Editors: Tom Whipple, Steve Andrews

Quote of the Week

“The US Department of Energy and private companies have invested billions of dollars since 1997 to bring the cost of CCS [carbon capture and sequestration] down enough to be used economically in coal- and gas-fired power plants. But failed pilot and demonstration projects litter the technology’s history, and it is still too expensive for widespread commercial use.”

“The principal objective of CCS advocates in fossil energy is not to reduce carbon emissions; it’s to let their companies extract and profit from as much coal, oil, and natural gas as possible before it’s gone, or someone makes them stop. For elected officials, CCS is a convenient political fix that allows them to avoid choosing sides in the competition between carbon and carbon-free energy.”

William S. Becker, journalist, author and climate expert

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Prices fell last week with spreading coronavirus cases in countries such as India tempering optimism around positive signs out of the US and Europe. Futures in New York rose the most in over a week on Friday but were unable to reverse a 1.6% weekly loss as the market weighed a global economic reopening that’s coming in fits and starts. The unprecedented oil inventory glut that amassed during the coronavirus pandemic is almost gone, underpinning a price recovery that’s rescuing producers but vexing consumers. Barely a fifth of the surplus that flooded into the storage tanks of developed economies when oil demand crashed last year remained as of February, according to the IEA.

According to the top executive at Schlumberger, drilling, well construction, and reservoir activity around the globe look set to pick up this year, particularly as second-quarter seasonal impacts iron out, and markets will accelerate in the second half of 2021, although at uneven paces. North America will see sustained activity growth in US land and offshore starting in the second quarter, especially once the spring break up in Canada is finished. International activity growth will “broaden” in the second quarter as seasonal recovery in Russia and China builds on continued growth in Africa, the Middle East, and Latin America.

Signs are emerging of a shift underway in the oil market, with demand weakening in Asia and picking up in the West, just as supplies of Iranian crude oil have climbed. This marks a reversal from 2020, when a bounce back in economic activity in China and India powered a recovery in oil prices after the blow dealt by Covid-19. Now, Chinese imports have slowed while a growing epidemic in India threatens to hit demand in the world’s third-largest consumer of oil.

Demand in the US and Europe, on the other hand, is expected to rally as vaccination efforts gather pace and restrictions on movement are eased. At the same time, supplies of sour Middle Eastern crude oils favored by refiners in Asia are rising. The Organization of Petroleum Exporting Countries has agreed to boost production to meet a pickup in global demand, while Iranian oil output has jumped since the fall.

US refiners were forced to source their heavy crude from somewhere else after the US sanctioned Venezuelan crude oil. These refiners may again be forced to resource crude oil as French bank Natixis stops funding the Ecuadorian oil trade. So far, six European banks have been called out for financing the trading of crude oil from Ecuador. Concerns have been raised that the oil industry has encroached on indigenous territories in Ecuador, including in the Amazon—the world’s largest rainforest. According to EIA data, the US imported 67.9 million barrels of crude oil from Ecuador in 2020, down from 74.6 million barrels in 2019.

In a rush to prove their environmental credentials, international oil companies are pledging billions in low-carbon energy investments and committing to net-zero goals over the next decade. Meanwhile, smaller oil and gas companies are snapping up the assets sold off by the oil majors. The Wall Street Journal reported last week that small energy independents are happy to relieve Big Oil of its unwanted assets as they bet on the long-term future of oil and gas.

OPEC: The cartel is unlikely to make any material changes this week to plans to ease the production cuts over the next three months, Russia’s Deputy Prime Minister Novak told reporters. OPEC+, which decided on April 1st to gradually return over 1 million b/d to the market between May and July, has the next meeting of the Joint Ministerial Monitoring Committee (JMMC) scheduled for April 28th. The conference will most likely focus on assessing the current oil environment rather than revising production targets as the market looks balanced. “If nothing extraordinary happens, we have already formed our three-month plans.”

According to the International Monetary Fund and Institute of International Finance, most Gulf countries, who are members of OPEC+, will see their breakeven oil prices ease in 2021. Kuwait, Saudi Arabia, and the UAE are OPEC members, while Oman is part of the broader OPEC+ alliance. Kuwait is the only country out of the four that will see its breakeven fiscal price rise.

If you ask oil majors what the last five years have been like, they will probably have something to say about price crashes and demand destruction. If you ask a large importer of crude, they’d have a completely different perspective. They may well praise price crashes that have allowed them to fill up on cheap oil, and they might even have a positive thing to say about the pandemic that brought prices to historic lows. However, this is a problem for the oil-producing cartel. OPEC, and its Russian and its Central Asian partners, have been working for years to keep international oil prices higher by curbing production. Success has been mixed for reasons outside OPEC’s control. Still, it can certainly be said that the efforts of the oil producer’s club have mostly paid off: oil prices are now at a much more comfortable level for them.

Shale Oil: Baker Hughes and Halliburton reported profits beating expectations and expressed optimism that oil demand and drilling activity will grow through the rest of the year and into 2022. Free cash flow at Baker Hughes nearly doubled to $498 million for Q1 from $250 million for the previous quarter as international and North American activity rose at the start of this year with the increase in oil prices.

