Editors: Tom Whipple, Steve Andrews

Quote of the Week

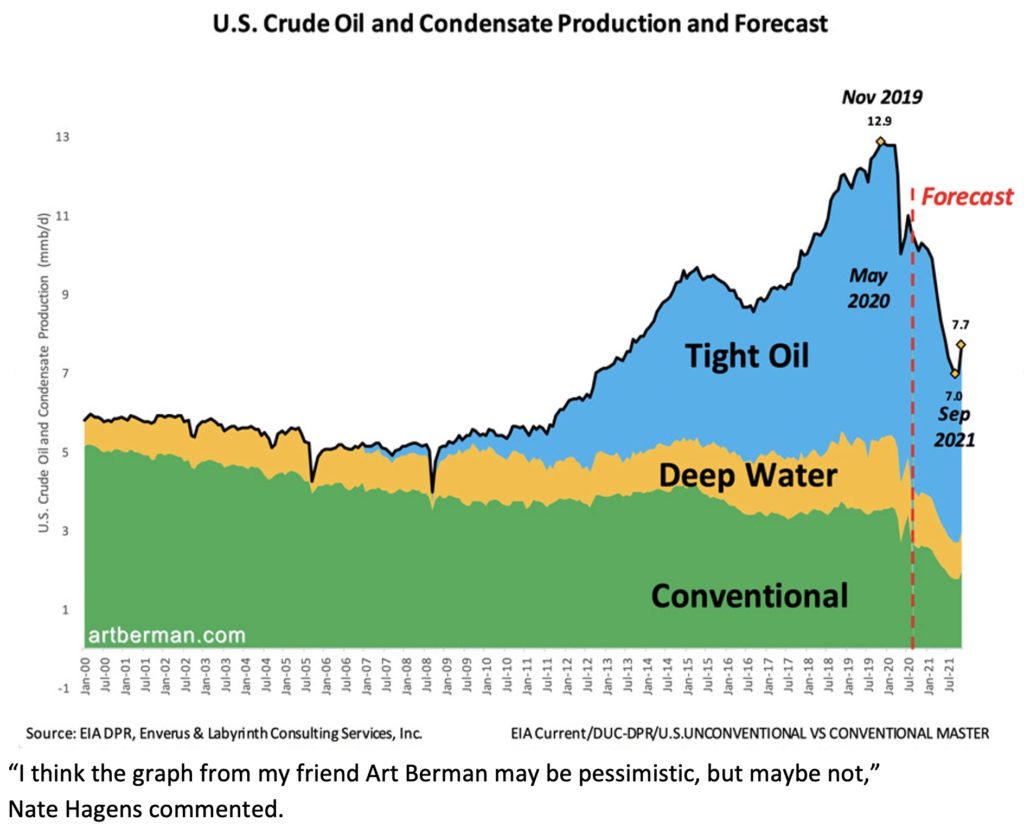

“If you took a poll and asked people what the single biggest casualty was from the pandemic, very few people would respond with ‘oil’. But no matter who wins the election, US oil production, including shale oil, is about to fall off a cliff, with massive consequences for society. For the setup of our modern way of life, oil is effectively our hemoglobin – and the COVID arrow hit at the heart of the industry as market prices are far below what it costs to extract oil from the ground.”

Nate Hagens is a writer, speaker and teacher focused on big-picture systems analysis

Graphics of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

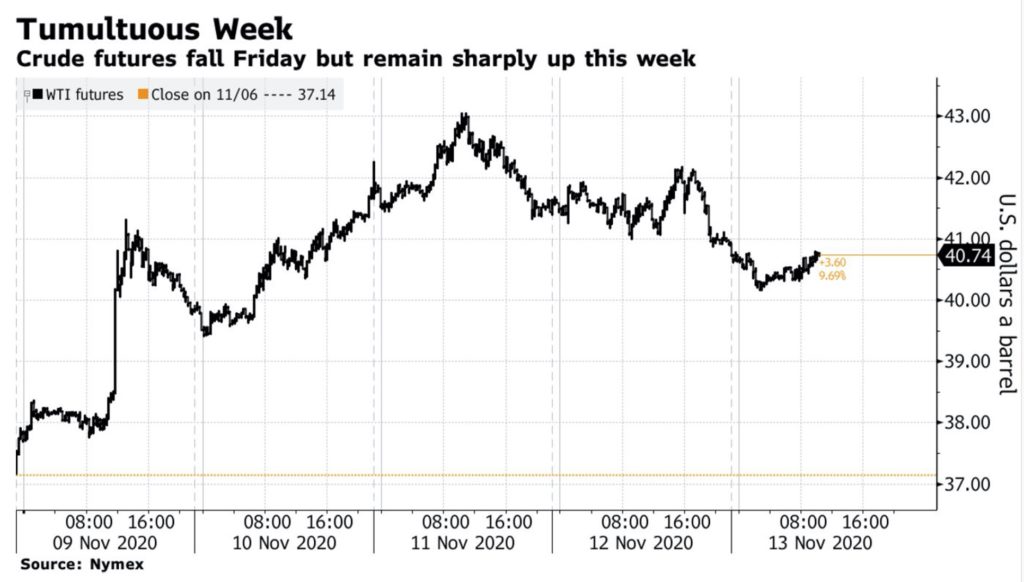

Oil: Futures fell 2.4 percent in New York on Friday, closing at $40.13, but still posted the largest weekly gain in a month as optimism about a potential Covid-19 vaccine jolted markets earlier in the week. While global oil markets rallied on the latest vaccine trial results, they are unlikely to feel any significant economic benefits until well into next year, the IEA said Thursday. The agency darkened its outlook for crude consumption in the months ahead, citing resurgent Covid-19 infection rates in the US and Europe. It now expects demand for 2020 to fall by 8.8 million barrels a day this year—400,000 barrels a day more than its last forecast.

