Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“We are going, for the first time in decades, to relaunch the construction of nuclear reactors in our country and continue to develop renewable energies.”

French President Emmanuel Macron

“The fossil fuel industry has spent decades denying and delaying real action on the climate crisis, which is why this is such a huge problem. Their influence is one of the biggest reasons why 25 years of UN climate talks have not led to real cuts in global emissions.”

Murray Worthy from Global Witness

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices notched the longest stretch of weekly losses since March, with President Biden keeping investors guessing about whether he’ll act to tame higher energy prices that are driving a surge in inflation. Futures in New York fell 1% to close at $80.79 on Friday, and London closed at $82.17. Near the end of the session, White House Press Secretary Jen Psaki declined to say whether Biden plans to release oil from the Strategic Petroleum Reserve. Biden has been weighing moves that include an SPR release to bring down the cost of gasoline at the pump.

Eleven Democratic senators, including several known for their concerns on climate change, urged Biden in a letter last week to act quickly with the national average price for a gallon of gasoline at its highest level since 2014. The senators invoked the “undue burden” on families and small businesses and pressed for the release of oil from the nation’s strategic reserve or even the more drastic step of banning the export of US crude.

Brent crude oil spot prices averaged $84 per barrel in October, up $9 from September and up $43 from October 2020. Crude oil prices have risen over the past year due to steady draws on global oil inventories; those draws averaged 1.9 million b/d during the first three quarters of 2021. The EIA estimates that 98.9 million b/d of petroleum and liquid fuels were consumed globally in October, an increase of 4.5 million b/d from October 2020 but 1.9 million b/d less than in October 2019.

US crude oil production averaged an estimated 11.4 million b/d in October, up from 10.7 million in September due to production increases following disruptions from Hurricane Ida. The EIA forecasts production will rise to 11.6 million b/d in December. The administration forecasts annual production will average 11.1 million b/d in 2021, increasing to 11.9 million b/d in 2022 as tight oil production rises in the US. Growth will come primarily due to onshore operators increasing rig counts, which will offset production decline rates.

Spot diesel prices are hovering near 2014 highs across major US trading regions, while California truck drivers have been struggling with retail market prices unseen since before the 2008 recession.

International Energy Agency: Natural gas prices may stay elevated if winter is cold and European imports do not rise, the head of the IEA, Fatih Birol, said on Friday. “If we don’t have a harsh winter in Europe and Russia increases exports, then we will see a relative softening of prices. However, it is possible prices will stay elevated if gas inbound to Europe does not rise and winter is harsh,” Birol said at an event in Istanbul.

OPEC: Iraq’s oil minister said that the OPEC+ group doesn’t plan to change the pace of easing the collective production cuts at its next meeting in early December and will review the output schedule in the first quarter of next year. The alliance plans to add all the 400,000 b/d in additional supply it has scheduled for each month. The group has faced criticism from oil-importing countries, including the US and Japan, for not boosting production more than the 400,000-b/d monthly increase given the tight oil market and high oil prices.

Global oil inventories have come down to pre-pandemic levels and may face further tightness as OPEC+ spare capacity nears a critical level by the middle of next year, “causing some people angst,” the head of Vitol Asia said Nov. 7th. OPEC+’s gradual approach to output hikes comes amid concern about the coalition’s spare oil capacity, which is being challenged by production hiccups at some producers, including Angola and Nigeria, security concerns in Libya, and sanctions on Iran and Venezuela.

There is a supply cushion of several million b/d. That is a minimal level, and people are concerned about it because they do not see investment in the US. What little non-OPEC investment has taken place is giving us some extra oil from Guyana and Norway’s Johann-Sverdrup and places like that, which is not enough.

Shale Oil: Nearly 60% of S&P 500 companies have reported third-quarter 2021 earnings, and the energy sector has again emerged as a standout performer. According to the latest FactSet data, the energy sector is reporting the second-largest positive difference between actual and estimated earnings (+15.9%), behind only the financial industry.

The US shale patch has emerged as class valedictorian. After a turbulent period characterized by mounting debts, dwindling cash flows, and awful share performance, US shale has roared back to life with the current earnings season, showing that the worst could be finally behind us.

Delek US Holdings sees Permian production activity picking up as Permian crude exports are seen growing as global demand rises. Still, rising global oil prices could entice US Permian producers to ease up on capital discipline and increase production more quickly than anticipated, an analysis from S&P Global Platts showed.

This year has seen an unprecedented level of merger and acquisition activity, which now stands at $53.9 billion, marking the highest activity level since 2014, according to S&P Global Platts Analytics. In all of 2014, the busiest year on record, merger and acquisition activity totaled $53.5 billion.

Natural Gas: European natural gas prices plunged Wednesday after signs Russian gas flows into Europe were increasing ahead of what’s expected to be a miserable winter of tight supplies and high energy costs. Dutch natural gas futures, the European benchmark, dropped as much as 12% to € 64.14 per megawatt-hour after Russia’s state energy company Gazprom showed flows to Europe via Ukraine and Poland increased.

Asian LNG prices rose last week following three weeks of decline as demand increased in China after a sharp drop in temperature. Industry sources said the average LNG price for December delivery into Northeast Asia rose to $31.5 per million BTUs, up $2 or about 6.8% from the previous week. Sustained temperatures below normal could deplete inventories rapidly and send buyers back to the spot market.

