Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Base decline is…the volume that oil and gas producers need to add from new wells just to stay where they are—it is the speed of the treadmill. Because of the large increases of recent years, the base decline production rate for the Permian Basin has increased dramatically, and we expect those declines to continue to accelerate. As a result, it is going to be challenging, especially for some companies with cash constraints, just to keep production flat.”

Raoul LeBlanc, vice president of Unconventional Oil and Gas at IHS Markit.

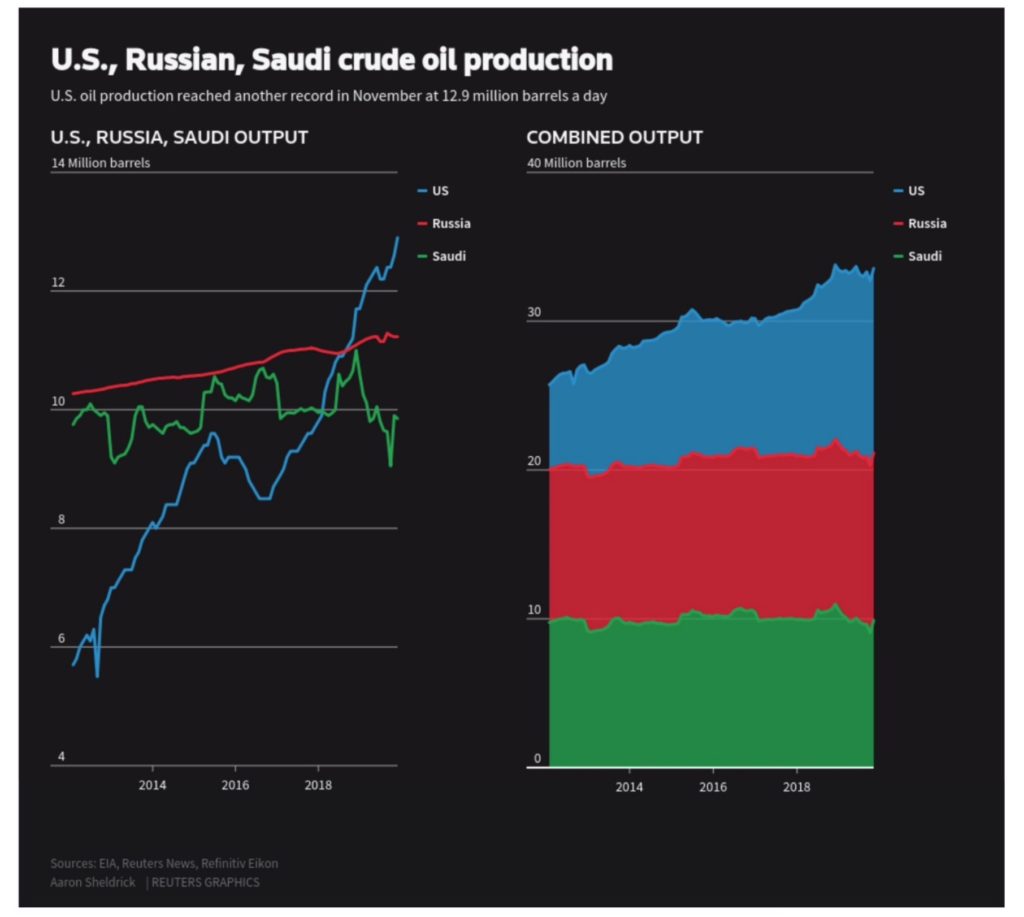

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil rose on Friday to its highest in nearly three months as progress in resolving the US-China trade dispute was announced, and a decisive Tory win in Britain’s general election appeared to settle two uncertainties that have plagued the markets for months. At the close, NY oil was just over $60 and London was $65.22. There are two major unknowns that will determine where the oil prices go next year. The first is how well OPEC and its associates adhere to the agreement to make additional production cuts, and the second is how much US shale oil production will increase in 2020. The IEA’s December Oil Market Report highlighted that even though the OPEC+ cut pact implies 500,000 b/d less oil supply, the first quarter of 2020 could see a significant build in global oil stocks. OPEC, Russia and its allies agreed earlier this month to deepen their production cuts to the tune of 1.7 million b/d from 1.2 million b/d. Saudi Arabia is offering up an extra 400,000 b/d of voluntary cuts starting in January. However, the IEA noted that it is dependent on all producers adhering to their quotas, including “those whose compliance so far has been less rigorous,” in particular Iraq and Nigeria, whose records have been poor. IEA data says Saudi Arabia’s average compliance has been 268 percent, while Iraq, the second-biggest producer in OPEC, has a conformity of just 60 percent over the lifespan of the deal. Saudi Arabia led the way even in November, cutting its output by 300,000 b/d to 9.90 million after October’s jump to 10.20 million b/d, according to the IEA estimates. Iraq showed a willingness to cut last month and lowered output, although it still pumped 140,000 b/d above its target. Venezuela, not part of the quotas, posted a substantial rebound in production in November to 780,000 b/d, from 700,000 the month before. The deal also exempts 1.5 million b/d of Russia’s condensate production, allowing Russia to increase condensate output by 800,000 b/d. The IEA left its increase-in-demand forecasts for 2019 and 2020 unchanged at 1 million b/d and 1.2 million b/d, respectively. It added that global oil demand increased by 900,000 b/d year on year in the third quarter, the strongest annual growth in a year, with nearly three-quarters of the growth occurring in China. The US’s Permian Basin is the last major US shale oil field that has been growing and hopes that it would increase its production on the order of 1 million b/d next year is the basis of the IEA’s forecast of a glut in the first part of 2020. However, last week IHS Markit, a consulting firm that follows shale oil production well by well, cast doubt on the optimistic future for shale oil. The IHS Markit analysis showed that newer wells in the Permian see their oil and gas production decline much faster than older wells so that operators will need to drill a significantly larger number of wells just to keep current production levels. Data from the new IHS Markit Automated Well Forecasting Technology showed that the base decline rate of the more than 150,000 producing oil and gas wells in the Permian Basin has “increased dramatically” since 2010 when horizontal drilling and fracking began. The surge in shale drilling and output in recent years has been accelerating because newer younger