Editors: Tom Whipple, Steve Andrews

Quote of the Week

“On my first day as president, I will sign an executive order that puts a total moratorium on all new fossil fuel leases for drilling offshore and on public lands. And I will ban fracking – everywhere.”

US Senator Elizabeth Warren (10/1)

Graphic of the Week

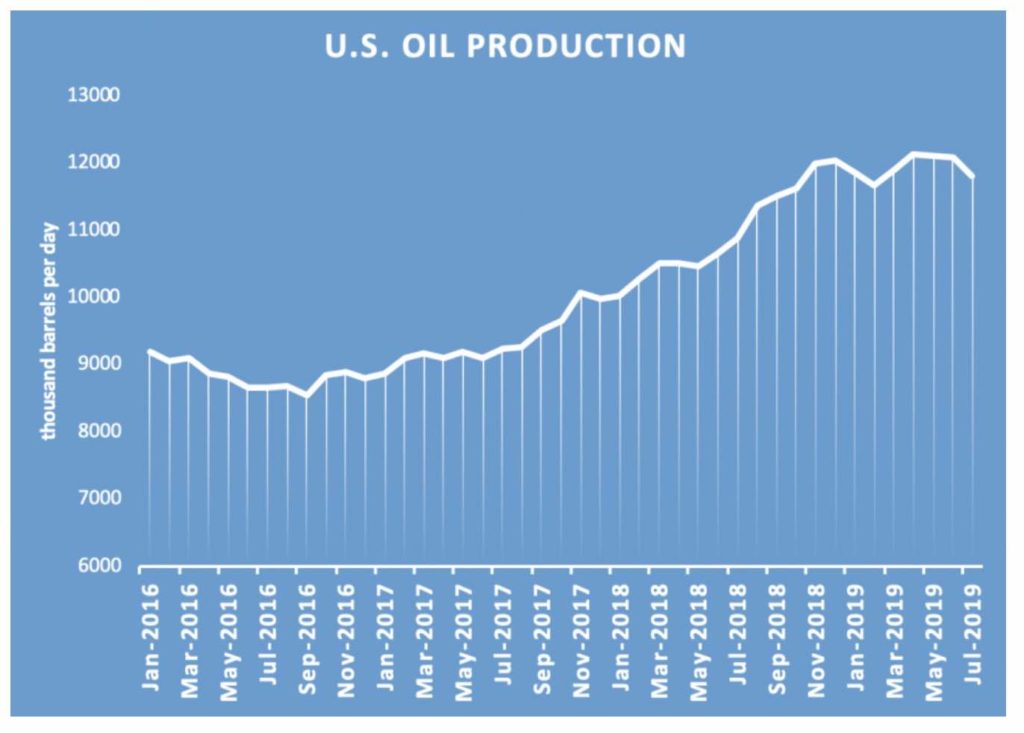

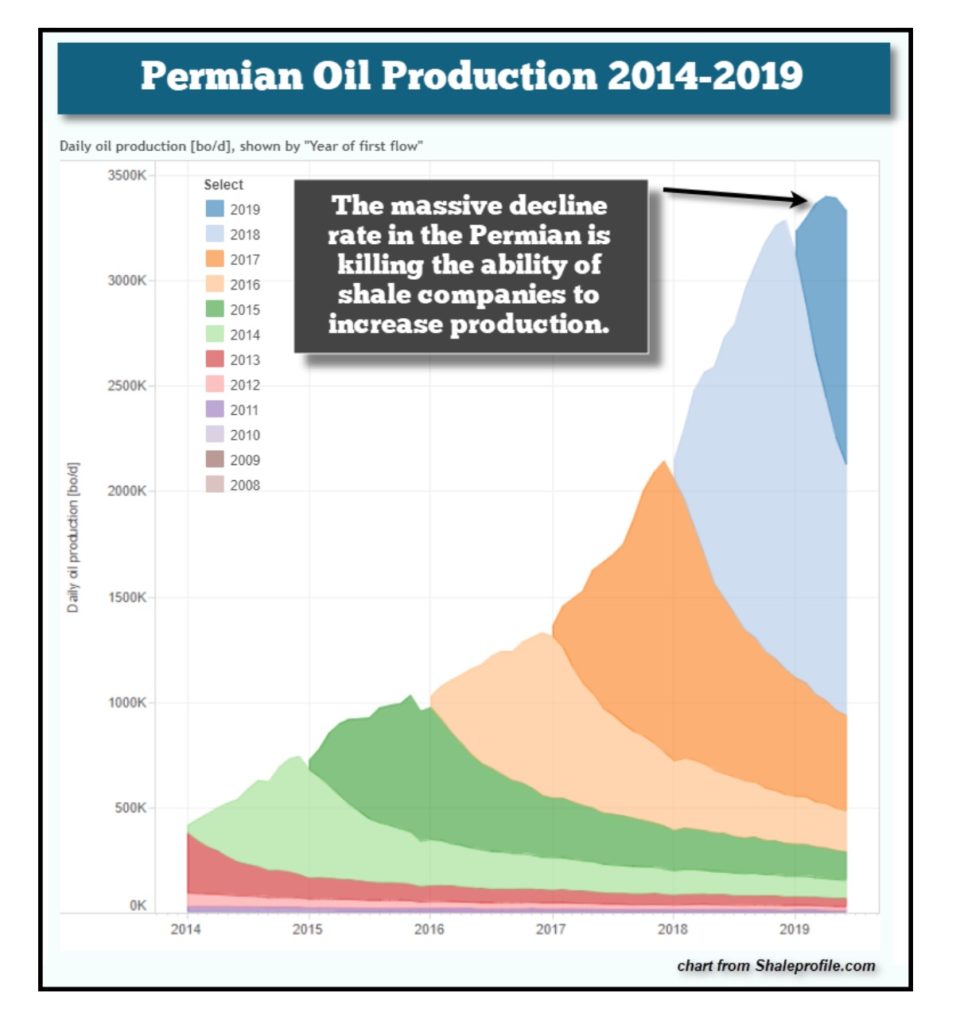

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil prices have hovered in the mid to low $50s since late July. They spiked briefly into the low $60s after the Saudi oil facilities were attacked but quickly settled back on news that the Saudis would be able to repair the damage quickly. Conventional wisdom says that the Russian-Saudi production freeze is keeping prices from going lower. At the same time falling demand is holding a lid on prices despite slowing production and lower exports in several countries. Geopolitical risk has receded as the top concern of oil traders. To quote one trader, “everything is about weak demand now.” OPEC’s oil production fell to a near-decade low for September, according to the latest Reuters survey, dropping below 29 million b/d, with Saudi Arabia accounting for most of the output drop. That’s a decline of 750,000 barrels per day on average, mostly from the decrease in oil production from Saudi Aramco after its facilities were attacked. The attacks took offline 5.7 million b/d on September 14th, equivalent to 5 percent of the total global oil supply. While some estimates said it could take Saudi Arabia months to restore production to pre-attack levels, according to Saudi officials within nine days, 75 percent of the damaged production capacity had been restored. Two days later, on September 25th, Saudis said they had has restored all of its production to pre-attack levels. The important development in recent months, however, is the slowing growth of US shale oil production. Only the Permian Basin, which produces about 46 percent of US shale oil, continues to grow significantly, and even this basin seems likely to go into decline shortly. Given that conventional oil, for a number of geologic and geopolitical reasons, has not grown enough to offset increased demand for the last ten years (and little new conventional oil is being found), it seems likely that oil shortages will develop unless demand falls more than anticipated. Despite the drilling of 5,000 new wells a year in the Permian Basin, production from newly drilled wells is barely enough to keep up with the rapid drop in production from legacy wells. |

The last three years was the worst period in seven decades for new conventional oil discoveries. A new report from IHS Markit finds that conventional discoveries plunged to a seven-decade low, and “a significant rebound is not expected.” Conventional exploration – as opposed to unconventional development, including shale – had already been trending down following the 2008 global financial crisis, but the collapse of oil prices in 2014 slowed conventional exploration further.

