Editors: Tom Whipple, Steve Andrews

Quote of the Week

“US crude production has already peaked, according to one of the country’s leading shale executives, as producers battered by the price crash shun new output growth and start trying to become profitable. ‘I don’t think I’ll see 13m [barrels a day] again in my lifetime,’ the 37-year-old Mr. Gallagher told the Financial Times.”

Matt Gallagher, CEO of Parsley Energy

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

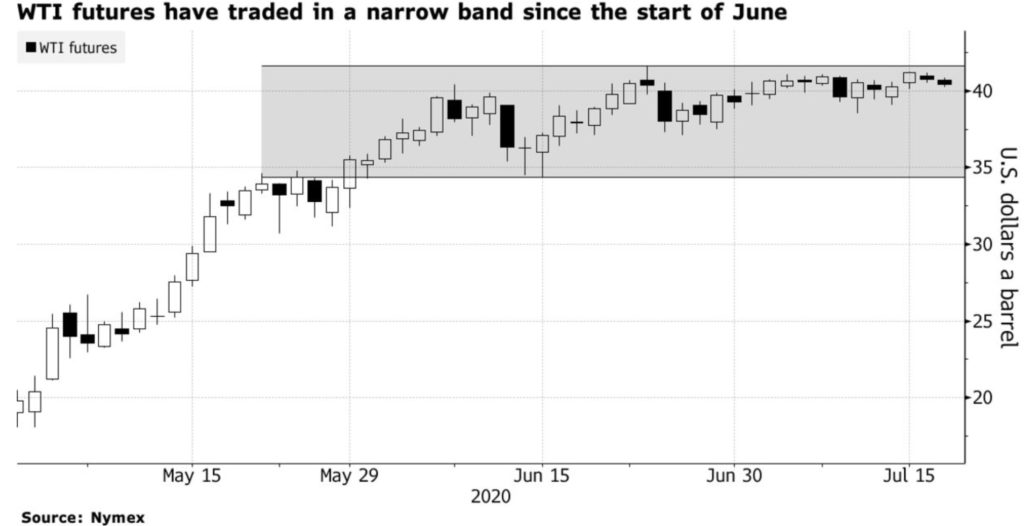

Oil prices edged lower on Friday as concerns increased about the surge in coronavirus cases sapping fuel demand while major crude-producing nations report sharp increases in output. The US reported at least 75,000 new COVID-19 cases on Thursday, a daily record. Spain and Australia reported their steepest daily jumps in more than two months, while cases continued to soar in India and Brazil. Consumption remains below pre-pandemic levels and fuel purchases are falling again as infections rise. Brent crude futures settled at $43.08, and West Texas Intermediate settled at $40.54. Both contracts were little changed from a week earlier.

Oil prices rose nearly 2 percent on Wednesday after a favorable US inventory report from EIA, an OPEC agreement to taper the production cuts, and assurances from President Trump that Washington will not levy sanctions on China for its treatment of Hong Kong. The news piggybacked on the good news from the EIA, which on Wednesday confirmed the API’s report a day earlier that crude oil stocks in the US had fallen by more than 7 million barrels.

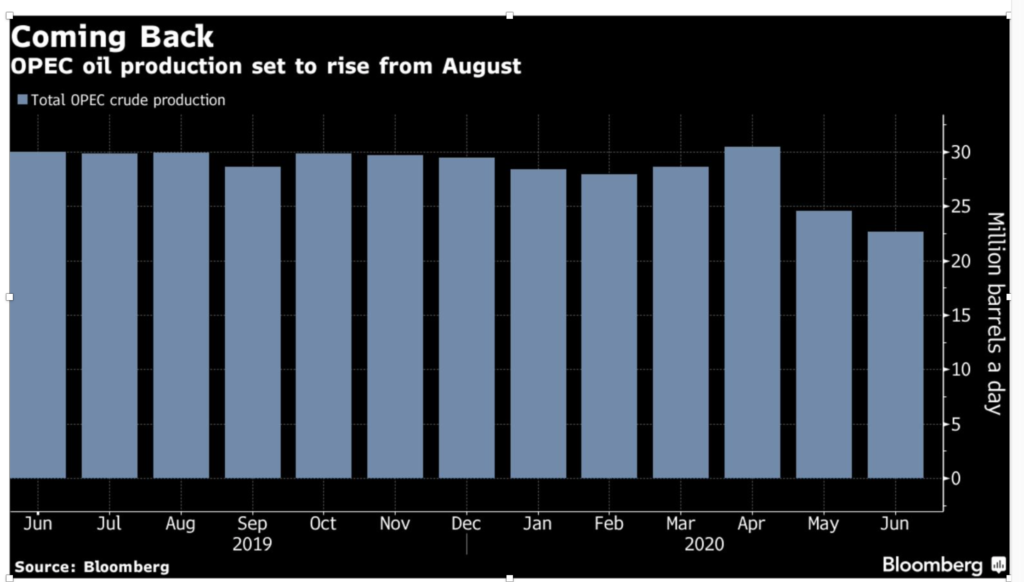

OPEC: Key members of OPEC+ agreed to loosen existing production caps by about 1.6 million b/d, partly reversing the output cuts enacted to stem a sharp price decline in the early days of the pandemic. In April, Saudi Arabia, the world’s largest oil exporter, led a push among the 23-producer group to cut collective output by 9.7 million b/d. The pandemic led to a collapse of oil demand.

Though the quotas are set to be eased in August, some of the production gains may be offset by compensatory cuts from Iraq, Nigeria, Kazakhstan, Angola, and other OPEC+ members that did not fully comply with their quotas in May and June. Those countries have agreed to make additional cuts in July, August, and September equivalent to their overproduction, which officials estimate would total up to about 300,000 to 400,000 b/d, on top of the scheduled 7.6 million b/d cuts those months.

OPEC petroleum export revenue fell to $564.9 billion in 2019 from $692.3 billion in 2018 as anemic demand growth and continued competition from non-OPEC producers impacted the group. The figures demonstrate the financial pain OPEC was already facing even before the pandemic wiped out nearly a fifth of global oil demand in the second quarter of 2020. They highlight the urgency behind the producer group’s efforts to prop up the market through production cuts, as the oil-dependent governments try to defend prices over market share.

