Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Many U.S. shale companies are drowning in debt. Just a few days ago, Extraction Oil & Gas, a large shale driller in Colorado, declared bankruptcy. Chesapeake Energy, which arguably best represents the debt-driven shale bonanza, is expected to file for bankruptcy any day now. The Chapter 11s, and even the “Chapter 22s” – a nickname for those that are set to declare bankruptcy for the second time – are expected to continue to rise. All the while, steep decline rates will likely more than overwhelm any new drilling that takes place. Oil prices have bounced off of April lows, but U.S. shale is far from a comeback.”

Nick Cunningham, Oilprice.com

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

New York oil futures rose 2.3 percent on Friday to close at $39.75, the highest level since March 6th. The 9.6 percent increase for the week marks the seventh gain in the last eight weeks. Brent settled at $42.19. Oil traders and Saudi Aramco talked up the strength of the demand recovery in recent days, and prices for some of the world’s major oil products have begun to move higher. OPEC+ assurances that output cuts would happen this time contributed to higher prices.

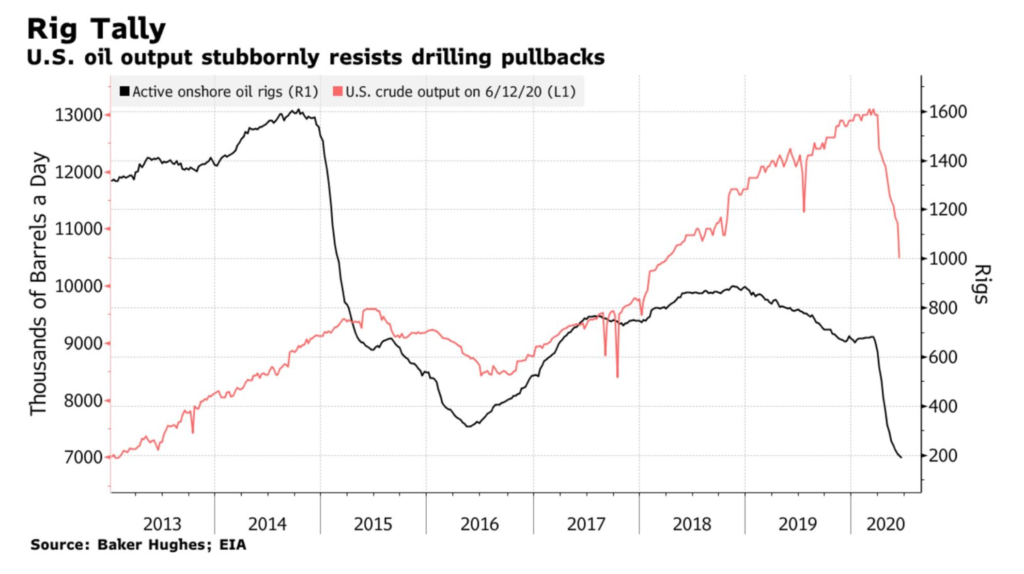

The EIA weekly stocks report showed US crude output declined for an eleventh straight week to just above 10 million b/d. That comes as the number of rigs drilling for oil had fallen 72 percent over the past 14 weeks to a level not seen since before the shale-oil revolution began at the beginning of the last decade. The report also showed that US petroleum inventories climbed to a record for the second week in a row, more than offsetting signs of a recovery in fuel demand. Gasoline and distillate inventories fell the week before last, reflecting a slight pick-up in demand as the summer driving season begins and the coronavirus lockdowns are easing in much of the country.

OPEC+: The cartel’s Joint Ministerial Monitoring Committee (JMMC), which met last Thursday, is confident that all members would reach their respective production quotas as laid out in the Declaration of Cooperation. The committee highlighted the 87 percent compliance rate for the cuts that were supposed to last through the end of June. Still, the group agreed to extend the cuts into July on the condition that all members fully comply with their cuts. The JMMC stressed how important it was for each country to reach 100 percent compliance, even if it took until September to make up for what laggard members such as Iraq and Kazakhstan overproduced.

