Editors: Tom Whipple, Steve Andrews

Quote of the Week

“This has been a dramatic year for the global energy sector, with the coronavirus pandemic slashing demand and upending market norms. Further to this, with investment in oil and gas taking a hit and renewable energy remaining resilient, some industry stakeholders are suggesting that 2020 could result in a permanent realignment of the global energy market.”

Oxford Business Group“

Graphics of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Renewables and new technologies 6. Briefs |

1. Energy prices and production

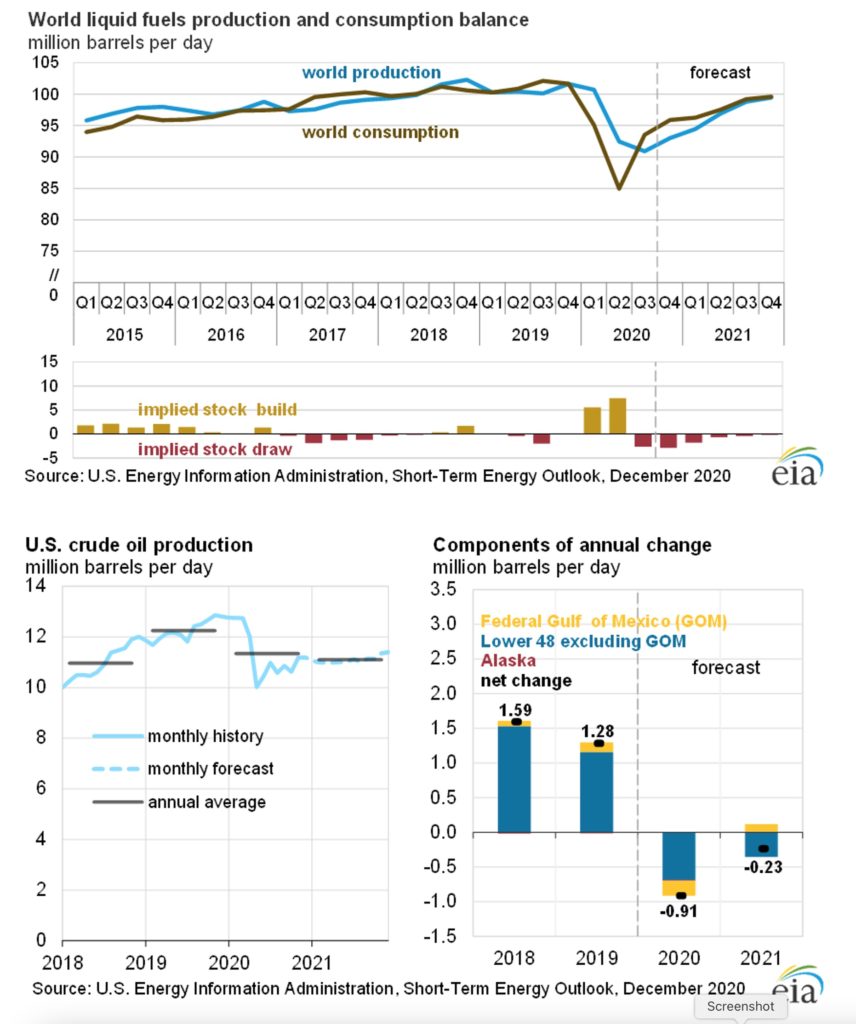

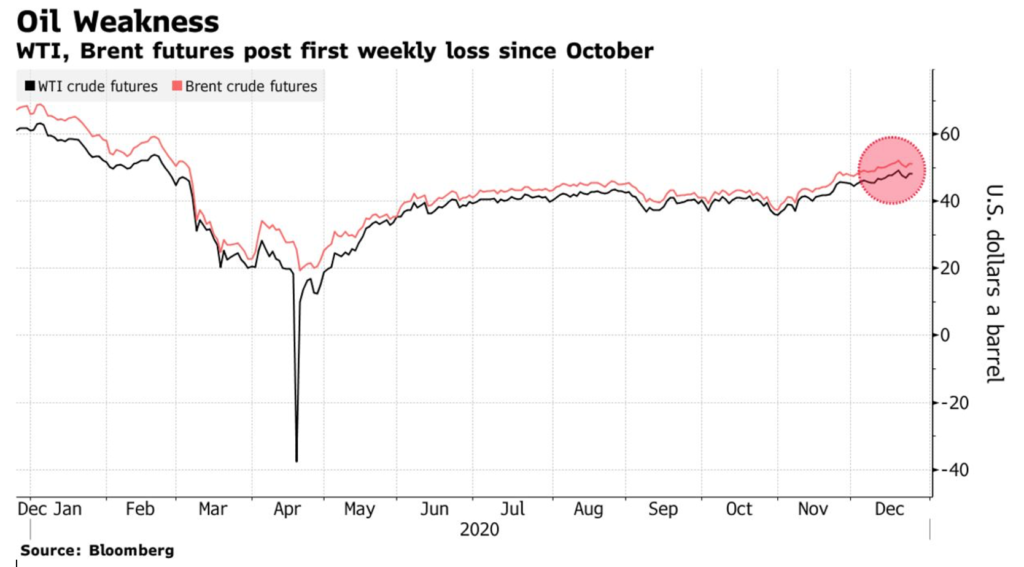

Oil: Weekly prices declined for the first time since October, as a new coronavirus mutation spread through parts of the world and poses risks to energy demand. Futures in New York slid 1.8 percent this week yet closed up on Thursday, with equities gaining after the UK clinched an historic trade deal with the European Union. Stricter restrictions were extended to much of England to contain the new strain of Covid-19, and China said it would pause flights to and from the UK. A cluster of infections in Sydney is growing and, in the US, New York City hospitalizations are at the highest since May.

After a run of seven weekly gains driven by euphoria over a series of vaccine breakthroughs, oil’s weakness points to the concerns over how long it will take for vaccines to roll out and the impact on energy consumption. Simultaneously, the OPEC+ alliance plans to add supply back to the market next year, another risk factor.

West Texas Intermediate settled at $48.23 a barrel on the New York Mercantile Exchange, while Brent ended the session at $51.29 a barrel on the ICE Futures Europe exchange. Neither WTI nor Brent traded on Friday due to the Christmas holiday

Crude oil prices moved higher after the Energy Information Administration reported an inventory draw of 600,000 barrels for the week to Dec. 18th. This compared with a draw of 3.1 million barrels estimated for the previous week.

