Editors: Tom Whipple, Steve Andrews

Quote of the Week

“While hydrogen fuel cell technology is very promising, we know that widespread adoption will take time. Many factors will influence this, including emissions regulations, infrastructure, hydrogen availability and total costs of ownership. Buses and trains will likely be some of the first applications to transition to hydrogen, with the Hydrogen Council predicting that heavy- duty trucks will fall further out on the curve with about 2.5 percent of hydrogen adoption in 2030.”

—Amy Davis, President of New Power Business, Cummins

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

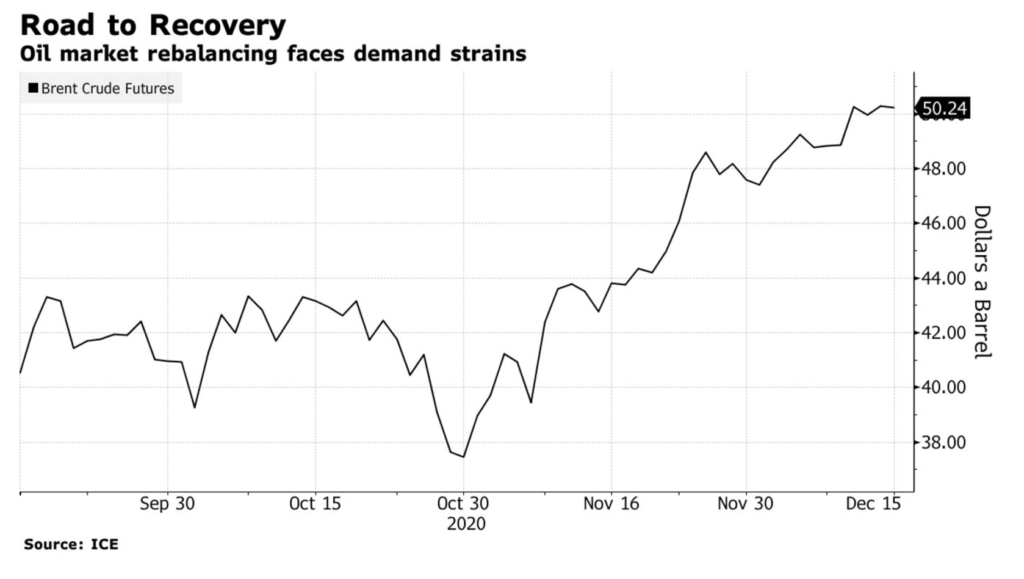

Oil: Prices rose for a seventh straight week as efforts to pass another US virus relief package added to optimism that the vaccine’s rollout will provide a boost in demand. Futures rose 1.5 percent in New York on Friday, extending this week’s rally to over 5 percent. Talks on a relief package have made some headway, and recent progress in rolling out a Covid-19 vaccine has also buoyed the outlook for consumption. Brent crude settled at $52.26 a barrel after touching $52.48, its highest since March. West Texas Intermediate settled at $49.10 after reaching $49.28, its highest since February.

Despite the vaccine optimism that has successfully boosted oil prices to February levels, the oil market is still in trouble. OPEC has once again lowered its demand forecast for this year and next while simultaneously agreeing to boost production. US refiners are closing refineries, extending the maintenance season, and upgrading less efficient units as demand for finished products continues to sag. US inventories of crude and gasoline are still high, even though US crude production is more than 2 million b/d off this year’s high seen back in March. Rig counts in the US continue to increase, and well completions are growing at a quicker pace. The Saudis have unleashed a $263 billion budget for 2021, representing a 7 percent reduction on 2020’s estimated spending as lower oil prices continue to impact their deficit.

The crude-oil glut left behind by the pandemic will clear by the end of next year, as markets face a gradual recovery marked by renewed strains on demand, the International Energy Agency said. “Demand is going to be lower for longer than expected” when the virus emerged in the spring, trimming forecasts for world fuel consumption following a new wave of lockdowns. “The market remains fragile,” the IEA warned. In Europe, a tentative recovery is reversing, with fuel consumption down this quarter amid a surge of Covid-19 infections and measures to control the spread of the virus.

The IEA expects that bloated crude inventories will subside in the coming 12 months. Global oil storage tanks will hold 625 million barrels more crude at the start of 2021 compared with pre-pandemic levels, an overhang that will dissipate by next December, the IEA said.

Exxon announced the latest in a string of discoveries off the eastern South American shore, this time in Suriname. This discovery shows that offshore oil may yet thrive. During the 2014-2015 oil price collapse, offshore oil drilling was one of the most affected areas. Offshore drilling companies went bankrupt, exploration projects were shelved, and staff was laid off.

Five years after the last crisis, offshore drilling is very much alive and cheaper than ever despite a heavy blow to rig owners from the slump in oil demand. According to Rystad Energy, offshore oil’s breakeven cost fell by about 30 percent between 2014 and 2018 and is now lower than the average breakeven for US shale oil. That may not be saying a lot since shale is among the higher-cost oil resources, but it says something loud and clear: offshore oil is getting cheaper to extract.