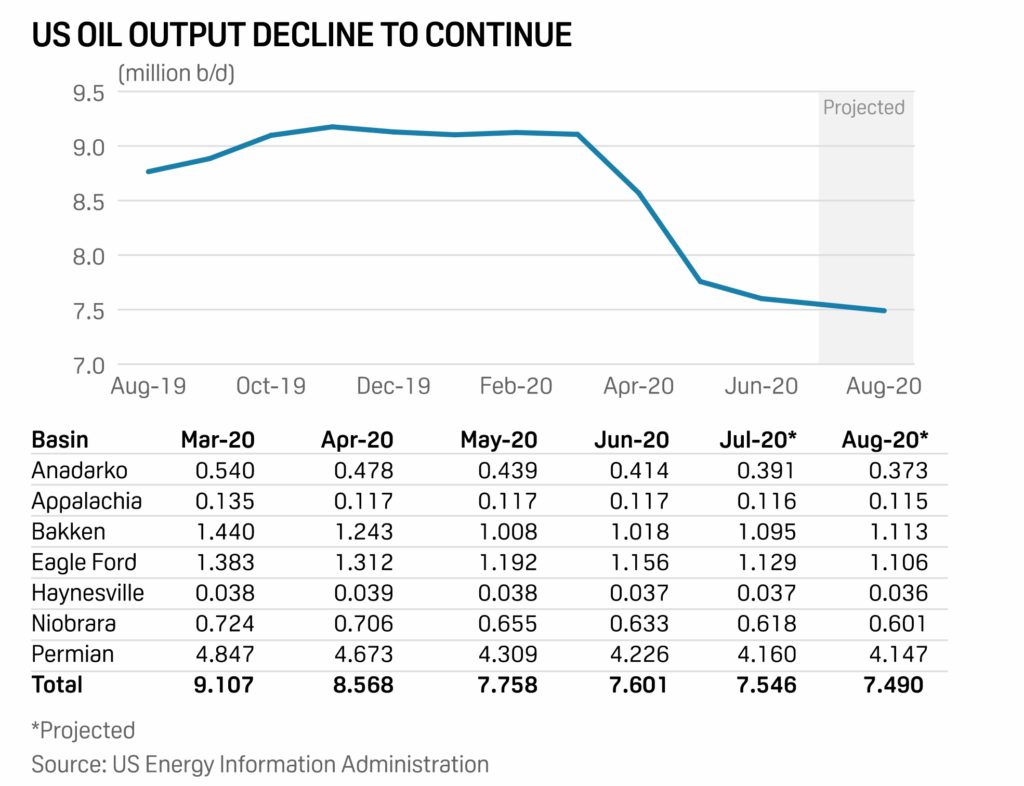

Shale Oil: US shale oil production, which was at over 9 million b/d as recently as March, will fall to 7.49 million b/d in August, down 56,000 b/d from July and the lowest in two years. EIA cut its estimate for July production by 86,000 b/d from last month’s outlook to 7.546 million b/d, according to its latest Drilling Productivity Report. Permian Basin oil production is expected to fall to 4.16 million b/d in July, down 103,000 b/d from last month’s outlook. EIA expects the West Texas/New Mexico basin to pump 4.147 million b/d in August, the lowest since March 2019. Note that in recent months, the EIA has underestimated the size of the production drop in forward months.

The EIA forecasts North Dakota’s Bakken Basin will pump 1.113 million b/d in August, up 18,000 b/d from July. However, last week North Dakota issued its monthly report showing its oil production had already dropped 30 percent in May to 858,395 b/d, way below the EIA’s estimate of 1.095 b/d in July. May’s oil production was down 43 percent from February’s 1.5 million b/d before the Saudi/Russian price war, and coronavirus lockdowns crashed global prices and demand.

State regulators had predicted that May would be the rock bottom for production shut-ins due to the pandemic. Still, the court-ordered shutdown of the 570,000 b/d Dakota Access Pipeline (DAPL) presents new uncertainty. Pipeline owner Energy Transfer secured a temporary stay of that order while an appellate court considers the ruling.

With the pipeline closed, about 300,000 b/d of North Dakota oil would need to move out of the state by rail if DAPL is forced to shut in August. All alternative pipelines max out their capacity, said Justin Kringstad, director of the state Pipeline Authority. He said crude-by-rail barrels would head first to the West and East coasts, with anything else heading to Cushing, Oklahoma, and the Gulf Coast if economics allowed.

Moving crude on DAPL to the Gulf Coast costs $6-$8 per barrel plus around $1 for gathering, Kringstad said. That compares with about $10 per barrel for all the costs associated with moving crude by rail from North Dakota to the West Coast.

Drillers did the bulk of May drilling activity in the Bakken with hedged production or drillers holding federal permits for wells that they wanted to drill before the November presidential election brings a potential change in administration and tighter drilling policies. But with DAPL stuck in legal court battles and uncertainty around takeaway capacity continuing, Bakken’s production base will fall. Lower completion activity for 2021 and beyond will result in lower projections of ~250k b/d. With the rest of the US shale oil basins wounded, Permian will be the only basin left to carry the US.

Prognosis: The recovery in global oil demand looks like it’s going to be slower than expected, as a resurgence in Covid-19 cases forces the re-imposition of lockdowns. All three of the world’s major oil forecasting agencies — the IEA, the EIA, and OPEC — have increased their demand destruction assessments in the third quarter of 2020, even as they see the depth of the crisis in the second quarter being less harmful than previously thought. In their latest monthly reports, the three agencies all saw third-quarter global oil demand falling further behind last year’s level than they did in June.

A Rystad Energy analysis shows the number of drilled wells globally is expected to reach around 55,350 this year, the lowest since at least the beginning of the century. The decline is a staggering 23 percent fall from 2019’s number of 71,946 wells. Rystad’s forecast, which extends to 2025, does not find it likely that last year’s number will be met or exceeded in the next five years. Drilled wells are expected to partly recover to just above 61,000 in 2021, as governments ease travel restrictions, boosting oil demand and prices. Then numbers will rise to just above 65,000 in 2022 and remain just below 69,000 until the end of 2025.

2. Geopolitical instability

Iran: Tehran is having a bad summer – the rapid spread of COVID-19, inflation, sanctions, oil production below 2 million b/d, and saboteurs blowing up a nuclear facility. The situation is so tight that money for Shiite insurgents in Iraq, Lebanon, Syria, and Yemen has been cut. Last week there were reports of anti-government riots breaking out in several cities across the country.

Iranian security forces fired tear gas on Thursday to disperse demonstrators gathered in the southwestern city of Behbahan, witnesses told Reuters, and there was a heavy presence of troops in other cities. Videos posted on social media from inside Iran showed protesters chanting, “Fear not, fear not, we are in this together.” Other videos showed a heavy presence of security forces in Tehran and Isfahan. Some protesters chanted slogans against top officials.

