Editors: Tom Whipple, Steve Andrews

Quote of the Week

“Until 2020, claims of peak oil just on the horizon were easily dismissed as naive and alarmist. Now, peak oil is suddenly upon us, an unforeseen stall in the status quo has afforded the world an unmissable opportunity to reorient the global economy toward decarbonization with not a moment to spare, and global leaders and thinkers such as the World Economic Forum are calling for a ‘new energy order’ and a ‘great reset.’”

Haley Zaremba, Oilprice.com

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: The course of the coronavirus continued to roil the oil markets last week. After a 10 percent gain since the beginning of the year, oil reversed last week as new outbreaks of the virus accompanied by recent lockdowns appeared worldwide. Reports that China has been forced into new lockdowns and that a new and possibly more lethal variant of the virus is spreading across Europe added to concerns. Delays in the delivery of vaccines are also causing worries that the impact of the virus will continue a while longer.

Futures fell 1.6 percent on Friday to the lowest level in nearly two weeks to close at $52 in New York and $55 in London. Energy shares were hit hard as the oil rally came to a halt, with new lockdowns reigniting oil demand fears. The EIA weekly stocks report showed domestic crude inventories increased for the first time since December, rising more than 4 million barrels last week.

The IEA lowered forecasts for global oil demand as renewed lockdowns to contain the pandemic temper the recovery expected this year. “The global vaccine roll-out is putting fundamentals on a stronger trajectory for the year, with both supply and demand shifting back into growth. But it will take more time for oil demand to recover fully as renewed lockdowns in many countries weigh on fuel sales.” The IEA said oil demand would be 600,000 b/d lower than previously forecast in the first quarter of 2021 and 300,000 b/d lower for the year. However, it still expects a strong recovery in the second half of the year as vaccinations accelerate. Still, the world’s swollen oil inventories stand to abate by 100 million barrels in the three months as Saudi Arabia and other OPEC+ nations curb supplies.

The Keystone XL pipeline project may be dead, but the US is still poised to pull in record imports of Canadian oil in coming years through other pipelines that are expanding. President Biden canceled Keystone XL’s permit on his first day in office Wednesday, dealing a death blow to a long-gestating project that would have carried 830,000 b/d of heavy oil sands crude from Alberta to Nebraska. Environmental activists and indigenous communities hailed the move. Still, traders and analysts say US-Canada pipelines will have more than enough capacity to handle increasing volumes of crude out of Canada, the primary foreign oil supplier to the US.

OPEC: The cartel will be closely watching for clearer signals from President Biden on whether he will ease sanctions on Iran and Venezuela. Any sanctions relief could unleash large volumes that would complicate the producer bloc’s efforts to rebalance the market. OPEC+ has instituted deep production cuts to support prices through the coronavirus crisis. But those gains could be wiped out by an increase of up to 1 million b/d of Iranian crude exports this year if sanctions relief is granted.

Iraq’s crude exports to India grew nearly double-digits last year, helping it retain India’s top oil supplier title in 2020. Still, Iraq may struggle to attain similar growth in 2021 if Tehran’s nuclear deal is resurrected. With 2020 being the first year when Iranian crude inflows into India dropped to zero, Iraq grabbed a market share of as high as 25 percent.