During March, higher oil prices and low interest rates prompted independent US oil producers to raise the most financing via debt and equity issues since August last year, the EIA said on Friday. The administration used data from Evaluate Energy and found that the listed US firms issued a total of $4.4 billion in debt and equity last month. The administration, however, warned that the findings of its analysis may not be indicative of the whole US oil industry right now because private companies do not have to report their debt-raising moves.

BP has been one of the companies most responsible for burning unwanted natural gas in the busiest US oil field. Now it is trying to clean up its act. The British oil giant plans to spend about $1.3 billion to build a network of pipes and other infrastructure to collect and capture natural gas produced as a byproduct from oil wells in the Permian Basin of Texas and New Mexico. On Monday it will announce plans to eliminate routine flaring of natural gas in the oil field by 2025.

Electricity: The Dept. of Energy has launched an aggressive 100-day plan to protect electric infrastructure from persistent and sophisticated cyber threats. DOE also lifted a prohibition by former President Donald Trump on procurement of specific bulk power system equipment from Chinese entities. The new initiative will take “swift, aggressive actions” to bolster the cybersecurity of electric utilities’ industrial control systems and secure the energy sector supply chain, DOE said in a release.

The plan calls on DOE’s Office of Cybersecurity, Energy Security, and Emergency Response to partner with utilities over the next 100 days to advance technologies and systems seen as key to modernizing the electricity sector’s cybersecurity defenses. An emphasis was placed on implementing measures that enhance a utility’s cyber visibility, detection, mitigation, and response capabilities. Tom Kuhn, president of the Edison Electric Institute, welcomed the new initiative, saying it was complementary to other Electricity Subsector Coordinating Council efforts already underway.

The Texas energy market is so large — second only to California’s — and its natural gas industry is so predominant that the impacts can be felt across the country when things go wrong there. “And in a state that eschews regulation, driving energy producers to cut costs as deeply as they can to remain competitive, things went spectacularly wrong the week of Valentine’s Day. When that big freeze hit Texas, the pain was shared across a wide area.”

With its ill-equipped natural gas systems shut down by the cold, Texas’s exports across the Rio Grande froze up, and 4.7 million customers in northern Mexico went without electricity— more than in Texas itself. The spot price of gas jumped 30-fold as far west as Southern California. And up by the Canadian border, gas utilities in Minnesota that turned to the daily spot market to meet demand say they had to pay about $800 million more than planned over just five days as the Texas freeze-up pinched off supplies.

In a new report, Enverus said 65% of producer respondents and 80% of pipeline company respondents identified loss of power as one of the main factors that affected operations during the storm. “Once power outages at power generation units began due to the extreme cold weather, natural gas production and transportation were impacted because surface facilities and infrastructure rely heavily on electricity for operations.”

Kinder Morgan surprised investors with a $1 billion windfall from the historic winter storm. The gain was so outsized that the pipeline operator results surpassed the average estimate by almost three times. Kinder disclosed a $116 million net income from voluntarily curbing power use during the disaster and reselling it at sky-high prices, which implies an $880 million windfall from gas sales. A Kinder Morgan spokesperson declined to comment on the figures.

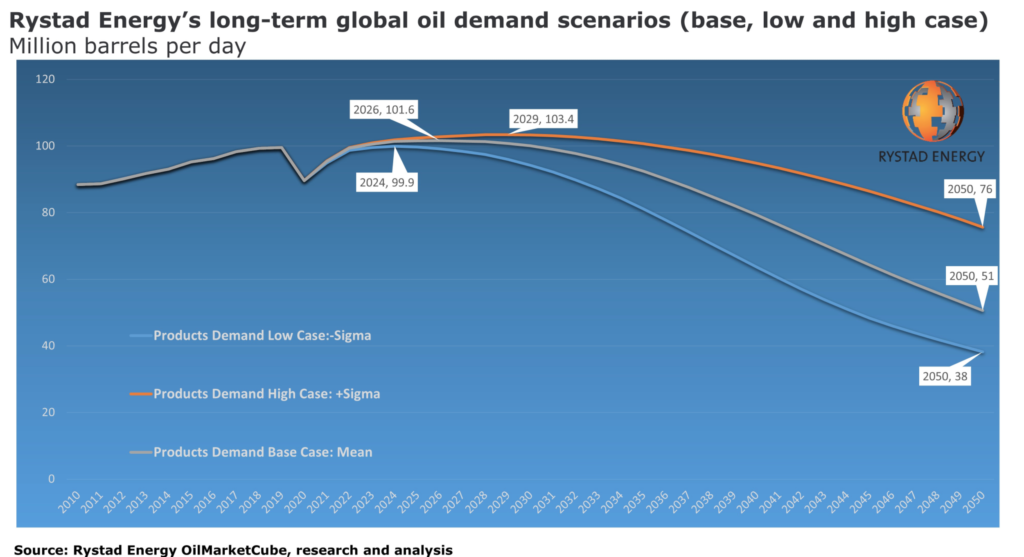

Prognosis: The adoption of electrification in transport and other oil-dependent sectors is accelerating and is set to chip away at oil sooner and faster than in Rystad Energy’s previous forecast. As a result of this transition, the consultancy is downgrading its peak oil demand forecast to 101.6 million b/d, a pinnacle that will come in 2026, earlier than thought, plateauing before falling below 100 million b/d after 2030.