Investors expecting an end-of-year rebound in the oil and gas industry could be in for a disappointment if figures published by Royal Dutch Shell are any indication. The energy giant gave a first taste of what could prove to be another bleak quarter for the industry. It warned of another multibillion-dollar impairment charge, significantly weaker oil trading, a loss in its upstream division, and fuel sales that remain sluggish.

OPEC: The cartel will take a more hands-on approach to global oil markets as it plans to meet more frequently. “We are meeting monthly because we believe that the market is still not recovered and is still extremely volatile,” Russian Deputy Prime Minister and former Energy Minister Novak said. “We need to adopt a hands-on approach and be able to react faster.” According to Saudi Arabia’s Energy Minister Abdulaziz bin Salman, this denser meeting schedule will also help OPEC+ get the upper hand in directing oil markets over speculators. “We are on the same page in our commitment,” bin Salman said following a meeting with Novak in Riyadh this weekend.

Shale Oil: More than 40 oil and gas companies in the US filed for bankruptcy protection in the first eleven months of this year, according to Haynes & Boone. Their cumulative debt load is $24.7 billion. However, things in the US shale oil business may not be as bad as the number of bankruptcies might suggest. Bloomberg Intelligence recently reported the value of oil and gas bonds trading at a distressed level in mid-March totaled $144 billion. By the end of November, this was down to $37 billion. And analysts expect a lot fewer bankruptcies next year. “The weakest have been culled from the herd,” says Bloomberg Intelligence analyst Spencer Cutter. “Most of the remaining companies may not be making much or any money with oil at $45 and natural gas below $2.75, but they have the liquidity to ride things out for a while.”

Diamondback Energy rounded off a tumultuous year for the US shale industry with the acquisition of two rival producers for about $1.4 billion that will expand the company’s position in the Permian Basin. Midland, Texas-based Diamondback’s investments are a bet on the shale sector’s resilience, whose production has dropped this year following the collapse of oil prices.

