Editors: Tom Whipple, Steve Andrews

Quote of the Week

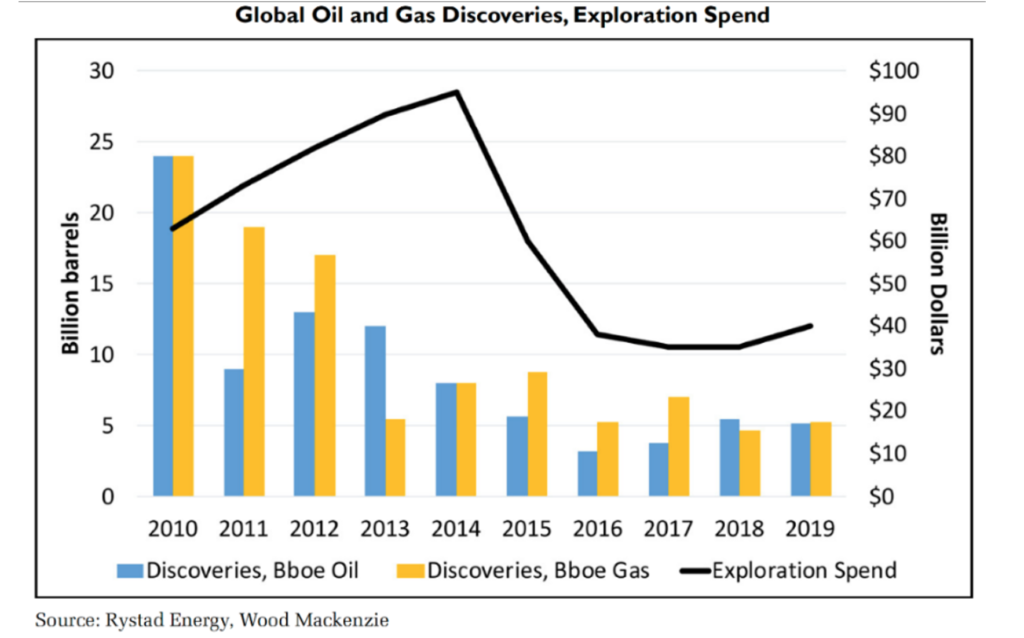

“Global oil and gas discoveries have been on a constant shrinking trend prior to and over the last decade, with oil discoveries reaching a low of 3.8 Bbo (billion barrels of oil) in 2016; in 2020 it was 4.3 Bbo. During the [decade], 89 Bbo were discovered while 289 Bbo of reserves were produced, a ratio of over 3 to 1, which is unsustainable.”

Rafael Sandrea, Energy Policy Research Foundation

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

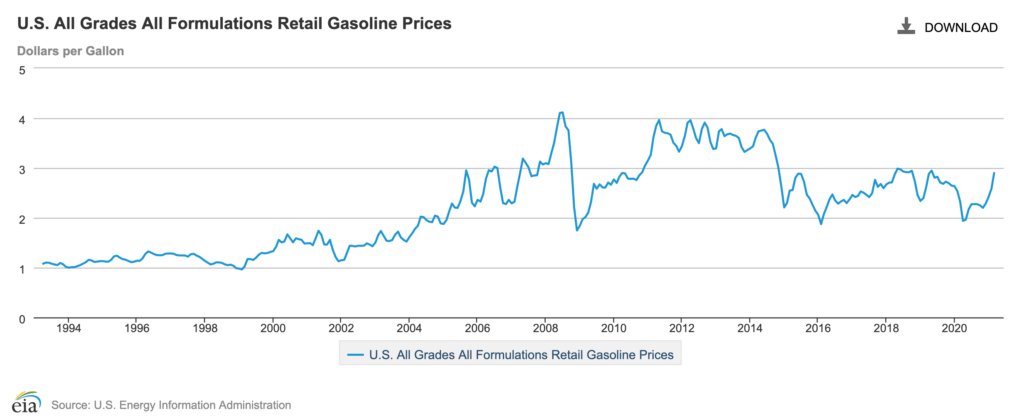

Oil: Last week, oil prices saw their biggest weekly gain since early March as signs emerged of a recovery from the pandemic gaining traction in the US and China. Futures in New York advanced 6.4% last week, despite eking out a slight loss on Friday. On the heels of robust economic figures out of the US, data from China showed its gross domestic product climbed 18.3% in the first quarter from a year prior as consumer spending beat forecasts. In March, China’s refiners processed about 20% more crude than a year earlier, pointing to the strength of the country’s rebound. JPMorgan analysts forecast that Brent would hit $70 again, with a boost in US demand likely bringing OECD inventories back to normal sooner than expected.

Crude oil prices climbed on Wednesday after the EIA reported oil inventories fell by 5.9 million barrels in the week to April 9th. This compared with an inventory draw of 3.5 million barrels for the previous week. For gasoline, the EIA estimated a modest inventory build of 300,000 barrels for the week to April 9th, with production averaging 9.6 million b/d.