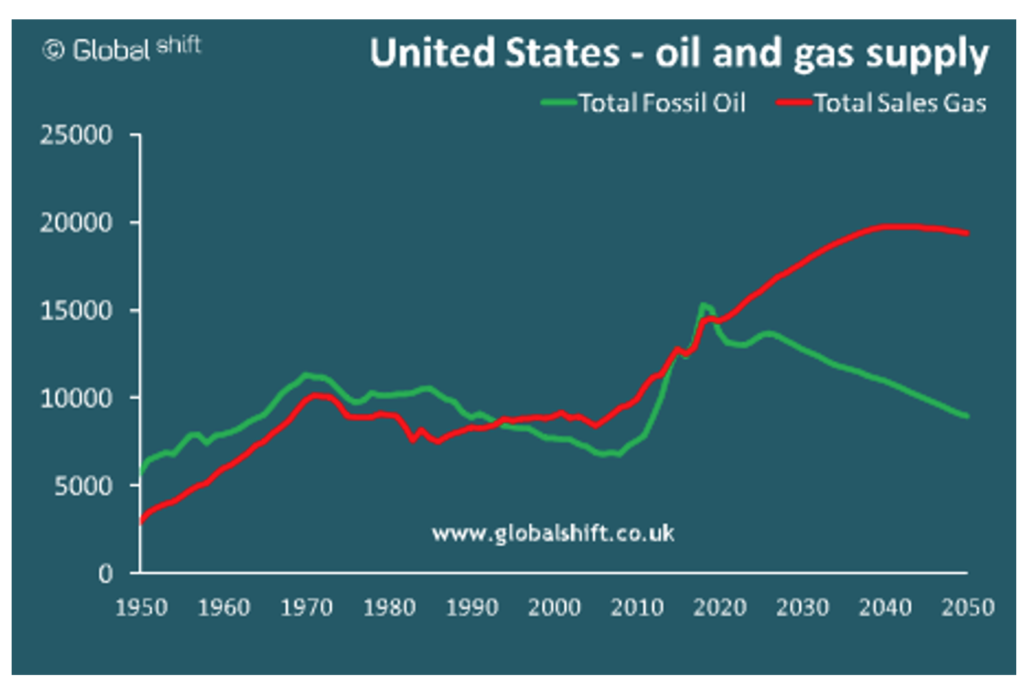

Shale Oil: The advent of US shale oil production a decade ago eventually shook OPEC’s foundations. But last year, OPEC crumbled under the weight of the pandemic that sent oil prices to all-time lows, including a one-day dip of WTI below zero. Now, shale is getting back on its feet, facing the temptation of increasing production as prices rebound above $50. The large producers are sticking to their cautious stance. As Pioneer’s president Richard Dealy told TheWall Street Journal last week, “there is little motivation for production growth.” He noted that the world does not seem to need more oil right now, so there is no reason to ramp up output.

The companies that carry out the oil industry’s grunt work have signaled that the worst crash in decades is over but cautioned that the sector was still many months away from a strong recovery. The three biggest oilfields service companies, bellwethers for the global industry, reported higher-than-expected earnings in the fourth quarter last week, saying activity had begun to pick up along with the oil price — especially in the battered US shale industry.

The number of rigs drilling for oil and gas in the US has risen for nine straight weeks and is now around 40 percent higher than the low point last summer, although it is still well below pre-pandemic levels. Better profits than expected and the rising rig count have fueled a rally in oilfield services shares. This is a sharp reversal from last year when the price crash tore through the sector, tipping more than 60 North American oilfield service companies into bankruptcy. Those bankruptcies left behind around $45 billion of debt, much of which was unsecured.

Baker Hughes’ chief executive Lorenzo Simonelli said he expects a “tepid investment environment” in the first half of this year before momentum builds later on. Increasingly the leading services firms bet that momentum will be driven by spending and drilling outside the US in places like the Middle East, Brazil, and West Siberia. It would be a seismic shift in the industry after a decade in which America’s shale producers far outspent their international rivals, pumping hundreds of billions of dollars into new wells. But the shale sector, hit especially hard during last year’s price crash, is now consolidating and shifting to an emphasis on profits over production growth.

That means roughly 2 million b/d in production lost from the US last year will be slow to come back, say oilfield services executives. ‘If we assume that the next two or three years will not give us the activity, intensity, and investment to recover this 2 million b/d, what will happen is that this 2 million will have to be supplied internationally,” said Olivier Le Peuch, head of Schlumberger.

According to Reuters interviews with executives, President Biden’s promises to ban new oil and gas drilling on federal lands would take years to shut off production from top shale drillers because they already have stockpiled permits. But smaller independent oil drillers are more worried about Biden’s vow to toughen regulations and stop issuing new licenses on federal lands as part of his sweeping plan to bring the economy to net zero emissions by 2050. Federal lands are the source of about 10 percent of the US oil and gas supply. Fossil fuels produced on federally managed lands and waters contribute nearly 25 percent of US greenhouse gas emissions.

Natural Gas: The EIA reported the largest weekly draw from gas in underground storage of the current heating season on Jan. 22nd. Still, Henry Hub futures continued to flounder as milder weather points to smaller withdrawals ahead.

The recent record-high spot prices of LNG in Asia may not hold long, but the surge could be a sign of what the future holds for natural gas prices globally. The growing LNG trade and the increasing importance of LNG on the global gas markets have upended how part of the worldwide gas supply is traded. It has made regional gas markets more interconnected. When spot LNG prices rally in north Asia, LNG sellers rush to send cargoes there, leaving fewer LNG cargoes going to Europe, where natural gas prices rise in a generally tighter market. This happened at the start of 2021. Surging spot LNG prices in Asia incentivized cargoes to the region instead of Europe. They sent UK prompt wholesale gas prices to a two-year high amid unusually low temperatures across Britain.

Shell turned the lights back on at its Prelude offshore LNG facility just as Asia was frozen by a cold spell that sent prices for liquefied natural gas sky-high. Shell wasn’t the only oil major that benefited from the price spike over commodity traders and independent producers of gas. An analysis from Reuters points to Shell and Total as two examples of why Big Oil is better placed to benefit from such price spikes: the supermajors simply have access to more LNG and the flexibility to re-route cargos. The coldest winter since 1966 in Asia sent gas and coal prices soaring earlier this month.

According to the Washington Examiner, the American Petroleum Institute will support federal regulations for oil and gas industry-generated methane. This is in stark contrast to its previous position against federally regulating greenhouse gas. Methane is sometimes vented or leaked during its extraction, causing climate concerns to grow in recent years. The API is hoping to get a seat at the negotiating table when it comes to how this methane will be regulated.

Prognosis: After a devastating 2020, Rystad Energy projected demand for oil products in the US to grow by 1.08 million b/d in 2021 to 19.1 million. This projection left politics aside, but if President Biden can live up to his promises after his inauguration, Rystad sees an upside to US products demand of about 350,000 b/d due to the planned short-term economic stimulus and his infrastructure plan. Together with a sizeable infrastructure package and an increased likelihood of additional short-term stimulus packages down the road, the Democratic policies will create more demand for oil products.

