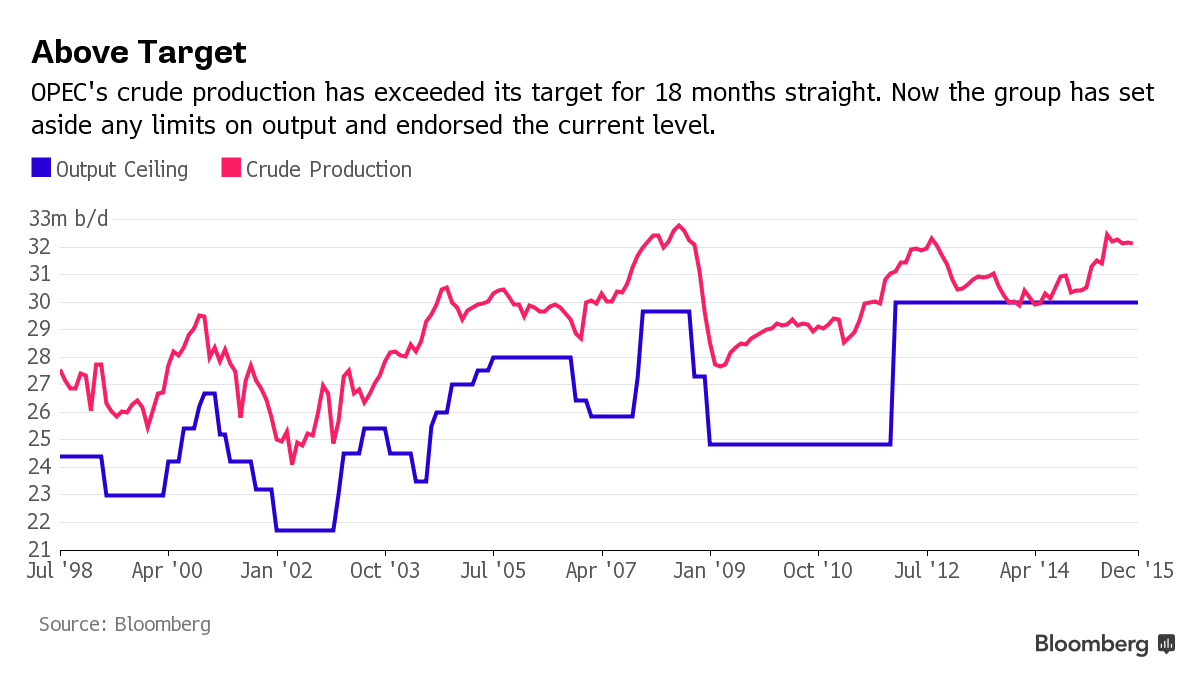

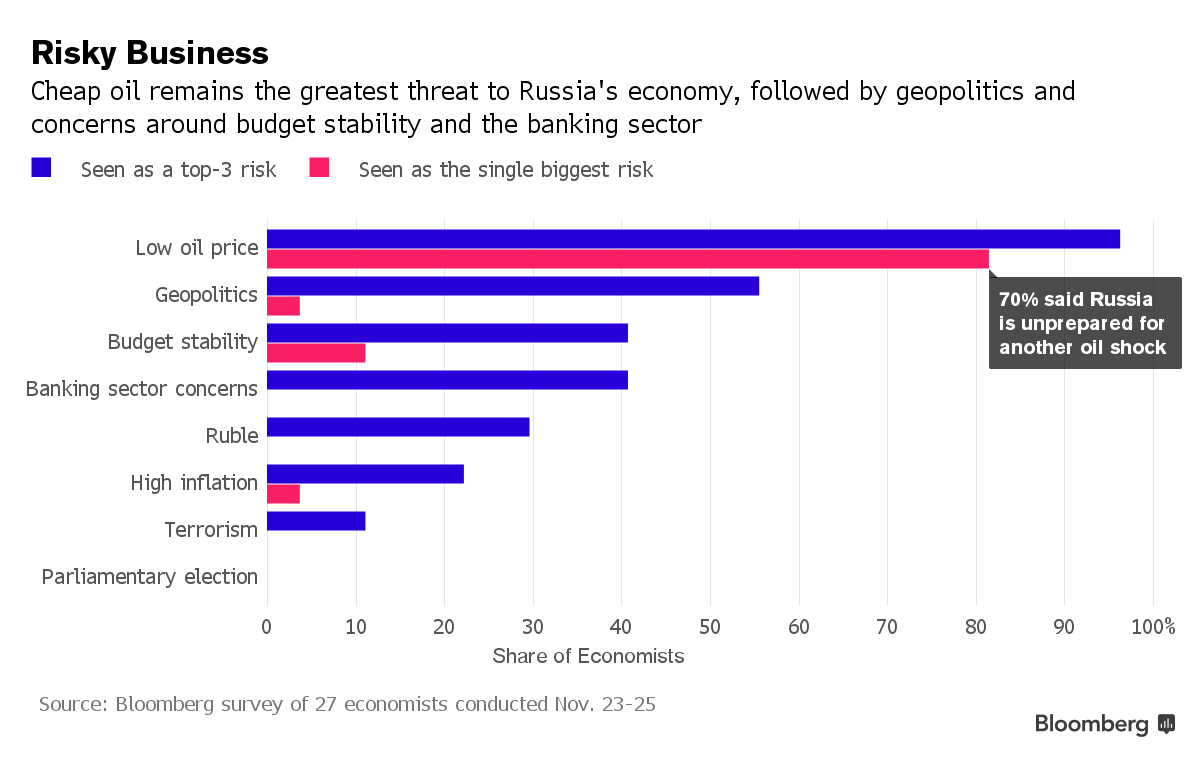

New York oil lost 35 cents last week closing at $40.39 a barrel after having dipped just before settlement to $38.99, the lowest price since August. In London Brent closed up 1.1 percent for the week at $44.66. Prices were weaker in the US as nationwide crude stocks climbed by 252,000 barrels, but stocks at Cushing, Ok storage depot rose by 1.8 million barrels. The US rig count was down by ten last week, after a two-rig increase the week before. Russia and the Saudis continue to pump at or near maximum capacity. Most brokers are expecting that Iran will be back into the markets in the first quarter of 2016 at about 500,000 b/d day to start.