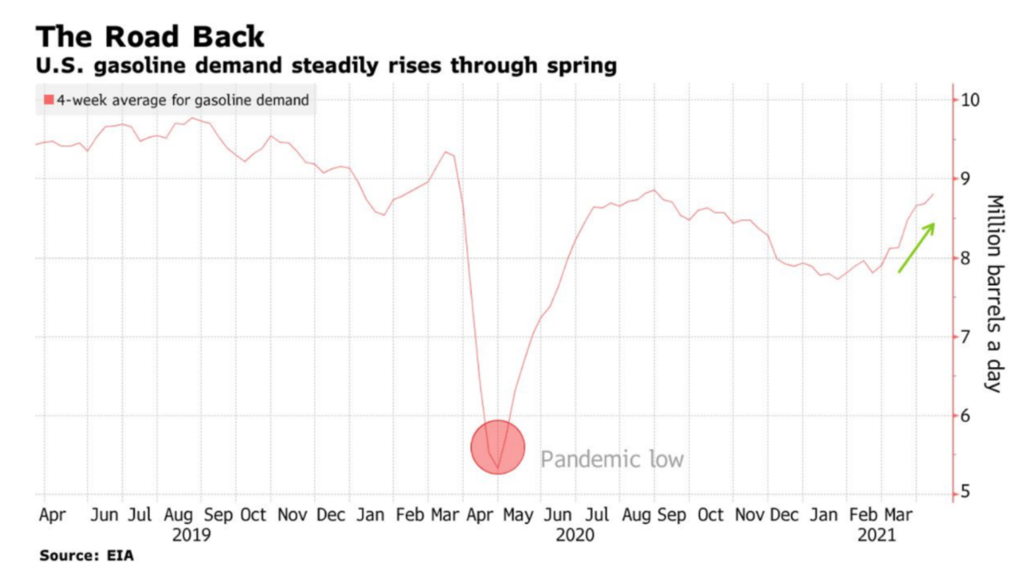

The IEA has sharply raised its world oil demand estimate for 2021, pointing to signs that the global economy is recovering faster than previously expected, particularly in the US and China. Stronger economic forecasts and “robust” indicators of prompt demand mean global oil demand will grow 230,000 b/d faster than previously forecast. World oil demand is now expected to expand by 5.7 million b/d in 2021 to 96.7 million, following a collapse of 8.7 million b/d last year, the IEA said.

Meeting rising gasoline demand heading into the summer months is the best bet for US refineries to stop the losses they had incurred last year and in the first quarter this year. US refiners had to not only suffer through the collapse in fuel demand when the pandemic started hitting mobility in March 2020, but many along the Gulf Coast had to shut operations for weeks during the Texas Freeze and pay higher electricity and natural gas costs.

President Biden told lawmakers at a White House meeting last week he was open to raising the gas tax by 5 cents and instituting a user fee on electric vehicles to pay for his infrastructure bill.

OPEC: Russia’s Deputy Prime Minister Novak told reporters that the OPEC+ alliance would gradually ease collective production cuts between May and July, as the ministers agreed earlier this month. Russia, the critical partner of OPEC, decided together with its allies led by Saudi Arabia to ease the collective production cuts by over 1 million b/d over the next three months to July. In early April, OPEC+ decided to gradually increase joint oil production by 350,000 b/d in May and June and by more than 400,000 in July. Additionally, Saudi Arabia will also ease its extra unilateral cut of 1 million b/d progressively for the next few months, beginning with monthly production increases of 250,000 b/d in May and June.

In its closely watched monthly oil market report released April 13th, OPEC raised its demand forecast by 190,000 b/d from its March estimate, expecting consumption to average 96.46 million b/d this year, citing economic stimulus programs and a further easing of COVID-19 lockdown measures. Year on year, global oil demand was projected to grow 5.95 million b/d in 2021, compared with the 5.89 million b/d forecast in March. Only two weeks ago, OPEC cut its 2021 oil demand growth forecast by about 5% to 5.6 million b/d after pressure by some members of an OPEC+ technical committee who favored maintaining tight production quotas.

Shale Oil: The EIA might be forecasting that the Permian Basin’s oil production will be rebounding soon, but overall, today’s US oil production is still 2 million b/d below levels seen in January 2020. The EIA’s Monthly Drilling Productivity Report forecasts that for the Permian Basin, production will return to 4.46 million b/d in May. That compares to 3.91 million in May 2020—but that was during the pandemic. In January 2020, the Permian basin’s average oil production was 4.79 mb/d. This means that oil production in the Permian Basin is down 327,000 b/d, or 7% under January levels. That’s a reasonably good recovery. But overall, US oil production is still sitting at 10.9 mb/d—compared to 12.9 mbpd in January of last year.

However, fracking in North America has almost recovered to pre-pandemic levels, with the count of new frac jobs reaching a 12-month high in March 2021, a Rystad Energy report shows. Rystad claims that the number of completed wells in the Permian basin during the first quarter of 2021 exceeded the required output maintenance level. So, oil production is set to rise in the current quarter – but will likely slow again later in the year. Rystad Energy has already registered 967 started frac operations in North America for March 2021.

Rystad has closely tracked the tight oil industry’s learning curve and believes that emerging trends are set to take the sector to a new level of “operational maturity.” The industry continues to switch to longer laterals in nearly all major US oil & gas basins, and no inflection point has been reached so far—one decade after the start of that fundamental trend.

Shorter 1-mile lateral well completions have become nearly non-existent, with only 13% of all horizontal completions from 2020-1Q21 exhibiting perforated lengths of under 6,000’. However, the industry is more frequently testing ultra-long laterals, of 2.5-3 miles, in recent quarters. Rystad says the market share of 11,000’+ laterals increased from less than 1% in 2014-2015 to around 8% in 2018-2019, which has subsequently surged to a staggering 19% in 2020-1Q21. Lateral wells of 3 miles are now being tested and adapted successfully even in basins that historically lag the country’s average perforated length – such as in New Mexico.

In that basin, Rystad is now tracking second-month production data for two of the new 3-mile laterals, each recovering 190,000-200,000 barrels of oil in the first two production months. The consulting firm believes that the growing length of lateral wells will allow significantly greater productivity from fewer rigs in coming years.

A vital source of funding for the US oil sector is drying up as private investors retreat, prompting stricken operators to make “last gasp” efforts to boost production and cash flow to lure in buyers. The exodus mirrors shale’s experience in public markets, where even before last year’s crash, investors had soured on an industry notorious for poor returns and weak environmental, social, and governance performance.

“Private equity has been decimated in this downturn,” said Wil VanLoh, head of Quantum Energy Partners, one of the largest PE investors in the shale patch. “The total amount of money available to private companies has shrunk and is going to stay much, much smaller.” The private money flight comes despite oil’s recovery to $60 a barrel — a price that allows many operators to break even and has raised investors’ hopes of a profitable exit from the sector.

The number of North American producers that filed for bankruptcy protection in the first quarter of 2021 reached the highest number for the first quarter since 2016. However, the wave of bankruptcies has significantly slowed since the peaks in the second and third quarter of 2020, law firm Haynes and Boone said in its latest tally to March 31st.

