Editors: Tom Whipple, Steve Andrews

Quotes of the Week

“…the IEA estimates that the oil industry needs to invest $365 billion per year. Last year, global capex fell to $350 billion and has not rebounded in 2021, and probably won’t in 2022 either. If capex stays stable at current levels, global oil supply will likely roll over around 2024 and then decline sharply thereafter.”

Morgan Stanley research note, quoted in Oil & Gas Journal

[To Big Oil CEOs at hearing in Congress] “You can either come clean, admit your misrepresentations and ongoing inconsistencies and stop supporting climate disinformation, or you can sit there in front of the American public and lie under oath.”

Rep. Ro Khanna (D-Calif.), chair of the House Oversight Subcommittee on Environment

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Futures rose above $84 a barrel on Friday, within sight of a multi-year high hit last week. Expectations that OPEC and its allies will keep supply tight countered a weekly rise in US inventories and the prospect of more Iranian exports. Oil posted a monthly gain for October of 11% on signs that consumption is outpacing supply and declining stockpiles. New York futures closed at $83.57 and London at $83.72. Last month’s advance shows the impact of an ongoing shortage of natural gas, which has boosted demand for oil products. At the same time, rising margins signal that crude consumption will remain strong as refiners continue to process more oil to meet demand. That could mean that global oil stockpiles will continue to fall in the coming months.

Algeria said on Thursday a crude output increase by OPEC and its allies in December should not exceed 400,000 b/d because of risks. Fuel consumption is soaring around the globe, and with millions of barrels of daily refining capacity offline, refiners still in the game are reaping some of their fattest margins in years. Globally, about 2.3 million b/d of refining capacity was shut down during the pandemic. Another 1 million barrels are likely to be shut down in the next year, Facts Global Energy analyst Steve Sawyer said. That’s just as demand is returning to pre-pandemic levels. Fuel demand is soaring, with cars jamming roads again and gas-to-oil switching gaining speed ahead of winter.

Crude oil tanks at the Cushing, Oklahoma storage hub are more depleted than they have been in the last three years, and prices of further dated oil contracts suggest they will stay lower for months. US demand for crude from refiners making gasoline and diesel has surged as the economy has recovered from the worst of the pandemic. In addition, demand across the globe means other countries have looked to the US for crude, also boosting draws out of Cushing. Analysts expect the draw on inventories to continue in the short term, which could further increase US crude prices that have already climbed by about 25% in the last two months.

The scarcity premium embedded in the structure of Brent crude oil futures widened to the most since 2013 last week, a sign of the tight market underpinning oil’s rally that pundits increasingly predict will push the market to $100 a barrel. Saudi Aramco said oil-output capacity worldwide is dropping quickly, and companies need to invest more in production. It’s a “huge concern,” Chief Executive Officer Amin Nasser said in an interview. “If there’s aviation pick up next year, that spare capacity will be depleted,” he said. “It’s now getting to a situation where there’s a limited supply — whatever is left that’s spare is declining rapidly.” Several oil and gas traders have criticized governments and climate activists for calling on companies to stop investing.

OPEC: An OPEC+ committee trimmed its forecasts for global oil demand growth this year to 5.7 million b/d from 5.8 million despite a continuing strong recovery in consumption. The Joint Technical Committee, which met on Thursday, left its demand growth forecast for next year steady at 4.2 million b/d. The source said the revision for 2021 was “nothing to worry about” as it updated actual data and rounding. Ministers from the OPEC, Russia, and their allies meet on Nov. 4th to decide output policy.

OPEC’s claim that there is no shortage in the physical oil market appears at odds with the upward trajectory of the futures market. Varying appetites for different quality and regional crudes is the missing link. While the level of buying interest in Middle East barrels appears to better match OPEC’s strategy to steadily bring crude back to the market, the bullish narrative that has pushed Brent above $85 is led by the appetite for sweeter grades, according to market participants and analysts.

Shale Oil: After posting their biggest quarterly profits in years, Exxon Mobil and Chevron disclosed plans to expand drilling in the Permian Basin. Latecomers to the West Texas shale fields, both last year slashed shale production and cut drilling as oil demand tanked. They could soon add two rigs each and rev up output, executives said on earnings calls. Exxon last quarter produced about 500,000 b/d of oil and gas from the Permian Basin using nine drilling rigs. The company’s third-quarter Permian output rose nearly 30% above the prior period. Chevron plans to add two drilling rigs and two crews to complete new wells in the Permian this quarter.

Natural Gas: Gas prices in the UK and continental Europe tumbled by as much as a fifth on Friday on further signs Russia will increase exports to the region after restricting supplies for months. On Friday, Russia’s Gazprom said it had hit its target for filling domestic storage two days after President Putin ordered the company to start filling its European storage facilities. The intervention comes after allegations that Moscow has stoked an energy crisis by holding back supplies.

