the potential impact of the Omicron Covid variant on global oil demand, pricing in a massive 7-million-b/d slump. Oil prices collapsed on Friday after the WHO characterized omicron as a “variant of concern,” especially if it escapes existing vaccine protection.

The US administration plans to propose revisions to the amount of biofuels oil refiners must blend into their fuel mix. President Biden’s administration has delayed decisions on 2021 blending obligations by more than a year, and it missed a deadline to finalize 2022 obligations this week. The delays came as the COVID-19 pandemic hammered fuel demand and Democratic lawmakers focused on other legislation. The oil and biofuel industries have called for the EPA to announce the proposals, saying delays have created uncertainty for the market.

International Energy Agency: “The deliberate policies of energy producers” are to blame for the soaring gas and electricity prices in Europe, the head of the IEA said last week. Fatih Birol also made a point of saying Europe’s energy crisis had nothing to do with the transition to renewable energy, though, as before, he did not explain why he believed there is no link.

A report from the IEA showed that renewable energy should account for nearly 95% of the increase in power capacity in the world through 2026, with solar power providing more than half the boost. The milestone comes despite rising costs for materials used to make solar panels and wind turbines. This year, new renewable power capacity will increase to a second consecutive all-time high in 2021, the agency said in its annual Renewables Market Report. “This year’s record renewable electricity additions of 290 gigawatts are yet another sign that a new global energy economy is emerging,” said Fatih Birol. “The high commodity and energy prices we are seeing today pose new challenges for the renewable industry, but elevated fossil fuel prices also make renewables even more competitive.”

OPEC+: The most anticipated event of last week – a decision from OPEC+ on whether it would halt its monthly 400,000 b/d oil production increase – ended up being a non-event as the countries agreed to stick with the original plan. However, they maintained the option to reverse that decision if necessary. While oil prices initially fell on the news, details about the caveats involved placated the market’s fears of OPEC+ disregarding Omicron risks. First, OPEC+ vowed to reconvene quickly if market conditions shift. Second, countries that have overproduced their quotas will see their upcoming production targets capped to balance their annual numbers.

OPEC+ again failed to hit its target production level, falling 34,000 b/d short. Under the OPEC+ deal, the ten actual OPEC members bound by the pact should be raising their combined production by 254,000 b/d each month out of the total OPEC+ monthly supply addition of 400,000 b/d. According to the Reuters survey, in November, OPEC’s crude oil production increased by 220,000 b/d to 27.74 million b/d. Thus the rise fell short increase that OPEC members should be implementing. With the exception of the Gulf Arabs, other OPEC members in Africa and South America are faced with declining or lower-than-expected production.

According to an internal report prepared for the meeting of the Joint Technical Committee, global oil stocks are set to rise faster than previously expected. As a result, OPEC+ expects global oil supply to exceed demand by as much as 3 million b/d during the first quarter of next year. The report analyzed oil market conditions before the Friday plunge in oil prices.

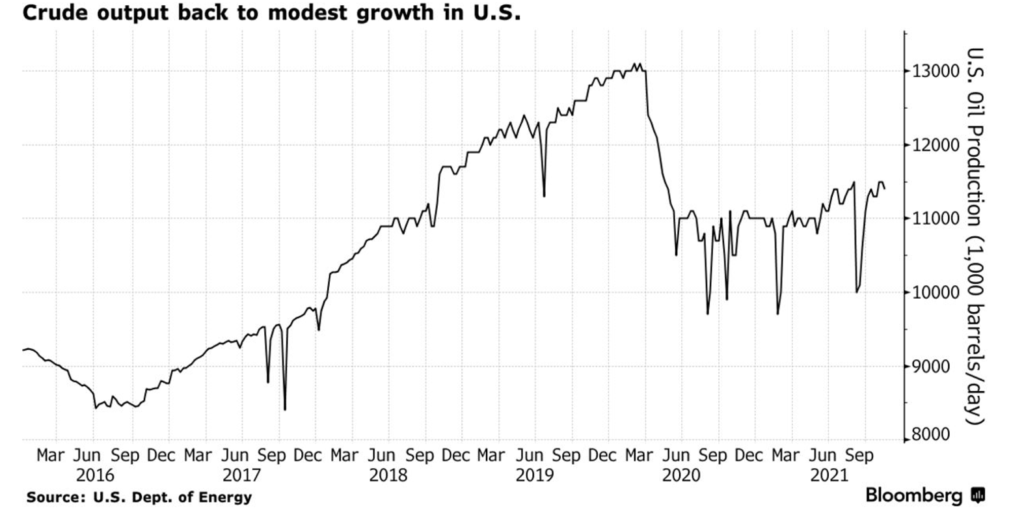

Shale Oil: US shale drillers will increase capital spending by nearly a fifth next year as they deploy more rigs and face more inflation, according to Rystad Energy. Expenditures will rise to $83.4 billion in 2022, the highest since the Covid-19 pandemic emerged in early 2020, with more than half of the increase due to “service price inflation.” However, that amount still is about a third lower than forecast levels in 2019, indicating that companies are more disciplined about basing production decisions on near-term changes in crude prices. Closely held explorers have expanded drilling aggressively this year to take advantage of higher oil prices while their publicly listed rivals resisted that urge and diverted cash to shareholders. In 2022, however, both groups will significantly increase budgets, the analysts wrote.

The US shale industry moderately increased drilling activity, having largely depleted the inventory of drilled by uncompleted (DUC) wells at the fastest clip in history so far this year. Completing DUCs costs much less than drilling a new well, so US operators have resorted to the backlog of DUCs. As a result, US shale producers raked in record cash flows amid rallying oil and gas prices for the third quarter. At the same time, the reinvestment rate among shale-focused firms, excluding the majors, hit an all-time low in Q3 and is set to decline this quarter further.