OPEC: The cartel slightly lowered its oil demand forecast for 2020 again, according to the latest version of the Monthly Oil Market Report. OPEC now expects global oil demand to fall by 9.77 million b/d in 2020 to reach 89.99 million b/d this year, compared to over 90 million b/d projected in its November report. OPEC’s projections for 2021 oil demand is 95.89 million b/d, down 410,000 from its forecast of 96.3 in its November report, and a 96.8 million b/d forecast in October.

Meanwhile, OPEC’s oil production increased in November, adding 707,000 b/d on average, mostly from Libya—not beholden to the production quotas–which accounted for 656,000 bpd of the increase. Production increases were also seen from Iran (+39,000 b/d), the UAE (+75,000 b/d), and Venezuela (+25,000 b/d).

OPEC’s analysts are painting a much gloomier view of the oil market in 2021 -– and yet indicate that the bloc and its allies could afford to be more aggressive with their planned increase in crude production in the months ahead. OPEC revised down its estimate of global demand from last month’s forecast by 1 million b/d for the first quarter of 2021 and 620,000 b/d for the second quarter, citing high uncertainty about the trajectory of COVID-19, as well as societal shifts away from travel.

Shale oil: US shale volumes and new well productivity per rig are expected to fall month-over-month in January as the industry enters the winter season and the number of drilled but uncompleted wells continues to decline. US unconventional oil output is projected to dip another 137,000 b/d to 7.438 million b/d in January, according to the EIA, after peaking at about 9.1 million b/d at the beginning of 2020. The EIA revised its December estimates to7.513 million b/d, down from its November report of 7.575 million b/d.

According to BloombergNEF’s estimates, US oil producers have cut their average breakeven costs from $56.50 per barrel last year to $45 a barrel now. Some of the most prolific areas in the US shale patch, such as the core of the Permian and Eagle Ford basins, have even seen breakeven costs dropping to an average of $36.50 per barrel now, from $44 a barrel last year. All companies, from the smallest driller to the largest corporations, have reduced capital spending this year in response to the collapse in oil prices, and they will continue to show spending discipline.

A total of 45 bankruptcies in the North American shale industry were filed in 2020, the second-highest number since oil prices abruptly plummeted to the $50/b level six years ago, Haynes & Boone said in a report. The international law firm, which has tracked energy bankruptcies since early-2015, said this year’s number was only exceeded by 2016 with 70. While most of those filing were privately held operators, 2020 saw some of the industry’s more significant producers file for bankruptcy, including Whiting Petroleum in April, Unit Corp in May, Chesapeake Energy in June, and Oasis Petroleum in September.

New Mexico’s State Land Office is putting an end to the commercial sale of freshwater for oil and gas developments to protect the state’s scarce freshwater resources. Effective Dec. 15, 2020, the State Land Office will not issue any new easements for commercial sales of fresh water for oil and gas development. It will no longer re-issue or renew existing easements for such use once they expire.

Crude oil production in North Dakota, home to the Bakken shale, is not expected to recover to pre-pandemic levels until late into 2022 due to the demand loss and the growing investor pressure on oil producers over environmental, social, and governance issues. North Dakota’s crude oil production plunged by 41.6 percent between December 2019 and May 2020, from 1.5 million b/d at the end of last year to just 900,000 b/d in May.

According to the latest available figures, North Dakota’s oil production in September and October 2020 held steady at around 1.22 million b/d. This is approximately 300,000 b/d lower than the all-time high monthly production of 1.519 million b/d in November 2019.

Last summer North Dakota producers faced another significant uncertainty—the Dakota Access Oil Pipeline’s future operations, the critical pipeline carrying crude out of the Bakken. The uncertainty is delaying oil companies’ plans to invest in bringing back online the output they had curtailed after the pandemic-driven crash in oil demand and prices.

Natural Gas: Spot prices for LNG delivery in Asia jumped to a six-year high this week as lower-than-normal temperatures in key LNG importers and continued growth in China’s industrial activity boosted demand. Spot LNG prices for January delivery jumped to over $12 per million Btu from less than $2 per million in the spring as a cold snap in the major LNG importers Japan, China, and South Korea raises demand. Moreover, China’s industrial output continued to grow in November, also boosting power demand. Recent unplanned supply issues at significant exporters, including Qatar, Australia, and Norway, are driving LNG prices even higher.

