Editors: Tom Whipple, Steve Andrews

Quote of the Week

[30 lawsuits allege that during Texas freeze gas suppliers were] “profiteering from scarcity during a declared disaster. What we believe is that this was a huge transfer of wealth at one of Texas’ worst points in our history… The result can’t be that prices become unconscionable.”

Paula Gold-Williams, CEO of CPS Energy, one of the plaintiffs

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: The markets posted their worst week since mid-March amid concerns that rising global coronavirus cases slowed economic recovery. West Texas Intermediate futures ended the week down 3.5% to close at $59.32. Brent closed at $62.95. With the OPEC+ countries planning to raise output by some 2 million b/d in May and June, markets now are focused on whether the demand recovery will be enough to absorb growing supplies. While consumption is climbing in India and the US, rising virus cases and stricter travel limits in Europe are muddying the forecast and putting pressure on crude prices.

US drillers kept the number of oil rigs unchanged last week, Baker Hughes said on Friday. However, analysts say more rigs are needed to keep production steady. Refinery runs are expected to reach 15.18 million b/d for the week ended April 9th as refineries continue to come back online in the Midwest and US Gulf Coast. This is up from the 15.04 million b/d of inputs across the country for the week ended April 2nd, according to the most recent weekly data, which showed US Gulf Coast utilization unchanged week on week at 83.1% of capacity.

US gasoline inventories climbed 4.04 million barrels to 234.59 million barrels last week. As imports jumped and refinery runs edged higher, gasoline imports rose 678,000 b/d to 1.3 million b/d, with the bulk of that increase – 635,000 b/d – heading to the US Atlantic Coast.

OPEC: Crude oil production from OPEC and its allies rose by 450,000 b/d in March, as Russia and Iraq pumped well above their agreed caps, while quota-exempt members Iran and Libya also boosted output. In Libya’s case, its production hit an almost eight-year high. The OPEC 13 pumped 25.20 million b/d in March, up 340,000 b/d from February, while their nine non-OPEC partners, led by Russia, produced 13.08 million b/d, a rise of 110,000. With the production gains, OPEC+ compliance with its quotas slipped to 111% in March, compared with 113.5% in February, juiced by Saudi Arabia voluntarily cutting an additional 1 million b/d since January.

The surprise decision from OPEC+ to ease the production cuts by a cumulative 2 million b/d by July relies on robust oil demand recovery expectations in the second quarter. Yet, recent demand suggests the alliance’s supply management policies could once again be more in the realm of guestimates. The easing of the collective cuts signals that OPEC+ expects demand to rebound strongly and justify supply increases. However, the COVID resurgence’s unpredictability in major economies lagging in vaccination programs could spoil the OPEC+ forecasts and supply management policies once again.

Occidental Petroleum praised OPEC and its allies for managing crude markets out of last year’s historic crash and said the US shale industry is thankful for its efforts. “They’ve been brilliant in the way they’ve handled it, the way they’ve been doing it,” Chief Executive Officer Vicki Hollub said at a conference. “Every US oil and gas company is appreciating their efforts.”

OPEC+ and US shale have been rivals for much of the last decade, with the Americans’ rapid growth eating away at the cartel’s share of the oil market and power to control it. But the US lost about 2 million b/d, or 15% of its production, over the past year, and producers’ diminished access to finance severely challenges future growth to capital and shareholder demands for cash returns over more output.

Shale Oil: US oil production remains about 2 million b/d lower than its pre-pandemic levels. Still, methane emissions are already back to their levels from before the coronavirus. This increase could threaten energy companies’ long-term growth prospects because investors’ priorities are changing. What investors want from oil and gas now is not just stable returns but lower carbon and methane emissions. Data from the Environmental Defense Fund shows that methane emissions in the US shale patch rebounded to pre-pandemic levels, after dropping sharply as oil and gas production fell last year. Methane is a much more potent greenhouse gas than carbon dioxide and has recently been garnering growing attention from regulators, environmentalists, and now, shareholders.

According to the EIA’s latest Monthly Drilling Report, fracking crews increased their activity in US shale basins, finishing off a slew of drilled but uncompleted (DUC) wells. As oil and gas companies focus on finishing off wells they’ve already drilled, observers wonder whether this is a fluke or whether the industry has learned its lesson about drilling wells that they are not likely to complete. The way to describe the DUC count is a “fracklog” because it measures the number of wells that have been drilled but not yet completed—essentially creating a backlog of half-finished wells that are not producing oil or gas. The higher the DUC count, the more money oil companies have spent drilling wells that are not yet working.

For the US shale industry, the DUC count has been a bellwether; the higher the DUC count, the more money oil and gas companies are sinking into wells stuck in limbo and not producing. This could either mean fiscal irresponsibility or a rapidly changing shift in the markets that too quickly rendered wells once deemed wise as obsolete.

