Editors: Tom Whipple, Steve Andrews

Quote of the Week

“We are yet to be confronted with the full-scale reality of the availability, compatibility, safety challenges and grave risks of the new marine low-sulfur fuel.”

Ioannis Plakiotakis, Greece’s merchant marine minister, told the International Maritime Organization, the United Nations’ shipping regulator, in late November that operators simply aren’t ready to meet the demand to cut sulfur emissions.

Graphics of the Week

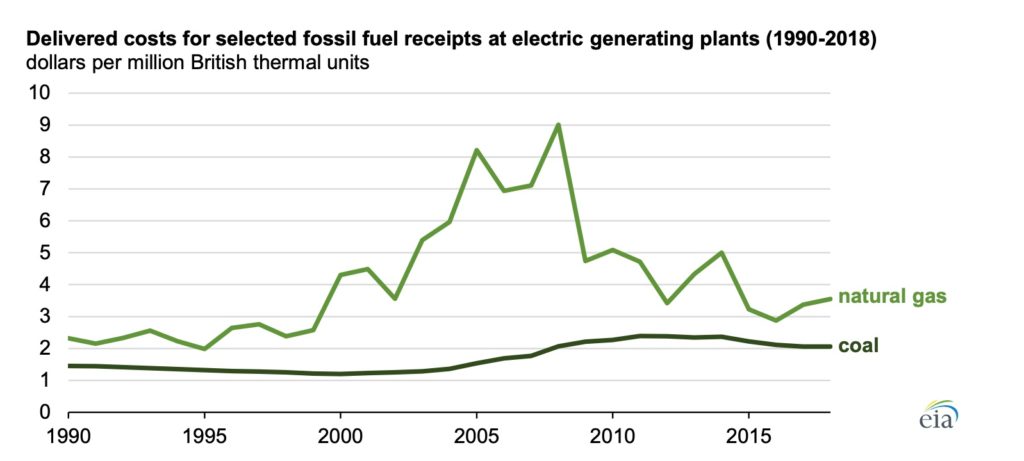

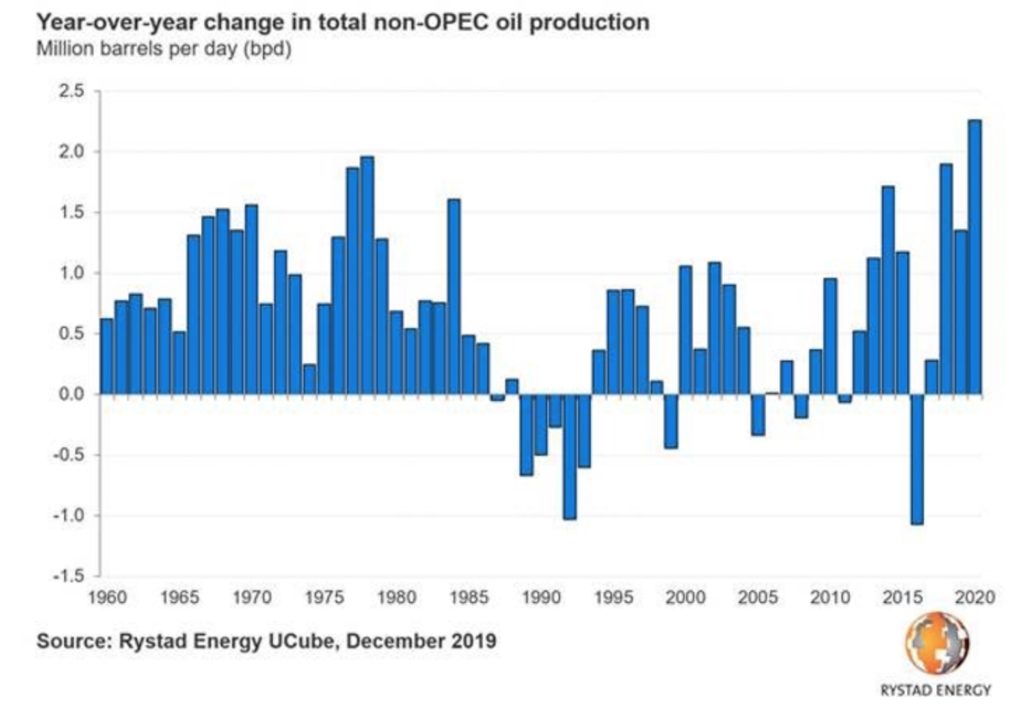

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and trade wars 5. Renewables and new technologies 6. Briefs 1. Energy prices and production Oil prices rose on Friday, closing at $59.08 in N.Y. and $64.31 in London, up about 7 percent for the week. The surge came as a meeting of OPEC and its allies agreed to deepen output cuts by 500,000 b/d in early 2020. The additional reductions will last throughout the first quarter, and the group will meet again in early March for an extraordinary meeting to determine if the cut will be extended. OPEC will shoulder around two-thirds of the additional cuts. OPEC reached a preliminary agreement on Thursday after talks went into the night, but the decision had to be approved on Friday by the broader group of countries that have been involved in an oil alliance since 2016. The way the cuts will be distributed among members and from what starting point will be crucial to determining its effectiveness in balancing global demand and supply. The cuts will tally around 1.7 million b/d, an increase of approximately 500,000 b/d from a prior deal for 1.2 million in curbs that expires in March 2020. Prince Abdulaziz bin Salman, the new energy minister of Saudi Arabia, said total cuts would be even higher at around 2.1 million b/d once a further voluntary decrease of 400,000 b/d from the kingdom is accounted for. The market is facing what may or may not be significantly higher U.S. shale oil production next year as well as additional barrels from other non-OPEC countries. If these production increases happen, they could create a supply glut in early 2020, undermining the cuts. The agreement to deepen oil production cuts has put OPEC members at odds with each other as they try to hammer out the individual production quotas. According to sources from the cartel who spoke to S&P Global Platts, the OPEC meeting featured vocal disagreements and the walkout of the Angolan delegation at one point during the deliberations. Under the deal, Saudi Arabia agreed to hold its crude production to 10.151 million b/d, down from its current quota of 10.311 million b/d. Russia’s quota would be 11.121 million b/d, down from 11.191 