The Long Term Impact Of The Oil Rig Crash

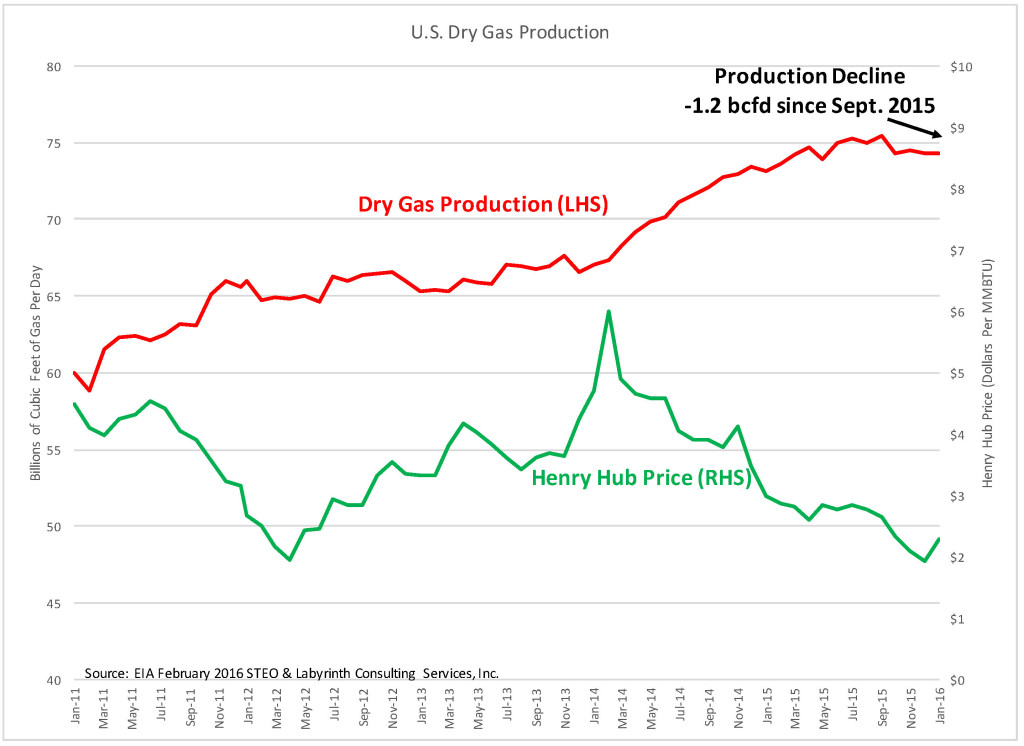

(oilprice.com) The North American Baker Hughes Rig Count came out Friday. The decline continues. Baker Hughes gives an oil and gas breakout for every basin and state with five years of historical data. Baker Hughes has twenty eight and one half years of historical data for total U.S. rigs but only five years for individual basins. Gas rigs peaked in August 2008 at 1,606 rigs, over six years before the peak in Oil rigs. On February, 26, gas total U.S. gas rig count stood at 102, a decline of over 93 percent. A closer look at the total U.S. total rig count.

October 10, 2014 1,609 rigs

February 26, 2016 400 rigs

Percent decline 75 percent