Nearly half of all oil pipelines from the Permian basin are expected to be empty by the end of the year. Pipeline companies went on a construction spree throughout 2018 and 2019 to handle blistering growth in US crude production to a record 13 million b/d. However, the coronavirus pandemic crushed both fuel demand and oil production, and neither has recovered fully, leaving many pipelines unused. Major pipeline companies are exploring ways to ship other products in those lines and considering selling stakes in operations to raise cash.

Natural Gas: Injections into US underground storage fields the week ended April 9th dwarfed the five-year average once again. Inventories increased 61 billion cf to 1.845 trillion. The build far surpassed the five-year average build of 26 billion. The week ended April 9th spanned the Easter holiday, which typically produces notable decreases in demand. Total demand fell 6 billion cf/d, with residential and commercial losses accounting for 4.5 billion of the drop.

Global gas demand is expected to increase by 3.2% year-on-year in 2021, enough to more than offset the lost consumption in 2020, the IEA said in its latest quarterly market report. Gas demand fell by 1.9% — or some 75 billion cm — in 2020, but recovery is expected this year, driven by demand in the industrial sector. “We expect globally to see a rebound, sufficient in our view not only to offset last year but also show some growth compared with 2019,” an IEA senior analyst said during a webinar presenting the report.

Natural gas is falling out of favor with emissions-wary investors and utilities faster than coal did. This phenomenon is catching some power generators unaware and potentially leaving them stuck with billions of dollars of assets they can’t sell. Citigroup Inc. and JPMorgan Chase & Co. are among the banks that strengthened their financing restrictions on thermal coal under pressure from shareholders wanting to avoid the fuel. The expectation is that gas is next. Executives at some western European companies say they’re already struggling to sell gas-fired facilities. The cost of renewables has dropped dramatically during the past decade, making gas-fired stations less competitive.

Electricity: For 4 million Texas households, the consequence of the February freeze was life without power, and for many, without drinkable water. Dozens died. But for the companies that have a stake in that market, the blackouts meant that billions of dollars went chasing after diminishing electrons. While some firms stand to lose fortunes, others — the ones with the power or natural gas to sell — have been reaping stupendous windfalls.

Now, the fight over who will pay and how much is gearing up. The action is taking place in federal bankruptcy courts, state courts, and in the Texas legislature. The state’s attorney general has ruled that customers of one company needn’t pay their bills. And more than 200 Texans have joined what is expected to be a flood of liability suits.

Texas came uncomfortably close to another round of rolling blackouts last week because grid operators misjudged the weather. The Electric Reliability Council of Texas, which manages most of the state’s grid, had counted on a mild cold front sweeping the state, lowering power demand. It didn’t happen. As a result, demand on the grid was about 3,000 megawatts higher than anticipated — or the equivalent of 600,000 homes.

The forecasting error, coming as 25% of power generation was offline for seasonal repairs, was another grim reminder of the vulnerability of Texas’s grid. The change in the weather forecast was hardly extreme, and the close call has raised questions about whether the grid operator, known as Ercot, can prevent a repeat of the February energy crisis.

Prognosis: Add Goldman Sachs to the list of forecasters calling for oil demand to peak sooner rather than later. The bank brought forward its forecast for peak oil demand in the transportation sector by one year to 2026, if not sooner, mainly due to the accelerating adoption of electric vehicles. Overall crude consumption will keep expanding this decade due to jet fuel and petrochemicals, but growth will be at an “anemic” pace past 2025. Goldman is the latest to reevaluate what the end of demand growth will look like for oil. Among the most aggressive calls is that from BP, which said last year that the era of oil demand growth might already be over.

Wood Mackenzie highlighted that oil demand would drop significantly under its Accelerated Energy Transition Scenario, and with it, oil prices. Within the company’s AET-2 scenario, oil demand begins to drop in 2023. Soon after, the company says the decline accelerates to year-on-year falls of 2 million b/d, reducing the need to about 35 million b/d by 2050. Consequently, by 2030 Wood Mackenzie would expect Brent crude prices to average $40 per barrel, down from the $60 to $70 per barrel range the industry is experiencing. By 2050, Brent may slide to between $10 and $18 per barrel, Wood Mackenzie outlined.

In the meantime, the US oil industry faces a new oil price war if shale production rebounds next year by rising 1 million b/d compared to this year, Scott Sheffield, chief executive at shale giant Pioneer Natural Resources, said last week. Last year, the OPEC+ group broke up their production pact in March after demand started crashing in the pandemic and the US crude oil production had hit 13 million b/d in the weeks before the start of the pandemic. “OPEC and Russia were upset that we grew too much,” Sheffield said. “If we ever start growing again too much, we’re going to have another price war.”

The markets are not headed to a new supercycle in oil, and $100 a barrel oil is still a very distant possibility unless major unexpected market shocks occur, analysts at the Oxford Institute for Energy Studies (OIES) said in their latest monthly short-term outlook. Despite the rising prices so far this year, and despite the expectations of improving global oil demand, the market is still missing critical triggers of an oil supercycle, especially later this year, OIES researchers and economists noted.

In the coming years, the power structure of global oil markets is set for a significant shakeup if the reserve life of International Oil Companies continues to decline. Dwindling investments, caused by an insensitive economic environment and the growth of activist investing, have resulted in a significant decline in new projects and the underdevelopment of existing or prospective opportunities. Citibank warned in a recent research note that IOCs, such as Shell, Exxon, and Chevron, are looking at a significant decline of reserve/production life spans.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

US-Russia-Ukraine: The Biden administration announced tough new sanctions on Russia and formally blamed the country for the sophisticated hacking operation that breached American government agencies and the nation’s largest companies. This is a new effort by President Biden to give more teeth to financial sanctions by choking off lending to the Russian government. The US barred American banks from purchasing newly issued Russian government debt, signaling the deployment of a critical weapon in Washington’s intensifying conflict with Moscow — threatening Russia’s access to international finance.