Shale Oil: Oil drilling shrank for a 14th straight week amid weak crude prices and skepticism about a recovery in energy demand. Drillers idled ten oil rigs in onshore US fields last week, bringing the total to 189. Despite last week’s rise in crude prices to a three-month high of around $40 a barrel, they still are more than 35 percent below the January high.

The rapid fall in the rig count over the last couple of months is reflected in the steady decline of EIA’s estimate of oil production in the US. Output fell again last week to 10.5 million b/d, which is 2.6 million b/d off the all-time high and 600,000 b/d lower than the week prior. The sharp drop in last week’s report may be partially due to the recent tropical storm which temporarily shut down about a third of US offshore production.

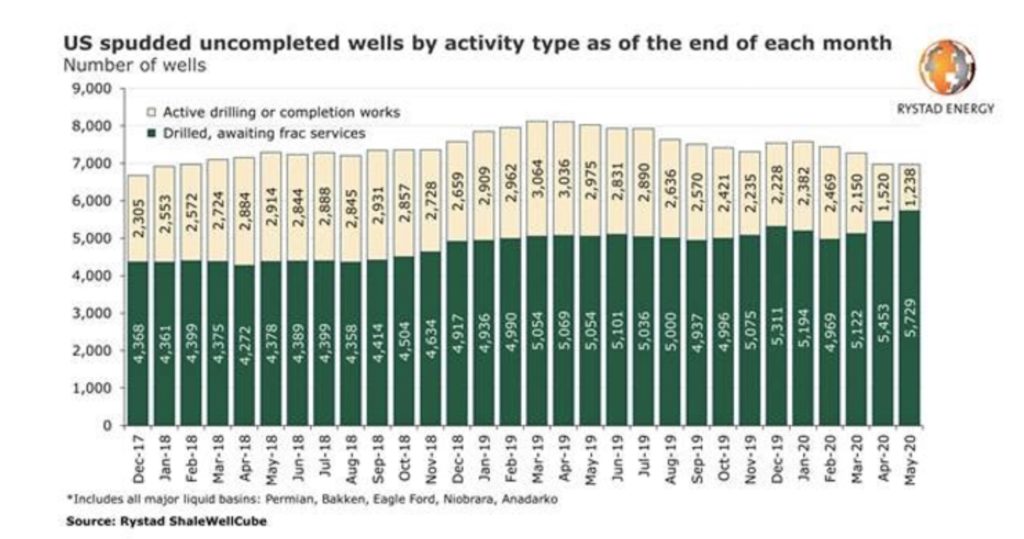

To keep US shale oil production steady at 7 to 8 million b/d requires about 600 drilling rigs making new wells to make up for the rapid depletion from existing shale oil wells. Now that the number of rigs drilling for shale oil has fallen to about 170, a decline in US oil production over the next 18 months is inevitable. Even if the price of oil should rise considerably in the immediate future, the 450+ additional rigs needed to maintain peak US shale oil production cannot be brought back online in time to prevent a decline of millions of barrels per day. Production could grow briefly this summer as recently shutdown wells are brought back into production adding as much as 500,000 b/d to daily production but by fall production will be dropping steadily. “The one wild card yet to be played that could impact the net decline by next fall or winter would be stepped-up completion of some drilled-but-uncompleted-wells.

Prognosis: The course of the coronavirus is almost certain to be the primary determinant of where the demand for and supply of oil and other energy goes in the next few years. We are currently in a phase where lockdowns around the world are being lifted, although many believe the reopening of many economic activities is premature. The virus is still spreading rapidly in Africa, Latin America, and the Middle East. Moreover, even in the US, China, Europe, where restrictions have been relaxed, there are indications that there may be more to come – perhaps much more.

A new report from the IEA says that oil demand may not recover to pre-pandemic levels until 2022. However, the surplus of crude oil is narrowing more quickly than expected. Global supply fell by 12 million b/d in May, year-on-year, due to the roughly 9.4 million b/d of cuts from OPEC+ and curtailments from the US and Canada, among others.

According to the IEA, oil demand is expected to fall by 8.1 million b/d in 2020 on an annual average basis, the largest decline ever recorded. OPEC is predicting that oil will only be down by 6.4 million b/d in the second half of 2020.