Iranian authorities are investigating a blaze that damaged seven ships at a southern Iranian port, the latest in a string of fires and explosions that have raised suspicions of coordinated sabotage targeting the nation’s infrastructure and a nuclear facility. Iranian state television showed black plumes of smoke billowing over the Bushehr port on Wednesday.

Beijing and Tehran are feeling the heat from Washington. The former is locked in a bitter, damaging trade war with the United States; Tehran has seen its economy badly hurt by sanctions reimposed by the Trump administration. Recent developments suggest these two American adversaries may be finding a greater common cause. Last week, Iranian Foreign Minister Zarif acknowledged in a parliamentary session that his government is, “with confidence and conviction,” in negotiations with China over a 25-year strategic partnership that could involve about $400 billion in Chinese investment through various sectors of the Iranian economy.

According to the New York Times, a document dated in June that its reporters obtained is a draft of a pending agreement. The pact between the two countries would increase intelligence sharing and security cooperation, including possible missions in Syria and Iraq. It would also see Chinese companies expand their footprints in Iranian railroads, ports, and telecommunications, while securing for Beijing a steady and discounted Iranian oil supply for the next quarter-century. China would develop free-trade zones in strategic locations in Iran, further binding the country into Beijing’s Belt and Road global trade and development initiative.

Iraq: Baghdad is cutting its oil exports to achieve full compliance with its production quota under the OPEC+ agreement. According to sources in Iraq’s state oil marketing company, at least six oil buyers in Asia were told that Iraq would not be supplying previously agreed volumes for August. Some were told they would not get any oil but will receive what they had agreed to buy in September. Others were told they would receive partial quantities of the contractual amount in August. Iraq was among the producers hardest hit by the oil price crash in March, as it depends heavily on its oil revenues for its spending.

Iraq has struck deals with oil field operators and state-run oil companies to augment the national power grid and stave off further protests prompted by recent blackouts. Significant power outages occurred last weekend in the southern provinces of Basra, and Dhi Qar – hubs of Iraq’s oil industry – as technical malfunctions in transmission infrastructure and two power stations cut power supplies.

The chemicals in the air across southern Iraq come from the smoky orange flames atop the oil wells, burning away the natural gas that comes up with the oil. Many countries have reduced the practice, known as flaring. According to the IEA, the amount of gas Iraq flares would be enough to power three million homes.

Flaring also produces chemicals that can pollute the air, land, and water. It has been shown to worsen asthma and hypertension, contribute to the incidence of some cancers, and speed climate change. The practice contributes to Iraq’s bizarre energy paradox: A country with some of the world’s largest oil and gas reserves faces a chronic power shortage and frequent blackouts. To feed its gas-powered electricity plants during the summer, it has to import gas, which it buys primarily from Iran.

As Iraq’s economy craters under the assault of collapsing oil prices and the coronavirus pandemic, it can ill afford the several billion dollars a year it spends buying gas from Iran.

After years of delays, Iraq opened a sizeable natural gas recapture plant in Basra in 2018 at an estimated $1.5 billion. But the plant is only a first step: it recovers a little more than half of the gas from three large oil fields. There are 15 oil fields in Basra Province alone. The Oil Ministry announced plans last month to develop plants that would recover most of the gas that is now flared in southern Iraq. The projects would be operational in two to three years. International energy experts say that given Iraq’s economic troubles, those projections are wildly optimistic.

Libya: Just two days after it lifted the force majeure on all oil exports, Libya’s National Oil Corporation declared force majeure again, citing a renewed blockade on its oil export terminals and blaming it on interference from the United Arab Emirates. Tripoli placed the oil terminals at Hariga, Brega, Zueitina, Es Sider, and Ras Lanuf under force majeure at the beginning of this year, after troops affiliated with the Libyan National Army occupied Libya’s oil export terminals and oilfields. The blockade at the ports lasted for more than six months. Still, parties were negotiating – and reached an agreement – for the re-opening of the oil terminals and the restart of oil production, which had plummeted to just 100,000 b/d compared to 1.2 million before the blockade.

In a statement last week, a spokesman for Hafter’s forces called for oil revenues to flow into a bank account in a foreign country with a “clear mechanism” to distribute funds equitably among Libya’s regions. Haftar has tried on occasion to export the oil from terminals he controls, but this has been blocked by the European warships and a reluctance of oil traders to deal with the Eastern government.

An absence of US leadership in Libya has allowed the confrontation to deepen, analysts say, as a spiraling proxy war stokes threats to American economic and security interests and provides Russia a platform to expand its clout in the Mediterranean. The US position on the margins of the conflict — complicated by uncertainty about which side Washington supports — takes on new significance as Russia, Turkey, and now possibly Egypt pour weapons and fighters into a combustible battle. “The US is essentially out of the game. The Libyans are unable to make their own decisions, entirely dependent on foreign actors,” a Western diplomat said. “There is total drift.”

Venezuela: Caracas’ heavy crude is suitable to process in complex refineries on the US Gulf Coast, but the sanctions have cut off Venezuelan oil flows to the US. Last year, when the US began putting sanctions on Maduro’s regime, refiners started to raise their imports of fuel oil from Russia. The US imported a record-high volume of 11 million tons for the full year 2019, double the fuel oil imports from Russia in the previous year. This year through June, American imports of fuel oil from Russia amounted to 5.3 million tons and are currently on track to match last year’s record imports, according to Refinitiv Eikon’s data.

The US Department of the Treasury again extended a license for three months to prevent creditors of Venezuela’s state-owned oil company PDVSA from taking control of US refiner Citgo as a result of missed payments on its 2020 bonds. The license, which was set to expire July 22nd, now runs until October 20th. PDVSA missed a principal payment on the 8.5 percent bonds in October 2019, setting up the possibility of losing US refiner Citgo, its most valuable overseas asset. In several lawsuits working their way through US courts, Venezuela’s creditors have tried to collect on old debts by seizing Citgo assets.

Venezuela’s PDVSA and US-based Chevron restarted production of extra-heavy crude in the Orinoco Belt at their Petropiar joint venture, which is currently operating at 72,000 b/d or 38 percent of capacity. PDVSA has resumed gasoline production at the Cardon refinery capable of processing 310,000 b/d that was hit by a fire last week which affected the catalytic cracking unit. The refinery has since resumed production of gasoline and is currently producing around 30,000 b/d of gasoline.

