Editors: Tom Whipple, Steve Andrews

Quote of the Week

[When promoting renewable power generation…] “Don’t come into my office talking about climate change or the environment. Talk about new jobs, talk about low-cost energy, talk about reduction of transmission lines. Learn to speak Republican here.”

Tim Echols, member of Georgia’s commission that regulates Georgia’s investor-owned utilities.

Graphic of the Week

| Contents 1. Energy prices and production 2. Geopolitical instability 3. Climate change 4. The global economy and the coronavirus 5. Briefs |

1. Energy prices and production

Oil: Prices advanced as hurricane Ida shut off some 59% of Gulf of Mexico crude production. At the same time, the Federal Reserve reinforced its support to begin tapering stimulus by the end of the year. Futures in New York rose 2% on Friday to post the biggest weekly gain in more than a year. Federal Reserve Chair Powell said the central bank could begin reducing its monthly bond purchases this year, though it won’t be in a hurry to start raising interest rates after that. Some 49% of Gulf natural gas production was also shut ahead of the storm. The Gulf accounts for roughly 17% of the nation’s oil production, totaling about 1.7 million b/d, and 5% of its dry gas production.

New York futures settled $1.32 higher at $68.74, and London’s Brent climbed $1.63 to $72.70. NYMEX gasoline settled 1.88 cents at $2.27/gal, and September low sulfur diesel rose 2.60 cents to $2.11/gal. The price of crude could be headed for a jump of between 20 percent and 50 percent, judging from a bullish breakout pattern that suggests a significant rally could be coming. The so-called “golden cross” appears on a chart when the short-term moving average of an asset crosses above its long-term moving average. The gold cross chart pattern points to a potential for a significant rally. “That’s only happened three times since the beginning of this century, and each of those three times has been followed by a further solid rally in crude oil, anywhere from 20%-50%.”

Crude inventories last week dropped for a third straight week while fuel demand rose to its highest since March 2020, the EIA said on Wednesday. Crude inventories fell by 3 million barrels in the week to Aug. 20th, slightly higher than analysts’ expectations. At 432.6 million barrels, crude stocks were at their lowest since January 2020. “A tick higher in refinery runs and a tick lower in imports has yielded a third consecutive draw to crude inventories – dropping them to their lowest since late January 2020.”

Shale Oil: Under normal circumstances, energy downturns have created perfect opportunities for oil and gas heavyweights to land prime assets on the cheap. A good case in point: the last oil bust of 2016 was followed by a sizable number of huge M&A deals in the sector, including the $60 billion tie-ups between Shell, BG Group, Canadian Oil Sands, and Suncor Energy, as well as a handful that fell through including the proposed merger between Halliburton and Baker Hughes. But Big Oil has now ditched that old playbook and appears largely disinterested in some M&A action this time around. As a result, the current year is shaping up as one of the slowest in the oil and gas industry.

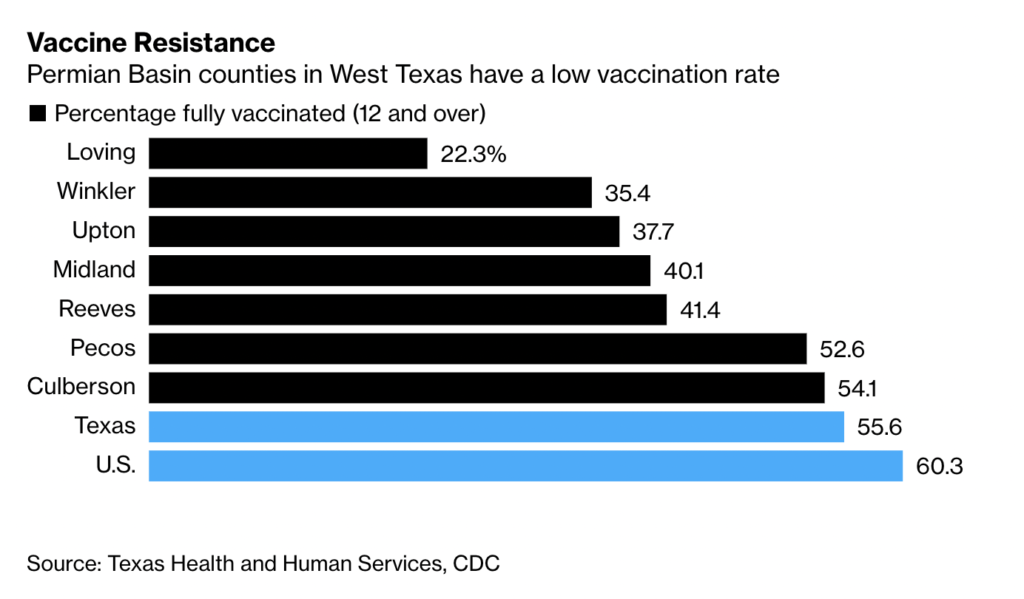

Pioneer Natural Resources, the largest oil producer in the Permian Basin, requires new hires to be vaccinated against Covid-19 as inoculation and mask mandates increase across the economy. Amid surging caseloads that are stressing medical facilities in West Texas, Pioneer also offers employees a one-time vaccine incentive of $1,000. In addition, Devon Energy Corp. is offering $500 to workers that show proof they took the shot by Oct. 15th. Meanwhile, Occidental Petroleum Corp. is extending a work-from-home option for some office staff through the end of October and taking steps to prevent viral spread on offshore platforms.

The second-biggest US fuel maker, Valero Energy, is compelling new hires at some refineries to get vaccinated. None of the country’s top shale drillers have implemented across-the-board vaccine mandates, but the requirements for new hires and cash incentives show the level of concern about the delta variant’s spread. Moreover, vaccination rates in some of the Permian region’s biggest oil-producing counties are much lower than state and national averages.