In 2021, the IEA forecasts that demand will rise by 5.7 million b/d, a considerable increase. At 97.4 million b/d, the predicted consumption for 2021 will be 2.4 million b/d below 2019 levels, although the IEA warned about significant uncertainty to all of these projections. It is difficult to see air travel, and cruise and container ships being back to anywhere near normal by then.

Road traffic has seen somewhat of a V-shaped recovery, not just because of the easing of lockdowns but also because more people are resorting to cars instead of mass transit to maintain isolation from the virus. Much of the current demand destruction is concentrated in the aviation sector, which is facing an “existential crisis,” the IEA said. Passenger traffic this year could be down 55 percent compared to 2019, according to data from the International Air Transport Association – and even this seems optimistic.

Looking at the longer-term, Rystad Energy’s annual global energy outlook predicts that the pandemic will expedite what is now known as “peak demand,” the flip side of the “peak oil coin”. Rystad says the rapid drop in capital expenditures in remote offshore areas will result in a reduction of the world’s recoverable oil by around 282 billion barrels. Globally, recoverable oil resources decrease to 1,903 billion barrels, 42 percent of which are in OPEC territory, and the remaining 58 percent is located outside the cartel.

2. Geopolitical instability

Iran: Tensions between Tehran and Washington may be easing a bit. Iranian Foreign Minister Zarif tweeted last week that “an agreeable solution is possible” for the United Nations nuclear watchdog’s request for access to two of Iran’s nuclear sites. The tweet came after the head of the UN’s atomic watchdog agency said that Iran must provide inspectors access to places where the country is thought to have stored or used undeclared nuclear material. Britain, France, and Germany said they would not back US efforts to trigger the reimposition of UN sanctions on Iran unilaterally, but said they wanted talks with Tehran over its ongoing violations of the 2015 nuclear accord.

Iran was hit hard by the coronavirus pandemic and does not need troubles from more US sanctions. Teheran can read polls as well as anybody and may have concluded that it is in their interest to see what happens in the US elections before deliberately provoking more trouble over nuclear weapons.

Iraq: The rapid spread of the virus is causing severe disruptions to oil sector operations and hurts the ability of Iraq’s security forces to respond to an intensifying insurgency. Confirmed cases of the infection are rising exponentially. In May, there were only 4,353 new cases nationwide. However, in the first 17 days of June, there have been 17,816. The official total in Iraq, with 40 million people, is now 25,000 cases. There is likely to be considerable under-reporting as Iran, with a population of 80 million, is reporting 200,000 cases. Iraq’s doctors are contracting the coronavirus by the hundreds, as a rising wave of infections threatens the country’s health-care system.

The state-run Basra Oil Company and the South Refineries Company have scaled back their current staffing. They are now operating with just one-quarter of their usual number of employees. Security forces responsible for fighting insurgents in northern Iraq have also been hit with coronavirus outbreaks. A senior Interior Ministry official said pandemic-related precautions had also caused security services across both the Interior and Defense ministries to cut down on training courses, reducing the overall effectiveness of the security forces by “15 to 20 percent.”

“The reason for the rise in cases is thought to be because people are ignoring curfews and their ignorance about the virus,” said a nurse at a hospital in Nassiriya. The pandemic impact is being felt around the country and becoming more visible as public officials fall ill. The pandemic is stretching Iraq’s health care system to its limit. “We are still holding up,” said a doctor in a Basra hospital. “But overall, the hospital and the other facilities can no longer hold up to the increasing number of cases.” For now, there are enough hospital beds, the doctor said, but the virus is also taking a toll on the country’s doctors and nurses. “Lately, we have been losing many of them, as they get infected and have to go into isolation,” the doctor said. “If it goes on like this – we can’t tell [what will happen].”

Iraq’s state-run North Oil Company has fallen two months behind in paying hundreds of local residents contracted to guard oil wells in the Kirkuk area, compounding the threats posed by an intensifying insurgency. The payment delays are one symptom of Iraq’s financial crisis, which has caused significant disruptions in other parts of the country’s oil sector.