The moves aim to exploit Russia’s weak economy to pressure Moscow to relent in its campaign to disrupt American political life and menace Ukraine. The limits on debt purchases, which apply to bonds issued by the Russian government after June 14th, could raise the cost of borrowing within the Russian economy, limiting investment and economic growth.

The Kremlin told Washington it would act decisively if the US undertook any new “unfriendly steps” such as imposing sanctions. The comments were made by Russian President Vladimir Putin’s foreign policy adviser Yuri Ushakov who invited the US ambassador in Moscow to talks following a phone call on Tuesday between Putin and US President Biden. Over the past month, Russia has deployed what analysts call the most extensive military build-up along the border with Ukraine since the outset of Kyiv’s war with Russian-backed separatists seven years ago. The mobilization is setting off alarms in NATO, European capitals, and Washington and is increasingly seen as an early foreign policy test for the Biden administration.

Russia’s ruble has been hit hard by mounting geopolitical tensions, as Moscow’s military build-up on the border with Ukraine and the prospect of fresh US sanctions unnerve investors. The country’s currency has dropped almost 5 percent in the past month, hitting a five-month low of around 77 to the US dollar. The ruble’s fall over the period has been among the most severe of any primary emerging market currency, trailing only the embattled Turkish lira.

The new round of US sanctions could have knock-on effects on the energy space while not specifically targeting the sector. Again, Germany’s foreign minister rejected calls to halt the Nord Stream 2 gas pipeline project, warning that such action could lead to a further escalation. Germany has continued to back the controversial 55 billion cm/year Nord Stream 2 pipeline, which is now 95% complete, despite opposition from the US and countries in eastern Europe.

US- Iran: Negotiators for the US and Iran, working to revive an international deal aimed at restricting Tehran’s atomic ambitions, are looking for ways to untangle a knot of interlocking American sanctions in exchange for Tehran’s return to limits on its nuclear activities. Iranian officials have said they want all the Trump-era sanctions removed before it returns to comply with the nuclear deal. The Biden administration says it is willing to lift all sanctions that are “inconsistent” with the nuclear deal but hasn’t identified those it will leave in place.

Iran’s top leader said his country would keep negotiating with world powers to salvage the 2015 nuclear deal. This pronouncement quashed speculation that Iran’s delegation would boycott or quit participating in a protest of the apparent Israeli sabotage of its primary uranium enrichment site. The declaration by top leader Ayatollah Ali Khamenei, who has the last word on security matters, came three days after an explosive blast at the Natanz enrichment site. Suspicion over the blast immediately fell on Israel, which has sabotaged the Natanz site before.

Iran indicated Thursday that it might be willing to compromise its stance, which has been firm for months. In an interview in Vienna, the chief Iranian negotiator said the parties would now begin the practical work of preparing a list of sanctions the US was willing to lift and the reciprocal actions Iran would take.

Iraq: Baghdad is talking with US energy companies to find potential buyers for ExxonMobil’s 32.7% stake in West Qurna 1. Iraq first awarded the contract to develop the southern field to Exxon, Shell, and Oil Exploration Co. in 2010. In 2018, Shell sold its stake to ITOCHU. Other partners in West Qurna 1 are PetroChina, ITOCHU Corp., Indonesia’s Pertamina, and Iraq’s Oil Exploration Co. Iraq’s relationship with Exxon was strained in 2019 when it withdrew its foreign staff in May, citing the deteriorating security situation. The withdrawal took place while ExxonMobil and PetroChina were in negotiations with the Iraqi government to run the Southern Iraq Integrated Project, a complex, multibillion-dollar development.

Libya: The National Oil Company produced 1.28 million b/d of crude in March, the company told OPEC in the producer group’s latest monthly oil market report. Crude production in March rose by 100,000 b/d compared to 1.18 million in February. Production in the first quarter of 2021 and January averaged 1.21 million b/d and 1.17 million b/d, respectively. This is the first time Libya has officially reported a monthly production figure to OPEC since March 2015.

The dispute over so-called field allowances paid to Libya’s Petroleum Facilities Guard has returned, with the potential to lead to some oil terminal closures later this month. The PFG, which controls crucial eastern terminals and some oil fields in Libya, has clashed with the finance ministry over salary and field allowance payments in the past few months. On April 11th, the PFG at Libya’s 300,000 b/d Es Sider terminal wrote a letter threatening to shut down exports by April 25th if their March salaries did not include field allowances.

Venezuela: The IMF won’t hand over $5 billion of special drawing rights to Venezuela to bolster its reserves as part of a massive injection of resources to member nations. The fund says its refusal is due to the dispute over who is the country’s legitimate leader. Venezuela would have been among the biggest recipients in terms of the percentage of GDP of $650 billion in special drawing rights that the IMF is planning to give countries to boost global liquidity. This is part of an effort to help low-income nations deal with mounting debt and Covid-19.

3. Climate change

The US is back in the Paris climate accord. The depth of its commitment will become clear this week when President Biden unveils the details of the nation’s pledge for reducing greenhouse gas pollution. President Obama pledged that the US would cut emissions 26% to 28% by 2025, a goal the country is not entirely on track to meet. But environmental advocates are pushing for Biden to set a goal of at least a 50% cut in US emissions by 2030, based on a slew of recent studies, including research by the UN and the National Academies of Science, showing that a 50% target is both necessary and achievable.

The Biden administration is considering singling out methane for significant reductions as part of a pledge to cut greenhouse gases in advance of the climate summit this week. Activists have pushed the administration to go further when it comes to methane since it is so potent that reductions over just a few years can be a significant weapon in the fight against climate change.

Efforts to identify and attribute global emissions will get a boost from satellites to be launched by a consortium including Carbon Mapper, the State of California, NASA’s Jet Propulsion Laboratory, and Planet Labs Inc. Data collected by the satellites will pinpoint and measure sources of methane and carbon dioxide, as well as more than two dozen other environmental indicators. The first two satellites are set to launch in 2023, with more to be added two years later. Carbon Mapper is a non-profit that plans to make high-emitting methane and CO2 sources publicly visible at the facility level to increase transparency on fossil-fuel industry emissions. The sector accounts for roughly a third of the methane generated by human activity.

