Editors: Tom Whipple, Steve Andrews

Quote of the Week

“We were just starting to stand on two legs. All that we were expecting this year, oil was a big part of that. The rug has just been swept out from under us.”

Reilly White, Professor at the University of New Mexico

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. The global economy and the coronavirus 4. Renewables and new technologies 5. Briefs |

1. Energy prices and production

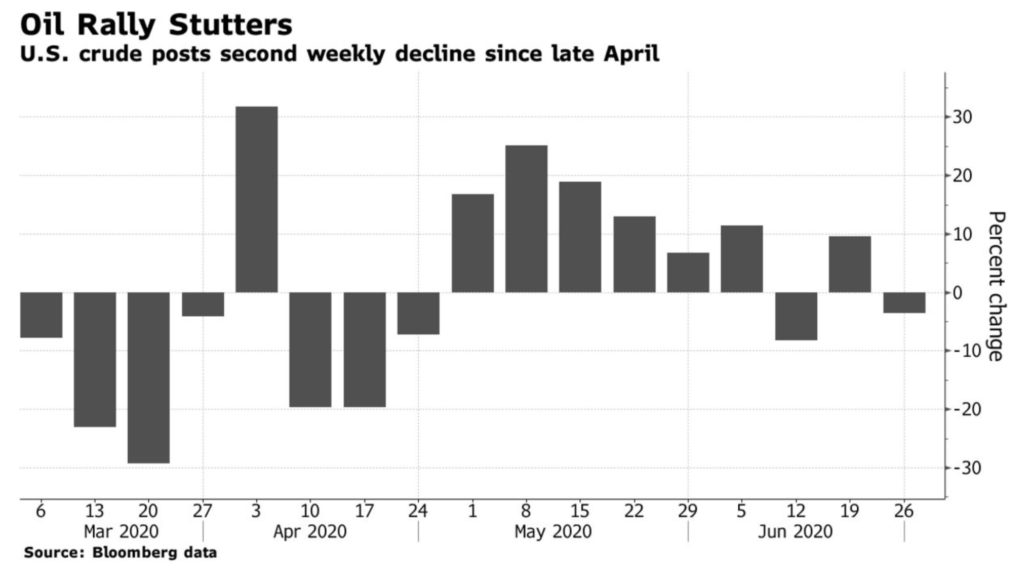

Oil posted its second weekly loss for the month as a surge in US coronavirus cases casts doubts on the market’s prospects for recovery. New York futures closed at $38 and London at $41 on Friday. The price slump comes just days after NY oil closed above $40 for the first time since early March and following a run of weekly gains that lifted oil from its historic plunge below zero in April. For the immediate future, the pandemic course seems to be in control of the oil markets. If the increasing number of cases continues to swamp medical facilities, it is likely the renewed shutdowns will lower demand again.

A cut tempered the price decline to Russia’s seaborne crude exports. Shipments of the Urals grade from its three main western ports are set to drop by 40 percent next month. The steep reductions underscore the OPEC+ alliance’s commitment to eliminating the oil glut built earlier this year. Crude stockpiles in the US are at record highs, and there’s talk that US shale producers could start bringing back output. The number of rigs drilling for oil fell by 1 to 188, suggesting that the steep drop in the US oil-rig count has likely coming to a close.

US commercial crude stocks climbed 1.44 million barrels to a record-high 540 million barrels in the week ended June 19th, EIA reported. The build pushed inventories to 16.2 percent above the five-year average for this time of year. An additional 1.99 million barrels of crude was deposited in the Strategic Petroleum Reserve, pushing stocks there to 653 million barrels. The return of US Gulf of Mexico production following Tropical Storm Cristobal pushed total US crude production up 500,000 b/d on the week to 11 million b/d the week before last.

According to EIA, crude exports jumped back over 3 million b/d the week before last for the first time in a month as exports to China remain strong. This marked the first-time weekly US crude exports topped 3 million b/d since the week ended May 22nd, when exports were reported at 3.18 million b/d.

Natural Gas: August futures slid to near a 25-year low last week weighed down by the lack of heat-driven demand and continued LNG weakness in overseas markets. On June 25th, prices at Appalachia’s benchmark Dominion South hub for September and October tumbled to just $1.07 per million BTUs and $1.13 per million BTUs, respectively, the two calendar months’ lowest settlements on record. Last week’s addition to natural gas in storage was larger than the markets expected with new gas injections for the week ending June 19th at 120 billion cf as compared to 103 billion last year.