The US Energy Information Administration cut its outlook for 2021 global oil demand growth by 360,000 b/d to 5.9 million b/d from last month’s forecast, based on uncertainty surrounding the pandemic response. EIA now expects global oil demand to average 92.9 million in 2020, plunging from 101.5 million b/d in 2019 due to the coronavirus pandemic. EIA forecasts global oil demand at 98.8 million b/d in 2021.

US crude oil inventories moved higher in the week ended Nov. 6th amid an unseasonable pullback in refinery demand. Commercial oil stocks climbed 4.28 million barrels to 488.71 million barrels. The build came mainly on the US Gulf Coast, where stocks surged 5.1 million barrels to 258.5 million barrels, and in the Rockies, which saw stocks increase 1.69 million to 24.62 million barrels, marking a more-than-7 percent jump on the week.

Tropical Storm Eta made landfall over North Florida on Thursday morning and became the 12th named storm to make landfall out of a record-breaking year of 29 named storms. The above-average tropical activity hurt the oil and gas industry’s offshore operations in the Gulf of Mexico. According to Bloomberg, some 41 million barrels were pulled offline because offshore oil and gas rigs were shuttered due to tropical activity.

Natural Gas: In October, the Henry Hub natural gas spot price averaged $2.39 per million Btu, up from an average of $1.92 in September. Higher natural gas spot prices reflected a more robust demand for liquefied natural gas exports as LNG terminals increased liquefaction following hurricane-related disruptions in August and September. The EIA expects Henry Hub spot prices to rise to a monthly average of $3.42 per million in January 2021 because of increasing domestic demand for natural gas for space heating, rising US LNG exports, and reduced production.

Permian Basin spot gas prices have been climbing back toward annual highs as West Texas production stumbles and rising LNG export demand pulls more supply to the Gulf Coast. In early October, a combination of short-lived factors pushed the market to a nearly 20-month high at $2.91 per million Btu. That move was followed by a sharp retracement in prices earlier this month.

The EIA continues to forecast lower average US natural gas production and consumption levels in 2021 compared with the prior two years. Still, it has raised its estimates for both measures in the first quarter and expects rising LNG export demand to help push up natural gas prices.

Germany’s gas demand, currently just above 90 billion cubic meters (Bcm) per year, is set to increase to more than 110 Bcm by 2034. However, as future supplies from Norway and the Netherlands dwindle, new imports must be sourced. A Rystad Energy comparative analysis shows that importing more Russian gas through the Nord Stream 2 project is the most reliable and cheapest option versus US LNG cargos and other intra-Europe pipe routes.

OPEC: The cartel is getting closer to deciding how to proceed in January. After discussing the options, which included deepening the existing production cuts, OPEC+ is now considering a three- to six-month delay to the production increase scheduled for January. The deeper cuts option, however, failed to gain much traction. On Nov. 30th and Dec. 1st, OPEC+ will make its final determination in how it will proceed. The group is currently cutting about 7.7 million b/d, and some OPEC members are ready for the nightmare that the production cuts would be over, and prices would fall precipitously. Libya says that it would not join in any production cuts until its production had rebounded and stabilized at 1.7 million b/d.

With a Covid-19 vaccine unlikely to rescue the global oil market for some time, the combination of weaker demand and rising oil supply provides a problematic backdrop to the December 1st meeting. The IEA’s current forecast, incorporating the quota increase of 2 million b/d included in the OPEC+ supply agreement, imply almost zero stock change in the first quarter of 2021. Unless the fundamentals change, the IEA believes re-balancing the market will make slow progress.

Shale Oil: The US oilfield services sector saw the worst of the downturn in the second quarter when producers dramatically cut drilling, well completion, and capital programs in the wake of the worst oil price rout in recent memory. In the third quarter, US producers brought some of the curtailed production back online and started adding rigs—albeit in slim numbers—for the first time since the first quarter.

The services sector added more than 6,400 new jobs last month in the latest sign that things are beginning to look up. There has even been some M&A activity, with Schlumberger’s offloading its shale oil business to Liberty Oilfield Services in September. Liberty will now become the second-largest hydraulic fracturing services provider in North America.

The price for drilling rights on an acre of land has tumbled, creating conditions ripe for more mergers and acquisitions. Drilling rights in the Permian Basin averaged about $24,000 an acre in recent deals, down 67 percent from 2018, according to Rystad Energy. Across the US shale industry, the average price is about $5,000 an acre, compared with $17,000 two years ago.

Texas’s oil regulator has helped reduce routine natural gas flaring, but its efforts fall short of more aggressive measures requested by some investors and significant producers. The Railroad Commission said producers would have to provide more detailed reasons on why they want to flare and more data and show efforts to reduce emissions. The new application process will reduce flaring by 50 percent to 80 percent in some circumstances, the commission said, without providing specifics.