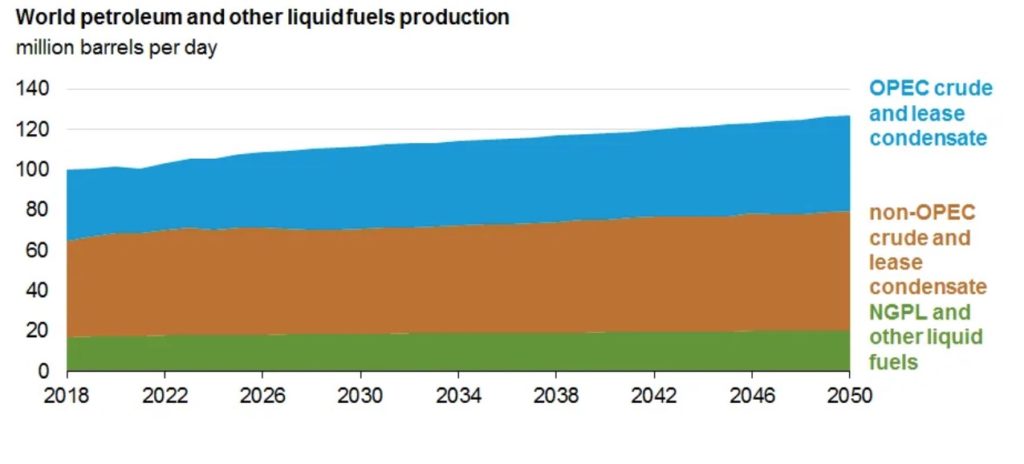

Despite global warming, sagging shale oil production, a massive drop in the discovery of new oil, and production outages from geopolitical disputes on the rise, the US’s Energy Information Administration just published an optimistic forecast for the next 30 years in its International Energy Outlook 2019. The government is predicting in its reference (or middle case) that total liquid oil production will increase from 100 million b/d in 2018 to 127 million b/d in 2050. Transportation energy consumption is forecast to increase by nearly 40 percent between 2018 and 2050. This growth is to be driven largely by non-OECD countries, where transportation energy consumption grows by nearly 80 percent between 2018 and 2050. Energy consumption for both personal travel and freight movement grows in these countries much more rapidly than in many OECD countries.

What is even more bizarre is that in the High Oil Price case, world liquid fuels consumption in 2050 is 4 million b/d higher than in the reference case. Non-OECD nations are to have faster economic growth, which contributes to higher energy demand. In the High Oil Price case, proportionally higher amounts of crude oil are supplied by countries that are not part of the Organization of the Petroleum Exporting Countries (OPEC). In the Low Oil Price case, world liquids consumption in 2050 is 1 million b/d higher than in the Reference case. Slower non-OECD economic growth assumptions lead to lower energy demand, but the lower prices mean that consumers use more liquid fuels. Low-cost producers located in OPEC countries supply more crude oil and condensate to the global marketplace.

These EIA’s projections run counter to what nearly all observers outside of the oil industry are saying about the future of oil production.

2. Geopolitical instability

The list of oil-producing countries that are pumping oil at less than capacity due to domestic unrest, embargoes, and other conflicts continues to grow. Some such as Iran and Venezuela are down by millions of barrels a day from their potential, and others such as Libya, Yemen, and Syria are down by hundreds of thousands of b/d or less. In September, OPEC’s production fell to a near-decade low partly due to geopolitical conflict, including losses caused by the attack on Saudi production facilities.

Last week rioting broke out in Iraq, leaving 100 dead and over 6000 wounded. Thousands have been involved in the nationwide protests, which are among the largest seen in decades and which were sparked by frustration over alleged government corruption, lack of basic services and growing unemployment. The demonstrations quickly spread from Baghdad to other cities at an intensity and speed which took security forces and the government by surprise.

Populist Shia politician and former militia leader Moqtada al-Sadr called for the government to step down and for new elections. His parliamentary bloc, which won the largest number of seats in last year’s elections, said it would boycott parliament when it meets to discuss the protesters’ demands.

Iraq oil production is now approaching 5 million b/d, making the country one of the biggest oil exporters in the world. It is too early to tell if the current unrest will slow production.

The good news last week is that the Saudis are considering a partial cease-fire with the Houthis in Yemen. Saudi Arabia’s move follows the Houthis’ surprise declaration of a unilateral cease-fire in Yemen last week. Similar cease-fires have broken down before, but the Houthis’ unexpected unilateral request for a cease-fire raised hopes in Riyadh and Washington that the Yemeni fighters might be willing to distance themselves from Tehran.

Despite the stream of threats between Riyadh and Tehran, there are rumors that talks between the two are underway to reduce tensions.

3. Climate change

According to a new report from the United Nations, climate change is already having staggering effects on oceans and ice-filled regions that encompass 80 percent of the Earth, and future damage from rising seas and melting glaciers is now all but certain. More than 100 scientists from around the world contributed to the latest report by the IPCC which comes on the heels of several other warnings the group has issued recently. Last fall, the IPCC said the world must make rapid, far-reaching changes to energy, transportation and other systems to hold warming below an increase of 1.5 degrees Celsius.

If emissions continue to increase, global sea levels could rise by more than three feet by the end of this century — about 12 percent higher than the group estimated as recently as 2013.

