Editors: Tom Whipple, Steve Andrews

Quote of the Week

I don’t like the market or the speculators or the media to take us for granted; that’s why I keep so many rabbits under my taqiyya [the traditional skullcap worn by Saudi men]. If you are less predictable, you become more in command.”

Prince Abdulaziz bin Salman, oil minister of Saudi Arabia

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

Oil: Futures in New York rose 0.2% last week, completely recouping a selloff on Monday that was stoked by the rapidly spreading delta variant. Fuel demand and road traffic from the US to Asia and Europe remains resilient, underscoring expectations that the recovery hasn’t been derailed and global inventories will continue to shrink. New York futures settled at $72.07 while Brent settled at $74.10.

Gasoline demand is essentially back to normal in many of the biggest oil-consuming countries, with road traffic data showing a similar trend. Over the past two weeks, Europe’s air traffic came close to two-thirds of flights in the same period in 2019. The market is more concerned about deficits and that we’re under-supplied in the near term.

US crude oil stockpiles rose the week before last, breaking a streak of eight weeks of declines, as imports surged to their highest in a year. Crude inventories rose by 2.1 million barrels in the week of July 16th to 439.7 million barrels. US crude imports rose to 7.1 million b/d, their highest since July 2020, boosting net crude imports to their highest since December at 4.6 million b/d. Exports also dropped 1.6 million b/d as the price differential between US crude futures and Brent crude has narrowed, making exports less attractive to foreign buyers.

The US is swimming in so much jet fuel that even this summer’s surge in air travel can’t save the market. According to the Transportation Security Administration, US air traffic has jumped to more than 2 million passengers a day, about 78% of where it was two years ago. That’s done little to diminish the massive glut in jet fuel stockpiles, which stand at their highest seasonal level in a decade. Part of the problem is that refiners are trying to cash in on resurgent gasoline demand by raising production rates, which leads to more jet fuel output. The global oil market can’t fully recover to pre-pandemic levels until jet fuel consumption is back to normal.

International Energy Agency: The global rebound from the pandemic is set to drive emissions of greenhouse gases to all-time highs, the IEA said last week. “We estimate that full and timely implementation of the economic recovery measures announced to date would result in CO2 emissions climbing to record levels in 2023, continuing to rise after that,” it said. Spending plans for clean energy allocated by governments worldwide in the second quarter of this year add up to $380 billion, making up just 2% of their total stimulus funds in response to the pandemic.

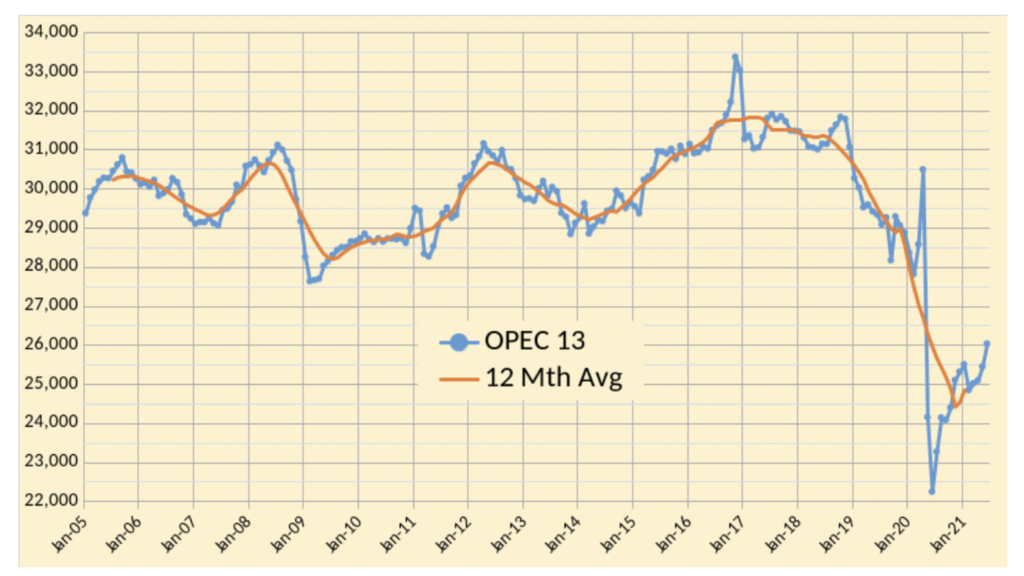

OPEC: The cartel and its allies have set aside their differences for now, with their deal to hike crude production, but the coalition’s internal battles for market share are just getting started. After two and a half weeks of wrangling, the OPEC+ alliance on July 18th agreed to pump 400,000 b/d more crude every month to cool off a potentially overheating market. The cartel also grants five countries – Saudi Arabia, Russia, the UAE, Iraq, and Kuwait – higher output targets starting in May 2022. It is a near-term win for the group and looks set to exacerbate the divide between its richer and poorer members. Some will struggle to produce at their quotas.