million b/d. OPEC would cut an additional 365,000 b/d under the plan, while the non-OPEC partners would cut an additional 131,000 b/d, the source said. Iran, Libya, and Venezuela remain exempt from the cuts, while Angola was allowed to maintain its current quota without any deeper cut. Year-on-year growth in U.S. oil output, which was averaging over 2.1 million b/d a year ago, has fallen by more than half as domestic production continues to break records, but at a significantly slower pace than 2018, according to EIA data. The last few weeks have seen a plethora of stories in the financial and oil industry press discussing the financial woes and contraction of the U.S. shale and gas industry. Drillers are cutting back amid heightened financial scrutiny from investors, as debt-fueled drilling has become increasingly hard to justify. But E&P companies focused almost exclusively on gas, such as those in the Marcellus and Utica shales, are in even worse shape. An IEEFA analysis found that seven of the largest producers in Appalachia burned through about a half-billion dollars in the third quarter. Gas production continues to rise, but profits remain elusive. This unprofitability raises the question of whether there will be enough gas supply in the U.S. a few years from now to support the ongoing conversion of electric utilities to gas and the growing number of LNG export terminals along the Gulf Coast. U.S. shale currently is the largest area of uncertainty in oil market forecasting, with estimates of total U.S. oil production growth next year ranging among forecasting organizations from 100,000 b/d to over 1.5 million b/d. Energy researchers IHS Markit and Wood Mackenzie separately put gains at 440,000 to 450,000 b/d while Goldman Sachs Group estimated an increase of 600,000 bpd. R.S. Energy Group puts U.S. growth at about 100,000 b/d next year. U.S. exploration and production companies, the ones with the boots on the ground in the Permian and other major American shale plays, acknowledge that the slowdown will be much worse than what the EIA, the International Energy Agency (IEA), or OPEC predict. |

2. Geopolitical instability

Iraq’s top Shi’ite Muslim cleric said that a new prime minister must be chosen without foreign (read Iranian) interference as gunmen killed at least 14 people, including three police, near a Baghdad protest site on Friday. It was the most violent flare-up in the capital for weeks and came a week after Iraqi’s prime minister, Adel Abdul Mahdi, said he would resign following two months of anti-government protests. More than 70 others were wounded near Tahrir Square, the main protest camp in the Iraqi capital, last week. Some 400 protesters have been killed since October 25th.