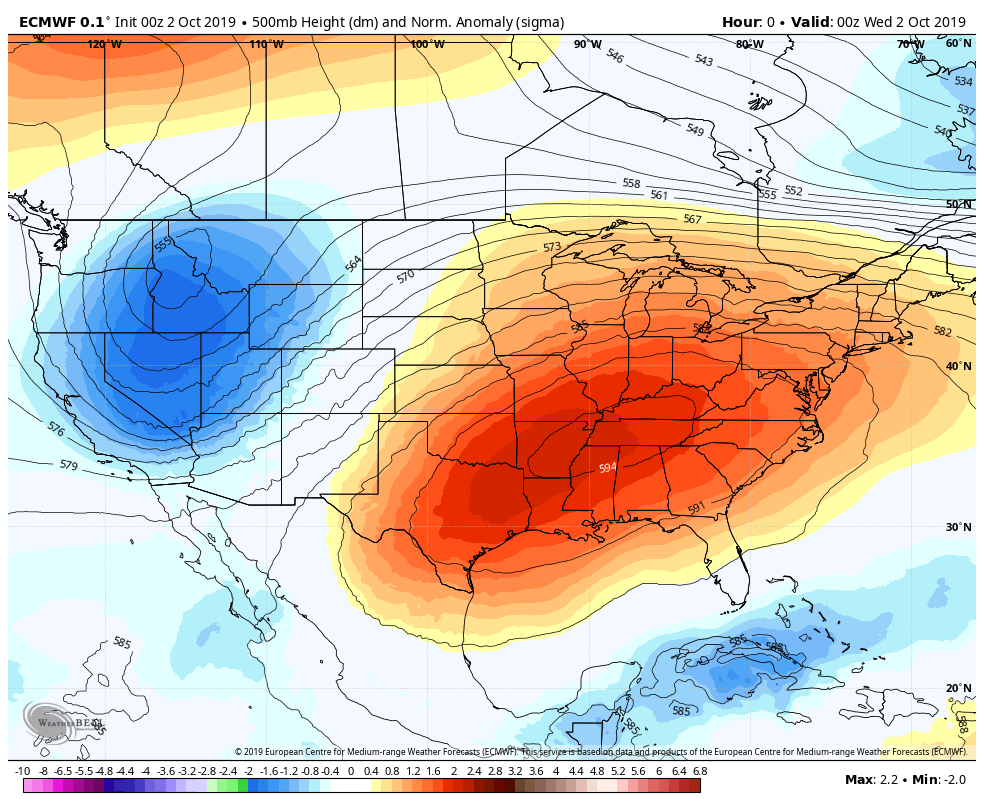

A heat dome over the eastern half of the US in early October is bringing high temperatures characteristic of July.

Siberia has been rapidly thawing as the region has warmed up faster than almost anywhere else on earth. Siberia’s temperatures have already spiked far beyond 1.5 degrees C. The permafrost which villages and cities are built — is in the midst of a great thaw, blanketing the region with swamps, lakes and odd bubbles of earth that render the land virtually useless. For the 5.4 million people who live in Russia’s permafrost zone, the new climate has disrupted their homes and their livelihoods. Rivers are rising and running faster, and entire neighborhoods are falling into them. Arable land for farming has plummeted by more than half, to just 120,000 acres in 2017.

4. The global economy and trade wars

For the past month, the press has been filled with stories warning about the deteriorating global economy. Headlines from the major newspapers tell the story:

“Global Trade Is Deteriorating Fast, Sapping the World’s Economy”

- NY Times 2 Oct.

“Gloomy Economic Outlook Takes Toll on Oil Prices”

- Wall Street Journal 2 Oct.

“Slowing Trade Hits Global Manufacturing”

- Wall Street Journal 2 Oct.

“European factory activity shrinks at most rapid pace since 2012”

- London Financial Times 1 Oct.

For now, declining demand is the top concern of the oil markets. Despite falling oil production, many traders believe that demand for oil will drop faster than supply.