Prognosis: Trade groups, often aligned with the GOP, have come to grips with the power change in Washington. Over the last several days, representatives from manufacturers, coal-mining companies, oil producers, and other industries have congratulated the president-elect on his victory – and signaled they are interested in helping shape Biden’s plans to tackle climate change. Biden’s proposal to spend $2 trillion over four years to reduce emissions while creating jobs was written in coordination with environmental activists and labor unions. Now companies want a seat at the table.

Occidental Petroleum CEO Vicki Hollub said the industry would be “OK” provided it pursues a long-term strategy and Total CEO Patrick Pouyanne said he sees increased US investment opportunities. Hollub said she did not share fears harbored by some of a clamp-down on the industry. Still, it was essential to “collaborate” with and educate the new administration on advances in the fracking industry and techniques such as carbon capture.

In its latest monthly oil market report, the IEA says re-balancing the oil market will make “slow progress” as fundamentals remain weak due to the poor outlook for demand and rising production in some countries. The IEA noted that the re-balancing was occurring at a slow pace. “Physical crude prices remain below futures, and this is a signal that markets are well supplied,” it said. The agency assumes that vaccines will be widely available from mid-2021, at which point mobility and oil demand will “return progressively to normal conditions.”

The US will see supply fall by 660,000 b/d in 2021 following a decline of 600,000 b/d this year, it added. But US production will rebound this month, as more offshore installations reopen after the departure of hurricanes Delta and Zeta.

The divergence of demand between Europe, the Americas, and the rest of the world is likely to persist. “We continue to assume in our outlook that countries will have to fight sporadic resurgences of the virus by implementing social distancing measures,” the EIA added. The demand bright spots remain centered on Asia, notably China and India. Indian oil demand has rebounded sharply as the South Asian country reopened its economy in October.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: President Rouhani said the new US administration has a chance to return to its “international obligations,” signaling he may be open to a new nuclear deal, which was broken by President Trump. “Now, a chance has turned up for the future US government to compensate past mistakes and return to the path of commitment to international obligations by respecting global norms,” Rouhani said in a weekly cabinet meeting.

Iran said it is open to negotiation but has placed various conditions on returning to the accord’s terms, plus compensation for President Trump’s withdrawal and sanctions. On Wednesday, Iran’s deputy foreign minister, Abbas Araghchi, was quoted in Iranian state media saying “the way back is open” for the US to the deal.

Meanwhile, Iran is continuing to build up its stockpile of low-enriched uranium and now holds roughly 12 times the amount permitted under the 2015 nuclear agreement, the UN Atomic Agency said in a report. The report’s findings underscore the challenge the incoming Biden administration faces in persuading Iran to return to the 2015 nuclear deal fully.

According to a senior oil and gas industry source, the net present value of Iran’s supergiant South Pars natural gas field has jumped from an estimated $116 billion last year to $135 billion. The reason behind the boost is that progress across all areas of the development, including the controversial Phase II, has picked up pace due to an increase in the involvement by Chinese companies. The Chinese operate around the US’s sanctions by carrying out individual contacted projects, not as official field developers. Tehran expects the entire South Pars project will be producing at or near Phase I capacity well in advance of the March 2022 official completion date.

Iraq: Crude production increased by about 150,000 b/d in October, significantly exceeding its official OPEC-plus quota. Nationwide output averaged 3.84 million b/d according to an analysis based on producing fields managed by both the federal government and the Kurdistan Regional Government.

Iraq’s parliament approved a $10.2 billion stopgap borrowing law, an essential measure to remain solvent through the rest of this year. The country with a bloated workforce is suffering through a decline in the oil price and is delaying paychecks to even essential civil servants. Political disputes derailed a 2020 budget, forcing Iraq to rely on the frameworks of the 2019 budget and a series of measures to draw from currency reserves and other borrowings.

Joe Biden’s win led to guarded optimism among Iraqi political, security, and business leaders, who believe his administration will feature a more predictable foreign policy. Iraqi leaders are hopeful that the Biden administration will ease tensions with Iran, reducing the frequency of violent incidents between Iranian proxy forces and US interests in Iraq.

Libya: Oil production has now reached 1.215 million b/d. Output started to rise in the middle of September after General Haftar lifted the eight-month-long blockade on Libyan oil fields and terminals. Since mid-September, the National Oil Corporation has gradually lifted force majeure resulting in Libya’s crude oil production rising from below 100,000 b/d during the blockade to as much as 500,000 b/d in the middle of October.

Venezuela: The head of Venezuela’s state oil company, PDVSA, and Venezuela’s vice-president and economy minister visited Russia last week to “deepen strategic alliances.” Russia, along with China, is one of very few allies the government in Caracas has left. State energy giant Rosneft had a joint venture with PDVSA for years before it was forced to leave the country after the US targeted two of its subsidiaries with Venezuela-related sanctions.

Soon after Rosneft announced its pullout, however, Moscow set up a new state-owned company named Roszarubezhneft, which took over Rosneft’s Venezuelan assets. Venezuela is trying to secure new oil deals with its ally under a new law passed recently by its National Assembly. Dubbed “Anti-Blockade Constitutional Law for National Development and Guarantee of Human Rights,” the law aims to counter the effects of US sanctions on the Venezuelan economy by offering new ways for foreign investors to participate in this economy and give more powers to the government.