In the updated base case, which Rystad calls the “Mean” case, oil demand will be whittled away mainly by a growing electric vehicle market. Aside from the staggering takeover of EVs, assumptions across all our scenarios (low-case, mean-case, and high-case) see oil demand being either phased out, substituted, or recycled across various sectors.

Rystad forecasts tectonic shifts – some sudden and others slowly evolving – in plastics recycling, a growing share of hydrogen in the petrochemical sector, and oil substitution in power, agriculture, and maritime sectors. Other sectors will still see thriving oil demand in the mid-term, such as trucks, maritime and petrochemicals, and aviation in the long term, where Rystad sees a sizable substitution of jet fuel with non-petroleum fuels such as bio-jet fuel.

“Oil demand will evolve in three phases. Through 2025, demand is still affected by the pandemic and EV sales are still slow to take off. Then from 2025-2035, structural declines and substitution impacts – especially in trucks – take hold. Finally, towards 2050, the recycling of plastics and accelerated technologies in maritime will be the final transition leg bringing oil demand further down towards 51 million b/d in 2050 in the mean case,” according to Rystad.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: Crude exports since the start of the month have averaged around 500,000 b/d according to a Reuters report that cites estimates from tanker tracking companies. This is lower than March levels but much higher than a year ago.

Diplomats working in Vienna to bringing the US back into the nuclear deal with Iran and world powers are taking a break from talks to consult with their leaders amid continued signs of progress. Russia’s delegate, Mikhail Ulyanov, after a meeting of the deal’s Joint Commission noted with satisfaction the progress in negotiations to restore the nuclear deal. “It was decided to take a break to allow the delegations to do homework and consult with their capitals,” he tweeted. The Commission will meet again next week.” Iran’s delegate, Deputy Foreign Minister Abbas Araghchi, sounded a positive note, telling Iran’s official IRNA news agency that the talks were “moving forward despite difficulties and challenges.”

The steady drumbeat of attacks on Iranian nuclear personnel and facilities, which intelligence officials said were carried out by Israel, highlights the seeming ease with which Israeli intelligence can reach deep inside Iran’s borders. The attacks, the latest wave in more than two decades of sabotage and assassinations, have exposed embarrassing security lapses and left Iran’s leaders looking over their shoulders as they pursue negotiations with Biden’s team.

Israel has dramatically expanded airstrikes on suspected Iranian missile and weapons production centers in Syria to repel what it sees as a stealthy military encroachment by its archenemy. The only Israeli intervention earlier in Syria’s conflict consisted of sporadic airstrikes to destroy arms shipments to the Iran-backed Lebanese group Hezbollah and prevent militias setting up bases in southwest Syria, close to Israeli territory.

Iraq: ExxonMobil is attempting to sell its stake in the West Qurna 1 oil field to PetroChina and CNOOC, setting an end-April deadline. Iraq aims to finalize the sale of Exxon’s stake in the oil field by the end of June. Exxon’s rival, US supermajor Chevron, rejected overtures to buy the share. Basra Oil Co., the state-run company overseeing crude production in the region, has “no objection” to a Chinese company buying the stake. PetroChina already owns 32.7% of it.

Iraq’s Oil Minister announced last week that the country plans to increase its oil production capacity to 8 million b/d by 2029, compared to the current production of around 3.8 million that factors in OPEC-mandated cuts. Based on its vast oil resources, he claims there is no reason why this output level should not be attained by that time or even the 9 million b/d or the 11 million posited by the IEA’s 2012 production analysis for Iraq. Even the lower of these two figures would allow Iraq to overtake Saudi Arabia as the number one oil producer in the Middle East, with the Kingdom producing just an average of 8.17 million b/d from 1973 to this year.

Libya: The National Oil Corporation declared force majeure on the port of Hariga due to lack of funds for infrastructure repairs, pushing the country’s crude oil production below 1 million b/d for the first time in months as NOC was forced to suspend production at several fields. The company blamed the shortage of funds on Libya’s central bank.

Production in several of Libya’s major eastern oil fields has been shut down, heightening the central government’s budget crisis. One national oil company subsidiary’s spokesman said it had halted pumping at its fields due to the government’s failure to send federal funds since September for operations. Agoco, as the subsidiary is known, operates eight oil fields with a total capacity of 250,000 b/d, which feed into the Marsa el-Hariga export terminal.

One of Libya’s state oil producers said it would have to cut as much as 100,000 b/d of output this week, a further sign that a budgetary crisis is threatening the OPEC member’s energy industry. Sirte Oil Co. will be forced to “reduce production and halt it completely within 72 hours,” the company said Thursday. The eastern-based firm blamed its “very critical” financial situation, the inability to fulfill contractual obligations to contractors, accumulation of debts and the lack of spare parts, fuel, and chemicals required for the operations.

Libya’s National Oil Corporation is banking on France’s Total to help it boost output and maintain some of its oil infrastructure. On April 20th, NOC chairman Mustafa Sanalla met with Total CEO Patrick Pouyanne where they discussed the upcoming plans of the French energy producer in Libya. Total is currently involved in increasing output at the giant Waha, Sharara, Mabruk, and Al Jurf oil fields. NOC said the development of the North Gialo and NC-98 oil fields is a priority for Total, and production from these sites is poised to rise by 175,000 b/d.

