Editors: Tom Whipple, Steve Andrews

Quote of the Week

[Tesla’s Model 3 is now the best-selling vehicle in both Europe and the UK.] “Not [just] electric. Flat out. If we’re going to succeed, we can’t ignore this competition anymore.”

—Jim Farley, Ford’s CEO, to employees this month

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Crude futures moved sharply lower on Friday as the markets weighed the impacts of new pandemic lockdowns in Europe and a stronger US dollar. WTI settled down $2.91 at $76.10, and Brent moved $2.35 lower to settle at $78.89. Oil demand in most major European economies continued to fall, as governments react to rising COVID-19 cases in most countries while supply chain disruptions continue to drag on activity.

On Thursday, governments from some of the world’s biggest economies said they were looking into releasing oil from their strategic reserves, following a rare request for a coordinated move to cool global energy prices and ahead of a meeting of major oil-producing countries. The Biden administration has asked a wide range of countries, including China for the first time, to consider releasing stocks of crude.

According to the EIA, releasing oil from the US government’s strategic reserve would have a “short-lived” impact on soaring fuel prices. “Our analysis shows that it’s generally a couple of months and that typically the other dynamics in the market would overtake any price decrease,” Stephen Nalley, EIA acting administrator, said.

A release of 15 million to 48 million barrels over a short period would bring crude prices down by about $2 a barrel, or the equivalent to as much as 10 cents per gallon of gasoline, Nalley added. Restricting exports of domestic crude also does little because US refiners rely on “tremendous” volumes of imported heavy oil that many of them are configured to process. The consensus among experts appears to be that there couldn’t possibly be enough barrels to bring about a lasting decline in oil prices, which makes such a move pointless.

Crude oil prices gained on Wednesday after the EIA reported a crude oil inventory draw of 2.1 million barrels for the week to Nov. 12th. At 433 million barrels, the authority said, crude oil inventories were 7% below the 5-year average for this time of year. The reported draw compared with an unexpected build of 1 mb for the previous week and analyst expectations of another build of 1.55 mb. In addition, the EIA reported an inventory decline of 700,000 barrels of gasoline for the reporting period, compared with a draw of 1.6 mb for the previous week.

Rystad Energy’s annual cost of supply analysis has revealed that costs within the upstream sector have come down considerably in 2021, making new oil more competitive and significantly cheaper to produce. As a result, the average breakeven price for new oil projects has dropped to around $47 per barrel – down around 8% over the past year and 40% since 2014, with offshore deepwater remaining one of the least expensive sources of new supply.

After hitting a six-year low in September, the IEA said on Tuesday that commercial oil stocks in OECD countries showed a marginal build in October, suggesting that the months of hefty inventory draw globally may be over. Europe led the stock drawdowns in September when total OECD industry stocks stood at 2.762 billion barrels, which was 250 million barrels below the five-year average and the lowest level since the start of 2015.

International Energy Agency: Growing crude supply could soon ease price pressures, the IEA said Tuesday. In its closely watched monthly market report, the agency said that the tight supply and demand balance in the global oil market could be about to ease. It expects output to rise by 1.5 million b/d in the remainder of 2021, with the US, Saudi Arabia, and Russia accounting for around half of that amount.

OPEC: The cartel said the global oil market would switch from being under- to over-supplied as early as next month as the economic rebound from the coronavirus pandemic falters. The group’s Secretary-General Barkindo comments come in the shadow of US politicians putting pressure on President Biden to decrease gasoline prices.

Biden’s next move has been a topic in Abu Dhabi, where some of the world’s biggest oil and gas companies and many energy ministers attended the Adipec conference. The four-day gathering that started Monday took place in the wake of the COP26 climate talks and energy prices soaring. This year, Brent crude has climbed almost 60% to above $80 a barrel, while natural-gas prices in Asia and Europe hit record highs recently.

OPEC+ member Russia says there is no shortage of oil in the global market, and there may even be a surplus starting early next year, adding to the chorus of other OPEC+ members to push back against calls from the US to raise output faster. “Inventories have stopped drawing, which shows there is no deficit now,” according to Russia’s Deputy Energy Minister Pavel.

OPEC+ compliance with oil production cuts stood at 116% in October, up from 115% the previous month, indicating the group continues to produce less than its agreed targets. Compliance for participating OPEC members in the group rose from 115% in September to 121% in October, the highest since May. However, compliance for non-OPEC participating producers stood at 106% in October, down from 114% in September.