Nagorno-Karabakh: Despite reports of sporadic clashes, the three-way pact signed by the presidents of Azerbaijan, Armenia, and Russia appeared to have brought calm in the disputed province after six weeks of fighting. According to Russian officials, the conflict in Nagorno-Karabakh has caused an estimated 5,000 deaths and forced more than 100,000 civilians to flee their homes for safer parts of the territory of Armenia.

Protests flared in the Armenian capital of Yerevan following the announcement of the favorable-to-Azerbaijan deal. Armenian Prime Minister Pashinyan said his official residence was ransacked, as residents vented their outrage over what they view as their government’s capitulation. Armenians across the globe took to social media to deride Mr. Pashinyan as a traitor. According to the agreement, Armenia must cede control of several districts by Nov. 15th. Some ethnic Armenians are destroying their homes and villages so that no Azerbaijanis can move in.

In Azerbaijan, state television broadcast scenes of celebrations, with people dancing and showering praise on their military and President Aliyev for what many Azeris view as moving a step closer to reclaiming the territory Nagorno-Karabakh, which they contend belongs to them.

The ending of the clashes over Nagorno-Karabakh is “good news” for the security of energy supplies to Europe and elsewhere, Azerbaijan’s energy minister, Shahbazov, said Nov. 12, referring to the settlement as a “victory” for his country, ahead of the start of ‘Southern Corridor’ gas supplies to Italy.

3. Climate change

President Biden will take office having made commitments to address global warming and with a 15-year plan to create carbon-neutral electricity across the US on the way to achieving net-zero emissions by 2050. Biden has promised to spend $2 trillion on a sweeping climate-and-job agenda. Getting that done wouldn’t be easy, with the Senate likely to be narrowly in Republican hands.

However, the deluge of climate caused disasters will continue to grow. With the realization among business leaders and the majority of the public that something must be done about carbon emissions, attitudes are likely to change. With only a narrow majority in the US Senate and the Biden administration’s willingness to compromise, substantial progress on climate change could be made in the coming years.

There are powerful climate levers available to the White House, and reason to expect that a president who prioritizes climate action can drive policy. Biden has already begun to appoint highly knowledgeable people supportive of policies that will foster a change to non-polluting energy. The Biden administration could do a lot without acts of Congress, such as adjusting the federal financial system to look at climate as a systemic risk or bring the sheer size of the US government to bear in purchasing decisions.

There is no shortage of ideas as to what should be done. These range from carbon pricing to shifting subsidies and tax breaks from fossil fuels to renewables. Some are recommending that climate experts be placed in every corner of the government to ensure climate change is considered in every action the government takes,

John Podesta served in the White House as a counselor in charge of climate and energy policy during President Barack Obama’s second term. He has some advice for the incoming team. The key is setting the right destination. That’s why these net-zero [emissions] commitments are so crucial. Podesta believes that accountability and ambition need to be organized and come from the president himself. You need structures in the White House to organize the whole government, such as the National Economic Council, which led to much better economic decision-making.

Climate change in the American West is making wildfires more extreme, and the financial fallout is unprecedented. From 1964 to 1990, the American insurance industry paid less than $100 million a year toward wildfire losses, on average. In the next two decades, that figure jumped to an average of $600 million annually. From 2011 to 2018, it was almost $4 billion a year.

In California, nonrenewals of home insurance policies climbed 31 percent from 2018 to 2019, with ZIP codes that had a “moderate to very high fire risk” seeing a 61 percent uptick. Insurers insist that unless they’re able to raise their California rates to account for future risk, they’ll stop writing policies, the same way they did for floods. Unless the federal government steps in with subsidized fire insurance for high-risk areas, many homes may become uninsurable with losses in the billions.

Just five of the 39 largest oil and gas companies have announced carbon-reduction targets that match levels needed to avoid a 2-degree Celsius temperature increase. Only 20 have taken initial steps to disclose how they plan to lower emissions produced by their operations and electricity use. It may seem like most of the world’s biggest polluters aren’t serious about climate change. The list of passive offenders includes four of the top-five ranked energy companies by stock market value: Chevron Corp., Exxon Mobil Corp., PetroChina Co., and Saudi Aramco.

Eni, Total, Reliance Industries, Galp Energia, and Woodside Petroleum are the only companies with targets in-line with the IEA’s Sustainable Development Scenario for 2030. On Tuesday, Occidental Petroleum became the first major US oil producer to aim for net-zero emissions from everything it extracts and sells.

4. The global economy and the coronavirus

Pfizer said last Monday that its COVID-19 vaccine might be 90 percent effective, based on early and incomplete test results. The company, which is developing the vaccine with its German partner BioNTech, is now on track to apply later this month for emergency-use approval from the US Food and Drug Administration. Not to be outdone, Moscow announced that its Sputnik V vaccine is 92 percent effective at protecting people from COVID-19. Early results from other vaccine manufacturers, whose COVID-19 vaccine is similar to that from Pfizer, have hinted that they too are already seeing good results and few vaccine safety problems.

The announcement was met by much celebration and spikes in the equity and oil markets. However, presently the coronavirus is still raging across much of the world. It will be many months before the 15 billion doses required to vaccinate the world’s population twice can be manufactured and distributed. During that time, many will be added to the 1.3 million deaths the world has already seen, and the lockdowns accompanied by economic hardships will continue.

United States: Eight days after the US hit 100,000 cases per day for the first time, the number topped 177,000 on Friday. The pandemic has risen to crisis levels in much of the nation, especially the Midwest, as hospital executives warn of dwindling bed space and as coroners deploy mobile morgues. Hospitalizations for Covid-19 also set a record last week, climbing to over 67,000.