Natural Gas: A steep drop in Permian gas production this year drives a significant shift in regional flow dynamics that’s likely to endure into 2021. Following a 3.8 billion cf/d, or nearly 30 percent, decline in Permian Basin gas production that came following the oil-market collapse earlier this year, West Texas producers have since struggled to mount a recovery. In December, output has averaged just 10.4 billion cf/d as the basin’s growing inventory of aging wells reverses a mid-summer rebound fueled mainly by previously curtailed production.

As the US Northeast digs out from its first significant winter storm, a bullish runup in first-quarter 2021 gas prices there is looking overdone now with weather forecasts and supply gains posing a risk to the rally. At Appalachia’s benchmark supply hub, Dominion South, the Q1 forward curve has gained 33 cents since Dec. 8th, most recently settling at $2.08 /million Btu.

US operators captured a record percentage of associated gas in oil-rich US plays in 2020 as new infrastructure combined with lowered output. In 2020, US producers reduced their flaring emissions substantially, according to observed satellite Visible Infrared Imaging by the National Oceanic and Atmospheric Administration.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: With an eye on US sanctions relief once President-elect Biden takes office, Iran’s leaders have ordered its oil sector to prepare to ramp up production and exports in 2021. Tehran will hold its next election in June, and the coming months will be the last chance for term-limited President Rouhani and his moderate allies to show the country that they can lead it back from years of deprivation. Many analysts expect the two sides to pursue a quick interim deal to waive some sanctions after Biden is inaugurated on January 20th. That could unlock a portion of Iran’s roughly 2 million b/d of shut-in crude exports. Still, a full agreement is likely to be more complicated due to political considerations in both countries, as well as the time needed to bring Tehran’s elevated low-enriched uranium levels back into compliance with the nuclear deal.

S&P Global Platts Analytics forecasts 160,000 b/d year-on-year volume growth in 2021 and another 700,000 b/d in 2022, with “significant upside risk of a speedier return,” given conciliatory indications from both the Biden camp and Iran’s Supreme Leader Ali Khamenei, who has ultimate authority over policy. The country exported around 585,000 b/d of crude and condensate in November, up about 95,000 b/d from October. Rouhani has submitted to parliament a budget for the coming Iranian year that starts March 20 with assumed oil sales nearly four times higher, at 2.3 million b/d.

Nearly a year after the US airstrike that killed an Iranian military leader, a senior American general said that Tehran is still considering retaliatory steps, raising the possibility of renewed confrontation in the Trump administration’s final days. The State Department has already withdrawn some personnel from the US Embassy in Baghdad ahead of the first anniversary of the January 3, 2020, strike on Maj. Gen. Soleimani.

Drilling operations at the first well in Phase II of Iran’s supergiant South Pars natural gas field officially began last week. Significant gas recovery from the enormous resource will commence in the second half of the next Iranian calendar year that starts on March 21, 2021. Along with completing the crucial Goreh-Jask pipeline oil export route by the end of the current Iranian calendar year, the country is building out its value-added petrochemicals production to at least 100 million metric tons per year by 2022 and ramping up production from its oil-rich western oil fields.

Iraq: The cabinet has approved a draft 2021 budget, sending parliament a bill with several likely flashpoints of controversy — including the devaluation of the currency, a record-setting deficit of $43.4 billion, and provisions for sharing revenue with the semi-autonomous Kurdistan Regional Government. Prime Minister al-Kadhimi faces a nearly impossible task of addressing significant problems with the structure of Iraq’s economy while also responding to a year-long financial crisis.

With budgets already stretched thin, Iraq’s budget is being taxed even more by its flaring natural gas policy while paying high prices to import natural gas from Iran. The process of flaring natural gas—a byproduct of oil production—is controversial on climate grounds. But the spokesman for the Ministry of Electricity, Moussa, said that paying high prices for gas from Iran in large quantities to generate electric power “constitutes a major defect.” Instead of paying high prices for Iran, Moussa proposes that the Parliamentary Oil and Energy Committee move to take advantage of local gas.