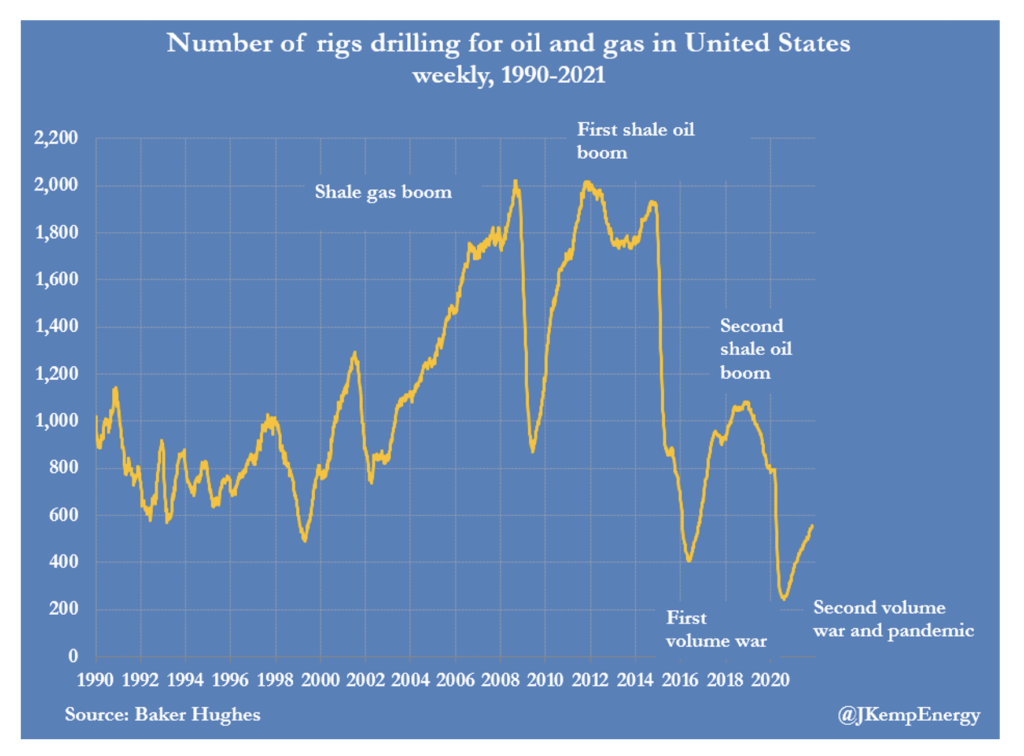

Shale Oil: US shale oil producers have added extra drilling rigs much more slowly than during the recoveries that followed the last two oil price slumps, limiting output and helping push prices to their highest level for seven years. But the number of active rigs and total production are likely to climb next year as the recovery matures and producers unwind some of the disinvestment measures they employed to cut costs in 2020/21.

The active oil rig count was just 461 last week, down from 683 immediately before the arrival of the pandemic in March 2020. The rig count is roughly half what it was the last time prices were near the same level in 2018, a sign of the pressure shale firms are under from investors to conserve cash and from OPEC+ not to infringe on market share.

US oil production has recovered to an estimated 11.5 million b/d, from a post-pandemic low of 10.7 million, but still far below the pre-pandemic record of 13.0 million b/d. In response to the slump, producers limited spending and conserved cash by completing previously drilled but uncompleted wells (DUCs) instead of drilling new ones. As a result, since August 2020, US firms have drilled just under 7,000 new oil and gas wells but completed a total of almost 10,800 and put them into production. The inventory of drilled but uncompleted wells has shrunk to 5,100 from a peak of almost 8,900 in August 2020.

Because of the fast depletion of shale oil wells, producers must constantly invest in exploring for and developing new sites, and drill new wells to offset output declines from older wells. As a result, for every million barrels per day of current production, there are 41 rigs drilling replacement wells, up from just 17 in August 2020 but down from 52 immediately before the pandemic.

During the slump, producers boosted efficiency by focusing on only the most prolific regions, formations, and well sites, employing only the most powerful and modern rigs. However, this strategy has inevitable limits. Past recoveries indicate producers will have to add extra rigs, including older and less powerful ones, and return to secondary regions, formations, and sites. In addition, drilling rates are likely to increase next year as the shale sector reaches the end of the inventory liquidation cycle and is forced to boost investment to maintain output.

US oil producers struggle to find enough crews, vehicles, and equipment to take advantage of rising global demand and a seven-year high in crude prices, say executives at oilfield service firms. The problems prevent the US from responding to higher prices. They could mean it takes longer for global output to match demand recovering from the coronavirus pandemic.

Over the past five months, upstream investments in the SCOOP-STACK have surged. In the week ended Nov. 17th, the rig count there climbed to a 20-month high at 41 – up from just 25 rigs this summer and a dramatic turnaround from the basin’s pandemic-fueled decline to just eight drilling rigs in July 2020.

The Bakken oilfield in North Dakota, the birthplace of America’s oil boom a decade ago, is struggling to recover from last year’s market crash even as crude prices have surged back to $80 a barrel. It reflects a broader slowdown in growth from America’s oil patch as companies keep spending down in a bid to redirect the windfall of cash from higher prices back to shareholders. But analysts say the Bakken faces a bleak future after years of intensive drilling.

Oil producers in the Bakken are now running into the “geological reality” that after a decade of rapid development, “most of the best wells have been drilled,” said Clark Williams-Derry, an analyst at the Institute for Energy Economics and Financial Analysis. “The dwindling number of high-quality wells left to drill — those that can produce high volumes of oil for a relatively low cost — will make it difficult for Bakken producers to get output back to pre-pandemic levels.”

Gulf of Mexico: Exxon Mobil and Chevron were among the top buyers at a federal auction of oil leases in the US Gulf of Mexico that generated more than $190 million – the highest since 2019. The auction was a boon for federal coffers but a potential setback for President Biden’s climate policies, whose administration tried to suspend federal lease sales to fight global warming before a court forced them to proceed.

In the sale, the Bureau of Ocean Energy Management, an arm of the Department of Interior, offered 80 million acres accounting for almost all available unleased Gulf of Mexico blocks. About 1.7 million acres were sold. Chevron was the auction’s biggest spender with $47.1 million, followed by Anadarko, owned by Occidental Petroleum, BP, and Shell.

