Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“Global momentum is growing for more ambitious greenhouse gas emissions reductions, but current policies and pledges are insufficient to meet the Paris Agreement goals.”

US National Intelligence Estimate, on the link between climate change and national security

“Crude oil could justifiably trade to the next level higher on the storage drought at Cushing alone. Forget about fuel switching, whether OPEC+ adds additional barrels, or dollar weakness: if Cushing continues to slide, it could get ugly quickly.”

Bob Yawger, director of the futures division, Mizuho Securities USA

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

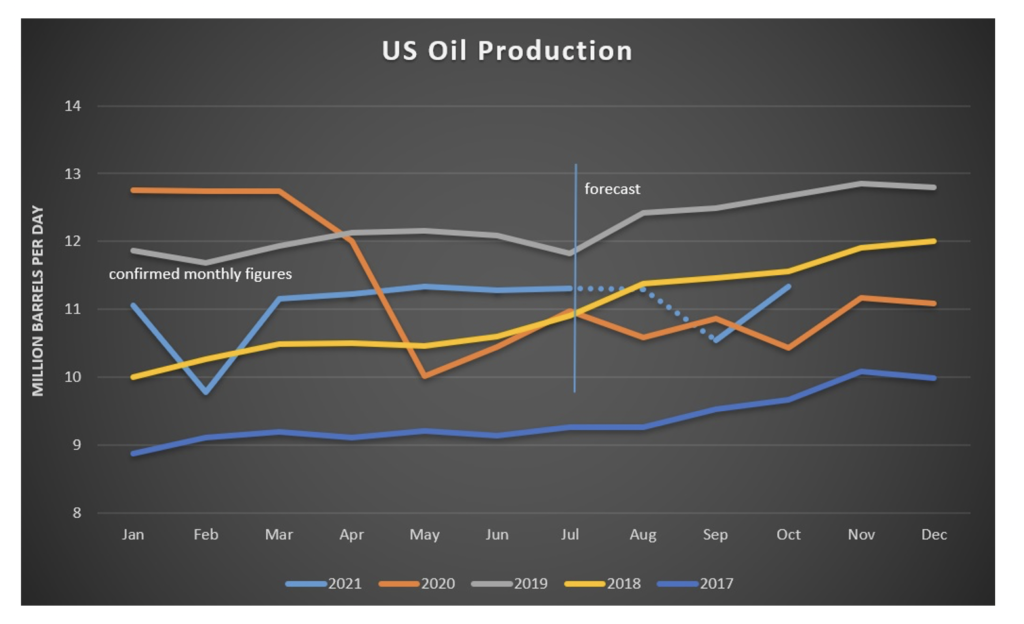

Oil: Futures rallied last week on concerns that rising consumption is racing ahead of supply. Oil prices rose early on Thursday, with Brent Crude rallying to $86.10—the highest price since October 2018. New York crude settled at a fresh seven-year high on Wednesday and closed Friday at $83.76. According to government data, US crude inventories fell by 431,000 barrels the week before last compared with a Bloomberg survey that had forecast a fourth weekly increase. Gasoline and distillate inventories also decreased more than expected. The market has tightened significantly as coal and natural gas shortages drive greater crude consumption, underpinning a rally in prices.

Stockpiles at the most significant US crude depot are approaching critically low levels. The last time that happened, crude cost more than $100 a barrel. The storage tanks in Cushing, Oklahoma, require a minimum oil level to maintain normal operations, which traders generally believe is around 20 million barrels. Unusual for this time of year, stockpiles declined more than 4 million barrels over the past two weeks to 31 million and are expected to keep dropping rapidly due to the world’s insatiable demand for US light sweet crude.

According to an EIA report, US crude exports in the week ended Oct. 15th were reported at 3.06 million b/d, up 546,000 b/d from the prior week. This marks the highest weekly export level EIA had reported since the week ended Aug. 13th, when US crude exports averaged 3.431 million b/d. In addition, this uptick on the weekly figure brought the four-week moving average of US crude exports over the period ended Oct.15th to 2.677 million b/d, up 63,000 b/d from the period ended the week prior.

As oil prices hit multi-year highs, some speculative traders are betting on the options market that oil could exceed $100 a barrel by the end of this year and even reach a record $200 per barrel by the end of 2022. Call options give traders the right—but not the obligation—to buy assets at a specific price, the so-called strike price, by a certain date. In recent weeks, the amounts of call options at triple-digit strikes have soared, suggesting that potential quick profits from options trades attract more speculative traders.

The surge in oil prices is drawing fund managers back into shares of oil and gas companies, even as some remain unsure that the price gains will stick. As a result, energy stocks in the S&P 500 are up 53.8% for the year to date compared with a 20.2% gain for the broader index. Rising demand from the global economic reopening collides with supply chain disruptions and inflation fears.

Surging prices for natural gas threaten to eat up the profit some oil refiners make on their fuels, forcing them to cut processing rates and even altering standard crude-buying patterns. Natural gas is central to making the hydrogen that oil refineries rely on for diesel-producing hydrocrackers and hydrotreaters. According to the International Energy Agency, the natural gas price surge has added up to $6 per barrel to the cost of processing more sulfurous crudes — as much as a tenfold increase compared with two years ago.