(Peak Oil Barrel)

The market is very tight, and a supply increase of 400,000 b/d will turn out to be a pittance, according to a senior analyst. On the other hand, he states that demand is significantly higher, despite the Covid-19 pandemic exploding in parts of the world, and oil prices are likely to climb much further by the time summer is over. Goldman Sachs said that the deal would support its view on oil while cautioning that near-term prices may gyrate amid concern about the delta variant. In addition, the planned output increase was moderate and would keep the market in deficit.

The deal proves that OPEC+ is very much intact and on course to manage a controlled and cautious tapering of cuts to avoid even the slightest risk of tipping the market into oversupply, said the founder of Vanda Insights in Singapore. However, quota-busting is likely to remain a thorn in the alliance’s side, especially when members start experiencing restraint fatigue as markets demand more oil, she added.

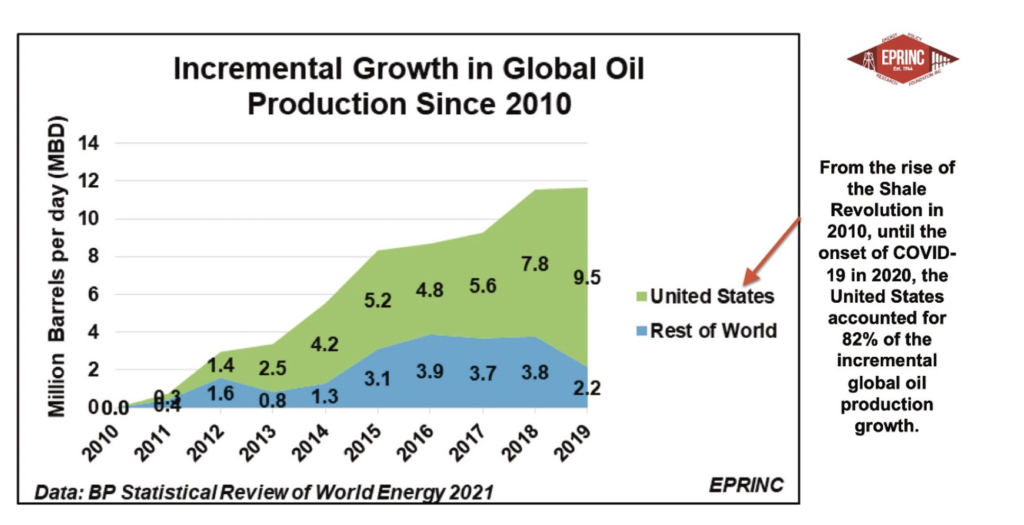

Shale Oil: Unlike previous boom-and-bust cycles, the shale oil industry has held off on boosting production and has focused on strengthening balance sheets, repaying loans, and rewarding shareholders. As a result of the commodity price rally this year and the discipline in capital spending, the industry is now financially more robust. Bankruptcies have been declined in recent months, and the energy loan default rate has dropped to the lowest level since the oil market crashed in March last year. In addition, low interest rates have prompted many US oil and gas firms to raise new debt, most of which goes to repaying existing liabilities, not to drill more wells.

A new report says that chief executives at US shale companies are continuing to receive bumper pay packets despite years of dismal returns. While most US oil bosses had their pay cut during last year’s price crash, the median decline in payouts was just 1% compared to the 2018 levels, according to analysis from Kimmeridge Energy Management.

Oilfield company Halliburton topped Wall Street earnings estimates and offered an optimistic view for energy services demand as the oil drilling downturn recedes. The company posted a 33% jump in second-quarter profit from the previous three months. Likewise, Schlumberger issued a bullish forecast for 2021 as second-quarter profit topped estimates due to surging margins. Still, oilfield activity levels remain far below pre-pandemic levels, and oil demand could face a threat with the resurgence of coronavirus variants in some parts of the world.

Baker Hughes, however, is not so optimistic, seeing shale drilling in North America slowing down in the second half of the year as explorers cling to promises of austerity. While oil prices are high enough for drillers to add rigs and increase output, investors have called on publicly traded ones to distribute profits to shareholders. That means slower growth in the region for oil contracting firms like Baker Hughes and Halliburton. Another 50 rigs could be activated in North America by the end of this year, CEO Lorenzo Simonelli told analysts. That would imply 15% growth in the Baker Hughes weekly rig count for the second half of the year, far slower than the 39% expansion seen during the first six months.

Natural Gas: Futures soared to $4 per million Btu in the US for the first time since December 2018 as summer heat intensified concerns about tight supplies later this year. The premium for March 2022 gas over April futures — essentially a bet on how undersupplied the market will be at the end of next winter — reached 62.9 cents, hovering near a record high.

Fuel prices are soaring across the globe as scorching weather stokes demand for electricity to run air conditioners. In the US, forecasts calling for above-average temperatures from late July through September have set a bullish foreground for a market already stretched thin by tight supply-demand fundamentals. The rally is also underpinned by concern about a potential supply shortfall in the winter when gas consumption peaks.

US oil and gas exporters have been warned that they face a further tightening of European anti-pollution rules despite energy’s exclusion from a swath of climate proposals introduced in Brussels last week. The European Commission’s new climate strategy confirmed that while steel, fertilizers, and other imports could face taxes based on the carbon emitted in their production, oil and natural gas would initially be left out.