Milder winter, lower demand during the pandemic, and high inventories, especially in Europe, have sent natural gas prices at the key benchmarks in Asia and Europe to record lows in recent months, making US exports of LNG uneconomical. According to the EIA, exports of LNG dropped from 8.1 billion cubic feet per day in January to just 3.2 billion in July. With the ability to secure new long-term supply contracts with buyers all but shut off, multiple developers of new US terminals and liquefaction units have put off expansion decisions until 2021 or beyond.

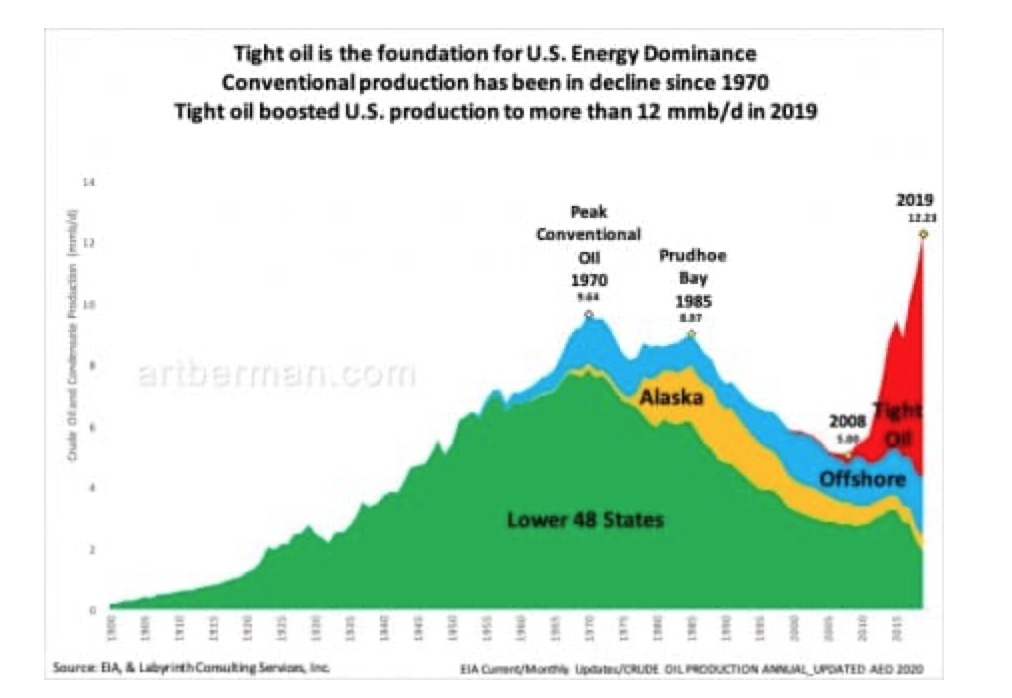

Shale Oil: In the 15 years since the first US shale boom, the industry has failed to return a profit. Over the past decade and a half, the sector totaled $300 billion in net negative cash flow, wrote down another $450 billion in invested capital, and saw more than 190 bankruptcies since 2010, according to a new report from Deloitte. The consulting firm estimates that the coming wave of write-downs could amount to another $300 billion.

The US shale industry more than doubled oil production over the past half-decade, a phenomenal increase in output. But “the reality is that the shale boom peaked without making money for the industry in the aggregate,” the consulting firm wrote in a searing indictment.

North Dakota suffered an 81 percent decline in oil and gas revenues in April that forced producers in one of the US’s most prolific shale plays to cut production substantially. Between March and mid-April, producers in the state idled some 40 percent of drilling rigs. For April, oil and gas revenues stood at just $38 million, local media reported.

Prognosis For the last few months, economies have been propped up by governments across the world going trillions of dollars further into debt to support their economies. Somewhere along the line, this will have to end, and the reality of millions of people without productive jobs becomes apparent. Now that it is increasingly accepted that the shale oil industry as a whole has never been profitable, shale oil is likely to change radically and take many years to recover – if ever. In the future, shale oil production will likely come from the major oil companies such as Chevron and Exxon. They will have to decide whether drilling can be profitable at whatever level oil prices stabilize.

Many analysts are saying that the recent jump in oil prices has been too much too fast given the fragile state of a global economy, which is held together by borrowing. Whenever the pandemic ends, either by vaccine or “herd immunity,” there will still be a need for energy from fossil fuels. There may be fewer airlines, but the pace of climate change suggests that increasing amounts of energy will be needed to mitigate its many effects. The rapid drop in capital spending by the fossil fuel industries indicates that fossil fuel prices will be higher, possibly much higher, when economies really rebound.