OPEC: The cartel+’s compliance with oil cuts fell slightly to 115% in September, indicating that as the alliance raises production targets, some members are still falling short as they face challenges in pumping more oil. The organization raised its output targets by 400,000 b/d in September. It has also agreed to raise them by a further 400,000 b/d in October and in November. However, underinvestment and maintenance problems have stymied efforts by Angola and Nigeria to increase output, an issue that is expected to continue impacting the West African producers.

Russian President Putin said on Thursday, “Currently, the OPEC+ countries are increasing production volumes, even slightly more than they agreed to do, but not everyone can do it,” “Not all oil-producing countries can quickly increase oil production. This is a long-term process, a long-term cycle.”

Only five producers in the OPEC+ alliance can significantly boost output in the short term. Nigeria and Angola are the hardest hit, with the pair having pumped an average of 276,000 b/d below their quotas for more than a year.

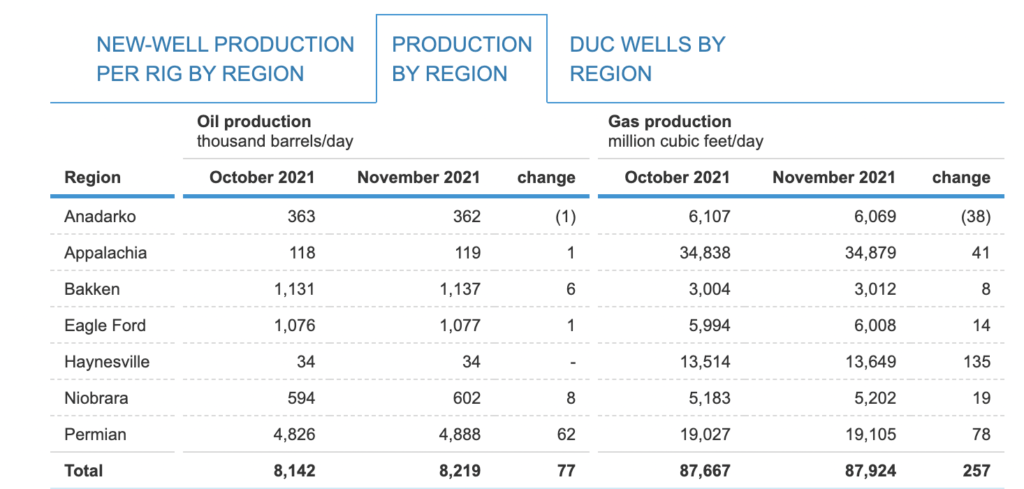

Shale Oil: While total production in the US is still lagging, the Permian Basin of West Texas and New Mexico is increasing output to an average of 4.826 million b/d in October and is forecast to rise to 4.888 million b/d in November. That’s close to a revised 4.913 million barrel-a-day record set in March 2020, just before the pandemic unleashed widespread demand destruction.

With the price of US crude approaching $85 per barrel for the first time in years, shale oil production is finally picking up. Although large public companies are still reluctant to boost output in any significant way lest they anger their cash-return-eager shareholders, smaller, private producers are ramping up to take advantage of the higher prices. “It’s a win for the privates without being a loss for the oil markets,” said Raoul LeBlanc, an analyst at IHS Markit.

As can be seen from the EIA’s Drilling Productivity Report, only the Permian Basin continues to grow significantly:

US antitrust regulators have extended the approval process for at least five oil and gas mergers and acquisitions in the last three months, as the Biden’s administration scrutinizes deals in a bid to tackle soaring energy prices. The slowdown comes amid growing pressure on policymakers to respond to consumer angst over skyrocketing retail gasoline prices as US crude futures hit multi-year highs. As a result, the White House has been calling US oil and gas producers to ask how they can help lower prices.

Natural Gas: The UK and European gas prices surged as much as 18% last Monday after a keenly awaited pipeline capacity auction showed no increase from Russia either through the Ukrainian pipeline system or lines passing via Poland to northwest Europe. Traders and analysts say the auction’s result is the latest indication that Russia is in little rush to send additional gas to Europe, leaving supplies tight as winter begins and raising the prospect of shortages if the weather is colder than usual.

Putin and Kremlin officials now are clearly saying that the Nord Stream 2 pipeline must be opened before Europe can expect a substantial increase in natural gas supplies from Russia. Nord Stream 2 would enable Moscow to send more natural gas to Western Europe without paying transit fees to Poland and Ukraine. While gas supplies have tightened globally, the IEA said it believed Russia could boost exports by about 15% to Europe.

The level of concern over supplies in Europe sent the benchmark gas contract for November delivery up after the auction results, rising 18% to €104 per megawatt-hour (yes, the UK seems to measure some natural gas prices in megawatt-hours), while the equivalent UK contract jumped more than 15% to 22.71 per therm. Prices are more than five times higher than a year ago, posing a threat to the economic recovery from the pandemic, with energy-intensive businesses warning they may need to curtail production.

Surging spot prices of liquefied natural gas in Asia give LNG producers and sellers an advantage in contract negotiations for long-term supply. Buyers in Asia, which relied very much on spot supply last year when LNG spot prices plummeted to $2 per million British thermal units, are now looking to lock in more long-term gas supply as spot prices hit a record of over $50/mmBtu for some cargoes traded earlier this month.