Venezuela: PDVSA started a maintenance shutdown of its Petropiar oil field in the Orinoco Belt. It’s being stopped in a programmed manner: 338 wells, nine multi-phase stations, and diluent re-pumping, as well as electric supply installations in the Hamaca station. The Petropiar field is operated by PDVSA and US-based Chevron in a 70-30 joint venture.

Yemen: The Houthi movement says they launched an attack with a drone on an Aramco facility in the southwestern Saudi city of Jizan as well as targeting the King Khalid airbase with two drones. The Saudi-led coalition said it had intercepted two Houthi explosives-laden drones fired at the Kingdom’s southern region and the city of Khamis Mushait, home to the airbase.

Russia-Ukraine: Russia’s defense minister ordered tens of thousands of troops recently deployed close to the border with Ukraine to return to their bases in a move likely to ease fears of a conflict and reduce tensions with the West. Moscow had moved as many as 100,000 troops, alongside tanks, military aircraft, and naval ships, to its border with Ukraine over recent weeks, according to Kyiv, sparking fears of a potential invasion. Russia’s ruble, which is sensitive to any threat of western sanctions, jumped as much as 1.4% against the dollar on the news.

With Ukraine’s president pleading this month for NATO membership and this week inviting Vladimir Putin to meet him in the conflict zone, the signal from the Russian leader was clear: Moscow still calls the shots in the Donbas. Zelensky’s offer to meet Putin was a tacit acknowledgment that Ukraine could not renege on the ceasefire deal. The military buildup was intended to convince Kyiv that it needs to change its policy course. Moscow wanted to make Kyiv sweat and show Ukrainians precisely what they can do to them, and that Ukraine will ultimately be on its own and that this is a reality the government needs to face.

3. Climate change

Last week, dozens of world leaders joined CEOs, activists, and Pope Francis for a two-day virtual summit hosted by President Biden on reducing climate change. The US met global expectations by pledging to halve its emissions by 2030 from 2005 levels – nearly doubling the last pledge made under former President Obama. Washington also intends to double its annual climate help to developing countries by 2024, compared with spending under Obama in 2013-2016.

China’s President Xi told the summit his country would begin phasing out coal use over 2026-2030 to reduce greenhouse gas emissions. Last year, Xi had said China would aim to become carbon neutral by 2060. “We will strictly control coal-fired power generation projects,” Xi said through the summit’s video link. He suggested that China’s coal consumption, by far the highest in the world, will reach a peak in 2025 and start to fall after that.

Among other national targets announced: South Korea said it would end all new financing for overseas coal projects and will soon set a more ambitious schedule for slashing carbon emissions; Japan raised its 2030 emissions reduction target from 26% to 46% below 2013 levels and pledged to continue to push for a 50% cut over the next decade; Canada raised its previous target of a 30% reduction below 2005 levels by 2030 to a range of 40-45% below that same baseline; Brazil said it would reach climate neutrality by 2050, 10 years earlier than previously pledged and repeated a promise made last week to end illegal deforestation by 2030.

President Biden’s new commitment to cut US emissions in half over the coming decade from 2005 levels is the most ambitious climate goal yet by an American leader. However, it isn’t the most far-reaching goal on the international stage, coming in behind the UK and the European Union. And it’s unlikely to prove sufficient to keep average global temperature rise below 1.5°C, according to various environmental groups.

In several recent studies, researchers have explored what a future America might look like if it wants to achieve Biden’s new climate goal of cutting emissions at least 50% below 2005 levels by the year 2030. By 2030, those studies suggest, more than half of the new cars and SUVs sold at dealerships would need to be powered by electricity, not gasoline. Unlike in Europe, the Biden plan does not include a firm date to phase out gasoline-powered vehicles. Nearly all coal-fired power plants would need to be shut down. Forests would need to expand. The number of wind turbines and solar panels dotting the nation’s landscape would need to quadruple.

While the goal is achievable in theory, researchers say, it’s an enormous challenge. To get there, the Biden administration would likely need to put in place a vast array of new federal policies, many of which could face obstacles in Congress or the courts. And policymakers will have to take care in crafting measures that do not cause severe economic harm, such as widespread job losses or spikes in energy prices.

The US and China, the world’s two biggest carbon polluters, agreed to cooperate in curbing climate change just days before President Biden’s virtual summit of world leaders to discuss the issue. In a joint statement, the agreement was reached by the US special envoy for climate John Kerry and his Chinese counterpart Xie Zhenhua during two days of talks in Shanghai last week. The two countries “are committed to cooperating and with other countries to tackle the climate crisis, which must be addressed with the seriousness and urgency that it demands.”

Global CO2 emissions from energy are seen rising nearly 5% this year, suggesting the economic rebound from COVID-19 could be “anything but sustainable” for the climate, the International Energy Agency said last week.

Climate change whipsawed through Europe last year, alternately baking locked-up economies beneath record heat before inundating them with unprecedented floods, underscoring the rising levels of uncertainty faced by the continent’s 500 million people. According to the Copernicus Climate Change Service, last year was one of the three warmest ever recorded in Europe and caps a six-year span when it’s never been hotter.

UK Prime Minister Boris Johnson announced deeper carbon cuts last week. The government will adopt a target of cutting carbon emissions by 78% from 1990 levels by 2035, in line with the Committee on Climate Change recommendations.