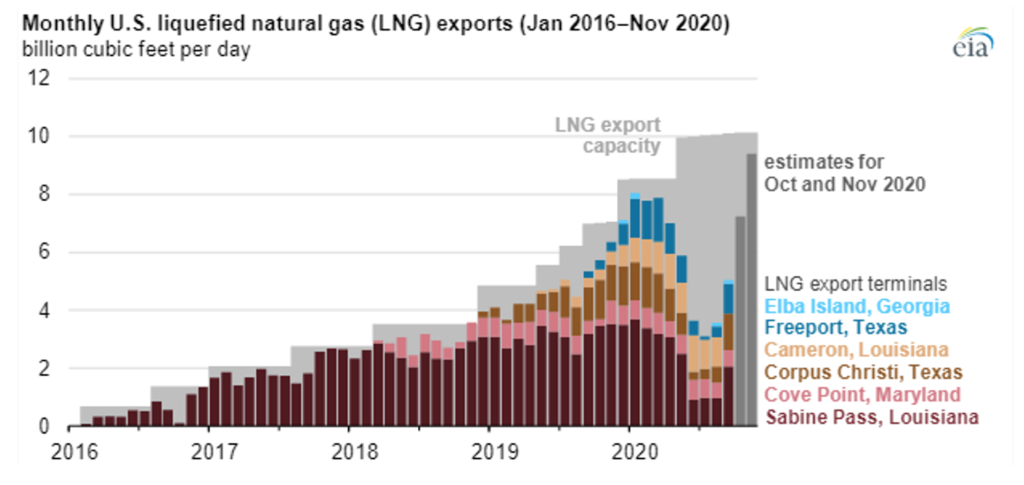

During the summer of 2020, monthly exports of LNG from the US were the lowest in 26 months but have since increased, and in November estimated LNG exports surpassed the previous record set in January 2020. The EIA estimates that November US LNG exports reached 9.4 billion cubic feet per day, 93 percent of peak LNG export capacity. Several factors contributed to the increase. International natural gas and LNG prices increased in Asia and Europe because global natural gas demand increased after COVID-19 restrictions were eased. Global LNG supply fell due to unplanned outages at LNG export facilities in Australia, Malaysia, Qatar, Norway, Nigeria, and Trinidad and Tobago. In addition, 2.7 billion cf/d of new US LNG export capacity was added.

Natural gas prices in the US Northeast were up sharply last week as the region’s first significant winter storm of the season approached, spiking heating demand. At the Boston-area Algonquin city-gates hub, cash prices were up nearly $5 since the start of last week, rising to $7.56 per million Btu in Dec. 15th trading. At hubs across the Northeast, cash prices are now highest since last winter and could strengthen further in the days ahead as freezing temperatures continue.

Prognosis: Oil market optimism risks derailing its recovery, with the recent rise in crude prices above $50 possibly incentivizing additional supply. Hopes that vaccines will revive the global economy, coupled with the OPEC+’s decision to delay bringing back much of the extra 2 million b/d oil planned for January, are supporting prices. Demand in critical hubs India and China have also supported higher prices. India appeared to turn the corner in October, with oil products demand up 2.5 percent year on year, ending seven straight months of decline. China has been carrying the world’s oil consumption in recent months, with crude imports in November bouncing back from a six-month low the previous month. Dollar weakness has been a contributing factor, too, given a barrel of oil is priced in the US currency.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Iranian President Rouhani said Thursday that he has “no doubt” the incoming US administration will rejoin the 2015 nuclear deal and remove punishing sanctions on Iran’s economy. His remarks came a day after Supreme Leader Ali Khamenei also appeared to endorse the swift resumption of Iran’s commitments under the deal if it would herald the end of harsh US sanctions. If Biden “returns to the situation as it was in 2017, then so will we,” said Rouhani. He had staked his reputation on the success of the accord only to see it unravel after US President Trump took office.

Biden has expressed readiness to rejoin the deal if Iran accepts the limitations on its nuclear activities that it abandoned after Washington withdrew. While Rouhani insisted that the US has to “make up for its past mistakes,” he also signaled that reparations for sanctions damage wouldn’t be a precondition for reviving the agreement. “If we start demanding compensation, then it just means sanctions will last longer,” Rouhani said. “We have to decide how big the damages are, who has to pay, will they pay, and which forum decides.” The Iranian president also expressed willingness to meet with Biden if the US lifts sanctions and returns to the agreement. If a meeting “were possible this hour, I wouldn’t postpone it to the next,” he said.

TankerTrackers, which uses satellite imagery to follow deliveries, estimated Iranian crude oil exports hit 1.2 million b/d during the fall, up from 481,000 in February. There are, however, more conservative Iranian export numbers from other sources, which suggest US sanctions have kept most Iranian crude bottled up. But the sharp increase seen across the three shipment trackers means Tehran has been more successful recently in selling its oil.

Tehran is planning to produce 4.5 million b/d of crude oil and condensate in its next year that starts Mar. 21st, and export 2.3 million b/d if current US sanctions are lifted. The country’s budget for next year assumes that the exports have a sanctions-free market for Iran.

Iraq: Baghdad is likely to be tested again in 2021 as the volatile country faces its deepest economic crisis in decades, with fractious parliamentary elections looming in June. Since OPEC teamed up with Russia and other allies in 2017 on a series of production cuts, Iraq has struggled to comply with its output quota. Baghdad cites its desperate need for oil revenues to rebuild after years of war and its long-standing dispute with the semi-autonomous Kurdistan region, which controls part of Iraq’s crude production.

Iraq is moving forward with plans to devalue its currency by nearly 23 percent in response to the dire financial crisis. This extreme policy measure will not come close to balancing a 2021 budget projected to authorize record spending. According to a provisional draft of the 2021 budget, the Central Bank of Iraq will move its long-standing currency peg from 1,182 Iraqi dinars per dollar to 1,450 dinars per dollar.

Iraq’s oil production, including output from the semi-autonomous Kurdistan region, fell 4 percent month on month in November, falling below its OPEC+ quota as bad weather disrupted exports from federal ports. The country pumped 3.685 million b/d in November, below its 3.804 million b/d allocation and down from 3.842 million b/d in October.