US natural-gas prices have shed 16% since hitting a 13-year high earlier this month, reversing some of a run-up that has prompted fears of exorbitant heating bills and higher manufacturing costs at a time of already high prices. A warm start to autumn is behind the decline. With most of the country yet to turn the heat on, gas has accumulated in storage facilities faster than expected and shrunk a deficit that, until recently, had prompted worries over winter price surges and even potential shortages.

US forecasts call for temperatures to remain unseasonably high into November. Meanwhile, on Thursday, federal weather scientists said their climate models predict a second straight winter of above-average temperatures, particularly in the South and East.

Thursday, the US EIA said that about one-third more gas than average was added to domestic stockpiles last week, the latest in a stretch of above-average weekly builds. As a result, inventories that ended August 7.7% below the recent average are now just 4.2% short, according to EIA data.

Coal: China’s coal prices hit a record high last Tuesday, buoyed by a widening power crunch and cold weather despite Beijing’s efforts to bolster supply. Thermal coal for January delivery hit a record $302 per ton. Then the National Development and Reform Commission, China’s state planner, said it was studying ways to intervene in record-high coal prices and would take all necessary measures to bring them back to a “reasonable range.” However, outside observers note that government interventions in the past have not always been successful in lowering prices.

After the announcement, China’s thermal coal futures plunged and turned in their worst week in five months. The most-traded contract on Zhengzhou Commodity Exchange hit the lower daily trading limit of 14% and settled at 1,408.4 yuan ($220) a ton on Friday. That was nearly 30% below a record high hit on Tuesday and down almost 15% for the week.

China’s new coal output rate, hiked this week in the teeth of an energy crunch, puts it on pace to produce more of the fuel this year than ever before if the increase is sustained, according to Reuters’ calculations based on official Beijing data. That record level is just under 4 billion tons. If new production rates are maintained until year-end, it significantly raises the potential to produce electricity in a country where most power is generated from coal.

China, a leading source of public financing and construction know-how for coal-fired generators, pledged to no longer build coal projects overseas, undercutting a pipeline of dozens of power plants in developing countries, including Vietnam. For Vietnam’s central planners, the timing was terrible when China announced it would no longer build coal-fired power projects abroad. In early September, an updated energy blueprint for the Southeast Asian nation unexpectedly sacrificed renewables through 2045 in favor of continued heavy reliance on coal, the single largest source of greenhouse gases that cause global warming.

Even as wealthier nations look to drive down carbon emissions to net-zero, many low- and middle-income countries remain hesitant to set similarly stringent targets. Doing so would mean often abandoning the most readily available source of electricity – coal.

Electricity: While electric vehicles are undoubtedly the future, the question of whether our power grid is also ready for the future has started to surface, especially in places like New York. Power outages and appeals from utilities for customers to cut back on usage have been commonplace in California and places like New York, Texas, and Louisiana. And while the nation stays focused on the future of vehicle travel, another bottleneck arises in power generation, a new Washington Post article points out. The report notes that the grid will be “challenged” by the need to deliver power to the cars. Gil Quiniones, head of the New York Power Authority, said: “We got to talk about the grid. Otherwise, we’ll be caught flat-footed.”

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Talks to restart the stalled nuclear deal will resume this week, an Iranian member of parliament said. The resumption comes about four months after negotiations were delayed as a new ultra-conservative administration took office. The news followed an Oct. 17th meeting with the foreign minister Hossein Amir-Abdollahian in parliament. This is the first time an Iranian official during the new presidency of Ebrahim Raisi has given a timetable for talks to begin again.

An Iran-flagged supertanker sailed from Venezuelan carrying 2 million barrels of heavy crude provided by state-run oil firm PDVSA, according to documents seen by Reuters and vessel tracking services. The shipment is part of a deal agreed by PDVSA and its counterpart National Iranian Oil Company that exchanges Iranian condensate for Venezuela’s Merey crude. The swaps aim to ease an acute shortage of diluents that has cut Venezuela’s oil output and exports.

Iraq: The oil production target announced last week is for 8 million b/d by the end of 2027, according to the country’s Oil Minister. According to the EIA, Iraq holds a conservatively estimated 145 billion barrels of proven crude oil reserves. In addition, the Oil Ministry says that Iraq’s undiscovered resources amount to around 215 billion barrels. This was also a figure arrived at in a 1997 detailed study by a respected oil and gas firm, Petrolog. However, even this figure did not include the parts of northern Iraq in the semi-autonomous region of Kurdistan.

Baghdad’s unstable relationship with the semi-autonomous Kurdistan has proven to be a significant obstacle, as is the endemic corruption across the country, particularly prevalent in the oil sector. Given that no real change has resulted from last week’s elections in Iraq, its latest crude oil production ambitions should be considered as they always have been, that is, by looking at what could be achieved theoretically and what is likely to happen.

In September, Iraq’s oil output rose by just over 100,000 b/d compared to August, as OPEC’s second-largest producer continued to show hefty monthly gains since higher quotas came into effect. September production from fields in both federal territory and the Kurdistan Region of Iraq totaled 4.34 million b/d, up from 4.23 million b/d in August.