US Henry Hub gas prices closed Friday at $5.51 per million British thermal units. That is up from just over $3 per million one year ago. The pinch shows a growing tension between exporters and domestic buyers who have enjoyed cheap gas for more than a decade. Some manufacturing and chemical companies have built entire businesses around low US gas prices.

US natural gas production continues to surge this month, hitting fresh 19-month highs propelled by gains in output across Appalachia, the Haynesville Shale, and the Permian Basin. Domestic gas production is at just over 93.9 billion cf/d, rising more than 2.2 billion cf/d, or about 2.4%, from its October average. The recent surge comes almost entirely from a handful of onshore fields where producers are ramping up output ahead of the heating season in a likely push to capture record prices this winter. In Appalachia, production climbed to a record-high 34.7 billion cf/d earlier this month.

American utilities are facing the highest natural-gas prices in years as they build stockpiles for winter. Exporters are sending more gas than ever to countries starved for the fuel. Pipelines to Mexico and Canada and tankers traveling to Europe and Asia have moved record amounts of US gas out of the country this year as parts of the world fall short of supplies. American frackers, meanwhile, are holding the line on new drilling as investors pressure them to maintain capital discipline and return money to shareholders. The result is that natural-gas exports are pushing domestic prices higher—only the second time this has happened since companies began shipping shale gas from the Gulf Coast to other countries in 2016. Demand for LNG has never been higher, but developers in North America are headed into the final weeks of the year without having approved one new project yet.

Coal: The EIA expects coal consumption in the electric power sector to rise by 80 million tons, or 18%, during 2021. The increase in the electric power sector’s use of coal reflects higher natural gas prices this year compared with last year. In addition, the lower price responsiveness of coal for electricity generation, which is likely the result of constraints on coal supply and low coal stocks, is contributing to upward pressure on natural gas prices.

US coal exports are forecast to rise by 20 million tons (29%) in 2021. Higher US exports reflect rising global demand for coal amid high natural gas prices. Exports are expected to remain relatively unchanged in 2022, when a 3 million ton increase in metallurgical coal exports is partly offset by a 2 million ton decline in steam coal exports. US coal production growth has not kept pace with rising domestic demand for steam coal in the electric power sector and export growth, leading to a drawdown in coal inventories held by the electric power sector.

John Kerry, US special envoy for climate, predicted the US would stop burning coal by the end of the decade. “By 2030 in the US, we won’t have coal,” Kerry said during an interview with Bloomberg at the COP26 climate conference in Glasgow. “We will not have coal plants.”

Electricity: According to the EIA, the share of electricity generation produced by natural gas in the US will average 36% in 2021 and 35% in 2022, down from 39% in 2020. In 2021, the share for natural gas as a generation fuel will decline in response to a higher delivered natural gas price for electricity generators, which should average about $5.12/million Btu compared with $2.39 in 2020. Due to the higher expected natural gas prices, the forecast share of electricity generation from coal rises from 20% in 2020 to about 23% in 2021 and 22% in 2022.

Prognosis: President Biden’s Infrastructure Bill is often painted as being anti-fossil fuels, but the bill will provide a significant boost to the oil and gas industry. With many climate change provisions being removed from the bill or significantly weakened, it is primarily a bill that will spark an economic recovery and boost energy demand.

With consumers already dealing with the fastest price increases in decades, another unwelcome uptick is on the horizon: a widely expected increase in winter heating bills. Natural gas used to heat almost half of US households has nearly doubled in price since this time last year. The price of crude oil — which affects the 10% of families that rely on heating oil and propane during the winter — has soared by similarly eye-popping levels. And those costs are being quickly passed through to consumers, who have become accustomed to cheaper energy prices in recent years.

The Bank of America says that Brent Crude prices could rise to as much as $120 per barrel in the first half of 2022 due to the global gas crisis, booming air travel with international flights returning, and a comeback of Asian demand. Although the US is not directly exposed to the natural gas crisis, Europe and Asia are, and the gas-to-oil switch will raise demand for crude. The other primary driver of higher demand and higher oil prices would be a significant return of travelers after the US re-opened borders to international vaccinated travelers last week.

According to ICE Futures data, adventurous options traders placed bets this week on oil prices hitting $250 and even $300 per barrel, betting for the first time this year that oil could exceed $250. On Thursday, options traders traded the equivalent of 5 million barrels of Brent at $250 and $300 call options. Call options give traders the right—but not the obligation—to buy assets at a specific price, the so-called strike price, by a certain date. Call options at triple-digit strikes have soared in recent weeks.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Belarus-Poland: Thousands of migrants, mainly from the Middle East, have traveled to Belarus in hopes of reaching the EU, but have been prevented by Poland and Lithuania, EU member countries, from entering. Thousands are camped along the border with Poland. EU leaders say the situation has been manufactured by the government of Belarus and is growing more volatile. Since summer, Belarus has issued tourist visas to people from Iraq, Syria, Yemen, and other countries and drove them to the borders of Poland, Latvia, and Lithuania. Some have even been provided with wire cutters to breach border fences.

The standoff involves far fewer migrants than the flows that poured into the continent after 2015. On most days, only a few dozen asylum seekers are managing to get across the border. But the imagery of cold and hungry migrants, directed by Belarusian troops toward a single border checkpoint, has played out on social media for days, roiling European politics.