Libya: Crude oil production continues to increase compared to production levels before the Libyan oil ports’ blockade. Libya’s Sirte Oil and Gas Production and Processing Company has increased production to over 100,000 b/d, compared to the average 55,000 b/d rate in January. Sirte Oil and Gas carried out a program to boost productivity and worked over 24 oil wells, which doubled its production. This news is not welcomed by OPEC+, which is doing its best to hold down production, while Libya is not subject to production restrictions.

Venezuela: PDVSA has begun transferring crude off a slowly sinking offshore oil storage facility. Governments in two neighboring countries have voiced concerns for months about the potential of a massive spill should the ship sink. Last week the company began the first of several transfers from the Nabarima, a floating storage and offloading vessel (FSO), anchored in the Corocoro oilfield off Venezuela’s eastern coast, onto a barge. The barge will ferry the crude onto PDVSA’s Icaro tanker, a process expected to take weeks.

3. Climate change

Last week, President-elect Biden continued to make choices for top officials in his cabinet that underscore his emphasis on combatting climate change and accelerating the move toward a clean energy transition. Biden’s decision to name two staunch environmentalists to the top climate and energy jobs in his administration underscores not only the urgency of the president-elect’s mission to tackle global warming but also the influence of the Democratic party’s progressive wing. Jennifer Granholm, a two-term governor of Michigan and renewables advocate, has been tapped to head up the Department of Energy. At the same time, Gina McCarthy, a former Environmental Protection Agency administrator, is set to take the new role of domestic climate tsar to oversee the administration’s plan across many federal agencies.

Biden’s recent picks for his environmental team will put environmental justice issues at the center of his administration’s agenda. Those picks are set to seriously tackle the disproportionate impact specific communities face from despoiled air and land.

It will take $2.5 trillion over the next decade to get the US on a path to a carbon-free economy, according to Princeton University researchers. Still, the transition will help to pay for itself, those researchers say. The effort is the first significant assessment since the election detailing how the US can transition to an energy system that satisfies scientific guidance for keeping the climate livable. While the upfront costs are high, they would be offset by savings associated with switching to cheaper electricity and creating as many as 1 million new jobs, according to the researchers.

China promised incremental new steps to address climate change in the next decade but signaled it would not reveal all of its plans before seeing the next moves taken by the US. Speaking at an online summit on the fifth anniversary of the Paris climate agreement, Xi Jinping said that by 2030 China would reduce its carbon intensity by over 65 percent. Carbon intensity is a measure of greenhouse gas emissions relative to economic activity. That goal means that as China’s economy grows, so will its emissions, but at a slower rate.

ExxonMobil says it would reduce its greenhouse gas emissions, bending to pressure from investors calling on the company to address the risks posed to its business by climate change. The company had long resisted such forces, and among the major multinational oil companies was the last holdout in refusing to commit to any corporate-wide emissions reductions. Exxon’s new emissions pledge is limited, modest and does not represent a change in strategy for the company, which has remained committed to expanding oil and gas production.

The production of LNG involves a certain amount of greenhouse gas emissions. Now, Wood Mackenzie is warning that global energy transition goals could threaten more than two-thirds of the world’s supply of LNG, leaving trillions of cubic meters of gas resources stranded. This forecast is a stark departure from pretty much all gas demand projections, which invariably see this demand growing as gas replaces oil with less polluting fossil fuel, especially in developing economies.

4. The global economy and the coronavirus

As the coronavirus continues its surge across the U.S. and Europe, where vaccinations recently began, total infections around the world have now topped 75 million.

United States: More than 128,000 people had been vaccinated as of Friday. But that total is just slightly more than half the number of new cases reported across the country the same day. The U.S., the world’s largest coronavirus hot spot with more than 17.6 million people who have been infected overall, reported on Friday its first single-day caseload of more than 250,000 new infections.

The number of Americans applying for unemployment benefits rose again last week to 885,000, the highest weekly total since September, as a resurgence of coronavirus cases threatens the economy’s recovery. The numbers show that nine months after the virus paralyzed the economy, many employers are still slashing jobs as the pandemic forces more business restrictions and leads many consumers to stay home.

China: The US added dozens of Chinese companies, including the country’s top chipmaker SMIC and Chinese drone manufacturer SZ DJI Technology, to a trade blacklist. The Trump administration is increasing tensions with China during its final weeks in office, leaving more problems for his successor.

China’s largest refiner, Sinopec, expects domestic demand for oil products to peak by 2025 due to COVID impacts and the rise of electric vehicles. “China’s oil products will enter a final growth phase before peaking in the next five years,” the Economics and Development Research Institute at Sinopec said. According to the research institute, gasoline demand in China will likely peak in 2025, while demand for diesel could peak as soon as next year. Chinese oil product demand is seen down by 7 percent this year, the institute said, as the pandemic cut consumption in China first.

Crude oil throughput at Chinese refineries, on the other hand, is expected to remain flat year over year in 2020, at around 13.4 million b/d, the think-tank forecasts. Sinopec’s Economics & Development Research Institute also foresee China becoming the world’s top refiner with about 20 million b/d of capacity by 2025.