The UK benchmark day-ahead contract dropped almost 20% after trading at record levels for most of October. While prices are still roughly three times the level of January 2021, the sell-off will provide much-needed relief to energy-intensive industries and boost hopes that the drag from gas prices on economies will not be as bad as first feared. However, concerns about inflation have also been heightened by the gas price surge, increasing pressure on central banks to consider raising interest rates.

While traders cautioned that prices could quickly head higher again if additional Russian supplies do not materialize in November, they said the signals from Moscow had been enough to stall the months-long rally.

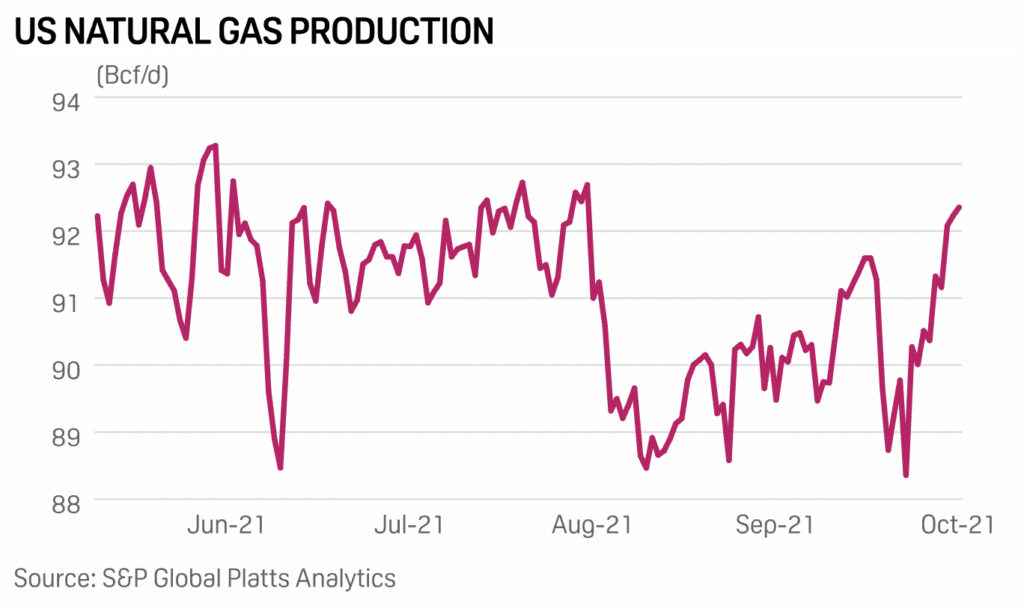

US natural gas futures soared almost 12% to a near three-week high last Monday on expectations liquefied natural gas exports will rise, and forecasts are calling for cooler weather and higher heating demand over the next two weeks than previously expected. “Today’s upward move is likely the beginning of tremendous volatility,” said Eli Rubin, senior energy analyst at EBW Analytics Group. Rubin noted the combination of the colder forecasts and rising LNG exports triggered “short-covering that amplified the move higher.”

Higher retail natural gas prices will be the primary driver for the expected increase in gas heating expenditures this winter. US households that primarily use natural gas for space heating will spend an average of $746 on heating between October and March. Forty-eight percent of US homes will pay 30% higher bills for heating this winter, as this is the share of US households that use gas for space heating.

The EIA said LNG exports in August 2021 were more than 2.6 times higher than the daily rate of LNG exported in August 2020. The average daily rate of LNG exports was also the highest for the month since EIA began tracking LNG in 1997. In August 2021, the US exported 9.6 billion cf/d of LNG to 29 countries – about 10% of our current production.

