Editors: Tom Whipple, Steve Andrews

Quote of the Week

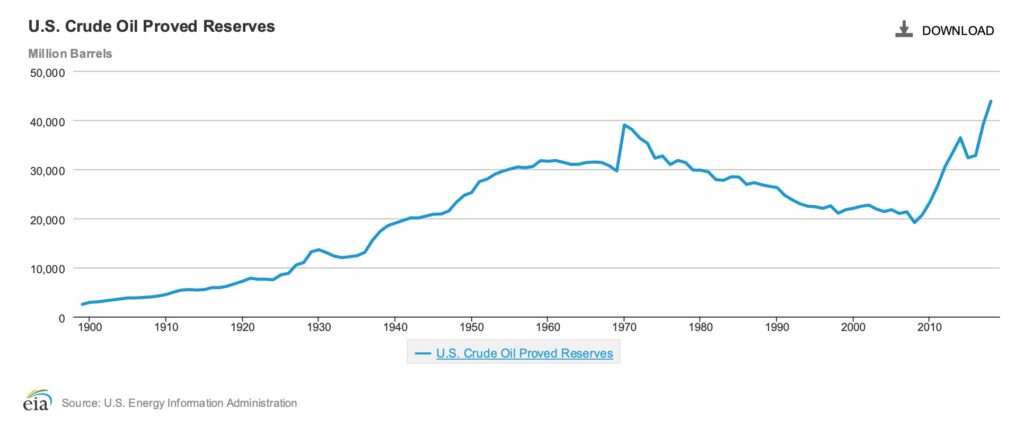

“Another year of stronger oil and natural gas prices increased 2018 oil and natural gas proved reserves in the United States to another all-time record level. Crude oil and lease condensate proved reserves rose by 12 percent, and natural gas proved reserves rose by 9 percent. US crude oil and lease condensate production increased by 17 percent, and US total natural gas production increased by 12 percent.”