European Union: Economic mobility in Europe’s biggest economies slipped in the week ending Dec. 13th as regional governments announced a new round of curfews, lockdowns, and travel limits to check surging COVID-19 infection rates ahead of the Christmas holiday. With most stores shut, tight limits on social contacts, no singing in church, and a ban on fireworks sales, Germany is ratcheting up its pandemic restrictions to cut the stubbornly high rate of coronavirus infections. Chancellor Merkel said she and the governors of Germany’s 16 states agreed to step up the country’s lockdown measures beginning Wednesday to Jan. 10th to stop the country’s exponential rise of COVID-19 cases.

Faced with a new mutation of the coronavirus with “significantly faster” transmission rates, Prime Minister Boris Johnson tightened pandemic restrictions, including banning travel abroad in some parts of the country and rolling back relaxed rules over the holiday period. The new mutation, or variants, was first detected in southeast England in September and is becoming more prevalent in recent cases.

The Netherlands is banning flights from the UK for at least the rest of the year in an attempt to make sure that a new strain of coronavirus that is sweeping across southern England does not reach its shores. The ban came into effect Sunday morning and the government said it was reacting to tougher measures imposed in London and surrounding areas by British Prime Minister Boris Johnson. The Dutch say they will assess “with other European Union nations the possibilities to contain the import of the virus from the United Kingdom.”

The UK and European Union are heading for a final battle over fishing rights as trade talks reach a climax, with officials cautiously predicting a deal within days. However, people close to the negotiations warned that the differences between the two sides on what access EU boats will have to UK waters are still substantial — and failure to reach an agreement would kill the whole deal.

German Chancellor Merkel repeated that the EU is prepared for no deal. “The Commission is again negotiating, with all our agreement, in these hours and days until the end of the week, to see if there can still be a solution,” she told Germany’s lower house of parliament. “There has been progress but no breakthrough.”

Russia: President Putin said last week that the state budget was becoming less dependent on oil and gas, critical exports for one of the world’s dominant petro-economies. Putin told reporters during a marathon end-of-year press conference it was positive that “70 percent of the Russian budget is not formed by oil and gas revenues”. “We are not completely there, but still, we are starting to get off the so-called oil and gas needle,” he said. The share of hydrocarbon revenues was 40 percent of the 2019 budget.

The controversial Russia-led gas pipeline Nord Stream 2 is likely to start delivering first gas to Germany by the end of 2021, Russian energy experts said. Last week, work off Germany’s coast, the endpoint of the pipeline, resumed, with the pipe-laying vessel Fortuna laying a 1.6-mile section of pipe. US sanctions have delayed offshore construction works as the US looks to thwart the pipeline’s completion by broadening the scope of sanctions against service providers and those funding vessels involved.

At the core of Russia’s hydrocarbons-related power is its Arctic oil and gas reserves. The Russian Arctic sector comprises over 35,700 billion cubic meters of natural gas and over 2,300 million metric tons of oil and condensate, the majority of which are located in the Yamal and Gydan peninsulas. According to recent comments from President Putin, the next 10-15 years will witness a dramatic expansion in the extraction of these Arctic resources, and the build-out of the Northern Sea Route as the primary transport route to export gas and oil in the global oil and gas markets, especially to China. Last week it was revealed that Russian oil giant Rosneft had discovered a massive new gas field in the Kara Sea.

Saudi Arabia: The kingdom reduced its budget plan for 2021 by 7 percent from this year’s response to the pandemic’s economic fallout, which pushed oil prices to multi-year lows. Riyadh will spend some $264 billion next year as it battles a substantial deficit resulting from the oil price collapse. Earlier this year, the kingdom was forced to implement some unpopular austerity measures, including a threefold increase in value-added taxes and the cancellation of so-called cost-of-living allowances for much of the population.

Saudi Arabia’s crude oil exports rose to 6.15 million b/d in October, up by nearly 100,000 b/d from September. Total oil exports from Saudi Arabia, including crude oil and total oil products, increased again month over month by 281,000 b/d to 7.38 million b/d in October, according to the JODI database, which collects self-reported figures from 114 countries.

According to a spokesman from the Saudi’s Ministry of Energy, a Singapore-registered commercial oil tanker was attacked by an “explosive-laden boat.” It is unclear who was behind the attack. The ship was anchored at the Port of Jeddah, a Saudi port. It was reported to be damaged in the early hours of Monday.

India: Official figures show the country exceeded 10 million new coronavirus infections on Saturday, much later than predicted only a month ago as the pace of infections slows. After hitting a peak of nearly 98,000 daily cases in mid-September, daily infections have averaged around 30,000 this month, helping India widen its gap with the US, the world’s worst-affected country with more than 17 million cases. The virus has so far killed 145,136 people in India.

Given that India has more than three times the population as the US and yet only about half the deaths from the coronavirus, these official statistics are suspect. Compared with the US, Europe, and much of Asia, India has fewer advanced medical facilities, so it seems likely that millions of Covid-19 cases are not being treated or reported to authorities.

Latin America: With more deaths per capita during the pandemic than any other region, Latin America is suffering from a second surge of Covid-19, ending a period of several months where cases and deaths declined. The surge is particularly acute in the region’s two biggest countries, Mexico and Brazil. Daily deaths in Brazil topped 1,000 on Thursday for the first day since September, and the country posted roughly 70,000 new daily infections on Wednesday and Thursday, a record. In Mexico, the daily death toll has doubled to about 600 a day from about 320 in mid-October. Mexico City has ordered nonessential businesses closed for the holiday season as a rebound in Covid-19 cases threatens to overwhelm hospitals.

