Editors: Tom Whipple, Steve Andrews

Quote of the Week

“We are deeply concerned about the Administration’s decision to, once again, play politics with our fuel system by increasing an already onerous biofuel mandate. If this arbitrary policy was conceived to help farmers, it provides no immediate relief — instead it only further distorts the fuels market.”

Mike Sommers, CEO of the American Petroleum Institute, and Chet Thompson, CEO of the American Fuel and Petrochemical Manufacturers

Graphic of the Week

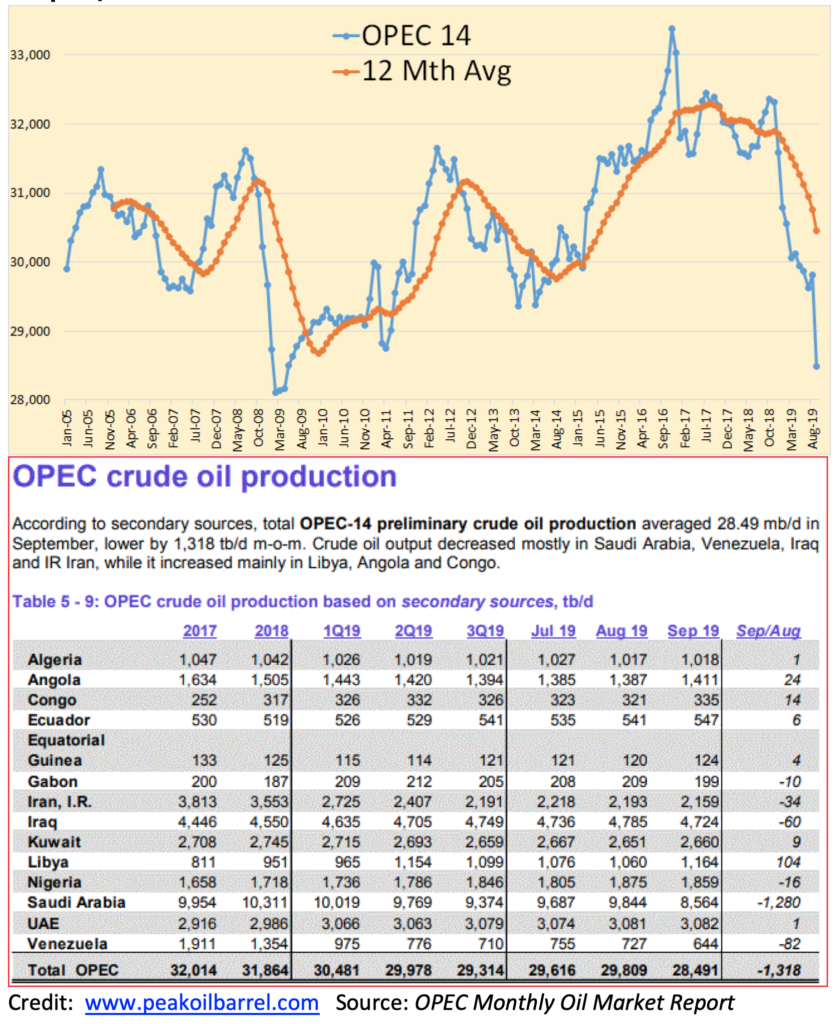

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Briefs 1. Energy prices and production Oil prices rose 2 percent on Friday after the US and China seemed to hammer out a trade deal that postponed tariffs. However, after studying the details – or lack thereof – investors lost much of their enthusiasm. Crude prices were down about 2 percent on Monday on worries that global crude demand could stay under pressure. The few details about the first phase of a U.S.-China trade deal did little to assure a quick resolution to the tariff fight. Some are saying that President Trump’s “Phase I” agreement is little more than terms that Beijing agreed to months ago. Last week’s gains were tempered by the International Energy Agency’s forecast for weakened demand in 2020. The chief executives of oil traders Vitol, Trafigura, and Gunvor, said at the Oil & Money Conference in London last week that oil prices are not going anywhere. Brent Crude will still trade range-bound in the $50s a year from now. The IEA cut its demand forecast once again to just 1 million b/d increase in 2019 and 1.2 million b/d in 2020, a cut of 100,000 b/d for both since the last forecast. The agency also raised its forecast for supply growth from non-OPEC sources by 400,000 b/d. The OPEC Monthly Oil Market Report says the cartel’s crude oil production was down 1,318,000 b/d in September. Most of that decline was due to the Iranian attack on the Saudi oil complex at Abqaiq. Algeria is in a slow decline. Angola is also in slow decline. The Republic of the Congo does not have enough production to be a factor one way or the other. Ecuador will leave OPEC at the end of December. Equatorial Guinea hardly produces enough to make a difference. Gabon is at 200,000 b/d. Iran is trying desperately to overcome sanctions but is not having a lot of luck. Iraqi crude production was down 60,000 b/d in September, but they are still 212,000 bpd above their quota. Kuwait is producing flat out and will continue a slow decline. Oil and gas firms in the US’ 10th District saw a moderate decrease in activity for the third quarter of 2019, according to results of the Kansas City Fed’s 3Q energy survey. While the second quarter saw slight activity increases, oil and gas firms in the 10th District saw a moderate decrease in activity for the third quarter of 2019. Drilling and business activity for energy companies