US Energy Information Administration

Graphic of the Week

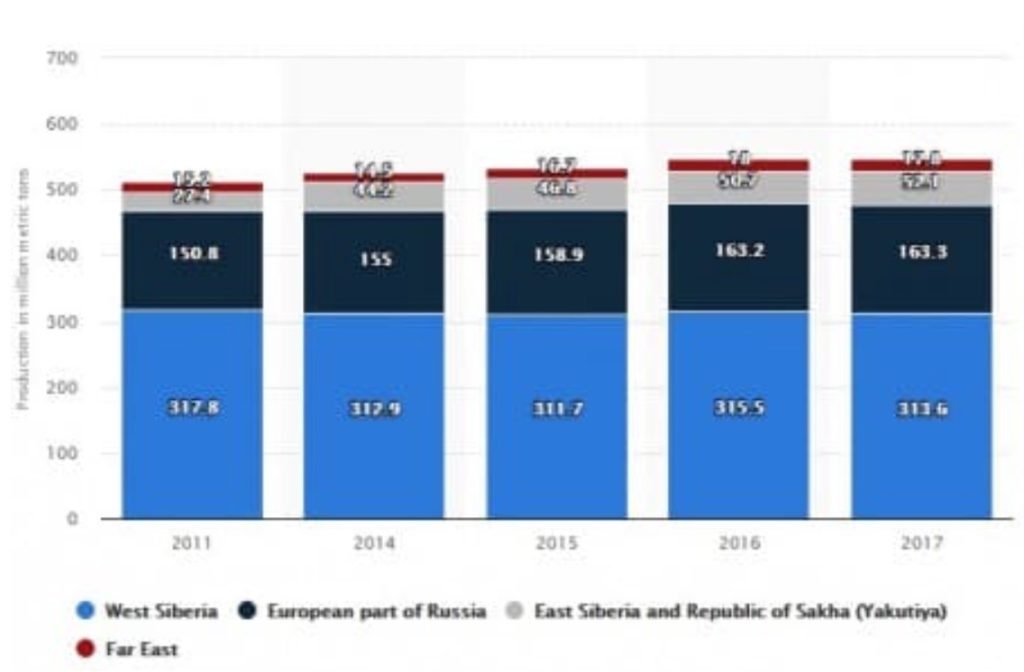

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil futures finished lower Friday, with declines accelerating after the weekly report on drilling rigs showed a significant increase. However, prices still climbed for a third straight week after easing US-China trade tensions lifted business confidence and the outlook for global economic growth. West Texas Intermediate settled Friday at $60.44, while Brent ended the week at $66.14. Oil didn’t move a lot last week but hit three-month highs, driven higher by the OPEC+ cuts, the U.S.-China trade de-escalation, the slowdown in shale, and the apparent stabilization in the global economy. There is a debate about how effective the additional OPEC+ cuts will turn out to be and whether the deal is significant or if it is merely a clever bit of repackaging existing realities. But the oil market bought it, helping to push prices up in the days following the OPEC and trade announcement. The IEA still sees a stubborn glut sticking around in the short term, but the extra 500,000 b/d in promised OPEC+ cuts helped change market sentiment. Last week the Trump administration, under impeachment pressures, threw in the towel on the trade war and agreed to reduce some tariffs on China and cancel others. In exchange, Beijing promised to buy massive volumes of agricultural goods. Again, it’s difficult to parse out reality from hype, but the fact that the trade war has shifted from escalation to de-escalation has provided a jolt to oil. US shale oil is also slowing. There is a wide range of shale oil production growth forecasts for 2020. These run from just a few hundred thousand barrels per day on the low end and around 1 million b/d or more on the upper end. JP Morgan raised its oil price forecasts for next year, as the bank expects OPEC’s production cuts to be effective in conjunction with expectations for better economic growth in emerging markets. The bank says that rather than oversupply, the oil market will be in a deficit next year, by 200,000 b/d. This is in stark contrast to its estimates from September, which assumed a 600,000 b/d oversupply situation for 2020. JP’s new forecast for the Brent crude oil benchmark is $64.50 for next year, up from earlier projections of $59. For 2021, the bank is expecting prices to fall to $61.50. For the US WTI benchmark, JP Morgan is projecting $60 per barrel next year. Goldman Sachs said that it would no longer finance coal projects or oil and gas exploration in the Arctic. In a new environmental policy, the investment bank acknowledged the urgency of climate change. It noted that not acting would be “costly for our natural environment, humans, and to the economy.” It appears to be the first time one of the largest US banks has cut off financing for entire swathes of the fossil fuel sector. US oil production in some of the most prolific shale basins is set to slow next month, according to new data from the EIA. Production in the Permian basin is forecast to increase from 4.694 million b/d this month to 4.742 million next month – only a 48,000 b/d increase. It represents the smallest increase since July. The Bakken – the second-largest shale basin — could see oil production increase from 1.523 million b/d to 1.526 million next month, an increase of just 3,000 b/d. Production in the Eagle Ford, the region with the third most production, is set to decrease in January, falling from 1.366 b/d in December to 1.357 in January. Signs of the shale slowdown predicted by many analysts, and the EIA itself, are already surfacing in the form of vacant hotels, a dip in home prices, a noticeable reduction in overtime hours for oil workers, and a change in standards for hiring. Texas’ Permian basin lost 400 jobs in the first ten months of this year, according to the Dallas Morning News. Overall, though, production from the seven highest-producing shale plays – the Anadarko, Appalachia, Bakken, Eagle Ford, Haynesville, Niobrara, and Permian – is expected to increase 30,000 b/d next month. However, this forecast represents a significant increase from the last Drilling Productivity Report, which showed a 10,000 b/d increase from November to December and an 18,000 b/d increase from October to November. Russia’s oil sector is facing challenges to maintain its current level of production. Although Russia ranks 8th in terms of proven oil reserves, it is the second-largest producer with an output of 11.2 million b/d. Only the US produces more, with, on average, 12 million b/d in 2019. While Russia’s proven reserves are almost 70 percent less than Saudi Arabia’s, it is on par when it comes to production. However, a majority of Russia’s oil originates from fields in Western Siberia that have been in operation for decades. Unless Russia can get arctic oil into large scale production or start fracking shale, it will eventually see a decline in production. |