In Texas and New Mexico, state regulators are already on the hook for cleaning up more than 7,000 orphaned oil and gas wells. These wells can leak contaminants into nearby air and water and even become significant sources of methane emissions. In these two major oil-producing states, the true scale of oil well abandonment is likely far greater than the official numbers; approximately 12,000 Texas wells are nearly statistically indistinguishable from the more than 6,000 already on the state’s abandoned rolls. Those additional wells will likely become officially abandoned within the next four years, tripling the state’s current cleanup cost estimate. All in all, Texas could be looking at a bill of just under $1 billion. And in New Mexico, about 421 additional wells appear to be no different than the state’s 687 already-orphaned wells.

Natural Gas: Above-average injections into US gas storage fields suggest stocks might fill early this year, presenting a possibly bearish market this summer. Storage inventories increased 20 billion cf to 1.784 trillion for the week ended April 2nd. According to EIA data, the build was less than the 30 billion cf addition reported during the same week last year, but above the five-year average injection of 8 billion. Lower weather-driven demand pushed US residential-commercial consumption down almost 2 billion cf/d for the week ended April 2.

LNG imports expanded the most in a year as Asia and Europe refilled inventories drained over the winter and as pandemic-ravaged economies slowly begin to reopen. Their imports jumped 5.8% in March from a year earlier, the biggest increase since March 2020. Demand for gas used in heating and power generation had been steadily growing before Covid-19, as nations shift away from coal-fired power over climate concerns. While European imports rebounded as dwindling stockpiles and high spot prices attracted cargoes from US export projects, Asian importers anchored the growth.

Chinese shipments surged more than 30% in March amid an effort by the nation’s new pipeline operator to open terminals to gas distributors. Supplies from the US made up nearly 30% of shipments. Global gas exports in March rose 4.2% from year-ago levels. Output from the US surged to a record high as projects ramped up production, while exports from Algeria, Oman, and Egypt also expanded.

Electricity: At least 30 lawsuits potentially worth billions of dollars have been filed in four states disputing responsibility for the massive electricity bills that hit many Texans in February. Some lawsuits accuse natural gas suppliers of price-gouging and overcharging utilities for gas they supplied. Suits filed by San Antonio-based utility CPS Energy alleges that gas suppliers were profiteering from scarcity, with some hiking their prices by a staggering 15,000%.

Other suits filed by gas suppliers, including ConocoPhillips, accuse utilities of not paying their bills. Yet others allege gas suppliers need to be relieved of their responsibility to supply the commodity to utilities with a backdate for the Texas Freeze period, which paralyzed much of the Lone Star State’s energy infrastructure. According to experts, more lawsuits will be filed in the coming weeks.

Prognosis: A more robust global economy will accelerate oil demand growth to 5.5 million b/d, the US EIA said in its Short-Term Energy Outlook for April, raising its demand growth forecast by 200,000 b/d. Global economic growth is now expected at 6.2 % in 2021, up by 0.4% from March, as per estimates from Oxford Economics which the EIA uses for prediction modeling.

Next year, global oil demand for liquid fuels is set to rise by another 3.7 million b/d over 2021 and exceed the pre-pandemic levels from 2019. World consumption of petroleum is set to average 101.3 million b/d in 2022, EIA’s latest estimates show.

Goldman Sachs is still bullish on oil and anticipates strong demand that would require OPEC+ putting another 2 million b/d on the market in the third quarter. This increase would come after the around 2 million additional barrels per day that the alliance and Saudi Arabia decided it will add between May and July. “We forecast a larger rebound in oil demand this summer than OPEC and the IEA, requiring an additional 2 million b/d increase in OPEC+ production from July to October,” Goldman Sachs said.

Cheniere Energy expects LNG demand to increase until 2040. However, it may decline beyond that due to continued global action to reduce greenhouse gas emissions, presenting risks for existing US liquefaction terminal operators and project developers. The conclusions were issued in a report assessing the long-term impact of climate change mitigation policies and trends in process or under consideration. North American exporters are under pressure to show that LNG produced from shale gas can bridge the energy transition to greater use of cleaner-burning fuels and aid rather than impede buyers’ carbon reduction goals.

A multibillion-dollar project to tap virgin oil fields in East Africa is expected to get the green light this week, highlighting an uncomfortable truth about the energy industry. Even as Total, the supermajor behind the new project straddling Uganda and Tanzania, makes genuine efforts to begin the transition to low-carbon energy, the industry is nowhere close to ending its appetite for oil. If you accept that petroleum demand may have already peaked — and that’s still a controversial opinion — the world is still expected to burn hundreds of billions of barrels of oil in the coming decades.

That gives plenty of incentive for giants like Total or Royal Dutch Shell, plus the hundreds of smaller explorers that remain in business, to keep searching the world’s frontiers for the next place to sink their drill bits. BP is the only oil major to have gone so far as to call an end to the era of oil demand growth. The London-based company said last year that consumption might never return to levels seen before the coronavirus pandemic. The rest of the industry still expects at least another decade or so of demand growth before the global need for oil maxes out. And even BP’s less bullish outlook shows a world where a lot more petroleum will be used.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Russia-Ukraine: A top Russian official has warned that Moscow could intervene to help Russian-speaking residents in eastern Ukraine if Ukraine launches an all-out assault on separatists there. Russian-backed separatist rebels and Ukrainian troops have been clashing recently in the east of the country. Russia has also been building up troops on the border with Ukraine. The official, Dmitry Kozak, said that Russian forces could intervene to “defend” its citizens. “Everything depends on the scale of the conflagration,” he said. He also warned that an escalation could mark the “beginning of the end” for Ukraine – “not a shot in the leg but also the face.” The US and Germany have both expressed concern about the increase in tensions.