Libya: Turkish Defense Minister Hulusi Akar warned that the forces of Khalifa Haftar and their supporters based in eastern Libya would be viewed as “legitimate targets” if they attempted to attack Turkish forces. Turkey is the leading foreign backer of Libya’s internationally recognized Government of National Accord based in Tripoli, which for years has been fighting Haftar’s Libyan National Army (LNA). The LNA is backed by Russia, the United Arab Emirates, and Egypt. In October, the GNA and LNA signed a ceasefire agreement, and the United Nations has been pushing a political dialogue aimed at elections next year as a solution. Russia on Wednesday called for international efforts toward a peace settlement in Libya to be intensified.

3. Climate change

In one of the most significant victories for US climate action in a decade, Congress has moved to phase out a class of potent planet-warming chemicals and provide billions of dollars for renewable energy and efforts to suck carbon from the atmosphere—an unproven technology”—as part of the $900 billion coronavirus relief package. The legislation, which Congress approved Monday, wraps together several bills with bipartisan backing and support from an unusual coalition of environmentalists and industry groups. President Trump is threatening to veto the bill, and we will not know the bill’s fate until later this week.

The legislation will cut the use of hydrofluorocarbons, chemicals used in air conditioners and refrigerators, hundreds of times worse for the climate than carbon dioxide. It authorizes a sweeping set of new renewable energy measures, including tax credit extensions and further research and development programs for solar, wind, and energy storage; funding for energy efficiency projects; upgrades to the electric grid and a new commitment to research on removing carbon from the atmosphere. And it reauthorizes an Environmental Protection Agency program to curb emissions from diesel engines.

The legislation also includes strong language on the “sense of Congress” that the Energy Department must prioritize funding for research to power the United States with 100 percent “clean, renewable or zero-emission energy sources.” “This is perhaps the most significant climate legislation Congress has ever passed,” said Grant Carlisle, a senior policy adviser at the Natural Resources Defense Council.

Big finance is turning its back on companies that aren’t conforming to a straightforward idea –sustainability. And it’s fueling one of the most significant transfers of capital the world has ever seen. In fact, within a year, 77 percent of institutional investors will stop buying into companies that aren’t, in some way, sustainable. And the new King of Wall Street is leading the charge. With over $7 trillion in assets under management, BlackRock says its clients will double their ESG (Environmental, Social, Governance) investments in just five years.

Money managers on the Street say climate change is their top concern and a ‘leading criterion’ when determining where they put their money to work. Sustainable assets already account for $17.1 trillion. But there could be as much as $120 trillion up for grabs. And that’s precisely why sustainable stocks are outperforming the market.

Methane emissions, especially those from the oil and gas industry, are becoming the new focus of attention for regulators and environmentalists. Tracking and measuring carbon dioxide emissions is now standard practice, but methane emissions used to be elusive. This is no longer the case, thanks to cutting-edge tech. The European Space Agency recently reported that its scientists had used data from two satellites to map methane emissions from space, in partnership with data analytics services provider Kayrros, which developed the tools that made not just the detection of individual methane releases possible, but also their duration and quantification.

4. The global economy and the coronavirus

A team of British scientists released a worrying study on Wednesday about the new coronavirus variant sweeping the United Kingdom. They warned that the variant is so contagious that new control measures, including closing down schools, might be necessary. Even that may not be enough, they noted, saying, “It may be necessary to accelerate vaccine rollout greatly.” “The preliminary findings are pretty convincing that more rapid vaccination is going to be an essential thing for any country that has to deal with this or similar variants,” Dr. Davies, an epidemiologist at the London School of Hygiene and Tropical Medicine.

The coronavirus’s new variant carries mutations that could mean children are as susceptible to becoming infected with it as adults – unlike previous strains, scientists said on Monday. Herd immunity against the novel coronavirus could require vaccination rates approaching as high as 90 percent, Dr. Anthony Fauci said in an interview published on Thursday in The New York Times.

United States: States and major cities across the country have imposed the most extensive restrictions on business and social gatherings since widespread lockdowns during the spring, in hopes of preventing a further surge in Covid-19 cases over the winter holidays. Even as Pfizer Inc. and Moderna Inc. deliver the first doses of the coronavirus vaccine, officials are pleading with a weary public to avoid the kinds of gatherings and travel that helped drive new cases to record levels nationally after Thanksgiving.