The land between the Tigris and Euphrates rivers is where the first complex human communities emerged. But as climate change produces extreme warming and water grows scarcer around the Middle East, the land is drying up. Years of below-average rainfall have left Iraqi farmers more dependent than ever on the dwindling waters of the Tigris and Euphrates. Fields are turning brown. Salt and pollution are killing the reeds.

Upstream, Turkey and Iran have dammed their waterways in the past two years, further weakening the southern flow, so a salty current from the Persian Gulf now pushes northward and into Iraq’s rivers. The salt has reached as far as the northern edge of Basra, some 85 miles inland.

According to the International Organization for Migration, a lack of access to clean water displaced more than 20,000 Iraqis in 2019, most of them in the country’s south. Dozens of farming villages are abandoned, except for an isolated family here and there. Moreover, saltwater intrusion is poisoning lands passed on for generations, from fathers to sons. The UN recently estimated that more than 100 square miles of farmland a year are being lost to the desert.

According to Berkeley Earth, Iraq’s average temperature has risen by 4.1 deg. F since the end of the 19th century, double the speed of the Earth as a whole. Climate scientists warn that the extreme temperatures facing places like southern Iraq are a small taste of what will follow elsewhere. Iraq’s climate woes have exacerbated shortages in everything from food to electricity generation. Fisheries have been depleted. In the country’s north, aid groups say that wheat production is expected to decline by 70%. In provinces without rivers, families are spending ever-larger portions of their monthly income on drinking water.

Libya: Oil Minister Mohamed Oun has suspended the head of the country’s state energy company, Mustafa Sanalla, for the second time in as many months, though he continues to work, according to sources in the country, as the political battle shows no sign of abating. Sanalla is being investigated both for financial irregularities at the National Oil Corp. and for insubordination, an Oct. 20th decree from the minister said.

Venezuela: Caracas hiked the price of its subsidized gasoline for vehicles and motor bikes, Venezuelan state oil firm PDVSA said on Saturday, an increase the government attributed to the recent cutting of six zeros from the local currency. The new price will come into effect as of Sunday Oct. 24th, bringing the cost of a liter of fuel to 0.10 bolivars ($.023 dollars), representing an increase of 1,900% on the price a year and a half ago.

Venezuela’s government has suspended internationally sponsored negotiations with the opposition and revoked the house arrest of six American prisoners after the US extradited a close ally of President Maduro to face money laundering charges. Venezuela’s chief negotiator Jorge Rodriguez said that his side would not attend the next round of talks due to be held in Mexico City on Sunday. This followed news that Alex Saab, a Venezuelan envoy, had been flown to the US on Saturday from the West African island of Cape Verde, where he was arrested last year.

The collapse of Venezuela’s oil industry could lead to significant environmental consequences. Oil spills are likely to increase due to a lack of infrastructure investment and maintenance. A crucial part of resurrecting Venezuela’s petroleum industry is conducting urgently required maintenance and overhauls on severely corroded industry infrastructure, including vital pipelines and refineries. It appears that the world’s worst modern economic collapse outside of war is no longer making the news it once was despite the humanitarian crisis deepening to the point where nearly all Venezuelans live in poverty and the growing regional threat posed by terrorists.

3. Climate change

Two of the most important events on the global diplomatic calendar occur at the end of this month. First, the Group of 20 meeting will take place in Rome on the weekend of Oct. 30th. Then, on Oct. 31st, COP26, the UN climate summit, will begin in Glasgow, Scotland. In both events, the topic of discussion is vital: How governments can work together to change the disastrous course of climate change.

But both will be missing an essential element: the attendance of some of the world’s critical politicians in the fight to reduce carbon emissions. For example, Russian President Vladimir Putin won’t attend the G-20 or COP26. Likewise, it is considered unlikely that China’s leader Xi Jinping, who has not traveled internationally since January 2020, will attend either.

A leak of documents shows several countries are trying to change a crucial scientific report on tackling climate change. The leak reveals that Saudi Arabia, Japan, and Australia are asking the UN to play down the need to hurry away from fossil fuels. It also shows some wealthy nations are questioning paying more to poorer states to move to greener technologies. The leak reveals countries pushing back on UN recommendations for action and comes just days before they will be asked at the summit to make significant commitments to slow down climate change and keep global warming to 1.5 degrees.

Saudi Arabia is pushing fellow oil producers to present a united front at the climate talks and oppose rising calls for a reduction in fossil-fuel investment, arguing that such a move could further push up energy prices. The kingdom, along with critical oil-producing allies, including the OPEC, is arguing publicly and privately that any calls for lower investment in new oil and natural gas development could lead to higher prices and widen the gap between rich and poor countries.

Major economies will produce more than double the amount of coal, oil, and gas in 2030 than is consistent with meeting climate goals set in the 2015 Paris accord to curb global warming, the United Nations and researchers said on Wednesday. The UN Environment Program’s (UNEP) annual production gap report measures the difference between governments’ planned production of fossil fuels and production levels consistent with meeting the temperature limits set in Paris. Under the pact, nations have committed to a long-term goal of limiting average temperature rises to less than 2 degrees Celsius above pre-industrial levels and attempting to restrict them even further to 1.5C. The report, which analyzed 15 major fossil fuel producers, found they plan to produce, in total, around 110% more fossil fuels in 2030 than would be consistent with limiting the degree of warming to 1.5C.