As much as 40% of the EU’s gas comes from Russia, about a fifth passing through Belarus. President Putin said that he’d talk to Lukashenko about gas flows to the European Union after the Belarusian leader threatened to interrupt supplies to the energy-strapped continent in the face of more EU sanctions. Any interruption in gas supplies would threaten the countries’ relationship as transit partners, Putin said.

Iran: Tehran said last week that the US should provide guarantees that it will not abandon the 2015 nuclear deal with world powers again if talks to revive the agreement succeed. Indirect negotiations between Iran and the US, which stalled in June after the election of hardline Iranian President Ebrahim Raisi, are set to resume on November 29th in Vienna to find ways to reinstate the deal.

China’s imports of Iranian oil have held above half a million b/d on average for the last three months, traders and ship-tracking firms said, as buyers judge that getting crude at low prices outweighs any risks from breaking US sanctions. The Biden administration has so far chosen not to enforce the sanctions against Chinese individuals and companies amid negotiations that could revive a 2015 nuclear deal that would allow Iran to sell its oil openly again.

Iran enjoys some of the lowest lifting costs per barrel in the world. Moreover, ahead of the new iteration of the nuclear agreement that Iran expects to have in place before March 2022, the country is looking to increase crude oil output. The increased output is to come not just from its major fields in West Karoun and shared fields with Iraq and others but also from lesser-known fields that nonetheless have billions of barrels of oil reserves, largely untapped. Moreover, there are additional benefits to developing these fields. Virtually all of Iran’s output has a guaranteed buyer in China, in line with the 25-year Iran-China deal; and second, news relating to these lesser-known fields is less likely to reach the Iranian public, which reacted negatively when the announcement of the scope of the Iran-China deal was made public.

Iraq: A drone attack that targeted the Iraqi prime minister last week was carried out by at least one Iran-backed militia, Iraqi security officials and militia sources said. Iran is unlikely to have sanctioned the attack as Tehran is keen to avoid a spiral of violence on its western border. Prime Minister al-Kadhimi escaped unhurt when three drones carrying explosives were launched at his residence in Baghdad. However, several of his bodyguards were injured.

The failed assassination attempt has ratcheted up tensions following last month’s parliamentary elections, in which the Iran-backed militias were the biggest losers. In response to the attacks, helicopters circled in the Baghdad skies while troops and patrols were deployed around Baghdad and near the capital’s fortified Green Zone, where the attack occurred. Supporters of the Iran-backed militias held their ground in a protest camp outside the Green Zone to demand a vote recount.

Ever since its occupation of Iraq in 2003 began to turn sour, the US has been fighting a rearguard action against Iran, cementing its influence in Iraq, with the opportunistic assistance of Russia initially and then China as well. This rearguard action initially involved the US giving Iraq billions of dollars in financial aid, most of which ended up in the offshore bank accounts of various officials. But unfortunately, the help did nothing to halt Iran’s extension of its power into all levels of Iraq’s political and economic infrastructure.

Baghdad has allowed state-run Iraqi National Oil Co. to start negotiations with Chevron to develop fields in the southern province of Dhi Qar. The ministry said that the Nasiriyah fields in Dhi Qar could initially produce 600,000 b/d of crude. Other potential projects in Dhi Qar are gas development and solar power plants.

Morocco-Algeria: For the past few weeks, a political, economic, and possibly security crisis has been building up between Algeria and Morocco, mainly caused by the continuing Western Sahara-Mauritania conflict. For decades, Morocco has exerted control over the Western Sahara, fighting a military confrontation with rebel movement Polisario which is backed by Algiers. Until now, Morocco has controlled most of the Western Sahara territory, considering it to be Moroccan. However, the conflict has spread to gas pipeline politics.

The Algerian economy, which has been hit hard by COVID-19, endemic corruption, mismanagement, and internal political strive, is struggling. Algeria’s leaders are also increasingly worried about Morocco’s growing political influence in the region and even its improving relations with Israel. Moreover, internal instability, especially after the death of Algeria’s former leader Bouteflika, has caused economic mayhem and has led its oil and gas sector, the primary source of income, to decline.

The strife between the two North-African nations has not significantly impacted Europe. Algerian President Tebboune ordered Sonatrach, Algeria’s state energy firm, to stop supplying natural gas to Spain through Morocco’s Maghreb pipeline.

Spain relies on natural gas for almost 50% of its energy needs. Most of it is being supplied via the Maghreb pipeline. As the Iberian Peninsula is not well connected to the European gas grid, importing gas from other European nations will also be challenging in the short term. Algerian natural gas supplies are still the main and, at present, the only real option. As the Maghreb-Europe gas pipeline delivered around 6 billion cm per year, the gap is immense.

The only other solution is increasing the Medgaz pipeline flow, which runs directly to Spain from Algeria. Usually, Medgaz provides around 25% of the natural gas imported to Spain. Algeria has pledged to raise its capacity from eight billion cm to ten billion cm a year, but Spain would still need around four billion more to cover its needs.

Libya: World powers gathered in Paris to discuss ways to stabilize Libya stressed the importance of next month’s pivotal presidential election and threatened sanctions against anyone who tries to undermine the vote. “The Libyan transition must be completed. The elections must take place in the best possible conditions,” said French President Macron on Friday at a press conference after the event, adding that the parties involved have committed to recognize the results, whatever they are.