Goldman Sachs says oil prices will be supported this year by the US’s upcoming stimulus package and the low probability of much Iranian oil returning to the global market. The relief package could stimulate the American economy, leading to a rise in US oil demand by around 200,000 b/d over 2021 and 2022. Goldman Sachs also sees Brent Crude averaging $65 in 2021.

The road ahead for the oil industry remains challenging amid new competitive threats and demands from investors. Global spending on oil and gas production is poised to stay below pre-pandemic levels through at least 2025, according to consulting firm Wood Mackenzie, as companies face pressure to improve returns and reduce their greenhouse-gas emissions. Meanwhile, investment in renewables and other clean energy technologies is taking off, threatening to eat into the market for oil and gas long-term. Though oil prices have notched gains since November, they’re expected to remain below levels that support attractive returns, particularly for an industry still recuperating from last year’s historic drop in fuel demand.

Non-fossil-fuel investments will climb to an annual average of $1.4 trillion, the IEA says, higher than the $935 billion it has projected for oil, natural gas, and coal. In the 2030s, it says, those investments will make up roughly two-thirds of energy spending.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: President Rouhani urged the incoming US administration to return to the 2015 nuclear agreement and lift sanctions on Tehran while welcoming the end of “tyrant” Trump’s era. “The ball is in the US court now. If Washington returns to Iran’s 2015 nuclear deal, we will also fully respect our commitments under the pact,” Rouhani said in a televised cabinet meeting.

Washington’s European allies hope the incoming Biden administration will take swift steps to restore the Iran nuclear deal amid mounting pressures, including Tehran’s boost in uranium enrichment and elections later this year that could usher in a more hardline government. President Biden had expressed continued support for the pact forged while he was the vice president in the Obama administration.

Iran has already started ramping up its crude oil production eyeing a return to pre-sanction levels in a month or two. Officials believe the market will be able to swallow the additional oil, bringing Iran’s total to somewhere between 3.9 million and 4 million b/d.

Iran’s currency strengthened to a five-month high against the dollar as Biden prepared to take office. The value of the US dollar on Iran’s unregulated, the open market was down to 228,000 rials last week — giving the beleaguered rial a 17 percent gain against the greenback since Jan. 6th. The rial had lost more than 70 percent of its value since May 2018, when President Trump abandoned the nuclear accord and imposed tough sanctions on Iran’s economy.

Massive blackouts and smog hit cities across Iran last week. It’s a toxic mix as the country, already under economic duress and suffocating US sanctions, simultaneously battles the region’s worst coronavirus outbreak. Blackouts are not new in Iran, where the aging and subsidized electricity sector is plagued by mismanagement. This time, however, officials are blaming bitcoin mining as partly to blame. A cryptocurrency researcher in Tehran told The Washington Post. “Mining is a tiny percentage of the overall electricity consumption in Iran.”

Iraq: As coronavirus rates have fallen, Iraqis are flouting the recommended virus precautions, many subscribing to a dubious belief in their immunity. That conviction, derided by scientists, has been publicly endorsed by regional and local health officials and some religious leaders. “We have reached a type of herd immunity,” one of Baghdad’s senior health officials wrote in a Facebook post. He still stands by those comments.

Rare twin suicide bombings struck a market Thursday in central Baghdad, killing 32 people and injuring 110 more. The blasts came midmorning as people were shopping for secondhand clothes at a market in Tayaran Square. A statement posted by the Islamic State claimed two of its men blew themselves up in the attack. Although security forces continue to fight small groups of Islamic State militants in Iraq’s peripheral regions, major security incidents in the capital are rare. Thursday’s attack was the deadliest to strike Baghdad in years.

Insurgents bombed a power transmission station in the Jalula area of Diyala province late Monday, depriving many residents of electricity — the latest in a string of incidents that highlight the unresolved security gaps in northern Iraq’s disputed territories. Officials blamed the attack on the Islamic State militant group. After losing control of its Iraqi territory in 2017, the group evolved into a guerrilla-style insurgency.

There could be trouble ahead in the recently signed $2 billion five-year prepayment oil supply deal between Baghdad and China’s Zhenhua Oil. When Moscow signed a similar deal with the Kurds, the Russian move disrupted the budgeted payments-for-oil between Kurdistan and Baghdad. The resulting financial crunch forced Baghdad to turn to Beijing for help. This suggests that Moscow and Beijing are moving to replace US influence in Iraq as the Trump administration showed little interest in the country.