in Colorado, Kansas, Nebraska, Oklahoma, Wyoming, northern New Mexico, and western Missouri fell from 7 to -23, which indicates a significant drop in activity. The Dallas Fed quarterly survey of the 11th District (firms in Texas, northern Louisiana and southern New Mexico) also noted a decrease in 3Q activity. The growth in US shale oil and natural gas production is grinding to a halt as low prices put drillers in a financial vice. The slowdown has been unfolding for much of 2019, but the latest slide in oil prices is another blow to cash-strapped companies. Share prices for many E&Ps are down sharply. Rig counts have fallen by 20 percent since last year, drilling is down, hotel rates are down, and employment is in decline. “If you can’t wring out any costs savings, then you’ve got to buy less stuff if you want to get your costs down, and that’s the phase we’re entering into,” Jesse Thompson, senior business economist. US shale oil plays are “riding the edge of profitability” at current prices, and the industry faces a significant slowdown in fracking activity if crude falls below $50 a barrel for a sustained period, according to Bloomberg. The majority of American shale wells could make money based on the $51.45 average futures price for West Texas Intermediate crude over the next two years, Bloomberg analyst Tai Liu said in a report Thursday. But he added that the historical floor price for US oil of $45, which in the past has been based on so-called half-cycle drilling costs, is likely to rise to $50 as investors use different metrics. New Mexico may be starting to surpass West Texas as the main focus of shale drilling, with rigs leaving from familiar areas in the Permian to other less drilled locales. While the rig count continues to fall overall, down roughly 20 percent from a recent peak last year, the rigs are also being shuffled between and within shale basins. The southeastern corner of New Mexico has emerged as one of the more favored areas of drilling. New Mexico’s portion of the Delaware basin (a part of the Permian basin) has actually seen a year-on-year increase in rigs. On the bright side of the shale oil business, Wood Mackenzie says it is bullish on ExxonMobil’s Permian growth campaign. “Exxon is clearly on target with a development approach unlike anything we’ve seen before in a shale basin,” WoodMac said in a company statement posted last week. “The supermajor is running an unprecedented 60 rigs in the Permian, up three-fold from just 20 rigs a year and a half ago, and it’s just getting started,” WoodMac added. In March this year, Exxon revealed that it was going to increase its Permian output to 1 million barrels per day by 2024. |

2. Geopolitical instability

It was a bad week for the Middle East. Turkish forces plunged into Syria to suppress the Kurdish insurgency, and somebody (possibly Saudi Arabia?) attacked and damaged an Iranian oil tanker transiting the Red Sea.