The Oil Ministry has approached international oil companies operating its largest oilfields to reduce production further, and they have agreed. An earlier report said Baghdad had asked BP, which operates the giant Rumaila field in the southern part of the country, to reduce by another 10 percent. Rumaila is Iraq’s biggest oil field and produces some 1.5 million b/d. Iraq’s production quota under the latest OPEC+ agreement for production control was 3.6 million b/d. According to Bloomberg calculations, the country exceeded this by as much as 600,000 b/d last month.

Iraq now expects to export 2.8 million b/d of crude oil in June as it seeks to firmly commit to the OPEC+ cuts. The government has ordered cuts at Rumaila, West Qurna-1, and Zubair, three of Iraq’s most prolific fields operated by BP, ExxonMobil, and Eni respectively.

3. Climate change

A special edition of the IEA’s annual World Energy Outlook examines more than 30 policies with the potential to lift the world out of its economic slump and generate climate-safe growth. Plummeting carbon emissions and big government spending—two of the significant developments in 2020—could create an unprecedented opportunity for the world to meet the goals of the 2015 Paris climate agreement, according to the IEA. With $1 trillion of investment over each of the next three years, global energy-related CO₂ emissions could end up falling in 2023 by 4.5 billion metric tons, or 14 percent of last year’s total.

The IEA is releasing its analysis at a time when many nations are beginning to consider what the next phase of the pandemic stimulus should look like, giving its recommendations unusual urgency. The energy sector has received limited stimulus funding thus far. Still, according to the report, more significant support would further the triple goals of recovery: growth, job creation, and climate-safe development.

Goldman Sachs says that clean energy investment has hit a critical investment point and that investment in renewables likely will take a huge leap during this decade. The firm believes that investment in renewable energy is set to surpass oil and gas for the first time next year. Trillions of dollars are slated to pour into wind, solar, batteries, EVs, and green infrastructure in the coming decade. This will “drive $1-2 trillion per year of green infrastructure investments and create 15-20 million jobs worldwide.”

The year 2020 has been all about heat. Population data and warming projections suggest that our 6,000-year era of “just-right temperatures” may end. Barring mass migration, a third of humanity may live in Sahara-like conditions by 2070. Lethal combinations of heat and humidity hadn’t been projected to appear until after midcentury. Still, a study of 40 years of hourly weather-station data from all over the world finds that the Persian Gulf and Indus River Valley are already close to deadly conditions. The same study shows that episodes of extraordinary humidity and heat have doubled in frequency since 1979.

A prolonged heatwave in Siberia is “undoubtedly alarming,” climate scientists say. The freak temperatures have been linked to wildfires, a huge oil spill, and a plague of tree-eating moths. On a global scale, the Siberian heat is helping push the world towards its hottest year on record in 2020. Temperatures in the polar regions are rising fastest because ocean currents carry heat towards the poles, and reflective ice and snow are melting away. Russian towns in the Arctic circle have recorded extraordinary temperatures, with Nizhnyaya Pesha hitting 86 degrees F on 9 June.

May tied for the hottest on record. The US is heading into a potentially blistering summer, with warmer than average temperatures expected across almost the entire country into September, according to government researchers.

4. The global economy and the coronavirus

As much of the industrialized world reopens, we are gaining insight into which sectors of the world’s economy have been so devastated by the pandemic that they are unlikely to recover in the near future. Discretionary activities such as tourism, vacation travel, cruises, and air travel have been hurt the worst. More than 70 percent of the world’s ports of entry—air, sea, and land—restrict foreign travel. International air travel is expected to remain at about 20 percent of normal for the immediate future. United Airlines says its revenue for June will be about 90 percent lower than last year. Hotels are empty, cruise ships are not running, and businesses are finding that teleconferencing is an efficient way of conducting business with remote clients.

When the pandemic finally ends, expect the global economy to be less globalized than before. Governments are using the crisis to erect barriers to commerce and bring manufacturing home. Companies are reassessing far-flung, multinational production networks that have proven vulnerable to disruption.

Foreign trade is forecast to fall by as much as a third this year, and direct foreign investment by 40 percent. International investors pulled $83 billion out of emerging markets in March alone, a single-month record, though the investment totals rebounded slightly in April and May. Nearly 90 governments have blocked the export of medical goods to preserve supplies for their citizens, while 29 did the same with food, according to Global Trade Alert.