When looking at price forecasts for next year, it’s enough to focus on trends in just two countries. The two are China and India. They are among the world’s top oil consumers, together accounting for almost a fifth of global oil consumption. China and India have been consistently trumping the United States in importance when it comes to oil price trends in recent years because the demand for oil has been growing a lot faster in both China and India. In China, oil demand has been increasing at an average annual rate of 5.5 percent, according to BP data cited by Kemp. In India, it has been growing by some 5.1 percent since 2008. Meanwhile, US oil demand has only been climbing by 0.5 percent over the last decade.

2. Geopolitical instability

Russia and Ukraine signed a protocol late on Friday, agreeing on terms for the transit of gas to Europe. This action concludes the long-awaited renewal of a deal due to expire at the end of the year. The move followed trilateral Russia-Ukraine-EU talks in Minsk and Thursday’s nine-hour talks in Berlin that resulted in the “agreement in principle” that moved the gas markets on Friday. Reports that both sides were closer to avoiding a third gas crisis since 2005 knocked prices across Europe on Friday morning, with UK contracts for delivery in January down 7 percent.

The new agreement is a positive development for Europe’s gas security, European Commission Vice President Maros Sefcovic said on Friday. “After these very intensive talks, I am very glad to say that we reached an agreement in principle on all key elements which I believe is very positive news for Europe, for Russia and Ukraine.”

President Trump signed a bill including new Nord Stream 2 pipeline sanctions into law, but it remains unclear whether the US sanctions will have any impact on the pipeline’s construction. “It may very well be that the sanctions do not have enough of a bite to have a meaningful impact on the construction activities,” said Annie Froehlich, a nonresident senior fellow with the Atlantic Council. Froehlich’s comments came during an Atlantic Council event Thursday, where views on the forthcoming sanctions and the administration’s path forward in imposing them appeared split.

However, Switzerland-based Allseas — which has been integral to laying the controversial Nord Stream 2 gas pipeline from Russia to Germany — has suspended pipelaying activity after the new sanctions were signed into law, the company said Saturday. The move by Allseas will undoubtedly mean further delays to the completion of the 55 billion cm/year pipeline, which had originally been scheduled to start operations at the end of 2019.

The much-vaunted deal involving the transfer of oil from the semi-autonomous region of Kurdistan in exchange for budget disbursements from Iraq’s federal government is in a lot of trouble. Not only are both sides amid domestic political upheavals, but both find themselves in a tug of war between foreign powers. It probably will be Russia, China, and Iran that will decide whether the oil-for-budget-payments deal goes ahead.

Iraqi Prime Minister al-Mahdi indicated he is unlikely to send a draft 2020 budget to Parliament. Instead, he will leave the next government to answer tough questions about how to pay a massive public-sector payroll, fund investment spending, and establish a stable financial and oil arrangement with the Kurdistan region. “Abd al-Mahdi saw the growing opposition against his government and the draft budget as well, so he did not want to send a draft budget to Parliament that could have increased this opposition,” said Shirwan Mirza, a member of the Parliament Finance Committee. “It’s not reasonable to get a caretaker government to make a financial plan.”

Fighting has escalated in Libya as warplanes bombed targets in Tripoli and two other cities shortly after the UN-backed government in the capital announced on Thursday that it was deepening military co-operation with Turkey. Gen Haftar’s self-styled Libyan National Army threatened on Friday that unless militias from the city of Misurata leave Tripoli by midnight on Sunday, their city will continue to be targeted “in an unprecedentedly intensive way.” The LNA ultimatum came after a night of airstrikes against targets in Tripoli, Misurata, and Sirte. Ahmed al-Mismari, a spokesman for the LNA, said they bombed sites used to store Turkish supplied weapons.