Corporate executives and investors say they want world leaders to embrace a unified and market-based approach to slashing their carbon emissions at this week’s climate summit. The request reflects the business world’s growing acceptance of the need to sharply reduce global greenhouse gas emissions, as well as its fear that doing so too quickly could lead governments to set heavy-handed rules that hurt profits. The US is hoping to reclaim its leadership in combating climate change when it hosts the April 22-23 Leaders’ Summit on Climate. Key to that effort will be pledging to cut US emissions by at least half by 2030 and securing agreements from allies to do the same.

Russia is one of the countries most vulnerable to climate change. A significant part of its territory is in the Arctic, which is warming more than twice as fast as the rest of the world. That’s showed in Siberia’s unusually high 2020 temperatures, two consecutive years of record wildfires, and thawing permafrost—the frozen ground covering vast swaths of the country. The disasters have caused extensive damage. June floods near Russia’s border with China in 2019 cost the nation more than $460 million. In total, major catastrophes may have led to just under $1 billion of losses in Russia that year. “The heatwave in Siberia in 2020 and the corresponding widespread fires are renewed evidence of climate change,” said Ernst Rauch, chief climate and geoscientist at global reinsurance provider Munich Re. “We view with concern the thawing permafrost soils, which amplify global warming by releasing methane.”

4. The global economy and the coronavirus

The safety scares engulfing the AstraZeneca and Johnson & Johnson vaccines have jeopardized campaigns to inoculate the world. They are undercutting faith in two sorely needed shots and threatening to prolong the coronavirus pandemic in countries that can ill afford to be picky about vaccines. With new infections surging on nearly every continent, signs that the vaccination drive is in peril are emerging, most disconcertingly in Africa.

A group of 175 former world leaders and Nobel laureates urges the US to take “urgent action” to suspend intellectual property rights for Covid-19 vaccines to help boost global inoculation rates. According to a new study published by the Lancet Infectious Diseases journal, a more transmissible coronavirus variant first detected in Britain does not cause more severe illness in hospitalized patients.

US: While some states have seen the coronavirus crisis start to dissipate, a spring wave of infections and hospitalizations is crashing across 38 states. Michigan may be the worst of the hot spots. The tide is turning on the availability of vaccines in the US, with the country on track to have hundreds of millions of excess doses by July. That surplus will come as many nations in the developing world face a years-long wait to vaccinate most of their population. The Biden administration so far has resisted mounting pressure to give its extra vaccine to other countries.

The US economy’s comeback is firing on all cylinders, with employment, retail spending, and manufacturing showing solid gains. Thursday’s barrage of economic data showed that some parts of the economy, like retail sales, have returned to or exceeded pre-pandemic levels. Applications for unemployment benefits, while still elevated, hit the lowest in 13 months. The rebound in demand reflected a wave of business reopenings last month, increased vaccination rates, and a fresh round of stimulus checks to households.

Consumer prices rose sharply in March as the economic recovery gained momentum, marking the start of an expected long pickup in inflation pressures. Some price increases reflected temporary factors. Still others showed how demand for many goods and services is reviving a year after the coronavirus pandemic shut down large swaths of the economy, analysts said.

European Union: The pandemic situation in Europe remains mixed. The UK hit its goal of offering a shot to all those over 50 three days early while England reopened shops, pub gardens, gyms, and hair salons after months of lockdown. The number of confirmed coronavirus cases in Germany jumped on Thursday by 29,426 to 3.073 million, the biggest increase since January 8 as the government seeks to push through tougher nationwide curbs to contain a third wave of the virus. French MPs have voted to suspend domestic airline flights on routes that can be traveled by direct train in less than two and a half hours as part of a series of climate and environmental measures.

Saudi Aramco, the world’s largest oil exporter, will meet only part of the demand for crude from the European and Mediterranean regions for loading in May. While three refiners have been given all the oil they had can use, three others will receive crude loadings in May below their asked amounts. Saudi Arabia is competing, among others, with Russia’s Urals grade in the European markets. Earlier this month, Aramco lifted its official selling prices to its most important outlet, the Asian market, but lowered the prices for its crude to Europe and the US. Urals crude looks more attractive to European buyers because it is at its lowest price in a year.

China: The head of the Chinese Center for Disease Control and Prevention conceded that the efficacy of Chinese coronavirus vaccines is “not high” and that they may require improvements, a rare admission from a government that has staked its international credibility on its doses. The comments come after the government has already distributed hundreds of millions of doses to other countries, even though the rollout has been dogged by questions over why Chinese pharmaceutical firms have not released detailed clinical trial data about the vaccines’ efficacy. China has struck deals to supply many of its allies and economic partners in the developing world and boasted that world leaders had taken their shots.

China’s economy grew at a record pace of 19% in the first quarter, rebounding from a pandemic slump early last year. While the reading is heavily skewed by the plunge in activity a year earlier, the jump is the strongest since 1992, when official quarterly records started. It signals that the world’s second-largest economy has continued to gain momentum after a 6.5% expansion in the last quarter of 2020 and that China has managed to largely bring the COVID-19 pandemic under control.

China’s exports rose 30.6% over a year ago in March as global consumer demand strengthened and traders watched for signs of what President Biden might do about reviving tariff war talks with Beijing. Exports rose to $241.1 billion, decelerating from the dramatic 60.6% rebound in the first two months of 2021. Imports rose 38.1% over a year ago to $227.3 billion in a sign of reviving Chinese activity. China’s exporters have benefited from the relatively early reopening of its economy while some other governments are re-imposing anti-virus curbs that limit business and trade.