Natural Gas: The Midwest power burn forecast looks poised for substantial upside risk in the coming months as natural gas generation is less responsive to Chicago prices than in years past. Gas burns per degree have risen from the five-year average, and the possibility of nuclear retirements all point to stronger gas burn than forecast.

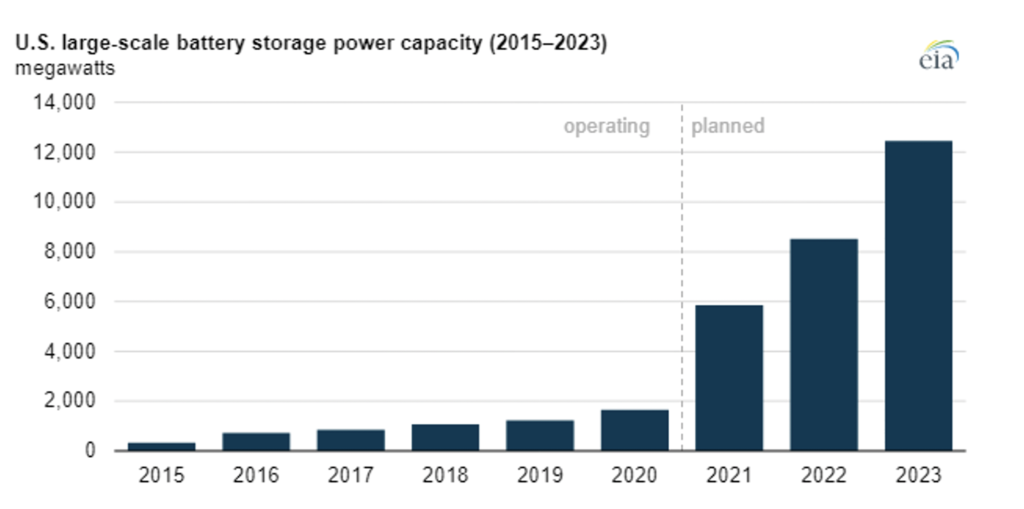

Electricity: Battery energy storage installations are up 439% from Q1. Texas leads additions with 1.489 GW. According to American Clean Power (ACP), US project developers installed 5.62 GW of clean power capacity in the second quarter of 2021, a record for Q2 installations and an increase of 13% year over year. According to an ACP statement accompanying the report, additions for the first half of 2021 totaled 9.915 GW, up 17% year on year to surpass 2020 as the most active six months in new clean power installations.

Electricity demand in Texas is expected to climb to an all-time high as searing heat grips the region. The National Weather Service issued a hazardous weather outlook for North and Central Texas because of hot and humid conditions that make it feel like 107 degrees Fahrenheit (42 Celsius). According to the Electric Reliability Council of Texas, power consumption on the state’s primary grid may surge to a record 75,094 megawatts in the hour ending at 6 pm local time. The Texas market is showing no signs of stress with this week’s smothering heat.

US Northeast power and gas prices saw significant rises on Aug. 24-25, trading amid the ongoing heatwave. In New York real-time marginal prices topped $1,000/MWh across the board at 6.05 pm ET Aug. 24th. In New England, the ISO internal Hub real-time marginal price was trading around $300/MWh simultaneously. Prices receded shortly after that to trade closer to their normal levels.

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: President Biden told Israeli Prime Minister Naftali Bennett that he was putting “diplomacy first” to rein in Iran’s nuclear program, but if negotiations fail, he would be prepared to turn to other unspecified options. The top American negotiator in the Iranian nuclear talks said Washington is prepared to compromise “on difficult issues” if Tehran does the same. In a sign the US recognizes the shift to hardline politics in Iran following the election of Ebrahim Raisi as president, Robert Malley said he hopes the Islamic Republic returns to the negotiating table “with a realistic approach.” The talks — to revive a 2015 accord that limited Iran’s nuclear program in return for US sanctions relief, including oil exports — have stalled since June.

Iran has “a lot of possibilities” to keep selling oil, President Ebrahim Raisi said on Aug. 21st. “There are many possibilities and grounds for oil sales,” Raisi said during his speech before a Parliament hearing on his proposed cabinet members, including oil minister Javad Owji. Raisi said one of his priorities would be to export more added-value refined oil products. Iran produced 2.52 million b/d in July, its highest since April 2019, according to the latest S&P Global Platts survey.

Iran said on Monday it is ready to ship more fuel to Lebanon if needed. A day later, the leader of Lebanon’s Iran-aligned Hezbollah group said more vessels carrying Iranian fuel would sail soon to help ease the country’s fuel shortage. “We sell our oil and its products based on our own decisions and the needs of our friend. Iran is ready to send fuel again to Lebanon if needed. Certainly, we cannot see the suffering of the Lebanese people.”

Iraq: Russia‘s second-largest crude oil producer Lukoil hopes to increase oil output at the West Qurna 2 project in Iraq to 480,000 b/d next year. Lukoil had previously considered quitting the project in the country due to the current investment climate, but Iraqi authorities refused its request to sell part of its stake. Lukoil said that production at West Qurna 2 in the second quarter was 50,000 b/d lower than the project capacity due to the OPEC+ agreement. “Next year we will increase production from the current 400,000 b/d to 450,000 b/d. Next development stage of the project is to reach production of 480,000 b/d.”

Iraq has approved plans to create a new company to finance the giant Rumaila oil field operated by BP. The UK major seeks to limit its exposure to high carbon intensity energy assets. “The Council of Ministers approved the establishment of Basra Energy Company to be the financing entity for developing the giant Rumaila field. It will become one of the most important pillars of the energy transition, and an important element of sustainable development in Iraq.” BP and PetroChina will wholly own Basra Energy Company Ltd.

French President Macron’s second trip to Iraq in less than a year could potentially help push a massive energy deal across the finish line for TotalEnergies. The visit to Iraq raises expectations that TotalEnergies could be close to finalizing a multi-billion-dollar energy deal it has been negotiating since April. “We have secured the terms and the reference on the contract. We’ve agreed with Total on the economic model,” said Iraqi Oil Minister Ihsan Ismaael in a July interview, expressing optimism that the final signing “should happen before September.”