wells decline much faster than older wells. “Base decline” is calculated by identifying the actual or forecasted production of all the wells onstream at the start of the year, then tracking their cumulative decline by the end of the year. Understanding base declines is critical for operators who must determine what level of drilling and production targets must be achieved for their company to grow production, and hopefully, maintain performance and provide returns to investors. “Base decline is also the volume that oil and gas producers need to add from new wells just to stay where they are—it is the speed of the treadmill,” said Raoul LeBlanc, vice president of Unconventional Oil and Gas at IHS Markit. “Because of the large increases of recent years, the base decline production rate for the Permian Basin has increased dramatically, and we expect those declines to continue to accelerate. As a result, it is going to be challenging, especially for some companies with cash constraints, just to keep production flat.” Over the years, many observers have noted that the decline of production from new shale oil wells is so substantial that increased shale oil production cannot be maintained indefinitely. It seems that Permian production may be going into decline in the next few years and with it the growth of “affordable” oil production. The announcement by Chevron last week that it was writing down some $11 billion in assets this quarter is another sign that the era of endless losses in the drilling for shale oil and gas may be coming to an end. Chevron has nearly 900,000 net acres across the Marcellus and Utica shale fields; its write-down highlights the stress spreading beneath the booming region, less famous but no less consequential than the Permian Basin of Texas and New Mexico. Chevron still is heavily investing in Permian drilling. The oil major hopes to produce 900,000 bpd from the Permian by 2023. But after several years of working in West Texas, it’s not clear that Chevron is generating a lot of cash. Chevron’s CEO Mike Wirth said earlier this year that Chevron’s Permian business wouldn’t achieve positive cash flow until 2020. Hydraulic fracturing has lifted gas output in Appalachia from about 4 billion cubic feet per day in 2011 to almost 34 billion this year. This glut has led to US natural gas prices falling from $4 per million BTUs in 2011 to $2.26 last week. In 2020 they will average less than $2 for the year, the lowest in real terms since the 1970s, consultancy IHS Markit forecasts. The Wall Street Journal says the admission that billions of dollars’ worth of assets are worth a lot less than previously thought could force others in the industry to “publicly reassess the value of their holdings in the face of a global supply glut and growing investor concerns about the long-term future of fossil fuels.” The write-down is also an indictment of shale gas drilling in Appalachia. Low prices and a track record of not producing any profits has soured investors on the sector. A recent analysis by the Institute for Energy Economics and Financial Analysis (IEEFA) found that the seven largest Appalachian gas drillers burned through a half a billion dollars in the third quarter. “Despite booming gas output, Appalachian oil and gas companies consistently failed to produce positive cash flow over the past five quarters,” the IEEFA report said. Chevron’s impairment charge is becoming the norm. Schlumberger took a $12.7 billion write-down in October, mainly due to the slowdown in shale drilling. BP wrote down $2.6 billion in assets in October, and Repsol took a $5 billion impairment more recently. Part of the reason why companies are increasingly acknowledging the likelihood of lower long-term prices is because of the energy transition. Supplies are abundant, primarily because of the hundreds of billions poured into shale. But on the other side of the ledger, long-term demand looks increasingly shaky. |