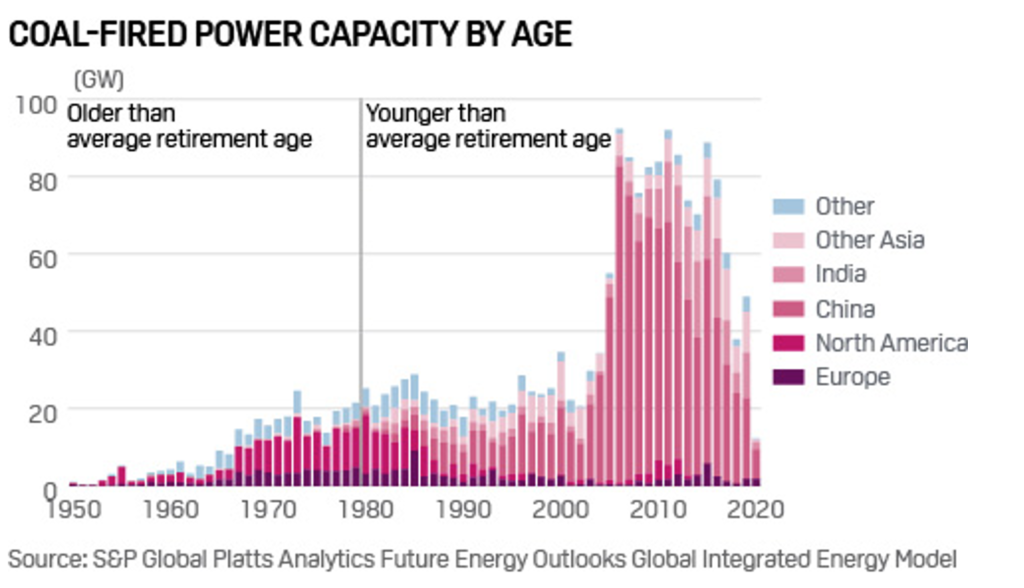

China’s coal output rose 16% in the first quarter year-over-year, bolstered by strong demand for winter heating and robust industrial activity. China churned out 970.56 million tons of coal between January and March, up from 829.91 million tons in the same period in 2020. While coronavirus restrictions in the first quarter of this year were less stringent than last year’s, output has been curbed by increased safety inspections at coal mines in China following several fatal accidents at mines across the country. Last year, coal mines were shut in January and February as the coronavirus outbreak forced Beijing to prolong the Lunar New Year holiday.

The throughput of Chinese refineries last month averaged 14.08 million b/d, up by 19.7% on the year thanks to the recovery in demand for fuels and China’s stocking up on finished products before maintenance season begins. The total amount of crude that passed through Chinese refineries during March was 59.79 million tons, and while a substantial increase on the year, it was lower than the throughput of Chinese refiners during the first two months this year.

China’s oil product exports are expected to rise by 31.7% year on year to around 54.7 million tons in 2021, as the recovery in the jet fuel market and an improving macro-economic outlook worldwide post COVID-19 supports demand. The increase will be a welcome reprieve to China’s oil product export markets after the country’s exports dropped sharply 17.4% on the year to 41.52 million tons in 2020, primarily due to a slump in jet fuel demand.

China’s ever-expanding oil refining capacity will increase competition among crude processors worldwide and weigh on their margins. China’s refining capacity will reach 900 million tons this year and rise to 980 mt by 2025. Capacity will outstrip local demand by at least 160 mt a year by 2025. A frenzy of refinery building means China is on track to surpass the US as the world’s biggest crude processor this year. Simultaneously, Beijing’s drive to de-carbonize the economy will weigh on demand growth for fuels like diesel and gasoline later in the decade.

In a bid to reduce refining overcapacity, China is stepping up pressure on independent refiners to uproot illegal tax practices and check if outdated facilities have been closed as required. China’s National Development and Reform Commission (NDRC) is launching inspections and audits at more than 50 private oil refiners, most of which are located in the Shandong province—the home of the independent refiners often referred to as “teapots.”

Russia: A revised oil strategy will focus on maximizing earnings from crude exports before hitting peak production in 2027-2029 and seeing world demand drop. The revised plan is in a draft document on energy sector development up to 2035 being reviewed by the State Duma. “The main Idea is the monetization of current oil and gas reserves and resources,” Pavel Zavalny, head of the Duma’s energy committee, said at the plan’s presentation. “Everything that can be produced should be produced while there is still demand to sell it,” he added.

Russia’s Ministry of Energy says the country is unlikely to return to pre-pandemic oil production levels. Before the pandemic, Russia produced 560 million tons of oil, or around 11.3 million b/d, hitting record levels in 2019. However, 2020 production levels decreased for the first time in over a decade as Russia agreed to cut production alongside OPEC+ countries to help stabilize oil prices. Under this agreement, Russia reduced production by 9% to 10.3 mb/d. The Energy Ministry believes that production levels will gradually increase, but not to pre-pandemic levels, reaching an estimated 11.1 mb/d by 2029 before ultimately dropping to 9.4 mb/d in 2035.

Current relations with the EU are the worst since the Cold War’s end. However, European and Russian economies are highly complementary. This has led to a level of dependence that has become a problem for certain countries. The complementarity of the economies has been mutually advantageous for decades: Russia exports vast volumes of raw materials and imports finished, often high-tech, machines. After the annexation of Crimea, new sanctions by the EU reduced Russia’s access to Europe’s financial sector. Energy imports, however, have remained stable, except for the pandemic period, which is worrying to many European countries.

President Biden faces growing pressure from Congress as his administration wrestles with using US sanctions powers against Nord Stream 2, the Russian natural-gas pipeline project to Europe. Mr. Biden opposes the pipeline, which would circumvent supply lines that run through Ukraine to transport Russian natural gas to US ally Germany, undermining Ukraine and strengthening Russia’s grip on the European energy market. The project, however, was conspicuously left out of a series of sanctions and other punitive measures against Moscow announced Thursday.

Saudi Arabia: Aramco has resumed tendering and development work on major offshore oil expansion projects that would give Saudi Arabia another 1.15 million b/d production capacity by 2024. After the oil price and demand collapse last year, Aramco idled offshore rigs and postponed the start of the expansion of several projects. Now Aramco is moving forward with the postponed start of the development work.

Higher oil prices and an expected rebound in the global economy and oil demand are set to lower the fiscal breakeven oil price of the major Middle Eastern oil producers this year and next. The breakeven oil price for Saudi Arabia is expected to drop to $65.70 in 2022 from $77.90 in 2020, the International Monetary Fund said in its regional economic outlook.