Colder weather in the Northern Hemisphere is partly to blame for the uptick in cases in Mexico by forcing more people indoors. But the more important factor across the region appears to be fatigue with social-distancing measures. In Brazil, people are increasingly gathering on the beach and at parties during the Southern Hemisphere summer. “People have completely let down their guard—they’re planning parties, traveling, and they will pay the price,” said Eliseu Waldman, an epidemiologist at the University of São Paulo.

5. Renewables and new technologies

There is a $205-billion opportunity in renewable energy for Southeast Asia from which China, Japan, and South Korea could benefit, Greenpeace said in a new report. “These three East Asian countries are top global energy investors, with established ties in Southeast Asia. But coal finance is drying up, and banks struggle to get a grip on clean energy finance. And state-backed public development banks once again need to play the trailblazer role to engage new markets.”

US solar power capacity additions accounted for 43 percent of all incremental power generation capacity through Q3 2020 and appear set to record 19 GW of new solar capacity installations in 2020.

BloombergNEF’s latest lithium-ion battery price index finds the current weighted-average price for lithium-ion storage batteries is $137 per kilowatt-hour. That’s down from nearly $1,200 per kilowatt-hour in 2010, a price decline of almost 90 percent in about ten years. There’s a significant variance among prices depending on the application. A battery used in a bus is less expensive than one used in an electric passenger car, which is less costly than one used for stationary energy storage on the power grid.

Solid Power, a developer of all-solid-state batteries for electric vehicles, announced that it is producing 20 Ah multi-layer all solid-state lithium metal batteries. In October, Solid Power had announced the production and delivery of the company’s first-generation multi-layer, multi-ampere hour all-solid-state lithium metal cells. Every cell that Solid Power produces is free of any liquid or gel. The 330 Wh/kg, 22-layer cells have higher energy density than any commercially available lithium-ion battery manufactured today, with a roadmap to surpass 400 Wh/kg by 2022.

Industry experts predict that hydrogen could become a globally traded energy source, just like oil and gas. Simultaneously, the Bank of America says the industry is at a tipping point and set to explode into an $11 trillion marketplace. A few months back, the European Union set out its new hydrogen strategy to achieve carbon neutrality for all its industries by 2050.

Xcel Energy will work with Idaho National Laboratory to demonstrate a system that uses a nuclear plant’s steam and electricity to split water. The new project is the first to pair a commercial electricity generator with high-temperature steam electrolysis technology. It builds on a project launched last year to demonstrate how hydrogen production facilities could be installed at operating nuclear power plants. This would be a game-changer for both atomic energy and carbon-free hydrogen production for numerous industries.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Insurer won’t back fossil fuels: Lloyd’s of London, the world’s largest insurance market, said it’s joining efforts to support the pivot to a lower carbon economy and set out a timetable to phase out coverage for some of the most polluting industries. Lloyd’s said Wednesday it would end investment in thermal coal-fired power plants, thermal coal mines, oil sands, and new Arctic energy exploration activities. (12/18)

LNG has emerged as the top choice among alternative fuels to marine gasoil and low-sulfur fuel oil to power ships. This paves the way for another growth opportunity for the natural gas and LNG industries…given that the shipping industry must reduce sulfur emissions. (12/18)

The first VLGC tanker powered by liquefied petroleum gas was headed toward the Panama Canal on Dec. 17th after loading at Enterprise Products Partners’ hydrocarbon terminal on the Houston Ship Channel. (12/18)

The Abu Dhabi National Oil Co – the key corporate proxy at the center of the US’s Middle East pushback against increasing Chinese and Russian influence across the region via the recent ‘normalization deals’ between Israel and the UAE and Bahrain –– last week further cemented this alliance with the award of a second major oil and gas exploration block concession to the US’s Occidental. (12/16)

Oman is moving full steam ahead with its oil production, establishing a new company for upstream oil and gas. Energy Development Oman (EDO) will have a stake in the majority state-owned Petroleum Development Oman (PDO) as well as developing independent projects. EDO will be primarily focused on Oman’s biggest oil field in Block 6, which currently produces 650,000 bpd. (12/14)

India hasn’t put the pandemic behind it, but its oil refineries have. Three state-run processors are currently operating at close to 100 percent capacity or higher. Behind the recovery is strong demand for gasoline and liquefied petroleum gas as many opt to drive their cars overtaking public transport and cook at home to avoid restaurants. (12/17)

Crude loadings of Nigeria’s critical crude Qua Iboe have been temporarily halted due to a fire at the terminal. Qua Iboe is Nigeria’s largest export grade and popular among global refiners, with India, the US, Canada, Italy, Spain, Indonesia, and the Netherlands being essential buyers. (12/15)

Nigeria might be under pressure to fund its 2021 budget following a 14 percent drop of its oil output—from over 1.7 mb/day down to 1.5 mb/day—during the first ten months of 2020. (12/15)

The growing oil boom in the offshore Guyana-Suriname Basin continues to gain pace after ExxonMobil announced that it had made a promising discovery off Suriname with partner Malaysia’s Petronas. (12/15)