2. Geopolitical instability

Brian Hook, the US State Department’s special representative for Iran, said Thursday that Iran’s lower exports since the US reimposed sanctions have cost Tehran some $50 billion in reduced revenues. The sanctions severely hindered the country’s push to expand refined product exports and ended foreign investment in its energy sector. Hook said that Iran’s revenues are currently falling at a rate of $30 billion per year.

Iranian oil exports, which averaged more than 1.7 million b/d in March, fell below 500,000 b/d in August, September, and October, based on estimates compiled from S&P Global Platts trade-flow software and shipping sources. Exports were 400,000 b/d in October with similar levels expected in November, according to preliminary Platts estimates.

Secretary of State Pompeo announced Wednesday that the United States plans to impose new sanctions on Iran’s largest shipping company and a major airline for what he said were their roles in transporting material for the country’s ballistic missile and nuclear programs. Pompeo said the sanctions on the shipping company and a subsidiary would not take effect until June 8, to give exporters of humanitarian goods to Iran time to find other transportation companies with which to work. The sanctions on the airline and three of its general sales agents are effective immediately.

Last week Iran’s Petroleum Engineering and Development Company announced that five new development wells and an appraisal well are to be spudded in North Azadegan to maintain current production levels. Senior energy sources in Iran say that this is only part of the picture, with much bigger plans having been agreed for rollout in the coming six months with the help of China and Russia.

Iran’s President Rouhani announced a “budget of resistance” to US sanctions, including a $5-billion loan from Russia. Rouhani said the budget would reduce Iran’s dependence on oil revenues to defy the effects of US sanctions. “This is a budget to resist sanctions … with the least possible dependence on oil,” Rouhani said. “This budget announces to the world that despite sanctions, we can manage the country.” The total size of the 2020/2021 budget is equal to almost $39 billion and is 10 percent higher than this year’s budget, Reuters noted, adding that it was lower in dollar terms because of a 35-percent rate of inflation booked for the current year.

The United States and Iran each freed a prisoner on Saturday in a rare act of cooperation. Iran released Xiyue Wang, a US citizen who had been held for three years on spying charges, while the United States freed Iranian Massoud Soleimani. He had been facing charges of violating US sanctions against Tehran. A senior US official said Washington was hopeful that Wang’s release would lead to the freeing of other Americans held in Iran and that it was a sign Tehran was willing to discuss other issues.

Recent protests in Iraq have demanded an end to rampant state corruption, the removal of foreign influences from Iraqi politics, and the proper provision of public services. The causes of these demands are partially shaped by the militia groups that began to emerge after the US invasion in 2003. The most significant of these groups, operating under the Shiite dominated umbrella of the Popular Mobilization Forces (PMF), utilize patronage links with Baghdad to support illicit economic activity that deprives the majority of Iraqis of wealth. This relationship partially explains why the PMF has been instrumental in repressing the protests in which over 300 people have died, and 15,000 have been injured.

Consequently, the structure of Iraqi governance, which generates the incentives for militias to maintain extortive economic practices, needs to be addressed before the demands of the protestors can be met. However, the extent to which these networked links have embedded themselves into Iraqi society implies that the problem of corruption and foreign interference will not be solved by simply replacing the current political elites but will require a bottom-up reconfiguration of much of the economy.