The uncontrolled coronavirus outbreak is prompting government officials across the nation to impose new restrictions on consumers and businesses, delaying the recovery of millions of jobs lost during the recession. Washington’s failure to provide additional financial support is compounding the economic distress. Though Federal Reserve Chair Powell this week repeated his call for a fresh round of pump-priming, the economy, for now, is left to navigate a winter of disease and loss unaided.

Last week’s count of new unemployment benefits applications was down from 757,000 the previous week, the Labor Department said on Thursday. Eight months after the pandemic flattened the economy, many employers are still slashing jobs.

China: In October, crude oil imports registered the first year-on-year decline since April, with a 6.5 percent drop to 10.06 million b/d as refiners slowed down on their purchases amid a drop in throughput and fewer import quotas. The fall in imports is likely to continue for the rest of 2020 due to the lower throughput and exhausted import quotas among private sector refiners.

Chinese refineries will likely have to lower utilization rates in 2021 amid growing refining capacity and limited oil product outlets overseas. Despite the lull in demand due to the global coronavirus pandemic, China’s refining capacity continues to rise. Many investments were made earlier and cannot be stopped, although demand for some oil products will peak sooner than expected, market sources said.

After a year of non-existent LNG exports from the US to China, American LNG cargoes started up again in March. US exports of LNG are set to grow in the coming years, thanks to the first commercial US-Chinese agreement for term supplies since the trade war that started in 2018. Beijing slapped tariffs on LNG in retaliation to US tariffs on billions of US dollars’ worth of Chinese goods. US LNG producer and exporter Cheniere Energy has recently signed a framework agreement with China’s Foran Energy Group to sell 26 LNG cargoes to the Chinese company over the next five years to 2025.

Worsening relations between Australia and China could threaten a deal that would have seen Woodside Petroleum sell a stake in a natural gas field and the $16-billion Scarborough liquefied natural gas project. Talks for the stake sales were suspended several months ago; however, they could be resumed after the diplomatic ruckus abates. The row erupted when Australia insisted on an international inquiry into the origin of the coronavirus, starting a trade war affecting more and more Australian industries. According to the Financial Times, the dispute has threatened as much as $4.6 billion worth of Australian exports to China.

China’s purchases of essential commodities fell in October from the prior month, mainly because of seasonal factors, including an extended holiday. While the nation’s broader imports couldn’t hold September’s pace, slumping to below-consensus growth of 4.7 percent, “a second straight monthly expansion suggests a continuing rebound in domestic demand,” according to Bloomberg Economics. Beijing’s meat imports this year are on track to reach the highest ever as the world’s top pork consumer increased purchases to meet demand after African swine fever slashed domestic hog numbers.

European Union: Alternative, high-frequency data show economic activity in several economies dropped steeply in the first weeks of November amid a fast rise in Covid-19 infections and expanding lockdown measures. The latest readings, which integrate data such as mobility, energy consumption, and public transport usage, suggest the decline was particularly substantial in France, Italy, Germany, and the UK. These countries have seen activity fall sharply as lockdown restrictions take effect.

The EU insists that the United Kingdom’s access to the EU energy market depends on Britain making concessions on fishing rights in British waters. In case a deal is not reached, and the EU plays the energy card, the UK risks losing easy access to imports of electricity and natural gas from EU member states such as the Netherlands, France, and Ireland. This could raise prices for consumers and increase the risks of blackouts. The EU and the UK are currently negotiating the exit of the UK from the European Union, which will take place on December 31.

The EU pressed ahead last week with plans to impose tariffs and other penalties on up to $4 billion worth of US goods and services over “illegal” American support for plane maker Boeing. This comes after the World Trade Organization authorized the US to put penalties on EU goods worth up to $7.5 billion — including Gouda cheese, single-malt whiskey, and French wine — over European support for Boeing rival Airbus.

Russia: The US is drawing up additional sanctions on the Nord Stream 2 natural gas pipeline project. House and Senate negotiators agreed to target insurers and technical certification companies working on the project in a defense bill that must pass by the end of the year. The move would add to the penalties that stopped work on the pipeline. By adding insurers and certification companies to the sanctions, the US will make it harder for Gazprom to complete Nord Stream 2, which will run 2,460 kilometers alongside an existing Nord Stream pipeline.

Gazprom and its backers, including Royal Dutch Shell Group, say the pipeline will be needed to meet increasing demand and add flexibility to the system. Opponents say it will allow Russia to choke off flows through Ukraine, the primary route to market for much of Gazprom’s gas. Fourteen European countries get more than 50 percent of their gas from Russia. German gas grid operators are “confident” that the country’s gas supply is secure for the upcoming winter despite the Nord Stream 2 gas pipeline not being available.

Russian refineries are coming out of their autumn maintenance programs but are expected to continue running at reduced rates due to poor economics. According to energy ministry data, Russian refineries processed 5.04 million b/d of crude in October, down 11.2 percent year on year and down 1.4 percent from September. Less refining reduced fuel oil output and exports compared with last year’s levels. Russia’s fuel oil production was down 8.4 percent year on year. Fuel oil exports in September, the latest available data, fell 5.1 percent on the year.