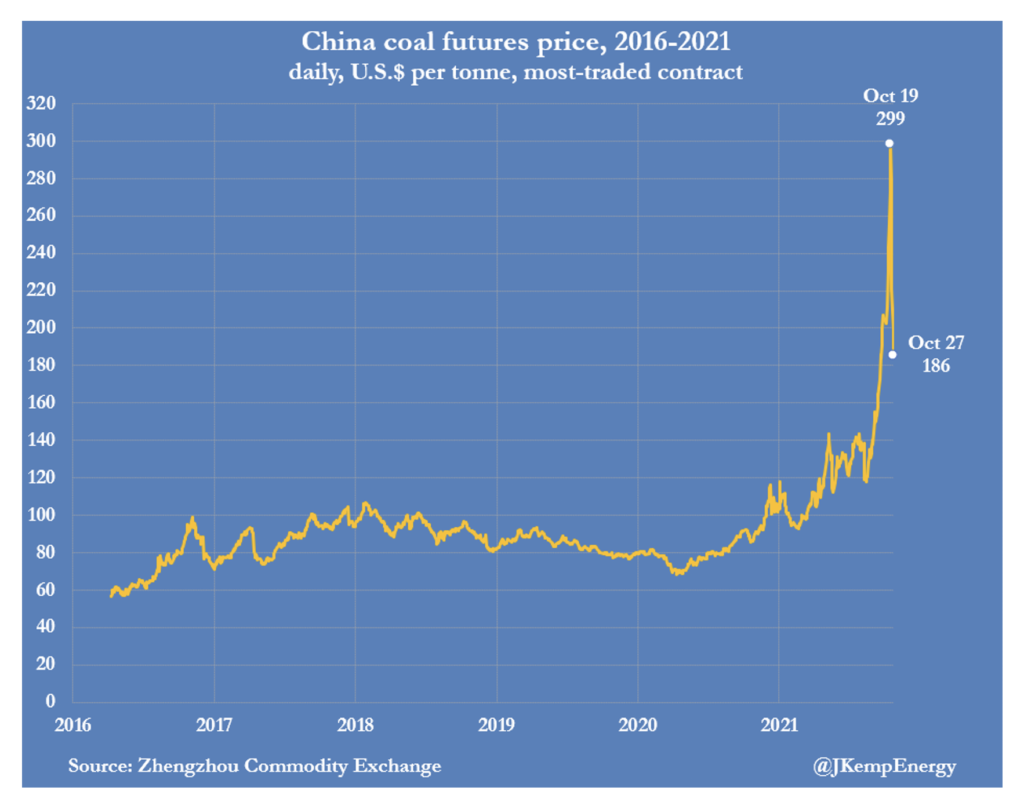

Coal: Leaders from the Group of 20 are split over phasing out coal and limiting global warming to 1.5 degrees Celsius, throwing into doubt whether ambitious climate change targets can be hit. G-20 nations, including the US, China, Russia, India, and Saudi Arabia, will attempt to forge a common position on how best to adhere to the 2015 Paris climate agreement, which asks countries to start reducing their emissions as soon as possible and achieve a climate-neutral world by midcentury.

Recent energy crises have also spurred leaders to rethink their stance on fossil fuels. In China, a coal supply shortage has led to significant revisions of the country’s carbon roadmap, elevating the importance of energy security, and creating wiggle room for adding more coal plants. Climate activists fear that without a positive signal from G-20 leaders, agreement at COP26 will be even harder to achieve. As a result, the G-20 and COP26 could be “mutually reinforcing or mutually weakening,” said one senior official involved in the talks.

According to Bloomberg, US coal miners are enjoying a surge in demand, with almost all of their production through the end of next year—and some into 2023 even—already sold. Prices are higher, too. Arch Resources, the second-largest coal miner in the United States, has sold its 2022 output at prices 20% above current spot market rates. This suggests that this year’s surge in coal demand may not be just a short-lived hiccup in the energy transition.

The campaign to stop the proliferation of coal plants may come down to a bit of financial engineering: pulling the plug on insurance coverage. More than 30 insurance companies have announced restrictions on underwriting coal projects, making it difficult for major coal operators to line up bank financing and investment for mines, transportation, and power plants. Without insurance, those investments could be too risky.

Electricity: US power utility Dominion Energy and Spanish turbine maker Siemens Gamesa said they would build the first US factory to make blades for offshore wind power, part of plans to make a regional supply hub for the industry. Siemens Gamesa and Dominion will invest $200 million to build the blade factory in Portsmouth, Virginia, near a marine cargo space Dominion is leasing to build turbines for the Coastal Virginia Offshore Wind project, or CVOW. The factory is expected to be finished around 2025. Dominion hopes CVOW will be the largest US offshore wind farm, with 180 platforms scheduled to be completed in 2026.

Germany, Denmark, Ireland, and six other European countries say they would not support EU electricity market reform ahead of an emergency meeting of energy ministers to discuss the recent price spike. European gas and power prices soared to record-high levels in autumn and have remained high, prompting countries including Spain and France to urge Brussels to redesign its electricity market rules. However, nine countries poured cold water on those proposals. In a joint statement they said they “cannot support any measure that conflicts with the internal gas and electricity market,” such as an overhaul of the wholesale power market.

Prognosis: Energy transition and peak demand predictions have spooked investors in oil, putting the prospect of peak production sooner than anticipated, accompanied by wild price spikes. Key climate talks are taking place, with fossil fuel in policy-makers’ crosshairs. But as it stands now, mobility curbs that hollowed out both spending on upstream oil projects and oil end-use may already be set to rein in the growth of both supply and demand permanently. “On current trends, global oil supply is likely to peak even earlier than demand,” the research department of bank Morgan Stanley said in a note last week.