5. Renewables and new technologies

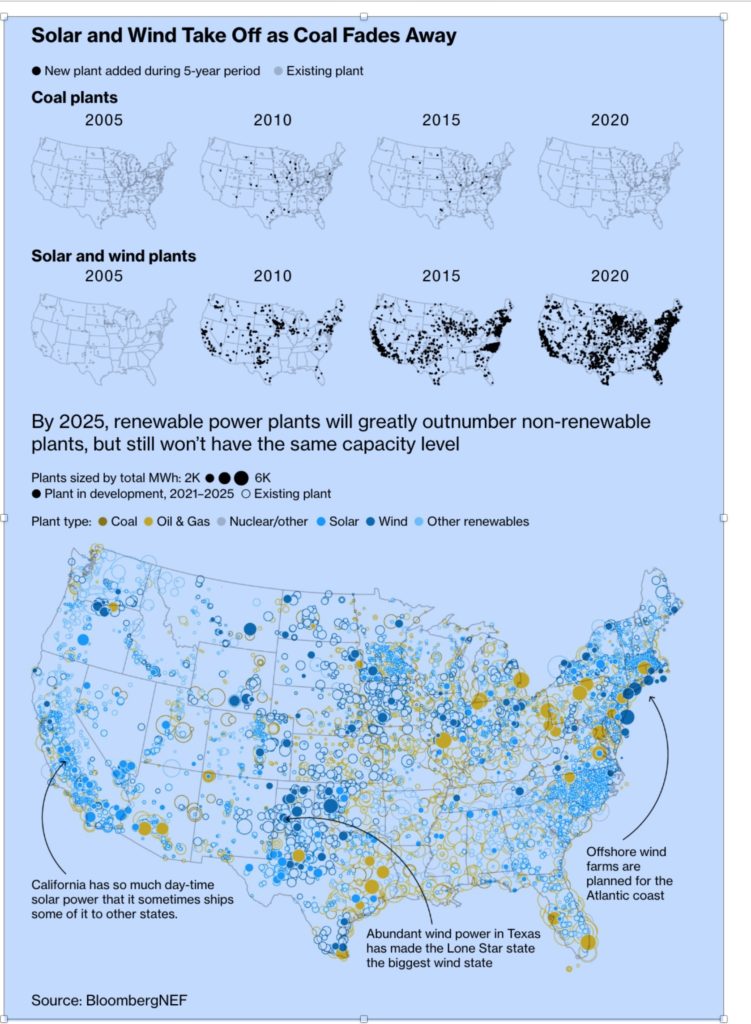

Clean energies hadn’t been able to compete in a market flooded with cheap fossil fuels. Governments around the world have long subsidized low- and no-carbon renewable energies like solar and wind because they hold great promise. Today, renewable energy is so cheap that the handouts they once needed are disappearing. Electricity generation has been the world’s biggest source of greenhouse-gas emissions. In the U.S., for the first time since the 1970s, this is no longer the case. Since 2016, American power plants have given off less carbon dioxide than the nation’s transportation sector, where oil continues to dominate. The turnabout owes a lot to cheap and cleaner-burning natural gas, but wind and solar farms are playing an increasingly important role.

In the U.S., natural gas remains king of the power mix, accounting for about 40 percent of the nation’s electricity. But renewable energy’s share is quickly climbing, reaching 25 percent earlier this year.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Oil and gas still loom large: While global leaders meet in New York to discuss solutions to climate change, the US’s EIA has offered a sober assessment of the world’s ability to wean itself off fossil fuels. Although renewables will be the fastest-growing energy source through 2050, oil consumption will still be key to meeting energy demand for decades, according to a report released Tuesday by the EIA. Fossil fuel use will keep climbing for the next 30 years. (9/25)

Oil and gas still the big dogs: OPEC’s research shows that the oil and gas industry will continue to dominate energy supply through their forecast period of 2040. That’s what OPEC Secretary General Mohammad Sanusi Barkindo revealed in a speech on September 26. Barkindo went on to say that OPEC expects to see “robust growth” in long-term global oil demand, which is expected to rise to almost 112 million barrels per day by 2040. (9/30)

Netherlands gas stop: The Netherlands recently announced that production at Groningen – Europe’s largest gas field – will be halted in 2022, eight years earlier than initially planned. Rystad Energy expects that there could be some residual production from Groningen up to 2030 as it is technically challenging to completely shut down production in such a short timeframe. The drastic drop in output from Groningen will redefine the European energy landscape. The field, which had a rebound in production at the start of this century, reaching 57 billion cubic meters (Bcm) in 2013, was for decades the central cog in northwest Europe’s gas system. (10/3)

Russia’s largest oil company Rosneft has set the euro as the default currency for all new exports of crude oil and refined products, as the state-controlled giant looks to switch as many sales as possible from US dollars to euros in order to avoid further US sanctions against it. Rosneft is the biggest oil exporter from Russia, selling around 2.4 million barrels per day (bpd) of oil, according to Reuters estimates. (10/4)