Saudi Arabia: With investors increasingly concerned about climate change, Riyadh is promoting its crude oil reserves as some of the world’s least polluting hydrocarbons. Several of its Middle East neighbors, such as Iran, Oman, and Iraq, however, cannot make such a claim. Considering life-cycle carbon emissions, Saudi Arabia’s oil has one of the lowest carbon intensity, or CI, ratings among major global producers, mainly due to its easy access to reserves and low flaring of associated gas.

The oil price collapse is depriving the Saudis of $27.5 billion in oil revenues this year. Crown Prince Mohammed bin Salman admitted that the current oil income is not enough to cover the Kingdom’s salary bill. Saudi Arabia had projected that this year’s revenues for the state would be $222 billion, of which $137 billion would come from oil. However, after the collapse in oil prices, Saudi Arabia’s oil revenues dropped to $109 billion, Mohammed bin Salman said. Thus, the price crash—which Saudi Arabia itself helped create by flooding the market with oil in April—cost the world’s top oil exporter just over $27.5 billion in oil revenues this year.

Saudi Arabia says it thwarted an attack against an oil products terminal near the border with Yemen, adding that the attempted attack was the deed of the Iran-backed Houthi rebels in Yemen. Saudi forces intercepted and destroyed two unmanned boats carrying explosives to a floating offloading platform that belongs to an oil products terminal at the port city of Jizan.

India: New Delhi imported an average of 3.71 million b/d of crude in September, down 9.8 percent year on year. This drop continues a weak trend as the fall-out from the coronavirus pandemic continues to dampen domestic fuel demand. In September, the imports were 10 percent lower than in August, reflecting a slowdown in economic activity due to restrictions imposed by the government to combat the spread of COVID-19. Over January-September, India’s crude imports fell 11.2 percent on-year to 3.98 million b/d. However, Asia’s third-largest petroleum consumer is poised to raise crude imports in the fourth quarter as major refineries lift run rates to boost transportation fuel output for the festive periods in November and December.

5. Renewables and new technologies

According to the IEA’s Renewables 2020 report, renewable power generation capacity will increase by 7 percent this year despite a 5-percent forecast decline in global energy demand. The agency also said the use of biofuels in industrial activity and transportation would decline this year. Still, the increase in renewables use will be strong enough to offset it, with the net increase in renewable energy demand seen at 1 percent.

According to a new report by the International Renewable Energy Agency, global renewable energy investment increased between 2013 and 2018, reaching its peak at $351 billion in 2017. The 2020 edition of Global Landscape of Renewable Energy Finance highlights that while a cumulative $1.8 trillion were invested during the five years, the amount falls short of achieving global climate commitments. Renewable energy investment slightly declined in 2018, with modest growth through 2019. Although this was mainly due to the decreasing costs of renewables, the total installed capacity continued to grow.

New developments in hydrogen use continue to make headlines. Japan is slated to get its first hydrogen shipment in March. Over the next 30 years, deliveries of zero-emission fuel are expected to ramp up exponentially as a means of replacing fossil fuels to become greenhouse gas neutral by 2050. This shift would require Japan to import the fuel using an armada of specialized tankers, according to Kawasaki Heavy Industries Ltd., the tank owner and the country’s only developer of a hydrogen supply chain.

A team at the University of Tokyo has demonstrated steam electrolysis using a solid acid electrolysis cell (SAEC) to produce hydrogen. The SAEC used a composite electrolyte. Hydrogen production was successfully established with Faraday efficiencies around 80%.

Australia announced that it had awarded “major project status” to the Asian Renewable Energy Hub. The move will accelerate the development of 15,000MW of wind and solar power to produce hydrogen and ammonia for export to the Asia-Pacific region with plans to scale that up to 26,000MW, making it the largest of its kind in the world.

The US’s National Renewable Energy Laboratory says that about 12.0 percent and 50 percent of the necessary Level 2 and DC fast EV charging equipment, respectively, required to meet projected demand in 2030, have been installed as of Q1 2020. At the beginning of March, there were 13,627 public and workplace DC fast chargers and 71,975 public and workplace Level 2 chargers available in the US.

Lithium-ion batteries may have just received a big boost. Scientists have found that adding conductive carbon fillers to an electrode material would improve battery performance with higher electrochemical utilization. This could allow lithium-ion batteries to overcome one of the constraints to achieving higher energy density while allowing reversible energy storage at the same time.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Biofuels dip: The International Energy Agency has cut its near-term forecast for global biofuels production as the COVID-19 crisis triggers the first annual decline in transport biofuels in two decades. (11/11)

As Europe moves into yet another wave of Covid-19 lockdowns, there is growing concern surrounding offshore workers’ future. Norway has been a critical testing ground for remote operations since initial experiments on small unmanned rigs in 2013, moving to control larger manned units remotely over the last few years. But it has found that driving jobs to land brings oil rig safety measures into question. (11/9)

China’s biggest refiner is eyeing a creative strategy to help rid Asia of a persistent diesel glut. Unipec, the trading arm of China’s biggest oil refiner Sinopec Group, hired a newly built very large crude carrier to load low-sulfur diesel in Asia for delivery to Europe. The vessel ordinarily would have sailed empty from its shipyard in Northeast Asia to the Middle East or West Africa, where it would pick up crude for the first time for delivery to customers across the globe. (11/13)

Nigeria may be heading towards another economic crisis with crude oil production threatened as the Petroleum, and Natural Gas Senior Staff Association of Nigeria has directed its members to proceed on a nationwide indefinite strike. (11/11)