Satellites are emerging as a tool to fight climate change, exposing hidden sources of greenhouse gas emissions and allowing governments to monitor compliance with international pacts. Over the past three years, satellite images have been used to spotlight previously unreported leaks of methane—or to bump up estimates of known emissions—in Russia, Turkmenistan, Texas’ Permian Basin, and elsewhere, in some cases triggering international scuffles. The disclosures have come from private companies, environmental watchdogs, and others, some working with data from multipurpose, space-agency-owned satellites.

Poland has called for the EU to cancel or delay parts of its plan to tackle climate change ahead of the Glasgow summit. In a paper circulated to others, Poland said Brussels should change or delay parts of its planned climate policies, warning that if an “excessive burden” is put on consumers, they may reject the EU’s climate aims.

4. The global economy and coronavirus

United States: Thousands of unvaccinated workers across the US face potential job losses as a growing number of states, cities, and private companies start to enforce mandates for inoculation against COVID-19. Thousands of police officers and firefighters are at risk of losing their jobs in the coming days under mandates that require them to report their vaccination status or submit to regular coronavirus testing.

The growing energy crisis is causing rising prices for groceries, cars, rent, and just about everything else. Americans have been here before — in the 1970s when oil shocks and soaring inflation defined the economy. While there are critical differences between the US economy then and now, the inflation numbers speak for themselves.

The backlog of ships outside the ports of Los Angeles and Long Beach — America’s largest gateway for ocean freight — is poised to worsen. There’s now a record of 80 container vessels waiting off Southern California, with more on the way from Asia. Moreover, the bottleneck that started almost exactly a year ago shows little sign of letting up, according to a Bloomberg analysis of shipping data.

Europe: Euro-area businesses are reporting a sharp slowdown in activity caused by an aggravating global supply squeeze that’s also producing record inflation. French manufacturing output declined at the steepest pace since stringent coronavirus lockdowns last year, while growth momentum deteriorated sharply in Germany. Since April, private-sector activity in the euro area slowed, though it remained above a pre-pandemic average. “The ongoing pandemic means supply-chain delays remain a major concern, constraining production and driving prices ever higher, both in manufacturing and in the services sector,” said Chris Williamson, chief business economist at IHS Markit, which compiles the survey.

The global upswing in trade leaves the UK behind, which is an early sign of the challenge which Brexit presents to its economy. Leaving the EU has put the UK outside the EU’s vast internal market of 445 million consumers and a customs territory that is bigger still. As a result, Brexit is hobbling trade just as its economy needs all its engines firing to power out of its worst downturn in a century.

For British businesses, the shift means reams of paperwork and ballooning costs. Moreover, trade with the EU accounts for about half of all British exports. As a result, the UK is trailing the trading performance of its peers as the pandemic recedes and global commerce picks up. The UK’s split with the EU also intensifies Britain’s disruption from the supply-chain bottlenecks bedeviling the global economy, including truck drivers and gasoline shortages.

Natural gas and coal prices are soaring in Europe, and it’s beginning to impact some of the region’s biggest metals producers. As a result, many metal producers in the area have announced cutbacks, and many more are likely to follow suit. As a result, cutbacks and energy-specific surcharges will become an increasing feature of the European metal market this year. It was only a matter of time, as a fourfold increase in power costs for some heavy consumers, on top of environmental carbon emissions levies, have finally proved too much for some European metals’ producers.

Britain’s energy market faces an absolute massacre that could claim another 20 suppliers unless the government urgently reviews the energy price cap, Scottish Power Chief Executive Keith Anderson told the Financial Times. “There is a significant risk you could see the market shrink back to five to six companies.”

China: Gross domestic product grew 4.9% year-on-year between July and September, compared with 7.9% in the three months ending in June. On a quarter-on-quarter basis, growth was just 0.2%. Steel mills have faced power cuts. Computer chip shortages have slowed car production. Troubled property companies have purchased less construction material. Floods have disrupted business in north-central China. It has all taken a toll on China’s economy, an important engine for global growth.

Nevertheless, two bright spots prevented the economy from stalling. Exports remained strong. And families, particularly prosperous ones, resumed spending money on restaurant meals and other services, as China succeeded once again in quelling small outbreaks of the coronavirus. As a result, retail sales were up 4.4% in September from a year ago.

Factory owners in China and their customers worldwide have been told to prepare for power supply disruptions becoming part of life as President Xi Jinping doggedly weans the world’s second-biggest economy off its dependence on coal. Months of shortages have cut power to households in China’s northeast and caused outages at factories across the country. But energy demand is still surging amid record demand for Chinese exports, and the problems will be compounded by the prospect of freezing temperatures in winter.

Daily crude oil processing rates fell again in September, to the lowest since May 2020, as feedstock shortage and environmental inspection crippled operations at refineries and a power crunch dampened refined oil demand from downstream users. Throughput last month fell 2.6% from a year earlier to about 13.64 million b/d. September throughput was also lower than 13.74 million b/d in August, which was a 15-month low. Throughput in the first nine months of the year was 14.09 million b/d, up 6.2% on year. China has been suffering from its worst power crunch in years, with at least 17 regions across the country asking industrial plants to reduce production to lower power load.