Venezuela: Japanese oil company Inpex Corp sold two Venezuelan oil and gas assets to Caracas-based Sucre Energy Group, as multinational firms retreat from the crisis-stricken nation. Sucre, a privately held exploration and production firm focusing on improving mature fields in Latin America, purchased Inpex’s 70% stake in the Gas Guárico natural gas partnership with state oil company PDVSA and its 30% stake in the Petroguarico oil joint venture.

Refiner Citgo Petroleum, the US subsidiary of Venezuela’s state-held oil firm PDVSA, expects to play a “bridge role” in a Venezuelan transition once US sanctions are lifted. Citgo could help revamp Venezuela’s decrepit refineries. The US sanctions on Venezuela have accelerated the demise of the state-oil firm PDVSA, which has also struggled with outdated equipment at refineries and plants due to a lack of investment in maintenance and spare parts. Venezuela had 1.3 million b/d of refining capacity, but currently just one-tenth of this capacity still is operational.

Venezuela’s socialist government sees the swap it made last week of shares in a Dominican oil refinery for defaulted bonds as a possible model for future deals. It seeks to mend ties with creditors. Such debt-for-equity swaps are common in corporate bankruptcy proceedings and have been employed by other Latin American countries emerging from default in the past. Thus, they could be part of a solution for oil-rich but crisis-stricken Venezuela to reduce its $160 billion debt load. But further swaps, especially for higher-value assets within Venezuela, face many obstacles.

3. Climate change

According to the newly released State of the Climate in 2020 report from the National Oceanic and Atmospheric Administration, Earth is arguably in worse shape than it’s ever been. While humanity grappled with the deadliest pandemic in a century, many metrics of the planet’s health showed a catastrophic decline in 2020. Average global temperatures rivaled the hottest. Mysterious sources of methane sent atmospheric concentrations of the gas spiking to unprecedented highs. Sea levels were the highest on record; fires ravaged the American West, and locusts swarmed across East Africa.

NOAA’s assessment, published last week in the Bulletin of the American Meteorological Society, draws on the work of 530 scientists from 66 countries. In the atmosphere, the researchers found no evidence that last year’s 6% to 7% dip in global annual emissions had any lasting effect. The roughly two gigatons of carbon dioxide not emitted during the most severe pandemic-related shutdowns have been dwarfed by the more than 1,500 gigatons humans have unleashed since the Industrial Revolution began.

The average concentration of carbon dioxide in the atmosphere in 2020 was 412.5 parts per million (ppm), about 2.5 ppm above the 2019 average. That is higher than at any point in the 62 years scientists have been taking measurements. Not even air bubbles trapped in ice cores going back 800,000 years contain so much CO2, suggesting current levels have no precedent in our species’ history. Moreover, carbon dioxide typically lingers in the atmosphere for a few hundred to 1,000 years. So, humans will have to stop emitting for much longer than a few months to make a meaningful dent in the pollutant concentrations.

Even as carbon dioxide emissions briefly slowed, 2020 saw the most significant annual increase in methane emissions. The gas only stays in the atmosphere for about a decade but can deliver more than 80 times as much warming as carbon dioxide in that time frame. Scientists don’t know why the concentration of methane spiked so dramatically — rising 14.8 parts per billion to its highest level in millennia. Of course, the drilling and distribution of natural gas help drive up methane emissions. But it is also produced by munching microbes, which are found in natural environments such as wetlands and human-built ones such as landfills and farms.

“It’s an ongoing investigation,” said Xin Lan, an atmospheric chemist at NOAA’s global monitoring laboratory in Boulder, Colo. But Lan has uncovered some clues. For example, the methane that comes from fossil fuel sources disproportionately includes carbon atoms with an extra neutron in their nuclei — a variety, or “isotope,” known as carbon-13. On the other hand, microbial origins of methane tend to be rich in carbon-12, which lacks the extra neutron and is slightly lighter.

Lately, the proportion of methane carrying the lighter carbon isotope has been rising, suggesting that the recent surge in greenhouse gas has microbial origins. For example, it might be coming from bacteria in the guts of livestock or decomposing sludge in landfills. But the more worrying possibility is that natural methane sources — such as salt marshes, peatlands, and mangrove forests — are emitting more as the planet warms. Higher temperatures can boost microbe metabolisms and thaw out permafrost, while rising sea levels may turn some coastal areas into methane-emitting bogs.

The high temperatures were especially noteworthy because they occurred during a La Niña year when natural variations in wind and water movement tend to cool the planet down. No previous year with a La Niña climate pattern has been so hot. Global average sea levels in 2020 rose for the ninth year in a row, NOAA said — a consequence of melting glaciers and ice sheets and expanding warmer waters. Sea levels are now about 3.6 inches above the average in 1993 when scientists began taking satellite measurements.

The litany of broken records was endless. The far northern town of Verkhoyansk, Russia, notched a high of 100 degrees Fahrenheit — the hottest temperature ever recorded within the Arctic Circle. On the other side of the planet, Esperanza Station broke Antarctica’s temperature record by 2 degrees Fahrenheit, hitting a balmy 64.9 degrees. Death Valley, Calif., may have seen Earth’s highest temperature in almost a century. Europe, Mexico, Japan, and the Indian Ocean archipelago of the Seychelles all saw their hottest years.

Super Typhoon Goni was the most powerful storm to make landfall, NOAA said, slamming the Philippines with 195 mph winds. There were so many tropical cyclones in the North Atlantic that meteorologists ran out of letters of the alphabet for naming them; by the time two Category 4 storms hit Nicaragua in November, officials had to use the Greek letters Eta and Iota.