Shale drillers’ newfound commitment to production discipline appears to be paying off as crude plunges toward a bear market. While West Texas Intermediate crude is poised for the largest monthly loss since the beginning of the coronavirus pandemic, its collapse isn’t dragging down equities the way it used to. The S&P Oil & Gas Exploration & Production ETF is notably outperforming the US benchmark, and 3 of the top 10 stocks in the S&P 500 Index this year are oil companies: Devon Energy, Marathon Oil, and Diamondback Energy. “It looks like the market is starting to reward better behavior by producers,” said a Houston-based money manager.

Natural Gas: US gas prices retreated as mild temperatures and fuel-switching to coal reduced the chance stocks will fall to critically low levels by winter’s end. Front-month futures have retreated to $4.10 per million BTUs, down from a peak of $6.30 in early October, which was the highest level in real terms since the financial crisis of 2008.

Asian LNG prices fell last week as spot demand from China remained muted despite the start of winter. But the drop in prices was kept in check by outages in Australia, which curbed cargo loadings. As a result, the average LNG price for January delivery into Northeast Asia fell to $34.60 per metric million BTUs, down $1.50.

In the coming decades Asia plans to reduce emissions from its power generation sector by replacing coal capacity with gas-fired electricity generation. As a result, Asia’s natural gas demand is set to nearly double by 2050. LNG suppliers are confident that strong gas demand growth in Asia in the coming decades will underpin the development of more projects this decade. In November, China was the top destination for US LNG. A shift in U.S. trade flows from Brazil to China came as strong US Gulf Coast netbacks incentivized deliveries to Asia even as congestion at the Panama Canal made the voyage longer and potentially more costly.

Russia has not materially increased natural gas supply via its pipelines to Europe, despite assurances from President Putin that Gazprom would start sending more gas after it completes filling Russian storage. Gas flows on the Yamal-Europe pipeline via Belarus to Poland and Germany were low or non-existent on some days and at times reversed to flow eastward from Poland. The uncertainty over how much additional volumes Gazprom would ship on top of its contractual obligations has kept European benchmark gas prices volatile over the past month.

Germany said last week it was continuing to work closely with the US on implementing a deal on the Nord Stream 2 pipeline. The Biden administration has waived sanctions on the pipeline operator and made a deal with Germany in July. However, last week it imposed further sanctions targeting Russia-linked Transadria and its vessel.

Plans by some nations to end the financing of gas exploration will prove a “fatal cost” for several emerging African economies, Senegal President Macky Sall said at the start of the China-Africa Summit. Like several other African countries, Senegal sits on billions of cubic meters of gas reserves. It is expected to become a major gas producer in the region, which will boost power supply and potentially spur double-digit economic growth from 2023.

Prognosis: The new Omicron variant of Covid-19 could cost the global oil market as much as 2.9 million b/d of demand early next year. A decline of this size would bring total demand down to 95.7 mb/d if it triggers more restrictions. That’s according to Rystad Energy, which warned that, if the variant spreads rapidly, oil demand could fall by 1.3 mb/d, to 97.8 mb/d, in December 2021 and by 4.2 mb/d, to 94.2 mbd, in January 2022. However, the company noted that as countries and governments learn to live with the Omicron variant or vaccine manufacturers adapt existing shots to counter the variant, the full-year impact will likely be less severe.

The world’s major banking houses are all over the map in their forecasts for oil prices for 2022, with the problem being the uncertainty about the Omicron virus’s impact on oil demand. In addition, concerns about how much OPEC can increase production are also being raised. Goldman Sachs commodity analysts remain moderately bullish on oil prices and see “obvious upside risks.” The Goldman analysts explained that US shale oil producers would likely continue to stick to their cautious approach to production growth, especially after the latest price drop.

Oil and gas analysts at Standard Chartered note that the likelihood of prices regaining $85 per barrel quickly appears limited. “Most of the rally that took Brent from below $70 per barrel in May to over $86 per barrel in late-October has unwound,” the analysts said in a market note. “We think the rally was a bubble based on a view that $100 per barrel was imminent, a view which resulted from significant overstatements of market tightness and demand.”

However, JP Morgan Global Equity Research says oil prices are expected to overshoot $125 a barrel next year and $150 in 2023 due to capacity-led shortfalls in OPEC+ production. “As OPEC+’s real volume potential is discovered, this should drive a higher risk premium to oil prices,” the bank said. “OPEC+ is not immune to the impacts of underinvestment…. We estimate ‘true’ OPEC spare capacity in 2022 will be about 2 million b/d (43%) below consensus estimates of 4.8 million,” the team wrote in a note. JP Morgan analysts don’t expect surplus global oil supply in the first quarter of next year. Instead, they note that OPEC+ might need to add a few more installments of 400,000 bpd monthly to bring the market closer to balance.

Chris Wood, global head of equity strategy at Jefferies, said, “In a fully reopened world, the oil price could go to $150 because the supply constraints are dramatic.” In recent years, the demonization of oil and gas, or as Wood described it—the “political attack”—on fossil fuels, has reduced investment in the industry, which still supplied 84% of global energy demand in 2020.

Deutsche Bank expects crude oil prices to drop considerably next year, dipping below $60 per barrel at the low end of the range. “It would be misguided to think of an OPEC pause on Thursday as bullish since we have assumed that in our model and still end up with a surplus in Q1,” the Deutsche analysts said.