The Turkish invasion was given a green light by Washington after President Trump tweeted that US forces would not resist the Turks and would be pulled back out of harm’s way. Later the President announced that the US was withdrawing all its forces from northwest Syria. The US announcement set off a firestorm across the Middle East, in Europe, and in Washington politicians of both parties said the President had betrayed a long-time ally. As Turkish forces moved deeper into Syria, the Kurds, fearing a massacre of Kurdish civilians, turned to the Russia-backed Assad government for help. As of Monday, Syrian forces were moving towards the Turkish invaders.

In the meantime, an unknown number of ISIS fighters, who were being held by the Kurds, escaped confinement when their guards left to confront the Turks. Tens of thousands of Kurds have been forced to flee their homes to avoid the fighting, and many have been killed.

President Trump was taken aback by the criticism resulting from his decision to abandon the Kurds. In an effort to quell the uproar, on Monday, he announced new tariffs on Turkey’s exports to the US and is talking about “powerful additional sanctions” on Ankara. The Turks have already said that if the US and the EU cause too much damage to their economy, they will retaliate by sending Syrian refugees living in camps along the Syrian border into the EU.

The situation is rapidly deteriorating into a quagmire equivalent to the rise of ISIS several years ago. It is too early to say how the situation will affect oil exports from the region. One apparent vulnerability is the pipeline, with a capacity of 1 million b/d, that export oil from Iraqi Kurdistan and northern Iraq through Turkey to the Port of Ceyhan. This will likely be closed down if the situation gets much worse.

Tehran says it will retaliate for the attack on its tanker after it confirms who is responsible. If the Saudis launched the attack, then we could be seeing an ongoing round of attacks and counterattacks between the two oil exporters. So far, however, Iran has not blamed the Saudis for the attack, which leaves room for doubt as to what happened to the Iranian tanker.

Tehran says it has strengthened its air defenses around its oil installations and export terminals. Washington is sending an additional 3,000 troops, mostly air, and missile defense personnel, to protect Saudi installations.

3. Climate change

The global climate continues to deteriorate with unusually powerful storms forming across the planet. Last week Japan was hit by the strongest typhoon in 60 years. Montana saw an unseasonable snowstorm last week, and a record northeaster currently is forming along the New England coast. Heavy snowfall and high winds over the past several days buffeted northern Farm Belt states where many farmers faced historic planting delays last spring.

Along the mid-Atlantic coast, sea levels are rising rapidly, creating stands of dead trees — often bleached, sometimes blackened — known as ghost forests. The water is gaining as much as 5 millimeters per year in some places, well above the global average of 3.1 millimeters, driven by profound environmental shifts that include climate change.

California had another serious brush fire that was complicated by the decision of the northern California utility to cut power at one time or another to nearly 2 million customers. The goal of the power cuts was to prevent aging power lines from causing more fires during windy conditions. As of Monday, of this week, power in California had been largely restored.

California will meet its 2030 climate targets more than three decades late, in 2061, and could be more than 100 years late in meeting its 2050 goal if the average rate of emissions reductions from the past year hold steady, according to a new study tracking more than a decade of environmental and economic indicators in the state. The eleventh annual California Green Innovation Index—released by the non-partisan non-profit Next 10 and prepared by Beacon Economics—finds the state needs to reduce emissions by an average of 4.51 percent each year—marking a three-fold increase from the 1.15 percent reduction seen in 2017.

Cases of Dengue fever are surging around the world, and some blame a changing climate. In Nepal, there have been nearly 11,000 cases of dengue since mid-July, according to government figures, more than five times the previous annual peak. From Brazil to Bangladesh, Honduras to the Philippines, the number of reported dengue cases has surged this year. There has been a “huge increase,” said Raman Velayudhan, the task force lead for dengue at the World Health Organization. “Unfortunately, things are a little grim at the moment.” Preliminary figures from the WHO show 2.7 million reported cases worldwide through August. This year’s final tally is likely to match the worst years on record for dengue.

Thousands of climate-change protesters took to the streets in cities around the world last week, launching two weeks of peaceful civil disobedience to demand immediate action to cut carbon emissions and avert an ecological disaster. In London, police arrested 276 activists from the Extinction Rebellion group as they blocked bridges and roads in the city center, and glued themselves to cars, while protesters in Berlin halted traffic at the Victory Column roundabout. Dutch police stepped in to arrest more than 100 climate activists blocking a street in front of the country’s national museum, and there were similar protests in Austria, Australia, France, Spain, and New Zealand.