The meeting was co-chaired by France, Germany, Italy, Libya, and the United Nations. US Vice President Kamala Harris, German Chancellor Angela Merkel, and Russian Foreign Minister Sergei Lavrov were among the high-level international and regional officials. Mohamed el-Manfi, head of Libya’s presidential council, and Prime Minister Abdul Hamid Dbeibah also attended.

3. Climate change

The UN climate talks ended Saturday with a deal that for the first-time targeted fossil fuels as the key driver of global warming, even as coal-reliant countries raised last-minute objections. While the agreement won applause for keeping alive the hope of capping global warming at 1.5 degrees Celsius, many of the nearly 200 national delegations wished they’d come away with more.

“If it’s a good negotiation, all the parties are uncomfortable,” US climate envoy John Kerry said in the final meeting to approve the Glasgow Climate Pact. “And this has been, I think, a good negotiation.” The two-week conference in Scotland delivered a significant win in resolving the rules around carbon markets. Still, it did little to assuage vulnerable countries’ concerns about long-promised climate financing from wealthy nations.

There was last-minute drama as India, backed by China and other coal-dependent developing nations, rejected a clause calling for the “phase-out” of coal-fired power. After a meeting between China, India, the US, and European Union envoys, the clause was hurriedly amended to ask countries to “phase down” their coal use.

During the conference, the US and China, the world’s two largest emitters of carbon dioxide, unveiled a deal to ramp up cooperation tackling climate change, including cutting methane emissions, phasing out coal consumption, and protecting forests. The framework agreement was announced by US climate envoy John Kerry and his Chinese counterpart Xie Zhenhua and was billed by both to tip the summit toward success. The head of the UN climate conference had earlier recognized that countries’ climate commitments so far in the talks would do too little to tame global warming and urged them to “get to work.”

A group of countries, companies, and cities are committed to phasing out fossil-fuel vehicles by 2040 as part of efforts to curb global warming. But the world’s top two carmakers, Toyota and Volkswagen, and significant car makers in China, the US, and Germany, did not sign up, highlighting the challenges in shifting to zero emissions. Headline signatories included Ford and General Motors, the world’s second-most populous country India and major corporate purchasers of vehicles, including Leaseplan, which rents 1.7 million cars in 30 countries.

Summit negotiators grappled with a fundamental math problem: The commitments governments have collectively made to slash greenhouse gas emissions don’t add up to what scientists think is needed to avoid the most destructive effects of global warming. Addressing that shortcoming was one of the main tasks of the summit’s second week.

The challenge is that most governments, including all the world’s major emitters, have recently updated their emissions plans and are expecting to spend the next few years passing them into law. The Biden administration is already waging domestic political battles to adopt its proposals. Other governments such as China have just submitted updated plans under the Paris accord after rebuffing pressure from the West to be more ambitious.

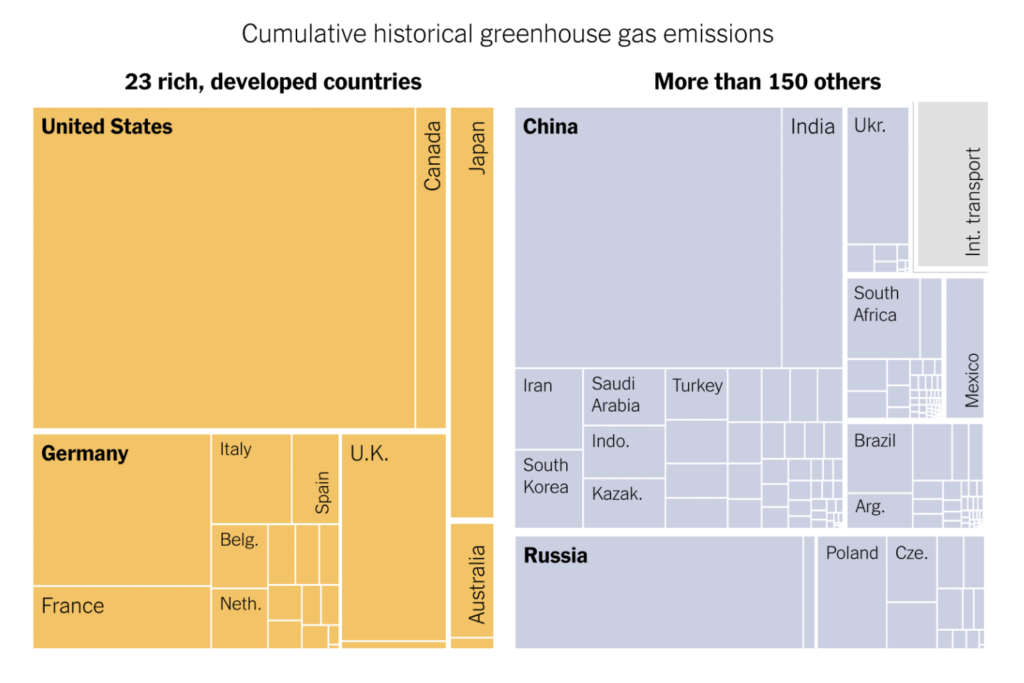

Across the world, many countries underreport their greenhouse gas emissions in their reports to the UN, a Washington Post investigation has found. An examination of 196 country reports reveals a giant gap between what nations declare their emissions to be versus the greenhouse gases they are sending into the atmosphere. The gap ranges from at least 8.5 billion to as high as 13.3 billion tons a year of underreported emissions — big enough to move the needle on how much the Earth will warm.