Grand Ayatollah Ali al-Sistani’s comments followed reports that a senior Iranian commander had been in Baghdad last week to rally support for a new government that would continue to serve Shi’ite Iran’s interests. “We hope a new head of government and its members will be chosen within the constitutional deadline” of 15 days since the resignation was formalized in parliament on Sunday, a representative of Sistani said in his Friday sermon in the holy city of Kerbala.

Insurgents from the Islamic State have launched a barrage of attacks in the past week, including increasingly complex, multi-pronged, nighttime operations against security forces stationed near the Naftkhana oil fields in northeastern Iraq. On Wednesday, three members of the Peshmerga security forces were killed as they repelled an attack in Dakka, which is an area long under Kurdistan Regional Government control.

The next thing that will happen in Iraq if protesters’ demands aren’t met is that they will target oil facilities. Such attacks are the only thing that will force any significant change, and oil revenues are the root cause of protests that have gone beyond anything Iraq has ever seen.

In Iran, two weeks after protests began, the government officially acknowledged that security forces used firearms to stop the widespread demonstrations. A report on state television on Tuesday said that some of the protesters killed in the crackdown were “rioters who have attacked sensitive or military centers with firearms.” It described how the armed forces had “deftly and vigilantly” fought back against “hostile groups.” A US State Department official said Thursday that 1,000 or more protesters may have been killed during weeks of unrest in Iran and that the US has received a video that shows troops firing machine guns mounted on trucks at protesters in one incident.

Iran’s Interior Ministry announced that protests hit more than 100 towns and cities in 29 of the country’s 31 provinces and led to 731 banks, 70 gas stations and 140 government sites set ablaze by the protestors. A nationwide Internet blackout obscured coverage of the demonstrations, making outside corroboration difficult. But activists, international organizations, and local journalists have pieced together a startling portrait of what took place: an unprecedented wave of state-sanctioned violence.

President Trump likes to say that Iran is “a different country” after 18 months of American sanctions, and the protests sweeping Iranian cities suggest he may be right. Even his most vociferous critics acknowledge that President Trump’s “maximum pressure” campaign helped fuel that unrest. But it is far from clear that what happened on the streets will make Iran more likely to renegotiate its nuclear deal or cut back its support for Shiite insurgencies in the region. If the lessons of the Arab Spring and the last big Iranian protests in 2009 are any guide, the crackdown on protesters may well succeed — and the Iranian government will press its case that the uprisings are more evidence of a broad American plot to destabilize the government.

US officials cite new intelligence suggesting Tehran’s finances are more dire than previously thought, bringing it closer to a financial crisis. Tehran is scraping the barrel on foreign-exchange reserves, a critical indicator of the country’s ability to control economic forces and to import equipment and supplies. That shortfall, combined with the oil drop-off and a widening trade deficit, puts Iran in even more considerable economic duress than in 2013, when the government of President Hassan Rouhani was pressured into starting nuclear negotiations. However, the state of Iran’s economy is clouded by unknowns, as the country’s economic statistics aren’t always considered reliable or transparent, and intelligence from US allies indicates Iran’s government may have sufficient amounts of off-book income to ease its shortfall.

Last week Libya’s internationally recognized government blamed the rival, eastern-based forces for airstrikes in the capital and the southern desert, which it said had caused civilian casualties. The Government of National Accord (GNA) did not say how many people had been killed and injured in the strikes, but military forces aligned with the GNA said 14 people had died. The attacks mark the latest escalation in an air campaign as the eastern-based Libyan National Army presses its military offensive on the outskirts of Tripoli and seeks to retain control over desert areas in the south.

For the second time in two weeks, Libya’s El Feel oilfield has been shut down, due to the closure of a valve on an oil export pipeline. The 73,000- b/d El Feel field was shut down two weeks ago due to airstrikes. The air attacks came after the eastern-based Libyan National Army (LNA), led by Khalifa Haftar, retaliated after forces loyal to the UN-backed Libyan government in Tripoli allegedly took control of the oilfield. “Production will remain shuttered until military activity ceases, and all military personnel withdraw from NOC’s area of operations.”