Top US oil firms are doubling down on drilling, deepening a divide with European rivals on the outlook for renewables, and winning support from big investors who do not expect the stateside companies to invest in wind and solar. Among a dozen US fund managers contacted by Reuters from companies overseeing about $7 trillion in assets, most said they prefer oil firms to generate returns from businesses they know best and give shareholders cash to make their renewable bets.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Talks with six world powers to revive a 2015 nuclear deal will resume by the end of November, Tehran’s top nuclear negotiator said on Wednesday.

A cyberattack disrupted the sale of heavily subsidized gasoline in Iran on Tuesday, causing long queues at gas stations across the country. However, the oil ministry said only sales with smart cards were disrupted, and clients could still buy unsubsidized fuel at higher prices. Millions of drivers rely on fuel cards, which the government uses to manage the distribution of subsidized gasoline. The disruption comes almost two years after a government hike in gas prices triggered widespread and violent protests across the country.

Iran has been a frequent target of cyberattacks since its nuclear program became a flashpoint in its relations with the West more than a decade ago. It often accuses Israel, a fierce critic of the 2015 deal and US efforts to rejoin it, of sabotaging uranium enrichment facilities and causing fires and explosions.

Iran has been suffering from chronic underinvestment after President Trump withdrew the US from the nuclear deal with Iran and reimposed economic sanctions that drove away the supermajors that had the means to help Tehran develop its oil and gas reserves. As a result, Iranian media reports that the country must secure some $50 billion in investment to develop its natural gas industry. Iran risks turning into a net gas importer unless it secures investments in its gas industry.

Iraq: An exodus of Western oil companies has left Russia in an advantageous position when negotiating production deals. Russia and Iraq have been tussling over production and profits at the West Qurna 2 oil field for years, and now Russia feels it could improve its position there. Moscow has always put geopolitical influence ahead of economic returns in Iraq, but now the opportunity has arisen for it to secure both.

Libya: Production of Es Sider crude has plunged 72% and will continue to decline for ten days due to a pipeline leakage that led to its closure. Waha Oil Co is currently producing 77,000 b/d of Es-Sider crude, down from 285,000 b/d. The leakage is in the 30-inch pipeline from Dahra to Es-Sidra. Tripoli continues to suffer from a lack of government funding to fix its deteriorating energy infrastructure.

Venezuela: The supervisory boards of Venezuela-owned Citgo Petroleum have held talks with US officials in Bogota, Colombia, seeking to extend Washington’s protection while Citgo pursues negotiations with creditors. Citgo is running out of time to achieve agreements to remain in Venezuelan hands. The refiner is caught between infighting among political groups that control its boards and a US federal court ready to begin a forced auction as early as next month. During the Bogota talks, which have not been publicly disclosed, Venezuelan representatives raised the need for extending Citgo’s protection.

3. Climate change

Leaders of the Group of 20 held a second day of talks on Sunday faced with the task of bridging their differences on how to combat global warming ahead of a crucial UN summit on climate change. Climate scientists and activists are likely to be disappointed unless late breakthroughs are made, with drafts of the G20’s final communique showing little progress in terms of new commitments to curb pollution.

A UN World Meteorological Organization report shows carbon dioxide levels surged to 413.2 parts per million in 2020, rising more than the average rate over the last decade despite a temporary dip in emissions during COVID-19 lockdowns. WMO Secretary-General Petteri Taalas said the current rate of increase in heat-trapping gases would result in temperature rises “far in excess” of the 2015 Paris Agreement target of 1.5 degrees Celsius above the pre-industrial average this century.

The world’s major economies, many of which helped fuel the Earth’s warming over the past century, are still failing to do their part to tackle the problem adequately. For example, the annual UN emissions gap report details how the Group of 20 collectively is not on track to meet the emissions-cutting pledges they made as part of the 2015 Paris agreement or the updated plans some countries have submitted ahead of the climate talks in Scotland.

Given that developed nations account for roughly three-quarters of global greenhouse gas emissions, their failures to set bold targets or fully meet existing goals are significant reasons the world remains on a path toward worsening climate catastrophes, the UN found. In addition, the report notes that the transformation away from fossil fuels is not happening nearly as fast as scientists have said is essential. The UN says that even with the updated pledges from many countries, the world is on a trajectory projected to warm 2.7 degrees Celsius (4.9 degrees Fahrenheit).

However, the UN does make clear that there is evidence of progress. Some key entities, such as the US, Canada, and the EU, have outlined new, more robust climate plans that, if implemented, would result in sharp cuts to emissions in those nations by the end of this decade. Other large emitters, such as China and India, have announced domestic targets such as peaking greenhouse gas emissions by 2030 or installing significant amounts of renewable energy, respectively.