3. Climate change

Democratic presidential candidate Biden proposed a $2 trillion clean energy and climate change package last week, a plan that would overhaul transportation, electricity, and heavy industry. Some of the highlights include making the entire electricity sector 100 percent carbon-free by 2035, retrofitting four million buildings over four years, building 500,000 EV recharging stations, and funding for researching a variety of carbon capture and storage as well as advanced nuclear power technologies. The package is significantly more aggressive than one he proposed earlier this year during the primary, which called for $1.7 trillion over ten years, intending to reach net-zero emission by 2050. This new plan calls for $2 trillion over four years and brings the electricity component of the net-zero goal forward to 2035. Moreover, there is a lot of focus on social justice.

Biden’s proposal is a very ambitious plan that moves the transition to clean energy closer than any serious proposal before. Those looking at the Biden plan from a more technical perspective have raised serious questions about its feasibility. The goal of clean electricity by 2035, for instance, surpasses even those of the most ambitious states, such as California and New York.

The Net-Zero America Project has been researching the infrastructure changes needed for a future free from fossil-fuel electricity. To meet Biden’s clean electricity goal and keep up with new demand from electric vehicles and heating, the US would have to build 4 billion megawatt-hours of new clean electricity generation over the next 15 years. That’s about 2.5 times the country’s current clean energy capacity (including nuclear and hydroelectric) and roughly equal to all the electric generation today.

According to two new studies, methane leaks from oil and gas production are one of the reasons behind increased methane emissions over the decade from 2007 to 2017. Methane leaks from oil and gas operations were the main contributor to higher methane emissions in the US. In South Asia, South America, and Africa, the most significant contribution came from agriculture, especially livestock farming. In China, the increase in methane emissions was driven by both the oil and gas industry, and agriculture.

The Middle East is making progress in cutting natural gas flaring even as the broader region, including North Africa and the US, shows no sign of a reduction, wasting billions of dollars in lost revenue if the gas were used. Saudi Arabia’s gas flaring has dropped 37 percent in the past three years, while Iran’s is down 29 percent and Qatar cut flaring by 12%, figures from London-based FGE show. Factors contributing to the drop are OPEC+ output cuts, which reduced associated gas production, US sanctions, which curbed Iran’s crude output, and improved management in gathering gas formerly flared for re-injection into oil fields.

In a stark new finding, a study shows that six straight months of anomalously mild conditions in large parts of northern Siberia so far this year, along with an Arctic temperature record of 100.4 degrees in June, would have been impossible without human-induced global warming. The study by the World Weather Attribution project was produced through a collaboration between climate researchers from multiple institutions in France, Germany, the Netherlands, Russia, Switzerland, and the United Kingdom. The researchers found that the prolonged January-to-June heat, which has led to a record spike in wildfires across the Siberian Arctic, was made at least 600 times as likely by human-caused climate change. This led them to conclude such an event would be nearly impossible in the absence of global warming.

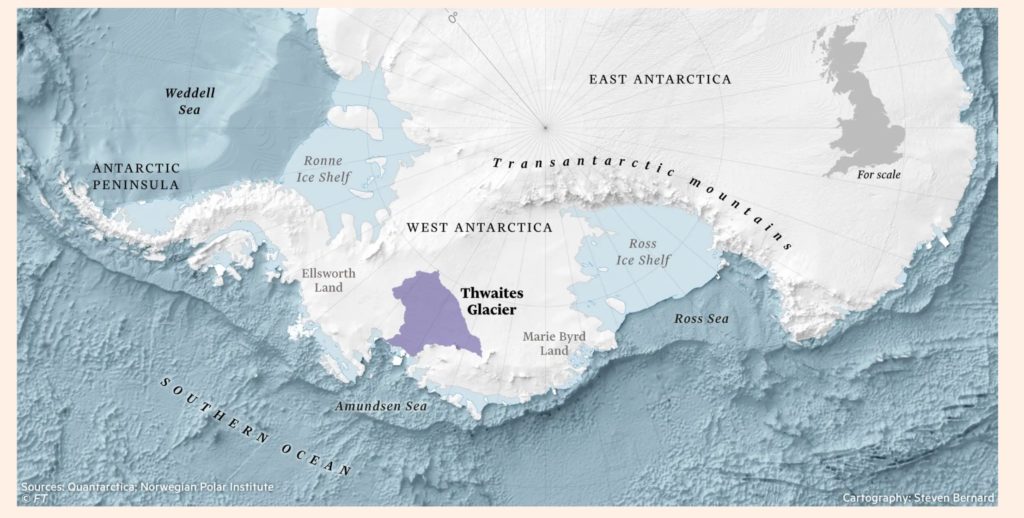

Even by the standards of Antarctica, there are few places as remote as Thwaites Glacier. Dubbed the “doomsday” glacier, Thwaites, perhaps more than any other place in the world, holds clues about the future of the planet. The glacier, which is the size of Britain and melting very quickly, is likely to contribute to sea-level rise during our lifetimes.

4. The global economy and the coronavirus

A surge in new cases and a resurgence of the coronavirus in places that had thought they’d beat it led to renewed lockdowns and worry that the recovery in oil demand might end. Companies around the world will take on as much as $1 trillion of new debt in 2020, as they try to shore up their finances against the coronavirus, a new study of 900 top firms has estimated. The unprecedented increase will see total global corporate debt jump by 12 percent to around $9.3 trillion, adding to years of accumulation that has left the world’s most indebted firms owing as much as many medium-sized countries.

United States: The Fed reported Wednesday that its latest survey of economic conditions around the country found improvements in consumer spending and other areas but said the gains were from very low levels seen when widespread lockdowns pushed the country into a deep recession. The report noted that business contacts in the Fed’s 12 regions remained wary about the future. “Outlooks remained highly uncertain as contacts grappled with how long the COVID-19 pandemic would continue and the magnitude of its economic implications,” the Fed said in its latest Beige Book.

The International Monetary Fund predicted Friday that the US economy would shrink 6.6 percent this year. The forecast is an upgrade from one the IMF made last month when it foresaw the American economy contracting 8 percent in 2020. The economy shrank at a 5 percent annual pace in the January-March quarter and is expected to contract a record 35 percent from April through June.

Gasoline demand in the US fell by 5 percent in the seven days to July 11th. Meanwhile, new Covid-19 case numbers in the US. have been rising fast. Last week, the country broke all daily records by reporting 77,000 new cases. These developments have prompted state officials to threaten new lockdowns, despite concern about what would happen to the recovery of the economy. People are once again driving less when they would normally be on the road more, as this is the height of the driving season.