Reconfiguration of the Iraqi economy is unlikely to happen soon. Iraq will likely be subjected to continuing protests, which could threaten its increasing oil production.

In Libya, General Haftar has announced “the decisive battle and the advance on the heart of Tripoli.” For the last eight months, his eastern-affiliated militia, the Libyan National Army, has been trying to take over the seat of the UN-recognized Government of National Accord. The fighting has continued without yielding a clear winner, but it has affected the oil industry as fields are the natural target for groups supporting one or another side.

Just last month, for example, forces loyal to the Government of National Accord seized control of the El Feel field, which produces about 73,000 bpd, from Haftar’s army. A few days later, the National Oil Corporation declared a force majeure on El Feel after an illegal turn of a valve on the pipeline that carries crude from the field to the Mellitah terminal. There was no information about the party responsible for the force majeure.

“We are ready to push back any more mad attempts by the Haftar putsch leader,” the Interior Minister of the GNA said, following Haftar’s announcement.

3. Climate change

A handful of major states resisted pressure on Sunday to ramp up efforts to combat global warming as the UN climate summit ground to a close, angering smaller countries and a growing protest movement that is pushing for emergency action. The conference, in its concluding draft, endorsed only a declaration on the “urgent need” to close the gap between existing emissions pledges and the temperature goals of the landmark 2015 Paris climate agreement – an outcome UN Secretary-General Antonio Guterres called disappointing.

The main task of the meeting was to create a framework that would allow countries to exchange carbon offsets or pay each other for emission-reducing projects. The carbon market is the only remaining part of the “rule book” for the Paris pact that has not yet been finalized after negotiators failed to resolve the issue at last year’s summit in Poland. Observers say there is a substantial risk of no deal being reached – again – on the subject.

Jennifer Morgan, executive director at Greenpeace International who has been attending climate summits for 25 years, said: “I have never seen the divide so large between what is happening inside these walls and what is happening on the outside.” She was referring to growing public anxiety over the devastating impacts of climate change and a youth protest movement that has led millions of people to take to the streets around the world, including 500,000 at a rally in Madrid last week.

The governments of the US, China, and Russia currently prefer to concentrate on economic growth and are not showing much interest in taking on the expense and disruption of confronting climate change. Last week the European Commission unveiled Europe’s “Green Deal” plan to fight global warming. The plan includes a sweeping set of environmental initiatives aimed at creating the world’s first carbon-neutral continent by 2050, touching everything from state aid rules to a green industrial policy and a carbon border tax on imports. The EU wants to become the first significant economic bloc to reach zero carbon emissions by 2050, and it expects to propose a climate law in March to codify the target.

The UN conference occasioned the release of several new reports on the pace of climate change. Taken together, they foresee dire consequences for the world – sooner than expected. Temperatures in the Arctic region remained near record highs this year, leading to low summer sea ice, cascading impacts on the regional food web, and growing concerns over sea level rise.

Climate change is hitting those regions dependent on high mountain glaciers and snowpacks for their water far harder than the world on average. Disappearing mountain snow and ice is putting these “water towers,” and the billions of people that depend on them, in ever more precarious positions. New research published last week in Nature identifies the most important and vulnerable “water towers” in the world.

Extreme weather patterns associated with heatwaves and droughts are raising the risks of simultaneous harvest failures of vital crops worldwide, such as wheat, corn, and soybeans. This situation is pushing the world closer to the edge of food price spikes, associated social unrest, and food shortages.

Trillions of dollars of market value could disappear due to climate change. The damage hits the global economy in multiple ways. Physical damage from more powerful natural disasters is on the rise, and 2017 and 2018 were the costliest back-to-back years for economic losses related to natural disasters. One example is the real estate market along coastlines, which will see both physical damage and a dramatic drop in value as the threat becomes increasingly apparent. That happens through a variety of mechanisms – people move away, zoning ordinances restrict building, insurance companies withdraw support, investors withdraw capital, etc. If sea levels rise by 6 feet by 2100, an estimated $900 billion in US homes would be lost.