The heart of the climate change issue is whether nations recognize that the situation is so bad that human civilization will be unrecognizable in a few centuries or even decades unless sacrifices are made now to curtail carbon emissions. Some major emitters as the US, Russia, and India are also significant producers of fossil fuel and are reluctant to give up this source of job and wealth. In some countries, primarily OPEC+ members, fossil fuel production and sales are the economies, and to slow fossil fuel production likely would lead to political upheavals.

Outside of the G20, few countries have the resources to transition from fossil fuels to non-polluting sources of energy. These countries account for about 25% of global emissions. The better-off countries have pledged some $100 billion to help others switch from fossil fuels to renewables, but this money has been slow in coming so far.

The most significant players in tamping carbon emissions, the US, Europe, Russia, and China, have governments which recognize the seriousness of the situation but are held back by those who are benefitting from the status quo and, more recently, by the energy crisis. In the US, programs that could make significant progress are held up in Congress. On the other hand, Europe has been making good progress with solar and wind programs, reducing the use of coal, and plans to shift much of its heavy industry to hydrogen.

Earlier this year, Beijing pushed a range of measures to discourage coal and control emissions. In late August, China’s Vice Premier, Han Zheng, convened a meeting of provincial leaders. He admonished them to “resolutely curb the blind development” of high-emissions projects like coal plants. However, a month later, amid escalating coal shortages and power outages, Mr. Han told leaders of state-owned energy companies that although those curbs were still necessary, the priority was to get coal-power generators cranking again. “Increase coal supplies by any means necessary.”

Last week, when China’s cabinet outlined measures to achieve its goals of reaching peak carbon emissions by 2030 and carbon neutrality before 2060, it also said food and energy security must be considered amid those efforts. The statement came as severe energy shortages in China threaten to overshadow Beijing’s efforts to curb greenhouse gas emissions. China should “manage the relationship between pollution reduction and carbon reduction and energy security, industrial supply chain security, food security and normal life of the people,” said a cabinet document. It also called for an effective response to the economic risks of the green and low-carbon transition, to “prevent overreaction, and ensure safe carbon reduction

After years of publicly dismissing climate change, President Putin is finally prodding officials to take its threat to Russia’s economy seriously. The shift in thinking means the Kremlin is likely to come to the COP26 climate change summit with proposals to synchronize its efforts to measure carbon emissions with those in Europe.

.

While the moves hardly amount to the kind of ambitious new emissions-reduction target for Russia that western capitals were hoping for, it’s a significant step for Putin as the leader of one of the world’s largest hydrocarbon producers, who until recently belittled climate issues. Officials say the new approach is being driven by a realization the EU, Russia’s largest trading partner, is serious about implementing carbon border regulations that will likely compel Russian companies to pay for excess emissions in critical industries. The Kremlin also sees climate issues as among the few areas of possible cooperation with the US and Europe after years of worsening relations.

4. The global economy and coronavirus

Higher fuel prices are weighing on global food supply chains, with transportation and farming costs climbing. The hardest hit will, once again, be those living in developing economies that are still struggling to recover from the impact of the pandemic.

The global semiconductor shortage is worsening, with wait times lengthening, buyers hoarding products, and the potential end looking less likely to materialize by next year. Demand didn’t moderate as expected. Supply routes got clogged. Unforeseen production hiccups slammed factories already running at total capacity. What’s left is widespread confusion for manufacturers and buyers alike. Some buyers trying to place new orders are getting delivery dates in 2024.

Shipping companies face a 2050 deadline set by the International Maritime Organization that seeks sharp cuts in vessels’ carbon-dioxide emissions. Supplies of methanol and ammonia—two cleaner-burning alternatives to crude-distilled bunker oil—are too limited to power the world’s 60,000 oceangoing ships, and those fuels are several times more expensive. Shipping operators are under pressure from governments and big customers such as Amazon to clean up vessels’ carbon emissions. But viable alternatives to fossil fuels are just taking shape.

New research by HSBC and Boston Consulting Group shows that supply chains would require as much as $100 trillion of investment to become net-zero emission by 2050.

United States: The US economy grew at a slow pace in the third quarter, but economists expect strong consumer demand and an easing pandemic to boost growth in coming months despite lingering supply constraints. The gross domestic product grew at a seasonally adjusted annual rate of 2.0% from July to September, marking the weakest quarter of growth since the recovery began in mid-2020. According to new government data released Friday, consumer prices rose at the fastest pace in 30 years in September while workers saw their most significant compensation boosts in at least 20 years.