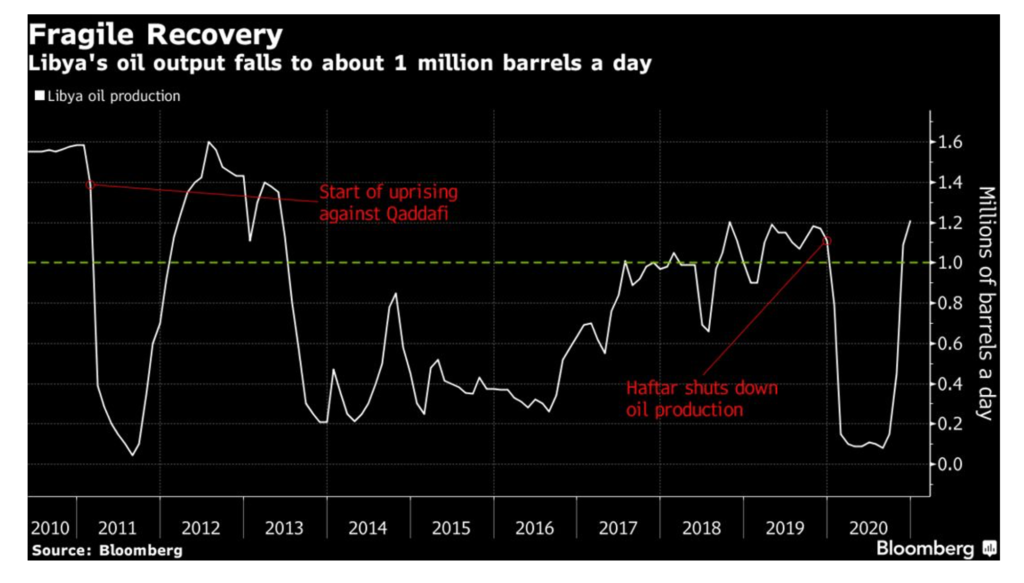

Libya: Oil production dropped by about 200,000 b/d after the closure of a leaking pipeline, underscoring how difficult it is for the country to maintain its output following almost a decade of civil war. Output has fallen to around 1 million b/d. Repairs could take two weeks.

Earlier this month Libya’s daily production surged to 1.25 million b/d from almost nothing in September after a truce between rival military forces. That caused problems for OPEC+, which are restricting supply to bolster oil prices following their coronavirus-triggered collapse last year. Due to its strife, Libya is exempt from the curbs.

Venezuela: The US Treasury sanctioned a series of European oil traders and crude tankers that allegedly helped a Mexican network work with Venezuela to evade US sanctions and move its crude oil to Asia and other parts of the world. The new sanctions came on President Trump’s last full day in office. His administration has sought to increase sanctions on Venezuela and make the penalties more challenging for the incoming Biden administration to unwind potentially.

Representatives of fuel suppliers to Venezuela, importers of Venezuelan oil, and advocacy groups said this month they plan to press the incoming Biden administration to reverse a ban on crude-for-diesel swaps. Since the last quarter of 2020, the US has barred companies from sending Venezuela diesel in exchange for crude. The ban has prompted concerns about the humanitarian impact of a possible deficit of diesel, widely used in Venezuelan public transportation, agriculture, and fuel for generators used as a backstop for frequent blackouts.

Millions of barrels of Venezuelan heavy crude, embargoed by the US, have been surreptitiously going to China. Ways to avoid detection and sanctions include ship-to-ship transfers, shell companies, and silenced satellite signals. Another technique is “doping” the oil with additives and changing its name in the paperwork to be sold as a wholly different crude without a trace of its Venezuelan roots. Palau’s island nation says a tanker that recently loaded Venezuelan oil was claimed to be the “Ndros,” a Palau-flagged ship scrapped in Pakistan in 2018.

3. Climate change

President Biden placed climate change squarely at the center of his agenda on Wednesday, using his first hours in office to rejoin the Paris climate accord and begin overturning more than 100 environmental actions taken by the Trump administration. On Thursday, climate envoy John Kerry said the US and other nations must commit to much deeper carbon cuts to avert dire climate impacts. The Interior Department issued an order requiring signoff from a top political appointee for any new oil and gas lease or drilling activity. The directive, which could slow approval for more than 400 drilling permit applications, prompted an immediate outcry from the oil and gas industry.

Those initial moves are the first in what promises to be a much longer — and more arduous — effort to unwind the Trump administration’s comprehensive environmental and energy policies. The four years were marked by aggressive deregulation prioritizing the fossil fuels industry and sidelining efforts to combat climate change or protect imperiled animals. However, legal experts warn that it could take two to three years to put many of the old rules back in place.

Climate change has not been a significant feature in US trade agreements; however, under President Biden, future trade agreements will be based on partners’ ability to meet their climate targets under the Paris agreement. Environmental advocates, trade experts, and lawyers say this shift will help build a global consensus to avert the worst effects of climate change, even though it may rattle certain allies. It will allow Biden to beef up environmental standards at home without the risk of American businesses losing out to companies that operate in countries with laxer environmental standards.

The IEA says oil and gas companies aren’t doing enough to reduce the release of methane, a potent source of planet-heating emissions seeping out of pipelines and production plants. A report published last week found the estimated 10 percent drop in methane emissions from oil and gas companies last year was primarily due to lower production amid a global decline in demand due to the pandemic. It warned that the amount of methane released into the atmosphere as part of the production process for fossil fuels could rebound again as economies recovered and the agency called on countries and companies to do more to plug those leaks.

California’s changing climate has pushed fire season to new lengths, triggering once-rare winter blackouts. State utilities cut power to more than 72,000 homes and businesses last week in a preemptive effort to prevent live wires from sparking wildfires as Santa Ana winds threaten to fan flames. Blazes are breaking out, nonetheless. While the Santa Ana winds usually die off by November, they’re increasingly extending further into winter, underscoring how wild California’s weather has become as climate change drives extreme heat and drought. Last year, record temperatures took down large swaths of the state’s power grid, and wildfires torched more acreage than ever before.