According to an estimate by AAA, nearly 85 million Americans are expected to travel from Dec. 23rd through Jan. 3rd, off only 29 percent from last year. In states across the country, small businesses and restaurants are being hit with de facto lockdowns because of occupancy limits or dining restrictions. At the same time, big-box retailers have been permitted to stay open, in part because their large stores allow for social distancing, prompting resentment from small-business owners.

Airlines are preparing to call back tens of thousands of workers they let go in October now that Congress has approved government assistance to cover carriers’ payroll through the end of March. The question is how long employees will be able to keep their jobs. The $900 billion relief package for households and businesses battered by the coronavirus pandemic includes $15 billion for airlines to pay all their workers.

The number of Americans seeking unemployment benefits fell by 89,000 last week to a still elevated 803,000, evidence that the job market remains under stress nine months after the coronavirus outbreak caused millions of layoffs. The latest figure, released Wednesday by the Labor Department, shows that many employers are still cutting jobs as the pandemic tightens business restrictions and leads many consumers to stay home. Before the virus struck, jobless claims typically numbered around 225,000 a week before shooting up to 6.9 million in early spring when the virus — and efforts to contain it — flattened the economy.

China: The Communist Party’s new pledge to fix the “demand-side” of the economy has prompted expectations the leadership will implement more egalitarian policies to stimulate consumer spending. Top party leaders used the phrase “demand-side reform” for the first time this month, in a departure from its past focus on “supply-side” changes, which involve upgrading industry and cutting capacity in bloated sectors.

Although China is the only major economy set to grow this year, the new slogan signals that the ruling party is worried about the uneven recovery in which household spending has lagged behind investment in real estate and infrastructure.

China has lifted restrictions on foreign investments in all energy sectors–including fossil fuels, new energy sources, and electricity generation, excluding nuclear power–the State Council Information Office said in a white paper published on Monday. The report, ‘Energy in China’s New Era,’ discussed the steps the nation has taken to reform foreign companies’ access to its energy industry. It says that “Market access for foreign capital in the energy sector has been extended, private investment is growing, and investment entities have become more diverse.”

A rally in Chinese corn prices is spurring the government to act, which includes taking an unusual step of bolstering supply at a time when sales from farmers are poised to expand. The government announced a plan last week to resume state corn sales, which will be the first time in years it is doing so during a seasonal peak period for farmers’ sales. Overseas purchases by the world’s second-biggest consumer have also surged, exceeding an annual corn-import quota set by the World Trade Organization for the first time.

China imported more wheat from US ports in the week that ended Dec. 17th, indicating Chinese buyers’ interest in US wheat has not waned as the country looks to meet its trade obligations and replenish its reserves. After a pause in trade seen in September and November as buyers awaited US presidential election results, China has been shipping in more than 60,000 mt of wheat every week since Nov. 19th.

PetroChina discovered a natural gas field with reserves above 100 billion cubic meters, Chinese state news agency Xinhua reported last week. The agency cited a company official who said the field could produce 610,000 cubic meters of gas plus 106.3 cubic meters of crude oil daily.

China’s gasoline and gasoil exports took a break in November from the highs reported in October due to improved domestic demand, while jet fuel outflow increased as demand from international flights continued to recover. In November, the country’s gasoline outflow slumped 33.9 percent to 1.26 million mt from the record high 1.91 million mt.

China has issued the first round of crude oil quotas for next year, and it is 18 percent higher than the respective round for 2019. The first 2021 quota batch equals almost 900 million barrels. China has been buying oil at record rates this year after a short lull during its lockdown in the spring. The country’s refiners took advantage of historically low prices to stock up, and so did the government, filling up its strategic oil reserve. Now the rate of imports is slowing down.

Despite a swift industrial recovery from the pandemic, factories in areas in China are working only part-time and residents in several provinces are asked to save electricity, while authorities are turning off streetlights and billboards, warning of coal shortages this winter. At the same time, Chinese authorities vehemently deny that the potential shortages have had anything to do with Australia’s diplomatic spat, which has turned into a real energy trade war.

Seafarers stuck for months on vessels carrying Australian coal off China’s coast are trapped between authorities who won’t let them unload their cargoes and buyers who won’t let them leave. Worsening relations between Beijing and Canberra have stranded 74 vessels, about 8.1 million tons of coal, and an estimated 1,480 mariners off Chinese ports. The original charterer of two of the ships wants them to sail somewhere else to relieve the exhausted seafarers, but so far, the traders who own the cargo won’t agree.