Exxon rounded out the top five, snapping up nearly a third of the tracts that sold for $14.9 million, making it the biggest buyer by acreage. One analyst said Exxon’s purchase of 94 shallow water blocks could be preparation for the company’s first carbon capture and storage project, a proposal that Exxon floated in April.

Natural Gas: Prices in the US could hit $6 per million Btu if forecasts for a cold start to the winter season materialize. The HFI Research firm noted that the latest 10-15-day weather forecast is pointing towards colder than usual weather, while supply is not growing and gas in storage is unlikely to rise further this year after an injection of 20 billion cu ft the week before last. The analysis noted that the cold spell might be temporary, citing forecast data for Alaska. However, it would be enough to push prices higher while production seems to be in decline.

US natural gas producers will face billions of dollars in hedging losses for 2022 as the global energy crunch boosts gas prices to multi-year highs, research by Rystad Energy shows. For months, expectations of strong LNG demand increased US futures to a 12-year high in early October, with prices nearly doubling from last year to trade around $4.94 per million Btu on Friday. As a result, eleven operators analyzed by Rystad stand to lose more than $5.2 billion in 2022 if the average price at the Henry Hub benchmark terminal remains at $4 per million, an amount that could double to about $9.8 billion if prices average $5 per million.

Temperatures on the European mainland and in the UK are set to slide starting next week. This first cold blast of the season will test the energy supplies across Europe. Higher heating demand could intensify the already fierce battle for liquefied natural gas cargo.

Germany’s energy regulator said it had “temporarily suspended” Nord Stream 2 pipeline certification, dealing a setback to the Kremlin-backed gas project and sparking a rise in the UK and continental European gas prices. The regulator said it could not yet approve the project, led by Russia’s Gazprom, because its owners had chosen to create a German subsidiary branch that was not yet correctly set up according to German law. The suspension comes at a critical time for European gas supply, with prices surging across the continent. In addition, Gazprom has been accused by some countries of restricting exports to western Europe to increase pressure on Germany and accelerate approval of the project.

Russian natural gas flows through the Yamal-Europe pipeline to Germany remained broadly steady last week. Belarusian President Lukashenko warned of potential retaliation against any new EU sanctions over a migrant standoff on the Belarus-EU border, including shutting the Yamal-Europe pipeline as gas flows crossed his country. His threat briefly pushed spot gas prices higher. However, Moscow quickly quashed the threat.

Exxon has put up for sale natural gas assets in the Barnett Shale in Texas. The assets include 2,700 wells spread across 182,000 acres, according to the report. So far, no buyer has been identified, and no agreements have been reached on the sale. Reuters cited an unnamed source as estimating the value of the assets at between $400 and $500 million. The sale is part of a divestment strategy undertaken by the supermajor after it was hit with a loss of $22.4 billion last year. The strategy aims to slim the company down to its most lucrative operations.

The Abu Dhabi National Oil Company is set to award engineering and construction contracts for a major offshore natural gas field to increase gas production and exports. The company, which pumps nearly all the oil in the United Arab Emirates, is focusing not only on boosting crude oil production capacity but also on increasing natural gas output.

Coal: US prices have jumped to their highest level in more than 12 years as the industry scrambles to keep pace with surging demand driven by power producers switching to the heavily polluting fossil fuel. The spot price of coal in the Central Appalachian region — a benchmark for the eastern US thermal coal market — jumped by more than $10 to $89.75 per short ton, the highest level since 2009. The use of coal has rebounded, driven by more robust electricity demand and a doubling of natural gas prices this year, leading some power generators to switch to the fuel. High international prices have also propelled US coal exports.

Electricity: The Texas electric grid could suffer a massive shortfall in generating capacity in a deep winter freeze, potentially triggering outages similar to those in February, according to a report on Thursday by an electric reliability authority. Texas lawmakers and regulators continue to investigate ways to bolster the grid to avert a repeat of last winter’s blackouts, which left 4.5 million customers without power in a deep freeze that killed more than 200 people. US power reliability regulators recommended electric grids strengthen cold weather rules and coordinate with the natural gas industry to prevent a recurrence of the February freeze in Texas.

EU wind power generation fell to the lowest in almost two months averaging 33.6 GW in the seven days to Nov. 14th. However, the lull in wind stretching into week 46 saw spot power prices for Nov. 15th soar with Central West Europe above Eur200/MWh.

Prognosis: Global oil markets remain very tight and heavily backward dated as demand returns to pre-pandemic levels, according to Jeremy Weir, the chief executive officer of global trading firm Trafigura. “We see a very, very tight oil market, but it’s not artificially tight because of what OPEC is doing. Demand is there,” Jeremy Weir said at the FT Commodities Asia Summit. Global crude benchmark Brent has recovered 60% since the start of the year, trading at above $80 a barrel, as the world’s economy rebounds from the pandemic.

An alternative view says crude oil prices are set to decline next year from the current levels of around $80 a barrel as global inventories will start to build again with supply rising more than demand, the US EIA said on Thursday. Brent Crude prices are set to average $72 per barrel next year, due to the expected surplus on the market on the back of rising production from the US and the OPEC+ group.