Relief among US exporters of liquefied natural gas would be misplaced given that separate rules on methane are expected in the coming months. “LNG exporters largely won a reprieve in the EU package,” said Bob McNally, head of Rapidan Energy, “but the commission is coming for them in methane regulations later this year.”

Coal: Supply disruptions, a drought in China, and rebounding electricity demand have fired up the market for thermal coal, making the world’s least liked commodity one of this year’s best-performing assets. Since the start of the year, the price of high energy Australian coal — the benchmark for the Asian market — has climbed 80% to almost $146 a ton, its highest level in more than a decade. South African equivalent is also trading at its highest level in more than ten years, rising 44% in 2021. That puts coal benchmarks ahead of two of this year’s best-performing asset classes: real estate, up 28%, and financial stocks, up 25%.

The Biden Administration is committing $300 million to invest in the economic redevelopment of coal and coal power plant-affected communities as part of $3-billion funding for investment in America’s communities. Secretary of Commerce Gina Raimondo said, “We believe that this $300 million investment in coal communities is the largest economic development that EDA has ever made in coal. And we know that it will enable these communities to recover, diversify their economies, and grow,”

Electricity: As demand for clean energy surges, developers struggle to find enough transmission lines to carry power to customers. One increasingly popular solution: retired coal plants. A retired power facility offers renewable energy producers a back door onto the grid. Denmark’s Orsted, for instance, is developing a 1.1-gigawatt wind farm off the New Jersey coast that’s expected to go into service in 2024. The turbines will be at least 15 miles from shore, and Orsted plans to connect them to the grid at two onshore sites, a coal plant that retired last year and a nuclear plant shuttered in 2018.

Brazil, Latin America’s biggest economy, is facing its worst drought in almost a century, disrupting hydroelectric dams – Brazil’s primary source of power generation. However, despite the stretched power system, the power company said it is not forecasting shortages for consumers. “Concerning meeting power requirements, there are significantly reduced surpluses in October, with the exhaustion of practically all resources in November,” the company said. Earlier this month, electricity generators were asked to postpone maintenance.

Prognosis: Higher electric vehicle adoption and rising fuel efficiency will bring peak road transportation fuel demand forward to 2027, four years earlier than previously thought, BloombergNEF said in a report. Last year, BloombergNEF expected gasoline and diesel demand for passenger vehicles and trucks to peak in 2031. However, this year, BNEF expects steep declines in fuel consumption in Europe and the US, where more EVs are being sold while conventional vehicles become increasingly efficient.

Two years ago, Wall Street banks were on their way out of a long-term relationship with the oil industry. Now, with oil prices over $70 for the first time in three years, big bond buyers are snapping up oil bonds once again. But there is a condition this time: investors don’t want borrowers to use the cash to drill new wells. Instead, they want them to use it to pay off older debt and shore up balance sheets. It makes sense, although it is a marked departure.

Is the refining sector in crisis? Demand for light products such as gasoline, diesel/gasoil, and jet/kerosene drives refinery utilization. However, even in a delayed energy transition, light product demand will plateau by the middle 2020s. So concludes global consultancy McKinsey & Company in its new report “Global downstream outlook to 2035.” According to the research, light product demand will fall by 2.8 million b/d from 2019 levels by 2035, assuming current trends. However, if the energy transition accelerates, the demand decline during the period will be a more dramatic 11.7 mb/d, McKinsey predicts. The consultancy foresees a particularly sharp drop in light product demand in Europe and North America. Still, it points out that one region – Africa – could see demand grow by 1 mb/d by 2030 under a delayed energy transition.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: The US is considering cracking down on Iranian oil sales to China as it braces for the possibility that Tehran may not return to nuclear talks or may adopt a harder line whenever it does. Washington told Beijing earlier this year its main aim was to revive compliance with the 2015 Iran nuclear deal and, assuming a timely return, and there was no need to punish Chinese firms violating US sanctions by buying Iranian crude. However, that stance is evolving given uncertainty about when Iran may resume indirect talks in Vienna. There is also the question of whether incoming Iranian President-elect Ebrahim Raisi is willing to pick up where the talks ended on June 20th or demand a fresh start.

The draft agreement between Iran and world powers over the possible restoration of the nuclear deal is incompatible with a recently passed Iranian law, a government spokesman in Tehran said last week. The Supreme National Security Council of Iran considers the draft agreement in breach of a new Iranian law passed in December 2020. The law obliged the Iranian government to limit nuclear site inspections and to expand uranium enrichment for peaceful purposes.

Iran is loading crude oil at the Jask oil terminal on the Gulf of Oman, adding its first export terminal outside the strategic Strait of Hormuz. A 1,000 km pipeline can transfer 1 million b/d of oil from the oil-rich southwest Khuzestan province to the terminal. Jask is an alternative to the Kharg exports terminal that is located inside the Strait of Hormuz.

According to activists and video footage, residents in southwestern Iran held large protests last week, denouncing the country’s leadership amid severe water shortages in the region. At least two people have been killed in the unrest. The protests in the oil-rich Khuzestan province along the border with Iraq appear to have rattled the government, which has been accused of responding with a heavy hand as it looks to prevent the demonstrations from spreading to other parts of the country.