United States: By several metrics, the US economy rebounded faster than many anticipated. Payrolls increased by several million in May, and consumer spending on cars and restaurant meals exceeded expectations as states loosened restrictions. But the jobless claims data remain a glaring blemish that shows volatility in a labor market that entered the year in solid shape. Many US employers still are shedding jobs at a substantial rate, which points to a slow and prolonged recovery from the recession.

US industrial production rose by less than forecast in May after a record slump a month earlier. Output at factories, mines, and utilities increased by 1.4 percent from the prior month after a revised 12.5 percent plunge in April, which was the largest in records back to 1919. The median projection in a Bloomberg survey of economists called for a gain of 3 percent. Factory production rose 3.8 percent in May, compared with the median estimate for a 5 percent advance.

The US oil and gas labor market is amongst the world’s most severely hit by the downturn. More than 100,000 oil and gas jobs have already been lost, with most of them coming from support activities.

The Trump administration is preparing a $1 trillion infrastructure package focused on transportation projects. The Department of Transportation’s preliminary version reserves most funds for projects such as roads and bridges. It will also set aside about a quarter of the money for priorities such as 5G wireless infrastructure and rural broadband.

A recovery in demand for gasoline in the US hit a plateau last week as coronavirus cases surged in some states, undercutting refiners’ efforts to ramp up low fuel production. According to EIA data on Wednesday, gasoline consumption inched lower last week after three straight weeks of rises. Gasoline supplied by refineries– a proxy for demand – eased 30,000 b/d to 7.9 million b/d amid a spike in new infections in six states. The dip in demand follows five consecutive weeks of increases in refining rates.

Spikes in coronavirus infection rates were reported last week in several US states, mainly in the South and West. President Trump said the US would not close businesses again despite rising numbers of new infections. “We won’t be closing the country again. We won’t have to do that,” Trump said in an interview.

China: Coronavirus restrictions in Beijing were tightened last week, canceling flights and closing schools to stem a new outbreak in the capital. Officials said on Wednesday that 31 new cases were discovered on Tuesday, bringing the total number of infections in the city over the past six days to 137. Nearly 1,300 flights, or 70 percent of those scheduled to depart from Beijing’s two airports, were canceled on Wednesday. Officials announced that anyone boarding a plane would have to take a nucleic acid test, designed to detect traces of the virus.

The volume of traffic on Beijing’s streets fell sharply last week as authorities attempt to quell the new outbreak. Traffic congestion in the Chinese capital was 29 percent at 8 am Thursday during morning rush hour, according to data from navigation company TomTom International. That compares with 67 percent at the same time a week earlier and 62 percent for average levels at that time during 2019.

China plans to accelerate purchases of American agricultural products to comply with the phase one trade deal following talks in Hawaii last week. Beijing intends the increase after purchases fell behind due to the coronavirus. China’s government has asked state-owned buyers to make efforts to meet the phase one pact. However, the new purchase effort comes at a troubled time for US-China relations, with President Trump escalating criticism of the Beijing’s handling of the coronavirus crisis and signing off on Congress’s rebuke over repression of the Muslim Uighurs.

China’s crude oil imports jumped to a record high of 11.34 million b/d in May, while refinery throughput increased to near-peak levels. While oil demand from China is rebounding, domestic consumption is likely lower than what the figures suggest because China stepped up its crude oil stockpiling this year and is trying to boost exports of refined oil products. According to calculations by Reuters, China hoarded crude oil at a rate of 1.88 million b/d between January and May, up by around 670,000 b/d from the 2019 estimated fill rate of 1.21 million b/d. Since China does not report inventories, analysts are trying to guesstimate how much crude it is directing to storage based on data of imports plus domestic production, minus refinery throughputs.

European Union: Germany’s economic output will fall further in the second quarter than in the first, but the easing of coronavirus-related restrictions and leading indicators suggest the trough has been passed. A gradual relaxation of the lockdown means the economic revival likely started from May, the government said in its monthly report. Still, it cautioned that the recovery in the second half of the year and afterward would be sluggish. Leading economic indicators did not point to a sustainable recovery in the job market in the next few months. The government predicted a significant decline in exports and imports for 2020 as a whole.