For years climate scientists have warned about the ferocious wildfires and hurricanes that are now overwhelming many communities. Today, alarms are ringing about a related financial danger: risks lurking within government bonds, the most significant part of the global debt market. As a result, a growing number of investors, academics, policymakers, and regulators are questioning whether credit ratings—the scores that underpin much of the financial system—are accounting for the impact that extreme weather events will have on borrowers.

According to UN data, global greenhouse gas emissions from agriculture and food production have risen by 17% over the past 30 years, underscoring their importance in limiting climate change. The food system — mainly deforestation from land conversion to agriculture and methane from the livestock sector — has come under the spotlight for its contribution to global warming. The sectors accounted for 31% of greenhouse gas emissions in 2019.

4. The global economy and coronavirus

Global inflationary pressures showed few signs of moderating last week, and more central banks are scrambling to temper them. In the US, consumer prices rose last month at the fastest annual pace in three decades. Germany’s council of economic advisers indicated that the risks of persistent inflation are growing as supply chain woes drag on and energy costs rise. Producer prices in China increased by the most in 26 years.

The world’s food import bill is set to jump even more than expected to a record this year, increasing the threat of hunger, especially in the poorest nations. The UN said higher shipping rates and prices of foodstuffs from grains to vegetables are likely to drive up the cost of importing food by 14% to $1.75 trillion. It also warned of higher bills as farm inputs get more expensive. Food prices have climbed to the highest in a decade, further pressuring household budgets strained by the pandemic and rising energy bills.

United States: Consumer prices accelerated in October as Americans paid more for gasoline and food, leading to the biggest annual gain in 31 years. There are more signs that inflation could stay uncomfortably high well into 2022 amid snarled global supply chains. Inflation pressures are also brewing in the labor market, where an acute shortage of workers is driving wages higher. Food banks already dealing with increased demand from families sidelined by the pandemic now face a new challenge — surging food prices and supply chain issues battering the nation.

The European Union: Coronavirus case numbers have soared, and Germany registered its highest infection rate since the pandemic began, with almost 40,000 cases in a day. Doctors in the intensive care Covid ward at Leipzig University Hospital warn this fourth wave could be the worst yet. This state of Saxony has the highest seven-day infection rate in Germany at 459 cases per 100,000 people.

Germany’s export-oriented economy used to be a reliable engine for pulling Europe out of slumps. Now, as the continent emerges from the pandemic, Germany is lagging. German manufacturers are struggling to produce cars and factory equipment because of parts and labor shortages. They face surging energy prices that are making sky-high electricity bills even higher. And they must invest hundreds of billions of dollars over coming years to meet new clean-energy standards.

The era of easy foreign trade and rapid globalization has given way to geopolitical tensions, transport bottlenecks, and pressure to manufacture locally. As a result, Chinese businesses, Germany’s biggest customers, are turning into competitors. In addition, demand for German luxury cars hangs in the balance as the world shifts toward electric vehicles. German industrial output in August was about 9% below its 2015 level, compared with a 2% increase for the eurozone as a whole.

China: Factory gate (wholesale) prices in China rose at their fastest pace in 26 years in October, as crippling power shortages and record commodity prices hit the world’s second-biggest economy. China’s official producer price index increased 13.5% compared with October 2020, its most significant monthly jump since 1995. The gain exceeded the 12.4% rise forecast by analysts polled by Reuters and outpaced September’s 10.7% reading, which was also the highest since 1995.

A set of critical economic data to be released on November 15th will be closely studied for signs that the slowdown is severe enough to prompt authorities to step up financial support. The weakness in the economy is coming from both the supply and demand sides, similar to when the virus initially hit the economy in early 2020. But the causes of supply shocks have shifted to electricity shortages, Beijing’s environmental curbs, and a crackdown on financial risk, which has hit the property market. At the same time, domestic demand continues to be hit by the Covid-zero strategy.

The acceleration in producer prices coupled with weakening manufacturing activity has raised fears of stagflation, complicating the country’s economic outlook as slowing growth poses a challenge to President Xi Jinping’s sweeping reforms of China’s business landscape. In addition, rising commodity prices have compounded the country’s energy woes.

After flooding in critical mining regions, China is battling soaring coal prices, and the government’s clean energy goals reduced output. At the same time, widespread power rationing led to a second monthly contraction in manufacturing activity in October.

An unusually early and cold start to winter in China adds to unease. Up to eight inches of snow blanketed much of northeastern China, closing airports, highways, and schools. In contrast to the region’s typically dry winters, forecasters in Heilongjiang, the province that borders Siberia, warn of record sleet, slush, and snowstorms. As a result, some 190 sections of icy national highways across nine provinces in northern China were shuttered over the weekend, and at least three provinces canceled classes. Beijing city turned on central heating nine days earlier than usual.

Last week, China’s state-owned power provider announced that power supply and demand in its service areas have returned to normal and rolling blackouts have decreased. Thermal coal futures on the Zhengzhou Commodity Exchange have been halved in the last few weeks, allowing state energy firms to purchase coal at lower prices.

Higher international oil prices and China’s crackdown on illicit import quota trade led to the lowest Chinese crude oil imports in three years in October. China imported 8.9 million b/d of crude last month, down from 9.99 million in September.