Ukraine’s defense minister said on Saturday his country could be provoked by Russian aggravation of the situation. The minister, Andrii Taran, said Russian accusations about Russian speakers’ rights could be the reason for the resumption of armed aggression against Ukraine. “At the same time, it should be noted that the intensification of the Russian Federation’s armed aggression against Ukraine is possible only if an appropriate political decision is made at the highest level in the Kremlin,” he said in a statement.

Iran: Diplomats from the US and Iran gathered in Vienna last Tuesday and Friday in an attempt to revive the 2015 nuclear agreement, the first potential thaw in diplomatic relations between Tehran and Washington since the Trump administration left the accord in 2018. American and Iranian officials aren’t meeting directly. Still, they are working through European intermediaries, who also gathered in the Austrian capital alongside representatives from the other parties to the deal, Russia, and China. Reports from Vienna say the US and Iran appear to have made headway in their indirect talks, which will resume on April 14th in Vienna. The Oil and Gas Journal, citing oil analytics firm Kpler, estimates that if there is an agreement on Iran’s nuclear plans, some 2 million b/d of Iranian crude could be added to OPEC’s total production.

On Friday, Iran released a South Korean ship and its captain seized in the Strait of Hormuz since January after South Korea promised to secure the release of $7 billion in Iranian funds frozen in South Korean banks under US sanctions. The Iranian foreign ministry said the chemical tanker was released after investigating environmental pollution and the South Korean government’s request. Iranian media quoted an unnamed Iranian official as saying Korean officials had given assurances that “they are trying to solve the problem.”

Iraq: Total crude exports in March, including flows from the semi-autonomous Kurdistan region, fell 0.8% month on month amid signs of tighter compliance with OPEC+ output cuts. OPEC’s second-largest producer exported 3.28 million b/d in March, down from 3.30 million b/d in February; Kurdish exports in March dropped 3% to 335,000 b/d from February. The Sarqala oil field has restarted after a dispute within the Patriotic Union of Kurdistan party led to the temporary shutdown of its 30,000 b/d.

Official estimates are that Iraq’s proven reserves of the conventional natural gas amount to at least 3.5 trillion cubic meters, or about 1.5 % of the world’s total, with around three-quarters of this figure comprising associated gas that is found in the same reservoirs as oil. The IEA, however, estimates that ultimately recoverable resources will be considerably larger, at 8.0 trillion cubic meters; around 30 % is thought to be in the form of non-associated gas.

Despite these vast potential gas resources, Iraq has made little substantial progress over the years on developing this potential either for associated or non-associated gas, mainly flaring the former and overlooking the latter. Last week, though, a heads-of-agreement deal was announced with French oil and gas giant Total to work on four major projects that include developing the associated gas sector.

Libya: The largest oilfield in Libya, the 300,000 b/d Sharara field, could see crude oil exports from it disrupted if members of the Petroleum Facilities Guard (PFG) follow through with their threat to shut down exports if their demands for payment are not met. The threats of guards disrupting exports over unpaid wages or other allowances are nothing new in Libya’s oil industry, which has been suffering for ten years from strikes and outbreaks of civil war since Muammar Gaddafi was toppled in 2011.

Venezuela: In recent weeks Venezuelan military and police have been conducting offensive operations in the southwestern state of Apure near the Colombian border. Aside from the humanitarian toll they are taking on the local civilian populace, they have sparked fears that Caracas is again ramping up pressure on its perceived mortal enemy Colombia.

Yemen: An explosion has damaged an Iranian cargo ship anchored off Yemen’s Red Sea coast, allegedly used by Iran’s Revolutionary Guards for intercepting enemy communications from Yemen. The blast that targeted the Saviz on Tuesday caused no casualties and was under investigation, a spokesman said. “The vessel was a civilian ship stationed there to secure the region against pirates,” he added. The New York Times reported that Israel had told the US it attacked the Saviz. Israeli officials did not comment, but it is the latest in a series of attacks on Israeli- and Iranian-owned ships, for which the arch-foes blame each other.

Mozambique: The attack on Palma bore all the hallmarks of the Islamist insurgents that have terrorized Mozambique’s far northern Cabo Delgado region for the past three years. Gunmen converged on a refugee-filled town. They waited, cutting off access by road. Then, at about 4 pm on March 24th, they opened fire. According to Mozambican officials, security consultants, and a report by the African Union, more than a hundred insurgents laid waste to the coastal town destroying civic buildings, robbing and setting fire to at least one bank. The insurgents killed dozens of people. Thousands fled the violence. Mozambique’s army says that the town is safe again, and “significant numbers” of insurgents died after days of battle.