The United Arab Emirates is finalizing talks on a $5-billion investment in a crude oil refinery project in Pakistan, with the construction of the facility likely to begin before this year’s end. (10/5)

Saudi Arabia’s wellhead crude production stands at 9.9 million b/d, with production capacity of 11.3 million b/d, the kingdom’s energy minister said Thursday. Following the attacks on Saudi Arabia’s Abqaiq crude processing facility and Khurais oil field on September 14 that took 5.7 million b/d of production capacity offline, the country maintained its supplies to customers by drawing from its crude inventories. They expect to be back to having full production capacity by the end of November. (10/3)

Oil shipping $$ blip: Key oil freight rates from the Middle East to Asia rocketed as much as 28% on Friday in a global oil shipping market spooked by US sanctions on units of Chinese giant COSCO for alleged involvement in ferrying crude out of Iran. In what the State Department called “one of the largest sanctions actions the US has taken” since curbs were re-imposed on Iran in November last year, two units of COSCO were named alongside other companies in claims of involvement in sanctions-busting shipments of Iranian oil. (9/28)

PetroChina has announced new additions of almost 741 billion cubic meters to its shale gas reserves in the Sichuan province as well as certified reserves of 358 million tons at the Qingcheng oil field. The company said that it had made a breakthrough in shale oil and gas exploration, which led to the upgrade in reserves. Shale gas—and oil too—has been touted as a potential solution to China’s energy problem, which comes down to demand outstripping supply. However, emulating the US shale boom has proven tricky. (10/1)

Libya’s National Oil Corporation has warned that the country’s crude oil production could drop sharply over the next nine months if the government in Tripoli does not release funds already approved for disbursement to NOC. (10/4)

Nigeria is ready to make the sacrifice and cut its oil production deeper if OPEC and allies decide in December that it is necessary to deepen the cuts, Nigerian Minister of State for Petroleum Resources told Bloomberg on Friday. Nigerian overproduction has offset some of the cuts of its fellow OPEC members at a time when the oil market continues to be oversupplied with rising US production and faltering oil demand growth. (10/5)

Venezuela saw its oil and oil products exports edge up to 845,000 bpd in September from 770,000 in August, but these higher exports couldn’t drain Venezuela’s overflowing oil stockpiles which further increased last month. Higher exports last month weren’t due to customers suddenly wanting to buy Venezuelan oil. The increased September exports of crude oil and refined products were chiefly due to more exports to Cuba and to the release of oil cargoes that had been sitting offshore Venezuela since the US imposed sanctions on Nicolas Maduro’s regime in early 2019. (10/3)

In Venezuela, PDVSA and China’s state-run CNPC have stopped all oil blending at their joint venture operation. All of the blend, known as the Merey blend, was shipped to China. Over half of the finished product went toward paying back loans that China extended to Venezuela and PDVSA. The oil blending operations were halted this week due to an untenable buildup in oil stocks in Venezuela as the US continues to clamp down on the Maduro regime in the Latin country, in what will surely create a ripple effect on other operations in Venezuela as well. (10/4)

Brazil’s massive transfer-of-rights oil auction to be held on November 7 has cleared one hurdle as the Brazilian Congress approved on Thursday one section of a larger bill that determines the specifics of the $25 billion auction. Brazil’s auction is expected to rake in $25.5 billion for the government. The auction will seek to sell oil blocks in the presalt zone off the coast of Brazil that had originally been given to state-run Petrobras to extract 5 billion barrels of oil. (9/30)

In Ecuador—a member of OPEC that has just announced its intention to quit the cartel—protested erupted after President Lenin Moreno said that fuel subsidies that had been in place for 40 years would end. According to Moreno, in office since 2017, the fuel subsidy is “perverse” and has distorted Ecuador’s economy over the past few decades. The country can no longer afford the US$1.3 billion subsidy, the president says as he pushed through with a US$2 billion package of fiscal reforms. (10/5)

Offshore Mexico, where US oil firm Talos Energy found nearly a billion barrels off the southern Gulf coast two years ago, saw the first discovery by a foreign firm since the oil industry was nationalized eight decades earlier. Now Mexico’s state-run oil firm Pemex wants to take over the lucrative project. The Pemex push to run drilling in the oilfield comes amid the ongoing drive by President Andres Lopez Obrador to return more control of Mexico’s energy sector to its state oil firm. (9/30)