China’s pipeline natural gas imports set a new record of 3.87 million tons in September, up 2.2% from the previous high of 3.79 million tons in August. China’s pipeline gas imports have been setting new records in the past three months, and September was the fourth consecutive month-on-month increase since June. Stockpiling for the coming winter has driven up China’s imports of natural gas in September, especially that of pipeline gas, as its prices were far lower than imported LNG. The surge was also driven by China’s pipeline gas imports from Kazakhstan, which saw a significant month-on-month increase of 39% in September, while LNG imports from Russia saw strong growth of 26.2%.

Dollar-bond defaults from Chinese property developers are rising quickly as the country’s housing market slumps, and the problem could worsen as a wave of debt from the beleaguered industry comes due in the coming months. According to Goldman Sachs, real-estate developers dominate China’s international high-yield bond market, making up about 80% of its total $197 billion of debt outstanding.

However, the market has already endured its worst selloff in a decade after property giant China Evergrande Group skipped interest payments to dollar bondholders in late September. Moreover, smaller rival Fantasia Holdings Group surprised investors by defaulting on debt that matured in early October.

Since then, at least four other Chinese developers have defaulted or asked investors to wait longer for repayment. The property crisis has become so bad that last week Beijing announced that it was intervening in the debt market and Evergrande’s monthly interest payments would be paid.

Russia: President Putin ordered most Russians to stay off work for a week later this month amid rising COVID-19 infections and deaths, and he strongly urged reluctant citizens to get vaccinated. In Russia, Covid-19 cases have surged to more than 34,000 a day, and daily deaths from the virus have surpassed 1,000, a record, according to the government’s coronavirus task force. Only about 42 million or about 30% of Russia’s 146 million inhabitants have been fully vaccinated, Prime Minister Mishustin said last week. This is a rate well below the US and most countries in the European Union.

Until last week, the government avoided strict restrictions because it said it needed to keep the economy working. The Kremlin has instead focused on public apathy on vaccination. It also did its best to conceal the extent to which the virus is hurting Russia. Official statistics showed 221,313 pandemic-related deaths by mid-October. Still, the independent demographer Alexey Raksha calculated that excess mortality — seen by analysts as the most reliable indicator of coronavirus deaths — has reached around 750,000. Raksha’s calculation used figures maintained by Rosstat, Russia’s statistical agency. Meanwhile, a report in the Moscow Times estimated the death toll at about 660,000.

Further west in the former Soviet Bloc, Romania is at the heart of a wave of Covid-19 sweeping across eastern Europe and the Balkans that threatens to overwhelm health services. The country’s daily toll of 19 deaths per million as of October 20th is the highest globally, just ahead of neighboring Bulgaria and Moldova. Moreover, Romania’s death rate is higher than at any point during the pandemic.

Eastern and Central Europe and Russia account for the world’s 12 highest Covid-19 death rates. The figures contrast starkly with western Europe, where death rates are about a tenth of those in the east and stand at less than one per million in several countries. Infections have also soared to unprecedented levels, particularly in the Baltic states. Latvia’s 115 daily new cases per 100,000 people are 30 times higher than Spain’s, and Lithuania’s rate of 94 is 24 times higher.

The operator of the Russia-led Nord Stream 2 gas pipeline said the first of the project’s two lines had been filled with so-called technical gas while still awaiting clearance to start sales to Europe. The pipeline, funded by Kremlin-owned energy giant Gazprom and its European partners, is expected to gain certification from a German regulator to begin commercial sales of natural gas. However, the approval process could take several months.

Russia says it could increase natural gas deliveries to Europe as soon as German authorities approve the Nord Stream 2 pipeline. The Financial Times reports that President Vladimir Putin says gas can be delivered “the day after tomorrow” if approval is granted “tomorrow.” Putin said Russia could provide an additional 17.5 billion cm of gas if the new pipeline gets the green light. According to the Financial Times this amount is equal to a tenth of Russian gas deliveries to Europe and Turkey last year and would come not a moment too soon as Europe continues to struggle to fill up its reserves ahead of winter.

However, the Russian president’s statement is also likely to spark anger in Europe since it confirms suspicions that Russia wants to withhold additional supplies for Europe until Nord Stream 2 is approved. For November, Russia’s Gazprom has booked about a third of offered additional gas transit capacity via the Yamal-Europe pipeline via Poland and has not booked any volumes via Ukraine. Auction results were shown on Monday. Gazprom’s data also showed its gas exports declined in the first half of October from the same period in September.

The pace of Russia’s wheat exports weakened as volumes fell 13% yearly to 13.6 million tons as of October 14th during the 2021-22 marketing year. For the year, Russia’s cumulative wheat exports stood at 12.8 million tons in the week to October 12th. As a result, S&P Global Platts Analytics reduced its estimate for Russian wheat exports to 36.5 million tons.

Saudi Arabia: On Saturday, the crown prince said that the world’s top oil exporter aims to reach zero-net emissions by 2060 and will more than double its annual target to reduce carbon emissions. Crown Prince Mohammed bin Salman and his energy minister said OPEC member Saudi Arabia would tackle climate change while ensuring oil market stability, stressing the continued importance of hydrocarbons. They were speaking at the Saudi Green Initiative, which comes ahead of COP26. The Saudis are trying to explain their position at COP26. They are in favor of cutting emissions, but not for another 40 years.