But analysts said the attack on Palma was an inflection point in what has until now been a widely ignored African war. The town is about 15km from an under-construction natural gas facility and, after hundreds of staff had to be evacuated to safety, its future is threatened. Even as President Filipe Nyusi insisted that the Palma attack “was not greater than others,” French energy group Total suspended the $20 billion development, which lies on the nearby Afungi peninsula and is Africa’s biggest private investment.

3. Climate change

Methane levels in the atmosphere surged during 2020, marking the biggest increase since records began in 1983, in what scientists called a worrying development for the planet. New data shows both methane and carbon dioxide reached record amounts in the atmosphere last year, despite the coronavirus pandemic slowing much of the world’s economy. Lori Bruhwiler, a physical scientist at the US National Oceanic and Atmospheric Administration, said the jump in methane levels was “fairly surprising — and disturbing”. “We don’t usually expect them to jump abruptly in a year,” said Bruhwiler. The exact reasons for the increase are not yet known.

Methane concentrations likely originate from many sources, including paddy fields, landfills, leaky natural gas pipelines, and coal stockpiles. Bangladesh, one of the countries most vulnerable to climate change, has also been revealed as a significant contributor of methane, a greenhouse gas about 80 times more potent in its first two decades in the atmosphere than carbon dioxide. The 12 highest methane emission rates detected this year by Kayrros SAS have occurred over Bangladesh. “It has the strongest sustained emissions we’ve seen to date where we can’t identify the source.”

The US Department of Energy announced up to $35 million for a new program focused on developing technologies to reduce methane emissions in the oil, gas, and coal industries: “Reducing Emissions of Methane Every Day of the Year” (REMEDY). The program seeks highly replicable system-level technical solutions that achieve an overall methane conversion of 99.5%, to reduce net greenhouse gas emissions.

In a new research piece, BloombergNEF finds that the levelized cost of hydrogen made from renewable electricity is set to fall faster than previously estimated. BNEF now forecasts that green hydrogen from renewables should be cheaper than natural gas (on an energy-equivalent basis) by 2050 in 15 of the 28 markets modeled, assuming scale-up continues.

These markets accounted for one-third of global GDP in 2019. BNEF found that green hydrogen should get cheaper than both blue hydrogen (from fossil fuels with carbon capture and storage – CCS) and even polluting grey hydrogen from fossil fuels without CCS. According to the BNEF forecast, the costs of producing green hydrogen from renewable electricity should fall by up to 85% from today to 2050, leading to costs below $1/kg by 2050 in most modeled markets.

The Atlantic hurricane season is poised to be another wild one. Forecasters predict an above-average 17 named storms sweeping out of the basin. Colorado State University said eight of those storms would become hurricanes, and four will grow into major systems with winds of at least 111 miles per hour. At this time last year, Colorado State predicted an above-average 16 storms for 2020. Ultimately, a record 30 formed, including 12 that struck the US.

4. The global economy and the coronavirus

Last week, the World Health Organization said infection rates are climbing in every region, driven by new virus variants and too many countries coming out of lockdown too soon. “We’ve seen rises (in cases) worldwide for six weeks. And now, sadly, we are seeing rises in deaths for the last three weeks,” WHO spokeswoman Dr. Margaret Harris said at a briefing in Geneva. In its weekly update, WHO said over 4 million COVID-19 cases were reported in the week before last. The increasing number of infections, hospitalizations, and deaths extends to countries where vaccinations are finally gaining momentum. That leaves even bleaker prospects for much of the world, where large-scale vaccination programs remain a more distant prospect.

The world economy is on course for its fastest growth in more than a half-century this year, yet differences and deficiencies could hold it back from attaining its pre-pandemic heights any time soon. The US is leading the charge, pumping out trillions of dollars of budgetary stimulus. The IMF is now forecasting a more robust economic recovery this year and next. However, the agency also warns that recoveries are diverging dangerously within and between countries.

United States: As states lift restrictions and coronavirus variants spread, federal health officials have warned that the fourth surge of cases could arise in the US even as the nation’s vaccination campaign gathers speed. Michigan is in tough shape; new patients and hospitalizations have more than doubled in the last two weeks. The six metro areas in the US with the most significant number of new cases relative to their population are all in Michigan. Several other states in the Upper Midwest, including Minnesota and Illinois, have also reported significant increases in new cases and hospitalizations. And in the Northeast, New York and New Jersey have continued to see elevated case counts.

Economists are ratcheting up their US growth forecasts as a fresh injection of government aid, rising vaccination rates and looser business restrictions combine to provide more tailwind for economic activity. According to a monthly survey of economists, expectations for gross domestic product growth surged more than a percentage point to an annualized pace of 8.1% in the second quarter. However, the number of Americans applying for unemployment benefits rose last week to 744,000, signaling that many employers are still cutting jobs even as more people are vaccinated and consumers gain confidence.

Treasury Secretary Yellen on Monday called for speeding up the distribution of coronavirus vaccines in poorer nations, arguing the US and global economies are threatened by the impact of covid-19 on the developing world. Many parts of the developing world are not on pace to have widespread vaccination of their populations until 2023 or 2024. Those countries have largely suffered more devastating economic impacts from covid, in part because they do not have the fiscal capacity to authorize emergency spending levels approved in the US.