4. The global economy and the coronavirus

A tentative finding by the British government shows a new variant of the coronavirus may be deadlier than the original. That possibility was raised by preliminary studies relying on small numbers of deaths and is not conclusive. But the prospect that the fast-spreading new mutation, already known to be more contagious, could also be more lethal compounded fears that even with the arrival of vaccines, the pandemic will remain a severe threat for some time.

The coronavirus delivered a lingering, possibly permanent, hit to business travel that is likely to weigh on employment and economic growth for years. Beyond the blow to airlines, hotels, travel agents, and rental-car companies, the drop in business travel is rippling through whole ecosystems of connected commerce.

When global restrictions to control the spread of Covid-19 were put into place last spring, businesses and road-warrior workers were forced to adjust. They began making sales calls and attending board meetings through videoconferences rather than on-site visits and adapting to virtual training and networking instead of conference-center seminars. Executives learned that more remote work, to a degree, was possible than they previously envisioned, which could lessen the need for business travel in the future, even after vaccines conquer the coronavirus.

The world is on the brink of “catastrophic moral failure” because of the unequal distribution of Covid vaccines, the head of the World Health Organization has warned. It is not fair for younger, healthy people in more prosperous nations to get vaccinated before vulnerable people in poorer states. So far, China, India, Russia, the UK, and the US have all developed Covid vaccines, and most of these nations have prioritized distribution to their populations. The need to test and distribute vaccines will last beyond 2022 in the sophisticated economies and then for the low- and middle-income countries, perhaps well into 2027 or 2030.

United States: About 900,000 workers filed for unemployment benefits two weeks ago as the labor market struggles to recover. Jobless claims, a proxy for layoffs, remain above the pre-pandemic peak of 695,000 and are higher than in any previous recession for records tracing back to 1967. The pandemic’s effects are restraining the economic recovery after steep losses last spring. Employers slashed 140,000 jobs in December, the first monthly decline in payrolls since the coronavirus shut down businesses last spring. Consumers cut back on purchases this winter after spending steadily for several months. A new round of fiscal stimulus—President Biden is pursuing $1.9 trillion in additional aid—and the prospect of widespread vaccine distribution also led economists to raise their growth projections.

China: Beijing launched mass coronavirus testing in some areas last week, as China battles its worst disease outbreak since March. Beijing reported a slight decline in new daily COVID-19 cases on Friday – 103 from 144 cases a day earlier. Compared to the rest of the world, these are small numbers of new cases, but the government has never been very open about the virus.

China’s economy picked up speed in the fourth quarter, with growth beating expectations as it ended a coronavirus-stricken 2020 in remarkably good shape and remained poised to expand further this year even as the global pandemic rages. According to a Reuters poll, the gross domestic product grew 2.3 percent in 2020, and China is expected to continue to grow with GDP set to expand at the fastest pace in a decade at 8.4 percent.

After a pandemic-hit start to 2020, China’s refiners boosted production from April, thanks to ultra-low crude prices and a rebound in the Chinese economy. Crude oil throughput at China’s refineries averaged 13.51 million b/d in 2020, a 3.2-percent increase over the previous year to a record-high processing volume.

One thing missing from China’s otherwise remarkable economic recovery is a strong rebound in consumer spending. Even though China was the only major economy to expand during the Covid-19 pandemic last year, its growth remains highly unbalanced, relying heavily on exports of manufactured goods to the US and elsewhere. Domestic consumption has lagged, with retail sales shrinking 3.9 percent in 2020 from the previous year and demand for imported goods falling slightly.

There are many reasons for the weakness. While China’s unemployment rate never shot up as much as it did in the US and Europe, many employers cut salaries or hours, leaving consumers anxious. Many opted to save more—a common tendency in China, which has long had a high savings rate. China’s government also didn’t hand out checks to consumers as the US did, choosing instead to focus on helping factories and other businesses.

The cold spell that left Asian countries scrambling to buy enough natural gas for heating and electricity generation earlier this month made headlines and spurred a massive rally in spot gas prices on the regional market. It also highlighted a problem with China’s electricity consumption: it grew too much, too fast. China’s electricity consumption in November increased by 9 percent (annualized). While most other economies were hobbled in November, China was the exception, with business activity booming, which to no small extent accounted for the surge in power consumption. This jump in business activity coincided with an increase in household electricity use, too, despite the fact the weather in November was milder than usual.

China blew past its previous record for renewable energy installations last year with a massive — and surprising — addition of wind power. The National Energy Administration said that China added 72 gigawatts of wind power in 2020, more than double the previous record. The country also added 48 gigawatts of solar, the most since 2017, and 13 gigawatts of hydropower.

Looking to reset the US-China relationship, Beijing is pressing for a meeting of its top diplomat with senior aides to President Biden to explore a summit between the two nations’ leaders. Beijing is planning a different message for Mr. Yang to bring to Washington than it had delivered during the Trump administration when trade issues were Washington’s priority. Now, with Mr. Biden emphasizing climate change and the pandemic, Mr. Yang plans to also focus on those issues, as well as getting in train an initial meeting between Messrs. Biden and Xi.