Recent legislation and last week’s announcement of a release of 50 million barrels from the US Strategic Petroleum Reserve could see America’s strategic stockpiles drop to around 314 million barrels by the start of the 2032 fiscal year. The stockpile is 618 million barrels as of early October 2021, the EIA said on Monday. If strategic crude oil stockpiles nearly halved over the next decade, they would stand in 2032 at their lowest level since March 1983.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Ukraine: Russian Foreign Minister Lavrov has warned that Europe could be returning to what he called the “nightmare of military confrontation.” At a European security conference in Sweden, Lavrov floated the idea of a new European security pact to stop NATO from expanding further east. Ukraine says Russia has amassed more than 90,000 troops there. Moscow denies it is preparing to attack Ukraine and accuses Kyiv of its own military build-up.

US Secretary of State Blinken warned Moscow of the “severe costs” Russia would pay if it invaded Ukraine, urging his Russian counterpart to seek a diplomatic exit from the crisis. Blinken delivered the warning to Foreign Minister Sergei Lavrov at what he called a “candid” meeting in Stockholm and said it was likely that Presidents Biden and Putin would speak soon.

President Vladimir Putin countered that Russia would be forced to act if US-led NATO placed missiles in Ukraine that could strike Moscow within minutes. As a result, Ukraine, a former Soviet republic that now aspires to join the European Union and NATO, has become the main flashpoint between Russia and the West. Relations have soured to their worst level in the three decades since the Cold War ended. Moscow perceives Ukraine as drifting into the Western sphere of influence. In the long run, this could weaken Russia’s status and economic position as the energy transition moves on.

Belarus: President Lukashenko said last week that he could shut down the transit of energy products if Poland closes its border with his country. The EU has blamed Lukashenko for using the migrants as “pawns,” while Lukashenko attests that something should be done about the humanitarian crisis. Lukashenko escalated tensions by indicating he is “serious” about halting energy products from Russia. However, Moscow played down the renewed threat. The Kremlin said on Dec. 1st that Belarus is a sovereign state able to carry out its own actions but added that President Putin expected the issue would not disrupt Moscow’s gas supply commitments.

Iran: After a break of more than five months, talks on reviving the 2015 Iran nuclear deal resumed last week in Vienna. With a more conservative government in Iran and a new set of Iranian negotiators who have said talks need to start with a complete lifting of sanctions, the mood was somber among Western negotiators.

The talks ran into difficulties Thursday, following a report by the International Atomic Energy Agency that Iran has again escalated its uranium enrichment despite renewed diplomacy. In the report, distributed to negotiators late Wednesday, the UN body responsible for monitoring Iran’s nuclear program said Iran is enriching uranium to 20% purity using advanced centrifuges at its Fordow facility. The original deal prohibited any enrichment at all.

The report drew an immediate angry response from Israel. In a phone call with Secretary of State Blinken, Israeli Prime Minister Naftali Bennett urged the U.S. to call off the talks immediately, accusing Iran of using “nuclear blackmail” as a negotiating technique.

One big question looms: Has Tehran advanced its nuclear work so much in the past two years that the 2015 deal can no longer be rescued? Restoring the pact, which placed limits on Iran’s nuclear activities in exchange for relief from economic sanctions, is a top foreign-policy goal of the Biden administration. However, Iran’s new president has delayed restarting talks while pressing ahead with nuclear work. In recent months, Iran has taken steps it had never taken before, including producing 60% enriched uranium, a small step from weapons-grade atomic fuel. Iran says its nuclear work is for nuclear energy and other peaceful purposes.

Iran, an arid and semi-arid country, is struggling with decades-long drought and rapid depletion of its water resources, a problem exacerbated by a growing population. Farmers near Isfahan are among the worst hit, arguing they have lost out as the government prioritized water to cities and industry. As protests grew, President Raisi ordered a new committee to look into the revival of Isfahan’s river. Vice-president Mokhber said the water problems would be resolved. “Each time there is a significant protest the regime loses a support base – this time it is the farmers- but it does not seem to worry anyone in the political system,” said an Iranian analyst.

Iraq: In November, federal oil exports, excluding flows from the Kurdistan region, rose 5% month on month to 3.27 million b/d, amid a higher OPEC+ quota. OPEC’s second-biggest producer is scheduled to have a higher quota of 4.23 million b/d in December.

The deterioration in national security due to climate change is a significant worry for Iraq’s Minister of Environment, Dr. Aziz al-Falahi. “We do not have water and food security,” he said in a recent interview. “I think these might result in what is called internally displaced populations. So, it has a great impact on our national security.”

Over-dependence on oil for government revenue, low investment in infrastructure, and reliance on cross-border water sources mean that Iraq is one of the world’s most vulnerable countries to the effects of climate change. Already, severe drought has forced agricultural workers to move into cities, further straining inadequate water and electricity distribution networks and increasing pollution. Iraq wastes about half the natural gas it produces, burning it off in flaring rather than using the valuable commodity for power generation.

Libya: As Libya prepares to hold its first-ever presidential election this month, many Libyans fear that the contest may push the country back into turmoil. Among the 98 people who have registered to run for President are two of the most divisive figures in recent Libyan history: Gaddafi’s son, Saif al-Islam Gaddafi, who the International Criminal Court wants on charges of crimes against humanity, and Khalifa Haftar, a warlord based in eastern Libya who carried out a year-long siege of the capital. In addition, interim prime minister Abdulhamid Dbeibah, who had previously pledged not to enter the race, has also registered to run.