3. Climate change

There was little good news from the COP25 meeting in Madrid last week. Climate change and its effects are accelerating, with climate-related disasters piling up, season after season. “Things are getting worse,” said Petteri Taalas, Secretary-General of the World Meteorological Organization, which on Tuesday issued its annual state of the global climate report. The report concluded that after a decade of what it called exceptional global heat, “it’s more urgent than ever to proceed with mitigation.” “The only solution is to get rid of fossil fuels in power production, industry, and transportation,” said Taalas.

Instead of beginning a long-awaited decline, global greenhouse gas emissions are projected to grow slightly during 2019, reaching another record high, according to a new analysis published last week. Total carbon dioxide emissions from fossil fuels and industry are expected to total 36.8 billion tons this year, a 0.6 percent increase from 2018. Global emissions have risen for three consecutive years, at a time when they should be starting to drop sharply if the world is to meet the goals of the Paris climate agreement. A report from the UN Environment Program said global emissions must fall by nearly 8 percent per year over the next decade to stay in line to limit warming to just 1.5 degrees Celsius (2.7 degrees Fahrenheit) above preindustrial levels.

A lake formed by glacial meltwater on the surface of the Greenland ice sheet briefly became one of the world’s tallest waterfalls for five hours in July 2018. The cascade, like many others on the ice sheet’s surface, was triggered by cracks in the ice sheet. In the case of this one meltwater lake that scientists closely observed in July 2018, the water cascaded more than 3,200 feet to the bottom of the glacier, where the ice meets bedrock. There, the water can help lubricate the base of the ice sheet, helping the ice move faster toward the sea. The new study raises questions about a finding contained in the UN Intergovernmental Panel on Climate Change, which found that surface meltwater is unlikely to be causing significant alterations to the flow of the ice sheet.

Officials in the Florida Keys announced last week what many coastal governments have long feared, but few have been willing to admit: As seas rise, the costs of protecting existing structures is prohibitive. The results of a study released last week focus on a single three-mile stretch of road at the southern tip of Sugarloaf Key. To keep those three miles of roadway dry year-round in 2025 would require raising it by 1.3 feet, at a cost of $75 million, or $25 million per mile. To protect against expected flooding levels in 2060, the cost would jump to $181 million.

4. The global economy and trade wars

There was no movement in the US-China trade negotiations last week, although spokesmen for both parties continue to say that progress is being made. President Trump said on Tuesday that a trade deal with China might have to wait until after the US presidential election in November 2020, denting hopes that the two would soon reach an initial agreement to ease the trade war. “I have no deadline, no,” Trump told reporters in London. “In some ways, I like the idea of waiting until after the election for the China deal. But they want to make a deal now, and we’ll see whether or not the deal’s going to be right; it’s got to be right.” Trump’s remarks sent stock prices tumbling.

President Trump’s top economic adviser said Friday that there are “no arbitrary deadlines” for completing a limited trade deal with China ahead of a new set of tariffs planned for later this month. “But the fact remains that Dec. 15th is a very important date, with respect to a no-go or a go on tariffs.”

China warned on Wednesday that the bill calling for a more robust US response to Beijing’s treatment of its Uighur Muslim minority would impact bilateral cooperation, casting further doubts on a near-term deal to end the trade war. The US House’s approval of the Uighur Act of 2019, which still has to be approved by the Republican-controlled Senate before being sent to Trump, has angered Beijing and further strains an already testy relationship. Several sources familiar with Beijing’s stance told Reuters that the bill could jeopardize the so-called phase one deal already fraught with disagreements and complications.

Last week there were mixed reports on the state of the global economy and the prospects for oil demand next year. The US job market strengthened, as hiring jumped and unemployment fell. Employers added 266,000 jobs in November, and the jobless rate fell to a 50-year low of 3.5 percent, matching September’s level. General Motors’ employees, who were on strike in October, helped drive a bounce back in manufacturing payrolls in November when they returned to work. Wages advanced 3.1 percent from a year earlier. The economy has continued to shuffle along but has pulled back from last year’s robust pace. Gross domestic product, a broad measure of goods and services across the economy, rose at a 2.1 percent annual rate in the third quarter, down from a 2.9 percent rate for 2018 as a whole.