Europe: Business activity has dropped sharply in the eurozone and the UK in the latest sign that tighter restrictions to contain rising coronavirus infections are dragging economies towards a double-dip recession. A eurozone survey showed most businesses reporting activity lower for the third month in a row while the equivalent UK index dropped to its lowest level since May.

European leaders are fearful that highly contagious coronavirus variants could overwhelm their medical systems. The group moved Thursday to begin reimposing border restrictions and to speed the distribution of vaccines. The leaders held back from endorsing a specific plan for borders. But Germany — which as the wealthiest and most populous EU member often drives its discussions — proposed strict, temporary bans on travel to the EU from countries where mutated forms of the coronavirus are already prevalent, including Britain. The proposal would restrict EU citizens from returning to their home countries if they are currently in an affected country and would be more stringent than previous border measures.

The European Central Bank is looking at a darkening economic picture as infections and deaths surge. With more than a trillion euros of pandemic stimulus still in the pipeline, President Christine Lagarde is expected to claim that the bank has the means to keep credit affordable and support the hoped-for recovery. Spiking virus totals have led Germany, the eurozone’s biggest economy, to extend restrictions on many businesses involving contact with the public until Feb. 14th, while Portugal hit a record for new infections and France imposed a 6 pm curfew. The winter surge suggests that the first quarter could see economic output fall again.

European air traffic fell sharply last week, shrugging off signs of an uptick recently, while economic mobility in Europe’s biggest economies remains little changed. Commercial air traffic within Europe averaged about 69 percent below 2019 levels in the third week of January.

A new study by the European Automobile Manufacturers’ Association found that there are currently 6.2 million medium- and heavy-duty commercial vehicles on the EU’s roads. Almost 98% of these trucks run on diesel; only 2,300 are zero-emission trucks. European truck makers estimate that around 200,000 zero-emission trucks will have to be in operation by 2030 to meet the CO2 targets for heavy-duty trucks. This would require a staggering 100-fold increase in nine years. However, the European Commission wants to have some 80,000 zero-emission trucks on the road by 2030, which falls far short of what is required by the CO2 regulation.

Russia: Moscow is preparing to make the earliest-ever shipment of liquefied natural gas to Asia, taking advantage of thinning ice in the Arctic Ocean and paving the way for a record-long navigation season this year. In early May, the super-chilled cargo from the Yamal LNG facility will beat last year’s record for the start of eastbound voyages through the Northern Sea Route by almost two weeks.

The Northern Sea Route, stretching more than 3,000 nautical miles between the Barents Sea and the Bering Strait, is the shortest passage between Europe and Asia. Its eastern part is usually shut for navigation for several months at the start of the year due to thick ice. Its increased use underscores how quickly the pace of climate change accelerates in the Earth’s northernmost regions.

The European Parliament has again called for the Nord Stream 2 gas pipeline project to be halted, this time in light of Moscow’s arrest of Russian opposition politician Alexei Navalny. The Parliament called on the EU and its member states to devise a new strategy for relations with Russia. Gazprom has warned investors that the Nord Stream 2 pipeline project could be suspended or discontinued due to “political pressure,” among other exceptional circumstances.

Berlin has always looked at the project from an economic standpoint. In contrast, the US and several European countries, including the Baltic states, Poland and the EU, have expressed concern about Russia using gas sales and its gas monopoly Gazprom as a political tool. Over the past months, the US has been broadening sanctions against service providers and vessels involved in the construction of Nord Stream 2 in a fresh attempt to keep the project from completion.

German Chancellor Angela Merkel said Thursday that she isn’t abandoning a German-Russian gas pipeline project that faces US sanctions but wants to talk to the new administration about the issue. The Nord Stream 2 pipeline faces bipartisan opposition in the US. Washington has said that the project would make Europe more dependent on Russian gas and hurt energy security. The Kremlin has responded by accusing the US government of promoting its liquefied natural gas.

Saudi Arabia: Crude exports rose to a seven-month high in November, and with production capped by the OPEC+ agreement, domestic stockpiles ended the month at a 17-year low. Shipments inched up slightly to 6.35 million b/d. With production holding at 8.97 million b/d — just below its OPEC+ quota — Saudi Arabia’s domestic crude stockpiles dipped in November to 143.43 million barrels, the lowest since November 2003.

Saudi Aramco may be forced to play catch-up in 2021 as rival oil companies closely aligned to OPEC policy race to add new production capacity and win back market share despite deep pandemic-induced output cuts. Aramco began 2020 with a capital expenditure budget of between $35 billion and $40 billion. Still, this figure was progressively lowered throughout the year as the demand shock caused by the global pandemic forced the kingdom into severe production cuts along with OPEC, Russia, and other allies. By the third quarter, Aramco’s CAPEX had been halved to $20 billion. Its pledge to maintain a hefty $75 billion dividend to shareholders — while many IOCs have slashed theirs — is a problem as well.

For most of last year, Saudi Arabia and its key partner in the OPEC+ deal, Russia, were head-to-head in a very close race for the top spot as the biggest crude oil supplier to China. In the end, Saudi Arabia edged past Russia, shipping on average 1.69 million b/d of oil to China. Saudi oil exports to China grew by 1.9 percent year over year in 2020. Russia’s exports saw larger growth last year than the rise in Saudi exports, 7.6 percent compared to 2019.