Fear of catching the coronavirus while traveling on public transit appears to be playing out across the country as transit agencies from coast to coast report lost revenues ranging from hundreds of millions of dollars to several billion. And in some of the nation’s biggest cities, budget deficits are hitting agencies so hard that they’re considering permanent cuts to subway and bus lines.

In California, the San Francisco Municipal Transportation Agency is projecting an estimated $568 million revenue loss over the next four years. The agency has already reduced service by 30 percent and said it might be forced to cut 40 bus lines without additional federal aid permanently. New York City’s Metropolitan Transportation Authority is facing an alarming budget deficit—a $10.3 billion loss over the next two years. One analysis estimates the authority would have to cut half of the city’s bus and subway lines to make up the difference.

A significant source of income–special unemployment payments for roughly 30 million unemployed people in the US–is set to end. This will threaten their ability to meet rent and bills and potentially could undercut the fragile economic recovery. In March, Congress approved an extra $600 in weekly unemployment benefits as part of its $2 trillion relief package to offset the impact of the coronavirus pandemic. That additional payment expires next week unless it gets renewed.

Executives who were bracing for a months-long disruption are now thinking in terms of years. Their job has changed from riding it out to reinventing. Roles once thought core are now an extravagance. Some strategies set back in the spring are now obsolete.

China: Beijing recorded an unexpectedly strong 3.2 percent expansion in the latest quarter after anti-virus lockdowns were lifted, and factories and stores reopened. The three months ending in June was a dramatic improvement over the previous quarter’s 6.8 percent contraction. But it still was the weakest positive figure since China started reporting quarterly growth in the early 1990s.

Chinese imports from the US rose for the first time since the coronavirus emerged earlier this year even as political tension between the world’s two largest economies continues to increase. China’s appetite for meat and other agricultural goods helped Chinese imports of US goods to jump by 11.3 percent in June from a year earlier, after a 13.5 percent drop in May. On Tuesday, President Trump shut the door on “Phase 2” trade negotiations with China, saying he does not want to talk to Beijing about trade because of the coronavirus pandemic.

Large parts of central and eastern China were reeling on Friday from the worst floods in decades, as disruption mounted for crucial supply chains, including essential personal protective equipment for fighting the coronavirus, and economic damage piled up. Wuhan warned residents to take precautions as water levels fast approached their maximum guaranteed safety level. The giant Three Gorges reservoir, which has been holding back more water to ease downstream flood risks, is more than 10 meters higher than its warning level, with inflows now at more than 50,000 cubic meters a second.

Economic activity in other parts of China, especially construction and steel and cement demand, has also been hurt by the flooding, suggesting some loss of momentum after a stronger than expected bounce in the second quarter from the coronavirus crisis. “We estimate recent floods in Yangtze River regions could lead to a gross drag of 0.4-0.8 percentage points on third-quarter GDP growth,” analysts at Morgan Stanley said in a note to clients on Friday.

Even the coronavirus hasn’t stopped Beijing’s $52 trillion asset bubble from getting more significant. A Chinese property boom in some megacities that many thought was unsustainable has resumed its relentless climb, with prices rising higher and investors chasing deals despite millions of job losses and other economic problems.

China’s June crude oil imports surged 34.4 percent year on year to an all-time high of 12.99 million b/d as Chinese buyers who rushed into the market to secure cheap crudes in late March received their deliveries in June. It was the first time China’s monthly crude imports had surpassed 12 million b/d and were 14.6 percent higher than the previous record high of 11.34 million b/d in May.

Crude oil throughput at China’s domestic refineries jumped 9 percent to an all-time high of 14.14 million b/d in June, absorbing some of the record high imports for the month. The volume is set to stay high in July. It was also the first time that China’s crude throughput rose above 14 million b/d.

Asia: Many of Asia’s developing countries have long relied on factories producing T-shirts, trousers, and shoes that employ millions of people and help them climb the income ladder. This is how Bangladesh slashed poverty; Vietnam began its manufacturing dream, and Myanmar set out to grow after years of crippling sanctions.

When the coronavirus struck, stores closed across North America and Europe. Western brands canceled orders worth billions of dollars, leaving shipments of sweaters and jeans with no takers. Hundreds of factories closed in waves across Asian industrial belts near Phnom Penh, Dhaka, and Yangon. Hundreds of thousands of garment workers, a vast majority of them women, have been suspended or laid off. Many had only just pulled themselves out of poverty. Their wages, while low, paid for regular meals, necessary medical treatment, and education to prepare their children and siblings for better-paying work.

In recent months, many workers have returned to their villages, cut back on food, and borrowed money to survive. Developing Asia will grow by just 0.1 percent this year—the slowest rate in six decades, the Asian Development Bank estimates.

European Union: Negotiations among the European Union’s 27 leaders for recovery plans worth €1.8 trillion ($2.06 trillion) dragged into a fourth day on Monday, leading to tense exchanges and fears of a breakdown. After three days of talks to agree a proposed spending package to lift Europe’s economy out of a coronavirus-sparked slump, EU leaders still hadn’t nailed down the size of the final plan, how much of it should be available in grants and some of the conditions attached.

The coronavirus has canceled business plans worldwide, but Europe’s push into electric cars isn’t one of them. Sales of battery-powered and hybrid vehicles have been better than the overall market amid a deeply painful recession, mainly thanks to governments’ actions. The 27-country European Union is moving ahead with a significant shift in transportation as part of the bloc’s efforts against climate change. Under regulatory pressure, carmakers are rolling out a slew of new electric models to meet stricter limits on greenhouse gases that come into full force next year.

Russia: Incomes in the second quarter plunged by the most since the country’s 1998 default as the economy took a double blow from the pandemic and slump in global oil demand. Real disposable incomes fell 8 percent between April and June compared with a year ago. “This situation with incomes is pointing to a lot of problems,” said Evgeny Nadorshin, chief economist at PF Capital in Moscow. “If incomes don’t recover, the economy may also fail to bounce back.”

The slump, which follows years of falling or stagnating living standards, is one of Putin’s most significant challenges as he paves the way to extending his two-decade rule. The coronavirus upended a plan to boost spending on social projects this year, with completion of the so-called National Projects likely pushed back until 2030.