US factory activity also has cooled this year, a reflection of the trade-war uncertainty and a global manufacturing slowdown. Manufacturing employment growth has slowed to a crawl in recent months. Factory jobs were up 0.6 percent in November compared with a year earlier, down from a peak of 2.3 percent growth in mid-2018.

The Institute for Supply Management said its monthly index measuring US factory activity fell to 48.1 last month from 48.3 in October amid weakness in new orders and exports. The data helped push stocks in the US and Europe towards their biggest one-day drop in almost two months, as investors were also unnerved by weak EU factory data and Trump’s decision to reimpose metals tariffs on Brazil and Argentina. It was the fourth consecutive month of contraction for the US manufacturing sector, though it remains in a stronger position than in September when the index was at its worst level in a decade.

The US government said last Monday it may slap punitive duties of up to 100 percent on $2.4 billion in imports from France of champagne, handbags, cheese, and other products. The threat came after concluding that France’s new digital services tax would harm US tech companies. French Finance Minister Le Maire said the European Union would strike back against the US if President Trump follows through on a plan to impose tariffs on French imports, in what could develop into a trans-Atlantic tit-for-tat trade war.

The eurozone economy grew at a modest pace in the third quarter with a negative impact from trade, while retail sales fell at their sharpest rate this year in October. Gross domestic product in the 19 countries sharing the euro was up 0.2 percent in the July-September period. Retail sales in the eurozone in October fell by 0.6 percent and were up a modest 1.4 percent year-on-year. The monthly decline was the steepest fall of 2019.

5. Renewables and new technologies

Hardly a day goes by without some sort of announcement relating to electric cars and trucks. These range from a spate of new electric models from large manufacturers such as GM, Ford, and Volkswagen, to multi-billion-dollar battery factories, to laboratory ‘breakthroughs.” For those living in the US, there currently are few incentives to buy an electric car. Due to the high cost of their batteries, electric vehicles cost more than the equivalent with internal combustion engines. Many have range problems, and unless you have a single-family home, refueling can be a hassle. Few places in America have air quality issues comparable to those in many Asian and African cities, so that the effects of climate change are coming to cause much concern in America slowly. All of these downsides to buying an electric vehicle will change in the next five years.

Last week we had news of Hyundai Motor’s plans to spend $52 billion in the next five years to develop a line of electric cars. GM and South Korea’s LG Chem announced they would spend $2.3 billion to build a battery factory in Ohio to supply the traction batteries for the 20 new electric models that GM plans to introduce in the next three years. Both GM and Ford are planning to introduce electric pickups and SUVs that are so popular with American car buyers. Mercedes-Benz announced that it had opened a factory for plug-in hybrid batteries in Thailand. The new plant is the third production facility in the company’s global battery production network.

There are several ways the adoption of electric vehicles can speed up. The first is to sell electric cars that are price-completive with internal combustion models. Another is the European approach, which is to announce that after a given date, it will be illegal to sell cars with internal combustion engines. In the US, we are trying government incentives to lower the initial costs. However, these incentives were number-of-each-electric-car-model-limited, and many rebates are about to expire.

China, which, unlike the US, has serious air pollution problems, has several programs to speed the adoption of electric cars. New monetary incentives are designed to make it very difficult or expensive to register new internal combustion vehicles in the most polluted cities. Beijing announced last week that the new target for 2025 electric car sales was increased from “over 20” to 25 percent. Last year, the sales of what Beijing calls “new energy vehicles” in China jumped by 61.7 percent to 1.256 million units. Total Chinese car sales reached 28.1 million cars last year, so they have a long way to go before reaching 25 percent.