2. Geopolitical instability

Iran: President Rouhani warned Iran’s exporters that they risk prosecution if they keep their foreign currency earnings offshore as the government struggles to stabilize the plummeting rial. Iran’s currency has fallen about 13 percent against the dollar during the past month, fueling already high inflation. The Islamic republic’s economy has been battered by crippling US sanctions and the impact of the coronavirus. The currency had stabilized after losing more than half its value after President Trump in 2018 withdrew the US from the nuclear deal and imposed new sanctions on the country. Iranian authorities have blamed the latest fall in the rial on Iranian exporters in sectors such as petrochemicals, whom they accuse of keeping their foreign currency earnings in overseas accounts.

Analysts and businessmen said exporters are reluctant to repatriate their foreign currency earnings because the government forces them to convert it into rials at a set government rate that prices the local currency far below the black-market value. The rial is trading at about 42,000 to the dollar officially, but at nearly 200,000 in the informal market. Iran’s central bank governor, said last week that out of $72 billion worth of revenues generated from the non-oil exports over the past two years, $27 billion had not returned to the country.

President Rouhani said that Iran would be open to talks with the US if Washington apologizes for exiting a 2015 nuclear deal and compensates Tehran. Iran has refused to hold any negotiations with the US, which is trying to force Tehran to negotiate a new and harsher deal, unless Washington lifts sanctions on Tehran first and returns to the original agreement. The Iranians are looking forward to the possibility that there will be a new administration in Washington next year and are signaling they are ready to talk if the administration changes.

Iraq: Baghdad raised the estimate of its oil revenues during May as the country benefited from the increase in global prices. May income was $2.136 billion, up from the previous estimate of $2.091 billion. Iraq hopes to earn $2.5 billion in oil revenues in June.

The Parliament passed a law authorizing new borrowing of nearly $18 billion to enable the government to pay public-sector salaries despite the financial crisis. “If the Parliament hadn’t passed the law, it would be blamed for the consequences of no salaries being paid this month” said one observer.

Iran is pressing Iraq to expand its oil and gas infrastructure deal with Beijing. Chinese money, equipment, and technology would allow Iraq to gradually increase its oil production to the 7 million b/d targeted for the end of 2022.

Libya: Turkey scored a significant geopolitical win when the Government of National Accord (GNA) successfully pushed Haftar out of Tripoli in early June. The battle for Libya’s oil is focusing on Sirte, with Egypt threatening to intervene if the GNA forces move to the east. Sirte is the gateway to Libya’s massive oil facilities and is a vital stronghold for General Haftar.

Egypt is alarmed by Turkey’s intervention, which it considers a regional foe because it supports the Muslim Brotherhood group, which Egyptian President Sisi ousted from power in 2013. Turkey has sent its GNA allies weaponry, including drones and anti-aircraft batteries. It has also dispatched military advisers, personnel to operate the drones and Syrian mercenaries to beef up anti-Haftar forces.

Gen Haftar’s side has benefited from extensive arms transfers and diplomatic support from the UAE, Egypt, Russia, and France. Moscow has supplied mercenaries and stationed sophisticated fighter jets in Libya after Gen Haftar’s defeats, in a warning to the Turks to limit their military support to northwest Libya. Analysts say a ceasefire in Libya will depend on whether Russia and Turkey can reach an agreement.

Russian and other foreign mercenaries entered the Sharara oilfield on Thursday evening to prevent the resumption of oil production from the largest Libyan oilfield. Early this month, the NOC resumed production at the 300,000 b/d oilfield after negotiating the opening of an oilfield valve that had been closed since January. Libya’s national oil company lifted the force majeure on crude oil exports from the Sharara and El Feel fields, confirming the return of production at El Feel, which is linked to Sharara. But just a day later, Sharara was shut down again.

Russian President Putin and French counterpart Macron called on Friday for a ceasefire in Libya and a return to dialogue. On Thursday, France, Germany, and Italy called on forces in Libya to cease fighting and for outside parties to stop any interference in a bid to get political talks back on track.

Venezuela: Reliance Industries, the owner of the largest refinery in India and the world, has stopped buying Venezuelan crude. Last year, Reliance purchased a quarter of the oil Venezuela exported, but the last time it bought Venezuelan oil this year was in March, and at a much lower rate than in 2019, at 117,650 b/d. Reliance is not alone in shunning Venezuelan oil, fearing repercussions from Washington. India’s second-largest refiner, Nayara Energy, has also stopped buying Venezuelan crude and is switching to Canadian, Kuwaiti, and Ecuadorian oil.