European Union: Britain and the EU sealed a Christmas trade agreement. Both sides hope this new economic and security accord will allow them to rebuild their relationship after years of Brexit acrimony. UK prime minister Boris Johnson and Ursula von der Leyen, European Commission president, clinched the deal after nine months of negotiations, culminating in haggling on Christmas Eve over fishing rights.

An upbeat Johnson said Britain had secured its negotiating objectives: “We have taken back control of our laws and our destiny,” he said. He added that it was “a good deal for all of Europe.” Brussels’ mood was soberer, with von der Leyen saying one of her main feelings was “relief” that “we can finally put Brexit behind us.” The EU side claimed to have defended its interests in a negotiation in which it sought to prevent aggressive undercutting of its businesses and protect its fishermen.

The last-minute trade deal between the UK and the European Union means businesses will be spared new tariffs and border disruption at the start of the new year. This economic shock would have compounded the employment and financial troubles inflicted by the pandemic.

News of the agreement Thursday brought sighs of relief from the offices of corporate bosses and politicians and consumers anticipating produce shortages and transport workers facing the potential of long backups at border crossings. Bank of England Governor Andrew Bailey recently warned that a failure to secure a UK-EU trade deal would have a more significant long-term impact on the British economy than the long-term effect of the coronavirus pandemic.

Britain has found two cases of coronavirus variant linked to South Africa, Health Secretary Matt Hancock said Wednesday, both of which are tied to contact with recent arrivals from that country. Hancock announced new restrictions on South African visitors and called on anyone who has recently been to that country or been in contact with a recent arrival from there to quarantine immediately, describing the temporary measures. At the same time, officials seek to understand the variant better.

Experts have cautioned that both new variants need additional study as scientists seek to understand the mutations and what effect — if any — they will have on vaccines. British authorities are tightening restrictions in response to the increase in cases. By Dec. 26th, about 24 million people faced Britain’s strictest coronavirus rules, under which all nonessential businesses are required to close.

Russia: Deputy Foreign Minister Ryabkov has accused the incoming administration of President-elect Biden of “Russophobia” and says he expects relations with the US to go “from bad to worse.” “It would be strange to expect good things from people, many of whom made their careers on Russophobia and throwing mud at my country.”

Relations between Moscow and Washington have deteriorated in recent years over issues including Russia’s seizure of Ukraine’s Crimea region in 2014, its role in wars in eastern Ukraine and Libya, its election meddling in the US and Europe, and a series of significant cyberattacks blamed on the Russians. Biden is expected to take a tougher stance toward the Kremlin on its human rights record and foreign policies than the outgoing President.

According to sources in the Trump administration, Washington is preparing more sanctions against the Gazprom-led Nord Stream-2 natural gas pipeline project. The news comes a day after the pipeline’s construction restarted in Danish waters after a suspension that lasted almost a year, again because of US sanctions.

Meanwhile, the Nord Stream 2 gas pipeline developer could resume pipelaying work in Danish waters as soon as Jan. 15th, according to a notice to seafarers published by the Danish Maritime Authority. According to the announcement, a section southwest of the Danish island of Bornholm up to the maritime border with Germany would be laid by the Russian pipelaying vessel Fortuna.

Saudi Arabia: The kingdom’s Red Sea crude terminals have taken on critical importance since tensions with Iran have threatened the key Gulf shipping lane through the Strait of Hormuz. Serving the Red Sea ports is Saudi Aramco’s 5 million b/d East-West Pipeline, which was hit by a drone attack in May 2019 and is still under repair. Yet, the state oil giant has been able to keep supplies flowing westward through a separate, reserve network of other pipelines that run parallel. Aramco does not highlight the existence of these extra pipelines, but sources familiar with the matter said they were part of the company’s strategic redundancy program.

India: The world’s third-largest oil importer and consumer turned from the worst-performing demand market in July into one of the fastest-growing fuel demand markets in November. India’s demand for all types of petroleum products has nearly reached pre-COVID levels, prompting domestic refineries to crank up crude oil processing rates. The rebound in one of the world’s biggest oil growth drivers before the pandemic highlights the two-speed global oil demand recovery. Asia is driving higher consumption and, consequently, oil prices, while Europe and the US are reeling from renewed restrictions to fight record COVID-19 infections.