Americans could soon see relief at the pump as US gasoline prices are set to decline if the drop in crude oil prices holds, Patrick De Haan, head of petroleum analysis at fuel-savings platform GasBuddy, said on Friday.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Ukraine: The buildup of Russian troops near Ukraine has left US officials perplexed, muddying the Biden administration’s response. Some Republican lawmakers have been pressing the US to step up military support for Ukraine. But increased aid to Ukraine risks turning what may be mere muscle-flexing by Russian President Putin into a full-blown confrontation that only adds to the peril for Ukraine and could trigger an energy crisis in Europe. But a weak US response carries its risks. It could embolden Putin to take more aggressive steps against Ukraine as fears grow he could try to seize more of its territory.

Iran: A hacking group sponsored by Iran’s government is launching disruptive cyberattacks against a wide range of US companies, including healthcare providers and transportation firms, according to a cybersecurity alert published by the US Homeland Security Department on Wednesday. The warning, jointly authored by the FBI and DHS’ Cybersecurity and Infrastructure Security Agency, said the hackers were exploiting old software vulnerabilities in products made by Microsoft and Fortinet to break into victim computer networks. While the vulnerabilities were patched, some customers haven’t updated their networks.

Iran’s stockpile of near-weapons-grade nuclear fuel has jumped significantly, according to a confidential report by the UN atomic agency that found Tehran has almost doubled its output of highly enriched uranium in recent months.

Russia has managed to secure the largest share in Iran’s huge Chalous gas discovery, followed by Chinese companies and then Iranian ones, a move that could have significant economic and geopolitical consequences. While Iran appears to have lost out economically on this deal, it will provide the Islamic Republic geopolitical support and the IRGC a nice slush fund. An agreement was finalized last week to develop Iran’s multi-trillion-dollar new gas discovery.

Iraq: Lukoil has submitted a preliminary development proposal for the Eridu field to Iraq’s oil ministry, which may yield an estimated 250,000 b/d at peak. According to the ministry, initial indications point to Eridu holding potential resources ranging between 7 billion and 12 billion barrels. The field, located in southern Iraq, was discovered in 2016. Lukoil has a 60% interest in the field and Japan’s Inpex Corp. 40%.

The government has authorized the newly revitalized Iraq National Oil Company (INOC) to directly negotiate with US’s Chevron to develop the long-delayed Nasiriyah oil field in the southern Dhi Qar province. The idea of developing the 4.36-billion-barrel oilfield has been mooted by a succession of governments in Iraq since INOC discovered it in 1975. The original plan to develop the field on a stand-alone basis was shelved in the lead-up to the 1980-1988 Iran-Iraq war. However, the field eventually came on-stream in 2009 and was listed on the 2009-2010 fast-track development plan, aiming to raise its output to at least 50,000 b/d in the first phase.

Analysts are beginning to talk more about the effects of climate change on Iraq. Unprecedented droughts are drying up farmland, driving migration to cities, and compounding economic hardships and instability. Springs are drying up, and once-lush pastures are stony and arid. There is no rain. Farmers and others are struggling to survive as drought enervates the land. It is only a matter of time before the need to deal with the effects of climate change will be a top priority for Baghdad.

Venezuela: The new oil production target set by PDVSA of 1 million b/d by the end of the year is unrealistic. Some estimates put the cost of fixing Venezuela’s oil industry at $200 billion. As long as US sanctions remain in place and international oil majors refuse to work with the country, it is doubtful there will be a recovery. At the start of 2021, Venezuela’s Oil Minister El Aissami announced that national oil company PDVSA was targeting petroleum production of 1.5 million b/d by the end of the year. When he made that statement in March 2021, Venezuela’s national oil company was pumping, according to OPEC, an average of 525,000 barrels of crude oil per day, or a third of that target.

Belarus: Poland accused Belarus on Friday of trucking hundreds of migrants back to the border and pushing them to attempt to cross illegally, only hours after clearing camps at a frontier that has become the focus of an escalating East-West crisis. The accusation by Poland suggests the situation has not been resolved by an apparent change of tack by Minsk, which on Thursday had cleared the main camps by the border and allowed the first repatriation flight to Iraq in months. European governments accuse Belarus of flying in thousands of people from the Middle East and pushing them to cross the EU border illegally.

In conversations last week with German Chancellor Angela Merkel, President Lukashenko proposed that the EU allow 2,000 migrants into its territory, an idea European leaders have refused. Belarus would then assist the remaining 5,000 migrants it says are now in the country, to return home. Poland plans to build a wall along its border to keep out migrants. Such initiatives have deflated the hopes of many migrants of getting to the West, including about 430 people who on Thursday returned to Iraq on a repatriation flight from Belarus.

Libya: The official candidates’ list for Libya’s December 24th presidential election includes Gaddafi’s son, General Haftar, former interior minister Bashagha, former Prime Minister Ali Zeidan, and Prime Minister al-Dbeibah. It’s a list that suggests renewed civil war after the election. Haftar is the controlling figure in the east and of the Libyan National Army that tried to take over Tripoli last year. The International Criminal Court wants Gaddafi’s son for crimes against humanity. Bashagha has played all sides, from the Turkey alliance to the rival Haftar-supporting side backed by Russia, Egypt, and the UAE. Meanwhile, Saleh is nominally perceived as a Haftar ally from the east, though he benefited nicely from the General’s failure to take Tripoli.