Gazprom has reported its first quarterly loss in more than four years as the coronavirus pandemic slashes gas demand and prices. A 30 percent fall in the value of the ruble during the first quarter of 2020 sparked by the oil price collapse compounded a slide in both shipments and prices for the Russian state gas group that is expected to continue throughout the year. The $1.64 billion loss underscores the deep fiscal pain that the Covid-19 pandemic will have on Russia, which is reeling from both an economic recession caused by a domestic lockdown and a significant reduction in government tax revenues from lower oil, gas and other commodity sales.

The value of Russian gold exports has exceeded the country’s proceeds from natural gas exports for the first time in Russia’s modern history. This is due to low demand and prices for natural gas and surging gold exports, estimates from Russia’s central bank and customs showed. Russia’s exports of gold reached US$3.58 billion in April and May, according to customs data.

The recent detention of journalists and critics of Putin is a sufficient concern that authorities are launching a new wave of attacks on opposition figures. Since Putin won a July 1st referendum that could prolong his power for years to come, journalists have been detained, the homes of Kremlin critics raided. A popular regional governor has been arrested on suspicion of organizing contract killings allegedly committed almost two decades ago.

Tens of thousands of people in Russia’s Far East marched in protests triggered by the popular regional governor’s arrest. Still, the protest has morphed into a wave of growing dissatisfaction over social issues and President Putin’s rule. Saturday’s demonstrations marked the eighth consecutive day of public actions since the July 9th arrest of Sergei Furgal, the governor of Khabarovsk, for his alleged involvement in the murders of two businessmen and the attempted murder of another 15 years ago. Mr. Furgal has denied any wrongdoing. Supporters believe he was targeted partly because of his 2018 gubernatorial victory over a Kremlin-backed candidate, which dealt a blow to the ruling party.

India: As the coronavirus pandemic accelerates in the world’s second-most-populous nation, India has crossed a once-unthinkable threshold — 1 million confirmed cases, joining the United States and Brazil in a club no country wants to enter. Yet behind the figure lies a paradox. India has about half the number of deaths — 25,000 — as the US and Brazil recorded at the same point in their outbreaks.

India’s comparatively low death rates — both as a percentage of total cases and per million — are a mystery. The Indian government has repeatedly cited the figures for reassuring a worried populace, saying such statistics show the country is faring better than many others in the pandemic. That optimism appears misplaced. Experts say government data on deaths is sure to be incomplete in a country where a vast majority of people die in rural areas and without any medical attention, making them less likely to be tested or diagnosed. Already there are numerous signs that coronavirus deaths are being missed or misreported. Testing rates per capita in India remain low.

Nearly four million people in India’s northeastern state of Assam and neighboring Nepal have been displaced by massive flooding from monsoon rains, with dozens missing as deaths rose to at least 189, government officials said on Sunday.

Saudi Arabia: The government has cut spending, suspended the cost of-living allowance for state employees, and this month increased VAT from 5 percent to 15 percent. Two years ago, Saudi Arabia and the UAE became the first two countries in the Gulf to introduce a VAT. Riyadh’s decision to triple it reflects how the social contract between Saudi citizens and the government is changing as Crown Prince bin Salman pushes his vision for economic and social reform. While older generations have enjoyed cradle-to-grave benefits and easy access to public sector jobs with almost no taxes, younger Saudis are expected to create jobs and work longer hours for lower pay in the private sector.

Saudi Arabia’s crude oil exports plunged to a nine-year low in May as the historic OPEC+ cuts began, according to data released July 16th by the Joint Organizations Data Initiative. Shipments dropped to 6.02 million b/d, the lowest since October 2010, from a record 10.237 million b/d just a month earlier. The 23-country OPEC+ coalition enacted a 9.7 million b/d production cut accord starting in May in response to the coronavirus crisis. The drop in exports came as the kingdom’s output declined to 8.486 million b/d, the lowest since December 2010, from the all-time high of 12.07 million b/d in April.

5. Renewables and new technologies

Wind energy is coming to the fore and is the new darling of corporate America. A big part of this increasing popularity is that wind turbines produce energy cheaply. The cost of producing electricity from wind has fallen by as much as 70 percent since 2009 according to the International Renewable Energy Agency (IRENA). As a result, the agency said in a recent report, “more than half of the renewable capacity added in 2019 achieved lower power costs than the cheapest new coal plants.”

When it comes to wind versus solar, wind has one other advantage beside lower cost. Wind makes a lot of energy that companies can now sell via virtual power purchase agreements (PPAs), which appeared on the market in 2013. Unlike regular PPAs, these do not require the buyer of renewable energy to buy the power directly. They can instead take the revenue generated by selling this electricity on the open market. As a result, virtual PPAs account for as much as 85 percent of wind power procurement from the corporate world. Wood Mackenzie has forecast that demand for wind power from just the largest US companies will reach 85 GW by 2030. But there are also smaller businesses that would want wind power.

Hydrogen seems to be on the way to becoming a significant part of the energy world. The plan is for emissions related to manufacturing hydrogen become minimal if not completely absent. Yet today, most hydrogen produced in the world —as much as 95 percent—is produced from natural gas, which compromises its “clean” credentials. The rest is produced through electrolysis, using solar and wind power. For now, hydrogen from electrolysis is 2-3 times more expensive than hydrogen using natural gas. However, the cost of wind and solar-produced electricity is dropping, and some are experimenting with producing hydrogen directly from water, using solar energy.

Another way to produce hydrogen that is currently under development is to use waste as the feedstock. Unlike using electricity and natural gas to produce hydrogen, there is no feedstock cost for municipalities. There are different approaches to waste-to-hydrogen production. Scientists from India’s Institute of Chemical Technology are grinding food waste, filtering the larger particles, and feeding it into an anaerobic digester, where bacteria break down the trash into gases, including hydrogen.

A California startup, Ways2H is processing the waste—including plastics—into small particles. These are then filtered to remove inert materials and fed into a gasification vessel along with ceramic beads and heated to 1,000 degrees Celsius (1,832 F). The heat turns the waste into methane, hydrogen, carbon monoxide, and carbon dioxide. Then the gases pass through a reforming vessel, where steam breaks down the methane into more hydrogen and carbon oxides.

Another hydrogen company, SGH2 Energy, uses plasma torches to break down the waste, which leaves out the production of ash and, according to the company, results in the purest hydrogen possible.