India’s recovery indicates the immediate support that strengthening oil demand in the key Asian markets, China and India, gives to oil prices, unlike vaccine news which contains more forward-looking expectations of mass vaccinations.

Nigeria: In a country going backward economically, carjacking, kidnapping, and banditry are among Nigeria’s rare growth industries. In addition to the 300 schoolboys recently kidnapped, Nigerian pirates abducted six Ukrainian sailors off the coast last week. The definition of a failed state is one where the government is no longer in control. By this yardstick, Africa’s most populous country is teetering on the brink.

President Muhammadu Buhari in 2015 pronounced Boko Haram “technically defeated.” That has proved fanciful. Boko Haram has remained an ever-present threat. Even if “ordinary” bandits carried out the mass abduction — as now looks possible — it underlines chronic criminality and violence. Deadly clashes between herders and settled farmers have spread to most parts of Nigeria. In the oil-rich but impoverished Delta region, extortion through the sabotage of pipelines is legendary.

Extortion is a potent symbol for a state whose modus operandi is the extraction of oil revenue from central coffers to pay for a bloated, ruinously inefficient political elite. Security is not the only area where the state is failing. Nigeria has more poor people, defined as those living on less than $1.90 a day, than any other country, including India. In non-Covid-19 years, one of every five children in the world out of school lives in Nigeria, many of them girls. The population, already above 200 million, is growing at a breakneck 3.2 percent a year. The economy has stalled since 2015, and real living standards are declining. This year, the economy will shrink 4 percent after Covid-19 dealt a further blow to oil prices.

5. Renewables and new technologies

Toshiba Corporation has developed a new magnetic material with characteristics that deliver significant improvements in motor efficiency at minimum cost and with the potential to win substantial reductions in power consumption. The company says the material is suitable for trains, automobiles, robots, and other applications requiring high reliability. Motors account for approximately half of the world’s electric power consumption. Any advance that can improve their efficiency promises significant benefits.

6. The Briefs (date of the article in the Peak Oil News is in parentheses)

In the Norwegian Sea, ConocoPhillips has made a large oil discovery close to a producing oilfield, the company said on Tuesday. Preliminary estimates point to the field containing between 75 million barrels and 200 million barrels of recoverable oil equivalent. An additional appraisal would determine the flow rates and the ultimate resource discovery, as well as a potential plan for development. (12/23)

Big write-down: Shell warned the market on Monday that it would book up to $4.5 billion more in post-tax charges in the fourth quarter, which would take the supermajor’s combined write-downs to over $22 billion in the year in which Big Oil significantly cut the value of their oil and gas assets. (12/22)

Iraq and Jordan are forming an electricity power grid that is fast becoming a highly controversial project due to Iraq’s persistent political game-playing with both the US and Iran. (12/23)

Deepwater India: Reliance Industries Limited and BP recently announced the start of production from the R Cluster, an ultra-deepwater gas field off India’s east coast. At more than 2,000 meters, it is the deepest offshore gas field in Asia. Together, they expect the projects to meet over 15 percent of India’s natural gas demand by 2023. (12/25)

Aussie LNG sale: Shell has sold a 26 percent stake in an Australian LNG project to Global Infrastructure Partners for $2.5 billion as part of efforts to reduce non-core assets in its portfolio. Yet LNG’s outlook is still bright despite an extended price rout that started last year and continued into this year, and Australia is one of the focal points of LNG development globally. (12/22)

Algeria’s oil and gas production in 2020 will total 143 million tons of oil equivalent, a decline of 8 percent from 2019, due to the pandemic and slow economic growth. (12/21)

Colombia’s output in 2020 is averaging 100,000 b/d less than it was in 2019. A small fraction of that decline was anticipated before the pandemic due to fields aging. But the bulk of the miss is due to declining demand and restrictive work rules imposed by wildcatters to protect office and oil field employees from the virus. (12/25)

Offshore Guyana, the Liza-1 well is pumping oil at a rate of 120,000 barrels/day. The 120,000-bpd milestone was supposed to be reached a year ago. Exxon, together with its partner in the Stabroek Block, Hess Corp, has made 18 discoveries there in less than five years. (12/23)