Meanwhile, tankers carrying nearly two months’ worth of Venezuelan oil production are stuck at sea as refiners refuse to accept the crude. Caracas’s exports are hovering near their lowest levels in more than 70 years, and the economy has collapsed, but Maduro has held on – to the frustration of Washington. The US has blacklisted more ships and merchants this month for their role in trading and transporting state-run PDVSA’s oil and threatening to add more to its sanctioned entities.

President Maduro said he has appointed a team to consider whether the price of the world’s cheapest gasoline should rise for drivers. Fuel shortages have plagued the nation for years, as gas costs less than a penny a gallon. Scarcity recently has even hit the capital of Caracas, sparking mile-long lines at filling stations that last for days.

3. The global economy and the coronavirus

World trade experienced an “unprecedented” decline in April as the significant economies suffered from strict coronavirus lockdowns. The eurozone was the hardest-hit area. The volume of global trade in goods dropped by 12.1 percent in April compared with the previous month – the most substantial monthly contraction since records keeping began in 2000. Combined with the 2-4 percent decline in world trade in March, global goods trade volumes fell 16.2 percent compared to the same period last year.

Trade volumes in the US dropped by 16.8 percent month on month in April, while trade in emerging Asia, including China and India, fell by 6 percent. After a mild expansion in March, Chinese export volumes shrank as the pandemic eased in the country. The new numbers suggest that global trade is on track to be more than 10 percent lower this year than in 2019, and points to a decline in goods trade in 2020 of comparable magnitude to that seen in the global financial crisis in 2009.

The coronavirus will push debt levels in the world’s wealthiest nations up by almost 20 percent on average this year — nearly double the damage seen during the financial crash. Moody’s new report looked at 14 countries from the US and Japan to Italy and Britain and calculated how coronavirus-induced economic slowdowns would hurt their finances. “We estimate that on average in this group, government debt/GDP ratios will rise by around 19 percentage points, nearly twice as much as in 2009 during the Great Financial Crisis.”

United States: The US recorded 45,000 new cases of COVID-19 last Friday, the largest single-day increase of the pandemic, bringing the total number of Americans who have tested positive to at least 2.48 million. A new survey by the US Centers for Disease Control and Prevention suggests the total number of coronavirus infections across the US could actually be six to 24 times greater than reported. The record for positive coronavirus tests comes as several states at the center of a new surge in infections took steps back from efforts to ease restrictions on businesses. After months of empty roads, lockdowns were relaxing, and people were getting behind the wheel. Then the coronavirus struck again. Californians, Floridians, and Texans are back in their homes. The recovery in driving that had restored highway travel nationwide back to 85 percent of last year’s levels is looking fragile.

As the pandemic sets records for hospitalizations, businesses are forced to rethink their plans to reopen as new modeling predicts the virus will kill 180,000 Americans by October. With the US seeing one of its highest-ever increases in cases, some states took drastic measures, imposing face mask orders and internal quarantines.

The number of laid-off workers seeking US unemployment aid barely fell last week, and the reopening of small businesses has leveled off — evidence that the job market’s gains may have stalled. The government also reported that the economy contracted at a 5-percent annual rate in the first three months of the year, a further sign of the damage inflicted by the pandemic. The economy is expected to shrink at a roughly 30 percent rate in the current quarter. That would be the worst quarterly contraction, by far, since record-keeping began in 1948.

Due to what analysts saw as a slide in oil and LNG exports, the US trade deficit in goods unexpectedly widened in May. The US international trade deficit in goods was US $74.3 billion in May, up by US $3.6 billion from US $70.7 billion in April.

China: After Peter Navarro, director of trade at the White House, told Fox News, “it’s over,” President Trump tweeted that the initial trade agreement with China is still on. Trump said: “The China Trade Deal is fully intact. Hopefully, they will continue to live up to the terms of the agreement!” Trump has been extremely critical of China’s efforts to contain the coronavirus early on, and the President repeatedly blames China for the pandemic.

Beijing has begun quietly delivering a message to Washington that US pressure over matters China considers off-limits could jeopardize Chinese purchases of farm goods and other US exports under the “Phase One” trade deal. Chinese leaders accuse Washington of meddling in areas such as Hong Kong, where China is imposing a sweeping national-security law, and Taiwan, which Beijing considers part of China. On Thursday, the US Senate passed by unanimous consent a bill that would put sanctions on Chinese officials, businesses, businesses, and banks that undermine Hong Kong’s limited autonomy from Beijing.