Chancellor Angela Merkel’s cabinet signed off on plans to raise another $70 billion in debt to finance the country’s most extensive stimulus program in recent history. The proposal has yet to be approved by parliament and would increase net borrowing to 218 billion euros this year. In March, the Bundestag, authorized a debt increase of 156 billion euros. After years of fiscal discipline that brought Germany scorn and admiration alike, the debt had fallen from over 80 percent of the gross domestic product in the wake of the 2008 financial crisis to around 60 percent. Now it is again projected to rise to 77 percent.

Russia: Moscow is showing an unprecedented commitment to the OPEC+ production cuts by complying with its share of the reductions. As part of the deal sealed in April, Russia pledged to cut its production by 19 percent from February 2020. Energy Minister Novak said in April that his country had to cut its oil production from around 11 million b/d to 8.5 million. So far in June, Russia’s crude oil production has averaged 8.549 million b/d, according to estimates by Russian news agency TASS based on official government figures.

According to the Russian energy ministry, gasoline production at Russia’s oil refineries slumped to the lowest level in 15 years in May due to oil production cuts and as lockdowns slashed demand.

Saudi Arabia: Aramco completed the purchase of a majority stake in petrochemicals major Sabic, buying over 2 billion shares in the company for a total of $69.1 billion. Aramco signed a deal to buy 70 percent in Sabic from the Public Investment Fund of Saudi Arabia in March 2019, for the equivalent of $69.1 billion. The acquisition was part of Aramco’s preparation for going public, which happened at the end of last year. Earlier this year, there were media reports that Aramco may delay its purchase because of the pandemic and oil’s price collapse. There were even reports Aramco was seeking to renegotiate the price of the deal as Sabic’s market cap plummeted by 40 percent.

Aramco has begun cutting hundreds of jobs as it reduces costs after the slump in energy prices. The company is letting go of mostly foreign staff across several divisions. The company employs almost 80,000 people and goes through a round of cuts annually but this year’s decrease is bigger than usual.

The Saudis have idled offshore rigs and postponed the start of an $18-billion expansion project. In early May, offshore drilling contractor Noble Corp. said that its jack-up rig located offshore Saudi Arabia will be suspended for up to one year. Earlier last week, Shelf Drilling said that it had received a notification on the suspension of operations for the High Island IV jack-up rig.

5. Renewables and new technologies

Although the pandemic has slowed clean energy investments, renewable energy and green technologies have emerged as winners in the post-virus world. As solar and wind energy are free after the installations have been made, it makes no sense to curtail these sources of energy as compared to coal and natural gas, which always entail fuel purchases. According to a recent report from the International Energy Agency, renewables will be the only energy sources to grow in 2020 compared to 2019, in contrast to all fossil fuels and nuclear energy.

Goldman Sachs reports that spending on renewables is set to overtake oil and gas drilling for the first time next year, as clean energy affords a $16 trillion investment opportunity through 2030. Renewables including biofuels will account for about a quarter of all energy spending next year, up from about 15 percent in 2014. This is partly driven by diverging costs of capital, as borrowing rates have risen to as high as 20 percent for hydrocarbon projects compared with as little as 3 percent for clean energy.

The UK aims to drive down greenhouse gas emissions from aircraft to make carbon-free transatlantic flights possible within a generation, according to Transport Secretary Grant Shapps. Shapps said he had formed a group bringing together leaders from aviation, environmental groups, and government to form the “Jet Zero Council,” as he seeks to rebuild the industry in the wake of the pandemic. “This group will be charged with making net-zero emissions possible for future flights. Within a generation, our goal will be to demonstrate flight across the Atlantic without harming the environment,” Shapps said.