In Peru, a perfect storm of lack of national leadership—three presidents within one week—the coronavirus’s impact on the economy, and civil unrest in the oil-producing region (related to numerous oil spills), is weighing heavily on industry operations. For November 2020, Peru’s oil production plunged 11.5 percent quarter over quarter and by a whopping 47 percent compared to a year earlier to an average of 33,484 barrels daily. (12/22)

Panama’s LNG bottleneck: Average Panama Canal passage wait times for Asia-bound LNG tankers from the US Gulf Coast without reservations are up to 13 days, the Canal Authority has reported. (12/25)

Bahamas: BPC has commenced drilling of the Perseverance #1 well in The Bahamas’ far-southern waters. The well targets P50 prospective oil resources of 770 million barrels – with an upside of 1.44 billion barrels. (12/23)

The US oil rig count for the shortened Christmas reporting week increased by one while the gas rig count grew by 2, Baker Hughes reported on Wednesday. The combined rig count totaled 348. (12/24)

Last-minute projects rush: The Trump administration is rushing to approve a final wave of large-scale mining and energy projects on federal lands, encouraged by investors who want to try to ensure the projects move ahead even after President-elect Biden Jr. takes office. (12/21)

US coal-fired power generation totaled 59.8 TWh in October, down 12.5 percent from September, according to EIA data. Year on year, generation declined 10.4%, and from the five-year average, generation was at a 32 percent deficit this year. Out of total power generation, coal took a 19 percent share last month. (12/24)

Texas #1 in RE: Texas is not the first state that one thinks of when someone mentions renewable energy. Yet Texas is already the biggest producer of electricity from wind farms in the country and is now on track to become the most significant US producer of solar power, too. Invenergy is building a 1.31-GW solar farm in Texas, scheduled to open during 2023, that is going to be the biggest in the US (12/25)

US solar growth: Megawatt-hours generated from solar facilities in the US rose 21.6 percent year on year in the third quarter. The increase is mostly the result of newly installed generation over the past year in markets such as the Western Electricity Coordinating Council and the Electric Reliability Council of Texas. (12/22)

GM’s CEO Mary Barra will give the opening keynote at the CES (Consumer Electronics Show) next month. She plans to explain how electrification is necessary to address environmental and societal change — and how GM is ready to play a central role. She has pledged to push out 30 battery-powered models by 2025. (12/25)

Self-driving permit in CA: Robotics company Nuro on Wednesday received the first-ever license to commercially deploy its self-driving vehicles in California, allowing the Silicon Valley firm to charge clients for its driverless delivery service. Nuro has been testing autonomous cars on California’s roads with safety drivers since 2017. (12/24)

Apple’s car in 2024? Apple Inc. is moving forward with self-driving car technology and targets 2024 to produce a passenger vehicle that could include its own breakthrough battery technology. Apple’s automotive efforts, known as Project Titan, had proceeded unevenly since 2014 when it first started to design its own vehicle from scratch. (12/22)

Green ammonia: Leading fertilizer company Yara plans to electrify its ammonia plant fully in Porsgrunn, Norway, with the potential to cut 800,000 tons of CO 2 per year, equivalent to the emissions from 300,000 passenger cars. Production from the electrified ammonia unit would be some 500,000 tons per year of green ammonia. Ammonia is the most promising hydrogen carrier and zero-carbon shipping fuel, and Yara is the global ammonia champion. (12/21)

EU emissions laggards: All of the EU’s member states but two—Belgium and Slovakia—have failed to show how they will slash air pollution to comply with the emissions limits set out in the EU’s National Emission Ceilings Directive. (12/21)

Enviro bonding disagreement: Sweden is fighting a draft European climate measure that it says could harm its world-beating green bond market. The European Commission, which wants to steer investors to socially and environmentally sustainable assets, proposes that only buildings certified as super-energy efficient by national authorities be included in its taxonomy. Being excluded would make financing more expensive. But national energy requirements differ. Since Sweden imposes some of Europe’s most stringent, the EU’s framework would ultimately dramatically shrink the pool of Swedish assets that could be funded with green bonds. (12/21)