In the past, the LNA has avoided targeting the self-governing city of Misurata, whose militia emerged as a formidable fighting force after the uprising of 2011 that ended the rule of strongman Gaddafi. Misuratan troops supported by US airstrikes also expelled ISIS from Sirte in 2017.

Turkey signed a military agreement with the Tripoli government in November that included provisions on intelligence-sharing, arms supply and the prospect of creating a “quick reaction force” for the Libyan military and police. Recep Erdogan, the Turkish president, has said repeatedly in recent weeks that he would be willing to send military assistance to Tripoli if the government formally requested it.

The conflict in Libya has turned into a proxy war with foreign governments lining up behind each of the warring sides. While Turkey is a main backer of the Tripoli government, supplying drones and armored vehicles, Gen Haftar has been supported by Egypt, the UAE, France, and Russia.

The US said new evidence and analysis of weapons debris recovered from an attack on Saudi oil facilities on Sept 14 indicates the strike likely came from the north, reinforcing its earlier assessment that Iran was behind the offensive. In an interim report of its investigation, Washington assessed that before hitting its targets, one of the drones traversed a location approximately 124 miles to the northwest of the attack site. However, the report noted that the analysis of the weapons debris did not definitely reveal the origin of the strike that initially knocked out half of Saudi Arabia’s oil production.

Reuters reported last month that Iran’s leadership approved the attacks but decided to stop short of a direct confrontation that could trigger a devastating US response. It opted instead to hit the Abqaiq and the Khurais oil plants of US ally Saudi Arabia, according to three officials familiar with the meetings and a fourth close to Iran’s decision making. Some of the craft flew over Iraq and Kuwait en route to the attack, according to a Western intelligence source cited by the report, giving Iran plausible deniability. The 17-minute strike by 18 drones and three low-flying missiles caused a spike in oil prices, fires and damage and shut down more than 5 percent of global oil supply. Saudi Arabia said on Oct 3 that it had fully restored oil output.

3. Climate change

The most interminable United Nations climate talks on record finally ended in Madrid with a compromise deal last week. Exhausted delegates, from nearly 200 nations, reached agreement on the critical question of increasing the global response to curbing carbon. All countries will need to put new climate pledges on the table by the time of the next major conference in Glasgow next year. Divisions over other questions – including carbon markets – were delayed until the next gathering. However, after two extra days and nights of negotiations, delegates finally agreed to a deal that will see new, improved carbon-cutting plans by next year.

The talks that stuttered to a belated and inconclusive close were undone by a technical issue that turned into a fatal obstacle. A central task of this year’s negotiations, was to establish rules for a new global carbon market—referred to as “Article 6” because it is the sixth article of the Paris climate accord—and create a system that would allow countries to pay each other for projects that reduce emissions.

The Trump administration has taken numerous high-profile steps to try to boost the coal industry, resulting in many of them tied up in legal challenges. The new order from the Federal Energy Regulatory Commission aims to accomplish many of the same goals. Energy regulators issued an order Thursday that likely will tilt the market to favor coal and natural gas power plants in the nation’s largest power grid region, stretching from New Jersey to Illinois. Critics say that it effectively creates a new subsidy to prop up uneconomical fossil fuel plants and that it will hurt renewable energy growth and consumers.

The transition to net-zero carbon emissions is the law of the land in the UK. To achieve net-zero, companies must put in place a transition plan creating enormous opportunities and risks. Modeling for the full extent of climate-related financial risk is complex and challenging. The Bank of England’s latest survey of the banking sector found that almost three-quarters of the banks, representing $11 trillion of assets, are starting to treat climate risks like other financial risks.

Scrubbers for large ships cost several million dollars but will allow the operators to avoid buying new low-sulfur fuel. Traders say low-sulfur fuel will be some 30 percent more expensive than conventional bunker fuel. That will give ships with scrubbers significant cost savings that companies expect to use to get an edge in competition for international cargoes. “There is a significant premium for scrubber-fitted vessels next year,” said George Lazaridis, head of research at Athens, Greece-based Allied Shipbroking Inc. “Those who put money into them made a big bet, and now it’s payback time.”