3. Climate change

While world leaders and negotiators are hailing the Glasgow climate pact as a reasonable compromise that keeps an essential temperature limit alive, many scientists wonder what planet these leaders are looking at. Crunching the numbers, they see an entirely different and warmer Earth. But many scientists are even more skeptical. Forget 1.5 degrees, they say. Instead, the earth is still on a path to exceed 2 degrees (3.6 Fahrenheit).

“The 1.5C goal was already on life support before Glasgow, and now it’s about time to declare it dead,” Princeton University climate scientist Michael Oppenheimer told The Associated Press. A few of the 13 scientists the AP interviewed about the Glasgow pact said they see just enough progress to keep alive the 1.5-degree C limit — and with it, some hope. But barely.It can be challenging to figure out what, exactly, was included in the “Glasgow Climate Pact.” Here are some major takeaways from the two weeks of negotiations:

1. Weakened fossil fuel language made the cut

The Glasgow Climate Pact is the first UN climate deal to explicitly mention the need to move away from coal power and subsidies for fossil fuels. But in the face of lobbying from top fossil-fuel-producing countries, the language was watered down several times during the negotiations.

2. The deal doesn’t include a fund for loss and damage

Even if the world stopped emitting greenhouse gases today, the irreversible effects of climate change are already here, from rising sea levels to more intense storms. In COP26 parlance, these unavoidable effects are known as “loss and damage.” Wealthy nations, which have historically added the most greenhouse gases to the atmosphere, successfully fought off a proposed fund to help developing countries deal with loss and damage. Instead, delegates agreed to start a dialogue about the idea, angering those who say such reparations are long overdue.

3. The deal keeps the 1.5-degree target alive — sort of

The Glasgow Climate Pact does not achieve the more ambitious goal of the 2015 Paris agreement: limiting global temperature rise to 1.5 degrees Celsius (2.7 degrees Fahrenheit) above preindustrial levels. But it means the world still has a shot at meeting that target.

4. The timeline for climate action was accelerated

The deal “requests” that world leaders “revisit and strengthen” their 2030 targets under the Paris agreement, known as “nationally determined contributions” or NDCs, by the end of 2022. That speeds up the typical five-year timeline for countries to submit new or updated NDCs.

5. Young people had a significant presence at COP26

More than 100,000 young people marched in the streets of Glasgow last weekend to demand climate action. Their presence was palpable inside the conference venue, where even former president Barack Obama urged the youth to “stay angry” about inaction on global warming.

The Glasgow Climate Pact says to investors and executives that the march to net zero is accelerating. The agreement, negotiated by almost 200 nations over two weeks, isn’t the pact some were hoping for. But it sets out a vision for a world that radically cuts back coal usage, eliminates fossil-fuel subsidies, and commits governments to the most ambitious targets of the Paris Agreement.

Skeptics argue that the full accord rests on a massive bet that the world’s biggest polluters will eliminate all their net emissions in the next few decades and say the recent surge in coal mining in China, India, and Australia proves just how hard this is going to be.

Governments’ massive spending kept the world economy afloat during the pandemic as officials mobilized a fiscal response to bolster household incomes and give businesses a fighting chance to survive. But the resulting nearly $300 trillion pile of debt held by governments, companies, and households will leave many countries with vulnerable finances and weigh on efforts to address urgent challenges such as climate change and aging populations.

According to a BlackRock report, insurers are getting increasingly worried about the perils of climate risk after a run of natural disasters. A significant majority of insurers now see climate as investment risk and are positioning portfolios accordingly. For its survey, BlackRock spoke with 362 executives at insurance companies representing $27 trillion in investable assets across 26 markets. As many as 95% of insurance executives who took part in the study confirm that climate risk will have a significant impact on how they build portfolios over the next two years.

4. The global economy and coronavirus

Food prices will likely stay elevated in 2022 as disruptions to the global supply chain are set to persist, according to the head of Cargill, who highlighted labor shortages as one of the most significant risks facing the industry. Whether it be meat processors, truckers, warehouse operators, or port staff, the global food system sees more competition for workers.

World fertilizer prices continue to soar as tightening supplies send costs up for farmers and consumers worldwide. In India, prices for the nutrient potash jumped 59% to $445 per metric ton. In Northwest Europe, potash prices rose the most since 2015. And in the US, the North American Fertilizer Price Index climbed to the highest price ever for a third week in a row.

United States: A surge in coronavirus cases in the Upper Midwest has some Michigan schools keeping students at home ahead of Thanksgiving. The military is sending medical teams to Minnesota to relieve hospital staff overwhelmed by COVID-19 patients. The worsening outlook in the Midwest comes as booster shots are being made available to everyone in a growing number of locations.

Former Treasury Secretary Lawrence Summers said he sees no more than a 15% chance that “it’s all going to work out well” for the US economy, with the probabilities much greater for either stubbornly high inflation or a slump in growth.

The supply chain crisis has grabbed national headlines and attracted the attention of the Biden administration, as shoppers fret about securing gifts in time for the holidays and consumer demand pushes inflation to its highest level in three decades.

The same congestion at US ports and shortage of truck drivers that have brought the flow of some goods to a halt have also left farmers struggling to get their cargo abroad and fulfill contracts before food supplies go bad. Ships now take weeks, rather than days, to unload at ports, and backed-up shippers are so desperate to return to Asia to pick up more goods that they often leave the US with empty containers rather than wait for American farmers to fill them up.