Those three figures command allegiance among rival segments of the Libyan population. None is likely to emerge as a unifying figure. On the contrary, many Libyans are afraid the election could stir renewed passions and grievances, plunging Libya back into civil war.

While Libya is a resource-rich country with the largest oil reserves in Africa, a decade of unrest has impoverished many in the country and made it a proxy battleground for foreign powers that have at times intervened with thousands of foreign fighters. Many fear the worst if either Haftar or Gaddafi wins.

Shell is considering a return to Libya with a plan to develop new oil and gas fields and infrastructure a decade after exiting the North African country because of unrest. The program marks a rare recent foray by the energy major which has promised to cut fossil fuel investment and slash greenhouse gas emissions. However, Shell still needs some new projects to maintain output since reserves in existing oil and gas fields have rapidly fallen after years of reduced drilling activity. Under its new plan, Shell would explore oil and gas fields in the onshore Sirte and Ghadames basins and the offshore Cyrenaica basin.

Venezuela: Oil production by Venezuela’s state PDVSA and its foreign partners rose to 660,000 b/d in November, up 40,000 from October. The recovery of production, especially in the Orinoco Belt, has been made possible by importing diluents from Iran. The 8.5% API extra-heavy crude extracted from the Orinoco Belt can only be marketed if it undergoes an upgrading process by blending it with light crude, condensates, or naphtha.

PDVSA’s diluent inventories, used to upgrade extra-heavy crude, totaled 1.7 million barrels in November, the highest level since 2019 when its naphtha and light crude imports were halted due to US sanctions. Diluent inventories had reached their lowest level of 12,000 barrels in September when PDVSA then received condensate imports from Iran, a country facing US sanctions. In end-September, PDVSA received 2 mb of condensate from Iran, and on Oct. 25th, a second of 2.1 mb. A cargo of Iranian condensate intended for Venezuela’s state-run oil company, PDVSA, the fourth delivery this year, will discharge at the country’s main oil port in the coming days.

Cyprus: Turkey threatened to block any unauthorized search for gas and oil in its exclusive economic zone in the eastern Mediterranean after Cyprus awarded hydrocarbon exploration and drilling rights to Exxon Mobil and Qatar Petroleum. A part of the license area in question violates Turkey’s continental shelf in the eastern Mediterranean.

In recent years, the disputed eastern Mediterranean has become an energy hot spot with significant natural gas finds for European Union member Cyprus, Israel, and Egypt. Turkey’s push to secure a share of the resources has exacerbated strains between historic rivals. As a result, the European Commission has urged Turkey to pursue de-escalation in the region while vowing to defend the interests of member states Greece and Cyprus if it didn’t.

3. Climate change

A record amount of renewable electricity was added to energy systems globally in 2021. Still, it remains about half of what is needed annually to be on track to reach net-zero emissions by 2050, according to the IEA. New renewable power capacity is forecast to reach 290 gigawatts this year, surpassing last year’s record of 280GW, said the IEA in its annual review of renewable energy. This compares with the current fossil fuel and nuclear power capacity of 4,800GW.

However, higher commodity prices, which were driving up the cost of producing and transporting solar panels and wind turbines, threaten to undermine investments in the short term, the report said. The global energy supply shortage “definitely provides a setback, but at the same time, it shows us the way out,” Fatih Birol, head of the IEA, told the Financial Times.

The IEA said in a report that France is not acting fast enough to meet its energy and climate targets. The country’s electricity market needs a more explicit policy strategy, it said. “By investing much more in energy efficiency, renewable energy, and nuclear power, France can accelerate progress on its key energy and climate goals,” said IEA Executive Director Fatih Birol.

A group of the world’s biggest asset owners is proposing to dramatically escalate joint public-private financing ventures in a bid to help developing countries weather the climate crisis. “This is a call for action,” said Nadia Nikolova with Allianz Global Investors, one of the Net Zero Asset Owner Alliance founders, which put forward the plan. The IEA estimates that the developing world needs more than $1 trillion annually to support the necessary transition to clean energy.

The planet’s warming is transforming the sprawling and fragile Arctic, moving it toward a future with less snow and more rain. But now, researchers say that unprecedented shift — and the profound impacts that are likely to accompany it — could come decades sooner than previously thought. According to new findings published in the journal Nature, the Arctic could become dominated by rain rather than snow during certain seasons by 2060 or 2070.

Melting permafrost could release massive amounts of planet-heating gases such as methane and carbon dioxide. In addition, the “greening” of once-frozen landscapes could provide fuel for ravenous wildfires that spew more greenhouse gases into the air and further warm the atmosphere. “What happens in the Arctic doesn’t stay in the Arctic,” Michelle McCrystall, a lead author of Tuesday’s study, said in an interview.

Desertification is a natural disaster playing out in slow motion in areas home to half a billion people, from northern China and North Africa to remote Russia and the American Southwest. The process does not generally lead to rolling sand dunes that evoke the Sahara. Instead, higher temperatures and less rain combine with deforestation and over-farming to leave the soil parched, lifeless, and nearly devoid of nutrients, unable to support crops or even grass to feed livestock.

That has made it one of the significant threats to civilization’s ability to feed itself. “There is a huge body of evidence that desertification already affects food production and lowers crop yields,” said Alisher Mirzabaev, an agricultural economist at the University of Bonn in Germany, who helped write a 2019 United Nations report on the topic. “And with climate change, it’s going to get even worse.”