The unrest comes during a delicate political transition in Iran and at a moment when the government is wrestling with overlapping crises: an unrelenting coronavirus outbreak, economic woes compounded by US sanctions, and widespread power outages that have set off other protests. In recent weeks, there have also been waves of labor unrest, including strikes by oil workers.

Iraq: Production in June was 4.05 million b/d, slightly lower than May output of 4.10 million. The country has averaged 4.08 mb/d in the first half of 2021, somewhat higher than its output targets under an OPEC-plus production agreement. Those constraints are set to ease further after the group reached a deal on July 18th will enable member countries to bring more production online and slightly reduce Iraq’s proportional share of future cuts.

Power cuts this summer will be exacerbated by blackouts in Iran, which supplies a large share of Iraq’s electricity and gas for power generation. In addition, recurrent Islamic State attacks on infrastructure do not help the situation. OPEC’s second-biggest producer has long suffered from severe power outages in the hot summer months, where temperatures in the south can top 50 C and have led to widespread protests in the past.

Three fires struck Basra oil facilities in separate and seemingly unrelated incidents on a single day. The incidents had no significant impact on oil and gas operations. Still, they highlight how the lax safety standards and poor management of public infrastructure that recently caused two devastating hospital fires can also affect Iraq’s oil sector.

Venezuela: A Chinese logistics firm, China Concord Petroleum Co., also known as CCPC, has emerged as a central player in the supply of sanctioned oil from Iran and Venezuela, even after it was blacklisted by Washington two years ago for handling Iranian crude. Last week, CCPC helped facilitate PDVSA’s importing more than half a million barrels of condensate to blend with its extra-heavy crude oil.

Importing condensate and exporting the resulting upgraded crude oil are currently sanctionable actions by the US. Panamanian-flagged “Rene”, the vessel that brought the condensate cargo in, is operated by shipping firm Issa Shipping Fze—based in Fujairah. Shipping documents show the condensate originated in Sri Lanka, which does not produce condensate. Those shipping documents also show that the Rene is scheduled to be loaded with PDVSA heavy crude for export.

The US Treasury Department has extended an order for three months blocking creditors of Venezuela’s state-owned oil company PDVSA from taking control of US refiner Citgo because of missed payments on its 2020 bonds. The order, which was set to expire Jul. 21st, now runs until Oct. 21st. The move shows a continuity of sanctions enforcement from the former Trump administration, although many analysts expect the Biden administration eventually to grant Venezuela some relief on humanitarian grounds.

Venezuela’s capital city is once again rationing gasoline after output at state-owned refineries slumped, forcing motorists to endure day-long queues to top off tanks. As a result, drivers prowl the streets for open filling stations as lines stretch for blocks in some areas. Because of breakdowns at PDVSA fuel-making plants, gasoline output has crashed by more than 40% since the end of June.

3. Climate change

The deadly weather that has unfolded in recent weeks has left climate scientists “shocked” and concerned that extreme events are arriving even faster than models predicted. For example, in southern Oregon, a fire over an area 25 times the size of Manhattan has raged for weeks, aided by a record-shattering heatwave.

In China, floods left 51 dead after a year’s worth of rain fell in a single day in the central city of Zhengzhou, causing more than $10 billion in damages. And in Russia, a state of emergency has been declared in Yakutia in the Far East, where authorities created artificial rain by seeding clouds with silver iodide to put out more than 200 fires.

Climate scientists say the severity of these events is simply “off-scale” compared with what atmospheric models forecast — even when global warming is fully considered. The 120-degree Fahrenheit temperatures brought on by the June heatwave in the Pacific Northwest were more in line with what researchers had imagined would occur later this century. Two dozen extreme weather and climate researchers who conducted an analysis in the days following the heatwave found it would not have happened in the absence of anthropogenic climate change.

The world will need to invest up to $173 trillion in greener energy infrastructure and supply over the next 30 years if it wants to achieve net-zero carbon emissions by 2050, BloombergNEF said in its New Energy Outlook 2021 report. According to BNEF, the world needs to more than double yearly investments to achieve net-zero emissions. Those investments should jump from around $1.7 trillion annually at present to “somewhere between $3.1 trillion and $5.8 trillion per year on average over the next three decades.”

New large-scale climate projects requiring financial backing of about $1 trillion a year will be needed to meet the Biden administration’s carbon goals, a US Energy Department official said last week. The Biden administration has set a goal to reach 100% carbon pollution-free electricity by 2035. In addition, the US Energy Department’s Loan Programs Office is intended to provide funding to emerging green technologies that may not qualify for financing from commercial banks.

Torrential rain has caused severe flooding in parts of central China, leaving train stations and roads submerged. More than 10,000 people in Henan province have been evacuated to shelters following the record rainfall. More than a dozen cities in the region have been affected by the flooding. Henan province, home to some 94 million people, has issued its highest level of weather warning following an unusually active rainy season. Many factors contribute to flooding, but a warming atmosphere caused by climate change makes extreme rainfall more likely.