Republican-led state capitols are considering bills that would punch holes in President Biden’s green revamp of the US electricity system by promoting fossil fuels or piling costs onto renewable energy. The proposed legislation reverses a dynamic that played out over the past four years when lawmakers in states controlled by Democrats moved to counteract Donald Trump’s climate rollbacks.

European Union: More than a year after the start of the pandemic, Europe is enduring a grim spring. Covid-19 infections, hospitalizations, and deaths are rising in many countries as the continent grapples with a more infectious variant, a shortage of vaccines, and public weariness with lockdowns. The latest pandemic surge in Europe, triggered by the spread of the now dominant B.1.1.7 strain of the virus is often called a “third wave,” but observed across the continent as a whole, it is more like a confused sea in which some national epidemics are worsening, some are reaching their peak and others are declining.

The UK’s vaccines advisory body said the Covid-19 vaccine produced by AstraZeneca should preferably not be given to people under 30 following concerns that it causes potentially deadly blood clots in very rare instances. The decision to restrict the vaccine for younger people is a setback for the UK’s flagship inoculation drive. It leaves the country increasingly dependent on Covid-19 shots developed and produced in other countries. It also lands another blow on the vaccine developed by AstraZeneca and the University of Oxford, which have faced questions about its efficacy and potential side effects even as tens of millions of doses have been administered following safety signoffs in more than 70 countries worldwide. The vaccine, which, unlike others, doesn’t need to be stored at super-cold temperatures, has been regarded as critical to the vaccine rollout in poorer countries, many with relatively young populations.

Spain and Italy have moved to limit the use of the Oxford/AstraZeneca vaccine to people aged above 60, in shifts that will complicate the countries’ efforts to step up their vaccination programs. Madrid and Rome’s decisions came after the European Medicines Agency said that there was a link between very rare blood clots in the brain and the AstraZeneca shot.

Germany and France, the euro area’s two largest economies, saw unexpected declines in industrial production in February, suggesting that coronavirus restrictions are increasingly harming parts of the economy that have proved resilient so far. German output dropped 1.6% month over month, surprising economists. Production in France slumped 4.7% and stagnated in Spain. France’s economy will rebound less than previously expected this year due to the latest four-week nationwide lockdown aimed at halting a surge in coronavirus cases.

Chancellor Angela Merkel supports demands for a short, tough lockdown in Germany to curb the coronavirus’s spread as infection rates are too high. Germany is struggling to tackle a third wave of the pandemic and several regional leaders have called for a short, sharp lockdown while the country tries to vaccinate more people.

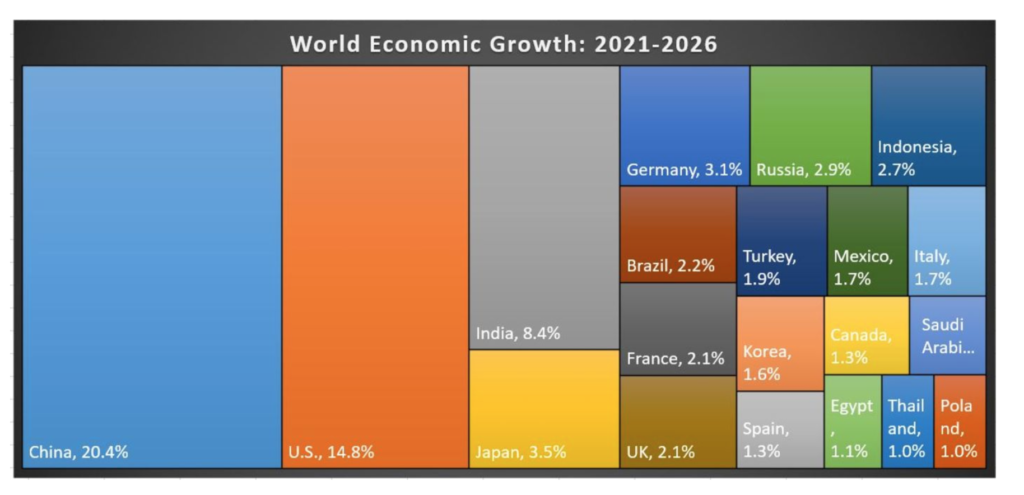

China: Beijing’s economy will drive global economic growth in the coming years as the world recovers from the pandemic that’s killed 2.9 million people, the International Monetary Fund predicts. According to Bloomberg calculations based on IMF forecasts, China will contribute more than one-fifth of the total increase in the world’s gross domestic product in the five years through 2026. Global GDP is expected to rise by more than $28 trillion to $122 trillion over that period, after falling $2.8 trillion last year in the biggest peacetime shock to output since the Great Depression.

According to the IMF, the US and India will be the second and third-biggest contributors to global growth in the period, with Japan and Germany rounding out the top five. Overall, the IMF forecasts that the global economy will expand 6% this year before slowing toward a 3% pace by 2026. It also warned that future expansion might be unevenly spread, with developing economies expected to have more significant losses and slower recoveries.