The European Commission is split over whether to postpone classifying hydrogen generated from fossil fuels as green energy under its landmark classification system for investors. The document is designed to guide those who want to direct their money into environmentally-friendly investments and help stamp out the misreporting of companies’ environmental impact, known as greenwashing.

4. The global economy and the coronavirus

While hopes are rising that a rapid rollout of Covid-19 vaccines is helping to tame the pandemic in the US, in much of the world the virus is still surging. Covid-19 case rates across much of the globe are at their highest levels since the start of the pandemic. The continuing race is between vaccinations and the challenge presented by new variants emerging and spreading quickly around the world.

The global economy shows signs of more robust growth as factories continue to boom and service businesses begin to see the benefits of vaccination programs. There were already signs of that rebound in the US and China during the early months of 2021. Surveys of purchasing managers released Friday indicate that Europe is also starting to participate in the recovery.

US: The State Department added about 100 countries this week to its “Level Four: Do Not Travel” advisory list, putting the United Kingdom, Canada, France, Mexico, Germany, and others on the list, citing a “very high level of COVID-19.” The Department now lists about 131 countries at Level Four.

The number of Americans applying for unemployment aid fell last week to 547,000, the lowest point since the pandemic struck and an encouraging sign that layoffs are slowing on the strength of an improving job market.

Senate Republicans outlined a counterproposal to President Biden’s $2.3 trillion American Jobs Plan, saying their $568 billion proposal focuses on what they deem “core infrastructure.” This includes only transportation networks, water systems, and broadband Internet while skipping the clean energy focus of Democrats’ plan.

European Union: Germany’s coronavirus infection rate rose over the weekend despite stricter restrictions and Finance Minister Olaf Scholz said he did not expect moves to ease curbs before the end of May. With almost two-thirds of adults in the UK immunized, Prime Minister Johnson started to relax advice on containing the virus. Bank of England Governor Andrew Bailey anticipates a strong recovery as households unleashes some of the $207 billions of savings accumulated during the lockdown.

Volkswagen has warned top managers to brace for a bigger production hit in the second quarter because of the global chip shortage. “We are being told from the suppliers and within the Volkswagen Group that we need to face considerable challenges in the second quarter, probably more challenging than the first quarter.”

The warning raises the possibility of higher losses for the world’s second-largest carmaker, which said last year it expected production output to fall by 100,000 vehicles in the first quarter of 2021 because of semiconductor shortages. VW has already warned it does not have the factory capacity to recoup lost output later in the year.

The steepening toll from the crisis is being felt across the automobile industry, with shortages expected to hit production until the second half of the year. Ford has in the last week closed a dozen facilities in North America and Europe, some for months, while Jaguar Land Rover will this week shut two of its UK factories. Renault last week suspended production guidance altogether, saying there was too much uncertainty in its supply chain. At the same time, Daimler cut more than 18,000 staff in Germany because of lower production levels.

China: China administered about 4.8 million vaccinations against COVID-19 on April 23rd, bringing the total number distributed to 216 million, according to data released by the National Health Commission. Sinovac Biotech has supplied 260 million doses of its COVID-19 vaccine globally, with over 60% provided to countries outside China. The company is producing more than 6 million doses of the COVID-19 vaccine per day.

China’s precise language around limiting coal consumption will dim the prospects for growth in coal-fired power generation, which dominates China’s energy mix. This would pave the way for a more aggressive push for fuels like natural gas/LNG, nuclear, and renewables. But given top billing at the climate summit on Thursday, President Xi did not offer any fresh policies. He only rehashed old promises.

Biden’s virtual conference has reinforced the sense that the US and China will seek common ground on the existential issue of climate change despite the fierce and nationalistic rivalry. Environmental groups say they were disappointed because Xi has staked out significant long-term goals to reach carbon neutrality by 2060 but has not presented clarity about getting there. Domestic considerations could drive Xi’s reluctance to offer any new initiatives at the summit, said Li Shuo, senior adviser at Greenpeace East Asia.

“Xi needs to balance divergent interests between domestic industrial groups and international expectations, the need to show China’s green image and also not be seen as caving to US diplomatic pressure,” Li said. “It’s precisely because it was a US-organized event that China might have been more hesitant to put more offers on the table

China sought to allay fears it wants to topple the dollar as the world’s primary reserve currency as Beijing makes bigger strides in creating its digital yuan. People’s Bank of China Deputy Governor Li Bo said the goal for internationalizing its currency is not to replace the dollar, and efforts to create a digital yuan are aimed at domestic use.

The appetite for near-term crude cargoes among China’s independent refiners is likely to take a backseat as they struggle to first clear stocks that have piled up at the ports. May and June crude buying volumes may remain subdued, clouding the buying outlook, even more when a government investigation on China’s private refining sector is going on.

Russia: Moscow is considering providing particular preferences to foreign companies willing to participate in joint projects on climate change and clean technologies, President Putin said last week. Speaking at the US Leaders’ Climate summit, he reiterated Russia’s “genuine interest in galvanizing international cooperation” in fighting climate change and meeting other vital global challenges. “Russia is willing to present a range of joint projects and consider potential benefits even for foreign companies that would like to invest in clean technologies, including in our country,” Putin said. He did not provide additional details on incentives under discussion.