In Mexico, oil theft is not uncommon, with most of it linked to local cartels using the services of crooked Pemex employees. Yet most of this theft takes place on land: over just two months in 2018, criminals drilled almost 2,300 illegal taps into Pemex pipelines in Mexico. Although oil and diesel stealing has been going on for decades, there has been an increase in criminal activity reported in the last four years. (10/2)

In Cuba, Russia plans to have its companies help the country to develop its oil and natural gas resources as part of a close energy cooperation, a senior Russian official said on Thursday, just as Russia’s Prime Minister Dmitry Medvedev began a two-day visit to Cuba amid growing U.S.-Cuba tension. Russia and Cuba are also discussing the use of nuclear technologies in medicine and agriculture, the Russian official said, adding that Russia is ready to assist Cuba should the Latin American country decide to develop nuclear power generation industry. (10/4)

US politics and oil, on steroids: The world energy market has shown over the past few weeks and months that it can easily cope with the collapse of Venezuelan oil exports, the cut-off of most supplies from Iran and even an attack on Saudi Arabia’s key oil export facilities. It is not, however, prepared for the dramatic change that could occur if the Democratic party wins next November’s US presidential election. (10/1)

Average US exports of crude oil rose by 966,000 bpd in the first half of 2019, compared to the first half of 2018. In June this year, the US set a monthly average record of 3.2 million bpd of crude oil exports, EIA data showed. Canada stayed the top foreign destination of US crude oil, with US exports rising by 3 percent year on year in H1 2019. US exports to Asia and Oceania jumped by 58 percent, with exports to South Korea, India, and Taiwan more than doubling. (10/4)

Biofuel flipflop: The Trump Administration is set to announce later on Friday a plan to boost ethanol and biodiesel demand and placate the farming lobby angered by the Administration’s waivers for dozens of oil refineries exempted from blending corn-based ethanol in fuels, The US biofuels policy has been pitting the oil refining industry against the Midwest farm lobby. While US President Donald Trump is a vocal supporter of the USoil industry, he also supports the Renewable Fuel Standard, especially corn-based ethanol, which protects farming jobs in the politically. (10/5)

EVs and declining labor needs: GM’s need to free up cash to invest in electrics has led it to make deep cuts in its core business, including its decision to close four US factories —a main point of friction in the longest walkout at GM since 1970. For the UAW, there’s no avoiding the harsh reality of a wider transition taking hold across the auto industry: Building electric vehicles requires far fewer workers, making it near-impossible to avoid job losses and wage cuts. In addition, fewer components are needed, and many of them are imported. (9/28)

Renewable energy winning cost war: Low- and no-carbon renewable energies like solar and wind power have long been subsidized by governments around the world because while they hold great promise for a clear, more sustainable energy future, they just couldn’t compete with natural gas, coal, and oil when it comes to the bottom line. But this week Bloomberg reported on the once unthinkable phenomena of solar and wind subsidies disappearing across the world because the industry has outgrown the need for them thanks to declining costs. (9/30)