The Chinese government is minting cash digitally in a re-imagination of money that could shake a pillar of American power. It might seem the money is already virtual, as credit cards and payment apps such as Apple Pay in the US and WeChat in China eliminate the need for bills or coins. But those are just ways to move money electronically. China is turning legal tender itself into computer code.

Cryptocurrencies such as bitcoin have foreshadowed a potential digital future for money, though they exist outside the traditional global financial system and aren’t legal tender like cash issued by governments. China’s version of a digital currency is controlled by its central bank, which will issue the new electronic money. It is expected to give China’s government vast new tools to monitor its economy and people. The digital yuan will negate one of bitcoin’s significant draws: anonymity for the user by design.

A year ago, Washington and Beijing signed the Phase One Trade Deal whereby Beijing committed to importing an extra $200 billion worth of American goods over the two years, including purchasing an additional $52.4 billion of US energy supplies from a baseline just $9.1 billion in 2017. But observers who have been hoping the new administration will mark a return to normalcy on trade issues, after the drama of tariff battles and tweet diplomacy of the Trump era, will be sorely disappointed. Two weeks ago, the new US trade representative, Katherine Tai, said all American tariffs will stay in place–at least for now. In other words, the US-China cold war remains alive and well despite a change of US administration.

Leaders of the US Senate Foreign Relations Committee seek to boost the country’s ability to push back against China’s expanding global influence by promoting human rights, providing security aid, and investing to combat disinformation. The draft measure, titled the “Strategic Competition Act of 2021,” mandates diplomatic and strategic initiatives to counteract Beijing, reflecting hardline sentiment on dealings with China from both Democrats and Republicans.

Russia: The government is slashing its estimates for domestic crude oil, gas, and coal production for 2021 and 2022, according to amendments in its energy development program. Oil production this year is set to stand at 517 million tons (mt), down from a previous estimate of 560 mt. Russia’s projected oil output in 2022 was also reduced, to 548 mt, down from earlier estimates of 558 mt. Forecasts for oil production for 2023 and 2024 remain unchanged. Natural gas production is also estimated lower than previous projections, as is coal output. Yet, the government kept its projection for LNG production unchanged at 30.1 mt this year.

A draft government document says the pandemic could continue to slow global oil demand until 2024, while the decarbonization plans in major European economies could arise as a new threat to Russia’s oil industry.

Saudi Arabia: Investors led by EIG Global Energy Partners agreed to acquire a roughly $12.4 billion stake in a new Saudi Aramco oil pipeline company. The group will receive a 49% equity stake in a newly formed entity with rights to 25 years of rate payments for oil shipped through the Saudi oil giant’s network of conduits, EIG said in a statement. The deal implies a total equity value of about $25 billion for Aramco Oil Pipelines.

The deal is part of Saudi Arabia’s drive to invite foreign investment and use the money to diversify its economy. Asset disposals also help maintain payouts to shareholders as well as investments in oil fields and refinery projects. Saudi Aramco paid a $75 billion dividend last year, the highest of any listed company, almost all of which went to the state.

India: New COVID-19 cases in India surged to a record of 152,879 on Sunday. The country battled the second wave of infections by pushing for faster vaccinations, with some states considering more onerous restrictions to slow the virus’s spread. According to Reuters, India leads the world in the daily average number of new infections reported, accounting for one in every six infections reported each day. According to data from the federal health ministry, daily cases have set record highs six times last week. Deaths have also surged, with the national health ministry reporting 839 fatalities on Sunday – the highest in over five months – as hospitals and crematoriums in some parts of the country grappled with the worsening situation.

The second surge in infections, which has spread much more rapidly than the first one that peaked in September, has forced many states to impose fresh curbs on activity. The administration in western Maharashtra state, which is home to the financial capital Mumbai and has the highest number of cases in the country, may impose additional measures beyond a weekend lockdown that will end early on Monday.

Brazil: The surge in COVID-19 deaths will soon surpass the worst of a record January wave in the US, with fatalities climbing for the first time above 4,000 in a day as the outbreak overwhelms hospitals. Brazil’s overall death toll trails only the US outbreak, with nearly 348,000 killed. But with Brazil’s healthcare system at the breaking point, the country could exceed total US deaths, despite having a population two-thirds that of the US. “It’s a nuclear reactor that has set off a chain reaction and is out of control. It’s a biological Fukushima,” said Miguel Nicolelis, a Brazilian doctor and professor at Duke University, who is closely tracking the virus.

5. Renewables and new technologies

China’s Longi Green Energy Technology, a solar company, is entering the hydrogen market. The firm, which manufactures wafers, cells, and panels, is the world’s largest solar company by market capitalization, at about $52 billion. Energy companies are increasingly turning to hydrogen as a possible carbon-free fuel produced by electrolysis of water powered by renewable energy and then stored and transported and used in everything from cars to electrical generators to steel mills. Most industrially used hydrogen is currently made using fossil fuels, a cheaper form of production than electrolysis, but leaves a carbon footprint.

Norway’s Hydro is exploring the potential for developing and operating hydrogen facilities to meet significant internal demand and serve an external market. This would leverage the company’s industrial and renewable power expertise. Hydro has unique capabilities that set it apart from other industrial players due to its renewable power positions and competence and large internal demand for gas replaced by green hydrogen solutions.