4. The global economy and trade wars

U.S.-China trade talks continued last week amid expectations that Beijing is ready to offer compromises aimed at getting President Trump to hold off on tariff increases set to take effect this week and in December. Financial markets rose Friday on prospects of any headway after five months of stalemate. However, China’s exports to the U.S. shrank by more than one-fifth last month, hit by heavier tariffs, underscoring the urgency for Beijing to resolve trade friction with Washington.

Chinese shipments to the US slumped nearly 22 percent in September from a year earlier, increasing from a 16 percent decline in August, data from the General Administration of Customs showed Monday. The U.S. decline was a major factor, along with a slowing global economy, in the 3.2 percent drop in total exports in September. That compared with August’s 1 percent decrease and was slightly worse than economists’ expectations.

High-level trade talks between China and the U.S. in the past few days yielded a truce. President Trump said the U.S. would shelve a planned increase in tariffs on $250 billion worth of Chinese goods in return for China’s assurance it would buy agricultural products from the U.S. worth $40 billion to $50 billion. The outcome is being seen as a win for China as it allowed Beijing to postpone action on concessions it doesn’t want to make.

5. The Briefs (date of the article in the Peak Oil News is in parentheses)

Abu Dhabi, the oil-producing member of the United Arab Emirates, has plans to take on global benchmarks Brent and West Texas Intermediate with its very own contract, Murban, Bloomberg reports. The Murban has yet to start trading: this is scheduled for 2020 after Abu Dhabi sets up a commodity exchange. If all goes well, the grade, which is light and sweet, could become a preferred import for Asian refiners. (10/12)

Saudi Aramco’s board of directors could give the final approval to what would be the world’s largest initial public offering (IPO) ever as soon as next week, Bloomberg reported on Thursday. Yet Aramco hasn’t made any final decision and it could still postpone or scrap those plans. (10/11)

Iran’s state oil company has struck natural gas at a new deposit, according to a report in PressTV. The report comes on the heels of news that China’s CNPC had pulled out from the South Pars Phase 11 project, which was supposed to be led by French Total. Total, however, left Iran last year after US sanctions snapped back, leaving CNPC with the opportunity to gain a majority in the project. (10/10)

Qatar, the world’s top liquefied natural gas (LNG) exporter, has recently commissioned the largest carbon dioxide (CO2) recovery and sequestration facility in the Middle East and North African region. Qatar’s LNG industry will be capturing and sequestering more than 5 million tons of CO2 per annum by 2025. Qatar has announced plans to increase its LNG production capacity by 43 percent—from 77 million tons annually now to 110 million tons a year by 2024. (10/9)

Freight rates to Asia have climbed to new heights after the United States sanctioned several Chinese tanker owners for “knowingly engaging in a significant transaction for the transport of oil from Iran, including knowledge of sanctionable conduct, contrary to US sanctions.” Now, US shippers—and elsewhere around the globe—are scrambling to find unsanctioned carriers for its crude oil, raising the price for chartering VLCCs. Last week, the cost of shipping from the Middle East to north Asia rose 19% the day after the sanctions were imposed. (10/8)

China’s crude oil imports from ship-to-ship transfers soared threefold between August and September to 910,000 tons, Bloomberg reports. It is no secret that Iran has taken to ship-to-ship transfers in the open sea to avoid US sanctions and continue exporting oil. (10/9)

China’s tanker owning company Cosco Dalian, which was sanctioned by the US two weeks ago for knowingly shipping Iranian oil, has seen one-third of its oil tankers turn off their automatic identification system (AIS) transponders in the past week. (10/10)

China and Russia could deepen their energy cooperation as Beijing is interested in working with Russia to develop nuclear power and wind power projects in the Arctic region. Russia and China already have deals to build nuclear power reactors in China, while the two countries could also develop the wind resources of the Arctic. (10/8)