Growth was hit by two significant factors: a surge in virus cases due to the highly contagious Delta variant of Covid-19 and deepening supply bottlenecks affecting goods from autos to food. In addition, dynamics that helped GDP grow at a historically fast rate in the first half of this year—government stimulus, widespread business reopenings, and rising vaccination rates—also faded.

A deepening freight logjam defies President Biden’s hopes of restoring regular cargo movements, hampering the economic recovery, and threatening consumers’ holiday shopping plans. Two weeks after administration officials announced steps toward round-the-clock operations at the nation’s chief port complex, the backlog of ships anchored off the coast of Southern California has only grown larger. Moreover, there is little sign that truckers are taking advantage of terminals’ extended hours to move containers off the crowded docks.

Europe: Germany’s coronavirus caseload took its most significant jump in two weeks, with over 28,000 new infections adding to worries about restrictions this winter. The number of new infections per 100,000 people over seven days stands at 130.2, up 12.2 points from 118.0 the previous day. Moreover, new infections have been steadily creeping up since mid-October. As a result, the number of COVID-19 patients in intensive care units has risen 15% within a week.

Berlin expects growth this year to be significantly weaker than predicted, as the lingering effects of the pandemic and a supply squeeze hinder a revival of Europe’s biggest economy. The cut in the 2021 outlook to 2.6% — compared with a prediction of 3.5% published at the end of April — reflects a scarcity in some raw materials and rising energy prices, particularly natural gas.

Fears that Europe could run low on natural gas this winter eased, sending fuel prices lower after Russian President Putin told Gazprom to ship more gas westward. European gas futures slid by almost 10% Thursday after Mr. Putin said the state energy giant should pump more gas to Germany and Austria as soon as it has filled stores at home. This is because Gazprom’s underground storage sites in Western and Central Europe are almost empty at a time of year when they would typically be brimming. The Kremlin released a transcript of a videoconference between Mr. Putin and Gazprom Chief Executive Alexei Miller. Mr. Putin told the executive to “start consistent and planned work on increasing the amount of gas in your underground depots in Europe” as soon as Nov. 8th.

European gas prices are more than five times as high as they were a year ago, even after Thursday’s slide, hurting consumers and holding back economies’ post-pandemic recoveries. The continent’s stores of gas are 15% below the average for the time of year. How soon Moscow’s announcement will have an impact on Europe’s floundering economy remains to be seen.

European officials and companies over the past decade successfully pressured Russian energy giant Gazprom, which is by far the bloc’s largest supplier, to replace long-term contracts linked to the price of oil with sales based on the real-time market price for gas. It was part of a broader effort, opposed by Gazprom, to foster a deeper marketplace where diversity of gas suppliers competed for Europe’s business. But Europe only addressed a portion of their long-term problems with gas. As a result, Russia remained the dominant supplier, giving Moscow huge influence over one of Europe’s leading electric power sources and home heating.

Some European officials suspect Putin’s been holding back the natural gas to pressure Europe into approving Nord Stream 2, the controversial new pipeline linking Russia to Germany. However, Russia is also concerned that excessively high prices could destroy demand and would like to see them fall by about 60%, according to people familiar with the situation

European corn farmers face the prospect of leaving crops in fields because of the energy crunch, a new sign of how the crisis heightens the risk of global food inflation. The grain typically needs to be dried down after it’s collected to ensure the proper moisture content, a task that’s becoming more costly as gas prices surge. Farmers in France, the European Union’s top producer, are being told by gas suppliers to prepare for shortages, use less of the fuel and even postpone harvests, if possible.

China: Coal futures prices saw their biggest fall in more than five years after the powerful state planner said there is still room to adjust coal prices after recent investigations of producers. “Initial results showed coal production costs are significantly lower than current spot coal prices,” the National Development and Reform Commission said in a statement. As a result, coal has fallen more than half from its record high of 1,982 yuan on Oct 19th. However, coal prices are still up more than 80% this year.

China’s economy risks slowing faster than global investors realize as President Xi’s push to cut its reliance on real estate and regulate sectors from education to technology combine with a power shortage and the pandemic. Bank of America and Citigroup are among those sounding the warning that expansion will fall short this year of the 8.2% anticipated by the consensus of economists. Moreover, the slump could last into next year, forcing growth below 5%, they warn. Strategists at Bank of America muse that Xi may even be embracing a once-in-two decades restructuring of the economy akin to Deng Xiaoping’s modernizations of the late-1970s and Zhu Rongji’s revamping of state enterprises and finance in the 1990s.

China’s efforts to ease an energy crunch by stabilizing volatile coal prices have been complicated by a surge in wholesale petrol and diesel costs, forcing filling stations to ration fuel. According to state media, a rise in the wholesale prices of gas and diesel, which have jumped almost 20% over the past month, has led to widespread rationing in recent days.