Beijing is still is committed to carrying out the trade deal, according to China’s top diplomat, Yang Jiechi, who stressed that both sides had to “work together.” The official said that meant, “the US side should refrain from going too far with meddling and Red lines shouldn’t be crossed.”

China’s growing crude oil stockpiles will hit a new high in June as refinery feedstock imports outpace the rise in refinery throughput, while storage availability encourages refiners to procure cheap crude actively. The slide in crude prices had helped Chinese buyers to purchase tankers full of cheap oil, for delivery from late May through June. As a result, trade flow and inventory tracker Kpler forecasts that China’s seaborne crude arrivals will hit 14.16 million b/d in June, a new record high following 10.21 million b/d in May. Some of the June arrivals are more likely to be discharged in July due to port congestion.

Chinese authorities have ordered state-run gas importers to share their infrastructure to avoid another gas shortage like the one it experienced during the winter of 2017. In December of that year, several million people in northern China were left without heat because there was not enough gas in the region, and the transportation network for gas was far from complete.

China’s gasoline exports fell 20 percent year on year to a 14-month low of 680,000 tons in May, while jet fuel exports plunged 62 percent over the same period to a five-year low of 560,000 tons. China’s total export volume of the three essential oil products of gasoline, jet fuel, and gas oil were down 25 percent on-year at 2.69 million tons.

The big three Chinese state-held firms – PetroChina, China Petroleum & Chemical Corporation (Sinopec), and China National Offshore Oil Corporation (CNOOC) – have been hit the worst by the pandemic. All three firms posted losses for the first quarter and cut capital expenditures for this year as the oil price collapse and the fuel demand crash dented their revenues. Going forward, revenues are expected to continue to be weak this year, and losses will likely mount in the coming quarters. Longer-term prospects are brighter due to government support and orders for companies to boost oil and gas production in China.

European Union: Close to 20,000 new cases and 700 deaths are being recorded daily in the WHO’s “European region,” covering 54 countries and seven territories across Europe, the Middle East, and Central Asia. Although most of the cases are outside of the EU, some European countries, including Armenia, Sweden, Moldova, and North Macedonia, have seen an increase in cases.

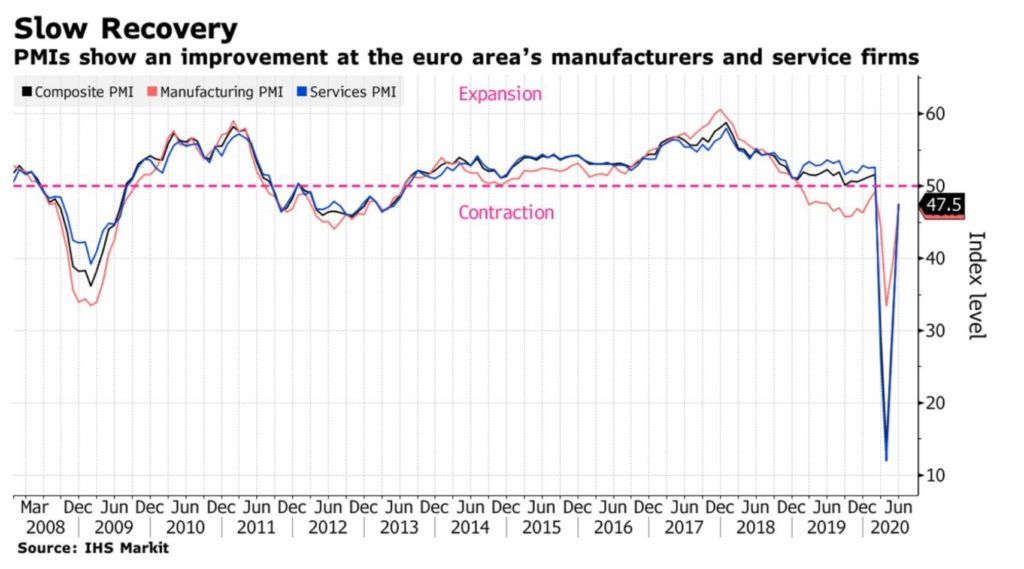

The pick-up in euro-area economic activity after the lifting of lockdowns in June is doing little to change the picture of a long, slow recovery and very high unemployment. The latest Purchasing Managers Indexes from IHS Markit showed an economic rebound underway in Europe, with France unexpectedly signaling expansion for the first time in four months. New business in the region continued to fall, with employment declining, and companies cutting prices to help sales.