Around half of all light-duty vehicles produced by automakers will be electric by 2040, S&P Global Platts Analytics said Wednesday. In its “Long-Term Electric Vehicle outlook,” Platts said EVs would start to gain market share as unit costs, primarily driven by the price of a battery pack, begin to come down and make mass-market ownership more viable. They anticipate that plug-in electric vehicle (PEV) adoption will accelerate in the long term, displacing internal combustion engine vehicles and eventually comprising a majority of global light-duty vehicle sales.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Maritime fuel switch 11th-hour pushback: Greece’s merchant marine minister says shipping operators aren’t ready to meet the demand to cut sulfur emissions. Greece runs roughly 20 percent of the world’s commercial fleet and has been leading a campaign to push back the IMO implementation date. Countries, including Russia, India, and Indonesia, also have voiced concerns over the fuel switch that will substantially raise operating costs. (12/5)

Offshore Norway, the vast Johan Sverdrup oilfield is already producing 350,000 b/d, two months after coming on stream for Equinor. Johan Sverdrup is now the largest producing oilfield in western Europe. With expected resources of 2.7 billion barrels of oil equivalent, Johan Sverdrup is one of the most significant discoveries on the Norwegian Continental Shelf ever made. Peak production with the second development phase is expected to reach 660,000 b/d. (12/4)

Brent’s pricing role: In the late 1980s, Brent crude became the benchmark on which most of the world’s oil was priced and is still used to set the price of the multi-trillion-dollar Intercontinental Exchange Brent futures market. Yet after 43 years of production, the field is a relatively minor producer. While the Brent benchmark will keep its name, it increasingly represents a blend of North Sea crudes, with the potential to include oil from other locations in the future. (12/3)

Israel’s biggest natural gas field, Leviathan, is set to begin gas supply to the local market within three weeks and start exports to Egypt and Jordan shortly after that, in a significant milestone for the energy landscape in Israel and the Eastern Mediterranean. Leviathan—discovered in 2010—together with other fields found offshore Israel in the past decade such as Tamar, Karish, and Tanin is expected to help Israel become energy independent. (12/3)

A Turkish diplomat has revealed a map which delineates waters in the Mediterranean claimed by Turkey, amid an ongoing months-long standoff with Cyprus and Greece over Turkish oil and gas exploration and drilling inside Cyprus’ Exclusive Economic Zone. (12/5)

Aramco to start trading: Following the largest-ever initial public offering, Saudi Aramco’s shares will be listed and start trading on the primary market of the Saudi oil exchange on Wednesday, Dec 11th. On Thursday, Saudi Aramco announced the final offer price for the offering. Saudi Arabia’s state oil giant priced its IPO at the top end of the range—32 Saudi riyals ($8.53), which made the share listing the largest in history, surpassing the $25-billion IPO of Alibaba on the New York Stock Exchange in 2014. (12/7)

In China, slowing gas demand will pressure international gas prices further, adding to the burden of producers, some of whom already have to deal with excess supply. The reasons for the slowdown will be economic: forecasters expect slower GDP growth in the world’s second-largest economy. For LNG exporters, however, the bad news is China’s rising domestic production plus the launch of a new pipeline that will send 38 billion cubic meters of gas from Russia to China by 2024. (12/6)

China will officially launch this week its long-mooted state oil and gas pipeline group combining the infrastructure assets of the state-owned energy majors into one huge midstream group, which analysts say could be worth between $80 billion and $105 billion. The new company is part of China’s efforts to allow its energy companies to focus on boosting exploration and production. (12/7)

Africa could provide as much a fifth of global demand for liquefied natural gas by 2025, up from 10 percent in 2018, due to considerable investments in the sector and some recent significant discoveries. Recent massive discoveries in Mozambique, Tanzania, Senegal, and Mauritania have aggregate reserves of 200 trillion cubic feet of gas reserves – an amount sufficient to supply two-thirds of current world demand for two decades. Besides, Nigeria alone possesses 200 trillion cubic feet of proven gas reserves. African gas properties have received significant investment interest from foreign energy firms like Total, ExxonMobil, Royal Dutch Shell, and others. (12/5)

Offshore Nigeria, a gang of pirates have kidnapped 19 sailors after waylaying, then boarding a supertanker loaded with oil on Dec 3rd. The attack occurred roughly 60-70 nautical miles south of Nigeria’s Bonny Island Offshore Terminal. It appears to be part of a growing trend, with six incidents and four kidnappings in the area of Tuesday night’s incident. The string of attacks suggests a well-armed and resourceful pirate action group, most likely operating from one or more “mothership”-type vessels. (12/5)