More robust fuel demand has boosted profits at crude oil refineries across Asia in recent weeks, but they have also been given a helping hand by lower exports of refined products from China. Beijing’s exports of refined fuels dropped in October to 3.95 million tons, snuffing out a slight rise in shipments in September and reverting to the declining trend seen since April. As a result, the past four months have been the weakest for fuel exports from China since a slump in mid-2020.

Several countries, including Japan, the UK, and the US, are urging Chinese customs officials to pause the rollout of regulations on food imports, arguing the measures risk further disrupting global supply chains. Diplomats from seven economies, including Australia, Canada, the EU, and Switzerland, expressed their concerns in an October 27th letter to Customs Minister Ni Yuefeng. The letter signers object to a pair of decrees handed down in April that require food importers to meet sweeping new registration, inspection, and labeling requirements by January 1st.

Russia: Moscow’s oil and gas discoveries fell to the lowest in five years in the first half of 2021, after last year’s crisis resulted in steep cuts in capital expenditures for exploration, GlobalData said last week. In the first half of this year, Russian companies found oil and gas at six very small fields, adding just 36 million barrels to reserves, which is equivalent to fewer than four days of Russian daily oil production, according to GlobalData estimates. While Russian oil production and revenues have benefited this year from the much higher oil prices due to the OPEC+ cuts and rebounding global demand, exploration has continued to suffer from the COVID-inflicted crisis in 2020, which forced companies to slash Capex for exploration drilling.

Saudi Arabia: Saudi Arabia reported economic growth of 6.8% on the year for the third quarter on the back of higher oil prices. This is the highest quarterly growth for the Kingdom since 2012. “This positive growth was due to the high increase in oil activities by 9.0% due to rising world demand for crude oil and the increase of Saudi production in 2021,” the Saudi General Authority for Statistics said. As a result, oil producers have seen a windfall, with Aramco booking a net profit of $30.4 billion for the third quarter.

5. Renewables and new technologies

Scientists at the Department of Energy’s Oak Ridge National Laboratory have developed a scalable, low-cost method to improve the joining of materials in solid-state batteries, resolving one of the significant challenges in the commercial development of safe, long-lived energy storage systems. Solid-state batteries incorporate a safer, fast-charging architecture featuring a solid-state electrolyte versus the liquid electrolytes in today’s lithium-ion batteries.

One of the challenges in manufacturing solid-state batteries is the difficulty of getting materials to join correctly and remain stable during repeated charging and discharging cycles. Scientists studying methods in a lab to overcome this characteristic, called contact impedance, have focused on applying high pressure and other methods.

Major airlines have committed to eliminating their net carbon emissions by 2050 even as they expect a fivefold increase in annual global passengers over the same period. To meet that ambitious goal, they’ve touted the potential of sustainable aviation fuel, or SAF, a product that is chemically identical to kerosene but more environmentally friendly.

Until technologies such as batteries or clean-burning hydrogen are commercially viable for powering large aircraft, which could take decades, SAF is the industry’s best option for getting greener. Yet for now, the alternative fuel is used only rarely in commercial flights. Its limited adoption results from two interconnected challenges: SAF is expensive for airlines to purchase, and production volumes remain constrained. SAF makes up only about 0.1% of the global aviation fuel supply.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Fossil fuels at COP26: More delegates at COP26 are associated with the fossil fuel industry than any country, an analysis shared with the BBC shows. Campaigners led by Global Witness found that 503 people with links to fossil fuel interests had been accredited for the climate summit of the total 40,000 attendees. These delegates lobby for oil and gas industries and campaigners say they should be banned. (11/8)

Offshore Norway, ConocoPhillips plans to develop the Tommeliten A gas and condensate discovery, with total investments expected to amount to 12.5 billion crowns ($1.46 billion). Located in the southern sector of Norway’s North Sea, Tommeliten A is estimated to hold reserves corresponding to 125 million barrels of oil equivalent. (11/8)

South Korea is flying a military oil tanker to Australia this week to airlift 27,000 liters of urea solution used in diesel vehicles and factories to cut emissions amid a dire shortage threatening to stall commercial transport and industries. Approximately two million diesel vehicles, mostly cargo trucks, are required by the government to use the additive. (11/9)

In Sierra Leone, at least 90 people were killed and more than 100 wounded in Freetown on Saturday when a fuel tanker truck exploded following a collision. Previous accidents with tanker trucks in the country have killed dozens of people who gathered at crash sites to collect spilled fuel and were hit by secondary blasts. In 2019, a tanker explosion in eastern Tanzania killed 85 people, while around 50 people were killed in a similar incident in Democratic Republic of Congo in 2018. (11/8)

Several African countries plan to exploit their oil and gas reserves to tackle poverty and energy shortages, representatives gathered in Dubai said this week in the face of pressure to end fossil fuel extraction to curb global warming. Officials and industry executives stressed that Africa as a whole has a relatively small carbon footprint, which Statista estimated accounted for 3.7% of global CO2 emissions in 2020. (11/13)

Nigerians are facing a “double jeopardy” of costly food and expensive cooking gas, according to economist and former industry official Muda Yusuf. The cost of propane has increased over 150% since prices hikes started last spring. Yusuf warned that there could be a relapse of accelerated deforestation if the spike is not checked. (11/12)

The Moroccan government is preparing port infrastructure for imports of liquefied natural gas to boost reserves after Algeria ended gas supplies through a pipeline on Oct. 31. (11/9)