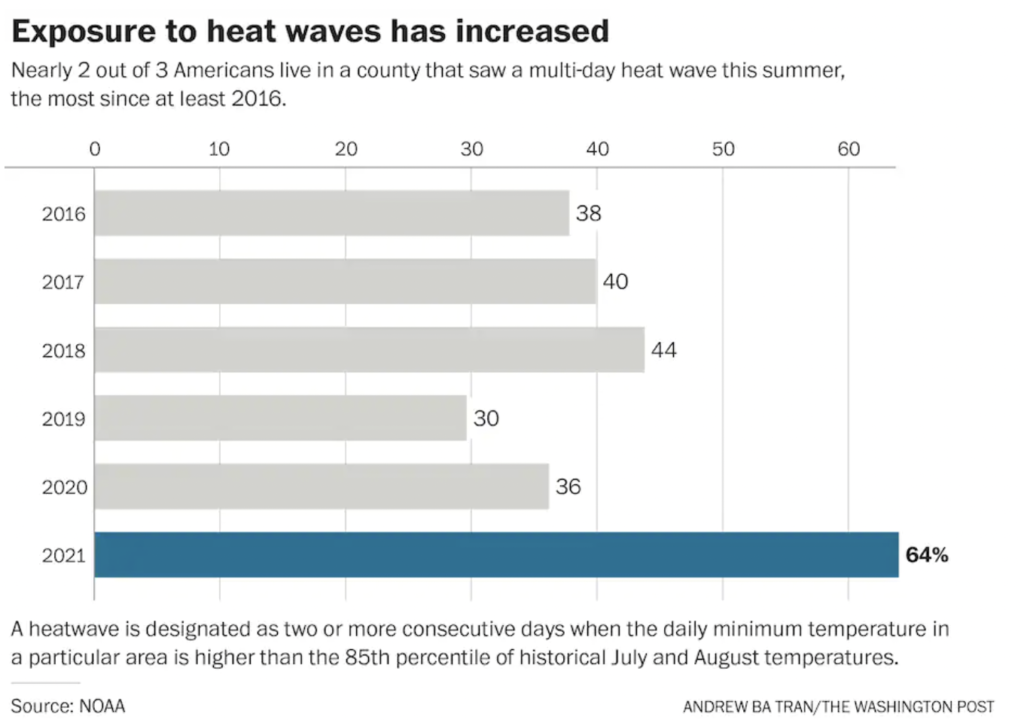

Legislators, scientists, and a think tank are convening to better adapt to the most lethal weather phenomenon — by categorizing and naming it in major US cities. In January, California Insurance Commissioner Ricardo Lara and other delegates will formally introduce legislation to rate and name heat waves in Los Angeles — potentially establishing the nation’s first ranking system for such occurrences. The categorization would help communities reduce the number of heat-related fatalities.

Heatwaves have a particular impact in Southern California, where they have become more frequent, intense, and longer lasting over the past five decades. Los Angeles is predicted by 2050 to experience an average of 22 extreme heat days annually — up from six days in the period from 1980 to 2000.

4. The global economy and coronavirus

Health officials say that the new coronavirus variant Omicron has become dominant in South Africa and is driving a sharp increase in new infections. Some 11,500 new Covid infections were registered in the latest daily figures. That is a sharp rise from the 8,500 cases confirmed the previous day. By contrast, daily infections averaged between 200 and 300 in mid-November.

According to the World Health Organization, Omicron has now been detected in 24 countries worldwide. Those who have already had other variants of coronavirus do not appear to be protected against Omicron, but vaccines are still believed to protect against severe disease.

The chief executive of Moderna has predicted that existing vaccines will be much less effective at tackling Omicron than earlier strains of coronavirus. He warned it would take months before pharmaceutical companies could manufacture new variant-specific vaccines at scale. The high number of Omicron mutations on the spike protein, which the virus uses to infect human cells, and the rapid spread of the variant in South Africa suggested that the current crop of vaccines may need to be modified next year.

United States: New York state reported 11,300 new Covid-19 cases, the most since January. As of Thursday, 56 hospitals in the state had a bed capacity of 10% or less. Governor Kathy Hochul last week issued an executive order, which took effect Friday, allowing state officials to limit non-essential hospital procedures to increase bed capacity and address staffing shortages.

The Biden administration will allow all international travelers to enter the US as long as they have received any vaccine authorized by the World Health Organization, even the relatively untested Chinese-made Sinovac and Sinopharm jabs. The proclamation was accompanied by detailed instructions for airlines, which will be expected to enforce the new vaccine mandates. Under the rules, anyone who has been inoculated with one of the seven vaccines authorized by the WHO will be allowed to enter the US by land or air.

US consumer confidence decreased to a nine-month low in November as accelerating inflation and a pickup in Covid-19 cases weighed on Americans’ views on the economy. Goldman Sachs economists cut their forecasts for the US economy this year and next after deciding the spread of the Omicron strain of the coronavirus would exert a “modest downside” drag on growth. Goldman Sachs now expects US gross domestic product to expand 3.8% this year, down from 4.2%. It reduced its 2022 estimate to 2.9% from 3.3%.

Hundreds of thousands of empty shipping containers are filling marine terminals in Southern California and truck yards across the region and tying up scarce trucking equipment as ocean carriers scramble to return empty boxes to factories in Asia. The gridlock on the export side of US supply chains mirrors the congestion tying up imports, and officials say it is complicating efforts to unwind the bottlenecks at the ports of Los Angeles and Long Beach.

Europe: Germany has tightened curbs on unvaccinated people and paved the way for mandatory Covid-19 vaccinations next year as it ramps up pressure on those refusing to be vaccinated. The country has hit its highest level of Covid infections since the pandemic began, putting unprecedented strain on hospitals.