Deforestation and other fast-moving changes in the Amazon threaten to turn parts of the rainforest into savanna, devastate wildlife and release billions of tons of carbon into the atmosphere, two renowned experts warned Friday. Thomas Lovejoy of George Mason University and Carlos Nobre of the University of Sao Paulo in Brazil, both of whom have studied the world’s largest rainforest for decades say “The precious Amazon is teetering on the edge of functional destruction and, with it, so are we.”

4. The global economy and trade wars

According to the Washington Post, the US economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats that may have eliminated the risk of a recession. “This marks a dramatic turnaround in momentum since August, when some forecasters predicted a 50 percent chance of a downturn starting by the end of next year.”

Much of the economic discussion last week centered on the implications of the US-China trade agreement. Administration officials hyped the agreement while skeptics expressed doubt that it would do much for the US economy. The “Phase I” agreement consisted of lifting the tariffs and retaliatory tariffs imposed in the last 18 months.

The US-China trade deal will nearly double US exports to China over the next two years and is “totally done” despite the need for translation and revisions to its text, US Trade Representative Robert Lighthizer said last week. The full details of the US-China deal have not been published, and it is billed as a preliminary deal for modest de-escalation while more comprehensive, and difficult, talks continue. Cheaper Brazilian soybeans already cover much of China’s near-term demand. The trade deal may be unsustainable as Beijing might not be able to buy $40 billion worth of US agricultural products annually due to economic and commercial reasons.

There is little doubt that China can scale up its purchases from the current pace of about $10 billion a year. Its pork production has been decimated by an African swine fever, and the nation can’t yet feed its population of 1.4 billion only with domestic suppliers. In nearly two decades of burgeoning American agricultural exports to China since its admission to the World Trade Organization, there has never been a period with the scale of growth foreseen by the US version of the deal.

Supportive central government policies lifted China’s economic activity in November—bolstering factory production. Consumer spending prompted some economists to raise their growth estimates for next year. While many remain cautious about the sustainability of any improvement in China’s economy, the better-than-expected data released last Monday would alleviate concerns about downside risks.

While the US’s and China’s economies seem to the holding their own, the same cannot be said for Europe. Euro zone business growth remained weak in December, with tepid foreign demand exacerbating a contraction in manufacturing and offsetting a slight pick-up in services activity, although some analysts saw signs of stabilization. IHS Markit’s Euro Zone Purchasing Managers’ Index (PMI) stayed at 50.6 in December. The German economy is more or less stagnating, the Economy ministry said on Monday, however, adding there are initial signs that an industrial recession could be coming to an end as orders stabilize. The ministry also said in its monthly report that indicators at the start of the fourth quarter pointed to subdued private consumption even though disposable incomes continued to rise.

Shell warned Friday of lower earnings and underwhelming output in the fourth quarter of 2019, weighed down by a weaker economic outlook as well as challenging trading conditions at its gas trading division, adding that it expects impairment charges of up to $2.3 billion. “Based on the macro outlook, post-tax impairment charges in the range of $1.7-2.3 billion are expected for the quarter,” the company said.

5. Renewables and new technologies

US utility-scale battery storage installations totaled around 1 GW in 2019 and expect that figure to nearly triple in 2020. However, policy decisions in the coming year are poised to shape the pace of growth and revenue potential for the sector. California’s Independent System Operator is the largest market for utility-scale storage, with the state’s energy storage mandate requiring the three largest utilities in the state to contract for 1.3 GW of storage by 2020.

Chief among the obstacles heading into 2020 is the tariffs currently imposed on Chinese lithium-ion batteries and related equipment. These tariffs are already slowing projects. While a phase one trade deal between the US and China was announced in mid-December, the impact and staying power of that deal remain to be seen.