Production costs at Chinese steel mills have increased, especially at electric arc furnaces, because of recent power rationing and government demands for energy consumption cuts. Steel mills have cut or halted production because of the power supply crunch since September. China’s biggest steelmaking hub Tangshan has ordered steel output curbs from Oct 28th to tackle worsening air quality in the city, forcing some 19,000 mt/day of capacity to close for about a week.

China’s capital city has been suffering through its worst air pollution since May due to its decision to boost coal production to address a power crunch. The worsening air quality highlights the challenges Beijing faces balancing its need to burn coal to heat homes and maintain economic growth with meeting its targets for addressing climate change.

The power crisis in China is driving aluminum alloy prices higher as supplies come under threat. China is limiting supplies of critical components used across a range of industries. So, while aluminum mills are unlikely to go short in the US, prices could rise.

Russia: There was a significant policy change last week when President Putin directed Gazprom to open the taps and send more natural gas to the EU. It was widely believed that Moscow was slowing deliveries as a means of forcing the EU to open the Nord Stream 2 pipeline immediately, negotiate long-term contracts for gas linked to oil prices, and eliminate the need to pay Ukraine and Poland transit fees.

While we may still learn of a deal to open the pipeline and negotiate long-term contracts, it may have struck the Kremlin that their actions could trigger a disastrous economic recession in the EU which would have rebounded to damage the much smaller and weaker Russian economy.

Russia on Saturday reported a record number of new coronavirus infections as authorities hope to stem the rising contagion by keeping most people off work for the next week. The government’s coronavirus task force reported 40,251 new infections in 24 hours. That brought Russia’s official COVID-19 death count to 237,380, by far the largest in Europe. The state statistics service Rosstat, which counts COVID-19 deaths by wider criteria, says the pandemic-long death toll is about 461,000 as of the end of September. Independent demographers using the Rosstat statics say the toll is closer to 750,000.

Saudi Arabia: Riyadh said it would use one of the world’s biggest natural-gas projects to make blue hydrogen as the kingdom steps up efforts to export a fuel seen as crucial to the green-energy transition. A large portion of gas from the $110 billion Jafurah development will be used for blue hydrogen, according to Energy Minister Abdulaziz bin Salman. It is made by converting natural gas and capturing carbon dioxide emissions. “We are the biggest adventurers when it comes to blue hydrogen,” Prince Abdulaziz said at a climate conference in Riyadh. “We’re putting our money where our mouth is on hydrogen. We have an excellent gas base in Jafurah. We will use it to generate blue hydrogen.”

5. Renewables and new technologies

ZeroAvia announced a collaboration with Alaska Air Group, the parent company of Alaska Airlines, to develop a hydrogen-electric powertrain capable of flying 76-seat regional aircraft more than 500 nautical miles.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

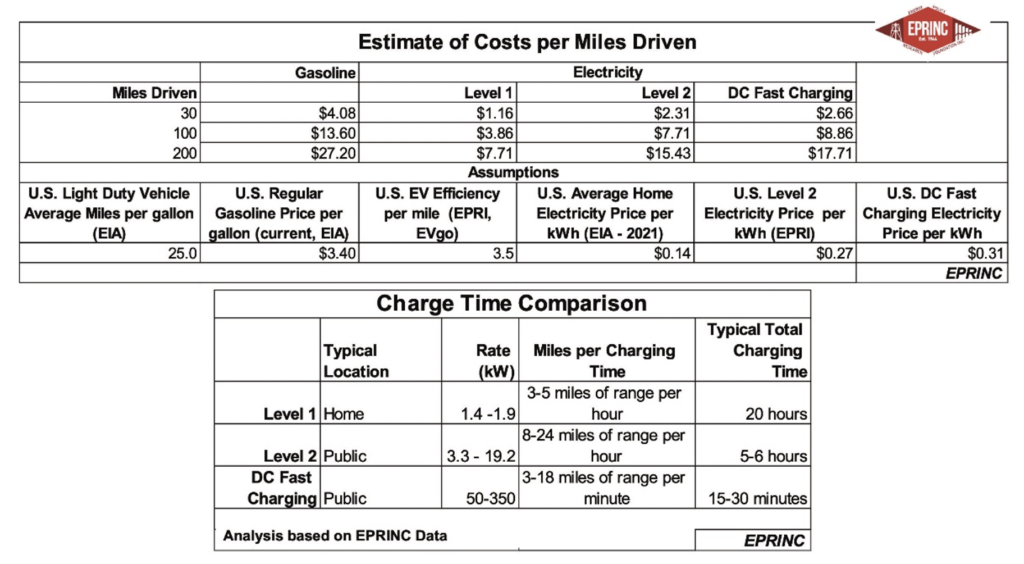

EIA’s global oil demand peak: Significant growth in EV sales and shares of sales through the projection period results in the global conventional gasoline and diesel light-duty-vehicle fleet peaking in 2038 in the US Energy Information Administration’s forecast. (10/28)