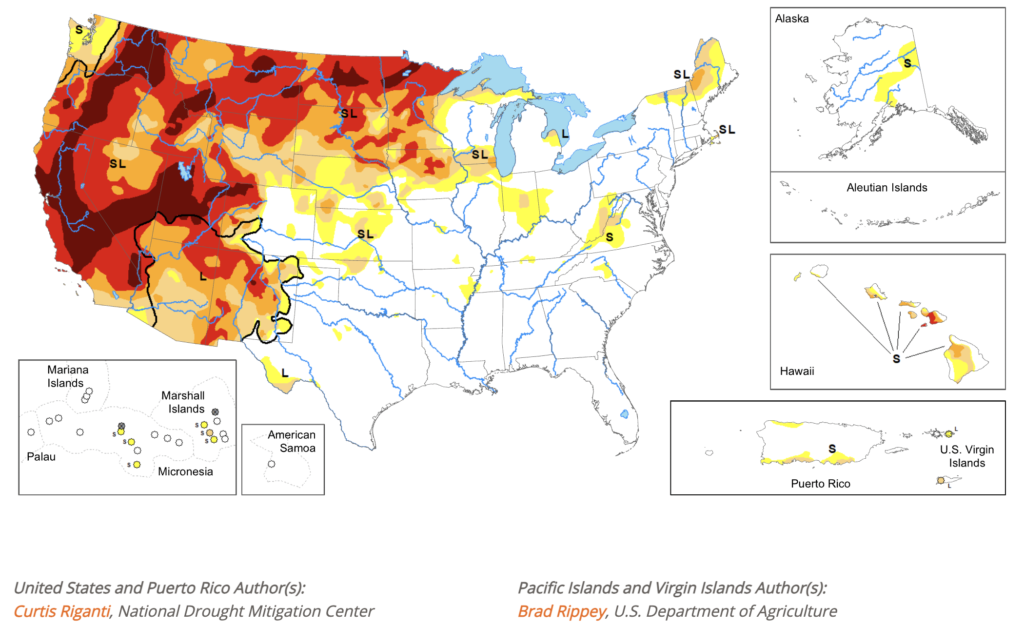

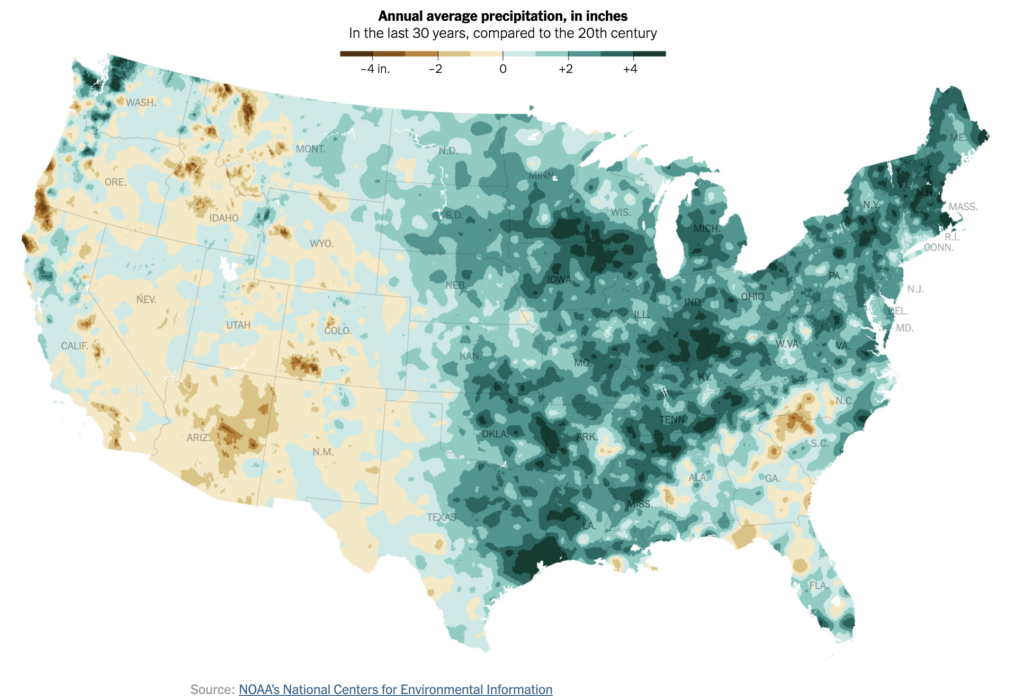

In the US, 47% of the landmass of the contiguous United States is experiencing drought conditions, according to the latest report from the US Drought Monitor, and it’s getting worse in the Northern Plains and everywhere west of the Rocky Mountains. Eight percent of land in the state now falls under that description, and about 50 percent is in extreme drought, the next level.

Tennessee’s flash floods underscore the peril climate change poses even in inland areas, where people once thought themselves immune. A physical phenomenon known as the Clausius-Clapeyron equation shows that for every 1 degree C (1.8 degrees F) of warming, the atmosphere can hold 7% more moisture. Because the relationship between temperature and humidity isn’t linear, even small amounts of warming can create exponentially wetter storms.

Climate change is making China’s annual summer floods worse, and cities housing millions of people aren’t prepared to handle the damage. Record-breaking rainfall in the central province of Henan killed more than 300 people last month, while downpours continue to swamp cities in several other regions. The tragedies make it clear to policymakers and citizens that Chinese cities, even the capital, are far from ready for the extreme weather events wrought by global warming. It’s not just the threat of floods. Greenpeace research has shown that China’s key metropolises are at risk of more prolonged and hotter summers in the coming decades.

According to a draft of Russia’s low-carbon development strategy, that nation expects to increase greenhouse gas emissions over the next 30 years and instead rely on its trees to meet its international climate obligations. As a result, emissions are seen rising 8.2% from 2019 levels to 2.29 billion tons of CO2 equivalent by 2050, according to the base-case scenario in the Economic Ministry’s draft.