The best opportunity for accelerating storage deployment growth would be creating an investment tax credit for standalone energy storage projects. However, Congress dashed hopes for such tax credits in 2020. The House Rules Committee attached a tax extenders package to the pending fiscal 2020 spending bill that did not include a new credit for energy storage.

India has one of the most ambitious renewable power programs in the world, with plans to have wind and solar account for 55 percent of the total energy mix by 2030. However, growth in India’s renewable energy output slumped to 5.7 percent over the seven months to October 2019, from 28.5 percent a year earlier, according to the country’s Central Electricity Authority. Among the reasons for the decline, the authority cited energy output curtailment by different states as well as a slump in energy demand. Last month, Indian media reported several coal-fired and nuclear power plants were being shut down temporarily for lack of demand. Some of these had been idle for months.

The Trump Administration has waived tighter rules for less efficient lightbulbs. The move is a blow to more than a decade of work by some lawmakers and environmental advocates to phase out inefficient lightbulbs in favor of newer technologies. Some lightbulb manufacturers have opposed that push, while climate activists, state attorneys general, and others argue that tighter standards are needed to increase energy efficiency in homes and reduce greenhouse gas emissions.

Scientists the world over have been trying to take a space-grade, super-efficient process for creating spray-on solar cells and make it economically feasible on earth. Everyone said it was impossible. Now, scientists from the National Renewable Energy Laboratory say they have cracked the code with a new process of D-HVPE (dynamic hydride vapor phase epitaxy) grown solar cells.

Efficiency is the Holy Grail of solar power and efficiency is what’s keeping solar power from dominating the energy market. At less than 20 percent, the efficiency of solar cells is much lower than that of gas-fired power plants, which have efficiency levels of between 42 and 60 percent. NREL scientists claim to have revolutionized the process of growing high-efficiency, space-grade material, by increasing a new material for solar cells using a method that is much cheaper than the one that is more widely used today.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Bunker fuel vs. LNG: As shipping companies prepare to bring their fleets into compliance with IMO 2020, LNG is poised to capture a small but growing portion of the international bunker fuel market in the US and across the globe. On January 1, 2020, ocean-going vessels have to cut the sulfur content in fuels to 0.5 percent from the previous limit of 3.5 percent established in 2012. To comply, fleet owners are switching to the use of low-sulfur fuel oil as well as non-petroleum-based fuels, such as LNG. (12/17)

EU still penalizes Russia: The EU unanimously agreed to prolong financial, energy and other economic sanctions against Russia for its role in the conflict in Ukraine by six months to July 31 due to the lack of full implementation of the Minsk peace agreements, the EU Council said Thursday. (12/20)

Russian dirty oil: A highly toxic and possibly illegally traded chemical substance—carbon tetrachloride—was the main culprit in the crisis with contaminated oil, which had Russia interrupt oil flows on its Druzhba pipeline to Europe for around two months this spring, Reuters reported on Wednesday, quoting the results of three different tests. (12/19)

Shares in Saudi Aramco dipped 3.27 percent on Thursday as the oil giant was hit by profit-taking, ending the trading week in Saudi Arabia among the top losers and wiping out a third of the rally at the start of the blockbuster initial public offering (IPO). The stock of the world’s largest oil company dropped on Thursday for a third consecutive trading day. Shares closed at $9.46, down from the highest closing price ($10.12) in just over a week of trading. (12/20)

Israel’s biggest natural gas field, Leviathan, is expected to begin production on Monday, the Israeli energy ministry said on Thursday after a Jerusalem court rescinded an injunction that it had granted two days earlier over emissions concerns. (12/20)

Royal Dutch Shell joined several big oil companies that have taken big financial hits because of a global glut of oil and gas. Shell said Friday that it would take an impairment charge of around $2 billion and warned of lower margins in its refining, chemicals, and retail businesses given the weaker economic outlook. (12/21)