Saudi Arabia: Data from the Joint Organizations Data Initiative showed that Saudi Arabia drew again on its crude stockpiles in February, while exports fell, reflecting the impact of its voluntary 1 million b/d production cut in addition to its OPEC+ production quota. The kingdom exported 5.63 million b/d in February, down 957,000 b/d from January. February saw the breaking of a seven-month run of increased shipments since a long-term low of 4.98 million b/d in June when stringent OPEC+ production caps were affected.

The Saudis will join the United States, Canada, Norway, and Qatar in forming a new platform for oil and gas producers to discuss how they can support the implementation of the Paris Agreement on climate change.

India: Every night, funeral pyres blaze on the banks of the Ganges, a grim symbol of the ferocious Covid-19 wave sparking a health crisis and human tragedy in India that is far surpassing anything seen last year. Patients are dying while their families search in vain for hospital beds. Supplies of oxygen and medicines are running low, leading to robberies of drugs from hospitals. Crematoriums and burial grounds cannot cope with the sheer number of corpses.

The devastation has sparked outrage at the lack of preparation among officials who believed that the worst of the pandemic was over. Only two months ago, India was reveling in its success of reining in the spread of the virus. Now it is reporting about 350,000 infections and some 3,000 deaths a day. Reports from India suggest that the official numbers are only a fraction of the toll the virus is taking. With a new variant suspected of stoking the surge, experts fear that India is on the same trajectory as Brazil, where a more contagious strain of the virus has hammered the country’s healthcare system and economy.

India’s strong rebound in domestic gasoline consumption will likely hit a roadblock in the near term amid fresh lockdowns in several states. The most extensive restrictions are on Maharashtra from April 14th until May 1st, affecting approximately 125 million people. Maharashtra’s capital city of Mumbai has seen driving activity — a proxy for gasoline demand — plummet to 70% below baseline levels as of April 10th, the lowest since July 2020 and sharply lower than the 40% above baseline levels that was recorded earlier in February.

One of the world’s largest carbon dioxide emitters, India could add more coal-fired electricity generation capacity despite the global push for clean power sources. India could still need new coal capacity to balance more renewable energy sources in the coming years. Coal is still the cheapest source of electricity, according to a draft of National Electricity Policy 2021.

5. Renewables and new technologies

Big Oil has been using carbon capture and storage (CCS) in an attempt to cut emissions from its operations. Now the world’s largest international oil companies see carbon capture and storage as a potential new revenue stream in the energy transition. The top oil firms are already involved in dozens of CCS or CCSU (U for utilization) projects from Norway to Australia, saying that the technology is recognized as critical to achieving the Paris Agreement goals.

BP, Shell, Total, Equinor, Eni, and National Grid formed the Northern Endurance Partnership to develop offshore carbon dioxide infrastructure in the UK North Sea, with BP as operator. The infrastructure will serve the proposed Net Zero Teesside, and Zero Carbon Humber projects to establish decarbonized industrial clusters in northeast England. Equinor is a joint venture partner with Shell and Total in developing the Northern Lights project in Norway, which is planned to deliver carbon storage as a service to help third-party industries reduce emissions.

The increased focus on CCS technologies, especially carbon storage as a service, has drawn criticism from environmentalists. According to them, the talk of CCS projects and technologies is nothing but “greenwashing,” while the aim to profit from a solution to the problem Big Oil has helped to create is nothing short of cynical.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Private companies’ share of UK oil and gas production reached nearly a third last year — up from just 8% a decade ago as a new breed of players, often backed by deep-pocketed private equity funds, continues to scoop up North Sea assets from retreating majors and utilities. (4/19)

Japan’s fuel imports have hit the highest level in more than two decades after series of incidents, including an earthquake and a refinery fire, curbed production at some of the nation’s processors. (4/21)

The disputed South China Sea may soon see an escalation in tensions over oil drilling rights between China and the Phillippines, according to Phillippine President Rodrigo Duterte. (4/20)

The death of Chad’s President Idriss Déby is likely to trigger political instability in the critical oil-producing country and the wider central African region, with a potential impact on its oil sector. Chad is the 10th-largest producer in Africa, pumping around 140,000 b/d. (4/21)

In Chad, the sudden death of President Déby on a desert battlefield is threatening more headaches for its biggest private creditor: commodities trader Glencore Plc. Trading firms like Glencore have over the years served as lenders of last resort—to the tune of $1 billion—to poor but commodity-rich nations like Chad that traditional creditors consider too risky. (4/22)

Angola, Africa’s largest oil producer just five years ago, has slipped to #3, behind Nigeria and conflict-ridden Libya. Angola is now betting on reviving its oil industry and jumpstarting its oil-dependent economy, which has been in recession for five years. Apart from aiming to attract investments in oil, Angola wants to sell up to 30% in its state oil firm Sonangol next year. (4/22)

Nigerians have been accumulating foreign currencies to protect their wealth from naira volatility and surging inflation. Africa’s largest economy devalued the local unit twice last year after a crash in the oil price triggered by the coronavirus pandemic hampered revenues. The naira has lost 66% of its value since 2009. (4/22)

In Brazil, during a difficult 2020, the hydrocarbon sector demonstrated its resilience in the face of a price crash and the COVID-19 pandemic. Hydrocarbon output rose 5.5% to a record 3.7 million barrels of oil equivalent daily. But now, there are genuine fears that heightened political turmoil and an ever-escalating pandemic could derail Brazil’s oil boom. (4/21)