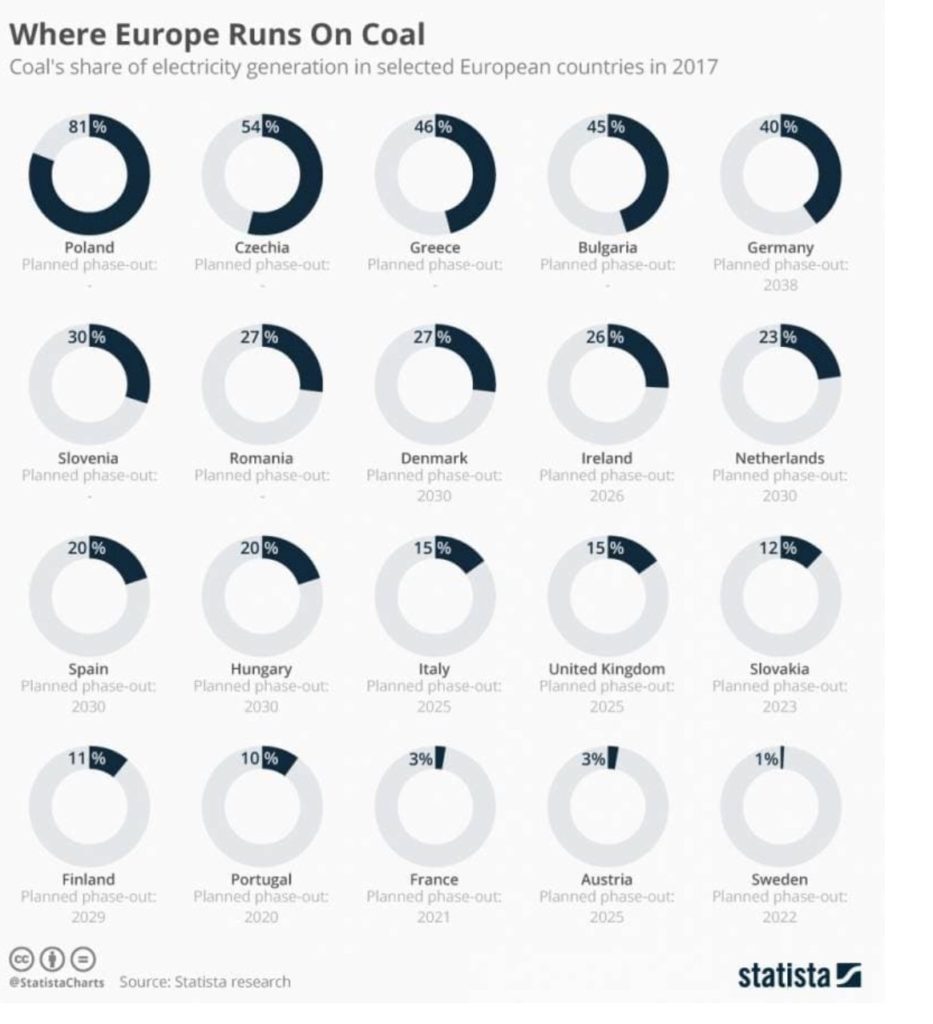

A sign of coal’s slow sunset: Stockpiles of coal are surging at some of Europe’s largest ports as utilities from Germany to Spain are increasingly favoring cleaner gas in power generation. Reserves at ports in Rotterdam, Amsterdam and Vlissingen last week rose to their highest levels since July. The uptake after the summer has slowed because of mild weather so far this autumn. Crashing natural gas prices have also made it more attractive for utilities to burn the fuel, just as solar and wind continues to eat into the overall share of fossil fuels. (9/28)

UK coal era ending: In Wales, the year-end shutdown of the Abertawe coal-fired power plant is a harbinger of what is to come as the UK–once the world’s largest coal consumer–prepares to end its addiction to the planet’s most polluting fossil fuel. It is one of only five operational UK coal-powered stations after Cottam in Nottinghamshire was closed on Monday after 50 years. Coal share of power supplied to the grid dropped from a peak of 88% in 1971 to single digits today. By next summer only three coal units will remain. (10/1)

Some EU coal hanging on: The end of the age of fossil fuels is not yet in sight in Europe. There are still a number of countries that generate a very large proportion of their electricity from coal. Despite the push by some to exit coal, not all countries have announced a date for phasing out its use. This applies in particular to those countries that have a high proportion of coal-fired electricity. Despite recent efforts to transition to renewable energy, Germany still lies in the upper quarter of the country comparison, behind countries such as Poland, Czechia, Greece and Bulgaria. Germany aims to phase out coal by 2038. (9/30)

Fossil fuel plants and water needs: Climate activists have raised concerns about the number of power plants planned for development in Asia, but the threat of climate change appears to be just one reason to think twice about building new power plants in the region. According to a new study, water shortages in Asia could make it increasingly difficult to cool new power plants. (9/25)

The heat is still on: A heat dome over the eastern half of the nation is bringing high temperatures characteristic of July, not October. The mercury is soaring well into the 90s from the nation’s capital to Florida to Texas, and just about everywhere in between. The District of Columbia broke its all-time monthly high temperature record with a temperature of 98 degrees, easily beating the old record of 96 degrees set on Oct. 5, 1941. (10/3)

Biggest berg in years: The Amery Ice Shelf in Antarctica has just produced its biggest iceberg in more than 50 years. The calved block covers 1,636 sq km in area – a little smaller than Scotland’s Isle of Skye – and is called D28. The scale of the berg means it will have to be monitored and tracked because it could in future pose a hazard to shipping. (10/2)

Tourists to Saudi Arabia? Saudi Arabia said on Saturday it would issue fines for 19 offences related to public decency, such as immodest dress and public displays of affection, as the Muslim kingdom opens up to foreign tourists. The Interior Ministry decision accompanies the launch of a visa regime allowing holidaymakers from 49 states to visit one of the world’s most closed-off countries. Until now, most visitors have been Muslim pilgrims and businesspeople. (9/28)