India: Crude oil imports surged in December to their highest in almost three years. Imports jumped by 29 percent in December compared to November and by 11.6 percent compared to December 2019, to more than 5 million b/d. Fuel demand in India posted its fourth consecutive monthly rise in December to the highest since February 2020. Fuel consumption was still 2 percent below the levels seen before the pandemic. Even the rebound in economic activity and transportation resulted in four straight months of rising fuel demand in India. India turned from the worst-performing demand market in July into one of the fastest-growing fuel demand markets in November, lending support to oil prices together with strong demand in China and progress with vaccine development and rollout.

Total is planning to invest heavily in India’s solar sector going into the next decade. The French company plans to invest $2.5 billion for a 20% stake in Adani Green Energy, the world’s largest solar developer. While Total will continue investing heavily in fossil fuels, the shift to green energy responds to national calls for a low-carbon future. The investment sees Total strengthen their partnership with Adani, planning for the future of India’s renewable energy development.

5. Renewables and new technologies

The Norwegian electrolysis company, NEL, aims to produce renewable hydrogen at $1.5/kg by 2025, outcompeting fossil fuel-derived alternatives. Scaling up electrolysis to multi-GW size is seen as essential in reducing capital costs. Still, the input cost of renewable electricity is the single most significant factor in green hydrogen cost. As such, NEL recognized the target was achievable only in particular markets.

According to the Hydrogen Council, the current global hydrogen market of 70 million tons is expected to grow eight times by 2050. “The hydrogen market is already large, but with only a fraction served by electrolysis, there are significant opportunities to turn the existing market green. We see a regulatory landslide across the globe, with the EU and the US pledging hundreds of billions of dollars into their zero-emission programs where hydrogen serves a vital part as the energy carrier of choice,” a council spokesman said. The growth would come from industrial applications, transforming diesel-based heavy-duty transportation. “These developments require low-cost electrolysis and ultra-fast fueling.”

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

LNG projects for 2021: Baker Hughes Co. expects as many as four liquefied natural gas projects globally to move to a final investment decision this year amid a global revival of the fuel after last year’s pandemic-induced collapse. (1/22)

The Abu Dhabi National Oil Company (ADNOC) is looking to form partnerships with companies from the U.S. to develop unconventional oil resources in the United Arab Emirates. The UAE is looking to boost its production capacity for when the OPEC+ output cuts end. (1/20)

Iran’s Supreme Leader Ali Khamenei has posted online an apparent call for an attack on Donald Trump in revenge for last year’s killing of its top military leader, Gen Qasem Soleimani. (1/23)

In Pakistan, a sharp squeeze in domestic gas availability and the surge in LNG prices that have pushed up the cost of gas-based power generation has prompted the country to turn to oil for power, a trend that could result in robust fuel oil consumption in the coming months. (1/20)

In Nigeria, the first export cargo of the newest crude grade (Anyala) is on its way to Northwest Europe. The crude is from new shallow-water Anyala West oil fields in the Niger Delta, which struck first oil in November. The new fields are expected to reach 60,000 b/d when fully developed. (1/19)

Ghana has been one of the bright stars of the oil and gas market in the 2010s, ramping up its crude production from virtually zero to some 215kbpd by the end of the decade. But more recent political oversight decisions indicate the Ghanaian government might be overexerting itself in making the nascent oil industry serve its interests. (1/18)

In Colombia, oil flow through the Cano Limon-Covenas pipeline was suspended on Friday after an attack near the border with Venezuela. Explosives started a fire. The 480-mile (773-kilometer) long pipeline can transport up to 210,000 barrels of crude oil per day. (1/23)

Majors are eying Suriname as the next big oil player. Suriname offers hope for low-cost oil. Exxon Mobil, Royal Dutch Shell, Total, Apache are all showing interest in the South American state, hoping Suriname will provide oil for as little as $30 to $40/barrel thanks to lower production costs. This cost is well below average US costs of almost $50 per barrel. Experts expect at least three or four billion barrels of reserves in Suriname’s waters. (1/22)

Canadian oil prices are set to rise during 2021, thanks to a decrease in crude supply competition to refineries on the United States Gulf Coast. Mexican heavy crude exports are down, opening up the market for Canada’s heavy oil. (1/21)

Less dirty oil sands: Researchers from three universities found that greenhouse gas emissions from three oil sand producers are declining. Current emissions are 14 percent to 35 percent lower than reported in previous studies. New technologies could further decrease those upstream emissions by 14 percent to 19 percent compared with current technology. (1/21)

Keystone pipeline stopped: After four tumultuous years, Canadian officials are optimistic that the inauguration of President-elect Joe Biden will mean a return to traditionally close relations between Canada and the US. But this week, they were dealt a stinging reminder that Biden will also bring the return of more familiar bilateral irritants — the Keystone XL pipeline. (1/20)

Alberta, which invested $1.1 billion of taxpayers’ money in the controversial Keystone XL project, is now considering the sale of pipe and materials to recoup some funds. (1/20)

The US oil rig count rose by 2 to 289 while the gas rig count increased by 3 to 88, Baker Hughes reported on Friday. The combined US rig count (377) remains 48 percent below last year’s count (791). Canada’s combined rig count is 161, down from last year’s 244. (1/23)