Vaca Muerta, Argentina’s biggest shale play, is poised for growth in oil and natural gas production as proposed legislation is expected to improve investment conditions. Still, analysts and executives warn that economic and political uncertainty could slow the pace. (4/20)

In Colombia, a recent sharp spike in COVID-19 cases has forced the reintroduction of lockdown measures. Those measures will impact many sectors of the economy, including the petroleum industry. During 2020, the oil price crash and COVID-19 pandemic sharply impacted the Andean country’s energy sector, causing the gross domestic product to contract by almost 7%. (4/19)

Guyana is poised to become one of the leading offshore producers in South America. After its latest discovery last year, Exxon revised its oil resources upwards to more than eight billion barrels of recoverable oil in the Stabroek Block. They expect 750,000 b/d by 2025. (4/22)

The US oil rig count decreased by one this week to 343, while the number of gas rigs stayed the same at 94, according to Baker Hughes Inc. (4/24)

The US Interior Dept. is canceling oil and gas lease sales from public lands through June amid an ongoing review of how the program contributes to climate change. The petroleum industry and its Republican allies in Congress have said the oil and gas moratorium will harm Western states’ economies without putting a significant dent in climate change. (4/22)

Interior Secretary Deb Haaland has issued an order rescinding a previous Interior department order, under President Donald Trump, to expand acreage available for oil and gas leasing in the 23-million-acre National Petroleum Reserve in northern Alaska. (4/20)

In California, Gov. Gavin Newsom on Friday said the state would stop issuing fracking permits by 2024 and halt all oil drilling by 2045, using his authority to take on the state’s powerful oil and gas industry in a year he will likely face voters in a recall election. (4/24)

While emissions from petroleum products like gasoline or jet fuel have long been known to be dangerous and are subject to regulation, asphalt and No. 6 fuel oil, classified as “heavy refinery liquids,” have been largely ignored by regulators. It was thought that their emissions were negligible. But in an 18-month investigation, Inside climate News found that emissions from heated tanks containing asphalt and No. 6 fuel oil pose a risk to the health of millions of American who live close to the tanks. (4/19)

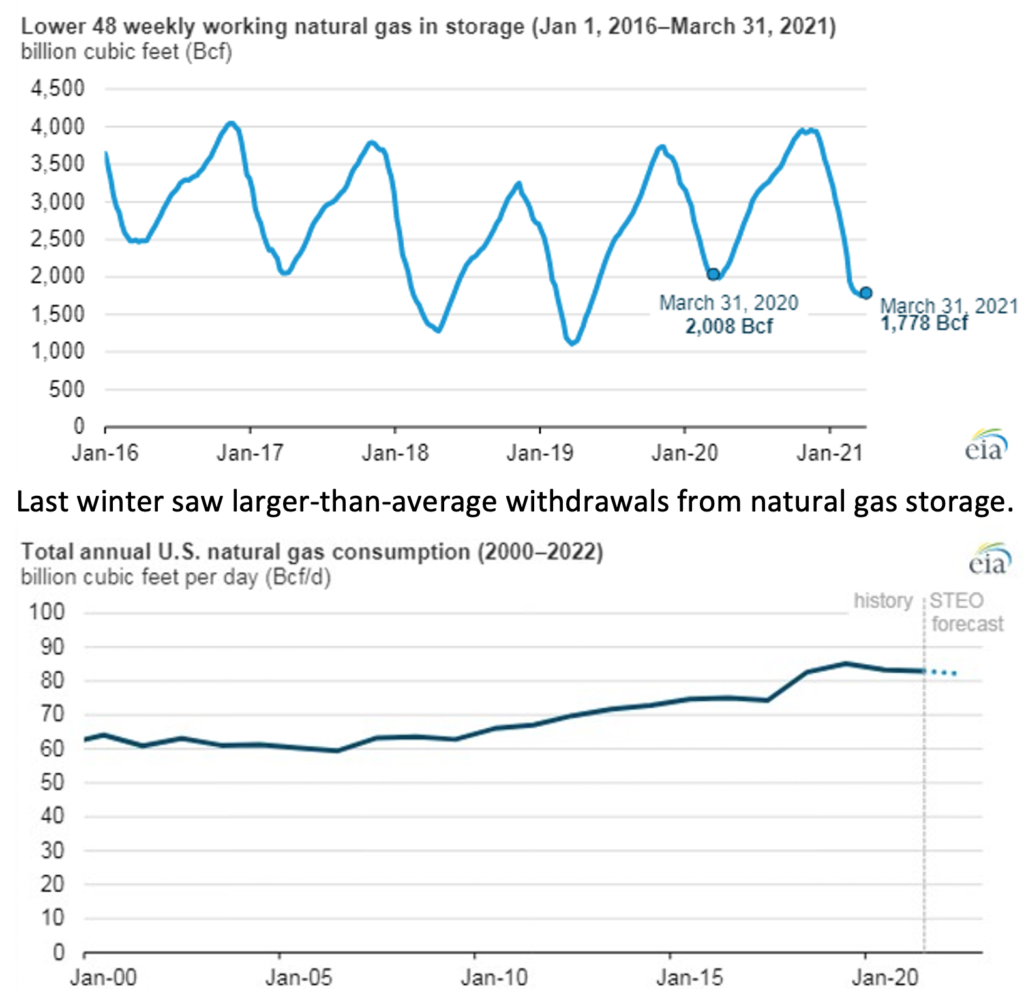

Natural gas withdrawals up: Significantly colder-than-normal temperatures in the Lower 48 states in late January through mid-February resulted in increased heating demand for natural gas in the United States, despite an otherwise warmer-than-normal winter. As a result, the winter had larger-than-average natural gas withdrawals. (4/20)