The report sums up the tricky picture for European businesses, which are reopening after coronavirus restrictions but face circumstances that are far from ordinary. European Central Bank officials said this week that while risks of financial turmoil have receded significantly, the recovery speed and scale remain “extremely uncertain.”

A rise in unemployment could compound the situation. While government-backed furlough programs limited an initial spike in joblessness during lockdowns, they can’t stem the tide indefinitely, particularly for industries likely to suffer long-term damage. German airline Deutsche Lufthansa SA is cutting thousands of jobs, while France’s Airbus is also reducing headcount.

Russia: Moscow reported around 7,000 new virus cases per day last week, pushing its nationwide case total to 630,000, the world’s third-highest tally. The country’s coronavirus crisis response center says the total death toll is some 9,000. This number is suspiciously low as other European countries have a far higher death rate among those contracting the disease. For example, the UK has reported about half the cases (312,000) that Russia has, but is reporting some 43,000 deaths.

Russia’s $1.6 trillion economy will be dealt another blow when the moratorium is lifted in October on companies filing for bankruptcy. The measure, which was a condition of government pandemic support program, helped protect healthy businesses from creditors but left those that won’t survive limping along. A survey of 2,300 companies, conducted by the Center for Strategic Research in Moscow at the end of April, shows that about a third of companies surveyed said they are at risk of bankruptcy. The surge in corporate failures threatens to compound an already painful year for Russia’s economy, heading for its worst slump in more than a decade.

European refiners bypass Russia’s flagship crude grade, Urals, which is now more expensive than Brent after Russia cut its exports as part of the OPEC+ agreement. Over the past few weeks, the price of Urals, a blend of heavy sour oil from the Urals mountains and light crude from Western Siberia, has risen to a premium to Brent prices after Russia significantly reduced its exports of the grade. Given that Moscow is cutting its exports to comply with the OPEC+ agreement, this should not be surprising.

According to Gazprom’s CEO, Gazprom and its Chinese partners are talking about increasing the capacity of its Power of Siberia gas pipeline to 44 Bcm/year from the current design capacity of 38 billion cm/year. He also said there was the potential for Russian pipeline gas export capacity to China to reach more than 130 billion cm/year in the future with other routes. Gazprom began its first gas exports by pipeline to China in December with the launch of the Power of Siberia.

Saudi Arabia: Saudi Arabia made good on its promise to flood the market with oil after the collapse of an earlier OPEC+ deal in early March. However, In April, the value of Saudi Arabia’s oil exports plummeted by 65.4 percent. As the Saudis flooded the market with excess oil, the value of the Kingdom’s crude exports plunged by US $12 billion from April 2019 levels.

Riyadh said it would not allow arrivals from abroad to attend the hajj this year due to the coronavirus. Only a limited number of Saudi citizens and residents will be permitted to make the pilgrimage with social distancing measures enforced. The number of coronavirus cases in Saudi Arabia has exceeded 180,000 with 1,500 official virus-caused deaths, following a rise in new infections over the past two weeks. The announcement means this will be the first year in modern times that Muslims from around the world have not been allowed to make the annual pilgrimage to Mecca, which all Muslims aim to perform at least once in a lifetime. Some 2.5 million pilgrims a year typically visit the holiest Islam sites in Mecca and Medina for the week-long hajj. Official data show Saudi Arabia earns around $12 billion a year from the hajj and the lesser year-round pilgrimage known as Umrah.

The government is creating a tourism development fund with an initial investment of $4 billion as part of efforts to diversify away from oil and polish its image as an attractive tourism destination. “The Tourism Development Fund will play a critical role in developing outstanding tourism experiences and unlocking the full potential of Saudi Arabia as a destination,” Tourism Minister Ahmed Al-Khateeb said in a statement. “The launch of the fund at this time, as the tourism sector faces unprecedented global challenges, is testament to investor and private-sector confidence in the long-term outlook for tourism in Saudi Arabia.

4. Renewables and new technologies

According to a report from Wood Mackenzie, the cost of US solar power is dropping faster than expected as the coronavirus stifles demand. Residential-system prices will fall 17 percent over the next five years, steeper than the 14 percent it had planned before the coronavirus. Wood Mackenzie also sees prices for commercial systems sliding 16 percent, and utility-scale installations will decline 20 percent over that period.