Agriculture accounts for about one-tenth of America’s goods exports and roughly 20% of what US farmers and ranchers produce is sent abroad. The industry depends on an intricate choreography of refrigerated trucks, railcars, cargo ships, and warehouses that move fresh products around the globe, often seamlessly and unnoticed.

The European Union: As temperatures drop and coronavirus infections spike across Europe, some countries are introducing increasingly targeted restrictions against the unvaccinated who are driving another wave of contagion and putting economic recoveries, public health, and an eventual return to prepandemic freedoms at risk.

Germany has entered a “nationwide state of emergency” because of surging coronavirus infections, the head of the country’s disease control agency said Friday. The director of the Robert Koch Institute said regular medical care could not be guaranteed anymore in some parts of the country because hospitals and intensive care wards are overstretched. In addition, Germany is set to introduce tighter curbs on people who have not been vaccinated against Covid-19, as cases in the country hit a record high.

In much of Eastern Europe, coronavirus deaths are high, and vaccination rates are low. Still, politicians have hesitated to impose the measures to curb the virus that experts are calling for. Earlier this month, a World Health Organization official declared that Europe is again the epicenter of the coronavirus pandemic.

Austria is to become the first country on the continent to make coronavirus vaccines mandatory to curb infections. Vaccines would be required for all Austrians from February 1st, with the government also reimposing a strict lockdown. The plans are the most far-reaching of new measures taken by European nations to ease pressure on hospitals

High energy prices drove inflation in the UK to a 10-year high of 4.2% in October, and energy is expected to fuel additional price hikes next year when the energy regulator is set to raise the so-called price cap. The UK has an “Energy Price Cap” in place, which protects households from too-high bills by capping the price providers can pass on to them, which burdens energy providers. The October inflation rate was well ahead of the Bank of England target of 2% inflation, which raises the odds of the central bank raising interest rates in December.

China: Beijing is battling the spread of its biggest COVID-19 outbreak caused by the Delta variant, according to numbers announced last week, with travelers from a city where infections have grown faster than elsewhere in the country subject to rigid quarantine rules in nearby areas. This marks China’s most widespread Delta outbreak, which has affected 21 provinces, regions, and municipalities.

China had given 76.3% of its population complete COVID-19 vaccine doses by Nov. 19th, an official at the National Health Commission said on Saturday. A total of 1.076 billion people in the country have received the required number of doses for their COVID vaccination, the NHC spokesperson Mi Feng said in a news briefing. A total of 65.73 million people has received a booster vaccine dose.

China’s economy performed better than expected in October as retail sales climbed and energy shortages eased. However, a slump in property values and rising Covid outbreaks show the recovery isn’t on solid ground yet. Industrial output rose 3.5% in October from a year earlier, while retail sales growth accelerated to 4.9%, beating economists’ forecasts. However, growth in fixed-asset investment eased to 6.1% in the first ten months of the year, with tighter curbs on the real estate market continuing to weigh on the sector.

China’s crude imports fell to a 39-month low, reflecting stock draws, weak refinery demand, and a likely delay reporting discharged cargoes over the National Day holidays. Deliveries to the independents were also poor as their operating environment has become more complex with more regulatory scrutiny, in line with government efforts to reduce emissions. However, the low crude import volumes could be short-lived due to increased inflows from new refineries, partly for line and tank fill.

Chinese officials reported Monday that their coal production surged to its highest level in years. The same day, officials in India’s capital readied a shutdown due to air pollution. The one-two punch from showed the difficulty of combating global warming. Spurred by high natural gas prices, Beijing appears to be readying to burn dirtier, cheaper coal to ease its citizens’ economic pain as cold weather sets in.

“China, like every other country in the world, is not only trying to minimize carbon emissions but also trying to balance that with economic needs,” said Michael Greenstone, director of the Energy Policy Institute at the University of Chicago.

Russia: Coronavirus deaths in Russia hit record highs for the second straight day Thursday. New daily cases appeared to be taking a downward trend but remained higher than during previous pandemic waves. Russia’s state coronavirus task force reported that 1,251 people died of COVID-19 since the day before, the most since Russia had its first virus outbreak in March 2020. Moscow is currently reporting some 257,000 deaths, but Russian demographers, who cite the number of deaths above what is expected, put the number around 760,000. This makes the total number of Russian deaths the second or possibly even the highest in the world. The US currently reports 769,000 deaths and has a population 2.2 times larger than Russia.

Saudi Arabia: The Crown Prince has unveiled another element of the NEOM megaproject, a floating industrial complex dubbed Oxagon. This project will focus on advanced technology such as space and robotics. Saudi Arabia recently came under attack for allegedly trying to block negotiations on climate action. It has been named among countries that have been attempting to downplay the urgency of such action.

Riyadh has announced plans to become a net-zero economy by 2060. This is a decade later than most economies have set as a deadline, but it is understandable given its dependence on fossil fuels. In the meantime, however, the Saudis have signaled repeatedly that they would use oil money for some ambitious projects, chief among them the $500 billion Neom smart city.

Neom is the flagship project of Vision 2030, Prince Mohammed’s brainchild, reducing Saudi Arabia’s reliance on oil revenues. A smart megacity powered by wind and solar and producing green hydrogen at a $5-billion facility, the project has often been questioned as perhaps a little too ambitious. The questions usually tend to rise when oil prices go down, but now that prices are high enough for Riyadh’s comfort, news about Neom is hitting headlines again.