In Mexico, the last time foreign interests were permitted to invest in oil, it did not end well. At the time, the Mexican president, Lázaro Cárdenas, seized foreign actors’ assets, used them to create the national oil monopoly Pemex, and exiled all international competitors. And now, nearly a century later, it’s looking as if history just may be set to repeat itself. The current president believes that the only entities to profit from Mexican resources should be Mexican workers, Mexican companies, and the Mexican government. (12/17)

Oil sands comeback? After years of shadowing the US shale boom, the Canadian oil sands are emerging from 2020’s historic market crash with a slew of upbeat outlooks from Wall Street equity analysts. (12/15)

According to Baker Hughes, Canada’s oil rig count dropped by 11 to 41, while their natural gas rig count increased by 2 to 61. The total count of 102 is down by 47 year over year. (12/19)

The US oil rig count increased by 5 to 263, Baker Hughes reported on Friday. Gas rigs rose by 2 to 81. Total oil and gas rigs in the US are now down by 467 compared to this time last year. (12/19)

Traveling hit again: The number of Americans taking road trips this Christmas is poised for a 25 percent slump, with most staying home amid soaring coronavirus cases, according to GasBuddy analysts. The estimate provides more evidence of gasoline demand declining sharply during the latest wave of the pandemic. (12/16)

Divesting oil stocks: The Rockefeller Foundation, set up by John D. Rockefeller in 1913 and funded with oil industry profits, decided to divest from fossil fuels and not make any new investment in the industry. (12/19)

California state regulators signed off on a three-year plan by Southern California Gas and San Diego Gas & Electric to sell what the utilities call “renewable natural gas” or “biogas.” This biogas comes from capturing methane from manure lagoons at dairy farms, landfills, and elsewhere. The utilities say the strategy is a way to reduce greenhouse gas release into the atmosphere and help California meet its climate goals. (12/19)

The toll on coal continues: Data from the EIA released earlier this year showed that US power companies announced the retirement of 546 individual coal-fired units from 2010 through the first quarter of 2019 or about one-third of the nation’s coal-fired generating fleet. More than 50 US coal companies declared bankruptcy during the period, with more than 100 GW of generating capacity taken offline. About 60 percent of the nation’s coal-fired power plants—318 out of 530—had been retired in the past ten years. (12/16)

Global coal demand is poised to rebound next year as the economy recovers, and the US and Europe may see the first increase in consumption in several years, the IEA said. Despite the global shift toward economies based on renewable energy, coal looks set to keep its role as the world’s biggest power source, although its share will slip to 35 percent in 2021 from 36.5 percent last year. (12/18)

Australia is studying plans to transform a disused underground coal mine into a pumped hydro facility, part of a broader effort to reuse retiring fossil fuel sites for renewable energy generation. The A$13 million pilot trial at the Newstan Colliery, about 140 kilometers northeast of Sydney, could offer a blueprint for dozens of expiring mines that’ll be retired in coming decades. (12/18)

Nukes of the North? Canada’s Minister of Natural Resources released a national SMR (Small Modular Reactor) Action Plan, which responds to the 53 recommendations identified in Canada’s SMR Roadmap launched in November 2018. (12/19)

Improving solar cells’ efficiency can make a massive difference to the amount of energy produced from the same surface area and the same amount of sunshine. Researchers have now hit the world record efficiency of 29.15 percent in the perovskite/silicon tandem solar cell category. (12/16)

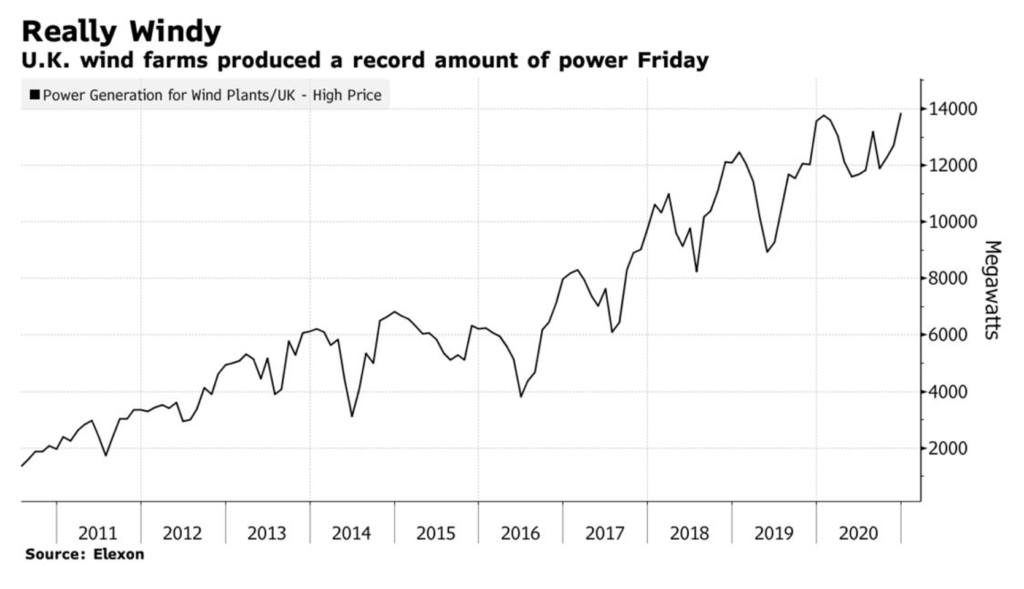

UK wind energy record: Wind turbines generated a record amount of UK power on Friday as the growing number of turbines at sea take advantage of the windy conditions off the coast. The record production is a glimpse of the future as the UK seeks to push $27 billion of investment to quadruple offshore wind capacity to help the country eliminate its carbon footprint by the middle of the century. (12/19)