The EU is preparing to spend billions of euros to convert a significant part of its economy to run on hydrogen in the coming decades. India, too, is embracing hydrogen as some of the country’s top energy companies, such as Indian Oil Corp., Reliance Industries, and Adani Group, are increasingly highlighting the urgency to move toward the carbon-free fuel. Which of the various processes for producing hydrogen – natural gas with CO2 sequestration, electrolysis, solar panels, or waste conversion – will turn out to be the most cost-effective is not year known.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Billions in write-downs: BP and Shell have revised their long-term price forecasts — BP to $55 per barrel of Brent crude, and Shell to $60. These revisions will likely render more assets worthless, adding them to the stranded asset count. In other words, these billions in write-downs may be just the beginning. (7/14)

Ireland might be the first Atlantic producer to quit both oil and gas altogether. Heretofore the Emerald Isle has had good chances of keeping its gas assets alive and in reasonably good health. But from now on, the odds are that future gas exploration will also go down the way of oil. Three political parties joined in a coalition, which stated last week that new licenses for gas exploration would be eliminated the same way oil exploration was wound down. (7/17)

Italian major Eni plans to exit traditional refining activities within the next decade as it is focused on bio-refineries and to accelerate its transition to low-carbon energy. (7/15)

In Russia, the ongoing development of new liquefied natural gas (LNG) projects will allow it to seize a 15-percent share of the global LNG market. Russian Energy Minister Alexander Novak wrote in an article in the Russian magazine Energy Policy. (7/18)

Offshore Australia: Shells Prelude floating liquefied natural gas project, with an annual capacity of 3.6 million tons, began shipping LNG last June. The first cargo sent more than eight years after the final investment decision—estimated at over $12 billion—was made two years after the FLNG vessel arrived at the site. In February this year, production was stopped following a technical problem. Production at the world’s largest FLNG installation still hasn’t been restored, which, during lowered demand due to the coronavirus, is not completely bad. The commercial breakeven price for gas produced at Prelude is as much as $20 per thousand cubic feet. This compares with prices between $2 and $3 per thousand cubic feet in April in the US. (7/16)

Canada’s oil production slumped to 4.4 million barrels per day (bpd) in May – the lowest output since the middle of 2016 when wildfires crippled oil sands production. Canada’s production of petroleum and other liquids averaged 5.6 million bpd in March. Still, after the oil price collapse of oil sands production into single digits and the coronavirus demand crash, production is down by 21%. (7/17)

The US oil rig count last week decreased by one rig for a total of 180, according to Baker Hughes data. The active gas rig count dropped by four for a new total of 71.

The combined rig count of 253 (including two “misc. rigs”) is down from 953, a 73 percent overall decline. (7/18)

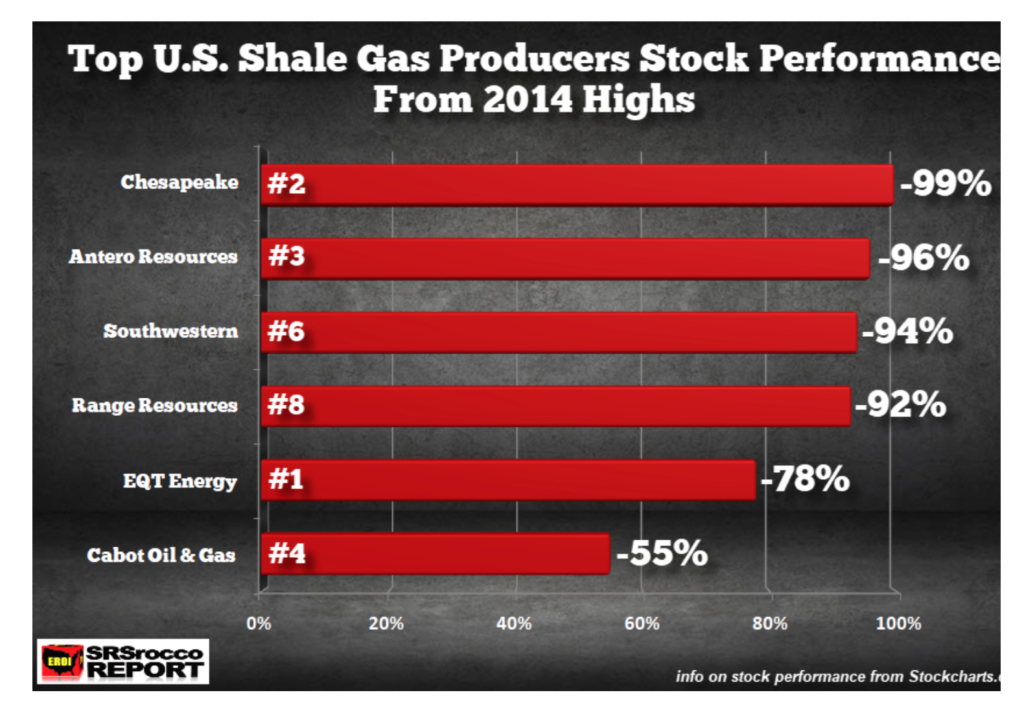

Abusing bankruptcy: Whiting Petroleum, a major shale drill in North Dakota that sought bankruptcy protection in April, approved almost $15 million in cash bonuses for its top executives six days before its bankruptcy filing. Chesapeake Energy, a shale pioneer, declared bankruptcy last month, just weeks after it paid $25 million in bonuses to a group of executives. And Diamond Offshore Drilling secured a $9.7 million tax refund under the Covid-19 stimulus bill Congress passed in March, before filing to reorganize in bankruptcy court the next month. It won approval from a bankruptcy judge to pay its executives the same amount as cash incentives. (9/13)

Bankruptcies w/ environmental twist: Almost 250 oil and gas companies could file for bankruptcy protection by the end of next year, more than the previous five years combined, according to Rystad Energy, an analytics company. The environmental consequences of a looming collapse could be severe, with taxpayers on the hook to deal with what the federal government estimates are more than three million abandoned oil and gas wells; two million are unplugged, releasing the methane equivalent of the annual emissions from more than 1.5 million cars. (9/13)

New oil export terminal: Operations by Buckeye Partners have begun at South Texas Gateway from a new terminal in the Port of Corpus Christi. Four pipelines will serve the facility. When all phases are completed, the two deepwater docks will be able to handle up to 800,000 barrels per day of throughput. (7/18)

Shunning fossils: When the University of Michigan’s chief financial officer asked the school’s Board of Regents in December to authorize a new $50 million oil-and-gas investment, they gave an answer he had never heard before: No. The board delivered the news at a meeting packed with student activists. They had spent months pushing the university to stop funding fossil-fuel companies. A few weeks later, the school said it was freezing all direct investments in such companies. (7/15)