Nigeria’s oil minister has disclosed that industry flared about 324 billion cubic feet of natural gas in 2017. That volume of flared gas was worth $1 billion and could produce 3000 megawatts of electricity daily. (12/3)

The two boards of Venezuela-owned refiner Citgo are fighting over the ownership of $57 million worth of crude oil (950,000 barrels) stranded at sea. The first Citgo board, which was appointed by—and is loyal to—the Maduro government in Caracas, had written to the captain of the tanker with the crude to ask that its load be released to Citgo’s parent company, PDVSA. The information reached the rival board, appointed in the US by Venezuelan opposition leader Juan Guaido, and the second board filed a request with a US court to declare the first board’s request null. (12/5)

Canada’s biggest oil companies sent mixed signals with a series of budget announcements this week, with some upbeat about next year and others more cautious, with plans to cut spending in a depressed growth environment. Husky Energy and Suncor seem to be the most careful, while Canadian Natural Resources is the most upbeat. (12/6)

The US oil rig count decreased by five while the number of rigs drilling for gas increased by two, according to Baker Hughes Co. Last week’s variations bring the nation’s total number of active rigs to 799, which is 276 fewer rigs than the count of 1,075 one year ago. The Permian basin has half the active rig count: 400. (12/7)

New Energy Secretary: Dan Brouillette has been confirmed to be the new US Energy Secretary by the US Senate, in a bipartisan vote of 70-15. Brouillette was previously the US Deputy Secretary of Energy. (12/4)

Evacuation #2: In Port Neches (TX), a city of about 14,000 people 95 miles east of Houston, officials issued a second evacuation order late on Wednesday when monitors found elevated levels of butane and butadiene, a cancer-causing petrochemical. Butadiene is the main product of a TPC Group facility in the city struck by last week’s blaze and blast. Schools were closed for the rest of the week. (12/6)

PG&E, California’s bankrupt power producer, said it had reached a $13.5 billion settlement with victims of some of the most devastating wildfires in the state’s modern history. The agreement helps smooth the way for the beleaguered company to emerge from bankruptcy. (12/7)

The global car market will have shrunk faster in 2019 than at the height of the financial crisis, with 4 million fewer vehicles sold than last year, according to the lobby group for the German auto industry. The Association of the Automotive Industry warned of further job losses during the next 12 months, with an ongoing downturn in China. (12/5)

Coal shutout: The Netherlands’ Senate, its upper house, is to vote next Tuesday on a parliamentary bill banning the use of coal in power generation by 2030. The proposal, adopted by the lower house Jul 4th, would see the country’s 4.7 GW of coal plant phased out in two steps, with two low-efficiency plants closed by 2025, and three newer plants closed by 2030. (12/5)

In Australia, a giant bushfire on the edge of Sydney, which has blanketed the city in smoke, causing a spike in respiratory illnesses and the cancellation of outdoor sports, will take weeks to control but will not be extinguished without heavy rains, firefighters said. Thousands of weary firefighters were on Saturday fighting nearly 100 blazes in New South Wales state. The mega-fire north of Sydney, Australia’s largest city, was created on Friday when several fires merged and was now burning across 335,000 hectares (830,000 acres). (12/7)

California’s wildfires have grown so costly and damaging that insurance companies — a homeowner’s last hope when disaster strikes — have increasingly been canceling people’s policies in fire-prone parts of the state. On Thursday, however, California took the highly unusual step of banning the practice, a decision that exacerbates the insurance industry’s miscalculation of the cost of climate change. (12/6)

Climate change and nutrient pollution are driving the oxygen from our oceans and threatening many species of fish. That’s the conclusion of the most important study of its kind, undertaken by conservation group IUCN. While nutrient run-off has been known for decades, researchers say that climate change is making the lack of oxygen worse. Around 700 ocean sites are now suffering from low oxygen, compared with 45 in the 1960s. (12/7)

Water stress, a hallmark of the American West, is spreading east. The shift is evident in Georgia’s agricultural heartland, where some crops have needed water from giant rotating sprinklers to prevent plants from drying up. (12/3)