Libya reopened five of its oil terminals after a day-long closure due to bad weather, sources said Monday, adding that the loadings halt only resulted in a minor loss of production. The bulk of the oil exported from the ports comes from the Waha fields, where output has recently averaged around 350,000 b/d. Representatives at state-owned National Oil Corporation declined to comment on current production levels. (12/17)

Offshore West Africa, BP has found high-quality natural gas reservoirs in all three wells it has recently drilled offshore Senegal and Mauritania, the supermajor said on Monday. (12/17)

In Argentina, President Alberto Fernandez takes office during an economic crisis. Like his predecessor, he has made fracking a centerpiece of the country’s economic revival. While the US shale industry is showing its age, Argentina’s Vaca Muerta shale is in its early stages, with only 4 percent of the acreage developed thus far. The country feels a sense of urgency. Declining conventional production from older oil and gas fields has meant that Argentina has become a net importer of fuels over the past decade. (12/18)

In Venezuela, production levels by state-owned PDVSA and its international partners in the Orinoco Belt rose to 500,000 b/d, or 38.5 percent of its 1.3 million b/d maximum capacity, up from 435,000 b/d November 4. Despite reactivation of some wells and the partial drainage of crude inventories, power failures and the low availability of diluents continue to affect crude pumping capacity. (12/18)

The US oil rig count increased by 18 this week to a total of 688, according to Baker Hughes. That makes it the first double-digit growth since the beginning of April. Active gas rigs in the US fell by four, according to the report, reaching 125. This compares to 197 gas rigs and 883 oil rigs one year ago, leaving the total rig count down by 267 despite the latest increases. (12/21)

US reserves record: Higher oil and natural gas prices in 2018 raised the proved reserves of oil and gas in the US to new all-time highs last year, the EIA said in its latest annual report. The US proved reserves of crude oil jumped by 12 percent, from 39.2 billion barrels at the end of 2017 to 43.8 billion barrels at end-2018, for the new record in proved oil reserves. Proved reserves of natural gas rose by 9 percent, from 464.3 trillion cubic feet (Tcf) at end-2017 to 504.5 Tcf at year-end 2018, setting the new US record for natural gas proved reserves. (12/17)

Pushback on more LNG: A US trade group representing manufacturers with $1 trillion in annual sales has gone on record against four liquefied natural gas (LNG) export applications submitted to the US Department of Energy (DOE). The organization claims that DOE, which authorizes LNG exports, and the LNG project developers have failed to determine whether enough gas pipeline capacity exists to serve domestic consumers as well as LNG exports. (12/21)

Cancer issue in PA: After a string of rare cancer cases struck several residents living amid the state’s mining and drilling operations, Pennsylvania Gov. Tom Wolf approved an investigation into potential links to fracking activities. (12/20)

EV charging: Germany’s Federal Minister of Transport and Digital Infrastructure announced the founding of a new national control enter for charging infrastructure. The mission of the National Control Center is to ensure the swift and coordinated establishment of nationwide charging options in Germany. Their first goal is putting in 1,000 quick charging locations. (12/21)

In Qatar, Volkswagen AG and the Qatar Investment Authority are partnering in Project Qatar Mobility, which will put a fleet of self-driving Level 4 electric shuttles into operation in the Qatar capital Doha in 2022. The goal is to develop a ground-breaking autonomous transport project and transform the future of urban mobility to a sustainable and commercial deployment of AD shuttles and bus services. (12/18)

Tennessee Valley Authority: The nation’s largest public utility, concerned about its income base, has started pressuring its customers to lock in long-term contracts that critics say could leave the region relying on fossil fuels for years to come. The TVA, a public utility owned by the federal government, serves a population of 10 million in seven southeastern states through a distribution network of local power companies. Since August, TVA has persuaded more than 80 percent of the power companies that distribute the electricity it generates to agree to 20-year contracts—a much longer timeframe than its past agreements. (12/17)

US coal production was estimated to be 12.7 million tons in the week ended December 14, down 18.4 percent from the year-ago week. (12/20)