India: New coronavirus infections reached a record last week, as crowds of pilgrims gathered for a religious festival despite strict coronavirus curbs. Health ministry data showed total infections up to 14.5 million. The official but likely undercounted death toll is now 175,000. After reporting less than 10,000 cases per day earlier this year, India has been the world’s worst-hit country since April 2nd. The government blames a widespread failure to heed curbs on movement and social interaction.

Migrant workers who had just started to resettle in the cities they left during last year’s outbreak are packing up to return to their villages again. Mumbai and its state of Maharashtra are at the center of the fastest-growing epidemic globally, with more than 150,000 new cases a day across India. The western state has imposed nighttime curfews and shut down malls, eateries, bars, and places of worship.

An expert panel of India’s drugs regulator has recommended emergency use approval of Russia’s Sputnik V coronavirus vaccine. India overtook Brazil to become the nation with the second-highest number of infections worldwide after the US.

As the summer months draw nearer, usually meaning a rise in oil demand for India, increased pandemic restrictions threaten this trend in the world’s third-largest oil importer. Fuel consumption in India remains lower than it was before the pandemic, with oil demand in 2020 dropping to its lowest level since 2007. As Mumbai and Maharashtra state enforce another round of restrictions, including a city-wide curfew during weekends, traffic reduction will likely cut the demand for fuel. Diesel consumption, used for trucks, farms, and factories across the country, accounts for 40 percent of India’s oil product sales. In March, diesel consumption was down 3 percent from 2019 levels and could drop significantly further if restrictions continue.

5. Renewables and new technologies

The holy grail of electric cars is the solid-state battery which, if it ever comes to market, offers the prospect of storing more energy, charging in minutes, having a longer life, being cheaper to manufacture, and being safer to use. Battery scientists worldwide have been trying to design such an energy storage device for decades with little success. In recent months, however, the QuantumScape Corp., a San Jose startup, has been garnering much attention after a public stock listing late last year briefly surpassed the valuation of Ford Motor Co. QuantumScape promises to extend the range of electric cars by as much as 50% over today’s lithium-ion technology while reducing charge time for a long drive to just 15 minutes.

So far, the breakthrough promised by QuantumScape is backed only by preliminary data released since December. It’s been mainly achieved by replacing the liquid electrolyte with something solid—a long-sought accomplishment that would make the product a solid-state battery.

QuantumScape’s biggest shareholder is Volkswagen, which means the world’s largest automaker is lined up to become its initial customer. Last month, at a PR event dubbed “Power Day,” VW executives laid out a plan to electrify almost its entire line of cars at the cost of hundreds of billions of dollars.

There is no evidence QuantumScape has figured out the challenge of manufacturing a new type of battery material at the scale required by Volkswagen—a company that sold more than 6 million cars in 2019—while keeping all those other qualities. QuantumScape says it’s nearly three years away from putting its battery in test cars. Don’t expect to see it at your local VW dealership until 2026 if everything goes right.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Shell expects to have produced 75% of its current proved oil and gas reserves by 2030. Shell reports its oil production peaked in 2019 and is set for a continual decline over the next three decades. (4/16)

China has set a world record for deep-sea drilling in the South China Sea, Chinese state media reported, while tensions in the disputed area are rising. It was not immediately apparent where the latest deep-sea drilling project took place precisely in the South China Sea. (4/12)

In Uganda, Total SE signed agreements for an oil development costing over $10 billion to transform the East African nation into a significant crude producer and exporter. (4/12)

Uganda has signed a landmark deal with Tanzania to construct the world’s longest electrically heated crude oil pipeline, working in partnership with French oil supermajor Total. The 1440km export pipeline, expected to be completed within three years, has an anticipated cost of $3.5 billion. The pipeline will be heated to manage the high viscosity of the Ugandan oil. (4/15)

Offshore Angola, Italian firm Eni has made a new light oil discovery after exploration activities recommenced following a year of pandemic restrictions. The deepwater discovery could hold as much as 200 to 250 million barrels of oil. (4/12)

Across Nigeria, a total of 1,161 pipeline points were vandalized between January 2019 and September 2020. During January 2019 alone, there were 230 instances of pipeline vandalism—over 7 per day. Nigeria spends billions of naira maintaining those pipelines. (4/13)

In Nigeria, there is a cloud of uncertainty surrounding $62 billion in outstanding taxes and royalties by major oil companies operating in the country. The energy companies failed to comply with a 1993 contract-law requirement that the government receives a more significant revenue share when oil price exceeds $20 per barrel. (4/13)

Guyana has estimated future oil production at 1 mb/day by 2027, from seven floating production, storage, and offloading vessels. For now, Guyana is producing 130,000 bpd from ExxonMobil’s Liza-1 well, which reached full-planned production capacity in March. (4/16)

Argentina’s oil and natural gas output could begin to fall in the next few days if protesting health workers and truckers continue to block access to fields in Vaca Muerta, a shale play that has been driving growth. (4/13)

In Ecuador, conservative candidate Guillermo Lasso, 65, won the presidential election and said he would propose new oil deals to private oil companies. The pro-business and free-market proponent promised to bring more foreign investment to Ecuador to create more jobs. (4/14)

Petroleos Mexicanos expects its gasoline sales won’t fully recover to pre-pandemic levels this year as lockdown measures hurt demand and competitors win market share. They are expected to lag 2019 levels by about 16%. (4/15)

The US oil rig count was up 7 to 344, while the gas rig count inched up by 1 to 94, according to the weekly Baker Hughes report. States with the most rigs were Texas (214), New Mexico (70), Louisiana (47), Oklahoma (21), Pennsylvania (18), North Dakota (15), West Virginia (11), Colorado (10), and Ohio (10). (4/17)

Imports of Russian oil, mainly fuel oil feedstocks and some crude, recently reached a 10-year high. Russian imports as a share of US total oil imports hit a record high of 8% in January. (4/17)

Permian slowdown: Nearly half of all oil pipelines leading out of the Permian Basin are projected to run completely dry by the end of 2021, according to reporting by Reuters. (4/16)