Syzygy Plasmonics, a technology company developing a high-performance photocatalyst for the industrial gas, chemical, and energy industries, announced a $23-million financing led by Horizons Ventures. The capital raised will fund product development and the commercialization of Syzygy’s photocatalytic reactor, which are critical steps toward delivering on the company’s mission to reduce emissions using light to replace heat from fossil fuels in chemical manufacturing and production.

Today, the production of chemicals such as plastics, fuels, fertilizers, and hydrogen is primarily reliant on fossil fuel. The heat demand to power the combustion processes for chemical production accounts for 3.6% of global greenhouse gas emissions. Syzygy’s photocatalytic technology replaces heat with light to trigger these chemical reactions—a transformation in industrial processing that aims to reduce 1 gigaton of CO2 emissions by 2040.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Vitol, Shell, and Exxon are expected to announce profits in Q1 2021 following a turbulent 2020. The three companies profit from increased oil demand and a rise in oil prices, giving analysts hope for a strong year in oil and gas. (4/9)

Europe’s latest addition to the list of nations willing to tap into their prospective hydrocarbon resources is located in the southeast of the Old Continent, in Montenegro. The small ex-Yugoslav republic with just slightly more than 600 000 inhabitants has witnessed its first offshore well spudded on March 25, 2021. (4/5)

Qatar Petroleum found itself in the LNG scene’s limelight in 2021, having clinched two major deals with Pakistan and China. For Pakistan, the new Qatar supply deal is a real boon for the economy. Pakistan recently doubled its LNG intake capacity. (4/7)

Nigeria’s refined petroleum products, especially gasoline, are being smuggled extensively to neighboring Cameroon, Benin, Togo, Chad, and the Niger Republic, which all share borders with Nigeria. (4/10)

Fracking activity in Vaca Muerta, the biggest shale play in Argentina, rose 7% to 733 frac stages in March from the previous month, reaching the highest level on record as a rise in oil and natural gas prices and a recovery in demand improves the prospects for sales. (4/6)

Argentina’s government is pushing for long-term oil price controls to protect their shale trove in Patagonia. Setting a ceiling and floor would be aimed at spurring oil-and-gas investments. While a cap would prevent bull runs in oil markets from triggering a surge in fuel prices, a floor would discourage major oil companies from pulling out if markets collapse. (4/10)

In Ecuador, since assuming office in 2017, President Lenin Moreno embarked upon a strategy of reforming and reviving the nation’s deeply troubled petroleum industry. The problems are so severe that Ecuador’s refineries cannot process sufficient fuel to meet local demand. (4/9)

In Mexico, a massive fire erupted on Wednesday evening at a 285,000 b/day oil refinery operated by Pemex in the city of Minatitlan in the eastern Mexican state of Veracruz. Five firefighters and two workers were hurt in the event. (4/9)

Canada’s climate strategy to significantly cut emissions and become a net-zero emissions economy by 2050 will create a seismic shift in the large oil and gas sector, where up to three-quarters of the workers, or up to 450,000 people, are at risk of displacement. (8/7)

The US oil rig count was unchanged at 337 this week while gas increased by 2 to 93, according to Baker Hughes Inc. (4/10)

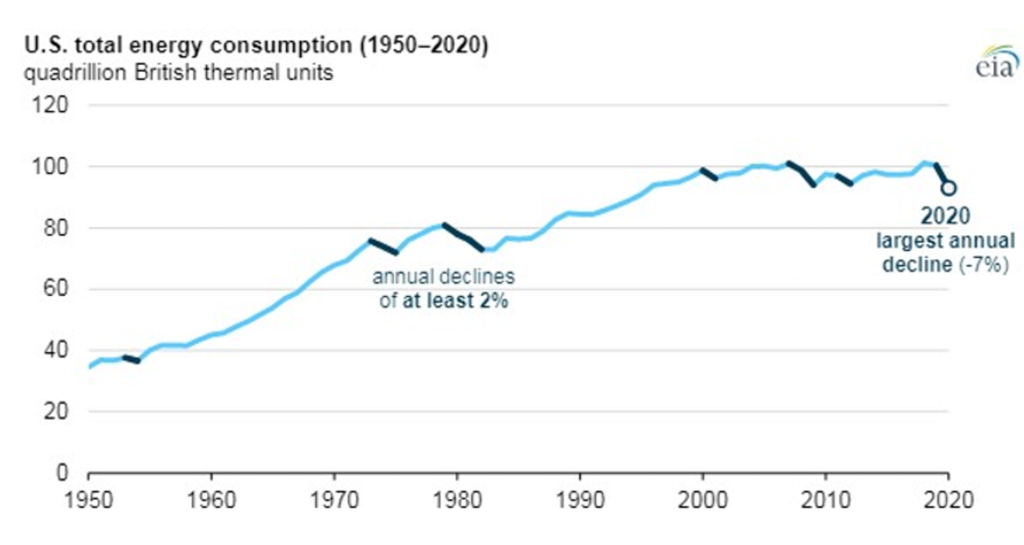

Total US energy use fell to 93 quadrillion British thermal units (quads) in 2020, down 7% from 2019, according to US EIA data. Last year marked the largest annual decrease in US energy consumption since data collection started in 1949. The transportation sector fell by 15%. (4/4)