Nigeria’s leaders have made a show of responding to the demands of a massive youth-led uprising over police brutality that recently brought the country to a standstill and captured global attention. The government has commissioned panels of inquiry into police brutality, and the president promised to disband the notoriously abusive police unit known as the Special Anti-Robbery Squad, or SARS. But protesters say the government is conducting a targeted campaign against people associated with the uprising to harass, impede and break up the movement — destroying any good faith the government had hoped to build. (11/14)

Piracy: Several oil tankers were attacked or approached with attempted attacks in the Gulf of Guinea off West Africa over the past six days. Five such incidents took place in the area in which pirates attacked four tankers, and one was approached while underway with the intent to attack. (11/11)

Offshore Columbia: While Brazil, Guyana, and to a lesser extent, Suriname lead when it comes to South American offshore oil, Columbia hopes to join that club. The Andean country’s Caribbean coast is believed to hold considerable oil and natural gas potential. It was with much fanfare that Colombia’s Minister of Mines and Energy announced the reactivation of offshore activity in Colombia at the start of October 2020. (11/11)

Columbia recovering: Despite significant headwinds, including a prolonged oil price slump, Colombia’s national oil company Ecopetrol reported a solid third quarter 2020 profit with a net income of around $222 million. This represented a notable improvement over the $6.5 million profit reported for the previous quarter, although it was significantly less than in 2019. (11/9)

As Mexico’s Pemex focused on easy-extraction shallow water projects, private players set their sights on deepwater alternatives. International companies are seizing the opportunity to explore Mexico’s reserves, with two exploration projects from Shell and China National Offshore Oil Corporation. According to Mexico’s National Hydrocarbons Commission, exploration of deep and ultra-deep waters accounted for 45 percent of investments and 80 percent of reserves in the last quarter. (11/12)

The US oil rig count increased for the week by 10 to 236 while gas rigs rose by 2 to 73, Baker Hughes reported on Friday. The total rig count of 309 is down 494 year over year. Canada’s oil rig count increased by 3 to 89, down 45 year over year (11/14)

Pipeline shut-down in 180 days: Michigan Gov. Gretchen Whitmer took legal action Friday to shut down Canadian-based Enbridge’s pipeline that carries oil beneath a channel linking two of the Great Lakes. Whitmer claims Enbridge has repeatedly violated terms of a 1953 easement by ignoring structural problems. While Michigan’s governor wants to shut the pipeline, Enbridge seeks to make the line more secure by building a tunnel under the strait to house the line. Line 5 carries as much as 540,000 barrels a day of Canadian petroleum liquids. (11/14)

Oil industry misdirection: FTI Consulting was hired by some of the world’s largest oil and gas companies to promote fossil fuels. An examination of FTI’s work provides an anatomy of the oil industry’s efforts to influence public opinion in the face of increasing political pressure over climate change, an issue likely to grow in prominence. The campaigns often obscure the industry’s role, portraying pro-petroleum groups as grass-roots movements. (11/12)

ANWR push: The Trump Administration will take critical steps to finalize a sale of oil drilling leases in the sensitive Arctic National Wildlife Refuge (ANWR) in Alaska just before Democrat Joseph Biden, who opposes drilling there, becomes president. Yet it’s unclear how many oil companies would have the appetite to mount costly operations in the remote Arctic wilderness amid low crude prices, steep public opposition, and regulatory uncertainty. Major central banks have sworn off financing Arctic drilling projects, and conservationists are also pressuring oil executives to rule out work in the region. (11/14)

Plant on hold: Houston-based Nacero LLC announced in March that it would build a $3.3 billion plant to convert natural gas into gasoline in the small city of Casa Grande, south of Phoenix, creating about 2,000 construction jobs and 265 permanent jobs. Nacero just announced that construction had been halted due to the reprioritization of projects. (11/14)

Net-zero #1: Shell will halve the crude oil processing capacity of its largest wholly-owned refinery globally, Pulau Bukom in Singapore, as part of its ambition to be a net-zero emissions business by 2050 or sooner. (11/11)

Net-zero #2: Occidental Petroleum became the first major US oil producer to aim for net-zero emissions from everything it extracts and sells, accelerating an industry trend that’s become commonplace in Europe. The company announced a target to reach net-zero emissions from its operations by 2040 and an ambition to do the same from customers’ use of its products by 2050. The plan relies heavily on capturing carbon dioxide and burying it, a technology that has so far been prohibitively expensive. (11/11)

Biodiesel pinch: Lockdowns, curfews, and fewer people eating out due to the coronavirus are dwindling the supplies of used cooking oil used in renewable fuels production, and refiners are now racing to procure feedstocks for biodiesel in California. (11/13)

Gas plant surge? Though electric utilities shut down costly and dirty coal-burning power plants, they also plan to build 235 gas-fired power stations across the country, according to figures compiled by the Sierra Club. The companies claim these are needed to replace coal plants and balance fluctuations in electricity generation from rising wind and solar power levels. Environmental groups decry those plans. (11/13)

Nat.gas no-go: San Francisco will ban natural gas in new buildings starting next year, becoming the latest city in California to clamp down on the heating and cooking fuel because of climate concerns. The measure will require all-electric construction for buildings — with exceptions for restaurants — starting in June 2021. (11/12)