Coal’s doldrums decade: The US coal sector is seeing little hope of improvement in the next few years, after a long list of bankruptcies, power plant closures, layoffs, and other troubles marred the industry’s timeline over the last decade. Now Federal records show US coal producers mined 1.09 billion tons of coal in 2010, a figure the US Energy Information Administration expects to drop by more than one-third to 697 million tons in 2019. (12/21)

IEA on world coal: Although coal demand is expected to decrease this year, it will remain mostly stable until 2024, driven by continued strong demand in major Asian economies such as India and China, the International Energy Agency said in its Coal 2019 report on Tuesday. While coal-fired electricity generation in the US and Europe is falling to levels unseen in decades, major Asian markets, including India, Southeast Asia, and China, will keep overall global coal demand steady over the next five years. (12/18)

Renewable tax credits: Clean energy producers voiced dismay on Tuesday at a US spending bill, saying it fell far short of what wind companies and solar developers had hoped for. Under the law, which passed the US House of Representatives on Tuesday, wind companies will get just one more year to land a significant subsidy, while solar developers lost out in their bid to extend another essential tax credit. (12/18)

Geothermal energy is, simply put, heat; heat that is generated from the decay of radioactive elements in the planet’s mantle. The amount of energy this heat translates into is stunning. According to the Union of Concerned Scientists, just 33,000 feet below the Earth’s surface, there is 50,000 times more energy than the energy all the oil and gas in the world can produce. This energy can be harnessed and used for heating and power generation. (12/16)

Sweden doubles down: Sweden is getting serious about banning the sale of new gasoline, and diesel-powered cars by 2030 as the government commissioned an inquiry on Friday into how the Scandinavian country could best phase out fossil fuels and ban sales of fossil fuel-powered vehicles. (12/21)

EV aviation R&D: The US Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E) announced up to $55 million in funding for two programs to support the development of low-cost electric aviation engine technology and powertrain systems. (12/19)

Bank takes a stand: Goldman Sachs will decline financing for new Arctic oil exploration and production and for new thermal coal mine development or strip mining in its updated environmental policy, which makes the investment bank the US bank with the strongest restrictions on funding fossil fuels. (12/17)

Aviation CO2: The failure of global climate talks in Madrid last week to decide the fate of billions of old carbon credits raises the stakes for the UN aviation body in Montreal, which must choose in March which offsets can be used for its carbon market. The aviation industry accounts for over 2 percent of global greenhouse gas emissions, and if left unchecked, emissions are expected to rise as passenger and flight numbers increase. (12/19)

Methane leaks: The first satellite designed to monitor the planet for methane leaks continuously made a startling discovery last year: A little known gas-well accident at an Ohio fracking site was one of the most massive methane leaks ever recorded in the US. The findings by a Dutch-American team of scientists, published Monday in the Proceedings of the National Academy of Sciences, mark a step forward in using space technology to detect leaks of methane, a potent greenhouse gas that contributes to global warming, from oil and gas sites worldwide. The scientists said the new findings reinforced the view that methane releases like these, which are difficult to predict, could be far more widespread than previously thought. Scientists report that with a single satellite observation, a single overpass, they are able to see plumes of methane coming from significant emission sources. (12/17)

Aussie heat & fires: A state of emergency has been declared in New South Wales, Australia, amid fears a record-breaking heatwave will exacerbate the state’s bushfire crisis. The nation endured its hottest-ever day on Tuesday, but that record was smashed again on Wednesday – which saw an average maximum of 41.9C (107.4F). Tuesday’s 40.9C had eclipsed the previous record of 40.3C, set in 2013. Authorities in New South Wales (NSW) are currently fighting about 100 fires, in a crisis that has lasted months. (12/19)

World pig wipeout: A devastating disease spreading from China has wiped out roughly one-quarter of the world’s pigs, reshaping farming and hitting the diets and pocketbooks of consumers around the globe. China’s unsuccessful efforts to stop the disease may have hastened the spread — creating problems that could bedevil Beijing and global agriculture for years to come. (12/18)