Moscow’s plan says the growth will be more than compensated for by doubling Russia’s forests’ estimated absorption capacity thanks to planting trees, reducing the number of fires, and restoring wetlands. However, while Russia’s vast forests, which are more extensive than India, are a critical carbon sink for the planet, obtaining accurate data on sequestration from woodlands is difficult. In addition, the government’s targets are challenged by the record-breaking wildfires that have ravaged its forests for each of the last three years.

Plumes of methane gas, one of the most dangerous greenhouse gases, are leaking into the atmosphere relentlessly from the European Union’s easternmost edge. Invisible plumes escape from Romania’s oil fields, gas pipes, and rusting storage containers.

4. The global economy and the coronavirus

Wealthy countries are finalizing plans to roll out Covid-19 booster programs to counter the threat from waning vaccine immunity, decisions that will further squeeze the supplies available to the developing world. This week, France joined the US and at least two dozen other countries by confirming it would administer third vaccine doses, capping the debates over the use of boosters that have rolled on all summer. Doing so has meant going against the World Health Organization, which has called for a moratorium on boosters and for any extra doses to be given to less vaccinated countries.

A supply chain crunch that was meant to be temporary now looks like it will last well into next year as the surging delta variant upends factory production in Asia and disrupts shipping, posing more shocks to the world economy. Manufacturers reeling from shortages of critical components and higher raw material and energy costs are being forced into bidding wars to get space on vessels. This pushes freight rates to records and prompts some exporters to raise prices or simply cancel shipments altogether.

If oil were the necessary component for the 1970s economy, chips would provide the same function in the 2020s. But, instead, chips now power everything from computers and phones to cars and appliances. And, as everyone knows by now, there is a shortage, with delivery times growing to more than 20 weeks. In addition, roughly 80% of all the chips in the world are made in Northeast Asia. Politicians realize how big a problem this is, and they have started to demand local manufacturing.

For the insurance industry to fulfill its stated commitment to combat climate change, it may want to accelerate its efforts to exit the oil and gas industry. To date, just one insurer has promised to take “significant action” in this regard, according to analysts at Société Générale SA. Australia’s Suncorp was the first to announce it would no longer provide coverage for all new oil and gas production projects. While insurers (23 in all) have moved to end their underwriting of coal-related activities, they have been slow to act on oil and gas. That’s mainly because the insurance market for those fossil fuels is considerably more prominent, with estimated premiums of more than $17 billion in 2018, compared with $6 billion for coal power.

United States: Americans are still buying up fuel to make the most of summer travel despite a new wave of Covid-19 outbreaks, allaying fears that a resurgent virus would choke off the oil market’s remarkable recovery this year. Last week, fuel consumption, measured by the amount of gasoline sent to the market, rose to the highest level since the end of July. The figures defy expectations that Covid-19 concerns would keep more Americans at home and drive down demand.

Some of the largest US food distributors are reporting difficulties fulfilling orders as a lack of workers weighs on the supply chain. For example, Sysco Corp, North America’s largest wholesale food distributor, turns away customers in areas where demand exceeds capacity. The company also said that prices for critical goods such as chicken, pork, and paper products for takeout packaging are climbing amid tight supplies.

The US and China are trading places in the economic growth race. US gross domestic product rose 12.2% in the second quarter of this year from a year earlier, outpacing China’s 7.9% gain. The American edge should continue for at least the next few quarters, many economists say. That would be the first sustained period since at least 1990 in which the US economy grew faster than China’s.

The European Union: Protection against COVID-19 offered by two doses of the Pfizer/BioNTech and the Oxford/AstraZeneca coronavirus vaccines begins to fade within six months, underscoring the need for booster shots, according to researchers in Britain. After five to six months, the effectiveness of the Pfizer jab at preventing COVID-19 infection in the month after the second dose fell from 88% to 74%, an analysis of data collected in Britain’s ZOE COVID study showed. For the AstraZeneca vaccine, effectiveness fell from 77% to 67% after four to five months. The study was based on data from more than 1.2 million test results.

One of Germany’s most significant challenges in the fight against climate change is to keep the lights on. As Europe’s biggest economy shuts its last nuclear reactor next year and utility RWE AG warns that coal plants may close earlier than planned, critics say green energy isn’t being added quickly enough. As a result, Germany’s ability to meet peak demand is poised to shrink rapidly over the next two years, increasing the risk of blackouts. So, in the last push to save her fading reputation as ‘The Climate Chancellor’ before stepping down after next month’s election, Angela Merkel announced Europe’s strictest emissions goals.

According to data from S&P Global Platts Analytics, the European Commission’s 2030 renewable hydrogen targets will require vast amounts of renewable power generation, amounting to around half the EU’s total renewables generation in 2019, according to data from S&P Global Platts Analytics. The EC in July unveiled one of its most ambitious legislative packages ever, publishing plans for new laws across numerous sectors designed to achieve its target of a 55% cut in greenhouse gas emissions by 2030 compared with 1990 levels, the so-called ‘Fit for 55’ program. The EU has also set a 40-GW electrolyzer capacity target by 2030, producing 10 million mt/year of renewable hydrogen.

China: Beijing’s campaign to clamp down on industries ranging from steel to education to property has roiled financial markets and curbed the growth outlook. The government has signaled more regulation for businesses in years to come. Still, economists say authorities will need to carefully manage the pace and intensity against an economy weakening faster than expected this year following fresh virus outbreaks. President Xi Jinping said China would strive to complete primary economic and social development targets set for this year.

Labor shortages are materializing across China as young people shun factory jobs and more migrant workers stay home, offering a possible preview of more significant challenges ahead as the workforce ages and shrinks. With global demand for Chinese goods surging this year, factory owners say they struggle to fill jobs that make everything from handbags to cosmetics. In addition, some migrant workers are worried about catching Covid-19 in cities or factories, despite China’s low caseload. Other young people are gravitating toward service-industry jobs that pay more or are less demanding.