The British government has set a target to make the country a net-zero economy by 2050, and transport emissions are proving among the toughest to lower. Aviation emissions currently account for more than 2 percent of global greenhouse gases but have risen by 70 percent in the last 15 years. The International Civil Aviation Organization forecasts that they will increase another 300 percent by 2050 unless other means of fueling aircraft are found.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

Global growth in primary energy consumption slowed down to 1.3 percent last year from 2.8 percent demand growth in 2018, with renewables a major growth driver in 2019, BP said in its annual Statistical Review of World Energy 2020 on Wednesday. Renewables, together with natural gas, accounted for three-quarters of last year’s increase in global energy consumption. The share of renewables in power generation rose to 10.4 percent and surpassed the share of nuclear energy in the global power mix for the first time (6/18)

Energy consultancy Wood Mackenzie has tested the cash margins of the seven oil giants using capital expenditure on a unit of production and post-tax cash flow plus, assuming Brent prices remain in the $30 to $70 range through 2030. The firm has concluded that Exxon has the least ability to weather a prolonged downturn, thanks to its exposure to 60 percent of the 30 lowest-margin assets owned by the supermajors. These include Kearl and Cold Lake (oil sands) in Canada that the firm has labeled a “huge drag” as well as Alaska’s Prudhoe Bay (mature onshore oil). Chevron has emerged at the top of the pile closely followed by Royal Dutch Shell. (6/17)

BP Plc will make the biggest write-down on the value of its business since the Deepwater Horizon disaster a decade ago, as the coronavirus pandemic hurts long-term oil demand and accelerates the shift to cleaner energy. In a dramatic revision that prompted questions about the affordability of its dividend, the British firm cut its estimates for oil and gas prices in the coming decades between 20 and 30 percent. It also expects the cost of carbon emissions to be more than twice as high as before. (6/16)

African drilling slump: Low oil prices are forcing drillers to dramatically curtail risky exploration, especially in frontier regions such as Africa. The reality of crude’s slump fully hit the continent in May as operating rigs halved in a month, the biggest slide since records started in 1975, according to Baker Hughes. Some massive oil and gas discoveries have been made in Africa this century — from Ghana to Mozambique — but the prospects of similar ones in the future look bleak as companies such as Tullow Oil and Sasol are slashing operations. (6/19)

Nigeria and Royal Dutch Shell have failed to implement most recommendations made by the United Nations to clean up oil pollution in the Niger River delta. The UN Environment Program in 2011 proposed the creation of a $1 billion fund to repair the damage done by decades of crude spills in the Ogoniland area in southeastern Nigeria. However, progress has been poor and the little work that has been done is sub-standard, according to advocacy groups. (6/19)

Exxon’s Guyana pickle: Exxon has reduced its crude oil production at the Liza offshore field in Guyana due to the risk of excessive flaring, according to the South American country’s regulator. Gas flaring has been a problem at the Liza field, prompting an environmentalist group to call on the supermajor in May to stop flaring. (6/17)

Venezuela is still sending oil to China despite stifling US sanctions. As of this Monday, the data suggested, there were 3.3 million barrels of Venezuelan crude waiting to unload at Chinese ports and another 5 million barrels en route to the port of Qingdao. Asian refiners, and Chinese refiners specifically, have a taste for Venezuelan oil, which is heavy and sour, and their refineries are equipped to profitably process such grades. (6/18)

Canada’s oil industry has arguably suffered more than its peers across its southern border or even most producers around the world. It may drag banks down with it. Bloomberg reported earlier this month that Canada’s largest banks reported an almost two-fold increase in impaired energy loans over their second quarter due to the oil price plunge and the pandemic. (6/16)

The US oil rig count declined for the 14 straight weeks, dropping 10 rigs to set the count at 189, Baker Hughes Inc. reported. Drillers also idled three gas rigs, making that total 75. (6/20)

Oil job losses: Nearly 85,000 people in the US oilfield services industry have lost their jobs due to the pandemic-driven oil price crash and demand destruction, Houston-based Petroleum Equipment and Services Association said in a new analysis this week, warning that it is likely significantly underestimating the jobs losses in the sector. (6/19)

Unacceptable flaring: Texas will look into policies to “drastically reduce” natural gas flaring from the state’s shale patch as investors become increasingly sensitive to climate change concerns. The call to action came from the head of the Texas Railroad Commission, which oversees oil and gas production. (6/17)

Pipeline decision overturned by SCOTUS: The Supreme Court removed a legal barrier to the construction of an $8 billion pipeline that would deliver natural gas from West Virginia, ruling the project could run under a major East Coast hiking trail. (6/16)