A meeting last week of senior officials from across the country decided to hold a vote in the Bundestag on whether to make vaccines mandatory, which would be likely from February. They also issued a decree that will require shots for workers at care homes and hospitals, similar to rules in Greece, Italy, and France. The idea of mandatory vaccines is under growing scrutiny in Europe. Ursula von der Leyen, the European Commission president, called this week to discuss a “common approach” to compulsory vaccinations. Austria last month said it would make vaccines mandatory. The German regulations laid out on Thursday will severely curb access to public and private activities for the unvaccinated.

European energy prices surged to record highs in autumn as tight gas supplies collided with high demand in economies recovering from the COVID-19 pandemic. While gas prices have retreated from the record highs in October, they remain relatively high. Energy ministers from the European Union’s 27 member countries met on Thursday to debate their response to energy prices. In a joint statement, Germany, Denmark, and seven other EU countries opposed overhauling the bloc’s electricity market in response to high energy prices, a move they said could increase the cost of adding renewable energy to the system in the long run.

With last week’s announcement in the UK that all new homes in the country will be required to have an EV charging point as part of its EV revolution, it begs the question – should government further mandate EV uptake? As countries around the globe strive for net-zero carbon emissions, will governments opt for bans on the sale of fossil fuel motor vehicles, will they rely on incentives and tax breaks, leave it up to individual choice, or let fossil fuel prices rise to where they are no longer affordable?

China: The country could face more than 630,000 COVID-19 infections a day if it dropped its zero-tolerance policies by lifting travel curbs, according to a study by Peking University mathematicians. In the report published in China CDC Weekly, the mathematicians said China could not afford to lift travel restrictions without more efficient vaccinations or specific treatments. Using data for August from the US, Britain, Spain, France, and Israel, the mathematicians assessed the likely results if China adopted the same pandemic control tactics as those countries.

China’s economy will become more dependent on its domestic market, former Chongqing mayor Huang Qifan said. Foreign trade accounted for 64% of China’s economy in 2006 and will gradually decline to about 25%, Huang said at a meeting in Guangzhou. The domestic market will grow as the middle-income population increases, he said.

China’s manufacturing purchasing managers’ index, or PMI, rebounded to 50.1 points in November, an expansion in manufacturing activity for the first time in two months but still the third lowest in 21 Months. China’s PMI was seen at 49.2 points in October and 49.6 points in September. Power shortages eased in November, leading to improved manufacturing production in China. However, new orders have now remained in contraction for four straight months. Similarly, new export orders contracted for the seventh month.

In line with market expectations, the average utilization rate at China’s four state-owned refiners rebounded by 2% to 82.6% in November, from a five-month low of 80.6% in October, while independent refiners also raised run rates with refining margins remaining good. This will likely continue to support the country’s crude throughputs in November after it rose 0.8% on the month to 13.81 million b/d in October from a 17-month low in September.

Record high spot LNG prices have triggered China’s rush for long-term LNG contracts with the US. Still, the deals also reflect pent-up demand for uncontracted volumes, attractive pricing offered by suppliers, the benefits of US LNG like destination flexibility, and optimism about future demand growth. Moreover, the deals come amid signs of cooperation between Beijing and Washington on trade, climate, and energy, and with China effectively becoming the world’s single-largest LNG importer, surpassing Japan. So far this year, at least eight Chinese companies, including state-owned national oil companies, have signed nearly a dozen long-term contracts with overseas suppliers, for a volume of almost 25 million mt/year, more than half of which were signed in the September-November period.

China expects to hold the 2022 Winter Olympics “smoothly” and on schedule, despite challenges posed by the Omicron coronavirus variant. A Foreign Ministry spokesman Zhao said, “I believe it will pose some challenges to our efforts to prevent and control the virus. Beijing is set to stage the Games from Feb. 4th to Feb. 20th, without foreign spectators and with all athletes and related personnel contained in a “closed-loop” and subject to daily testing for COVID-19. Under its “zero-COVID” policy, China has had what are among the world’s strictest COVID-19 prevention measures.

Russia: Last week inflation jumped to the highest level since July, adding weight to the case for the Bank of Russia to deliver another significant increase in its key interest rate later this month. Consumer prices rose 0.46% in the week ended Nov. 29th, more than double the pace the week before. The agency blamed higher costs for a range of foods, the ruble decline, and a surge in prices for Turkish New Year vacations for the increase.

According to the Russian energy ministry’s data, Russia produced around 10.89 mb/d of crude and condensate in November. Production volumes have risen over the last year in line with increases to OPEC+ quotas. The group has been relaxing production cuts in response to growing demand and recovering markets amid vaccine rollouts and governments easing lockdowns.

Deputy Prime Minister Alexander Novak claimed that the country’s oil companies are ready to raise production to pre-pandemic levels. If OPEC+ sticks to the original agreement of bringing 400,000 b/d of oil online each month, that would see Russia reach pre-pandemic levels by May. All Russian oil companies have confirmed they can raise production to the levels before the pandemic if the alliance chooses to proceed with monthly increases in output.

Russia’s Gazprom reported a record quarterly net profit of $7.8 billion for the third quarter, reflecting high natural gas prices. It said it expected even higher earnings during the 4th quarter. Gas prices have surged on tight supply to record highs in Europe, Gazprom’s key source of revenue. Windfall revenues from high European gas prices mean Russia’s Gazprom will likely not start pumping gas through the Nord Stream 2 pipeline before certification, and it will likely not press Germany to speed up the process. Pumping gas without German approval would only incur a modest fine. Still, as Germany gets new political leadership and Russia’s ties with the West are severely strained, a source at Gazprom said it was content to wait.