This year, higher natural gas prices are expected to result in the first annual decline in US gas-fired electricity generation since 2017, the US EIA said. Generation from gas-fired power plants is set to decline by about 8 percent, mainly due to an expected rise in natural gas prices from $2.37 per MMBtu during 2020 to $3.35 during 2021—a 41 percent increase. (1/20)

ConocoPhillips reported Friday that it had completed its acquisition of Concho Resources. The transaction creates an approximately $60 billion company with a resource base of roughly 23 billion barrels of oil equivalent with a WTI cost of supply below $40 per barrel and an average cost of supply below $30 per barrel. (1/19)

Last hurrah? Big banks, climate activists, and banking reform advocates don’t agree on much, but they have joined forces to denounce a proposed Trump administration rule that would make it harder for banks to cut ties with the fossil fuel industry. The rule is drawing fierce opposition from some strange bedfellows. (1/18)

A US court tossed out one of President Donald Trump’s signature efforts to roll back environmental regulations just one day before he leaves office, scrapping a rule meant to prop up the ailing coal industry. (1/20)

European car sales plunged by 23.7% last year as the pandemic provoked the worst crisis ever to hit the capital-intensive industry. New car registrations sank to 9.9 million units. All significant markets recorded double-digit declines. (1/19)

Battery superfast charge: An Israeli firm has announced the first superfast EV battery that can charge in just five minutes. The technology could spark a real EV revolution as it would eliminate one of the buyers’ most significant concerns—range anxiety. (1/21)

EV angles: A new study from MIT researchers uncovers the kinds of infrastructure upgrades that would make the most significant difference in increasing the number of electric cars on the road, a critical step toward reducing greenhouse gas emissions from transportation. The researchers found that installing charging stations on residential streets, rather than just in central locations such as shopping malls, could have an outsized benefit. (1/22)

Daimler AG’s Mercedes-Benz rolled out its first battery-powered SUV as part of a plan to take on Tesla and Volkswagen. The EQA’s retail price will be set around 47,541 euros ($57,734) and have a range of approximately 486 kilometers (302 miles). (1/22)

EV cost shaving: Mercedes-Benz is taking on one of the most complex industry challenges with the rollout of its battery-powered EQA: selling small electric cars without a big profit squeeze. The German manufacturer modified its GLA crossover underpinnings to reduce upfront investment and save time compared to building an all-electric vehicle from scratch. (1/20)

Cruise and General Motors have entered a long-term strategic relationship with Microsoft to accelerate self-driving vehicles’ commercialization. To unlock cloud computing potential for self-driving vehicles, Cruise will leverage Azure, Microsoft’s cloud and edge computing platform, to commercialize its autonomous vehicle solutions at scale. (1/21)

CO2 capture tools: Using technology to suck carbon dioxide out of the sky has long been dismissed as an impractical way to fight climate change — physically possible but far too expensive to be of much use. Yet a growing number of corporations are pouring money into so-called engineered carbon removal — for example, using giant fans to pull carbon dioxide from the air and trap it. The companies say these techniques, by offsetting emissions they can’t otherwise cut, may be the only way to fulfill lofty “net zero” pledges. (1/19)

CO2 capture $$ prize: Elon Musk said he plans to donate $100 million toward a prize for the best carbon capture technology, weeks after he became the world’s richest person. (1/22)

H2 issues: A key challenge in developing the hydrogen economy comes from the high cost of transportation, which could be three times the cost of production. Gas-based “blue” ammonia will likely comprise the bulk of future hydrogen transportation given its lower production costs compared with renewable ammonia and the ease in transport compared with liquified hydrogen, equity analyst HSBC said in a Jan. 18 research note. (1/19)

Danish H2: Denmark’s Ørsted has taken a final investment decision on the demonstration project H2RES, which will use offshore wind energy to produce renewable hydrogen. The project is expected to make its first hydrogen in late 2021. H2RES will have a capacity of 2 MW. The facility will produce up to around 1,000 kg of renewable hydrogen daily. (1/22)

The hydrogen-powered aviation startup ZeroAvia Inc. has raised $37.7 million from the UK government and a group of investors that includes funds founded by Bill Gates and Amazon.com Inc. ZeroAvia said it aims to use the money to advance the development of technology that could cut carbon emissions from the aviation sector by replacing fossil-fuel-burning propulsion with a hydrogen fuel-cell system. (1/19)

Southern ice sheets: a new study, published Thursday in the journal Nature Communications, finds that beneath the surface layer of waters circling Antarctica, the seas are warming much more rapidly than previously known. Furthermore, the study concludes, this relatively warm water is rising toward the surface over time, at a rate three to 10 times what was previously estimated. (1/23)

Cargo storm-damaged: A cargo ship operated by A.P. Moller-Maersk A/S lost several hundred containers in the Pacific Ocean while sailing through heavy seas from China to Los Angeles. This is the latest in a spate of incidents in which boxes are carrying millions of dollars’ worth of goods have gone overboard. The company said the Maersk Essen, which has capacity for more than 13,000 containers, lost an estimated 750 of them on Jan. 16. (1/22)