Since January, Chinese tech stocks’ best weekly rally may not be enough to persuade some investors to return to a market still reeling from an unprecedented private-industry assault. The Hang Seng Tech Index rally, which tracks Chinese tech stocks listed in Hong Kong, fizzled out toward the end of this week amid headlines of fresh crackdowns, trimming its weekly gain to 7.3%. Members of the gauge have seen more than $1.3 trillion of value wiped out since a February peak as the index remains 42% lower.

The price of iron ore has fallen roughly 40% since mid-July on concerns about demand from China, which makes more than half the world’s steel. The downturn has dealt a blow to iron ore producing countries, notably Australia and Brazil. In addition, an expectation that China’s steel output will shrink is fueling the fall. China, which until recently was churning out steel at record rates, wants to keep steel output at 2020 levels this year. “That requires large cuts to steel output,” said Rohan Kendall, an Australia-based analyst at consulting firm Wood Mackenzie.

According to official data, steel output in July was 8.4% weaker than a year earlier, its first monthly decline for 2021 from 2020 levels. Still, the output will need to fall roughly 12% for August through December to meet Beijing’s goal compared with the year-earlier period. Recent data also suggest that China’s economic recovery is flagging. Monthly indicators of industrial, consumption, and investment activity have all fallen short of expectations.

The Meishan terminal at China’s second-busiest port reopened Wednesday following a two-week shutdown that further snarled already stressed shipping routes in Asia. The terminal was about a quarter of the Ningbo-Zhoushan port’s capacity and was shut from Aug. 11th after a worker was found to be infected with Covid-19. The congestion and delays global shipping routes due to Covid have only worsened this year as Chinese exports hit new records due to rising global demand.

US officials have begun blocking the import of solar panels that they believe could be products of forced labor in China. Industry executives and analysts said solar panels from at least three Chinese companies had been targeted in recent weeks. A Customs and Border Protection spokesman confirmed that the agency has “made several detentions” of products under the import ban.

China’s liquefied natural gas imports are expected to increase slower in the second half of the year after blistering growth over the first six months. Still, the moderation is unlikely to put a brake on surging international prices. China usually steps up imports of the fuel in the second half to meet winter demand. Still, high prices have curbed buying, a pull-back in China’s economic recovery, and a lack of new receiving terminals. After 28% year-on-year growth in the first half, second-half shipments are estimated to rise 12%-13% from a year earlier.

China’s state-run energy major Sinopec said it had discovered a new 100-million-ton oil and gas field in the Tarim Basin in its Xinjiang region. An exploration well achieved a daily flow of 6,315 barrels of crude and 590,000 cubic meters of natural gas. However, Sinopec gave no precise resource estimate, saying that more than 100 million tons of oil and gas had been discovered.

China also announced a significant shale oilfield in the Daqing Oilfield cluster with expected reserves of 1.27 billion tons of oil, China’s Xinhua news agency reported. Daqing Oilfield is one of China’s major onshore production centers, and the new discovery is expected to help it boost its oil production in the coming years. In addition, China National Petroleum Corporation aims to increase shale oil production from shale formations in Daqing to reverse the overall decline in the area’s production.

Approvals for major new coal power plants by China’s local authorities show the tension in the nation’s efforts to meet climate goals, even as the overall total of projects given the go-ahead falls. Local authorities approved 24 plants with a combined capacity of 5.2 gigawatts, a 79% decline from the same period in 2020, Greenpeace said in a report published Wednesday. Even so, most of that capacity will come from three large-scale projects earmarked for potential support from the central government. “There are still mixed signals on coal,” said Li Danqing, a Beijing-based project leader for Greenpeace East Asia. “Provinces are still anticipating financial support on coal.” As a result, China’s policymakers have offered conflicting signals on plans to meet President Xi Jinping’s goal of zeroing greenhouse gas emissions by 2060 and reducing coal consumption from 2026.

East Asia: The robust economic recovery from last year’s coronavirus low is losing momentum as a surge in Covid-19 cases sees shops empty again and factories close, dimming prospects for corporate profit growth after a blockbuster half year. The rapid spread of the highly infectious virus’ Delta variant and low vaccination rates have caught much of the region off-guard, especially in emerging markets. According to a Bank of Japan board member, Japan’s economic recovery will be delayed more than previously expected as the delta variant pushes up infections to record levels.

Oil stored in ships has been stacking up off key Asian ports as a crackdown in China on private crude oil processors has blunted purchases and disrupted flows, including some US-sanctioned barrels from Iran. After hitting a near three-month high earlier this month, vessels off Singapore, Malaysia, and China held about 62 million barrels last week. Venezuelan oil and Iran’s heavier grade — commonly imported as bitumen mixture — are among the varieties held.

“These barrels sitting off Southeast Asia are distressed,” said Anoop Singh, Singapore-based head of East of Suez tanker research at Braemar ACM Shipbroking Pte. “They’re going to have a tough time finding homes other than China, unless the situation surrounding the US sanctions changes dramatically, or China’s clampdown on its independents is eased.”

Russia: Moscow seems intent on selling the world’s very last barrel of oil. As other energy superpowers and petro-states across the globe scramble to diversify their economies and establish a foothold in the burgeoning green energy transition, Russia has stalwartly refused to ease its reliance on its fossil fuels industry. As a result, it is vying for the distinction of being the last man standing in an industry whose days are inevitably numbered. However, this strategy could pay off for years or even decades to come, unless the global economy falls so drastically that nobody wants to buy Russian oil.

Russia regards its Arctic oil and gas development the same way the US saw its shale oil and gas sector around 15 years ago, a genuinely game-changing opportunity to alter the balance of power in the world’s hydrocarbons markets. The Vostok Oil project, run by state oil giant Rosneft, is the cornerstone of these Arctic ambitions, combining the exploration and development of several colossal oil and gas fields. Rosneft is now in talks with various groups of investors on taking part in the Vostok Oil project. Whether groups succeed in securing an interest will say much about the geopolitical balance in the oil and gas industry in the coming years.