Theft from oil pipelines in Colombia is booming as criminal gangs look to replace dwindling supplies of smuggled Venezuelan gasoline for use in the drug trade. Gasoline is a critical component in making cocaine, but there have been shortages of fuel in Venezuela during that country’s social and economic crisis. (11/9)

The US oil rig count rose this week to 454—a 4-rig increase since last week and a 218 rig increase since this time last year, according to Baker Hughes Co. The number of gas rigs increased by 2 to 102. (11/13)

The White House said on Tuesday it is not contemplating shutting down Enbridge Inc’s Line 5 pipeline after Canada last month invoked a 1977 treaty with the US to trigger bilateral negotiations over it. Line 5 is at the center of a long-running dispute between Calgary, Enbridge, and the state of Michigan that has embroiled the Canadian and US governments. (11/10)

US retail gasoline prices are poised to average more than $4 a gallon in three states for the first time in 13 years as energy prices surge and fan fears of inflation. (11/13)

President Biden’s administration targets one of the stricter sources of climate-warming greenhouse gases with a plan that calls for the US aviation sector to reach net-zero emissions by 2050. Biden’s 40-page plan released Tuesday calls for increasing production of sustainable airplane fuels and developing new aircraft technologies. (11/11)

CA gasoline price record: According to data from Gas Buddy, gasoline prices in California have reached their highest prices ever recorded. Average prices hit $4.68 per gallon today in California, beating out previous records set in 2008 and 2012. (11/12)

Two offshore drilling contractors, Maersk Drilling and Noble Corporation have agreed to create a combined company with a fleet of 20 floaters and 19 jack-up rigs. (11/10)

Biofuels brinksmanship: US merchant oil refiners like Monroe Energy and PBF Energy are playing chicken with the White House, making moves in the biofuels credit market that could force them to close plants and fire union workers unless the Biden administration bails them out by changing the rules on blending biofuels in gasoline. (11/12)

EV boost: The roughly $1 trillion infrastructure package passed by Congress provides a spark to efforts to build a national network of EV charging stations. Among several measures, the bill directs $5 billion to expand electric-vehicle highway charging, which once in place would let drivers take longer road trips without the fear of running out of power. (11/8)

Lithium-ion battery pack prices fell 89% from 2010 to 2020, with the volume-weighted average hitting $137/kWh. $100/KWh is considered the Holy Grail where EVs will achieve cost parity with ICEs. (11/11)

EV charging technology: Ford and Purdue University researchers are working on a new, patent-pending charging station cable that could combine with in-development vehicle charging technology, making it easier for people to transition to EVs with seamless re-charging. Purdue researchers focus on an alternative cooling method by designing a charging cable to deliver an increased current. (11/11)

Coal in the crosshairs: Shipping companies that transport the world’s coal are in the crosshairs of some financial backers who are cleaning up their businesses in the absence of a genuinely global drive by nations to renounce the dirtiest fossil fuel. In a sign of investors taking the initiative, six European firms collectively representing over 5% of the estimated annual $16 billion capital financing requirements of the dry bulk industry told Reuters they were either reducing their exposure to vessels that transport coal or were considering doing so. (11/13)

The most severe cloud of methane detected in Australia in more than a year was spotted last month by satellite over one of the country’s top coal-producing regions. “Intermittent methane releases from underground mines, such as the ones mentioned, are a part of normal operations,” Australia’s Department of Industry, Science, Energy and Resources said. The agency is implementing a methane accounting system using Sentinel data “to assess the implications of methane releases.” (11/12)