Saudi Arabia: Aramco expects its Jafurah shale play to yield up to 2 billion cf/d of gas, 418 million cf/d of ethane, and 630,000 boe/d of gas liquids and condensates by 2030, as the company ramps up its development of unconventional resources. Awarding engineering and construction contracts worth $10 billion for work on the field, Saudi Aramco said the projects would expand its gas production while providing feedstock to support growth in its chemicals and hydrogen sectors. Jafurah is located in Saudi Arabia’s Eastern Province and is the kingdom’s largest discovered non-associated gas reservoir with some 200 trillion cf of resources.

United Arab Emirates: The Abu Dhabi National Oil Company will invest as much as $127 billion in upstream, downstream, and low-carbon fuel businesses between 2022 and 2026. With the 5-year capital spending plan, the company looks to “further stimulate growth and diversification.” Alongside its capital spending for the next 5 years, the company announced an increase in its national reserves of 4 billion barrels of oil and 16 trillion cubic feet of natural gas.

5. Renewables and new technologies

Commonwealth Fusion Systems said it had raised more than $1.8 billion in the most significant private investment for nuclear fusion yet as startups race to be the first to generate carbon-free energy like the sun. Big-name investors backing the latest funding round for the Massachusetts-based company include Microsoft co-founder Bill Gates and George Soros via his Soros Fund. Some of Commonwealth Fusion’s competitors, including Helion Energy Inc., have recently secured massive funding as investors pile into clean energy technologies.

Italian energy company Eni is ready to invest more in a nuclear fusion project it feels could be a game-changer in the race to produce limitless clean electricity to power cities and industry, the head of the project at Eni said. In 2018 Eni injected $50 million, as starting investment, to become the single biggest shareholder in Commonwealth Fusion System (CFS), a firm set up by the Massachusetts Institute of Technology to produce energy by fusing atoms at temperatures as hot as the sun. CFS is in a new round of financing for its next 2025 deadline. But despite decades of research, no one to date has been able to produce net energy through fusion—or more energy than it takes to create a fusion reaction.

BP confirmed it is planning a new large-scale green hydrogen production facility in the Northeast of England to deliver up to 500MWe of hydrogen production by 2030. To be developed in multiple stages, HyGreen Teesside is expected to match output to demand and build on experience to drive down costs. BP aims to start production by 2025, with an initial phase of some 60MWe of installed hydrogen production capacity. A final investment decision on the project is expected in 2023.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Shipping boom: The ten leading publicly listed container shipping lines are on track to earn a record $115 billion to $120 billion in profit in 2021, a windfall that could transform the industry’s structure as those earnings are reinvested. (12/2)

Shipping: The record volume of cargo moving through the US’s busiest port complex is likely to continue amid high consumer demand for goods, the Port of Long Beach head said. (12/2)

Shipper desperate: CMA CGM Group, one of the world’s biggest ocean carriers, is dangling incentives of as much as $200 a container for help in clearing the backlog at Southern California’s ports. (11/30)

In the UK, Royal Dutch Shell pulled out of a controversial oil project, leaving the development of a new North Sea field hanging in the balance. Environmental groups have campaigned against Cambo, saying the project is at odds with the UK’s goal of reaching carbon neutrality by 2050. Despite that opposition, CEO Ben Van Beurden publicly supported the field until recently, arguing that the investment was needed to slake ongoing British demand. (12/4)

Norway’s oil and gas production revenues hit a record high this year and shows no signs of slowing down. While Norway is a significant supporter of clean energies, it is also a firm believer that the energy transition can only be achieved by using oil and gas production profits. (11/29)

Offshore Angola, TotalEnergies, started production of CLOV Phase 2. The tie-back project is expected to reach production of 40,000 boe/d in mid-2022. Phase 2—which lies about 140 km from the Angolan coast in water depths of 1,100-1400 m—was launched in 2018 and contained resources estimated at 55 MMboe. (12/4)

Nigerian independent oil and gas company Seplat Energy and a partner are in competitive discussions to acquire ExxonMobil’s Nigerian shallow water business. This year, the company has divested some of its assets in Africa, selling an 80% interest in a Ghanaian offshore block and proposing to offload its stake in the Doba oilfield in Chad. (12/2)

Offshore Guyana. ExxonMobil’s success sees it forecasting that it will be pumping over 800,000 barrels of light sweet crude oil per day by 2026. Last year, a report from Wood Mackenzie predicted Guyana will be pumping 1.1 million b/d by 2027, making it the 11th country to reach the 1 million milestone. (12/1)

Through a Canadian regulator’s decision last week, Enbridge lost a chance to secure shipping contracts for as long as 20 years and could lose volume to its rival, Canadian government-owned Trans Mountain, which has sold space under long-term agreements for its expanded capacity that is due for completion in late 2022. (12/1)

The US oil rig count stayed flat at 467, while gas rigs stayed at 102, according to Baker Hughes Co. (12/4)

Methane leaks: The House Science Committee has notified the chief executives of ten major oil companies that they must disclose more data about their methane emissions, a potent greenhouse gas, in one of America’s biggest oil and gas producing regions. The lawmakers said the companies’ current approach to monitoring methane emissions in the Permian Basin is inadequate. (12/4)

A US national security review has delayed the sale of Royal Dutch Shell’s controlling interest in a Texas refinery to Mexico’s national oil company Pemex. (12/1)

O&G employment: The oil and gas industry risks a considerable workforce shortage as more than half of workers in the sector seek to move into the renewable energy industry, a survey published on Tuesday showed. The survey showed that 43% of workers want to leave the energy industry altogether within five years. (12/1)