Greenland is losing ice seven times faster than it was in the 1990s. The assessment comes from an international team of polar scientists who’ve reviewed satellite observations over 26 years. They say Greenland’s contribution to sea-level rise is currently tracking what had been regarded as a pessimistic projection of the future. It means an additional 7 cm of ocean rise could now be expected by the end of the century from Greenland alone. The rapid melting threatens to put many millions of people in low-lying coastal regions at risk of flooding. It’s estimated roughly a billion people live today less than 10 meters above current high-tide lines, including 250 million below 1 meter.

A new poll shows that Americans remain shaky on the details of climate science even as they have grown increasingly concerned about human activity warming the earth. The survey shows that in just five years, the percentage of people calling climate change a “crisis” has jumped from 23 percent to 38 percent. More than 3 in 4 US adults and teenagers alike agree that humans are influencing the climate. The overwhelming majority of them say it’s not too late for society to come up with solutions. Still, a third of adults who say humans are causing climate change don’t think they can personally make a difference.

The poll shows a shocking lack of understanding of the forces behind climate change, with 43 percent of adults and 57 percent of teens citing “plastic bottles and bags” as a major contributor. More than a third of American adults, 37 percent, cited “the sun getting hotter” as a major contributor, and 21 percent called it a minor contributor. (The sun has shown no net increase in radiance since 1950 and is a negligible factor in the observed spike in atmospheric temperature, according to NASA.)

4. The global economy and trade wars

President Trump and China have agreed to a partial “phase one” trade deal after 21 months of wrangling. Trump tweeted Friday that the agreement is “large” and “amazing.” Top Chinese officials held a rare news conference to emphasize this deal was a win for them that meets the “growing needs of the Chinese people.” Stocks hit record highs Thursday as Wall Street applauded the news but ended little changed Friday as details of the agreement trickled out.

The settlement commits China to buy at least $40 billion of US agricultural goods annually, tightens protection for US intellectual property, and bans the forced transfer of technology from US companies.

It also contains commitments on the Chinese side against competitive devaluations of its currency and measures to improve access to its market for US financial services. However, China did not make concessions on some of the most significant sources of strain in the bilateral relationship, such as its use of industrial subsidies and state-owned enterprises, as well as cyber theft, leaving those thorny issues to a later stage.

In exchange for those concessions, the US agreed not to proceed with a new increase in levies on $156 billion of Chinese consumer goods planned for last Sunday, and it will cut tariffs on $120 billion of Chinese imports that began in September to 7.5 percent from 15 percent. Washington is still maintaining 25 percent tariffs on about half of all Chinese imports, worth about $250 billion, which began when the trade war started in March 2018.

The agreement is to be signed in early January and take effect a month later. Assuming it holds, it marks the most significant de-escalation in trade tensions between Washington and Beijing since the tariff fight began. The deal will obviously give a boost to the global economy, which has been shaky of late.

China established an economic growth target for 2020 of around 6 percent, which is a reduction from the 6-6.5 percent it hopes to achieve this year. Numerous outside observers note there are significant flaws in Chinese economic growth statistics so that they are not comparable to those announced by other countries. The Chinese Communist Party is always trying to support growth to limit job losses that could affect social stability but are facing pressure to tackle debt risks caused by pump-priming policies.

China’s companies acquired some massive debts as they expanded, and the world’s investors and lenders rushed to offer them even more money. Now the bills are coming due, and a growing number of Chinese companies can’t pay up, a sign that Beijing is feeling the stress from its worst slowdown in nearly three decades. A decade ago, when the global financial crisis threatened world growth, China began a giant stimulus push to build roads and bridges and create jobs. To fund it, banks lent heavily, and local governments started raising money.

The push resulted in the most massive credit expansion by any single country, in terms of the size of its economy. The banking system more than quadrupled in size, from $9 trillion at the end of 2008 to $40 trillion today.

Eurozone industrial production fell as expected in October because of a decline in the output of capital goods, estimates from the European Union’s statistics office, Eurostat, showed on Thursday. Eurostat said production in the 19 countries sharing the euro fell 0.5 percent month-on-month for a 2.2 percent year-on-year decline. Capital goods production fell by 2 percent on the month for a 3.6 percent year-on-year fall even though the output of durable and non-durable consumer goods rose. Now that the UK is on track to leave the EU early next year, Britain is likely to suffer more economic problems.