5. The Briefs (date of article in the Daily Energy Bulletin is in parentheses)

Neutral zone stall: Chevron is set to resume oil exports in July from a long-dormant operation it shares with Saudi Arabia and Kuwait’s governments, oil officials said Monday. The expected output surge of roughly 80,000 barrels a day will come as Chevron’s partners—both OPEC members—seek to help the cartel curb exports in the aftermath of global pandemic-induced lockdowns slashed oil demand by about a third. (6/23)

Offshore Israel, UK-based Energean is developing a cluster of gas fields. Work to lay the main 90 km pipeline to the mainland is now complete. An 8 Bcm/year FPSO will gather gas from the fields and ship them to buyers via the new pipeline. (6/23)

Offshore Yemen, a tanker with 1 million barrels of oil, which has been moored for five years, could explode or sink, the United Nations said in the latest warning that an environmental disaster and potential disruption of oil shipping routes around the Red Sea is waiting to happen. The floating storage and offloading (FSO) unit SAFER has been sitting off Yemen’s coast since early 2015 and hasn’t been maintained or attended. (6/27)

Pakistani power outages: A series of announced and unannounced power load-shedding in different cities, including Lahore, has gone up amid scorching heat. Tripping and burning of wires have become a routine problem due to increased load. With the intense heat, complaints of power outages have also increased. (6/22)

Pakistanis recently witnessed a repeat of the 2015 petroleum shortage. Once again, the reason was the falling global prices and the attempt by the oil industry to avoid inventory losses. The difference this time was that the crisis developed over some time, persisted too long and saw a far poorer response from the government. There was no sign the authorities concerned, regulators and market players had learned any lesson from the January 2015 crisis. (6/25)

Mexico’s largest oil refinery, the Salina Cruz refinery, is offline after a fire broke out in the refinery following a 7.4 magnitude earthquake in the area. Mexico’s Pemex said that the fire was immediately extinguished. The refinery has an installed capacity of 330,000 barrels of crude oil per day but hasn’t been producing that much for quite some time. (6/24)

In Canada, more than 1 million barrels per day (bpd) of curtailed crude oil production in Canada and lower demand in the pandemic have resulted in a rare occurrence in Canada’s pipeline takeaway capacity in recent years. There is space available on the few pipelines taking Canada’s crude oil to the United States. (6/24)

The US oil rig count decreased for the week by one rig, according to Baker Hughes data, bringing the total to 188. Gas rigs remained flat at 77. Canada’s overall rig count fell this week by 4 to just 13 active rigs. (6/27)

New US oil price benchmark: S&P Global Platts and Argus Media will launch new benchmarks for pricing US crude oil that is being exported to replace the West Texas Intermediate benchmark. The new benchmarks will seek to put US oil for export on an equal footing with Brent crude, which is currently used for the pricing of more than 50 percent of the oil exported around the world. (6/27)

Opening more of Alaska for drilling: The US Department of the Interior will open 7 million acres of additional Alaska lands to oil and natural gas leasing in a plan released June 25. Interior officials have approved a Final Environmental Impact Statement for a revised land management plan in the 23 million-acre National Petroleum Reserve-Alaska. NPR-A is west of currently producing fields on the North Slope. (6/27)

Job cuts: Exxon Mobil is preparing to let go between 5% and 10% of its US-based employees subject to performance reviewed. Exxon’s job cuts will be characterized as performance-based, and not considered layoffs, technically speaking. Exxon has not been immune to the drastic effects of the coronavirus pandemic and the oil price war that has destroyed demand for crude oil and eaten into profit margins for that reduced demand. It has attempted to tighten its belt in response. (6/27)

New Mexico’s fiscal shock: As Covid-19 shock waves reverberate across US oil towns, perhaps nowhere is their speed and severity more apparent than in America’s newest shale powerhouse. Just months ago, New Mexico, the third-biggest producer of US oil, approved the state’s largest budget ever, paid for by an oil boom that made up 40% of the state’s revenues in 2019. Now that plan has been slashed by more than $600 million, affecting everything from pay raises for state workers to a program designed to provide free community college to state residents. Oil-producing states across the US face a double whammy with both drilling and overall consumer spending cut back by the pandemic. (6/24)

A Colorado environmental group is reviving a push to get an anti-fracking measure on the state’s November ballot, just two weeks after a prior sponsor said it was halting its efforts because of the coronavirus pandemic. The drive marks the third try in four years to tighten drilling regulations in the fifth-largest US oil-producing state. (6/26)

Orphaned well costs: The number of non-operational orphaned wells could skyrocket when the oil industry is in danger of entering structural decline. North Dakota regulators are currently seeking federal money to pay for hundreds of newly orphaned wells. The actual cost of plugging old wells is often way higher than is typically cited on company balance sheets. According to a new report from Carbon Tracker, plugging old oil and gas wells may cost as much as ten times what the industry routinely estimates. (6/22)