The catastrophic floods that swept northwest Europe last week were a stark warning that stronger dams, dikes, and drainage systems are as urgent as long-term climate change prevention, as once-rare weather events become more common. The destruction left by the torrents that terrorized swathes of western and southern Germany, Belgium, and the Netherlands, smashing buildings and bridges, killed more than 150 people.

As the European Union gets serious about fighting climate change, experts are fielding more calls than ever from polluters seeking help to trap, process, and store their carbon emissions. The business of capturing carbon emissions—a pricey process with dubious efficacy to date—from industrial plants that make everything from cement to energy will get a push from the European Commission’s ambitious climate plan and a continued rally in carbon permits, as widely forecast by analysts, traders, and utilities.

While the industry isn’t profitable yet, operators expect it will be soon. One of the first projects to come online will be Northern Lights, the transport and storage component of Longship, the Norwegian government’s full-scale carbon capture and underground storage project. Some of the technology for the facility is set to be ready in 2024.

The world’s largest oil firms may need to be careful relying on carbon capture and storage to reduce emissions from operations as much as they would like. Almost every major oil and gas firm has said it would design facilities with CCS to cut the carbon footprint of its operations. However, US oil supermajor Chevron has just had to admit that its massive CCS project at the Gorgon LNG facility in Australia has fallen short of the requirements set by the regulators.

Western Australian regulators approved the Gorgon LNG project, operated by Chevron, with Exxon and Shell holding 25% each as joint venture partners, with the requirement that at least 80% of reservoir CO2 is removed and injected. Chevron, however, has injected only 30% of the CO2 due to ongoing problems with the systems.

4. The global economy and the coronavirus

No one expected a vaccine gap between the global rich and poor that was this bad, this far into the pandemic. Inequity is everywhere: Inoculations go begging in the US. At the same time, Haiti, a short plane ride away, received its first delivery July 15th after months of promises — 500,000 doses for a population over 11 million.

Data from the US and China, which account for more than half of world growth, suggests a slowdown in the current blistering pace of the global economy alongside rising prices for all manner of goods and raw materials. Coinciding with a resurgence in the Delta variant of COVID-19, markets may be sending alarm signals about the global economic outlook.

United States: Most Americans who haven’t been vaccinated against COVID-19 say they are unlikely to get the shots and doubt they would work against the aggressive delta variant despite evidence they do. Among American adults who have not yet been vaccinated, 35% say they probably will not, and 45% say they definitely will not, according to a poll from the Associated Press-NORC Center for Public Affairs Research

Economists see limited disruptions to the economy as local health officials try to avoid restrictions and boost vaccinations in response to the recent case surge. The economists are more concerned about inflation than the Delta variant as they assess the economic outlook.

The US energy sector lost 10% of its workforce last year because of the coronavirus pandemic, according to a report unveiled last week. The US energy workforce, from fossil fuels to solar power, shed 840,000 jobs in 2020. According to the report, the most significant declines were in petroleum and natural gas fuels, with a combined loss of 186,000 jobs, or 21% of their workforce.

The European Union: Scorching heat boosted electricity prices across Europe, adding to a long list of factors that have sent power costs surging this summer. The extreme temperatures increased demand for cooling when consumption was already rising as the world emerges from the global pandemic.

Britain’s economy showed signs of slowing in July as euphoria following the easing of coronavirus restrictions and a resurgence of the coronavirus caused widespread staff shortages. An index based on a survey of purchasing managers fell unexpectedly to its lowest since March when most stores and restaurants were still shut. The findings contrast with official government statistics showing a surge in retail sales last month when consumers celebrated European championship soccer games.

China: High oil prices and China’s crackdown on the use of oil import quotas could result in the lowest crude oil import growth since 2001. Analysts estimate that the recent clampdown on the import and tax practices of independent refiners and the significantly higher oil prices this year could result in flat or slightly rising crude oil imports in China in 2021. As a result, oil imports could grow by up to 2% in 2021, which would be the lowest growth rate in two decades and much lower than the 9.7% average growth rate in annual imports since 2015.

China’s oil companies plan to further slash their exports of oil products to a six-year low of 1.07 million tons in August due to limited export quota availability. The volume was 7% lower than the planned 1.15 million tons in late June for July and well below the monthly average volume of 4.38 million tons in the first half.

China offered millions of barrels of oil from its strategic state reserves this month in an unprecedented move to try and quell inflation brought on by rising costs of everything from food to fuel. The country will supply about 3 million tons — or 22 million barrels — to significant refineries. The decision is the latest in a slew of measures by Beijing to rein in skyrocketing costs caused by a post-pandemic economic recovery.

Six months after taking office—and amid continuing internal deliberations—the Biden approach to China is taking shape. Officials are pressing ahead with the Trump administration’s tougher line on Beijing while bringing allies on board on more issues to increase leverage, administration said.

A new study suggests that the Sinopharm vaccine offers insufficient protection from COVID-19 among the elderly, raising questions for dozens of countries that have given the Chinese company’s shots to their most vulnerable populations. China rejected a World Health Organization plan for the second phase of an investigation into the origin of the coronavirus, which includes the hypothesis it could have escaped from a Chinese laboratory.