While parts of the US economy, such as employment and the equity markets are doing well, others are sending signals of troubles ahead. US retail sales increased less than expected in November as Americans cut back on discretionary spending despite a strong labor market. This decline is raising fears the economy is slowing a bit faster than anticipated in the fourth quarter. The report from the Commerce Department on Friday bucked a recent raft of reasonably upbeat data on the labor market, housing, trade, and manufacturing that had suggested the economy was growing at a moderate speed. Falling diesel consumption in the US is a significant warning sign of manufacturing output continuing to contract and volume of freight plunging.

5. Renewables and new technologies

Denmark is moving forward with plans to build an artificial island tying in power from offshore wind farms of up to 10 gigawatts (GW) of capacity, more than enough to supply all households, as part of efforts to meet ambitious climate change targets.

Total installed onshore wind power capacity in the US has already exceeded 100 gigawatts, with more than half of that nameplate capacity installed over the past seven years, the EIA said last week. Onshore wind capacity in the US has surged in recent years, more than tripling over the past decade.

Data released last week by the Solar Energy Industries Association shows that solar power is also surging. The association said 2.6 GW of solar PV was installed in the third quarter of this year, which was a 25 percent increase from Q2 2019 and an increase of 45 percent from Q3 2018. In the past quarter, companies installed a “record-setting” 700 MW of residential rooftop PV. The solar association believes installed PV capacity in the US will “more than double” over the next five years, with annual installations reaching 20.1 GW in 2021.

There was mixed news about the growth of the electric vehicle industry. China’s production of “new energy vehicles” (mostly electric) fell 36.9 percent year on year to 110,000 units in November, continuing year-on-year declines posted each month since July, but up 15.8 percent from October.

However, the switch-over to more electric vehicles is moving along well in Europe, where climate change is taken more seriously. The European Commission approved $3.53 billion of state aid for research and innovation in battery technology. The approval is for projects in Belgium, Finland, France, Germany, Italy, Poland, and Sweden to support research and innovation in the common European priority area of batteries. The public funding is expected to unlock an additional $5.5 billion in private investments. The completion of the overall project will be in 2031.

Chinese electric bus manufacturer BYD has secured the largest single order to date for full battery-electric buses in Europe in a deal with the Dutch subsidiary of global public transport provider, Keolis. The order comprises 259 BYD “eBuses” scheduled for delivery starting next summer.

Germany’s Bild newspaper reported last week that Tesla plans to build 500,000 electric vehicles a year at its new factory on the outskirts of Berlin. The German newspaper Frankfurter Allgemeine Zeitung reported that Tesla would invest up to $4.41 billion in the plant, which will provide 10,000 jobs. Construction will start in 2020, the newspaper reported.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

With global gas supplies growing faster than demand and forecasters warning of a deepening glut, it was only a matter of time before analysts began talking about a gas version of OPEC with the power to control international prices. But is an OGEC even possible? There is already an organization of gas exporters. It’s called the Gas Exporting Countries Forum and involves a dozen countries, led by Russia, Qatar, and Iran. The list of members also includes Nigeria, Africa’s top LNG producer; Egypt, which has recently staked a claim in the international gas market with several discoveries; and Libya. Of the top 10 natural gas exporters in the world, four are members of GECF, led by Russia, which is the largest natural gas exporter. (12/11)

In Russia, the head of the nation’s largest oil firm, Rosneft, has pitched a massive Arctic oil project—Vostok—to Japanese companies in Tokyo, looking for foreign investment into the project estimated to cost as much as US$157 billion. (12/12)

Still sanctioning Russia: US lawmakers have included sanctions on companies helping Russia’s gas giant Gazprom to complete the Nord Stream 2 pipeline project in the National Defense Authorization Act for the US defense in 2020. The sanctions in the bill, which US lawmakers must pass to authorize defense expenditures, would target subsea construction vessels that lay the pipeline and managers at firms connected with those vessels. (12/11)

Lebanese gas boom? Based on currently available geophysical data, the Lebanese government estimates that the offshore oil and gas frontier areas in the East Mediterranean may hold around 25 trillion cubic feet of natural gas reserves, though this has yet to be proven. An initial exploration well is expected to be drilled in block four by the end of 2019, or in early 2020. Once an exploration blind spot, the Eastern Mediterranean is now a hot region of interest, and a relatively unexplored swath off the coast of Lebanon – which is surrounded by known hydrocarbon systems – offers great promise. (12/11)