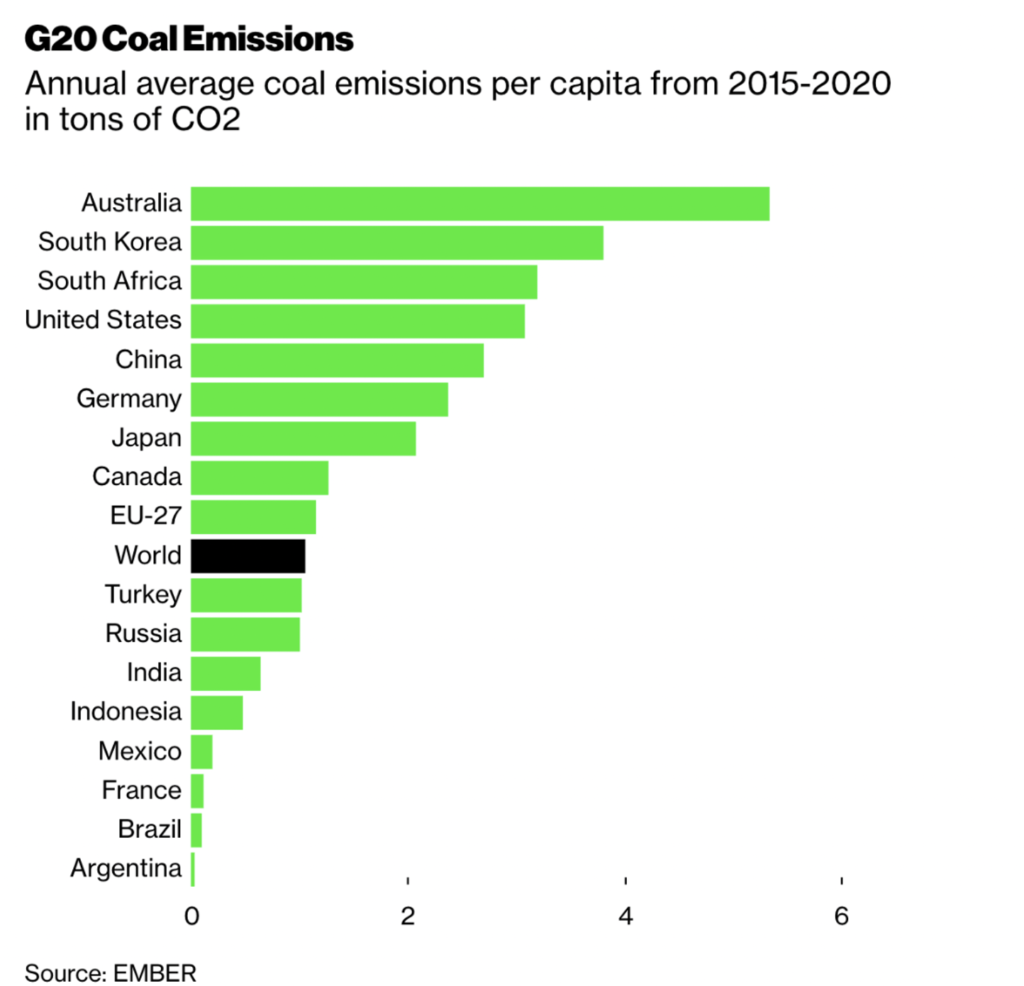

Largest emissions: India and China are the world’s two biggest coal polluters, but Australia and South Korea lead the world in emissions from the world’s dirtiest fossil fuel when you adjust for population size. (11/13)

France will build new nuclear reactors to help the country lessen its dependence on foreign countries for its energy supplies, meet global warming targets and keep prices under control, President Emmanuel Macron said on Tuesday. (11/10)

More nukes: Rolls-Royce announced that following a successful equity raise, it has established the Rolls-Royce Small Modular Reactor (SMR) business to bring forward and deliver the next generation of low-cost at scale low-carbon nuclear power technology. Rolls-Royce Group, BNF Resources UK Limited, and Exelon Generation Ltd will invest $264 million in the next three years. (11/10)

Down-under solar: While the Australian government has dragged its feet on committing to a net-zero climate target in one of the world’s biggest fossil fuel exporters, the nation’s 10 million households are picking up some of the slack. More than 3 million rooftop solar systems have been installed, and 2021 is on track to another record year. Australia led the world in per-capita uptake of solar power — 22% higher per capita than Germany or Japan in 2020. (11/9)

Thailand’s floating solar: The world’s largest hydro-floating solar farm—equivalent to about 70 soccer fields in size–has begun generating power in Thailand. While 145,000 solar panels harness power from the sun during the day, three turbines convert energy from flowing water at night. The $34 million solar farm, which joined the grid on Oct. 31, is the first of 16 projects planned in key Thai reservoirs. (11/9)

Zimbabwe’s second-largest city, Bulawayo, will be without water supply for 48 hours due to worsening power outages affecting the southern African nation. The water shortage is an additional burden on residents and businesses already experiencing lengthy daily power outages. (11/13)

Metals industry will boom: Clean-energy technologies require more metals than their fossil fuel-based counterparts. According to a recent Eurasia Review analysis, prices for copper, nickel, cobalt, and lithium could reach historical peaks for an unprecedented, sustained period in a net-zero emissions scenario, with the total value of production rising more than four-fold for the period 2021-2040, and even rivaling the full value of crude oil production. (11/11)

H2 buses: In West Covina (CA), Foothill Transit has ordered 13 New Flyer hydrogen fuel-cell-electric Xcelsior CHARGE H2 forty-foot heavy-duty transit buses. Foothill Transit already operates one of the largest fleets of electric buses in America and has 20 fuel-cell electric buses on order. (11/9)

H2 heavy trucks: Daimler Truck AG and TotalEnergies signed an agreement on their joint commitment to the de-carbonization of road freight in the EU. The partners will collaborate in the development of ecosystems for heavy-duty trucks running on hydrogen. (11/12)

More H2: Royal Dutch Shell and Norsk Hydro have signed a memorandum of understanding and begun initial work to identify opportunities to produce and supply renewable hydrogen. (11/9)

Air taxis? South Korea demonstrated a system for controlling urban air mobility vehicles (UAM) on Thursday. It hopes it will serve as taxis between major airports and downtown Seoul as soon as 2025, cutting travel time by two-thirds. A trip from Incheon International Airport to central Seoul is expected to cost around $93 when commercial journeys start in 2025 – more expensive than premium taxis – but drop to approximately 20,000 won per trip after 2035 when the market matures. (11/11)

Hyundai Motor Group (HMG) is launching a new company called Supernal, LLC to take its future mobility vision forward. An evolution of HMG’s Urban Air Mobility Division, Supernal is developing a family of electric air vehicles and convening public and private stakeholders to shape the emerging Advanced Air Mobility (AAM) industry. (11/10)

Researchers at Purdue University have developed a new ultra-white paint that reflects 98% of sunlight and can keep surfaces up to 19 degrees F cooler than their ambient surroundings. This new paint, which may become available for purchase in the next year or two, could someday help combat global warming and reduce reliance on air conditioners. (11/10)