China’s power production hit an all-time high in mid-July. Thermal coal prices are at an all-time high on tight demand-supply. This means that despite the risk of blackouts and scorching temperatures in July, power companies could not fully ramp up electricity generation.

Areas in China have started to warn residents and businesses that peak summer demand amid a heatwave could lead to outages as electricity grids buckle under peak-load surges. Beijing and Xi’an have warned residents and factories that there would be scheduled outages as electricity grid operators struggle to keep up with record power demand. Xi’an temporarily cut off power to some districts last week and has asked owners of electric vehicles to charge them outside peak demand hours.

China aims to install more than 30 gigawatts of new energy storage capacity by 2025 to boost renewable power consumption while ensuring the stable operation of the electric grid system. New energy storage refers to electricity storage processes that use electrochemical, compressed air, flywheel, and supercapacitor systems but not pumped hydro, which uses water stored behind dams to generate electricity when needed.

Russia: The third wave of COVID-19 infections has lifted reported daily deaths in Russia to record highs in recent weeks, and sluggish demand for vaccines from a wary population has finally begun to grow with a big official push to boost uptake. With vaccination now compulsory in some Russian regions for people working in close contact with the public, such as waiters and taxi drivers, shortages have appeared.

On Saturday, Russia reported 23,947 new coronavirus cases and an all-time repeat high in the number of deaths related to the virus, at 799. The country has been in the grip of a surge in cases that authorities blame on the more contagious Delta variant. However, some officials have suggested that cases, at least in Moscow, have started to decline in recent days. The national death toll linked to COVID-19 rose to 153,095. The federal statistics agency has kept a separate count and said Russia recorded around 290,000 deaths related to COVID-19 from April 2020 to May 2021.

Deputy Prime Minister Alexander Novak said Russia would raise its oil output in the second half of the year thanks to the new deal agreed by the OPEC+ group to increase their total production. Novak said Russia would start increasing oil output monthly by 100,000 b/d from this August and reach the pre-crisis production level in May 2022.

Russia is ready to introduce a ban on gasoline exports as soon as this week amid record-high wholesale prices. Last Thursday, the price for a ton of 95-octane gasoline exceeded 60,000 rubles for the first time in the St. Petersburg International Mercantile Exchange history. As a result, Russia exported 5.83 million tons of gasoline, or some 15% of its total production, according to calculations based on the Federal Customs Service data.

Moscow plans to boost the use of electric cars by rolling out charging infrastructure in the coming years. The use of electric vehicles in Russia lags far behind other European capitals. But Moscow plans to install 200 electric charging stations annually starting this year. There are around 2,000 electric cars in Moscow now, and their number increases every year by about 10-15%. Charging infrastructure must appear for it to grow more. So, it was natural that Moscow, a city of over 12.5 million inhabitants, would follow the global trend that has seen a boom in electric vehicle use in recent years.

The Biden administration reached an agreement with Germany on Wednesday that allows for the completion of the Nord Stream 2 pipeline between Russia and Germany, ending a heated dispute between the two allies that overlapped three successive US administrations. In addition, Germany will invest in Ukraine’s green technology infrastructure in exchange for an end to US efforts to block the Nord Stream 2 pipeline. Further, Berlin and Washington will work together to mitigate Russia’s energy dominance in Europe.

The Biden administration viewed the project as a dilemma that forced it to choose between restoring its beleaguered relationship with Berlin and keeping its public promise to oppose the project, 90% complete when President Biden took office. US officials doubted that US sanctions could prevent its completion and argued that a deal with Germany rather than a protracted fight offered the best outcome.

India: Excess deaths during the pandemic could be a staggering ten times the official COVID-19 toll, likely making it modern India’s worst human tragedy. This conclusion comes from the most comprehensive research yet on the ravages of the virus in the south Asian country. Most experts believe India’s official toll of more than 414,000 dead is a vast undercount, but the government has dismissed those concerns as exaggerated and misleading.

The report released Tuesday estimated excess deaths — the gap between those recorded and those that would have been expected — to be between 3 million to 4.7 million between January 2020 and June 2021. It said an accurate figure might “prove elusive,” but the actual death toll “is likely to be an order of magnitude greater than the official count.”

An estimated two-thirds of people in India have Covid-19 antibodies, according to a new government survey that has raised hopes that the worst of the country’s pandemic crisis is over, despite a sluggish vaccination campaign. The study of more than 36,000 people in 70 districts across 21 Indian states found that 62% of unvaccinated Indians had antibodies indicating past exposure to the virus.

India has fully vaccinated just 6.5% of its population, while about a quarter of the population has received at least one dose. Moreover, the figures appear to confirm what epidemiologists have long claimed: India’s official coronavirus statistics — 31 million confirmed infections since the start of the pandemic — vastly understate the actual spread of the virus in the country.

South Africa: Wave after wave of coronavirus is pummeling South Africa’s fragile economy and its largely unvaccinated population, creating a spiral of death, lockdowns, and anger that has fueled the country’s worst rioting since the collapse of white minority rule in 1994. At least 215 people died in the violence across South Africa’s two most populous provinces, and more than 3,400 have been arrested. While the looting had quieted by Monday, the situation remains tense in parts of the country.