The Libyan government has released state funding to the tune of $1.06 billion to the National Oil Corporation that NOC will use to maintain oil production in the current year. Last week, NOC’s chairman warned Libya’s oil production could drop steeply during financial 2019-2020 unless the Government of National Accord, which is internationally recognized, provided the funds it had agreed to allocate for NOC’s needs. (10/9)

Nigeria may face an easier task to finally fall in line with its share of the OPEC+ production cuts after OPEC has recently raised the African producer’s oil output ceiling. OPEC has raised the quota for Nigeria to 1.774 million bpd. (10/10)

The Nigerian government, through its attorney-General, Abubakar Malami, says it is determined to recover over $62 billion from multi-national oil companies for ‘under-payment’ to the country since 1998. Under the country’s joint operating agreement, Nigeria is authorized to review the existing profit-sharing formula with its partners once crude oil prices at the international oil market rise above $20 per barrel. (10/11)

In Angola, if someone had reported the government was preparing its state oil company for privatization three years ago, many would have laughed refused to believe it. In 2016, Sonangol was in shambles and rumor got around that the company couldn’t even afford to buy toilet paper for its offices. Now three years later, it is preparing for an initial public offering. A lot has changed since 2016. (10/11)

In Mozambique, Exxon could announce the final investment decision for the Rovuma LNG project very soon, according to the African country’s government. Exxon partnered with Italy’s Eni and Chinese CNPC on the $30-billion Rovuma project, which could have a total annual capacity of 15.2 million tons. Production should begin in 2024. Exxon has stakes in LNG capacity totaling more than 65 million tons per year. (10/8)

In Brazil, ExxonMobil, Chevron, Shell, BP, and Total all won offshore oil exploration blocks in the first of three bidding rounds this year which fetched a record total amount of signing bonuses. The 16th oil concession bidding round held on Thursday raised a total of US$2.17 billion in signing bonuses, a record for the concession rounds in Brazil. (10/11)

Ecuador’s state-owned energy company Petroamazonas has suspended production at three fields amid protests against rising fuel prices that have forced the government to move from the capital Quito to the coastal city of Guayaquil. Reuters quotes the Ecuadorian energy ministry as saying the field was “taken” by “individuals not affiliated with the operation.” Ecuador increased fuel prices by up to 120 percent earlier this month and this sparked protests among farmers and indigenous peoples. (10/9)

Ecuador’s state-run oil company, declared on Wednesday a force majeure on all oil trading operations, according to an evening Tweet by Petroecuador, citing mass protests that have disrupted the country’s oil industry. Petroecuador also said that it had completely shut down the TransEcuadorean Pipeline System known as SOTE, which normally carries 360,000 barrels per day, because it does not have enough oil to move through it. (10/11)

Guyana’s oil revenue should start to flow any minute now. ExxonMobil’s floating production, storage and the offloading vessel has been offshore since August. There’s talk of oil before the end of this year, and first cash as early as February. With 12 more ExxonMobil finds and two from Tullow, Guyana is now well over six billion barrels and counting. Guyana already has almost as much confirmed oil as Mexico. But Mexico has to share the oil wealth around 130 million people. Guyana has just 750,000. (10/7)

Venezuela’s oil production took another hit in recent days, as the country struggles with brimming storage tanks and no buyers. PDVSA slashed output in the Orinoco Belt to just 200,000 bpd, according to Bloomberg, after averaging roughly double that for much of this year. The lack of space in storage forced production cuts, including at joint venture projects, where output has been more stable. Production fell by more than half from 1.6 million barrels per day in 2018 to a little more than 750,000 bpd in July. (10/8)

At least three Venezuelan fuel tankers are heading towards Cuba today, part of a flotilla meant to free up domestic storage space while defying a US campaign to cut off Venezuela’s oil supply to its political ally. Up to 3mn bl of refined products and heavy crude that Venezuelan state-owned PdVSA is dispatching to Cuba in the first half of October should help partially alleviate a critical storage deficit that has forced down Venezuelan production toward 500,000 b/d. (10/7)

The US oil rig count rose by two to 712, the first increase after seven consecutive weeks of declines, according to GE’s Baker Hughes. The active gas rig count slipped by one to 144. The combined total of 856 rigs inched up by one unit.