The 3rd Cartel Senate of the Dusseldorf Higher Regional Court, responsible for energy industry law proceedings, rejected Nord Stream 2 AG’s complaint that the new pipeline should be exempt from regulations. This means the Nord Stream 2 pipeline will have to follow regulations relating to third-party access rules, requirements on transparent tariffs, and the legal unbundling of transportation and production operations.

Last week, German Chancellor Angela Merkel offered reassurances that Ukraine would not suffer from Russia’s Nord Stream 2 pipeline opening. Still, Ukraine said talks about its future as a transit country had been vague. On her final visit to Kyiv before retiring as chancellor next month, Merkel said “gas should not be used as a geopolitical weapon” by Russia and that Germany could impose new sanctions on Moscow if necessary. “It is important that Ukraine remains a transit land,” she said.

The Biden administration has slapped sanctions on a Russian ship and two companies involved in the Nord Stream 2 gas pipeline, but opponents of the nearly completed project said the measures would not stop it. President Biden separately issued an executive order allowing for sanctions to be imposed on certain Russian pipelines. But opponents of the $11 billion project to bring Arctic Russian gas under the Baltic Sea to Germany said the pipeline would likely be completed.

Saudi Arabia: In June, the value of the kingdom’s oil exports increased 123% to $16.4 billion from a year earlier, while non-oil exports rose by around 41%. Overall exports increased by nearly 92% in June compared to a year earlier when international trade was curbed by lockdowns and travel disruptions related to the coronavirus crisis, said the General Authority for Statistics. Oil exports accounted for 72% of total exports in June, up from 62% last June. The world’s biggest oil exporter, Saudi Arabia, was battered in the previous year as oil prices plummeted and measures to contain the COVID-19 pandemic hurt its non-oil economy.

India’s population is projected to grow to 1.52 billion people by 2036, surpassing China as the world’s most populous country around 2031. Even though India’s growth rate is slowing considerably, it is growing all the same. The monumental size of the subcontinent means that India’s growth will have a massive impact on the rest of the world as humanity struggles to mitigate the effects of climate change.

More than half of the Indian population is on track to join the middle class. “Because India’s demographics are much younger compared to China and the US, India’s middle class could be the largest in the world (in terms of numbers of people) by 2025.” While this bodes well for the livelihoods of millions of people, it also means an increased demand for a wide range of goods and services. This translates to greater energy use and more significant emissions.

India’s petrochemicals demand is expected to jump ten times by 2050, according to the president of India’s Chemicals and Petrochemicals Manufacturers’ Association. Demand for petrochemical products will double every nine years at an annual growth rate of 8%. The country’s demand for petrochemicals has also been growing faster than the economy in recent years. Indian petrochemical manufacturers could benefit from the surge in demand by co-locating petrochemical production facilities together with refineries. The petrochemical-refinery clusters would allow petrochemical producers to cut capital expenditure (CAPEX) by up to 30% and operating costs by 20%.

5. The Briefs (date of the articles in the Daily Energy Bulletin is in parentheses)

In the UK’s North Sea, Siccar Point Energy is delaying work on its Cambo oil field, a target of vociferous criticism by environmental activists who want the oil left in the ground. Project development is not expected to begin until next year. (8/25)

The Netherlands’ advertising watchdog ruled that a Royal Dutch Shell advertising campaign that said customers could offset the carbon emissions from their fuel purchases is misleading. Shell offers customers the option of paying extra for fuel, such as gasoline, saying it will use the proceeds to plant trees and re-absorb carbon dioxide from the atmosphere. The Advertising Code Committee agreed with a complaint from nine law students who said the company could not prove it is fully offsetting the emissions. (8/28)

The Lebanese government said it was raising gasoline prices by 66% in a partial reduction of fuel subsidies as it seeks to ease crippling shortages that have brought the country to a standstill. (8/23)

Lebanon’s energy ministry said it had picked Dubai’s ENOC in a tender to swap 84,000 tons of Iraqi high sulfur fuel oil with 30,000 tons of Grade B fuel oil and 33,000 tons of gasoil. This is part of a deal between the two countries that allows the cash-strapped Lebanese government to pay for 1 million tons of Iraqi heavy fuel oil a year in goods and services. (8/27)

In Egypt, Siemens Energy and Egyptian Electricity Holding Co. have signed a memorandum of understanding to develop a hydrogen-based industry with export potential, including a 100-200 MW pilot electrolyzer facility, as the North African gas producer seeks to create a clean energy industry. Egypt wants to have 43% of power from renewables by 2035. (8/26)

A new wave of security threats in Nigeria, highlighted by a growing wave of kidnappings and attacks on oil industry workers, poses a significant challenge to Africa’s largest oil producer and a key supplier of light sweet crude grades to Europe. (8/28)

Nigeria’s Nigerian National Petroleum Corporation will supply 300,000 b/d of crude to the 650,000 b/d Dangote oil refinery, which is now under construction, to bolster its crude’s domestic fuel supply and guarantee outlets. (8/27)

Brazil talks with Argentina about potentially building a $5-billion natural gas pipeline from the Argentinian Vaca Muerta shale play. A gas pipeline from the prolific Vaca Muerta shale in Argentina’s province Neuquén could be one option for reducing natural gas prices in Brazil, according to Brazil’s President Jair Bolsonaro.

While Brazil’s push for greater oil exploration is strong, leading the government to predict another oil boom in the coming years, experts are less specific. Many believe that the current exploration projects will simply sustain Brazil’s crude production levels rather than enhance them. However, several oil majors are taking this bet as TotalEnergies and Chevron both announce plans to ramp up their operations in the country. (8/24)

Mexico’s Pemex has restored part of the oil production suspended after Sunday’s fatal fire that killed seven people. Still, the pace of output recovery could be slower than expected because of technical issues, including well re-connection. Mexico’s crude oil production was reduced by more than 400,000 b/d early this week. Pemex’s CEO said that the deadly weekend fire on a platform in the southern Gulf of Mexico could have been caused by a gas leak.