Southeast Asia: Indonesia has converted nearly its entire oxygen production to medical use just to meet the demand from COVID-19 patients struggling to breathe. Overflowing hospitals in Malaysia had to resort to treating patients on the floor. And in Myanmar’s largest city, graveyard workers have been laboring day and night to keep up with the grim demand for new cremations and burials.

Images of bodies burning in open-air pyres during the pandemic’s peak in India horrified the world in May. Still, in the last two weeks, the three Southeast Asian nations have now all surpassed India’s peak per capita death rate as a new coronavirus wave, fueled by the virulent delta variant, tightens its grip on the region. The deaths have followed record numbers of new cases being reported in countries across the region that have left healthcare systems struggling to cope and governments scrambling to implement new restrictions to slow the spread.

5. Renewables and new technologies

Form Energy, a startup, says it has developed an iron-air chemistry battery. The company’s first commercial product is a rechargeable battery capable of delivering electricity for 100 hours at system costs competitive with conventional power plants and less than one-tenth the cost of the lithium-ion battery chemistry. The elemental metal for its design – iron – is one of the safest, cheapest, and most abundant minerals on Earth. Form Energy’s iron-air battery breathes in oxygen and converts the iron to rust, then turns the rust back into iron and breathes out oxygen, discharging and charging the battery in the process.

For a lithium-ion battery cell, the workhorse of electric vehicles and today’s grid-scale batteries, the nickel, cobalt, lithium, and manganese minerals used currently cost between $50 and $80 per kilowatt-hour of storage. Using iron, Form believes it will spend less than $6 per kilowatt-hour of storage on materials for each cell. Packaging the cells together into a complete battery system will raise the price to less than $20 per kilowatt-hour, a level at which academics have said renewables plus storage could fully replace traditional fossil-fuel-burning power plants.

Toyota Motor’s Chief Scientist explained why the firm is not a proponent of ditching internal combustion engines and switching to only battery-powered vehicles (BEV) as soon as possible. Instead, he argues that a diversity of electrified drivetrains better addresses climate change than “a monoculture of only BEVs” for two main reasons: Battery cell production is expensive, uses natural resources, and produces significant greenhouse gases. In addition, maximizing the benefit of every battery cell produced requires using them smartly. This means putting them into a more substantial number of “right-sized” electrified vehicles, including HEVs and PHEVs, instead of placing them all into a fewer number of long-range BEVs. This is particularly important because presently, it is difficult to recycle the kinds of batteries used in BEVs.

6. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

Shell has today confirmed that it would appeal against a landmark court ruling requiring the oil giant to cut emissions faster than it had planned to. The Anglo-Dutch firm said that it had been unfairly singled out by the ruling, which it said was not an “effective” way of tackling climate change. In May, a court in the Hague ordered the firm to slash greenhouse emissions by 45% from 2019 levels by 2030. (7/22)

Global miner BHP Group is considering getting out of oil and gas in a multibillion-dollar exit as it looks to speed up its retreat from fossil fuels. The world’s biggest miner is reviewing its petroleum business and considering options, including a trade sale. (7/21)

Kuwait’s oil sector is expected to contract in 2021 due to the ongoing OPEC+ production cut agreements, which will stifle the Gulf state’s economic growth. (7/19)

The future of Mozambique’s gas ambitions hinges on its ability to end a deadly insurgency linked to Islamic State. Yet four months after gunmen overran Palma, a town housing TotalEnergies contractors, the insurgents still control swathes of territory and a key port while the army is in tatters. TotalEnergies has said its $20 billion gas project will remain on hold until security is restored in the province in a “verifiable and sustainable manner.” (7/22)

In Latin America, there are emerging fears of Arab-spring-like developments occurring across the region, with many countries rocked by widespread anti-government protests since 2019. Colombia, Latin America’s fourth-largest oil producer and economy, recently became the epicenter of broad anti-government dissent, with the Andean nation rocked by nationwide protests for over two months. (7/20)

In Mexico, crude production by private operators reached a new record of 70,000 b/day in June while state oil company Pemex struggles to stop the decline of its output. (7/24)

The US oil rig count rose by seven last week to 387 while the gas rig count stayed flat, according to Baker Hughes Inc. The total count hit 491, just about double the 240 it was last year at this time. Canada’s overall rig count fell this week by 1. Oil and gas rigs in Canada now sit at 149 active rigs, up 107 on the year. (7/24)

Woman breaks glass ceiling: Exxon Mobil Corp’s new chief financial officer Kathyrn Mikells is the first woman and external hire to join the oil major’s management committee, as energy firms search to diversify their workforce in response to investor pressure. (7/20)

Upping cybersecurity: The Department of Homeland Security on Tuesday required owners and operators of critical pipelines that transport hazardous liquids and natural gas to implement “urgently needed protections against cyber intrusions.” It was the second security directive issued by the department’s Transportation Security Administration since May after a hack of the Colonial Pipeline disrupted fuel supplies. (7/21)