India: The nation injected its billionth COVID-19 vaccine dose on Thursday, a hopeful milestone for the country where the delta variant fueled a crushing surge earlier this year, and missteps initially held back its inoculation campaign. About half of India’s nearly 1.4 billion people have received at least one dose, while around 20% are fully immunized.

India is considering maintaining strategic reserves of natural gas and imported coal to address future supply shocks, a senior power ministry official said, as the nation battles a crippling coal shortage. A surge in power demand combined with a fall in imports due to high global coal prices have led to supply disruptions and power cuts lasting up to 14 hours a day despite record supplies from state-run Coal India, the world’s biggest coal miner. Alok Kumar, India’s power secretary, said countries increasingly meet their own needs first when there is a supply crunch, citing the example of Russia curtailing supplies to European nations because they wanted more gas locally.

The largest power generating company in India, NTPC Ltd, is looking for bids to import at least one million tons of coal for the first time in two years. NTPC aims to use the imported coal at power plants that are located far from India’s coal mines, as the energy crisis has depleted coal stocks in the country. The first tender in two years for overseas coal supply highlights the shortage of the fuel in India, where coal accounts for 70% of total electricity generation.

India’s gasoil consumption fell in the first half of October from the same period in the previous year. Diesel sales by the country’s state fuel retailers came in at 2.4 million tons during Oct. 1-15, a decline of about 9.2% from last year and down 0.9% from the same period in 2019. Sales of gasoil, which account for about two-fifths of India’s overall refined fuel consumption, are directly linked to industrial activity in Asia’s third-largest economy. In contrast, gasoline sales stayed above the pre-COVID levels at 1.05 million tons as people continued to prefer using personal vehicles over public transport for safety reasons.

5. Renewables and new technologies

Working with Boeing and World Energy, Rolls-Royce has carried out a successful test flight of its 747 Flying Testbed aircraft using 100% Sustainable Aviation Fuel (SAF) on a Trent 1000 engine. The plane had one Trent 1000 engine running solely on 100% SAF, while three RB211 engines ran on standard jet fuel. Initial indications confirm no engineering issues, providing further proof of the fuel’s suitability for commercial use. In addition, last week, Rolls-Royce confirmed that all its Trent engines will be compatible with 100% SAF by 2023.

Geothermal is available year-round, is not variable renewable energy like wind or solar, and already exists in many locations in a commercial capacity. One of the biggest challenges facing the scalability of geothermal plants is cost. In Italy, a team of scientists has proposed repurposing old oil and gas wells, which already are dug deep into the heat of the Earth, as geothermal energy plants.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Israel is considering the construction of a new onshore pipeline to Egypt to quickly boost natural gas exports to its neighbor in the wake of the recent tightening of global supplies. (10/22)

Soaring prices and demand for liquefied natural gas (LNG) in Asia have pushed spot LNG freight rates to over $200,000 per day as traders scramble to book vessels to ship the fuel to energy-starved markets in Asia. (10/22)

Chinese authorities are imposing new hurdles for fertilizer exporters amid growing concerns over surging power prices and food production, a move that could worsen a global price shock and food inflation. (10/20)

Peru’s state-owned Petroperu hopes to extract oil once again in the Andean nation by the end of the year to supply crude to its Talara refinery. Under new socialist President Pedro Castillo, the move signals a return to oil production for Petroperu after more than two decades focused only on oil refining, transportation, storage, and sales. (10/21)

Canada’s Enbridge shut down its Line 5 oil pipeline for several hours on Tuesday after protesters trespassed onto a facility in Michigan and tampered with the pipeline. Line 5 is at the center of a long-running environmental dispute between Calgary-based Enbridge and the state of Michigan that has embroiled the Canadian and US governments. (10/21)

The US oil rig count fell 2 to 443 while gas rigs rose 1 to 99, according to Baker Hughes’ weekly count. That was the first decline for oil rigs and the first increase in gas rigs since early September. The total rig count is now at 542, up 255 from this time last year, but still under the 790 active rigs as of March 2020. (10/23)

An oil-data startup backed by Palantir Technologies Inc. co-founder Joe Lonsdale plans to help energy explorers, bankers and investors figure out how much crude and natural gas reserves trapped underground are worth. (10/22)

Exxon Mobil’s remade board of directors is debating whether to continue with several major oil and gas projects as it reconsiders its investment strategy in a fast-changing energy landscape. Several directors have expressed concerns about a $30 billion liquefied natural gas development in Mozambique and another multibillion-dollar gas project in Vietnam. (10/21)

Jet fuel costs rocket: A sharp rise in fuel prices is threatening the airline industry’s slow recovery from the coronavirus crisis. The price of jet fuel has doubled to almost $750 per metric ton over the past year. Delta Air Lines last week singled out fuel costs as it forecast a swing back to a loss in the final three months of the year, after only its second profitable quarter since the crisis began. (10/18)

A new ruling about drilling in California will ban the permitting of oil and gas wells within 3,200 feet of community sites, including homes, schools, hospitals, nursing homes, and daycare centers. California is one of the only oil-producing states with no regulations on how close oil and gas wells can operate to such facilities. (10/23)