US President Donald Trump claimed to have created and saved the US oil industry in a White House roundtable with stakeholders positively impacted by law enforcement on Monday. “I created it; we became number one. We have millions of jobs. And we saved it, so Texas is not going to have to let go of millions and millions of people. We’re number one in oil, as you know — oil and gas — by far. We’re now number one in the world. And we would have had millions of people out of work. I saved it. After saving the oil and gas business, and millions and millions of jobs — I’m leading Texas by one point? I don’t think so,” the president added. (7/15)

NEPA rollback: President Donald Trump is ready to roll back a foundational Nixon-era environmental law that he says stifles infrastructure projects, but that is credited with ensuring decades of scrutiny of significant projects and giving local communities a say. In Atlanta, Trump announced changes Wednesday to the National Environmental Policy Act’s regulations for how and when authorities must conduct environmental reviews, making it easier to build highways, pipelines, chemical plants, and other projects. (7/16)

Court push-back: The US Bureau of Land Management’s rationale behind canceling the bulk of Obama administration-era regulations of methane from oil and natural gas sources on public lands was “wholly inadequate,” a federal judge has ruled. (7/17)

Why haven’t biofuels taken off? The biofuel revolution that we were promised is nowhere to be seen. EIA projects the consumption of all biofuels will rise from 7.3 percent of total fuel consumption in 2019 to just 9 percent in 2040, and that’s only if oil prices fail to recover. The oil crash and global pandemic have battered biofuels to the brink of collapse. The Trump administration has all but abandoned any existing biofuel mixing mandates, and Joe Biden’s big new green energy plan makes no mention of biofuels at all. (7/17)

VMT cutback permanent: Working from home and online shopping have become the new normal, and that will reduce driving in the US by up to 270 billion miles a year, according to a new study. The research by consultant KPMG International finds the cocoon culture Covid-19 has created is not going away — even if a vaccine is made widely available — and that will have potentially dire consequences for the auto industry. KPMG predicts as much as a 10 percent permanent reduction of the almost 3 trillion miles typically traveled every year with vehicle ownership declining to slightly less than two cars per household. (7/16)

The biggest battery storage system in the US connected to California’s electricity grid, giving the state more flexibility to bank excess solar power generated during the hottest parts of the day and deploy it later. (7/14)

CA’s battery boom: The California Independent System Operator, which manages a grid that powers 80 percent of California, added 62.5 megawatts to its storage capacity in June when the initial phase of the Energy Storage project came online in San Diego. If all planned projects are completed on schedule, the grid operator’s storage capacity will expand six-fold by the end of 2020 from 136 megawatts at the beginning of the year, the ISO said. The current size is 216 megawatts. (7/14)

The million-mile battery for electric vehicles (EVs) could hit the market very soon, giving a boost not only to zero-emission vehicle ownership but also to renewable energy generation. While the million-mile battery will outlast whatever car it is placed in, it could still be put to good use after its initial purpose, providing a boon to the used EVs market or energy storage. (7/14)

Energy storage booming: the US is set to increase its energy storage capacity in the coming years significantly and contribute to the global energy storage boom, with China and the US “set to dominate with over 54 percent of the market by 2024 shared between them.” (7/16)

Coal exports out of the terminals in the Hampton Roads region in Virginia were at a three-year low in June, down 26.3 percent from May and 44.1 percent lower than 2.77 million st in the year-ago month. (7/17)

Different nuclear fusion angle: DPF (dense plasma focus) is opening the door to a streamlined, low-cost fusion future — and for gaining more support once again for nuclear as a smart power source to tap into. That comes years after the current technology, atomic fission, lost support. (7/16)

H2: By 2030 the production of hydrogen fuel by the electrolytic splitting of water—which can be carbon-free provided renewables produce the electricity used in the process—could become cost-competitive with currently predominant methods that require the use of natural gas as a feedstock, according to an analysis by the IHS Markit Hydrogen and Renewable Gas Forum. Costs for producing green hydrogen have fallen 50 percent since 2015. An additional 30 percent could reduce them by 2025 due to the benefits of increased scale and more standardized manufacturing, among other factors. (7/16)

Climate flooding: There’s going to be a lot more flooding in New York this year as climate change causes sea levels to rise. According to a NOAA report, the battery, at the southern tip of Manhattan, flooded ten times in the 12 months through April. In the year-long period that began in May, the agency expects it to happen as many as 14 times. During the early 2000s, the battery would flood less than five times per year. Tides rose at least 1.6 feet (0.5 meters) or above-average high-tide levels because global warming is causing water to expand and glaciers to melt. (7/15)

China’s floods: This summer, torrential rains have caused severe floods in China, killing more than 100 people, forcing 1.7 million to relocate and racking up more than 61.8 billion yuan ($8.8 billion) direct loss. In many cities along the Yangtze River, houses are submerged, cars afloat, and bridges have been washed away. (7/14)

Three Gorges Dam: As China counts the costs of its most punishing flood season in more than three decades, the role played by the massive and controversial Three Gorges Dam – designed to help tame the Yangtze river – has come under fresh scrutiny. Critics say the historically high-water levels on the Yangtze and its major lakes prove the Three Gorges Dam isn’t doing what it was designed for. (7/14)

Water wars: In Ethiopia, a reservoir behind its disputed Grand Renaissance Dam on the River Nile has started filling with water – a day after talks with Egypt and Sudan ended without agreement, officials say. Ethiopia sees the hydroelectric project as crucial for its economic growth. But Egypt and Sudan, which are downstream, fear the large dam will significantly reduce their access to water. Years of fraught negotiations have failed to reach a consensus on how and when to fill the reservoir, and how much water it should release. (7/16)

Population crash? Researchers at the University of Washington’s Institute for Health Metrics and Evaluation have warned that the planet is not prepared for an ongoing global population crash and that the impact will be “jaw-dropping”. The research highlights that the global fertility rate will almost halve to 2.4 in 2017 and projections indicate that it will fall below 1.7 by 2100. For further context, in 1950, an average of 4.7 children were being born for every woman. The research suggests that almost every country on the planet could have shrinking populations by the end of this century, with 23 nations projected to halve by 2100. (7/16)

Britain’s economy could shrink by more than 14 percent this year. Government borrowing risks approaching 400 billion pounds ($500 billion) if there is lasting damage from the coronavirus, government budget forecasters warned on Tuesday. (7/14)