EIA’s annual Summer Fuels Outlook, released with EIA’s Short-Term Energy Outlook, expects a 15% increase in US highway travel this summer but still less highway travel than in the summer of 2019. Prices at the pump will average $2.78 a gallon from April to September in the US, more than 30% higher than last summer and the highest since 2018. (4/7 + 4/8)

Californian drivers are edging closer to paying $4/gal of gasoline with the state open for business again and Gov. Gavin Newsom planning for a summer with almost no restrictions.(4/9)

Discoveries in Alaska by an Australian independent could provide hope for bigger oil finds yet to come in the country’s National Petroleum Reserve. (4/5)

New oil export hub: Startup Max Midstream plans to put a new Texas crude export hub on the map in early May when it ships its first cargo bound for northwestern Europe. The overall goal is establishing an export hub — between Houston and Corpus Christi — where there is little existing ship traffic, and the Port of Calhoun can focus primarily on crude shipments to Europe. (4/7)

Pipeline pullout: Phillips 66 Partners is officially pulling out of the long-deferred Liberty Pipeline project designed to move 350,000 b/d of crude oil from the Rockies and Bakken Shale to the benchmark Cushing, Oklahoma, hub. (4/7)

The Dakota Access Pipeline will not be ordered to shut down while pending review, government lawyers told US District Judge Brian Boasberg on Friday, much to the ire of environmentalists who have long called for the pipeline to be shut down. The government is still reserving the right to shut down the pipeline at any time during the review. (4/10)

Biofuels vs. EVs: The president and auto industry maintain the nation is on the cusp of a gigantic shift to electric vehicles and away from liquid-fueled cars, but biofuels producers and some of their supporters in Congress aren’t buying it. They argue that now is the time to increase sales of ethanol and biodiesel, not abandon them. (4/8)

Methane leaks: US oil production remains about 2 million b/d lower than its pre-pandemic levels. Still, methane emissions are already back to their pre-pandemic levels. (4/5)

CO2 storage: Oxy Low Carbon Ventures will offtake and transport carbon dioxide from NextDecade Corp.’s Rio Grande LNG project in Brownsville, Texas, under a deal between the companies. The deal requires permanently sequestering the CO 2 underground. (4/5)

The US EIA forecast coal production of 585 million tons in 2021 is up 8.6% from 2020 output. In its latest forecast, coal exports for 2021 should be up 13.6% from last year’s exports. (4/7)

Sustainable nukes? French President Emmanuel Macron co-signed a letter calling on the European Commission to include nuclear energy in its Green taxonomy. (4/5)

South Korea has shut two nuclear reactors due to an influx of marine organisms just two weeks after restarting them after an earlier influx, company officials said April 8, adding to the country’s potential LNG demand for power generation. (4/8)

Norway’s $1.3 trillion oil fund made its first investment in renewable infrastructure as its CEO said he wanted to “tune up” returns at the world’s largest sovereign wealth fund. The fund said it would pay €1.4 billion for a 50% stake in a Dutch offshore wind farm. (4/8)

Shipping companies ordered a record volume of container ships last month in a sign of the industry’s confidence in booming global trade following the pandemic. (4/8)

Ever Given locked down: Egypt won’t release the ship that blocked the Suez Canal for nearly a week in March until its owners agree to pay as much as a billion dollars in compensation. (4/9)

Greenland mining bruhaha: China’s ambitions to develop a massive rare-earth mine have run into tricky local politics in a part of the world the US considers vital to its national security interests. The party which opposes the mining project won a plurality of votes in a snap election. The mining project was expected to produce 10% of the world’s rare earths. (4/8)

The US is the world’s largest helium producer, accounting for roughly 40% of the global supply. Unfortunately, the US National Helium Reserve in Amarillo, Texas–the world’s single largest source of helium over the past 70 years–is nearly exhausted. (4/7)

H2 first: The European innovation project Flagships will deploy the world’s first commercial cargo transport vessel operating on hydrogen, plying Paris’ river Seine later this year. (4/10)

H2 MOU: Denmark-based Everfuel A/S has signed a Memorandum of Understanding with an undisclosed German-Norwegian shipping company for collaboration on hydrogen supply to a new zero-emission shipping solution. (4/10)

In Alaska, temperatures more than 40 degrees below zero are gripping the state beneath a record-cold air mass in the lower atmosphere. Since February, Alaskans have endured abnormally cold weather, including a record -24 deg F in Fairbanks last Tuesday. (4/10)

Drought: Colorado researchers report a lack of monsoon rainfall last summer and spotty snowfall this winter has worsened the Western drought dramatically in the past year, and spring snowmelt won’t bring much relief. (4/10)

Free ice cream! China is deploying a medley of tactics, some tantalizing—including free ice cream—and some threatening, to achieve mass vaccination on a staggering scale: a goal of 560 million people, or 40% of its population, by the end of June. (4/7)