Protecting lapsed leases: The federal government has allowed bankrupt shale significant Chesapeake Energy to stop drilling at more than 100 leases on federal lands without losing ownership of the assets, Reuters has reported, citing data that shows the approvals have been granted since the start of the coronavirus crisis. (6/24)

Michigan judge ordered June 25 that Enbridge to shut its Line 5 crude and NGL pipeline after damage to the system’s support structure was identified last week. Enbridge had restarted the reportedly undamaged western leg of the dual pipeline system during the weekend against the wishes of Michigan Governor Gretchen Whitmer, who took legal action with the state attorney general seeking to have it shut again. (6/26)

Total wholesale power sales in the first quarter of 2020 came at 1.33 billion MWh, a decline of 4.2% from Q1 2019, according to data filed with the US Federal Energy Regulatory Commission. The decrease was due in large part to warmer-than-normal winter weather and the onset of the coronavirus pandemic. (6/22)

Global nuclear generating capacity was 391.1 GW as of December 31, 2019, with 443 operational reactors in 30 countries, a fall of 4.5 GW from 386.6 GW at the end of 2018, the International Atomic Energy Agency said in a statement June 26. The IAEA attributed the drop to “Japan’s decision to permanently shut down five reactors that had not generated electricity since 2011.” At the end of 2019, more than 57.4 GW of capacity, or 54 reactors, were under construction in 19 countries, including four building their first reactor. (6/27)

Dam deal coming: Egypt, Ethiopia, and Sudan will agree on a deal to fill the giant Blue Nile dam in two to three weeks, following mediation by the African Union to broker a deal to end a decade-long dispute over water supplies. (6/27)

The EV sector is looking to issue a ‘Battery Passport,’ which can be seen as a global quality seal and verification tool on a digital platform that will share value chain data of EV batteries. The battery passport will advance the sector’s sustainability, help recycling efforts, and reduce its carbon footprint. (6/22)

In Nevada, Governor Steve Sisolak announced the “Clean Cars Nevada” initiative, which will evaluate the adoption of new regulations to provide Nevadans with more choices for low and zero-emission electric passenger cars and trucks at dealerships throughout the state beginning in 2024. (6/24)

Container sailings from Asia to Europe and across the Pacific are down at least 25% so far this year, according to Copenhagen-based research group Sea Intelligence Consulting, and several carriers are lined up for government bailouts or preferential loans. (6/24)

Asian air passenger traffic faltered for the fourth consecutive month in May as air travel demand buckled under the pressure of the coronavirus pandemic. Asia Pacific airlines carried 785,000 international passengers in May, marking a 97.5% plunge year on year. Their air cargo volume was also down significantly, dropping by 19%. (6/26)

Climate lawsuit: The Attorney General of Minnesota filed a lawsuit against Exxon, the American Petroleum Institute, and Koch Industries, alleging they spent decades deceiving the public about climate change. The charges, brought against the companies and API by AG Keith Ellison, include fraud, deceptive trade practices, and false statements in advertising. (6/26)

In Vietnam, some farmers planted rice this week in a paddy field on the outskirts of Hanoi using headlamps to illuminate the water-logged ground in front of them. The Tam Thanh commune farmers say they have been forced to work at night in the fields to avoid searing temperatures that they say have gotten worse over the years. (6/25)

Arctic heat & fires: A Siberian town with the world’s widest temperature range has recorded a new high amid a heatwave contributing to severe forest fires. The temperature in Verkhoyansk hit 38 degrees Celsius (100.4 F) on Saturday. The town is located above the Arctic Circle in the Sakha Republic, about 4,660 kilometers northeast of Moscow. The city of about 1,300 residents is recognized by the Guinness World Records for the most extreme temperature range, with a low of minus-68 degrees C (minus-90 F) and a previous high of 37.2 C. (98.9 F). In the Sakha Republic, more than 275,000 hectares (680,000 acres) are burning. (6/22)

Sahara sand storm: The most far-reaching and potent outbreak of dust from the Sahara Desert in decades has begun to significantly affect the Lower 48 states, with the air quality deteriorating markedly on the Gulf Coast on Friday. (6/27)

Sandstorms may dampen hurricanes: A satellite shows the dust plume over the Caribbean and a second one emerging off the coast of Africa on Tuesday. These windstorm events may dampen summer hurricane activity. If upper-level winds are too strong, they can tear apart a developing storm. (6/24)