RE growth rockets: Despite market uncertainty and construction delays in the pandemic, US renewable power capacity installations have surged to a record this year. Solar capacity installations are set for a 43 percent increase this year. The United States is on course to see a record-breaking 23 GW of wind turbine capacity additions this year, smashing the previous record from 2012 by nearly 10 GW. (12/17)

World’s largest RE park: India’s Prime Minister Narendra Modi officially launched the construction of a megapark that will produce 30,000 megawatts of renewable energy and be the world’s largest renewable energy facility. (12/16)

The growth in China’s EV sales would help spur demand for battery metals and lend strong support to China’s battery metals prices. China’s EV sales might reach 1.8 million units in 2021, up 40% from 2020. (12/17)

Electric vehicles are set to erase conventional cars’ current price advantage when battery pack prices drop to $100 per kilowatt-hour in 2023, BNEF’s new 2020 Battery Price Survey showed on Wednesday. Lithium-ion battery pack prices have declined by 87 percent from 2010 to 2019, with the volume-weighted average hitting US$156/kWh last year, according to estimates from BNEF. (12/17)

Critical battery metals often come from unsustainable and ethically compromised sources, while vehicle batteries often end up as waste at the end of their lifecycle. As EVs sales have grown in recent years, so have the number of companies working to recycle the spent EV batteries to extract valuable minerals. (12/15)

Battery development: Oak Ridge National Laboratory researchers have developed a new family of cobalt-free cathodes with the potential to replace the cobalt-based cathodes typically found in today’s lithium-ion batteries that power electric vehicles and consumer electronics. These novel cathodes are designed to be fast-charging, energy-dense, cost-effective, and longer-lasting. (12/19)

Chicago EV charging deserts: while electric cars are registered throughout Chicago, they, along with the city’s charging stations, are most heavily concentrated in the city’s affluent and mostly white North Side. As of 2018, 70 percent of all public charging stations were located in just three community areas. (12/16)

EU trucks and carbon: Europe’s truck manufacturers have concluded that by 2040 all new trucks sold need to be fossil-free to reach carbon-neutrality by 2050. It will be possible to meet this target provided the right charging/refueling infrastructure is built, and a coherent policy framework is put into place, including CO 2 pricing to drive the transition. (12/16)

The biggest van and truck manufacturers in Europe have committed to phasing out traditional combustion engines running on diesel by 2040, ten years earlier than initially planned, the Financial Times reported on Monday ahead of an official announcement from the truck makers. The companies, including Ford, Scania, Man, Volvo, DAF, Daimler, and Iveco, have signed a joint commitment to phase out diesel trucks within two decades and work to roll out vehicles running on hydrogen or using battery technology. (12/15)

Ammonia-fueled tanker: The technology group Wärtsilä and Grieg Edge, the innovation hub of Norwegian shipping group Grieg Star, are jointly running a project to launch an ammonia-fueled tanker producing no greenhouse gas emissions by 2024. (12/19)

Rail investment to return: Siemens AG sees the rail market bouncing back from a coronavirus slump, aided by an international push to slash CO2 emissions from transport. The global market for trains and related infrastructure will expand by a quarter over the next three years to exceed pre-coronavirus levels. (12/18)

$$ backing H2: The hydrogen-powered aviation startup ZeroAvia has raised $37.7 million from the UK government and a group of investors that includes funding by Bill Gates and Amazon.com Inc. ZeroAvia said it aims to use the money to advance the development of technology that could cut carbon emissions from the aviation sector by replacing fossil-fuel-burning propulsion with a hydrogen fuel-cell system. (12/17)

British Airways will work with hydrogen plane startup ZeroAvia to speed the switch to hydrogen power for commercial aircraft. (12/14)

H2 tech: Southern California Gas Co. will field test a new technology that can simultaneously separate and compress hydrogen from a blend of hydrogen and natural gas. The new technology works by applying an electrical current across a hydrogen-selective membrane to allow only hydrogen to permeate it while blocking the natural gas components. (12/18)

Carbon sink investment: BP has bought a controlling stake in the largest US producer of carbon offsets, doubling down on a bet that preserving forests will be critical to companies meeting their carbon-reduction goals. The oil giant in late 2019 made a $5 million venture investment in Pennsylvania’s Finite Carbon, which helps landowners sell their forests as carbon sinks. With majority ownership of Finite, BP plans to take global the business of paying landowners not to cut down trees. (12/16)

Six warmest years: Next year is already set to be among the hottest on record, even as the planet experiences the temporary cooling effect of the La Nina phenomenon, according to the UK’s Met Office. The six warmest years on record have all occurred since 2015.

Germany will set another temperature record this year, marking the hottest period since such data collection begun in 1881 and the third year of extreme weather conditions. No cold spells are expected for the rest of the year, making it inevitable that 2020 will go down as the warmest year in the country’s history. (12/17)