Offshore oil has a well-deserved bad rap over the decades because of oil spills. But if we’re talking about emissions, offshore oil produces fewer than other forms of oil production. (4/13)

Plugging tens of thousands of abandoned oil wells across the US risks rewarding fossil fuel operators who shirk their clean-up responsibilities and hooking the industry on taxpayer bailouts, critics say. The president’s $2tn infrastructure proposal includes $16bn for cleaning up disused wells and mines. (4/15)

Drilling ban? As many as 375 local and state elected officials are calling on the Biden Administration to institute a ban on new oil and gas drilling permits on federal lands and in federal waters and stop energy infrastructure for fossil fuels. (4/14)

CA’s neighborhood O&G drilling: In California, there’s nothing preventing frackers or drillers from setting up shop right next to your home, school, or hospital. A new state bill called SB 467 may reshape the lives of frontline communities by eliminating fracking and instituting mandatory buffer zones between oil and gas extraction and places of occupancy. (4/13)

The US power sector has reduced emissions by 52% from levels projected 15 years ago as the Biden Administration is targeting to decarbonize the electricity grid by 2035. Business-as-usual projections saw annual carbon dioxide emissions rising from 2,400 to 3,000 million metric tons (MMT) from 2005 to 2020, but actual 2020 emissions fell to 1,450 MMT. (4/15)

A new kind of power plant that doesn’t add greenhouse gases to the atmosphere is being built in the US, potentially providing a way for utilities to keep burning natural gas without contributing to global warming. Net Power intends to build two natural gas power plants in the US that will have all its emissions captured and buried deep underground. (4/17)

China’s coal output rose 16% in the first quarter from the same period last year, bolstered by strong demand for winter heating and robust industrial activity. (4/16)

China’s coal showdown: Authors of a new report say China must close just over half its 1,058 coal-fired power plants in a decade to meet climate pledges – but they insist the move will save cash. That’s because renewables are now so much cheaper than coal. (4/16)

Age of coal fleet: When it comes to the energy transition, much of the focus falls on deploying new technologies. New electric vehicle models, wind/solar capacity additions, and new hydrogen electrolyzer plants certainly grab the headlines. Still, the turnover rate of existing infrastructure will be a critical determinant of how quickly sectors can transition to low carbon pathways. (4/16)

South Korea summoned Japan’s ambassador to Seoul on Tuesday to protest the Japanese government’s plan to release vast amounts of contaminated water built up at the wrecked Fukushima plant after treatment and dilution. (4/13)

South Korean battery makers LG Energy Solution and SK Innovation Co agreed on Sunday to settle disputes over electric-vehicle (EV) battery technology, avoiding a potential setback for US EV ambitions. As part of the settlement, SK will pay LG over $1.8 billion. (4/12)

Battery competition: After years of ceding the EV battery business to foreign companies, Europe wants in. Prospective manufacturers are popping up in the Nordic region, Germany, France, the UK, and Poland in a competition to chip away at the dominance of China’s Contemporary Amperex Technology and South Korea’s LG Energy Solution. (4/15)

The VW Group Components plant in Braunschweig is doubling its production of battery systems, from 250,000 to 500,000 per year, for the latest electric vehicle generation. (4/17)

More batteries: Ultium Cells LLC, a joint venture of LG Energy Solution and General Motors, will invest more than $2.3 billion to build its second battery cell manufacturing plant in the US. The facility will be located in Spring Hill, Tennessee. (4/17)

The cost of building solar farms has been declining for several years, making solar power increasingly popular with projects of all sizes mushrooming around the world. However, the tide is now turning as new utility PV projects are starting to become more expensive due to increasing costs for modules, shipping, and labor, a Rystad Energy report reveals. (4/15)

In Hong Kong, CLP Holdings Ltd. is looking for offshore wind technology to help meet a growing need for renewable energy. Limited land supply in the city poses a challenge to building clean-power capacity. (4/12)

E-ferry boats: ABB has secured a contract with Spanish shipbuilder Astilleros Gondán to supply the all-electric power solution for fast 40-meter urban passenger ferries transporting up to 540 passengers each across Lisbon’s Tagus River. (4/13)

E-H2 dual-mode trains: The Auvergne-Rhône-Alpes, Bourgogne-Franche-Comté, Grand Est and Occitanie regions in France have signed the first order for dual-mode electric-hydrogen trains in France. (4/13)

The six-day log jam in the Suez Canal last month, caused by the EverGiven container vessel, produced a spike in ship pollution visible from space. (4/14)

Suez ripple effect: Maersk has warned that customers should not expect a quick return to routine services after the Suez Canal blockage, which the world’s largest shipping company predicts will keep disrupting global supply chains for weeks. There will be negotiations for berthing slots at ports and delayed ships missing their next scheduled voyage, and more. (4/12)

GHG inventory: The US Environmental Protection Agency (EPA) released its 28th annual Inventory of US Greenhouse Gas Emissions and Sinks. It presents a national-level overview of yearly greenhouse gas emissions from 1990 to 2019. Total GHG emissions decreased from 2018 to 2019 by 1.7% (after accounting for sequestration from the land sector). Greenhouse gas emissions in 2019 (after accounting for sequestration from the land sector) were 13% below 2005 levels. Total GHG emissions in 2019 were up 1.8% from 1990 levels. (4/17)

Japan has ambitious plans to be entirely carbon-neutral by 2050. The government hopes hydrogen can be part of the solution. (4/16)

India envisages a bright future for hydrogen in the next 15-20 years, supplementing natural gas via blending in the grid and compressed natural gas for vehicles. India has already been experimenting with combining hydrogen into CNG. Still, the current cost of the blend was higher than the unblended CNG because the cost to produce hydrogen is much higher than the cost of the natural gas. (4/16)

Temperatures in the Arctic Ocean, an area that significantly influences the world’s weather, were much warmer last month than the average for the past two decades. Northeastern Canada and Greenland were also much warmer-than-average for February. Scientists have linked this warming to extreme weather events elsewhere in the world. (4/14)