Exxon Mobil will award most US employees below-inflation pay increases—averaging 3.6%–in early 2022 despite a strong rebound in earnings over the past 12 months. The highest average increases will be awarded to employees working in the so-called upstream division that drills oil and natural gas. The pay awards signify how many white-collar Americans aren’t in line for the kind of salary raises seen for other cohorts such as truck drivers and factory workers amid labor shortages and a spike in inflation. (12/4)

Exxon Mobil on Wednesday set annual capital spending through 2027 at $20 – $25 billion, allocating money to low-carbon projects and extending its previously projected investment rate for two years. This year, an oil-price rebound has generated substantial profits that let Exxon pay down debt, maintain its dividend, and fund a new low-carbon business. (12/2)

ExxonMobil has broadened goals to reduce the amount of carbon dioxide released with each barrel of oil it pumps, applying them across company operations but avoiding deeper emissions cuts endorsed by rivals in Europe. The company aims to reduce company-wide greenhouse gas intensity by 20-30% by 2030. Exxon’s previous target was a reduction of 15-20% by 2025. (12/2)

United Airlines is flying a jet with more than 100 passengers from Chicago to Washington, DC, on Dec. 1 using 100% sustainable aviation fuel (SAF), marking the first commercial flight ever using only renewable energy. (12/2)

More SAF: Aemetis, Inc., a renewable fuels company focused on harmful carbon intensity products, has an offtake agreement with American Airlines for 280 million gallons of blended fuel containing sustainable aviation fuel (SAF) to be delivered over the 7-year term of the contract. The agreement’s value is estimated to be more than $1.1 billion. (12/3)

Nissan Motor Co. said Monday it plans to spend $17.6 billion over the next five years to add 20 new battery-powered vehicles to its lineup. The company hopes to recapture a degree of its prominence in the electric-vehicle race after its pioneering introduction of the Leaf EV more than a decade ago. (11/30)

The rental-car industry, long a big bulk-purchaser of new models in the car business, is sharpening efforts to add more battery-powered vehicles to fleets, the latest in a broader global shift among companies embracing greener technologies to cut their GHG emissions. (11/29)

EV charging: Electric vehicle sales have soared by 160% over the past year, and the trend is showing no sign of slowing. More than 300 million new EV charging ports will be required globally by 2040, up from fewer than six million today. The electric vehicle charging market is expected to be valued at as much as $1.6 trillion in the coming years. (11/29)

South African state power utility Eskom sees an opportunity to emerge from years of crisis by shifting from coal-fired power generation towards natural gas and renewables. (12/1)

Coal closure: The Dutch government has agreed on the closure compensation for a 731-MW Onyx coal-fired power plant in Rotterdam. Riverstone, the plant owner, commissioned in 2015, is to receive up to Eur212.5 million ($240 million) to shut the plant and end coal use within two months after certain conditions are met. (12/1)

Coal methane leak: Just inland of Australia’s east coast, a single coal mine run by Glencore Plc emitted 230,000 tons of methane a year in 2018 and 2019, according to satellite data from the European Space Agency. That had the same climate warming impact as the annual pollution from more than 4 million US cars. (11/30)

Another SMR: GE Hitachi Nuclear Energy, an alliance between General Electric Co and Japan’s Hitachi Ltd, will build a small modular nuclear reactor (SMR) with Ontario Power Generation (OPG). OPG will deploy the SMR at its site in Darlington, where it has a license to build a new nuclear power site that it expects to complete around 2028, the company said in a press release. (12/3)

Nuke problem: A design flaw in the reactor pressure vessel could cause a problem that was made public in June at French company EDF’s jointly owned nuclear power plant in China, according to a whistleblower. One of the reactors at the facility in Taishan, which China General Nuclear Power Group operates with state-controlled EDF, was halted in August for maintenance pending the outcome of an investigation into fuel damage. (11/30)

Green H2: Solar power costs in the best Asia Pacific locations are already cheap enough for $2/kg green hydrogen production or lower, Philippe Malbranche, assistant director-general of International Solar Alliance, told delegates at an Asian Reuters energy conference. (4/3)

H2: Two studies—led by a team from Seattle City Light, Pacific Northwest National Laboratory (PNNL), and Sandia National Laboratories—are exploring the potential of shifting from fossil fuel to clean hydrogen as fuel to power medium-and heavy-duty vehicles. (12/2)

La Niña is set to wreak havoc during Argentina’s upcoming summer when soybean and corn plants grow across the Pampas farm belt. Precious little rain will fall in January and February across much of the critical growing region because of the weather pattern. (11/30)

Arctic shipping: Moored off the small Arctic town and port of Pevek in the Akademik Lomonosov — the world’s first floating nuclear power plant and a sign of how President Vladimir Putin’s ambitions for Russia’s far east are taking shape. These days the port part of Moscow’s plan is to open up a major shipping lane through the Arctic and bring natural resources within easier reach. (12/2)

McDonald’s methane problem: With 39,000 restaurants in 119 countries, McDonald’s Corp. serves more beef than any other restaurant chain on the planet — between one to two percent of the world’s total. Cattle belch out large quantities of heat-trapping methane, making beef the most harmful food for the climate, with at least five times the warming of pork or chicken and more than 15-times the impact of nuts or lentils. (12/2)

Plastics: According to a congressionally mandated report released Tuesday, the US ranks as the world’s leading contributor of plastic waste and needs a national strategy to combat the issue, according to a congressionally mandated report released Tuesday. (12/2)