Saudi Aramco’s initial public offering (IPO) is the centerpiece of the Saudi crown prince’s vision for diversifying the kingdom away from its oil dependence by using the $25.6 billion raised to develop other industries. But that is well below his 2016 plan to raise as much as $100 billion via a blockbuster international and domestic IPO. Riyadh scaled back its ambitions after overseas investors balked at the proposed valuation, and only 1.5 percent of Aramco shares were listed on the Riyadh stock exchange on Wednesday, a tiny free float for such a huge company. (12/12)

Aramco’s shipping division has issued an expression of interest in the chartering of up to a dozen LNG carriers beginning in 2025, Reuters reports. Liquefied natural gas is a big part of Aramco’s diversification efforts seeking to reduce its almost exclusive dependence on crude oil exports through a bigger focus on natural gas and petrochemicals. (12/10)

India to join IEA? The members of the International Energy Agency have agreed to establish a “strategic partnership” with India that would serve as a pathway for the South Asian country’s eventual membership, the IEA said in a statement at the weekend. The move is significant because the IEA only allows OECD nations as members under its current charter, and India is one of eight countries that have a non-member “association” status. (12/9)

China launched its long-awaited national pipeline company Monday, a move that is set to expand infrastructure access to energy industry stakeholders. The new company is expected to break up long-existing monopolies in China’s oil and gas sectors, with the ultimate goal of enhancing supply security and lowering the cost of the country’s energy consumption. (12/9)

China’s auto market, the world’s biggest, is set for the third year of contraction with a 2 percent decline in sales next year, hit by a weaker economy and U.S.-China trade tensions, the country’s top auto industry body said on Thursday. The China Association of Automobile Manufacturers expects sales to slide to about 25.31 million vehicles in 2020. (12/12)

In Ghana, a private company and its local partners have discovered 1.5 billion barrels of oil in place offshore the West African country, the company Springfield E&P said on Wednesday. Springfield and its partners Ghana National Petroleum Corporation and GNPC EXPLORCO also found 700 billion cubic feet of gas in the West Cape Three Points Block 2 they had recently drilled. (12/12)

Venezuela’s PDVSA produced between 926,000 and 965,000 bpd of crude oil last month, up by as much as 20 percent from the previous month when the average was 761,000 bpd. (12/12)

In Mexico, Pemex’s new oil discovery at the Quesqui field might paradoxically prove to be the worst news of 2019 for the energy sector, as it will be used to justify a shunning of badly needed private investment for years to come, veteran Mexico energy watcher Duncan Wood said Wednesday. The onshore find, announced Friday, in the southeastern Tabasco state holds 3P reserve potential of 500 million barrels, according to state-run Pemex, which plans to drill 11 new wells with a total production of 69,000 b/d next year. (12/12)

The US oil rig count grew by four last week, the first such increase in weeks, according to Baker Hughes Co. However, the gas rig count decreased by four, leaving the total rig count unchanged at 799 but down 272 from last year at this time. Canada’s overall rig count increased this week, with oil and gas rigs increasing by 15, after last week’s 12-rig increase. Oil and gas rigs in Canada now stand at 153, down 21 year over year. (12/14)

Chevron said Thursday it would go ahead with its Anchor project in the Green Canyon area of the Gulf of Mexico, sanctioning the industry’s first deepwater high-pressure development. The use of this new technology, which can handle pressures of 20,000 psi, opens the door to other high-pressure opportunities in the Gulf of Mexico for Chevron and other industry players. (12/13)

Exxon’s good-news/bad news: In his 55-page ruling, New York State Supreme Court Justice Barry Ostrager said the attorney general’s office had failed to prove the company violated either the Martin Act, a broad antifraud statute commonly used to pursue financial crime, or other similar laws. Still, he noted the case was a securities-fraud one, and his ruling only revolved around that issue. “Nothing in this opinion is intended to absolve ExxonMobil from responsibility for contributing to climate change through the emission of greenhouse gases in the production of its fossil fuel products.” (12/11)