US coal production and consumption have been on a decline since peaking in 2008 and 2007, respectively. Last year, total U.S. renewable energy consumption increased by 1 percent compared to 2018, while coal consumption slumped by almost 15 percent year on year, the EIA said. (6/19)

China’s coal: Within their next five-year plan, which is under development now, China will likely ease the pressure on local governments to shut older, inefficient coal mines as it seeks to meet rising demand for the most-polluting fuel to spur its economic recovery. But the lack of a hard target now for closures of old mines would underscore the continuing dependence on coal in China, which mines and burns half the world’s supply. Total coal production capacity may rise to 5 billion tons a year by 2025, from 4.1 billion currently, according to Daiwa. (6/16)

China’s carbon dioxide emissions increased by 3.4 percent last year, higher than the ten-year average growth rate of 2.6 percent, BP’s Statistical Review of World Energy showed on Wednesday—the highest growth rate of Chinese emissions since 2011. Chinese CO2 emissions accounted for the single largest share of global carbon emissions last year – 28.8 percent. (6/20)

India’s coal decision: India has taken an historic step towards ending the state monopoly on the mining and selling of coal by auctioning off 41 mines in the country, a move that allows private companies to enter the sector. The announcement, which puts an end to more than four decades of state control over the coal industry, aims to solve a fuel shortage that threatens to choke the nation’s industrial activity. India is the world’s third-largest producer of coal, behind China and the US, yet it has heavily relied on imports because of mismanagement and an onerous bureaucracy in coal exploration, production and power generation. (6/19)

India’s solar push: India’s onward march to boost its renewable energy capacity and build domestic capacity for making solar equipment got fresh impetus when Adani Green Energy Ltd won a bid to make 8 GW of photovoltaic solar power projects over the next five years. India imports about 90% of its solar equipment today, so this development could serve to lessen that import dependence. (6/18)

Nile hydro tiff persists: A last-ditch attempt to resolve a decade-long dispute between Egypt and Ethiopia over a huge new hydropower dam on the Nile has failed, raising the stakes in what is a tussle for control over the region’s most important water source. The talks appear to have faltered over a recurring issue: Ethiopia’s refusal to accept a permanent, minimum volume of water that the Grand Ethiopian Renaissance Dam should release downstream in the event of severe drought. (6/19)

Africa’s pandemic: The spread of the new coronavirus is now accelerating in many countries in Africa, where medical resources are stretched, rumors are rife and efforts to stop the pandemic are sometimes haphazard. (6/17)

Merchant ship crew members stranded at sea for months due to coronavirus-related travel restrictions could now start refusing to further extend their contracts and stop working, potentially disrupting global trade. Roughly 80 percent of global trade is carried by ships. (6/17)

Shipping weakness: Shipping lines that move the vast majority of the world’s manufactured goods have canceled more than a quarter of all sailings on Asia-to-Europe and trans-Pacific lanes, the world’s biggest trade routes, since the beginning of March, according to maritime data providers. The cancellations equate to the withdrawal of more than 4 million containers of capacity. Carriers have continued to drop departures scheduled for the third quarter, signaling expectations of continued weak demand by major Western importers. (6/17)

Mask or don’t fly: United Airlines and American Airlines say they could ban travelers who don’t comply with a new industry-wide mandatory mask policy that went into effect last week. (6/17)

What ‘herd immunity’? Sweden has made less progress than expected in achieving immunity to the coronavirus, according to its state epidemiologist. After leaving schools, shops and restaurants open throughout the pandemic, contagion rates in Sweden are much higher than anywhere else in the Nordic region. Its Covid-19 mortality rate is among the worst in the world. In a study over the past six weeks in the Stockholm region, only about 14 percent of people tested have developed Covid-19 antibodies. That compares with a study published this month of Bergamo — once the Covid-19 epicenter in Italy — which showed that 57 percent had developed antibodies. (6/17)

In Canada, a company called EarthRenew plans to showcase a new, patented technology that turns livestock waste—a critical environmental problem—into a new organic fertilizer while generating its own electricity along the way for added revenue. Most of the raw material for their patented new fertilizer process is free because EarthRenew’s processing plant at Strathmore, in Calgary, sits on a 25,000-head cattle farm.