India: Air pollution remained extremely high in the Indian capital last week even after authorities closed schools indefinitely and shut some power stations to reduce smog that has blanketed the city for much of the month. According to SAFAR, India’s leading environmental monitoring agency New Delhi’s air quality remained “very poor.” The concentration of tiny airborne particles less than 2.5 microns in diameter — known as PM 2.5 — neared 300 micrograms per cubic meter in some parts of the city. The maximum safe level is considered to be 25 micrograms per cubic meter.

Employers were asked to allow half of their staff to work from home for a week, and construction activities were halted. Of the 11 coal-fired plants within a 300-kilometer (186 miles) radius of Delhi, six will be closed until the end of November.

India’s top court is deliberating on the lockdown — a first of its kind to stem pollution and not control coronavirus infections. It’s not clear how far it would go, but the New Delhi government has already shown its willingness to impose an emergency weekend lockdown, similar to the one implemented last year.

Japan: The economy contracted much faster than expected in the third quarter as global supply disruptions hit exports and business spending plans and fresh COVID-19 cases soured the consumer mood. While many analysts expect the world’s third-largest economy to rebound in the current quarter as virus curbs ease, worsening global production bottlenecks pose increasing risks to export-reliant Japan.

Tokyo unveiled a record $490 billion spending package on Friday to cushion the economic blow from the COVID-19 pandemic, bucking a global trend towards withdrawing crisis-mode stimulus measures and adding strains to its already tattered finances.

On Saturday, Japanese Prime Minister Kishida said his government is considering releasing oil from its reserves in response to rising crude oil prices. It would be the first time for Japan to release oil reserves for the sake of lowering prices. However, the country has previously tapped its reserves to cope with natural disasters and geopolitical risks.

Korea: Factory-gate prices in South Korea rose at the fastest pace since 2008 last month, fueling inflation concerns and adding to reasons for the central bank to raise interest rates next week. Producer price inflation from a year earlier picked up to 8.9% from a revised 7.6% in September, the Bank of Korea said Friday. An 85.6% jump in prices of coal and oil-related products led the gains.

5. Renewables and new technologies

The electrocatalytic conversion of CO2 using renewable energy could establish a climate-neutral, artificial carbon cycle. Excess energy produced by photovoltaics and wind energy would be stored through the electrocatalytic production of fuels from CO2 and then be burned as needed. Conversion into liquid fuels would be advantageous because they have high energy density and are safe to store and transport. However, the electrocatalytic formation of products with two or more carbon atoms (C2+) is challenging.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Royal Dutch Shell announced a major overhaul of its legal and tax structure that will see the company move from the Netherlands to London amid deteriorating relations with its home country for a century. The changes come as Shell is battling activist investor Dan Loeb, demanding the company split itself into two to attract shareholders leaving the energy sector because of concerns over climate change. (11/16)

Power prices in the UK soared to the second-highest level on record last week as low wind levels exposed the market to a supply crunch. UK coal plants were operating at 1.5GW of capacity on Monday morning. UK gas prices are more than three times as high as at the start of the year, as imports from Russia to Europe slowed, and periods with low wind increase dependence on costly fossil fuel power. (11/15)

The Indian economy may be languishing under the pressure of coal shortages, but the subcontinent is betting its future on solar. (11/15)

Kazakhstan’s dilemma: Energy demand is high, and supplies are low from Europe to Asia. In Kazakhstan, the government has kept energy prices artificially low, inviting a new and unforeseen challenge: the rise of energy-intensive cryptocurrency mining is now compounding the energy crisis. (11/19)

In Nigeria, the Federal Government has indicated that it will be rebuilding the upstream sector to ramp up crude oil production by 100% to 3.0 million barrels per day, up from an average of 1.5 million since this year. (11/18) (Editors’ note: we’ve heard this in the past–often.]

In Nigeria, oil has been spilling from a well owned by Aiteo Eastern E&P and state-run NNPC for two weeks, residents and politicians said on Friday, adding it threatened the environment and local economy. Aiteo said on Nov. 9th an “extremely high order” oil spill had started on Nov. 5th and that pressure on the wellhead meant it was impossible to halt it immediately. (11/20)

For offshore Guyana, FPSO operator SBM Offshore has been awarded contracts to perform front-end engineering and design for an FPSO for the Yellowtail development project. According to SBM, this will be the largest producing unit ever built by SBM. First oil is expected by 2025. (11/18)

The widespread flooding in British Columbia has forced Trans Mountain Pipeline Corp. to shut down its pipeline system and suspend work on its expansion project. (11/18)

On Tuesday, the port of Vancouver, Canada’s largest, said that all rail access had been cut by floods and landslides further to the east, a development that could hit shipments of grain, coal, and potash. (11/17)

British Columbia is rationing petrol over fuel shortage fears after a significant storm cut off-road and rail links. Canadian Armed Forces personnel have begun arriving to help with recovery efforts in the flood-stricken region. On Friday the province also issued travel restrictions. (11/20)

The US oil rig count rose seven to 461 this week, their highest since April 2020, while gas rigs were steady at 102, according to Baker Hughes Co. That puts the total rig count up 253, or 82%, over this time last year. (11/20)

On Alaska’s North Slope, ConocoPhillips is pushing forward on its massive Willow development and has not lost time in its schedule, despite a recent federal court ruling that overturned Trump administration approval for the project. The company plans to spend $4 billion to $6 billion on Willow. (11/18)