The US oil rig count rose by 5 to 410 this week, while gas rigs were unchanged at 97, according to Baker Hughes. In August, drillers added 25 oil rigs, the most in a month since January, putting the oil rig count up for 12 months in a row for the first time since July 2017. The gas rig count, meanwhile, declined by six, its first monthly decline since October 2020. (8/28)

Leasing restart: The Biden administration said it would take steps to restart the federal oil and gas leasing program in the next week and plans to hold a Gulf of Mexico auction as soon as October. The move comes two months after the US Interior Department first said it would comply with a June 15 federal judge’s order blocking its months-long pause in oil and gas leasing on federal lands and waters. (8/25)

SRP: The US Department of Energy said Monday it would sell up to 20 million barrels of crude from the emergency oil reserve to comply with legislation passed in recent years. (8/24)

US refiner Phillips 66’s decision to sell a Louisiana oil processing plant offers a critical test of investors’ views on the pace of the transition to electric vehicles. Phillips 66, the fourth largest US refiner, on Tuesday said it had put its 255,600-b/d Alliance plant on the market, citing “the evolving energy landscape.” (8/26)

Keystone: A US government watchdog found multiple problems with the construction, manufacture, and design of the Keystone pipeline, validating President Biden’s decision to revoke the permit for a Keystone XL extension. Lawmakers requested the Government Accountability Office report in November 2019 after more than 11,000 barrels of oil leaked from the pipeline system in two releases in less than two years. (8/24)

Pipeline security: The American Petroleum Institute has published an updated edition of its cybersecurity standard for pipelines, which it says provides a comprehensive approach to cyber defense for critical infrastructure. (8/23)

The US oil and gas pipeline industry is looking for new opportunities to lay steel in the ground with pipes that carry the carbon dioxide produced when fossil fuels are burnt. Wall Street is pushing the industry to show how it will adapt to demands for a lower-carbon world. (8/30)

Chevron Corp. is accelerating its push to convert cow manure into renewable natural gas as part of its effort to reduce its carbon footprint. The oil major and its joint venture partner Brightmark LLC will build another ten facilities to produce dairy biomethane to fuel long-haul trucks. They’re already developing 28 plants in seven states; the first begins production this year. (8/25)

Alaskan option? With the world headed into a low-carbon energy future, Alaska, rich in fossil fuels, is trying to hitch a ride on the green bandwagon. A joint project underway by the University of Alaska Fairbanks and the US Department of Energy is looking at whether ammonia could be made from vast proven natural gas reserves on the North Slope with the hydrogen in the ammonia used as a carbon-free fuel. (8/24)

The world’s most extensive container-shipping line is making a $1.4 billion investment in a greener fleet. AP Moller – Maersk A/S has ordered eight new vessels, each costing $175 million, that can be propelled by cleanly made methanol instead of oil-based fuel. (8/24)

The problem with running ships on green fuels is not the vessel technology; it’s the fuel product scarcity, Maersk’s chief executive Søren Skou told Bloomberg earlier this month. (8/23)

The world’s fleet of giant supertankers is the oldest it has been since 2002, the latest sign of an illicit trade that owners say is damaging business. For months, publicly traded shipowners have noted that the transport of sanctioned cargo from Iran and Venezuela has weakened the tanker market and helped drive earnings to the lowest in years. (8/28)

Fuel cell trucks: Starting in 2023, a dedicated line at Toyota Motor Manufacturing Kentucky will begin assembling integrated dual fuel cell (FC) modules destined for use in hydrogen-powered, heavy-duty commercial trucks. The FC modules bring Toyota’s electrification strategy further into focus. It will allow truck manufacturers to incorporate emissions-free fuel cell electric technology into existing platforms with the technical support of Toyota under the hood. (8/26)

EV charging: In a significant acceleration of its electric vehicle charging business in the US, Siemens plans to produce more than 1 million EV chargers for US homes and businesses over the next four years, according to the German engineering giant. This would be a significant jump from the roughly 75,000 EV chargers the company installed in the US over the past decade. (8/26)

Researchers at the MIT Energy Initiative have investigated the grid impacts of scaled-up highway fast-charging (HFC) infrastructure. Although highway fast-charging stations for electric vehicles are needed to address range concerns, the characteristics of HFC electricity demand—its relative inflexibility, high power requirements, and spatial concentration—have the potential to impact grid operations adversely as HFC infrastructure expands. (8/23)

California Climate Investments —a program designed to put billions of dollars to work to reduce greenhouse gas emissions—is funded with proceeds from the State’s Cap-and-Trade GHG emissions reduction program and is administered by the California Air Resources Board (ARB). (8/25)

Reinsurance giant Swiss Re announced Wednesday that it had signed the world’s first long-term agreement to take carbon directly out of the air. The contract with Climeworks AG, one of the world’s leading direct air-capture startups, will net the climate technology company $10 million over ten years. (8/27)

Drought: Canada, the world’s biggest canola grower and a major wheat producer, forecasts a 26% drop in supplies of its main crops as drought ravages output and inventories shrink. Grain and oilseed exports are expected to fall in the marketing year that started Aug. 1 for most crops, and stocks will drop due to low supplies. (8/27)

American farmers are preparing to fire up their tractors earlier this year, and it’s an unexpected gift to oil markets. Scorching and dry weather has sped up crop development, and corn and soybean fields should be ready for harvesting several weeks earlier than usual. The value of diesel, the tractor fuel for the harvest, rose more than 12% since Aug. 20 in the Chicago and Tulsa, Oklahoma, cash trades. (8/27)

Plastic pullback: The UK government has announced plans to ban single-use plastic cutlery, plates, and polystyrene cups in England as part of what it calls a “war on plastic.” Ministers said the move would help to reduce litter and cut the amount of plastic waste in oceans. (8/28)