US production capacity for renewable diesel could increase significantly through 2024, based on announced projects and those that are under construction, according to the US Energy Information Administration. (7/22)

Burying power lines: At the cost of 10 to 30 billion dollars, California power company Pacific Gas and Electric said on Wednesday it would bury 10,000 miles of power lines in high-risk fire zones as a safety measure after its equipment caused multiple destructive wildfires over several years. The utility, which called the project a multi-year initiative, maintains more than 25,000 miles of overhead distribution power lines in the highest fire-risk zones, or more than 30% of its total distribution overhead system. (7/22)

Japan has rebooted different power plants, including a nuclear reactor inactive for ten years, and taken other steps to avoid a power crisis as temperatures soar and demand for cooling surges, especially in Tokyo, where the Olympics begin on Friday. (7/21)

Japan will raise its target for renewable energy in the country’s electricity mix for 2030 as it pushes to cut emissions to meet commitments under international agreements on climate change. The industry ministry’s policy draft released on Wednesday says renewables should account for 36-38% of power supplies in 2030, double the level of 18% in the financial year to March 2020. Ultimately, Japan aims for a “carbon neutral society” by 2050. (7/21, 7/23)

Net zero-step: Britain’s government plans to create a new energy system operator to help the country meet its net zero emissions target, which could remove National Grid’s responsibilities, which is viewed as a potential conflict of interest. (7/20)

A Japanese coal problem: Thanks to low-interest loans from the Japan International Cooperation Agency, Bangladesh is currently building the Matarbari coal plant: a power complex set to be completed by 2024. It constitutes one of the most significant and most controversial tests of Tokyo’s commitment to helping phase out fossil fuels. (7/23)

Brazil’s national power grid operator has asked electricity generators to postpone maintenance and technical work for as long as possible to help avoid worsening the energy crisis stemming from the country’s worst drought in almost a century. (7/19)

EU’s EV sales: European sales of conventional gasoline and diesel vehicles by market share slumped sharply (by 19% to a total of 61%) in the second quarter of 2021 as a growing appetite for battery-powered mobility continued to support sales of electric and hybrid cars. Electric vehicle sales jumped more than 200% over the year, while plug-in hybrid sales more than tripled since 2020. (7/24)

Mercedes-Benz is getting ready to go all-electric by the end of the decade, where market conditions allow, shifting from electric-first to electric-only. By 2022, Mercedes-Benz will have battery electric vehicles (BEV) in all segments the company serves. From 2025 onwards, all newly launched vehicle architectures will be electric-only, and customers will choose an all-electric alternative for every model the company makes. (7/23)

Wireless EV charging: The Indiana Department of Transportation and Purdue University early in July announced plans to develop the first contactless wireless-charging concrete pavement highway segment. The project will use innovative magnetizable concrete developed by German startup Magment GmbH enabling wireless dynamic charging of electric vehicles as they drive. (7/20)

Investment shift: The CME’s Comex and London Metal Exchange are squaring up for the industrial revolution that is electrification. Both exchanges are busy developing and, more importantly, marketing products catering to the industry’s need to hedge exposure to forwarding prices for key battery ingredients. (7/23)

EV systemic problem? The widespread adoption of EVs may negatively impact land use, according to a new study. The study explores three relevant issues: the impact of EVs’ operating costs on urban size, the space requirements of charging facilities, the land demand of energy production through renewables. (7/19)

The solar systemic problem? Waste disposal is not a popular topic of discussion in the media when it comes to renewable energy. But the International Renewable Energy Agency estimated in 2016 that unless we make significant changes to our treatment of solar panels, they could add up to 78 million tons of waste. (7/23)

Hybrid planes: Surf Air Mobility Inc. has signed a purchase agreement with Textron Aviation for up to 150 Cessna Grand Caravan EX single-engine turboprop aircraft. All 150 will be a hybrid electric aircraft. (7/22)

H2 plane: Deutsche Aircraft, the new purpose-driven German aircraft Original Equipment Manufacturer, and Universal Hydrogen Co. announced a technical collaboration to complete a design study to incorporate Universal Hydrogen’s modular capsule technology into the Dornier 328 program. The Dornier 328 is a turboprop-powered commuter airliner. (7/22)

H2 Olympic flame: The flame at Tokyo’s National Stadium and another cauldron burning along the waterfront near Tokyo Bay throughout the games were sustained in part by hydrogen, the first time the fuel source has been used to power an Olympic fire. (7/24)

Britain’s supermarkets, wholesalers, and haulers struggled on Thursday to ensure stable food and fuel supplies after an official health app told hundreds of thousands of workers to isolate themselves after contact with someone with COVID-19. British newspapers carried front-page pictures of empty shelves in supermarkets. (7/22)

Food waste extraordinary: An estimated 2.5 billion tons of food was lost on farms or wasted by retailers or consumers globally, accounting for about 40% of production, according to research by World Wildlife Fund and UK retailer Tesco Plc. The figure tops the previous estimates by about 1.2 billion tons, with farming in wealthier countries being a bigger offender than assumed. (7/22)