3D + oil industry? The oil and gas industry is finally getting in on the 3D printing revolution, using the technology to solve supply chain problems, lower costs, and reduce emissions. The tech could save the oil and gas industry $30 billion annually. (11/16)

US President Joe Biden on Monday announced a step toward prohibiting oil and gas development outside the New Mexican boundaries of the Chaco Culture National Historical Park as part of a Native American tribal summit he is hosting. (11/16)

Gasoline price spike: Just 32% of Americans plan to drive for Thanksgiving this year as gasoline prices are expected to be the second most expensive for a holiday ever, the annual survey of fuel-savings platform GasBuddy showed this week. Pre-pandemic, 65% said they would drive for a holiday. When asked what it would take for them to drive more, an overwhelming 78 percent said, “lower gas prices.” (11/19)

Jet fuel price spike: Many US airlines have been chasing customers with fare sales, but rising fuel costs are likely to change that soon. A recovery in air travel demand has triggered a quick rebound in jet fuel prices. (11/17)

EV firestorm: President Biden says he wants to save the planet and save union jobs. The electric-vehicle tax credit in his social spending package shows how those aims can sometimes conflict. The proposal being negotiated by House and Senate Democrats gives consumers the entire $12,500 tax write-off only if they buy electric vehicles assembled by union workers using American-built batteries. Automobiles produced in nonunion factories would qualify for $4,500 less. (11/18)

Leaders of the United States, Canada, and Mexico will meet for the first time in five years on Thursday to promote economic integration. Still, tensions over the auto industry, ‘Buy American’ policies, and a Mexican energy bill could weigh on talks. Both Canada and Mexico are worried about Biden’s ‘Buy American’ provisions and a proposed electric vehicle tax credit that would favor unionized, US-based manufacturers. (11/18)

CA EV push: The California Energy Commission (CEC) has approved a three-year $1.4 billion plan to help California achieve its electric vehicle charging and hydrogen refueling goals. The CEC said the plan will support California Governor Gavin Newsom’s executive order phasing out the sale of new gasoline-powered passenger vehicles by 2035. (11/17)

Carmakers are no longer just struggling to match Tesla on electric vehicle technology but are scrambling to come close on production too. Forecasts for six big car groups out to 2024 indicate that Volkswagen is the only legacy carmaker on track to overtake Tesla for EV production. While the others are expected to increase the number of EVs they sell rapidly, none will come close to rivaling Tesla. (11/20)

Lucid Group Inc. became the latest electric-vehicle startup to top automotive icon Ford Motor Co. in market value, another example of how investor enthusiasm intensifies for car companies that shun gasoline. Lucid’s rising market valuation comes as other automotive startups are emerging to challenge the traditional car companies in the race to dominate the future of the automobile. Lucid just earned MotorTrend’s car of the year award. (11/17)

Ford wants to become the world’s largest electric car maker, overtaking industry leader Tesla and larger rivals, including Volkswagen. In a tweet, CEO Jim Farley outlined the US carmaker’s significantly revamped ambitions, predicting a more comprehensive selection of battery vehicles would propel the group past more established competitors. The Michigan-based group now expects to produce 600,000 battery vehicles a year globally by the end of 2023. (11/19)

Ford and General Motors are looking to get into the semiconductor business after a year of computer-chip shortages that snarled their global factory output. Ford on Thursday morning outlined a strategic agreement with US-based semiconductor manufacturer GlobalFoundries Inc. to develop chips, a pact that could eventually lead to joint US production. GM later said it was forging ties with Qualcomm Inc. and NXP Semiconductors NV and has agreements to co-develop and manufacture computer chips. (11/19)

A US judge overseeing trade issues on Tuesday overturned a decision by then-President Donald Trump to allow a reimposition of tariffs on some imported solar panels. The decision by Judge Gary Katzmann of the US Court of International Trade is a defeat for some domestic manufacturers. (11/17)

In Botswana, India’s Jindal Steel & Power Limited will start building a coal mine in southeastern Mmamabula coalfields in 2022 to supply the export market and a planned coal power plant. Despite the global shift from coal, Botswana is pushing ahead with developing its estimated 212 billion tons of coal resources. (11/20)

“Smaller” nukes: In addition to the Rolls-Royce small modular reactor (SMR), another type of SMR has been in the news. The natrium reactor, financed by Bill Gates’ Terrapower, announced that Terrapower would build its demonstration reactor at a former coal plant site in Wyoming. The specific location will be announced later this year. Mr. Gates referred to a $4 billion price tag for this 345 MW facility. (11/19) (Editor’s note: what’s small about 345 MW?)

Deforestation in the Brazilian Amazon rainforest has reached a 15-year high. The surge prompts environmentalists and scientists to question the government’s willingness to meet its recent pledge to end illegal woodlands destruction by 2028. About 5,100 square miles of Brazil’s Amazon—bigger than the size of Connecticut—was denuded in the 12 months between August 2020 and the end of July, a rise of 22% from the previous year. (11/20)

A feed additive that cuts methane burped out by cows — a significant contributor to agricultural emissions — moved a step closer to being sold in Europe. The European Union’s food watchdog said Dutch nutrition company Royal DSM NV’s “Bovaer” product is safe and effective for dairy cattle. (11/20)