Lax oversight? The US Dept. of the Interior lacks a robust oversight process to monitor and ensure the safety and integrity of some 8,600 miles of active offshore oil and gas pipelines located on the seafloor of the Gulf of Mexico, the US Government Accountability Office (GAO) said in a report on Monday. (4/20)

The nation’s largest coal miners’ union said Monday it would accept President Biden’s plan to move away from coal and other fossil fuels in exchange for a “true energy transition.” Such a plan would include thousands of jobs in renewable energy and technology to make coal cleaner. (4/20)

Poland’s plan to carve out coal-fired power plants would free up state-owned companies to invest in clean energy. But the program has to win over trade unions, the European Union’s executive and gain approval from Poland’s bickering coalition government. (4/20)

Swiss lender UBS has tightened its financing criteria for those involved in coal-fired power generation and mining, Arctic oil and tar sands, and would lay out a more detailed climate action plan later this year. (4/23)

OPEC’s Fund for International Development is among a group of development banks providing $114 million of loans to build the largest privately-owned solar plant in Egypt. (4/23)

Truce in CA: The Biden team moves to end a legal battle with California over the state’s authority to regulate motor-vehicle emissions, setting the stage for stricter regulations on the auto industry. The Trump administration’s Transportation Dept. had adopted a new policy that said California couldn’t set its fuel-economy standards. Biden will undo that policy. (4/22)

Toyota signaled a shift in its climate change stance on Monday, saying it would review its lobbying and be more transparent as it faces increased activist and investor pressure. The carmaker came under scrutiny after siding with the Trump administration in 2019 in a bid to bar the state of California from setting its own fuel-efficiency rules. (4/20)

Ford is planning more downtime at five North American factories due to a global semiconductor shortage, further disrupting the output of a popular sport-utility vehicle and the F-150 pickup truck. (4/22)

Car kerfuffle: The Trump administration sidelined career EPA staffers when weakening pollution rules for new passenger vehicles. A new report provides fresh fodder for the Biden administration to tighten mileage and greenhouse gas standards for new automobiles. (4/22)

EU battery push: In 2020, Fitch Solutions analysts recorded 37 manufacturing projects for EV batteries and related components and materials worth $21.04 billion. The projects give an idea of which regions are most active in developing a localized supply chain. Western Europe claimed the biggest number of projects with 17, or 43.5% of the total. (4/19)

The shift to electric cars in Europe is proving to have staying power. Fully electric and plug-in hybrid vehicles accounted for about 15% of passenger-car sales in the first quarter of 2021. That’s almost double the sales for the year-earlier period. (4/23)

The maritime industry, under growing pressure to reduce shipping’s carbon emissions, is coming to a growing consensus that liquefied natural gas will provide an intermediate solution toward finding cleaner fuel to power ships. (4/23)

The first hydrogen-powered passenger trains built by Alstom SA are set to debut in Germany next March, after undergoing a lengthy trial period. (4/24)

New H2 team: Chevron and Toyota Motor North America have reached a memorandum of understanding to pursue a strategic alliance on hydrogen. (4/23)

Europe experienced its hottest year on record last year, while the Arctic suffered a summer of extreme wildfires partly due to low snow cover as climate change impacts intensified. EU scientists issued a stark reminder that the impacts of a warmer world are already here. (4/22)

Trapping carbon: Organizers of a $20 million contest to develop products from greenhouse gas that flows from power plants announced two winners Monday ahead of launching a similar but much bigger competition backed by Elon Musk. Both winners made concrete that trapped carbon dioxide. (4/20)

More trapping carbon: Exxon proposed a giant, $100 billion hub to capture carbon dioxide emissions along the US Gulf Coast in Texas but warned that government funding would be required to pay for and develop it. It would be the world’s biggest carbon capture and sequestration project. (4/20)

Climate change is bringing rising sea levels and increased flooding to some cities worldwide and drought and water shortages to others. For the 11 million inhabitants of Chennai, it’s both. India’s sixth-largest city gets an average of about 1,400mm (55 inches) of rainfall a year. Yet in 2019, it hit the headlines for being one of the first major cities in the world to run out of water—trucking in 10 million liters a day to hydrate its population. (4/19)

As many as one in five water wells worldwide is at risk of running dry if groundwater levels drop by even a few meters, according to a new study appearing Thursday in the journal Science. Wells supply water for half the world’s irrigated agriculture, as well as drinking water to billions of people, but demand for water generally has not been regulated. (4/23)

Thyssenkrupp has signed a contract with Illinois-based CF Industries to supply a 20-megawatt alkaline water electrolysis plant to produce green hydrogen at their Donaldsonville, Louisiana, manufacturing complex. The work is expected to begin later in 2021 and finish in 2023. (4/23)