Coal no-go: Toshiba said it will stop taking orders for new coal-fired power plants as it makes a broader push to embrace renewable energy, though it will still complete work on about ten other facilities. The engineering-to-technology giant will continue to manufacture steam turbines and offer maintenance services for existing coal-power plants. (11/12)

US coal’s share of electricity generation will fall to 20 percent, according to the US EIA. Coal production is expected to drop by 26 percent below the 705.3 million tons produced in 2019, and the lowest output since 504.18 million tons was produced in 1964. (11/11)

Peabody Energy, the world’s largest private-sector coal producer, said there was a risk it could go bankrupt for the second time in five years, as it raced to renegotiate debts in the wake of tumbling demand for the fossil fuel. The company is at the center of upheaval in energy markets as natural gas and renewables replace coal on the North American power grid. (11/10)

Nuke restart: A local governor in Japan has approved plans from utility Tohoku Electric Power to restart one of its nuclear reactors damaged in the 2011 earthquake and the following tsunami, the same that caused the reactor meltdown at Fukushima. The Onagawa atomic power was swamped by the 2011 tsunami but had its cooling system intact, unlike the Fukushima plant south of Onagawa. The loss of reactor core cooling led to three nuclear meltdowns. (11/13)

Solar cheaper: The world’s best solar power schemes now offer the “cheapest…electricity in history” with the technology less expensive than coal and gas in most major countries. That is according to the International Energy Agency’s World Energy Outlook 2020. (11/9)

EV push: The inauguration of former Vice President Joe Biden, who worked hand in hand with Obama to set strict regulations, will be a welcome event for the industry. That’s because Biden will bring something that manufacturers from Volkswagen to General Motors to Tesla badly need: help to sell electric vehicles. Biden has already outlined a plan that will replenish money for a tax credit that gives consumers $7,500 for buying an electric car, and he wants to build 500,000 charging stations across the US (11/14)

VW’s EVs: Volkswagen AG plans to invest around $86 billion in the development of electric vehicles and other new technologies over the next five years, as the world’s largest automaker races to overtake Tesla Inc. as the leading maker of electric cars. (11/14)

Ford’s EV move: Ford Motor Company announced that its Kansas City Assembly Plant would build the all-new E-Transit van. This is part of a more than $3.2 billion investment in Ford’s North American manufacturing facilities series of new electric vehicles for commercial and retail customers. The new E-Transit will join the all-electric F-150 announced in September and the all-electric Mustang Mach-E, which begins arriving in dealers’ showrooms next month. (11/11)

Electrify America has opened more than 500 electric vehicles (EV) charging stations across the US, with more than 2,200 individual DC fast chargers since opening its first site in May 2018. Stations are located along major routes and metro areas, placed near shopping, banking, and dining amenities. Each station has between three and ten individual DC fast chargers to accommodate multiple vehicles charging at one time. (11/11)

Russia’s EV buses: Moscow has launched its 500th electric bus. The KAMAZ 6282 uses lithium-titanate batteries and has a range of 70 km on one charge. The electric bus is charged in 6-12 minutes with ultrafast charging stations using a half-pantograph. (11/14)

Self-driving part: Velodyne Lidar said on Friday it would introduce a new lidar unit, a key sensor in self-driving cars, with a target price of less than $500 and no moving parts. Velodyne became a public company in September and is one of several companies vying to supply automakers with lidar. This sensor generates a three-dimensional map of the road ahead. (11/14)

Japan’s first H2 shipment: The import terminal in the city of Kobe is slated to get its debut hydrogen shipment in March. Over the next 30 years, deliveries of zero-emission fuel are expected to ramp up exponentially as Japan seeks ways to replace its heavy fossil fuel use and meet a pledge to become greenhouse gas neutral by 2050. (11/9)

Indonesia’s economy has fallen into recession for the first time since the Asian financial crisis more than two decades ago as the country struggles to control the pandemic. Southeast Asia’s largest economy contracted at a 3.5 percent annual pace in July-September, the second consecutive quarterly contraction. The economy shrank at a 5.32 percent pace in the previous quarter. (11/9)

Tax home workers? White-collar staff reaping the financial benefits of working from home should be taxed to help other workers who aren’t getting the same advantages, experts at Deutsche Bank said in a new report. In its report on how to rebuild the economy after COVID-19, the bank proposed a 5 percent daily tax on each employee that continues to work from home, which could raise tens of billions of dollars for governments. (11/13)

New hurricane warning: In studying climate change’s impacts on hurricanes, scientists have focused on what occurs over water, when storms are forming and strengthening, picking up heat and moisture as they churn over the ocean. But a new study looks at what happens after hurricanes make landfall and work their way inland. The research suggests that climate change affects storms during this phase of their life as well, causing them to weaken more slowly and remain destructive for longer. (11/12)

Shipping container shortage: Shortages of the ribbed steel boxes that have plied the global economy for a half-century are plaguing transpacific routes. The need boosts the purchase price of new containers and leases rates by 50%, snarling port traffic, adding surcharges, and slowing deliveries heading into the holidays. (11/10)

Private car ownership is under threat. Conventional car ownership is under attack. Three of the companies at the heart of the challenge to traditional car ownership are Facedrive, Steer, and utility giant Exelon. (11/10)

Flying cars are actually coming? In an announcement that drew immediate comparisons to “The Jetsons,” the city of Orlando, Fla., and a German aviation company formally unveiled plans on Wednesday to build the first hub for flying cars in the US. There is a caveat: The aircraft is still in the developmental phase. (11/12)