Investors fleeing fossil fuels: As many as 1,485 institutional investors, representing a massive $39.2 trillion of assets under management, have so far committed to at least some form of divestment from fossil fuels. In 2014, investors with just $52 billion assets under management had the same pledge to shift investments away from fossil fuels. (10/27)

Nigeria’s oil minister said it would meet its three million barrels per day quota allocated to the country by OPEC. He acknowledged that Nigeria today produces just 1.3 million b/d. (10/26)

The Nigerian National Petroleum Corporation yesterday predicted that the nation needed about $2.7 billion worth of investment to meet the rising demand for petroleum products. (10/28)

In Nigeria, despite the oil price rally, the government is not reaping much from its crude sales as the nation continues to buy refined crude at high prices due to the moribund state of domestic refineries. (10/25)

Offshore Guyana, ExxonMobil’s operations are proving to be highly profitable. Breakeven costs for its projects are expected to drop from $35 per barrel to $25 per barrel, an industry low. ExxonMobil has a very favorable production sharing agreement and low royalty rates. (10/28)

The US oil rig count rose by 1 to 444 while the gas rig count also inched up by 1 to 100, according to Baker Hughes. The total rig count is now at 544, up 248 from this time last year, but still under the 790 active rigs as of March 2020. (10/30)

The US Supreme Court on Friday agreed to hear a bid by states and industry groups to limit federal power to regulate carbon emissions from power plants under a landmark environmental law. The court’s decision to take up the case could complicate efforts by President Joe Biden’s administration to issue new and more stringent regulations under the Clean Air Act aimed at reducing emissions linked to global climate change. (10/30)

Climate message grilling: The first-ever US congressional dressing down of oil bosses for alleged climate-change subterfuge devolved into a fractious spat over environmental racism, electric-car subsidies, and fat pay packages. Exxon Mobil Corp and Chevron Corp’s bosses and executives from Royal Dutch Shell Plc and BP Plc were urged to resign on Thursday by progressive Democrats during a House Oversight and Reform Committee hearing. (10/29)

Climate disinfo: Big Oil majors, including Exxon, BP, Shell, and Chevron, may be subpoenaed to turn over financial documents as part of a congressional probe into alleged disinformation about the industry’s effect on the climate. (10/29)

New York environmental regulators on Wednesday rejected permits to build two natural gas-fired power plants as the state focuses more on renewable projects and energy efficiency to meet its greenhouse gas reduction goals. (10/28)

Oil state oil jobs lagging: The COVID-19 pandemic crushed Alaska’s oil industry, and it is still struggling to find its feet despite soaring crude prices. Jobs numbers are creeping up around the country, but five states — Alaska, Hawaii, Wyoming, New Mexico, and Louisiana — have not yet recovered more than half of the jobs lost. Four are significant oil producers. (10/28)

Exxon Mobil Corp on Friday pledged to revive its long-dormant share repurchase program next year, bolstered by a jump in profit and improved cash flow in the third quarter as rising global economic activity has caused fossil fuel demand surge. The higher profit follows several years of lackluster returns and heavy spending at Exxon. (10/30)

Tesla reached $1 trillion in market value after its stock price more than doubled this past year on surging vehicle sales and rising profits. Investors pushed the electric-vehicle maker over the line after Hertz ordered 100,000 autos to be delivered to the rental-car company by the end of next year. Electric vehicles will comprise more than 20% of Hertz’s global fleet with the current order. (10/26)

EV charging: The German government is topping up the funding for private charging stations for electric cars in residential buildings by a further €300 million. Starting tomorrow, German citizens can again secure a 900-euro government grant for their charging station at home. (10/26)

Capturing big wind: In Japan, a start-up called Challenergy has designed a turbine that works in cyclonic conditions, which typically shut down most wind installations. Japan experiences, on average, 26 typhoons and tropical storms a year. (10/29)

To increase water supply during the severe drought, prosperous Marin County is considering buying water from agricultural areas and piping it across the San Francisco Bay. (10/27)

In China, vegetable prices are surging after heavy rain swamped crops this month, fueling concern over food prices at a time when consumers must brace for a hike in energy costs in the run-up to winter. (10/27)

Brazil’s carbon dioxide emissions soared last year due to more significant deforestation in regions including the Amazon, dealing a fresh blow to President Jair Bolsonaro’s environmental credentials. Emissions rose 9.5% versus 2019 vs. global emissions, which fell 7% due to the Covid-19 pandemic. (10/30)