Biofuel flip-flop: President Trump is trying to patch up his badly damaged relationship with American farmers. On Friday, the Trump administration announced its latest proposal that comes as a sort of apology to ethanol groups for an earlier decision to favor refineries. The EPA will continue to issue so-called “hardship” biofuel waivers to smaller refineries while now requiring larger refineries to use even more biofuel. (10/10)

US Secretary of Energy Rick Perry denied on Monday reports that he was preparing to resign next month, saying that he doesn’t plan to go anywhere. Secretary Perry is planning to hand in his resignation in November, Politico reported last week, citing three unnamed sources in the know. (10/8)

Halliburton Company has laid off 650 employees in the U.S., the Houston-based oilfield services giant confirmed Wednesday. The company cited local market conditions. The decision affects the company’s Rockies region, which includes Colorado, Wyoming, New Mexico and North Dakota. Today’s layoff announcement follows an eight percent workforce reduction the company completed in the second quarter. (10/10)

US refinery outages for the season peaked this week, reaching 3.797 million b/d offline for planned and unplanned work, about half of which is in the US Gulf Coast, according to S&P Global Platts Analytics data. Now USGC refiners will have 1.921 million b/d of crude processing capacity offline as of October 11, with US West Coast refiners having 445,000 b/d offline as coastal refiners look to ensure their plants in are maximum diesel mode ahead of low-sulfur marine-fuel mandates under IMO 2020. (10/12)

GOM lease sale: The US Department of the Interior’s Land and Mineral Management and Bureau of Ocean Energy Management (BOEM) are proposing a regionwide lease sale in March 2020 for 78 million acres in the federal waters of the Gulf of Mexico. Lease Sale 254 will include about 14,585 unleased blocks, located from three to 231 miles offshore, in the Gulf’s Western, Central and Eastern planning areas in water depths from nine to more than 11,115 feet. (10/8)

EV buses: Miami-Dade, Florida, has agreed to purchase 33, 40-foot Proterra Catalyst E2 electric buses with Duo Power drivetrain technology and up to 75 plug-in Proterra chargers. With 33 electric buses and charging systems, Miami-Dade represents the largest electric bus order on the East Coast. (10/8)

Batteries booming: The soon-to-be $92.2 billion battery market just got a huge boost. Scientists have just created the world’s first long-cycle Li-Carbon Dioxide battery, and in a market-shredding first: it’s fully rechargeable. The hunt for advanced materials that will catapult battery technology to another level started decades ago. The search has been furious and diligent as researchers and scientists try to give the $90+ billion market exactly what it wants. And the market is set to reach this $92.2 billion as soon as 2024—up from $37.4 billion in 2018. (10/8)

Toyota’s hydrogen car: Toyota Motor Corp unveiled a completely redesigned hydrogen-powered fuel cell sedan on Friday in its latest attempt to revive demand for the niche technology that it hopes will become mainstream. Japan’s biggest automaker has been developing fuel-cell vehicles for more than two decades, but the technology has been eclipsed by the rapid rise of rival battery-powered electric vehicles promoted by the likes of Tesla. (10/11)

Climate and BP: When Bob Dudley became BP’s chief executive in 2010 he faced a political and public backlash in the US after the deadly Gulf of Mexico blowout. He had to bring the energy major back from the brink of collapse and secure its societal license to operate. Nearly a decade on, as he hands over a revived company to Bernard Looney, BP’s long-term survival is once again under scrutiny amid pressure to act on climate change – a challenge that the entire oil and gas industry is grappling with. (10/8)

Flying cars? Porsche and Boeing signed a Memorandum of Understanding to explore the premium urban air mobility market and the extension of urban traffic into airspace. With this partnership, both companies will leverage their respective market strengths and insights to study the future of premium urban air mobility vehicles. (10/11)