New offshore oil terminal: Enbridge has an option to purchase an ownership interest in Enterprise’s Sea Port Oil Terminal (SPOT) if SPOT receives a deepwater port license. The SPOT project would comprise onshore and offshore facilities, including a fixed platform approximately 30 nautical miles off the Brazoria County, Texas, coast in about 115 feet of water. The company added that SPOT would be designed to load VLCCs at rates of approximately 85,000 barrels per hour – equating to almost 2 million barrels per day. (12/10)

Nat.gas boom to bust: A decade ago, natural gas was heralded as the fuel of the future. In shale fields across the country, hydraulic fracturing uncorked a lucrative new source of supply. Energy giants like Exxon Mobil and Chevron snapped up smaller companies to get in on the action, and investors poured billions of dollars into export terminals to ship gas to China and Europe. The boom has given way to a bust. A glut of cheap natural gas is wreaking havoc on the energy industry, and companies are shutting down drilling rigs, filing for bankruptcy protection, and slashing the value of shale fields they had acquired in recent years. (12/12)

Nat.gas bans: With concerns about natural gas’s impact on climate change rising, several Massachusetts cities and towns have started exploring outright bans on new natural gas hookups in commercial and residential buildings. Berkeley (CA) passed the first such ban in the country this past summer, and other West Coast cities have since followed with similar restrictions. But in Massachusetts, as Cambridge discovered on Wednesday, it might be harder—if not impossible—to do. The reason: the city ordinances and town bylaws in Massachusetts may conflict with existing regulations that are governed by the state. (12/14)

Nat.gas-to-gasoline: IHI E&C International Corp. has won a front-end engineering and design (FEED) study for a first-of-its-kind natural gas-to-gasoline plant in Texas, gas monetization technology developer Primus Green Energy Inc. reported Wednesday. Primus commissioned the FEED study along with a global petrochemicals joint venture partner whose identity was not disclosed. (12/13)

Sustainable aviation fuel: KLM has purchased sustainable aviation fuel for flights out of Amsterdam Airport Schiphol. The sustainable fuel is produced by Neste from used cooking oil and will reduce CO 2 emissions by up to 80 percent compared to fossil kerosene. Using sustainable aviation fuel is currently one of the most effective ways to reduce CO2 emissions in the airline industry. (12/11)

ZEV push: California is joining seven other states and the District of Columbia in committing to develop an action plan to put hundreds of thousands more zero-emission trucks and buses on their roads and highways. The partners will present a proposed memorandum of understanding to the governors of the states and the mayor of the District of Columbia for consideration in the summer of 2020. (12/13)

Cadillac to go 100 percent EV? The head of General Motors Co’s Cadillac luxury brand said on Thursday that a majority, and possibly all, of the brand’s models, would be electric vehicles by 2030. (12/14)

PG&E under fire: In a letter Friday to PG&E, the Democratic governor said the company’s plan “fails to address most of the issues we previously raised,” including a transformed corporate board and sufficient financial stability to make significant safety investments. PG&E has until Tuesday to respond and make changes to the plan, under a deal it struck last week to settle claims with wildfire victims for $13.5 billion. (12/14)

US wind power: Total installed onshore wind power capacity in the United States has already exceeded 100 gigawatts (GW), with more than half of that nameplate capacity installed over the past seven years, the US EIA said on Monday. Onshore wind capacity in the US has more than tripled over the past decade. As of the third quarter of this year, Texas had the most onshore wind capacity installed—26.9 GW—followed by Iowa, Oklahoma, and Kansas. (12/10)

The Trump administration has promised to give individual states more power to set their strategies for curbing air and water pollution. But states may not be up to the job: A whopping 30 states have cut their environmental budgets over the past decade, a new study found. And it’s raising concerns among environmental advocates about whether states have enough resources to stop polluters. (12/10)

Oceanic oxygen depletion: Climate change and nutrient pollution are driving the oxygen from our oceans and threatening many species of fish. That’s the conclusion of the biggest study of its kind, undertaken by conservation group IUCN. While nutrient run-off has been known for decades, researchers say that climate change is making the lack of oxygen worse. (12/7)

Mt. Everest melting? Data from a newly installed weather station atop Mount Everest shows that the mountain experiences some of the most intense sunlight on the planet. This effect is amplified to an astounding degree at the 29,000 ft mountain and will eventually result in the melting of the ice at the summit. (12/14)