Los Angeles/Long Beach gasoline prices have risen to $4.54 per gallon for regular gasoline. That price is up to $1.36 in a year—a 30% increase. According to the API, California has the highest gasoline tax and fees in the nation and accounts for $0.669 of each gallon of gasoline. This does not include the 18.4 cents per gallon in federal excise taxes. (10/23)

The cost of going solar is about to become more expensive as polysilicon prices are erupting and will likely remain elevated due to factory shutdowns in China. Polysilicon is a super-refined form of silicon used in solar panels for its semiconductor-like material properties. Spot prices for polysilicon bottomed at $6.30/kg in mid-2020 and have jumped 600% to $36.09/kg as of last week, according to BloombergNEF. China is a top producer of polysilicon. (10/22)

The wind energy sector is exploding this year, with European and Chinese companies leading the way in a race to build the world’s largest wind turbine. While Denmark and the UK appear to be leading the industry now, China is working hard to create a footprint in Europe. Unfortunately for the wind turbine manufacturers, they still aren’t making money, and much more investment will be needed. (10/22)

The real problem for nuclear energy in the US is a lack of trust in government, plus negative public opinion regarding the energy source itself. (10/21)

In France, strikes by workers over social and employment issues cut nuclear power generation by about 5.4 gigawatts (GW) on Tuesday, and by 1.4 GW at hydropower stations, EDF data showed. The disruption represented approximately 12.2% of available production capacity on Tuesday late afternoon. (10/20)

Ahead of COP26, the UK National Grid showed that fossil fuels generated 62% of its energy, while renewables chipped in just 6.3%. By far, natural gas is the source of most electricity for the UK’s grid, at 60%. Coal kicked in just 2%, and oil none. Nuclear power—a source of much debate about its clean or dirty status–was responsible for 12.6% of its electricity. (10/19)

The giant Itaipu hydroelectric power plant, wedged between Paraguay and Brazil on the Parana River, faces an energy crunch amid record low river and rainfall levels that experts say could last into next year. The Itaipu Dam, which supplies around 10% of the energy consumed in Brazil and 86% of that used in landlocked Paraguay, has recorded its lowest output since the hydroelectric plant began operating at total capacity in 2005. (10/21)

EVs to upend jobs: Thousands of companies making, selling, and servicing traditional vehicles face an uncertain future as the country transitions to electric cars. From metal fabricators to auto mechanics and corn growers, the coming era of electric vehicles will upend jobs across the economy. (10/23)

EV surge: Despite a shortage of semiconductors, the Volkswagen Group delivered 122,100 BEVs (battery-electric vehicles) to customers in the third quarter (July to September), an increase of 109% compared with the prior-year quarter. The BEV share of total deliveries rose to more than 6% in Q3. There also continued to be strong demand for vehicles with a plug-in hybrid drive (PHEVs). (10/18)

Tesla delivered roughly 73% more vehicles than in the year-ago period, thanks partly to their ability to navigate persistent global supply-chain disruptions. Also underpinning that growth was an uptick in sales of cars made in China, now home to Tesla’s most significant auto plant by output. (10/21)

New EV maker: Foxconn, the Taiwanese electronics giant that assembles Apple’s iPhones, on Monday showed off the first physical fruits of its effort to become a significant player in electric vehicles: a luxury sedan, a sport utility vehicle, and a bus. (10/19)

US-based lithium? Compass Minerals announced the successful, third-party conversion testing of lithium brine resources into both lithium carbonate and battery-grade lithium hydroxide, representing a significant milestone in its previously announced lithium development project. The company believes this is the first known conversion to battery-grade lithium hydroxide from the sustainable lithium brine resource originating from the Great Salt Lake. (10/20)

Water-scarce Egypt aims to more than quadruple desalination capacity by granting private companies concessions from its sovereign wealth fund to build 17 plants with sustainable solar energy over the next five years. The plan fits into Egypt’s push to diversify its freshwater sources for a fast-growing population as it faces competition for Nile River water from the giant hydropower dam that Ethiopia is building upstream. (10/21)

CA’s 2nd driest year: The 12-month period from Oct. 1 through Sept. 30 when surface-water supply is tracked, known as a water year, was the second driest on record based on precipitation and runoff. Only in 1924 was there even less rain and snowfall in a year. Gov. Gavin Newsom has asked Californians to cut their water use by 15% considering the conditions. (10/19)

Thus, CA’s fires: As of Oct. 6, 7,883 fires have burned through more than 2.48 million acres in California, according to the most recent state and federal data. The five-year average over that same period is 7,312 fires and more than 1.2 million acres. (10/19)

A forecast for a developing drought in the US southern Plains is the latest threat to dwindling world wheat supplies. This year, hard red winter wheat, a bright spot compared to paltry spring wheat production, was recently planted and will need a robust harvest next year to counteract a global shortfall in supplies. But a three-month US weather forecast calling for drought in key growing areas could put the crop at risk in places like Kansas, the biggest producer of the grain used to make all-purpose flour. (10/23)

Green concrete: Some of the top cement and concrete manufacturers have pledged a new 25% reduction in CO2 emissions by 2030. The industry has more comprehensive plans to achieve net-zero in concrete manufacturing by 2050. (10/18)